Tag: S&P 500

Member Weekly Swing Trade Update Jan 30, 17 – Swing Trading $OAK, $GOOGL, $AMZN and more.

Good morning swing traders and welcome to our weekly swing trading memo for the week of Jan 30, 2017!

Don’t hesitate to email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

One new chart added for today and there will be more through the week this week. The rest are from the previous report. The new add is Oak Tree Capital $OAK.

It is important to note the other charts below have not been updated since being first inserted here, so be sure to look up most recent trading ranges before considering trades.

This Swing Report is in Development (as with $VIX, $SPY algos) – But We’re Getting There.

Below you will find my top ten picks for swing trading in the first quarter of 2017 (plus a few bonus picks I will be swing trading). I am currently in the middle of compiling the due diligence and charting set-ups for publication for over fifty charts so this list may grow considerably – I am excited about 2017.

As mentioned previous, I will also include our regular algorithmic modeling equities relating to Oil, Gold, Miners, Silver, US Dollar, Volatility and SPY in my 2017 reports (in addition to the ten others listed below) FYI.

In my reports I will focus on both long term holds and swing trading these equities with an intent to try and time the highs and lows (pull-backs) as best as possible. I know many propose that picking the highs and lows isn’t the best method – but to be frank it has served me well over the years.

Also, I should mention, that any of the stocks below that do not trade well (or as planned) I will switch out with another choice as the weeks progress. But the intent is to hold ten investment / swing stocks (per below) and also swing trade in and out of the regular algorithmic modeling equities I mentioned also.

Oh, and the updates will be coming out more often than weekly also (thought I should mention that).

First step is to get charts out with levels I will be trading. Then I’ll put out more DD on each also.

I am going to start below with ones that are most timely and build this out from there (in order of priority for my personal trades and what I see going on in the market).

The Ten Swing Trades I am going to focus on in the First Quarter of 2017 are as follows:

1 – Alphabet (Google) $GOOGL, $GOOG

We like this chart. Watch for an upside break out of the triangle. The principles apply the same to $GOOG and $GOOGL charts fyi. Also, watch the MACD close, it looks primed for a move. Earnings are Thursday. If price breaks to downside I will update with levels to watch. Also, the is a chart below that shows upside target.

Link to live $GOOGL chart in TradingView.

https://www.tradingview.com/chart/GOOGL/isvDnbTQ-Swing-Trading-Member-Chart-GOOGL/

1003.17 Price Target in 2017 with upside break-out. Alphabet (Google) $GOOGL

Technically, the price target (should price break to upside) is 1003.17 before Jan 29 2018.

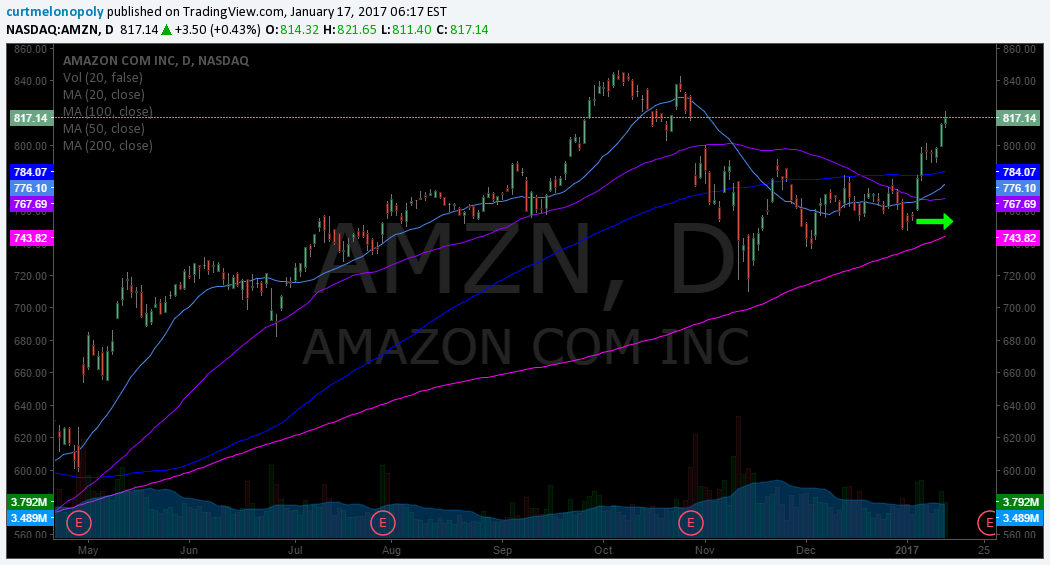

2 – Amazon $AMZN

My fourth priority is Amazon. I don’t want to over simplify this trade – but the bottom line is I’m looking for a pull-back and an entry as close to that 200 day (pink line with green arrow) as possible. I don’t think this stock will stop anytime soon. DD to follow soon.

3 – Juno $JUNO

4 – CombiMatrix Corp $CBMX

My second priority is $CBMX. I am already in this swing and plan to enter in dips at the diagonal trend line (blue). Initial target area is around 5.57 with much greater potential upside. The Trump factor may cause this to come off a bit so my bias is toward late spring for first price target.

https://www.tradingview.com/chart/CBMX/qtdyUyY0-CBMX-Swing-Trade/

5 – OakTree Capital $OAK

Oaktree Capital Group, LLC (OAK) today announced that it will report fourth quarter and full year 2016 financial results prior to the opening of the New York Stock Exchange on Tuesday, February 7, 2017.

http://finance.yahoo.com/news/oaktree-schedules-fourth-quarter-full-133000267.html

Was trading at 37.57 – 38.00 when we originally started to look at it, currently trades at 41.65.

42.71 – 43.50 is our short term swing target (less than 3 months).

49.58 is our 2017 target. No target date.

Our traders will be watching earnings (much like we did with Google last week and we will be doing with Amazon this week). Pending earnings and price action this will be when we enter a trade. Some of our swing traders have obviously seen decent gains since we first put this on our swing trading list a number of weeks back (good timing actually), but our traders have not taken a position yet.

Oaktree Capital Trading View Live Charting:

https://www.tradingview.com/chart/OAK/w2CBerv2-Swing-Trading-Newsletter-Oaktree-Capital-OAK/

6 – VanEck Vectors Russia ETF $RSX

7 – BOFI Holdings $BOFI

8 – Sunoco Logistics Partners $SXL

9 – US Silica Holdings $SLCA

My fifth priority is $SLCA. Again, another simple chart and it will require some patience. I see a pull-back coming and huge upside under the Trump inertia in to summer. I am looking for a pull-back to the 50 day (yellow arrow) or the 100 day preferably (blue arrow). If it gets away on me I’ll likely chase it and scale in 1/5th at a time.

10 – EOG Resources $EOG

The Bonus Picks for 2017 I will be Swing Trading also:

1 – $GREK Global Greece ETF

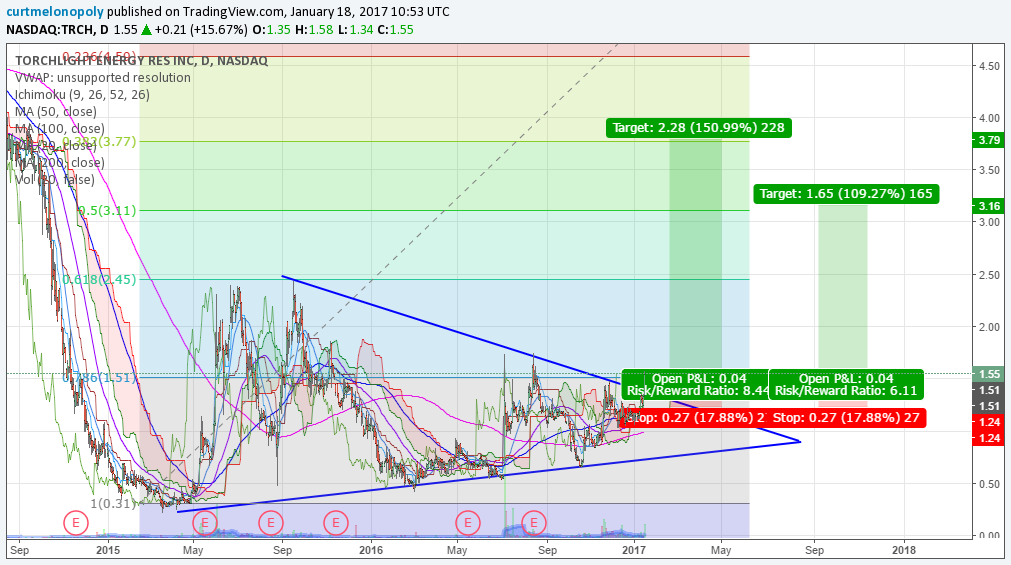

2 – $TRCH Torchlight Energy

https://www.tradingview.com/chart/TRCH/xxpZ4uPM-TRCH-Swing-Trade/

3 – $NG Nova Gold

The first swing of 2017 I will be entering (likely today) is NovaGold. First target is 6.46 area and second target is 7.30 area. It is currently trading at 5.10. It’s full extension is over 8.50.

https://www.tradingview.com/chart/NG/1Sz7RDKg-NG-Novagold-Swing-Trade/

Our Standard Algorithmic Modeling Securities I will be providing Swing Trade levels for are:

1 – $SPY

2 – $VIX

My seventh priority is the VIX. I see a pull-back in the market coming and a lift in VIX. The primary trade I am looking for is actually a short in the VIX when it gets upside it’s bolllinger band (it’s a little more complicated than that – specifically with timing and I will be putting an alert out when I do it anyway) – I’ll also play some short term longs in $TVIX or $UVXY.

https://www.tradingview.com/chart/VIX/t6YF7SQY-VIX-Short-Swing-Trade-Above-Bollinger-Band/

3 – $DXY

4 – $SLV

5 – $GLD – Gold (and miner’s $GDX)

My third priority on this list are the miner’s – $GDX and leveraged friends. This one is risky but comes with large gains if miner’s get moving and price breaks in to next quadrant above the yellow one outlined on the chart below. And for the risk taker it can be traded with leveraged ETN’s. There are inherent risks however; one is that price is not at bottom of the trading quadrant so an entry here is not ideal and the obvious issue is the Trump factor.

https://www.tradingview.com/chart/8QOM4r5s/

6 – $USOIL / $WTI

In overnight lab work our developers established a diagonal trendline (blue line in chart that has a blue arrow pointing at it) that has established itself as strong support. If you take a swing trade against that support (as as close to it as possible) then look to the upside of that white dotted arrow line as your target long. Ratchet up stops there.

Email or DM me on Twitter anytime with thoughts or questions!

I will be updating regularly now – I need to get as much done here before inauguration for my own trading too so that’s a major motivator – I will send out updates as I update!

Cheers!

Curtis.

Article Topics; Swing Trading, $GOOGL, $AMZN, $JUNO, $CBMX, $OAK, $RSX, $BOFI, $SXL, $SLCS, $EOG, $NG, $TRCH, $GREK, $USOIL, $GOLD, $GLD, $SILVER, $SLV, $SPY, S&P 500, $DXY, $VIX

Member Weekly Swing Trade Update Jan 23, 17 – Swing Trading, $GOOGL and more.

Good morning swing traders and welcome to our weekly swing trading memo for the week of Jan 22, 2017!

Don’t hesitate to email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

One new chart added for today! The rest are from the previous report. The new add is Alphabet (Google) $GOOGL. They report earnings this Thursday!

This Swing Report is in Development (as with $VIX, $SPY algos) – But We’re Getting There.

Below you will find my top ten picks for swing trading in the first quarter of 2017 (plus a few bonus picks I will be swing trading). I am currently in the middle of compiling the due diligence and charting set-ups for publication for over fifty charts so this list may grow considerably – I am excited about 2017.

As mentioned previous, I will also include our regular algorithmic modeling equities relating to Oil, Gold, Miners, Silver, US Dollar, Volatility and SPY in my 2017 reports (in addition to the ten others listed below) FYI.

In my reports I will focus on both long term holds and swing trading these equities with an intent to try and time the highs and lows (pull-backs) as best as possible. I know many propose that picking the highs and lows isn’t the best method – but to be frank it has served me well over the years.

Also, I should mention, that any of the stocks below that do not trade well (or as planned) I will switch out with another choice as the weeks progress. But the intent is to hold ten investment / swing stocks (per below) and also swing trade in and out of the regular algorithmic modeling equities I mentioned also.

So bottom line is that I am in process here, building it out, it isn’t done, it’s going to take a lot more time than I ever imagined, but I’ll be updating and building this out considerably now forward. Again, sorry about the delays.

Oh, and the updates will be coming out more often than weekly also (thought I should mention that).

First step is to get charts out with levels I will be trading. Then I’ll put out more DD on each also.

I am going to start below with ones that are most timely and build this out from there (in order of priority for my personal trades and what I see going on in the market).

The Ten Swing Trades I am going to focus on in the First Quarter of 2017 are as follows:

1 – Alphabet (Google) $GOOGL, $GOOG

We like this chart. Watch for an upside break out of the triangle. The principles apply the same to $GOOG and $GOOGL charts fyi. Also, watch the MACD close, it looks primed for a move. Earnings are Thursday. If price breaks to downside I will update with levels to watch. Also, the is a chart below that shows upside target.

Link to live $GOOGL chart in TradingView.

https://www.tradingview.com/chart/GOOGL/isvDnbTQ-Swing-Trading-Member-Chart-GOOGL/

1003.17 Price Target in 2017 with upside break-out. Alphabet (Google) $GOOGL

Technically, the price target (should price break to upside) is 1003.17 before Jan 29 2018.

2 – Amazon $AMZN

My fourth priority is Amazon. I don’t want to over simplify this trade – but the bottom line is I’m looking for a pull-back and an entry as close to that 200 day (pink line with green arrow) as possible. I don’t think this stock will stop anytime soon. DD to follow soon.

3 – Juno $JUNO

4 – CombiMatrix Corp $CBMX

My second priority is $CBMX. I am already in this swing and plan to enter in dips at the diagonal trend line (blue). Initial target area is around 5.57 with much greater potential upside. The Trump factor may cause this to come off a bit so my bias is toward late spring for first price target.

https://www.tradingview.com/chart/CBMX/qtdyUyY0-CBMX-Swing-Trade/

5 – OakTree Capital $OAK

6 – VanEck Vectors Russia ETF $RSX

7 – BOFI Holdings $BOFI

8 – Sunoco Logistics Partners $SXL

9 – US Silica Holdings $SLCA

My fifth priority is $SLCA. Again, another simple chart and it will require some patience. I see a pull-back coming and huge upside under the Trump inertia in to summer. I am looking for a pull-back to the 50 day (yellow arrow) or the 100 day preferably (blue arrow). If it gets away on me I’ll likely chase it and scale in 1/5th at a time.

10 – EOG Resources $EOG

The Bonus Picks for 2017 I will be Swing Trading also:

1 – $GREK Global Greece ETF

2 – $TRCH Torchlight Energy

https://www.tradingview.com/chart/TRCH/xxpZ4uPM-TRCH-Swing-Trade/

3 – $NG Nova Gold

The first swing of 2017 I will be entering (likely today) is NovaGold. First target is 6.46 area and second target is 7.30 area. It is currently trading at 5.10. It’s full extension is over 8.50.

https://www.tradingview.com/chart/NG/1Sz7RDKg-NG-Novagold-Swing-Trade/

Our Standard Algorithmic Modeling Securities I will be providing Swing Trade levels for are:

1 – $SPY

2 – $VIX

My seventh priority is the VIX. I see a pull-back in the market coming and a lift in VIX. The primary trade I am looking for is actually a short in the VIX when it gets upside it’s bolllinger band (it’s a little more complicated than that – specifically with timing and I will be putting an alert out when I do it anyway) – I’ll also play some short term longs in $TVIX or $UVXY.

https://www.tradingview.com/chart/VIX/t6YF7SQY-VIX-Short-Swing-Trade-Above-Bollinger-Band/

3 – $DXY

4 – $SLV

5 – $GLD – Gold (and miner’s $GDX)

My third priority on this list are the miner’s – $GDX and leveraged friends. This one is risky but comes with large gains if miner’s get moving and price breaks in to next quadrant above the yellow one outlined on the chart below. And for the risk taker it can be traded with leveraged ETN’s. There are inherent risks however; one is that price is not at bottom of the trading quadrant so an entry here is not ideal and the obvious issue is the Trump factor.

https://www.tradingview.com/chart/8QOM4r5s/

6 – $USOIL / $WTI

In overnight lab work our developers established a diagonal trendline (blue line in chart that has a blue arrow pointing at it) that has established itself as strong support. If you take a swing trade against that support (as as close to it as possible) then look to the upside of that white dotted arrow line as your target long. Ratchet up stops there.

Email or DM me on Twitter anytime with thoughts or questions!

I will be updating regularly now – I need to get as much done here before inauguration for my own trading too so that’s a major motivator – I will send out updates as I update!

Cheers!

Curtis.

Article Topics; Swing Trading, $GOOGL, $AMZN, $JUNO, $CBMX, $OAK, $RSX, $BOFI, $SXL, $SLCS, $EOG, $NG, $TRCH, $GREK, $USOIL, $GOLD, $GLD, $SILVER, $SLV, $SPY, S&P 500, $DXY, $VIX

Member Weekly Swing Trade Update Jan 20, 2017

Good morning swing traders and welcome to our weekly swing trading memo for the week of Jan 16, 2017!

Don’t hesitate to email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below only one new chart added for today! The rest are from the previous report. It’s $USOIL $WTI that can be traded also with $UWT $DWT, $USO, $UCO, $SCO etc… Anyway, oil has established a support area that would be decent as a swing trade – see below for details.

This Swing Report is in Development (as with $VIX, $SPY algos) – But We’re Getting There.

Below you will find my top ten picks for swing trading in the first quarter of 2017 (plus a few bonus picks I will be swing trading). I am currently in the middle of compiling the due diligence and charting set-ups for publication for over fifty charts so this list may grow considerably – I am excited about 2017.

As mentioned previous, I will also include our regular algorithmic modeling equities relating to Oil, Gold, Miners, Silver, US Dollar, Volatility and SPY in my 2017 reports (in addition to the ten others listed below) FYI.

In my reports I will focus on both long term holds and swing trading these equities with an intent to try and time the highs and lows (pull-backs) as best as possible. I know many propose that picking the highs and lows isn’t the best method – but to be frank it has served me well over the years.

Also, I should mention, that any of the stocks below that do not trade well (or as planned) I will switch out with another choice as the weeks progress. But the intent is to hold ten investment / swing stocks (per below) and also swing trade in and out of the regular algorithmic modeling equities I mentioned also.

So bottom line is that I am in process here, building it out, it isn’t done, it’s going to take a lot more time than I ever imagined, but I’ll be updating and building this out considerably now forward. Again, sorry about the delays.

Oh, and the updates will be coming out more often than weekly also (thought I should mention that).

First step is to get charts out with levels I will be trading. Then I’ll put out more DD on each also.

I am going to start below with ones that are most timely and build this out from there (in order of priority for my personal trades and what I see going on in the market).

The Ten Swing Trades I am going to focus on in the First Quarter of 2017 are as follows:

1 – Google $GOOGL

2 – Amazon $AMZN

My fourth priority is Amazon. I don’t want to over simplify this trade – but the bottom line is I’m looking for a pull-back and an entry as close to that 200 day (pink line with green arrow) as possible. I don’t think this stock will stop anytime soon. DD to follow soon.

3 – Juno $JUNO

4 – CombiMatrix Corp $CBMX

My second priority is $CBMX. I am already in this swing and plan to enter in dips at the diagonal trend line (blue). Initial target area is around 5.57 with much greater potential upside. The Trump factor may cause this to come off a bit so my bias is toward late spring for first price target.

https://www.tradingview.com/chart/CBMX/qtdyUyY0-CBMX-Swing-Trade/

5 – OakTree Capital $OAK

6 – VanEck Vectors Russia ETF $RSX

7 – BOFI Holdings $BOFI

8 – Sunoco Logistics Partners $SXL

9 – US Silica Holdings $SLCA

My fifth priority is $SLCA. Again, another simple chart and it will require some patience. I see a pull-back coming and huge upside under the Trump inertia in to summer. I am looking for a pull-back to the 50 day (yellow arrow) or the 100 day preferably (blue arrow). If it gets away on me I’ll likely chase it and scale in 1/5th at a time.

10 – EOG Resources $EOG

The Bonus Picks for 2017 I will be Swing Trading also:

1 – $GREK Global Greece ETF

2 – $TRCH Torchlight Energy

https://www.tradingview.com/chart/TRCH/xxpZ4uPM-TRCH-Swing-Trade/

3 – $NG Nova Gold

The first swing of 2017 I will be entering (likely today) is NovaGold. First target is 6.46 area and second target is 7.30 area. It is currently trading at 5.10. It’s full extension is over 8.50.

https://www.tradingview.com/chart/NG/1Sz7RDKg-NG-Novagold-Swing-Trade/

Our Standard Algorithmic Modeling Securities I will be providing Swing Trade levels for are:

1 – $SPY

2 – $VIX

My seventh priority is the VIX. I see a pull-back in the market coming and a lift in VIX. The primary trade I am looking for is actually a short in the VIX when it gets upside it’s bolllinger band (it’s a little more complicated than that – specifically with timing and I will be putting an alert out when I do it anyway) – I’ll also play some short term longs in $TVIX or $UVXY.

https://www.tradingview.com/chart/VIX/t6YF7SQY-VIX-Short-Swing-Trade-Above-Bollinger-Band/

3 – $DXY

4 – $SLV

5 – $GLD – Gold (and miner’s $GDX)

My third priority on this list are the miner’s – $GDX and leveraged friends. This one is risky but comes with large gains if miner’s get moving and price breaks in to next quadrant above the yellow one outlined on the chart below. And for the risk taker it can be traded with leveraged ETN’s. There are inherent risks however; one is that price is not at bottom of the trading quadrant so an entry here is not ideal and the obvious issue is the Trump factor.

https://www.tradingview.com/chart/8QOM4r5s/

6 – $USOIL / $WTI

In overnight lab work our developers established a diagonal trendline (blue line in chart that has a blue arrow pointing at it) that has established itself as strong support. If you take a swing trade against that support (as as close to it as possible) then look to the upside of that white dotted arrow line as your target long. Ratchet up stops there.

Email or DM me on Twitter anytime with thoughts or questions!

I will be updating regularly now – I need to get as much done here before inauguration for my own trading too so that’s a major motivator – I will send out updates as I update!

Cheers!

Curtis.

Article Topics; Swing Trading, $GOOGL, $AMZN, $JUNO, $CBMX, $OAK, $RSX, $BOFI, $SXL, $SLCS, $EOG, $NG, $TRCH, $GREK, $USOIL, $GOLD, $GLD, $SILVER, $SLV, $SPY, S&P 500, $DXY, $VIX

Weekly Swing Trade Member Update Jan 18, 2017

Good morning swing traders and welcome to our weekly swing trading memo for the week of Jan 16, 2017!

Don’t hesitate to email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below only one new chart added for today! The rest are from the previous report. It’s $TRCH and it’s a doozie!

This Swing Report is in Development (as with $VIX, $SPY algos) – But We’re Getting There.

Below you will find my top ten picks for swing trading in the first quarter of 2017 (plus a few bonus picks I will be swing trading). I am currently in the middle of compiling the due diligence and charting set-ups for publication for over fifty charts so this list may grow considerably – I am excited about 2017.

As mentioned previous, I will also include our regular algorithmic modeling equities relating to Oil, Gold, Miners, Silver, US Dollar, Volatility and SPY in my 2017 reports (in addition to the ten others listed below) FYI.

In my reports I will focus on both long term holds and swing trading these equities with an intent to try and time the highs and lows (pull-backs) as best as possible. I know many propose that picking the highs and lows isn’t the best method – but to be frank it has served me well over the years.

Also, I should mention, that any of the stocks below that do not trade well (or as planned) I will switch out with another choice as the weeks progress. But the intent is to hold ten investment / swing stocks (per below) and also swing trade in and out of the regular algorithmic modeling equities I mentioned also.

So bottom line is that I am in process here, building it out, it isn’t done, it’s going to take a lot more time than I ever imagined, but I’ll be updating and building this out considerably now forward. Again, sorry about the delays.

Oh, and the updates will be coming out more often than weekly also (thought I should mention that).

First step is to get charts out with levels I will be trading. Then I’ll put out more DD on each also.

I am going to start below with ones that are most timely and build this out from there (in order of priority for my personal trades and what I see going on in the market).

The Ten Swing Trades I am going to focus on in the First Quarter of 2017 are as follows:

1 – Google $GOOGL

2 – Amazon $AMZN

My fourth priority is Amazon. I don’t want to over simplify this trade – but the bottom line is I’m looking for a pull-back and an entry as close to that 200 day (pink line with green arrow) as possible. I don’t think this stock will stop anytime soon. DD to follow soon.

3 – Juno $JUNO

4 – CombiMatrix Corp $CBMX

My second priority is $CBMX. I am already in this swing and plan to enter in dips at the diagonal trend line (blue). Initial target area is around 5.57 with much greater potential upside. The Trump factor may cause this to come off a bit so my bias is toward late spring for first price target.

https://www.tradingview.com/chart/CBMX/qtdyUyY0-CBMX-Swing-Trade/

5 – OakTree Capital $OAK

6 – VanEck Vectors Russia ETF $RSX

7 – BOFI Holdings $BOFI

8 – Sunoco Logistics Partners $SXL

9 – US Silica Holdings $SLCA

My fifth priority is $SLCA. Again, another simple chart and it will require some patience. I see a pull-back coming and huge upside under the Trump inertia in to summer. I am looking for a pull-back to the 50 day (yellow arrow) or the 100 day preferably (blue arrow). If it gets away on me I’ll likely chase it and scale in 1/5th at a time.

10 – EOG Resources $EOG

The Bonus Picks for 2017 I will be Swing Trading also:

1 – $GREK Global Greece ETF

2 – $TRCH Torchlight Energy

https://www.tradingview.com/chart/TRCH/xxpZ4uPM-TRCH-Swing-Trade/

3 – $NG Nova Gold

The first swing of 2017 I will be entering (likely today) is NovaGold. First target is 6.46 area and second target is 7.30 area. It is currently trading at 5.10. It’s full extension is over 8.50.

https://www.tradingview.com/chart/NG/1Sz7RDKg-NG-Novagold-Swing-Trade/

Our Standard Algorithmic Modeling Securities I will be providing Swing Trade levels for are:

1 – $SPY

2 – $VIX

My seventh priority is the VIX. I see a pull-back in the market coming and a lift in VIX. The primary trade I am looking for is actually a short in the VIX when it gets upside it’s bolllinger band (it’s a little more complicated than that – specifically with timing and I will be putting an alert out when I do it anyway) – I’ll also play some short term longs in $TVIX or $UVXY.

https://www.tradingview.com/chart/VIX/t6YF7SQY-VIX-Short-Swing-Trade-Above-Bollinger-Band/

3 – $DXY

4 – $SLV

5 – $GLD – Gold (and miner’s $GDX)

My third priority on this list are the miner’s – $GDX and leveraged friends. This one is risky but comes with large gains if miner’s get moving and price breaks in to next quadrant above the yellow one outlined on the chart below. And for the risk taker it can be traded with leveraged ETN’s. There are inherent risks however; one is that price is not at bottom of the trading quadrant so an entry here is not ideal and the obvious issue is the Trump factor.

https://www.tradingview.com/chart/8QOM4r5s/

6 – $USOIL / $WTI

Email or DM me on Twitter anytime with thoughts or questions!

I will be updating regularly now – I need to get as much done here before inauguration for my own trading too so that’s a major motivator – I will send out updates as I update!

Cheers!

Curtis.

Article Topics; Swing Trading, $GOOGL, $AMZN, $JUNO, $CBMX, $OAK, $RSX, $BOFI, $SXL, $SLCS, $EOG, $NG, $TRCH, $GREK, $USOIL, $GOLD, $GLD, $SILVER, $SLV, $SPY, S&P 500, $DXY, $VIX

Weekly Swing Trade Member Memo – Jan 9, 2017

Good morning swing traders and welcome to our weekly swing trading memo for the week of Jan 9, 2017!

Don’t hesitate to email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

This is Only an Intro Memo.

Below you will find my top ten picks for swing trading in the first quarter of 2017. I am currently in the middle of compiling the due diligence and charting set-ups for publication. I will have this out to members within 48 hours. I apologize for the delay. I found myself deep in to the charting, financials and company technical dynamics of over fifty companies while doing my research for 2017 swing and investment trades – I didn’t expect to get that deep and involved in my research. But I did and that has caused a bit of delay.

I will also include our regular algorithmic modeling equities relating to Oil, Gold, Miners, Silver, US Dollar, Volatility and SPY in my 2017 reports (in addition to the ten others listed below) FYI.

I am very encouraged getting back in to investing and swing trading this year – I have been on the sidelines for the better part of two years as the markets have been more sideways than up or down. But I see 2017 as a really strong investing and swing trading year.

So below I only share my top picks and will have complete swing and investment reports out within 48 hours and thereafter I will have weekly swing set-ups published like clock-work moving forward. In my reports I will focus on both long term holds and swing trading these equities with an intent to try and time the highs and lows (pull-backs) as best as possible. I know many propose that picking the highs and lows isn’t the best method – but to be frank it has served me well over the years.

Also, I should mention, that any of the stocks below that do not trade well (or as planned) I will switch out with another choice as the weeks progress. But the intent is to hold ten investment / swing stocks (per below) and also swing trade in and out of the regular algorithmic modeling equities I mentioned also.

The Ten Securities I Am Going to Focus on in the First Quarter of 2017 are as Follows:

Google $GOOGL

Amazon $AMZN

Juno $JUNO

CombiMatrix Corp $CBMX

OakTree Capital $OAK

VanEck Vectors Russia ETF $RSX

BOFI Holdings $BOFI

Sunoco Logistics Partners $SXL

US Silica Holdings $SLCA

EOG Resources $EOG

So if you could, bear with me for another 48 hours and I will have complete charting and due diligence out to our swing trade members and onward and upward for 2017!

Oh, and I should mention, I did receive a number of emails over Christmas and will be responding to them in conjunction with turning around my report here over the next couple days.

Cheers!

Curtis.

Article Topics; Swing Trading, $GOOGL, $AMZN, $JUNO, $CBMX, $OAK, $RSX, $BOFI, $SXL, $SLCS, $EOG, $USOIL, $GOLD, $GLD, $SILVER, $SLV, $SPY, S&P 500, $DXY, $VIX

Weekly Swing Trade Member Newsletter – Dec 19, 2016

Good morning swing traders and welcome to our weekly swing trading newsletter for the week of Dec 19, 2016!

Don’t hesitate to email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private mesage Curt in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

The information below can be quite involved so we don’t mind assisting as needed!

Please review previous swing newsletter here: https://compoundtrading.com/weekly-swing-trade-member-newsletter-dec-12-2016/

My primary seven swing set-ups this week are:

$SPY S&P 500

S&P 500 Keep it Simple Chart of Day. Buy sell 200 20 MA cross on 1 Hr. $SPY $ES_F $SPXS $SPXL

This is one of the best swing set-ups on $SPY and it is really simple (for tighter ranges please refer to FREEDOM the SPY Algo).

When the 200 and 20 MA cross on the 1 Hr use it as buy and sell triggers. Simple.

FX: $USOIL $WTI

You can use a number of instruments to trade oil such as FX $USOIL $CL_F CL $UWT $DWT $USO $UCO $SCO and more…. I am using $UWT and $DWT.

Per last newsletter:

The important thing with oil is to watch the Fibonacci levels, trend lines (diagonal and horizontal), your moving averages and your trading widths (margins / pivots). I can’t discuss the algorithm here but I can refer you to Epic the Oil Algo twitter feed for various public posts.

Widths / trading range pivots – Because oil is in a break-out you want to take your long positions at the bottom of the yellow lines and I as I mentioned in the last swing newsletter I WOULD NOT short oil in an uptrend at the top of the yellow lines. Wait to short it when it is in a confirmed downtrend – and now is not a confirmed downtrend.

Here is the long position I entered this week in $UWT:

20 MA on 4 Hour Buy – Sell Trigger. Crude algo intra work sheet 407 AM Dec 19 FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT #algo

So now my long position is still long as long as price is over 20 MA on the 4 hour chart (per below) or I may exit at any time. The point is, the next entry trigger I will use long wth $UWT is when the price goes below the 20 MA on the 4 hour chart and then price crosses back up through the 4 hour. This (in addition to support and resistance indicators I gave you last week) is a prmary indicator for long buys in crude oil right now.

$GOLD – $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG

Here is what I wrote last week:

So last week I said;

Here again I cannot share the proprietary algorithm components of Rosie’s algo but I can share with you the publicly posted data. Rosie predicted in July that Gold would hit this range but also warned of a 90% chance that Gold would have to hit the bottom of a quadrant on her charting. That would put Gold near 1133.00. I am waiting to see if this occurs and I will take a long trade in $NUGT at that time with a normal swing stop of about 4% and then if uptrend confirms I will scale in at 3 stages. Initial order 2000 shares the 5000 then 10000 then 20000 adding at pullbacks.

The idea in swing trading is to catch the trend reversal and then scale in when confirmed.

Good thing I waited! Price has downtrended since. It isn’t at my preferred 1133.00 so I am going to watch – if it starts to take off upward I will start to nibble with long positions with tight stops. No particular level that I would do that – just if it started to move for any more than a day and it looked like it had momentum. Then slowly enter. BUT THE PREFERRED play is to wait for that 1133.00 WHICH COULD COME QUICK NOW.

Here is the simple chart of the day for Gold swings:

Keep it Simple Chart of Day. 100 MA 1 WK Buy Sell Trigger. Gold algo intra work sheet 1022 PM Dec 18 $GOLD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG #algo

When the price of Gold turns back up above the 100 MA (blue line) on the 1 week chart that is as simple an indicator swings as you can get. And sell when it turns down below. I am watching this and other indicators per previous. For tighter tighter time-frames refer to Rosie the Algo subscription – but for swings I would use this indicator.

$SILVER $SLV $USLV $DSLV

As I wrote last week:

Silver is in exactly the same position as Gold – wait for the Gold confirmation before entering IMO. Use the same scaling principals. Watch SuperNova Silver twitter feed too.

I have always said that Silver will hold up better in a downtrend, but it doesn’t mean you take a long position yet. Sure, it came up a bit since last week, but the idea is to catch the tren reversal and scale in to it for a large gain over time.

Here is a simple chart of the day for Silver swing trading:

SILVER Keep it Simple Chart of Day. 1 Week Buy over 200 and 20 MA Sell Under 20 MA $SL_F $SLV $USLV, $DSLV

So this is an indicator set-up for Silver swing trading that I will be using. Buy signal is when price is over 200 and 20 MA on the 1 week chart and sell signal is when price is under the 20 MA.

For tighter tighter time-frames refer to SuperNova Silver Algo subscription – but for swings I would use this indicator.

$VIX

Last Week I Wrote:

I am going to enter a long position in $UVXY or $TVIX for a short term swing (less than 10 days hopefully) at as close to 12.20 as I can get – if I can’t get that I am looking at 12.77.

Considering the geo political environment I won’t be shorting the $VIX unless it gets really extended to topside – which it is not right now.

So it came down to my price target and I didn’t take a trade – I watched. Then it spiked and I would have had a short term gain. Now it’s sitting back at my buy target area and I am going to watch.

If it starts upward I will likely take a trade long in $TVIX or $UVXY and exit by ratcheting up my stops as it goes. Where exactly where I take that trade? I don’t know. But I’m getting more confident with it because of two reasons.

1. At the end of day Friday the there was $VIX insurance buying even while $SPY was spiking at end of day and $XIV (which is the opposite of $VIX) wasn’t moving like it normally does when there is a $SPY spike. Now, $VIX isn’t determined by $SPY but it is a signficant factor. So when they move in this way it is time to pay attention.

2. ALSO, the CNN fear and greed indicator is near all time highs for greed. If you study it out there is a correlation – when greed is this high 9 times out of 10 there is a spike in $VIX because if nothing else investors start taking out insurance. http://money.cnn.com/data/fear-and-greed/

Now, if the $VIX does spike, and the spike is significant I will short the $VIX because that is always easy money – but that is something that has to be determined on an intra level and I can’t give you levels here on a swing alert.

Here is a keep it simple swing trade for the $VIX on the long side and the short side that I will be using:

$VIX Keep it Simple Chart of Day. 50 MA cross 200 MA to upside buy and when it turns under 20 MA sell short. $TVIX $UVXY $XIV

It doesn’t get much easier than that for long and short side of $VIX – but you do need to babysit it close because it can swing drastic – so set stops.

$DXY – US Dollar ($UUP)

$DXY Keep it Simple Chart of Day. 200 MA and 50 MA 1 Day Cross Buy Sell Trigger $UUP

The simplest swing trading indicator on the US Dollar I was able to find. 200 MA and 50 MA cross on the 1 day chart for long and short positions.

$JUNO

Last week I wrote this:

This is a wash-out snap-back swing that I really like. It is up in premarket today but I believe there is a lot of room here. My timeframe is 3 months and I expect a lot of that gap fill to come in to play at 29.83. It has resistance at 22.87 but I don’t think it will hold. One of my favorite swings right now.

So this one didn’t do as well, but I am holding and I will enter with more of a position if it gets back up off it’s feet and starts trending up. Like I wrote, my time-frame is 3 months so I will be patient.

So $JUNO has continued to be soft… I am still in and holding – I will be looking for a long add when I get solid buy triggers. I will update mid week if I take a long position trade.

$CBMX

I wrote this last week:

This IMO opinion is a fantastic opportunity – but it does have its risk. You wll have to research the company on your own and make a determination for yourself. But if you find after your research that you think it’s a decent hold for a month or two it is one of the best swing plays on the market at this price IMO. I’m looking to add today to my position.

Well this one worked out well too, I am currently adding in near the 2.90 level. A mid term hold for (3 – 6 months) and I expect close to 50% gain on it. But it is high risk so set stops.

I am still in this. I will be adding to my position long if and when price nears the yellow line on chart.

This comment from last week remains the same:

That’s about it for this week. I am waiting for the market inflection to settle down and a little more of the indices to settle on the other side of this Trump trade before scaling in to any indices plays and the like. But as I said I am running about 40 charts on plays I am looking at and hope to start adding some of those for next Sunday!

Have a great week and if you have any questions email anytime!

Best of luck!

Email us with any questions!

Article Topics; Swing Trading, $JUNO, $CBMX, $USOIL, $GOLD, $GLD, $SILVER, $SLV, $SPY, S&P 500, $DXY, $VIX