Tag: UGAZ

Part2 – Natural Gas (NATGAS) Trade Alert 2.08 Long Rallied to 2.50s Fast – What’s Next? $NG_F $UGAZ $DGAZ $UNG

The Natural Gas Trade is Heating Up – What a Sweet Trade Set-Up.

Trading natural gas futures or ETN’s / ETF’s like $UGAZ $DGAZ or $UNG can provide excellent returns if you get your trade set-up right. Below we demonstrate what precision trading in natural gas can do for your returns. Our members have enjoyed a series of recent swing trade alerts that have worked well for us. See below.

In our Oct 5, 2020 Natural Gas Swing Trading Newsletter (unlocked) we provided a video from our Weekly Swing Trading Study Webinar and charting for a Natural Gas trade set-up long in the channel.

The Oct 7, 2020 Swing Trade Alert:

NATURAL GAS (NATGAS) 30 min levels, greens and grays are your key levels, will be watching close post oil EIA today #swingtrading $NATGAS

https://twitter.com/SwingAlerts_CT/status/1315663604667109376

The trade alert worked out great and the buy trigger 2.08s hit for long entries and Natural Gas rallied to 2.50s fast.

https://twitter.com/SwingAlerts_CT/status/1315663604667109376

Prior to this, our swing trading platform had traded the Natural Gas falling wedge pattern break-out for excellent returns. See the previous member natural gas newsletter link above.

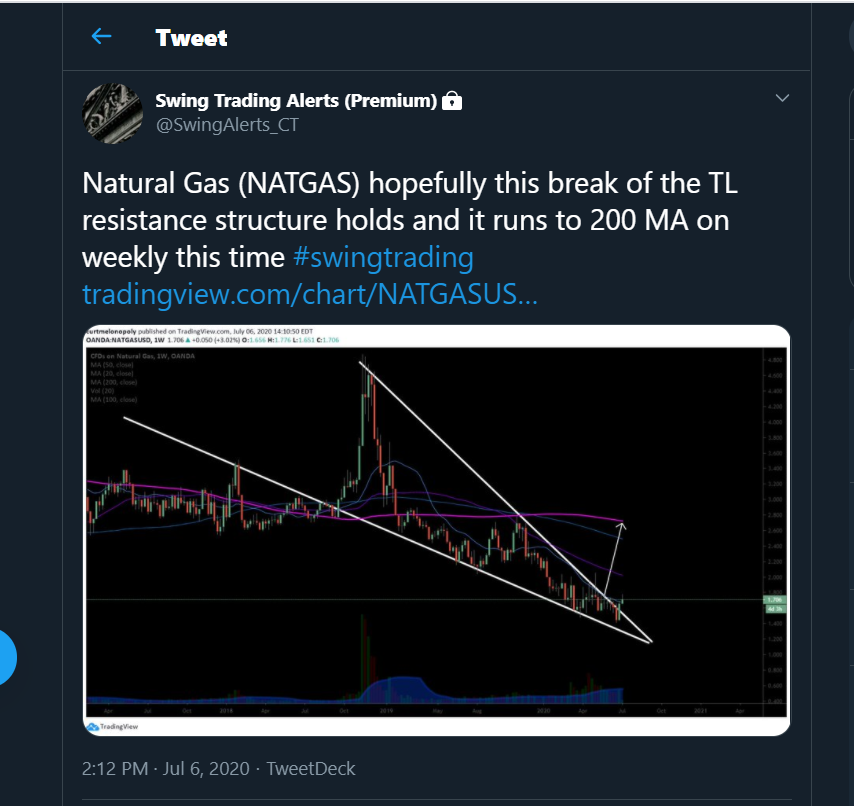

Natural Gas (NATGAS) hopefully this break of the TL resistance structure holds and it runs to 200 MA on weekly this time #swingtrading

Swing trade alert feed:

The question now is, what’s next?

Swing trade members can review the next set-up in Natural Gas trade in newsletter:

Protected: Natural Gas Trading Newsletter (Premium Swing Trading Post) Part 3

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com.

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 300.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; swing trading, newsletter, natural gas, natgas, $NG_F, $UGAZ, $DGAZ, $UNG

PreMarket Trading Plan Mon July 3 $SPEX, $OPXA, $XIV, $USOIL, $GLD, $WTI, $DXY, $NATGAS #Discord

Compound Trading Chat Room Stock Trading Plan and Watch list for Monday June 3, 2017; $SPEX, $OPXA, $USOIL, $GLD, $WTI, $DXY, $NATGAS, #Discord – $XIV, $WMT, $NFLX, $UUP, $SSH, $LGCY, $TRCH, $ESEA, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Morning traders!

Monday is open house day in our live trading room.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to info@compoundtrading.com and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it.

Reporting and algorithms: We expect all to updated between now and Wednesday morning.

Connect with me on Discord and lets take this up a notch!

https://twitter.com/CompoundTrading/status/880670140454637569

Most recent lead trader blog / video posts:

Oil trading session with EPIC the Oil Algorithm in oil trading room. $USOIL $WTI $CL_F #CL $USO $UWT $DWT #OIL #OOTT #IA #EPICEDGE

Oil trading session with EPIC the Oil Algorithm in oil trading room. $USOIL $WTI $CL_F #CL $USO $UWT $DWT #OIL #OOTT #IA #EPICEDGE pic.twitter.com/tddfB6fhAH

— Melonopoly (@curtmelonopoly) July 3, 2017

Oil Trading Room – How to Use Oil Algorithm Chart & Recent Trades $USOIL $WTI $CL_F $USO #OIL #OOTT

Oil Trading Room – How to Use Oil Algorithm Chart & Recent Trades $USOIL $WTI $CL_F $USO #OIL #OOTT https://t.co/LCzv9RisxI

— Melonopoly (@curtmelonopoly) June 30, 2017

Mid day trade set-up review June 30 $DXY, $SPY, $XIV, $USOIL, $FEYE, $NXE, $HAIN, $URG, $CLLS …: http://youtu.be/6BEk5bVEkGw?a via

https://twitter.com/CompoundTrading/status/881759689880612866

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports will be out soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Morning momentum stocks on watch so far: $SPEX, $OPXA

Bias toward / on watch: $CARA for a possible bounce, Natural Gas should get a bounce soon, Oil should come off soon, Dollar should get moving soon, and Gold should get wacked soon. Soon being in next 30 days inflection on watch.

OTC on watch:

Gapping Premarket: $SPEX, $OPXA

Recent Momentum Stocks to Watch:

Stocks with News:

Recent SEC Filings to Watch: $PSTG Jun 22, CFO Sells 8255 Shrs; Net: -108.43k; Acq’d: 0; Disp’d: 8255 13.14/s https://is.gd/cQHEjO

Earnings On Deck:

Holds: $WMT, $NFLX, $XIV, $UWT, $UUP test starter swings. All other holds are small size (less than 5% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (not including my swing trading or algorithm charting trades).

Recent Chart Set-ups on Watch: $TRCH, $ESPR, $FEYE, $SLX, $CLLS, $IMDZ, $VRX, $HIIQ, $FSLR, $JUNO, $CELG, $VFC and many more on the mid day reviews on You Tube. We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day.

Market Outlook:

Holiday Tuesday and Monday short day at 1:00 EST!

Futures higher in positive start to third quarter.

Futures higher in positive start to third quarter – https://t.co/Ck9DxUIXdI

— Investing.com News (@newsinvesting) July 3, 2017

Market News and Social Bits From Around the Internet:

8:30 am

US Consumer Spending

9:45 am

Manufacturing Index

10:00 am

-Manufacturing Index

-Construction Spending

$BABA Alibaba PT raised to $201 from $158 at Deutsche Bank

$OPXA reverse merger agreement with Acer Therapeutics.

New ticker $ACER

Nevada begins legal weed sales $ACBFF $AERO $AMMJ $APHQF $BLOZF $CANN $CBDS $CBIS $CVSI $FIRE

GSK signs $43M deal for drug discovery AI https://seekingalpha.com/news/3276707-gsk-signs-43m-deal-drug-discovery-ai?source=feed_f … #premarket $GSK

$EYES Announces Expansion of Medicare Coverage for Argus II Retinal Prosthesis System to 11 Additional States and the District of Columbia

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $SPEX, $OPXA, $TEAR, $ESEA $SSG $NGE $SPEX $NSPR $PIXY $DCTH $IDXG $NXTD $DGAZ $DUST $NIB $GASL $JDST $FCAU $WEAT $TSLA I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Recent Upgrades: as time allows I will update before market open or refer to chat room notices.

(6) Recent Downgrades: as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $SPEX, $OPXA, $UGAZ, $USOIL, $GLD, $WTI, $DXY, #Discord, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD

Post-Market Tues Mar 21 $ESPR, $HTBX, $PTIE, $NAK, $NG_F, $UGAZ, $GC_F, $JNUG, $DUST

Review of Compound Trading Chat Room Stock Trading, Algorithm Charting Calls and Live Stock Alerts for Tuesday March 21, 2017; $ESPR, $HTBX, $PTIE, $NAK, $NG_F, $UGAZ, $GC_F, $JNUG, $DUST – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Per recent;

Weekly Simple Swing Trade Charting is out:

https://twitter.com/CompoundTrading/status/843442032894865408

Overview and Summary Review of Markets, Chat Room, Algo Calls, Trades and Alerts:

In play today in chat room; $ESPR, $HTBX, $PTIE, $NAK, $NG_F, $UGAZ, $GC_F, $JNUG, $DUST

$PULM was a decent runner on the day but I didn’t trade it because we were in $ESPR and watching the market movements. Some were cleaning up there risk and those type of things.

Our traders continue to do well with Natural Gas on the turn with $UGAZ and the Gold turn in $JNUG. I am still sitting in a small $DUST position that I will either add to or pivot to long Gold or miner’s in $JNUG or $NUGT if Gold confirms to upside – but it has been mostly sideways the last few months and Gold is struggling with the resistance identified by our algo some weeks back (long before Gold was anywhere near where it is).

$NAK is also on a turn here and our room has been all over it.

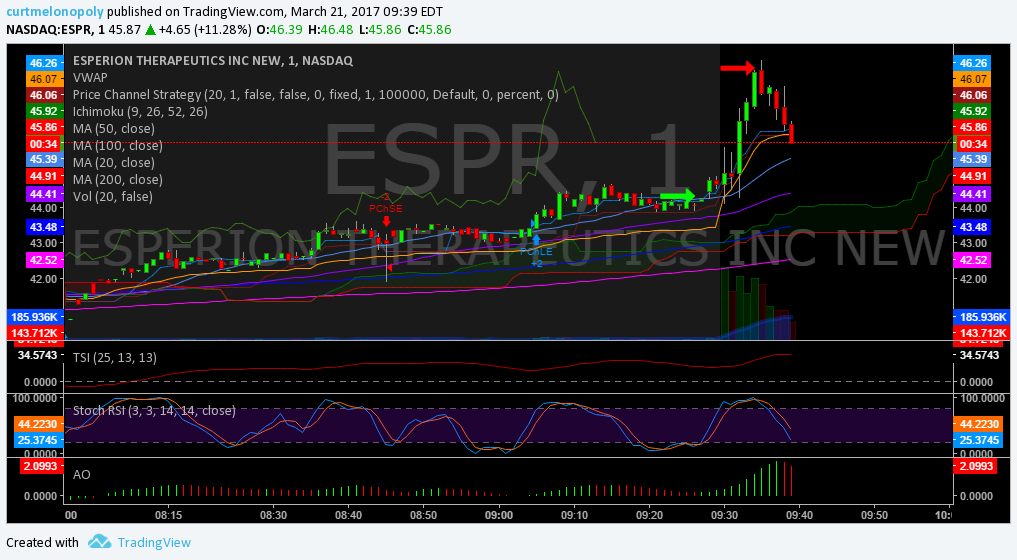

My morning momentum play was in $EPSR and it was a near perfectly executed trade. The video explains the chart indicators I use that got me out of the trade right on time very near the top – and there is video for it below. I got in because the market was weak but $ESPR had run the day before aggressively and in premarket it was aggressive coming in to the open. So I entered and sent an alert to our members right before open and added a few times and exited right before it turned back down. Awesome momentum trade – test book.

$ESPR Entered 44.52 premarket 1350 shares closed 934 47.63 Live on trading video with explanations will be in postmarket post for today.

$ESPR Entered 44.52 premarket 1350 shares closed 934 47.63 Live on trading video with explanations will be in postmarket post for today. pic.twitter.com/4MGT6tlh5I

— Melonopoly (@curtmelonopoly) March 21, 2017

Premarket trading plan (member post) can be found here:

https://twitter.com/CompoundTrading/status/844168525673586688

Premarket was all about: $ESPR, $HTBX, $PTIE

$ESPR was up about 7% but it wasn’t hitting a lot of the scanners in social etc but I was watching it because it ran the day before of course.

$ESPR up 7.47% Premarket pic.twitter.com/3qaoSpwd0d

— Melonopoly (@curtmelonopoly) March 21, 2017

$PTIE was up 66% premarket so this and $HTBX were where most trader’s were focused when I looked around (we have most rooms on our monitors and social etc).

$PTIE up 66% premarket on news. pic.twitter.com/zNv9xvHM2N

— Melonopoly (@curtmelonopoly) March 21, 2017

$PTIE Pain Therapeutics’ Remoxy ER Secures FDA Regulatory Guidance (PTIE, EGLT) https://t.co/TrUEOiSJCD

— Melonopoly (@curtmelonopoly) March 21, 2017

$HTBX was up 23% premarket on news also.

$HTBX up 23% premarket on news. pic.twitter.com/Ce6yCRcbdc

— Melonopoly (@curtmelonopoly) March 21, 2017

$HTBX Heat Biologics Reports Positive Interim Phase 2 Lung Cancer Results in Patients Treated with HS-1… https://t.co/zwHEVPcCRF

— Melonopoly (@curtmelonopoly) March 21, 2017

Through the evening and early morning in the algo lab I was tweeting a storm of tweets about how the market looked bearish and had been for a few days and sure enough Tuesday was the day. Nailed it to the day but we did know it was coming. Our $SPY algo nailed the interim top AGAIN and we were sending messages in our reporting to members on different services (even on these post market trading results posts). So we were more than ready.

I can here the bears.

— Melonopoly (@curtmelonopoly) March 21, 2017

A first? 😂 We can defy natural order can't we? I mean really come on! https://t.co/ApAapQQJxa

— Melonopoly (@curtmelonopoly) March 21, 2017

Hey how's was that timing for putting my suit on? Muhahahahaha 🐻🐨🐼🐾

— Melonopoly (@curtmelonopoly) March 21, 2017

Algorithmic Chart Modeling Reports / News:

The interesting thing I find about our algorithmic model charting is that they always keep us on top of not just trading ranges and the like but they have all been hitting the important turns like our Gold algo hitting the top last year and the most recent bottom turn, our dollar algo is all over it and our SPY algo had us ready for this top and on and on.Or even our oil algo, always nailing it. It has added an element to my trading that I couldn’t do without – becoming used to it for sure when originally I struggled with it (like anyone would I suppose).

Mid December our algo published yellow line (arrows) as main resistance on a turn. $GC_F $GLD $XAUUSD $GDX $GDXJ $NUGT $DUST $JNUG $JDST pic.twitter.com/sefQQUPkr4

— Rosie the Gold Algo (@ROSIEtheAlgo) March 21, 2017

https://twitter.com/EPICtheAlgo/status/844200332385177600

We notified members in most recent trading range over last week that our algorithm identified a divergence and to expect an interimn top.

— Freedom $SPY Algo (@FREEDOMtheAlgo) March 21, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Stocks, ETN’s, ETF’s I am Holding:

I am holding (in order of sizing – all moderately small size to micro sizing) – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| PULM | 3.88 | 39.57% | 22785823 | Top Gainers | |

| VSR | 1.55 | 37.17% | 5287900 | Top Gainers | |

| SILC | 46.74 | 20.74% | 450800 | Top Gainers | |

| BBGI | 11.50 | 14.20% | 83800 | Top Gainers | |

| HOS | 4.19 | 12.94% | 2561000 | Top Gainers | |

| IDXG | 2.45 | 11.36% | 361423 | Top Gainers | |

| BBGI | 11.50 | 14.20% | 83800 | New High | |

| MESO | 9.30 | 6.90% | 89057 | New High | |

| SILC | 46.74 | 20.74% | 450800 | New High | |

| AQN | 9.47 | 0.53% | 159100 | New High | |

| FIZZ | 78.86 | 0.24% | 368278 | Overbought | |

| CLNT | 2.65 | -0.75% | 42571 | Overbought | |

| VSR | 1.55 | 37.17% | 5287900 | Unusual Volume | |

| PTIE | 0.99 | 45.59% | 32934664 | Unusual Volume | |

| FLQD | 27.40 | -0.74% | 50800 | Unusual Volume | |

| XRLV | 29.45 | -1.04% | 1785700 | Unusual Volume | |

| BWXT | 47.14 | 0.62% | 1514900 | Upgrades | |

| ABUS | 3.20 | -4.48% | 564112 | Earnings Before | |

| TSLA | 250.68 | -4.29% | 6891700 | Insider Buying |

The markets to me look toppy (as I’ve noticed previous). So last weekend we produced some simple swing charting that keeps me level when looking at the markets (examples below). Simple charting I find grounds you to simple trades which in turn keeps you profitable in toppy or sideways markets. So I find the practice crucial even though our algorithmic modeling can cut up a chart on any time-frame and I can trade scalping like nobody’s business with them… but I have businesses etc and I can’t be a minute by minute trader (right now anyway). So keeping it simple helps me and many on our swing trading side of the platform really appreciate the simple view because they have day jobs or businesses etc.

The Markets Looking Forward:

$DUST $GC_F 1251 – 1256 and I'll start loading. You only live once.

— Melonopoly (@curtmelonopoly) March 21, 2017

This is one perspective of things possible going forward:

Why we're in for a repeat of the 1929 crash https://t.co/LzY9ewocux pic.twitter.com/bMsM39YXxC

— Business Insider (@BusinessInsider) March 20, 2017

Swing Trading Reports / News:

The quarterly performance report link is above in the intro to this post – we have been killing and below are some of the recent simple swing trading charts.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

https://twitter.com/CompoundTrading/status/843404659993731072

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

Results are in for Gold trading vote:

Will the next leg in #Gold trading be up or down? Round 3. Tie breaker! $GC_F $GLD $XAUUSD $GDX $NUGT $DUST $JDST $JUNG

— Melonopoly (@curtmelonopoly) March 13, 2017

https://twitter.com/CompoundTrading/status/843410816565039104

Silver $SLV:

https://twitter.com/CompoundTrading/status/843414571817693184

https://twitter.com/CompoundTrading/status/843415778812604417

Crude Oil $USOIL $WTI:

https://twitter.com/CompoundTrading/status/843409023730835457

https://twitter.com/CompoundTrading/status/843410816565039104

Volatility $VIX:

https://twitter.com/CompoundTrading/status/843405940875444224

$SPY S&P 500:

https://twitter.com/CompoundTrading/status/843402575152013312

https://twitter.com/CompoundTrading/status/843401400084135936

$NG_F Natural Gas:

Natural gas on fire… I’ll try and get some time to start covering it more closely. On a side note we’re going to start covering emerging markets and USDJPY closer too soon hopefully.

Live Trading Chat Room Transcript: (on YouTube Live):

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Also, times are Central Mountain below (we’re working on the fix now), so for New York ET time add two hours to all times. Also, most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Important note: There are a few pieces of the transcript missing from Tuesday. We’re learning that when there’s an interruption in service that we have to restart the room and reset transcripts and it is a bit cumbersome so we are thinking of trying a different service next week. We’ll get on the right platform and we’ll get the transcripts etc sorted.

There is a morning momentum trade that I did right before open and during open that has live voice broadcast that early traders would likely benefit from (with additional comments earlier in this post). I will try and get a detailed trade explanation video done (we’re in studio for 3 days this weekend doing nothing but educational videos – yes we booked 3 days wow).

6:50 AM

Compound TradingTrading Plan Mar 21 $HTBX, $PTIE, $NAK, $NG_F, $KALY, $USRM, $BLKG LINK: https://compoundtrading.com/premarket… PASSWORD: PRE0321

7:01 AM Curtis Melonopoly I will be traveling today again by 10:15 but I’ll still be in room on my phone.

7:07 AM MarketMaven M The $HTBX news is decent

7:08 AM MarketMaven M Nick’s nakity $NAK looks good

7:10 AM Curtis Melonopoly y a watching $NAK close

7:12 AM MarketMaven M Apple unveils new 9.7-inch iPad, (RED) edition iPhone 7 and 7 Plus

7:15 AM wintonresearch ha hey guys

7:15 AMCurtis Melonopoly long $ESPR 44.52

7:16 AM Curtis Melonopoly 1/5 size tester 450 shares

7:17 AM MarketMaven M hey Nicholas

7:18 AM Flash G My swing trading list is solidly in play – looking at a few others too.

7:18 AM Flash G morning!

7:20 AM Mathew w metals on a ripper here right before open. looking like rampage mode will begin shortly

7:22 AM MarketMaven M $AXSM offering through Ladenburg

7:28 AM MarketMaven M $ESPR long 44.64 lol

7:31 AM MarketMaven M $ESPR whooo hoo oh lol maybe not

7:31 AM MarketMaven M come on

7:33 AM Curtis Melonopoly $ESPR add 46.31 450

7:33 AM Curtis Melonopoly $ESPR lol

7:33 AM MarketMaven M Add 46.45

7:34 AM Curtis Melonopoly add 47.42 $ESPR

7:34 AM Curtis Melonopoly in 3 of 5 sizing

7:35 AM Curtis Melonopoly closed 1350 shares 47.63 nice win

7:35 AM Curtis Melonopoly out completely

7:35 AM MarketMaven M I’m still in

7:35 AM MarketMaven M opps now I’m out

7:36 AM MarketMaven M 47.45

7:36 AM MarketMaven M nice trade curt

7:37 AM Curtis Melonopoly on the mic for that trade BTW forgot to mention

7:37 AM Curtis Melonopoly explanation on mic of why I exited where I did

7:38 AM MarketMaven M ya thanks curt caught that on speakers

7:43 AM MarketMaven M snap back entry?

7:45 AM Curtis Melonopoly $SCON on scanner but I don’t like the stock

7:46 AM Flash G Bonds on high alert here folks.

7:47 AM wintonresearch $SCON has been a penny stock for like 15 years

7:48 AM wintonresearch $URRE moving up again

7:48 AM wintonresearch i like it

7:50 AM Curtis Melonopoly $HTBX approaching VWAP

7:50 AM Curtis Melonopoly $URRE going to go parabolic soon imo

7:50 AM wintonresearch i agree Curtis

7:54 AM wintonresearch$ UGAZ continuing up

7:55 AM Curtis Melonopoly $ESPR 42.68 lol

8:00 AM Flash G My $CMG swing doing well here but watching closely

8:04 AM Curtis Melonopoly $BLKG almost half what I sold it for yesterday lol really entry soon maybe

8:04 AM MarketMaven M that’s almost sad lol

8:05 AM wintonresearch $JNUG perky

8:05 AM Curtis Melonopoly ya this could be the trend break our algos looking for here soon

8:06 AM Curtis Melonopoly if it ends up confirming I’ll flip long hard… but it keeps messing with resistance etc

8:06 AM Curtis Melonopoly $GC_F I’m referring to

8:08 AM wintonresearch would like to see GDX:GLD above 0.2 for rally to be confirmed

8:08 AM Curtis Melonopoly see there it is at the algorithm line again (yellow)

8:09 AM Curtis Melonopoly Gold really sticks to the math it’s interesting. Back tested math.

8:10 AM MarketMaven M ya you’ve had that algo line on there for many months

8:10 AM MarketMaven M i think before Christmas

8:13 AM MarketMaven M $SNAP is my watch today now

8:13 AM MarketMaven M looks like a good long here soon

8:14 AM MarketMaven M up 2.8% and looking beastly

8:15 AM MarketMaven M It’s working on the third 5 min soldier as Curt calls em

8:16 AM Curtis Melonopoly probably a better EOD or early play tomorrow IMO

8:16 AM Curtis Melonopoly that last 5 min candle not the best at top there 20.50 range

8:16 AM MarketMaven M I see

8:17 AM Curtis Melonopoly but don’t let me discourage it

8:17 AM MarketMaven M ya I’ll watch it

8:19 AM Flash G $IBB is on a test of LOD

8:19 AM Scott Ryan gm

8:21 AM Curtis Melonopoly hey scott

8:21 AM Curtis Melonopoly Gold looks more real than it has in a while

8:22 AM MarketMaven M GM Scott!

8:22 AM Flash G $IBB wow could get interesting

8:23 AM wintonresearch $MUX a good play on both gold and silver

8:23 AM MarketMaven M Have never traded it

8:26 AM MarketMaven M The only reason I’m not going long miner’s is that stupid yellow algo line curt wtf lol

8:26 AM Curtis Melonopoly tell us how u really feel ?

8:27 AM Curtis Melonopoly $SSH at 52 week lows so I may wack it hard for a test soon long

8:28 AM Flash G $ES_F looking sickly today

8:29 AM Flash G ”Risk-off” feelings here

8:30 AM wintonresearch $URRE getting that look

8:32 AM Curtis Melonopoly looks like $STUDY time for me and some travel here soon. Bears are coming out to play I think.

8:32 AM wintonresearch speaking of weak SPY $FAZ chart looks strong

8:33 AM Curtis Melonopoly I’ll be in the room but travel prep time for me. and I’ll be in here while traveling FYI.

8:33 AM Flash G looks mucky for sure – we’ll see

8:34 AM Curtis Melonopoly you called it yesterday flash

There is missing transcript here… with an outage.

9:03 AM MarketMaven M $SGDH my micro play now entering here

9:04 AM MarketMaven M $SDGH

9:04 AM MarketMaven M pot

9:18 AM wintonresearch $FAZ

9:18 AM MarketMaven M time to btd?

9:18 AM MarketMaven M ya Nich

9:47 AM Flash G via @bespokeinvest Financials getting hit the most today by wide margin. Down 2.25%. Remaining sectors down 0.75%-1.25%. Utilities, Staples up on the day.

9:51 AM Scott Ryan trend days dont usually bounce … looking short

Inline image 1

9:58 AM Mathew w XLE actually decently strong here along with most of the miners, juniors seem to be lagging a bit

10:15 AM Flash G I’m watching with great interest

10:18 AM Mathew w Added to SWN and ECR swings. ECR avg 2.2 and SWN about 7.6. Looking late spring time frame on both of these

10:24 AM Flash G $SWN was on my watch – that looks really good $ECR I haven’t looked at yet.

10:25 AM Mathew w ECR similar play. Both in the ng space. I’m also in CRK as well. All 3 should see higher in coming weeks with nice set ups off of bottoms and hammers yesterday

10:32 AM Flash G I’ll have to look.

10:48 AM MarketMaven M $RGSE chatter about CEo buying shares

10:48 AM MarketMaven M Been watching the stock lately

11:07 AM MarketMaven M.

11:13 AM Curtis Melonopoly had oil come off just a tad more I’d be long

11:37 AM Curtis Melonopoly gold anywhere near 1251 to 1256 I’m loading dust

11:37 AM MarketMaven M lololol

11:43 AM Mathew w loading dust for a reversal in gold? Man, with these currency moves that’

11:43 AM Curtis Melonopoly $BEBE wrecked wow

11:43 AM Mathew w that’s a bold bet

11:43 AM Mathew w Im still just in a few juniors and SLW for e’s today but shorting here seems tough

11:43 AM Curtis Melonopoly loading is not totally committed ?

11:44 AM Mathew w fair enough.

11:50 AM Curtis Melonopoly long 5.07 $BEBE

11:51 AMCurtis Melonopoly1 / 5 size 2800

11:51 AM MarketMaven Mholy risky man today

11:53 AM Chat disconnected. Please wait while we try to reconnect you.

11:53 AM Successfully connected.

11:53 AM MarketMaven M okay fine I will 1 / 10 size it haha 5.12 600

11:53 AM MarketMaven M.

12:10 PM wintonresearch FAZ still rockin

There is 20 minutes missing here because of another outage.

12:32 PM Curtis Melonopoly sold be be small loss 4.80 .32 cents on 600 or 190.00 ish

12:33 PM Curtis Melonopoly $BEBE

12:41 PM MarketMaven M I’m back lol

12:41 PM Flash G Yup me also

12:46 PM Curtis Melonopoly sorry about the outage lol

12:49 PM Flash G I was just thinking about Gold

12:50 PM Flash G After looking at Curt’s comments

12:50 PM Flash G its been sideways pretty much for 2 months!

12:50 PM Curtis Melonopoly yup

12:54 PM MarketMaven M $ONCS HOD was watching this all day

12:54 PM MarketMaven M I see your point on Gold flash I’ve stayed out of it completely

12:54 PM MarketMaven M I couldn’t reconcile Trump and Gold trade and all that comes with it clearly

12:55 PM MarketMaven M I remember last year Curt’s DXY algo telling everyone it was going to break out and he people didn’t believe it and look what happened

12:57 PM Flash G Yes I recall and I also know that the algo has it in a quadrant Curt and I talked about – it’s still in play until it isn’t as far as the algo is concerned – its all a complicated play

1:09 PM Curtis Melonopoly Gold will be interesting if it gets up over resistance could be a huge trade

1:10 PM Flash G Seems to be a big if lately

1:10 PM Flash G Miners have been a difficult trade.

1:12 PM MarketMaven M $FUEL- Rocket Fuel Expands Partnership with IBM by Embedding Watson Cognitive Capabilities into Its Predictive Marketing Platform

1:14 PM MarketMaven M VRX NHOD

1:14 PM MarketMaven M $VRX – I’m in it I am going to win

1:32 PM MarketMaven M |Really liking the $SNAP set-up likely a long tomorrow if market settles down

1:35 PM MarketMaven M BLOCK TRADE: $NE 300,000 shares @ $5.80 [15:34:08]

1:38 PM MarketMaven M $HTBX strong EOD here – may be a good set-up for morning

1:42 PM Eric Lunianga Lovely day

1:43 PM Curtis Melonopoly $BLKG 20 now lol I sold at 55 yesterday crazzzy

1:45 PM MarketMaven M Hey Eric

1:45 PM MarketMaven M $BTCS off 60% lol

1:45 PM Eric Lunianga Hey man

1:45 PM Curtis Melonopoly Good day to you eric

1:45 PM Eric Lunianga Hey Curt

1:46 PM Flash G well that was quite a day

1:46 PM Flash G no trades but watching that was kinda fun

1:46 PM Eric Lunianga Indeed, let’s see it continue

1:46 PM Flash G tomorrow is the deciding up or down i suppose

1:47 PM Flash G lol no I’m long a bunch still but that can change and i’m green with 90% or more so ya either way works

1:47 PM Flash G but i do have some large plays but i can turn – I go both ways

1:48 PM Flash G Could be a good trade if we see a correction

1:48 PM Eric Lunianga good on you

1:48 PM MarketMaven M Curt and I made a lot of bank the last correction the last two actually or sorry I’ve traded three with him

1:49 PM MarketMaven M Curt hammers down hard in corrections lol mad man comes out

1:49 PM Curtis Melonopoly omg

1:49 PM Eric Lunianga you got him hard just thinking about it lol

1:50 PM Flash G I do recall

1:50 PM Flash G I was there Maven

1:50 PM Flash G the last one anyway

1:50 PM MarketMaven M correction = new house as he says

1:51 PM Curtis Melonopoly wow what a EOD convoy lol

1:51 PM Eric Lunianga makes sense

1:55 PM MarketMaven M well peeps

1:55 PM MarketMaven M shutting her down – here’s to a glass and a good nights sleep and maybe carnage tomorrow!

1:56 PM Flash G night Maven

1:56 PM Flash G I’m going to think long and hard in aftermarket whether to hold my positions or not

1:56 PM Flash G or I may just take some risk off

1:57 PM Curtis Melonopoly I’m 93% cash so no thought for me just watch

1:58 PM Flash G good position to be curt

1:59 PM Flash G $HTBX closing strong – not my thing but its a good close

1:59 PM Flash G Well have a good night y’all

1:59 PM Curtis Melonopoly ya u too flash

1:59 PM Curtis Melonopoly I’ll shut er down now cya eric

Be safe out there!

Follow our lead trader on Twitter:

Article Topics: $ESPR, $HTBX, $PTIE, $NAK, $NG_F, $UGAZ, $GC_F, $JNUG, $DUST – $XOM, $NE, $ONTX, $DUST, $TRCH, $LGCY, $SSH, $ASM – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

PreMarket Trading Plan Tues Mar 14 $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ

Stock Trading Plan for Tuesday Mar 14, 2017 in Compound Trading Chat room. $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ – $ONTX, $DUST, $USRM, $XOM, $NE, $BLKG, $DRYS, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Trading Room Open House: We continue running open house – which will end soon (we just want to get this new platform settled first).

Trading Room Attendance: With our commercial multi-user algorithm chart modeling client platform launch, upcoming 24 hour oil trading room and coding for our algorithm models for our trader’s cockpit (you’d have to read our story on our website to understand our build-out plans)… I won’t be in the trading room as much starting Tuesday March 14, 2017. I expect to be in the room most days the first hour or two and then I have to turn my attention to the platform development daily and assistance our software developers require of me. I will still have my monitors on and will likely comment and/or run intra-day review broadcasts etc – I just won’t be in the room minute by minute.

The Quarterly Swing Trading Performance Review P/L with Charting is Published. The Algorithms and Daytrading Quarterly Performance Reports are being compiled as I write and will be posted soon.

https://twitter.com/CompoundTrading/status/841078264537993218

The trading group link is below – if you have any problems let us know.

Open House Today – Live Broadcast Trading 9:30 AM https://t.co/7H84KcZXgh $MGI $ETM $TNXP $ONCS $DWT $UGAZ #chatroom #stocks #premarket

— Melonopoly (@curtmelonopoly) March 14, 2017

Yesterday’s trading results here:

https://twitter.com/CompoundTrading/status/841614605264797700

Keep it Simple Swing Charting Post:

https://twitter.com/CompoundTrading/status/840839909573349376

Results of Gold trade vote are in!

RESULTS ARE IN! Will the next leg in #Gold trading be up or down? Round 3. Tie breaker! $GC_F $GLD $XAUUSD $GDX $NUGT $DUST $JDST $JUNG https://t.co/7NVSaMQ3Kh

— Melonopoly (@curtmelonopoly) March 14, 2017

Current Holds / Trading Plan:

Even though my holds are small in size I would like to start focusing on trading out of some of these, if not all.

All small to mid size holds in this order according to sizing – $ONTX, $DUST, $USRM, $XOM, $NE, $BLKG, $DRYS, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI.

Per recent’ $DUST I will close for a loss if Gold holds 1260 – sucks, but it was a relatively small position (to portfolio size) but I didn’t follow the golden rule… when a trade goes against your plan cut fast and I didn’t so I will likely pay the price. And I guess what has become the second golden rule… listen to the algos… they haven’t been wrong yet – so yes, I didn’t listen to my own invention ROSIE the Gold Algo (give Rosie a little plug there she deserves it lol). Embarrassing, especially because ROSIE nailed the bottom many weeks in advance of the bottom – all I had to do was listen and boom new house. Sad.

Market Outlook / Trading Plan:

Markets appear to be awaiting the Fed and a number of other factors.

I do have $NFLX on watch as a short, and long watches for swings also $TAN, $ABX, $JNUG, $WYNN, $SLX, $TWLO, $X, $XME, $AKS and a few others.

#Fed, in shift, may move to faster pace of rate hikes https://t.co/kCSWCuAKod via @Reuters

— Melonopoly (@curtmelonopoly) March 14, 2017

New Oil Price War Looms As The OPEC Deal Falls Short | https://t.co/8uM3eZ2UfT https://t.co/H3IITX2bS6 #oilprice

— Melonopoly (@curtmelonopoly) March 14, 2017

https://twitter.com/NorthmanTrader/status/841304382025191424

https://twitter.com/ThinkTankCharts/status/841581618380865537

Morning Momo / News and Social Bits From Around the Internet:

Momo Watch: $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ

S&P -0.22%.

10-yr +0.02%.

Euro -0.21% vs. dollar.

Crude -0.66% to $48.08.

Gold +0.12% to $1,204.50.

Corning downgraded to Neutral at Goldman Sachs; 1.5% pre-market http://seekingalpha.com/news/3250899-corning-downgraded-neutral-goldman-sachs-1_5-percent-pre-market?source=twitter_sa_factset … #premarket $GLW

EnteroMedics’ vBloc featured on TV show; shares ahead 21% premarket http://seekingalpha.com/news/3250897-enteromedics-vbloc-featured-tv-show-shares-ahead-21-percent-premarket?source=feed_f … #premarket $ETRM

Tesla debuts in South Korea tomorrow http://seekingalpha.com/news/3250896-tesla-debuts-south-korea-tomorrow?source=twitter_sa_factset … #premarket $TSLA

$AMD shares dumping premarket–down to 14.01 from yesterday’s close of 14.28

Ackman’s loss on Valeant could be over $5B; shares slip another 12% premarket http://dlvr.it/NcyLlw #investing #news

Aurinia’s stock plummets 24% in active premarket trade after stock offering prices at deep discount http://dlvr.it/NcyG8L MARKETWATCH

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ $ARRS $DSW $OPK $DRYS $YY $PLX $UWT $UNG $MAT $NVDA $JNUG

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List: $TAN, $ABX, $JNUG, $WYNN, $SLX, $TWLO, $X, $XME, $AKS

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $WOR $ZEUS $RS $DGX $GDOT $DIS $TXRH $OXY $CTB $LADR $ETH $MAA $ARRS $TDG as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $WUBA $HLIT $GGP $ABT $AMPH $GLW as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ – $MGTI, $NE, $XOM, $USRM, $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $DRYS – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F

PreMarket Trading Plan Fri Mar 10 $TEUM $CATB $PRKR $VCEL $UGAZ $BP $AUPH $SNAP

Stock Trading Plan for Friday Mar 10, 2017 in Compound Trading Chat room. $TEUM, $CATB, $PRKR, $VCEL, $UGAZ, $BP, $AUPH, $SNAP – $SPXL, $BLKG, $ONTX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $DRYS, $MGTI – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

The trading group link is below – if you have any problems let us know.

https://twitter.com/CompoundTrading/status/840191606556831744

Yesterday’s trading results here:

https://twitter.com/CompoundTrading/status/840140663744221184

Current Holds / Trading Plan:

All small to mid size holds in this order according to sizing – $SPXL, $ONTX, $DUST, $USRM, $XOM, $NE, $BLKG, $DRYS, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI.

Per recent’ $DUST I will close for a loss if Gold holds 1260 – sucks, but it was a relatively small position (to portfolio size) but I didn’t follow the golden rule… when a trade goes against your plan cut fast and I didn’t so I will likely pay the price. And I guess what has become the second golden rule… listen to the algos… they haven’t been wrong yet – so yes, I didn’t listen to my own invention ROSIE the Gold Algo (give Rosie a little plug there she deserves it lol). Embarrassing, especially because ROSIE nailed the bottom many weeks in advance of the bottom – all I had to do was listen and boom new house. Sad.

Market Outlook / Trading Plan:

The open looks decent so we may get a good Friday yet!!!

Watching Gold, Miner’s and Silver once again very close – here’s our Gold trade vote.

Will the next leg in #Gold trading be up or down? Round 2. $GC_F $GLD $XAUUSD $GDX $NUGT $DUST $JDST $JUNG

— Melonopoly (@curtmelonopoly) March 5, 2017

Volatility is now on my radar again $TVIX $UVXY.

https://twitter.com/CompoundTrading/status/838728237698035713

Morning Momo / News and Social Bits From Around the Internet:

Momo Watch: $TEUM $CATB $PRKR $VCEL $UGAZ $BP $AUPH $SNAP

8:30am

Employment Situation

1pm

Baker-Hughes Rig Count

$ULTA shares down 4.3% premarket. Ulta shares fall as company offers softer outlook.

Southwest shares down 3% premarket

Cara Therapeutics Q4 expenses up 130%, top-line data from Phase 2/3 study of IV CR845 expected t… http://seekingalpha.com/news/3250331-cara-therapeutics-q4-expenses-130-percent-top-line-data-phase-2-3-study-iv-cr845-expected?source=twitter_sa_factset … #premarket $CARA

Futures add to advance after strong jobs numbers http://seekingalpha.com/news/3250330-futures-add-advance-strong-jobs-numbers?source=feed_f … #premarket $TLT $TBT $UUP $UDN

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $TEUM $CATB $PRKR $VCEL $UGAZ $BP $AUPH $SNAP

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $FLY $LHCG $YUM $CPT $FMSA $ASML $IBKC $CNSL $INAP $ATU $ABBV $MRO $SRRA $FRAC $COBZ $HIMX as time allows I will update before market open or refer to chat room notices.

(6) Downgrades:$GES $PAY $IONS $ABCO $LOXO $MD $KKMB $SGRY $DG as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $TEUM, $CATB, $PRKR, $VCEL, $UGAZ, $BP, $AUPH, $SNAP – $MGTI, $NE, $XOM, $USRM, $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $DRYS – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F

PreMarket Trading Plan Wed Mar 8 $OCRX, $PRKR, $BIOC, $SNAP, $DUST, $UGAZ

Stock Trading Plan for Wednesday Mar 8, 2017 in Compound Trading Chat room. $OCRX, $PRKR, $BIOC, $SNAP, $DUST, $UGAZ – $ONTX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

All algo, post market trading results and swing trading updates are now out.

The trading group link is below – if you have any problems let us know.

NOTICE: Promo users of any algorithm chart modeling will not receive updates effective now due to our commercial user contract obligations.

— Melonopoly (@curtmelonopoly) March 8, 2017

https://twitter.com/CompoundTrading/status/839387908977078272

We will be streaming live trade at You Tube Live today. Public Open House. Link here https://t.co/no1jMzvdB7 #stocks #trading #premarket

— Melonopoly (@curtmelonopoly) March 8, 2017

Current Holds / Trading Plan:

All small to mid size holds in this order according to sizing – $ONTX, $DUST, $USRM, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI.

Per recent’ $DUST I will close for a loss if Gold holds 1260 – sucks, but it was a relatively small position (to portfolio size) but I didn’t follow the golden rule… when a trade goes against your plan cut fast and I didn’t so I will likely pay the price. And I guess what has become the second golden rule… listen to the algos… they haven’t been wrong yet – so yes, I didn’t listen to my own invention ROSIE the Gold Algo (give Rosie a little plug there she deserves it lol). Embarrassing, especially because ROSIE nailed the bottom many weeks in advance of the bottom – all I had to do was listen and boom new house. Sad.

Market Outlook / Trading Plan:

Earnings on deck:

#earnings $THO $MOMO $ULTA $FNSR $MEET $MVIS $DKS $CLNE $CIEN $CARA $URBN $MIK $DXYN $LGIH $SCMP $BIOC $BTE $CASY https://t.co/rsllzs6MVb

— Melonopoly (@curtmelonopoly) March 5, 2017

Watching Gold, Miner’s and Silver once again very close – here’s our Gold trade vote.

Will the next leg in #Gold trading be up or down? Round 2. $GC_F $GLD $XAUUSD $GDX $NUGT $DUST $JDST $JUNG

— Melonopoly (@curtmelonopoly) March 5, 2017

Volatility is now on my radar again $TVIX $UVXY.

https://twitter.com/CompoundTrading/status/838728237698035713

Morning Momo / News and Social Bits From Around the Internet:

Momo Watch: $OCRX, $PRKR, $BIOC, $SNAP, $DUST, $UGAZ

7am

MBA Mortgage Apps

8:15am

ADP Employment Report

8:30am

Productivity and Costs

10am

Wholesale Trade

10:30am

Petroleum Report

Ten-year yield back at top of range http://seekingalpha.com/news/3249490-ten-year-yield-back-top-range?source=feed_f … #premarket $TLT $TBT

Health Insurance Innovations down 13% premarket on pending stock sales by shareholders http://seekingalpha.com/news/3249489-health-insurance-innovations-13-percent-premarket-pending-stock-sales-shareholders?source=feed_f … #premarket $HIIQ

Vera Bradley’s stock plunges 14% premarket after Q4 results.

Express Stock Drops Premarket on Weak Guidance $EXPR

Tepper shorts bonds http://seekingalpha.com/news/3249471-tepper-shorts-bonds?source=feed_f … #premarket

Retailers Express and Urban Outfitters each issued weak outlooks. $EXPR down 10% #premarket. $URBN down 7%.

The Children’s Place +7% after doubling dividend, adding buybacks http://seekingalpha.com/news/3249467-childrens-place-plus-7-percent-doubling-dividend-adding-buybacks?source=feed_f … #premarket $PLCE

$CAT-astrophe? Caterpillar down 3% #premarket after NYT reports about last week’s probe by feds. Cites accusations of tax/accounting fraud.

PetroQuest Energy -9% premarket after wide Q4 earnings miss http://seekingalpha.com/news/3249497-petroquest-energy-minus-9-percent-premarket-wide-q4-earnings-miss?source=feed_f … #premarket $PQ

$ABEO Receives Orphan Drug Designation in the European Union for EB-101 Gene Therapy Clinical Trial for Epidermolysis Bullosa[+]

FDA to review Keryx Bio’s application for expanded use of Auryxia; shares ahead 5% premarket

Ladder Capital down 5% as backers sell http://seekingalpha.com/news/3249505-ladder-capital-5-percent-backers-sell?source=twitter_sa_factset … #premarket $LADR

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $OCRX $PRKR $HH $BIOC $REXX $HTBX $XTLB $SHIP $XTNT $UGAZ $HEAR $SCMP $AVAV $PLCE $HRB $CBAY $FNBC $TSL

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: $HIIQ $URBN $LAND $AUPH and $FMBI. I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $IPXL $WFT $OMC $EVH $NAV $BXE $SWKS $CCI $MIK $UDR $AVB $VOD as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $GOLD $BT $URBN $NMBL $FIG $AF $NSM $TV as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $OCRX, $PRKR, $BIOC, $SNAP, $DUST, $UGAZ – $MGTI, $NE, $XOM, $USRM, $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F

PreMarket Trading Plan Wed Feb 22 $ONCS, $OWCP, $GRMN, $DCTH, $UGAZ, $FNMA, $BSTG

Stock Trading Plan for Wednesday Feb 22, 2017 in Compound Trading Chat room. $ONCS, $OWCP, $GRMN, $DCTH, $UGAZ, $FNMA, $BSTG – $UWT, $ONTX, $VRX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $CBMX – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Member newsletters for algos, swing trades and post market reports will not be sent this morning (I got wacked with a winter fly bug and Sartaj is deep in developer land) so we’ve booked off time this evening to update them all for distribution prior to Thursday market open.

https://twitter.com/CompoundTrading/status/834361934090641410

Current Holds / Trading Plan:

All small to mid size holds in this order according to sizing – $UWT, $BSTG, $ONTX, $VRX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $CBMX, $DUST (looking for a way out on $DUST – was expecting one final significant spike in USDJPY before drop – didn’t get it so hoping for a pull back in miners soon – if not I’ll have to take the loss). $CBMX is a hold till late spring if necessary (you would have to do your own DD on the company and make your own determination).

I entered $RNVA AM the other day small position and exited yesterday. I haven’t alerted $RNVA and $BSTG trades because I expect to be in and out of them and a few other micros lots over the next while… also have $BLPH, $OWCP, $TENX, $ACST and others on this micro watchlist.

As noted before I may exit $VRX and $UWT.

I was asked by a member last night whether I alert my swing trades in the room or on SMS and Email from our swing trade subscription side and the answer is no, I keep them separate. The swing trading service isn’t a live alert service.

Market Outlook / Trading Plan:

My outlook is very similar to yesterday. It seems Crude Oil $WTI has pushed its trade range right up near resistance to parallel $Gold, $Silver, and the $DXY US Dollar – they are all at decisions. Interesting scenario. $VIX is still dead and $SPY has another leg forming. The markets seem pensive but bullish at the same time. Again, interesting IMO.

Many of our regulars in the room were killing momos yesterday… which by the way is interesting how these can sneak up on you… I reviewed a number of them and the follow through was definitely better in these on Wednesday – there were a number of them. When I seen some of our members in $EYEG right out of the gate at market open I thought oh no… but it worked out for them – in conversations I had with members through the day and after market it seems the group did really well. I missed the momos because I was expecting the follow through to be light – but I was wrong on that.

I am really interested in where the bottom is for natural gas, so I am watching $UGAZ close. I think Mathew tagged 2.54 as a possible bounce area in the room yesterday and this morning it did tag that area and has bounced a bit. Also watching the resistance in oil as you know to possibly exit the $UWT swing soon. Also really curious to see what Gold and Silver and the Dollar do here with the Trump trade follow through.

$FNMA is my shoulda from yesterday, I was all over it when it came off hard and was going to take an entry on the snap back and its up 23% in premarket trading at 3.32.

$ONCS is up 32% trading at 1.85 premarket.

Morning Momo / News and Social Bits From Around the Internet:

Momo Watch: $ONCS, $OWCP, $GRMN, $DCTH, $UGAZ, $FNMA, $BSTG

7am

Mortgage Apps

8:55

Chain Store Sales

10am

Home Sales

11:30

2-Year Auction

1pm

5-Year Note Auction

Fed Powell speaks

2pm

FOMC

Futures lower ahead of Fed minutes http://seekingalpha.com/news/3245184-futures-lower-ahead-fed-minutes?source=feed_f … #premarket

US Dollar – closed at the 50 DMA – Fed’s Minutes at 2 pm.

GPS maker Garmin shares jump 6% premarket as earnings blow past estimates.

United Therapeutics revenues up 9%; non-GAAP EPS up 30% in FY16 http://seekingalpha.com/news/3245172-united-therapeutics-revenues-9-percent-non-gaap-eps-30-percent-fy16?source=twitter_sa_factset … #premarket $UTHR

Shares of $MBLY climbed 4.8% in premarket trade Wednesday after the company reported stronger-than-expected fourth-quarter earnings.

#Mobileye Q4 EPS of 22c beats by 2c. Revenue of $104.6m beats by $8.2m.

$MBLY +5.16% at 48.50 premarket.

Red-hot Russia ETF has first outflow since November http://seekingalpha.com/news/3245154-red-hot-russia-etf-first-outflow-since-november?source=feed_f … #premarket $RSX.

Premarket: Global stocks top 2016 gains, U.S. dollar up before Fed minutes http://trib.al/TfVngg2 from @GlobeBusiness

$SRPT Janney Capital reiterated Buy rating and a $65 price target.

$SRRA Wedbush initiated Sierra Oncology coverage with an Outperform rating and $4 price target.

$JUNO Initiating at OUTPERFORM on Potential Best-In-Class CAR-T.

Toll Brothers up 4% after beat, raised guidance, dividend initiation http://seekingalpha.com/news/3245199-toll-brothers-4-percent-beat-raised-guidance-dividend-initiation?source=twitter_sa_factset … #premarket $TOL

Neuralstem gets U.S. patent covering the use of NSI-189 in MDD; shares up 3% premarket.

Aetna announces $3.3B accelerated share repurchase $AET http://dlvr.it/NRn86L.

$IMDZ Receives Orphan Drug Designation for G100 Intratumoral Pdt Candidate

$GBT offering. 5.1M shares at $24.50 per share.

$ARGS stock resumes trade, plunges 73% premarket after disappointing trial news

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: Gainers: $ONCS 32%, $JAGX 21%, $NVDQ 20%, $SRRA 9%, $PIP $MBOT $GRMN $GNC $CNAT $MBLY $SPWH $STNG $LYG $SBLK $TOL $UVXY

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $DCP $CXP $STM $ECL $EXAS $PH $WMT $STNG as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $TEP $ENT $DISCA $ENTL $MNTA $AU $IHG $ECL $VFC $AAT $FSLR $HAR $OMC $RL $CSIQ $TRVG $TRIP $TVPT $UPS $AUY $SAGE $LMAT as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $ONCS, $OWCP, $GRMN, $DCTH, $UGAZ, $FNMA, $BSTG – $UWT, $BSTG, $ONTX, $VRX, $SSH, $ASM, $CBMX, $DUST, $TRCH, $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F