Year: 2020

Schedule Change: Sunday Swing Trading $STUDY Session June 28

Schedule Change: Sunday Swing Trading $STUDY Session June 28, 2020

Evening traders,

Tonight’s Swing $STUDY Webinar will not run as normal, I am going to use the time to update all the charting and alarms for trading signals to be ready for what I think will possibly be a significant week of trade entries.

I see either this week or next being VERY CRITICAL. So I want to be ready.

So I’m going to update all the charts and alarms and send a series of swing trade reports out through the night for our swing trading members.

Also, we have a large oil trade in progress with EPIC V3.1.1 and I want to be available to our techs as needed through the night.

Thanks

Curt

How To Swing Trade Stock Time Cycles: STONECO Trade Review, Part 1 #swingtrading #timecycles

Swing Trading Structured Charting Stock Time Cycles for Predictable Wins and Significant Gains. Part 1.

The STONECO (STNE) Trade Provides an Excellent Opportunity for a Tutorial on How to Swing Trade Stock Time Cycles.

Time cycles are through-out the financial markets, indices, sectors, equities (stocks), commodities, currencies, crypto and in every corner of the financial markets.

- One of the single most considerable trader “edges” we have in our tool kit are time cycles.

- Stock time cycles allow for a trader to gain a better probability edge.

- Time cycles in stock trading allow a trader to better time entries and exits in a trade, time trades and establish appropriate size risk.

The STONECO trade example provides swing traders with a clear idea of how this swing trading strategy works.

In Part 1 we look at the the trade executions, the entries and profit taking areas of trade.

In Part 2 (Premium User) we will look at how exactly traders can replicate our success in this specialized area of swing trading expertise. How to chart the structure of the stock, choosing the best time-frame for the trade, time cycles, advanced Fibonacci Retrace levels and chart modeling, sizing your trade, exits and entries, risk management and more.

Okay, lets look at the trade itself first:

Finding a systematic trading process provides a trader’s edge. The more a trader has, the better. Learn to play the game better, achieve better returns.

Life is like a game of cards. The hand you are dealt is determinism; the way you play it is free will.

Jawaharlal Nehru

Life is like a game of cards. The hand you are dealt is determinism; the way you play it is free will.

Jawaharlal Nehru

— Melonopoly (@curtmelonopoly) June 18, 2020

Below is a tweet I sent out today that includes screen shots of the swing trade alert feed of the charting and alerts for exits and entries in this time cycle trade.

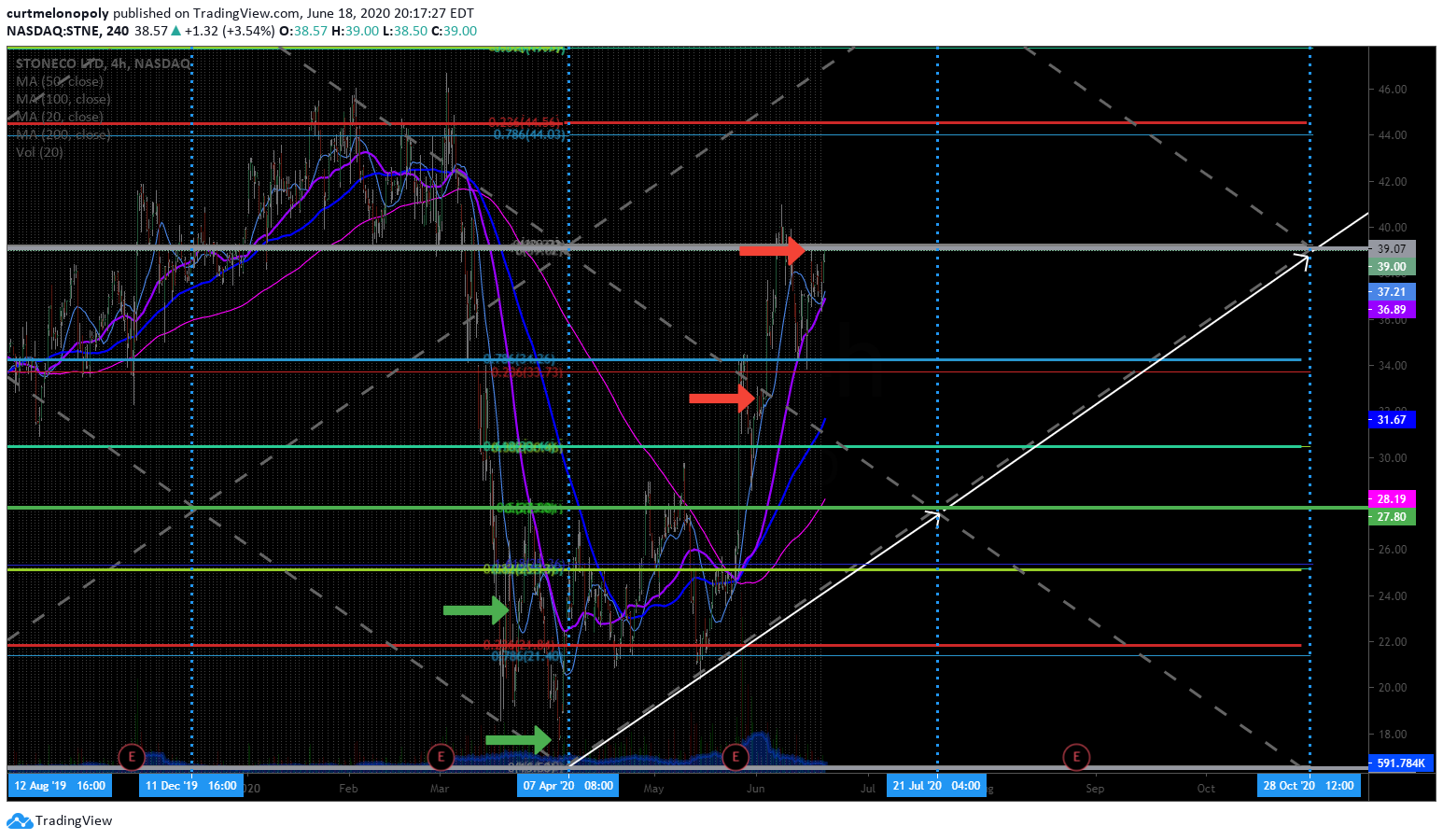

What #timecycle #swingtrade looks like on structured model.

Vertical blue lines are time cycle peaks.

Long IN SIZE & added IN SIZE in to time cycle sell off (blue vertical, trading fear) while others panic.

Near double $STNE time cycle trade

Alerts & charting

What #timecycle #swingtrade looks like on structured model.

Vertical blue lines are time cycle peaks.

Long IN SIZE & added IN SIZE in to time cycle sell off (blue vertical, trading fear) while others panic.

Near double $STNE time cycle trade🎯🏹🔥

Alerts & charting👇 pic.twitter.com/nlOqqKDqrx

— Melonopoly (@curtmelonopoly) June 19, 2020

“Long in SIZE” means that I entered this trade and ADDED to the trade in size. 4/10 sizing (20% on the initial entry and 20% on the adds) for me is massive. This means I was 40% in this trade long of what my maximum trade size tolerance was, most trades

I don’t get above 30% because I am a position trader within the structure of the financial instrument. I need room to get out of the trade if it goes against me.

How? I know where the next support is. If I’m in a trade 30% size I can amp up my size on a very short term at the next support say another 30% for a bounce back to my entry and clear out. If that leg support doesn’t bounce or hold then I need to exit the swing trade. This is how I win a significant percentage of swing trades, I manage size and I know the playing field of trade (the structure of the stock chart support and resistance).

You can see in the swing trade alerts in the above tweet with screen shots that my first entry didn’t hold and the trading price of the stock continued down. This is an example of sizing properly, managing risk and knowing your charting structure to win big.

My second entry, “the adds” were as price was collapsing in to the peak timing of THE TIME CYCLE (see blue vertical line).

The sell off was the COVID fear sell off and we were managing over 60 equity swings so the alerts weren’t the most clear, however, we do and did provide other reporting, swing trade $STUDY sessions and various other subscriber guidance. The screen shots of the swing trade alert feed provided are just some examples.

As the trade started to go my way I started to trim profits and today trimmed profits to the point of only having 5% of my original size left because a key area of the stock structure is where trade was post market today.

You can see in the chart below the time cycles, the key horizontal Fibonacci levels for support and resistance, the diagonal Fibonacci trend lines and the entries (marked in green arrows) and the exit areas of the swing trade (marked with red arrows).

I encourage anyone that wants to learn how to increase their win rate swing trading (or even day trading) and returns on trades to increase your Profit and Loss to learn how to trade time cycles.

The power of these structured swing trade set ups we are working with can’t be understated

2x – 10x wins with high probability & managed process to protect downside. And we’re coding it too.

Do your DD, review the alert feed and see for yourself.

#SwingTrading $VERI

The power of these structured swing trade set ups we are working with can't be understated 🎯🏹🔥

2x – 10x wins with high probability & managed process to protect downside. And we're coding it too.

Do your DD, review the alert feed and see for yourself. #SwingTrading $VERI pic.twitter.com/g7hYaNjmeW

— Melonopoly (@curtmelonopoly) June 18, 2020

An example of time cycles in volatility is in the article below, we are currently writing a series of time cycle articles for our swing trade members to learn how this trading strategy can increase profitability significantly.

In Part 2 we unpack exactly how this trading strategy works – technical analysis and charting the structure of the stock, trading time-frames, time cycles, advanced Fibonacci Retrace levels, sizing, exits and entries, risk management and more.

As always, if you have any questions reach out anytime [email protected].

Peace and best.

Curt

Current List of Available P&Ls (remaining dates are in progress now to be released soon):

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trades.

- Swing Trading Alert Profit Loss – Annualized ROI 1543.93% Feb 1-Feb 21, 2020. $200,000.00 – $230,051.00 #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trading Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics: Swing Trading, Time Cycles, Stocks, How To, Trade, Alerts, Charting