Trading Set-Ups Report and Video for $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

What’s New!

April Sale On Now! 10 Promo Codes Per Select Items Only! Sale items end April 30, 2018 or if the Promo Code limit for the specific item has been reached (10). If there is no sale price beside the item listed the maximum promo codes have been used. Click here for available Promo Codes.

Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

Information about our next trade coaching event May 4, 5, 6 can be found here Trade Coaching Boot Camp.

Now available for serious traders – Legacy All Access Membership.

24 Hour Crypto Trading Desk opens May 2018 along with our Coding Algorithm Models for Machine Trading. Formal announcements to follow.

The Mid Day Trade Set-Ups Video:

Mid Day chart trading set-ups April 24 (summary).

You may or may not know, but the market sold off fairly heavy yesterday. Below is a summary of the mid day video review of the chart set-ups we are following. Also there are links below of other recent videos.

$SPY – Dumped April 2, modeled in advance, we entered in drop, trimmed at resistance and added over all the way up. 262.67 267.99 major buy sell pivots. Trade resting per my alert last week. 262.27 April 27 bearish target in play. Other targets listed on video.

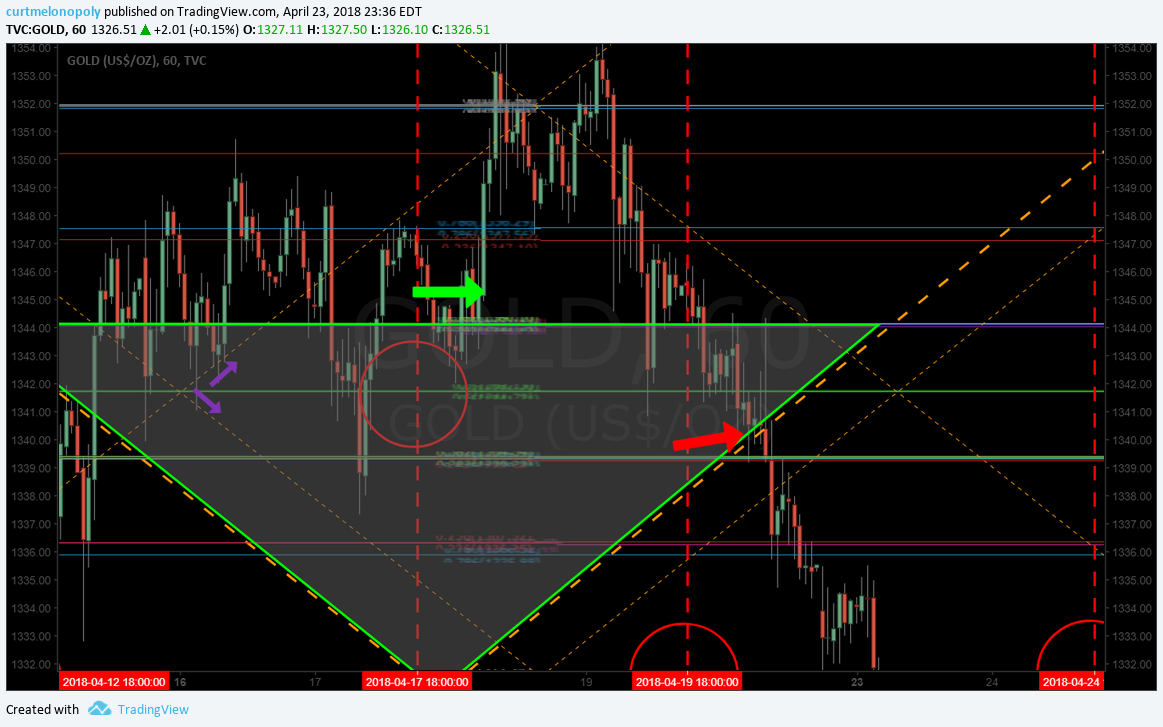

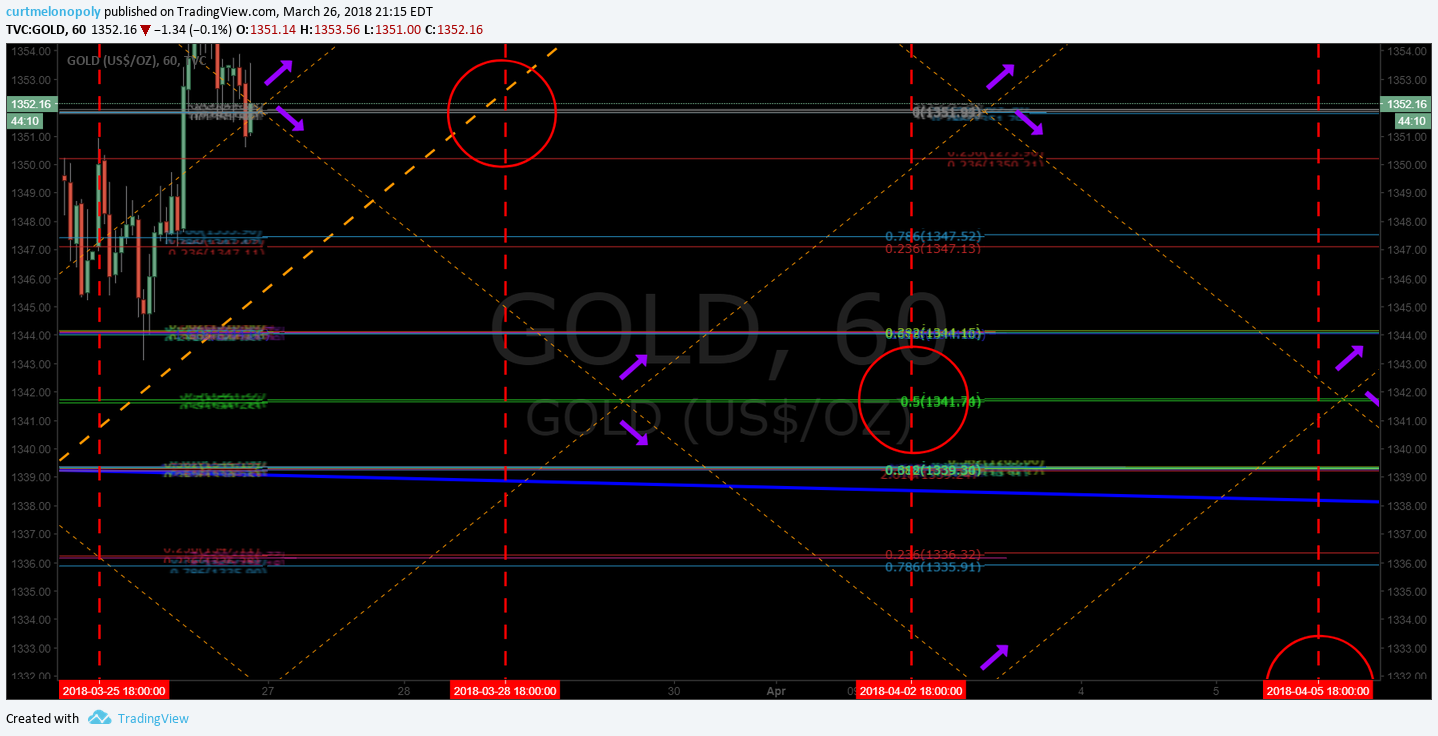

GOLD $GC_F $GLD – Started long hedge position 1352.86 May 4 price target, 1385.86, 1315.05 1277.09 bearish scenario targets same date May 4.

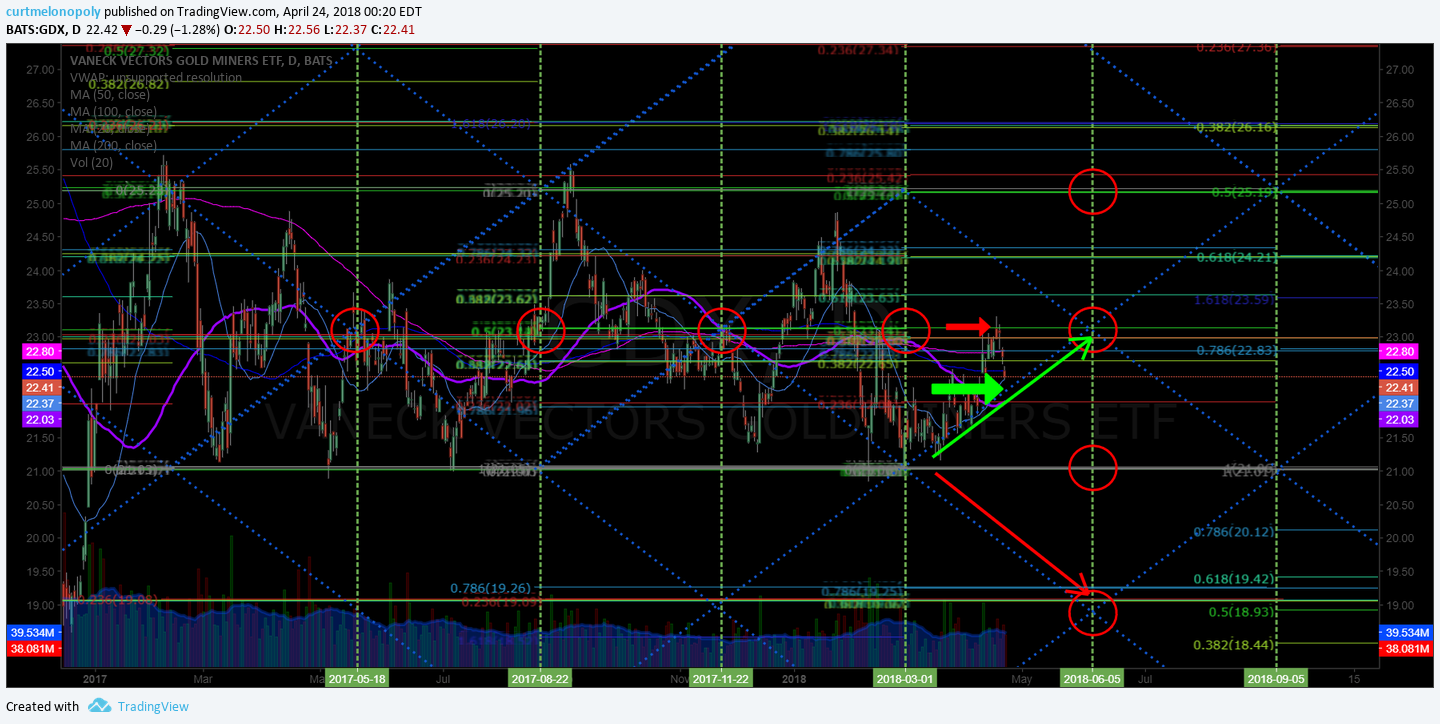

$GDX Gold Miners – Alert went out last night of support intra and it has bounced, resistance 23.14 22.97 22.80 22.65 June 4 time cycle targets 23.14 likely 21.07 bearish and 25.14 bullish 27.31 most bullish scenario.

Bitcoin $BTC – Swing trading model – How we knew the turn was in play, we alerted buy side and hit it near perfect. Trim in to resistance areas and add above. 13842.00 May 21 Bullish Target, 9891.90 moderately bullish, 5871.60 bearish. New up channel shown. On daytrading model resistance 9380.00 9878.90 April 28 price target.

$GOOGL – we nailed wash-out snap back and is now testing 200 MA support. 9855.00 support. 11035.00 price target July 2 bullish scenario.

$ATOS – Resistance pivot (primary) 5.38.

$SNAP over 15.75 targets 16.50.

$EVLV – in to the 200 MA and backed of on the daytrade.

$HEAR – charting has some structure. Target 17.80 200 MA weekly chart on bull side move.

$CHEK – Off halt wanted over 100 MA to 200 MA and left for coffee and boom it hit while I was away. Alerted in 8s and target on daytrade move 13s. Can’t get them all.

$MARA over 50 MA 1.75 targets 2.25 and over that 2.80 price target. Long term chart is junk.

$PRTA – traded on daytrade flat, wash-out snap – back trade, nailed the turn and then it came off. Will be watching very close the days going forward.

$ZDGE – Over 4.00 long side trade. I like the structure of the chart.

$TSLA – Caught this on the wash out snap back trade. 279.80 support really important area. 381.00 Nov 15 2018 price target.

$FB – Another wash-out snap back that went really well. Price targets hitting and structure of model has been perfect. Now came off after hit mid quad resistance.

Recent Trading Set-Up Review Webinars

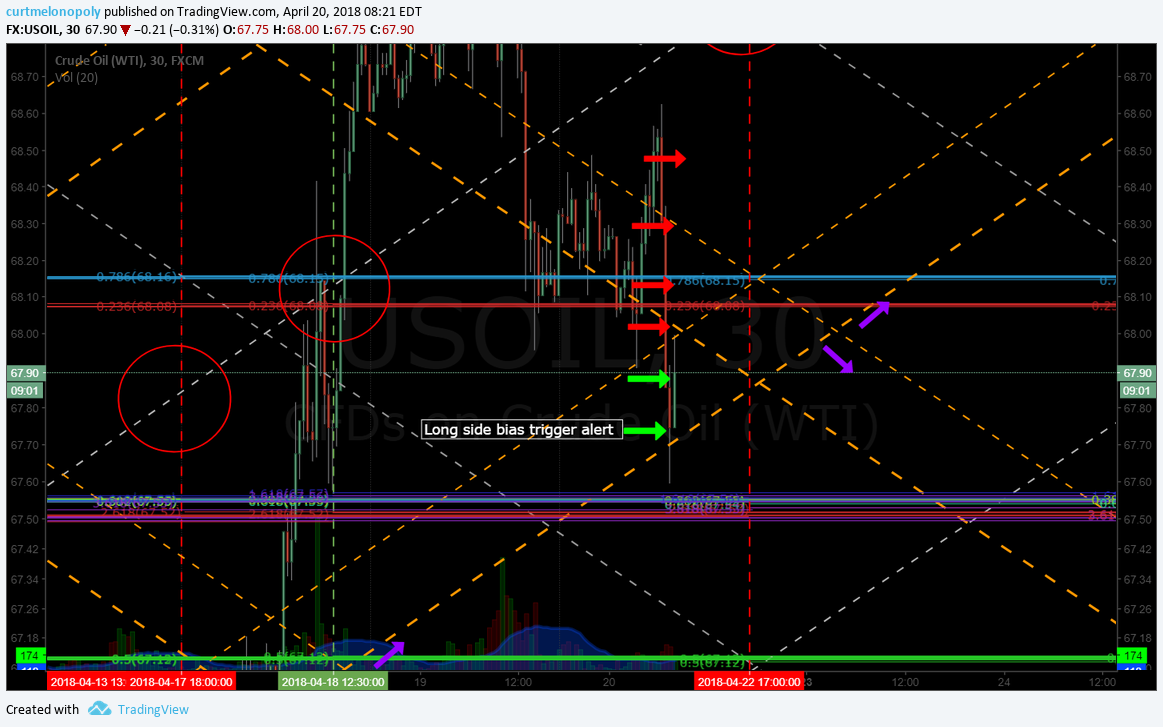

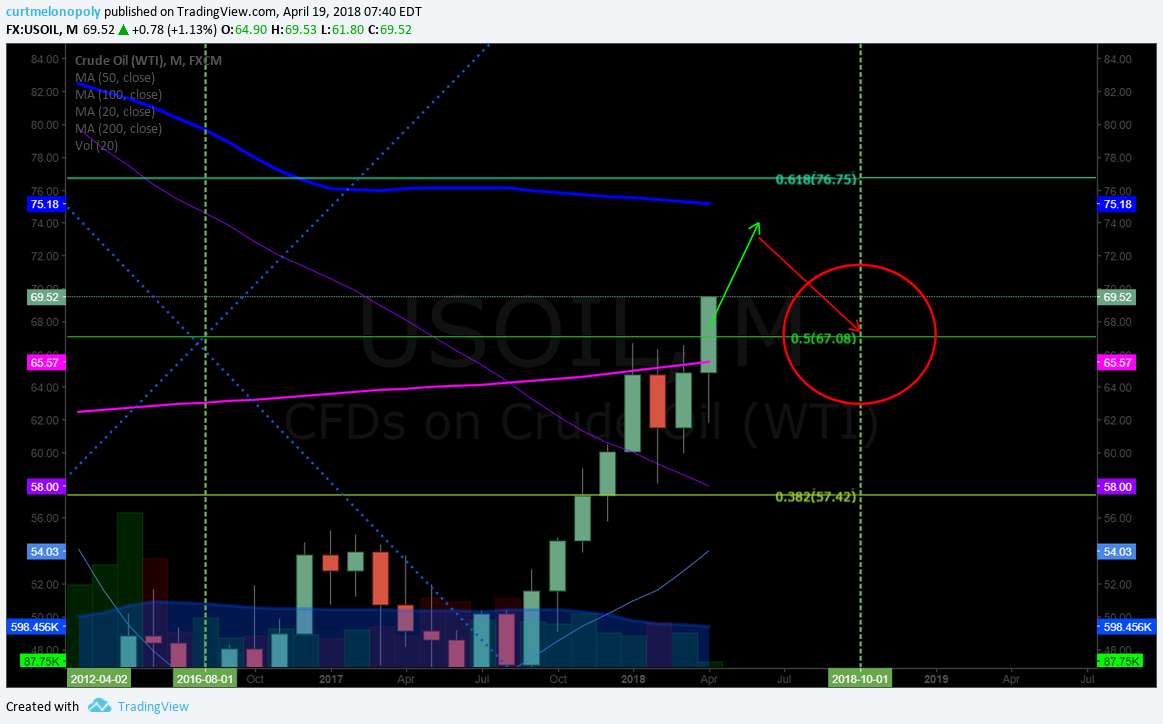

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

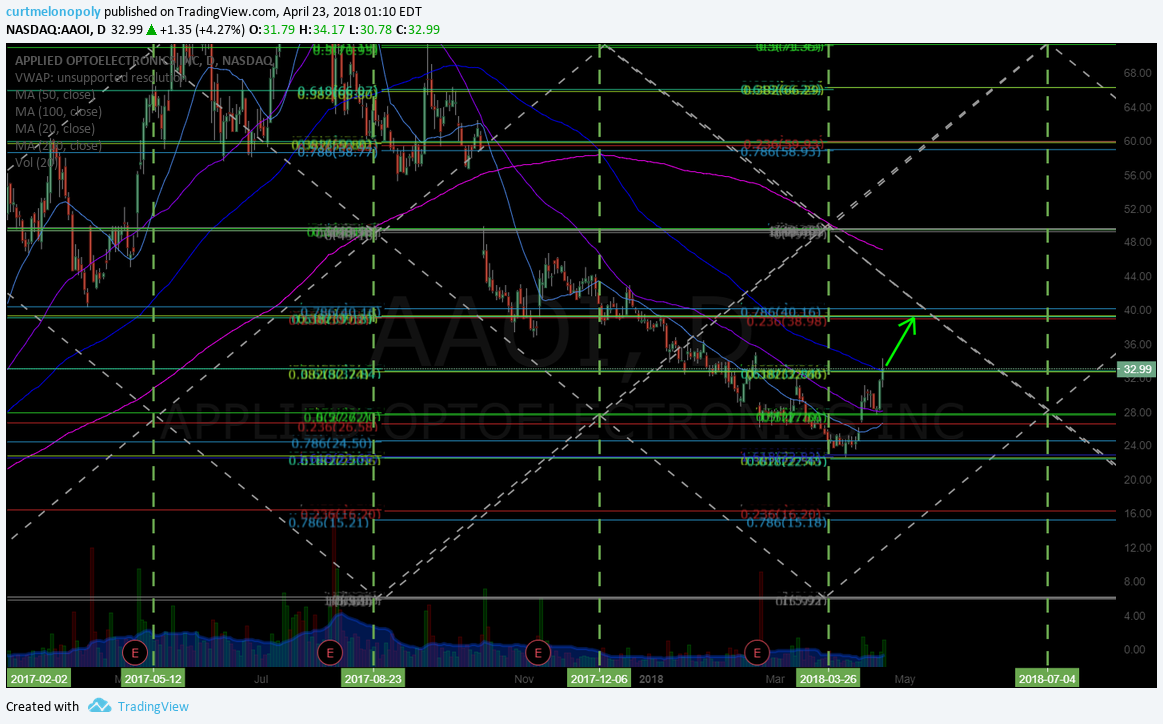

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.