Year: 2020

White Paper October 17, 2020: EPIC V3.1.1 Crude Oil Machine Trading – 19 Week 100% Win Rate Achieved

59%+- Returns: Real-World EPIC V3.1.1 Oil Trade Performance and Why ROI Is Expected to Grow.

October 17, 2020 EPIC V3.1.1 Oil Trading Software Update.

The EPIC Oil Machine trading software is now much further along in development.

In short, the software is now extremely stable, the average intra-sequence draw-down much lower, the win rate very high, ROI approaching 60% and expected to slowly and steadily increase in a stable environment.

The ROI is much lower than the 150% our team was targeting with early versions but provides an extremely stable environment, which is considerably more important.

The majority of the changes to the code were done during the black swan crude oil negative trading price event of 2020 (COVID 19).

The white paper update below is a near copy of the original Sept 23, 2019 paper with edits reflecting changes to the code architecture.

Historical white paper publications for the EPIC software development can be found here:

- September 23, 2019: White Paper Updated Dec 29, 2019: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading

- June 4, 2020: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL

- April 19, 2020: EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

Draft white paper outlining key reasons EPIC v3 oil futures machine trading software outperforms conventional trading methods:

In the most recent version of the software, specific to the 7 point list below, the most significant changes were to point 5 and 7. Specific to point 5, the EPIC IDENT™ system gains more intelligence and becomes more significant to win rate as time goes on and specific to point 7, the trajectory game component decision weight was significantly lowered.

The two primary changes noted significantly changed the win rate to the high side and lowered the average draw down size intra sequence.

- Lightening Fast Decisions. EPIC crude oil trading software executes trades to over 9300 weighted decisions instantly. The instructions provided within the architecture is growing daily. A human trader cannot make decisions as quickly, cannot process the data required for most intelligent trading probabilities and cannot execute trades as precisely.

- Algorithmic Chart Models. The EPIC software includes over thirty proprietary algorithmic chart models and the catalogue is growing. The algorithmic models have been designed, tested and refined in real-world trade for over 4 years by a team of day traders, each with over 20 years of experience. The oil trading models represent all time-frames from 15 second to monthly time-frames of trade. The algorithmic models have been back-tested to sixty months historically.

- Conventional Charting. The software includes conventional charting structures on all time-frames, also back-tested sixty months.

- Common Trade Set-Ups. Included in the software are common trade set-ups that oil day traders implement. This is dynamic and additions are made regularly to the software code reflecting current structured trade set-ups.

- Order Flow. EPIC IDENT™ is data-driven order flow intelligence in real-time to achieve best outcomes. The software includes and executes to a proprietary order flow identification system that tracks behavior (specifically isolating other market machine liquidity) and weighs identified entities and historical trade patterns to its trade decisions (instructions). EPIC IDENT™ increases its intelligence as it gathers data intra-day specific to liquidity flow, historical patterns, time of day, volatility, various preferences, latency, rejects and more. The method is similar to back-testing charting, however, the process is real-time. In short the software is looking for “fingerprints” within market liquidity. We cannot back-test 60 months as with charting but back-testing from date of software inception is possible. The EPIC IDENT™ system is the primary reason for the most recent version 100% win rate (June 1, 2020 to October 17, 2020).

- Time Cycles. Time cycles are within all algorithmic and conventional trading model structures, order flow also has identified time cycles and other time cycle events such as weekly reporting in oil markets such as API, EIA and rig counts. Additionally there are time-of day market time cycles around the world. Time-cycles are included in the software architecture.

- ROI Trajectory “Game”. IN THE NEWEST SOFTWARE UPDATE this component of the software was significantly lowered in decision weight. From previous paper descriptions: The EPIC software has a “game” element in that it is designed to continue its most recent ROI trajectory (or return to its trajectory of ROI should it have a draw-down period). In other words, if the trajectory of ROI is for example 100% and it draws-down to 80% it then will “weigh” trade decisions more to the most probable trade set-ups until the ROI trajectory is returned. It also will push its decision “weight” to exceed the current ROI trajectory to establish a better ROI to which it is then “obligated” to maintain and correct to, hence the expectation that the ROI will continue to improve over time. This is the “machine learning” component of development. We are finding that the software is discovering increasingly more creative ways to “game” the ROI return trajectory. This Sept 4, 2019 document details an insider look at this topic within development. Edited Sept 5, Draw-Down Oil Daytrading Session: Question and Answer Review | EPIC V3 Crude Oil Machine Trading Software.

Combined, these advantages enable the EPIC v3 Crude Oil Trading software to outperform conventional trading methods.

Introduction.

The world of public market trade is rapidly changing. It is estimated (depending on source) that over 80% of crude oil futures are not traded by humans and are now traded by machine.

Machine trade may be simple bot style software, high-frequency software or more sophisticated architecture as with the EPIC v3 class of algorithm.

Our team commenced the oil trading software development journey five years ago with algorithmic chart model development. From day one we employed computer scientists to work with us on a daily basis to build software emulating our trading methods.

Over time the software started to win more trades than our traders and today we rely almost solely on the software to execute trades. We simply “tweak” the software at each trade sequence to improve performance.

EPIC v3 software is our 3rd generation oil trading software. EPIC v1 tested returns at about 20% per annum, EPIC v2 at 40% per annum and EPIC v4 architecture was too aggressive for our risk threshold. We settled on EPIC v3 and have been refining its code trade by trade since.

The current EPIC v3 win-rate consistently comes in at +-100% per trade sequence (variable by +-0% as of the date of publication).

The current EPIC return is projected at 59% per year based on real world performance (audited trades available) and is expected to increase slowly over time. The current period of time spans approximately 19 weeks and includes hundreds of trade executions.

Black Swan Update, June 1-October 15 Profit & Loss YTD +$74,940 or $234,184 59% ROI Per Annum. EPIC V3.1.1 Oil Machine Trade 400k Account (time stamped alerts, audited P&L) #OOTT $CL_F $USOIL $USO #oiltradealerts #oiltradingroom

https://twitter.com/EPICtheAlgo/status/1317286168111828992

Account Size – ROI and Draw-Down Volatility.

The smaller the account size traded the more difficult it is for the software to limit risk to down-side and provide optimum returns.

The software is designed to trade within a sequence of trade within structures or set-ups. As the oil market price changes, the software trading logic uses all the different data to update the decision tree utilizing the instruction rule-set.

You can imagine this as a dot plot process similar to the game “go” – not exactly, but the concept helps to visualize how the software plots a sequence plan for trade.

The “ebb and flow” of regular oil market trade allows opportunity for the software to plot a plan of trade within a sequence, the larger the account the more dots can be plotted (trades can be “bite sized” entries within an “ebb and flow”).

The sample account size for the purpose of this document is 400,000.00. A 1,000,000.00 account would expect approximately half the volatility / draw-down exposure and up to 50% more return. A 10,000,000.00 account would be considerably more stable to draw-down risk and potential returns and so on.

Draw-down Protocol.

During any particular 7 day trading period the EPIC v3 software protocol (as of October 17, 2020 updates) expects on average draw-down no more than as follows;

- Account size and average drawdown 10,000,000.00 = 1%, 1,000,000.00 = 1.5%, 400,000.00 = 3%, 300,000.00 = 5%, 200,000.00 = 8%.

Hard stop architecture is in place post black swan event of 2020..

Real-World Trader / Investor Use.

In real-world examples the EPIC v3 oil trading software is being used daily by oil traders as an additional indicator and / or as an auto trading mechanism.

Examples include the Compound Trading Group live oil trading room (live broadcast of trades via voice and charts), live alert service via Twitter and Discord private server feeds and regular Oil Trading Reports that include algorithmic and conventional chart structures and guidance.

Additionally, SOVORON™ uses our data flow to integrate to their platform. SOVORON™ ‘Algorithmic machine trading of your personal Crude Oil Futures exchange account’. See www.sovoron.com for information.

Architecture of API Trade.

EPIC v3 software is designed to be deployed remotely – accessing an account and executing trades. This provides the account holder with ultimate control. The account holder grants the software access and the software executes machine trades to the account. The account holder can turn on or off access at any time. Architecture provides opportunity for decentralized platform integration.

Documentation.

Video. Our team traders and engineers have live video recording of the trading sessions with EPIC v3 software within a trading room environment.

Trader and Developer Repository. We provide guidance to our subscriber (paywall) clients in a Discord private server (charts and trade set-up explanations) in a real-time environment. The private server acts as a repository for our developers and our trading service (paywall) clients.

Live Trade Alerts. All trades have been broadcast over mic in a live trading room (recorded as mentioned above) and most have been alerted by way of text instruction to the Discord private server and/or private Twitter feed for time-stamped evidence.

Broker Accounts. The EPIC v3 trades are real-world trades and as such broker profit and loss statements can be made available.

Client Reporting. We provide regular reporting to our trading service clients (paywall) that explains the process of execution by the software. Examples of the guidance provided, trade alerts issued, Discord private server discussions and live trading room video can be found in this document (which is one of many published) Daytrading Crude Oil in Oil Trading Room: 6 Trades, 6 Wins. How We Did It | Alerts, Strategies, Video, Charts. This document provides a standard update document provided to our clients Protected: Crude Oil Trading Report Strategies | Alerts, Signals, Charts, Algorithms, Trading Room, P&L | Premium | Sept 2, 2019 use password CLTRADER.

Conclusion.

This paper outlines the opportunity that change in machine trade within global finance markets presents.

Competitors within the machine trade industry are becoming more and more refined / successful – the best in class are assumed to be winning a larger portion of proceeds.

The most significant immediate challenge developers face in machine trade within financial markets is building a product that can win within a prescribed threshold of stability limiting down-side and yet over-perform conventional trading methods.

Soon thereafter the challenge becomes competing against “like-kind” machine trade peers and being best in class.

It is our expectation that fewer and fewer competitors will achieve more of the proceeds (as a whole of trade in public markets) at an exponential rate, which does provide urgency to development and deployment.

The EPIC v3 trading software achieves consistent, predictable and very adaptable architecture that provides exceptional ROI potential.

Business Inquiries.

For information about oil trade alerts, oil trading room and oil trade reporting contact Compound Trading Group at [email protected].

For information about automated machine trading platforms contact our agent representative Richard Regan as follows:

CONTACT US

Email [email protected]

Phone 1-849-861-0697

Follow:

Article Topics; Crude, Oil, Trading, Algorithm, Machine Learning, DayTrading, Futures, EPIC, Trade Alerts, Oil Trading Room, $CL_F $USO

Part2 – Natural Gas (NATGAS) Trade Alert 2.08 Long Rallied to 2.50s Fast – What’s Next? $NG_F $UGAZ $DGAZ $UNG

The Natural Gas Trade is Heating Up – What a Sweet Trade Set-Up.

Trading natural gas futures or ETN’s / ETF’s like $UGAZ $DGAZ or $UNG can provide excellent returns if you get your trade set-up right. Below we demonstrate what precision trading in natural gas can do for your returns. Our members have enjoyed a series of recent swing trade alerts that have worked well for us. See below.

In our Oct 5, 2020 Natural Gas Swing Trading Newsletter (unlocked) we provided a video from our Weekly Swing Trading Study Webinar and charting for a Natural Gas trade set-up long in the channel.

The Oct 7, 2020 Swing Trade Alert:

NATURAL GAS (NATGAS) 30 min levels, greens and grays are your key levels, will be watching close post oil EIA today #swingtrading $NATGAS

https://twitter.com/SwingAlerts_CT/status/1315663604667109376

The trade alert worked out great and the buy trigger 2.08s hit for long entries and Natural Gas rallied to 2.50s fast.

https://twitter.com/SwingAlerts_CT/status/1315663604667109376

Prior to this, our swing trading platform had traded the Natural Gas falling wedge pattern break-out for excellent returns. See the previous member natural gas newsletter link above.

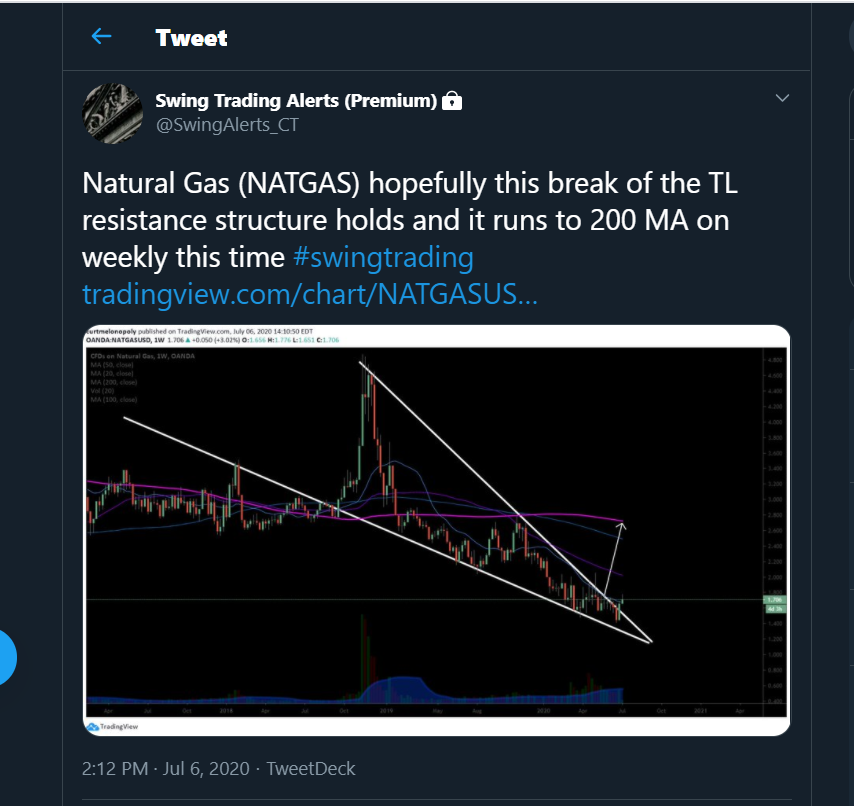

Natural Gas (NATGAS) hopefully this break of the TL resistance structure holds and it runs to 200 MA on weekly this time #swingtrading

Swing trade alert feed:

The question now is, what’s next?

Swing trade members can review the next set-up in Natural Gas trade in newsletter:

Protected: Natural Gas Trading Newsletter (Premium Swing Trading Post) Part 3

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 300.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; swing trading, newsletter, natural gas, natgas, $NG_F, $UGAZ, $DGAZ, $UNG

Swing Trading Natural Gas Newsletter – Trading Plan, Alerts and Charting.

Natural Gas Trading Newsletter

Weekly Swing Trade Study Sunday Webinar video is below – clip is specific to Natural Gas trade set up..

Natural Gas (NATGAS) falling wedge pattern worked out almost perfect on weekly chart time frame. $NG_F #swingtrading

Natural Gas (NATGAS) 30 minute time frame may have intra week swing set up forming 2.08 – 2.50 ish. On watch. #swingtrading $NG_F

Natural Gas Long Swing Trade Tweets (Private feed that clients only can click and see links)

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Per NATGAS video we did take trims this morning, yes. Trading 2.298 now, difficult to say where pull back will occur, will be in report.

12:50 PM · Aug 17, 2020

https://twitter.com/SwingAlerts_CT/status/1295402694304247808

Swing Trading Alerts (Premium)

@SwingAlerts_CT

My next trim profit (20% on top of 35% yesterday) on Natural Gas will be if we near 100 MA before pulling back. #swingtrading $NATGAS

3:17 PM · Aug 4, 2020

https://twitter.com/SwingAlerts_CT/status/1290728573293268996

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Trimming NATGAS long 2.039 35%

12:23 PM · Aug 3, 2020

https://twitter.com/SwingAlerts_CT/status/1290322319915855873

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Natural Gas (NATGAS) hopefully this break of the TL resistance structure holds and it runs to 200 MA on weekly this time #swingtrading https://tradingview.com/chart/NATGASUSD/2ew8DAGT-Natural-Gas-NATGAS-hopfully-this-break-of-the-TL-resistance-st/

2:12 PM · Jul 6, 2020

https://twitter.com/SwingAlerts_CT/status/1280202942298152965

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Natural Gas (NATGAS) we’ve added longs bit by bit per alerts, thesis is when oil comes off natural gas pops here.

2:14 PM · Jun 11, 2020

https://twitter.com/SwingAlerts_CT/status/1271143770092904449

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Natural Gas (NATGAS) did hold for a double bounce at that diagonal TL as suspected, small pull back I’ll add $NG_F #swingtrading https://tradingview.com/chart/NATGASUSD/YDzO2CiV-Natural-Gas-NATGAS-did-hold-for-a-double-bounce-at-that-diagon/

11:01 AM · Apr 23, 2020

https://twitter.com/SwingAlerts_CT/status/1253338099582558209

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Starting a Natural Gas long swing 2.25s only 5% size and will add on dips. 20 MA first test (light blue) $NATGAS #swingtraidng

9:26 AM · Dec 11, 2019

https://twitter.com/SwingAlerts_CT/status/1204769324671668224

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 100.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; swing trading, newsletter, natural gas, natgas, ng_f

Swing Trade Reporting Upgrades Coming October 2020 – Coding, Reporting, Alerts, Price Changes

Swing Trade Reporting Platform Upgrades, What’s Next.

Good day traders,

Our swing trading alert, reporting and webinar platform has done very well. It’s been just shy of five years and our performance year over year continues to go up.

We’re not stopping there.

Next we will be taking what we’ve learned in our machine trading area of crude oil and implementing the strategies to our swing reporting and alerts.

You may or may not know that our most recent version of the EPIC V3.1.1 oil trading algorithm has won 100% of its trades since launch of June 2020. Needless to say, we have developed a structured trading system that comes with considerable success, so we’re excited about bringing this to our swing traders.

Starting in October reporting will include regular reports specific to one stock or commodity at a time that will explain exactly how to trade the instrument on various time frames using both conventional technical analysis and algorithm chart models. As we distribute the specific trading plans we will also start the process of coding them for trade and alert the trades to the private member feed.

Essentially each report will provide a detailed trading plan with charting and will accompany regular trade alerts for that instrument of trade whether it be a stock, commodity, currency, volatility etc.

It is our goal to complete approximately 150 structured reports, alert the trades and start the coding for them all before January 2021.

Our swing trading platform will also still include various other stock alerts, webinars and reporting as our clients have come accustomed to.

New pricing will be posted to the website this weekend that will reflect the expansion of our platform. Current customers (as long as they renew prior to subscription expiry) will always keep their entry price and will not experience price increases. The price increases are for new clients only.

Any questions send me a note anytime to [email protected].

You can expect the new reporting to start rolling out within a week at most.

Thanks

Curt