Tag: $UAA

PreMarket Trading Plan Tues Oct 30: Earnings, Crude Oil, TTWO, UAA, LEVB, PYX, BOX, NBEV, BLDP …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Tuesday October 30, 2018.

In this premarket trading edition: Earnings, Crude Oil, TTWO, UAA, LEVB, PYX, BOX, NBEV, BLDP and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development Work in Progress:

- Ask for a tour of our member swing trading alert feed – we’ve done well through this and expect it to get better through Q1 2019. Been through many downturns over 30 years. Check the feed and tell me I’m wrong. #swingtrading #premarket https://twitter.com/curtmelonopoly/status/1057255452621324289

- Platform Expansion This Week – Nominal Intermittent Down Time Expected: 1. We are integrating web mail servers with machine trading api’s for our clients, this may cause intermittent downtime for email info@compoundtrading.com – use compoundtradingofficial@gmail.com if you experience issues. 2. We are moving our main fiber line – expect full trading room platform downtime for up to 30 mins.

- Oct 30 – Lead trader booked for main trading room for market open 9:30 AM, 12:00 PM mid day review and futures trading this evening 6:00 PM (as available and as market demands).

- Trade Coaching Boot Camp Cabarete Nov 30 – Dec 2, 2018 Winter Sessions Sell Out Fast (it is warm here after-all) so act fast if you plan to be here with us! https://compoundtrading.com/trade-coaching-boot-camp-cabarete-nov-30-dec-2-2018/.

- https://twitter.com/curtmelonopoly/status/1054318666878238720

- Main live trading room – 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars and when Lead Trader is not available.

- What’s New / Work in Progress (week of Oct 29 we expect to clear this WIP list):

- Machine trading signals to be fed in to main trading room starting mid to late week of Oct 29.

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November for each of the seven trading models and swing and daytrading – 8 in total to be announced (online only).

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

October 30 Trading Plan: I published a swing trading report (Part B of the special series) last night – from that report and Part A of the series I have many stocks on watch that I think are decent candidates for long swings soon. I am watching a major support area on oil transpire in premarket, if it fails it may be another ladder down, if not it may be a decent long. Gold, Silver, BTC are under pressure and likely to be so now until Nov 11 ish. Sell-off should calm for a bit soon, other side of Nov 11 time cycle unclear at this point. VIX likely short set-up here. Those are my general bias near term but let price do the talking.

In equities also watching WMT, MCD, AAOI closely for long positions.

October 29 Trading Plan: Watching. Looks like a bounce in equity markets possible. Watching.

October 24 Trading Plan: It’s all about oil $WTI $CL_F today, then it will be about GOLD $GLD, SILVER $SLV, VIX $VIX and SP500 $SPY for me thereafter. Watching the TESLA $TSLA play and MCDONALDS $MCD very close. Everything else will be reviewed on swing trading report due out today.

October 23: Notes per below remain in play. New position long in Silver is working from 14.63’s as a swing trade, oil short in to open yesterday worked, watching for an intra-day bounce possible in to open in oil and then down likely. Gold has a bounce as does VIX as I expected in to this time cycle. Momentum daytrading is very dangerous right now. Watching some swing trades in equities (forming a report right now and I’ll release it today).

Considering a long term (6 months or more) swing trade in $MCD soon. Long.

$VIX up more than double since we were alerting time cycle run #premarket.

October 22: I have a new position in Silver in 14.63’s long that may get some pressure but there is a plan to add at support below. Earnings season may help equities some here near term – but it is dubious.

I will continue chewing around the edges of this crude oil sell-off at support areas for a reversal to the retracement and try and get a decent short position also when I can at upside resistance. Serious, serious pressure here in oil trade BUT support areas for possible reversal are starting to hit now on various charting time-frames and structures – BUT that doesn’t mean it will reverse. It reverses when it reverses, trade the indicators not bias.

Watching NFLX, SQ, ROKU, SHOP, FEYE very close right now and swinging them all. TSLA trade yesterday went great, still holding 25% on the swing side. Today is all about OIL with EIA.

PSTG has an upgrade I’m watching also.

I am leaning toward equity markets possibly holding up in to end of Oct early Nov, Gold Silver Crypto likely pressure in to that time frame, Oil likely pressure in to that time frame and VIX also. And then end of Oct early Nov that should switch.

This is a leaning bias – a general outlook. However, I do see significant risk that could trigger volatility at any time here. But generally equity markets should hold to that late Oct early Nov with VIX GOLD SILVER OIL under pressure and then the opposite should turn toward mid Dec time cycle peak. See the most recent oil trading strategies video.

I know I’ve been promising the remaining model reports for some time, last night we ran the machine trading tests on EPIC and it is working so I can leave the staff to that and now start getting the reporting out. The software development part of our biz I have to admit has been a challenge to our time.

It’s difficult to explain in short how complicated software development is with machine trading launch. But we’re learning to manage it. We’re in it to win it – we won’t give up and we’re making serious progress, that’s the bottom line.

Looking for possible short term sell off in oil with a spike in VIX, Gold, Silver and then markets should levitate for short term bringing VIX Gold Silver Crypto soft and then reversal again and again and rinse and repeat to mid December 2018 minimum.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Market Observation:

Markets as of 8:18 AM: US Dollar $DXY trading 96.68, Oil FX $USOIL ($WTI) trading 66.46, Gold $GLD trading 1222.56, Silver $SLV trading 14.43, $SPY 265.30 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6272.50 and $VIX trading 24.2.

Momentum Stocks / Gaps to Watch:

TTWO:RED DEAD LAUNCH GETS BIGGEST OPENING WEEKEND OF ALL TIME

Stocks making the biggest move premarket: KO, GE, PFE, TPR, UAA & more –

https://www.cnbc.com/2018/10/30/stocks-making-the-biggest-move-premarket-ko-ge-pfe-tpr-uaa–more.html

Stocks making the biggest move premarket: KO, GE, PFE, TPR, UAA & more – https://t.co/puluxQsJbH

— Melonopoly (@curtmelonopoly) October 30, 2018

News:

$URGN FDA Grants Breakthrough Therapy Designation UGN-101 For The Treatment Of Patients With Low-Grade Upper Tract Urothelial Cancer (LG UTUC)

Recent SEC Filings / Insiders:

Recent IPO’s:

Initial public offerings haven’t enriched investors so far this financial year amid volatility in the market.

Initial public offerings haven’t enriched investors so far this financial year amid volatility in the market.https://t.co/mYWuYAMqQK

— NDTV Profit (@NDTVProfitIndia) October 30, 2018

Earnings:

HCA shares up 3.1% premarket after earnings beat.

Mastercard stock rises after earnings beat.

#earnings for the week

$FB $AAPL $BABA $GE $IQ $MA $BIDU $EBAY $CHK $XOM $EA $TEVA $GM $UAA $TNDM $BP $SPOT $ON $FDC $ADP $CVX $KO $AMRN $SBUX $X $ABBV $PFE $FIT $PAYC $YNDX $OLED $ABMD $WTW $ANET $WLL $LL $FEYE $DDD $RIG $SNE $KEM $NWL $STX $BAH $FTNT

http://eps.sh/cal

#earnings for the week$FB $AAPL $BABA $GE $IQ $MA $BIDU $EBAY $CHK $XOM $EA $TEVA $GM $UAA $TNDM $BP $SPOT $ON $FDC $ADP $CVX $KO $AMRN $SBUX $X $ABBV $PFE $FIT $PAYC $YNDX $OLED $ABMD $WTW $ANET $WLL $LL $FEYE $DDD $RIG $SNE $KEM $NWL $STX $BAH $FTNThttps://t.co/r57QUKKDXL https://t.co/w6cD7uO3t7

— Melonopoly (@curtmelonopoly) October 29, 2018

#earningsseason calendar

$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAY

#earningsseason calendar$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAYhttps://t.co/r57QUKKDXL https://t.co/exPTAW20yW

— Melonopoly (@curtmelonopoly) October 17, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

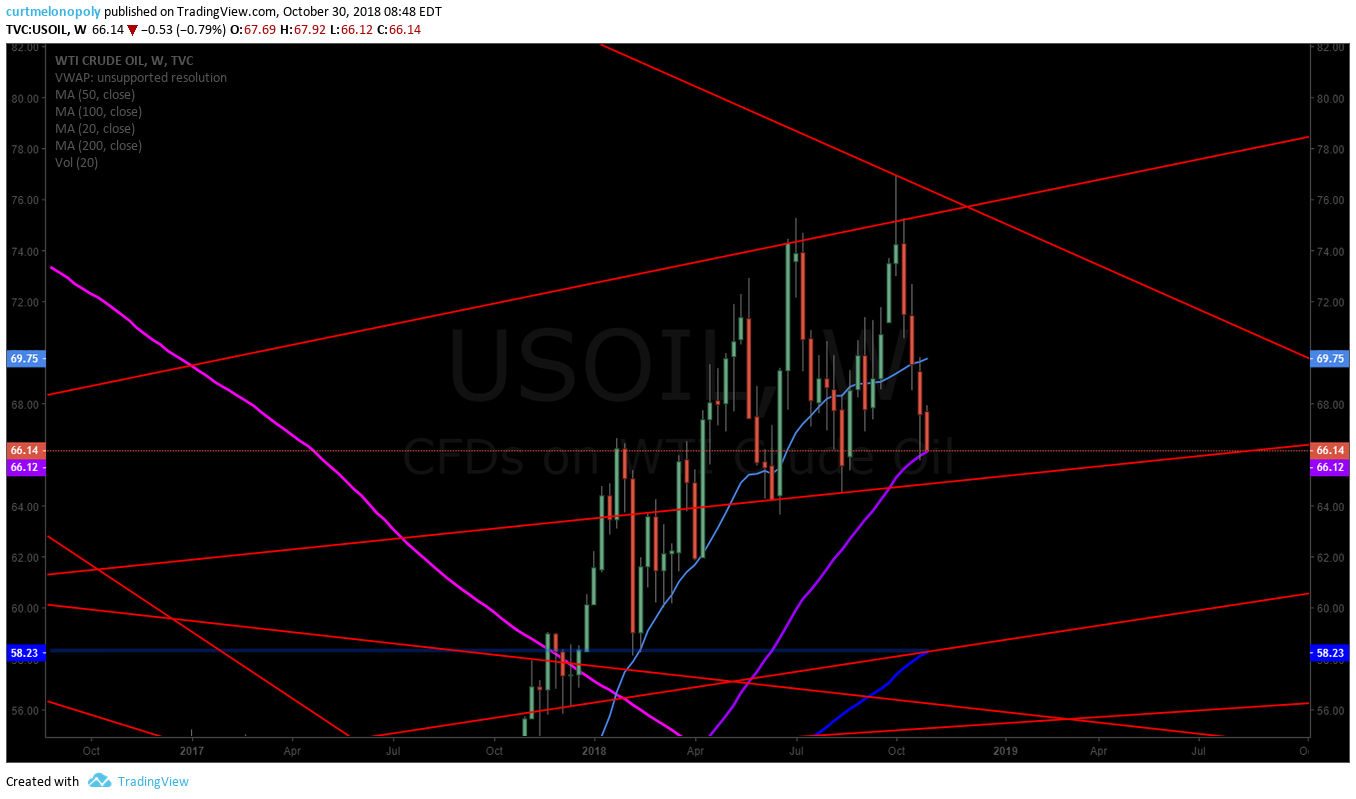

Crude Oil – The only chart that matters today (beyond EPIC Oil Algorithm) FX USOIL WTI CL_F USO #crudeoil

Swing trading with technical analysis $BLDP

Swing trading with technical analysis $BLDP #swingtrading #tradealerts pic.twitter.com/WURkhsEzCt

— Melonopoly (@curtmelonopoly) October 30, 2018

Swing trading with technical analysis $LEVB

Swing trading with technical analysis $LEVB #swingtrading #tradealerts pic.twitter.com/tnYe1Cj7iO

— Melonopoly (@curtmelonopoly) October 30, 2018

Swing trading with technical analysis $PYX

Swing trading with technical analysis $PYX #swingtrading #tradealerts pic.twitter.com/36IfTDhB2Q

— Melonopoly (@curtmelonopoly) October 30, 2018

Swing trading with technical analysis. $NBEV

Swing trading with technical analysis. $NBEV #swingtrading #tradealerts pic.twitter.com/IKvPhqzOtk

— Melonopoly (@curtmelonopoly) October 30, 2018

Swing trading with technical analysis. $BOX

Swing trading with technical analysis. $BOX #swingtrading #tradealerts pic.twitter.com/CCyhDBJ135

— Melonopoly (@curtmelonopoly) October 30, 2018

Crude oil 4 hour chart. Trendlines. FX USOIL WTI $CL_F $USO #Oil #trading #chart #OOTT https://twitter.com/EPICtheAlgo/status/1056884532408926208

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade pic.twitter.com/M4NDXkdoMi

— Melonopoly (@curtmelonopoly) October 29, 2018

Machine trade in oil top tick hit perfect 67.62 to penny HOD, trimmed added numerous all win side and closed 90% 66.83. Nice trade.

On the daily oil chart price ended the week right above the 200 MA and above the primary pivot marked on the chart.

Crude oil trade in to open yesterday: Nailed the Crude Oil Short in Trading Room at Open.

Trade alert this morning to trim Silver and add above: Trimming Silver 14.78 per price target will add above.

Trade alert yesterday : Long Silver 14.63 target 14.78 tight stops.

Silver Weekly Chart has a MACD turn up possible, watching for a possible run up Oct 21 756 PM #Silver #Algorithm $SLV $USLV $DSLV

Gold (Daily) With MACD turn back up price above pivot near 200 MA resistance test – this trade is on high watch #GOLD $GC_F $XAUUSD $GLD

Gold (Daily) With MACD turn back up price above pivot near 200 MA resistance test – this trade is on high watch #GOLD $GC_F $XAUUSD $GLD pic.twitter.com/JNfF5U9u7L

— Rosie the Gold Algo (@ROSIEtheAlgo) October 21, 2018

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT pic.twitter.com/vlOAl0ze6A

— Melonopoly (@curtmelonopoly) October 16, 2018

Crude Oil Trading Strategy with Trend-Lines on Weekly Chart.

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts pic.twitter.com/tcbGIESXQF

— Melonopoly (@curtmelonopoly) October 9, 2018

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading pic.twitter.com/1on7qS3aYJ

— Melonopoly (@curtmelonopoly) October 9, 2018

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm pic.twitter.com/qa0HueviTl

— Melonopoly (@curtmelonopoly) October 9, 2018

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don't. It is that simple. https://t.co/k4HO2izAT7

— Melonopoly (@curtmelonopoly) October 9, 2018

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Trump wants a great deal

-Huge day for earnings

-Euro-area GDP misses

-Markets mixed

-Coming up…

https://bloom.bg/2PsZ7C0

The Stock Market is up massively since the Election, but is now taking a little pause – people want to see what happens with the Midterms. If you want your Stocks to go down, I strongly suggest voting Democrat. They like the Venezuela financial model, High Taxes & Open Borders!

The Stock Market is up massively since the Election, but is now taking a little pause – people want to see what happens with the Midterms. If you want your Stocks to go down, I strongly suggest voting Democrat. They like the Venezuela financial model, High Taxes & Open Borders!

— Donald J. Trump (@realDonaldTrump) October 30, 2018

holy shit

holy shit pic.twitter.com/OhlKe0oD9B

— Alastair (@StockBoardAsset) October 30, 2018

Smart Money Flow Index now at lowest since Jan. 1996…

https://twitter.com/epomboy/status/1057244599578755072

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ESIO $GSL $ACHV $DFBG $TTWO $AKAM $UA $UAA $CHGG $CCCL $KEM $DRYS $MYSZ $NSPR $UGAZ $BP

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $HES $WERN $CSTM $SCHW $CHGG $PSX $JBLU $COOP $SNDR $XPO $ODFL $CVE $GRFS $NVDA $POR $JWN $AMED $AKAM

$PRTO initiated at Buy at Maxim. PT $5

(6) Recent Downgrades: $ELVT $ETFC $UAL $SAVE $LUV $WFT $ARCB $GPC $UNFI $DDS $FLEX

AMD price target cut to $26 from $33 at Cowen

TriNet Group $TNET PT Lowered to $54 at Credit Suisse

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Earnings, Earnings, Crude Oil, TTWO, UAA, LEVB, PYX, BOX, NBEV, BLDP

PreMarket Trading Plan Fri Apr 28 $SLV, $USLV, $AMLH, $RTIX, $BLMN, $SNAP, $JUNO, $GREK, $UAA

Compound Trading Chat Room Stock Trading Plan and Watchlist for Friday April 28, 2017; $SLV, $USLV, $AMLH, $RTIX, $BLMN, $SNAP, $JUNO, $GREK, $UAA – $SSH, $LGCY, $TRCH, $ESEA, $MGTI, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Last week Thursday, Friday and Monday post market reports will be out soon (we’re a little behind with processing reports).

Today’s Live Trading Room Link: https://compoundtrading.clickmeeting.com/livetrading

I just might take another crack at 2 week double my account trading challenge ?Live in room recorded ? Slay that dragon finally?? #trading

I just might take another crack at 2 week double my account trading challenge 🎯Live in room recorded 🎥 Slay that dragon finally🔥😲 #trading

— Melonopoly (@curtmelonopoly) April 28, 2017

Most recent lead trader blog posts:

Now I’m Inspired! My Guarantee to Struggling Traders (and Yours). Part 3 “Freedom Traders” Series.

https://twitter.com/CompoundTrading/status/853764002584944640

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports are being compiled as I write and will be posted soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Most recent Keep it Simple Swing trade Charting (MACD, MA, Stoch RSI, SQZMOM focus):

https://twitter.com/CompoundTrading/status/853551912599400448

Most recent Market Open Momentum Stock Trades Video (most recent available to public – there may be others in member’s newsletters):

Market Opening: $BLMN $SNAP $RTW $JUNO $GREK $CLWT $SSKN $MDGS

https://twitter.com/CompoundTrading/status/857640279783952384

Most recent Mid Day Chart Set-Up Review Video (most recent available to public – there may be others in member’s newsletters):

Midday Chart Setup Review: $USOIL $WTI $SPY #GOLD $GDX $DXY $MSL $CVI

https://twitter.com/CompoundTrading/status/857640467416195074

Trading Plan (Buy, Hold, Sell) and Watchlists:

Morning momentum stocks on watch so far: End of month flows today…watch your stops!

Markets: $SPY $ES_F $SPX mid range floating, $GLD, $GDX, $SLV are getting a bump in overnight trade. $USOIL, $WTIC is getting a bit of a bump like I expected in yesterday’s report but it is still under significant pressure and continues in a downward channel. $DXY under continued pressure as is $VIX.

Our futures

Our futures pic.twitter.com/0W8N7jaULQ

— Melonopoly (@curtmelonopoly) April 28, 2017

Commodities

Commodities pic.twitter.com/qPSFpAx7R1

— Melonopoly (@curtmelonopoly) April 28, 2017

Active OTC on watch: $PVCT and $LIGA (I hold),$AMLH vol picking back up and EOD action Thursday was awesome and it has filings on top of that near close could get explosive again. and $BLDV $UPZS $OPMZ $MMEX $AMLH $ACOL $BVTK $USRM $ORRV $JAMN $PFSD

$AMLH Premarket. Closed strong yesterday and recent filings. OTC #trading

$AMLH Premarket. Closed strong yesterday and recent filings. OTC #trading pic.twitter.com/fo1Jjhtddj

— Melonopoly (@curtmelonopoly) April 28, 2017

Gaps to Watch: $UAA – major down pressure with upside gap to fill.

Stocks with News: $BMRN

SEC Filings to Watch: NASDAQ | SEC Filing $RXII “not less than 1-for-2 and not greater than 1-for-40,” http://secfilings.nasdaq.com/filingFrameset.asp?FilingID=12019637&RcvdDate=4/27/2017&CoName=RXI%20PHARMACEUTICALS%20CORP&FormType=DEFA14A&View=html …

Short Term Trader’s Edge: #SILVER $SLV $USLV Silver I am thinking runs in to early next week.

Holds: Most holds are small to mid size holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $MGTI, $LIGA, $PVCT

Various Chart Set-ups on Watch: $UNP, $LL, $MACK, $AGN, $CRM, $BRE, $RARE

Break-out Chart Set-Ups: $YNDX Buy on dips, $SSW has a resistance break-out, $HF, $CRY, $NOK.

Moving Averages Chart Set-Ups: $RTIX, $BLMN, $SNAP, $JUNO, $GREK, $UAA (20 MA about to cross up 50 MA)

$UAA Interesting Chart Set-up. #premarket #trading pic.twitter.com/dol8A90z4w

— Melonopoly (@curtmelonopoly) April 28, 2017

Midday Chart Setups – Basic Algorithmic Modeling (a sneak peak of our lab work): $AKBA $JUNO $GREK https://t.co/rzvoZaUobZ #fintech #models

— Melonopoly (@curtmelonopoly) April 26, 2017

$JUNO 200 MA swoooping down and 20 MA may punch thru with price above and it's beach time. #freedomtraders #swingtrading #charts pic.twitter.com/il41bnGac0

— Melonopoly (@curtmelonopoly) April 26, 2017

$RTIX 20 MA thru 200 MA on daily bullish SQZMOM green MACD cross. From member homework. @CampingHiking1 #FreedoTraders Great Work! #trading pic.twitter.com/HEaUXBjena

— Melonopoly (@curtmelonopoly) April 26, 2017

Market Outlook :

S&P 500 – Failure at the swing (RSI), if they go after 2400 today – 401K distribution Monday, Apple buy backs on Tues and Wed. Fed decision.

https://twitter.com/ThinkTankCharts/status/857888219979022338

Per recent reports:

There are significant resistance clusters above recent highs in oil and the S&P so I will be very cautious to upside going forward until recent highs are taken out and confirmed. I see significant upside challenges in Oil and SPY with most recent highs being taken out.

Market News and Social Bits From Around the Internet:

8:30am

-GDP

9:45am

Chicago PMI

10am

Consumer Sentiment

1pm

BHI Rig #

1:15pm

Fed Brainard Speaks

2:30pm

Fed Harker Speaks

Royal Caribbean’s stock climbs 1% premarket after Q1 results

Ford’s stock gains premarket as recalls ding earnings that still beat fo.. Related Articles: http://bit.ly/2pFUCqW

ExxonMobil shares up 1.1% premarket

Exxon Mobil beats by $0.08, misses on revenue https://seekingalpha.com/news/3261234-exxon-mobil-beats-0_08-misses-revenue?source=twitter_sa_factset … #premarket $XOM

$WDC – Wells Fargo downgrades Western Digital (NASDAQ:WDC) from Outperform to Market Perform.

$BMRN receives FDA approval,

Qualcomm -4% on Apple-related profit warning https://seekingalpha.com/news/3261214-qualcomm-minus-4-percent-apple-related-profit-warning?source=feed_f … #premarket $QCOM

$SBUX down 5% #premarket

Oof. Time Inc. says it isn’t for sale. Many thought it would be bought. $TIME plunges 20% #premarket.

Ouch! Qualcomm cuts Q3 fiscal guidance as Apple holds back royalties – http://cnbc.com/id/104427517

Ouch! Qualcomm cuts Q3 fiscal guidance as Apple holds back royalties – https://t.co/L98mlAopN1

— Melonopoly (@curtmelonopoly) April 28, 2017

$GM ?? +2.35% 41.2B vs 40.752B Est. 1.72 adj vs. 1.48 #premarket #earnings

$GM 🔥🎯 +2.35% 41.2B vs 40.752B Est. 1.72 adj vs. 1.48 #premarket #earnings

— Melonopoly (@curtmelonopoly) April 28, 2017

Premarket: Global stocks pause near record highs on Trump policies http://trib.al/omB6HJj From @GlobeInvestor

Premarket: Global stocks pause near record highs on Trump policies https://t.co/zMstY9LRcI From @GlobeInvestor

— The Globe and Mail (@globeandmail) April 28, 2017

#5things

-GDP day

-Trump’s North Korea warning

-Britain unites EU

-Markets flat

-Oil earnings due

https://bloom.bg/2pt4ZgU

#5things

-GDP day

-Trump's North Korea warning

-Britain unites EU

-Markets flat

-Oil earnings duehttps://t.co/NzWHJNsPQG pic.twitter.com/BExJMjWYc4— Bloomberg Markets (@markets) April 28, 2017

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List : $WDC, $SWN, $GOOGL, $MTL $GOOG $SPH $UBS $AMZN $RBS $CNHI $JNUG $MT $GM $SAN $NUGT $VALE $MU $RIO $RIG I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: $BIDU $ATHN $GIMO $SBUX $JDST $QCOM $SYF $FCEL $TIME $STAY $DUST $SNCR $SWKS $EXPE $DWT I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $CHKP $IVC $BOKF $LPLA $ALGN $WDC $URI $SAM as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $GWB $AOS $AAWW $BMS $AMZN $EFX $GIMO $MMLP $ALLE $CHDN $ZBH $TEX $COLM $EXPE $AVT $ENTG $X as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $SLV, $USLV, $AMLH, $RTIX, $BLMN, $SNAP, $JUNO, $GREK, $UAA – $PVCT, $LIGA, $MGTI, $ONTX, $SSH, $LGCY, $TRCH, $ESEA – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD