Selling Against An Intra-Day Bullish Break-out In Crude Oil Is Difficult. Here’s How We Day Short-Sold The Trump – China Break-Out News Yesterday.

The trade sequence in this report is a real-world example from our oil trading room. The intra-day oil futures short selling strategy / sequence as of the time of writing this report is not complete so there will be a Part 2 to this post.

Tuesday was a bullish break-out day for crude oil markets. Trump messaged to the world that some tariffs would be delayed and this sent oil soaring in price intra-day.

Oil prices continued to rally on Tuesday, this time on reports that the United States has decided to delay the next round of tariffs that were to be imposed on Chinese goods.

The delay gives hope to a skittish market that the trade war really won’t go on forever.

For WTI, oil prices had climbed 4.30% by 12:36pm EDT to trade at $57.29. Brent Crude was trading up even more at 4.70%, at $61.32—resuming its over $60 per barrel that it had fallen under during the first week of August as the trade war stoked fears of souring oil demand growth.

In addition to the tariff delay, which will now go into force on December 15, the United States will also be taking some of the items on that tariff list off completely, according to its newest policy document published on the Office of the United States Trade Representative website. While the list hasn’t been made public, it will include items that will be removed “based on health, safety, national security, and other factors”.

https://oilprice.com/Energy/Energy-General/Oil-Spikes-As-US-Delays-Tariffs-On-Chinese-Goods.html

When the intra-day price in the bullish break-out (on Trump news) was over-extended technically on charts and trade was starting to get in to overhead supply (order-flow), we began a short selling sequence.

Below is the first part of this article because (as I mentioned above) the short selling sequence is still in play and includes a significant number of trade executions.

So for today’s article I will include a chart that shows / maps out each trade execution as I and the v3 EPIC machine trading software executed the trades, the raw footage from the oil trading room and some miscellaneous charting. Then in Part 2 of this article (when the trade sequence is complete) I will explain each trade execution in detail so that it may help you with your crude oil day trading strategies.

Before digging in to this article, please read the introductory article for this series here: How Oil Day Traders Can Learn to Trade Better Using Success & Failure of Our Trading Development Team – Part 1.

The articles in this series are sent direct to the mailing list – so be sure to register now, click here.

Also, The Most Recent Oil Trade Profit Loss Results For v3 Machine Trading (trade alerts) Sample Set;

For Aug 9, 2019: v3 Profit & Loss: Daily +$995 YTD +$8,526 Projected $94,306 or 94% Per Annum. Oil Machine Trade 100k Account (v4 period excluded) #OOTT $CL_F $WTI $USO #MachineTrading #OilTradeAlerts

For Aug 9, 2019: v3 Profit & Loss: Daily +$995 YTD +$8,526 Projected $94,306 or 94% Per Annum. Oil Machine Trade 100k Account (v4 period excluded) #OOTT $CL_F $WTI $USO #MachineTrading #OilTradeAlerts pic.twitter.com/bPJVI49MIL

— Melonopoly (@curtmelonopoly) August 11, 2019

Tuesday’s Live Oil Trading Room Session.

Please note:

- When we alert 1/10 that means (for example) on an account of 100,000.00 that would normally execute a trade size of maximum 10 contracts, 1/10 size then represents 1 contract. We use a 100k account for our sample set for simplicity.

- Trades are alerted to a live trading room by voice (by leader trader) and published as time allows to an oil trading alert feed on Twitter and in Discord private member server.

As mentioned above, Tuesday’s daytrading session in crude oil futures was a short selling strategy in to a spike in price that was over extended technically.

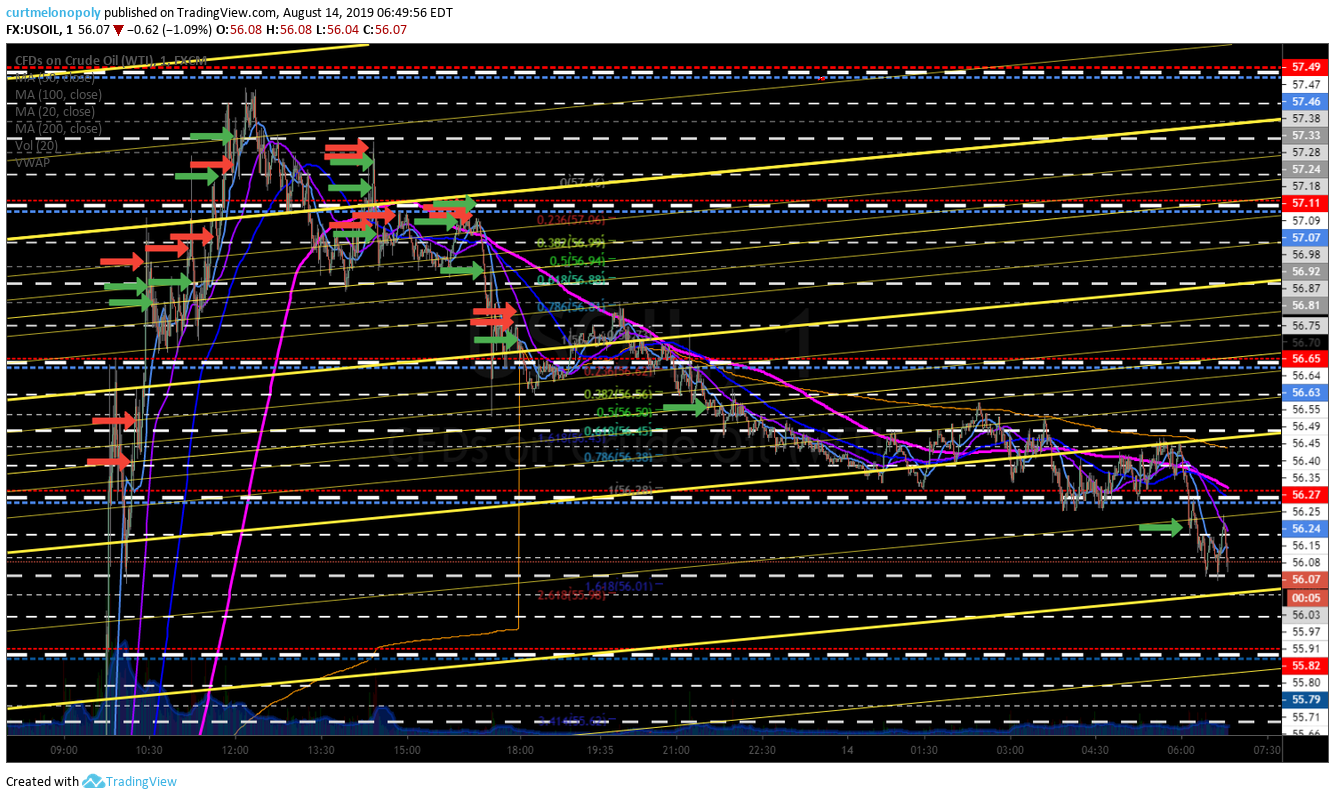

Below is a chart that shows / maps each location of trade (red are the short selling trades and green are the buy or cover trades, each arrow is 1/10 size). Part 2 of this article will be published tomorrow when this sequence is complete.

At time of writing we are green (positive, profitable) in the trade sequence and it will be interesting to see how it completes.

The short selling sequence below is a protocol within the v3 EPIC Crude Oil Machine Trading Software code.

First a few screen capture images from the private oil chat server and associated alerts and charts and then the main chart showing location of each trade is below that.

Below is an image screen shot from the private member oil trading server of the first trade alerts on the day.

And an image of the chat oil room server showing charts of alerted trades etc.

Below is a one minute chart from oil trading room that shows all the crude oil futures buy and selling of contracts in the short bias sequence.

Red arrows are short selling and green arrows are buys / cover trades. My apologies for the noisy chart but this is my personal work chart I use for working with the developers for the machine trade side of our work.

The bottom right arrow (green) is the most recent cover buy from the oil trade alerts while I write this article in premarket.

And below is a screen shot of most recent oil trade alert from Jeremy stating that the software covered the last of the short selling contracts but is still in a short bias sequence.

Also Jeremy notes that the machine trade software (and myself with manual trade execution) are now on profitable side of the trade sequence, which isn’t bad performance for the v3 software that is less than 6 weeks old and just ran its first larger short selling sequence in to over extended intra-day trading range on the Trump news. So I’m very satisfied because I would have assumed this would be a red or loss day on first go round in this specific new sequence.

Each time the software encounters a similar set-up it will execute for a better ROI, this is the power of machine trading.

The software (v3 EPIC Oil Machine Trade Software) has had 1 red day for 0.2% draw down since it was launched – it has been running for about 5 weeks. It has had a few trade sequences that it was in the red during the sequence (such as this) but has always come up profitable on the day it completes a sequence (with the one exception).

The key with the v3 vs v4 is that the v3 software only holds at most 1/10 size in to an intra-day range (it will hold more on a high frequency very short term basis) and v4 would hold easily 3/10 or more on a much wider range of trade – this allowed for significant volatility in profit and loss.

The smaller holds in to pressure with v3 allows for a projected loss day of 1 in 10 estimated to be equal to the average win day – excellent, balance risk-reward threshold, especially if it can do 80% or more annual returns (which appears to be the case). The smaller holds also allows for v3 to maneuver easier when off-side intra-day because it always has ample “dry powder” to work with.

JeremyToday at 6:11 AM

Buy / cover 1/10 56.18 hold 0 but still in sequence to sell

Software well green.

If the software ends the sequence and/or flips to a buy sequence will advise, but at this point it is still short sequence.

I will explain each trade execution you see in the chart above in a future post when this trade sequence is complete, which I expect will occur today prior to the EIA report at 10:30.

Live Oil Trading Room Video.

Please note: The video below is a raw feed only of the oil trading room for the whole daytrading session. To listen to comments by the lead trader that contain specifics to his thinking as he and/or the software are trading and sending out alerts, look at the time of the oil trade alert and correlate that to the video and go to that part of the video.

On Tuesday, in the video below, I wasn’t providing real in depth trade guidance verbally to the room like I normally attempt to do, I was alerting the trades however. I was busy with our developers because this set-up was new to the v3 machine trade code (each new set-up in oil trade requires “teaching” of the software).

If you are struggling with your trading and need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com and remember that I am doing an oil trading information webinar once a week for now on (covering our software status and trading techniques) so email me if you would like to attend this next one – you will need a special link and access code to attend.

Thanks,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, short selling, trading, strategies, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL, how to trade, alerts, trading room