Tag: $BLUE

PreMarket Trading Plan Tues Dec 12 $PTI, $RPRX, $OSTK, $RIOT, $COTY, $VRX, $CELG, $BLUE, $AAOI, $SPPI, Bitcoin, Oil, Gold, Silver, $SPY, $VIX

Compound Trading Chat Room Stock Trading Plan and Watch List Tuesday Dec 12, 2017 $PTI, $RPRX, $OSTK, $RIOT, $COTY, $VRX, $CELG, $BLUE – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Christmas at Compound Trading. We’re emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and Christmas FYI. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports. #premarket

Christmas at Compound Trading. We're emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and Christmas FYI. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports. #premarket https://t.co/1CNAfDsAeI

— Melonopoly (@curtmelonopoly) December 5, 2017

Most of the models are complete and out – the few remaining are in process and will be delivered soon. $SPY, $DXY, $VIX, Silver final edits are in process right now. All models including swing trading newsletters will have more refined buy sell triggers implemented between now and Jan 1 and also the $BTC blog post is currently in editing awaiting two important replies from exchange operators (we are giving them a bit of room to respond to us).

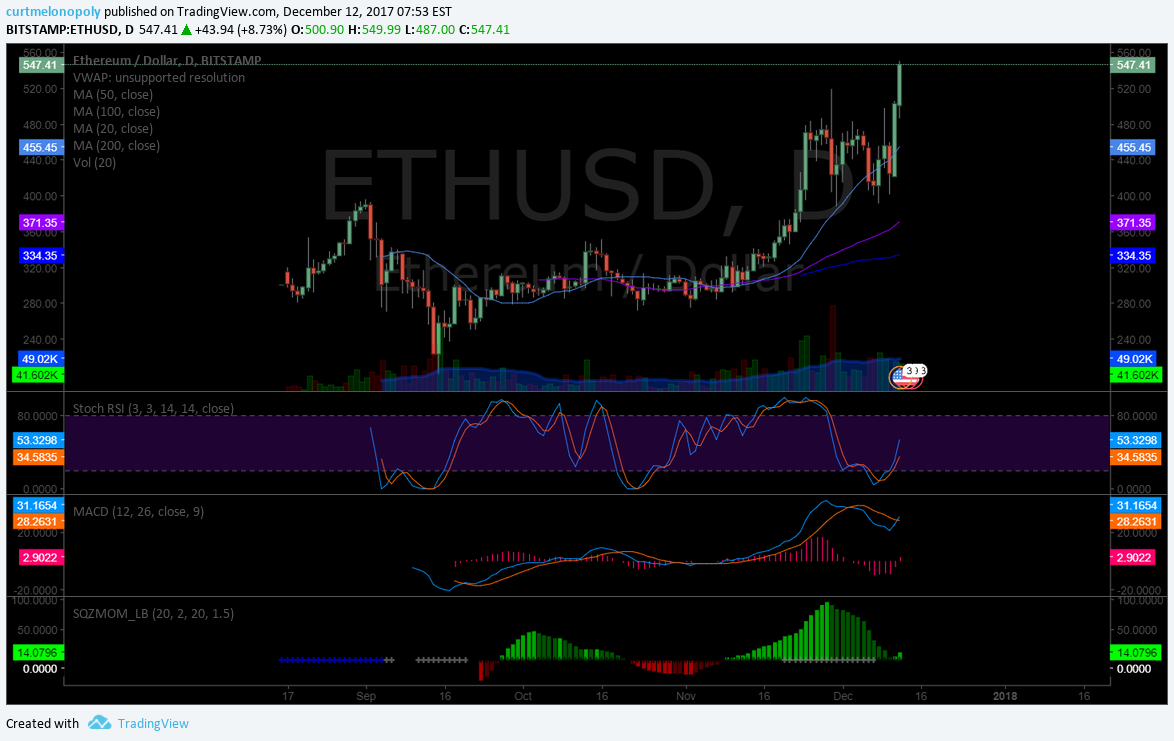

Also $ETH and $LTC models will be done as with other trending cryptos as they come along. Yes.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Per recent; EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto was released Sept 1.

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. Looks like a master class will happen in Columbia Jan 2018 – will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

Part 2 of Episode 4 Podcast – Data Scientist

Part 2 – Episode 4 Podcast : Data Scientist Fireside, https://t.co/r85TlxJ9a4

— Melonopoly (@curtmelonopoly) October 23, 2017

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Fri Dec 8 Trade Set-ups $BTC, Crypto Scenarios, Gold, $WTI, OIL, Algorithms, $VRX, $SQ, $MYL …

Dec 7 Swing Trade Chart Set-Ups $OSIS, $SQ, $DPW, $FSLR, $FB, $TVIX, $XIV …

Dec 6 Swing Trading chart set-ups $ETSY, $FSLR, $VTGN, $APTN, $LMFA, $VRA …

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Swing Trade Set Ups Nov 17; Oil, $WTI, $JJC, Copper, Bitcoin, $BTC, $OSTK, $AMBA, $HMNY, $AAOI…

Swing Trade Set Ups Nov 15 $XIV, $SPY, $OSTK, $HMNY, GOLD, OIL, $SQ, $SORL, $WPRT….

BEST Trade Set-ups in a while! Nov 10 (starts 4:42): OIL, GOLD, $VIX, $VRX, $ROKU, $AAOI, $HTZ …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

$PTI, $RPRX, $OSTK, $RIOT, $COTY, $VRX, $CELG, $BLUE and many others from recent trading action and lists. Watching oil resistance and possible jump in Gold and VIX.

Per recent:

Crypto related still on watch. $OSTK, $MARA, $MGTI, $RIOT, $XNET, $BTCS and more.

$AAOI still on watch for the follow-through move after wash out in to gap. Oil watching for a possible large entry in $DWT again (oil short ETN). $SPPI still holding and looking for it to run out of it’s gap and go set-up.

Morning Momentum / Gap / News / PR / IPO Stocks on Watch: $PTI, $RPRX

Recent IPO’s :

Also watching: $COTY, $FSLR, $VRX, $OSI, $BLUE, $CELG, $ATKX

Market observation / on watch:

US Dollar $DXY flat at 93.94, Oil $USOIL $WTI 58.44 up in early trade, Gold / Silver moderate – Gold intra day trading 1242.00, $SPY bullish / risk off 266.31 and $BTCUSD $XBTUSD 17267.00 strong overnight post futures open and $VIX trading 9.4.

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

Recent / Current Holds, Open and Closed Trades

Overnight trade in oil went really well. Big win.

Per previous;

Small loss on Friday in $SQ and hold small position in $NUGT and previous swings $AAOI and $SPPI. Flat oil trade overnight.

1/10 size Gold and $NUGT still long, yesterday nailed $VIX short at open SS $TVIX and $VIX inverse with $XIV – still hold 50% of $XIV swing position from yesterday and holds over time $AAOI and $SPPI.

In a 1/10 long Gold position under water on, 1/10 $NUGT, hit a morning momo trade yesterday in $FSLR and still holding $AAOI and $SPPI.

Closed my $DWT and CL trades from Friday on Monday when internet got back up for wins.

Wednesday $CMG trade went well for the win, $DWT (oil short) trade went well for the win, and the crypto exchange(s) crash caused some losses on some accounts but we did manage to get out on most accounts. We had a problem with five (more on this soon).

Closed oil short for nice win after adding 2/10. Close $AMMJ swing for small win. $XNET win yesterday was sweet technically. And Bitcoin we are absolutely killing it.

Chart Set-ups on Watch:

$COTY is setting up!!! 200 MA on daily breached!

$CELG From Last Week Gap Fill Swing Trading Set-Up Notes on Chart https://www.tradingview.com/chart/CELG/IaPH3DRj-CELG-News-Gap-Fill-SwingTrade-Set-Up-from-last-wk-see-notes/ … Detailed algorithmic chart model for intra-day trade will be emailed to mailing list subs b4 premarket Mon – so get on our mailing list and it will be sent to you! https://compoundtrading.com/contact/[/url

$CELG From Last Week Gap Fill Swing Trading Set-Up Notes on Chart https://t.co/1ahQ9c5pAk Detailed algorithmic chart model for intra-day trade will be emailed to mailing list subs b4 premarket Mon – so get on our mailing list and it will be sent to you! https://t.co/OxDbJ1HNL4 pic.twitter.com/3tnCwUuxsV

— Melonopoly (@curtmelonopoly) December 10, 2017

$OSI I find the symmetry in this chart almost unbelievable. Mind boggling. #premarket https://www.tradingview.com/chart/OSIS/HIXKIxE6-OSI-I-find-the-symmetry-in-this-chart-almost-unbelievable-Mind/ …

$OSI I find the symmetry in this chart almost unbelievable. Mind boggling. #premarket https://t.co/V0QF3GKcV6 pic.twitter.com/W9XIzGHyGR

— Melonopoly (@curtmelonopoly) December 7, 2017

Market Outlook:

Bullish

Fed Survey: Tax cuts and rate hikes on the way https://t.co/HctZ479ziT pic.twitter.com/YzqgDHoDe0

— The Exchange (@CNBCTheExchange) December 12, 2017

Market News and Social Bits From Around the Internet:

Stocks making the biggest moves premarket: PEP, MAT, VZ, MYL & more http://cnb.cx/2l4HQkT

Stocks making the biggest moves premarket: PEP, MAT, VZ, MYL & more https://t.co/M4ji9Cci3t https://t.co/j2EQG1R4hL

— Melonopoly (@curtmelonopoly) December 12, 2017

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $PTI, $RPRX, $GLYC $SDRL $TNXP $OMER $NVFY $RIOT $XNET $SSC $DPW $NETE $OSTK $SYRS $TEUM $MBOT $MARK $GROW $SRAX

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $VZ $NAV $TER $MTB $RF $STI $NEP $ZAYO $ABT $THC $HCA $COTY $NOC $ATVI $DVA $MDT

(6) Recent Downgrades: $CASY $ONCE $PEN $PEGI $AIV $COLM $MIK $FIS $RTN $DHI $GD $TDG $JUNO $OAS $EA $WEB $SNPS $SSNC $NOW $RNG $QTWO $QLYS $PTC $NEWR $TYPE $MODN $MIME $IMPV $GDDY $FTNT $CSGP $CHKP $CUDA $ADBE $CASY

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $PTI, $RPRX, $OSTK, $RIOT, $COTY, $VRX, $CELG, $BLUE, $AAOI, $SPPI, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY

PreMarket Trading Plan Mon Dec 11 $BLUE, $AKTX, $CELG, $ARGX, $AAOI, $SPPI, Bitcoin, Oil, Gold, Silver, $SPY, $VIX

Compound Trading Chat Room Stock Trading Plan and Watch List Monday Dec 11, 2017 $BLUE, $AKTX, $CELG, $ARGX, $AAOI, $SPPI – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Christmas at Compound Trading. We’re emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and Christmas FYI. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports. #premarket

Christmas at Compound Trading. We're emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and Christmas FYI. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports. #premarket https://t.co/1CNAfDsAeI

— Melonopoly (@curtmelonopoly) December 5, 2017

Most of the models are complete and out – the few remaining are in process and will be delivered soon. $SPY, $DXY, $VIX, Silver final edits are in process right now. All models including swing trading newsletters will have more refined buy sell triggers implemented between now and Jan 1 and also the $BTC blog post is currently in editing awaiting two important replies from exchange operators (we are giving them a bit of room to respond to us).

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Per recent; EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto was released Sept 1.

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. Looks like a master class will happen in Columbia Jan 2018 – will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

Part 2 of Episode 4 Podcast – Data Scientist

Part 2 – Episode 4 Podcast : Data Scientist Fireside, https://t.co/r85TlxJ9a4

— Melonopoly (@curtmelonopoly) October 23, 2017

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Fri Dec 8 Trade Set-ups $BTC, Crypto Scenarios, Gold, $WTI, OIL, Algorithms, $VRX, $SQ, $MYL …

Dec 7 Swing Trade Chart Set-Ups $OSIS, $SQ, $DPW, $FSLR, $FB, $TVIX, $XIV …

Dec 6 Swing Trading chart set-ups $ETSY, $FSLR, $VTGN, $APTN, $LMFA, $VRA …

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Swing Trade Set Ups Nov 17; Oil, $WTI, $JJC, Copper, Bitcoin, $BTC, $OSTK, $AMBA, $HMNY, $AAOI…

Swing Trade Set Ups Nov 15 $XIV, $SPY, $OSTK, $HMNY, GOLD, OIL, $SQ, $SORL, $WPRT….

BEST Trade Set-ups in a while! Nov 10 (starts 4:42): OIL, GOLD, $VIX, $VRX, $ROKU, $AAOI, $HTZ …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Definitely $BLUE, $CELG, $ATKX are on watch.

Per recent:

Crypto related still on watch. $OSTK, $MARA, $MGTI, $RIOT, $XNET, $BTCS and more.

$AAOI still on watch for the follow-through move after wash out in to gap. Oil watching for a possible large entry in $DWT again (oil short ETN). $SPPI still holding and looking for it to run out of it’s gap and go set-up.

Morning Momentum / Gap / News / PR / IPO Stocks on Watch:

$BLUE premarket up 24% trading 211.00 on new data.

Recent IPO’s :

Also watching: $FSLR, $VRX, $OSI

Market observation / on watch:

US Dollar $DXY flat at 93.90, Oil $USOIL $WTI 57.50 up in early morning trade, Gold / Silver up a tad – Gold intra day trading 1250.00, $SPY moderate / risk off and $BTCUSD $XBTUSD 16905.00 strong overnight post futures open and $VIX trading 10.00 and flat from Friday.

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck: $CASY $IRET $KMG $PPHM

upcoming #earnings releases with the highest #volatility

$ARWR $PIR $SCHL $PAY $NX $ABM $KMG $NDSN $JBL $CASY $ORCL $ADBE $SAFM $IRET $PPHM $COST

upcoming #earnings releases with the highest #volatility $ARWR $PIR $SCHL $PAY $NX $ABM $KMG $NDSN $JBL $CASY $ORCL $ADBE $SAFM $IRET $PPHM $COST https://t.co/G03AkxdbvH

— Melonopoly (@curtmelonopoly) December 10, 2017

Recent / Current Holds, Open and Closed Trades

Small loss on Friday in $SQ and hold small position in $NUGT and previous swings $AAOI and $SPPI. Flat oil trade overnight.

Per previous;

1/10 size Gold and $NUGT still long, yesterday nailed $VIX short at open SS $TVIX and $VIX inverse with $XIV – still hold 50% of $XIV swing position from yesterday and holds over time $AAOI and $SPPI.

In a 1/10 long Gold position under water on, 1/10 $NUGT, hit a morning momo trade yesterday in $FSLR and still holding $AAOI and $SPPI.

Closed my $DWT and CL trades from Friday on Monday when internet got back up for wins.

Wednesday $CMG trade went well for the win, $DWT (oil short) trade went well for the win, and the crypto exchange(s) crash caused some losses on some accounts but we did manage to get out on most accounts. We had a problem with five (more on this soon).

Closed oil short for nice win after adding 2/10. Close $AMMJ swing for small win. $XNET win yesterday was sweet technically. And Bitcoin we are absolutely killing it.

Chart Set-ups on Watch:

$CELG From Last Week Gap Fill Swing Trading Set-Up Notes on Chart https://www.tradingview.com/chart/CELG/IaPH3DRj-CELG-News-Gap-Fill-SwingTrade-Set-Up-from-last-wk-see-notes/ … Detailed algorithmic chart model for intra-day trade will be emailed to mailing list subs b4 premarket Mon – so get on our mailing list and it will be sent to you! https://compoundtrading.com/contact/[/url

$CELG From Last Week Gap Fill Swing Trading Set-Up Notes on Chart https://t.co/1ahQ9c5pAk Detailed algorithmic chart model for intra-day trade will be emailed to mailing list subs b4 premarket Mon – so get on our mailing list and it will be sent to you! https://t.co/OxDbJ1HNL4 pic.twitter.com/3tnCwUuxsV

— Melonopoly (@curtmelonopoly) December 10, 2017

$OSI I find the symmetry in this chart almost unbelievable. Mind boggling. #premarket https://www.tradingview.com/chart/OSIS/HIXKIxE6-OSI-I-find-the-symmetry-in-this-chart-almost-unbelievable-Mind/ …

$OSI I find the symmetry in this chart almost unbelievable. Mind boggling. #premarket https://t.co/V0QF3GKcV6 pic.twitter.com/W9XIzGHyGR

— Melonopoly (@curtmelonopoly) December 7, 2017

Market Outlook:

Moderate

Stocks making the biggest moves premarket: ADP, FIT, X, LKQ & more

Stocks making the biggest moves premarket: ADP, FIT, X, LKQ & more – https://t.co/xI3UdlJOAI

— Melonopoly (@curtmelonopoly) December 11, 2017

Market News and Social Bits From Around the Internet:

10am

Job Openings and Labor Turnover Survey (JOLTS)

11am

4-Week Bill Announcement

11:30am

6-Month Bill Auction

$BLUE premarket +23% bluebird bio Presents New Data from Clinical Studies of LentiGlobin™ Gene Therapy in Transfusion-… https://finance.yahoo.com/news/bluebird-bio-presents-data-clinical-213000666.html?soc_src=social-sh&soc_trk=tw … via @YahooFinance

$AKTX Premarket trading 5.79 up 18.2% Akari Therapeutics Announces Phase II COBALT trial of Coversin™ in Patients with PNH Met the Prim… https://finance.yahoo.com/news/akari-therapeutics-announces-phase-ii-210500724.html?soc_src=social-sh&soc_trk=tw … via @YahooFinance

$NTLA Intellia Therapeutics Reports Genome Editing Data From Sickle Cell Disease at ASH: ‘Approximately 80-95 percent editing was achieved in CD34+ cells’

$REGN – Regeneron Reports FDA Accepted sBLA Filing For 12-Week Dosing Of EYLEA Injection For Patients With Wet AMD

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ARGX, $BLUE, $AKTX $CHFS $CBIO $MYSZ $KDMN $SNSS $VSTM $CAPR $OSTK $RIOT $MARA $DPW $CSIQ $XNET $JUNO $CELG $LABU $TRVG $AKS $UGAZ $GILD

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $X Axiom Capital upgrades United States Steel from Sell to Hold. $GBT, $SNSS upgraded to Outperform, $ADP, $BLUE, $VSTM, $SEND

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $BLUE, $AKTX, $CELG, $ARGX, $AAOI, $SPPI, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY

PreMarket Trading Plan Thurs Nov 30 $VKTX, $GILD, $BLUE, $VRX, $AAOI, $SPPI, Bitcoin, Oil, Gold, Silver, $SPY, $VIX

Compound Trading Chat Room Stock Trading Plan and Watch List Thursday November 30, 2017 $VKTX, $GILD, $BLUE, $VRX, $AAOI, $SPPI – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Good morning all – I am on conference today re: crypto exchanges – so I will be in live trading room(s) by text but will not be live on mic broadcast at any point. Have a great day TTYL!

And yes, the model updates are rolling out as of now and all will be completely out today. A small delay with crypto exhange crashes.

Good morning all – I am on conference today re: crypto exchanges – so I will be in live trading room(s) by text but will not be live on mic broadcast at any point. Have a great day TTYL!

— Melonopoly (@curtmelonopoly) November 30, 2017

Rules based trading should never resemble gambling (on balance of probabilities a trader should have an edge w proper sizing etc). What occurred yesterday on many crypto exchanges is opposite of rules based winning discipline. Will write a blog post this weekend. #crypto $BTC

Rules based trading should never resemble gambling (on balance of probabilities a trader should have an edge w proper sizing etc). What occurred yesterday on many crypto exchanges is opposite of rules based winning discipline. Will write a blog post this weekend. #crypto $BTC

— Melonopoly (@curtmelonopoly) November 30, 2017

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Per recent; EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto was released Sept 1.

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. Looks like a master class will happen in Columbia Jan 2018 – will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

Part 2 of Episode 4 Podcast – Data Scientist

Part 2 – Episode 4 Podcast : Data Scientist Fireside, https://t.co/r85TlxJ9a4

— Melonopoly (@curtmelonopoly) October 23, 2017

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Swing Trade Set Ups Nov 17; Oil, $WTI, $JJC, Copper, Bitcoin, $BTC, $OSTK, $AMBA, $HMNY, $AAOI…

Swing Trade Set Ups Nov 15 $XIV, $SPY, $OSTK, $HMNY, GOLD, OIL, $SQ, $SORL, $WPRT….

BEST Trade Set-ups in a while! Nov 10 (starts 4:42): OIL, GOLD, $VIX, $VRX, $ROKU, $AAOI, $HTZ …

Wed Nov 8 Trade Set-Ups Review: $SPI, $BTC, $VRX, $AAOI, $KBSF, $LEU, $ONCS, $DEPO, $SNAP…

Nov 7 Trade Set-Ups Review: $DVN, $GOOGL, $TSLA, $HMNY, $VRX, $AAOI, $MYO, $TOPS, $BTC…

Nov 6 Trade Set-Ups Review: GOLD, $GLD, $HMNY, $RCL, $BTC, $WTI, $USOIL, $FB, $TOPS, $SPPI, $BAS…

Nov 2 Trade Set-Ups Review: $TSLA, $USOIL, $GPRO, $DRNA, $GSIT, $W …

Nov 1 Trade Set-Ups Review: $MDXG, $OSTK, OIL, $WTI, $AMBA, $TRIL, $AAOI, $UAA, $LBIX, $DWT…

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

$VKTX, $GILD, $BLUE all have upgrades that should give reason to a run.

Crypto related still on watch. $OSTK, $MARA, $MGTI, $RIOT, $XNET, $BTCS and more.

$AAOI still on watch for the follow-through move after wash out in to gap. Oil watching for a possible large entry in $DWT again (oil short ETN). $SPPI still holding and looking for it to run out of it’s gap and go set-up. $VRX I hold a very small position and watching for daytrading set-ups.

$TAN and $CLDX interest me and $TWLO and $VRX are on my watch.

Morning Momentum / Gap / News / PR / IPO Stocks on Watch:

Recent IPO’s :

Also watching: From previous $FEYE and $AMD $MXIM, $DIS, $HIIQ, $CELG, $ROKU, $HTZ

Market observation / on watch:

US Dollar $DXY flat at 93.14 from yesterday 93.18. Oil $USOIL $WTI 57.87 and under important support still, Gold / Silver moderate – Gold intra day is trading at 1280.90. $SPY is moderate / risk – off, $BTCUSD $XBTUSD 9806.00 after all time highs yesterday and significant wiplash and $VIX trading at 10.5 up slightly from 10.1 yesterday.

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck: $ALTR $AMBA$ FIVE $NTNX $ULTA $UTI $VMW $ZUMZ

Recent / Current Holds, Open and Closed Trades

Wednesday $CMG trade went well for the win, $DWT (oil short) trade went well for the win, and the crypto exchange(s) crash caused some losses on some accounts but we did manage to get out on most accounts. We had a problem with five (more on this soon).

Per previous;

Closed oil short for nice win after adding 2/10. Close $AMMJ swing for small win. $XNET win yesterday was sweet technically. And Bitcoin we are absolutely killing it.

Another great run in Bitcoin trading?? $BTC #Bitcoin $XBTUSD #Crypto

That worked out well. At 7pm (arrow) I hit buy every time a tick would flash red . Worked out. $BTC #Bitcoin $XBTUSD 10,000!

Oil trade went well. Just follow the chart. @EPICtheAlgo $WTI $USOIL $USO $UWT $DWT #Oil #OOTT #Premarket

Market open win long $XNET when shorties over stayed their welcome. Beat em with technical know how. Video on deck that explains in detail as it played out live.

Opened 1/10 oil short this morning in premarket – likely hit $DWT hard soon, long Bitcoin yesterday through to bottom and released all but 30% or so on most accounts near recent highs, still in small $VRX, small $SPPI, and $AAOI looking for the run north in to the gap.

Closed $AMBA, $VRX, $LCADF for nice gains. Had a small loss on oil short last week $DWT. Traded Bitcoin all weekend for significant gains in the accounts.

Holding $AMBA 50%, $SPPI, $AAOI

Copy from above: I closed $HMNY for a profit and will continue to watch for a run. Bitcoin testing ATH and we’re looking at 87’s possible – bought on dips again last night and releasing bits up here. $AAOI still on watch for the follow-through move after wash out in to gap. $AMBA I closed half yesterday for profit. Oil watching for a possible large entry in $DWT soon (oil short ETN) – old my $UWT for a profit yesterday. . $SPPI had a decent day yesterday and still holding.

Also got killed on a short and long flip in $XNET yesterday.

Some nice swing trades on the go with $BTC Bitcoin deep dip buy entries last night, $HMNY bought last week, $UWT #oil bought at low yesterday $AMBA bought last week. #premarket

Chart Set-ups on Watch:

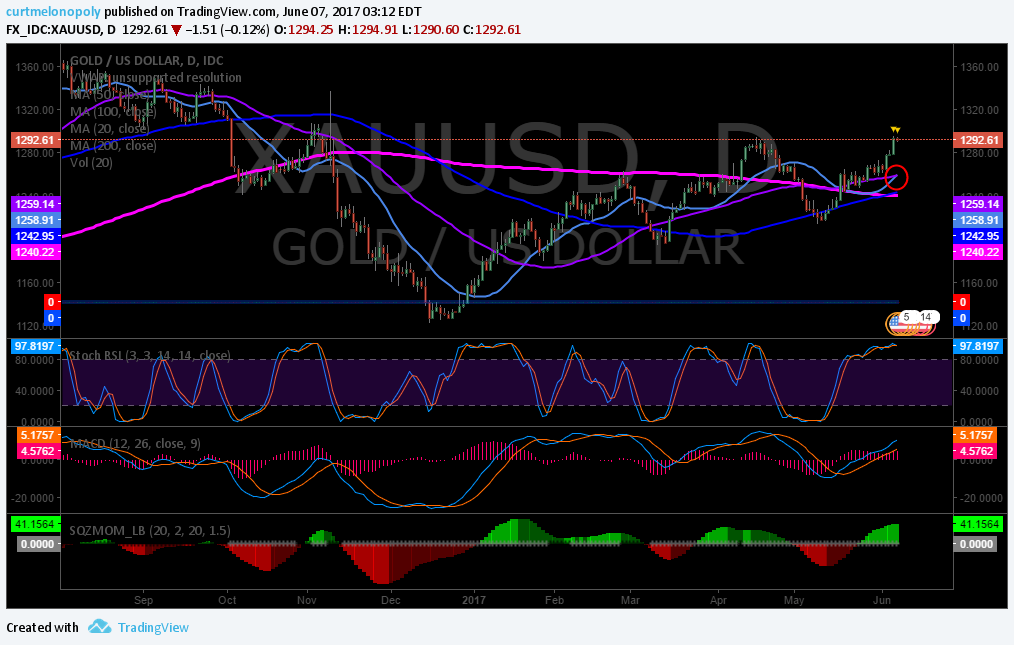

Gold chart has cracks. Premarket trading plan includes Gold on watch. $GLD $GOLD $DUST $NUGT

Per previous;

New are $FEYE and $AMD.

$FEYE watching for over 14.76 over 200 MA with MACD turn up for gap fill and beyond long.

$AMD Swing trade buy sell triggers – be sure MACD is turned up with SQZMOM Stoch RSI trending up at entry.

Adding $TAN, $ABX and $CLDX to my chart watchlist for those set-ups.

As above, starting to look at cyber crime stocks – $VEEV etc – obvious catalyst with Bitcoin and also with $OSTK. Looks like $TSLA may sell off more so looking at it close for a long if it really washes out.

Gold algorithm dialed in tight now and keeps hitting targets. Hit Sunday Nov 19 18:00 target perfect to the second and cent. @ROSIEtheAlgo #Gold $XAUUSD $GC_F $GLD $NUGT $DUST #Algorithm

See other mid day charting trade set-up reviews on You Tube. The set-ups are key to success if you’re swing trading (even daytrading).

We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day. Many of the mid day reviews are published “private” for members only so be sure to watch your email inbox for these among other member only videos.

Market Outlook:

$SPY S&P 500 On Hold Long Signal – risk off.

https://twitter.com/ThinkTankCharts/status/936182981248606209

Market News and Social Bits From Around the Internet:

Stocks making the biggest moves premarket: SHLD, CMG, MIK, GPS, NOK & more http://cnb.cx/2Ar24vh

Stocks making the biggest moves premarket: SHLD, CMG, MIK, GPS, NOK & more https://t.co/Y6FaeE0vND pic.twitter.com/biKDLn2JLw

— The Exchange (@CNBCTheExchange) November 30, 2017

8:30am

Initial Jobless Claims

8:30am

Personal Income and Outlays

8:30am

Fed’s Mester speech

9:45am

Chicago PMI

9:45am

Consumer Comfort Index

10:30am

NatGas Inventory

$GILD upgraded to buy at Maxim with $94 P

$BLUE PT raised to $200 from $170 at Maxim

Viking Therapeutics given $6.00 PT by Roth Capital. buy rating. http://ift.tt/2k9liin $VKTX #VKTX

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $DGAZ $CTL $JCP $CS $RYB $QD $ASML $MU $UWT $BT $SQ $TEVA $AMAT $SVXY $STM $NVDA $BCS $XIV $BABA $PYPL $TNA

(2) Pre-market Decliners Watch-List : $SMTC $JACK $WDAY $MARA $RIOT $XNET $BOX $JNPR $MYO $SGH $DPW $CAPR $LB $PZRX $RYAAY $AZN $GLD

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $WAIR $HCA $TPIC $MDCO $AEM $GG $BSX $CNI $MLNT $GILD $TV

(6) Recent Downgrades: $ABX $GPS $RCL $DSGX $STBZ $CATY $XRAY $NCLH $PFS $FFIC $ISBC

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $VKTX, $GILD, $BLUE, $VRX, $AAOI, $SPPI, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY

PreMarket Trading Plan Mon Oct 9 $SWCH, $SHOP, $VERI, $ROKU, $BLUE, $BABA, $JUNO, Gold, Oil, $WTI, Bitcoin, $XTBUSD, $BTC

Compound Trading Chat Room Stock Trading Plan and Watch List Monday Oct 9, 2017 $BLUE, $JUNO, $BABA, $SWCH, $SHOP, $VERI, $ROKU Gold, Oil, $WTI, $XTBUSD – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund which will bring some slight changes.

The financing or our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:

EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto was released Sept 1.

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. Looks like a master class will happen in Columbia Jan 2018 – will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent lead trader blog / video / social posts:

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Sept 19 Trade Set Ups $ARRY, $AAOI, $HMNY, $VERI, $SPY, $EPZM, $XBTUSD, $BTC https://www.youtube.com/watch?v=ZvtMmsETa70&t=3913s … #trading #premarket #rulesbasedtrading

Sept 19 Trade Set Ups $ARRY, $AAOI, $HMNY, $VERI, $SPY, $EPZM, $XBTUSD, $BTC https://t.co/QOfRSxeFzP #trading #premarket #rulesbasedtrading

— Melonopoly (@curtmelonopoly) September 21, 2017

Sept 15 Trade Set-Ups $PI, $SNAP, $ARRY, $VERI, $TTOO, $MRTX, $HMNY…

Sept 14 Trade Set-ups Review $NATGAS, $HTZ, $FENG, $WTI, $JKS, $VERI…

Sept 12 Trade Set-ups Review $CVS, $PI, $XXII, $TTOO, $ARWR, $HCN, $SHOP, $ABEO …

Unlisted

Sept 6 Trade Setup Review $ATHX, $GIII, $LFVN, $NDLS, $ZKIN, $SPY, $VIX, $USOIL, $WTI and more…

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Morning Momentum / Gap / News / PR Stocks on Watch:

$SWCH IPO, $SHOP wash out bounce, $VERI wash-out bounce and $ROKU for break out after wash out.

Market observation / on watch:

US Dollar $DXY flat overnight but in uptrend turn perhaps. Oil $USOIL $WTI continues under pressure – I alerted EPIC members at recent high that I was short bias going fwd a number of days, Gold / Silver are moderately up in overnight session (I continue to warn that Gold especially is vulnerable), $SPY continues moderately in bull form, $BTCUSD $XBTUSD has been making a trend turn after recent consolidation after its run up post Jamie Dimon – we have been hitting every turn lately with the team and our returns have been outstanding, and $VIX under continued pressure at 10.0 at five year low volatility (I have been saying since before the election – this time could be different).

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

Recent / Current Holds, Open and Closed Trades:

$ROKU I closed near the top Friday for decent gains on that swing and hold $AAOI and $SNAP yet. I am also ina $XBTUSD (Bitcoin) swing from weekend trade.

Previous recent notes:

My $ROKU play looks very strong in premarket – I have been warning shorts publicly and in room very specifically told members a number of times Friday could be very active to upside. I continue to hold $AAOI and it may be a loser that I will cut if it fails 200 MA on daily.

Yesterday I closed $ATEC flatish after scalping a win previous day and $VERI I closed at a loss. Still holding $SNAP, $AAOI and tiny $OMVS position.

First quarter was easy set-up trading, second quarter got a tad tighter and by third quarter many if not most charts were extended and now the rotation is like wack a mole so I am consolidating a master list of the best most predictable structurally sound charts and will just trade them until market sorts itself.

Recently closed off $ARRY decent and entered $ATEC and $VERI yesterday. Still holding $SNAP, $AAOI, and a tiny $OMVS position.

A tad concerned about $AAOI as Applied Optoelectronics $AAOI Stock Rose, Cardinal Capital Management Lowered Its Stake by $2.73 Million …

Yesterday was good. Re entered $ARRY and it looks good. Added to $AAOI and took some off later in day for a profit. Lots of plays in and out of now – market is in much better shape.

I trimmed some positions yesterday and added some ($CUR, $ARRY, $VERI, $AAOI) and I’m active in Bitcoin $XBTUSD right now and looking at oil bias short and Gold trading soon (and miners). Review video when posted for details.

Last week on the Bitcoin dump we entered the Bitcoin fray with a buy of Bitcoin, since then on Monday I entered $XBTUSD (am looking for a move up and adds over time – it has an area of resistance to work through – but the MACD on the daily may be about to turn up here and that would be big – $GBTC on OTC play I am considering with China scenario) and trimmed some $ARRY. Still holding $ARRY and $SNAP and have some very small other positions.

Friday was an excellent trading day. Accounts all up on the day about 5%.

Review on $WTI, $SNAP, $ARRY and $TVIX trade in Mon and Tues mid day videos. Last night I took a quick oil scalp small and got a paper cut in a Gold short.

Friday I went long $ARRY $SNAP and hedged with $TVIX (which is getting hammered premarket). Also in Oil in overnight trade with the smaller position accts flat at time of post and large account positions a tad underwater on it. But the chart is on my side (risk – reward).

Closed that $AMBA trade for a small loss and the most recent oil trade from last report for a win.

Thursday no trades other than closing $MSFT overnight for small profit.

Yesterday was choppy and I nailed an oil scalp in overnight trading. In $MSFT yesterday on daytrade and swing side, in $CUR on daytrade side still and holding $UUP on swing trading side still.

Yesterday I had wins intra in $XIV and shorting $TVIX. also had an overnight hold in $CUR that is yet to be determined.

$XIV, $ARWR, $PETS wins on Thursday. On Wednesday oil $WTI big win and $PETS and $AMD on daytrade small account build yesterday.

Yesterday I closed $UWT daytrade for small win, large oil trade for win, small Gold trade for win and small loss in $TVIX. Recently $XIV I closed in premarket for small gain, still holding some position from previous, $UGLD (closed in premarket July 31 small gain), $FEYE (closed for nice gain), $SRG (closed for nice gain), $NFLX (closed for huge gain), $IPXL (closed for gain), $AKCA (closed nice gain), $MCRB (closed small gain), $WMT (closed excellent gains), $UUP (closed small loss), $BWA (closed tiny loss), Holding: $XIV and new entry $AMMJ. All other holds are small size (less than 4% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (all not including select swing trading or algorithm charting trades).

Recent Chart Set-ups on Watch:

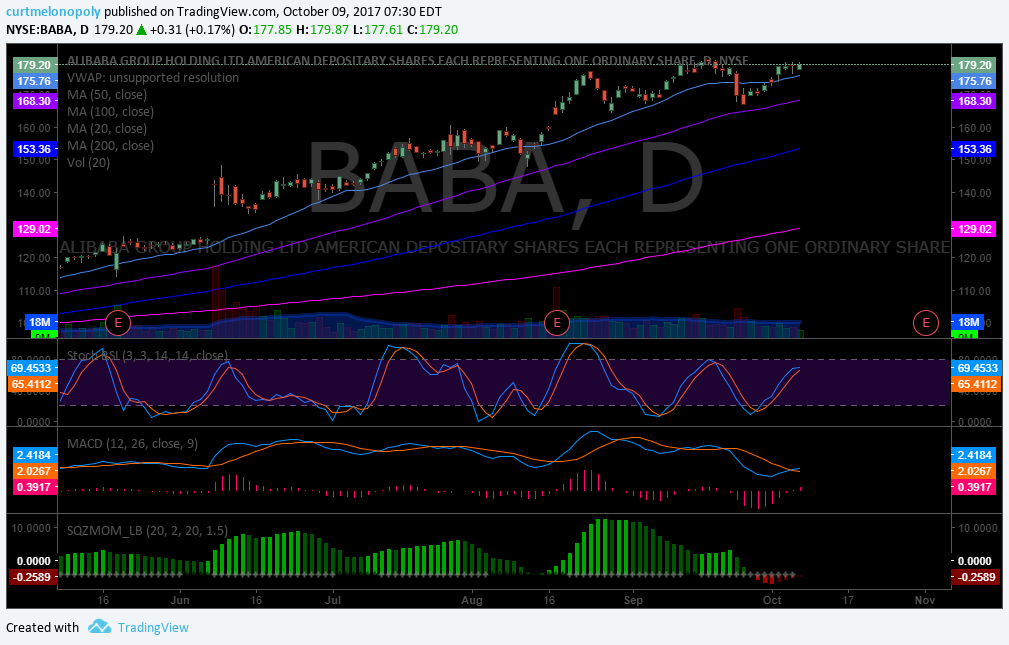

I am adding $BABA to my short term watch… it looks like a break of recent 52 week highs is a new leg at minimum. Bitcoin could also see a mjor break-out if it breaches considerable resistance not far overhead.

Per recent; Adding $BBRY to list on ER and 200 MA trending. $GBTC, $AAOI, $FIT, $FSLR, $JKS, $FEYE $LACDF, $CTSH, $NVO, $TSLA, and $AAMJ. $NLNK and $PI are recent chart set ups – $GPRO for possible break out on chart and recent new includes $SNAP and $ARRY – $ARWR, $CDNA, $XXII, $SHOP (wash-out), $SENS, $HCN, $GTHX, $EDIT, $IPI, $XOMO, $MBRX, $PDLI, $LPSN and more that can be reviewed on You Tube videos or on weekly Swing Trading reports.

See other mid day charting trade set-up reviews on You Tube. The set-ups are key to success if you’re swing trading (even daytrading).

We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day. Many of the mid day reviews are published “private” for members only so be sure to watch your email inbox for these among other member only videos.

Market Outlook:

Bullish.

Market News and Social Bits From Around the Internet:

$JUNO PT raised to $56 from $34 at Maxim. I told members early 2017 when wash-out happened this would be the target area (near term fair value price target I quoted).

$BLUE PT raised to $170 from $100.

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $CLNT, $MBOT, $INTT $CDNA $CGEN $BVXV $MNKD $FLXN $VERI $MZOR $CLSN $BLDP $JNUG $NUGT $USLV $RAD $PLUG

(2) Pre-market Decliners Watch-List : $SWCH $XXII $LINU $PTCT $RGSE $CONN $TUR $GE $TSLA $QGEN $WYNN $MDT

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $BTI $MULE $IBKC $INCR $ETFC $VRTS $STI $MS $DIS $SBGL $JNJ $KSS

(6) Recent Downgrades: $VIAB $MLNX $BT $HUM $DVA $PTCT $CCOI $AMTD $BOFI $GS $GFI $SLG $ESRX $KNSL $CONN $TTWO $SYMC $ATVI $SYNA $DO $ZEN $YELP $MDT

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $BLUE, $JUNO, $SWCH, $SHOP, $VERI, $ROKU, Gold, Oil, $WTI, Bitcoin, $XTBUSD, $BTC, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY

Post-Market Tues June 6 $MXIM, $CTIC, $NIHD, $EGLT, $JASO, $EBIO, $GLD, $WTIC, $ACLS, $BLUE, $LTBR

Compound Trading Tuesday June 6, 2017 Review of Chat Room Day Trading, Swing Trading, Algorithm Charting, Videos and Live Alerts. $MXIM, $CTIC, $NIHD, $EGLT, $JASO, $EBIO, $GLD, $WTIC, $ACLS, $BLUE, $LTBR – $LIGA, $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Wed 10:00 #EIA Report Oil Trade Charting Review hosted by Epic Oil Algo. Public Welcome $USOIL $WTI $CL_F #OIL #OOTT

https://twitter.com/EPICtheAlgo/status/872131872742158336

24 hour oil room open is moved up to June 12, 2017.

https://twitter.com/EPICtheAlgo/status/871780515719901187

Don’t Miss This! Compound Trading Webinar Schedule: Day Trading, Swing Trading. Oil, Gold, Silver, SPY, VIX, USD, Equities…

https://twitter.com/CompoundTrading/status/866406995775148033

Most Recent in Freedom Trader Series: (On deck: How to Develop Your Trading Plan)

Trading Set-ups. Video Explains Predictable Winning Process. Part 6 b) “Freedom Traders” Series.

Last market trading session Post Market Stock Trading Results can be found here:

Stock Trading Results Mon June 5 $LOXO, $EVI, $CLSN, $VHC, $NAKD, $AMZN, $NFLX, $GLD,… https://compoundtrading.com/stock-trading-results-mon-june-5-loxo-evi-clsn-vhc-nakd-amzn-nflx-gld-wtic-spy/ …

https://twitter.com/CompoundTrading/status/872053957958541312

Most recent Premarket Trading Plan Watch-list can be found here (locked to respect members and unlocked to public about a week later for transparency): We are many posts behind on post market trading results – we’ve been working overtime to get oil trading room launched early and the post market reports took a backseat – now that we’re ready we’ll have them all caught up soon.

Protected: PreMarket Trading Plan Tues June 6 $NIHD, $GLD, GOLD, $USOIL, $WTIC, $BLUE, $THC, $JASO

https://twitter.com/CompoundTrading/status/872068276863553537

Been behind on these last two weeks cause we're busy getting 24 hr oil room ready – we're ready so we'll get trading results caught up soon.

— Melonopoly (@curtmelonopoly) June 6, 2017

Premarket Session:

#Premarket Chart and Trade Setup Review: $USOIL $WTI #GOLD $NIHD $EGLT $JASO $EBIO: http://youtu.be/ZE5AnEjE390?a via @YouTube

https://twitter.com/CompoundTrading/status/872081148222091265

$BLUE, $THC both have upgrades this morning and we reviewed them in mid day review yesterday (unless it was in general chat lol)

$BLUE, $THC both have upgrades this morning and we reviewed them in mid day review yesterday (unless it was in general chat lol)

— Melonopoly (@curtmelonopoly) June 6, 2017

$NIHD Premarket up 55% on partnership news.

$NIHD Premarket up 55% on partnership news. pic.twitter.com/x55GeCQnqZ

— Melonopoly (@curtmelonopoly) June 6, 2017

Been on my chart watchlist for a few weeks…. JA Solar gets $6.80/share takeover bid https://seekingalpha.com/news/3271788-ja-solar-gets-6_80-share-takeover-bid?source=feed_f … … #premarket $JASO

Been on my chart watchlist for a few weeks…. JA Solar gets $6.80/share takeover bid https://t.co/PalRI5ZYNu … #premarket $JASO

— Melonopoly (@curtmelonopoly) June 6, 2017

Market Day, Chat Room Trades and Personal Trades:

$MXIM, $CTIC, $NIHD, $EGLT, $JASO, $EBIO, $GLD, $WTIC, $ACLS, $BLUE, $LTBR

$MXIM I closed my swing trade for a gain, $CL $WTI I had some decent daytrading (see algo section below) and I got a bit of a snipe in $CTIC. The others listed all have a story in the room also:)

2017-06-06 8:13 Curt M_1 $CTIC 5000 filled 3.264 Long 1000 3.12 test $CTIC 2017-06-06 8:25 Curt M_1 Out 3.327 6000 avg

2017-06-06 13:54 Curt M_1 Closed $MXIM swing trade 48.50

Learning How-to Trade Stocks, Chart Set-Ups, Lessons and Educational:

Midday Chart and #SwingTrading Setup Review: $USOIL $WTI $GOLD $ACLS $BLUE $LTBR: http://youtu.be/2xeko-B4H5o?a via @YouTube

https://twitter.com/CompoundTrading/status/872162334105636864

$ACLS Text book trade setup example https://www.tradingview.com/chart/ACLS/Un2DsJIW-ACLS-text-book-trade-set-up-example/ … @reedshermanator brought to the room thanks!

$ACLS Text book trade setup example https://t.co/Z3EhDhEQDE @reedshermanator brought to the room thanks!

— Melonopoly (@curtmelonopoly) June 6, 2017

If there’s anything I can do to help with your trading drop me a line on contact page or DM https://compoundtrading.com/contact/ #howto #trade #stocks

If there's anything I can do to help with your trading drop me a line on contact page or DM https://t.co/1CNAfDsAeI #howto #trade #stocks

— Melonopoly (@curtmelonopoly) May 8, 2017

Stocks, ETN’s, ETF’s I am holding:

Been holding these small bags wayyyy tooo long. I am holding (in order of sizing – all moderately small size – under 5% of my daytrading acounts) – $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| VTL | 3.30 | 28.16% | 490267 | Top Gainers | |

| FENX | 1.81 | 20.67% | 274648 | Top Gainers | |

| ZN | 1.79 | 17.76% | 906494 | Top Gainers | |

| EGLT | 2.75 | 17.02% | 8607470 | Top Gainers | |

| GIII | 22.92 | 15.23% | 11616600 | Top Gainers | |

| DNR | 1.65 | 13.79% | 6480179 | Top Gainers | |

| AMRS | 3.60 | 1536.36% | 1291104 | New High | |

| CAMT | 7.67 | 7.12% | 2775937 | New High | |

| LITE | 62.85 | 8.74% | 4147417 | New High | |

| MDSO | 78.11 | 6.61% | 1323058 | New High | |

| COO | 241.62 | 0.30% | 333530 | Overbought | |

| CAMT | 7.67 | 7.12% | 2775937 | Overbought | |

| EMIH | 24.95 | -0.10% | 290707 | Unusual Volume | |

| COVS | 2.45 | 11.36% | 8878789 | Unusual Volume | |

| PNTR | 11.65 | 4.02% | 456090 | Unusual Volume | |

| OHGI | 1.15 | 69.12% | 3244704 | Unusual Volume | |

| BEL | 13.35 | 5.12% | 471514 | Upgrades | |

| ASFI | 6.60 | -2.22% | 2107 | Earnings Before | |

| RILY | 14.70 | 1.38% | 52593 | Insider Buying |

Algorithm Charting News (Artificial Intelligence, Intelligent Assistants, Big Data and More):

NOTICE: Next Generation of my Algorithm to be released prior to June 15. $GC_F $XAUUSD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG #Gold

NOTICE: Next Generation of my Algorithm to be released prior to June 15. $GC_F $XAUUSD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG #Gold

— Rosie the Gold Algo (@ROSIEtheAlgo) June 7, 2017

#CL trading with @EPICtheAlgo Long 47.25 add 47.17 closed 47.81. $USOIL $WTIC $CL_F $USO $UWT $DWT #OIL #OOTT #trading #algorithms

#CL trading with @EPICtheAlgo Long 47.25 add 47.17 closed 47.81. $USOIL $WTIC $CL_F $USO $UWT $DWT #OIL #OOTT #trading #algorithms pic.twitter.com/uTnnBNbnSS

— Melonopoly (@curtmelonopoly) June 7, 2017

Oil through target at exact penny and second for 430 Tues. EPIC Oil Algorithm Chart FX $USOIL $WTI #OIL $USO $UWT $DWT $CL_F #OOTT #Algo

https://twitter.com/EPICtheAlgo/status/872212699526045696

Member Notice: 24 hr real time oil trade alerts now set up for my members. Follow @oilalerts_ct $CL_F $USOIL $WTI $USO #OIL #OOTT

https://twitter.com/EPICtheAlgo/status/869753868619350016

Friday 100 ET algo target hit. EPIC Oil Algorithm Chart FX $USOIL $WTI #OIL $USO $UWT $DWT $CL_F #OOTT #Algorithm

Friday 100 ET algo target hit. EPIC Oil Algorithm Chart FX $USOIL $WTI #OIL $USO $UWT $DWT $CL_F #OOTT #Algorithm pic.twitter.com/aQoxN23EuF

— Melonopoly (@curtmelonopoly) June 2, 2017

S&P 500 $SPY Algorithm chart targets from today hit. $ES_F $SPXL, $SPXS @FREEDOMtheAlgo

S&P 500 $SPY Algorithm chart targets from today hit. $ES_F $SPXL, $SPXS @FREEDOMtheAlgo pic.twitter.com/si0h8D7aUx

— Melonopoly (@curtmelonopoly) June 1, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News / Chart Set-ups:

$CTHS Closing position in premarket 67.30 area from 61.78 entry. #swingtrading

$CTHS Closing position in premarket 67.30 area from 61.78 entry. #swingtrading https://t.co/nvbTe12Df3

— Swing Trading (@swingtrading_ct) June 5, 2017

$MXIM This swing trade going better now – took some pain in beginning on my break-out #powertrade thesis. #swingtrading

$MXIM This swing trade going better now – took some pain in beginning on my break-out #powertrade thesis. #swingtrading pic.twitter.com/yXWHvS7bq6

— Melonopoly (@curtmelonopoly) May 31, 2017

Closing $ATHM swing t42.11 range premarket from 40.22 entry. Under 5% not the best on that one but it works – quick. #breakout #swingtrade

Closing $ATHM swing t42.11 range premarket from 40.22 entry. Under 5% not the best on that one but it works – quick. #breakout #swingtrade pic.twitter.com/6FUEIZFfD0

— Melonopoly (@curtmelonopoly) May 31, 2017

$NFLX swing trade going well. Trading 163.20 premarket from 148.40 entry. #swingtrading

$NFLX swing trade going well. Trading 163.20 premarket from 148.40 entry. #swingtrading pic.twitter.com/k9RSfrLHZA

— Melonopoly (@curtmelonopoly) May 31, 2017

$AMZN Trading 997.11 premarket from 822.74 entry #swingtrading

$AMZN Trading 997.11 premarket from 822.74 entry #swingtrading pic.twitter.com/xX907Drzay

— Melonopoly (@curtmelonopoly) June 1, 2017

Most recent swing trading platform publications:

Protected: Weekly Swing Trading Stocks Tues June 6 $Gold, $MXIM, $BWA, $ATHM, $LIT, $BABA, $NFLX, $TAN, $BA, $WYNN #swingtrading #premarket

Protected: Weekly Swing Trading Stocks Tues June 6 $Gold, $MXIM, $BWA, $ATHM, $LIT, $BABA, $NFLX, $TAN, $BA, $WYNN #swingtrading #premarket https://t.co/BcuBKxkyja

— Swing Trading (@swingtrading_ct) June 6, 2017