Compound Trading Tuesday April 11, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading and Live Stock Alerts. $PLUG, $ETRM, $DWT, $XIV, $USOIL, $WTIC, $AMZN, $GLD, $GDX – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Most recent lead trader blogpost: When You Learn It – You Are Free (Part 1 of Freedom Traders). My Stock Trading Story.

https://twitter.com/CompoundTrading/status/848681468125745153

Trade risk management psychology and mechanics is a discipline itself. I am convinced a small study library could be filled on the topic.

— Melonopoly (@curtmelonopoly) April 1, 2017

If you missed it, here is the Previous Day Stock Trading Results:

https://twitter.com/CompoundTrading/status/851716882709319680

Today’s Premarket Trading Plan – Watchlist can be found here:

https://twitter.com/CompoundTrading/status/851778312422785024

Most recent Simple Swing Trade Charting

Most recent Swing Trading Newsletter:

https://twitter.com/CompoundTrading/status/851408768357335041

Review of Markets, Chat Room, Algorithm Charting, Trades and Alerts:

Nice to get positive feedback:) Keeps one motivated. Click for recent Compound Trading Testimonials.

Learning so much from this group of helpful, humble traders. https://t.co/Zb6su53JUH

— Leanne (@CampingHiking1) April 12, 2017

Premarket watch-list for me was all about:

Protected: PreMarket Trading Plan Tues Apr 11 $SALE, $TNXP, $STRM: $SPXS – $SPY, $DUST – $GLD, $GDX, $DWT –…

$TSLA Tesla up premarket .2% after strong day yesterday. #bull pic.twitter.com/l7oLW2Jfqd

— Melonopoly (@curtmelonopoly) April 11, 2017

In play today in chat room and on markets:

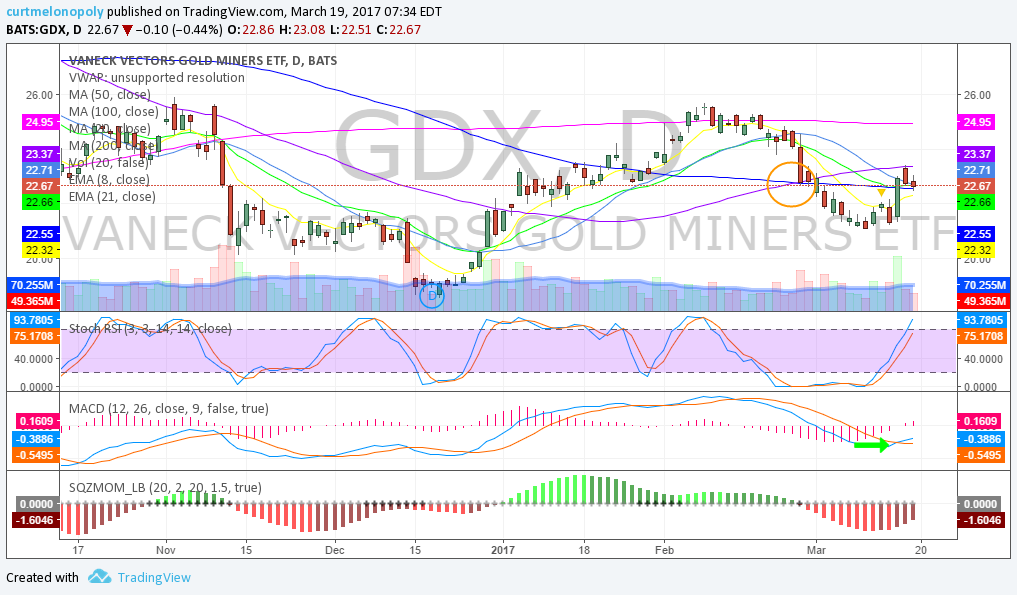

$PLUG, $ETRM, $DWT, $XIV, $USOIL, $WTIC, $GLD, $GDX

I closed my $PLUG overnight swing that worked well, took a small papervut on $ETRM, had a mid afternoon $XIV trade go well and entered $DWT long 1/5 sizing based on @epicthealgo signals. Over noon hour we reviewed a number of charts such as Gold, Miner’s, Oil and various equities.

$PLUG decent 5000 add on 5000 long entry from yesterday and scalped and out at open.

— Melonopoly (@curtmelonopoly) April 11, 2017

Momentum plays on the day –

$PLUG DIdn’t get intra-day top, but a scalp off overnight hold nonetheless. $PLUG trade video below.

$PLUG DIdn't get intra-day top, but a scalp off overnight hold nonetheless https://t.co/ObnJSlCuiA

— Melonopoly (@curtmelonopoly) April 11, 2017

Got my daily papercut. … $ETRM the b@stard lol.

Got my daily papercut. … $ETRM the b@stard lol.

— Melonopoly (@curtmelonopoly) April 11, 2017

Long $XIV 64.495 for a tester 1/4 size

Long $XIV 64.495 for a tester 1/4 size

— Melonopoly (@curtmelonopoly) April 11, 2017

$XIV out https://t.co/ScY4xuDCZE

— Melonopoly (@curtmelonopoly) April 11, 2017

Trading Lessons, How-to and Educational:

#Intraday and #SwingTrading Chart Review: $PLUG $XIV $USOIL $DWT $XRT $JUNO $BOFI $URRE $GREK #GOLD $GLD $GDX

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size to micro sizing) – $DUST, $DWT, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

Unavailable because this report is process late.

Market Outlook:

Why #Fed's plan to shrink the balance sheet could trigger a global bond crash. https://t.co/mHPRM1z9Mo pic.twitter.com/jIIDvheq8r

— Holger Zschaepitz (@Schuldensuehner) April 10, 2017

Fed. Unwinding 4.5 YUGE Ts #trillion What a tribe. https://t.co/nvyGQ40kKb

— Melonopoly (@curtmelonopoly) April 6, 2017

We have been warning folks (as a result of algorithm anomalies picked up) for sometime about significant resistance not far above in Oil and SPY so it will be interesting to see if we get through it. Here’s just some of the posts. The oil resistance cluster is much larger than the one identified on $SPY.

We notified members in most recent trading range over last week that our algorithm identified a divergence and to expect an interimn top.

— Freedom $SPY Algo (@FREEDOMtheAlgo) March 21, 2017

To be clear, our algorithm @FREEDOMtheAlgo alerted a $SPY anomaly recently. Which has us cautious until recent high taken out and confirmed.

— Melonopoly (@curtmelonopoly) April 3, 2017

I wouldn't get too excited long $SPY $ES_F $USOIL $WTI etc. until most recent highs are taken out and confirmed.

— Melonopoly (@curtmelonopoly) March 30, 2017

7 of… A break to upside of $SPY $WTI algo resistance would signal what can only be described as "unnatural" I suppose…

— Melonopoly (@curtmelonopoly) March 19, 2017

Algorithmic Chart Model Trading / News:

Target hit exact time and price called Sunday – hit Tuesday 430 PM dead center! Apr 11 FX $USOIL $WTIC $CL_F $USO $UCO $SCO $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/852365451245965312

I have come to respect algorithmic chart modeling like a deep sea fishing vessel respects a weather forecast. #trading #charts #signals

I have come to respect algorithmic chart modeling like a deep sea fishing vessel respects a weather forecast. #trading #charts #signals

— Melonopoly (@curtmelonopoly) April 8, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

$AMZN Amazon swing trade going well. In 822.00 area trading 896.00.

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

NA

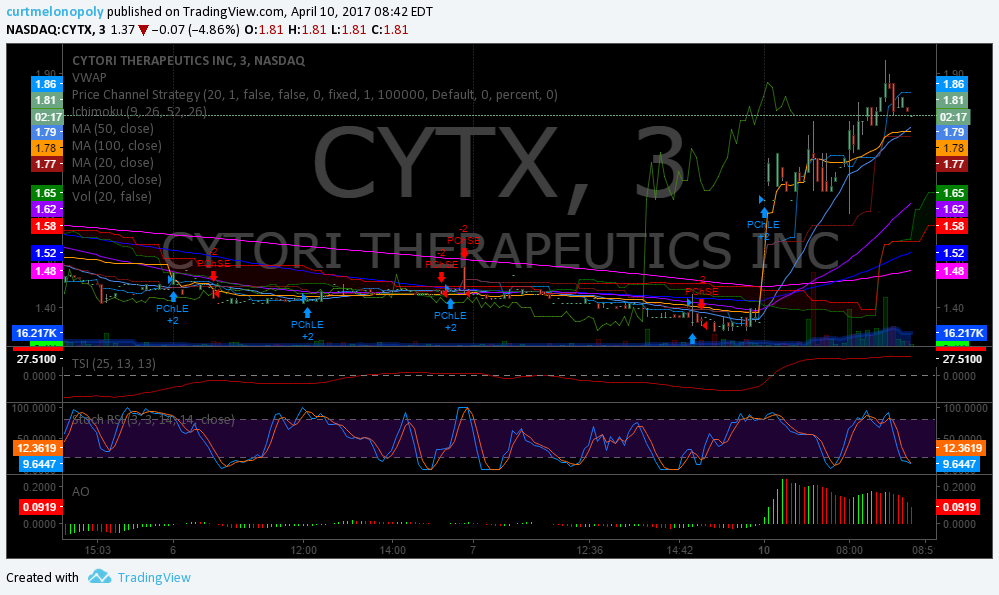

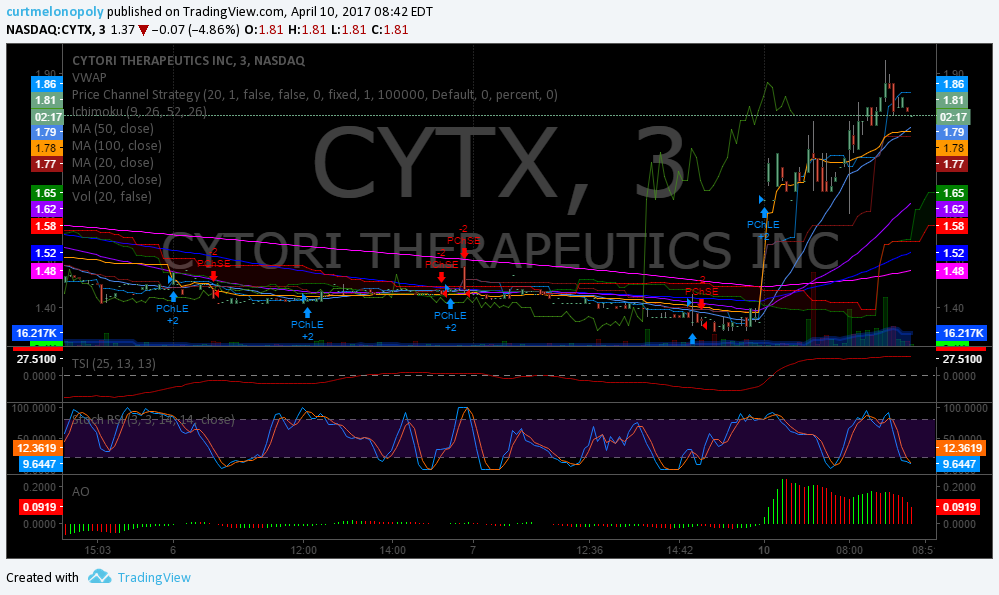

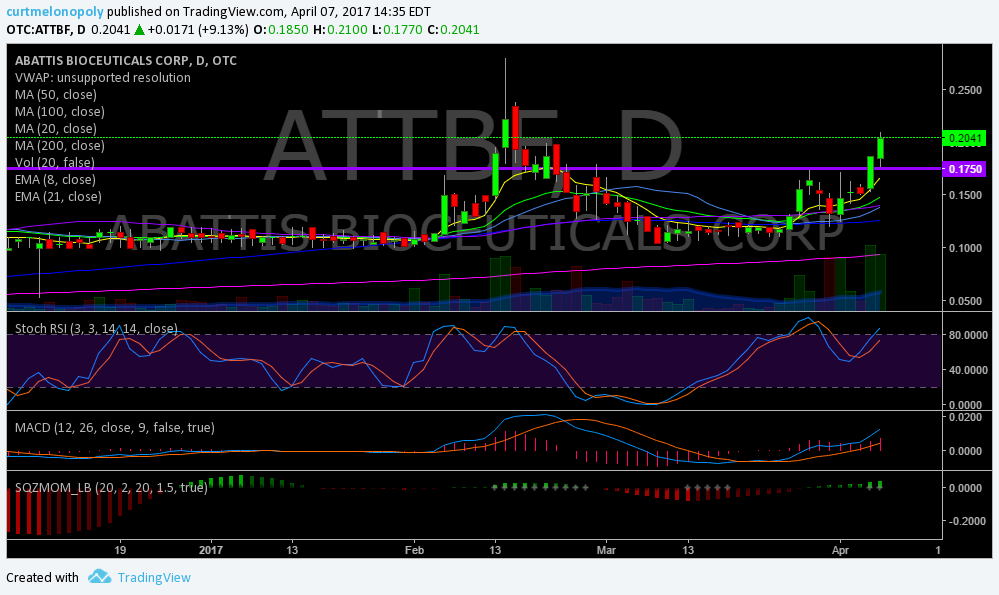

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

{40 year} Gold Seasonality Chart. #Gold $GLD $SLV $GDX $GDXJ $NUGT $DUST #Silver https://t.co/bJnAoWCHPS

— Melonopoly (@curtmelonopoly) April 2, 2017

Silver $SLV:

NA

Crude Oil $USOIL $WTI:

#Oil Watch: Brent (chart) and WTI have nearly recovered to the post #OPEC deal price range of Dec-Feb — #OOTT #shale

#Oil Watch: Brent (chart) and WTI have nearly recovered to the post #OPEC deal price range of Dec-Feb — #OOTT #shale pic.twitter.com/V7HjtUbq0r

— Javier Blas (@JavierBlas) April 10, 2017

Volatility $VIX:

NA

$SPY S&P 500:

See warnings above.

$NG_F Natural Gas:

NA

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix.

Curt M: Protected: PreMarket Trading Plan Tues Apr 11 $SALE, $TNXP, $STRM: $SPXS – $SPY, $DUST – $GLD, $GDX, $DWT – $USOIL, $WTICLINK: https://compoundtrading.com/premarket-trading-plan-tues-apr-11-sale-tnxp-strm-spxs-spy-dust-gld-gdx-dwt-usoil-wtic/PASSWORD: PREMARK041117Trading room link – come visit us! https://compoundtrading.clickmeeting.com/livetrading

Curt M: $NADL under debt restructring – no holding

Linda: lol no bag holding?

Curt M: On mic for open in 1 min>>>>>>>>>>>>>>

Curt M: $NASL, $TNXP for open

Curt M: Shippers on watch baltic is up 2.5%

Sartaj: Recording

Hedgehog Trader: hi all

Hedgehog Trader: yow NADL

Curt M: hey

Flash G: $TSLA a star

Curt M: Long 2.61 5000 shares add to yesterday 5000 shares

Curt M: $PLUG

Hedgehog Trader: fellow fuel cell stock which I mentioned $FCEL is smoking

lenny: Watching $PYDS

Flash G: Tillerson landed

Sammy T: $XENO tanking

Curt M: $GDXJ flagging off its pivot – test time

Curt M: Closed 10000 2.582 for a win from yesterday and today’s entry

Curt M: 5.3 cents win on 10000 shares

Sammy T: $GPRO b/o

Sartaj: Off mic, Curt, or still some left for openings?

Curt M: Off for now yes thanks

MarketMaven: $SPX 50 ema test around the corner

Hedgehog Trader: Curt

Hedgehog Trader: $VAPE watch

Hedgehog Trader: 50dma getting closer

Hedgehog Trader: to 200dma

MarketMaven: Gold has power

lenny: $HEB CEO 200000 insider buy

Curt M: Shoulda gave $PLUG some more room

Optionsavvy: how do I turn volume off ?

Curt M: Good question I’ll ask Sartaj

lenny: what volume? the ding?

Optionsavvy: no all volume. I need to listen to a conference call and want to mute this screen while I am on call

lenny: oh

Sartaj: You might have to leave the conference

Sartaj: This one, I mean

lenny: lol

Sartaj: Unless you’re on Google chrome

Sartaj: then you can mute individual tabs

Optionsavvy: yes I am

Sartaj: You ought to be able to find the volume settings for individual tabs in your Volume button in the system tray, or try right clicking on the ClickMeeting window right at the top, and see if any volume settings come up

Sartaj: There’s no obvious way for users to mute the presenter, unfortunately

Curt M: Oil respecting resistance so far – could be a good short lining up

Yetty: sweeeet ccall on $PLUG I nailed it off your buy yesteday just sold thanks

Optionsavvy: ok thanks anyway Sartaj

Optionsavvy: I’ll be back in a bit

Curt M: peace

Sartaj: No problem. Let me know over Twitter DM if there’s no space here

Sartaj: and we can make some room

MarketMaven: $IWM green

Flash G: Breasth is positive too

Flash G: Breadth

Tradergirl: hey all, no volume/mute or is it just me?

bob: Curt isn’t on mic right now

Tradergirl: ok, thank you bob

bob: so not just you lol

bob: np

Tradergirl: lol

Curt M: curts tired lol

Curt M: hey tradergirl and bob whats hot?

bob: you know, losing my mind over staring at candles all day. the usual lol 🙂

Curt M: ha

Curt M: I have dry powder and pent up mojo lol loooking for one just one outta the park this week

Hedgehog Trader: $NAK still coiled

Sammy T: we’ll get one

Sammy T: There’ll be a good halt intra day yet this week

Flash G: $SPY 50 MA broke

Hedgehog Trader: AIQ halted

Sammy T: $LEDS r/g

Flash G: $VIX a record…. since election

frank: $XIV should be good soon Curt

Flash G: $SPX $SPY under last week lows

Sammy T: Silver reverse on 4 hr testing mid BB – likely fails IMO

Curt M: $ETRM long 6.275 2000

Curt M: tight stop

Curt M: On mic >>>>>>>>>>>>>>>>>>>>>>

Curt M: Add over 6.40 or failure VWAP tight stop

Curt M: Stopped $ETRM 6.19 2000 shares

Curt M: Long $DWT 23.676 500

Curt M: On mic >>>>>>>>>>>>>>>>>>>>>>

Curt M: Off mic >>>>>>>>>>>>>>>>>>>>>

Curt M: Long $DWT position is 500 at 1/5 sizing will consider another 4 entries at each upside resistance

Curt M: My fills just came in less but we’l leave it where it is for the log – chippy entries

optionsavvy: back

optionsavvy: DOW breaking mid term supp here. next tgt is a major at 20427.60 on the DJI

MarketMaven: hey ssavvy

optionsavvy: GM maven

Flash G: $USDJPY on 200 Day

optionsavvy: I’d paste a chart if I could 🙂

Flash G: we all getting chart power over next couple days – was talking to curt about it

Flash G: Post it on your Twitter

Flash G: then put the twitter link to your tweet in here

optionsavvy: see red circles for supp https://twitter.com/Optionsavvy/status/851812424873279492

optionsavvy: IWM stronger on intraday relative basis that will be my long

optionsavvy: yep bounce playing out. I missed my buy

Curt M: Lol – sometimes I feel very slowwwwww with compouters

Flash G: Watching $IWM lpay today also

optionsavvy: brb

Curt M: Off mic >>>>>>>>>>>>>>>>>>>>>>>>>>>>

Hedgehog Trader: nanocap $ICLD looks to be setting up

Hedgehog Trader: what ya think Curt?

Curt M: $ICLD?

mezi: I like it lol

lenny: I am in it

Hedgehog Trader: nice

Curt M: $FIT new smartwatch delayed due to production issues. #yahoo

lenny: dull day

lenny: homework day

Curt M: On mic re XIV trade >>>>>>>>>>>>>>>

Curt M: Out $XIV 64.93 looking for re-entry later off mic >>>>>>>>>

Curt M: Small win

Sartaj: Reminder that we actually do have this: https://compoundtrading.com/partner-programs/

Hedgehog Trader: wonder if $NAK is gonna run

Sartaj: Be back in a bit

Sartaj: Back

Curt M: $NADL halt

Curt M: tank

Curt M: Oil’s closing…. down from here lol

Sartaj: Yes

Hedgehog Trader: speaking of Tank $TNK chart looking interesting

Sartaj: EPIC is… EPIC

Curt M: lol

Hedgehog Trader: $SINO even better

Hedgehog Trader: https://twitter.com/HedgehogTrader/status/851865391840321538

Hedgehog Trader: my SINO chart

Curt M: Nice chart $SINO

Curt M: $X looks really juicy

Curt M: Here;s the live $X chart with indicators mentioned https://www.tradingview.com/chart/X/2Eq99WSf-X-up-3-has-21-ema-MACD-cross-SQZMOM-about-to-turn-green-Stoch/

MarketMaven: POWER HOUR

Hedgehog Trader: GDX moving closer to 24.71 200 dma

Hedgehog Trader: nice i got a million retweets on SINO

Hedgehog Trader: but it looks sweet

Curt M: nice

Hedgehog Trader: one of the stronger shippers for some time

Curt M: I will have to concede to the Gold long soon – a few days yet

Hedgehog Trader: ashes to ashes, $DUST to $DUST

Flash G: It’s the battle zone here for Gold and Oil

Curt M: not quite dust yet

Curt M: odds are against dust tho thats for sure

Hedgehog Trader: miners seasonal trend is up from mid-march to early June

Curt M: Can you not unblock people on Stocktwits lol?

lenny: Never tried

Sartaj: I’ll check

Sartaj: Yes, it is

Sartaj: https://www.stocktwits.com/settings/blocked

Curt M: thanks

Curt M: That should be about it for Gold for the day

Hedgehog Trader: $URRE looks perky again

Hedgehog Trader: bit of a pause/doji day

Hedgehog Trader: looks like it could resume soon though

Curt M: $DRYS reverse split

Curt M: $URRE should get serious lift soon

Hedgehog Trader: yes

Curt M: Gold gold gold

Hedgehog Trader: $CEF which holds physical gold and silver is trading at a 6.7% discount to NAV

Hedgehog Trader: kind of a longer term idea

Curt M: If Trump gets on to this North Korea thing any more seriously then metals going nuts now lol

Curt M: Could happen any second imo

Hedgehog Trader: you mean any Tweet now

Curt M: Trump is a NFA kind of guy

Curt M: lol

Curt M: funny when u think about it

Hedgehog Trader: guys i’m hitting THE BUTTON #MAGA

mezi: LMFAO

Curt M: $TVIX swing over night?

Flash G: NO

Flash G: Garbage.

Curt M: True but….

Curt M: Bears shouldn’t go anywhere near $WIX imo

Sartaj: DoD Rep. is giving a press conference on missile strike

Curt M: N korea? or Syria?

Sartaj: Syria

Curt M: They couldn’t have waited 20 mins lol

Hedgehog Trader: full moon

Curt M: hahaha

Curt M: They’re gonna pump the cr@p outta SPY right now

Hedgehog Trader: with full moon over, i do think miners will rally tomorrow

Hedgehog Trader: $ABX looks good, plus lots of insider support/buys

Curt M: i hope not

Curt M: lol

Curt M: but u can’t win em all

Hedgehog Trader: for sure

Curt M: $TVIX HOD! Buy buy !

Curt M: nah

Hedgehog Trader: VIX is like whack a mole, come out your hole

mezi: You guys have been on with your calls. No need to gamble.

MarketMaven: Slow and steady

deb: tomorrow should be good

deb: for picking up bargains for swings in to next week

Flash G: Risk off environment.

lenny: As long as bombs don’t drop on NK next week very likely decent I agree

Curt M: $NADL – meet your new bagholders

Curt Melonopoly: http://oilprice.com/Latest-Energy-News/World-News/Russia-Signals-Weighing-Extension-Of-Oil-Output-Cuts.html

deb: have a good evening

Sammy T: ya see ya on flipside of the moon

Curt M: have a great night y’all!

Curt M: Thanks for the help Nicholas!

Hedgehog Trader: no prob Curt 🙂

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $PLUG, $ETRM, $DWT, $XIV, $USOIL, $WTIC, $AMZN, $GLD, $GDX – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500