Tag: $CCJ

Swing Trade Alerts Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC …

Swing Trading Alert Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 as Alerted to Member Private Feed, Trading Room and/or Newsletter Reporting. #swingtrading #tradealerts

Tickers Alerted on Swing Trade Feeds: $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC, $APDN, $PD, $KBE, $RCUS, $GC_F, $SI_F, $CL_F, $APO, $CCJ, $CAE, $TECK, $TACO, $VXX, $BIIB, $CLVS,

- Important Summary Detail:

- Period Swing Trade Alert Return (ROI) = 131.26% (based on this reporting period only)

- ROI Calculator Link Here: https://www.calculator.net/roi-calculator.html?beginbalance=200000&endbalance=462520&investmenttime=date&investmentlength=2.5&beginbalanceday=04%2F01%2F2020&endbalanceday=04%2F30%2F2020&ctype=1&x=62&y=20

- Our goal is to provide the best swing trading alert and newsletter service available. The highest winning percentage with the most consistent returns.

- The objective of providing a Swing Trade Alert Summary P&L is for the purpose of trader’s investigating whether our alert service is appropriate for their personal trading and also for our existing members to have a reference point of trade alert history.

- Swing trades as applicable are announced on mic live, recorded live in live trading room, alerted to private time stamped Twitter feed and emailed. Some trades are detailed further in the regular swing trade report newsletters (as part of the bundle package), in Sunday Swing Trade $STUDY Webinars or by other methods for guidance that may be sent to subscribers.

- Links are provided in the Trade Alert P&L spreadsheet below to each alert as they occurred on the member trade alert feed for member reference (must be a subscriber to alert feed service to view the links). Most of the alerts on the private member Twitter feed include charting and chart links. Over time we will also include links below in spreadsheet to other trade alert guidance provided to our traders, such as; video recordings to live trades as they occurred in the trading room (our YouTube channel), various commentary on social networks, email trade set up guidance, trading room chat guidance, newsletters, swing trade $STUDY webinars, etc..

- The Trade Alert P&L results in this series are specific only to actionable “alerted” trade set-ups to members and not all trades otherwise executed (non alerted) by our traders. It is impossible to alert every ebb and flow add and trim, the major parts of swing trade set ups are alerted and that is what is represented in the P&L reporting – the actionable parts only, that which a trader using our service can action easily and clearly.

- A historical time stamped spreadsheet of alerts is available (by request and by order from Twitter archive service),

- Results in the swing trade P&L series does not represents machine or futures trading but may reference instruments of trade on equity markets surrounding our futures trading activity when parallel trading is occurring by our traders. More detail here: https://compoundtrading.com/disclosure-disclaimer/.

- Study guides outlining each trade set-up, (how the trade was identified and traded with charting) are being made available to applicable members as time allows. For the study guide only subscription click here. As each study guide is released you will receive a copy via email. Bundle members receive the study guides as part of the bundle package.

- Our swing trade platform is available as subscription (monthly, quarterly, annually): One time 50% discount code available for a trial month for new subscribers, use code: “trial50” for a limited time at check-out.

- 1. Swing Trade Alerts. Swing Trade Alerts to Private Twitter Feed and via Email,

- 2. Swing Trade Newsletter Reports: Ongoing swing trading report articles emailed to members detailing trade set-ups and trade in play,

- 3. Swing Trade Study Guides: Swing Trade Study Guide for in-depth review of select swing trade set-ups and how we traded each set-up.

- 4. Swing Trade Bundled Package: Swing Trading Packaged Bundle Including; Alerts, Study Guides & Reporting.

- 5. Swing Trading Webinar: The next Swing Trading Webinar is Sunday July 12, 2020 7:00 PM – 11:00 PM EST. All registrants receive a video copy after the event if you cannot be in attendance live. The webinars review trade set ups for each upcoming week and as time allows each key swing trade from our P&L statements explaining how the trade set-up was identified and executed. Attendees will receive a copy of the charting used to structure the trade. Time is also allotted for attendee question and answer and trade set-up strategies attendees may need assistance with. Cost for Ten Weeks of $STUDY Webinars (40 hours of trade set-up $STUDY prep): Non members 100.00, current members 50.00. There is a 25 person room limit. To register for the live swing trade webinar event click here or to receive a video copy of the live event afterward click here.

- 6. Trade coaching is also available one on one with our lead trader via Skype, for trade coaching click here.

- We regularly reconcile trading alert profit & loss statements for review (as time allows). Check our Twitter feeds or blog for regular updates as we publish consolidated reports.

- Current Swing Trade Alert P&L List is here (more recent dates are in progress to be released soon):

- Swing Trade Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC …

- Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $GLD, $SLV, $BTC …

- Swing Trading Alert Profit & Loss: Feb 1-28, 2020. Monthly Gain +$54,129.00. ROI 27.06%.$SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $YEXT, $FVRR…

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trade Alerts.

- Swing Trading Alert Profit Loss: Feb 1-21, 2020 3 Week Interim Gain +$30,051.00. ROI 15.03%. $SQ, $TEVA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $SRPT, $UBER, $YEXT, $FVRR…

- Swing Trading Alert Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading Alert (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Alert Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Swing Trading Profit Loss – Win 90% . ROI 131.26%. April 1 – 30, 2020. $200,000.00-$454,676.00 #swingtrading #tradealerts

Google Drive Document Link: https://docs.google.com/spreadsheets/d/1GVMx_8TcMuQglo4IN_oN03VwbcF2WVoG2mHd0gN4G9s/edit?usp=sharing

| Date | Entry (EST) | Exit (EST) | Long, Short, Close, Trim, Add | Symbol | Size | Buying Price | Selling Price | Profit/Loss | Running P/L | Alert Link | ||||||

|

* Note: there are a series of oil trades that have to yet be moved to this ledger from lead trader.

|

||||||||||||||||

| 4/30/2020 | 12.05 PM | Long | $LUV | 500 | 30.78 | 0 | ||||||||||

| 4/30/2020 | PRE | Trim 50%: 25 hold 25 | $OSTK | 25 | 8.73 | 14.83 | 152.5 | 462520 | ||||||||

| 4/30/2020 | 8:05 AM | Trim 10% | $BTC | 70 | 5900 | 8878 | 20846 | 462368 | ||||||||

| 4/30/2020 | POST | Trim 25 hold 25 | $AAPL | 25 | 268.1 | 294 | 647.5 | 441522 | ||||||||

| 4/29/2020 | 12:49 PM | Trim 90 hold 370 | $SPXL (SPY Bull ETF) | 90 | 33.7 | 37.15 | 310.5 | 440875 | ||||||||

| 4/29/2020 | 12:17 PM | Trim 90 hold 460 | $SPXL (SPY Bull ETF) | 90 | 33.7 | 36.98 | 295 | 449565 | ||||||||

| 4/29/2020 | Trim 30% 30 of 150 hold 20 | $KBE | 30 | 28.23 | 35.21 | 209 | 440270 | |||||||||

| 4/29/2020 | 10:26 AM | Trim 90 hold 550 of 640 | $SPXL (SPY Bull ETF) | 90 | 33.7 | 36.8 | 279 | 440061 | ||||||||

| 4/29/2020 | PRE | Trim 10% hold 320 | $CAE | 80 | 14.1 | 17.22 | 249.6 | 439782 | ||||||||

| 4/29/2020 | PRE | Take profit to 90% sell 180 hold 30 | $MA | 180 | 247 | 273.2 | 4716 | 438533 | ||||||||

| 4/28/2020 | 11:23 | Add 1/10 size long | $TECK | 300 | 7.71 | 0 | ||||||||||

| 4/28/2020 | PRE | Trim 10% | $IBB | 30 | 123 | 128.7 | 157 | 434817 | ||||||||

| 4/28/2020 | PRE | Trim 10% | $TACO | 240 | 4.4 | 5 | 144 | 434660 | ||||||||

| 4/28/2020 | 7:01 AM | Trim 10% | $AXP | 20 | 84.5 | 86.25 | 35 | 434516 | ||||||||

| 4/28/2020 | 6:57 AM | Trim 10% 20 of 140 hold 120 | $LVS | 20 | 44.5 | 47.8 | 66 | 434481 | ||||||||

| 4/28/2020 | 6:54 AM | Trim 10% 90 of 730 hold 640 | $MA | 90 | 247 | 269.5 | 2025 | 434415 | ||||||||

| 4/28/2020 | PRE | Trim 50% | $CAE | 400 | 14.1 | 17.2 | 1240 | 432390 | ||||||||

| 4/28/2020 | PRE | Trim 50% $KBE | $KBE | 150 | 28.23 | 31.5 | 490.5 | 421150 | ||||||||

| 4/28/2020 | 10:27 AM | Trim 270 of 900 hold 730 | $SPXL (SPY Bull ETF) | 270 | 33.7 | 36.3 | 648 | 430660 | ||||||||

| 4/27/2020 | 3:00 PM | Trim 90 of 300, hold 210 | $MA | 90 | 247 | 264.9 | 1611 | 430012 | ||||||||

| 4/27/2020 | 10:25 AM | Trim 30% 60 of 200 hold 140 | $LVS | 60 | 44.55 | 47.7 | 187 | 428401 | ||||||||

| 4/27/2020 | 9:56 AM | Close $INO | $INO | 20 | 11.03 | 15.22 | 88 | 428214 | ||||||||

| 4/27/2020 | 9:55 AM | Trim 10% 60 of 600 hold 540 | $TLRY | 60 | 8.04 | 9.26 | 70.8 | 428126 | ||||||||

| 4/27/2020 | PRE | Trim 40 hold 50 | $AAPL | 40 | 268.1 | 284.9 | 672 | 428055 | ||||||||

| 4/25/2020 | POST | Close 50 | $RCUS | 50 | 15.5 | 30 | 725 | 427383 | ||||||||

| 4/24/2020 | 3:40 PM | Starter long | $TLRY | 600 | 8.04 | 0 | ||||||||||

| 4/24/2020 | 3:03 PM | Starter long | $LVS | 200 | 44.55 | 0 | ||||||||||

| 4/24/2020 | PRE | Starter long | $CCJ | 600 | 9.83 | 0 | ||||||||||

| 4/24/2020 | PRE | Long | $AXP | 200 | 84.5 | 0 | ||||||||||

| 4/23/2020 | PRE | Trim to 90%, hold 20 | $INO | 130 | 11.03 | 12.49 | 189.8 | 426658 | https://twitter.com/SwingAlerts_CT/status/1253265769372286976 | |||||||

| 4/22/2020 | Trim 25% | $INO | 50 | 11.03 | 11.46 | 21.5 | 426469 | https://twitter.com/SwingAlerts_CT/status/1252974838672691200 | ||||||||

| 4/21/2020 | 11:54 AM | Short starter | $TSLA | 20 | 694.5 | https://twitter.com/SwingAlerts_CT/status/1252627996730707968 | ||||||||||

| 4/21/2020 | 10:00 | Add $APPL 268s per alert hold 90 | $APPL | 85 | 268.1 | 0 | ||||||||||

| 4/21/2020 | 11:00 | Trim $VXX 300 hold 100 | $VXX | 300 | 43 | 47.8 | 1440 | 426448 | ||||||||

| 4/21/2020 | PRE | Trim 50% of position | $OSTK | 50 | 8.73 | 11.89 | 158 | 425008 | https://twitter.com/SwingAlerts_CT/status/1225566766350393345 | https://twitter.com/SwingAlerts_CT/status/1252243687624622085 | https://twitter.com/SwingAlerts_CT/status/1255091263185059841 | |||||

| 4/20/2020 | 11:18 AM | Long Starter | $CLVS | 300 | 11.18 | 0 | https://twitter.com/SwingAlerts_CT/status/1252255241615130629 | |||||||||

| 4/20/2020 | 12:00 | Close | $BIIB | 30 | 335 | 350 | 450 | 424850 | ||||||||

| 4/20/2020 | 10:48 | Long starter | $ACB | 1200 | 0.71 | 0 | https://twitter.com/SwingAlerts_CT/status/1252247665758347264 | |||||||||

| 4/17/2020 | 4:03 PM | Sell 25% | $MA | 100 | 247 | 260 | 1300 | 424400 | ||||||||

| 4/17/2020 | Sell 25% | $TACO | 600 | 4.4 | 4.67 | 162 | 423100 | |||||||||

| 4/17/2020 | PRE | Long | $TACO | 2400 | 4.4 | 0 | ||||||||||

| 4/16/2020 | PRE | Long | $CAE | 800 | 14.1 | 0 | ||||||||||

| 4/16/2020 | POST | Long | $SPXL (SPY Bull ETF) | 900 | 33.7 | 0 | https://twitter.com/SwingAlerts_CT/status/1247072443723845638 | |||||||||

| 4/16/2020 | 1:39 PM | Trim profit to 90% 450 of 500 | $RCUS | 450 | 15.5 | 29.2 | 6165 | 422938 | ||||||||

| 4/16/2020 | 16:42 | Long in Size | $MA | 400 | 247 | 0 | https://twitter.com/SwingAlerts_CT/status/1250887337917243393 | https://twitter.com/SwingAlerts_CT/status/1250463929765187585 | https://twitter.com/SwingAlerts_CT/status/1250463036634251266 | https://twitter.com/SwingAlerts_CT/status/1250444010117726214 | ||||||

| 4/16/2020 | POST | Trim to 90% – 35 of 40 hold 5 | $AAPL | 35 | 261.9 | 296 | 1193.5 | 416773 | ||||||||

| 4/15/2020 | PRE | Trim 100 of 200 | $APDN | 100 | 3.01 | 8.51 | 550 | 415580 | ||||||||

| 4/14/2020 | PRE | Trim profit 25% 75 of 150 | $INTC | 75 | 48.42 | 58.7 | 771 | 415030 | ||||||||

| 4/14/2020 | PRE | Trim 25% profit | $PD | 150 | 17.2 | 19.12 | 288 | 414259 | https://twitter.com/SwingAlerts_CT/status/1249980190769496064 | |||||||

| 4/14/2020 | PRE | Trim 2 hold 2 | $GC_F | 2 | 1516.01 | 1725.77 | 41952 | 413971 | ||||||||

| 4/14/2020 | POST | Trim 90%, trim 180 old 20 | $BABA | 180 | 180.75 | 205 | 4365 | 372019 | https://twitter.com/SwingAlerts_CT/status/1249803532032716801 | |||||||

| 4/13/2020 | 4:14 PM | Trim 10% Long hold 40% | $AAPL | 10 | 261.9 | 272.9 | 110 | 367644 | ||||||||

| 4/9/2020 | Settlement | Close stop at entry | $CL_F | 1 | 24.07 | 24.07 | 0 | |||||||||

| 4/9/2020 | 9:31 AM | Cover short | $TSLA | 20 | 544,33 | 558.2 | -277.4 | 367544 | ||||||||

| 4/9/2020 | 7:14 AM | Trim 45% oil swing profit hold 5% | $CL_F | 5 | 24.07 | 27.3 | 16150 | 367822 | ||||||||

| 4/9/2020 | PRE | $VIX wknd ins adds to 30% $VXX | $VXX | 300 | 43 | 0 | https://twitter.com/SwingAlerts_CT/status/1248206283087503361 | |||||||||

| 4/9/2020 | 9:15 AM | Trim 50% Long hold 50% | $AAPL | 50 | 261.9 | 270 | 405 | 351672 | https://twitter.com/SwingAlerts_CT/status/1247880159010549765 | |||||||

| 4/8/2020 | 11:34 | Long | $KBE | 300 | 28.23 | 0 | https://twitter.com/SwingAlerts_CT/status/1247911880082980864 | https://twitter.com/SwingAlerts_CT/status/1247910820144648195 | ||||||||

| 4/8/2020 | 10:04 | Short (small) | $TSLA | 20 | 544.33 | 0 | https://twitter.com/SwingAlerts_CT/status/1247888116553142272 | https://twitter.com/SwingAlerts_CT/status/1247889336458022912 | ||||||||

| 4/8/2020 | PRE | Long | $AAPL | 100 | 261.9 | 0 | ||||||||||

| 4/7/2020 | 8:07 AM | Trim oil 50% swing profit | $CL_F | 6 | 24.07 | 24.97 | 5400 | 351267 | ||||||||

| 4/7/2020 | 15:06 | Long swing trade oil | $CL_F | 12 | 24.07 | 0 | ||||||||||

| 4/6/2020 | 1:14 PM | Trim profit on swaps 25% | $BTC | 75 | 5900 | 7147 | 1247 | 345867 | ||||||||

| 4/6/2020 | 1:14 PM | Trim Gold Long (2 @ 100) hold 4 | $GC_F | 2 | 1516.01 | 1654 | 27598 | 344620 | ||||||||

| 4/6/2020 | 1:14 PM | Trim Silver Long (2 @ 5000) hold 1 | $SI_F | 2 | 12.7 | 14.82 | 21200 | 317022 | ||||||||

| 4/6/2020 | PRE | Long | $ZM | 100 | 128.2 | 0 | ||||||||||

| 4/6/2020 | PRE | Long | $TWTR | 500 | 23.09 | 0 | ||||||||||

| 4/6/2020 | PRE | Long adds 100 hold 200 | $BABA | 100 | 187.11 | 0 | ||||||||||

| 4/6/2020 | PRE | Long adds | $STNE | 200 | 16 | 0 | ||||||||||

| 4/3/2020 | 2:23 PM | Close | $CL_F | 1 | 20.44 | 27.99 | 7550 | 295822 | ||||||||

| 4/3/2020 | 4:00 AM | Trim oil | $CL_F | 1 | 20.44 | 25.63 | 5190 | 288272 | ||||||||

| 4/2/2020 | 10:45 AM | Trim oil | $CL_F | 2 | 20.44 | 26.6 | 12320 | 283082 | ||||||||

| 4/2/2020 | 10:40 AM | Trim oil 50% of 50% approx | $CL_F | 4 | 20.44 | 26.4 | 23840 | 270762 | ||||||||

| 4/2/2020 | 1:43 AM | Trim oil trade 50% of total | $CL_F | 8 | 20.44 | 21.81 | 10960 | 246922 | ||||||||

| 4/2/2020 | 10:29 AM | Trim Silver Long (2 @ 5000) | $SI_F | 2 | 12.7 | 14.41 | 17100 | 235962 | https://twitter.com/SwingAlerts_CT/status/1245720000817659907 | https://twitter.com/SwingAlerts_CT/status/1245716238954872832 | https://twitter.com/SwingAlerts_CT/status/1245714843761606656 | |||||

| 4/2/2020 | 10:29 AM | Trim Gold Long (2 @ 100) hold 6 | $GC_F | 2 | 1516.01 | 1609 | 18598 | 218862 | https://twitter.com/SwingAlerts_CT/status/1245720000817659907 | https://twitter.com/SwingAlerts_CT/status/1245716238954872832 | https://twitter.com/SwingAlerts_CT/status/1245714843761606656 | |||||

| 4/2/2020 | 4:27 AM | Cover 25% | $APO | 75 | 34.4 | 30.87 | 264.75 | 200264 | ||||||||

| 3/31/2020 | 12:10 | Long oil swing in size | $CL_F | 16 | 20.44 | 200000 | ||||||||||

| 200000 | ||||||||||||||||

|

*The goal has been to keep the alert feed simple to allow traders (subs) to structure their own trades, sizing, instruments etc, however, we will be transitioning to a more specific detailed alerting process in 2020 (digital auto platform).

|

||||||||||||||||

|

*Run the trades, win rate avg return range you see alerted on the spreadsheet with your preferred sizing, risk tolerance, instrument type and see what your returns would be based on the swing alerts of our platform.

|

||||||||||||||||

|

*The trade alert links in spreadsheet will only open for premium subscribers (for use of reference) if you would like a tour of the feed to view the time stamped alerts contact us – the P&L represents alert feed as it was alerted.

|

||||||||||||||||

|

*Subscribers can click on alert link for details of alert and also see charting and links to live Trading View charting, structured models, etc for each set up.

|

||||||||||||||||

|

*See addendum documentation for; Volatility derivative options trading structures/strategies used for $OVX $VIX $USO $SPY $SPX Gold Silver Crude Oil Bitcoin.

|

||||||||||||||||

|

*Many trades in Volatility, Indices, Commodities, Crypto etc are structured as futures or ETF options or lev swaps that take time to detail at intraday alert level – soon trade alerts will include more detail with digital traders platform launch.

|

||||||||||||||||

|

*For these P&Ls (until strategy structures include more detail n alerts) we have kept the entries as simple as possible so traders can execute on the actionable set-up.

|

||||||||||||||||

|

*Crude oil: lead trader primarily uses a 10 bet position trading strategy on day trades and a 30+ bet system on swings (max size can vary) and EPIC V3.1.1 machine trading a fixed 30 bet system on either.

|

||||||||||||||||

|

*Swing clients know in 9/10 trade set ups when lead trade executes a position a profit trim is taken if on right side of trade and then if price returns to buy lead trader has stops there (unless otherwise noted).

|

||||||||||||||||

|

*For specific or itemized trade set-up strategies or instrument stuctures as needed for any of the trades in progress email Jen & Curt at compoundtradingofficial@gmail.com or clients can Whatsapp Curt direct.

|

||||||||||||||||

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com.

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 100.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Profit Loss, Trade, Alerts, Newsletter, Stocks, Commodities, Crypto, .$AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC, $APDN, $PD, $KBE, $RCUS, $GC_F, $SI_F, $CL_F, $APO, $CCJ, $CAE, $TECK, $TACO, $VXX, $BIIB, $CLVS

PreMarket Trading Plan Fri July 28 $FSLR, $KOOL, $COTY, $CCJ, $USOIL, $WTI, $GLD, $GDX, $SPY, $DXY

Compound Trading Chat Room Stock Trading Plan and Watch List for Friday July 25, 2017 $FSLR, $KOOL, $COTY, $CCJ – $UGLD, $SSH, $LGCY, $TRCH, $ESEA, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to info@compoundtrading.com and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

I Know – It’s Fluke:) You’re Welcome is what I want to say to the Twitter world – but I’ll just share less and less and let hollywallstreet soak in their… oh right they win I forgot… right.

Just closed out the rest of my swings for a sweet profit month ? (except Gold long starter – holding that). #swingtrading

Just closed out the rest of my swings for a sweet profit month 🔥 (except Gold long starter – holding that). #swingtrading

— Melonopoly (@curtmelonopoly) July 26, 2017

Private Fund / Personal Trading Going Forward:

Next week (starting Monday or Tuesday) I will be trading for our private fund (as mentioned in the trading room and on recent Master Class video) which will bring some slight changes.

The financing or our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years they will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been very positive and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of intelligent assistance algorithm models) we are engaging the implementation of our private fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will considerably increase.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. I will be trading the algorithm models (the six we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade for our private fund will not be disclosed.

- ROI Objective. I will be trading under the goal / target of returning 100% per month (which is near impossible, especially for the 24 month period I will be trading). 50% would be very good and 25% is my minimum goal. So at minimum I am looking for 25% ROI per month compounded over 24 months. The fund size will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others I train as we progress may continue the legacy fund thereafter in some form or another.

Reporting and Next Gen Algorithms:

New GOLD alerts Twitter feed is @GoldAlerts_CT

Oil, Gold, and Silver algorithm model updates were published last night and VIX, SPY, DXY were not. We’re hoping to have more regular rotation for VIX, SPY, DXY commencing next week.

Post market catch up posts still on to do list (we have about thirty from last quarter to post for transparency). Hopefully going forward now that we aren’t releasing any new algorithm models etc I’ll be able to get the rhythm of reporting cycle fluent / regular. It was the development / math etc of the models that took most of the energy so it should be good going forward. Between now and Christmas we’re just locking in what we have tighter and tighter so it sounds like a good plan:)

Quarterly PL’s are in process.

Master Class Charting Series Webinars:

Master Class at 2:00 PM today. Every Tues, Wed, Thur, Fri from 2 PM to 3:30 PM until complete. All members receive a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members (anyone to date as of Tuesday when it starts) receives it free.

If you are a member that has received the video series and you ask me questions in the trading room, on DM, email etc that has the answer contained in the Master Class Series I will defer you to the training videos going forward:) That actually goes for any of the published reporting FYI.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent lead trader blog / video / social posts:

Master Class Video 5 has been sent to member email inboxes. It is published as “unlisted” so please respect that.

Thursday mid day trade set-up review has also been sent to member email inboxes and is also provided as “unlisted” to members only. Please respect the link.

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Jul 20 Trade Set Up Charts $SRG, $USOIL, $AEZS, $SRPT, $AKCA, $MCRB, $AMBC, $DFFN, $SHLD and more…: http://youtu.be/KXNyBqxYq9g?a via

https://twitter.com/CompoundTrading/status/888985218346082304

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports will be out soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Morning Momentum Stocks on Watch:

Other Gaps of Note Premarket:

Short term bias toward / on watch:Oil $USOIL $WTI to upside, $DXY US Dollar to continue under pressure, Gold / Silver moderate to upside (currently long $UGLD test size). $SPY moderate and $VIX moderate – there is a general time / price cycle terminating now-ish and a serious one early to mid Sept… so I am watching closer as summer rolls on.

OTC on watch:

Recent Momentum Stocks to Watch:

Recent SEC Filings to Watch:

Some Earnings On Deck: Fri #earnings $XOM $AAL $CVX $ABBV $MRK $COL $IMGN $WFT $COG $LAD $BCS $TEN $WY $MGLN $GT $LYB $YNDX $CS $B $AAN

Recent / Current Holds, Open and Closed Trades: $FEYE (closed for nice gain), $SRG (closed for nice gain), $NFLX (closed for huge gain), $IPXL (closed for gain), $AKCA (closed nice gain), $MCRB (closed small gain), $WMT (closed excellent gains), $UUP (closed small loss), $BWA (closed tiny loss), Holding: $UGLD. All other holds are small size (less than 5% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (all not including select swing trading or algorithm charting trades).

Nice. $UGLD 3x Gold ETN up 2.56% yesterday #swingtrading pic.twitter.com/pseULq4Uy0

— Melonopoly (@curtmelonopoly) July 27, 2017

$HIIQ closed yesterday 28.95 from 23.90 long.

$HIIQ closed yesterday 28.95 from 23.90 long. pic.twitter.com/XlfyMJNnoq

— Melonopoly (@curtmelonopoly) July 27, 2017

$IPXL closed yesterday 19.30 from 18.87.

$IPXL closed yesterday 19.30 from 18.87. pic.twitter.com/2o2n3sU6on

— Melonopoly (@curtmelonopoly) July 27, 2017

$WMT closed yesterday 78.76 from 74.81.

$WMT closed yesterday 78.76 from 74.81. pic.twitter.com/BX1U2eu1tv

— Melonopoly (@curtmelonopoly) July 27, 2017

$AKCA closed yesterday 14.53 from 12.53 entry.

$AKCA closed yesterday 14.53 from 12.53 entry. pic.twitter.com/H1QC04yuOj

— Melonopoly (@curtmelonopoly) July 27, 2017

$MCRB Opened long 14.00 closed 14.16 didn’t act right #swingtrading

$MCRB Opened long 14.00 closed 14.16 didn't act right #swingtrading pic.twitter.com/LyaUZKruBB

— Melonopoly (@curtmelonopoly) July 25, 2017

$AAOI That was a nice $3000.00 win – again decent ROI. 9 days to ER and it’s scraping the ceiling again! wow! trading 95.63 #swingtrading

$AAOI That was a nice $3000.00 win – again decent ROI. 9 days to ER and it's scraping the ceiling again! wow! trading 95.63 #swingtrading pic.twitter.com/92vIa2Ghtv

— Melonopoly (@curtmelonopoly) July 25, 2017

$SPWR Open 10.52 closed 11.30 1000 for $800.00. Nice ROI. Trading 11.06 with ER in 7 days and in the bowl. #swingtrading

$SPWR Open 10.52 closed 11.30 1000 for $800.00. Nice ROI. Trading 11.06 with ER in 7 days and in the bowl. #swingtrading pic.twitter.com/aigmPr1MBC

— Melonopoly (@curtmelonopoly) July 25, 2017

$SRG Swing trade went well. 46.06 entry 1000 closed 49.94 and 48.18 from 46.06 (error in other alert) for near $3000.00 gain. #swingtrading

$SRG Swing trade went well. 46.06 entry 1000 closed 49.94 and 48.18 from 46.06 (error in other alert) for near $3000.00 gain. #swingtrading pic.twitter.com/eTWGovCHXq

— Melonopoly (@curtmelonopoly) July 25, 2017

$NFLX NetFlix 159.35 entry closed 188.40 200 for near $6000.00 gain. Trading 187.91 and may go again here. Watching. #swingtrading

https://twitter.com/curtmelonopoly/status/889719084568465408

$FEYE closed 15.76 fr 14.40 entry up $650.00 on 500. ER in 7 days and scraping a break-out level. #swingtrading

$FEYE closed 15.76 fr 14.40 entry up $650.00 on 500. ER in 7 days and scraping a break-out level. #swingtrading pic.twitter.com/UtiUvv3ObF

— Melonopoly (@curtmelonopoly) July 25, 2017

Down about 400.00 on that swing trade test of $DXY support area in $UUP. We’ll see how it handles next support. #swingtrading

Down about 400.00 on that swing trade test of $DXY support area in $UUP. We'll see how it handles next support. #swingtrading pic.twitter.com/ON1QWKFr0W

— Melonopoly (@curtmelonopoly) July 25, 2017

Recent Chart Set-ups on Watch: $PDLI, $DVAX, $GNC, $MBRX, $LPSN, $ESPR, $SENS, $R, $SNAP and others. See mid day reviews on You Tube (member only on email also FYI).

Also below $FSLR up on earnings (one we’ve been watching), $KOOL up premarket (another on our watchlist) and $COTY is setting up on 200 MA move.

We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day. Many of the mid day reviews are published “private” for members only so be sure to watch your email inbox for these among other member only videos.

$FSLR premarket up 9% on earnings. Been way ahead of this move since it started and just haven’t executed it. Congrats longs.

$FSLR First Solar beats Street 2Q forecasts https://finance.yahoo.com/news/first-solar-beats-street-2q-202556387.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

$KOOL premarket up 20% on new patent issuance.

$KOOL Cesca Therapeutics Announces Issuance of New Cellular Processing Patent CAR-T Cell Manufacturing https://finance.yahoo.com/news/cesca-therapeutics-announces-issuance-cellular-110000374.html?.tsrc=rss

$COTY Nice move off its 200 MA #tradingprocess

$COTY Nice move off its 200 MA #tradingprocess pic.twitter.com/uOifc35kba

— Melonopoly (@curtmelonopoly) July 25, 2017

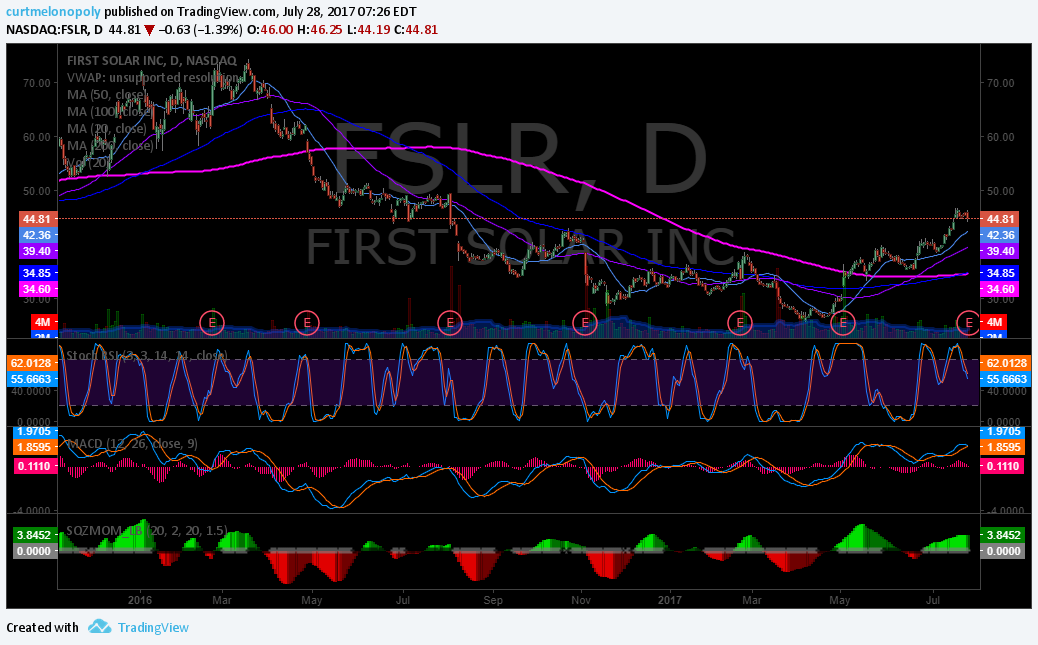

$CCJ I will look at if it gets up over 100 MA on weekly and proves itself in bowl on daily. #tradingprocess

$CCJ I will look at if it gets up over 100 MA on weekly and proves itself in bowl on daily. #tradingprocess #premarket #swingtrading pic.twitter.com/GqUrUXez5E

— Melonopoly (@curtmelonopoly) July 28, 2017

Market Outlook:

Earnings season.

Fri #earnings $XOM $AAL $CVX $ABBV $MRK $COL $IMGN $WFT $COG $LAD $BCS $TEN $WY $MGLN $GT $LYB $YNDX $CS $B $AAN https://t.co/lObOE0uRjZ pic.twitter.com/j2kENP3ruc

— Earnings Whispers (@eWhispers) July 27, 2017

Market News and Social Bits From Around the Internet:

8:30am

-GDP Q2

-Employment Cost Index

10am

Consumer Sentiment

1pm

Baker-Hughes Rig Count

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $KOOL 20%, $FSLR 8%, $LOGM $IMGN $CVRS $TVIX $UVXY $BIDU $LABD $VXX $DEO $SQQQ $CS $STM $TZA $DB $RACE $SAN $LOGI I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Recent Upgrades: $VFC $ALGN $MKC $SJM $COP $SJW $DPZ $LOGM $HA $XL $SEAS $ALXN as time allows I will update before market open or refer to chat room notices.

(6) Recent Downgrades: $DB $ZBH $JCI $X $VC $QEP $PLT $FLO $SAVE $ECHO $SBUX $TOO $BOJA $TTMI $MSFG $CASH $RNR $HP $OAK $THRM $EGHT $PDFS $OZRK $SBUX as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $FSLR, $KOOL, $COTY, $CCJ, $USOIL, $WTI, $GLD, $GDX, $SPY, $DXY – $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Premarket, Watchlist, Stocks, Trading, Plan, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY