Compound Trading Swing Trade Report Sunday October 14, 2018 (Part A).

Swing Trading Signals and Stock Picks In this Issue: FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ.

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part A of this special swing trading report covering stocks that we have recently been trading or have been active stocks traded by our members and/or stocks that were recently covered at the Trade Coaching Boot Camp. Basically we are consolidating all the most recent swing trade strategies in to a few reports prior to earnings season kicking in. After this short series of reports we will return to the regular rotational reports and also introduce some themed swing trading reports (we have one for swing trading pot stocks, we are working on a financials report and an energy special report currently).

Swing trading set-ups in this short series of reports over the few weeks will provide charting and trade signals for the following equities; FEYE, ROU, SHOP, ARWR, TSLA, AGN, CRON, SQ, XBIO, FB, DIS, LEVB, NBEV, NIHD, BZUN, BLDP, AMD, OSI, CARA, BABA, EDIT, AAPL, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT among others. If you have any swing trading charting requests send them to us on email. The first of the trading set-ups in this series are included below.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service to also include special reports for earnings season, special trade set-ups, and swing trade alerts direct to your email inbox. Per above, soon we will also be producing themed reports.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red type for ease of review.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent. For newer members, if you need a password for a locked historical post please email us your request.

Password “tradingrules” Oct 8 – Protected: Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Password “HEREWEGO” Oct 7 – Protected: How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Password “TRIM” Oct 4 – Protected: Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Password “VIX” Oct 2 – Protected: Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Password “oiltrade” Oct 3 – Protected: Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Password “89” Sept 26 – Protected: Trade Alerts | Day Trade & Swing Trades (w / video) Trading Square $SQ, $DIS, $NFLX, $AMD, OIL, $FB, $GOOGL and more.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Current Swing Trading Signals and Stock Charts.

FIREEYE (FEYE) Trading 16.68, on 200 MA support, mid quad key support 16.22, with MACD turned down – key bearish signal. #swingtrade $FEYE

Key resistance trade signal is at 19.24 on this chart with key support trade signal for FEYE at 13.05. The MACD turned down on the daily chart is a bearish signal but price is above 200 MA and above primary support for the range (mid quad horizontal Fibonacci line) at 16.18.

Under 16.18 is a short to a possible price target of 13.05 Dec 3, 2018.

Above 16.18 is a long to a possible price target of 19.32 Dec 3, 2018.

Indecisive trade will see 16.18 range Dec 3, 2018.

No current trader bias for the FEYE trade set-up – indecisive, but recent trajectory does suggest 19.32 Dec 3, 2018 as long as price holds 16.18 and 200 MA.

Fireeye Inc.: “Fireeye’s right. We just spoke to Fireeye. Unfortunately, Fireeye’s business is connected with North Korea, Russia and China, and those three guys are still coming at us with everything they have. That’s why I like Fireeye.” Cramer’s lightning round Published 7:07 PM ET Wed, 10 Oct 2018 Updated 7:25 PM ET Wed, 10 Oct 2018 https://www.cnbc.com/2018/10/10/cramers-lightning-round-buy-becton-dickinson-literally-tomorrow.html?__source=yahoo%7Cfinance%7Cheadline%7Cstory%7C&par=yahoo&yptr=yahoo

https://twitter.com/swingtrading_ct/status/1051529749590360065

ROKU (ROKU) trading 60.41, MACD turned down bearish signal, above 200 MA with support 58.20, price targets in report $ROKU #swingtrading

The MACD turned down is a considerably bearish signal, the 200 MA on ROKU chart is at 45.69 so it could easily see some considerable downside. However, the algorithmic channel support (first possible, at yellow uptrending line) is at 53.82 and trade recently bounced well off that area. I will be watching the channel support area for a possible trade long pending the general market sentiment near-term.

Near term support is also at 58.20 (mid quad Fibonacci support) and range support (trading box) is at 53.50. Range resistance on ROKU chart is at 63.16.

If downward pressure ensues then 48.49 Oct 30, 2018 time cycle is probable and even 38.40 is possible.

If market sentiment turns up and trade in ROKU turns up then 68.11 is most likely Oct 30 and 78.00 possible but far from probable.

Indecisive trade scenario sees 58.00 range Oct 30, 2018.

No current trade bias, however, as with others (considering the market sell-off last week) I will be watching general market sentiment going forward for a trade either way in ROKU.

It Will Be Awhile Longer Before Roku Stock Stops Falling $ROKU #swingtrading https://finance.yahoo.com/news/awhile-longer-roku-stock-stops-164144120.html?soc_src=social-sh&soc_trk=tw

It Will Be Awhile Longer Before Roku Stock Stops Falling $ROKU #swingtrading https://t.co/eXH2rfci5p

— Swing Trading (@swingtrading_ct) October 14, 2018

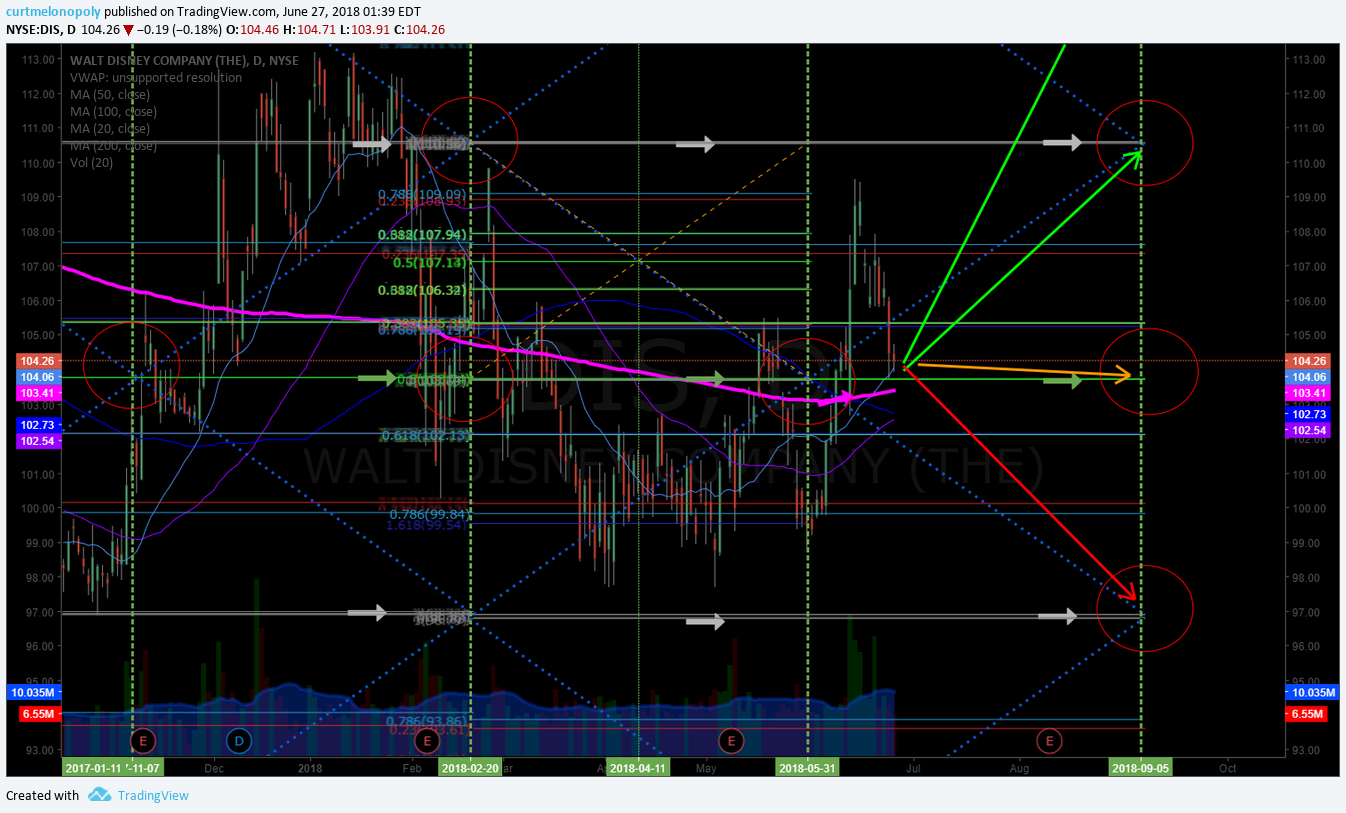

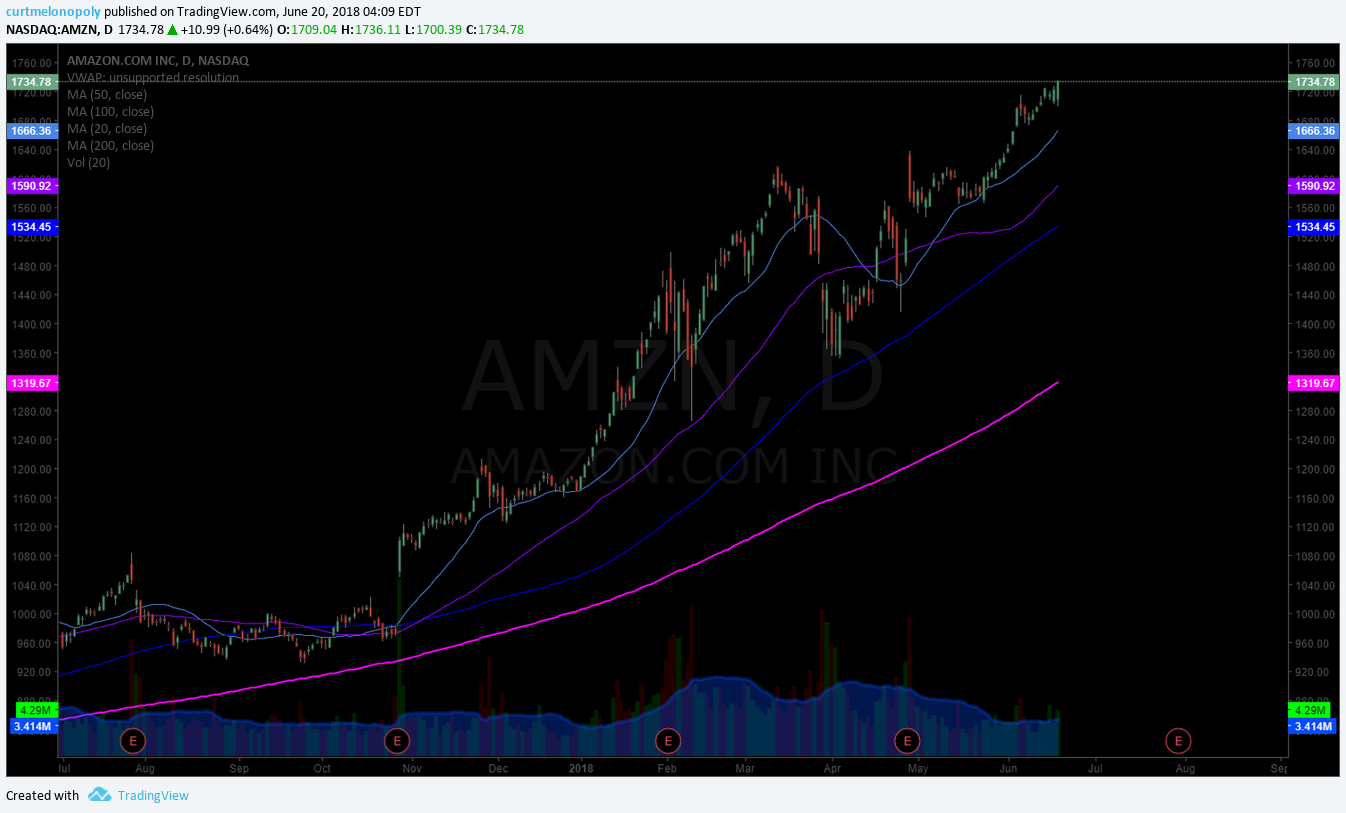

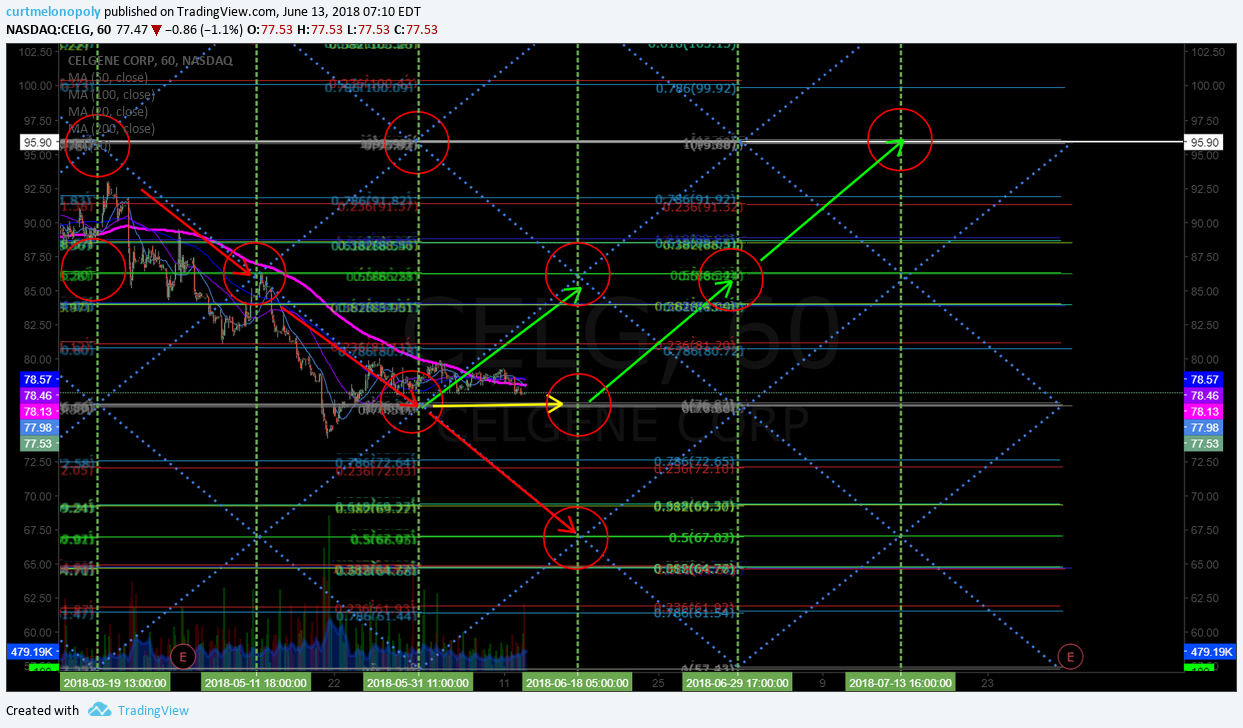

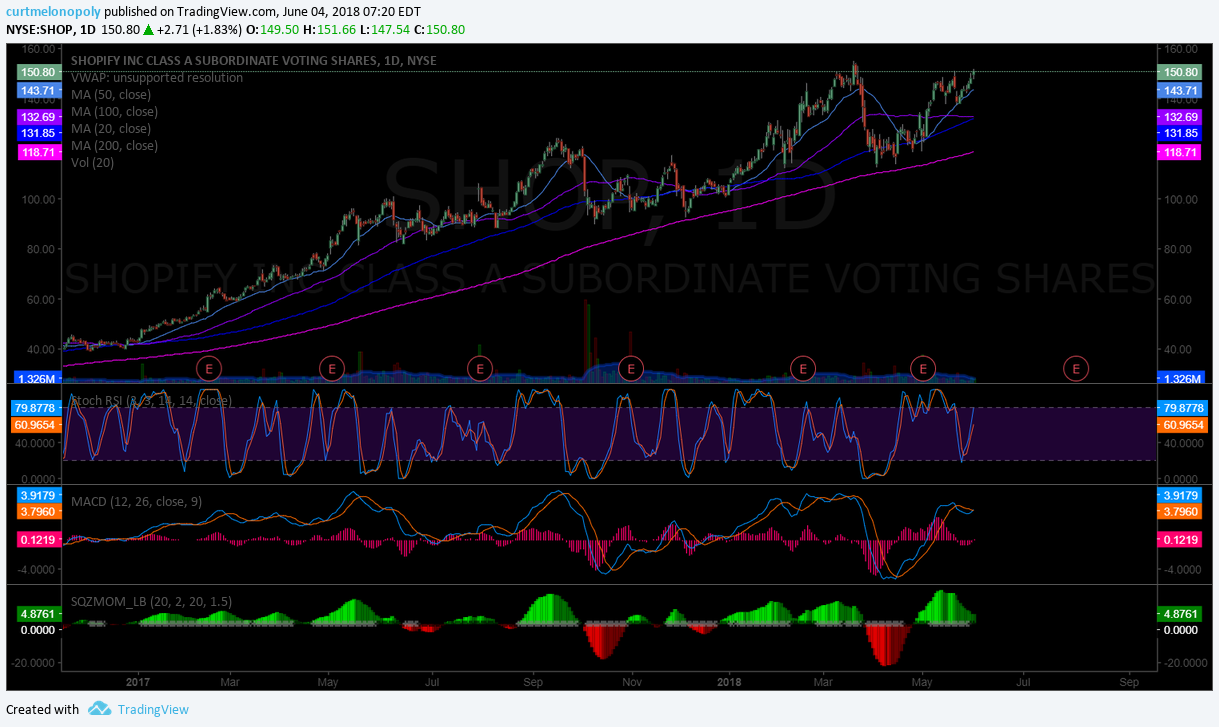

SHOPIFY (SHOP) Trading under 200 MA under main range pivot support is bearish with channel support test near $SHOP #swingtrading

With earnings in 11 days I am watching SHOPIFY very close here to see how trade handles the prospective algorithmic charting channel support area on chart (yellow up-trending line on chart below). If that line fails 116.22 is probable price target for Jan 10, 2019 swing trade with 92.01 possible and 67.59 price target not likely but there.

In a bullish scenario (a turn above the 200 MA with MACD turned back up on daily chart) targets 166.27 probable and 190.89 in a break-out scenario (not likely but definitely possible if the market sentiment turns risk off again).

The trade signal short is the channel support and the trade signal long is MACD down with 200 MA upside breached.

What Should Investors Expect When Shopify Reports Earnings? $SHOP https://finance.yahoo.com/news/investors-expect-shopify-reports-earnings-190000338.html?.tsrc=rss

The future looks bright for Shopify. As e-commerce continues to capture an even greater percentage of retail, the company is positioned to reap even further gains over the years and decades to come. Investors should take a long-term view, however, as the stock price will continue to be volatile. Brace yourself for the wild ride to continue when the company reports on Oct. 25.

What Should Investors Expect When Shopify Reports Earnings? #swingtrading #earnings $SHOP https://t.co/dJJrVM1dRI

— Swing Trading (@swingtrading_ct) October 14, 2018

ARROWHEAD PHARMA (ARWR) MACD turned down but over 200 MA and channel support. On watch for adds to trade. $ARWR #swingtrading #tradealerts

I am currently in a swing trade position (starter size) and will look to add to the swing long at the 200 MA support if trade hits that mark this week (I was hoping it was going to hit end of week last week on late Friday afternoon trade but it didn’t quite get there).

If trade breaks the 200 MA to the downside then 8.90 price target is in play for November 28, 2018 time cycle completion (which is also at the algorithm chart model prospective channel support – yellow line on chart).

The most important support trade signal in near term trade (this week) is that trade closed Friday right near the trading box support range in the 12.65 range. If ARWR sees a bounce then 16.25 is in play for Nov 28th.

Here’s Why Arrowhead Pharmaceuticals (ARWR) Skyrocketed Almost 30% in September #swingtrading $ARWR https://finance.yahoo.com/news/apos-why-arrowhead-pharmaceuticals-skyrocketed-195800224.html?soc_src=social-sh&soc_trk=tw

Here's Why Arrowhead Pharmaceuticals (ARWR) Skyrocketed Almost 30% in September #swingtrading $ARWR https://t.co/oZJf02WuO7

— Swing Trading (@swingtrading_ct) October 14, 2018

TESLA (TSLA) At trading box range support EOD Friday, in a bounce it targets 280.34 Nov 20, 2018 $TSLA #swingtrading

MACD on daily chart is turned down, but TESLA stock trades somewhat eradic in normal course of trade. The range is the most important consideration and I have TESLA on high watch for a significant bounce here. The trading range is fairly consistent and as long as maret sentiment doesn’t completely plummet near-term I’ll likely take a trade for a bounce to upper price target at 279.56 Nov 20, 2018, trading at close Friday 258.78.

As Tesla continues to ramp up production in the fourth quarter, “we can expect the brand to continue to gain ground on the luxury leaders”

Tesla (TSLA) sales in the U.S. are gaining on BMW and other luxury car makers $TSLA https://on.mktw.net/2EhlMge.

Tesla (TSLA) sales in the U.S. are gaining on BMW and other luxury car makers #swingtrading $TSLA https://t.co/rypKnG8zL8

— Swing Trading (@swingtrading_ct) October 14, 2018

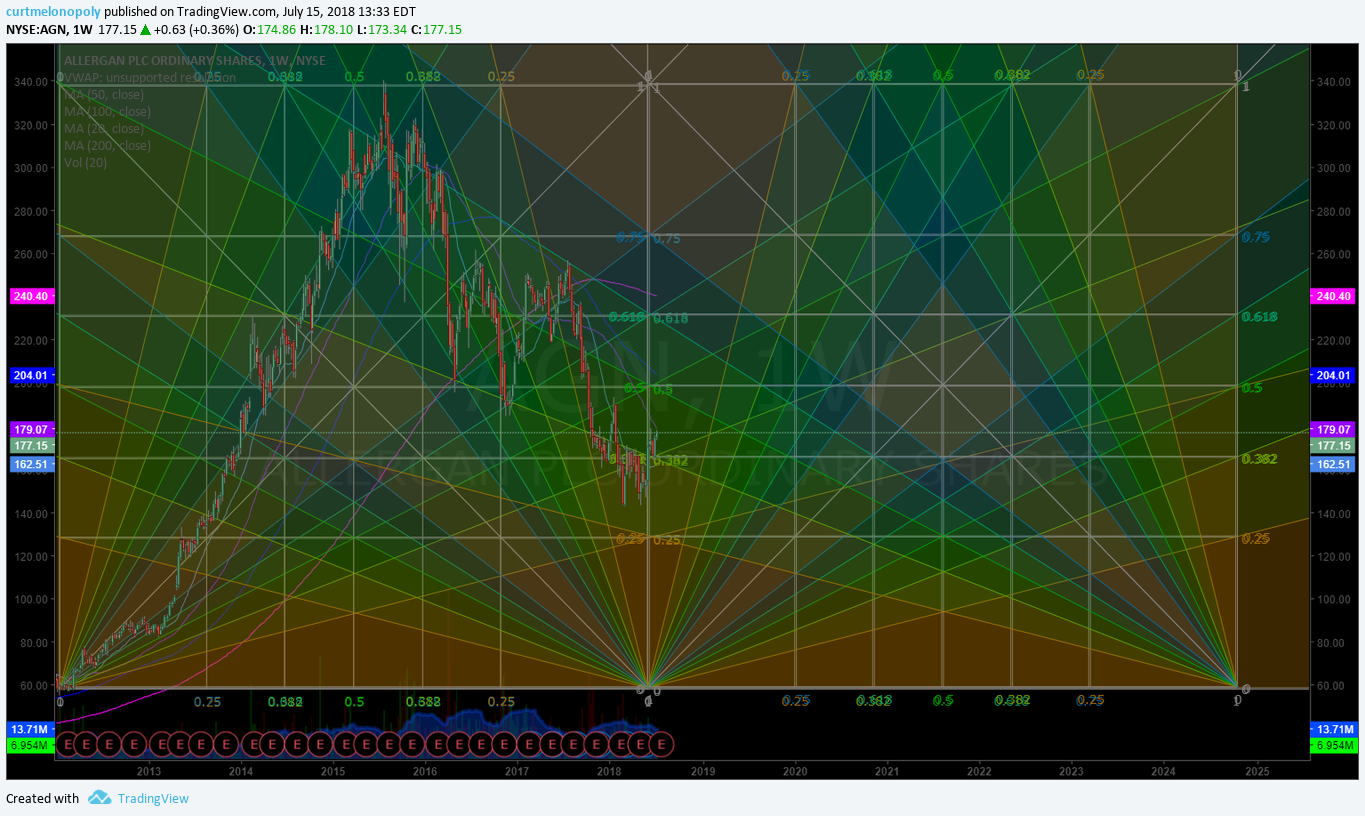

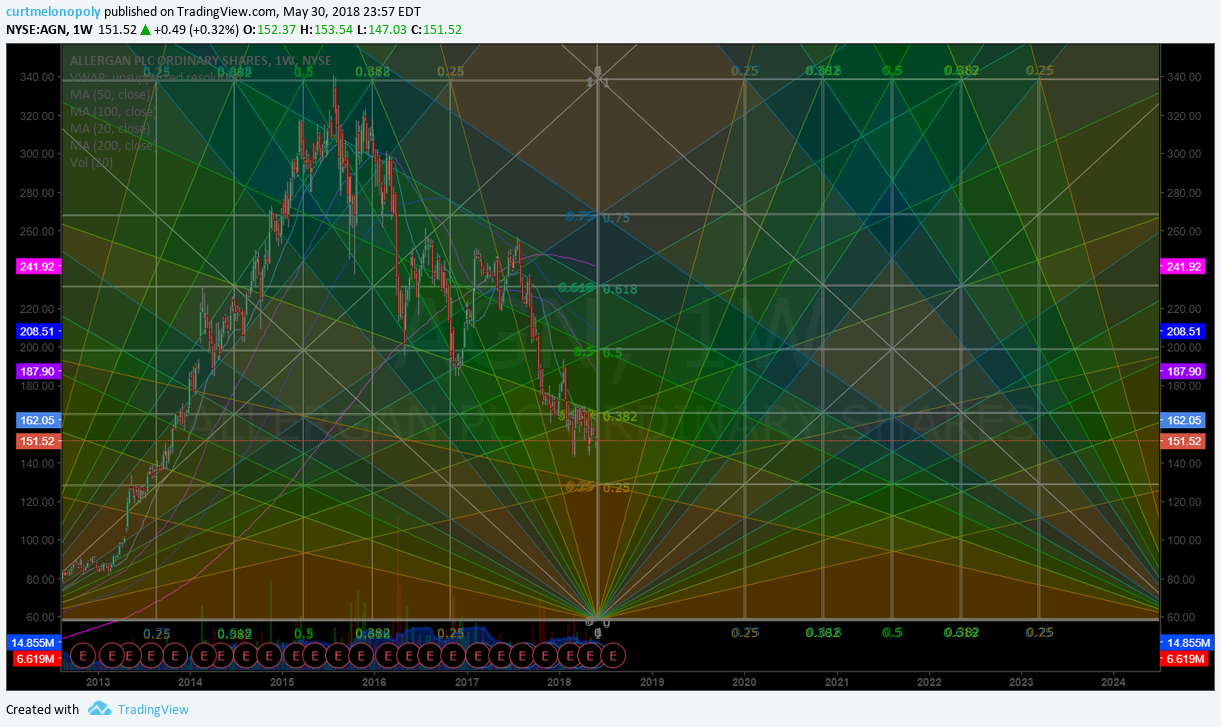

ALLERGAN (AGN) swing trade couldn’t be going any better, add to long at 200 MA or channel support, trim at resistance points $AGN #swingtrading #chart

With earnings in sixteen days and AGN presenting soon (see news article below), trade near 200 MA support – I will consider adding to my position there if it looks to be holding and pending market sentiment, if not I will surely add at algorithmic charting model channel support on the chart as noted below.

Allergan (AGN) To Present Data From 13 Abstracts At The 2018 American Society For Dermatologic Surgery $AGN … https://finance.yahoo.com/news/allergan-present-data-13-abstracts-201500714.html?soc_src=social-sh&soc_trk=tw

Allergan (AGN) To Present Data From 13 Abstracts At The 2018 American Society For Dermatologic Surgery #SwingTrading $AGN … https://t.co/dMM6aw6sVq

— Swing Trading (@swingtrading_ct) October 14, 2018

CRONOS (CRON) above 10.25 buy signal for upside price target, below 8.40 short to price target. $CRON

If trade stays in trading box short at resistance in 10.25 range long at 8.40 range for a bounce in trading box. However, it looks like it could turn here. This is a 240 minute chart and not a daily chart for lower time frame trading.

Also of note, the MACD on 240 min chart just turned back up and the Squeeze Momentum indicator flashed green in last 4 hours of trade on Friday.

3 Cannabis Companies Making Headlines in October #swingtrading $CRON #PotStocks https://finance.yahoo.com/news/3-cannabis-companies-making-headlines-144500687.html?soc_src=social-sh&soc_trk=tw

3 Cannabis Companies Making Headlines in October #swingtrading $CRON #PotStocks https://t.co/uaqaKk1ip5 v

— Swing Trading (@swingtrading_ct) October 14, 2018

SQUARE (SQ) above 74.00 targets 78.64 next. Resistance at 76.27 and 82.27 if in upside trade. $SQ #swingtrade #tradealerts

I really like this trade set-up long again. If markets get momentum this could see a decent upside return. Careful with the resistance areas noted and also note that the chart model is “rough” and needs some work, but good enough to provide signals for an upside swing trade here.

2 Great Stocks That Just Went on Sale SQUARE (SQ) #swingtrading $SQ https://finance.yahoo.com/news/2-great-stocks-just-went-112200807.html?soc_src=social-sh&soc_trk=tw

2 Great Stocks That Just Went on Sale SQUARE (SQ) #swingtrading $SQ https://t.co/X8bmMcr6nr

— Swing Trading (@swingtrading_ct) October 14, 2018

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, Signals, Alerts, FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ