Tag: $MGI

Swing Trade Set-Ups (Earnings) Part 6b : $INS, $MDB, $MGI, $TERP, $HD, $ROKU, $ETSY, $QQQ, $VIX, $GLD…

Swing Trading Strategies, Alerts, Charts, News. August 22, 2019…

Below are Swing Trade Set-Ups Currently On Watch, This is Part 6B; $INS, $MDB, $MGI, $TERP, $HD, $ROKU, $ETSY, $MCD, $QQQ, $VIX, $X, $TEUM, $ARWR, $AU, $GC_F…

Earnings Season Swing Trade Positions Reporting Special Notes:

Per recent;

Aug 22 – On Aug 19 we entered $QQQ long in low 187s, it hit 189.23 yesterday and we have a 197s price target in to Sept 9 week. On the 16th we added to the Gold short (2nd position) 1512.29 and it is trading at time of writing 1497.90. On August 12 we entered long $OSTK and got quickly stopped for a 4% loss on a starter position on some CEO news that sent the stock tumbling, one of our few losses lately. The $TEUM trade went well 2.60 – 3.60 and we’re looking at other entries soon. $MRO swing trade set-up has been flat thus far (post alert). The VIX time cycle has been spot on and we’ll be looking for longs in to the week of Sept 9 in advance of Oct 21 week time cycle peak. The $AU and $ARWR trades were / are outstanding performers and we continue to work with / have on watch because both should be considerable trades again soon. $AU long on other side of Sept 9 going in to Oct 21 and $ARWR adds to long position at key support areas. $DXY we are still watching for a short cycle, $SPY we didn’t long in to Sept 9 and chose $QQQ instead, $BTC we are watching for a possible bullish run on the other side of Sept 9 week. Other considerations are below.

Over the next few weeks the number of set ups to be sent out is expected to increase because of the Sept 9 and Oct 21 time cycle inflections nearing.

Per recent;

July 31 – We entered a new swing trade yesterday in TESLA that is doing excellent, closed the AMD swing trade prior to earnings which was a great call because it lost a lot of value after earnings were posted after market, are trading the Crude Oil move that seen a huge gain after the swing trade alert was issued and today we look at National Oilwell Varco, Trex and Chegg after they had larger than normal earnings price moves.

We’re also working on time cycle trades for SPY, VIX, Gold, Silver, DXY, BTC and more than we will report on soon.

Per recent;

July 22 – Below are some equities in focus this week with earnings, the follow- up reports on deck deal with other earnings focus equities and time cycles for the indices and specific instruments we focus on (GOLD, SILVER, VIX, SPY, OIL, US DOLLAR, BITCOIN).

Per recent;

Over the coming days we will be re-visiting all recent swing trade set-ups, alerts and trades in progress to reconcile the trades in advance of earnings and prepare for the new on other side of each new set up from earnings reports. This will involve a significant number of posts, trade alerts, mid day reviews in the trading room and videos that our members will receive a copy of.

Executing your swing trading strategy with our charting reports and live alerts involves using the key support and resistance areas of the charting, time cycle peaks, trajectory of trade and conventional indicators such as MACD cross-over and Moving Averages.

Alerts are not always issued at each add or trim to positions because that is simply not possible so you do have to manage your trade.

In many instances a clear swing trade strategy is laid out in the newsletter and/or videos so that you can manage the swing trade according to your risk threshold and account size.

If you struggle to establish a trading strategy with the information provided on our reporting, videos and alerts then some trade coaching is recommended to get you started.

Part 6b Earnings Swing Trades:

I have included Part 5 and 6 below for perspective, for parts 1 – 4 in this earnings season refer to recent premium member reports.

INTELLIGENT SYSTEMS (INS)

INTELLIGENT SYSTEMS (INS) could run in to end of Sept, above 54.60 targets 67.37 and 79.31 possible #swingtrading $INS

Intelligent Systems Corporation (INS) Skyrockets 8.24% Today. But Here’s The Catch #swingtrading $INS https://pressrecorder.com/2019/08/22/intelligent-systems-corporation-ins-skyrockets-8-24-today-but-heres-the-catch/

MONGO DB (MDB)

MONGO DB (MDB) if this continues bullish I see two scenarios, both should see another gap through trading box $MDB #swingtrading

Over 153.70 or channel support or a bounce off trading box are all long signals I am watching.

3 Cloud Stocks To Buy Now @themotleyfool #stocks $FIVN $MDB $PAYC https://www.fool.com/investing/2019/08/22/3-cloud-stocks-to-buy-now.aspx

MONEYGRAM INTERNATIONAL (MGI)

MONEYGRAM INTERNATIONAL (MGI) has double, triple or more written all over it here #swingtrading $MGI

TERRAFORM POWER (TERP)

TERRAFORM POWER (TERP) continues to run up in channel, solid trade structure set up #swingtrading $TERP #earnings

See this previous special report with links etc; TERRAFORM POWER (TERP) How to trade TerraForm Power earnings and swing trade it to next time cycle.

HOME DEPOT (HD)

HOME DEPOT (HD) has been a perfect channel trade since special report, however, at full extension it is a short soon #earnings $HD

Either of the two price targets marked should be the retrace area as Home Depot stock will be at full extension very soon, likely other side of Sept 9 2019 this is an excellent short trade.

ROKU Inc (ROKU)

ROKU Inc (ROKU) has been trading bullish in channel since Dec 21 2018, looking for long blue sky positions for in to Sept 9 week $ROKU

Stop Worrying About Roku Stock’s Valuation #swingtrading $ROKU https://finance.yahoo.com/news/stop-worrying-roku-stock-valuation-122715703.html?soc_src=social-sh&soc_trk=tw

MCDONALDS (MCD)

MCDONALDS (MCD) I like long on other side of Oct 21, likely short at top of channel and long in to Oct 21 $MCD #swingtrading

At this point my bias is not in stone so at channel resistance and channel support I will look at the price relative to timing and make a decision.

3 Blue-Chip Dividend Stocks to Buy as Bond Yields Fall & Global Worries Rise https://finance.yahoo.com/news/3-blue-chip-dividend-stocks-192907901.html?soc_src=social-sh&soc_trk=tw #swingtrading $MCD

UNITED STATES STEEL CORP (X)

UNITED STATES STEEL CORP (X) As price nears lower end of range on weekly I can’t help but consider a long soon $X #swingtrading

U.S. Steel plans to lay off hundreds of workers in Michigan https://finance.yahoo.com/news/u-steel-plans-lay-off-213610778.html?soc_src=social-sh&soc_trk=tw

ETSY INC (ETSY)

ETSY (ETSY) I really like this pull back set up for a long in to price targets on chart model $ETSY #swingtrading

ETSY long premarket 55.75 for trade price targets and trajectory in charting https://twitter.com/SwingAlerts_CT/status/1164459394882572289

Etsy CEO: Q2 Was A ‘Breakthrough’ Quarter #swingtrading $ETSY https://finance.yahoo.com/news/etsy-ceo-q2-breakthrough-quarter-192514678.html?soc_src=social-sh&soc_trk=tw

Per recent;

Part 5 Earnings Swing Trades:

#earnings for week

$NVDA $BABA $WMT $CSCO $JD $CGC $GOLD $SYY $AMAT $TLRY $M $GOOS $JCP $AAP $EOLS $TSG $STNE $AZRE $LK $TME $ERJ $CSIQ $YY $HUYA $NINE $DE $TDW $CRNT $HYGS $QD $TPR $BRC $BEST $PAGS $VFF $NTAP $RMBL $CACI $BE $CWCO $NEPT $A #swingtrading

#earnings for week$NVDA $BABA $WMT $CSCO $JD $CGC $GOLD $SYY $AMAT $TLRY $M $GOOS $JCP $AAP $EOLS $TSG $STNE $AZRE $LK $TME $ERJ $CSIQ $YY $HUYA $NINE $DE $TDW $CRNT $HYGS $QD $TPR $BRC $BEST $PAGS $VFF $NTAP $RMBL $CACI $BE $CWCO $NEPT $A #swingtrading https://t.co/4Zv7Jukrqo

— Swing Trading (@swingtrading_ct) August 12, 2019

OVERSTOCK (OSTK)

OVERSTOCK (OSTK) Long in premarket post ER for a possible 50% + trade, watch further model reports soon. #swingtrade $OSTK #tradealert

Why Overstock.com’s Stock Jumped 17% Today https://finance.yahoo.com/news/why-overstock-com-apos-stock-171100193.html?soc_src=social-sh&soc_trk=tw

WALLMART (WMT)

WALLMART (WMT) Likes to trade the channels on this model, after earnings it should be a channel trade in the model either way, on watch $WMT #ER

Walmart, Alibaba and some big-name pot companies keep earnings season rolling #swingtrading #ER $WMT $BABA https://on.mktw.net/2Mggc0v https://twitter.com/swingtrading_ct/status/1160861625760583681

Marathon Oil Corporation (MRO)

Swing Trading Alerts

@SwingAlerts_CT

Swing entry starter long in $MRO did trigger in 12.80s, set up will be on weekend report..

9:28 AM · Aug 9, 2019 https://twitter.com/SwingAlerts_CT/status/1159818732329414657

Marathon Oil’s Drilling Machine Delivers Another Profit Gusher in Q2 #swingtrading $MRO

Marathon Oil's Drilling Machine Delivers Another Profit Gusher in Q2 #swingtrading $MRO https://t.co/8TgfJ0zCHu

— Swing Trading (@swingtrading_ct) August 9, 2019

Marathon Oil Risk Reward for this Swing Trade is Very High. The Set-Up is Good at Support, Lets See How a Starter Works Out #swingtrading $MRO

A simple swing trade strategy here; trade is near multi area supports with good earnings season sentiment, risk-reward is significantly in favor of bulls, if it fails exit the trade early and re-enter later. Remember, you can always re-enter.

Arrow Pharmaceuticals (ARWR)

Swing Trading Alerts

@SwingAlerts_CT

Arrow Pharmaceuticals (ARWR) Another double return swing, start trims in to 30.00. Nice trade from 15s. Let a bit run. $ARWR #swingtrading

https://twitter.com/SwingAlerts_CT/status/1159653769744920576

Looking For Growth? Take A Look At These Biotechnology Stocks #swingtrading $ARWR (link: https://www.investors.com/news/technology/biotech-stocks-best-biotech-companies-to-invest-in/) investors.com/news/technolog… vi

Looking For Growth? Take A Look At These Biotechnology Stocks #swingtrading $ARWR https://t.co/Oci9VUsUsp vi

— Swing Trading (@swingtrading_ct) August 9, 2019

Arrow Pharmaceuticals (ARWR) was a great swing trading, however, let it come down to channel support now before re entering long $ARWR #swingtrade

Swing Trading Alerts

@SwingAlerts_CT

AngloGold Ashanti (AU) Near double, if you haven’t already in to time cycle peak, time to take some profits add longs mid way to Oct 21 cycle #swingtrading #Gold $AU

https://twitter.com/SwingAlerts_CT/status/1159469811396685824

Curtis Melonopoly

@curtmelonopoly

While Gold $GLD $XAUUSD $GC_F did get some range for the bulls, we hammered down long on AngloGold Ashanti (AU) $AU for near a double #swingtrading #Gold

While Gold $GLD $XAUUSD $GC_F did get some range for the bulls, we hammered down long on AngloGold Ashanti (AU) $AU for near a double #swingtrading #Gold

— Melonopoly (@curtmelonopoly) August 8, 2019

AngloGold Ashanti (AU) Near double, if you haven’t already in to time cycle peak, time to take some profits add longs nearing Oct 21 time cycle in Gold #swingtrading #Gold $AU

PARTEUM CORP (TEUM)

Swing Trading Alerts

@SwingAlerts_CT

PARTEUM CORP (TEUM) trading 3.60 from 2.60 trade alert, considering ER it’s time to take profit along the way $TEUM #swingtrade #earnings

https://twitter.com/SwingAlerts_CT/status/1158321103418351616

Pareteum Joins Russell 3000 Index https://finance.yahoo.com/news/pareteum-joins-russell-3000-index-100000783.html?soc_src=social-sh&soc_trk=tw

Pareteum Announces Second-Quarter 2019 Financial Results https://finance.yahoo.com/news/pareteum-announces-second-quarter-2019-200500905.html?.tsrc=rss

PARTEUM CORP (TEUM) the trade alert to exit at 3.60 from 2.60 trade alert buys worked, now watch for channel support buys $TEUM #swingtrade #earnings

And finally, be sure to watch our trade alerts on our alert feeds and in live trading room. If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Swing Trade and Day Trading Reports (charts can be brought down to Day Trading time frame):

Recent Premarket Notes (published as time allows, what we’re up to with our trading):

Premarket Notes July 31, 2019: FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD …

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Set Ups, Strategies, Alert, Signals, Earnings, $INS, $MDB, $MGI, $TERP, $HD

Swing Trading Strategies, Charts, Alerts w/ Video | Premium $PXD $TLRY $TSLA $EEM $AGN $AMD $INTC $XOP $MGI $BOX $FB $PLUG $BTC $LYFT $IOTS $SQ $STNE $TEUM $AU …

Swing Trading Set-Ups, Strategies, Alerts, Charts, News. June 24, 2019.

Below are Swing Trade Set-Ups Currently On Watch (in addition to the others in recent reporting) $PXD, $TLRY, $TSLA, $EEM, $AGN, $AMD, $INTC, $XOP, $MGI, $BOX, $FB, $PLUG, $BTC, $LYFT. $IOTS, $SQ, $STNE, $TEUM, $AU, $OIH.

Live Trading Room Swing Trade Video Review From June 20, 2019 2:22 PM.

All the swing trading alerts, strategies, charts and various set-ups are reviewed in detail on the video below from the live trading room.

Crude Oil (USOIL WTI)

Near resistance (as of time of video) 57.66 uptrending trend-line above, updated signals and charting in the most recent oil report distributed to members.

PIONEER NATURAL RESOURCES (PXD)

PIONEER NATURAL RESOURCES (PXD) through first Fib resistance target closed Friday 155.21 up from 148.50 swing trade alert with 161.00 area first Fibonacci resistance over-head.

From Swing Trade Alert 8:22 AM – 20 Jun 2019 (screen capture of alert below);

PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model. #swingtrading #tradealert https://www.tradingview.com/chart/PXD/pwpvHlyt-PIONEER-NAT-RES-PXD-Long-PXD-148-50-for-160-98-price-target/ …

Swing Trade Alert Screen Capture – PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model.

TILRAY (TLRY)

TILRAY (TLRY) Nice swing trade from 46.10 for 49.03 PT 1 and thru other resistance, trading 50.45 $TLRY #swingtrade #alert

Add in to each resistance and add above on trajectory or add on pull-backs.

It doesn’t get much easier than this – trade by numbers (lines).

From Swing Trade Alert to Trim in to Resistance 10:12 AM – 20 Jun 2019;

TILRAY (TLRY) in to key resistance, trim in to it add above to next #swingtrading #alerts $TLRY https://www.tradingview.com/chart/TLRY/cPAkfJnL-TILRAY-TLRY-in-to-key-resistance-trim-in-to-it-add-above-to-n/ …

From Swing Trade Alert Original Entry 8:04 AM – 20 Jun 2019;

Long $TLRY 46.10 for 49.03 PT # 1 details on report to follow, see previous charting.

TESLA (TSLA)

TESLA (TSLA) short, trade found support and bounced, stop at entry, resistance test above, could go either way. $TSLA

This trade started off well and as a daytrade it was excellent. On the swing it is still in play but trade did bounce at support below so be sure to exit before any loss as it is on the right side still. The trade is so close to the lower end of its trading range there’s no wisdom in holding if it turns against the original entry 225.05.

From Swing Trade Alert Feed 8:00 AM – 20 Jun 2019

Short $TSLA 225.05 for 203.42 1st PT, details in report upcoming. #swingtrading

EMERGING MARKETS ETF (EEM)

EMERGING MARKETS ETF (EEM) Long term swing trade, add at bottom of channel long trim at top $EEM #swingtrade

MACD, Stochastic RSI, and Squeeze Momentum on daily time frame are all trending up.

From Swing Trade Alert Feed 8:07 AM – 20 Jun 2019 Long $EEM 43.06 with 45.50 Price target # 1, details in upcoming report

ALLERGAN (AGN)

ALLERGAN (AGN) Trading 130.75 up from 116.00 original alert, see video report from trading room for the trading strategy going forward on this one and / or follow support and resistance points on chart. $AGN #swingtrade

ALLERGAN (AGN) swing from 116.00 doing well trading 130.81, trim in to 136 area resistance add above $AGN #swingtrade #alert

From June 18 Report;

ALLERGAN (AGN) from yesterday Swing Trade Report up 4.24% today closing 120.64 trim in to 128.00 add above $AGN #swingtrade #alert

Ironwood and Allergan Report Positive Topline Data from Phase IIIb Trial of LINZESS® #swingtrading $AGN https://finance.yahoo.com/news/ironwood-allergan-report-positive-topline-200500616.html?soc_src=social-sh&soc_trk=tw https://twitter.com/swingtrading_ct/status/1141170424769896452

From June 17, 2019 Report:

ALLERGAN (AGN) After significant sell-off this looks ready for a bounce near key over sold support now $AGN #swingtrade

The area of support just below trade (see white arrow) looks to be a key area that is likely to find support and bounce. If it does bounce then I see three areas of key snap back for bullish trade. A general trajectory of trade possible in a bullish scenario is included below with 3 white arrows. We will see how trade near term is, but I like it for a bounce to at least the first price target (first white uptrending arrow).

7 Stocks Ripe for M&A as Trade War Pushes Market Off Record Highs https://www.investopedia.com/7-stocks-ripe-for-m-and-a-as-trade-war-pushes-market-off-record-highs-4689910?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

ADVANCED MICRO DEVICES (AMD)

ADVANCED MICRO (AMD) has hit every upside price target (albeit some late) load at bottom of channel for 40.00 PT in trajectory #swingtrade $AMD – Of all the plays on radar between here and election, this is in top 10% imo. Load channel support. https://www.tradingview.com/chart/AMD/ngLZ4D1C-ADVANCED-MICRO-AMD-has-hit-every-upside-price-target-albeit-s/ …

Current trade pressure down in to time cycle peak, however, I expect it to turn very bullish in to October, 2019.

INTEL CORP (INTC)

June 24 – See Video for swing trading strategy.

Per June 18 Report;

INTEL CORP (INTC) from June 14 alert up 2.69% trading 47.37 today with MACD and SQZMOM trend up, watch 200 MA above #swingtrade $INTC

Nvidia and Intel’s Mobileye Both Continue Racking Up Autonomous Driving Deals #swingtrading $INTC

S&P OIL and Gas ETF (XOP)

June 24 – S&P OIL and Gas ETF (XOP) Swing trade doing well from 25.39 alert hit 27.09 trading 26.71. Add at each pull back and run the trend until MACD on 4 hour turns down. #swingtrade #tradealert

Per June 18 Report;

S&P OIL and Gas ETF (XOP). From yesterday’s alert bounced 2.69% today, MACD confirming, model to follow for trade strategy #swingtrading $XOP

ETFs & Stocks From Top-Ranked Sector to Buy #swingtrading $XOP

S&P OIL and Gas MACD cross up with double bottom, 20% move possible here. On watch for bounce. #swingtrading $XOP

MONEYGRAM INTERNATIONAL (MGI)

June 24 – See Video for swing trading strategy.

Per previous;

MONEYGRAM INTERNATIONAL (MGI) Up 167% today, sure looks like a bottom pattern, 200 MA on weekly minimum price target in continuation scenario, on high watch for Wed premarket $MGI #swingtrade #daytrade #alert

MoneyGram Soars on $50M Investment From Blockchain Startup Ripple #swingtrading $XRP $MGI https://www.thestreet.com/investing/cryptocurrency/moneygram-soars-on-ripple-investment-14994298

BOX INC (BOX)

Per alert below this is on watch, review video for trading strategy.

BOX INC (BOX) Is revving up again for a big move, looking for a possible move to 23.00, fast $BOX #Swingtrading #tradealerts

FACEBOOK (FB)

June 24, 2019 – Review video for trading strategy in detail.

PLUG POWER (PLUG)

June 24, 2019 – Review video for trading strategy in detail.

BITCOIN (BTC)

June 24, 2019 – Review video for trading strategy in detail.

ADESTO TECHNOLOGIES (IOTS)

June 24, 2019 – Review video for trading strategy in detail.

SQUARE (SQ)

June 24, 2019 – Review video for trading strategy in detail.

STONECO (STNE)

June 24, 2019 – Review video for trading strategy in detail.

PATEUM (TEUM)

June 24, 2019 – Review video for trading strategy in detail.

ANGLO GOLD (AU)

June 24, 2019 – Review video for trading strategy in detail.

OIL SERVICE (OIH)

June 24, 2019 – Review video for trading strategy in detail.

LYFT INC (LYFT)

June 24, 2019 – Review video for trading strategy in detail.

Per une 18 report;

LYFT INC (LYFT) bullish chart trading 64.40 targets 75.44 Jul 5 with 68.82 resistance (trading box) #swingtrading $LYFT

Disney resorts get a Lyft with rideshare partnership #swingtrading $LYFT $DIS https://www.bizjournals.com/losangeles/news/2019/06/18/disney-resorts-get-a-lyft-with-rideshare.html

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing Trading, Set Ups, Strategies, Alert, Signals, $PXD, $TLRY, $TSLA, $EEM, $AGN, $AMD, $INTC, $XOP, $MGI, $BOX, $FB, $PLUG, $BTC, $LYFT. $IOTS, $SQ, $STNE, $AU. $OIH, $WTI, $USOIL #Oil

PreMarket Trading Plan Tues Mar 14 $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ

Stock Trading Plan for Tuesday Mar 14, 2017 in Compound Trading Chat room. $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ – $ONTX, $DUST, $USRM, $XOM, $NE, $BLKG, $DRYS, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Trading Room Open House: We continue running open house – which will end soon (we just want to get this new platform settled first).

Trading Room Attendance: With our commercial multi-user algorithm chart modeling client platform launch, upcoming 24 hour oil trading room and coding for our algorithm models for our trader’s cockpit (you’d have to read our story on our website to understand our build-out plans)… I won’t be in the trading room as much starting Tuesday March 14, 2017. I expect to be in the room most days the first hour or two and then I have to turn my attention to the platform development daily and assistance our software developers require of me. I will still have my monitors on and will likely comment and/or run intra-day review broadcasts etc – I just won’t be in the room minute by minute.

The Quarterly Swing Trading Performance Review P/L with Charting is Published. The Algorithms and Daytrading Quarterly Performance Reports are being compiled as I write and will be posted soon.

https://twitter.com/CompoundTrading/status/841078264537993218

The trading group link is below – if you have any problems let us know.

Open House Today – Live Broadcast Trading 9:30 AM https://t.co/7H84KcZXgh $MGI $ETM $TNXP $ONCS $DWT $UGAZ #chatroom #stocks #premarket

— Melonopoly (@curtmelonopoly) March 14, 2017

Yesterday’s trading results here:

https://twitter.com/CompoundTrading/status/841614605264797700

Keep it Simple Swing Charting Post:

https://twitter.com/CompoundTrading/status/840839909573349376

Results of Gold trade vote are in!

RESULTS ARE IN! Will the next leg in #Gold trading be up or down? Round 3. Tie breaker! $GC_F $GLD $XAUUSD $GDX $NUGT $DUST $JDST $JUNG https://t.co/7NVSaMQ3Kh

— Melonopoly (@curtmelonopoly) March 14, 2017

Current Holds / Trading Plan:

Even though my holds are small in size I would like to start focusing on trading out of some of these, if not all.

All small to mid size holds in this order according to sizing – $ONTX, $DUST, $USRM, $XOM, $NE, $BLKG, $DRYS, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI.

Per recent’ $DUST I will close for a loss if Gold holds 1260 – sucks, but it was a relatively small position (to portfolio size) but I didn’t follow the golden rule… when a trade goes against your plan cut fast and I didn’t so I will likely pay the price. And I guess what has become the second golden rule… listen to the algos… they haven’t been wrong yet – so yes, I didn’t listen to my own invention ROSIE the Gold Algo (give Rosie a little plug there she deserves it lol). Embarrassing, especially because ROSIE nailed the bottom many weeks in advance of the bottom – all I had to do was listen and boom new house. Sad.

Market Outlook / Trading Plan:

Markets appear to be awaiting the Fed and a number of other factors.

I do have $NFLX on watch as a short, and long watches for swings also $TAN, $ABX, $JNUG, $WYNN, $SLX, $TWLO, $X, $XME, $AKS and a few others.

#Fed, in shift, may move to faster pace of rate hikes https://t.co/kCSWCuAKod via @Reuters

— Melonopoly (@curtmelonopoly) March 14, 2017

New Oil Price War Looms As The OPEC Deal Falls Short | https://t.co/8uM3eZ2UfT https://t.co/H3IITX2bS6 #oilprice

— Melonopoly (@curtmelonopoly) March 14, 2017

https://twitter.com/NorthmanTrader/status/841304382025191424

https://twitter.com/ThinkTankCharts/status/841581618380865537

Morning Momo / News and Social Bits From Around the Internet:

Momo Watch: $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ

S&P -0.22%.

10-yr +0.02%.

Euro -0.21% vs. dollar.

Crude -0.66% to $48.08.

Gold +0.12% to $1,204.50.

Corning downgraded to Neutral at Goldman Sachs; 1.5% pre-market http://seekingalpha.com/news/3250899-corning-downgraded-neutral-goldman-sachs-1_5-percent-pre-market?source=twitter_sa_factset … #premarket $GLW

EnteroMedics’ vBloc featured on TV show; shares ahead 21% premarket http://seekingalpha.com/news/3250897-enteromedics-vbloc-featured-tv-show-shares-ahead-21-percent-premarket?source=feed_f … #premarket $ETRM

Tesla debuts in South Korea tomorrow http://seekingalpha.com/news/3250896-tesla-debuts-south-korea-tomorrow?source=twitter_sa_factset … #premarket $TSLA

$AMD shares dumping premarket–down to 14.01 from yesterday’s close of 14.28

Ackman’s loss on Valeant could be over $5B; shares slip another 12% premarket http://dlvr.it/NcyLlw #investing #news

Aurinia’s stock plummets 24% in active premarket trade after stock offering prices at deep discount http://dlvr.it/NcyG8L MARKETWATCH

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ $ARRS $DSW $OPK $DRYS $YY $PLX $UWT $UNG $MAT $NVDA $JNUG

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List: $TAN, $ABX, $JNUG, $WYNN, $SLX, $TWLO, $X, $XME, $AKS

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $WOR $ZEUS $RS $DGX $GDOT $DIS $TXRH $OXY $CTB $LADR $ETH $MAA $ARRS $TDG as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $WUBA $HLIT $GGP $ABT $AMPH $GLW as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ – $MGTI, $NE, $XOM, $USRM, $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $DRYS – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F

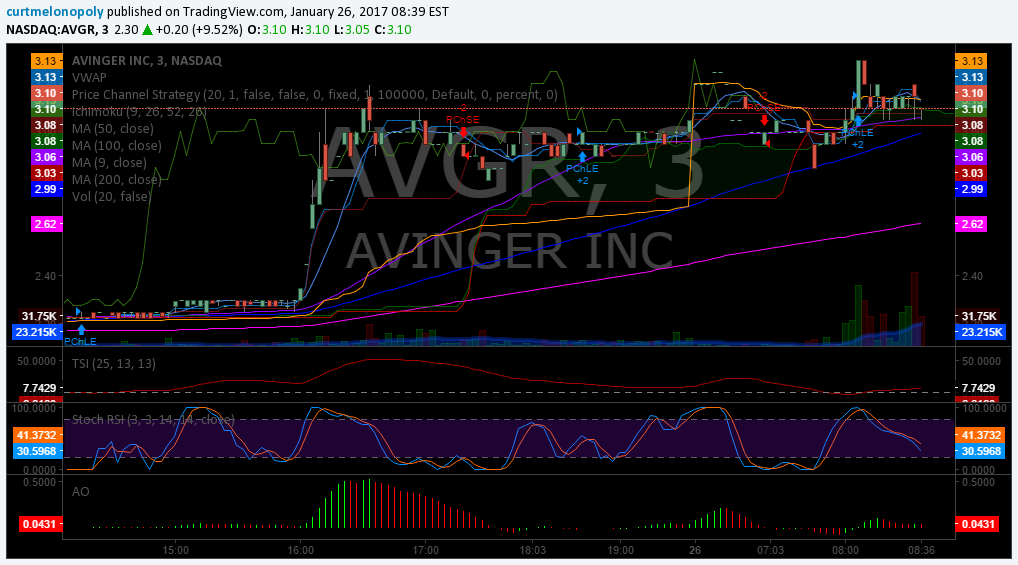

PreMarket Trading Plan Thur Jan 26 $AVGR, $MGI, $FFHL, $FNCX, $RLMD – $NUGT $DUST $JNUG $JDST $USLV $DSLV

My Stock Trading Plan for Thursday Jan 26, 2017 in Trading Chat room. – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session!

Notices:

Per previous;

https://twitter.com/CompoundTrading/status/823791504602710016

Feature Post: “Why our Stock Algorithms are Different than Most“. If you are using our algorithmic model charting it is a must read.

Review: If you are not reviewing the post market trading results along with this please do so. We assume our trading room subscribers review it everyday. There is often information applicable to and not included in this premarket report. You will find the post market trading result reports on our blog daily.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

New Service Options: EPIC the Oil Algo now has an Oil Report only option vs. bundle w/ 24 hr trading room. Plans from $4.10 per day w/promo code.

New Service Options: Entry-Level trader one-on-one trade coaching and entry-level trade academy options now available in addition to intermediate / advanced trading academy and coaching.

Current Holds:

All very small positions – $ROKA, $TRCH, $ESEA, $CBMX, $JUNO, $DUST (looking for a way out on $DUST – was expecting one final significant spike in USDJPY before drop). $CBMX and $JUNO are holds till spring if necessary (you would have to do your own DD on the companies and make your own determination).

General Market Outlook:

Gold is in trouble and at a very important decision area – review Rosie the Gold Algo report for details. $DXY and $USDJPY still wildcard. $VIX is getting crushed to lows as I expected. $SPY got lift as expected. $GDX – as per previous…. careful, if market gets idea that Trump not going to help miner’s like market thinks whoompf.

Rosie the Gold Algo, Epic the Oil Algo, SuperNova Silver and the others continue to hit calls so I’m pumped.

https://twitter.com/EPICtheAlgo/status/824287143103057920

What price of Gold did after my alert of algo quadrant test. 324 AM Sept 25, 17 $GC_F $GLD $XAUUSD $GDX $GDXJ $NUGT $DUST $JNUG $JDST pic.twitter.com/vP7PrUENj2

— Rosie the Gold Algo (@ROSIEtheAlgo) January 25, 2017

Per previous;

My general bias (as a trader – not algo math) is for the market to be somewhat flat or deflate prior to Jan 20 inauguration, Gold and Silver to get further lift but back off between Wednesday afternoon and Monday. After the inauguration my bias is toward Gold and Silver getting punished when the Trump train gets moving again (no telling if this will be days or weeks or even a few short months). But I do think Trump will crush Gold, Silver etc and the $VIX at some point. The $VIX I will be watching close. Oil I think has headwinds. Natural Gas I am continuing to watch. Smaller Gold / Silver / Oil companies and Shippers / Greece I am watching very close also. But of course with Brexit in the news, the OPEC situation and inauguration I am going to stay very nimble and likely trade volatility and Gold related most of the week.

Early in 2017 I will be watching very closely bonds, $USDJPY, markets in general for direction (of course there are hundreds of variables).

Metals, energy and financials are three areas I am looking to for 2017 for trading margin – with bio in fourth place on my list. And per previous we’re expecting some action in bonds to the upside a high probability.

As a trader, it is the margin / volatility I am focused toward and getting on the right side of a market / sector turn and scaling in to that.

All algos (Oil, SPY, Gold, Silver, Dollar, VIX) have hit their targets now (long term since July and short term) so we are running calculation targets for all six algos for all time charting time-frames and expect these reports to start rolling out first week of January 2017.

Morning Momo / News Bits:

Momo Watch: $AVGR, $MGI, $FFHL, $FNCX, $RLMD

8:30

Jobless #

8:30

Int trade

Chicago Index

9:45

Index Flash

10a

Home Sale

10:30

NG #’s

11a

KC Mfg

1p

7Yr Note

4:30

Fed Bal Sheet

Wholesale Inventories Dec. 1.0%, Exp. 0.1%

Low floaters up in premarket $FNCX $NURO $RXII $FFHL $PULM $CAPN $RADA

EARNINGS: Ford beats estimates on revenue, but affirms 2017 outlook as ‘generally lower’ than last year http://cnb.cx/2j7Rphd

Radian +1.9% after topping estimates http://seekingalpha.com/news/3237807-radian-plus-1_9-percent-topping-estimates?source=feed_f … #premarket $RDN

Raytheon falls after Q4 miss http://seekingalpha.com/news/3237808-raytheon-falls-q4-miss?source=feed_f … #premarket

JetBlue gains after earnings http://seekingalpha.com/news/3237809-jetblue-gains-earnings?source=feed_f … #premarket $JBLU

Pfizer’s C. diff vaccine candidate successful in mid-stage study http://seekingalpha.com/news/3237810-pfizers-c-diff-vaccine-candidate-successful-mid-stage-study?source=feed_f … #premarket $PFE

$POT -5.2% premarket after posting weaker than expected Q4 earnings

#Mattel maintained at buy at Moness Crespi. Price target cut $3 to $34.

$MAT -12.23% at 27.70 premarket #stocks

Royal Caribbean’s stock surges 2.7% premarket after Q4 results http://ift.tt/1sXtiiU

Celgene Q4 top line up 16%; non-GAAP earnings up 34%; shares ahead 1% premarket

$NURO Full year 2016 revenue of $12.0 million was up 65% from $7.3 million in 2015. #Premarket

BLACKSTONE GROUP LP SHARES UP 2.8 PCT AT $31.49 IN PREMARKET TRADE AFTER RESULTS

Endo restructures; 90 jobs cut; shares up 1% premarket $ENDP

Caterpillar dips on softer guidance http://seekingalpha.com/news/3237791-caterpillar-dips-softer-guidance?source=feed_f … #premarket $CAT

L-3 Communications beats by $0.27, beats on revenue http://seekingalpha.com/news/3237818-lminus-3-communications-beats-0_27-beats-revenue?source=twitter_sa_factset … #premarket $LLL

Weight Watchers pushed higher by Oprah news again http://seekingalpha.com/news/3237816-weight-watchers-pushed-higher-oprah-news?source=twitter_sa_factset … #premarket $WTW

Moneygram +30% on WSJ report of Alibaba interest http://seekingalpha.com/news/3237813-moneygram-plus-30-percent-wsj-report-alibaba-interest?source=twitter_sa_factset … #premarket $MGI $BABA

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: Gainers: $AVGR 37%, $MGI 30%, $FFHL 23%, $FNCX 22%, $RLMD 18%, $CAPN $NURO $VNR $LGCY $URI $UGAZ $PKX $NOW $EBAY $JDST $DUST

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: Losers: I will update before market open or refer to chat room notices.

(3) Other Watch-List: $NG, $URRE, $AUMN, $GLDD, $EGI, $UEC, $GSS, $GPL, $MNGA, $LTBR, $XRA, $AUY, $NAK are on my watchlist.

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $MTOR $WNC $WGL $CLVS $GWW $MSM $IP $PAC $SGMS $RES $PKX $URI $EL $BANC $CPF $RES $WASH as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $JNJ $ACAT $NAP $CDXS $IGT $MAT $HOPE $MDP $WOOF $HSKA $VAR as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $AVGR, $MGI, $FFHL, $FNCX, $RLMD, $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $CBMX, $JUNO, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F