Tag: $XNET

PreMarket Trading Plan Tues Feb 6 $VIX, $VVIX, $XIV, $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL

Compound Trading Chat Room Stock Trading Plan and Watch List Tuesday Feb 6, 2018 $VIX, $VVIX, $XIV, $XNET, $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL – Gold Miners $GDX, Silver $SLV, $USOIL, US Dollar Index $USD/JPY $DXY, S&P 500, Volatility … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

$XIV news is pending per below.

The obscure volatility security that’s become the focus of this sell-off is halted after an 80% plunge http://cnb.cx/2BemWWn

Credit Suisse is said to consider redemption of volatility note https://www.bloomberg.com/news/articles/2018-02-06/credit-suisse-is-said-to-consider-redemption-of-volatility-note …

Updated charting will be sent today to members for… charts that are unusually affected due to significant volatility. Any outstanding charting / reports before Wed market open at latest (Crypto, Swing, Silver).

A Quick Member Update – 2018 Plans and Current Status

https://twitter.com/CompoundTrading/status/951798787521089543

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months.

- Term of Project. The term is 24 months (as mentioned above). Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are / will also be trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia, Brasil, and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Recent Educational Videos:

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Caution. Watching close the sell-off for direction.

Per recent:

Market observation / on watch:

US Dollar $DXY up from yesterday’s report – pressure has slowed (broadening bottom on model) trading 89.65, Oil FX $USOIL ($WTI) down trading 63.24, Gold / Silver moderate – Gold intra day trading 1336.50 down slightly from yesterday, $SPY significant pressure trading 257.94, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 6830.00 under significant pressure, and $VIX trading 49.2 up significantly from yesterday.

Recent Momentum Stocks to Watch:

News:

Recent SEC Filings:

Recent IPO’s:

Some Earnings On Deck:

#earnings for the week

$NVDA $TSLA $TWTR $SWKS $SNAP $DIS $ATVI $GILD $GM $CMG $BMY $AGN $TEVA $TTWO $BP $COHR $SYY $REGN $NTES $FEYE $ARNC $CVS $EXPE $SKX $HES $BAH $CMI $OCLR $GOLD $CHD $IRBT $LITE $GRUB $CTLT $GOOS $HAS $KORS $MCY $TRVG $ONVO $PM

#earnings for the week$NVDA $TSLA $TWTR $SWKS $SNAP $DIS $ATVI $GILD $GM $CMG $BMY $AGN $TEVA $TTWO $BP $COHR $SYY $REGN $NTES $FEYE $ARNC $CVS $EXPE $SKX $HES $BAH $CMI $OCLR $GOLD $CHD $IRBT $LITE $GRUB $CTLT $GOOS $HAS $KORS $MCY $TRVG $ONVO $PM https://t.co/lObOE0dgsr pic.twitter.com/SZzp8UrZ88

— Earnings Whispers (@eWhispers) February 3, 2018

Recent / Current Holds, Open and Closed Trades

New position $XNET 1/10 size long from Monday. Holding $XIV 1.5/10 sizing (per above awaiting news decision), $SPXL 1/10 size, small sizing golds $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00 1/40 size, $DUST 1/20 size recently close 50% for win, $ROKU, $GSUM, $JP, $SLCA, $INSY (all small size) and very small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Per recent;

Holding $XIV 1.5/10 sizing, $SPXL 1/10 size, small sizing golds $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $GSUM, $SPXL, $JP, $SLCA, $INSY and very small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Closed $FB position yesterday for win, closed $XIV for win and re entered $XIV. Holding $XIV, $SPXL, $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Trimmed at highs and then added heavy $XIV yesterday, added $SPXL near lows, traded $WYNN for win and held some and some other minor trades (all wins). Holding $SPXL, $FB, $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Added Monday 1/10 size $SPXL, 1/10 $GE, 1/10 $DUST. Traded short oil for a small win on swing from Friday to Monday early the traded again Monday morning for a loss 1/10 size. Friday trimmed $SPXL to 1/20 size hold, trimmed $FB to 1/20 size hold, holding long $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Trade short oil for a small win on swing from Friday to Monday early. Friday trimmed $SPXL to 1/20 size hold, trimmed $FB to 1/20 size hold, holding new entries $WKHS, $GE. Holds on Bitcoin at 9700.00, trimmed 50% of $ROKU hold, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.

Added $SPXL, new add $WKHS, $GE. Holds on Bitcoin at 9700.00, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.

The USD Dollar is the most oversold since before the financial crash of 2008

Trimmed $FB and $ROKU Tuesday and entered $DUST 1/10 starter size. Holds on Bitcoin at 9700.00, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.

The USD Dollar is the most oversold since before the financial crash of 2008

Long $ROKU on Monday (still long – good trade so far), added to $SPXL and $GSUM. Holds on Bitcoin at 9700.00, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short and $OMVS micro size

I added 1/10 to $GSUM and $FB late Friday and trimmed 25% of $SPXL for a nice win and still hold 25%. Holds on Bitcoin at 9700.00, $FB, $GSUM, $SPXL, $JP, $SLCA small on $AAOI, $SPPI, Gold short and $OMVS micro size.

$ROKU daytrade yesterday for a win https://twitter.com/DayAlerts_CT/status/953636447889784832, also an oil daytrade for a win, and new long in Bitcoin at 9700.00. Holds on $FB, $GSUM, $SPXL, $JP, $SLCA small on $AAOI, $SPPI, Gold short and $OMVS micro size.

Opened 1/10 long $FB on Friday going well, 1/10 long $GSUM also (currently near flat) and per previous closed 50% of $SPXL long 2/10 sizing position and hold 50% for win, entered $JP long (1/10) and holding $SLCA, and in some accounts $AAOI, $SPPI, Gold short (all small) and $OMVS micro size.

Closed 50% of $SPXL long 2/10 sizing position and hold 50% for win, entered $JP long (1/10) and holding $SLCA, $AAOI, $SPPI, Gold short (all small) and $OMVS micro size.

Chart Set-ups on Watch:

Per recent;

$VIX over upper bollinger band creates excellent short side risk-reward. Use additional MACD signal. $TVIX $UVXY $XIV #volatility

Don’t look now but MACD turning up on $DXY US Dollar Index $UUP #swingtrading

$GDX in dangerous territory on 200 MA on Daily with MACD and SQMOM turned down. Bearish. $NUGT $DUST $JDST $JNUG

Gold hit mid quad resistance, broke thru, lost retest to downside, targets in play. MACD turn down. $GC_F $GLD $XAUUSD Feb 4, 2018

Oil resistance check. 50% Fibonacci, mid quad on monthly chart.. $USOIL $WTI $CL_F #OIL #OOTT $USO $UWT $DWT

$ARRY Weekly chart suggests long term structure needs price over 14.89 on weekly now thru after June 3 time cycle. If so, it is up. #swingtrading https://www.tradingview.com/chart/ARRY/EZbQb5F4-ARRY-Weekly-chart-suggests-long-term-structure-needs-price-over/ …

$ARRY Weekly chart suggests long term structure needs price over 14.89 on weekly now thru after June 3 time cycle. If so, it is up. #swingtrading https://t.co/CA9E9zdGU0 pic.twitter.com/fkUJzMFe9Q

— Melonopoly (@curtmelonopoly) February 1, 2018

$CDNA Had a significant pivot created on long term charting the week of Nov 6, 2017 at 5.80. Below is very bearish – bullish if it holds. Tested, held, testing again now. https://www.tradingview.com/chart/CDNA/f0zgaiG1-CDNA-Had-a-significant-pivot-created-on-long-term-charting-the/ … #swingtrading #charting

$CDNA Had a significant pivot created on long term charting the week of Nov 6, 2017 at 5.80. Below is very bearish – bullish if it holds. Tested, held, testing again now. https://t.co/rtxs7AGCSO #swingtrading #charting pic.twitter.com/jpfj7a3y3D

— Melonopoly (@curtmelonopoly) February 1, 2018

$AAOI The stock is trading 64% below last summer’s 52-week highs with earnings in 21 days I will be looking for a bounce. #earnings #trading

Buy sell trading triggers on simple $SNAP chart model have worked well. #swingtrading #charting https://www.tradingview.com/chart/SNAP/qJ0gRCyt-Buy-sell-trading-triggers-on-simple-SNAP-chart-model-have-worke/ …

$AMMJ Ammerican Cannabis buy sell triggers at white arrows for your swing trade. Triggers and targets have been spot on. #swingtrading

$AMD important levels to watch for trading earnings. Bull scenario targets first 14.95 and bearish 12.25 first #premarket

$AMBA on watch for short set-up in play premarket – under pressure here #swingtrading https://www.tradingview.com/chart/AMBA/U5yggomh-AMBA-on-watch-for-short-set-up-in-play-premarket-under-pressu/

Market Outlook:

Stock futures point to Dow drop of about 550 points at the open, S&P drop of nearly 50 points and Nasdaq drop of 85 points http://cnb.cx/2nGfgoo

Stock futures point to Dow drop of about 550 points at the open, S&P drop of nearly 50 points and Nasdaq drop of 85 points https://t.co/ErtDja9VdQ pic.twitter.com/kO178liK1L

— CNBC Now (@CNBCnow) February 6, 2018

What global policy makers are saying about the stock slide https://bloom.bg/2BGYqyd

What global policy makers are saying about the stock slide https://t.co/1BocZqtV1X pic.twitter.com/EMLPKtykfa

— Bloomberg (@business) February 6, 2018

#5things

-Stocks fall

-Volatility surges

-Bonds bid

-Commodities hit

-Cryptocrunch

https://bloom.bg/2BGtZsf

#5things

-Stocks fall

-Volatility surges

-Bonds bid

-Commodities hit

-Cryptocrunchhttps://t.co/6XXbff5j2Z pic.twitter.com/jF2gBtJ92x— Bloomberg Markets (@markets) February 6, 2018

Market News and Social Bits From Around the Internet:

ChOTD-2/6/18 #3) Volatility Of VIX $VVIX: Highest Reading Ever

ChOTD-2/6/18 #3) Volatility Of VIX $VVIX: Highest Reading Ever https://t.co/UnDUUmeyIf

— Melonopoly (@curtmelonopoly) February 6, 2018

Stocks making the biggest moves premarket: GM, AGN, TPR, CNC, WCG, BDX & more http://cnb.cx/2BHwTN5

Stocks making the biggest moves premarket: GM, AGN, TPR, CNC, WCG, BDX & more https://t.co/og6l9T3vB9 pic.twitter.com/l2HGjpKFxq

— The Exchange (@CNBCTheExchange) February 6, 2018

Key measure of market volatility — the VIX — jumps above 50, highest level since Aug 2015 http://cnb.cx/2BK9Np6

Key measure of market volatility — the VIX — jumps above 50, highest level since Aug 2015 https://t.co/9QNCWfG4cs pic.twitter.com/CedPeP8JKY

— The Exchange (@CNBCTheExchange) February 6, 2018

Wall Street relearns a lesson as a favorite bet on volatility blows up http://cnb.cx/2BG3YsQ

Wall Street relearns a lesson as a favorite bet on volatility blows up https://t.co/ahmOGlx7pq pic.twitter.com/0C7YG0Du5n

— The Exchange (@CNBCTheExchange) February 6, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $UVXY, $TVIX, $VIIX $VXX $VIXY $SDOW $TZA $YANG $SOXS $LITE $SPXS $SPXU $DRIP $SQQQ $LABD $FAZ $DXD $SDS $DGAZ $QID $MU $DWT $OILD $SH $SCO $QCOM $NOK $GM

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $ZG, $SWKS, $MU, $GRUB, $MTCH, $SWN, $RDFN

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $VIX, $XIV, $VVIX, $XNET, $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL

PreMarket Trading Plan Fri Jan 12 $XNET, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, Oil, $WTI

Compound Trading Chat Room Stock Trading Plan and Watch List Friday Jan 12, 2018 $XNET, $JP, $SLCA, $INSY, $SPXL – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

A Quick Member Update – 2018 Plans and Current Status

https://twitter.com/CompoundTrading/status/951798787521089543

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Dec 28 Swing Trade Set-Ups; $SPY, $SPXL, $NATGAS, $SRNE, $ZKIN, $WPRT

Dec 27 Swing trade set-up review $SPY, Gold, $BTC.X, $BVXV, $XXII, $VRX, $EKSO…

Dec 26 swing trading review $SPY, $WTIC, OIL, $DMPI, $APTO, $FTFT, $INSY, $JRJC, $BWA, $ADOM…

If you’re a trader learning, need set-ups, have interest in our 2018 plans, what we see in markets fwd, want to see live trades / on fly analysis or learn bit about how we model charts and more…. this video is for you.

Dec 13 Swing Trade Set-Ups; $OSTK, Gold, $NUGT, $WTI, OIL, EIA, $VRX, $CELG, $AAOI, $RIOT, $MCIG

Fri Dec 8 Trade Set-ups $BTC, Crypto Scenarios, Gold, $WTI, OIL, Algorithms, $VRX, $SQ, $MYL …

Dec 7 Swing Trade Chart Set-Ups $OSIS, $SQ, $DPW, $FSLR, $FB, $TVIX, $XIV …

Dec 6 Swing Trading chart set-ups $ETSY, $FSLR, $VTGN, $APTN, $LMFA, $VRA …

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Recent Educational Videos:

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Friday looks like managing trades day and get set for a huge week next week imo.

Per recent:

Looking for large entries as we near and exit (the turn) Jan 9 time cycle peak in Oil, VIX, Bitcoin, Gold, Silver, SPY, DXY and others.

Crypto related still on watch. $MGIT, $OSTK, $ROKU, $MARA, $MGTI, $RIOT, $XNET, $BTCS and more.

Morning Momentum / Gap / News / PR / IPO Stocks on Watch:

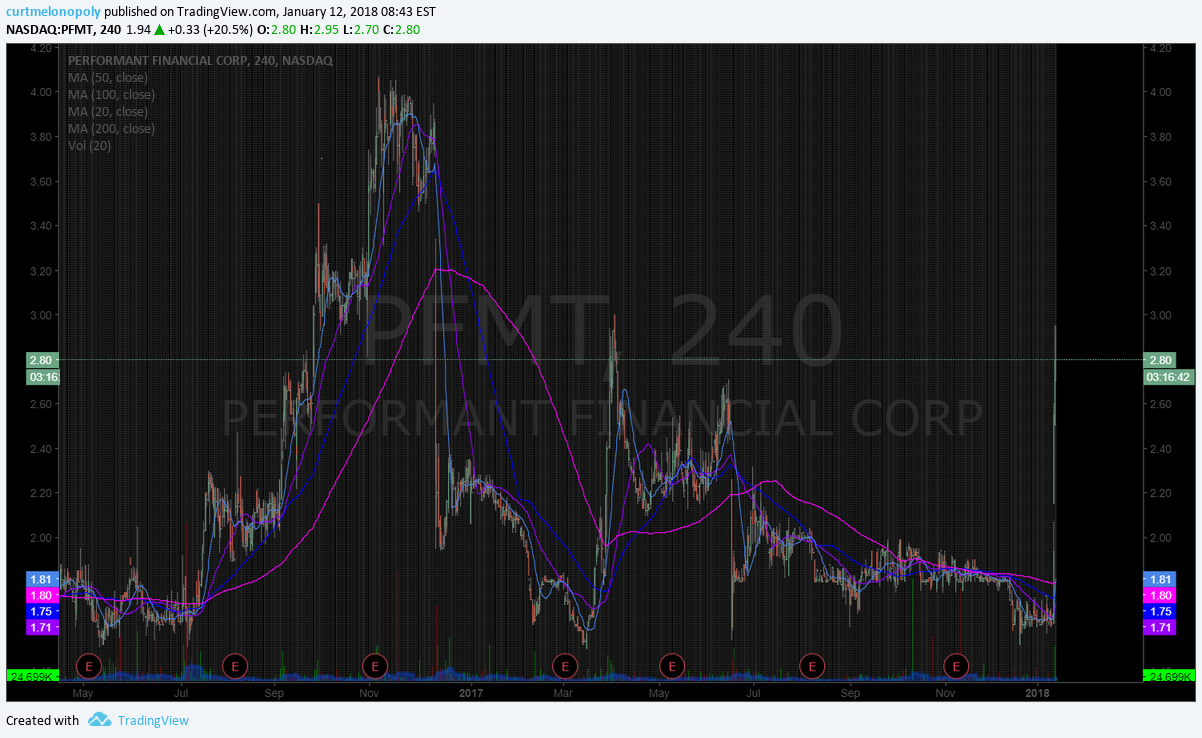

$MARA, $PFMT

Market observation / on watch:

US Dollar $DXY pressure 91.82, Oil FX $USOIL ($WTI) pressure as it nears algorithm model range resistance 63.17, Gold / Silver bullish pop with dollar weekness – Gold intra day trading 1325.52, $SPY continues in bull bias 276.56, Bitcoin $BTC.X $BTCUSD $XBTUSD 14032.00 near main support / resistance noted previous for time cycle peak Jan 9, and $VIX trading 9.9 and moderate.

Recent Momentum Stocks to Watch:

$XNET

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

upcoming #earnings releases with the highest #volatility

$SHLM $SVU $AYI $INFY $MSM $SNX $FCEL $PRGS $HELE $KBH $SCHN $DAL $LEN $WFC $BLK $SJR $JPM $PNC

upcoming #earnings releases with the highest #volatility$SHLM $SVU $AYI $INFY $MSM $SNX $FCEL $PRGS $HELE $KBH $SCHN $DAL $LEN $WFC $BLK $SJR $JPM $PNC https://t.co/SOHo9clUoB

— Melonopoly (@curtmelonopoly) January 7, 2018

Recent / Current Holds, Open and Closed Trades

Closed 50% of $SPXL long 2/10 sizing position and hold 50% for win, entered $JP long (1/10) and holding $SLCA, $AAOI, $SPPI, Gold short (all small) and $OMVS micro size.

Per recent;

New $SPXL long 2/10 from Wednesday, closed $XNET 2/10 long for excellent gain, hold $INSY and the trading plan under pressure is on video, $AAOI looking for a bottom here soon now and holding small, $SPPI hold small, $OMVS hold micro size.

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video. If you want to win over 80% of your trades, learn how your technicals work. https://www.youtube.com/watch?v=zovJQY9dLhc … #swingtrading #tradingprocess

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video. If you want to win over 80% of your trades, learn how your technicals work. https://t.co/jjMmthfgjC #swingtrading #tradingprocess

— Melonopoly (@curtmelonopoly) January 11, 2018

Recent swing trade $SPXL. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It’s all on the feed. https://compoundtrading.com #tradingedge

Recent swing trade $SPXL. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It's all on the feed. https://t.co/gVwyx9OY6Q #tradingedge pic.twitter.com/D0n1ByBYFW

— Melonopoly (@curtmelonopoly) January 11, 2018

Recent day trade $XNET. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It’s all on the feed. https://compoundtrading.com #tradingedge

Recent day trade $XNET. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It's all on the feed. https://t.co/gVwyx9OY6Q #tradingedge pic.twitter.com/rLzj7fx88n

— Melonopoly (@curtmelonopoly) January 11, 2018

Recent day trade $UGAZ. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It’s all on the feed. https://compoundtrading.com #tradingedge

Recent day trade $UGAZ. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It's all on the feed. https://t.co/gVwyx9OY6Q #tradingedge pic.twitter.com/A1pdL0nHp9

— Melonopoly (@curtmelonopoly) January 11, 2018

Recent day trade $INSY long 12.83 closed 13.45. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It’s all on the feed. https://compoundtrading.com #tradingedge

Recent day trade $INSY long 12.83 closed 13.45. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It's all on the feed. https://t.co/gVwyx9OY6Q #tradingedge pic.twitter.com/uZPJhY1Ncm

— Melonopoly (@curtmelonopoly) January 11, 2018

Added $SLCA long 2/10, added $XNET long 1/10, holding small $INSY and from previous small $AAOI, $SPPI, $OMVS and Gold short.

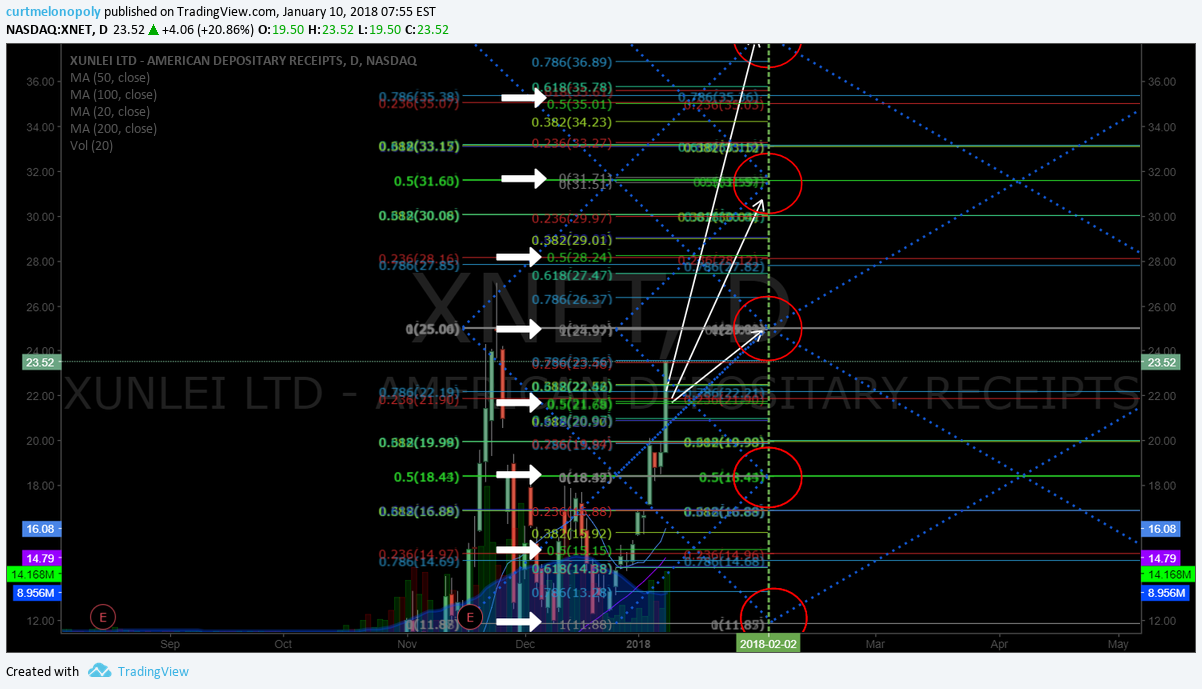

$XNET Buy sell triggers at white arrows, quads, Fibonacci levels, targets. #swingtrading #tradingedge #premarket

$XNET Buy sell triggers at white arrows, quads, Fibonacci levels, targets. #swingtrading #tradingedge #premarket pic.twitter.com/kuxKyg20DF

— Melonopoly (@curtmelonopoly) January 10, 2018

All are small entries that I can trade out of if issue because of sizing. But I am looking to scale in to trades large at the turn of this broad time cycle in markets.

Closed final 5% of $SPY long via $SPXL Friday for really nice swing gains (largest sizing in last 12 months), $INSY swing from last week is above water at 1/10 sizing, Gold short 1/10 size is in play for an add today possibly, still hold small in some accounts $AAOI, $SPPI, $OMVS long term.

Generally on really high alert now going in to market time cycle peak Jan 9 – very tuned in to plays coming out of that peak.

Trimmed all by 5% of $SPY long via $SPXL yesterday for nice swing gains (largest sizing in last 12 months), Oil trade yesterday flat (could have exited as a win but I was testing short thesis and now this morning it is off considerably but I missed the down) holding 1/10 size $INSY (underwater) swing and the daytrade as previously noted was a win, still hold small in some accounts $AAOI, $SPPI, $OMVS long term.

Holding 1/10 size $SPXL and trimmed the rest for a really nice win (massive sizing). Daytrade in $INSY went well Wed for a win at open and holding an $INSY swingtrade small 1/10 position from Wed. Holding in some accounts $AAOI $SPPI long (small) and $OMVS really small position. Looking for large entries as we near Jan 9 time cycle peak in Oil, VIX, Bitcoin, Gold, SPY, DXY and others.

SP500 time cycle price target couldn’t have bee more precise today – perfect hit on model and swingtrade going exceptionally well. $SPY $SPXL $SPXS #algorithm #model @FREEDOMtheAlgo

Closed end of day Tues 1/5 size in $SPXL ($SPY log) and had a daytrade at open I took a small haircut on. Small position.

Chart Set-ups on Watch:

Watching all charts on list above plus the ones listed here below:

$OAK, $RSX, $BOFI, $GREK, $EOG, $SLCA

Per previous:

$APRI can get serious upside over 100 MA on weekly – volume coming in. Decent risk reward area managed properly. #swingtrading #premarket

$APRI ca get serious upside over 100 MA on weekly – volume coming in. Decent risk reward area managed properly. #swingtrading #premarket pic.twitter.com/2I3qLEm7RK

— Melonopoly (@curtmelonopoly) January 8, 2018

$FIT trading 5.90 sitting right on 200 MA under 20 50 100 MA’s – decision time.

$FIT trading 5.90 sitting right on 200 MA under 20 50 100 MA's – decision time. pic.twitter.com/ALp7ckwUee

— Melonopoly (@curtmelonopoly) January 8, 2018

$XRT Nice clean mid quad price time target hit on this daily swing trading chart model. #swingtrading

$XRT Nice clean mid quad price time target hit on this daily swing trading chart model. #swingtrading pic.twitter.com/LUooEZPHqr

— Melonopoly (@curtmelonopoly) January 8, 2018

$AMBA Weekly chart provides perspective on clean trade through time price cycle targets at upper lower quads #tradingedge #swingtrading

$AMBA Weekly chart provides perspective on clean trade through time price cycle targets at upper lower quads #tradingedge #swingtrading pic.twitter.com/LKLmKnZR9L

— Melonopoly (@curtmelonopoly) January 7, 2018

$SSW Doesn’t get better than this structurally – see detailed notes on chart for swing, MACD trend w SQZMOM Stoch RSI targets in play per previous. #swingtrading https://www.tradingview.com/chart/SSW/H6sFkke6-SSW-Doesn-t-get-better-than-this-structurally-see-notes-on-ch/ …

$XOMA what can I say – structurally perfect – watching MACD Stoch RSI – see previous symmetry notes #swingtrading https://www.tradingview.com/chart/XOMA/9y9DePCl-XOMA-what-can-I-say-structurally-perfect-watching-MACD-Stoc/

Gold cleared huge quad wall test on daily chart can it hold it for the win… $GLD $GC_F $XAUUSD $GDX #Gold #pricetargets

MACD looks good here but could trend down quad wall to a lower target vs. upper.

https://www.tradingview.com/chart/GOLD/KHg3tqKf-Gold-cleared-huge-quad-wall-test-on-daily-chart-can-it-hold-it-f/ …

$JP bullish sidewinder still in play with price above 50 MA with 20 MA possible underside breach. MACD trending. #swingtrading https://www.tradingview.com/chart/JP/BvYOntdt-JP-bullish-sidewinder-still-in-play-with-price-above-50-MA-with/

Market Outlook:

#5Things

-Inflation data

-Oil

-Merkel nears a deal

-Crypto crackdown

-Global stocks mixed

https://bloom.bg/2mxn4Ir

#5Things

-Inflation data

-Oil

-Merkel nears a deal

-Crypto crackdown

-Global stocks mixedhttps://t.co/iFQcudACXh pic.twitter.com/E5Ez1vDkkT— Bloomberg Markets (@markets) January 12, 2018

Stocks making the biggest moves premarket: BLK, JPM, HUM, ANTM, DKS, AXP & more http://cnb.cx/2Dqj43C

Stocks making the biggest moves premarket: BLK, JPM, HUM, ANTM, DKS, AXP & more https://t.co/0dIFfUKLU9 https://t.co/lQFyRkgHlI

— Melonopoly (@curtmelonopoly) January 12, 2018

Market News and Social Bits From Around the Internet:

Earnings season is underway and it’s going to be a really good one

Earnings season is underway and it's going to be a really good one https://t.co/4tq2EJSuKl

— Melonopoly (@curtmelonopoly) January 12, 2018

2-Year Treasury yield tops 2% for the first time since 2008 https://bloom.bg/2mvXlA6

2-Year Treasury yield tops 2% for the first time since 2008 https://t.co/l5VSFbzGMm pic.twitter.com/ET3BFPJnYe

— Bloomberg Markets (@markets) January 12, 2018

$MYSZ MySize Receives Overwhelmingly Positive Response to its Innovative Measurement Technology at CES

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $PFMT, $MARA, $SEII $USAU $TOUR $PSTI $SSC $RMGN $UGAZ $JNUG $FNSR $DPW $KSS $TWTR $CNIT $USLV $TEUM $HMY $NUGT $ROKU

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $XNET, $JP, $SLCA, $INSY, $SPXL, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY

PreMarket Trading Plan Thurs Jan 11 $XNET, $NTNX, $JP, $XPO, $SLCA, $INSY, $SPY, $BTC.X, Bitcoin, Gold, Oil, $WTI

Compound Trading Chat Room Stock Trading Plan and Watch List Thursday Jan 11, 2018 $XNET, $NTNX, $JP, $XPO, $SLCA, $INSY, $SPY, $BTC.X, Bitcoin, Gold, Oil, $WTI – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

All charting and reporting for swing and algorithm models are out except $BTC.X, $VIX, $SILVER – they will be out soon. If you have any questions about the reporting or suggestions please send us a note.

Yes. FYI, and to answer DM’s and emails, our new crypto algorithm charting models for 2018 will have $XRP, $LTC, $ETH etc in addition to $BTC. Due out before Jan 15, 2018. We’re just finishing 2017 commitments first. #premarket #crypto

Yes. FYI, and to answer DM's and emails, our new crypto algorithm charting models for 2018 will have $XRP, $LTC, $ETH etc in addition to $BTC. Due out before Jan 15, 2018. We're just finishing 2017 commitments first. #premarket #crypto

— Melonopoly (@curtmelonopoly) January 8, 2018

Thanks for the support in our start-up year! Our 2018 plans are in this post.

https://twitter.com/CompoundTrading/status/945635490795065344

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Dec 28 Swing Trade Set-Ups; $SPY, $SPXL, $NATGAS, $SRNE, $ZKIN, $WPRT

Dec 27 Swing trade set-up review $SPY, Gold, $BTC.X, $BVXV, $XXII, $VRX, $EKSO…

Dec 26 swing trading review $SPY, $WTIC, OIL, $DMPI, $APTO, $FTFT, $INSY, $JRJC, $BWA, $ADOM…

If you’re a trader learning, need set-ups, have interest in our 2018 plans, what we see in markets fwd, want to see live trades / on fly analysis or learn bit about how we model charts and more…. this video is for you.

Dec 13 Swing Trade Set-Ups; $OSTK, Gold, $NUGT, $WTI, OIL, EIA, $VRX, $CELG, $AAOI, $RIOT, $MCIG

Fri Dec 8 Trade Set-ups $BTC, Crypto Scenarios, Gold, $WTI, OIL, Algorithms, $VRX, $SQ, $MYL …

Dec 7 Swing Trade Chart Set-Ups $OSIS, $SQ, $DPW, $FSLR, $FB, $TVIX, $XIV …

Dec 6 Swing Trading chart set-ups $ETSY, $FSLR, $VTGN, $APTN, $LMFA, $VRA …

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Recent Educational Videos:

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) and Watch Lists.

$XNET, $NTNX, $JP, $XPO, $SLCA, $INSY, $SPY, $BTC.X, Bitcoin, Gold, Oil, $WTI

Per recent:

Looking for large entries as we near and exit Jan 9 time cycle peak in Oil, VIX, Bitcoin, Gold, Silver, SPY, DXY and others.

Crypto related still on watch. $MGIT, $OSTK, $ROKU, $MARA, $MGTI, $RIOT, $XNET, $BTCS and more.

Morning Momentum / Gap / News / PR / IPO Stocks on Watch:

NA

Market observation / on watch:

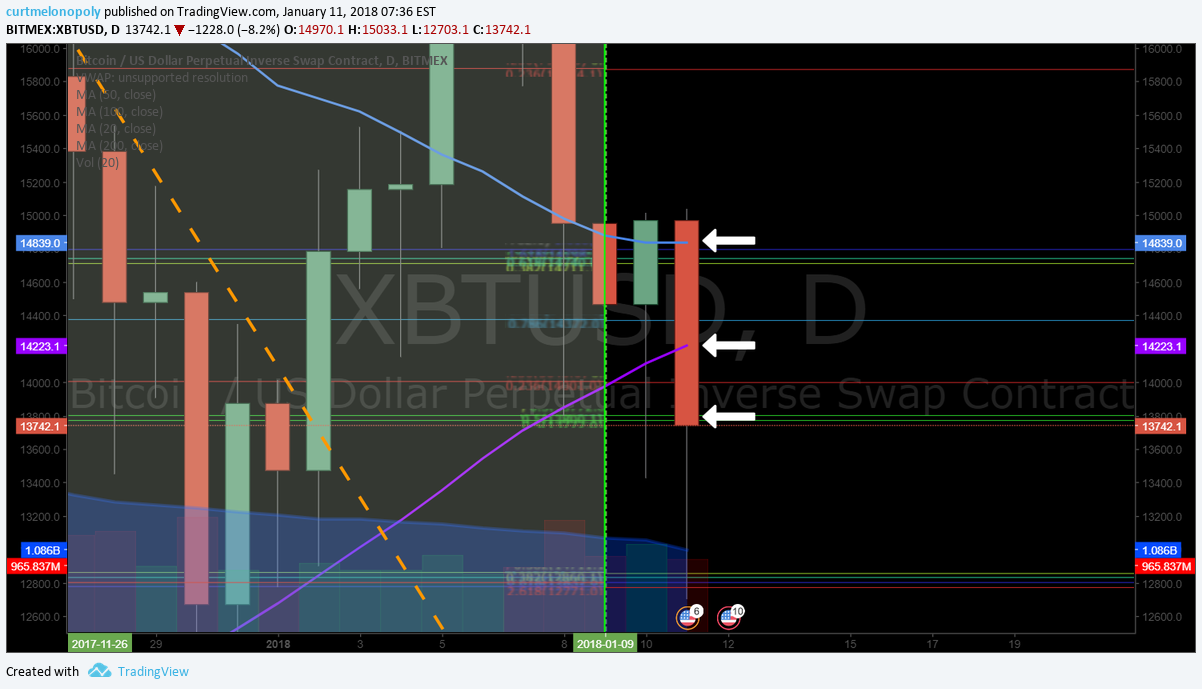

US Dollar $DXY moderate 92.44, Oil FX $USOIL ($WTI) continues bullish run 63.86, Gold / Silver moderate – Gold intra day trading 1321.52, $SPY moderate to bull bias 274.78, Bitcoin $BTC.X $BTCUSD $XBTUSD 13695.00 near main support / resistance noted previous for time cycle peak Jan 9, and $VIX trading 9.8 down from yesterday 10.4 at same time.

Recent Momentum Stocks to Watch:

$XNET

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

upcoming #earnings releases with the highest #volatility

$SHLM $SVU $AYI $INFY $MSM $SNX $FCEL $PRGS $HELE $KBH $SCHN $DAL $LEN $WFC $BLK $SJR $JPM $PNC

upcoming #earnings releases with the highest #volatility$SHLM $SVU $AYI $INFY $MSM $SNX $FCEL $PRGS $HELE $KBH $SCHN $DAL $LEN $WFC $BLK $SJR $JPM $PNC https://t.co/SOHo9clUoB

— Melonopoly (@curtmelonopoly) January 7, 2018

Recent / Current Holds, Open and Closed Trades

New $SPXL long 2/10 from Wednesday, closed $XNET 2/10 long for excellent gain, hold $INSY and the trading plan under pressure is on video, $AAOI looking for a bottom here soon now and holding small, $SPPI hold small, $OMVS hold micro size.

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video. If you want to win over 80% of your trades, learn how your technicals work. https://www.youtube.com/watch?v=zovJQY9dLhc … #swingtrading #tradingprocess

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video. If you want to win over 80% of your trades, learn how your technicals work. https://t.co/jjMmthfgjC #swingtrading #tradingprocess

— Melonopoly (@curtmelonopoly) January 11, 2018

Recent swing trade $SPXL. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It’s all on the feed. https://compoundtrading.com #tradingedge

Recent swing trade $SPXL. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It's all on the feed. https://t.co/gVwyx9OY6Q #tradingedge pic.twitter.com/D0n1ByBYFW

— Melonopoly (@curtmelonopoly) January 11, 2018

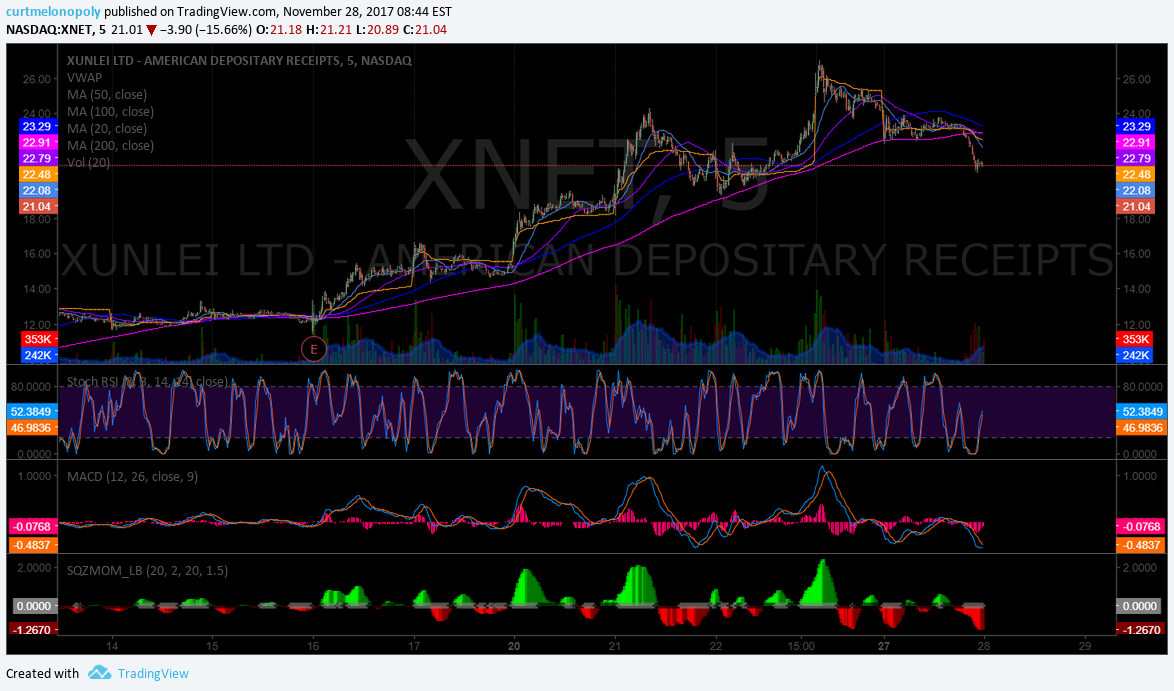

Recent day trade $XNET. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It’s all on the feed. https://compoundtrading.com #tradingedge

Recent day trade $XNET. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It's all on the feed. https://t.co/gVwyx9OY6Q #tradingedge pic.twitter.com/rLzj7fx88n

— Melonopoly (@curtmelonopoly) January 11, 2018

Recent day trade $UGAZ. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It’s all on the feed. https://compoundtrading.com #tradingedge

Recent day trade $UGAZ. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It's all on the feed. https://t.co/gVwyx9OY6Q #tradingedge pic.twitter.com/A1pdL0nHp9

— Melonopoly (@curtmelonopoly) January 11, 2018

Recent day trade $INSY long 12.83 closed 13.45. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It’s all on the feed. https://compoundtrading.com #tradingedge

Recent day trade $INSY long 12.83 closed 13.45. If interested in subscribing to well over 80% historical win rate ask to see the alert historical feed for proof before subscribing. It's all on the feed. https://t.co/gVwyx9OY6Q #tradingedge pic.twitter.com/uZPJhY1Ncm

— Melonopoly (@curtmelonopoly) January 11, 2018

Per recent;

Added $SLCA long 2/10, added $XNET long 1/10, holding small $INSY and from previous small $AAOI, $SPPI, $OMVS and Gold short.

$XNET Buy sell triggers at white arrows, quads, Fibonacci levels, targets. #swingtrading #tradingedge #premarket

$XNET Buy sell triggers at white arrows, quads, Fibonacci levels, targets. #swingtrading #tradingedge #premarket pic.twitter.com/kuxKyg20DF

— Melonopoly (@curtmelonopoly) January 10, 2018

All are small entries that I can trade out of if issue because of sizing. But I am looking to scale in to trades large at the turn of this broad time cycle in markets.

Closed final 5% of $SPY long via $SPXL Friday for really nice swing gains (largest sizing in last 12 months), $INSY swing from last week is above water at 1/10 sizing, Gold short 1/10 size is in play for an add today possibly, still hold small in some accounts $AAOI, $SPPI, $OMVS long term.

Generally on really high alert now going in to market time cycle peak Jan 9 – very tuned in to plays coming out of that peak.

Trimmed all by 5% of $SPY long via $SPXL yesterday for nice swing gains (largest sizing in last 12 months), Oil trade yesterday flat (could have exited as a win but I was testing short thesis and now this morning it is off considerably but I missed the down) holding 1/10 size $INSY (underwater) swing and the daytrade as previously noted was a win, still hold small in some accounts $AAOI, $SPPI, $OMVS long term.

Holding 1/10 size $SPXL and trimmed the rest for a really nice win (massive sizing). Daytrade in $INSY went well Wed for a win at open and holding an $INSY swingtrade small 1/10 position from Wed. Holding in some accounts $AAOI $SPPI long (small) and $OMVS really small position. Looking for large entries as we near Jan 9 time cycle peak in Oil, VIX, Bitcoin, Gold, SPY, DXY and others.

SP500 time cycle price target couldn’t have bee more precise today – perfect hit on model and swingtrade going exceptionally well. $SPY $SPXL $SPXS #algorithm #model @FREEDOMtheAlgo

Closed end of day Tues 1/5 size in $SPXL ($SPY log) and had a daytrade at open I took a small haircut on. Small position.

Long 4.5/10 size $SPXL. Holding in some accounts $AAOI $SPPI long (small) and $OMVS really small position.

Closed end of day Tues 1/5 size in $SPXL ($SPY log) and had a daytrade at open I took a small haircut on. Small position.

Long 5/10 size $SPXL. Holding in some accounts $AAOI $SPPI long (small) and $OMVS really small position.

Closed $VRX trade – I had scaled in a lot larger than I alerted along the way last Friday – but the alerts were enough to scale and exit and use the signals to bank. Anyway, I followed it all the way down and then back up in the model provided in the room and sold near the recent top. Didn’t get the top though and I knew I was selling prior to the top but that’s how I trade – I take the middle if I can – consistent wins is all I look for. Compound my winnings with consistent low stress model high probability trading.

Opened $VRX trade on Friday that I am partially out and closed $NUGT for a small gain.

Closed $OSTK swing for gain. Holding Gold, $NUGT, $AAOI, $SPPI

Chart Set-ups on Watch:

Watching all charts on list above plus the ones listed here below:

$OAK, $RSX, $BOFI, $GREK, $EOG, $SLCA

Per previous:

$INSY premarket up 4.49% trading 11.18. In it to win it. #swingtrading

$INSY premarket up 4.49% trading 11.18. In it to win it. #swingtrading https://t.co/QNMEXDArjD

— Melonopoly (@curtmelonopoly) January 8, 2018

$APRI can get serious upside over 100 MA on weekly – volume coming in. Decent risk reward area managed properly. #swingtrading #premarket

$APRI ca get serious upside over 100 MA on weekly – volume coming in. Decent risk reward area managed properly. #swingtrading #premarket pic.twitter.com/2I3qLEm7RK

— Melonopoly (@curtmelonopoly) January 8, 2018

$FIT trading 5.90 sitting right on 200 MA under 20 50 100 MA’s – decision time.

$FIT trading 5.90 sitting right on 200 MA under 20 50 100 MA's – decision time. pic.twitter.com/ALp7ckwUee

— Melonopoly (@curtmelonopoly) January 8, 2018

$XRT Nice clean mid quad price time target hit on this daily swing trading chart model. #swingtrading

$XRT Nice clean mid quad price time target hit on this daily swing trading chart model. #swingtrading pic.twitter.com/LUooEZPHqr

— Melonopoly (@curtmelonopoly) January 8, 2018

$AMBA Weekly chart provides perspective on clean trade through time price cycle targets at upper lower quads #tradingedge #swingtrading

$AMBA Weekly chart provides perspective on clean trade through time price cycle targets at upper lower quads #tradingedge #swingtrading pic.twitter.com/LKLmKnZR9L

— Melonopoly (@curtmelonopoly) January 7, 2018

Oil trade clear of 200 MA on weekly and in to historical resistance points now. MACD SQZMOM Stoch RSI all have room but… we shall see here $USOIL $WTI $CL_F #OOTT #OIL $USO $UWT $DWT

Oil trade clear of 200 MA on weekly and in to historical resistance points now. MACD SQZMOM Stoch RSI all have room but… we shall see here $USOIL $WTI $CL_F #OOTT #OIL $USO $UWT $DWT pic.twitter.com/I7yfn4jFK4

— Melonopoly (@curtmelonopoly) January 7, 2018

$GDX Daily chart has time cycle peak Feb 28, 2018. Top of quad for most bullish, mid quad 25.20 indecisive resistance, lower quad bearish.

$GDX Daily chart has time cycle peak Feb 28, 2018. Top of quad for most bullish, mid quad 25.20 indecisive resistance, lower quad bearish. pic.twitter.com/4EwkYz4AU3

— Melonopoly (@curtmelonopoly) January 7, 2018

$SSW Doesn’t get better than this structurally – see detailed notes on chart for swing, MACD trend w SQZMOM Stoch RSI targets in play per previous. #swingtrading https://www.tradingview.com/chart/SSW/H6sFkke6-SSW-Doesn-t-get-better-than-this-structurally-see-notes-on-ch/ …

$XOMA what can I say – structurally perfect – watching MACD Stoch RSI – see previous symmetry notes #swingtrading https://www.tradingview.com/chart/XOMA/9y9DePCl-XOMA-what-can-I-say-structurally-perfect-watching-MACD-Stoc/

Gold cleared huge quad wall test on daily chart can it hold it for the win… $GLD $GC_F $XAUUSD $GDX #Gold #pricetargets

MACD looks good here but could trend down quad wall to a lower target vs. upper.

https://www.tradingview.com/chart/GOLD/KHg3tqKf-Gold-cleared-huge-quad-wall-test-on-daily-chart-can-it-hold-it-f/ …

$JP bullish sidewinder still in play with price above 50 MA with 20 MA possible underside breach. MACD trending. #swingtrading https://www.tradingview.com/chart/JP/BvYOntdt-JP-bullish-sidewinder-still-in-play-with-price-above-50-MA-with/

Market Outlook:

Stocks making the biggest moves premarket: DAL, DST, KBH, WM, MAR, F, CVX & more http://cnb.cx/2DlJTpN

Stocks making the biggest moves premarket: DAL, DST, KBH, WM, MAR, F, CVX & more https://t.co/XH85E9R32d pic.twitter.com/VA5aGoqbwM

— The Exchange (@CNBCTheExchange) January 11, 2018

Market News and Social Bits From Around the Internet:

BREAKING: Wal-Mart is boosting its starting hourly wage to $11 and delivering bonuses to employees, capitalizing on the U.S. tax overhaul to stay competitive in a tightening labor market #tictocnews https://bloom.bg/2mkVWMb

XPO Logistics $XPO PT Raised to $106 at Credit Suisse; Reiterates Outperform

$NTNX Nutanix (NTNX) PT Raised to $42 at KeyBanc

8:30am

Initial Jobless Claims

8:30am

Producer Price Index

9:45am

Consumer Comfort Index

10:30am

NatGas Inventory

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $SECO $RMGN $NBEV $FCEL $DPW $AKER $MEIP $WPCS $XRX $MYSZ $DST $SSNC $TEUM $BOIL $KBH $NQ $SSNC $UNG

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $FSLR, $UAL, $AAL, $NTNX, $XPO, $NFLX

(6) Recent Downgrades: $LPCN

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $XNET, $NTNX, $JP, $XPO, $SLCA, $INSY, $SPY, $BTC.X, Bitcoin, Gold, Oil, $WTI, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY

PreMarket Trading Plan Wed Jan 10 $HMNY, $SEII, $XNET, $SLCA, $INSY, $SPY, $BTC.X, Bitcoin, Gold, Oil, $WTI

Compound Trading Chat Room Stock Trading Plan and Watch List Wednesdau Jan 10, 2018 $HMNY, $SEII, $XNET, $SLCA, $INSY, $SPY, $BTC.X, Bitcoin, Gold, Oil, $WTI – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

All charting and reporting for swing and algorithm models are out except $BTC.X, $VIX, $SILVER – they will be out soon. If you have any questions about the reporting or suggestions please send us a note.

Yes. FYI, and to answer DM’s and emails, our new crypto algorithm charting models for 2018 will have $XRP, $LTC, $ETH etc in addition to $BTC. Due out before Jan 15, 2018. We’re just finishing 2017 commitments first. #premarket #crypto

Yes. FYI, and to answer DM's and emails, our new crypto algorithm charting models for 2018 will have $XRP, $LTC, $ETH etc in addition to $BTC. Due out before Jan 15, 2018. We're just finishing 2017 commitments first. #premarket #crypto

— Melonopoly (@curtmelonopoly) January 8, 2018

Thanks for the support in our start-up year! Our 2018 plans are in this post.

https://twitter.com/CompoundTrading/status/945635490795065344

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Dec 28 Swing Trade Set-Ups; $SPY, $SPXL, $NATGAS, $SRNE, $ZKIN, $WPRT

Dec 27 Swing trade set-up review $SPY, Gold, $BTC.X, $BVXV, $XXII, $VRX, $EKSO…

Dec 26 swing trading review $SPY, $WTIC, OIL, $DMPI, $APTO, $FTFT, $INSY, $JRJC, $BWA, $ADOM…

If you’re a trader learning, need set-ups, have interest in our 2018 plans, what we see in markets fwd, want to see live trades / on fly analysis or learn bit about how we model charts and more…. this video is for you.

Dec 13 Swing Trade Set-Ups; $OSTK, Gold, $NUGT, $WTI, OIL, EIA, $VRX, $CELG, $AAOI, $RIOT, $MCIG

Fri Dec 8 Trade Set-ups $BTC, Crypto Scenarios, Gold, $WTI, OIL, Algorithms, $VRX, $SQ, $MYL …

Dec 7 Swing Trade Chart Set-Ups $OSIS, $SQ, $DPW, $FSLR, $FB, $TVIX, $XIV …

Dec 6 Swing Trading chart set-ups $ETSY, $FSLR, $VTGN, $APTN, $LMFA, $VRA …

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Recent Educational Videos:

Jan 3 Market Open Trades $SPY, $SPXL, $INSY, $JP trade set-ups, algorithm models, trading plan.

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Watching $HMNY momo and $SEII on blockchain PR.

Per recent:

Looking for large entries as we near Jan 9 time cycle peak in Oil, VIX, Bitcoin, Gold, Silver, SPY, DXY and others.

Crypto related still on watch. $MGIT, $OSTK, $ROKU, $MARA, $MGTI, $RIOT, $XNET, $BTCS and more.

Morning Momentum / Gap / News / PR / IPO Stocks on Watch:

$HMNY, $SEII

Market observation / on watch:

US Dollar $DXY moderate near support trading up intra at 92.47, Oil FX $USOIL ($WTI) continues bullish run 63.47, Gold / Silver moderate to bullish – Gold intra day trading 1322.52, $SPY bulish trading lately off some early today 273.55, Bitcoin $BTC.X $BTCUSD $XBTUSD 14051.00 near main support noted previous for time cycle peak Jan 9, and $VIX trading 10.4 with some lift at time cycle peak conclusion in markets.

Recent Momentum Stocks to Watch:

$XNET

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

upcoming #earnings releases with the highest #volatility

$SHLM $SVU $AYI $INFY $MSM $SNX $FCEL $PRGS $HELE $KBH $SCHN $DAL $LEN $WFC $BLK $SJR $JPM $PNC

upcoming #earnings releases with the highest #volatility$SHLM $SVU $AYI $INFY $MSM $SNX $FCEL $PRGS $HELE $KBH $SCHN $DAL $LEN $WFC $BLK $SJR $JPM $PNC https://t.co/SOHo9clUoB

— Melonopoly (@curtmelonopoly) January 7, 2018

Recent / Current Holds, Open and Closed Trades

Added $SLCA long 2/10, added $XNET long 1/10, holding small $INSY and from previous small $AAOI, $SPPI, $OMVS and Gold short.

$XNET Buy sell triggers at white arrows, quads, Fibonacci levels, targets. #swingtrading #tradingedge #premarket

$XNET Buy sell triggers at white arrows, quads, Fibonacci levels, targets. #swingtrading #tradingedge #premarket pic.twitter.com/kuxKyg20DF

— Melonopoly (@curtmelonopoly) January 10, 2018

All are small entries that I can trade out of if issue because of sizing. But I am looking to scale in to trades large at the turn of this broad time cycle in markets.

Per previous;

Closed final 5% of $SPY long via $SPXL Friday for really nice swing gains (largest sizing in last 12 months), $INSY swing from last week is above water at 1/10 sizing, Gold short 1/10 size is in play for an add today possibly, still hold small in some accounts $AAOI, $SPPI, $OMVS long term.

Generally on really high alert now going in to market time cycle peak Jan 9 – very tuned in to plays coming out of that peak.