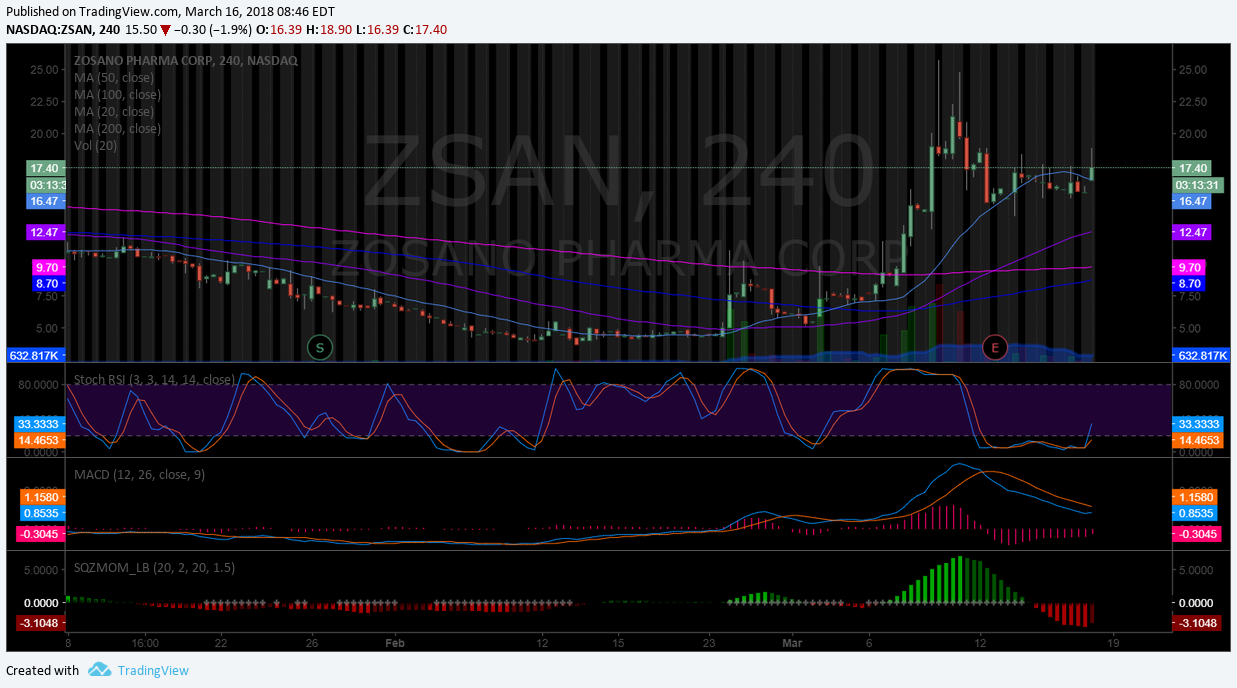

Tag: $ZSAN

PreMarket Trading Plan Fri Mar 16 $DXR, $ZSAN, $TIF, $JNJ, $ADBE, $ULTA, $WMT, $NKE

Compound Trading Chat Room Stock Trading Plan and Watch List Friday Mar 16, 2018: $DXR, $ZSAN, $TIF, $JNJ, $ADBE, $ULTA, $WMT, $NKE – SP500, $SPY, $SPXL, $SPXS, $BTC, Bitcoin, Gold, $GLD, $GC_F, Gold Miners, $GDX, $DUST, $NUGT, OIL, $WTI, $CL_F, $USOIL, Volatility, $VIX , Silver, $SLV, US Dollar Index, $DXY … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Member Note: Trade coaching location move in progress. Live broadcasts resume Monday Mar 19, 2018.

Member Note: Our new trade coaching location moving process starts tomorrow. As such live trading rooms will not be open until later in the week. All other services as normal. Will advise.

— Melonopoly (@curtmelonopoly) March 12, 2018

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Trading Boot Camp May 4 – 6:

Trading boot camp May 4-6, 2018. Ten student limit. Discount code coach30 at checkout. Get in touch with us today for a free consultation. #coaching #consultant #trading #wallstreet https://compoundtrading.com/trade-coaching

- In person with group at Boot Camp or take part live online “virtually” in the training. We are also booking private online sessions.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

#SwingTrading Midday Review – Compound Trading: $LTBR, $ANF, $MOMO, $APTO, $USOIL, $WTI, $BA, $NFLX

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

#SwingTrading Midday Review: $BZUN $SPY $COT $AMRC

Using the S&P500 to Confirm Momentum Correlates: $SPY/$BZUN Model Structures

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Recent Educational Videos:

Want to learn how to trade stocks for consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: TIF, JNJ, ADBE, ULTA, WMT, NKE & more

Stocks making the biggest moves premarket: TIF, JNJ, ADBE, ULTA, WMT, NKE & more https://t.co/QsiWLAgnrs

— The Exchange (@CNBCTheExchange) March 16, 2018

Market Observation:

US Dollar $DXY trading 90.07, Oil FX $USOIL ($WTI) trading 61.33, Gold $GLD trading 1320.50, Silver $SLV trading 16.45, $SPY trading 275.00 last, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 8207.00, and $VIX trading 16.2.

Recent Momentum Stocks to Watch:

News:

$ZSAN *DJ Zosano Reaches Enrollment Milestone in M207-ADAM Long-term Safety Study

(Dow Jones 03/16 04:30:50)

Recent SEC Filings:

Recent IPO’s:

Earnings:

Earnings movers this AM:

•Adobe ($ADBE) – EPS beat, revenue beat

•Jabil Circuit ($JBL) – EPS beat, revenue beat

•Tiffany ($TIF) – EPS beat, revenue beat, comps miss

•Broadcom ($AVGO) – EPS beat, revenue beat

Earnings movers this AM:

•Adobe ($ADBE) – EPS beat, revenue beat

•Jabil Circuit ($JBL) – EPS beat, revenue beat

•Tiffany ($TIF) – EPS beat, revenue beat, comps miss

•Broadcom ($AVGO) – EPS beat, revenue beat pic.twitter.com/o920B9QzTe— CNBC Halftime Report (@HalftimeReport) March 16, 2018

#earnings for the week

$OSTK $AVGO $DDD $QD $ULTA $DKS $NVAX $SIG $DG $REV $CTRP $DSW $EGLT $TIF $CARA $VRAY $ADDYY $ACRS $KRO $HDS $ARLZ $AGEN $WSC $HTHT $EXPR $PETX $GLMD $BITA $NERV $JILL $SFIX $COUP $CLNE $TACO $EPZM $GERN $TNP $TLYS $HIBB $AXAS

#earnings for the week$OSTK $AVGO $DDD $QD $ULTA $DKS $NVAX $SIG $DG $REV $CTRP $DSW $EGLT $TIF $CARA $VRAY $ADDYY $ACRS $KRO $HDS $ARLZ $AGEN $WSC $HTHT $EXPR $PETX $GLMD $BITA $NERV $JILL $SFIX $COUP $CLNE $TACO $EPZM $GERN $TNP $TLYS $HIBB $AXAS https://t.co/lObOE0dgsr pic.twitter.com/5nIBsE3k4o

— Earnings Whispers (@eWhispers) March 10, 2018

Trade Set-up Alerts – Recent / Current Holds, Open and Closed Trades:

New alerts platform in transition – full roll out week of Mar 19.

Charts and Chart Set-ups on Watch:

$ZSAN premarket up 10.3% trading 17.10 on milestone PR

$DXR premarket up 35% trading 18.10 #momentumstocks #premarket

Per recent;

$LTBR Lightbridge psychedelic chart structure with specific buy sell triggers

$NFLX How to trade the move with price targets #swingtrading

Oil Chart Resistance Intact Mar 4. 50% Fibonacci, mid quad on monthly. $USOIL $WTI $CL_F #OIL #OOTT $USO $UWT $DWT

Gold against underside of 50 MA on Daily Chart. Decision coming… $XAUUSD #Gold $GLD $GC_F

$SPY MACD pinch – on watch here as MACD daily predictable directional swing trade indicator.. Mar 4 1046 PM $SPXL $SPXS

Silver Indecisive – MACD Daily provides consistent trend directional trade indication and ROI. $SLV $DSLV $USLV #Silver

$VIX Weekly Stochastic RSI trending down consistently now.

Per recent;

Gold – Long drawn out process on the monthly. Decision coming… $XAUUSD #Gold $GLD $GC_F

Market Outlook, Market News and Social Bits From Around the Internet:

U.S. housing starts cooled in February after a robust January https://bloom.bg/2IstamQ

U.S. housing starts cooled in February after a robust January https://t.co/2Sat3glJHg pic.twitter.com/fJZONkEga3

— Bloomberg Markets (@markets) March 16, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $DXR $SEED $AMRS $ZSAN $KODK $KBSF $OPK $SMRT $OPGN $AVGR $AUPH $FEYE $JBL $YTEN $XXII $ADBE $ETE $QCOM $ETP $ULTA $AMLP $GERN $MU

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $NFLX $PEBO $PFPT $PFSW $PRGO $RNG $SODA $TMST $TRHC $USFD $VC $VLY $CTWS $DDD $DEI $DG $EEFT $EGHT $EHC $EPAM $FDX $GCO $H $III $INFN $KPTI $LPSN $MMI $MSFT $MU $ADAP $ADBE $ADM $AGFS $AKCA $ALDR $ALE $ALXN $ANET $AUPH $AVGO $BAC $BKNG $CBAY $CLR $CRSP $CSCO $CTRP $BBU $LL $NEP $NVTR $QTS $SCVL $THO $TS $WCG $WDC $WGO

Western Digital upgraded to 32% upside https://seekingalpha.com/news/3339879-western-digital-upgraded-32-percent-upside?source=feed_f … #premarket $WDC

(6) Recent Downgrades: $SBAC $SLB $SND $SYNC $TACO $TCP $TRP $ULTA $VIVE $XONE $EQGP $EQM $HAL $HR $ICON $IVTY $JILL $KINS $MMP $MRAM $MRCC $NEOS $NNN $NWL $OFIX $OLP $PETX $PULM $AAPL $ADT $ALLY $ALLy $AM $AMGP $AMT $AVD $AXP $BANC $BAS $BNFT $CARA $CI $CLAR $CX $DG $DM

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $DXR, $ZSAN, $TIF, $JNJ, $ADBE, $ULTA, $WMT, $NKE

Post-Market Wed Feb 15 $FNCX, $EVOK, $FIG, $ZSAN, $EDIT, $USOIL, $UWT

Review of Compound Trading Chat Room Stock Trading, Algorithm Stock Charting Calls and Alerts for Wednesday Feb 15, 2017; $FNCX, $EVOK, $FIG, $ZSAN, $EDIT, $USOIL, $UWT – $DUST, $ASM, $SSH, $VRX, $JUNO, $CBMX, $TRCH, $LGCY etc …

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Yesterday’s trading results can be found here:

Yesterdays Stock Trading Results Tues Feb 14 $ZAIS, $GALT, $PHMD, $RELV, $CYNO, $LPTH, $UGAZ https://t.co/hi2rttXp8E

— Melonopoly (@curtmelonopoly) February 15, 2017

Overview Perspective & Review of Markets, Chat Room, Algo Calls, Trades and Alerts:

Premarket was again a very busy and impressive premarket. Normally our room is quiet premarket with folks preparing for the day, but there were some traders that couldn’t resist.

Anyway, one of our traders hit three huge movers in the premarket ($FNCX, $EVOK, $FIG) and nearly doubled her account size before the bell even rang – and then she kept hitting later in the day on $ZSAN and $EDIT – as did others).

My big win was on $NOVN and Mathew was moving around his trade positions too. EPIC the Oil Algo hit the 10:30 Tuesday target dead on this morning so our $USOIL $WTI Oil related long hold in $UWT is doing well.

We have a really skilled group in the room – not that I have anything against the rooms with early traders, but it is nice to have a large percentage that are skilled – and best of all, our early traders mature in to positive returns faster than most I think (because of the other traders in their midst). It seems that way anyway.

Premarket Momo Action Jackson: $FNCX, $FIG, $EVOK Watching: $UGAZ, $UWT, $BSTG and more….

— Melonopoly (@curtmelonopoly) February 15, 2017

Congrats members in room hitting $EVOK, $FNCX out of park lol – I missed em. One member she near doubled up small account on 3 plays wowza!

— Melonopoly (@curtmelonopoly) February 15, 2017

The $NOVN trade I knocked out of the park (it terms of timing but not in terms of percentage gains like the other traders in our room hit the 70% type wins in premarket). I took an alert in the room on a halt in $NOVN and when it re-opened for trade hit it right away for 3000 shares and then near immediate for another 6000 long. My cost average was just under 6.60 and I closed for 7.70 (near the top of the spike).

Some of our SMS and email alert folks asked me today why they did not receive the trade alert from me – on these really quick ones it’s impossible – from the time I entered long to my exit it was less than 70 seconds (if I remember right) – so in that 1 minute there is no possible way to alert. I couldn’t even alert the room in a perfect way – I did, but it wasn’t perfect. Mathew was doing a voice broadcast updating our room on the markets, commodities, currencies etc during the time also.

One way to fix that is on Twitter you can get my Tweets live notifications (you can set this on your feed) and you can also subscribe to the room and get live text interaction in the room. I know these two options may not be possible as some folks work etc and thats why you get the SMS alerts and are not in the room. So we are endeavoring to get you every single trade (no matter how quick) on SMS and email, but it isn’t always possible.

$NOVN off halt https://t.co/zdzfHYZlqQ

— Melonopoly (@curtmelonopoly) February 15, 2017

$NOVN Nice win 6.60 to 7.70 9000 shares. https://t.co/pAXbjBWw2W

— Melonopoly (@curtmelonopoly) February 15, 2017

Momentum / Note-able Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| ZSAN | 2.85 | 41.09% | 35149505 | Top Gainers | |

| BRN | 2.45 | 38.41% | 93570 | Top Gainers | |

| NOVN | 6.44 | 34.45% | 5432657 | Top Gainers | |

| EVOK | 3.40 | 30.27% | 20648868 | Top Gainers | |

| EDIT | 24.30 | 28.84% | 5610805 | Top Gainers | |

| FIG | 7.99 | 28.66% | 151445269 | Top Gainers | |

| FIG | 7.99 | 28.66% | 151445269 | New High | |

| BRN | 2.45 | 38.41% | 93570 | New High | |

| WGBS | 6.60 | 14.78% | 393318 | New High | |

| WIX | 61.50 | 16.15% | 2359703 | New High | |

| WOOF | 90.93 | 0.18% | 1491274 | Overbought | |

| SWIR | 25.65 | 1.58% | 591364 | Overbought | |

| FIG | 7.99 | 28.66% | 151445269 | Unusual Volume | |

| CIDM | 1.69 | 26.12% | 8472808 | Unusual Volume | |

| FWDB | 25.53 | 0.83% | 74815 | Unusual Volume | |

| SPXH | 32.66 | 0.40% | 179823 | Unusual Volume | |

| ACOR | 25.40 | 6.50% | 1195211 | Upgrades | |

| ADHD | 1.30 | 8.33% | 3245132 | Earnings Before | |

| MLVF | 20.80 | -0.95% | 12592 | Insider Buying |

Stocks, ETN’s, ETF’s I am Holding:

I am holding (in order of sizing – all moderately small to small sizing) $UWT, $ONTX, $DUST, $VRX, $CBMX, $JUNO, $TRCH, $LGCY, $SSH, $ASM:

Trading and The Markets Looking Forward:

Per yesterday, “The small and micro momentum stocks continue to pop, however, traders need to be cautious because often its the low floats and thin trade can be difficult to chip out of positions – caution warranted in many ways.”

These low float micros have in past signaled the end of a cycle in the market – keep that in mind.

Per yesterday, “Our standard plays that reflect the six algorithm charting we do are all at decisions at either support or resistance so this should get really interesting soon.”

Epic our FX $USOIL $WTI Oil Charting Algorithm Wednesday 10:30 EIA target area hit (not perfect to the cent and second but trade was in target area and very near center at exact time). Note: The Periscope / Twitter post heading below is incorrect – it should read Wednesday not Tuesday.

Quick review crude #Oil 10:30 Tues #EIA report trade with EPIC the Algo $USOIL $WTI $USO $UWT $DWT $CL_F https://t.co/1zLPdBtRU6

— Melonopoly (@curtmelonopoly) February 15, 2017

https://www.periscope.tv/curtmelonopoly/1vOxwYmBPQrGB?t=2

Per yesterday, “Our swing trading side continues to outperform all my expectations for 2017 (you can find the most recent unlocked swing trading newsletter on our blog) – I had a feeling it was going to do well, just didn’t quite expect a grandslam. We’re in the middle of compiling our next set of stock picks for the swing trading members and will have them out over next few days – hopefully that batch will bring the same type of returns as the new year batch did and continue to in most instances.

US Dollar $DXY $USDJPY $UUP:

$DXY US Dollar is threatening to the trend reversal side, but not confirmed, awaiting market direction.

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

Gold and Miner’s are both at what we consider key resistance.

Silver $SLV:

Silver is at what consider key resistance area also (along with Gold).

Crude Oil $USOIL $WTI:

Crude oil continues to threaten a key support area that we have used as an area of accumulation long (we’re long as long as the trend is in place – the trend is your friend and we’re trading the range until it isn’t).

As noted above EPIC the Oil Algorithm hit the Wednesday 10:30 AM target call – chart below.

Wed #EIA 1030 target call area hit. Within 6 cents of time and price called. Crude algo intra work sheet 1030 AM Feb 15 FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

Volatility $VIX:

Volatility continues its flat line.

$SPY S&P 500:

$SPY continues the break-out. Trade the Fibs and buy the dip until you can’t. Respect stops.

Natural Gas:

It seems to be near a low IMO, we’re watching.

Momentum Trades:

As noted above, the low float micros and small cap issues continue in momo.

Swing Trading:

As noted above, we have literally sent one out of the park after another. Continues to look good forward.

Earnings:

#earnings $TEVA $GRPN $TMUS $AMAT $CSCO $PEP $TSEM $ON $MGM $FDC $SHOP $ABX $INCY $QSR $MRO $LNCE $WEX $DCIX $TAP https://t.co/lObOE0dgsr pic.twitter.com/QuvZZLvneN

— Earnings Whispers (@eWhispers) February 11, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Announcements in Compound Trading Chat Room:

The weekend webinar series went very well! You will find the links to the videos of each 20 minute webinar on our Twitter feed! Such as with this;

https://twitter.com/CompoundTrading/status/831261256162144258

Compound Trading Stock Chat-room Transcript:

Miscellaneous chatter may be removed.

Announcements in room:

08:50 am Curtis M : PreMarket Trading Plan Wed Feb 15 $FNCX, $FIG, $CIDM, $PTX, $GRPN, $UGAZ, $UWT LINK: https://compoundtrading.com/premarket-trading-plan-wed-feb-15-fncx-fig-cidm-ptx-grpn-ugaz-uwt/

09:40 am Curtis M : Techs are working on room access issue and being able to chat issue lol – new software last night may have something to do with it but I doubt it.

Transcript:

Premarket chatter missed before recorder was turned on.

09:05 am Curtis M : $FNCX, $EVOK, $FG, $BSTG, $UHAZ, $UWT

09:09 am MarketMaven M : wow

09:09 am MarketMaven M : Just also nailed $EVOK with with premarket buy – all out now – up over 70%

09:10 am Lenny T : That was a great play out also

09:13 am Curtis M : congrats on those guys

09:15 am MarketMaven M : DOuble up on account haha

09:15 am MarketMaven M : 3 plays

09:19 am Lenny T : that was crazy momo

09:22 am Sammy T : congrats marketmaven

09:30 am Lenny T : $FNCX way off

09:31 am Lenny T : $FNCX over 4.50

09:31 am Curtis M : L $FNCX 4.52

09:32 am Curtis M : If it doesnt hold VWAp I will cut

09:33 am Curtis M : Out 4.38 small loss on 1000 shares

09:33 am Sammy T : Think I may go back in myself

09:34 am MarketMaven M : not the best open

09:40 am Curtis M : Techs are working on room access issue and being able to chat issue lol – new software last night may have something to do with it but I doubt it.

09:41 am Sartaj Hundal : No problems here

09:41 am Sartaj Hundal : I’d recommend using a new browser to those having issues, or updating their current one

09:41 am Curtis M : back in 5

09:46 am Mathew Waterfall : Issues for me getting into the room. In some $SWN premarket and $JNUG premarket as well

09:46 am Mathew Waterfall : Looking to trim some $JNUG already but gold actually acting well here

09:47 am MarketMaven M : ya a few reported issues

09:47 am Mathew Waterfall : Added back some $PLG here as well

09:48 am Mathew Waterfall : Worked for me to switch over from Chrome to IE if anyone has similar issues in the future on not being able to load the chat window

09:51 am MarketMaven M : whats IE?

09:51 am Mathew Waterfall : Also cut my $TRQ position in half. Hasn’t been getting the action I’ve wanted slight win there and will leave a trailer

09:51 am Mathew Waterfall : Internet Explorer MMM. I know old school

09:53 am MarketMaven M : i saw curt using oprah so i tried it but ok IE thanks

09:53 am MarketMaven M : oprah haha opra

09:54 am Mathew Waterfall : Yea I use chrome for everything so not sure where the issue was this AM but easy fix

09:55 am Sandra Q : $FFHL $KALV $CIDM on my watch

09:56 am Mathew Waterfall : Ton of call sweep action basically everywhere. Big ones are $AAPL, $BAC, $GRPN, $INVA but seeing a ton of call flow right off of the open

09:56 am Sandra Q : congrats on that double up this morning MarketMaven you’re buying aftermarket tonight

09:58 am Mathew Waterfall : $SWN watching through 9.15 area. Add there

10:05 am MarketMaven M : back in $EVOK btw at 4 though why not be a piggy

10:07 am OILQ K : way to go

10:08 am Mathew Waterfall : $JUNO into the gap

10:08 am Sammy T : twas sweet action pm

10:09 am Sammy T : whats going on with $BSTG curt?

10:11 am Mathew Waterfall : Stopped out of $UEC on the trailer I had on. Winner there and horrible action today after that opening pop

10:11 am Curtis M : $BSTG some guys I know are accumulating so on watch

10:12 am Curtis M : $SHOP at 52 week highs and I held that mother for 6 months before I dropped it for a loss last year fark

10:14 am Mathew Waterfall : Looking to start shorting up here. $TZA calls, possibly $SPY puts

10:18 am Dave D : $NOVN halt

10:19 am Mathew Waterfall : All you metals players survive that dollar spike alright?

10:19 am Mathew Waterfall : Was scary there for like 15 minutes lol

10:19 am Sammy T : I played around it all daytrading only

10:20 am Dave D : dollar hasnt been easy on me but survive

10:20 am Mathew Waterfall : nice job, so did I sammy. This range offers us great opps to play those flushes and bounces

10:21 am Mathew Waterfall : On the mic

10:21 am Dave D : got ya clear ni prob mat

10:22 am Sammy T : kk

10:25 am Curtis M : L NOVN at 6.60 cost avg sorry alert didn’t work when i pressed enter

10:26 am Curtis M : Out $NOVN 7.70 decennt win 9000 shares

10:27 am Curtis M : all good out

10:29 am Dave D : I followed on that $NOVN curt but only got .30 cents

10:30 am Lenny T : ur making a lot of sense today Mathew:)

10:30 am Lenny T : like it

10:30 am Sandra Q : I went with ya silent curt

10:30 am MarketMaven M : haha me too!!! that was nuts action

10:31 am MarketMaven M : ya you’re right lenny Mat keeps my head on lolol

10:31 am Mathew Waterfall : haha thanks Lenny, I have my days

10:31 am MarketMaven M : that was an awesome alert btw good call way to be on it guys

10:32 am MarketMaven M : what a day

10:32 am Mathew Waterfall : Oil, wow huge buiold confirmed. This is playing out like last year but the market isn’t going lower. Weird action IMO

10:33 am MarketMaven M : oil is mad science

10:34 am Mathew Waterfall : Science can only matter so much when we are at record inventory numbers

10:35 am MarketMaven M : lol

10:36 am Mathew Waterfall : Just picked up a starter amount of $UGAZ because I love a good pain trade

10:38 am Mathew Waterfall : Eyes on $LNG here along with my $SWN pos as well

10:38 am Dave D : had my finger on trigger for $UGAZ 24 times last 24 hours

10:39 am Dave D : :0

10:39 am Mathew Waterfall : Me to Dave. I just went in small with the idea that i would let it float and add if we get move downward price action. Keeping it very small allows me to not owrry about the losses as much

10:40 am Dave D : have to be on it close

10:45 am Curtis M : Going to review #EIA report crude oil trade with EPIC Algo chart in a couple minutes – if you are on obile and cant here it you can find it on my periscope anytime later

10:50 am Sammy T : oil will crash! hahahaha bear

10:50 am Curtis M : not in to the oil trade sammy? 🙂 dont blame ya

10:51 am Sammy T : not not now

10:51 am Curtis M : ha

10:53 am MarketMaven M : should just follow that epic thing ha

10:53 am MarketMaven M : goin on lunch has a big day cya soon

10:55 am Sandra Q : good idea me too

10:57 am Mathew Waterfall : Sense all the cool kids are doing it, gonna take a quick break back in a few

10:59 am Curtis M : kk

10:59 am Sammy T : ha

11:16 am MarketMaven M : not much goin on I think i will go back for a bubbly: now:)

11:16 am Lenny T : queen today!

11:17 am Lenny T : I have’t left yet going now

11:17 am Lenny T : lunhc

11:26 am Curtis M : crude came off pretty heavy there but stopped at that dotted white algo fib line

11:27 am Curtis M : gotta remember those fri targets are weak just saynig

11:31 am Mathew Waterfall : Not much going on on my end but I did reset everything and got the chat to open inChrome so that’s a win

11:31 am Lenny T : winners!

11:32 am OILK K : $FUN looks FUN at 52 week highs too! Winner

11:33 am OILQ K : fun nnny

11:33 am OILQ K : luv

11:34 am Mathew Waterfall : $TZA Mar 24c’s at .15. First short stab here

11:34 am Lenny T : GL!

11:34 am Sandra Q : Gonna need it Mat! 🙂 careful

11:34 am Dave D : cheeky

11:36 am Mathew Waterfall : We’ll see. Trading optiosn means defined risk up front. Take the size you’re comfortable with. It goes to 0 and I won’t loose any sleep over it

11:37 am Mathew Waterfall : Feel free to timestamp this right or wrong howeve

11:38 am Dave D : ha timestamp! men are always right anyway

11:39 am Mathew Waterfall : We’ll call that $IWM 139 and see where we go from here. with a month until expiration on those bad boys

11:57 am Mathew Waterfall : $PLG on a ripper from this morning. These smaller names should come to life shortly

11:58 am MarketMaven M : ! $PLG I missed it

12:01 pm Mathew Waterfall : I hit a readd this morning on the weakness, looking for 2.50’s then 4’s long term

12:06 pm MarketMaven M : wow!

12:28 pm MarketMaven M : curt AC investor watching your screen?

12:28 pm NewbiHH O : Hi guys

12:28 pm MarketMaven M : hey newbi

12:28 pm NewbiHH O : hi

12:29 pm Curtis M : whu u ask MM?

12:29 pm MarketMaven M : he just longed $PRKR and you’ve had it up for last 45 mins … curious if u guys know ieach other

12:30 pm NewbiHH O : did u guys nail the oil today?

12:30 pm Curtis M : ah nope

12:30 pm NewbiHH O : that report was confusing again..

12:30 pm Curtis M : nice wins this morning btw MM nice double up

12:31 pm NewbiHH O : nice

12:31 pm MarketMaven M : EIA report? newbi

12:31 pm NewbiHH O : yes..

12:31 pm NewbiHH O : i thought it was a short..but it ripped

12:31 pm MarketMaven M : ya I think thats why Curt gave up trading his method ad follows EPIC lolololol cry

12:32 pm MarketMaven M : that happened to curt not long ago too

12:32 pm NewbiHH O : that happen to me last week..lol

12:32 pm MarketMaven M : last week i think

12:32 pm MarketMaven M : ya

12:32 pm MarketMaven M : he was freaknh mad

12:33 pm MarketMaven M : $PRKR curt!

12:33 pm MarketMaven M : nice call

12:33 pm Curtis M : got it from bottoms up twitter feed

12:34 pm NewbiHH O : what price at $PRKR?

12:35 pm MarketMaven M : curt just put it on screen an hour or go or so maybe 45 mins ago

12:35 pm Curtis M : not in it

12:36 pm NewbiHH O : oh

12:37 pm MarketMaven M : lowfloater again

12:39 pm NewbiHH O : $WIX near $62

12:39 pm NewbiHH O : /zb

12:40 pm NewbiHH O : $AIG

12:41 pm NewbiHH O : I only made one trade today..$AIG

12:41 pm NewbiHH O : oil spooked me again..

12:41 pm MarketMaven M : work out?

12:41 pm MarketMaven M : the trade?

12:42 pm NewbiHH O : yeah..shorted it at open

12:42 pm MarketMaven M : nice

12:42 pm NewbiHH O : thx

12:43 pm NewbiHH O : edit

12:43 pm NewbiHH O : edit

12:43 pm Dave D : $EDIT JIG

12:43 pm NewbiHH O : dang it..cant short it

12:44 pm NewbiHH O : any news ?

12:44 pm Dave D : $prkNOT SURE

12:45 pm Dave D : sorry not sure

12:45 pm NewbiHH O : ah…$edit

12:54 pm Lenny T : $WIX $BAC the two I’m looking at for EOD entries

12:54 pm Lenny T : and $AMZN

01:01 pm NewbiHH O : $WIX 15min looks like a RBI

01:02 pm Mathew Waterfall : $WIX is a smoker. Seems like tripple digits are in its future

01:04 pm NewbiHH O : $EDIT baout to pop

01:10 pm NewbiHH O : $RDUS about to pop..but tape slow

01:10 pm Mathew Waterfall : natty flush

01:11 pm NewbiHH O : ah…

01:12 pm Mathew Waterfall : 200 day around 2.89 which it bounced off of yesterday so watching that for support

01:21 pm Mathew Waterfall : What you thinking here on natty Curt? It’s a tough one to read

01:22 pm Curtis M : vol may no tbe low enough yet on daily – may not be bottom

01:23 pm NewbiHH O : /ng if we dont get a2.931 bove we test 2.909?

01:23 pm Edward Johansson : hi guys, who should I message for support? just wondering about sms service

01:24 pm Mathew Waterfall : Lower vol than summer bottom and similar to fall but yea not a ton in the futures

01:24 pm Curtis M : hi Ed sure ya email in if u dont mind

01:24 pm Edward Johansson : cool, will do

01:24 pm Curtis M : afternoon seeson just getting going

01:24 pm Curtis M : thanks 🙂

01:25 pm Mathew Waterfall : I’mn looking for a clear 2.951 or risk another 200 day Newbi

01:25 pm NewbiHH O : ah..got it

01:26 pm Mathew Waterfall : We tested abover there but couldn’t hold it. That’s yesterdays high and VWAp at 2.957 so short term what I’m watching

01:26 pm Curtis M : The chart bot has naioed the buys recent on daiily natty

01:26 pm NewbiHH O : ah ha

01:26 pm NewbiHH O : thats the one on the screen

01:26 pm Curtis M : the blue

01:26 pm Curtis M : 4 buy alerts would have been decent

01:27 pm NewbiHH O : okay.. do you have a youtube vid? i was wondering about the screen..haha

01:27 pm NewbiHH O : $EVOK poop

01:28 pm Curtis M : lol Mat hate to put your financial life in the hands of a chart bot but …. lol

01:28 pm NewbiHH O : anyone watching $CTIB ? low vol..but popping

01:29 pm Curtis M : should rip on the 200 u would think tho

01:29 pm Mathew Waterfall : Im so small in $UGAZ I don’t really care lol

01:29 pm Mathew Waterfall : I’m watching this while metals and currency figures itself out

01:29 pm Sartaj Hundal : Newbie, can you email info@compoundtrading.com?

01:30 pm Curtis M : still think its 200 day

01:30 pm Curtis M : sorry 200 ma or 2.70 at worst

01:31 pm Mathew Waterfall : another 200 day touch would make it a nice double bottom. I have a ton of levels in the 2.6’s on my chart so there is some more support down there as well but obviously a long way to fal

01:32 pm NewbiHH O : ah.. isee

01:35 pm Curtis M : best math we have says 2.70 and i think 2.45

01:38 pm Mathew Waterfall : How do you figure 2.45? Moving into summer season with a lot of support below makes that a tough conclsuion for me

01:39 pm Curtis M : 2.45 based on sesame street only doesnt go any further lol

01:40 pm Mathew Waterfall : I’m not saying you’re wrong lol I just can’t get that far. I take trades like this level to level. If we break the 200 and close below I will pitch my small position until it firms

01:40 pm Curtis M : june 12 2013

01:41 pm Curtis M : ya who knows

01:42 pm Curtis M : wish we had the math down on it

01:42 pm Mathew Waterfall : Funny I was thinking we are in a similar pattern as 2012 into 2013 off of that low

01:42 pm Mathew Waterfall : April 2012 low and chart looks about similar from last springs low

01:43 pm Curtis M : very possible

01:48 pm NewbiHH O : SLAB

01:49 pm NewbiHH O : DXTR

01:49 pm Dave D : add $TRCH

01:50 pm Mathew Waterfall : $EEM seeing some flows here as well. Forget who asked about that last week

01:50 pm NewbiHH O : lol.. missed that bounce with .04 onn $SLAB.. -.-

01:56 pm Sammy T : $zsan TIME

01:56 pm Sammy T : $SPY time

01:56 pm Sammy T : my time

01:58 pm Sammy T : shkreli short

02:20 pm Dave D : adding last 1/3 to $EWZ swing

02:21 pm Cara R : $EWZ been in it for a few weeks Dave, positive I think

02:22 pm Curtis M : $ZSAN look at that Stoch RSI

02:22 pm Curtis M : on the 3 just reved flat at 11

02:23 pm MarketMaven M : i have some of that oink oink

02:33 pm Mathew Waterfall : Pit close and OPEX done. Oil might see some movement into the end of the week with that out of the way

02:35 pm Sammy T : I wish the FEd would just shut the f up and ya shut up would help

02:35 pm Mathew Waterfall : Don’t we all Sammy, don’t we all

02:37 pm NewbiHH O : $NVRO

02:37 pm Sammy T : $NVRO what?

02:39 pm Sandra Q : $NVRO spike Sam

02:50 pm Sandra Q : Power Hour better be power hour

02:51 pm Mathew Waterfall : Feels like someone turned off the market and it’s just melting up sooooo slowly

02:52 pm Greg L : yup

02:54 pm NewbiHH O : $CYTX

02:55 pm NewbiHH O : AIRM

02:59 pm NewbiHH O : NVRO about to pop again

03:00 pm NewbiHH O : looking for 97 if pops

03:02 pm NewbiHH O : meh

03:02 pm NewbiHH O : no vol coming at the high..

03:03 pm NewbiHH O : done for today.. cu guys tomorrow

03:03 pm NewbiHH O : bye

03:05 pm Mathew Waterfall : Have a good night

03:05 pm Lenny T : ccya mat

03:05 pm Lenny T : oh newbie

03:05 pm Lenny T : got it was studying

03:06 pm Sandra Q : me2

03:06 pm Mathew Waterfall : Slow day, see yall tomorrow for some hopefolly better action. Feel like I’ve been saying tht for the past week

03:07 pm Sandra Q : ya

03:07 pm MarketMaven M : pre market baby

03:30 pm Mathew Waterfall : Turn your dictionary to a picture of a blow off top and this is what it looks like. Frustrating part is it can go on for a while. Keeping my trades small and tight right now because my macro bias won’t let me get too long into this thing

03:31 pm Sammy T : same

03:32 pm Mathew Waterfall : As a day trade you don’t need to trade all day every day. This is great patience practice for me if nothing else

03:42 pm Nicholas Winton : watch $ICLD over next week or so- nice bottoming chart

03:49 pm Sandra Q : thank you nich quiet afternoon

03:49 pm Sandra Q : iafter a carzy premarket today

03:49 pm Sandra Q : i guess i should go bye bye see you all\

03:50 pm MarketMaven M : by asandy!

03:50 pm MarketMaven M : thanks for being my partner in bank this morning

03:50 pm Mathew Waterfall : See yall tomorrow am. Maybe I’ll join you for some of this premarket action that I hear so much about lol

03:50 pm MarketMaven M : yeah!

03:50 pm MarketMaven M : i am leaving now tooooo shopping\

03:51 pm Sandra Q : night all

03:52 pm Mathew Waterfall : A little color on that rumor I was talking about earlier if interested

03:52 pm Mathew Waterfall : https://twitter.com/LONGCONVEXITY/status/831968801084338176/photo/1

03:52 pm Lenny T : cool

03:59 pm Lenny T : bye

04:00 pm Curtis M : nite all

Be safe out there!

Follow our lead trader on Twitter:

Article Topics: $FNCX, $EVOK, $FIG, $ZSAN, $EDIT, $USOIL, $UWT – $DUST, $ASM, $SSH, $VRX, $JUNO, $CBMX, $TRCH, $LGCY – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

PreMarket Trading Plan Mon Feb 13 $SINO, $ZLTQ, $ZINO, $ZSAN, $BCEI, $AEZS, $IMMU, $PLUG, $KBSF, $UGAZ, $JDST, $JNUG

Stock Trading Plan for Monday Feb 13, 2017 in Trading Chat room. $SINO, $ZLTQ, $ZINO, $ZSAN, $BCEI, $AEZS, $IMMU, $PLUG, $KBSF, $UGAZ, $JDST, $JNUG – $VRX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $CBMX, $JUNO – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session!

Notices:

NA

Current Holds / Trading Plan:

All small size – $VRX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $CBMX, $JUNO, $DUST (looking for a way out on $DUST – was expecting one final significant spike in USDJPY before drop). $CBMX and $JUNO are holds till spring if necessary (you would have to do your own DD on the companies and make your own determination).

General Market Outlook:

$SPY has been active and markets continue to improve for daytrades a bit, $VIX dead so watching for spikes, $OIL in multi-week range (if they stop manipulating it will drop), $GOLD and $SILVER everyone has gone bull so we will see, $USDJPY $DXY most say is going down so we’ll see, and natural gas looks like its near an interim bottom.

Morning Momo / News and Social Bits:

Momo Watch: $SINO, $ZLTQ, $ZINO, $ZSAN, $BCEI, $AEZS, $IMMU, $PLUG, $UGAZ, $JDST, $JNUG

#earnings $TEVA $GRPN $TMUS $AMAT $CSCO $PEP $TSEM $ON $MGM $FDC $SHOP $ABX $INCY $QSR $MRO $LNCE $WEX $DCIX $TAP https://t.co/lObOE0dgsr pic.twitter.com/QuvZZLvneN

— Earnings Whispers (@eWhispers) February 11, 2017

8:00 AM:

S&P +0.17%.

10-yr -0.17%.

Euro -0.07% vs. dollar.

Crude -0.63% to $53.52.

Gold -0.46% to $1,230.25.

Goldman Sachs raising $AAPL price tgt to $150 from $133, says the iPhone8 will have 3D sensing, ie $LITE

Zeltiq shares leap 12% in premarket on news of takeover by Allergan http://on.mktw.net/2lBbehS

$TEAR – Osmolarity System Was Approved By Republic of Korea And Is Scheduled For Commercial Launch In India

Goldman Sachs sees Hasbro rally extending http://seekingalpha.com/news/3242801-goldman-sachs-sees-hasbro-rally-extending?source=twitter_sa_factset … #premarket $HAS

Axovant’s nelotanserin shows treatment benefit in mid-stage dementia study; shares up 5% premarket http://seekingalpha.com/news/3242797-axovants-nelotanserin-shows-treatment-benefit-mid-stage-dementia-study-shares-5-percent?source=feed_f … #premarket $AXO…

At $43B+, #Tesla’s market cap is now over 85% of Ford.

Michael Kors to report Q4 results late due to technical glitch http://seekingalpha.com/news/3242795-michael-kors-report-q4-results-late-due-technical-glitch?source=feed_f … #premarket $KORS

Boeing -1.4% on downgrade http://seekingalpha.com/news/3242787-boeing-minus-1_4-percent-downgrade?source=feed_f … #premarket $BA…

$TEVA up 6% premarket after no new shoe drops in their press release.

Sage Therapeutics’s depression candidate SAGE-217 shows positive treatment effect in Part A of m… http://seekingalpha.com/news/3242779-sage-therapeuticss-depression-candidate-sageminus-217-shows-positive-treatment-effect-part?source=feed_f … #premarket $SA…

$KBSF running premarket.

Allergan takes out ZELTIQ for $2.47B http://seekingalpha.com/news/3242804-allergan-takes-zeltiq-2_47b?source=feed_f … #premarket $AGN $ZLTQ

$AEZS 16% PRE

CBRE Group buys Capstone Financial http://seekingalpha.com/news/3242806-cbre-group-buys-capstone-financial?source=feed_f … #premarket $CBG

Macy’s on the move after Barron’s tees it up http://seekingalpha.com/news/3242805-macys-move-barrons-tees?source=twitter_sa_factset … #premarket $M

Global miners move higher alongside copper prices http://seekingalpha.com/news/3242807-global-miners-move-higher-alongside-copper-prices?source=twitter_sa_factset … #premarket $BHP $RIO $GLCNF $GLNCY

$ZSAN 3.8mg Dose of M207 Meets Both Co-primary Endpoints in the ZOTRIP Pivotal Efficacy Trial in Migraine

Flagstar Bancorp has almost 50% upside – Piper Jaffray http://seekingalpha.com/news/3242819-flagstar-bancorp-almost-50-percent-upside-piper-jaffray?source=feed_f … #premarket $FBC

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: Gainers: $PLX, $MDGS, $BLFS, $DGAZ, $PLUG, $SDRL $TEVA $TSEM $CMRE $ELOS $MT $IMMU $BBRY $JDST $VALE $FCX

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List: $UGAZ, $JDST, $JNUG, $SINO, $ZLTQ, $ZINO, $ZSAN, $BCEI, $AEZS, $IMMU, $PLUG

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $MPEL $NUE $JCP $CMRE $FBC $PBR $TSU $REGN $SBCF $GTE $TWIN as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $EVR $MASI $OXY $AKS $AUO $FSFR $TRV $AGU $WSM $CVA $INOV $RAI $TAC $LPT $CEB $BA $GCI $MDU as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $UGAZ, $JDST, $SINO, $ZLTQ, $ZINO, $ZSAN, $BCEI, $AEZS, $IMMU, $PLUG – $VRX, $SSH, $ASM, $CBMX, $JUNO, $DUST, $TRCH, $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F

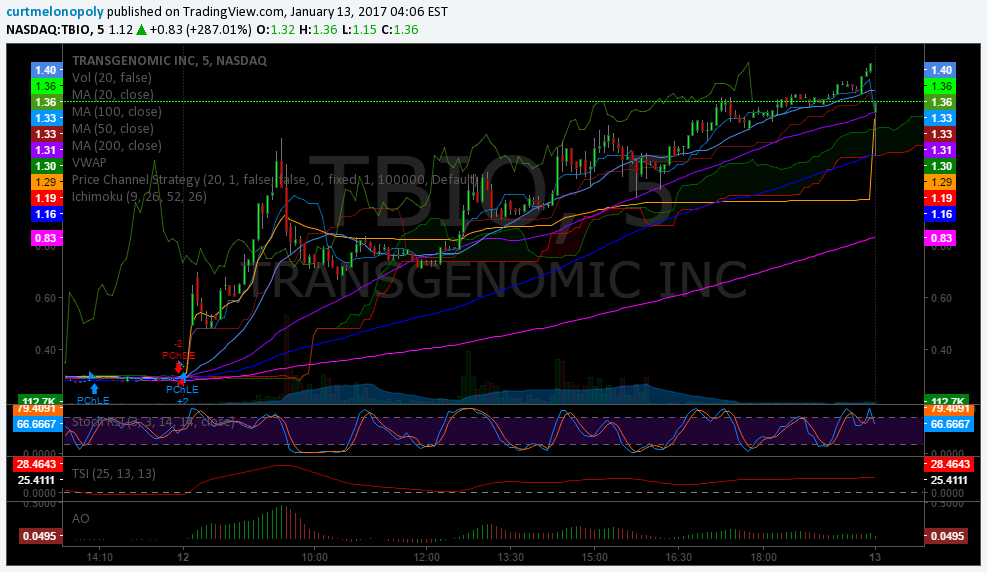

Post-Market Thurs Jan 12 $TBIO, $BVXV, $ZSAN, $TCCO, $URRE – $NUGT $DUST $USLV $DSLV $UWT $DWT $UGAZ $DGAZ $JNUG $JDST

Review of my Chat Room Stock Day Trades, Algorithm Charting Calls and Alerts for Thursday Jan 12, 2017 $TBIO, $BVXV, $ZSAN, $TCCO, $URRE – $MYOS, $FFHL, $TCCO, $URRE – $SPY, $GLD, $GDX, $SLV, $USDJPY, $DXY, $USOIL, $WTIC, $VIX, $NG_F…

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/.

Notices:

Official Launch: Four days down and on to day five! This Monday was our official launch! If you want to watch a thirty year trading veteran in action with a 2 week challenge – to double his trading account in two weeks, come on in and take a look at how its done.

Big week coming🔥 Official Launch @CompoundTrading Monday🎉 All algorithms published for launch🚀 2 week double account challenge live🎥 #stocks pic.twitter.com/MGPCTAdDsx

— Melonopoly (@curtmelonopoly) January 7, 2017

https://twitter.com/CompoundTrading/status/818629447498792961

https://twitter.com/CompoundTrading/status/819339460907270144

https://twitter.com/CompoundTrading/status/819747180797894660

SMS / Email Alerts: Our system was upgraded so all members will now start receiving them for each trade (morning momo trades may not have time to process alerts outside room fyi).

New Service Option: We now also offer a stand-alone trading room option (vs. bundle w/ trading room, premarket newsletter and alerts) at 59.00 /mth and w/ promo code is 1.22 per day.

New Service Option: EPIC the Oil Algo now has an Oil Report only option (vs. bundle w/ 24 hr trading room launching early 2017) at 199.00 and w/promo code works out to just over 4.00 day.

New Service Option: Entry-Level trader one-on-one trade coaching and entry-level trade academy options now available in addition to intermediate / advanced trading academy and coaching.

Feature Post: There is a feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are using our algorithms or charting it is a must read.

Overview Perspective & Review of Chat Room, Algo Calls, Trades and Alerts:

So much happening this week I can’t possibly review every trade. Watch videos as Sartaj releases them for detailed account. I was in $TBIO, $BVXV, $ZSAN, $TCCO, $URRE and more. Wasn’t as good as other days this week but still profitable and worth it. Choppy. Overtraded. Was hoping to increase my sizing as week went on but I’ve had to decrease sizing as week progresses. Hoping Friday is the big day of the week. I’m ready to be aggressive if window opens.

We’re winning.

Momentum / Noteable Stocks Today:

|

Holding:

$DUST, $CBMX, $JUNO, $TCCO, $ZSAN

Looking Forward:

Winning. Double account in two weeks.

The algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Announcements in Trading Room:

na

Stock Chat-room Trading Transcript:

Miscellaneous chatter may be removed.

Sartaj buy / sell alerts below are for Curtis.

08:34 am Sartaj Hundal : https://www.tradingview.com/chart/HSGX/zmF6o3o6-HSGX-One-Minute/

08:36 am Sartaj Hundal : https://www.tradingview.com/chart/RNVA/PcTglpZ4-RNVA/

08:36 am Sartaj Hundal : https://www.tradingview.com/chart/BSPM/0IqtwGDP-BSPM/

09:09 am Sartaj Hundal : https://www.tradingview.com/chart/TBIO/0q4ULBD9-tbio/

09:10 am Sartaj Hundal : https://www.tradingview.com/chart/OPGN/IavMkwL3-opgn/

09:10 am Sartaj Hundal : https://www.tradingview.com/chart/AUMN/rIbjEby3-aumn/

09:24 am Mathew Waterfall : Looking at $BIOC for a quick bounce here.

09:24 am Mathew Waterfall : Also $ETRM

09:33 am Sartaj Hundal : OR WAS THAT “OUT”?

09:34 am Sartaj Hundal : OUT $URRE 3.82 500 SHARES

09:39 am Carol B : $CIEN L

09:39 am Sartaj Hundal : Correction: Out 1/2 would be 4500

09:39 am Sartaj Hundal : Scaling in 2000 shares $APOP avg 5.14

09:40 am Sartaj Hundal : LONG 1000 SHARES 5.54 $APOP

09:41 am Sartaj Hundal : Scaling out 5.86, all shares $APOP

09:43 am Mathew Waterfall : out some $jnug at 9.17 for a pullback. into some $USLV at .59

09:45 am Sartaj Hundal : SCALING OUT $URRE 3.90

09:46 am MarketMaven M : Long$APOP

09:48 am John M : Wow $APOP halts again holding 1000

09:50 am darnel p : $AMD a bit off a short

09:51 am OILQ K : Like $XGTI looking for entries

10:00 am Surf T : In som $THST

10:00 am Surf T : Curt u still bullsh $GDX?

10:00 am Mathew Waterfall : Picked the wrong horse this AM playing $BIOC instead of $ETRM it looks like

10:01 am Mathew Waterfall : hate that

10:01 am Curtis M : ugh

10:01 am Curtis M : yup $GDX till next tues wed

10:02 am Mathew Waterfall : Still like it, expect a fade as has been the usual to buy more on a dip. will be watching both $NUGT and $JNUG. Plan on holding $USLV for a while

10:03 am Mathew Waterfall : Meanwhile $TLT still killing it. Love that

10:03 am Curtis M : yup

10:05 am darnel p : I have a stop on at 2.47 $TCCO – small play I’ll take the loss if need be

10:05 am Curtis M : Darnel – I am gonna follow that lol

10:05 am Curtis M : Mine small too

10:06 am Mathew Waterfall : wow $gdx strong like bull. wondering if we see the daily pullback today or not

10:06 am Curtis M : ya like my alarm huh lol

10:06 am Curtis M : GDX great play should have executed on my conviction bahahaha shite

10:07 am Mathew Waterfall : I’ve learned just to go with my gut on those plays. my gut also said sell my $JNUG for the daily puillback so it’s not always right lol

10:07 am Curtis M : yeah

10:08 am Sartaj Hundal : back

10:15 am Sartaj Hundal : Was in a call, what was the order size and price?

10:15 am Sartaj Hundal : LONG $TBIO 5000 SHARES 0.78

10:17 am Curtis M : I have a stop to sell TBIO at .73 – going to get a coffee back in 20 to take a look at oil gold etc

10:18 am Curtis M : Lol Out TBIO small loss .73

10:18 am Sartaj Hundal : OUT $TBIO SMALL LOSS 0.73 5000 SHARES

10:19 am Mathew Waterfall : looks like a ton of inventory at .8 for $tbio

10:25 am Sartaj Hundal : LONG $ZSAN 3000 SHARES 1.43

10:28 am Carol B : In some $ZSAn w ya

10:32 am John M : $KOS blocks guys

10:32 am John M : $CNHI blocks too

10:33 am Mathew Waterfall : Scanners almost empty here and market internals pointing to the downside. Not much on my board that Im too excited about

10:35 am Mathew Waterfall : GDX Feb 25 Call Buyer +23k for $0.64

10:36 am Mathew Waterfall : here’s the miners fase. will start to pick up some shares here and know that we are likely to see some more downside

10:36 am Mathew Waterfall : *fade

10:36 am Curtis M : On ph w broker re TCCO stop didnt trigger – $ZSAN holding so far

10:41 am Curtis M : So $TCCO stop didnt trigger Darnel and took t off flying with out – also on ZSAN its a hold for me – so both holding – rehit later or sell at loss we’ll see – but I think market will keep taking these for rides

10:41 am Curtis M : Wack a mole

10:44 am Flash G : $AAOI momo

10:57 am Curtis M : Thanks Mat!

10:57 am Rob D : thanks Matt good overview

11:09 am Surf T : market looking very dangerous but it will likely pop again late day

11:10 am Flash G : Curt you holding $ZSAN and $TCCO?

11:10 am Curtis M : Yes small positions hold for aft pop

11:15 am Sartaj Hundal : LONG 200 5.02 $BGXV

11:15 am Sartaj Hundal : 2000*

11:16 am Sartaj Hundal : $BVXV

11:16 am Curtis M : Hopefully I can get on right side of one of these – choppy very choppy

11:18 am Curtis M : Problem is if you’re going to play them you gotta chew around the edges till they take hold or you miss them – so u either play or dont but chew small size

11:19 am Curtis M : Correction: $BVXV 5.05 fill

11:21 am Sartaj Hundal : OUT 5.80 $BVXV

11:22 am Sartaj Hundal : 1000 SHARES

11:27 am Curtis M : looks lke low float mania for a while – dont see me in Oil Gold charts etc for some ime until it slows down

11:31 am Curtis M : On Hold w broker for 17 mins

11:31 am Curtis M : worst ever

11:33 am Sartaj Hundal : LONG 6000 SHARES $BVXV

11:38 am Sartaj Hundal : OUT 6000 SHARES $BVXV 7.17

11:39 am Sartaj Hundal : Very interesting

11:41 am Sartaj Hundal : How many shares of TCCO?

11:43 am Sartaj Hundal : Okay

11:46 am Mathew Waterfall : /GC holding steady over 1200 is a good sign. USD/JPY still on a downtrend. $GDX couldn’t make a higher high but I’m looking for a bounce play

11:50 am Mathew Waterfall : USD/JPY 113’s. Getting smoked

11:54 am Mathew Waterfall : Thought you actually went long spy here lol

11:54 am Mathew Waterfall : Not horrible against 225 but not my play

11:54 am Sartaj Hundal : My mistake

12:03 pm Mathew Waterfall : PLaying $OPXA range today for small scalps. Unloaded some at .94. Reentry around .85. This is one that will have legs sooner or later. Not a Curt play but a mellow grinder

12:04 pm Mathew Waterfall : Final target is 1.05 then 1.15 if it can get going.

12:05 pm Curtis M : thats awesome – whats a Curt play bahaha? super nova or super crash? in 14 seconds or less? 🙂

12:05 pm Mathew Waterfall : Basically lol. I wasn’t considering super crash, those have been rare

12:06 pm Curtis M : haha ya these low floats i ride em when they’r’e rolling late 2015 early 2016 same story

12:06 pm Curtis M : then market correction lol

12:06 pm Curtis M : last time I was on beach – oh yes right i need to go to the beach

12:07 pm Mathew Waterfall : I will say you have many tools at your disposal so smoke em if you got em

12:07 pm Mathew Waterfall : Playing Costa RIca trip for next winter already lol

12:07 pm Curtis M : lol

12:07 pm Mathew Waterfall : *planning

12:07 pm Curtis M : ya ionly thing holding me back is my adopted Bull dog – trying to sort it

12:08 pm Curtis M : $IBB green boys

12:14 pm Mathew Waterfall : $IWN breaking out of bull flag to the downside. Was leader on the way up

12:14 pm Mathew Waterfall : Will be watching the close closeley here

12:15 pm Mathew Waterfall : Also losing fib support

12:19 pm Curtis M : $IBB action decent

12:23 pm Curtis M : Big volatility coming next 5 market days imo

12:24 pm Mathew Waterfall : There’s gotta be. The closer we get to Trump sitting in the oval office the more nervous people will be

12:24 pm Curtis M : yup

12:25 pm Curtis M : is it wrong for me to look forward to that? ha

12:25 pm Mathew Waterfall : I call that making lemonade

12:26 pm Curtis M : haha

12:38 pm Mathew Waterfall : $DUST scalps against downtrend in $GDX working nicely

12:57 pm Curtis M : After 3 calls to broker… I still own $TCCO yay fark

01:03 pm MarketMaven M : nce call on the bonds guys… still slowly on the move

01:05 pm Curtis M : back in 5 for the ramp

01:05 pm Mathew Waterfall : Thanks. Over todays high is importnant. Stopped just short of the 09 crash high at 123.15

01:05 pm Mathew Waterfall : Need over that for more

01:09 pm Curtis M : $MYCC halt news

01:23 pm Surf T : $HMNY looking good here

01:51 pm Mathew Waterfall : $OPXA. Boom

01:51 pm Mathew Waterfall : Sold some at 1.05. Seen this movie before lol

01:52 pm Curtis M : nice took a bit but u go it

01:53 pm Mathew Waterfall : Yepp. I like the set it and forget it plays every now and then. Buy order for more at .85 if it retraces

01:53 pm Mathew Waterfall : Still scalping $DUST here and htere. Not much else attractice ATM

02:00 pm Mathew Waterfall : $IWM back into support here and over crucial fibs. Impressive market strength, this market still needs a flush here IMO

02:02 pm Mathew Waterfall : Q’s making a bit of a double top set up on the day. put tweezers as they say on the second ascent

02:03 pm Mathew Waterfall : $GDX ugly on the 5′. Guess I was right earlier about the fade today

02:04 pm Curtis M : likely run aain tomorrow or late today

02:04 pm Mathew Waterfall : Yea they are ramping jpy as usual. I expect this pattern to play out over the next week. Gap up/run the miners and flush the market, ramp usd/jpy and reverse

02:06 pm Carol B : some waking up

02:14 pm Mathew Waterfall : I feel like I need to wake up. Today has been a grinder

02:14 pm Curtis M : ya i made that mistake yesterday i think it was then i was late to party

02:18 pm Curtis M : I have a certain type of market person telling me full moon was at noon today thats why it slowed and thats why it will start to wake up again here

02:18 pm Curtis M : interesteing dude actually

02:18 pm Mathew Waterfall : Is that why I am growing hair and turning into a werewolf?

02:19 pm Curtis M : he said we are mostly water and like the tide it affects us

02:20 pm Curtis M : he’s oddly rght very often … interesting but not my thing – but find it curious how right this guy is

02:20 pm Curtis M : mssed my buy trigger on KALV

02:20 pm Curtis M : talking about tides and moons instead haha

02:21 pm Mathew Waterfall : lol I missed mine on $DUST as well. o well just wait for another opp

02:23 pm Curtis M : $TBIO got its pop

02:23 pm Curtis M : so were poppin

02:26 pm Curtis M : its like fishing when they just nibble

02:29 pm Curtis M : $ROSG may go after $TBIO fyi

02:34 pm Curtis M : wake up

02:34 pm Mathew Waterfall : Market waking up to the upside. TICKS trending up no 1000+ but going positive

02:36 pm Curtis M : $TROV and $ROSG high watch

02:49 pm Curtis M : This market is gong to rip after inauguration

02:49 pm Curtis M : or b4 but def after

02:50 pm Curtis M : just my humble opinion lol

02:51 pm Curtis M : $TBIO could get snaky

02:56 pm Mathew Waterfall : I still think we’re in for a dump sooner or later. I don’t see this keeping up through the next month or so. Last coupl days seems like cracks starting to show to me

02:56 pm Curtis M : ya dump then rip then dump then rip plz

02:56 pm Mathew Waterfall : That would be great

02:57 pm Mathew Waterfall : Gold getting smashed here and I exited $DUST way too early. NEaring buy zone for a $GDX bounce

02:59 pm Curtis M : other side of the moon baby

02:59 pm Curtis M : lol

03:00 pm Surf T : money time guys coming up

03:01 pm Curtis M : $MRNS perky

03:01 pm Mathew Waterfall : $NUGT for a bounce

03:01 pm Mathew Waterfall : wrong under .5 on $GDX

03:02 pm Curtis M : Chart bot likes $TROV here

03:06 pm Curtis M : $TBIO leg in 500 shares 1.217

03:09 pm Curtis M : $TBIO could rip 50 – 70 cents

03:09 pm Curtis M : or not

03:10 pm Curtis M : risking 5 cents

03:12 pm Curtis M : I guess Im risking 7 cents

03:21 pm Curtis M : Sorry Sartaj that was 5000 not 500 $TBIO

03:26 pm Tyler H : $TBO on its way to 4 times float traded today

03:26 pm Mathew Waterfall : Miners moving like junk. Im done for the day I think. Tried a couple scalps in NUGT. NO nounce so a couple scratches

03:26 pm Tyler H : $MRNS is my pick

03:26 pm Curtis M : enjoy your evening

03:26 pm Sammy T : bye Mathew!

03:27 pm Mathew Waterfall : I’ll hang around until close but sitting on my hands basically

03:27 pm Jack D : $MRNS great candidate for tomorrow

03:29 pm darnel p : $ROKA flow here

03:30 pm Curtis M : Out at 1.182 small loss

03:30 pm Curtis M : $TBIO

03:30 pm Curtis M : Sartaj corrction 1.181

03:31 pm Curtis M : choppy day fo me but still up lol

03:31 pm Curtis M : but chop chop

03:35 pm Mathew Waterfall : Seriously same here

03:35 pm Mathew Waterfall : So choppy

03:35 pm Curtis M : It was worth it – but barely

03:36 pm Mathew Waterfall : OPXA flying 1.30. OUt of everything. Will buy more on a pullback if and when that happens

03:36 pm Curtis M : I hate to be that way – but I dont just lke to get by – just not my thing

03:36 pm Curtis M : some people take offence to that is what Im saying

03:36 pm John M : NOT ME

03:37 pm darnel p : Meee either haha

03:37 pm Mathew Waterfall : This isn’t a good game for people who accept average.

03:37 pm darnel p : good one!

03:38 pm Curtis M : If $TBIO goes I am going to hammer down so hard – sad but true even if theres 10 mins

03:52 pm Curtis M : Holding $ZSAN $TCCO on

03:52 pm Carol B : my only hold $NUGT

03:53 pm Sammy T : nght

03:54 pm Curtis M : Cya Sammy

03:54 pm Curtis M : I should prbs hold $NUGT too but just but

03:54 pm Mathew Waterfall : Have a good night all. I’m going to practice my axe skills to make it through this chop tomorrow

03:55 pm Sandy S : Buy guys – still learning everyday with you guys.

03:55 pm Curtis M : Nice catch Mathew

03:56 pm Curtis M : Gonna shut er down 4 mins early. Over and out.

Article Topics: $TBIO, $BVXV, $ZSAN, $TCCO, $URRE – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500