Welcome to Compound Trading Swing Trading Report Wednesday June 20, 18 Part B.

In this issue; $GOOGL, $AMZN, $LITE, $XRT, $EXP, $VFC, $FIT, $CALA, $BOFI, $EOG, $TRH, $NG, $GREK, $SLCR, $RSX and more …

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Good day!

This swing trading report is one in five in rotation. The goal is to rotate the five reports every 5 to 6 weeks (one per week).

June 20 – This report is part B, part A was published June 13.

June 20 – More recently our coding team has started and many of the regular equities will be coded to our #IA trading platform. The first of which is to upgrade the swing trading charts with intra-day levels of trade. Going forward many charts will have such levels.

The reports are in the process of upgrades to included buy and sell triggers identified on charting of select instruments that are nearing trade set-ups usually represented at key / primary support and resistance areas of chart (usually the mid quad key support and resistance) with a white or green horizontal arrow.

The triggers (price and / or other indicators) will also be programmed in to our charting for attendees to the live trading room and alerts will flash on screen in the trading room. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you formulate.

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

To remove the indicators (MACD, Stochastic RSI, Squeeze Momentum Indicator represented at bottom of chart) double click on chart body – and same to return the indicators.

If you receive a report and you are not subscribed to the specific service it is a complimentary issue..

Our apologies if you receive more than one copy – it means you are on more than one subscription list. We are working to resolve this issue.

Newer updates below in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

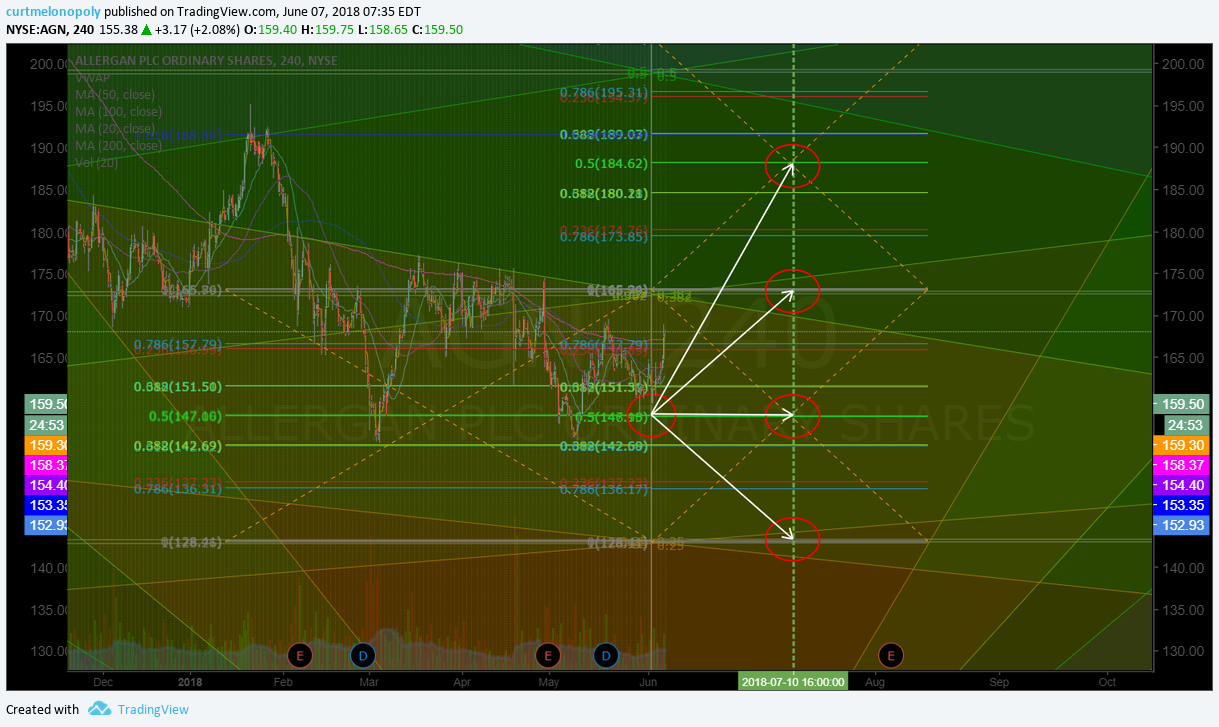

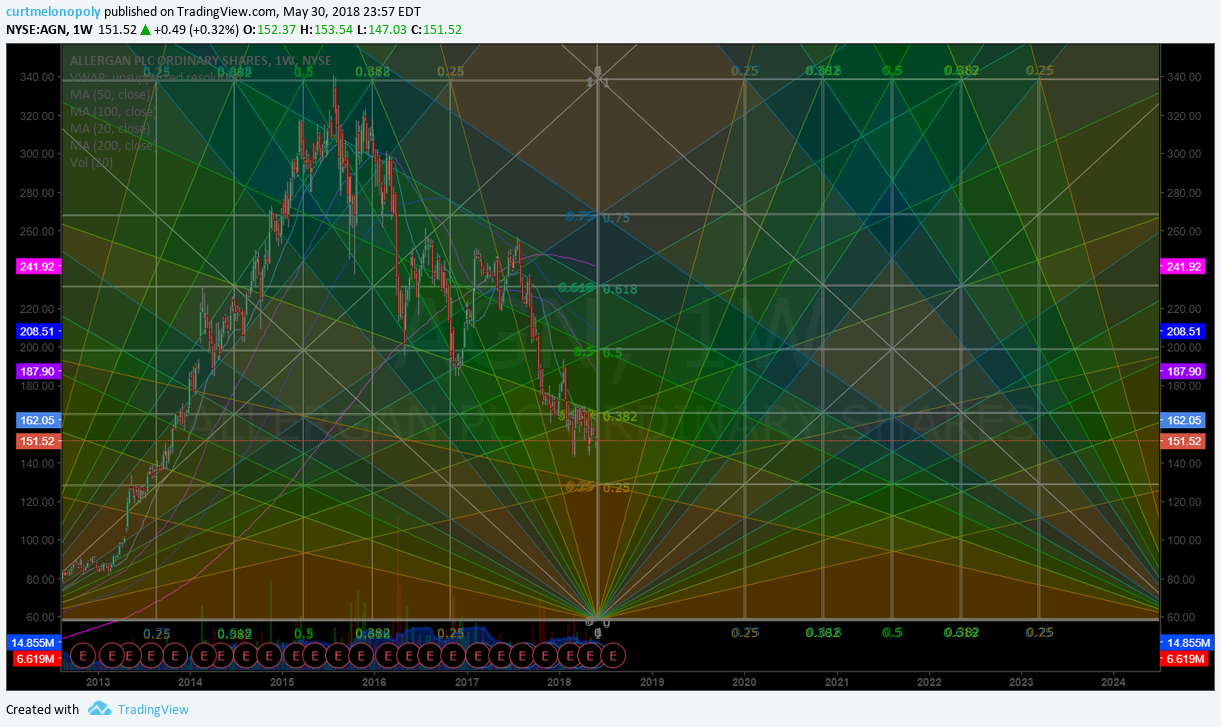

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

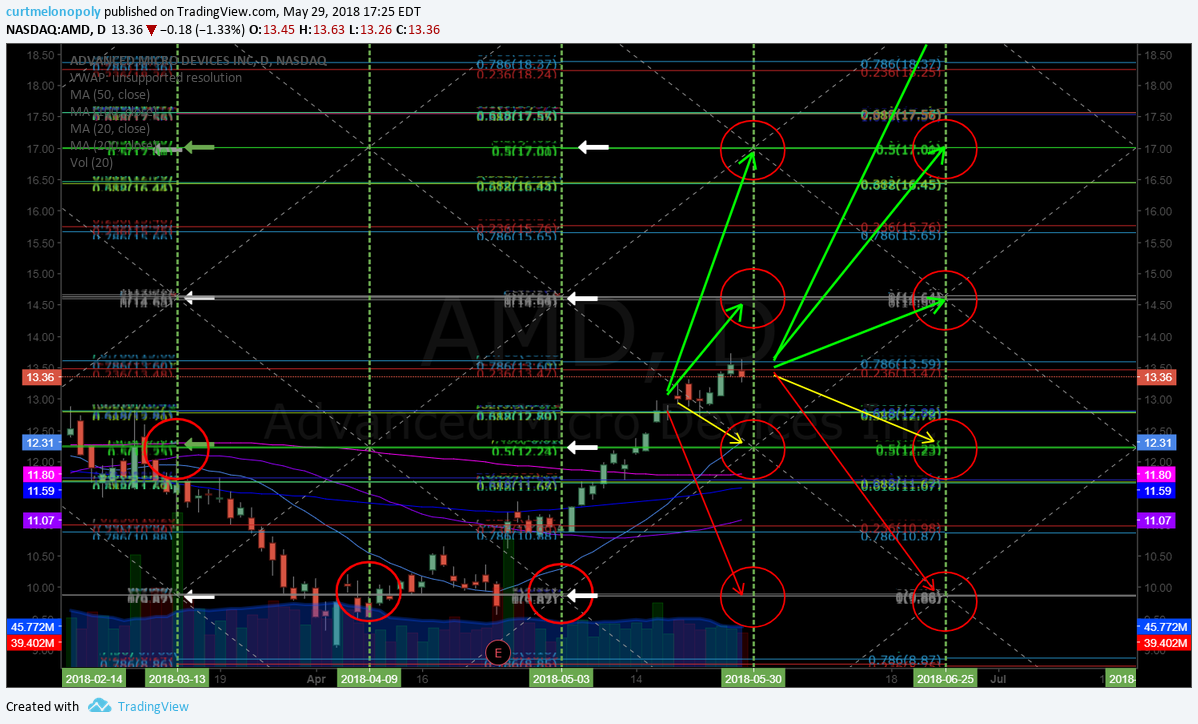

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

$AMBA – Ambarella Inc.

June 13 – Ambarella (AMBA) If this holds 40.10 in to June 21 time cycle it will bounce on other side of that. $AMBA #snapback #washout #swingtrading

April 29 – I published a two part special report on the $AMBA swing trade, you can find them below. As the trade proves out I will post member exclusive set-ups and alerts. Could be a good one here.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Part 2 – The Battle Plan | How to Trade the $AMBA Move

Summary of the trade set-up on AMBA:

$AMBA closed April 27 at 46.75.

Trend Change: This set-up is a long over 49.50 (if 49.50 area is held) for a major trend change to the upside. Resistance is at 51.50 area in this scenario (trim in advance and add over).

or for Active Trading: This is a long over 47.25 in to resistance near 49.40 (trim in advance and add over).

Be sure to trim longs in advance of that and then if resistance is breached add over that to the next resistance and then rinse and repeat. The horizontal fib lines on the chart show you support and resistance points.

On the short side for a day trade… Friday’s close was 46.75 and the next support is in the 44.55 range… so if there is pressure on the stock in premarket or at open Monday then a short in to the 44.55 support may work out. But be cautious, this thing has science all over it saying that a snap-back is very possible and it should be vicious when it starts.

Support and Resistance Levels – I’ve made the chart easy to manage visually by adding white arrows to each major support and resistance level. The white arrows are your primary buy sell triggers.

Note also the “trading quad walls”. These are Fibonacci based diagonal trend-lines that form a trading structure “quadrants”. They also act as support and resistance.

The red circles are price targets. The price targets for June 10, 2018 time cycle peak are 58.60 (bullish), 49.40 (moderate), 40.13 (bearish). Trade in accordance to price action toward the appropriate target. It is paint by numbers trading – just follow the rules and if your trade fails be sure to cut losses quickly and be ready to turn with price as needed. Trust the plan.

The MOST INTERESTING THING about this set-up is the possibility for a trend reversal based on a simple wash-out down trend with a snap-back that could see a significant three to six month trend to the upside.

In Part 3 (for our Swing Trading Members) I will cover that scenario for significant gains should that transpire.

Also… pay attention to the downside bearish scenario playing out here. If that occurs I will do a Part 3 specific to that and include a detailed trading plan.

My Personal Earnings Rule: 95% of the time I will not hold in to earnings. Trade your plan however you wish.

Mar 21 – $AMBA swing trade technically perfect 54.72 targets 58.66 Mar 30 . Chart Notes.

https://www.tradingview.com/chart/AMBA/rOpynBS5-AMBA-swing-trade-technically-perfect-54-72-targets-58-66-Mar-30/ #swingtrading #pricetargets

Feb 20 – $AMBA over 49.40 is a buy and below a sell – currently testing support resistance area.

Feb 20 – $AMBA Not a great risk reward chart set up here with MACD and SQZMOM up and Stochastic near top. #trading

AMBA buy sell triggers.

40.10 Primary

49.45 Primary

51.70

54.66

57.57

58.56 Primary

63.00

65.68

67.53 Primary

$COTY

June 12 – COTY. Double historical bottom with MACD turn on the Daily Chart. $COTY #swingtrading

Even though I don’t like the stock and I don’t think it will bounce far I think it will, and I may the setup seriously here and o for a near term swing trade if it firms.

April 29 – This $COTY chart is a nightmare, will likely bounce to 200 MA soon. But I may discontinue coverage soon also. Watching.

$FSLR – First Solar

June 13 – FIRST SOLAR (FSLR) Weekly under key historical resistance. Not enough ROI yet to engage. $FSLR #swingtrading

If this dumps in to an area of acceptable return – goes on a wash-out, then I’ll look at a long side trade on a wash-out snap-back scenario.

First Solar a Steal, SunPower Less Sunny: Analysts By Shoshanna Delventhal | June 12, 2018 — 10:36 AM EDT

April 29 – $FSLR trading closed Friday 77.90 and is in break-out on the daily. We’ll look at the weekly and find resistance to watch for.

April 29 – $FSLR on the weekly chart – between here and 86.00 imo is pensive… however, it seems to have the indications to do it. Over 86 long. If I had to predict what’s next… the pull back is near and at each turn up after a pull-back it’s a long. And then if and when it gets up over 86.00 it’s a structured trade to the upside. At that point (over 86.00 held) I will chart the trade structure with specific lower time frame support and resistance and price targets along with time-cycles etc.

$AAOI – Applied Opto Electronics Inc

June 13 – APPLIED OPTOELCTRONICS (AAOI). 49.50 July 5 target in play trading 43.52 intra. Trim in to that key resistance and add above. $AAOI #swingtrading

How Applied Optoelectronics Inc. Stock Rose 46% Last Month

Motley Fool

Anders Bylund, The Motley Fool

Motley Fool June 12, 2018

https://finance.yahoo.com/news/applied-optoelectronics-inc-stock-rose-165800531.html?.tsrc=rss

April 29 – $AAOI closed the session Friday 33.76 above main trading area support around 27.50

This $AAOI chart went out to the private server on April 23, 2018;

$AAOI over 32.90 targets 39.18 then 40.66. Watch for 50 MA overhead. (purple)

$AAOI over 20 50 100 MA, indicators trending (MACD, Stochastic RSI, SQZMOM, above mid quad Fibonacci diagonal support are all bullish. Watch quad Fib downtrending trendline, FIB horizontal resistance lines and especially 200 MA on way to July targets.

I prefer the upper target as long as trade can breach the 200 MA.

$AAOI News: SUGAR LAND, Texas, April 18, 2018 (GLOBE NEWSWIRE) — Applied Optoelectronics, Inc. (AAOI), a leading provider of fiber-optic access network products for the internet datacenter, cable broadband, telecom and fiber-to-the-home (FTTH) markets, today announced that it will release financial results for its first quarter ended March 31, 2018 on Tuesday, May 8, 2018.

$AAOI News: Applied Optoelectronics, Fiber-optic network provider Applied Optoelectronics Inc (NASDAQ: AAOI) has been a regular on the FIS Astec list for months. Utilization jumped 23 percent last week, pushing short interest up to 92 percent of available shares.

Mar 21 – $AAOI Sitting on 200 MA on weekly chart. If it bounces watch for 20 MA upside resistance. #watchlist #swingtrading

This is my nemesis from 2017 and now in to 2018. I am absolutely convinced this will run to at least the mid 45s this year, if not more. Earnings will be the turn imo (at latest) in about 45 days ish.

At least I admit the conviction trade struggles 🙂

$HIIQ – Health Ins Innovations

June 12 – Health Innovations (HIIQ) What a great trading structure in channel hitting mid targets. Watching. $HIIQ chart. #swingtrade

I really have no excuse for missing the long side trade on the most recent run. I’ve caught it earlier in its bullish trend but this last run I missed all together.

April 29 – $HIIQ under pressure with ER in 3 days. Bias to a downside dump in to earnings and upside targets 31.15 maybe 35.70 Aug 10 – but post earnings price action will tell the story.

Mar 21 – $HIIQ What a sweet trade for our swing trading members…. hit first and second targets near perfect boom town. #swingtrading #tradingtowin

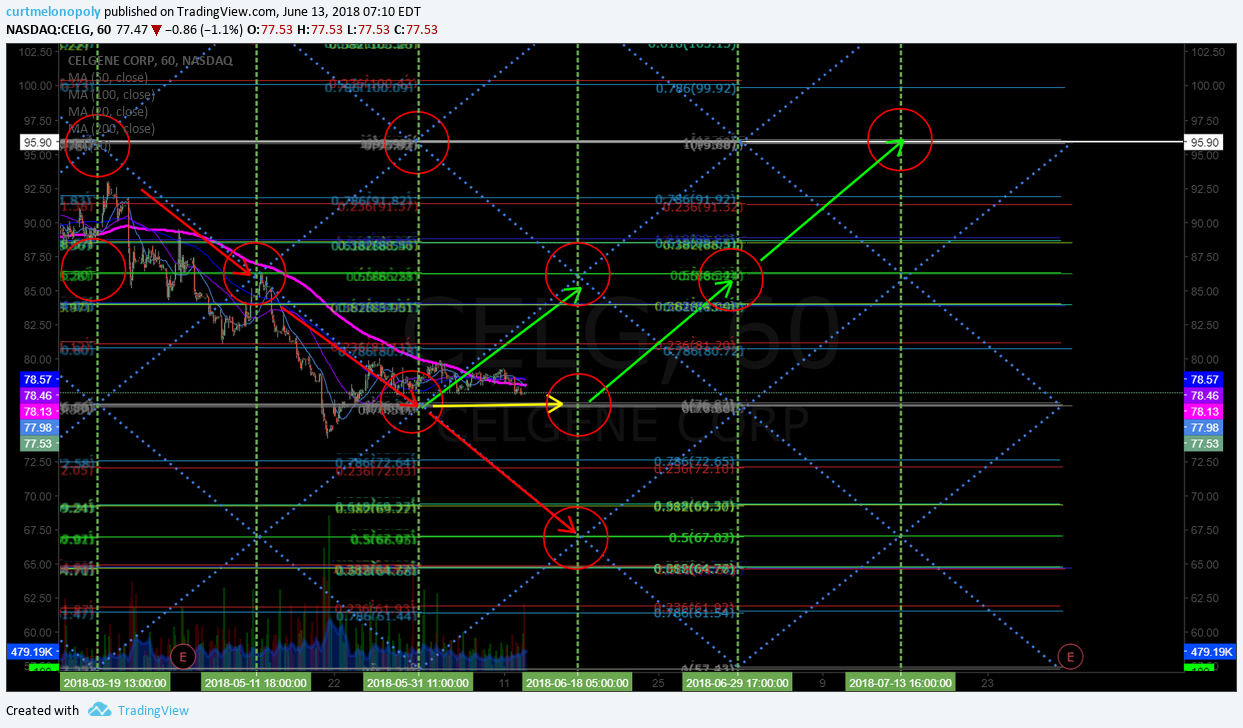

$CELG – Celgene

June 12 – CELGENE (CELG) It is very possible we get a reversal here. Needs to hold that mid quad suppot. #swingtrading

June 12 – CELGENE (CELG) If you do get a reversal here, this is your likely up channel with price targets. #swingtrading

April 29 – $CELG with earnings in 4 days. Upside bias 105.41 downside 86.09 June 9 time cycle pending earnings price action.

Of special note with this set-up is where trade closed Friday (91.18). This specific area of the chart is a volatile area (see yellow circles to left). There are large gaps between Fib support and resistance areas. Prepare for volatility in to earnings.

I think it’s likely we see lift in to earnings. But as always trade price direction in to most logical target between support and resistance as noted on chart.

April 8 – $CELG 86s to 91s off real-time alert, buy sell trigger now. Looking for next price target in time cycle. #swingtrading

Trade wasn’t bullish enough to get to last price target BUT nonetheless it was a decent buy side trade alert in to the most recent time cycle.

Refer to my last real-time swing trading alert post on $CELG here: https://www.tradingview.com/chart/CELG/RwZItPb8-CELG-hit-last-price-target-targets-95-90-Apr-3-Chart-notes/

Now trade is sitting right on top of a mid quad price support (signalling a decision area). When price exits a time cycle and is at the mid quad this signifies the bull bear fight at the buy sell trigger. If it was trading / trending under I could confidently alert a short side trade in to the next time cycle. The same works above the quad support to the next upside bullish price target in to the next time cycle. In this instance, trade is not signalling yet which way we are going.

I will real-time alert the set-up as it concludes over the coming days.

My personal trader bias is short in to next downside price target in to next time cycle peak (see vertical dotted green lines for time cycle conclusions).

1:21 PM – 8 Apr 2018 $CELG 86s to 91s off alert, buy sell trigger now. Waiting for trade direction triggers. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/ …

https://twitter.com/SwingAlerts_CT/status/983031984753692672

5:56 PM – 26 Mar 2018 $CELG hit last price target – targets 95.90 Apr 3. Chart notes. https://www.tradingview.com/chart/CELG/RwZItPb8-CELG-hit-last-price-target-targets-95-90-Apr-3-Chart-notes/ …

https://twitter.com/SwingAlerts_CT/status/978390139201302529

Mar 26 –

$CELG Celgene 2.58% hit our last price target and now $CELG targets 95.90 April 3 peak time cycle on 60 minute chart as most probable with MACD turned up on daily. Trading 87.03 intra. If it fails trade in direction of the possible targets. #swingtrading

Use the chart model to trim and add at horizontal Fibonacci support and resistance and watch the blue diagonal trend-lines for support and resistance also.

$CELG targets 95.90 April 3 as most probable with MACD turned up on daily. Trading 87.03 intra.

Feb 20 – $CELG under 96.00 resistance is bearish to 86.00 support Feb 28 cycle peak. 60 Min stock chart.

Jan 7 – $CELG So far in this washout very indecisive trade – watching for 60 min time cycle peaks for trade lift to bring time frame out for swing trade.

In other words, as soon as trade gets bullish on the 60 minute time-frame then I can chart the daily time frame for a proper swing trade. So I am watching the mid quad time cycle peaks for possible lift for a clue to begin trading it and move to a daily time-frame chart for a swing trade post wash-out.

$LITE – LUMENTUM

June 20 – LUMENTUM (LITE) Bounce near key mid quad support today 54.04, trading 55.60, over 56.50 res targets 65.00 July 30 $LITE #swingtrading

Lumentum CFO change comes from ‘a position of strength,’ says Needham

Published: June 8, 2018 8:58 a.m. ET

April 29 – Per last report “From here $LITE targets 64.95 April 6 with MACD turned down” and … yes it hit that target near perfect.

$LITE With earnings in 2 days it seems oversold. Expect a bounce at quad wall. Bias to 105.41 June 4. Bearish 86.09.

March 26 – Doesn’t get much better than this. Great trade set-up for our swing trading platform, hit upper target and more (early), was alerted on report Feb 20 for Apr 9 PT. $LITE #swingtrading

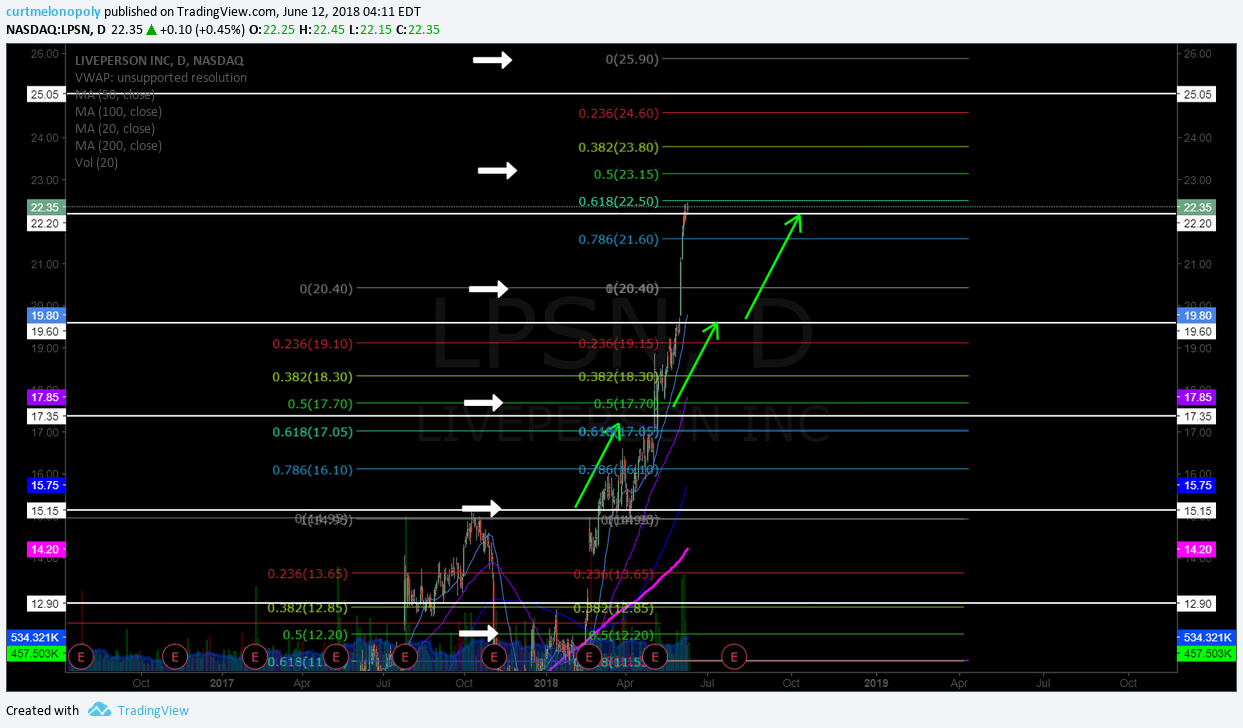

$CALA – Calithera Biosciences

June 20 – CALITHERA BIOSCIENCES (CALA) Time cycle peak July 9 with price trend to bottom quad – likely turns on other side of time cycle to next upside mid quad at 10.75 timing May 2019 for cycle peak (or more). On watch. $CALA #swingtrade

May 13 – $CALA targeting 3.00 range July 6. Trending down quad wall near perfect. Watch for bounce. #swingtrading

This is quite amazing actually. With so much pressure to downside it is remaining structural. Great short trade but risk reward is diminishing as it nears it’s previous lows from Dec 2016. Watching for a bounce now.

News: Calithera Biosciences Inc (NASDAQ:CALA): Is Breakeven Near? https://finance.yahoo.com/news/calithera-biosciences-inc-nasdaq-cala-003530591.html?.tsrc=rss

Mar 26 – $CALA trending toward lower target and indecisive, but MACD may turn up here. Needs at least 8.30 for upside.

$XRT – SPDR S&P Retail ETF

June 20 – SPDR S&P RETAIL ETF (XRT) Although impressive, the move likely motivated by squeeze, watch the main resistance in 51.00 area. #swingtrading $XRT

Or maybe I’m biased because I missed my execution on the trade that was set-up in the last post so well.

Also note the main 51.00 area resistance was hit really early.

If price ends up over 51.00 in to next trading range structure I will re-issue a new chart model and distribute to members.

What Drove Retail Sales Higher in May?

https://marketrealist.com/2018/06/what-drove-retail-sales-higher-in-may

SPDR S&P RETAIL ETF (XRT) Although impressive, the move likely motivated by squeeze, watch the main resistance in 51.00 area. #swingtrading $XRT

May 13 – $XRT Under 45.00 is a short bias and over 46.00 is long bias. Retail ETF.

March 26 – $XRT short set up at 44.90 area if price gets there. Under significant structural pressure now. #swingtrading

Jan 7 – $XRT Nice clean mid quad price time target hit on this daily swing trading chart model. #swingtrading

$XRT Symmetry suggests 41.36 ish May 2019 but be sure to trade with price action. As trade leaves this target area I will chart lower time frames as the trade gives indication to up or downside. Chart link below FYI (from previous reports).

$EXP Building Materials

Main Buy Sell Triggers:

140.00

118.00

95.60

73.37

June 20 – EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target.

Lack of inventory is creating a tight housing market.

https://finance.yahoo.com/video/lack-inventory-creating-tight-housing-170810691.html?.tsrc=rss

May 13 – With earnings on deck this week watch this one close. 118.00 upside 93.00 downside. Good range. $EXP

Also of note; when it recently bottomed it was technically perfect to the buy trigger noted on the chart (white arrow) and now trade is above the 200 MA on daily chart. It is set to rocket if earnings are received well by the street.

Mar 26 – $EXP 118.00 or 140.00 Oct 30 2018 with MACD turned up and above 200 MA with volume.

$FIT – FITBIT

June 20 – FITBIT (FIT) Hit upside price target on model early on news (see report) then retraced, now watching $FIT #swingtrading

Feature post published – FITBIT INC CLASS A (NYSE: FIT). How to Trade FitBit for 40% Gain (Member Exclusive) $FIT #swingtrading #daytrading #chart

Don’t Bother Chasing the Most Recent Fitbit Inc. Stock Rally

InvestorPlace

Laura Hoy

InvestorPlaceJune 19, 2018

https://finance.yahoo.com/news/don-t-bother-chasing-most-162425293.html?.tsrc=rss

May 13 – Trading 5.21 with flat indicators and bottom ish pattern that doesn’t look healthy. Alarmed and ready if it moves.

Mar 26 – $FIT near its previous lows, may get a bottom bounce soon. Watching Stoch RSI for a trade.

$VFC

June 20 – VFC Looking for an all time high break-out. On watch. $VFC #Chart

May 13 – Trading 77.94 with MACD on daily trending down. Won’t look at it until MACD crosses up.

Mar 26 – $VFC on weekly looks like it has some chop left. No trade.

Alphabet (Google) $GOOGL, $GOOG

June 20 – ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

May 13 – $GOOGL bounced perfectly early April at the buy sell trigger, now at the next buy sell trigger. Above long and below short.

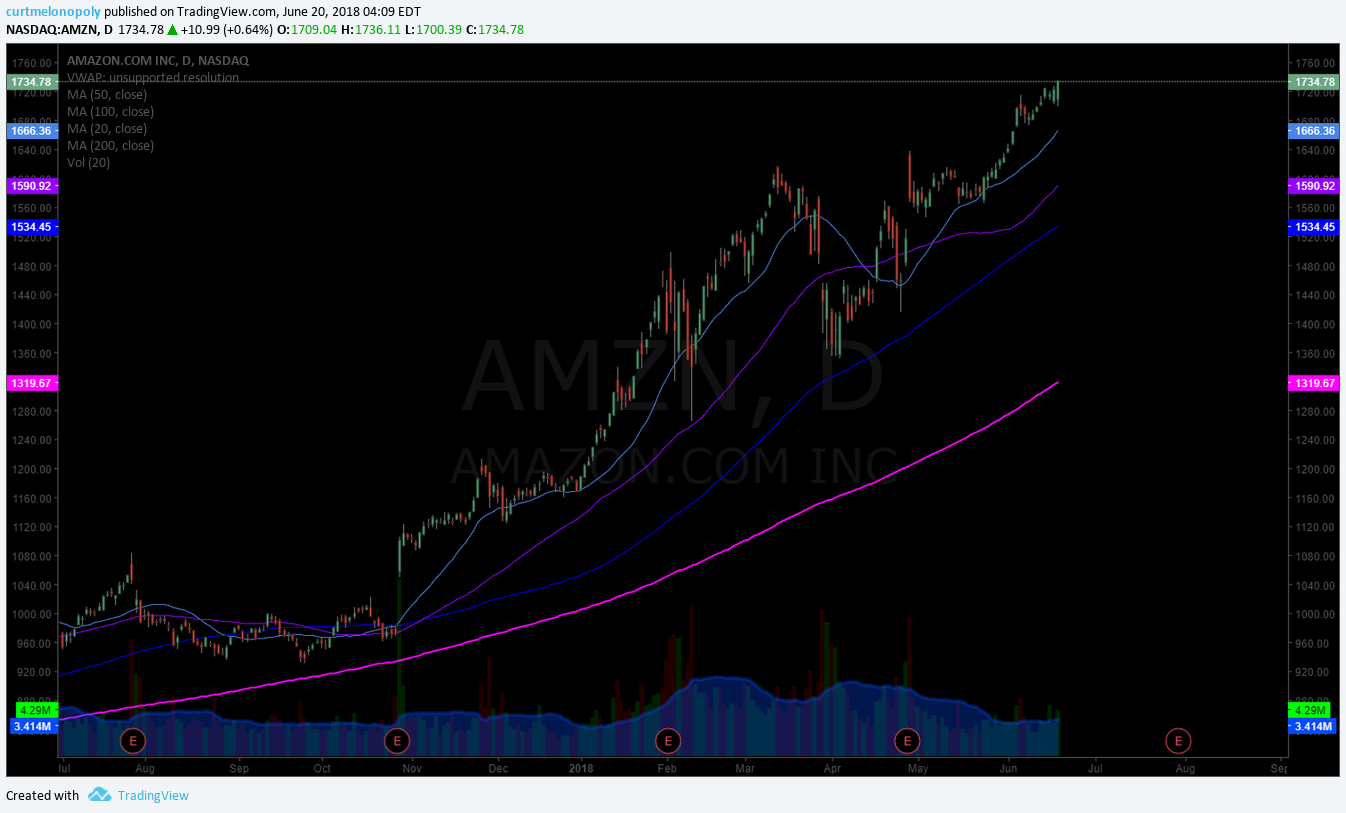

Amazon $AMZN

June 20 AMAZON (AMZN) Premarket on the move ATH 1743.00 up .5% $AMZN #premarket

What can I say, Amazon continues its move and I just haven’t had the right timing to get in on the ride. Will look for a pull back for entry.

May 13 – $AMZN near all time highs. Watching for structure on break-out. To be determined.

OakTree Capital $OAK

June 20 – OAKTREE (OAK) Trade targeting 37.30 for early Dec unless it gets a bounce up over mid quad. $OAK #stock #chart

May 13 – Trading 40.05 indicators are flat – on watch for a trade.

Mar 26 – $OAK Risk reward near long side now, watching for Stoch RSI to turn on weekly. #swingtrading

VanEck Vectors Russia ETF $RSX

June 20 – Trading 20.30 there is no way to form a solid thesis long or short here yet.

May 13 – Keenly watching $RSX trade for a breach through 200 MA with structure. On watch.

BOFI Holdings $BOFI

June 20 – BOFI has been working on a break out since March 13 and has not yet built structure – range bound ATH structure without a proper break trading 42.40. Watching.

May 13 – $BOFI chart has the ingredients for a structured break-out of previous highs here. Watching very close now.

Mar 26 – $BOFI Great trading set-up from earlier this year. Indicators extended and long side RR is limited. No new trade. Weekly chart shown.

US Silica Holdings $SLCA

May 20 – Trading 28.13 with indicators indecisive. Watching.

May 13 – $SLCA is still indecisive relative to risk reward IMO. Watching.

Mar 26 – $SLCA trading 25.08 with indecisive indicators on all time-frames

Jan 9 – $SLCA Will likely start a long position today on this set up. Will alert and chart the trade if so.

$EOG EOG Resources

June 20 – $EOG No easy trade here either way. Working on top end structure. Watching.

May 13 – $EOG Yet another great trade set up from this year, on watch for structured upside break also.

Mar 26 – $EOG watching resistance on weekly just under 109 for upside or downside trade. #swingtrading Upside targets 134.00 area and downside 83.00 area.

$GREK Global Greece ETF

June 20 – Trading 9.24 continued pressure per last report under 200 MA on weekly. Watching.

May 10 – $GREK Watching for strength in a move over 200 MA on weekly chart.

Mar 26 – $GREK on weekly is a short when Stoch RSI peaks and turns down if price under 200 MA. Watching.

$TRCH Torchlight Energy

June 20 – Trading 1.36 indecisive.

May 13 – Trading 1.20 indecisive.

Mar 26 – Trading 1.36 indecisive.

Jan 9 – Trading 1.26 indecisive but that could change soon.

$NG Nova Gold

June 20 – Trading 4.66 indecisive to bearish. Watching.

May 13 – Trading 4.90. As with previous report… it is moderately bullish but RR isn’t the best.

March 26 – Trading 4.68 has some bullside indications for follow-through but I’m not convinced at this point. Watching only.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

To register as a swing trading member click here.

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $GOOGL, $AMZN, $LITE, $XRT, $EXP, $VFC, $FIT, $CALA, $BOFI, $EOG