Trading Set-ups. Video Explains Predictable Winning Process. Part 6 b) “Freedom Traders” Series.

Part Six b) of the “Freedom Traders” Series: Trading Set-ups. Video Explains Predictable Winning Process.

This post is the video / blog companion to “Trading Set-ups. How-To Develop a Systematic – Predictable Process. Part 6 a) “Freedom Traders” Series”. It is a $STUDY for Traders Endeavoring to Trade With a High Degree of Probability.

Introduction.

The video below will provide overview explanations of the various trade set-ups I use with different types of trading I do (Swing Trading, Day Trading and Algorithmic Model Trading).

I endeavor in this series of posts to first provide an overview of my trading systems and through subsequent posts I will break-out the details of each trade set-up I use.

Check back to the posts in this section (section 6 of the Freedom Traders series) because 6 a. and 6 b. will be updated regularly with new set-ups added to the overview lists and the subsequent posts in section 6 will have more and more specific trade set-up videos and blog posts included in the series.

The Purpose.

As explained in the introduction to this series (in Part 6 a), the purpose of this part of the series is to assist traders in developing their own predictable trading systems.

A large part of a successful trading plan is having a predictable trading system that you can rely on – a “rules-based trading process”.

Finding at least one trading system that will work the majority of the time, that is easy to use, fits your personality, is predictable and easily reproducible is key.

Trading Set-Ups Overview: Overview Video Number One.

This video touches on a number of chart set-ups / indicators / disciplines specific to day trading and swing trading and not so much algorithmic chart modeling. It is approximately 30 minutes in length and it provides a working foundation (overview) of the type of trading I execute.

You won’t find high flying ideas, hot new stocks of the week or some other high flying idea here.

You will however find systematic trading principles that will return 80% + win rates. Very predictable set-ups that can be duplicated with a high degree of success. Below the video are some itemized notes reflecting the content of the video.

Topics in Trade Set-ups Video 1:

- Description of types of trading I do.

- Day Trading, Swing Trading, Algorithmic Model Trading.

- Chart Example Used for Video.

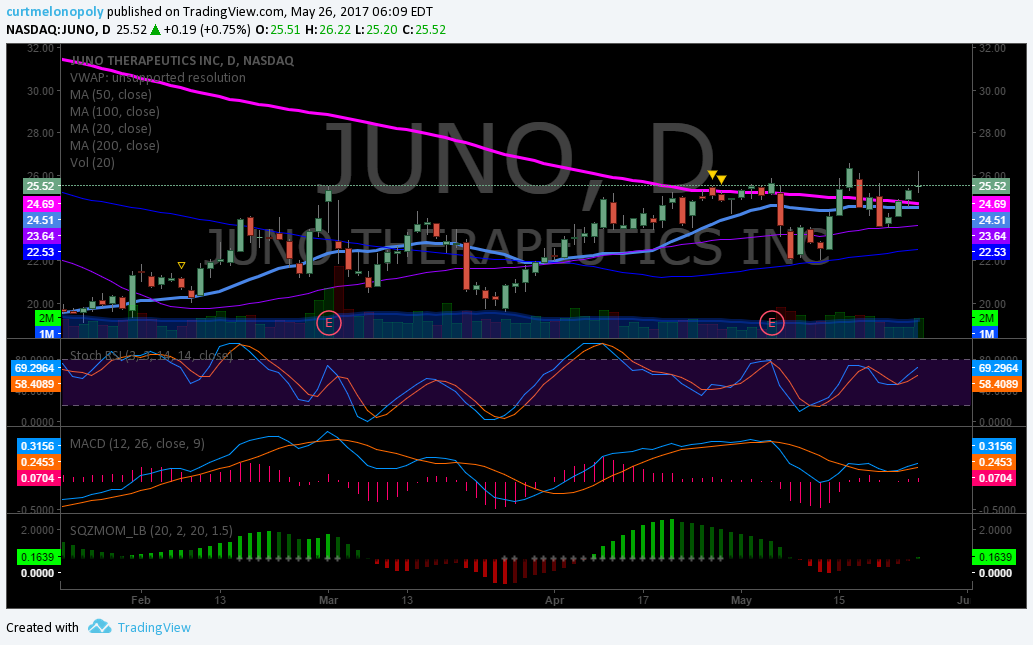

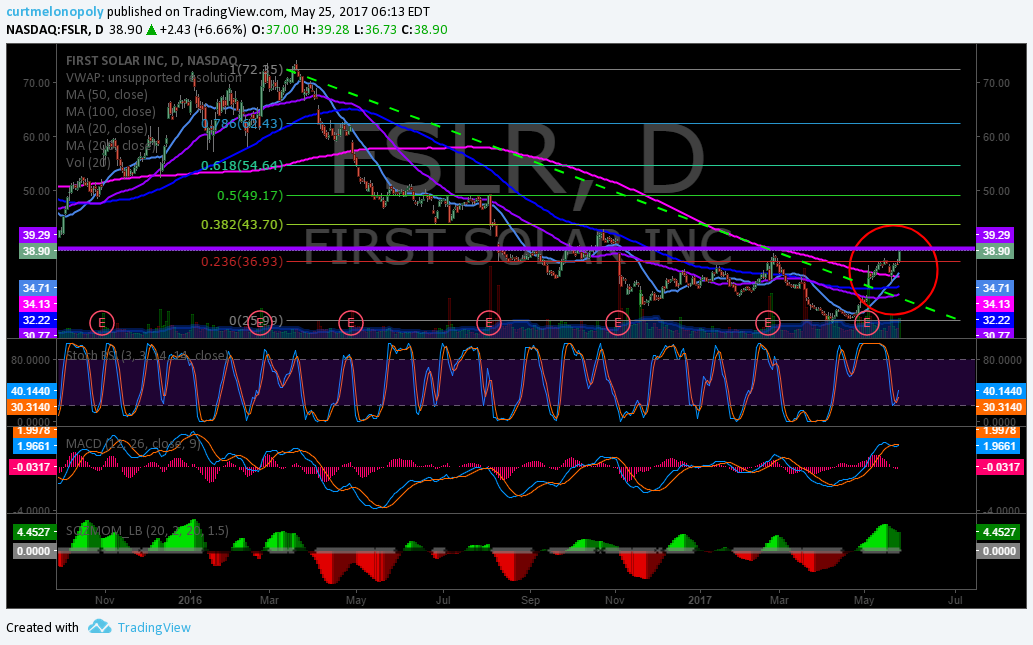

- $FSLR.

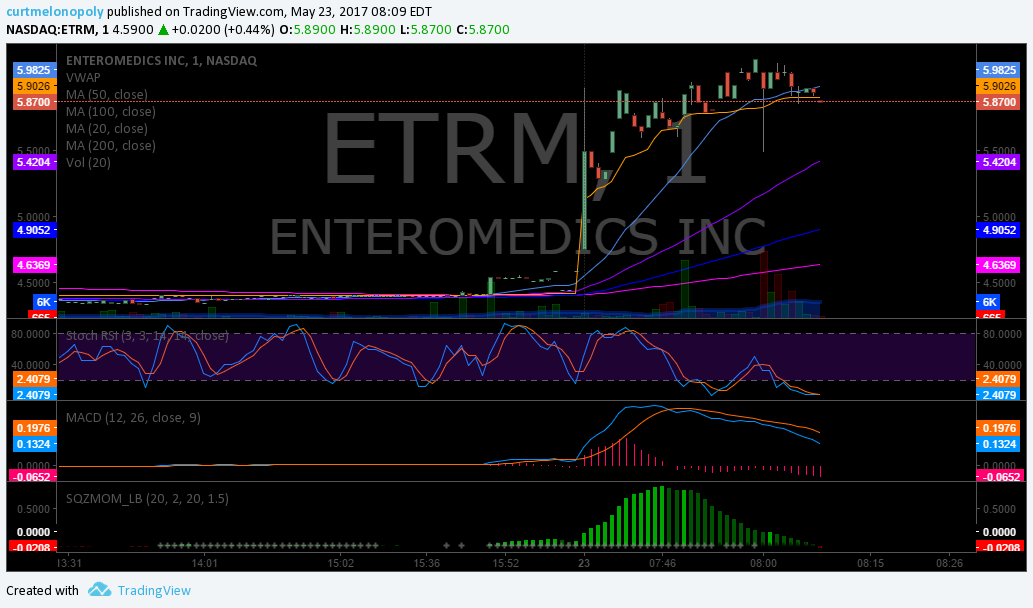

- Indicators Used on Video.

- Wide Time Frame Moving Averages: 20 MA, 50 MA, 100 MA, 200 MA.

- Stochastic RSI.

- MACD.

- Squeeze Momentum Indicator.

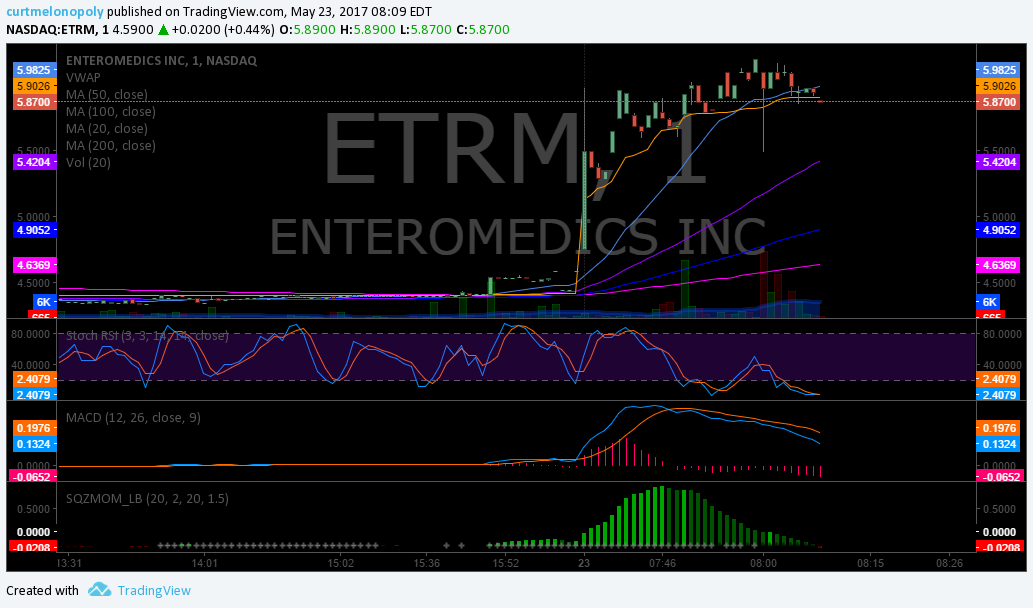

- Short Time Frames I Use 8 ema, 21 ema, VWAP.

- Explanation of Mid Day Chart Reviews and Trade Set Ups in Trading Room.

- Provides repetition for our traders in executing trade set-ups.

- Provides new chart and trade set-up ideas daily to members.

- Provides opportunity for members to ask questions about their own chart and trade set-ups.

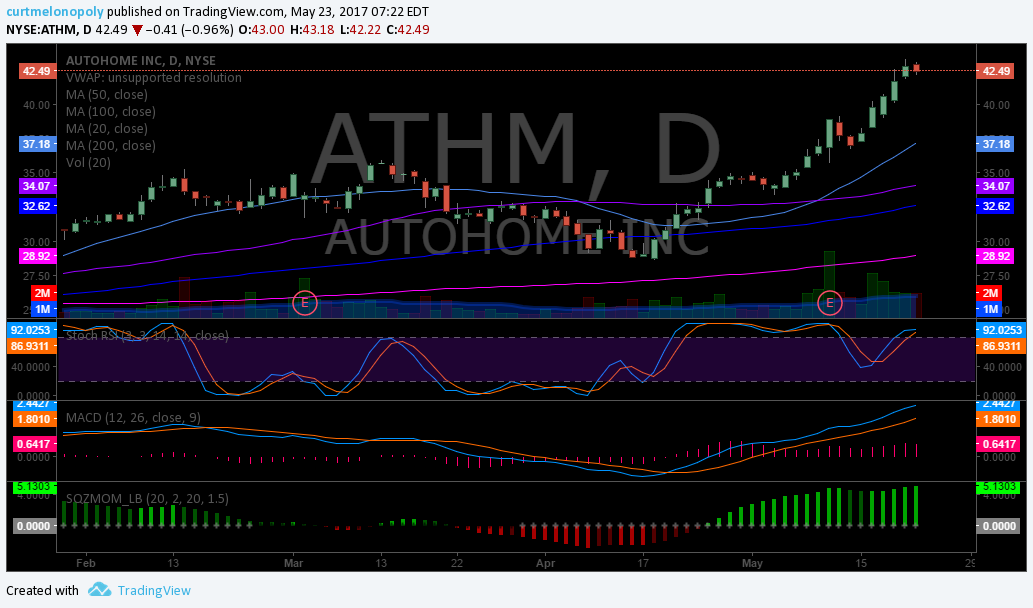

- Trading Set-Up # 1 – Price Breach of 200 MA on Daily Chart.

- The predictable trade is at the breach of the 200 MA.

- The 20 MA breaches the 50 MA, the 20 MA breaches the 100 MA, the 20 MA breaches the 200 MA.

- Entering long based on the daily chart and taking sell triggers on lower chart time-frames (opposite action of moving averages with price below instead of price above).

- Trading the bowl and break-out above the 200 MA.

- Confirming the bottom play with the early indicator of MACD.

- I rely heavily on MACD for swing trading platform.

- Stoch RSI started to rise at same time MACD started to signal bottom.

- Stoch RSI helps time trade.

- Increasing volume is critical.

- SQZMOM confirmed bottom with trend up.

- Trading Set-up # 2 – Bottom Play Prior to Breach of 200 MA on Daily Chart.

- MACD crosses, Stoch RSI crosses up, SQZMOM trends up.

- Test of price to 20 MA and indicators cross back up then test of 50 MA etc.

- Trading and testing through the moving averages until trade gets above 200 MA and then you’re in to trading set-up #1.

- Chart Time-Frames and MA Action are Critical for Trading the Stock (Timing entries and exits).

- Confirming your trade bias through looking at the different time frames including weekly, daily, hourly, 30 minute, 15 minute, 5 minute, 3 minute and 1 minute charts depending on your time-frame.

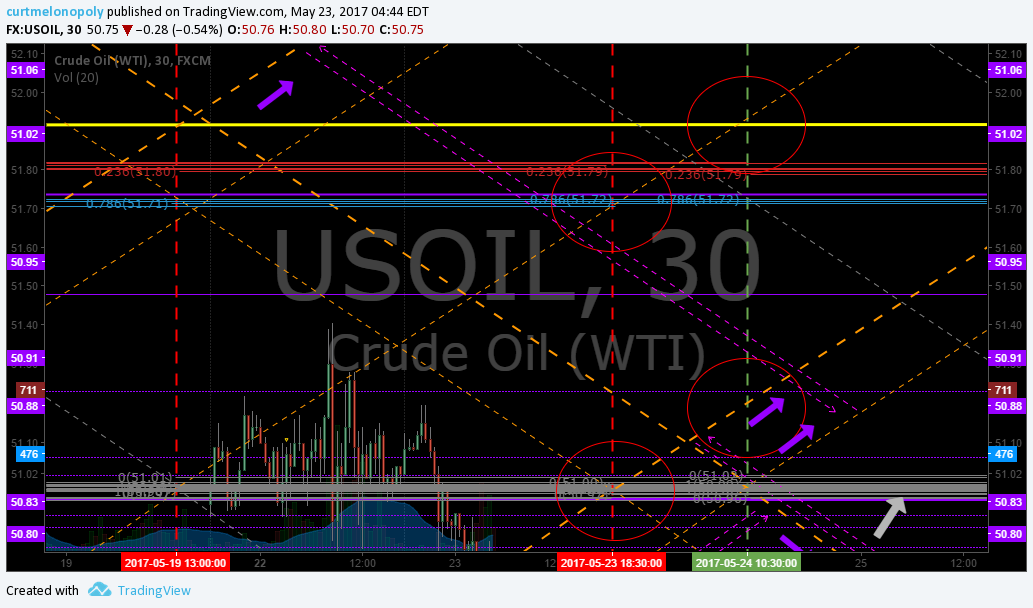

- Fibonacci should confirm the moving averages as support and resistance points on the chart.

- Moving averages are a modern representation of the tape.

- Timing entries and exits based on indicators.

- Price above MA’s is critical in bullish bias trade and opposite is true for bearish outlook on various time frames and exits can be timed in trade.

- Example Long Set-Up at 52.05 on chart culminating in sell signal at 70.35 – a 40% increase before you get sell signal on chart.

- Trading through the MA’s before the 200 MA breach is possible (bottom play – trade set-up #2).

- Chart Resistance and Support Levels.

- Fibonacci, Natural Horizontal Chart Resistance and Moving Averages.

- Trading Earnings.

- I rarely hold through earnings. I sell in to and re-enter after earnings.

- Low risk trading is my goal.

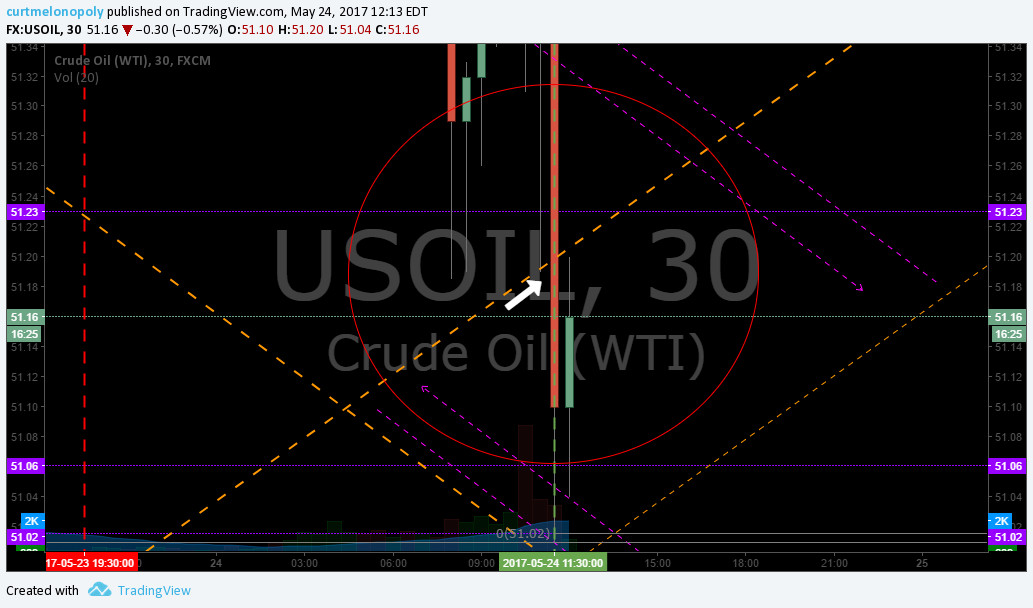

- Algorithmic Modeling and Fibonacci.

- Basic algorithm quadrants and diagonal resistance.

- $FSLR Chart Examined for a Day-Trade.

- Moving through the time-frames and various places to enter your trade – what quantifies bullish and bearish and timing your trade.

- A day trade hopefully becomes a swing or trend trade. 14% ROI on monthly trade example.

- Enter on tight time-frame (after confirming your wide time-frames set-up).

- Confirming your entry with “power”. Avoiding getting cut up with fast exits. Timing trades with power.

- Price, Trigger, Power, Trade, Risk, Reward. PTPTRR. Being ready for the power trade with the moving average set-ups.

- Legging in 20% at a time. Five leg principle in a move.

- Knowing where your most likely resistance is in the move and exiting the trade.

Closing.

That concludes the video / blog portion of the trade set ups overview that accompanies “Trading Set-ups. How-To Develop a Systematic – Predictable Process. Part 6 a) “Freedom Traders” Series. Hopefully this series will assist you in building a rules based trading process.

As I mentioned at the outset, I will next post a series of articles to explain the fine details of each trade set-up I use. The videos will also detail many other indicators I use. I will also be explaining more in future about how our algorithmic model trading indicators are used.

Remember to check back to this specific post and part a because the list of indicators and the overview of each will grow with time.

As mentioned in Part A I also highly recommend taking in our regular trading webinars and most specifically the mid day trade and chart set-up reviews.

Repetition breads success. Repetition provides laser focused trading skills that only comes from practice, practice, practice.

Our team time in the mid day chart and trade set-ups is a training ground for success through repetition and fresh trade ideas.

Click here for the link to sign on to any of our services. https://compoundtrading.com/shop/

Message me anytime with your story or questions. And if you follow me on Twitter and I don’t follow back so you can DM then send us an email to [email protected] with your Twitter handle.

Also in closing, I will mention again that I have had a number of people message me to get involved in our various launch initiatives – with moderating, coding and various other levels of interest. I will be writing back to those inquiries early June (in advance of our 24 Hour Oil Trading Room Launch).

Cheers!

Curtis

Previous Freedom Trader Post Links:

Part 1 : My Personal Stock Trading Story. How I Blew up Two Accounts and then Learned How to Trade.

Part 2: Trading Checklist (Rules) I Follow Before Triggering a Stock Trade.

Part 3: Now I’m Inspired. A Struggling Trader That Inspired Change.

Part 4: We Want (Need) You! Apply to Nearest Recruiting Station.

Part 5: Learn How to Trade Stocks (Build a Small Account) Following my Journey.

Part 6 a: Trading Set-ups. How-To Develop a Systematic – Predictable Process.

Article Topics; Compound, Trading, Freedom, Traders, Learn, How to, Set-Ups, Process, Moving Averages, Fibonacci, MACD, Video, Indicators, Day Trading, Swing Trading.