Post-Market Mon May 22 $PBYI, $MOMO, $RTIX, $CALA, $MXIM, $JKS

Compound Trading Monday May 22, 2017 Review of Chat Room Day Trading, Swing Trading, Algorithm Charting, Videos and Live Alerts. $PBYI, $MOMO, $RTIX, $CALA, $MXIM, $JKS – $LIGA, $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

24 hour oil room open may get moved up to June 12, 2017 vs July 1. #pumped

24 hour oil room open may get moved up to June 12, 2017 vs July 1. #pumped

— Melonopoly (@curtmelonopoly) May 23, 2017

Sorry About the Waiting List! Fixed it.

There were half as many on the trade room waiting list at one point today as there were in room. Sorry guys n gals. Just expanded room now?✌

There were half as many on the trade room waiting list at one point today as there were in room. Sorry guys n gals. Just expanded room now👍✌

— Melonopoly (@curtmelonopoly) May 23, 2017

So we’re going to post the trade reviews and the chart setups from midday review everyday going forward. Trade setups critical.

So we're going to post the trade reviews and the chart setups from midday review everyday going forward. Trade setups critical.

— Melonopoly (@curtmelonopoly) May 23, 2017

Don’t Miss This! Compound Trading Webinar Schedule: Day Trading, Swing Trading. Oil, Gold, Silver, SPY, VIX, USD, Equities…

https://twitter.com/CompoundTrading/status/866406995775148033

Complete $SPY S&P 500 Algorithm Rolls-Out this Week. A New Milestone at Compound Trading. #premarket $ES_F $SPXL $SPXS

Update: We are on schedule here and the complete model will be assembled his weekend and released Sunday night for next week. Then I think Gold is next (it will take less than two weeks to publish it in whole as the math is complete on it also. Actually the math is complete and tested on five of six of the algorithms so they will all be published in whole very shortly now). $SPY will be getting it’s own 24 hour trading room also – not sure when, but $SPY and Gold will get their own 24 hour trading rooms like EPIC sometime before end of 2017.

Complete $SPY S&P 500 Algorithm Rolls-Out this Week. A New Milestone at Compound Trading. #premarket $ES_F $SPXL $SPXS https://t.co/M3aaGpDRSK

— Freedom $SPY Algo (@FREEDOMtheAlgo) May 16, 2017

Learn How to Trade Stocks (Build a Small Account) Following my Journey. Part 5 “Freedom Traders” Series.

Update: Just for those that have asked, the near future posts coming for Freedom Traders series focuses on trading disciplines and technical set-ups that many have asked for. I’m actually going to try and write a book this Christmas consolidating it all (see mid day chart reviews on our YouTube channel and that will give you some insight as to direction – although the series will cover so much more). At minimum we’ll consolidate it in to a training seminar series with video set etc to make it easy for new traders and more experienced alike I suppose to digest it all.

Learn How to Trade Stocks (Build a Small Account) Following my Journey. Part 5 “Freedom Traders” Series. https://t.co/3WOEzWx3Gi

— Melonopoly (@curtmelonopoly) May 13, 2017

Last market trading session Post Market Stock Trading Results can be found here:

Stock Trading Results Fri May 19 $DYN, $CALA, $GLYC, $EXP, $USOIL, $WTIC

https://twitter.com/CompoundTrading/status/866466973491879936

Most recent Premarket Trading Plan Watch-list can be found here (locked to respect members and unlocked to public about a week later for transparency):

Protected: PreMarket Trading Plan Mon May 22 $BIOC, $RDUS, $CMCM, $JKS, $CALA, $USOIL, $WTI, $UWT

https://twitter.com/CompoundTrading/status/866637360506830849

Please note, for the next while, you will have to review the raw trading room footage (vs. snippet footage) to catch Premarket Chart Set-Ups, Market Open Trades, Intra-day Trades and Mid Day Chart Set Ups. Our staff time are being utilized up for other components of the platform and we also are producing the high quality learning library for our premium members. Once done, we’ll return to publishing the segments daily.

Premarket Session:

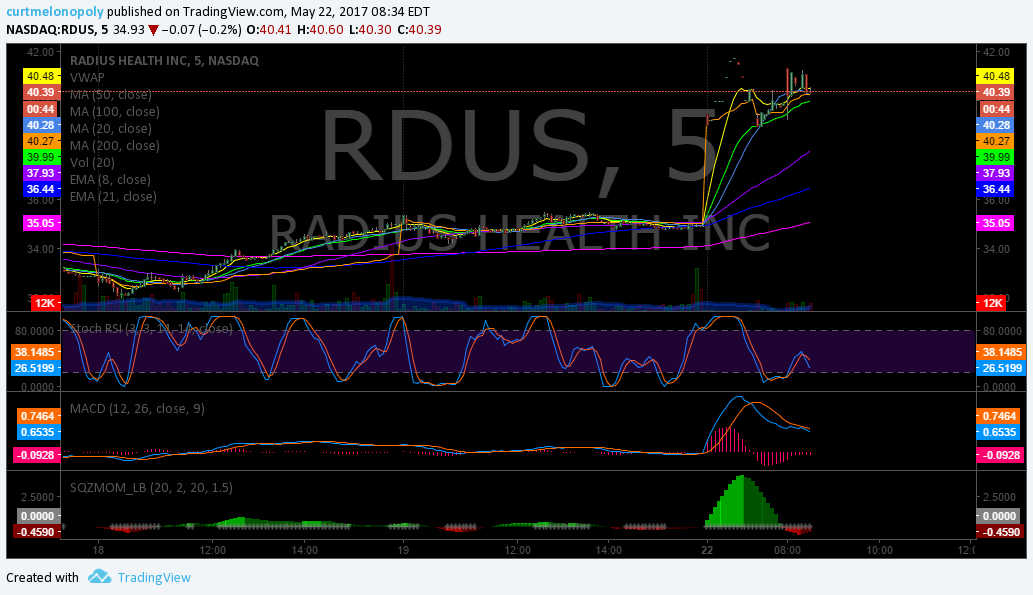

$RDUS Premarket up 15.63%

$RDUS Premarket up 15.63% pic.twitter.com/q3eWzcRCal

— Melonopoly (@curtmelonopoly) May 22, 2017

Market Day, Chat Room Trades and Personal Trades:

In Play: $RDUS, $GLYC, $QHC, $BIOC, $SPWH, $BITA, $WTW, $CMCM High Uncertainty: $YRD, $VSM, $JKS

In Play: $RDUS, $GLYC, $QHC, $BIOC, $SPWH, $BITA, $WTW, $CMCM High Uncertainty: $YRD, $VSM, $JKS https://t.co/qbHZSKV2uh

— Melonopoly (@curtmelonopoly) May 22, 2017

Trades: $PBYI, $MOMO, $RTIX, $CALA, $MXIM, $JKS

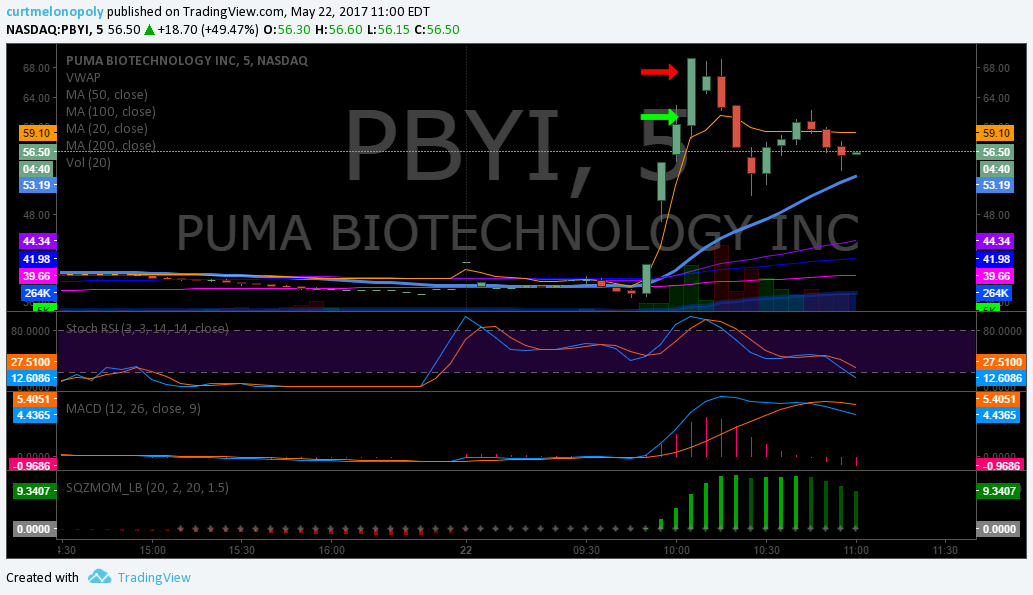

$PBYI was an alert from our scanners on the halt. Hit the meat of the momentum for sure. Some in the room got a little more on the top than I did though. But a great trade all around for a momentum trade.

$PBYI and $MOMO puts me up 2450.00 on day and back on track with trading challenge (made up for bit of shortfall last week).

$PBYI and $MOMO puts me up 2450.00 on day and back on track with trading challenge (made up for bit of shortfall last week). https://t.co/YoPYuWhhLz

— Melonopoly (@curtmelonopoly) May 22, 2017

$PBYI Open 62.10 Closed 67.70 400 for 2240.00+

$PBYI Open 62.10 Closed 67.70 400 for 2240.00+ pic.twitter.com/Sm7QrVmQLn

— Melonopoly (@curtmelonopoly) May 22, 2017

$MOMO was an alert from Quarry Rock (you’d have to review the room transcript below to get set-up), anyway, got a scalp but not the whole I wanted. Small win – few hundred.

$RTIX I didn’t trade today but our members are in it – lots of our swing trading members and some of our day trading members are. It was a set-up from our mid day reviews we do in the room from 12 noon to 1 pm everyday on chart set ups. Writing a book this winter and I’m going to use these chart set-ups and trade reviews as the outline for the book. Starting Tuesday we’re going to do trade recap reviews first at noon and then move on to chart set ups all covered in that 1 hour! $RTIX has been a winner between 10 – 15% for members so far.

$RTIX http://schrts.co/4cNK7F up 10% since entry and still holding. Thanks @curtmelonopoly for confirming this one for me weeks ago.

$RTIX https://t.co/hjR1PznfUl up 10% since entry and still holding. Thanks @curtmelonopoly for confirming this one for me weeks ago.

— Leanne (@CampingHiking1) May 22, 2017

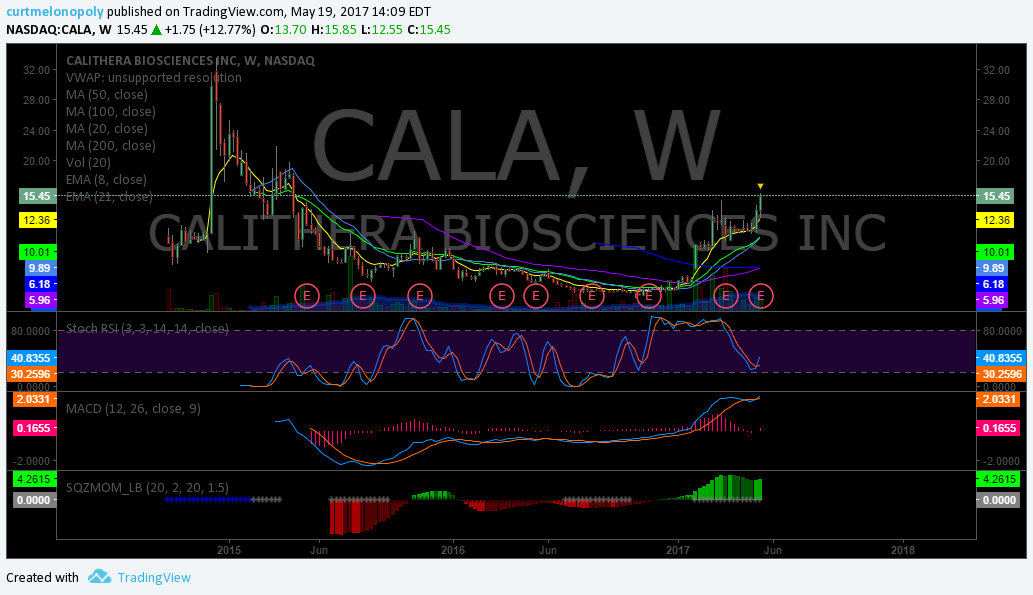

$CALA was an end of day swing trade alerted Friday to our swing trade members. It closed today at 16.50 from 15.55 entry.

Long $CALA 15.55 This is a break out play high risk 1/5 size 500 shares 1/5 size only to test set up.

$MXIM is off a few pennies and was an alert to swing trade members May 17. Holding.

Long $MXIM 46.94 range premarket 5:14 AM May 17, 2017 MACD crossed up 20MA thru 50 MA. Confirmed break out hold till MACD cross down.

$JKS I alerted to swing trading members long in premarket at 18.65 it closed the day at 19.00.

Long $JKS small starter 18.65 500 long will liquidate likely before earnings in 4 days. If it gets lift I’ll add until closing. In report.

Learning How-to Trade Stocks, Chart Set-Ups, Lessons and Educational:

Reviewing Monday’s raw video coverage from trading room – there’s a lot, I mean a lot of trade knowledge in transcript and chart setups etc.

Reviewing Monday's raw video coverage from trading room – there's a lot, I mean a lot of trade knowledge in transcript and chart setups etc.

— Melonopoly (@curtmelonopoly) May 23, 2017

Members: It’s a new week! Get a trading plan and charts over for review if you want my input! 2nd set of eyes won’t hurt! $STUDY #trading

Members: It's a new week! Get a trading plan and charts over for review if you want my input! 2nd set of eyes won't hurt! $STUDY #trading

— Melonopoly (@curtmelonopoly) May 22, 2017

When you know the rules, you can then develop a rules based trading system that suits your needs and personality. Then bow to it. #trading

When you know the rules, you can then develop a rules based trading system that suits your needs and personality. Then bow to it. #trading

— Melonopoly (@curtmelonopoly) May 21, 2017

If there’s anything I can do to help with your trading drop me a line on contact page or DM https://compoundtrading.com/contact/ #howto #trade #stocks

If there's anything I can do to help with your trading drop me a line on contact page or DM https://t.co/1CNAfDsAeI #howto #trade #stocks

— Melonopoly (@curtmelonopoly) May 8, 2017

Stocks, ETN’s, ETF’s I am holding:

Been holding these small bags wayyyy tooo long. I am holding (in order of sizing – all moderately small size – under 5% of my daytrading acounts) – $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI, $LIGA (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| NUTR | 42.15 | 50.54% | 640871 | Top Gainers | |

| PBYI | 52.60 | 39.15% | 12377082 | Top Gainers | |

| COOL | 16.78 | 24.85% | 631018 | Top Gainers | |

| SORL | 8.74 | 22.58% | 8935634 | Top Gainers | |

| MNKD | 1.37 | 21.24% | 8713958 | Top Gainers | |

| INFU | 1.50 | 15.38% | 261582 | Top Gainers | |

| SORL | 8.74 | 22.58% | 8935634 | New High | |

| NUTR | 42.15 | 50.54% | 640871 | New High | |

| BBRY | 11.32 | 9.06% | 22113713 | New High | |

| BF-B | 56.92 | 7.54% | 3814687 | New High | |

| DAIO | 7.88 | 8.39% | 238215 | Overbought | |

| BF-B | 56.92 | 7.54% | 3814687 | Overbought | |

| CNFR | 7.30 | -4.94% | 286857 | Unusual Volume | |

| TATT | 12.00 | -1.23% | 234616 | Unusual Volume | |

| NUTR | 42.15 | 50.54% | 640871 | Unusual Volume | |

| ORG | 27.88 | 2.32% | 58948 | Unusual Volume | |

| BX | 31.88 | 6.73% | 20581599 | Upgrades | |

| AIRT | 19.50 | 0.00% | 0 | Earnings Before | |

| GST | 1.21 | 11.01% | 2411947 | Insider Buying |

Algorithm Charting News (Artificial Intelligence, Intelligent Assistants, Big Data and More):

Complete $SPY S&P 500 Algorithm Rolls-Out this Week. A New Milestone at Compound Trading. #premarket $ES_F $SPXL $SPXS

Complete $SPY S&P 500 Algorithm Rolls-Out this Week. A New Milestone at Compound Trading. #premarket $ES_F $SPXL $SPXS https://t.co/M3aaGpDRSK

— Freedom $SPY Algo (@FREEDOMtheAlgo) May 16, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News / Chart Set-ups:

$CTSH Swing Trade Going Well. Trading 65.42 from 61.78 entry. 20 MA may breach 100 MA on weekly may add. MACD SQZMOM trending. #swingtrading

$CTSH Swing trade live chart #premarket https://t.co/jVsQ4gJ8Jg

— Melonopoly (@curtmelonopoly) May 22, 2017

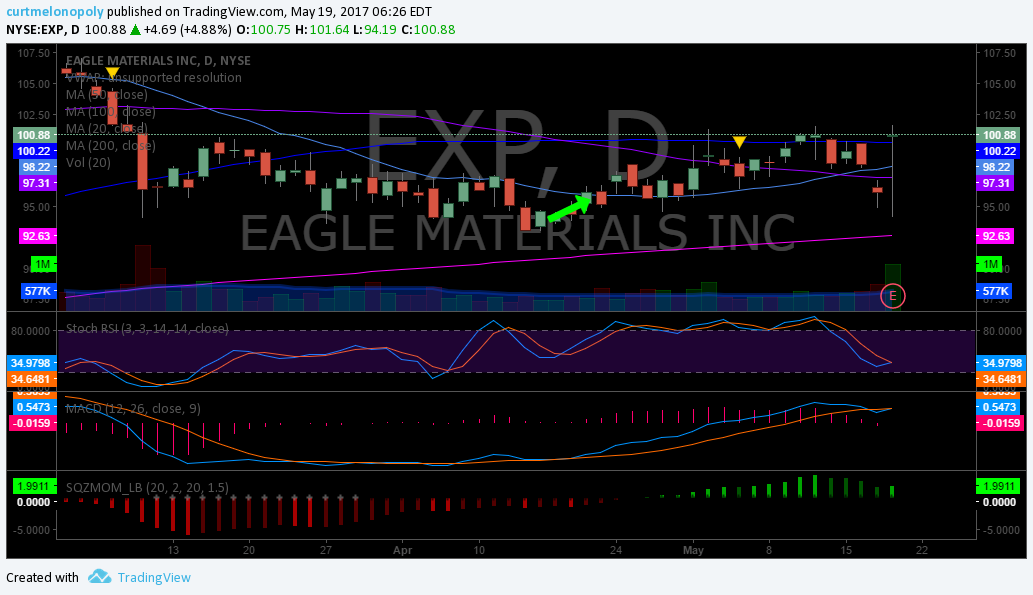

$EXP Holding from 95.90 trading 100.88 MACD could cross up and boom time. We’ll see. #swingtrading

$EXP Holding from 95.90 trading 100.88 MACD could cross up and boom time. We'll see. #swingtrading pic.twitter.com/FrsCfb0Gd4

— Melonopoly (@curtmelonopoly) May 19, 2017

Took a lot of heat when I published this for members when 811.00 … it may actually happen $GOOGL “Feb 3 – 1003.17 Price Target in 2017”

Took a lot of heat when I published this for members when 811.00 … it may actually happen $GOOGL "Feb 3 – 1003.17 Price Target in 2017"

— Melonopoly (@curtmelonopoly) May 19, 2017

Most recent swing trading platform publications:

Protected: Swing Trading Thurs May 18 $HIIQ, $AMBA, $EOG, $COTY, $FSLR, $AAOI, $XRT, $GOOGL, $AMZN, $VFC, $GREK …. #premarket

Protected: Swing Trading Thurs May 18 $HIIQ, $AMBA, $EOG, $COTY, $FSLR, $AAOI, $XRT, $GOOGL, $AMZN, $VFC, $GREK …. #premarket https://t.co/0eD6c1Bsp6

— Swing Trading (@swingtrading_ct) May 18, 2017

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

Regular Watch List Updates / News:

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

Leveraged funds increased bullish dollar bets by 23% in wk to May 16, ahead of the turmoil. JPY selling was particularly strong #FOREX

Leveraged funds increased bullish dollar bets by 23% in wk to May 16, ahead of the turmoil. JPY selling was particularly strong #FOREX pic.twitter.com/K2ro5E3p6E

— Ole S Hansen (@Ole_S_Hansen) May 21, 2017

Gold $GLD, $XAUUSD, $GC_F :

#Gold selling continued in wk to May 16 despite emerging safe-haven demand. Net-long hit eight week low following a 30k lot reduction

#Gold selling continued in wk to May 16 despite emerging safe-haven demand. Net-long hit eight week low following a 30k lot reduction pic.twitter.com/g57EhVWfyG

— Ole S Hansen (@Ole_S_Hansen) May 21, 2017

Gold Miner’s $GDX:

NA

Silver $SLV:

A fifth week of #silver fund selling reduced the net-long from a record 99,000 lots to just 18.300 lots.

A fifth week of #silver fund selling reduced the net-long from a record 99,000 lots to just 18.300 lots. pic.twitter.com/e8kzslVxqL

— Ole S Hansen (@Ole_S_Hansen) May 21, 2017

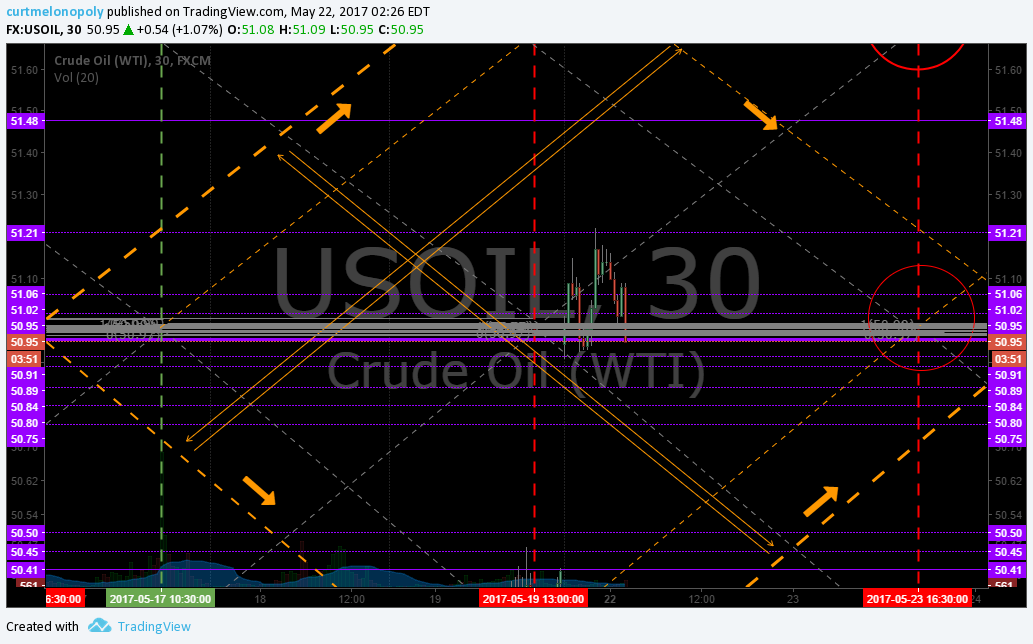

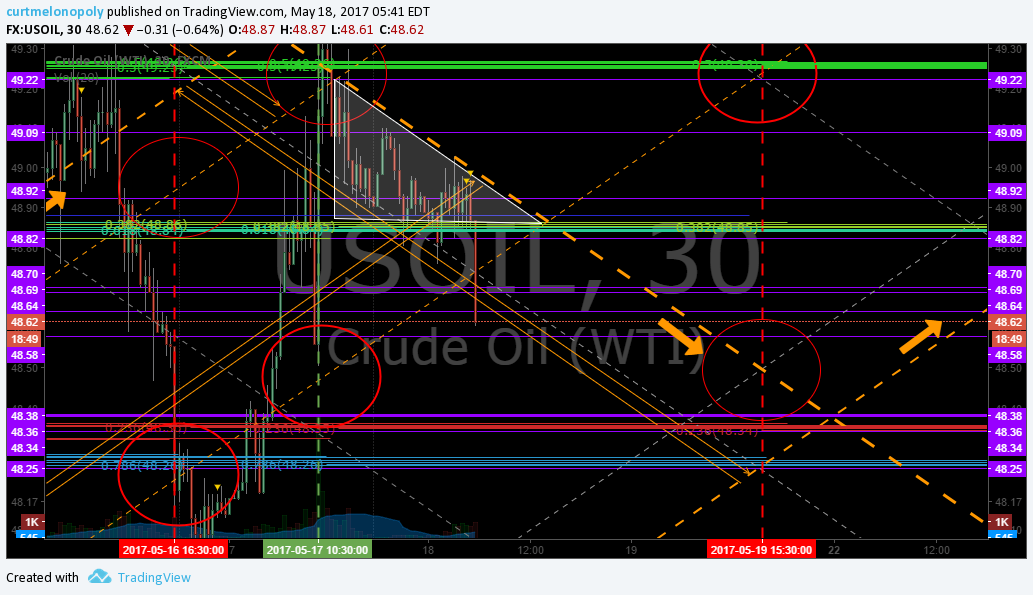

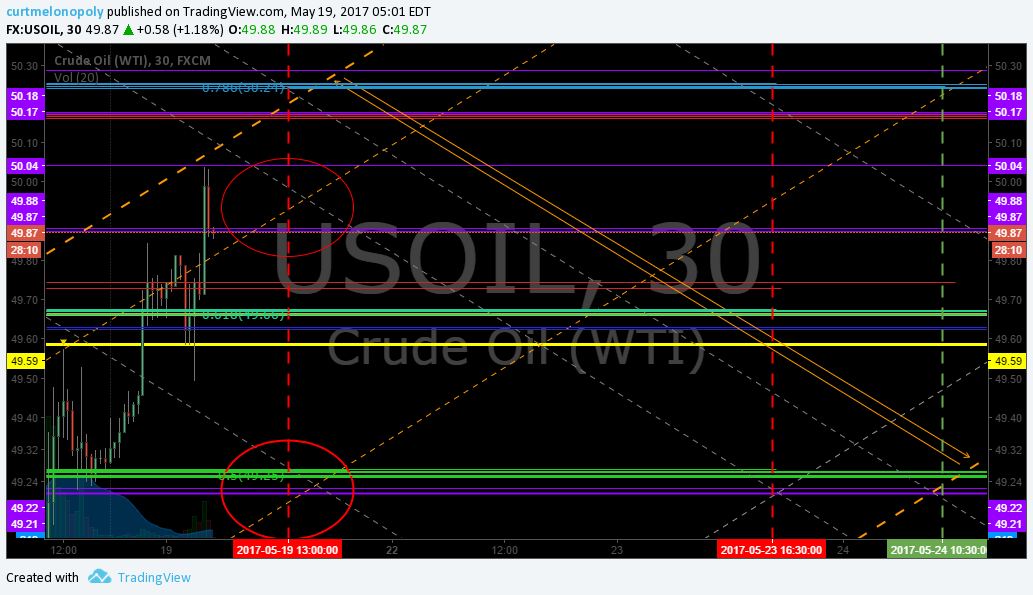

Crude Oil $USOIL $WTI:

#OPEC | monitoring committee to recommend a 9 month production cut extension. Kuna. #OOTT

https://twitter.com/Lee_Saks/status/866635506548973568

OPEC Thinks Deeper Cuts Might Not Be Required | http://OilPrice.com http://oilprice.com/Energy/Oil-Prices/OPEC-Thinks-Deeper-Cuts-Might-Not-Be-Required.html … #oilprice

OPEC Thinks Deeper Cuts Might Not Be Required | https://t.co/8uM3eZ2UfT https://t.co/l66868GRpB #oilprice

— Melonopoly (@curtmelonopoly) May 22, 2017

OPEC’s grand coalition to limit oil output will be put to the test in Vienna https://www.wsj.com/articles/can-opecs-grand-coalition-hold-1495419000 … via @WSJ

OPEC’s grand coalition to limit oil output will be put to the test in Vienna https://t.co/AeXz3WjYgG via @WSJ

— Melonopoly (@curtmelonopoly) May 22, 2017

Volatility $VIX ($UVXY, $TVIX, $XIV):

The Simplest Reason Behind Collapsing Volatility: Hedge Funds Are Barely Trading | Zero Hedge

The Simplest Reason Behind Collapsing Volatility: Hedge Funds Are Barely Trading | Zero Hedge https://t.co/lnDoYvW40r

— Melonopoly (@curtmelonopoly) May 20, 2017

$SPY S&P 500 / $SPX:

Interesting divergence between “fundamentals” vs “technicals” sentiment spreads vs $SPX

Interesting divergence between "fundamentals" vs "technicals" sentiment spreads vs $SPX pic.twitter.com/fjo0lyVtXt

— Topdown Charts (@topdowncharts) May 21, 2017

Markets Looking Forward:

upcoming #earnings $MOMO $AZO $TTWO $TOL $DSW $CBRL $A $KIRK $NDSN $DSX $LXFT $CRMT $YIN $EVLV $RAVN $QTNT $TEDU

upcoming #earnings $MOMO $AZO $TTWO $TOL $DSW $CBRL $A $KIRK $NDSN $DSX $LXFT $CRMT $YIN $EVLV $RAVN $QTNT $TEDU https://t.co/K6tuS7fjQI

— Melonopoly (@curtmelonopoly) May 22, 2017

Gross hedge fund leverage is at new all time highs

Gross hedge fund leverage is at new all time highs pic.twitter.com/rmgdETFqlc

— zerohedge (@zerohedge) May 20, 2017

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day).

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix. Also, please note, sometimes pieces of the transcript are missing (also something we are working on). But the video is raw and complete.

Curt M_1: Protected: PreMarket Trading Plan Mon May 22 $BIOC, $RDUS, $CMCM, $JKS, $CALA, $USOIL, $WTI, $UWTLINK: https://compoundtrading.com/premarket-trading-plan-mon-may-22-bioc-rdus-cmcm-jks-cala-usoil-wti-uwt/PASSWORD: MONDAYBANKToday’s Live Trading Room Link: http://compoundtrading1.clickmeeting.com/livetrading

Market Maven: Write a messageMorning!

Flash G: Morning Maven

Lenny: Monday bank. Like the password.

Curt M_1: Morning folks. Need a few moments to get a grip on premarket – busy day here.

Curt M_1: On mic at 9:10 for premarket >>>>>>>>>>

Sandra: gm crew

Hedgehog Trader: hi all

Market Maven: hey Nicholas!

coleman: morning everyone

Market Maven: morning coleman!

Curt M_1: On mic in 2 mins for premarket review >>>>>>>>>>>

Tracy: Good morning everyone! First day in the room, Nice to meet you all!

Market Maven: Welcome Tracy! Glad to have ya

Tracy: Thank you!

Flash G: Feels like a good week on deck. Welcome Tracy:)

Tracy: Thx Flash!

Sandra: Nice to have new names / faces 🙂 GM

Tracy: GM Sandra!

Curt M_1: ok guys and gals 1 min

Tracy: And it is a GM already, I’ve been holding RDUS and it’s UP! YAY!

Curt M_1: On mic for premarket review >>>>>>>>>>>>>

coleman: iraq wants 6 month extension to cts

coleman: saudis wan t9

coleman: i think saudi minister is on way to baghdad to discuss

Tracy: Can you please do CCCR, CBIO and TNXP?

Tracy: Thx!

Tradergirl: gm all, welcome Tracy, shld be an interesting wk lol

Tracy: Waiting on news on CBIO, last time it ran it ran 400%. Low float

Tracy: Hi Tradergirl, Thx!

Chris: Hello all, i am new here 🙂

Tradergirl: hey Chris, fab week to be hanging with KK

Hedgehog Trader: Curt- BIOC has 21% short interest

Hedgehog Trader: 6 days to cover at avg volume

Tracy: Curt, what do you think SGMO will do from here, down this am .10, I’m holding.

Tracy: Hi Chris, I’m new here too!

Market Maven: Sitting on hands so far

Market Maven: Welcome Chris!

Tracy: Huge spread, no vol yet on CBIO

Sandra: too choppy

Lenny: bulls getting chopped for sure

Tracy: Very surprised to see SRPT down so much.

Tracy: Any thoughts on BBRY? It’s up 2.55%

Market Maven: Careful with $BBRY IMO – not that its bad

Market Maven: just doesn’t have a great history

quarryrock: good am all

Hedgehog Trader: hey roc

Tracy: Thanks MM.

Tradergirl: was wondering where u were Q

Hedgehog Trader: Curt, what you think on UEC chart

quarryrock: hi running late – im long $-TTWO $68.31

quarryrock: looking to exit near $70

Tradergirl: uj usdjpy looks to be struggling

quarryrock: curt did you cover $MOMO?

Hedgehog Trader: Rock and Curt $URA closing in on 200 dma

Hedgehog Trader: uraniums

Curt M_1: $PBYI Halt

Tradergirl: yen carry usu leads fyi

quarryrock: nice ! HH. USLV surpassed last weeks high

Tracy: PBYI just rocketed to $55

Tracy: RDUS back up to 38.62

Curt M_1: Long 62.10 $PBYI 62..10 400

Market Maven: In with ya

quarryrock: ill raise my stop on $ttwo if it breaks past 69.31

quarryrock: wow Puma!!!

Curt M_1: Sold 67.70 400 shares damn its still flying

Lenny: Still holding too

Flash G: You should be fine off the halt.

Market Maven: Got a bad feeling lol

Tradergirl: metals = fab/gold fear trade kicking in? look to want higher

Tradergirl: having probs across all social media today and electric in home/phone, solar storm? dunno

Cara: Im in $PBYI too kinda freaked now

Ned: Morning all. Chris and Tracy welcome. Ive been absent for a bit myself.

Cara: Hey Ned nice to have ya back!

Cara: And yes Welcome TRacey and Chris!

Cara: $PBYI could go 150% IMO

Cara: Off halt

Ned: Thanks Cara

Carol: Closed $PBYI

Carol: Thanks Curt! Awesome call!!

Dave: Lot of bull tape now popping off here

Market Maven: Nice win on $PBYI all out

Flash G: Another new care for Maven to start Monday

Lenny: Hoolding

Lenny: holding

Tracy: Is there an entry point here, it’s heading back up.

Tracy: Your voice is crackly.

Tracy: Cam

Curt M_1: Bad internet today. Not sure why

Tracy: Can’t understand a word you’re saying!

Market Maven: It’s ok on my side. Odd.

Lenny: I ended up cutting when u flagged Curt good call.

Curt M_1: Voice any clearer?

Lenny: Seems ok here

Tracy: Yes, much better, thanks!

quarryrock: ok $TTWO through $69.31 so im going to lock in this $1 gain on 500 shs

quarryrock: $NTAP on watch

Curt M_1: ended up around 2300.00 on $PBYI nice way to start week

Market Maven: 26710.00

Flash G: OMG she actually REVEALED!

quarryrock: nice job!

Tracy: Wow, kudos Maven!

Market Maven: blushing

quarryrock: unreal!!! PBYI love it

quarryrock: all out of $TTWO DT scalp + $1.04 $520

Flash G: Monday Bank!

quarryrock: wow as soon as I sell my TTWO rips .25

Leanne: We’re mature!

Leanne: stop saying that Curt!

Leanne: rough night but I made it

Leanne: no

Tracy: I’m in the right place cuz I’m old too. I sat out PBYI to watch, but Kudos to all.

Leanne: Next one I”m in with ya all

Tracy: Sorry Leanne, yes, mature.

Leanne: Market is closed next Monday?

quarryrock: $PI is ripping

Tracy: $carA is moving at a pretty good clip

Tracy: I’m in CARa, lots, long and still down, so happy to see it coming back up

jon: what time frame are the candles on the live spy chart?

Leanne: The noon hour reviews are indespensible.

quarryrock: $PI on watch for a fade

Tracy: If it goes above vwap will you do another entry?

quarryrock: i cant locate any shs at either of my brokers to ss $PI

Tracy: pbyi 61.70

Tracy: You’re saving me from making mistakes already.

Tracy: Thx!

Leanne: scotch

Leanne: for some

Tracy: LOL.

Market Maven: Thanks Mr Kaptain K

Market Maven: as tradergirl calls ya

Market Maven: where’s flash?

Curt M_1: hes in the room i think

Flash G: yes

Flash G: too early for scotch going for coffee myself

Lenny: Oil should be ready in an hour or two IMO for a decent trade long on the week.

Curt M_1: You’re likely right Lenny

quarryrock: $NTAP straddle is priced off a $39.50 strike – ER is Wed AH has a 7.5% implied move – prolly wont touch this one until Wed and see if I can scalp it pre ER then

Lenny: Learning your moves QR slowly

quarryrock: TY i try to rip a few pennies on the names that have reports – adds up over time Singles and Doubles

Flash G: hmmmm

Flash G: Maybe Hedge Hog will know

Flash G: bout the solar storms

Flash G: Thats his work kinda

Flash G: sounds like my coffee’s ready see you soon

Sledge: $PBYI made my month. Just saying. Happy about that.

Leanne: Congrats Sledge!

Sledge: Appreciate that Leanne.

quarryrock: good work Sledge!

Sledge: TY!

Sledge: It does look like a good week coming. Seems that way.

Sledge: Guess I should break before the lunch reviews too. C ya soon.

Mack: Wish I could get 10 more like $PBYI. But I agree Sledge that was good timing after a soft week last week.

Mack: I was in room only a few times due to work but it wasn’t a great week last week.

Mack: Small wins only.

Curt M_1: I was log $JKS in premarket on Swing Trading side. Long $JKS small starter 18.65 500 long will liquidate likely before earnings in 4 days. If it gets lift I’ll add until closing. In report.

Curt M_1: And $CALA was long on Swing Trading side of our platform EOD Friday. Long $CALA 15.55 This is a break out play high risk 1/5 size 500 shares 1/5 size only to test set up

Curt M_1: Nice to see them both playing out.

Curt M_1: There’s the $PBYI drift

Tradergirl: sorry guys, back now, anyone still there?

Tracy: I’m here.

Leanne: me too

Flash G: here!

Tracy: Curt, could you look at CVU, it’s up 7%, parts supplier to LMT.

Market Maven: He’s gone till noon. But put it in room at noon and he will.

Tradergirl: hi, just checking charts, usdjpy not good/proxy for broad mkts, cl < 111 = no bueno

Flash G: r u a valley girl? tradergirl?

Lenny: I think we have more women than men

Lenny: Just an observation

Lenny: Don’t say it Maven

Tradergirl: no valley whatsoever flash loooool

Tradergirl: probs need to toss “whilst” from my vocab too hah

Flash G: u r a flatlander then or a mountain girl or an ocean girl?

Flash G: flatlander u must be

Tradergirl: canadian to us transplant

Tradergirl: how bout all u guys, know some from great white too like KK

Tradergirl: ocean

Market Maven: Lot of Canucks in here I know that love those canuckers!

gary y: on the lake in Tennessee

Tradergirl: we are mexicans in sweaters as they say

Market Maven: Me – German now NY and Panama

Tradergirl: how cool mm! love the idea of living diff places

Tradergirl: gary where in TN? lots of growth there

gary y: eastern part of state

quarryrock: BTO $GDX weekly $23 Puts for a trade here. I think we see the miners pb a bit – HH whats your thoughts?

gary y: lots of snowbirds move here to retire, no income tax

quarryrock: paid .17

Market Maven: hey lenny

Lenny: i know girls r better traders i know i know but i’m catching u fast

Market Maven: haha

Market Maven: been a good year ol len

Lenny: watching PI thinking why am i not in this

Mack: Is hedge hog not around

Mack: Was thinking PB in miners also

Cara: hell likely be back for noon

quarryrock: may take a day or two play out but lets see on GDX. seems extended short term

Chris: am i back?

Chris: ok working

Chris: tx curtis

Market Maven: Thanks Chris I’ll message him hes back at noon

Market Maven: BTW Chris you’ll get a data dump of emails from Sartaj tonight

Chris: ok tx

Chris: perfect thanks 🙂

Market Maven: Sartaj and team are night crawlers (tech guys)

Market Maven: hahaha

Chris: one more question regarding the trades. do they appear here in this chat window or somewhere else, and how do i know which of the members belongs to the core team?

Chris: 🙂 i am a tech too, maven

Market Maven: ha oops

Market Maven: lol

Market Maven: Curt and Sartaj are partners. Myself, Lenny, Flash, Sandra and a few others are helping with launch – we’ve traded with Curt for about 5 years ish.

Market Maven: And then there’s misc mods they are training up right now and tech support for various rooms opening starting with oil next month.

Tradergirl: thx mm for that, always wondering who’s in The Circle of Trust lol

Market Maven: Think Oil room will be open June 12 now.

Market Maven: oil room wil lbe open early for sure

Tradergirl: wti oil struggling here but sitting on hands as i had higher 52-4, on watch

Market Maven: Then SPY and Gold open I think Sept

Curt M_1: Hey yall I am getting scans ready see ya in 5 to 10

Market Maven: Its kind of a give back thing for the group and well u get bored day in day out so its fun

Market Maven: And Curt’s algos… that kinda did it

Curt M_1: Talkin about me I c? 🙂

Market Maven: ya about how you were going to retire hahahahaha

Flash G: good grief

Flash G: good luck

Flash G: got my scotch and ready

Flash G: MM did you guys ever get us off 1 server

Market Maven: soon

Market Maven: trying to make curt portable:)

Curt M_1: 3 min to chart reveiew>>>>>>>>>>

Tradergirl: mm literally spit up my daiquiri, KK retiring. now that’s funny.

Flash G: Cheers TG

Tradergirl: actually I really don’t drink, but might be driven to soon

Curt M_1: On mic for review>>>>>>>>>>> 12:03 ET

Tradergirl: lolllll

Tradergirl: fwiw KK i have higher, literally sitting on hands

Tradergirl: on wti

coleman: the headlines won’t stop

coleman: all day today

Tradergirl: same page kk, do they prop it into mtg or drop just b4 usu?

coleman: yeah i’m here

coleman: not able to edit in the chart i have or change time frames

Tradergirl: ya, but which is the best “news” for wk, i’m trying to figure out is eia > vienna? don’t know enough fundys

coleman: it’s in “view only”

coleman: not a big deal

coleman: are you asking if the weekly EIA number is more important than the OPEC meeting tradergirl?

coleman: just popped

Tradergirl: ya coleman, so i’ve heard historically tends to drift up into vienna but with eia right before, do they sell the news wed or thurs, not sure if that makes sense

coleman: yeah it does. Just my opinion, all eyes are on OPEC meeting, much more important than EIA this week

quarryrock: and there is $TTWO at $70

Tradergirl: good to know kk/coleman, thought so, just wanted to be sure as I usu just read price but if there’s easy repeatable road map on timeframe, i’ll take it

coleman: IRAQI OIL MINISTER SAYS AGREES WITH SAUDI ARABIA ON EXTENDING OPEC OIL OUTPUT CUTS FOR FURTHER 9 MONTHS

coleman: complete reversal from this morning

Tradergirl: ya, price holding steady looks to want higher

coleman: i think OPEC pulls that in order to lure more shorts in, fuel to go higher

Tradergirl: agree 100% coleman, was just talking with a price action person abt this, levels hit then headlines. magic.

Tradergirl: vrx pls

Tradergirl: want in buy/hold

Tracy: $CARA please

Leanne: you covered mine last night, greatly appreciated. Have to go back hunting…

Leanne: CBIO

Leanne: also FH

gary y: has anybody not got slaughtered?

Leanne: I’ve lost many limbs Gary….

Leanne: and then I arrived here.

Chris: 5 digits slaughter on me 🙂

Leanne: a thief of subs

Leanne: a snake!

Leanne: you’re dumping while subs are buying

Leanne: hmmmm,,,, like some other ‘gurus’ I know of

gary y: well, we’re done with those guys now

Leanne: yup, yup, yup

Tom: $PBYI did you say you were looking for another possible set-up today ?

Tracy: Losing audio

Leanne: also losing audio

Leanne: souding underwater

Tracy: Can’t hear anything you’re saying. PBLI is really tanking

Chris: audio is terrible atm

Curt M_1: Sorry about audio

Curt M_1: will wrap soon

Tradergirl: ok guys gl to all back at screens tonight

Curt M_1: Just going to look at momos real quick

Curt M_1: We have the new computers now FYI and techs setting up this week lol

Tracy: Barely

gary y: sorta

Tracy: oooh, sounded better for 1 second.

Leanne: sounds like you’re standing in a windstorm

Tracy: nope

Tracy: nope doesn’t sound good

Curt M_1: Sorry about audio, we’ll get it fized up over next couple days with new computers.

Curt M_1: I’ll type here set ups for afternoon.

Curt M_1: $SORL over 8.78 watching for further upside

Curt M_1: Fib resistance and support on screen for $SORL above 8.78

Curt M_1: $COOL looking for either 50 MA to breach 100 MA (blue) …. or 20 MA to breach 200 MA (pink) on weekly – but not a set up that will transpire today – anyway that confirms next long

Tracy: Seems like some FDA concerns are causing this PBYI waterfall.

Curt M_1: You do have short term momo possible on $COOL with Stoch RSI possible curl up on weekly

Curt M_1: $PBYI not set up yet on any time frame for a lng anyway

Curt M_1: On a daytrade you’d want SQZMOM at bottom to trend up green, MACD to curl up, Stoch RSI to curl up and price to start working thru MA’s and preferrably over VWAP

Leanne: Curtis can you put up SORL please

Curt M_1: Want it published? u don’t have trading view yet tho do YOU! lol

Leanne: well I have tc2000 and I’ll switch but it’ll take me time to learn and, and.and… I know. I should switch but my tc2000 alerts go to my phone if I’m not at computer.

Leanne: i’ll just do it

Leanne: the wrath of Curtis

Curt M_1: haha you’ll thank me

Curt M_1: trusyt me

Leanne: another thing for this old cat to learn

gary y: I gotta change too

gary y: got tc2000

Curt M_1: where you will need it is in a few weeks when you start using real indicators with me

Curt M_1: chart bots and stuff like that

Curt M_1: next level sh@t

Market Maven: truth there

Leanne: ok, so I have some time. nest monday when markets are closed and my kids are in school I will get a paid sub and learn but you better expect I’ll need help

Lenny: big data is important part of what you’ll learn too

Lenny: big data in that you need to be able to process data

Leanne: the free version just isn’t enough so I’ll do it

Lenny: its cheapo

Curt M_1: okay done with $SORL?

Leanne: yesssssss

Curt M_1: do you want me to publish it?

Leanne: nope got it

Curt M_1: k

Market Maven: He’ll teach you to always win FYI

Leanne: he already is, I’m such a sponge in this room, one day I hope I can give back as you all have given to me.

Curt M_1: See how the Stoch RSI came down whlie price went up?

Leanne: yes

Curt M_1: find that

Curt M_1: Now if the Stoch RSI curls back back its boom time

Curt M_1: The reason is the bulls didn’t sell

Curt M_1: the held – that’s called the “sheriff” or “Jailer” more comonly

quarryrock: the fade was the right call on $PI but couldnt get my paws on any shares

Curt M_1: When the Jailer holds the float thats what you want to see

Curt M_1: just 1 example of bulls at work

Curt M_1: Riskier play but it has the makings of some serious momo going forward – high probability

gary y: need pro or pro+ tradingview?

Curt M_1: just pro

Curt M_1: I think difference is number of charts you can save

gary y: thx

Curt M_1: np

Curt M_1: This $PCOM has our set up

Curt M_1: ran in to it by accident

Curt M_1: It has res on the weekly at 13.80 ish but between here and there its pretty open skies

Curt M_1: about 30%+

Curt M_1: And the 20 MA still has to get thru 50 MA and 100 MA on weekly

Flash G: That is a valid set up Curt

Flash G: Post earnings also.

Curt M_1: Volume is the issue however

Tracy: is it safe to get into PCOM now or too late

Curt M_1: Tiny volume

Tracy: So wait for volume. Having a heck of a time following with no volume, sorry if I’m asking dumb questions

Curt M_1: Theres two problems Tracy…. 1 it has small volume 2 the MACD is possibly about to trend down (it is undecided)… but on a whole its a decent setup – I would give it about 75 out of 100

Market Maven: The goal is to study out the charts Tracy and pick the highest probability ones of a group

Flash G: I do about ten hours of study for every entry.

Market Maven: Flash is exceptional thoiugh.

Lenny: Thats about what I do on my swings – not my daytrades of course. But anything you hold overnight.

Tracy: Thx all. I only know about half of what I am looking at on these charts. Makes more sense every day, only been trading full time for about six months. Aooreciate the tips

Tracy: Appreciate

Lenny: I like $PCOM but its not the best out there right now.

Curt M_1: Thanks guys. Good comments. True.

Curt M_1: So I’m showing you how to find set ups

Tracy: I’m doing way better on my swings than on my daytrades.

Curt M_1: Daytrades have different skill set. But short term swings you can really profit on if you get good.

quarryrock: $MOMO dipping all day ahead of ER slowly

Curt M_1: The reason I’m going through gainers is because they are likely setting up moreso than just any stock you look at.

Curt M_1: You’d be surprised what I can tell you from a chart.

Tracy: I can’t seem to pick good day trades to save my life. I could have gotten into PBYI at 38 this morning but they were saying it could move 65% one way or the other so I did nothing. So I decided to be safe and wait. I never pick the right choice.

Curt M_1: I can tell you the fundamentals typically from the way a chart acts.

Curt M_1: You’ll have to just follow our lead on daytrades. Watching first is best.

Tracy: Yes, I’m waatching, thank you.

sbrasel: Anyone still holding $uslv? i hit my target

Lenny: We win most trades Tracy.

Lenny: The trick in my opinion is canceling the noise and focusing on the charts.

Tracy: I can tell already I picked the best room to join Lenny. I keep telling myself that I have only been doing this six months, and I’m still standing and refuse to quit. Very determined to make this work.

Lenny: it works

Tracy: 🙂

Curt M_1: Tracy – you had asked me to look at this earlier? $GSM?

Tracy: Yes, thanks

quarryrock: this $MOMO drop intensifying

Curt M_1: Problem is price is below 20 MA on weekly.

Curt M_1: Problem is 100 MA is acting as resistance

Curt M_1: Blue line

Tracy: Is the RSI curling up good or bad?

Curt M_1: If price gets over 100 MA on weekly and the 20 MA on the weekly breachs the 100 ma WITH PRICE ABOVE the 100 MA then its a long

Curt M_1: Deal with the MA’s first

Curt M_1: Once the MA’s line up on all time frames then you pick your spots based on other indicators

Curt M_1: I’ll try and get a blog post done specifically on the steps this week

Tracy: So the MA’s are the first thing to look at always?

Curt M_1: Always

Curt M_1: Weekly then daily then hourly at least

Tracy: Got it. And when the smaller crosses above a larger it’s good, and when it crosses below a larger it’s bad

Curt M_1: If price gets above the 100 MA then where is the main resistance on weekly chart on $GSM?

Tracy: $11.17?

Curt M_1: 14.36 at 200 MA but it will trend down some

Curt M_1: Then you use your Fibs to figure out exactly where it will be

Tracy: I see that but why isn’t it 11.17 cuz that is the price it tried to get above before and failed

Curt M_1: That isn’t main resistance

Curt M_1: That’s false

Curt M_1: It is resistance but not the primary resistance for a price target

Tracy: Okay so the fibs are saying it was at 13?

Curt M_1: There’s lots of different resistance points. I’m just pointing out your primary issue.

Tracy: That is helpful because I always get out too early.

Curt M_1: So if price gets above your 100 MA your next main resistance is the 200 MA

Curt M_1: The main one – the big issue.

Curt M_1: So $GSM is a good setup if price is above 100 MA and 20 MA breaches it

Curt M_1: Then you look at history

Curt M_1: The last time was March 23 that happened and Nove 18

Curt M_1: Nov 4 2013

Curt M_1: Then you can do a basic symmetry extension

Tracy: to see how much it went up and what to expect?

Curt M_1: yup

Curt M_1: The more history you can find of a stock that has predictability in set ups in past the higher the probability it will happen in future.

Curt M_1: Proven tested quantifiable fact

Tracy: So if it goes over the 200 it could go up to over $22?

Curt M_1: It doesn’t have a lot of history – thats its main problem

Curt M_1: But yes price over 100 MA with 20 MA breaching it should see (should) see full extension.

Curt M_1: But history is scarce.

Curt M_1: So you continue searching charts and then after you’ve searched enough you pick one.

Curt M_1: And lastly you then bring it down to 1 day and then 60 min and then 15 min and then 5 mii and then day trade it until you see that it gets lift and then scalle in to it

Tracy: Where on your chart is the volume, is that the bottom part? Or is the bottom part the short squeeze part>

Curt M_1: It’s hard to see volume on here – last priority anyway

Curt M_1: Volume comes with set up

Curt M_1: no set up no volume

Curt M_1: set up almost always has volume – $PCOM is a low volume stock period thats a different scenario

Curt M_1: low float or low volume stocks are unpredictable

Curt M_1: ganblers like them

Curt M_1: on balance

Curt M_1: liquidity is your friend don’t believe the ganbling houses – they aren’t playing the highest probability and highest reproducable scenarios

Tracy: When they run they run hard, however, predicting when that is going to happen is next to impossible. I sometimes think this is all just legalized gambline.

Curt M_1: the big wins look fancy but math doesn’t support their predictability

Curt M_1: GURUS like low floats because a GURU can manipulate them easily

Curt M_1: Me and six other traders in here can move in to a low float 2.00 stock and make it 2.000 right now

Curt M_1: And then dump it on everyones head

Curt M_1: Think about it 2.00 x 100000 shares traded is peanuts

Curt M_1: Happens all day everyday

Curt M_1: Thats why their set ups don’t pass the smell test when I look at the charts – I can tell you exactly who and whne is doing that

Tracy: Yes I can spot the obvious ones now, but I think there are way more that I don’t recognize as bogus.

Curt M_1: Theyre stealing your money

Tracy: And they’re doing a great job at it.

Curt M_1: Within a month in here you’ll know exactly who is and when. Because the chart doesn’t pass the smell test.

Tracy: They’re certainly stealing my buying power.

Curt M_1: They’ve been doing it since the beginning of the markets.

Curt M_1: All because they’re too lazy to do it right.

Flash G: I’ll take another scotch.

Tracy: Have two, one for me!

Flash G: ok

Leanne: as an example CHGG is one of those happening now, pumped up by a guru

Curt M_1: lets take a lookat it

Curt M_1: See whats happening here with $COOL?

Tracy: That would be great, I need to know how to spot them.

Curt M_1: Jailer big time player controlling this

Tracy: What’s a jailer?

Curt M_1: Holds large part of float

Tracy: so a Market Maker?

Curt M_1: basically ya different types but ya

quarryrock: $LITE is having a beautiful day. watching

Curt M_1: This might really get serious

Tracy: serious how?

Curt M_1: Like go up

quarryrock: ive got $MOMO as a possible long here for end of day scalp. waiting as lots of shorts piled into this today –

Curt M_1: So if 50 MA breaches 100 MA on weekly which isn’t likely to happen today I’m long

Tracy: With the MA crossover.

quarryrock: the day trade shorts will cover before close

Tracy: Got it. And price has to be above the 100 when the 50 breaches

Curt M_1: always price above

Curt M_1: QR you aren’t holding thru ER r U?

quarryrock: no way

quarryrock: just a surgical move only – if at all. watching closely here

Tracy: quarryrock, a long scalp just means you’re buying (not shorting) and the scalp means you’ll sell same day or hold?

Curt M_1: you’ll use options I assume

Tracy: Those two words together…long and scalp, are confusing me.

Lenny: its valid

Lenny: likely off the 100 MA on the 60

Lenny: likely put shorties into toastville

Lenny: t obe precise

quarryrock: sorry ill usually say ss long or swing on my stock trades for Options usually BTO or STC

Market Maven: i might go with you guys

Leanne: me too

Market Maven: it makes sense to me

Tracy: no clue but I’m following along!

Market Maven: haha

Market Maven: might not get to 100 MA

Market Maven: its at LOD

Curt M_1: Anyway, I covered all that not just for benefit of Tracy but the whole room needs a fresher once in a while. But anyone new in room should do their homework after today and watch mid day reviews. And just DM me with questions as needed. Then we don’t clog the feed in room. We’re going to go on to next stages in set ups next few days.

quarryrock: scalps for me are somewhat larger trades looking to capture smaller expected stock moves long or short. sometimes repeatedly throughout the day.

Tracy: Thx!

Curt M_1: Going to watch oil close on the day here – GL with $MOMO if you guys go before I come back to it.

Tracy: Thanks all for your patience!

Curt M_1: hey no prob

Curt M_1: DM anytime

sbrasel: Quarryrock rsi is super low at 28 how far can it fall

Curt M_1: guarantee ya QR is deep in something lol – he’s an intense trader – totally awesome energy

quarryrock: hi sorry juggling my day job here too! haha. are you asking about $MOMO?

sbrasel: just waiting for the knife to hit the floor

quarryrock: well one of two things likely to happen on that stock. it will either continue to sell off possibly hard into the close or we could see them cover early and get a decent bounce play.

quarryrock: last hour of trading it should reveal itself

quarryrock: as they report ER tomorrow am

sbrasel: i jumped in small

quarryrock: not bad

quarryrock: ill join you here small

quarryrock: im also long $ttwo again at $68.99

quarryrock: same trade as this am. looking for end of day ramp to $70

quarryrock: ill keep a closer stop and protect my earlier profits on the name

quarryrock: 500 sha

sbrasel: QR you sill in silver?

sbrasel: $uslv?

quarryrock: not today missed it. im short gdx via puts

quarryrock: $23 Ps weeklies basically unchanged all day

quarryrock: as a side $LITE may fade here a bit

quarryrock: watch $TTWO ramp

quarryrock: the straddle is definitely priced on the $70 strike so lets see if they take it there before close.

Tracy: OCK was halted. VERY Low volume…37,000 shares traded all day.

quarryrock: they are leaning on $MOMO still

Curt M_1: $OCX off halt

sbrasel: bears crushing it

quarryrock: $41.67 is my stop

Tracy: BBRY wow.

Curt M_1: Ya lol great momo

quarryrock: all of the china plays strong today $WB $SINA $BABA –

quarryrock: $MOMO last one left to report i believe

Tracy: Sold my bbry into the spike for a profit. 🙂

Curt M_1: Way to go!

Curt M_1: Monday Bank

quarryrock: power hour!

Lenny: $OCX over 8 its mine long

sbrasel: $momo going green

quarryrock: yep last 30 mins make or break. ill sell regardless end of day

Tracy: Lenny, what indicator did you use to pick $8 for an entry?

quarryrock: like to see her over $43.50

sbrasel: thats my target

Lenny: Watch the video from Curt on trading quarters I’ll see if I can dig it up

Tracy: Thank you!

Curt M_1: Long $MOMO 700 42.48

Curt M_1: giddy up

Lenny: in right behind ya a penny

Market Maven: lol I was 2 pennies

Market Maven: had my finger on trigger

Flash G: nice turn guys – quarry the man on that one

Flash G: price over 50 MA on the 3 will jelp

quarryrock: Ty need my TTWO to respond im almost stopped out

Flash G: fish hook loooks set

Flash G: another 10 cents you got em by the nards

Flash G: damn

Market Maven: it should go

Lenny: I think this one should cover it Tracy https://www.youtube.com/watch?v=bzGOQJMeA4U&index=12&list=PLTeUfxpy0iabcmz58TgC-CQ4Q-MnRLxic not sure though

Tracy: Thanks Lenny!

Lenny: welcome

Tracy: Curt, I clicked on this link and is says access is private?

Curt M_1: hmmm

Leanne: me too, same thing

Lenny: We’ll have to dig you up one soon:)

Curt M_1: I’ll be in blog land soon anyway and publishing various clips so at latest a couple days from now – but later tonight I’l try

Curt M_1: We gotta get a library built

Curt M_1: lol time

Curt M_1: should be able to tonight ho

ny75: curt you holding momo overnight or day trade?

Curt M_1: day only

ny75: thanks

quarryrock_1: here goes $TTWO ramp it up!!!

Curt M_1: np

Curt M_1: Was hopeing for 43.30 in last 10 minutes

Curt M_1: or better

Lenny: Tracy, you’ll likely run in to trading quarters explanation as you go thru videos anyway

Tracy: Thanks again Lenny!

quarryrock_1: might just be a bag of groceries on $MOMO need a spike here

Lenny: This one might do it https://www.youtube.com/watch?v=gzi21YD_x5Y

Tracy: Yes, thanks, that one opens!

Curt M_1: I’ll get the glog posts and vids polished up for trade set ups done – I’ll focus on that going forward

Curt M_1: The raw vids suck cause you have to watch so much bla to get the goods

Curt M_1: Here comes the 20 MA 50 MA pinch

Curt M_1: 11 mins left

quarryrock: here come the Video Gamers ! to ramp TTWO

Tracy: LOL, QR, why do you call them video gamers?

quarryrock: TTWO is a video game company i

quarryrock: im out barely made lunch money on MOMO lol

quarryrock: flat on second trade of $TTWO

Curt M_1: Closed 700 $ 42.82 $MOMO

Curt M_1: sorry screen fn froze

quarryrock: my GDX puts are now green so ill ride those

quarryrock: didnt get our spikes but a nice Green Day here for a Monday overall

Curt M_1: have a great night people!

Market Maven: you also curt

Tracy: Thanks again everyone!

Lenny: talk to ya

Lenny: no prob tracy

quarryrock: thanks all!

Ned: bye all

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $PBYI, $MOMO, $RTIX, $CALA, $MXIM, $JKS, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500