Swing Trading Report. In this Special Earnings Season (Member Edition) Tuesday Aug 7, 2018: $DIS, $AMD, $AAPL, $WMT, $FB, $JKS, $EXP, $LTBR, $SPY, $DXY and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from Aug 6 mid day review, published August 7, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review sessions will become the premise for our next major Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

All quoted support and resistance are approximate.

June 12 Swing Trading Regular Report is referenced in this special earnings report. Members can reference that report for charts you may need (or review the video) as some charting is not included in the report below due to weekly reporting time constraints. Also, please be sure to check date on the chart as the date may not reflect publish date depending on the scenario.

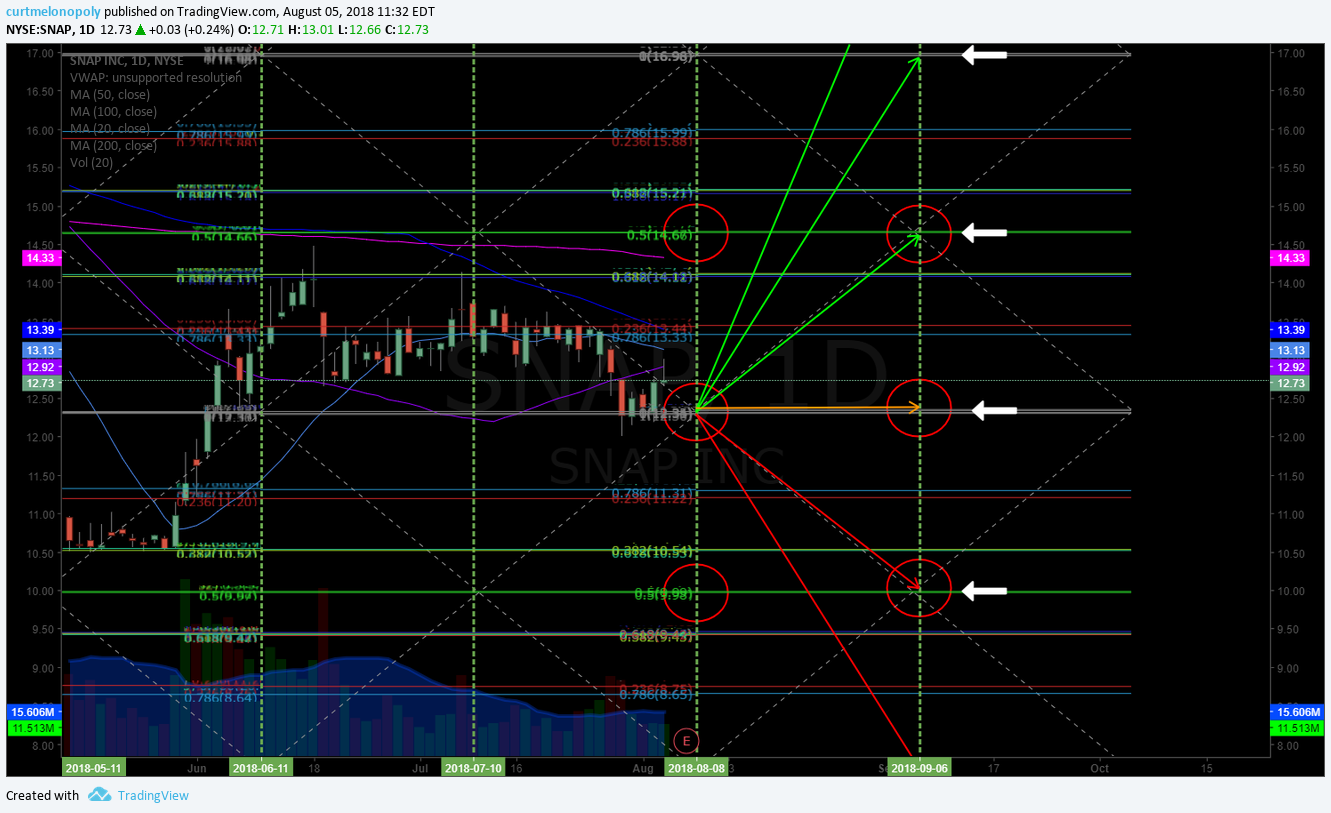

Earnings Season Stocks Covered in This Report; $DIS, $AMD, $AAPL, $WMT, $FB, $JKS, $EXP, $LTBR, $SPY, $DXY

Report published Aug 7 and recorded Aug 6, 2018 Mid Day Swing Trading Review.

July 12 Swing Trading Regular Member Report is referenced in this special earnings report. Members can reference those two reports for charts you may need.

Tickers:

SP500 $SPY – 283.74 by trigger hit, 284.93 resistance, bullish price target 299.00 on same day.

US Dollar $DXY – Watching the range resistance / support test area now for possible long trade. On a sell-off will not short.

Eagle Materials $EXP – Post earnings, positive earnings, trading 100.00, quad wall (Fibonacci trend line) support bounce 98.87. 179.92 resistance. Looking for a long side trade over upside resistance on chart.

DISNEY $DIS – Earnings Tuesday, price target 124.19 in a post earnings squeeze, downside 110.50 (yet to be seen),

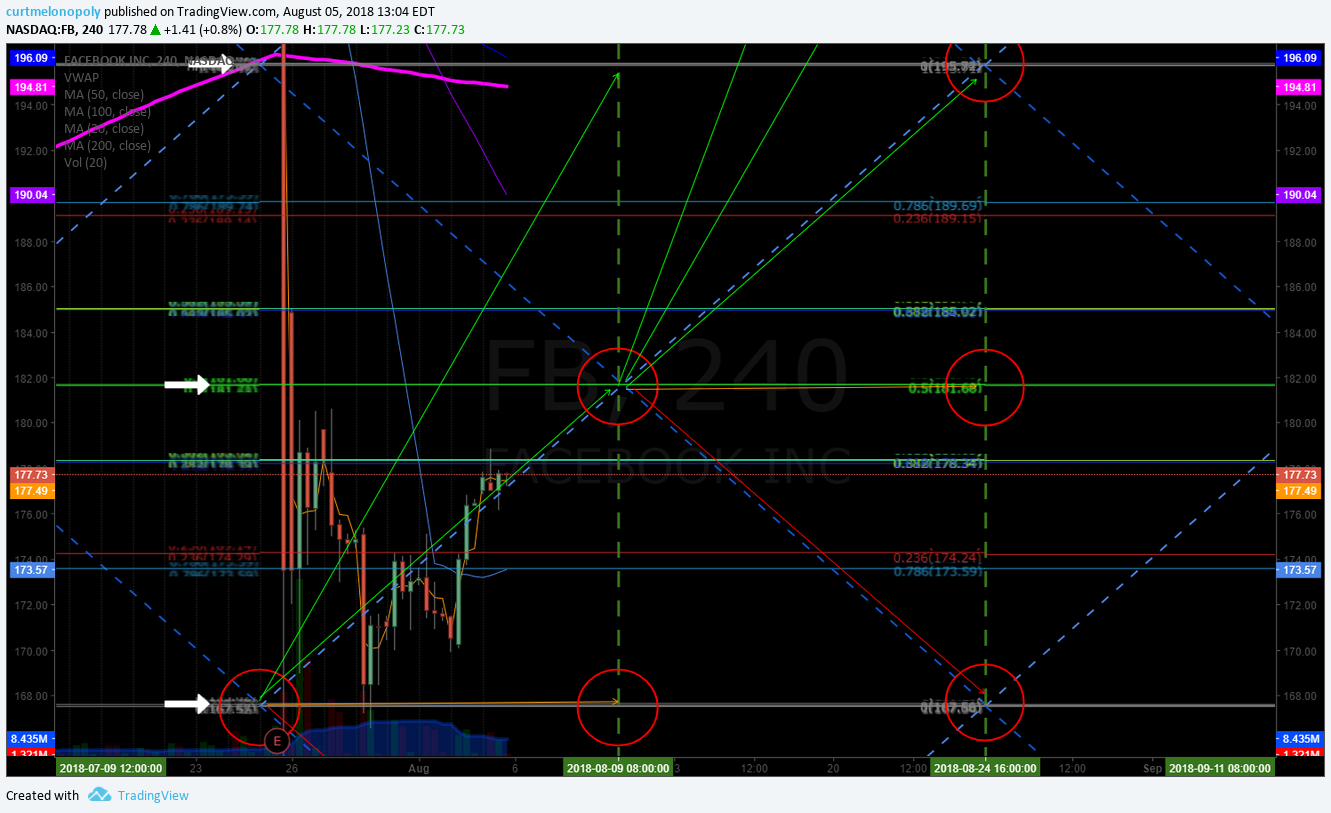

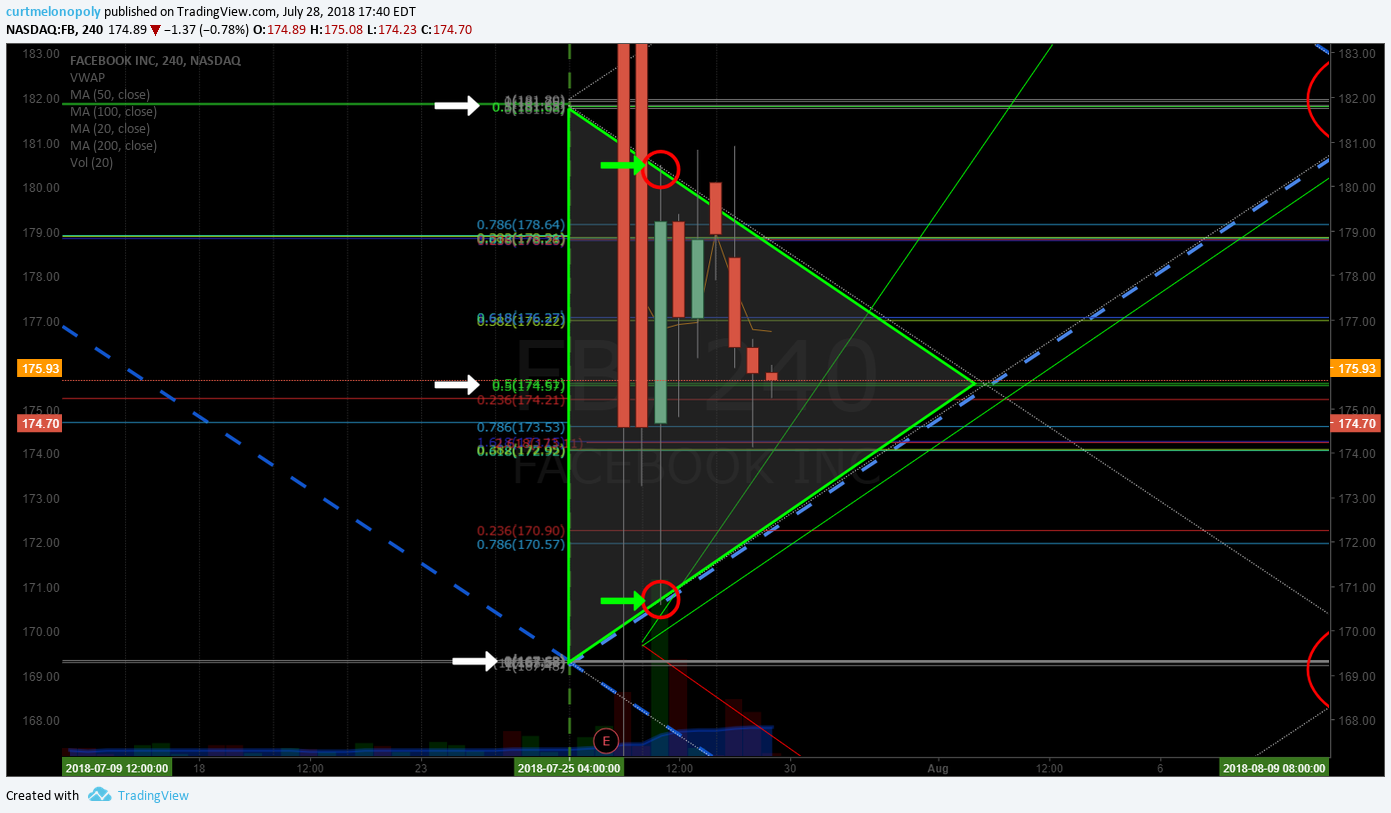

FACEBOOK $FB – Facebook has been paying the bills this year. Traded last wash-out snap-back and now trading this one. Trading intra-day at quad wall resistance (down trending Fibonacci trend-line). Has 50 MA coming down over hear on 4 HR chart with 200 MA above that. Resistance 195.71, trading intra-day 183.69, support 181.70. Trading range reviewed on video. 195.71 price target Aug 9 in bullish trade scenario.

APPLE $AAPL – Chart structure clean, resistance 205.30 and launched upside 209.80 next resistance 212.63. The buy sell triggers are explained on video for our charts (the white arrows). Main 200.58 support, 212.61 resistance, intraday resistance 209.80, intraday sup 205.77. Trading intraday 208.78 on other side of earnings. Trade alert sent out to members to trim longs in to the upside resistance area on chart. #swingtrading #earrnings

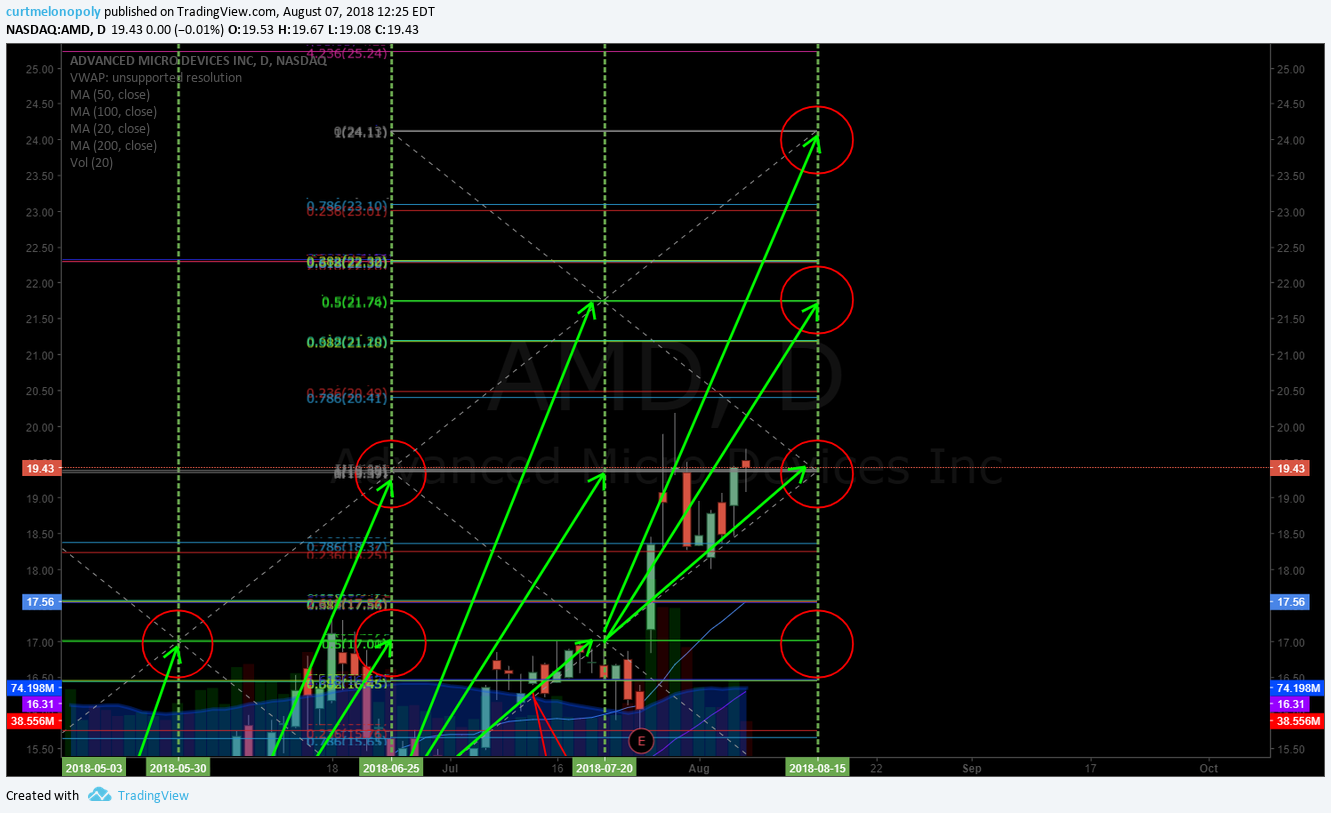

Advanced Micro $AMD – Against main pivot resistance 19.35 trading intra day, hit target July 20, trending for upside if over resistance the target is 21.75 Aug 15 with 24.50 most bullish, 17.04 in a sell-off is price target intra-day.

WALLMART $WMT has earnings in ten days and is still struggling with 200 MA. Looks like a 200 MA upside resistance test in play. 91.10 main pivot resistance, 82.83 structural support. Intra day 87.17 support / resistance.

LightBridge Corp $LTBR – still under 200 MA running along support .896. Can’t trade it until over 200 MA for a long and short I’m not interested in for risk / reward.

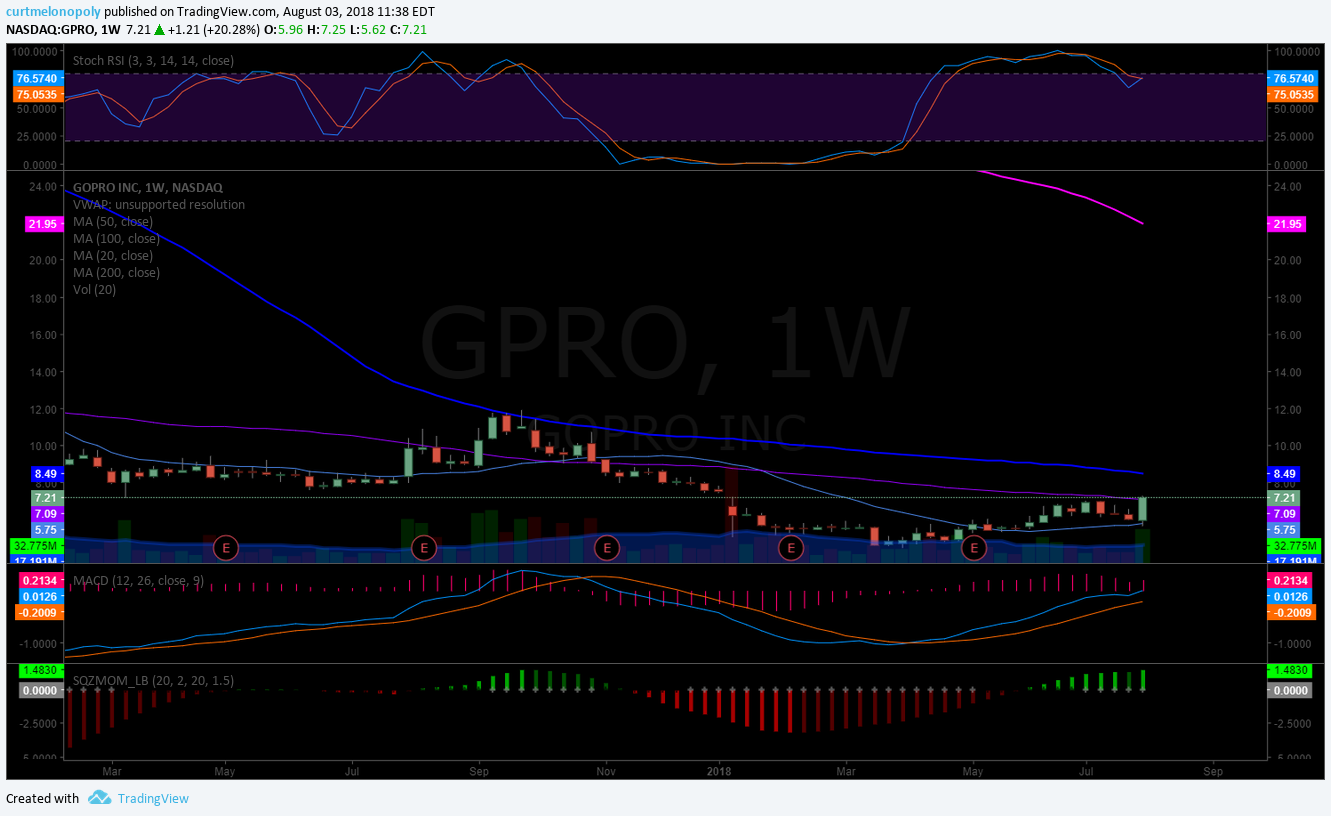

Jinko Solar $JKS – Earnings in 7 days, 50 MA has made its way down with 20 MA and price, this is a good area to watch for a possible pop.

Not on video, included in editing below:

EDITAS MEDICINE (EDIT) Hit downside channel support #, over 27.96 adds for longs under channel support broken trade. $EDIT #swingtrade

#swingtrading #earnings #tradealerts

Charts and Chart Links re: Member Version.

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:https://twitter.com/swingtrading_ct

Visit our Free Public Chat Room on Discord.

#swingtrading #tradealerts #trading #earnings

Follow Me: