Tag: $HTZ

PreMarket Trading Plan Wed May 23: $SNES, $AVGR, $ESPR, Fed, #EIA, OIL, $WTI, $USOIL, Gold, $SPY, $HTZ, $PG, $BTC, $NFLX, $AAPL more.

Compound Trading Trading Plan and Watch List Wednesday May 23, 2018.

In this edition: $SNES $AVGR $ESPR, Fed, #EIA, OIL, $WTI, $USOIL, Gold, $SPY, $HTZ, $PG, $BTC, $NFLX, $AAPL and more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Quick Update: Reporting, Live Rooms, New Team Members, Pricing, Discounts, Trade Coaching, New Book https://compoundtrading.com/quick-update-reporting-live-rooms-new-team-members-pricing-discounts-trade-coaching-new-book/

What’s New at Compound Trading April / May 2018. https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

Price Increase: Platform wide price increase May 15, 2018. Does not affect existing members. Official announcement to follow.

Machine Trading: May 15, 2018 the new teams start. Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Global Rally Stalls as Trump Doubts North Korea Summit, Questions China Trade https://www.thestreet.com/markets/stocks-14598714 via @TheStreet

Global Rally Stalls as Trump Doubts North Korea Summit, Questions China Trade https://t.co/VI8Gr3Mdhf via @TheStreet

— Melonopoly (@curtmelonopoly) May 23, 2018

12 Stocks To Watch For May 23, 2018 https://benzinga.com/z/11761904 $HPE $INTU $LB $LOW $NTAP $URBN $TIF $TGT $WSM $RRGB $RL $TCS

https://www.benzinga.com/news/earnings/18/05/11761904/12-stocks-to-watch-for-may-23-2018

20 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/11763248 $CARA $TIF $CMTA $LOW $MET $PFNX $RRGB $TCS $TGT $ARDX

Market Observation:

As of 8:21 AM: US Dollar $DXY trading 93.593, Oil FX $USOIL ($WTI) trading 71.86, Gold $GLD trading 1294.09, Silver $SLV trading 16.49, $SPY 271.14, Bitcoin $BTC.X $BTCUSD $XBTUSD 7878.00 and $VIX trading 14.4.

Momentum Stocks to Watch: $AVGR $SNES $CARA $TIF

News:

$SNES $AVGR $ESPR $BLIN $CARA $DCAR $KOOL $MBOT $VLRX $XSPL

$ESPR Esperion shares halted on late-stage trial results

$AVGR Avinger Receives FDA Clearance of Next Generation Pantheris Device

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$LOW $TGT $BBY $KSS $AZO $NTNX $TJX $SPLK $TOLL $QD PSTG $DPW $NTAP $HPE $MNRO $FL $AAP $MDT $TIF $INTU $LB $ADSK $MCK $IGT $URBN $CBRL $RL $TD $CTRP $VEEV $ROST $RY $NDSN $WUBA $LX $HRL $PLAB $GPS $EV $DY $DXC $GSM $TTC $RDCM

http://eps.sh/cal

#earnings for the week$LOW $TGT $BBY $KSS $AZO $NTNX $TJX $SPLK $TOLL $QD PSTG $DPW $NTAP $HPE $MNRO $FL $AAP $MDT $TIF $INTU $LB $ADSK $MCK $IGT $URBN $CBRL $RL $TD $CTRP $VEEV $ROST $RY $NDSN $WUBA $LX $HRL $PLAB $GPS $EV $DY $DXC $GSM $TTC $RDCM https://t.co/r57QUKKDXL https://t.co/kTMLDoQ8zI

— Melonopoly (@curtmelonopoly) May 20, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Keep it Simple Gold Trade MACD Daily Chart says Gold still on sell side. $XAUUSD $GC_F $GLD #Gold

No easy trade. Last time Gold dumped 200 MA on daily it bounced at mid quad. #Gold #Chart #Daily

Should be interesting action. End of time cycle at right of screen on the model. Rosie Gold Algorithm. #Gold $GLD $GC_F $XAUUSD $NUGT $DUST

Gold trade since last report up in to resistance apex and dumped hard. Rosie Gold Algorithm. #Gold $GLD $GC_F $XAUUSD $NUGT $DUST

Gold monthly offering a decent risk reward to bulls here. $XAUUSD $GLD $GC_F $GLD $UGLD $FGLD #Gold #Chart

Price hit 2 of 3 intra targets in that trade. Not a bad oil, not great. Next trading plan short at resistance in to EIA lower target.

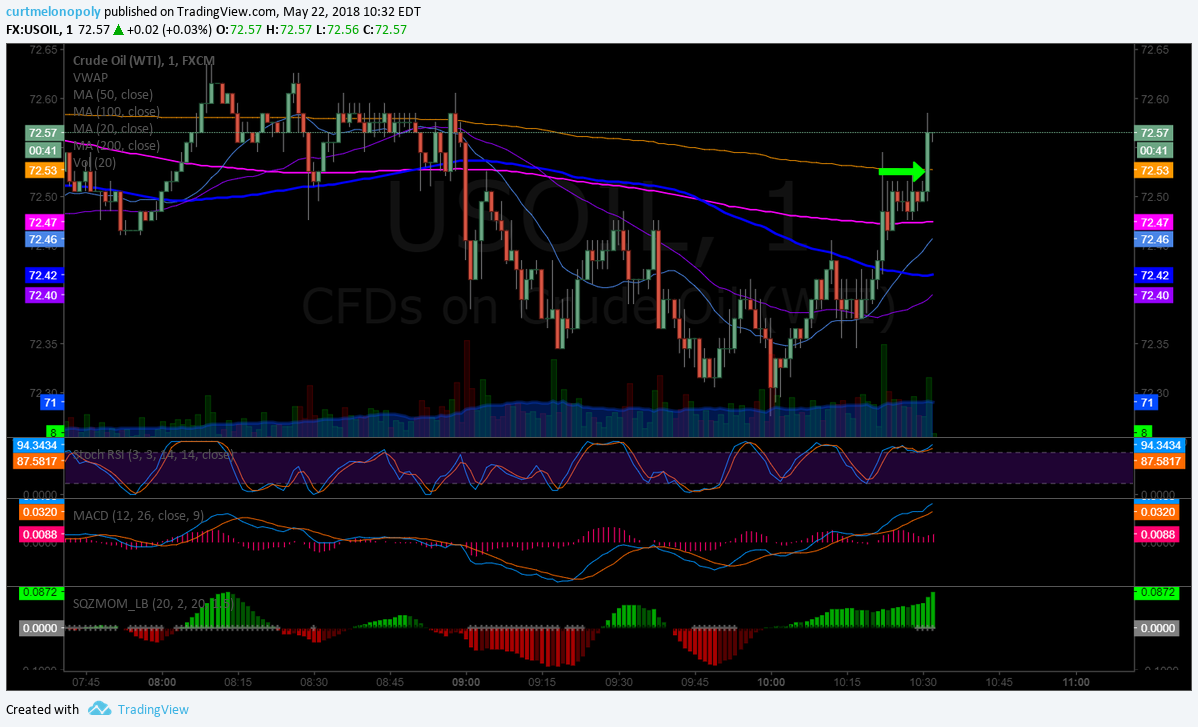

Buy side alert 72.53 over VWAP on 1 min and resistance on model – starter size. EPIC Oil Algorithm Chart FX $USOIL $WTI #OIL $USO $UWT $DWT $CL_F #OOTT #Algo

$AAPL – 188.62 main pivot buy sell trigger, trading 188.86 intra, 191.41 194.82 200.60 main resistance

$SPY – 273.30 resistance, 273.60, 274.51, 276.04, 276.30, 278.43 – .50 May 30 main resistance price target.

$NFLX Momentum today trading 331.17 intra resistance support 328.50 triggers in to 337.80 – .83

$PG Wash-out snap-back trade set-up 50 MA on daily resistance. On watch for continued trade.

US Dollar Index Daily Chart MACD flat, price above main pivot (red line) over 200 MA. $DXY $UUP

Oil Monthly. Above important chart pivot nearing 100 MA. Use caution long in to 100 MA resistance. $USOIL $WTI $USO #OIL

Nice clean weekend trade. White arrow – alert. Green arrow – buy trigger. Red arrow – resistance per alert. Red circles – price targets. $BTC $XTUSD #Bitcoin #Cryptotrading

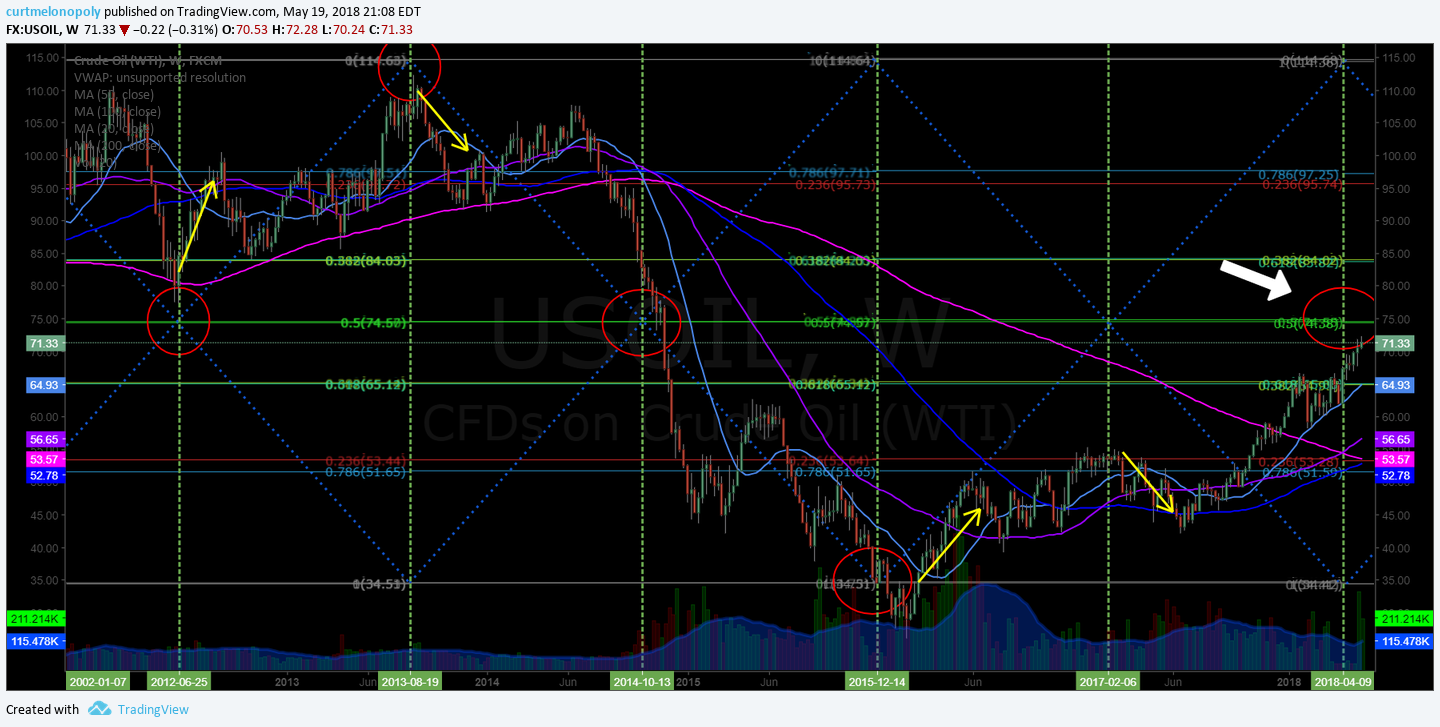

Dating back to 2002, 12 of 13 major time cycles on weekly oil chart have seen trend reversal to some extent or another (detailed post on deck to blog) #OILChart

$HTZ trading 17.89 premarket – trim in to 50 MA on hourly add above.

Simple symmetrical time cycle on weekly, Volatility reversal leading in to July 23 ish probable. $VIX $UVXY $TVIX

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Summit doubts add to geopolitical risks

-Markets drop

-Lira plunges

-It’s PMI day

-Fed minutes due

https://bloom.bg/2IX3TUW

#5things

-Summit doubts add to geopolitical risks

-Markets drop

-Lira plunges

-It's PMI day

-Fed minutes duehttps://t.co/jDiHpAicwi pic.twitter.com/dQc0iOjXCt— Bloomberg Markets (@markets) May 23, 2018

Economic Data Scheduled For Wednesday

Economic Data Scheduled For Wednesday pic.twitter.com/M7OJNNBzvL

— Benzinga (@Benzinga) May 23, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List:

(2) Pre-market Decliners Watch-List : $RRGB $FWP $PFNX $TCS

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $KRO $JWN $CELG $GOL $FCX $WLL $OAS $WEC $GDS $ARLP $KRO $WPX $PE $NFX

$MU Stifel Nicolaus Maintains Buy on Micron Technology, Raises Price Target to $106

(6) Recent Downgrades: $DSW $INTU $RRGB $RIO $SHAK $MRT $LTC $MRT

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $SNES $AVGR $ESPR, Fed, #EIA, OIL, $WTI, $USOIL, Gold, $SPY, $HTZ, $PG, $BTC, $NFLX, $AAPL

PreMarket Trading Plan Mon May 21: $ADOM $BOXL, $FB, OIL, $BTC, $BOX, $ITCI, $EXP, $LAC, $HTZ, $SPY more.

Compound Trading Trading Plan and Watch List Monday May 21, 2018.

In this edition: $ADOM $BOXL, $FB, OIL, $BTC, $BOX, $ITCI, $EXP, $LAC, $HTZ, $SPY and more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Quick Update: Reporting, Live Rooms, New Team Members, Pricing, Discounts, Trade Coaching, New Book https://compoundtrading.com/quick-update-reporting-live-rooms-new-team-members-pricing-discounts-trade-coaching-new-book/

What’s New at Compound Trading April / May 2018. https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

Price Increase: Platform wide price increase May 15, 2018. Does not affect existing members. Official announcement to follow.

Machine Trading: May 15, 2018 the new teams start. Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: GOOGL, GE, MBFI, TSLA, FOXA & more https://www.cnbc.com/2018/05/21/stocks-making-the-biggest-moves-premarket-googl-ge-mbfi-tsla-foxa-more.html

Premarket analyst action – healthcare https://seekingalpha.com/news/3358182-premarket-analyst-action-healthcare?source=feed_f … #premarket $AMAG $ACHN $SBRA $HTA

23 Stocks Moving In Monday’s Pre-Market Session http://benzinga.com/z/11747801 $ATXI $MBFI $FITB $CYAD $WAB $GE $LHO $MNRO $CETX $LX $CHA

23 Stocks Moving In Monday's Pre-Market Session https://t.co/ivu7Zv0iOJ $ATXI $MBFI $FITB $CYAD $WAB $GE $LHO $MNRO $CETX $LX $CHA

— Benzinga (@Benzinga) May 21, 2018

Market Observation:

As of 9:00 AM: US Dollar $DXY trading 93.66, Oil FX $USOIL ($WTI) trading 71.39, Gold $GLD trading 1287.07, Silver $SLV trading 16.49, $SPY 272.99, Bitcoin $BTC.X $BTCUSD $XBTUSD 8503.00 and $VIX trading 13.0.

Momentum Stocks to Watch: $ADOM $BOXL

News:

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$LOW $TGT $BBY $KSS $AZO $NTNX $TJX $SPLK $TOLL $QD PSTG $DPW $NTAP $HPE $MNRO $FL $AAP $MDT $TIF $INTU $LB $ADSK $MCK $IGT $URBN $CBRL $RL $TD $CTRP $VEEV $ROST $RY $NDSN $WUBA $LX $HRL $PLAB $GPS $EV $DY $DXC $GSM $TTC $RDCM

http://eps.sh/cal

#earnings for the week$LOW $TGT $BBY $KSS $AZO $NTNX $TJX $SPLK $TOLL $QD PSTG $DPW $NTAP $HPE $MNRO $FL $AAP $MDT $TIF $INTU $LB $ADSK $MCK $IGT $URBN $CBRL $RL $TD $CTRP $VEEV $ROST $RY $NDSN $WUBA $LX $HRL $PLAB $GPS $EV $DY $DXC $GSM $TTC $RDCM https://t.co/r57QUKKDXL https://t.co/kTMLDoQ8zI

— Melonopoly (@curtmelonopoly) May 20, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Oil Monthly. Above important chart pivot nearing 100 MA. Use caution long in to 100 MA resistance. $USOIL $WTI $USO #OIL

Nice clean weekend trade. White arrow – alert. Green arrow – buy trigger. Red arrow – resistance per alert. Red circles – price targets. $BTC $XTUSD #Bitcoin #Cryptotrading

Dating back to 2002, 12 of 13 major time cycles on weekly oil chart have seen trend reversal to some extent or another (detailed post on deck to blog) #OILChart

$BOX testing upside buy sell trigger in 28.34 area. Trim in to and add above. #swingtrading

$ITCI in to resistance on model trading 22.21 intra, trim in to it add above. Next PT 23.77 support 21.21. #swingtrading #daytrading

$FB has now retraced to near mid quad support price target 181.72 for May 18. New price targets for June 4 time cycle on chart.

Since the May 11 article we have successfully traded the wash-out snap-back swing trade in $FB. First part of the move here.

$AMD triggering long side add over 12.80 targeting 13.47 13.60 with significant resistance 14.62 #swingtrading

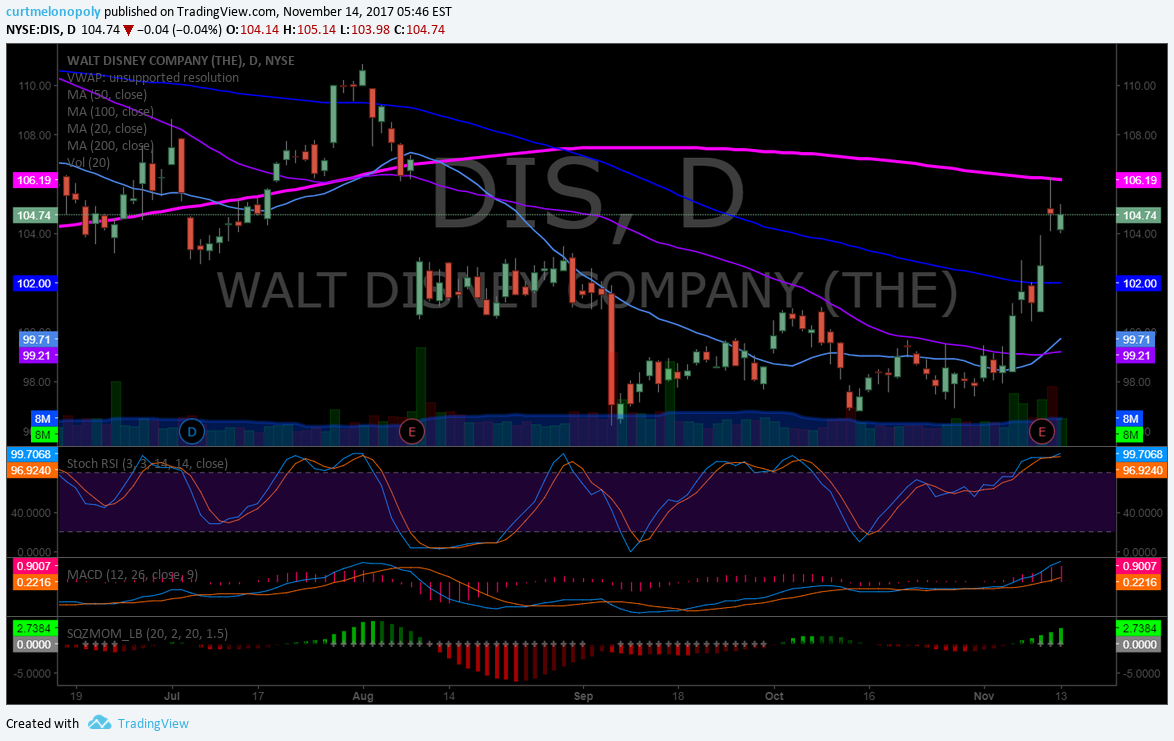

Disney over 200 MA over 103.76 resistance trading 103.96 targets 105.28 next resistance #swingtrading $DIS

Intra Cellular over 21.24 resistance trading 21.36 next target 22.28 and main price target resistance 23.80. #swingtrading

Intra day chart model update for $BOX swing trade #swingtrading #daytrading

$AMBA over 51.60 mid quad res over 200 MA trading 52.19 HOD targeting 54.25 54.75 58.66 #swingtrading

$AAOI hit HOD 33.12 at resistance above targets 37.27 38.69 40.11 200 MA 49.56 July 4 unlikely #swingtrading

$LAC Lithium trading 6.30 power bounce off mid quad 5.40 targeting 6.43 6.54 200 MA res, Jan 1 price targets 7.81 12.60

$MXIM over 20 MA on weekly is a long to 61.38 area. Pivots noted on chart.

Path of least resistance of US Dollar weekly chart 200 MA 94.80 area $DXY

CITI bought conistently at historical support noted previous. MACD trend up. Resistance above. Riding 200 MA. $C

Swing trade $EXP excellent swing trade over buy side 106.10 trim in to 112.28 resistance, next 177.70 major res.

$EDIT flying here hit 37.20 trim in to 37.60 add above – it’s a power move and thats mid quad resistance

$SPY up and over adds to next resistance 274.51 trim in to it add above

$HTZ trading 17.89 premarket – trim in to 50 MA on hourly add above.

Gold. Monthly. $XAUUSD $GC_F $GLD $NUGT $DUST $JDST $JNUG #Gold

Simple symmetrical time cycle on weekly, Volatility reversal leading in to July 23 ish probable. $VIX $UVXY $TVIX

$VIX under moving averages on Daily Chart and under lower bollinger. Long bias RR setting in.

Doesn’t really matter how you draw the lines – there’s a decision coming on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Massive time cycle comes due late July on Gold Daily. Structure in place still. May 14 218 AM #Gold $GLD $GC_F $XAUUSD $NUGT $DUST

With earnings on deck this week watch this one close. 118.00 upside 93.00 downside. Good range. $EXP

$CALA targeting 3.00 range July 6. Trending down quad wall near perfect. Watch for bounce. #swingtrading

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-U.S.-China trade truce

-Italy government

-Dollar outlook

-Markets mixed

-Coming up…

https://www.bloomberg.com/news/articles/2018-05-21/five-things-you-need-to-know-to-start-your-day … pic.twitter.com/eVnMKXcSdW

#5things

-U.S.-China trade truce

-Italy government

-Dollar outlook

-Markets mixed

-Coming up…https://t.co/yl4t4HnL6n pic.twitter.com/eVnMKXcSdW— Bloomberg Markets (@markets) May 21, 2018

Economic Data Scheduled For Monday

Economic Data Scheduled For Monday pic.twitter.com/bFqQY9i0HX

— Benzinga (@Benzinga) May 21, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ADOM $BOXL $MBFI $CVM $NBRV $FORD $ATXI $SHLD $VLRX $CLNE $BRZU $TRXC $LHO $MU $SOXL $BLNK $HUYA $EVHC $HEAR $CHK $FCAU $NXPI $GE

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $ADOM $BOXL, $FB, OIL, $BTC, $BOX, $ITCI, $EXP, $LAC, $HTZ, $SPY

PreMarket Trading Plan Tues May 15: $CLWT, $SORL, $XENE, $RCON, $DIS, $ITCI, $HTZ, $BOX, $EDIT more.

Compound Trading Trading Plan and Watch List Tuesday May 15, 2018.

In this issue: $CLWT, $SORL, $XENE, $RCON, $DIS, $ITCI, $HTZ, $BOX, $EDIT, $SPY, $BTC, $ETHUSD, OIL, $CALA, $EXP and more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Quick Update: Reporting, Live Rooms, New Team Members, Pricing, Discounts, Trade Coaching, New Book https://compoundtrading.com/quick-update-reporting-live-rooms-new-team-members-pricing-discounts-trade-coaching-new-book/

What’s New at Compound Trading April / May 2018. https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

Price Increase: Platform wide price increase May 15, 2018. Does not affect existing members. Official announcement to follow.

Machine Trading: May 15, 2018 the new teams start. Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: HD, ULTA, CBS, TSLA, F, WYNN & more –

Stocks making the biggest moves premarket: HD, ULTA, CBS, TSLA, F, WYNN & more – https://t.co/g5NO1T5SLw

— Melonopoly (@curtmelonopoly) May 15, 2018

25 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/11712868 $A $HAIR $ISNS $VIPS $HD $SWCH $APTO $BOXL $CLWT $LPTH $MYND $SORL $DAVE $XENE $VRX $SYMC

25 Stocks Moving In Tuesday's Pre-Market Session https://t.co/IM88xE4jNT $A $HAIR $ISNS $VIPS $HD $SWCH $APTO $BOXL $CLWT $LPTH $MYND $SORL $DAVE $XENE $VRX $SYMC https://t.co/25mIuNitLW

— Melonopoly (@curtmelonopoly) May 15, 2018

Market Observation:

As of 8:21 AM: US Dollar $DXY trading 92.67, Oil FX $USOIL ($WTI) trading 71.84, Gold $GLD trading 1306.89, Silver $SLV trading 16.36, $SPY 272.98, Bitcoin $BTC.X $BTCUSD $XBTUSD 8770.00 and $VIX trading 13.2.

Momentum Stocks to Watch: $CLWT $SORL $XENE $RCON

News:

$AYTU, $CLWT, $HTBX, $MDGS, $PFNX, $SGLB, $SORL, $XENE

$GILD KITE Announces New Worldwide Facilities and Expanded Collaboration With National Cancer Institute to Support Cell Therapy Pipeline

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$WMT $HD $AMAT $CSCO $M $JCP $DE $TTWO $BZUN $MZOR $NTES $KEM $A $VIPS $CSIQ $LONE $HQCL $MARK $SORL $JWN $DGLY $EXP $SWCH $AZN $CPB $NM $GDP $BCLI $MGIC $TGEN $KMDA $JACK $ATNX $HTHT $MANU $NINE $MTBC $VRTU $RXN $AMRS $FLO

#earnings for the week $WMT $HD $AMAT $CSCO $M $JCP $DE $TTWO $BZUN $MZOR $NTES $KEM $A $VIPS $CSIQ $LONE $HQCL $MARK $SORL $JWN $DGLY $EXP $SWCH $AZN $CPB $NM $GDP $BCLI $MGIC $TGEN $KMDA $JACK $ATNX $HTHT $MANU $NINE $MTBC $VRTU $RXN $AMRS $FLO https://t.co/r57QUKKDXL https://t.co/EFUpuZmWFi

— Melonopoly (@curtmelonopoly) May 14, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

$DIS long side trade doing well – IT IS AT a trim in to 200 MA zone intraday now.

$ITCI cleared the 50 MA getting in to first intra day resistance at red horiz lines

$EDIT flying here hit 37.20 trim in to 37.60 add above – it’s a power move and thats mid quad resistance

$SPY up and over adds to next resistance 274.51 trim in to it add above

$HTZ trading 17.89 premarket – trim in to 50 MA on hourly add above.

Per recent;

$BOX Weekly Algorithmic Model Chart #earnings #trading

Gold. Monthly. $XAUUSD $GC_F $GLD $NUGT $DUST $JDST $JNUG #Gold

Simple symmetrical time cycle on weekly, Volatility reversal leading in to July 23 ish probable. $VIX $UVXY $TVIX

$VIX under moving averages on Daily Chart and under lower bollinger. Long bias RR setting in.

Doesn’t really matter how you draw the lines – there’s a decision coming on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Massive time cycle comes due late July on Gold Daily. Structure in place still. May 14 218 AM #Gold $GLD $GC_F $XAUUSD $NUGT $DUST

With earnings on deck this week watch this one close. 118.00 upside 93.00 downside. Good range. $EXP

$CALA targeting 3.00 range July 6. Trending down quad wall near perfect. Watch for bounce. #swingtrading

Bull bear fight is on with dollar closing the week at the 50 MA. Watch that close. $DXY $UUP

$SPY Daily Chart, ending week bullish with a break above upper TL and 20 MA near breach 50 MA. $ES_F $SPXL $SPXS

Oil Monthly. Right at pivot, between 100 MA Resistance 200 MA Support. MACD SQZMOM trending up Stoch high. $USOIL $WTI $USO #OIL

Market Outlook, Market News and Social Bits From Around the Internet:

Economic Data Scheduled For Tuesday

Economic Data Scheduled For Tuesday pic.twitter.com/RJDq9ZqGNs

— Benzinga (@Benzinga) May 15, 2018

#5things people in markets are talking about today:

-China policy

-Erdogan wants monetary control

-Retail sales

-Markets mixed

-European growth

https://bloom.bg/2rLbU4H

#5things people in markets are talking about today:

-China policy

-Erdogan wants monetary control

-Retail sales

-Markets mixed

-European growthhttps://t.co/fUUQWVknFI https://t.co/q0ylxeePqw— Melonopoly (@curtmelonopoly) May 15, 2018

To prevent oil spiking to $100 over Iran, Saudi Arabia and Russia might have to step in

https://twitter.com/EPICtheAlgo/status/996369476022099969

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $CLWT $SORL $XENE $RCON

(2) Pre-market Decliners Watch-List : $VIPS $KOOL $EOLS $SBGL $SPY $QQQ $IWM

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

$TSLA Morgan Stanley cuts Tesla TSLA PT to $291 from $376, 2020 EPS to -0.12 USD from +2.76 USD

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

In Closing:

A few hours of trade coaching or study on exactly how to trim in to resistance and how to add to your positions on winners and how to cut losses properly and quickly will return huge dividends.

You can subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $CLWT, $SORL, $XENE, $RCON, $DIS, $ITCI, $HTZ, $BOX, $EDIT

PreMarket Trading Plan Fri May 11: $MOSY, $SPY, $GDX, $WTI, $AAPL, $AMBA, $HTZ, $AGN, $AMD more.

Compound Trading Trading Plan and Watch List Friday May 11, 2018.

In this issue: $MOSY, $SPY, $GDX, $WTI, $AAPL, $AMBA, $HTZ, $AGN, $AMD and more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Our apologies for the late reporting this week (trade coaching events and coding office set-up delayed us). Next week will be on schedule.

Quick Update: Reporting, Live Rooms, New Team Members, Pricing, Discounts, Trade Coaching, New Book https://compoundtrading.com/quick-update-reporting-live-rooms-new-team-members-pricing-discounts-trade-coaching-new-book/

What’s New at Compound Trading April / May 2018. https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

Price Increase: Platform wide price increase May 15, 2018. Does not affect existing members.

Machine Trading: May 15, 2018 the new teams start. Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds and near future (4) Machine Learning.

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 9, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: NVDA, DBX, YELP, NWSA, TRI, RDFN & more

Stocks making the biggest moves premarket: NVDA, DBX, YELP, NWSA, TRI, RDFN & more https://t.co/pppzvg8rIZ

— Melonopoly (@curtmelonopoly) May 11, 2018

6 Stocks To Watch For May 11, 2018 https://benzinga.com/z/11693439 $NVDA $SYMC $TRI $TTD $YELP $WOW

6 Stocks To Watch For May 11, 2018 https://t.co/Y7AO56Kidl $NVDA $SYMC $TRI $TTD $YELP $WOW

— Benzinga (@Benzinga) May 11, 2018

Market Observation:

As of 8:10 AM: US Dollar $DXY trading 92.72, Oil FX $USOIL ($WTI) trading 71.28, Gold $GLD trading 1324.41, Silver $SLV trading 16.77, $SPY 272.30, Bitcoin $BTC.X $BTCUSD $XBTUSD 9337.00 and $VIX trading 13.5.

Momentum Stocks to Watch:

$MOSY $TTD

News:

$ATOS $MOSY $RCKT

$KTOV Kitov Announces Consensi™ Commercialization Agreement for China

Kitov also has a 5/31/18 PDUFA date

$RXII Enters into Material Transfer Agreement with Iovance Biotherapeutics

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$NVDA $DIS $JD $VRX $ROKU $CTSH $PETS $TSN $SYY $WB $AMC $EA $GRPN $ETSY $MTCH $BKNG $MCHP $AAOI $ICPT $TWLO $SRE $LPX $ENB $SN $ETP $TSEM $ALB $KOS $MNK $TTD $ICHR $DNR $OAS $MNST $MELI $SINA $MAR $TEUM $BUD $DISCA $ARQL $CTL

#earnings for the week$NVDA $DIS $JD $VRX $ROKU $CTSH $PETS $TSN $SYY $WB $AMC $EA $GRPN $ETSY $MTCH $BKNG $MCHP $AAOI $ICPT $TWLO $SRE $LPX $ENB $SN $ETP $TSEM $ALB $KOS $MNK $TTD $ICHR $DNR $OAS $MNST $MELI $SINA $MAR $TEUM $BUD $DISCA $ARQL $CTL https://t.co/r57QUKKDXL https://t.co/MH3qVcVQ6Z

— Melonopoly (@curtmelonopoly) May 6, 2018

Trade Set-up Alerts & Reports. Recent / Current Holds, Open and Closed Trades:

$SPY Daily Chart, ending week bullish with MACD turned up, price above MA’s and 20 MA about to cross. $ES_F $SPXL $SPXS

$AAPL premarket

$GDX has played out perfect hitting 22.99 today with 23.13 target. Be sure to take profits. #swingtrading

This is a big test for $FB here, wise to be trimming in to this resistance and add above.

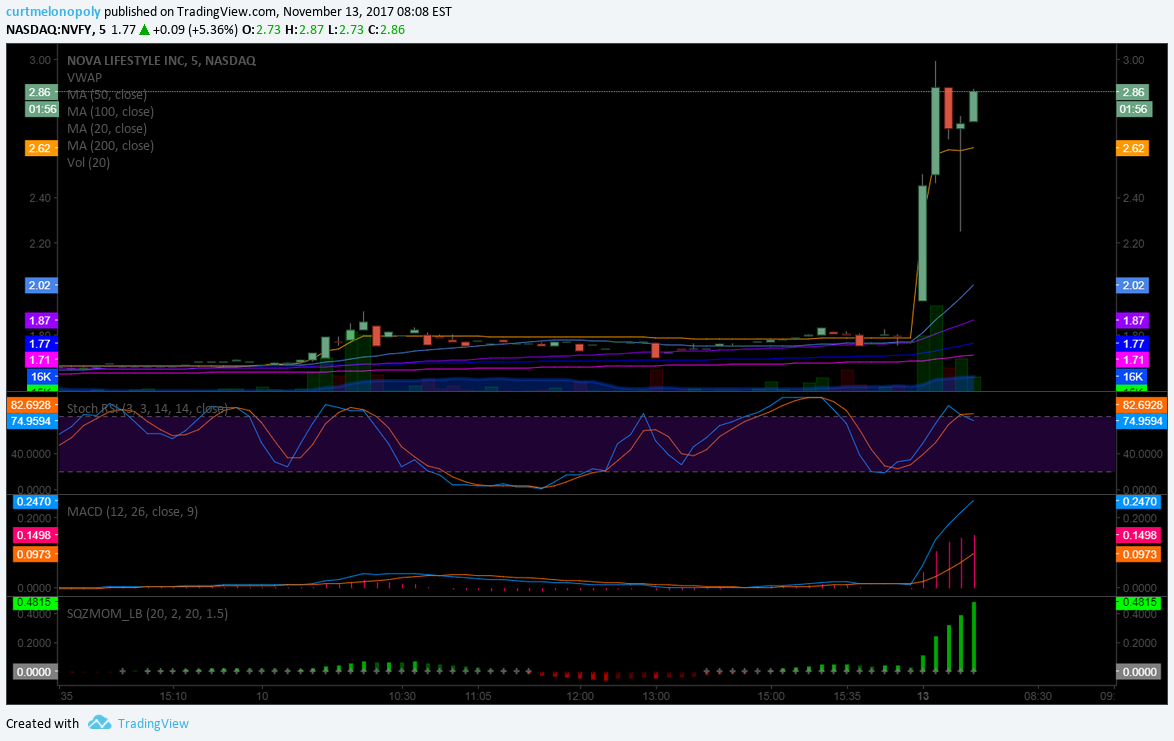

$HTZ In it to win it. Trading 17.60 up 2.7% #daytrading #snapback #washout

Long side bias $HTZ over 200 MA on 3 min buy side 17.51 for 18.50 target on 5 min 200 MA

$TSLA long side adds triggered over 50 MA targeting 100 MA 318.00 (trim into add above) then 326.00

100 MA resistance test on oil monthly chart comes in right where Fib resistance comes in on weekly chart. $USOIL $WTI

$AMBA strength in to time cycle peak, over 200 MA trading 52.21 targeting 54.26 54.65. Careful other side of time peak expect some retrace possible.

$AMD over 200 MA targeting 12.24 significant resistance at mid quad, trim in to it and add above.

Per recent;

$JD came off hard after alert to trim. Nice quick gap fill play. Holding ER is dangerous.

$DXY US Dollar watch the 92.40 area. Above is structural and bullish bias. $UUP

$AMBA hit 51.60 today per alert next price target 51.50, trim in to resistance add above. Above 200 MA 51.93 targets 54.23

$AMBA hitting alerted targets – Part 1 of 2: How to Trade the Move. Do Not Ignore This Trade Set-Up | 40% ROE 3 Mos https://t.co/cn9VfebT0t

— Melonopoly (@curtmelonopoly) May 9, 2018

$AAPL swing trade set up going well. 186.68 at open with 188.60 target in site. Trim as it nears.

Long swing traders in oil need to pay close attention to 100 MA on monthly 75.00 area. FX $USOIL $WTI

$ITCI did get pop at 200 MA support as expected and alerted. MACD cross but SQZMOM still red. Up 7.8% today. Trading 19.43.

$SSW nailed the target for May 9 perfect. Swing trading precision. #swingtrading

US Dollar Index looking serious about this move. Above 200 MA and MACD took flight. $DXY $UUP

$AGN time cycle expires June 4 and they present soon. And it’s a massive time-cycle completion. Notes on chart. #swingtrading

Market Outlook, Market News and Social Bits From Around the Internet:

Economic Data Scheduled For Friday

Economic Data Scheduled For Friday pic.twitter.com/b58ED7vpfx

— Benzinga (@Benzinga) May 11, 2018

#5things

-Trump’s North Korea opportunity

-U.S. yield curve

-Fall of Rome

-Markets mixed

-Unusual oil comments

https://bloom.bg/2I7Gf8N

#5things

-Trump's North Korea opportunity

-U.S. yield curve

-Fall of Rome

-Markets mixed

-Unusual oil comments https://t.co/f9wvl8tbp8 pic.twitter.com/UAxnAcLMOt— Bloomberg Markets (@markets) May 11, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MOSY $TTD $ANFI $FRTA $KTOV $IMMR $AMH $RXII $DGSE $VRAY $ADXS $IQ $MAURY $SITO $MT $SOXS $EXEL $RBS $JNUG $USLV

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

$NVDA $VZ $JEC $VYGR $USB $NHI $BMA $SUPV $FTI $ZYME $MRT $RBS $BFR $RARE $MERC $GXP $SRPT $SATS $AKCA $TPRE $BIDU

HubSpot Inc $HUBS PT Raised to $120 at RBC Capital

The Trade Desk $TTD PT Raised to $80 at RBC Capital

(6) Recent Downgrades:

$MG $LB $SYMC $IHG $TU $TSU $PSDO $TGI $MATR $KSS $HALO $COTY $OBLN

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $MOSY, $SPY, $GDX, $WTI, $AAPL, $AMBA, $HTZ, $AGN, $AMD

PreMarket Trading Plan Tues Nov 14 $DIS, $MXIM, $AMBA, $VRX, $AAOI, $HIIQ, $CELG, $ROKU, $HTZ, $HMNY, $SNAP, Bitcoin, $BTC, Oil, $WTI, Gold

Compound Trading Chat Room Stock Trading Plan and Watch List Tuesday November 14, 2017 $DIS, $MXIM, $AMBA, $VRX, $AAOI, $HIIQ, $CELG, $ROKU, $HTZ, $HMNY, $SNAP, Bitcoin, $BTC, Oil, $WTI, Gold – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:

$SPY, $VIX, $DXY models are currently in re-balance / re-do mode for upcoming coding in 2018. Crypto model is being re-done in light of recent volatility. All to be complete prior to Nov 20, 2017.

Per recent; EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto was released Sept 1.

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. Looks like a master class will happen in Columbia Jan 2018 – will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

Part 2 of Episode 4 Podcast – Data Scientist

Part 2 – Episode 4 Podcast : Data Scientist Fireside, https://t.co/r85TlxJ9a4

— Melonopoly (@curtmelonopoly) October 23, 2017

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

BEST Trade Set-ups in a while! Nov 10 (starts 4:42): OIL, GOLD, $VIX, $VRX, $ROKU, $AAOI, $HTZ …

Wed Nov 8 Trade Set-Ups Review: $SPI, $BTC, $VRX, $AAOI, $KBSF, $LEU, $ONCS, $DEPO, $SNAP…

Nov 7 Trade Set-Ups Review: $DVN, $GOOGL, $TSLA, $HMNY, $VRX, $AAOI, $MYO, $TOPS, $BTC…

Nov 6 Trade Set-Ups Review: GOLD, $GLD, $HMNY, $RCL, $BTC, $WTI, $USOIL, $FB, $TOPS, $SPPI, $BAS…

Nov 2 Trade Set-Ups Review: $TSLA, $USOIL, $GPRO, $DRNA, $GSIT, $W …

Nov 1 Trade Set-Ups Review: $MDXG, $OSTK, OIL, $WTI, $AMBA, $TRIL, $AAOI, $UAA, $LBIX, $DWT…

Oct 31 SwingTrade Set-Ups Review: $UAA, $TAN, $SPPI, $SHOP, $SNGX, $AKS, $HMNU, OIL, $BTC, $VRX…

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Morning Momentum / Gap / News / PR / IPO Stocks on Watch: $ROKU

Recent IPO’s $FEDU $CBTX $IFRX $MCB

From recent: $VRX has a beat – high on watchlist. Shippers, low floats and oil related small caps have been active. Starting to look at cyber crime stocks – $VEEV etc.

Also watching $MXIM, $DIS, $AMBA, $VRX, $AAOI, $HIIQ, $CELG, $ROKU, $HTZ, $HMNY, $SNAP, Bitcoin, $BTC, Oil, $WTI, Gold

Shippers list: $TOPS $DRYS $SHIP $ESEA $DCIX

Market observation / on watch:

US Dollar $DXY flat / up ish lately trading 94.53. Oil $USOIL $WTI has lift in recent days / weeks, in multi month sideways action but near highs now and currently near important intra day support in model / just under important chart resistance on wide-frame swing trading 56.46, Gold / Silver in flat range with late week down last week and overnight bounce (closed my position for win on ss) – Gold intra day is trading at 1275.71. $SPY is moderate but does have a MACD turning down on daily, $BTCUSD $XBTUSD has had a major sell-off (technical in nature with Fib retracement) and $VIX up trading at 11.7.

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

Recent / Current Holds, Open and Closed Trades:

$WYNN was previously closed for a win, Gold trade ss went well and a win.

Closed Gold short 1270.40 #GOLD $GC_F $GLD $XAUUSD $NUGT $DUST #algorithm #rulesbasedtrading pic.twitter.com/e059wPE6bu

— Melonopoly (@curtmelonopoly) November 14, 2017

Previous recent trading position notes:

Live trade in $ROKU on video and how I knew exactly where to enter and exit on extensions here : https://twitter.com/curtmelonopoly/status/928605860074532864 … #trading

Recent trades in $ROKU and $VRX have gone well. Hold $WYNN swing trade going very well, Gold short going well from Friday, $SNAP very small position needs to be traded out of and $AAOI swing trade is improving. $SPPI swing trade I may have to cut at a small loss.

Back in Bitcoin and doing well obviously with overnight trade, holding $AAOI (survived ER), holding 1 small $SNAP position, $SPPI swing holding, $WYNN holding and going well as is $FB small position(s). Holding small oil play through EIA. Watching Gold here with weekly chart bullish slant.

Closed $DWT starter for a loss. $WYNN, $FB going well. $AAOI will see soon – ER on deck. $SPPI flattish swing.

Flipped to a small oil long premarket also.

Looking for Bitcoin chart to reconstruct for a long hammer down.

New position in $WYNN going well, we got out of $SHOP swing right before it tanked, $FB going we close (that was a decent swing ROI), $SPPI swing trade I am holding, $DWT small swing trade position holding for now – watching oil close and $AAOI (our toughest trade all year) we are unfortunately holding in to earnings.

New position in $WYNN going well, we got out of $SHOP swing right before it tanked, $BTC trades going well, $FB going well and $AAOI we shall see in to earnings here ugh.

No trades Tuesday other than $XTBUSD.

Hold small $SNAP (win), holding $SPPI (YTBD), hold some $FB (win), $XBTUSD many trades & all wins (only thing we can claim that – we don’t lose), $AAOI underwater and holding waiting for a bounce for a double down, $SHOP holding and trimmed some (winning), Gold closed my short for a win, and oil no new position as of yet.

Out 99% of $SNAP for win, new swing in $SPPI in to earnings. Hold most of $FB swing for winning exits, $XBTUSD Bitcoin we have been winning of course and especially with most recent downturn and spiking yesterday (we bought all the way down and sniped off some on bounces) and $AAOI holding, $SHOP holding. In a tight oil trade premarket long and a swing in Gold short.

Yesterday killed Bitcoin and an oil scalp. Holding $AAOI, $SNAP, $SHOP.

Holding everything still… trimmed some $SNAP and keep winning on Bitcoin 100 x leverage 24 hours a day 7 days a week.

Recent Chart Set-ups on Watch:

Review You Tube posts. Most recent of interest are $DIS, $MXIM, $CELG, $HIIQ, $AMBA, $ROKU, $HTZ, $AAOI, $HMNY

$DIS premarket trading 104.50 Gap fill complete, meet 200 MA with MACD SQZ Stoch RSI up 20 MA breaching, post ER. #swingtrading See notes on Trading View Chart https://www.tradingview.com/chart/DIS/wgCnLho9-DIS-premarket-trading-104-50-Gap-fill-200ma-MACD-see-notes/ …

$DIS premarket trading 104.50 Gap fill complete, meet 200 MA with MACD SQZ Stoch RSI up 20 MA breaching, post ER. #swingtrading See notes on Trading View Chart https://t.co/Q7QuYaMqgK pic.twitter.com/LN7T7PBeLl

— Melonopoly (@curtmelonopoly) November 14, 2017

Per recent;

$AMBA could rip in to earnings in 17 days – Stoch RSI close to bottom with a break above sees 61.00 fast 65.00 possible. #swingtrading

$AMBA could rip in to earnings in 17 days – Stoch RSI close to bottom with a break above sees 61.00 fast 65.00 possible. #swingtrading pic.twitter.com/1iqGppNGQF

— Melonopoly (@curtmelonopoly) November 13, 2017

Per recent;

As above, starting to look at cyber crime stocks – $VEEV etc – obvious catalyst with Bitcoin.

$OCN is added to my watchlist thanks to JDee in the room on mid day chart review and $SPPI which I am in.

From Monday in the room $LCI (thanks to Sean) and $HIIQ are on my watchlist.

I am adding $ONTX to my short term watch… it has its 200 MA and is in a bull formation. $BABA, $BBRY. $GBTC, $AAOI, $FIT, $FSLR, $JKS, $FEYE $LACDF, $CTSH, $NVO, $TSLA, and $AAMJ. $NLNK and $PI are recent chart set ups – $GPRO for possible break out on chart and recent new includes $SNAP and $ARRY – $ARWR, $CDNA, $XXII, $SHOP (wash-out), $SENS, $HCN, $GTHX, $EDIT, $IPI, $XOMO, $MBRX, $PDLI, $LPSN and more that can be reviewed on You Tube videos or on weekly Swing Trading reports.

See other mid day charting trade set-up reviews on You Tube. The set-ups are key to success if you’re swing trading (even daytrading).

We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day. Many of the mid day reviews are published “private” for members only so be sure to watch your email inbox for these among other member only videos.

Market Outlook:

Moderate…. $VIX is starting to rumble.

Credit Slips – SPX(inverted) vs. Credit

Credit Slips – SPX(inverted) vs. Credit pic.twitter.com/3vtKA4m04t

— MQTA (@Steen_Jakobsen) November 14, 2017

Per recent;

JNK Bonds – still the chart to watch – big week in the markets.

Moderate with a concern toward MACD on daily $SPY chart.

$SPY MACD remains decent buy sell trigger and is currently threatening lower. S&P 500 $SPY 525 AM Nov 13 $ES_F $SPXL, $SPXS https://t.co/xnVSgtdSzo pic.twitter.com/CmCoIFJvq3

— Melonopoly (@curtmelonopoly) November 13, 2017

Market News and Social Bits From Around the Internet:

Stocks making the biggest moves premarket: HD, GE, AAP, DKS, BWLD, KO, GS & more –

Stocks making the biggest moves premarket: HD, GE, AAP, DKS, BWLD, KO, GS & more – https://t.co/j1xqJLoNPg

— Melonopoly (@curtmelonopoly) November 14, 2017

$HD Home Depot premarket up 2.8% trading 169.90 on earnings #daytrading #swingtrading

$HD Home Depot premarket up 2.8% trading 169.90 on earnings #daytrading #swingtrading pic.twitter.com/3cxizT5Yng

— Melonopoly (@curtmelonopoly) November 14, 2017

US Producer Price Index up 0.4% in Oct, vs 0.1% increase expected

US Producer Price Index up 0.4% in Oct, vs 0.1% increase expected https://t.co/VOsWbc26Jn

— CNBC Now (@CNBCnow) November 14, 2017

Per previous;

Upcoming #earnings releases with the highest #volatility

$ANW $SORL $WPRT $SCVL $ASUR $WUBA $SFUN $DQ $YRD $ANF $SSYS $SITO $FL $IGT $BBY $MTSI $DKS $VBLT

upcoming #earnings releases with the highest #volatility$ANW $SORL $WPRT $SCVL $ASUR $WUBA $SFUN $DQ $YRD $ANF $SSYS $SITO $FL $IGT $BBY $MTSI $DKS $VBLThttps://t.co/lObOE0dgsr pic.twitter.com/BMWsZtM719

— Earnings Whispers (@eWhispers) November 13, 2017

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ITUS, $BWLD, $ISNS $AAP $DHXM $JAGX $TCON $MARK $IGT $SSYS $ROKU $ZX $TGTX $CLSN $ACRX $VOD $BLDP $HMNY

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $CVRR $KNX $SHPG $PBF $LKSD $MMI $ZBH $DK $WETF $CJ $DB $DAVE $ADMA $MRTX $ADP

(6) Recent Downgrades: $PSX $TFX $STO $BGNE $JD $RES $GE $HLT $CF $RES

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $DIS, $MXIM, $AMBA, $VRX, $AAOI, $HIIQ, $CELG, $ROKU, $HTZ, $HMNY, $SNAP, Bitcoin, $BTC, Oil, $WTI, Gold, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY

PreMarket Trading Plan Mon Nov 13 JNK Bonds, $NVFY, $AMBA, $VRX, $AAOI, $HIIQ, $CELG, $ROKU, $HTZ, $HMNY, $SNAP, $WYNN, Bitcoin, $BTC, Oil, $WTI, Gold

Compound Trading Chat Room Stock Trading Plan and Watch List Monday November 13, 2017 JNK Bonds, $NVFY, $AMBA, $VRX, $AAOI, $HIIQ, $CELG, $ROKU, $HTZ, $HMNY, $SNAP, $WYNN, Bitcoin, $BTC, Oil, $WTI, Gold – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Really proud of this lady! Give her a follow she’s doing great!

Congratulations! Glad we have team green from red and on their way to freedom! Takes hard work like Leanne put in. Nice job Leanne! #premarket #freedomtraders https://t.co/FeSqsnmppD

— Melonopoly (@curtmelonopoly) November 8, 2017

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:

$SPY, $VIX, $DXY models are currently in re-balance / re-do mode for upcoming coding in 2018. Crypto model is being re-done in light of recent volatility. All to be complete prior to Nov 20, 2017.

Per recent; EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto was released Sept 1.

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.