Tag: Crypto

PreMarket Trading Plan Thurs July 26: Earnings, $FB, $AGN, OIL, $WTI, GOLD, Crypto, $BTC , US Dollar, $DXY more.

Compound Trading Premarket Trading Plan & Watch List Thursday July 26, 2018.

In this edition: Earnings, $FB, $AGN, OIL, $WTI, GOLD, Crypto, $BTC , US Dollar, $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

July 24 Member Memo: Trade Coaching Boot Camp Prep, Machine Trading, Next Gen Models, Trade Alerts, Reporting, Swing Trading Earnings

Scheduled Events:

- Thursday July 26 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- Any questions send me an email [email protected]

- July 25-27 – Weekly newsletter reporting and invoicing distributed to members (delayed this week due to next gen algorithms being integrated in to our trading platforms).

- July 23-July 31 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a complimentary version without algorithmic charting).

- End of July – Next generation algorithm models roll out in to August 14, 2018 (machine trading Gen 1).

- End of July – New pricing structure published representing next generation algorithm models (existing members no change).

- End of July – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: selloff Protected: Trading Facebook (FB) Earnings Wash-out on Revenue Growth Warning (Member Edition) $FB #trading

Password: AR, Protected: Swing Trading Report (Members): Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Password: WOW, Protected: Swing Trading Report (Members): Earnings Season Charting July 24 $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Unlisted Private Member Video – Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Unlisted Private Member Video – Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Unlisted Private Member Video – Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: CMCSA, LUV, FB, QCOM & more –

Stocks making the biggest moves premarket: CMCSA, LUV, FB, QCOM & more – https://t.co/Txh5AkjgVD

— Melonopoly (@curtmelonopoly) July 26, 2018

Market Observation:

Markets as of 8:14 AM: US Dollar $DXY trading 94.23, Oil FX $USOIL ($WTI) trading 689.23, Gold $GLD trading 1228.14, Silver $SLV trading 15.52, $SPY 283.34, Bitcoin $BTC.X $BTCUSD $XBTUSD 8210.00 and $VIX trading 12.3.

Momentum Stocks to Watch: $SVU $BPI $ARNC $XLNX

News:

$AGN Allergan’s stock set to rally after earnings beat and raise, new stock repurchase program

https://twitter.com/CompoundTrading/status/1022447396003958786

$DPW DPW Holdings’ Enertec Systems awarded $4.3M contract

Recent SEC Filings:

Insider Buys Of The Week: BlackRock, Dish Network, Walgreens https://benzinga.com/z/12054592 $BLK $DISH $WBA

Recent IPO’s:

IPOs expected to price/trade today*:

– Aurora Mobile $JG

– Berry Petroleum $BRY

– Cango $CANG

– Focus Financial Partners $FOCS

– Liquidia Technologies $LQDA

– Pinduoduo $PDD

– Tenable Holdings $TENB

Your Thursday morning Wake Up Call:

IPOs expected to price/trade today*:

– Aurora Mobile $JG

– Berry Petroleum $BRY

– Cango $CANG

– Focus Financial Partners $FOCS

– Liquidia Technologies $LQDA

– Pinduoduo $PDD

– Tenable Holdings $TENB*subject to change

— Benzinga (@Benzinga) July 26, 2018

Biotech Allakos prices IPO at $18, above price range

$RUBY 10.3M shares at $23 and $CRNX 6m shares at $17

$CRNX Crinetics Pharmaceuticals prices IPO at $17 a share

The IPO Outlook For The Week: Tech & International Exposure https://benzinga.com/z/12052697 $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA

The IPO Outlook For The Week: Tech & International Exposure https://t.co/A0rfpmunIn $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA https://t.co/Hrc0OwWq24

— Melonopoly (@curtmelonopoly) July 22, 2018

Earnings:

Mastercard stock falls after company reports in-line revenue, earnings beat

McDonald’s earnings and sales beat estimates

Bristol-Myers shares lift on Q2 profit, revenue beats

Xerox misses profit expectations but beats on revenue, sets $1 billion buyback plan

Raytheon shares rise after Q2 profit, revenue beats

StockTwits Earnings to Watch

Tue – $T $VZ $LMT $JBLU $BIIB $IRBT $MMM $LLY $TXN

Wed – $FB $AMD $F $GILD $PYPL $V $BA $HM $KO $ABX

Thu – $AMZN $INTC $SBUX $CMG $FSRL $SPOT $MCD

Fri – $TWTR $XOM $ABBV $CVX

Via @StockTwits

#earnings for the week

$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX

#earnings for the week$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX https://t.co/r57QUKKDXL https://t.co/rFjdIyBH0d

— Melonopoly (@curtmelonopoly) July 22, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

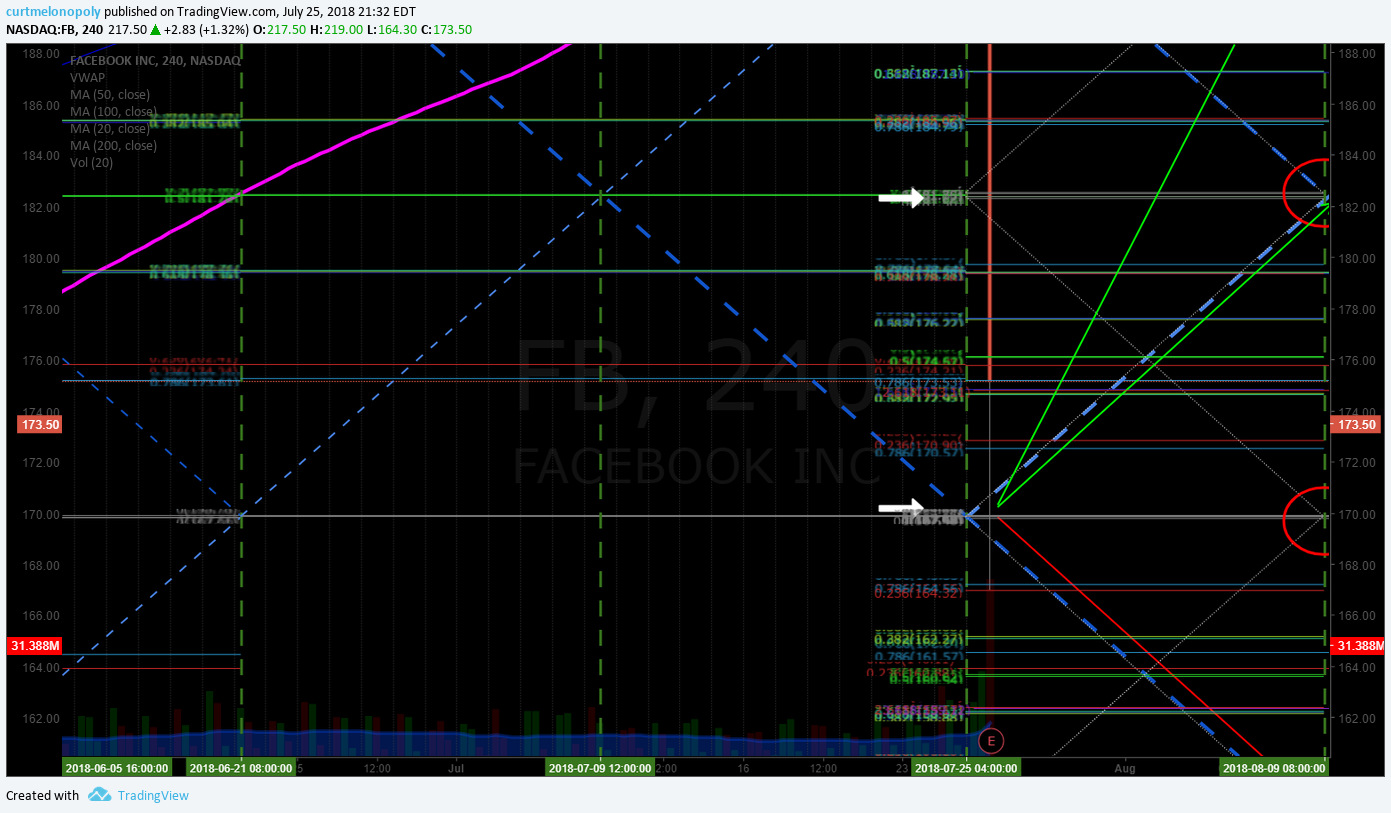

FACEBOOK (FB) Trading Facebook wash-out on earnings. Trading levels for daytrading and swingtrading. $FB #daytrade #swingtrade #chart

Scalp to start the day. EPIC the Oil Algorithm $USOIL $WTI $USO #Oil #trading

Scalp to start the day. EPIC the Oil Algorithm $USOIL $WTI $USO #Oil #trading pic.twitter.com/4foUVxkv3z

— Melonopoly (@curtmelonopoly) July 26, 2018

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo pic.twitter.com/pKL1iKE5T1

— Melonopoly (@curtmelonopoly) July 25, 2018

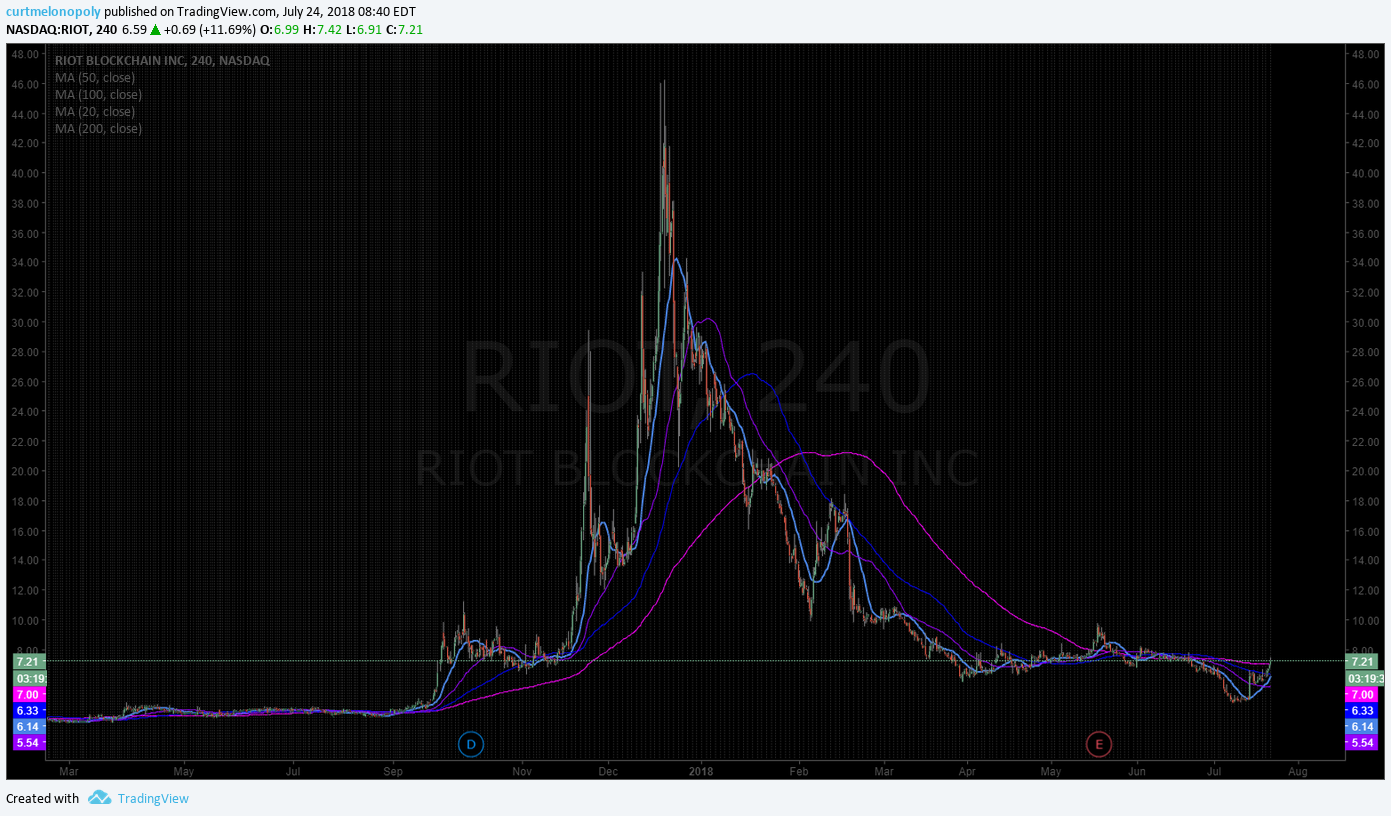

The $RIOT daytrade from yesterday went well: 7.30s – 8.40s nice mover and returns.

Working well #daytrading #towin $RIOT #blockchain pic.twitter.com/CyaVAM35UB

— Melonopoly (@curtmelonopoly) July 24, 2018

Arrow Pharmaceuticals (ARWR) Over mid quad resistance. Long side bullish bias. $ARWR #swingtrading #earnings

ALPHABET (GOOGLE) Trading over main resistance pivot 1211.60 intra 1262.34 on earnings 1318.52 price target. $GOOGL #swingtrading

ARROWHEAD Pharna (ARWR) Took first long side entry today on swing trade over mid quad pivot $ARWR

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

Celgene (CELG) trading 86.81 with earnings in one day at quad wall resistance over mid quad support $CELG

RIOT BLOCKCHAIN (RIOT) over 200 MA on 240 Min chart closed 8.40 with trade entries 7.30s today. #trading $RIOT

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://bloom.bg/2v1ggWS

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://t.co/qtnhhrvPmk pic.twitter.com/jWDcwkA9O6

— Bloomberg Markets (@markets) July 24, 2018

MACD still trending down on daily oil chart with price above 100 MA under 20 and 50. #OIL $USOIL $WTI

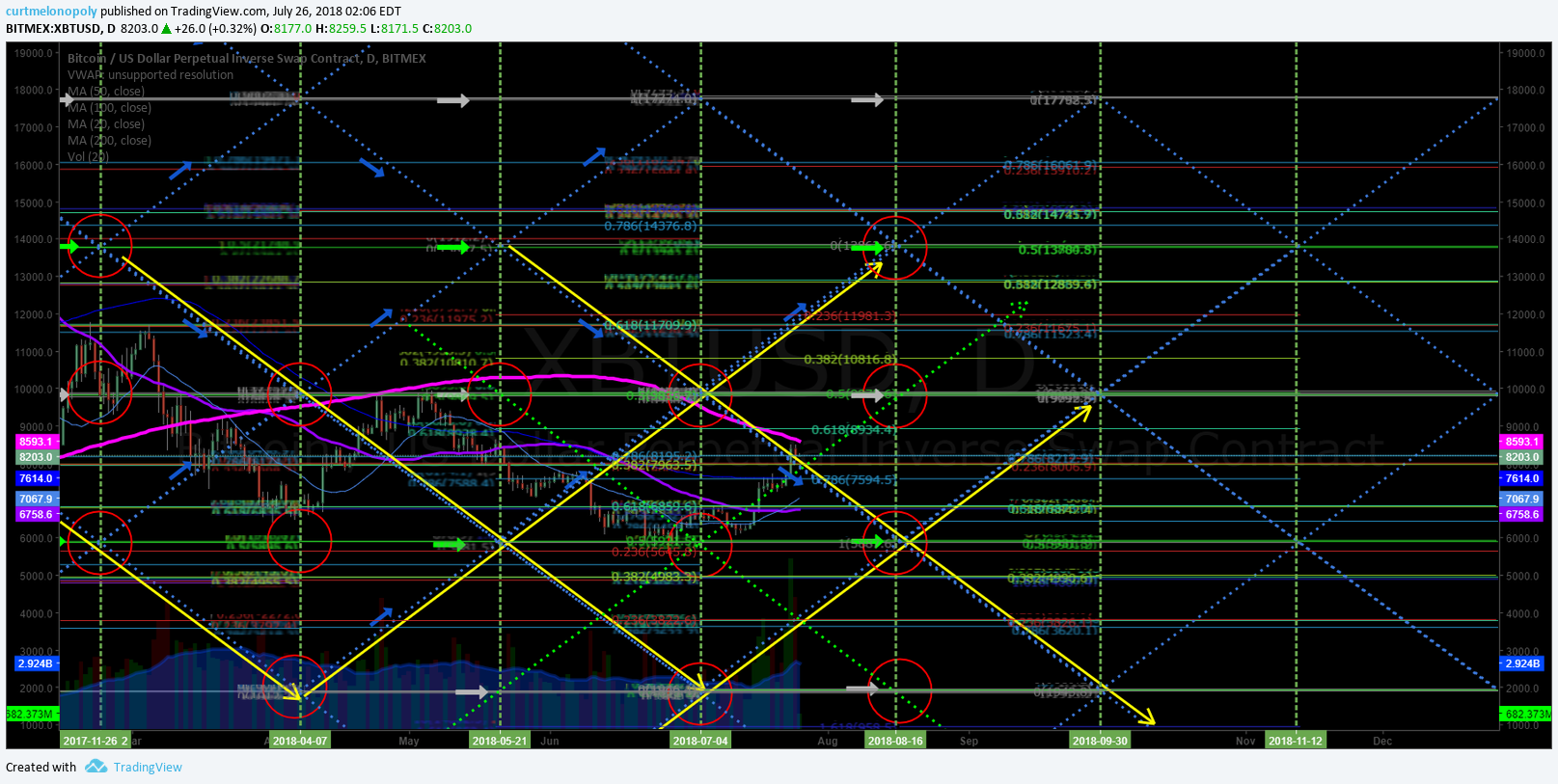

Bitcoin trading like a conventional equity now. Launched off 50 MA testing 100 MA resistance soon. $BTCUSD $BTC #Bitcoin #premarket https://twitter.com/CryptotheAlgo/status/1019561358600409088

US Dollar Index (DXY) Chart. Perfect move from structure to structure at resistance now to next possible. $DXY $UUP #USD #swingtrading #dollar

Gold chart (Daily) MACD may cross up here at previous December low support test. #GOLD #CHART $GC_F $XAUUSD $GLD

Gold chart monthly – trade sitting on 50 MA test and under bottom trendline. #Gold #Chart $GLD $XUAUSD $GC_F

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

ALLERGAN (AGN). Excellent swing trade in progress trading 177s targets 180.21 184.21 189.03 etc. $AGN #chart

NETFLIX (NFLX) Triggering long in premarket over 400.00 targets 412.00 then 422.00 a key range pivot resistance. $NFLX #swingtrading

Market Outlook, Market News and Social Bits From Around the Internet:

Your Thursday morning Speed Read:

– Markets await Amazon’s afternoon Q2 report with bated breath – will it boost its market cap to $1T? $AMZN

– Dunkin Brands’ bakes up a Q2 beat, but cuts FY18 outlook 🍩 $DNKN

– Iran plans national cryptocurrency to circumvent US sanctions $SPY

Your Thursday morning Speed Read:

– Markets await Amazon's afternoon Q2 report with bated breath – will it boost its market cap to $1T? $AMZN

– Dunkin Brands' bakes up a Q2 beat, but cuts FY18 outlook 🍩 $DNKN

– Iran plans national cryptocurrency to circumvent US sanctions $SPY— Benzinga (@Benzinga) July 26, 2018

#5Things

-Trump, Juncker cool trade tensions

-Facebook plunges

-It’s ECB day

-Markets rise

-Another huge earnings day

https://bloom.bg/2LQ7DWC

#5Things

-Trump, Juncker cool trade tensions

-Facebook plunges

-It's ECB day

-Markets rise

-Another huge earnings dayhttps://t.co/4susNk7wYl pic.twitter.com/xQxuV9XCh5— Bloomberg Markets (@markets) July 26, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $SVU $TAOP $CRMD $ARNC $UAA $UA $AWX $XLNX $AMD $QCOM $BTI $TRCH $DPW $GNC $CNHI $SQQQ $CMCSA

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $DAN $FCB $XLNX $NSC $IART $FFBC $FCX $EDU $CBRL

(6) Recent Downgrades: $DDD $HFWA $ROIC $FB $NGD $ELF $SNBR $OC $CHFC $CCJ $SKX

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Earnings, $FB, $AGN, OIL, $WTI, GOLD, Crypto, $BTC , US Dollar, $DXY

Bitcoin Algorithm (Crypto). Thurs July 26. $BTC $XBTUSD $XBT $ETH $LTC $XRP #Bitcoin #Algorithm

Bitcoin Algorithm Report (Crypto). Thursday July 26, 2018. Includes Time Cycles, Price Targets and Buy / Sell Triggers.

$BTC $BTCUSD $XBTUSD $XBT $BTC.X $ETH $LTC $XRP #Bitcoin #Crypto

Hello, my name is Crypto the Bitcoin Algorithm. Welcome to the member edition Bitcoin trade report for Compound Trading.

Like our other algorithmic chart models, I am in development and testing for coding phase to be used as an intelligent assistant for our traders. My algorithm charting model is specifically suitable for the use and purpose of trading Bitcoin $BTCUSD, Bitcoin/USD perpetual swaps $XBTUSD, Bitcoin related equities and you will find additional preliminary algorithmic modeling for $ETH, $LTC and $XRP in this report.

Note: The $XBTUSD (Bitcoin swaps) model is built on a chart from BitMEX. Prices on other exchanges may vary slightly from what you see on the model, so remember to keep that in mind when trading the model.

Notices:

- More extensive chart models for $BTCUSD, $ETHUSD, $XRPUSD, $LTCUSD and others (such as a few bitcoin related equities) will be featured in future reporting.

- Join us in our private Crypto Trading room server on discord!

- For newer users – read the blog post about how to trade Bitcoin here.

Primary Methods of Bitcoin Trade:

The primary method of trade we have found works with the most predictability is to wait for bitcoin to breach the upper right wall of a quadrant (the orange, blue or grey diagonal dotted lines – the thicker lines are more significant as they represent wider time-frames) and confirm over the next horizontal Fibonacci resistance. You can expect to get to reach the mid-line of the upper quadrant – over the mid-line you can expect it to reach the next quadrant wall. Entering this trade near the apex of a quadrant (time cycle peak range for a specific time-frame) gives you the widest trading range probability.

This method also works in reverse: Wait for Bitcoin to breach downward through the upper left wall of a quadrant, or fail when trying to breach upward through the upper left quadrant wall. Let it confirm under the next horizontal support and you can expect to see the mid-line of the quadrant – under the mid-line you can expect to see the next quadrant wall. Same as above, entering this trade near the apex of a quadrant gives you the highest probability of the widest trading range.

Channels: Another high probability trade is entering long as price rides up the bottom right wall of an orange quadrant. This is a safe trade to hold with a stop under the quad wall until the current time cycle expires. This trade works in reverse as well. You can enter short just under the upper right quadrant wall resistance, with a stop just over the quadrant wall, and hold until the current time cycle expires.

Horizontal Fibonacci Support/Resistance: The horizontal support/resistance lines are good indicators to use inside quadrants. The light green 0.5 Fibonacci line and the grey 1.0 or 0 Fibonacci levels (mid-lines) are the most significant. Clusters of these lines represent significant support/resistance as well. Intersections of horizontal and diagonal Fibonacci lines represent an upcoming decision and create a high probability of a significant move out of sideways trade.

Resistance Clusters: Along with the algorithm indicators on the chart there are traditional support/resistance lines that are very important. When these lines converge volatility tends to increase. Under the cluster is a high probability short. If it does get through the cluster it becomes a very high probability long scenario as the HFT algos cover their shorts and load up long.

Targets: Red circles on charting. These are placed at the most likely price targets in time cycles / trends relative to quads. These are still in very early stage of development/testing and should be used for observation only at this point. Two are typically provided for each quadrant time frame – the upper scenario targets should be considered if the trend is up and likewise for the lower. I do not recommend entering trades based on these targets. Also, at times the mid quad support / resistance line is highlighted with a target if trade is not extremely bullish or bearish.

Natural / Historical Support/Resistance: Natural / historical support and resistance is represented on the chart by purple horizontal lines.

Conventional Charting: Conventional charting should be weighed against the model(s) with all trade decisions.

In summary, our first generation Bitcoin algorithm chart model uses the following indicators (listed from most predictable to least in terms of win rate):

- Trading range created by long term algorithmic modeled quadrant support and resistance (blue dotted lines)

- Trading range between buy/sell trigger levels (grey/green arrows and solid lines)

- Directional channels formed by long term algorithmic modeled support and resistance

- Horizontal Fibonacci support and resistance (multi-colored horizontal lines)

- Conventional Natural support and resistance (purple horizontal lines)

- Long term conventional trend lines (red diagonal lines)

- Conventional MA’s

Bitcoin Algorithm – Daily Chart (Suitable for Swing Trading):

Click link to open initial chart viewer screen, then share button at bottom right of screen, then make it mine, then double click on chart body to hide or reveal indicators at bottom of chart (MACD etc).

Bitcoin Algorithm. Daily chart model testing 50 MA resistance in possible turn up channel. 207 AM July 26 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daily chart model testing 50 MA resistance in possible turn. 302 AM July 17 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Trading Plan (Observations / Chart Indicators):

July 26 – As with the last two previous reports, it is a 50 MA resistance test but the trajectory of downdraft is changing and a turn is possible soon. Watching.

July 17 – As with previous, it is a 50 MA test but the trajectory of downdraft is changing and a turn is possible soon. Patiently watching.

July 9 – Trading just under 50 MA, watching for a decision at the 50 MA test for direction.

June 26 – Range bound trade – waiting for a direction.

June 19 – My current bias and trading plan is exactly what it was last report (range bound trade)

June 11 – If Bitcoin $XBTUSD dumps lower than 5900.00 then high probability it continues in down channel (illustrated down channel with yellow arrows). It holds and up channel is in play (also illustrated on charting).

On the daytrading chart below it seems too early to comment on a bias… looking for structure to build.

My personal bias is it should turn up channel, conventionally that makes sense in trading after a dump, however, the 5900.00 is key as a mid quad area.

A few tweets / comments in private Bitcoin member serve recently reflecting my bias:

And we’re there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto

And we're there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto pic.twitter.com/fK3u1dM7mx

— Melonopoly (@curtmelonopoly) June 10, 2018

Bitcoin Algorithm. 30 Minute Charting (Suitable for Daytrading BTC).

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 324 AM July 26 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 327 AM July 17 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 136 AM July 9 $BTC $XBTUSD #Bitcoin #Algorithm

Recent Bitcoin Real-Time Trade Alerts / Charting Set-up Alerts

If you are reviewing this newsletter (as a historical unlocked post) and not a member of our service and would like a tour of our private discord server (trading chat / alerts etc) or our private Twitter member $BTC alert feed let us know. You can check out our call rate for yourself. Transparent trading is important to us.

July 26 – Alert examples will be updated soon.

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading pic.twitter.com/RM68yktgur

— Melonopoly (@curtmelonopoly) May 20, 2018

May 13 – Will post recent alerts soon when time allows.

Per recent;

April 29 – There have been many calls since bottom on our private server and private twitter feed… I’m not going to take the time to post them here right now but I will post this rant of tweets… the private member alerts I’ll post next report if time (they were all spot on alerts).

I even told ya how I knew where the bottom was. $BTC #Bitcoin #algorithm

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading screenshot

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading

$BTC near HOD and some bullish action on intra. Tweet screen shot.

$BTC near HOD and some bullish action on intra. $BTC #bitcoin #calls

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading pic.twitter.com/l1pafs56QD

— Crypto the BTC Algo (@CryptotheAlgo) April 18, 2018

Bitcoin coming in to a possible buy trigger zone on daytrading chart. $BTC #Bitcoin

https://twitter.com/BTCAlerts_CT/status/978317583987429376

$BTC Bitcoin popped now 400 points since alert of support. Not a bad RR here for long test. If nothing else a day trade.

https://twitter.com/BTCAlerts_CT/status/978397655796801538

Bitcoin time price cycle peak coming April 7 – path of least resistance down target but my bias is to up. Trade price. We start trading live again Monday so I’ll broadcast our trading group moves live for this setup. $BTC #Bitcoin #trading #crypto (alerted in private member Discord server)

And the result…. price is dumping in to lower target identified on trade alert…. intrad-day getting close. Charting wins. Trader bias not so good on this one.

Ethereum Algorithm. Basic Charting Model on Daily Time Frame:

Ethereum Algorithm. Daily Chart. Price testing 50 MA resistance, in channel. On watch. July 26 26 332 AM $ETH $ETHUSD #Ethereum #Algorithm

Ethereum Algorithm. Daily Chart. 625 resistance 418 support July 9 316 AM $ETH $ETHUSD #Ethereum #Algorithm

Ethereum Algorithm. Daily Chart. Price in channel, with weak trade. On watch. June 26 434 AM $ETH $ETHUSD #Ethereum #Algorithm

Litecoin Algorithm. Basic Charting Model.

Primary buy sell triggers on Litecoin daily chart:

475.00

381.00

287.00

192.00

98.00

July 26 – No significant change to below;

Litecoin Algorithm. LTC showing signs of possible bottom turn reversal. July 17 332 AM $LTCUSD #Litecoin #Algorithm

Litecoin Algorithm. LTC still in down trend channel. July 9 324 AM $LTCUSD #Litecoin #Algorithm

Ripple Basic Algorithm Charting Model $XRP

July 26 – No noteworthy change.

July 17 – No noteworthy change.

July 9 – No noteworthy change.

May 13 – Ripple needs .932 for a chance for a bullish structured run. $XRP $XRPUSD.

I put some tighter time from Fib structure in the model for those that asked for daytrading signals.

Per recent;

May 10 – Nothing to report. Flat.

April 29 – $XRP flat but over 200 MA on daily.

BUT still great returns from 40s to near 90s WOW.

https://www.tradingview.com/chart/XRPUSD/0aDABOJz-XRP-flat-but-over-200-MA-on-daily/

Per recent;

April 22 – $XRP over .888 targets 1.31 then 1.65 mid term. Daytrading model on -deck. #ripple

Crypto News:

Crypto Markets Recover After Weekend Losses Saw Bitcoin at Lowest 2018 Level

< End of report >

Any questions give us a shout anytime!

Follow Me:

Live Twitter Alert Feed for Bitcoin Trade Set-ups: @BTCAlerts_CT, Public Feed: @cryptothealgo

To Subscribe to our Crypto Services:

Link to Services and Pricing Overview (master list).

Link to Standalone $BTC Crypto Newsletter.

Link to Real-Time Live Bitcoin Alerts (Twitter).

Link to Crypto Bundle (Alerts, Private Trading Discord Server, Newsletter).

Review historical (unlocked to public) Weekly Bitcoin Newsletter Algorithm Reporting. Scroll down landing page to get to historical reports.

Post topics; Crypto, Algorithm, BTC, Bitcoin, chart, $BTC, $BTCUSD, $XBTUSD, $BTC.X, $ETH, $LTC, $XRP, trade, price targets, time cycles

PreMarket Trading Plan Wed July 25: Earnings, #EIA, OIL, $WTI, $RIOT, $TORC, $HMNY, $NVRO, $IRBT, GOLD, Crypto, $BTC , US Dollar, $DXY more.

Compound Trading Premarket Trading Plan & Watch List Wednesday July 25, 2018.

In this edition: Earnings, #EIA, OIL, $WTI, $RIOT, $TORC, $HMNY, $NVRO, $IRBT, GOLD, Crypto, $BTC , US Dollar, $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

July 24 Member Memo: Trading Coaching Boot Camp Prep, Machine Trading, Next Gen Models, Trade Alerts, Reporting, Swing Trading Earnings

Scheduled Events:

- Wednesday July 25 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 10:30 EIA Report Oil Trading – access limited to live trading room / EPIC Oil Algorithm members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- Any questions send me an email [email protected]

- July 25-26 – Weekly newsletter reporting and invoicing distributed to members (delayed this week due to next gen algorithms being integrated in to our trading platforms).

- July 23-July 31 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a complimentary version without algorithmic charting).

- End of July – Next generation algorithm models roll out in to August 14, 2018 (machine trading Gen 1).

- End of July – New pricing structure published representing next generation algorithm models (existing members no change).

- End of July – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: AR, Protected: Swing Trading Report (Members): Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

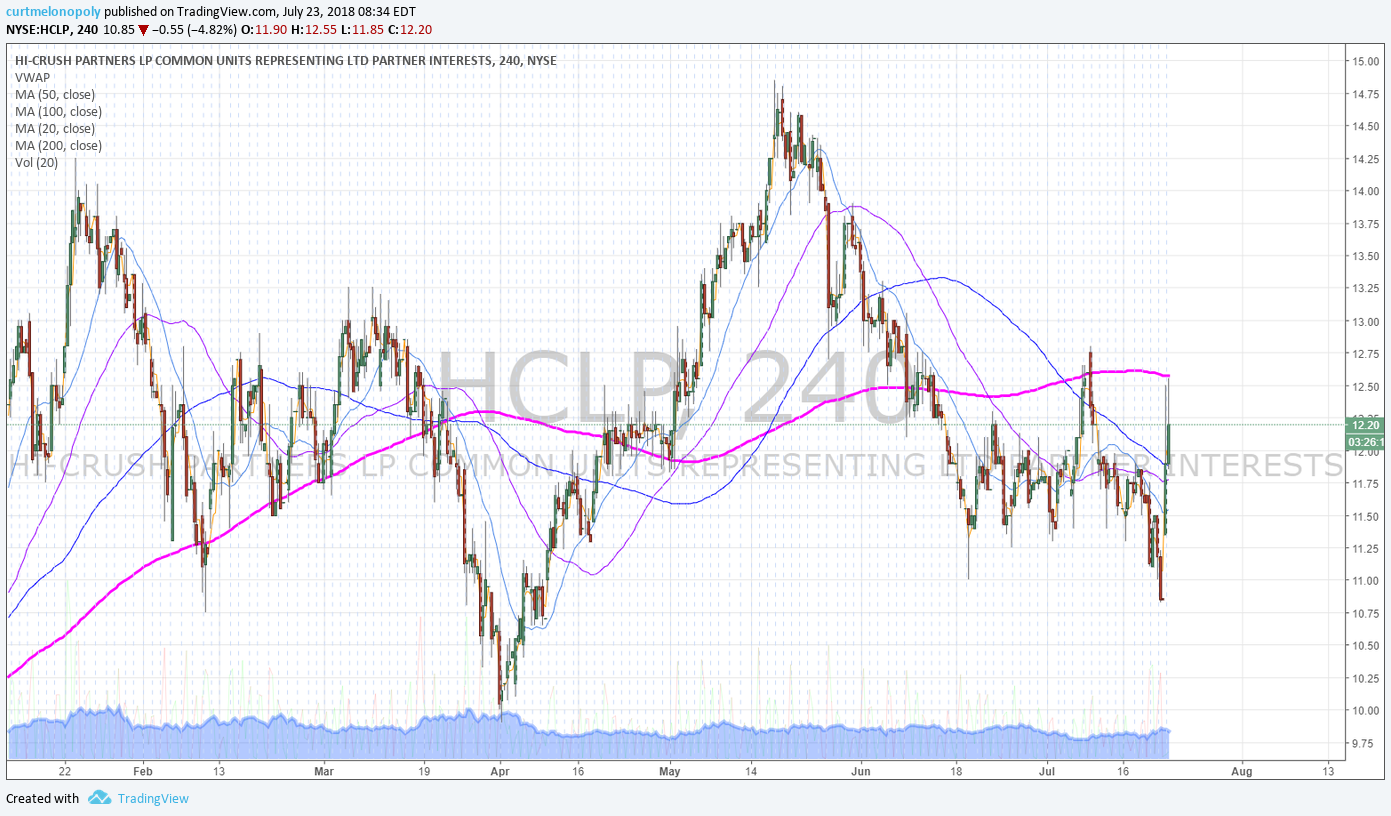

Password: WOW, Protected: Swing Trading Report (Members): Earnings Season Charting July 24 $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Unlisted Private Member Video – Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Unlisted Private Member Video – Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Unlisted Private Member Video – Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: KO, GM, BA, FCAU, UPS & more –

Stocks making the biggest moves premarket: KO, GM, BA, FCAU, UPS & more – https://t.co/NbxGklLWAH

— Melonopoly (@curtmelonopoly) July 25, 2018

Market Observation:

Markets as of 8:14 AM: US Dollar $DXY trading 94.49, Oil FX $USOIL ($WTI) trading 68.57, Gold $GLD trading 1232.14, Silver $SLV trading 15.59, $SPY 281.18, Bitcoin $BTC.X $BTCUSD $XBTUSD 8227.00 and $VIX trading 12.6.

Momentum Stocks to Watch: $RIOT, $TORC, $HMNY, $NVRO, $IRBT

$TORC ResTORbio’s stocks rockets on positive trial results, just as post-IPO lock up expires https://on.mktw.net/2JQ23Sh

$TORC Short % of Float (Jun 14, 2018) 419.52%

ResTORbio’s stocks rockets on positive trial results, just as post-IPO lock up expires

News:

MoviePass parent Helios and Matheson implements 1-to-250 reverse stock split, boosting share price

$RUBY Rubius Therapeutics (RUBY) Agrees to Acquire Manufacturing Facility in Smithfield, Rhode Island

$TEUM: Pareteum Awarded $3 Million 5-Year Contract in North Africa

$CYTR CytRx Announces Centurion BioPharma Corporation’s Filing of a Provisional Patent Application.

$CHFS Department of Veterans Affairs Awards a $6.5 million Blanket Purchase Agreement to CHF Solutions to Supply Aquadex FlexFlow System for Outpatient Services in Tampa, Fla.

Recent SEC Filings:

Insider Buys Of The Week: BlackRock, Dish Network, Walgreens https://benzinga.com/z/12054592 $BLK $DISH $WBA

Recent IPO’s:

Biotech Allakos prices IPO at $18, above price range

$RUBY 10.3M shares at $23 and $CRNX 6m shares at $17

$CRNX Crinetics Pharmaceuticals prices IPO at $17 a share

The IPO Outlook For The Week: Tech & International Exposure https://benzinga.com/z/12052697 $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA

The IPO Outlook For The Week: Tech & International Exposure https://t.co/A0rfpmunIn $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA https://t.co/Hrc0OwWq24

— Melonopoly (@curtmelonopoly) July 22, 2018

Earnings:

Freeport-McMoRan’s stock jumps after earnings and revenue rose above expectations

Hawaiian Holdings +5% after earnings, upgrade https://seekingalpha.com/news/3373389-hawaiian-holdings-plus-5-percent-earnings-upgrade?source=feed_f … #premarket $HA

Norfolk Southern rides higher after earnings https://seekingalpha.com/news/3373399-norfolk-southern-rides-higher-earnings?source=feed_f … #premarket $NSC

StockTwits Earnings to Watch

Tue – $T $VZ $LMT $JBLU $BIIB $IRBT $MMM $LLY $TXN

Wed – $FB $AMD $F $GILD $PYPL $V $BA $HM $KO $ABX

Thu – $AMZN $INTC $SBUX $CMG $FSRL $SPOT $MCD

Fri – $TWTR $XOM $ABBV $CVX

Via @StockTwits

#earnings for the week

$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX

#earnings for the week$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX https://t.co/r57QUKKDXL https://t.co/rFjdIyBH0d

— Melonopoly (@curtmelonopoly) July 22, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

$TORC Premarket up 142% trading 21.79 on lock up exp, results, short interest. $TORC #daytrading

The $RIOT daytrade from yesterday went well: 7.30s – 8.40s nice mover and returns.

Working well #daytrading #towin $RIOT #blockchain pic.twitter.com/CyaVAM35UB

— Melonopoly (@curtmelonopoly) July 24, 2018

Arrow Pharmaceuticals (ARWR) Over mid quad resistance. Long side bullish bias. $ARWR #swingtrading #earnings

ALPHABET (GOOGLE) Trading over main resistance pivot 1211.60 intra 1262.34 on earnings 1318.52 price target. $GOOGL #swingtrading

ARROWHEAD Pharna (ARWR) Took first long side entry today on swing trade over mid quad pivot $ARWR

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

Celgene (CELG) trading 86.81 with earnings in one day at quad wall resistance over mid quad support $CELG

RIOT BLOCKCHAIN (RIOT) over 200 MA on 240 Min chart closed 8.40 with trade entries 7.30s today. #trading $RIOT

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://bloom.bg/2v1ggWS

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://t.co/qtnhhrvPmk pic.twitter.com/jWDcwkA9O6

— Bloomberg Markets (@markets) July 24, 2018

MACD still trending down on daily oil chart with price above 100 MA under 20 and 50. #OIL $USOIL $WTI

Bitcoin trading like a conventional equity now. Launched off 50 MA testing 100 MA resistance soon. $BTCUSD $BTC #Bitcoin #premarket https://twitter.com/CryptotheAlgo/status/1019561358600409088

US Dollar Index (DXY) Chart. Perfect move from structure to structure at resistance now to next possible. $DXY $UUP #USD #swingtrading #dollar

Gold chart (Daily) MACD may cross up here at previous December low support test. #GOLD #CHART $GC_F $XAUUSD $GLD

Gold chart monthly – trade sitting on 50 MA test and under bottom trendline. #Gold #Chart $GLD $XUAUSD $GC_F

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

ALLERGAN (AGN). Excellent swing trade in progress trading 177s targets 180.21 184.21 189.03 etc. $AGN #chart

NETFLIX (NFLX) Triggering long in premarket over 400.00 targets 412.00 then 422.00 a key range pivot resistance. $NFLX #swingtrading

CITIGROUP INC (C) Keeps working that support line. No bias here. Watching. $C #stock #chart

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

Market Outlook, Market News and Social Bits From Around the Internet:

Your Wednesday morning Speed Read:

– Former Fiat Chrysler CEO Sergio Marchionne has died $FCAU

– Thermo Fisher’s Q2 earnings and revenues top estimates, as the consultant raises its FY18 overlook $TMO

– Bitcoin takes a breather after breaching $8K psychological level $BTC

https://twitter.com/Benzinga/status/1022065207198269440

Stunning correlation between the 10-year and S&P 500 could point to new highs for stocks https://cnb.cx/2NIFSQ8

Stunning correlation between the 10-year and S&P 500 could point to new highs for stocks https://t.co/e6eashKEIe pic.twitter.com/hg6KAg16Rz

— CNBC International (@CNBCi) July 25, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $TORC $CRMD $NVRO $CODX $IRBT $VICR $AUDC $RETA $TRVN $HA $TVIX $TKC $UVXY $CEI $GLW $DTE $VXX $USLV

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

$NBIX PT raised to $122 from $100 at Baird.

W.R. Berkley $WRB PT Raised to $78 at RBC Capital

TD Ameritrade $AMTD PT Lowered to $60 at Morgan Stanley

Texas Instruments $TXN PT Raised to $113 at Morgan Stanley

$BIIB PT raised to $348 at Baird.

$RETA PT raised to $185 from $95 at Citi, added to US Focus List.

IQVIA Holdings $IQV PT Raised to $143 at Baird

Needham & Company Remains Bullish on G-III Apparel Group $GIII As Ivanka Trump Closes Fashion …

Rockwell Automation +3.5% on guidance boost https://seekingalpha.com/news/3373390-rockwell-automation-plus-3_5-percent-guidance-boost?source=feed_f … #premarket $ROK

Centene $CNC PT Raised to $152 at Piper Jaffray

Kimbell Royalty Partners LP $KRP PT Raised to $26 at RBC Capital

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Earnings, #EIA, OIL, $WTI, $RIOT, $TORC, $HMNY, $NVRO, $IRBT, GOLD, Crypto, $BTC , US Dollar, $DXY

PreMarket Trading Plan Tues July 24: $CELG, $RIOT, $ATI, $LLY, $GOOGL, $BIIB, $BRN, $VZ Earnings, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , US Dollar, $DXY more.

Compound Trading Premarket Trading Plan & Watch List Tuesday July 24, 2018.

In this edition: $CELG, $RIOT, $ATI, $LLY, $GOOGL, $STLD, $BIIB, $CR, $BRN, $WHR, $SNV, $INFN, $DGX, $MMM, $UTX, $VZ Earnings, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , US Dollar, $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

July 24 Member Memo: Trading Coaching Boot Camp Prep, Machine Trading, Next Gen Models, Trade Alerts, Reporting, Swing Trading Earnings

Scheduled Events:

- Tuesday July 24 – Lead trader (and/or other team members) will be active in live trading room as follows and as available (as things can change fast in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- Any questions send me an email [email protected]

- July 23 – July 27 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day reviews) and sent to our subscribers in lieu of the weekly swing trading report.

- https://twitter.com/swingtrading_ct/status/1021107913950212096

- End of July – Next generation algorithm models roll out in to August 2018 (machine trading Gen 1).

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

A Tidbit About our Structured Algorithmic Models

“The thing about our algorithmic structured models is that we get the structure first, and then math can explain how to get there. The math confirms the model but doesn’t provide us with the model. We start at the end result and then confirm it with conventional math.

And yes, in our trading bootcamp we do teach this process. The process of how we get there – all steps except the black box final gen models (gen 5). But yes, generation 1 thru 4 models and the process therein I teach to our attendees and record it for home study thereafter.”

The thing about our algorithmic structured models is that we get the structure first, and then math can explain how to get there. The math confirms the model but doesn't provide us with the model. We start at the end result and then confirm it with conventional math.

— Melonopoly (@curtmelonopoly) July 18, 2018

Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

https://twitter.com/CompoundTrading/status/1012166019765370881

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

25 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/12063230 $ATI $LLY $GOOGL $STLD $BIIB $CR $BRN $RIOT $WHR $SNV $INFN $DGX

25 Stocks Moving In Tuesday's Pre-Market Session https://t.co/tzOneljgN7 $ATI $LLY $GOOGL $STLD $BIIB $CR $BRN $RIOT $WHR $SNV $INFN $DGX

— Benzinga (@Benzinga) July 24, 2018

Your Tuesday morning Speed Read:

– ‘COLOR US UNIMPRESSED’ Iran’s Foreign Minister, continuing Twitter beef w/U.S. President Trump $SPY $USO

– Harley-Davidson reports Q2 adj. EPS $1.52 vs $1.34 est, sales $1.7B vs $1.4B est $HOG

– Bitcoin regains $8K level, HODLers rejoice $BTC

Your Tuesday morning Speed Read:

– 'COLOR US UNIMPRESSED' Iran's Foreign Minister, continuing Twitter beef w/U.S. President Trump $SPY $USO

– Harley-Davidson reports Q2 adj. EPS $1.52 vs $1.34 est, sales $1.7B vs $1.4B est $HOG

– Bitcoin regains $8K level, HODLers rejoice $BTC— Benzinga (@Benzinga) July 24, 2018

Stocks making the biggest moves premarket: MMM, UTX, VZ, LLY & more –

https://www.cnbc.com/2018/07/24/stocks-making-the-biggest-moves-premarket-mmm-utx-vz-lly–more.html

Stocks making the biggest moves premarket: MMM, UTX, VZ, LLY & more – https://t.co/OyJJdIk3SI

— Melonopoly (@curtmelonopoly) July 24, 2018

Market Observation:

Markets as of 8:12 AM: US Dollar $DXY trading 94.50, Oil FX $USOIL ($WTI) trading 68.30, Gold $GLD trading 1227.14, Silver $SLV trading 15.51, $SPY 281.53, Bitcoin $BTC.X $BTCUSD $XBTUSD 8322.00 and $VIX trading 12.1.

Momentum Stocks to Watch: $RIOT

$ATI $HLX $BIIB $HOG $WERN $UTX $STLD, $VZ $LMT $GOOG

RIOT BLOCKCHAIN (RIOT) premarket trading up 9.71% 7.24 with resistance 9.70s #premarket #trading $RIOT

RIOT BLOCKCHAIN (RIOT) premarket trading up 9.71% 7.24 with resistance 9.70s #premarket #trading $RIOT pic.twitter.com/zT665zD6PM

— Melonopoly (@curtmelonopoly) July 24, 2018

News:

$CELG #premarket Celgene shares lift on positive results for cancer drug trial https://on.mktw.net/2LlA7vd

Recent SEC Filings:

Insider Buys Of The Week: BlackRock, Dish Network, Walgreens https://benzinga.com/z/12054592 $BLK $DISH $WBA

Recent IPO’s:

Biotech Allakos prices IPO at $18, above price range

$RUBY 10.3M shares at $23 and $CRNX 6m shares at $17

$CRNX Crinetics Pharmaceuticals prices IPO at $17 a share

The IPO Outlook For The Week: Tech & International Exposure https://benzinga.com/z/12052697 $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA

The IPO Outlook For The Week: Tech & International Exposure https://t.co/A0rfpmunIn $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA https://t.co/Hrc0OwWq24

— Melonopoly (@curtmelonopoly) July 22, 2018

Earnings:

Biogen Q2 top line up 9%; non-GAAP EPS up 15%; shares up 6% premarket https://seekingalpha.com/news/3372775-biogen-q2-top-line-9-percent-non-gaap-eps-15-percent-shares-6-percent-premarket?source=feed_f … #premarket $BIIB

$VZ Premarket – Verizon shares rise 3% after company beats 2Q earnings and revenue expectations

Lockheed Martin +3% after strong Q2 beat, upsized full-year guidance https://seekingalpha.com/news/3372773-lockheed-martin-plus-3-percent-strong-q2-beat-upsized-full-year-guidance?source=feed_f … #premarket $LMT

StockTwits Earnings to Watch

Tue – $T $VZ $LMT $JBLU $BIIB $IRBT $MMM $LLY $TXN

Wed – $FB $AMD $F $GILD $PYPL $V $BA $HM $KO $ABX

Thu – $AMZN $INTC $SBUX $CMG $FSRL $SPOT $MCD

Fri – $TWTR $XOM $ABBV $CVX

Via @StockTwits

#earnings for the week

$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX

#earnings for the week$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX https://t.co/r57QUKKDXL https://t.co/rFjdIyBH0d

— Melonopoly (@curtmelonopoly) July 22, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

RIOT BLOCKCHAIN (RIOT) premarket trading up 9.71% 7.24 with resistance 9.70s #premarket #trading $RIOT

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://bloom.bg/2v1ggWS

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://t.co/qtnhhrvPmk pic.twitter.com/jWDcwkA9O6

— Bloomberg Markets (@markets) July 24, 2018

MACD still trending down on daily oil chart with price above 100 MA under 20 and 50. #OIL $USOIL $WTI

Bitcoin trading like a conventional equity now. Launched off 50 MA testing 100 MA resistance soon. $BTCUSD $BTC #Bitcoin #premarket https://twitter.com/CryptotheAlgo/status/1019561358600409088

US Dollar Index (DXY) Chart. Perfect move from structure to structure at resistance now to next possible. $DXY $UUP #USD #swingtrading #dollar

Gold chart (Daily) MACD may cross up here at previous December low support test. #GOLD #CHART $GC_F $XAUUSD $GLD

Gold chart monthly – trade sitting on 50 MA test and under bottom trendline. #Gold #Chart $GLD $XUAUSD $GC_F

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

ALLERGAN (AGN). Excellent swing trade in progress trading 177s targets 180.21 184.21 189.03 etc. $AGN #chart

NETFLIX (NFLX) Triggering long in premarket over 400.00 targets 412.00 then 422.00 a key range pivot resistance. $NFLX #swingtrading

CITIGROUP INC (C) Keeps working that support line. No bias here. Watching. $C #stock #chart

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

Market Outlook, Market News and Social Bits From Around the Internet:

Economic Data Scheduled For Tuesday

Economic Data Scheduled For Tuesday pic.twitter.com/aKxskQDciJ

— Benzinga (@Benzinga) July 24, 2018

#5things

-Trump sets terms for Mueller interview

-It’s PMI day

-China stimulus

-Markets rise

-Coming up…

https://bloom.bg/2LmeMSt

#5things

-Trump sets terms for Mueller interview

-It's PMI day

-China stimulus

-Markets rise

-Coming up…https://t.co/IuLmwg9esS pic.twitter.com/GMfwu1Q3kF— Bloomberg Markets (@markets) July 24, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $LPNT $CTRV $BRN $DDE $HCLP $HAS $JMEI $MARA $NXTD $RIOT $CLF $CYH $TLRY $UWT $SLS $AEMD $TKC $VKTX $SESN $SYNT

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Guggenheim Reiterates Buy on Grubhub $GRUB Ahead of 2Q Report

Turtle Beach +2.3% after Oppenheimer target boost https://seekingalpha.com/news/3372774-turtle-beach-plus-2_3-percent-oppenheimer-target-boost?source=feed_f … #premarket $HEAR

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $CELG, $RIOT, $ATI, $LLY, $GOOGL, $STLD, $BIIB, $CR, $BRN, $WHR, $SNV, $INFN, $DGX, $MMM, $UTX, $VZ Earnings, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , US Dollar, $DXY

PreMarket Trading Plan Mon July 23: $HCLP, $LPNT, $TLRY, $AXTI, $DDE, $HAS, $AGN, $TSLA, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , US Dollar, $DXY more.

Compound Trading Premarket Trading Plan & Watch List Monday July 23, 2018.

In this edition: $HCLP, $LPNT, $TLRY, $AXTI, $DDE, $HAS, $AGN, $TSLA, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , US Dollar, $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Monday July 23 – Lead trader (and/or other team members) will be active in live trading room as follows and as available (as things can change fast in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- Any questions send me an email [email protected]

- July 23 – July 27 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day reviews) and sent to our subscribers in lieu of the weekly swing trading report.

- https://twitter.com/swingtrading_ct/status/1021107913950212096

- End of July – Next generation algorithm models roll out in to August 2018 (machine trading Gen 1).

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

A Tidbit About our Structured Algorithmic Models

“The thing about our algorithmic structured models is that we get the structure first, and then math can explain how to get there. The math confirms the model but doesn’t provide us with the model. We start at the end result and then confirm it with conventional math.

And yes, in our trading bootcamp we do teach this process. The process of how we get there – all steps except the black box final gen models (gen 5). But yes, generation 1 thru 4 models and the process therein I teach to our attendees and record it for home study thereafter.”

The thing about our algorithmic structured models is that we get the structure first, and then math can explain how to get there. The math confirms the model but doesn't provide us with the model. We start at the end result and then confirm it with conventional math.

— Melonopoly (@curtmelonopoly) July 18, 2018

Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

https://twitter.com/CompoundTrading/status/1012166019765370881

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

23 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/12056287 $LPNT $TLRY $AXTI $DDE $HAS $CCT $SYNT $ARVO $TSLA $VRNT $CALM $PZZA

https://twitter.com/CompoundTrading/status/1021370857132879874