Tag: $PLUG

Swing Trading Strategies, Charts, Alerts w/ Video | Premium $PXD $TLRY $TSLA $EEM $AGN $AMD $INTC $XOP $MGI $BOX $FB $PLUG $BTC $LYFT $IOTS $SQ $STNE $TEUM $AU …

Swing Trading Set-Ups, Strategies, Alerts, Charts, News. June 24, 2019.

Below are Swing Trade Set-Ups Currently On Watch (in addition to the others in recent reporting) $PXD, $TLRY, $TSLA, $EEM, $AGN, $AMD, $INTC, $XOP, $MGI, $BOX, $FB, $PLUG, $BTC, $LYFT. $IOTS, $SQ, $STNE, $TEUM, $AU, $OIH.

Live Trading Room Swing Trade Video Review From June 20, 2019 2:22 PM.

All the swing trading alerts, strategies, charts and various set-ups are reviewed in detail on the video below from the live trading room.

Crude Oil (USOIL WTI)

Near resistance (as of time of video) 57.66 uptrending trend-line above, updated signals and charting in the most recent oil report distributed to members.

PIONEER NATURAL RESOURCES (PXD)

PIONEER NATURAL RESOURCES (PXD) through first Fib resistance target closed Friday 155.21 up from 148.50 swing trade alert with 161.00 area first Fibonacci resistance over-head.

From Swing Trade Alert 8:22 AM – 20 Jun 2019 (screen capture of alert below);

PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model. #swingtrading #tradealert https://www.tradingview.com/chart/PXD/pwpvHlyt-PIONEER-NAT-RES-PXD-Long-PXD-148-50-for-160-98-price-target/ …

Swing Trade Alert Screen Capture – PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model.

TILRAY (TLRY)

TILRAY (TLRY) Nice swing trade from 46.10 for 49.03 PT 1 and thru other resistance, trading 50.45 $TLRY #swingtrade #alert

Add in to each resistance and add above on trajectory or add on pull-backs.

It doesn’t get much easier than this – trade by numbers (lines).

From Swing Trade Alert to Trim in to Resistance 10:12 AM – 20 Jun 2019;

TILRAY (TLRY) in to key resistance, trim in to it add above to next #swingtrading #alerts $TLRY https://www.tradingview.com/chart/TLRY/cPAkfJnL-TILRAY-TLRY-in-to-key-resistance-trim-in-to-it-add-above-to-n/ …

From Swing Trade Alert Original Entry 8:04 AM – 20 Jun 2019;

Long $TLRY 46.10 for 49.03 PT # 1 details on report to follow, see previous charting.

TESLA (TSLA)

TESLA (TSLA) short, trade found support and bounced, stop at entry, resistance test above, could go either way. $TSLA

This trade started off well and as a daytrade it was excellent. On the swing it is still in play but trade did bounce at support below so be sure to exit before any loss as it is on the right side still. The trade is so close to the lower end of its trading range there’s no wisdom in holding if it turns against the original entry 225.05.

From Swing Trade Alert Feed 8:00 AM – 20 Jun 2019

Short $TSLA 225.05 for 203.42 1st PT, details in report upcoming. #swingtrading

EMERGING MARKETS ETF (EEM)

EMERGING MARKETS ETF (EEM) Long term swing trade, add at bottom of channel long trim at top $EEM #swingtrade

MACD, Stochastic RSI, and Squeeze Momentum on daily time frame are all trending up.

From Swing Trade Alert Feed 8:07 AM – 20 Jun 2019 Long $EEM 43.06 with 45.50 Price target # 1, details in upcoming report

ALLERGAN (AGN)

ALLERGAN (AGN) Trading 130.75 up from 116.00 original alert, see video report from trading room for the trading strategy going forward on this one and / or follow support and resistance points on chart. $AGN #swingtrade

ALLERGAN (AGN) swing from 116.00 doing well trading 130.81, trim in to 136 area resistance add above $AGN #swingtrade #alert

From June 18 Report;

ALLERGAN (AGN) from yesterday Swing Trade Report up 4.24% today closing 120.64 trim in to 128.00 add above $AGN #swingtrade #alert

Ironwood and Allergan Report Positive Topline Data from Phase IIIb Trial of LINZESS® #swingtrading $AGN https://finance.yahoo.com/news/ironwood-allergan-report-positive-topline-200500616.html?soc_src=social-sh&soc_trk=tw https://twitter.com/swingtrading_ct/status/1141170424769896452

From June 17, 2019 Report:

ALLERGAN (AGN) After significant sell-off this looks ready for a bounce near key over sold support now $AGN #swingtrade

The area of support just below trade (see white arrow) looks to be a key area that is likely to find support and bounce. If it does bounce then I see three areas of key snap back for bullish trade. A general trajectory of trade possible in a bullish scenario is included below with 3 white arrows. We will see how trade near term is, but I like it for a bounce to at least the first price target (first white uptrending arrow).

7 Stocks Ripe for M&A as Trade War Pushes Market Off Record Highs https://www.investopedia.com/7-stocks-ripe-for-m-and-a-as-trade-war-pushes-market-off-record-highs-4689910?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

ADVANCED MICRO DEVICES (AMD)

ADVANCED MICRO (AMD) has hit every upside price target (albeit some late) load at bottom of channel for 40.00 PT in trajectory #swingtrade $AMD – Of all the plays on radar between here and election, this is in top 10% imo. Load channel support. https://www.tradingview.com/chart/AMD/ngLZ4D1C-ADVANCED-MICRO-AMD-has-hit-every-upside-price-target-albeit-s/ …

Current trade pressure down in to time cycle peak, however, I expect it to turn very bullish in to October, 2019.

INTEL CORP (INTC)

June 24 – See Video for swing trading strategy.

Per June 18 Report;

INTEL CORP (INTC) from June 14 alert up 2.69% trading 47.37 today with MACD and SQZMOM trend up, watch 200 MA above #swingtrade $INTC

Nvidia and Intel’s Mobileye Both Continue Racking Up Autonomous Driving Deals #swingtrading $INTC

S&P OIL and Gas ETF (XOP)

June 24 – S&P OIL and Gas ETF (XOP) Swing trade doing well from 25.39 alert hit 27.09 trading 26.71. Add at each pull back and run the trend until MACD on 4 hour turns down. #swingtrade #tradealert

Per June 18 Report;

S&P OIL and Gas ETF (XOP). From yesterday’s alert bounced 2.69% today, MACD confirming, model to follow for trade strategy #swingtrading $XOP

ETFs & Stocks From Top-Ranked Sector to Buy #swingtrading $XOP

S&P OIL and Gas MACD cross up with double bottom, 20% move possible here. On watch for bounce. #swingtrading $XOP

MONEYGRAM INTERNATIONAL (MGI)

June 24 – See Video for swing trading strategy.

Per previous;

MONEYGRAM INTERNATIONAL (MGI) Up 167% today, sure looks like a bottom pattern, 200 MA on weekly minimum price target in continuation scenario, on high watch for Wed premarket $MGI #swingtrade #daytrade #alert

MoneyGram Soars on $50M Investment From Blockchain Startup Ripple #swingtrading $XRP $MGI https://www.thestreet.com/investing/cryptocurrency/moneygram-soars-on-ripple-investment-14994298

BOX INC (BOX)

Per alert below this is on watch, review video for trading strategy.

BOX INC (BOX) Is revving up again for a big move, looking for a possible move to 23.00, fast $BOX #Swingtrading #tradealerts

FACEBOOK (FB)

June 24, 2019 – Review video for trading strategy in detail.

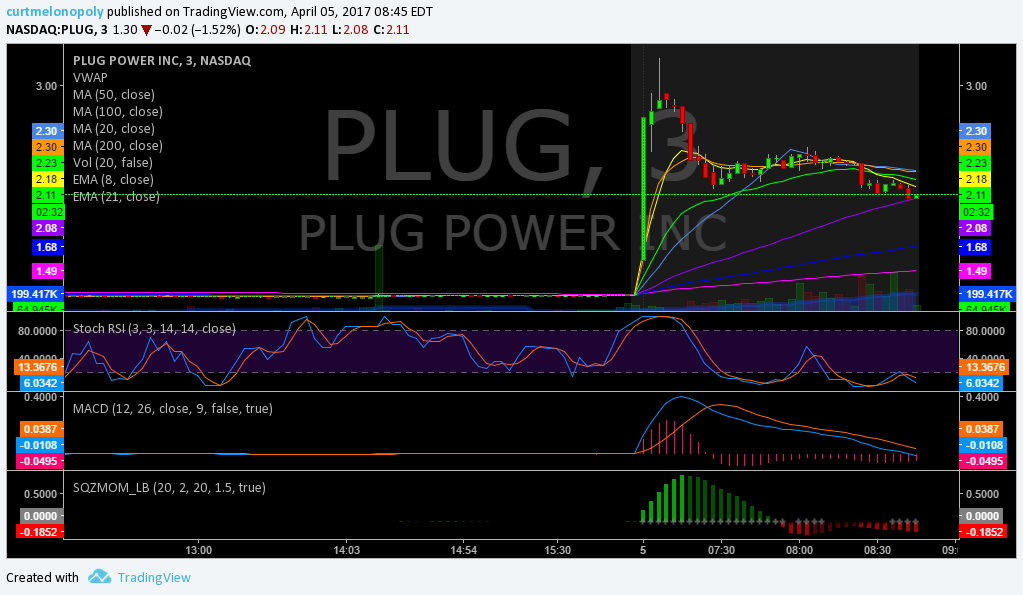

PLUG POWER (PLUG)

June 24, 2019 – Review video for trading strategy in detail.

BITCOIN (BTC)

June 24, 2019 – Review video for trading strategy in detail.

ADESTO TECHNOLOGIES (IOTS)

June 24, 2019 – Review video for trading strategy in detail.

SQUARE (SQ)

June 24, 2019 – Review video for trading strategy in detail.

STONECO (STNE)

June 24, 2019 – Review video for trading strategy in detail.

PATEUM (TEUM)

June 24, 2019 – Review video for trading strategy in detail.

ANGLO GOLD (AU)

June 24, 2019 – Review video for trading strategy in detail.

OIL SERVICE (OIH)

June 24, 2019 – Review video for trading strategy in detail.

LYFT INC (LYFT)

June 24, 2019 – Review video for trading strategy in detail.

Per une 18 report;

LYFT INC (LYFT) bullish chart trading 64.40 targets 75.44 Jul 5 with 68.82 resistance (trading box) #swingtrading $LYFT

Disney resorts get a Lyft with rideshare partnership #swingtrading $LYFT $DIS https://www.bizjournals.com/losangeles/news/2019/06/18/disney-resorts-get-a-lyft-with-rideshare.html

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing Trading, Set Ups, Strategies, Alert, Signals, $PXD, $TLRY, $TSLA, $EEM, $AGN, $AMD, $INTC, $XOP, $MGI, $BOX, $FB, $PLUG, $BTC, $LYFT. $IOTS, $SQ, $STNE, $AU. $OIH, $WTI, $USOIL #Oil

Swing Trading Set – Ups | Premium | TEUM, PLUG, SQ, FB, GOOGL

Swing Trade Set-Ups to Watch.

A Group of Swing Trade Set-ups for your Trading Strategy this Week.

I have no idea if this next time cycle is going to be bullish or bearish, so lets consider either and trade them up or down until we know.

Trade # 1

ALPHABET (GOOGL) trading 1068.37, over 1167.00 sees 1250.00, under 1040 sees 945.00 $GOOGL #swingtrading

I have been saying for some time that Google, Facebook and Twitter would come under pressure, and here it is. I always traded support long on Google and Facebook until about six months ago, now you want to focus on resistance to short side imo.

Either way you trade it I’ve marked your most important decisions.If it trades any higher than 1160.00 I think you need a really good reason to stay long, or at least have solid tight stops in place.

Watching for a resistance trade to short.

Trade # 2

FACEBOOK (FB) Trading 173.35, over 174 sees 189.00, under 161.00 sees 146.00 $FB #swingtrade

Facebook seems to be spinning a better catalyst story than Google for now, so it has more short term reason to rise in price. I still don’t like it longer term so I am looking for a resistance area to short. The chart below is a guide.

Trade # 3

TWITTER (TWTR) trading 37.93, over 45.50 sees 52.00, under 33.00 sees 25.00 #swingtrading $TWTR

Same with Twitter, I don’t think it is going to do well over the next 5 or 6 years, or better said, I think the down side risks are significant, so I’m looking for resistance to short.

Trade # 4

Square (SQ)

SQUARE is on the move again, one of the top watches on Monday. I am extremely bullish on square to possible 90’s, trade the green arrows up. $SQ #swingtrade #tradealerts https://www.tradingview.com/chart/SQ/dMaElx3w-SQUARE-SQ-I-am-extremely-bullish-on-square-to-possible-90-s-t/

Why Square Stock Is Worth at Least $80 After Raising Guidance https://finance.yahoo.com/news/why-square-stock-worth-least-120815807.html?soc_src=social-sh&soc_trk=tw #swingtrading $SQ

Trade # 5

PLUG POWER (PLUG) Price target 3.48 early October 2019 if price gets bullish between now and then. On watch. #swingtrade

This is a symmetry trade, if I can lock in a turn up in momentum (it likely pulls back first) then I will trade it to the extension to upside as noted on chart.

Trade # 6

PARTEUM CORP (TEUM) Risk reward in this channel extremely high for at least a double, tight stops n go $TEUM #swingtrade

The risk reward in this trade set up is hard to ignore, TEUM is a top watch Monday morning. Use caution, stops and simple discipline in sizing and the risk reward set up here is unusually high for a trade higher.

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; SQ, TEUM, PLUG, FB, GOOGL, TWTR, Swing Trading, Set Ups, Strategies

Post-Market Tues Apr 11 $PLUG, $ETRM, $DWT, $XIV, $USOIL, $WTIC, $AMZN, $GLD, $GDX

Compound Trading Tuesday April 11, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading and Live Stock Alerts. $PLUG, $ETRM, $DWT, $XIV, $USOIL, $WTIC, $AMZN, $GLD, $GDX – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Most recent lead trader blogpost: When You Learn It – You Are Free (Part 1 of Freedom Traders). My Stock Trading Story.

https://twitter.com/CompoundTrading/status/848681468125745153

Trade risk management psychology and mechanics is a discipline itself. I am convinced a small study library could be filled on the topic.

— Melonopoly (@curtmelonopoly) April 1, 2017

If you missed it, here is the Previous Day Stock Trading Results:

https://twitter.com/CompoundTrading/status/851716882709319680

Today’s Premarket Trading Plan – Watchlist can be found here:

https://twitter.com/CompoundTrading/status/851778312422785024

Most recent Simple Swing Trade Charting

Most recent Swing Trading Newsletter:

https://twitter.com/CompoundTrading/status/851408768357335041

Review of Markets, Chat Room, Algorithm Charting, Trades and Alerts:

Nice to get positive feedback:) Keeps one motivated. Click for recent Compound Trading Testimonials.

Learning so much from this group of helpful, humble traders. https://t.co/Zb6su53JUH

— Leanne (@CampingHiking1) April 12, 2017

Premarket watch-list for me was all about:

Protected: PreMarket Trading Plan Tues Apr 11 $SALE, $TNXP, $STRM: $SPXS – $SPY, $DUST – $GLD, $GDX, $DWT –…

$TSLA Tesla up premarket .2% after strong day yesterday. #bull pic.twitter.com/l7oLW2Jfqd

— Melonopoly (@curtmelonopoly) April 11, 2017

In play today in chat room and on markets:

$PLUG, $ETRM, $DWT, $XIV, $USOIL, $WTIC, $GLD, $GDX

I closed my $PLUG overnight swing that worked well, took a small papervut on $ETRM, had a mid afternoon $XIV trade go well and entered $DWT long 1/5 sizing based on @epicthealgo signals. Over noon hour we reviewed a number of charts such as Gold, Miner’s, Oil and various equities.

$PLUG decent 5000 add on 5000 long entry from yesterday and scalped and out at open.

— Melonopoly (@curtmelonopoly) April 11, 2017

Momentum plays on the day –

$PLUG DIdn’t get intra-day top, but a scalp off overnight hold nonetheless. $PLUG trade video below.

$PLUG DIdn't get intra-day top, but a scalp off overnight hold nonetheless https://t.co/ObnJSlCuiA

— Melonopoly (@curtmelonopoly) April 11, 2017

Got my daily papercut. … $ETRM the b@stard lol.

Got my daily papercut. … $ETRM the b@stard lol.

— Melonopoly (@curtmelonopoly) April 11, 2017

Long $XIV 64.495 for a tester 1/4 size

Long $XIV 64.495 for a tester 1/4 size

— Melonopoly (@curtmelonopoly) April 11, 2017

$XIV out https://t.co/ScY4xuDCZE

— Melonopoly (@curtmelonopoly) April 11, 2017

Trading Lessons, How-to and Educational:

#Intraday and #SwingTrading Chart Review: $PLUG $XIV $USOIL $DWT $XRT $JUNO $BOFI $URRE $GREK #GOLD $GLD $GDX

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size to micro sizing) – $DUST, $DWT, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

Unavailable because this report is process late.

Market Outlook:

Why #Fed's plan to shrink the balance sheet could trigger a global bond crash. https://t.co/mHPRM1z9Mo pic.twitter.com/jIIDvheq8r

— Holger Zschaepitz (@Schuldensuehner) April 10, 2017

Fed. Unwinding 4.5 YUGE Ts #trillion What a tribe. https://t.co/nvyGQ40kKb

— Melonopoly (@curtmelonopoly) April 6, 2017

We have been warning folks (as a result of algorithm anomalies picked up) for sometime about significant resistance not far above in Oil and SPY so it will be interesting to see if we get through it. Here’s just some of the posts. The oil resistance cluster is much larger than the one identified on $SPY.

We notified members in most recent trading range over last week that our algorithm identified a divergence and to expect an interimn top.

— Freedom $SPY Algo (@FREEDOMtheAlgo) March 21, 2017

To be clear, our algorithm @FREEDOMtheAlgo alerted a $SPY anomaly recently. Which has us cautious until recent high taken out and confirmed.

— Melonopoly (@curtmelonopoly) April 3, 2017

I wouldn't get too excited long $SPY $ES_F $USOIL $WTI etc. until most recent highs are taken out and confirmed.

— Melonopoly (@curtmelonopoly) March 30, 2017

7 of… A break to upside of $SPY $WTI algo resistance would signal what can only be described as "unnatural" I suppose…

— Melonopoly (@curtmelonopoly) March 19, 2017

Algorithmic Chart Model Trading / News:

Target hit exact time and price called Sunday – hit Tuesday 430 PM dead center! Apr 11 FX $USOIL $WTIC $CL_F $USO $UCO $SCO $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/852365451245965312

I have come to respect algorithmic chart modeling like a deep sea fishing vessel respects a weather forecast. #trading #charts #signals

I have come to respect algorithmic chart modeling like a deep sea fishing vessel respects a weather forecast. #trading #charts #signals

— Melonopoly (@curtmelonopoly) April 8, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

$AMZN Amazon swing trade going well. In 822.00 area trading 896.00.

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

NA

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

{40 year} Gold Seasonality Chart. #Gold $GLD $SLV $GDX $GDXJ $NUGT $DUST #Silver https://t.co/bJnAoWCHPS

— Melonopoly (@curtmelonopoly) April 2, 2017

Silver $SLV:

NA

Crude Oil $USOIL $WTI:

#Oil Watch: Brent (chart) and WTI have nearly recovered to the post #OPEC deal price range of Dec-Feb — #OOTT #shale

#Oil Watch: Brent (chart) and WTI have nearly recovered to the post #OPEC deal price range of Dec-Feb — #OOTT #shale pic.twitter.com/V7HjtUbq0r

— Javier Blas (@JavierBlas) April 10, 2017

Volatility $VIX:

NA

$SPY S&P 500:

See warnings above.

$NG_F Natural Gas:

NA

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix.

Curt M: Protected: PreMarket Trading Plan Tues Apr 11 $SALE, $TNXP, $STRM: $SPXS – $SPY, $DUST – $GLD, $GDX, $DWT – $USOIL, $WTICLINK: https://compoundtrading.com/premarket-trading-plan-tues-apr-11-sale-tnxp-strm-spxs-spy-dust-gld-gdx-dwt-usoil-wtic/PASSWORD: PREMARK041117Trading room link – come visit us! https://compoundtrading.clickmeeting.com/livetrading

Curt M: $NADL under debt restructring – no holding

Linda: lol no bag holding?

Curt M: On mic for open in 1 min>>>>>>>>>>>>>>

Curt M: $NASL, $TNXP for open

Curt M: Shippers on watch baltic is up 2.5%

Sartaj: Recording

Hedgehog Trader: hi all

Hedgehog Trader: yow NADL

Curt M: hey

Flash G: $TSLA a star

Curt M: Long 2.61 5000 shares add to yesterday 5000 shares

Curt M: $PLUG

Hedgehog Trader: fellow fuel cell stock which I mentioned $FCEL is smoking

lenny: Watching $PYDS

Flash G: Tillerson landed

Sammy T: $XENO tanking

Curt M: $GDXJ flagging off its pivot – test time

Curt M: Closed 10000 2.582 for a win from yesterday and today’s entry

Curt M: 5.3 cents win on 10000 shares

Sammy T: $GPRO b/o

Sartaj: Off mic, Curt, or still some left for openings?

Curt M: Off for now yes thanks

MarketMaven: $SPX 50 ema test around the corner

Hedgehog Trader: Curt

Hedgehog Trader: $VAPE watch

Hedgehog Trader: 50dma getting closer

Hedgehog Trader: to 200dma

MarketMaven: Gold has power

lenny: $HEB CEO 200000 insider buy

Curt M: Shoulda gave $PLUG some more room

Optionsavvy: how do I turn volume off ?

Curt M: Good question I’ll ask Sartaj

lenny: what volume? the ding?

Optionsavvy: no all volume. I need to listen to a conference call and want to mute this screen while I am on call

lenny: oh

Sartaj: You might have to leave the conference

Sartaj: This one, I mean

lenny: lol

Sartaj: Unless you’re on Google chrome

Sartaj: then you can mute individual tabs

Optionsavvy: yes I am

Sartaj: You ought to be able to find the volume settings for individual tabs in your Volume button in the system tray, or try right clicking on the ClickMeeting window right at the top, and see if any volume settings come up

Sartaj: There’s no obvious way for users to mute the presenter, unfortunately

Curt M: Oil respecting resistance so far – could be a good short lining up

Yetty: sweeeet ccall on $PLUG I nailed it off your buy yesteday just sold thanks

Optionsavvy: ok thanks anyway Sartaj

Optionsavvy: I’ll be back in a bit

Curt M: peace

Sartaj: No problem. Let me know over Twitter DM if there’s no space here

Sartaj: and we can make some room

MarketMaven: $IWM green

Flash G: Breasth is positive too

Flash G: Breadth

Tradergirl: hey all, no volume/mute or is it just me?

bob: Curt isn’t on mic right now

Tradergirl: ok, thank you bob

bob: so not just you lol

bob: np

Tradergirl: lol

Curt M: curts tired lol

Curt M: hey tradergirl and bob whats hot?

bob: you know, losing my mind over staring at candles all day. the usual lol 🙂

Curt M: ha

Curt M: I have dry powder and pent up mojo lol loooking for one just one outta the park this week

Hedgehog Trader: $NAK still coiled

Sammy T: we’ll get one

Sammy T: There’ll be a good halt intra day yet this week

Flash G: $SPY 50 MA broke

Hedgehog Trader: AIQ halted

Sammy T: $LEDS r/g

Flash G: $VIX a record…. since election

frank: $XIV should be good soon Curt

Flash G: $SPX $SPY under last week lows

Sammy T: Silver reverse on 4 hr testing mid BB – likely fails IMO

Curt M: $ETRM long 6.275 2000

Curt M: tight stop

Curt M: On mic >>>>>>>>>>>>>>>>>>>>>>

Curt M: Add over 6.40 or failure VWAP tight stop

Curt M: Stopped $ETRM 6.19 2000 shares

Curt M: Long $DWT 23.676 500

Curt M: On mic >>>>>>>>>>>>>>>>>>>>>>

Curt M: Off mic >>>>>>>>>>>>>>>>>>>>>

Curt M: Long $DWT position is 500 at 1/5 sizing will consider another 4 entries at each upside resistance

Curt M: My fills just came in less but we’l leave it where it is for the log – chippy entries

optionsavvy: back

optionsavvy: DOW breaking mid term supp here. next tgt is a major at 20427.60 on the DJI

MarketMaven: hey ssavvy

optionsavvy: GM maven

Flash G: $USDJPY on 200 Day

optionsavvy: I’d paste a chart if I could 🙂

Flash G: we all getting chart power over next couple days – was talking to curt about it

Flash G: Post it on your Twitter

Flash G: then put the twitter link to your tweet in here

optionsavvy: see red circles for supp https://twitter.com/Optionsavvy/status/851812424873279492

optionsavvy: IWM stronger on intraday relative basis that will be my long

optionsavvy: yep bounce playing out. I missed my buy

Curt M: Lol – sometimes I feel very slowwwwww with compouters

Flash G: Watching $IWM lpay today also

optionsavvy: brb

Curt M: Off mic >>>>>>>>>>>>>>>>>>>>>>>>>>>>

Hedgehog Trader: nanocap $ICLD looks to be setting up

Hedgehog Trader: what ya think Curt?

Curt M: $ICLD?

mezi: I like it lol

lenny: I am in it

Hedgehog Trader: nice

Curt M: $FIT new smartwatch delayed due to production issues. #yahoo

lenny: dull day

lenny: homework day

Curt M: On mic re XIV trade >>>>>>>>>>>>>>>

Curt M: Out $XIV 64.93 looking for re-entry later off mic >>>>>>>>>

Curt M: Small win

Sartaj: Reminder that we actually do have this: https://compoundtrading.com/partner-programs/

Hedgehog Trader: wonder if $NAK is gonna run

Sartaj: Be back in a bit

Sartaj: Back

Curt M: $NADL halt

Curt M: tank

Curt M: Oil’s closing…. down from here lol

Sartaj: Yes

Hedgehog Trader: speaking of Tank $TNK chart looking interesting

Sartaj: EPIC is… EPIC

Curt M: lol

Hedgehog Trader: $SINO even better

Hedgehog Trader: https://twitter.com/HedgehogTrader/status/851865391840321538

Hedgehog Trader: my SINO chart

Curt M: Nice chart $SINO

Curt M: $X looks really juicy

Curt M: Here;s the live $X chart with indicators mentioned https://www.tradingview.com/chart/X/2Eq99WSf-X-up-3-has-21-ema-MACD-cross-SQZMOM-about-to-turn-green-Stoch/

MarketMaven: POWER HOUR

Hedgehog Trader: GDX moving closer to 24.71 200 dma

Hedgehog Trader: nice i got a million retweets on SINO

Hedgehog Trader: but it looks sweet

Curt M: nice

Hedgehog Trader: one of the stronger shippers for some time

Curt M: I will have to concede to the Gold long soon – a few days yet

Hedgehog Trader: ashes to ashes, $DUST to $DUST

Flash G: It’s the battle zone here for Gold and Oil

Curt M: not quite dust yet

Curt M: odds are against dust tho thats for sure

Hedgehog Trader: miners seasonal trend is up from mid-march to early June

Curt M: Can you not unblock people on Stocktwits lol?

lenny: Never tried

Sartaj: I’ll check

Sartaj: Yes, it is

Sartaj: https://www.stocktwits.com/settings/blocked

Curt M: thanks

Curt M: That should be about it for Gold for the day

Hedgehog Trader: $URRE looks perky again

Hedgehog Trader: bit of a pause/doji day

Hedgehog Trader: looks like it could resume soon though

Curt M: $DRYS reverse split

Curt M: $URRE should get serious lift soon

Hedgehog Trader: yes

Curt M: Gold gold gold

Hedgehog Trader: $CEF which holds physical gold and silver is trading at a 6.7% discount to NAV

Hedgehog Trader: kind of a longer term idea

Curt M: If Trump gets on to this North Korea thing any more seriously then metals going nuts now lol

Curt M: Could happen any second imo

Hedgehog Trader: you mean any Tweet now

Curt M: Trump is a NFA kind of guy

Curt M: lol

Curt M: funny when u think about it

Hedgehog Trader: guys i’m hitting THE BUTTON #MAGA

mezi: LMFAO

Curt M: $TVIX swing over night?

Flash G: NO

Flash G: Garbage.

Curt M: True but….

Curt M: Bears shouldn’t go anywhere near $WIX imo

Sartaj: DoD Rep. is giving a press conference on missile strike

Curt M: N korea? or Syria?

Sartaj: Syria

Curt M: They couldn’t have waited 20 mins lol

Hedgehog Trader: full moon

Curt M: hahaha

Curt M: They’re gonna pump the cr@p outta SPY right now

Hedgehog Trader: with full moon over, i do think miners will rally tomorrow

Hedgehog Trader: $ABX looks good, plus lots of insider support/buys

Curt M: i hope not

Curt M: lol

Curt M: but u can’t win em all

Hedgehog Trader: for sure

Curt M: $TVIX HOD! Buy buy !

Curt M: nah

Hedgehog Trader: VIX is like whack a mole, come out your hole

mezi: You guys have been on with your calls. No need to gamble.

MarketMaven: Slow and steady

deb: tomorrow should be good

deb: for picking up bargains for swings in to next week

Flash G: Risk off environment.

lenny: As long as bombs don’t drop on NK next week very likely decent I agree

Curt M: $NADL – meet your new bagholders

Curt Melonopoly: http://oilprice.com/Latest-Energy-News/World-News/Russia-Signals-Weighing-Extension-Of-Oil-Output-Cuts.html

deb: have a good evening

Sammy T: ya see ya on flipside of the moon

Curt M: have a great night y’all!

Curt M: Thanks for the help Nicholas!

Hedgehog Trader: no prob Curt 🙂

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $PLUG, $ETRM, $DWT, $XIV, $USOIL, $WTIC, $AMZN, $GLD, $GDX – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

Post-Market Mon Apr 10 $PLUG, $CYTX – $STRP, $WTIC, $GLD, $GDX, $DXY

Compound Trading Monday April 10, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading and Live Stock Alerts. $PLUG, $CYTX – $STRP, $WTIC, $GLD, $GDX, $DXY – $DVN, $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is trading group involved with day trading, swing trading and algorithmic model chart trading.

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Most recent lead trader blogpost: When You Learn It – You Are Free (Part 1 of Freedom Traders). My Stock Trading Story.

https://twitter.com/CompoundTrading/status/848681468125745153

Trade risk management psychology and mechanics is a discipline itself. I am convinced a small study library could be filled on the topic.

— Melonopoly (@curtmelonopoly) April 1, 2017

If you missed it, here is the Previous Day Stock Trading Results:

https://twitter.com/CompoundTrading/status/850320579198668801

Today’s Premarket Trading Plan – Watchlist can be found here:

https://twitter.com/CompoundTrading/status/851417565377302528

Most recent Simple Swing Trade Charting

Most recent Swing Trading Newsletter:

https://twitter.com/CompoundTrading/status/851408768357335041

Review of Markets, Chat Room, Algorithm Charting, Trades and Alerts:

Nice to get positive feedback:) Keeps one motivated.

https://twitter.com/TradingInPearls/status/851710428266844160

Premarket watch-list for me was all about:

PreMarket Trading Plan Mon Apr 10 $CYTX, $GERN, $SPXS – $SPY, $DUST – $GLD, $GDX, $DWT – $USOIL, $WTIC #daytrading #chatroom

$CYTX Premarket up 32% on news.

$CYTX Premarket up 32% on news. pic.twitter.com/zA4oT0tyr2

— Melonopoly (@curtmelonopoly) April 10, 2017

$STRP premarket up 150% on AT&T buy-out for 95.63 share

$STRP premarket up 150% on AT&T buy-out for 95.63 share pic.twitter.com/MoP5iwEHOd

— Melonopoly (@curtmelonopoly) April 10, 2017

$STRP Premarket news

$STRP Premarket news https://t.co/H2ahqBHXF9

— Melonopoly (@curtmelonopoly) April 10, 2017

In play today in chat room and on markets:

Last week I was range bound to 1500.00 a day (really choppy) until Thursday got better around +2500.00 then Friday was flat and even took a small cut and Monday took a small razor cut at open and took a long position in $PLUG at EOD, Was looking at a long in $UUP (surrounding Yellen report) but didn’t, and I’m looking closely at an Oil and Gold / Miner’s short possibility. Swing trades are doing well of course because they are more consistently controlled (wider time frames with simple charting entries and exits do that).

Momentum plays on the day –

$STRP, $SITO, $LEDS, $CYTX, $SWFT, $AXON

In Play: $STRP, $GSAT, $TXMD, $GERN, $SWFT, $CYTX, $RCII, $AKRX High Uncertainty: $XCRA, $T, $DISH

In Play: $STRP, $GSAT, $TXMD, $GERN, $SWFT, $CYTX, $RCII, $AKRX High Uncertainty: $XCRA, $T, $DISH https://t.co/biura3xk6A

— Melonopoly (@curtmelonopoly) April 10, 2017

Carter Worth is lit tonight and makes a compelling case for $TSLA

Carter Worth is lit tonight and makes a compelling case for $TSLA pic.twitter.com/q6W3TRMiK5

— CNBC's Fast Money (@CNBCFastMoney) April 10, 2017

Trading Lessons, How-to and Educational:

If you can’t back a trade w/ tech set-up or at min fundamentals… then you deserve to take a loss. Like me w my one paper cut at open ha.

If you can't back a trade w/ tech set-up or at min fundamentals… then you deserve to take a loss. Like me w my one paper cut at open ha.

— Melonopoly (@curtmelonopoly) April 10, 2017

More

1/ $STUDY trading plan ex. that was sent in $CRME. Here’s what I think (and remember there’s all kinds of methods – mine are one of many).

1/ $STUDY trading plan ex. that was sent in $CRME. Here's what I think (and remember there's all kinds of methods – mine are one of many). pic.twitter.com/Xltw87YZfI

— Melonopoly (@curtmelonopoly) April 10, 2017

Stocks, ETN’s, ETF’s I am holding:

$DVN Opened long swing trade yesterday 42.62 Premarket 43.30 #swingtrading #Oil Link w chart indicators for those that asked in next post. pic.twitter.com/ASN6sGRiZ6

— Melonopoly (@curtmelonopoly) April 7, 2017

I am holding (in order of sizing – all moderately small size to micro sizing) – $DVN, $DUST, $PLUG, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| STRP | 91.64 | 151.21% | 5459539 | Top Gainers | |

| SITO | 3.12 | 47.87% | 1016379 | Top Gainers | |

| LEDS | 4.33 | 30.03% | 346117 | Top Gainers | |

| CYTX | 1.72 | 25.55% | 17617127 | Top Gainers | |

| SWFT | 24.77 | 23.73% | 26262797 | Top Gainers | |

| AXON | 18.54 | 22.54% | 4692028 | Top Gainers | |

| STRP | 91.64 | 151.21% | 5459539 | New High | |

| AKTX | 19.70 | 6.49% | 1918705 | New High | |

| EVRI | 5.86 | 22.08% | 4371728 | New High | |

| AXON | 18.54 | 22.54% | 4692028 | New High | |

| STRP | 91.64 | 151.21% | 5459539 | Overbought | |

| AKTX | 19.70 | 6.49% | 1918705 | Overbought | |

| CYTX | 1.72 | 25.55% | 17617127 | Unusual Volume | |

| FPP | 0.51 | 28.62% | 1034113 | Unusual Volume | |

| XCRA | 9.63 | 7.00% | 8929133 | Unusual Volume | |

| STRP | 91.64 | 151.21% | 5459539 | Unusual Volume | |

| AMZN | 907.04 | 1.36% | 3178955 | Upgrades | |

| CASI | 1.14 | 1.79% | 57296 | Earnings Before | |

| PLSE | 21.55 | 7.32% | 379913 | Insider Buying |

The Market Outlook:

Why #Fed’s plan to shrink the balance sheet could trigger a global bond crash. https://www.bloomberg.com/news/articles/2017-04-09/a-foreign-threat-to-u-s-treasuries-that-dwarfs-fed-s-debt-hoard …

Why #Fed's plan to shrink the balance sheet could trigger a global bond crash. https://t.co/mHPRM1z9Mo pic.twitter.com/jIIDvheq8r

— Holger Zschaepitz (@Schuldensuehner) April 10, 2017

This Week

$JPM $C $WFC $FAST $DAL $TSM

Next Week | preview

M $NFLX

T $GS $BAC $ISRG

W $EBAY $BLK $CSX

T $MXIM $VZ $MAT $SHW

F $GE $HON $SLB

This Week$JPM $C $WFC $FAST $DAL $TSM

Next Week | preview

M $NFLX

T $GS $BAC $ISRG

W $EBAY $BLK $CSX

T $MXIM $VZ $MAT $SHW

F $GE $HON $SLB pic.twitter.com/HtjHi2L0dw— Tom Wrigley (@WrigleyTom) April 9, 2017

Fed. Unwinding 4.5 YUGE Ts #trillion What a tribe. https://t.co/nvyGQ40kKb

— Melonopoly (@curtmelonopoly) April 6, 2017

We have been warning folks (as a result of algorithm anomalies picked up) for sometime about significant resistance not far above in Oil and SPY so it will be interesting to see if we get through it. Here’s just some of the posts. The oil resistance cluster is much larger than the one identified on $SPY.

We notified members in most recent trading range over last week that our algorithm identified a divergence and to expect an interimn top.

— Freedom $SPY Algo (@FREEDOMtheAlgo) March 21, 2017

To be clear, our algorithm @FREEDOMtheAlgo alerted a $SPY anomaly recently. Which has us cautious until recent high taken out and confirmed.

— Melonopoly (@curtmelonopoly) April 3, 2017

I wouldn't get too excited long $SPY $ES_F $USOIL $WTI etc. until most recent highs are taken out and confirmed.

— Melonopoly (@curtmelonopoly) March 30, 2017

7 of… A break to upside of $SPY $WTI algo resistance would signal what can only be described as "unnatural" I suppose…

— Melonopoly (@curtmelonopoly) March 19, 2017

Algorithmic Chart Model Trading / News:

Midday Algorithm and Swing Reviews: $USOIL $GLD $GOLD $GDX $DXY $AKS $DVN $UUP: http://youtu.be/JfnwvcGbPXU?a #daytrading #swingtrading

Midday Algorithm and Swing Reviews: $USOIL $GLD $GOLD $GDX $DXY $AKS $DVN $UUP: https://t.co/LCLCUxIM4E #daytrading #swingtrading https://t.co/D7Lc0CYsdv

— Melonopoly (@curtmelonopoly) April 10, 2017

I have come to respect algorithmic chart modeling like a deep sea fishing vessel respects a weather forecast. #trading #charts #signals

I have come to respect algorithmic chart modeling like a deep sea fishing vessel respects a weather forecast. #trading #charts #signals

— Melonopoly (@curtmelonopoly) April 8, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

Simple swing charting that keeps me level when looking at the markets (see swing trade simple charting link above). Simple charting I find grounds you to simple trades which in turn keeps you profitable in toppy or sideways markets.

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

See mid day review video above.

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

{40 year} Gold Seasonality Chart. #Gold $GLD $SLV $GDX $GDXJ $NUGT $DUST #Silver https://t.co/bJnAoWCHPS

— Melonopoly (@curtmelonopoly) April 2, 2017

Silver $SLV:

NA

Crude Oil $USOIL $WTI:

The biggest engine of global #oil demand growth in 2016 (India) is slowing down in 2017 https://www.bloomberg.com/news/articles/2017-04-10/india-s-oil-demand-contracts-3rd-month-amid-demonetization-drag … #OOTT #OPEC #oil #shale

The biggest engine of global #oil demand growth in 2016 (India) is slowing down in 2017 https://t.co/87RPYQjKku #OOTT #OPEC #oil #shale pic.twitter.com/YdGmut4pU1

— Javier Blas (@JavierBlas) April 10, 2017

#Oil Watch: Brent (chart) and WTI have nearly recovered to the post #OPEC deal price range of Dec-Feb — #OOTT #shale

#Oil Watch: Brent (chart) and WTI have nearly recovered to the post #OPEC deal price range of Dec-Feb — #OOTT #shale pic.twitter.com/V7HjtUbq0r

— Javier Blas (@JavierBlas) April 10, 2017

Volatility $VIX:

Highest $Vix close of 2017 today. Only 2nd close above upper BB since the election (the other was 2/28; $SPX ATH on 3/1)

Highest $Vix close of 2017 today. Only 2nd close above upper BB since the election (the other was 2/28; $SPX ATH on 3/1)

— Urban Carmel (@ukarlewitz) April 10, 2017

$SPY S&P 500:

See warnings.

$NG_F Natural Gas:

NA

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix.

lenny: $PLUG looks good on dips, Gold looks bad, Oil looks good, $CYTX for open

MarketMaven: morning len

Sammy T: $XGTI

Curt M: $STRP, $ENRJ, $CYTX morning gaps for open

Curt M: $RPRX Halt

Curt M: https://www.thestreet.com/story/14079870/1/at-amp-t-signs-deal-to-acquire-straight-path-communications.html?puc=yahoo&cm_ven=YAHOO&yptr=yahoo

Curt M: AT&T (T) isn’t slowing down its acquisitions, having signed a deal with Straight Path Communications, (STRP) to purchase the communications asset company for $95.63 per share in an all stock merger.

Curt M: $RPRX Names Larry Dillaha Its Permanent Pres and CEO

MarketMaven: Short Week this week.

Flash G: A glass of scotch early.

Flash G: Buy-outs like 30 years ago in process

Curt M: On mic >>>>>>>> for open

MarketMaven: ss $AKRX

Sartaj: Are you speaking? Can’t hear you

Curt M: I am

Sartaj: Yes

Sartaj: Now it is working

Flash G: $TSLA my love.

Hedgehog Trader: $FCEL

Curt M: Long $CYTX 2.02 2000

Curt M: $CNAT 52 week high

Curt M: $TOPS tape string

Curt M: $CEI tape strong

MarketMaven: $TOPS rockin

Hedgehog Trader: lol amen

Curt M: $ENRJ +130% Halt

Curt M: $CYTX out 1.84 small loss to start week lol

Curt M: $SPX above 20 MA

Flash G: $MOMO strong

Hedgehog Trader: Curt, take a look at $FCEL

MarketMaven: $PLUG on the move

Flash G: $AMZN, $TSLA, $BABA swing trades in good shape.

lenny: $CYCC on da move

Flash G: hahaha

lenny: $ENRJ shorts have worked

Sartaj: Fighting over scraps

Curt M: That’s it for open. Doing scans and setting up for reviews to start around 11:30 EST. Run swing trade set ups between 11:30 – 1:00 PM EST today >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Carol B: Thanks Curt

lenny: $SLIO vol

Sammy T: Would short $TSLA here if it wasn’t Tesla

Flash G: $MOMO impressive

lenny: $HA curt

Curt M: $GLBS Halt – surprise surprise

Curt M: $NAKD vol

lenny: $SKLN HOD

Curt M: $GLBS watching for a 5.00 break off halt

Hedgehog Trader: wow nice

Curt M: As suspected it’s a shipper morning

Hedgehog Trader: fish and ships

Hedgehog Trader: watch $SINO shipper close to breaking above 50 dma

Flash G: $CAT strong too

Curt M: Full moon tonight?

Sartaj: Yes, reading charts is the new astrology

Hedgehog Trader: full moon tues

Hedgehog Trader: usually mkt weakness around it

Hedgehog Trader: trade nimbly

Curt M: off mic to prepare for review of swing charts at lunch>>>>>>>>>>>>>>>>>>>>

lenny: Cramer loves $TSLA

Flash G: $BABA may find residence in a new leg up

Curt M: Calls in solar…. $SPWR $FSLR etc

Hedgehog Trader: i hate when Cramer loves anything

Hedgehog Trader: Gartman-like powers

Curt M: So true Nich

Curt M: catch ya guys at lunch – not 11:30 it will be at 12:00 🙂

Hedgehog Trader: $URRE

Hedgehog Trader: WHEEE

Hedgehog Trader: $NAJK Curt

Hedgehog Trader: sorry

Hedgehog Trader: $NAK

Hedgehog Trader: my signals suggest to expect a new uptrend on $NAK here as i tweeted

Curt M: busting a gut watching this chat from tradingview

Curt M: 1 min to mid day review >>>>>>>>>>>>>>>>

Sartaj: Ready to receive

Curt M: On mic >>>>>>>>>>>>>>>>>>

Curt M: back in min

Leanne: Thanks Curtis

Curt M: Off mic >>>>>>>>>>>>>>>>>>>>>

Hedgehog Trader: nice, thanks Curt!

Curt M: np

Hedgehog Trader: weird move for $AKS

Curt M: 🙂

Tradergirl: Thanks Curt, very good stuff and spot-on imo.

Curt M: Well thanks 🙂

Carol B: Yepp:)

Curt M: Going to scan for afternoon plays. Catchya in a bit.

Flash G: $MOMO no stop just go

Sammy T: $CCCL shorts covering

Flash G: Senior bulls stepped in to $NFLX

Curt M: $CCJ break out

Sartaj: See everyone tomorrow

Sartaj: Will keep everyone in the loop for our new SMS alerts platform

Hedgehog Trader: nice recipe sharing on tradingview

Curt M: haha

Sammy T: $BLDP action

lenny: $AKTX squeeze

lenny: $CYCC on the move

Curt M: $PLUG 52 WK Highs

Curt M: $HOG chatter 73.00 BO

Flash G: Today is more about knowing when not to trade.

Flash G: $NVDS interesting strength in to close

MarketMaven: Granny on deck

Curt M: $PLUG HOD again

Curt M: Long $PLUG 2.456 5000

Curt M: Might get out of my $MGTI bag yet

MarketMaven: ha mee too

Curt M: Holding $PLUG overnight

Hedgehog Trader: PLUG is such a good stock Curt

Hedgehog Trader: especially now with AMZN stake

Hedgehog Trader: it’s greentech, which is a sector i see doing really well going forward

Hedgehog Trader: plus it has a great product that saves time and money

Flash G: $URRE looks good too

lenny: I’m in it Flash

Hedgehog Trader: $URG is another u stock that looks ready

shafique: good night

Curt M: cya shaf

Curt M: $LEDS strong close also

People respect achievement

People respect trying to achieve

People respect going for it but missingNo one respects not trying@EdLatimore

— Steve Burns (@SJosephBurns) April 9, 2017

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $PLUG, $CYTX – $STRP, $WTIC, $GLD, $GDX, $DXY – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

Post-Market Wed Apr 5 $PLUG, $CALI, $INNL, $USOIL, $WTIC

Compound Trading Wednesday April 5, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading and Live Stock Alerts. $PLUG, $CALI, $INNL, $USOIL, $WTIC – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is trading group involved with day trading, swing trading and algorithmic model chart trading.

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

New lead trader blogpost: When You Learn It – You Are Free (Part 1 of Freedom Traders). My Stock Trading Story.

https://twitter.com/CompoundTrading/status/848681468125745153

Trade risk management psychology and mechanics is a discipline itself. I am convinced a small study library could be filled on the topic.

— Melonopoly (@curtmelonopoly) April 1, 2017

Big Changes: Even though we post my trades and trading room transcript and video daily (which has been a massive time investment) as of now we are posting intra-day small videos to our Twitter feed and YouTube – every trade as they happen. Each will have details of setup and reasoning for each trade. We will still post complete trading room session to Youtube also.

Even though we post my trades and trading room transcript and video daily (which has been a massive time investment lol) starting Monday…

— Melonopoly (@curtmelonopoly) April 1, 2017

If you missed it, here is the Previous Day Stock Trading Results Tuesday April 4 (public):

Unlocked: Stock Trading Results Tues Apr 4 $INNL, $GNCMA, $BNTC, $USOIL, $WTIC, $GLD, $DXY #daytrading https://t.co/ooegfo9frG

— Melonopoly (@curtmelonopoly) April 5, 2017

Premarket Trading Plan – Watchlist (member) for Wednesday April 5 session can be found here:

Protected: PreMarket Trading Plan Wed Apr 5 $PLUG, $INNL, $NEOT, $USOIL, $WTIC, $RIG, Oil Plays on Watch #trading #stocks #premarket https://t.co/2yIK9PGFeQ

— Melonopoly (@curtmelonopoly) April 5, 2017

The Weekly Simple Swing Trade Charting (public) is out. This week however had a lot of indecision in the charts:

Swing Trading Newsletter (member) is Published:

https://twitter.com/CompoundTrading/status/849524916135354368

Review of Markets, Chat Room, Algorithm Charting, Trades and Alerts:

Premarket watch-list for me was all about:

$PLUG Premarket up 63%. Plug Power.

$PLUG Premarket up 63%. Plug Power. pic.twitter.com/1tVPDm2ri4

— Melonopoly (@curtmelonopoly) April 5, 2017

$INNL Premarket is up 43% #tradingplan #stocks #daytrading

$INNL Premarket is up 43% #tradingplan #stocks #daytrading pic.twitter.com/ohHnImHzwg

— Melonopoly (@curtmelonopoly) April 5, 2017

In play today in chat room and on markets:

$PLUG, $INNL, $BLDP, $USOIL, $WTI, Oil Plays on watch. Premarket watchlist.

$PLUG, $INNL, $BLDP, $USOIL, $WTI, Oil Plays on watch. Premarket watchlist.

— Melonopoly (@curtmelonopoly) April 5, 2017

$PLUG, $CALI, $INNL were the momentum plays on the day.

$PLUG I traded later in the day for a 1 cent loss on 10000 shares and $INNL I had on the swing trading side of our platform and on the daytrading side. The swing side we sold during premarket and I held 2000 shares on daytrading side hoping for a premarket pop and didn’t get it. Both I sold for a profit because I took the trade the afternoon before long for the swing and the news came out that night. Reminded me of the $VHC play last year (same thing happened) but in that instance I went in with 60% of my portfolio. Huge win then. $CALI I didn’t trade.

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size to micro sizing) – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so. I am now 95% cash in daytrading account.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| PLUG | 2.25 | 73.08% | 135165700 | Top Gainers | |

| CALI | 4.04 | 41.75% | 14341126 | Top Gainers | |

| INNL | 2.19 | 20.33% | 16645566 | Top Gainers | |

| EVI | 21.90 | 14.36% | 57709 | Top Gainers | |

| PNRA | 312.94 | 14.21% | 12161000 | Top Gainers | |

| SCON | 1.46 | 14.06% | 1189979 | Top Gainers | |

| WCST | 2.60 | 14.04% | 357524 | New High | |

| BKJ | 16.65 | 7.77% | 18600 | New High | |

| SXE | 4.08 | 11.48% | 712500 | New High | |

| AUXO | 6.00 | 8.30% | 765294 | New High | |

| FIZZ | 85.45 | -0.06% | 435207 | Overbought | |

| WHLR | 13.30 | -3.20% | 141218 | Overbought | |

| TGC | 1.05 | 50.00% | 5889226 | Unusual Volume | |

| CALI | 4.04 | 41.75% | 14341126 | Unusual Volume | |

| UNIS | 0.31 | -75.25% | 7603524 | Unusual Volume | |

| VII | 0.96 | 152.63% | 4885300 | Unusual Volume | |

| AU | 11.85 | 1.72% | 4412400 | Upgrades | |

| GBX | 47.25 | 10.01% | 3848700 | Earnings Before | |

| SYNL | 12.30 | 1.65% | 30934 | Insider Buying |

The Markets Looking Forward:

Fed. Unwinding 4.5 YUGE Ts #trillion What a tribe. https://t.co/nvyGQ40kKb

— Melonopoly (@curtmelonopoly) April 6, 2017

We have been warning folks (as a result of algorithm anomalies picked up) for sometime about significant resistance not far above in Oil and SPY so it will be interesting to see if we get through it. Here’s just some of the posts. The oil resistance cluster is much larger than the one identified on $SPY.

We notified members in most recent trading range over last week that our algorithm identified a divergence and to expect an interimn top.

— Freedom $SPY Algo (@FREEDOMtheAlgo) March 21, 2017

To be clear, our algorithm @FREEDOMtheAlgo alerted a $SPY anomaly recently. Which has us cautious until recent high taken out and confirmed.

— Melonopoly (@curtmelonopoly) April 3, 2017

I wouldn't get too excited long $SPY $ES_F $USOIL $WTI etc. until most recent highs are taken out and confirmed.

— Melonopoly (@curtmelonopoly) March 30, 2017

7 of… A break to upside of $SPY $WTI algo resistance would signal what can only be described as "unnatural" I suppose…

— Melonopoly (@curtmelonopoly) March 19, 2017

Algorithmic Chart Model Trading / News:

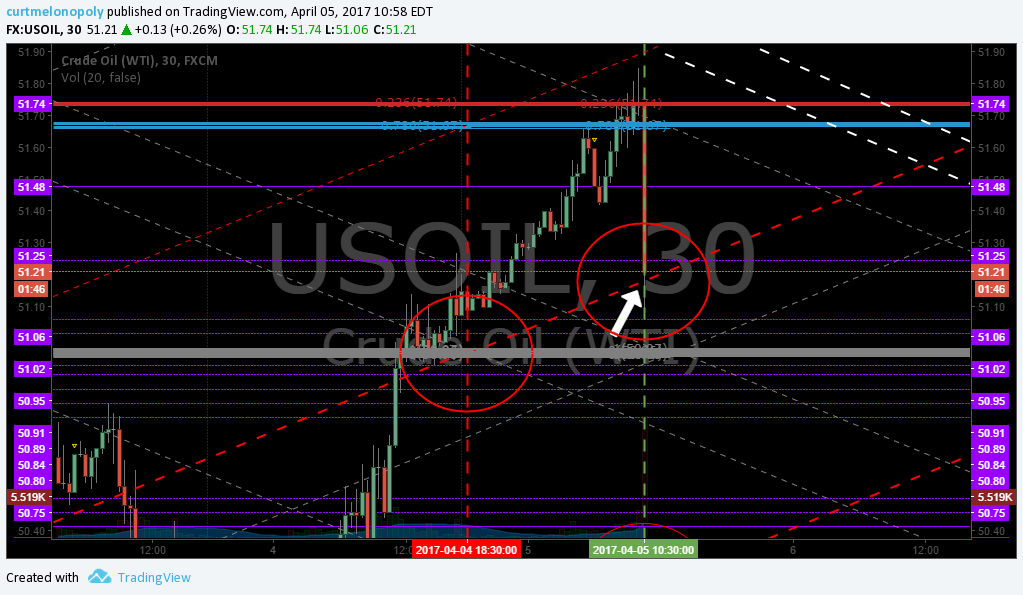

Epic the Oil Algo was at it again with a crazy price target hit to the penny and exact time at Wednesday #EIA report time at 10:30 AM. That call was made Sunday for that exact time and price Wednesday and what made it more interesting was how oil literally fell from the sky and landed right in the middle of the target. We caught it on video.

#EIA Price hit target exact time & price called Tues 10:30. Crude algo. $USOIL $WTIC $CL_F $USO $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/849642844360802304

There it is live on video wow crazy. Dead center! Oil drops in to target exact time and price 🔥🔥🔥 EPIC the OIL Algo. $USOIL $WTI #OIL #EIA https://t.co/1rJHKTV7P5

— Melonopoly (@curtmelonopoly) April 5, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

Simple swing charting that keeps me level when looking at the markets (examples below). Simple charting I find grounds you to simple trades which in turn keeps you profitable in toppy or sideways markets.

https://twitter.com/CompoundTrading/status/848756853169283073

$BABA Swing Trade going well. Our Swing Trading side is in at 104.64 trading at 108.17. #swingtrading pic.twitter.com/x2zOezrBQ3

— Melonopoly (@curtmelonopoly) April 4, 2017

$NFLX March 29 we entered swing trade 145.50 when MACD turned, trading 146.82, stop at flat and re-enter if we have to. #swingtrading pic.twitter.com/DI8fiL6nsv

— Melonopoly (@curtmelonopoly) April 4, 2017

$AXP American Express. So close. SQZMOM about to turn, MACD cross on deck just need PTPTRR to line up. Need volume & power. #swingtrading pic.twitter.com/V4dGTTw0T9

— Melonopoly (@curtmelonopoly) April 4, 2017

$ABX Setting up nicely. Above 200 MA, wait for Stoch RSI to turn, SQZMOM green MACD turns up and kapow! Some volume & power would help too. pic.twitter.com/Umdcrc6ffV

— Melonopoly (@curtmelonopoly) April 4, 2017

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

NA

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

{40 year} Gold Seasonality Chart. #Gold $GLD $SLV $GDX $GDXJ $NUGT $DUST #Silver https://t.co/bJnAoWCHPS

— Melonopoly (@curtmelonopoly) April 2, 2017

Silver $SLV:

Silver Gold Platinum Palladium money pos. https://t.co/JGMkj0oLb8

— Melonopoly (@curtmelonopoly) April 2, 2017

Crude Oil $USOIL $WTI:

849631751106199554

EPIC the Oil Algo Killing it as usual:

Price hit target centre exact time and price called for Tues 10:30. Crude algo. FX $USOIL $WTIC #OIL $CL_F $USO $UCO $SCO $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/849638081720270848

Tanker Traffic Points At Much Tighter #Oil Markets | https://t.co/8uM3eZkvEt https://t.co/wIwcqnBfFi #oilprice #OOTT $USOIL $WTI $CL_F

— Melonopoly (@curtmelonopoly) April 5, 2017

$WTI $CL_F $USOIL net long short https://t.co/hpRZPGo4fM

— Melonopoly (@curtmelonopoly) April 2, 2017

Volatility $VIX:

$VIX #gamma #diverge https://t.co/UR56MiAx6Z

— Melonopoly (@curtmelonopoly) April 6, 2017

$VIX delay… https://t.co/2aT85XuyXo

— Melonopoly (@curtmelonopoly) April 1, 2017

$SPY S&P 500:

$SPX P/E Ratio above 10 year average. https://t.co/3BzGNUugvs

— Melonopoly (@curtmelonopoly) April 3, 2017

$NG_F Natural Gas:

NA

Live Trading Chat Room Transcript: (on YouTube Live):

2 Part video (Part 1 embed below go to our Youtube channel for Part 2)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix.

Leanne: good morning

Sammy T: hey chick mom trader beast leanne!

Sammy T: seen your win

Sammy T: congrats

HedgehogTrader: hi, nice on INNL

Sammy T: ya Leanne nailed it

Leanne: Hi Sammy, not yet, I can’t trade pre market so didn’t sleep much

Sammy T: I did too and I think Lenny

Leanne: besides Curtis gets all the credit

Sammy T: dont do that lololol

Leanne: I do way better not trading anything in the am and waiting til later in the day

Sartaj: Okay, I’m ready

Curtis M: On mic premarket review >>>>>>>>

Leanne: not sure where it’s going to go or what my plan should be in 10 mins on it. thoughts?

Leanne: I was up but can’t trade pre market

optionsavvy: gm

Sartaj: Good morning

optionsavvy: WILN from last week may actually go now. not a whole lot of charts on my scan

optionsavvy: CL_F strong headed to 53. any small drillers you guys like ?

optionsavvy: ERF driller irreg vol pre with bid above yesterday close

HedgehogTrader: watch $FCEL

optionsavvy: gm

optionsavvy: INNL into supply here. RR not in favor of long imo

optionsavvy: ty

Sartaj: PreMarket Review over, Curt?

optionsavvy: trying PSDV . same sector as INNL . PSDV on support but going to cut it loose below 1.65

Leanne: you are not old

optionsavvy: INNL looking for supp mid 1.9s

optionsavvy: mid term imo

optionsavvy: 3/15 confirmed

optionsavvy: CHK trending

Sartaj: Want this recorded, Curt?

optionsavvy: lots of green in my small oil driller WL

Curtis M: Drillers look great

Curtis M: Long 2.17 add $INNL to yesterday

optionsavvy: ESES not bad RR but needs vol

Curtis M: 1000 share add $INNL sorry

Curtis M: $TGC halt violation

optionsavvy: SPY into res here. watch for turn so not a place to put on longs imo immed time frame

Curtis M: $AMZN swing hammer nice on that swing

Curtis M: $QCP halt

Curtis M: $QCP News pending

Curtis M: Stop on $INNL 1.95 looking for break of res

Curtis M: $CHK does look good

optionsavvy: INNL 2.53 top of bracket imo

optionsavvy: QQQ AT highs ?

HedgehogTrader: when the fuel cell stocks run like PLUG is you follow BLDP also and FCEL which is close to busting out

Curtis M: $CBIO tape bullish

lenny: Can’t get enough of $TSLA #AMZN just asying

Curtis M: Oil getting really close to resistance now

Curtis M: If it comes off res and goes in to downdrift the fuel cell etc plays likely will too

optionsavvy: FRSH into a spot to short imo

optionsavvy: re running scans now. nothing I like

optionsavvy: MEMP pretty chart pattern but I dont trade sub 1 stocks so

MarketMaven: Short $CALI

Flash G: $VRTX HOD

optionsavvy: not from scan but digging through old WL and SCON shows up. nice looking chart

Flash G: $CVS blocks this morning

Curtis M: $TGC halt

optionsavvy: starter short SPY

optionsavvy: may have jumped the gun a little on SPY short but ready to add

HedgehogTrader: fwiw my signals are getting a mkt upturn close to apr 6th

optionsavvy: added SPY short . now half size

Curtis M: $SPY hit our first primary upside price target extension perfect there…. there’s one more not far above but that’s the main one.

Leanne: 16 yr old just walked into my office and looked at your screen, thought it was an art project!

Sartaj: Not the first time we have heard that. Mathematics and Art are cousins

optionsavvy: I have 237.24 and 237.56 is the max an prem entry short . above that long again

Curtis M: Oil report on deck in 15 mins

Curtis M: Grabbing a quick coffee for that event

MarketMaven: Closed $CALI

MarketMaven: Watching $KONE

Curtis M: On mic in 3 mins for oil report

Sartaj: Great. FYI, for anyone curious.. putting together $INNL snippets onto YouTube through the afternoon

Curtis M: on mic>>>>>

Curtis M: #EIA report

Leanne: Thanks all, have to leave for a bit, back after lunch

Curtis M: kkk

Sartaj: Great snippet, Curt

hais: what is the target for friday?

Sartaj: Look at the end of the wedge. There is a likelihood for price to reach the upper target intersecting at the yellow and red-dotted line, and then falling down to the lower target

optionsavvy: starting to look like I chased SPY down the rabbit hole 😐

Curtis M: Off mic >>>>>>>> #EIA report $USOIL $WTI EPIC the Algo Review

HedgehogTrader: hey, i did say i was picking up a SPY turn 🙂

Curtis M: $SPY price was .03 over our upside price target extension

Curtis M: Top of dotted red line was the price target

HedgehogTrader: looking for a kitchen sink rally w oil, spy, speculative stocks, you name it

optionsavvy: been noticing staffing companies trending and showing up on scans. may be a cyclical trade coming soon in sector

optionsavvy: DHX on scan just now

Curtis M: I’m going to have to wait for crude to get back to top of channel to short or bottom of channel to long – I missed my chance ugh mid channel isn’t the best place

optionsavvy: mkts could fall out of bed right here and my feelings wouldnt be hurt 🙂

optionsavvy: TF breaking down

Curtis M: Well that was a little crazy. The oil traders got a little excited on DMs there. They actually followed EPICs instructions and nailed that long to channel resistance and then the short kaboom – what a play. I missed lol

Curtis M: I’m the one charting it and I miss it how does that work?

Curtis M: Ca;t teach stupid. hahaha

MarketMaven: 🙂

MarketMaven: jokes

MarketMaven: Someone thumbs down EPICs video hahaha oh ya right I’d like to see you do that buddy

Curtis M: really hmmm kids

Sartaj: https://youtu.be/LOW5ltNoc_0?list=PLTeUfxpy0iabQ3uQYO8aAbX2hG_NcbJCX In case anyone wants to prove that naysayer wrong 🙂

Sartaj: You just can’t impress people sometimes… that video captured the target hit in real time.

Sartaj: Refresh the pages, Curt. That should work

optionsavvy: IV on puts starting to inflate as if a down move is becoming more probable in mkts

Hedgehog Trader: FCEL huge volume building

Curtis M: Going to reboot hopefully I don’t lose ya

Curtis M: $CGI halt

Sartaj: $CGI resumed

Curtis M: $CGI long 5.26 1000

Hedgehog Trader: $NAK back at 200 dma

Curtis M: 5.28 correction

Curtis M: On mic >>>>>

Curtis M: Out at 5.26

Sartaj: Deploying to YouTube

Curtis M: No need t o publish no

Sartaj: Okay

Curtis M: rebooting

Curtis M: 1000 $PLUG 2.26 for a pop will scale if confirms. Simple time of day.

Curtis M: Wow interent throttled hard today

Curtis M: Long 4000 $PLUG 2.24

Sandra: $QSR cup and handle set up looks good

Curtis M: FOMC at 2 so maybe we get action shortly thereafter

MarketMaven: In $OLUG here

MarketMaven: $PLUG

MarketMaven: 2.267

Curtis M: Looking for 2.50 for possible add

Curtis M: $VIX has died

Curtis M: Long $PLUG 5000 2.293

Curtis M: On mic >>>>>>>>>>>>>>>

Curtis M: My $DUST swing up 3.3% hope it continues

Curtis M: $JNUG got hammered today

Hedgehog Trader: i think DUST is going to get dusted

Curtis M: Selling in to the news

Hedgehog Trader: NAK at 200 dma

Curtis M: lol

Hedgehog Trader: i get turn for miners

Curtis M: just made me laugh first time today

Hedgehog Trader: who, me?

Curtis M: yup

Curtis M: you dust comment

Hedgehog Trader: ha

Hedgehog Trader: EXK pulled back and filled gap

Hedgehog Trader: for those who want a kick ass silver miner

Curtis M: I’m watching DUST with awe

Flash G: My $TSLA

Hedgehog Trader: btw Flash, my forecasting signals get giant move in $LTBR starting around apr 5-6

Hedgehog Trader: if it starts to turn up with oil, energy sector, we’ll see a kaboom

Curtis M: SQZMOM on $PLUG getting greenish lol come on

Curtis M: Scott Gottlieb is at the Senate Confirmation Hearing #FDA #TRUMP pick

Hedgehog Trader: DUST going down

Hedgehog Trader: EXK going up

Hedgehog Trader: perfect gap fill

Curtis M: Is your monitor working right?

Sandra: Gold bugs

Sartaj: Quick coffee break brb

Curtis M: kk

Curtis M: $SICK halt

Hedgehog Trader: if my trade goes the wrong way i’ll turn my monitor upside down

Hedgehog Trader: lol never heard of that ETF

Curtis M: $SICK is the Gotlieb factor at work

Sartaj: Back

Curtis M: $PLUG looking good here

Curtis M: MACD turned up

Hedgehog Trader: in 2013 PLUG ran from under 60c to $11 in 3 months

Hedgehog Trader: rode it to about $7

Hedgehog Trader: FCEL and BLDP also tripled or more

Hedgehog Trader: hence i like FCEL here

Hedgehog Trader: FCEL 62M mkt cap

Curtis M: Increasing volume on $PLUG last 4 mins

Curtis M: MACD Stock RSI SQZMOM all look good

Curtis M: On mic >>>>>>>>>>

Sartaj: Do you want that uploaded as an educational piece?

Sartaj: Got about 5 minutes of content there

Curtis M: We may as well finish the trade

Curtis M: its not a lot of value yet lol

Sartaj: I will probably have to snip together these intraday ones later. If you weren’t planning on doing swing or algo reviews, I could work on yesterdays instead. What’s it looking like for the rest of the market hours?

Curtis M: No sure

Curtis M: No reviews just possible trades

Sartaj: Okay

Flash G: Dollar air after FOMC

Hedgehog Trader: copper up strong as i forecast, nearly 3% on day

Hedgehog Trader: watch elite copper junior $TGB

Flash G: Nice one

Curtis M: Got myself in to a tight one – hate these

Hedgehog Trader: $NAK is one and it is on 200 dma

Curtis M: acorns were my fav as a kid for some reason

Hedgehog Trader: are we talking nuts and balls in this room?

Curtis M: right now I’d take a 200 hit hmmmmm

Curtis M: should i stay or should i go

MarketMaven: when in doubt flee

Hedgehog Trader: oh oh oh GDX

Hedgehog Trader: movin on up wheezy

Curtis M: oh oh

Leanne: Curtis, I’m just getting back and trying to catch up, are you in PLUG?

Curtis M: yes

Hedgehog Trader: bad boy bad boys whatcha gonna do when the Hedgehog comes for youuu (DUST longs)

Curtis M: 10000 shares avg 2.265 I think but I might cut for loss

Curtis M: its ughhhhhhhhhhhh boring

Curtis M: tonight doesn’t look good to hold in to

Curtis M: sentiment isn’t great out in the winds of the market imo

Curtis M: and miners I feel worst for them

Hedgehog Trader: $ICLD turning up

Hedgehog Trader: don’t feel bad for miners, face ripper coming

Flash G: Red – $IBB

optionsavvy: value broke on indexes ruhh rohh

Curtis M: doesnt look great but you know… they’ll ust make PPT work overtime

Curtis M: poor miner bulls trapped again

optionsavvy: taking half SPY Puts off here

optionsavvy: ride rest for free

Curtis M: nice

optionsavvy: <bows gracefully>

Curtis M: Ride or Die

Curtis M: lol

Curtis M: OK! Giddy up!

Curtis M: $PLUG time

Curtis M: MACD Volume SQZMOM ready

Curtis M: There we go

Curtis M: torture today lol

Curtis M: ballz

Curtis M: what is with the interenet today wow

Flash G: Trimming some excess long swing trades in to EOD all winners. Has been good this year.

Curtis M: We had a good run on those swing Flash from late Dec to now.

Curtis M: I think I did 45% or so and you likely more.

Flash G: No, I am at 38%

optionsavvy: I may have to take the exit on rest of SPY this was a bit of a lucky trade

Sartaj: Seems like a theme today

MarketMaven: Your daytrading is better than that though Curt

Curtis M: That was a disciplined trade imo

Curtis M: $SPY at res and oil at res kinda obvious looking back but at the time…. things always clear in reverse

optionsavvy: agree but DOW divergence from NASD is what tipped me off to trade. IWM was strong when I took the SPY otherwise that would have been my pick

optionsavvy: old futures guy beat into me that when the NASD diverges strong and DOW isnt playing along be very careful

Curtis M: makes sense

Curtis M: okay i have to bail on $PLUG this stoch rsi turn up its 3:29

Curtis M: time not on my side

Hedgehog Trader: Curt GDX

Hedgehog Trader: popping up

Curtis M: poor miner bulls i really feel deeply for them

Curtis M: ok GIDDY UP $PLUG

Sartaj: lol

Hedgehog Trader: $DUST exhibiting cement boots chart pattern

Curtis M: I’ll fix that chart next lol

Curtis M: I am out 10000 down exactly 1 penny

Sartaj: Phew

Curtis M: stupid waste of time lol

Hedgehog Trader: late buyers are getting plugged

Curtis M: lol

Curtis M: Might be time to short $VIX soon

Curtis M: Whomever reads this transcript PLEASE BE ADVISE there was a lot of sarcasm in here today. Fed day.

Curtis M: Ok if miners get 24.17 I’m all in long if its in the box that it hits 24 . 17

Curtis M: until then I’ll hold $DUST

Curtis M: how do you like them ballz? hedge? u there? lol

Flash G: He fell asleep

Curtis M: Ah huh! That would likely coincide with 200 MA test

Curtis M: oh well missed the bad news muhahahaha

MarketMaven: 🙂

Hedgehog Trader: back

Hedgehog Trader: i had to tickle someone

Curtis M: read transcript then I will show you magic chart

Hedgehog Trader: i’m all about the magic

Curtis M: Miners need 24.17 or they’re dead

Curtis M: at minimum sideways

Curtis M: in the box

Curtis M: they don’t get it in the box it’s down

MarketMaven: he fell asleep

Curtis M: Now the internet is speedster

Hedgehog Trader: i know about 24

Hedgehog Trader: lol

Curtis M: did you see the chart?

Hedgehog Trader: yes sir

Curtis M: our SPY calculations have been spot on for months – should have traded it everytime

Curtis M: trusting the math…. takes time

Sandra: have a good nihgt all

Curtis M: cya sandra

Hedgehog Trader: GDX:GLD ratio nice uptrend since early march dip

Curtis M: good night john boy

Curtis M: need to make 2000.00 tomorrow today was meh

Curtis M: see ya later guys

Hedgehog Trader: ciao and thanks Curt

Sartaj: See you all later

Flash G: bye all

If this post was of benefit to you, be kind and share it on social media for us please!

Follow our lead trader on Twitter:

Article Topics: $PLUG, $CALI, $INNL, $USOIL, $WTIC – $XOM, $NE, $ONTX, $DUST, $TRCH, $LGCY, $SSH, $ASM – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

PreMarket Trading Plan Wed Apr 5 $PLUG, $INNL, $NEOT, $USOIL, $WTIC, $RIG, Oil Plays on Watch

Compound Trading Chat Room Stock Trading Plan for Wednesday April 5, 2017; $PLUG, $INNL, $NEOT, $USOIL, $WTIC, $RIG – $ONTX, $DUST, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Today’s Live Trading Room Link: https://compoundtrading.clickmeeting.com/livetrading

New blog post: When You Learn It – You Are Free (Part 1 of Freedom Traders). My Stock Trading Story.

https://twitter.com/CompoundTrading/status/848681468125745153

Tuesday April 4, 2017 Stock Trading Results

https://twitter.com/CompoundTrading/status/849590289136328704

The Quarterly Daytrading Performance Review P/L with Charting is Published.

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L with Charting is Published. The Algorithms Quarterly Performance Reports are being compiled as I write and will be posted soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Most recent Keep it Simple Swing trade Charting Post on Sunday April 2, 2017 (MACD, MA, Stoch RSI, SQZMOM focus):