Swing Trading Report and Video for July 19, 2018.

In this Edition: $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

The Mid Day Trade Set-Ups Video:

Trade set-ups on this video; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

Mid Day Chart Swing Trading Set-ups July 19, 2018 Summary:

Note: Voice broadcast on this video starts at 1:47.

Swing Trading Review of charts from July 19 Mid Day Review. Between Monday July 23 and Friday 27 we will be reviewing the charting for all one hundred equities we follow on our swing trading platform (it’s earnings season so it is important to be on top of the charting and buy sell trigger alarms). Each report from mid day will be sent to swing trading members daily.

Tickers covered; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

$VIX – Volatility time cycle on large weekly structure is coming to conclusion near mid next week. Watch for a possible trend reversal in the $VIX as we complete the time cycle. $VIX is currently in downtrend pinch on chart.

US Dollar $DXY – Algorithm model summary review (review dollar algorithm reports for complete detail or review mid day chart review videos from recent months). Intra day at resistance and if it trades above the resistance look to next structure above. Very bullish and 97.00 upside is very possible. Detail on video.

$SPY – Over 281.04 is a long side trade trigger 283.89. Support at 278.66. How to trade the algorithmic model (60 min) is discussed some on video. Other main support and resistance areas discussed.

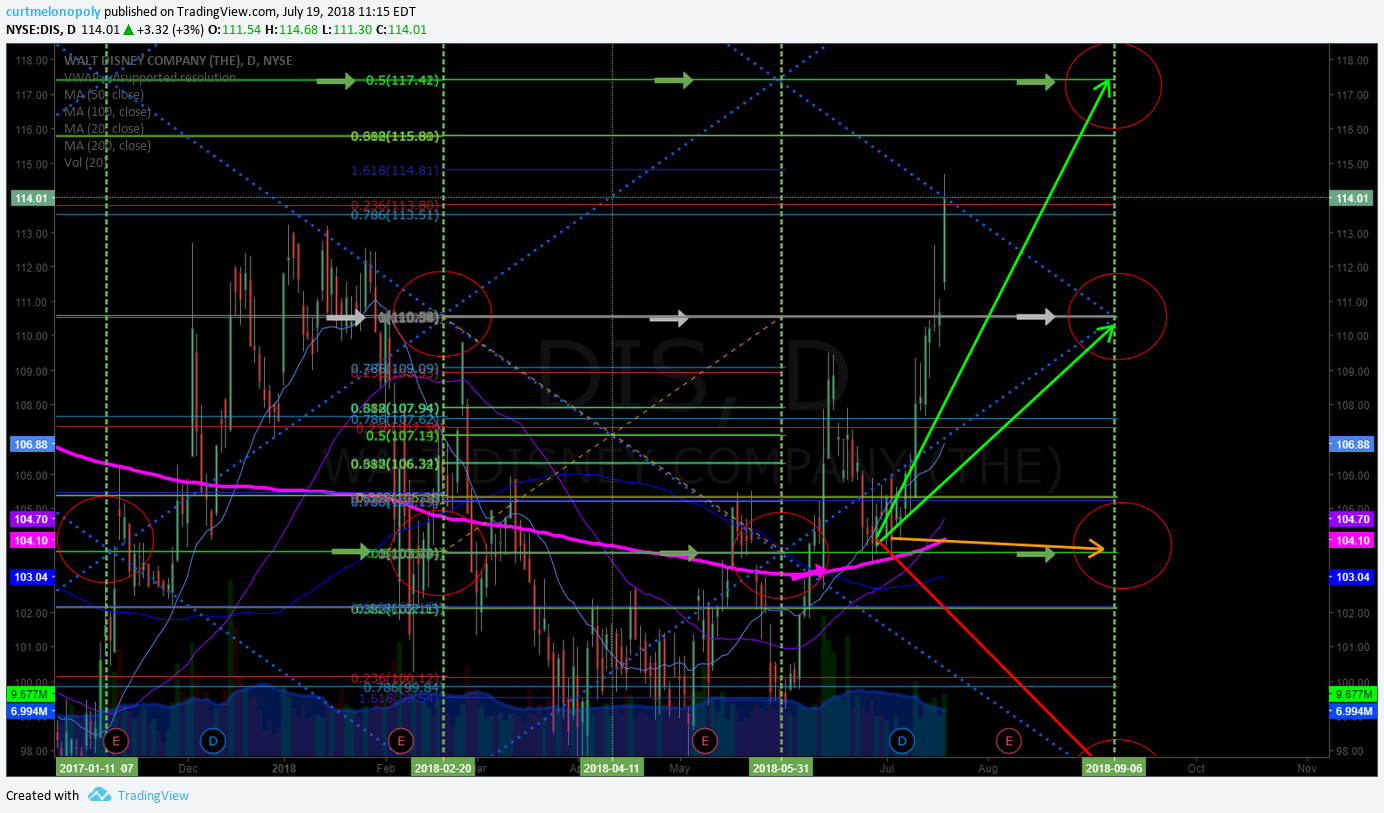

$DIS – Disney has been a great trade. The algorithmic charting has been good. Hit resistance today at a Fibonacci horizontal. Price Targets: Bullish 117.53 early Sept, 110.60 if it comes off, 103.68 is the bearish target, trade each support and resistance on way to each target. Up over today’s resistance is a long to price target on video.

$RCL – Royal Caribbean, short warning was good and it popped and got in to price target early so this is a trim 115.00 resistance, 98.50 is bearish scenario. 131.00 is bullish price target scenario above 115.00. On an upside trajectory watch the 200 MA (pink line) overhead.

$RKDA – Conventional charting reviewed for Arcadia Biosciences, This chart has lots of room to move. 50 MA is getting close to price on daily chart and that puts this on watch for a huge potential move up. We have alarmed the chart for when / if price crosses 50 MA and we’re looking for a run to the 100 MA (14.00 possible from 8’s). Watch the 200 MA overhead on way to 100 MA if that scenario occurs.

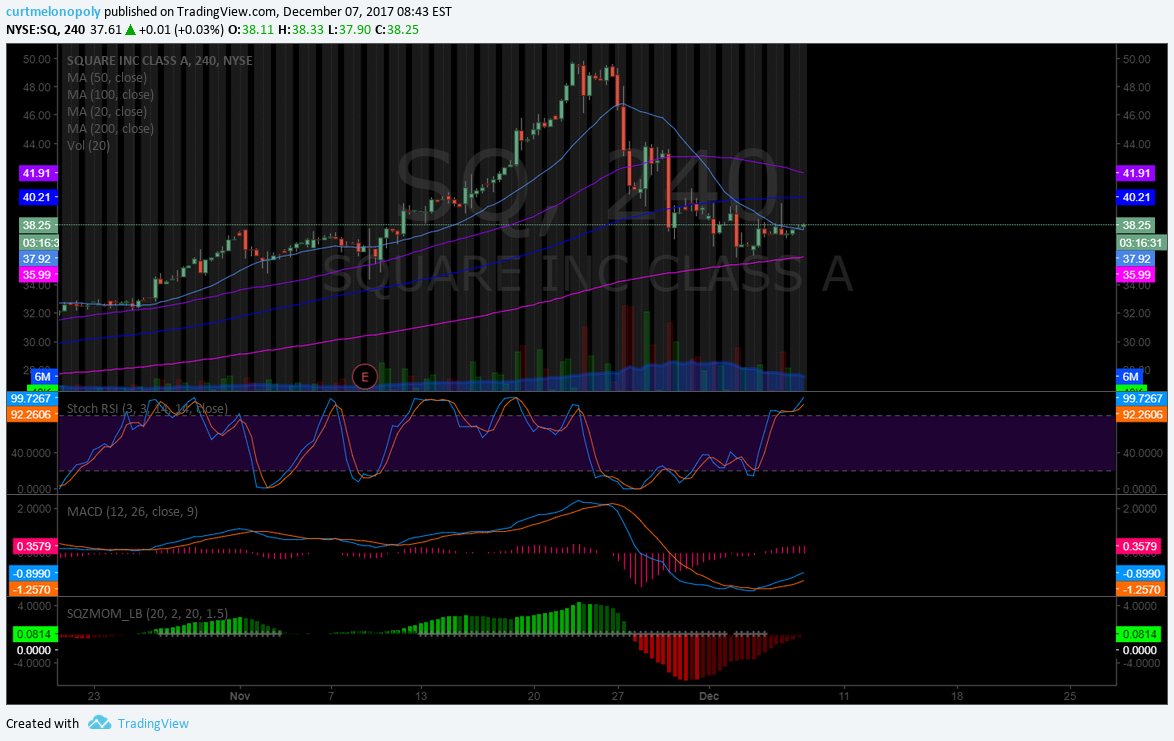

$SQ – Square, chart seems over extended and a revisit to 20 MA should occur soon. Longs should be cautious.

$HEAR – What a move, missed the major part of the move and only got daytrade snipes. Longs should trim in advance of a retrace.

$SMIT – daytraders chart and that’s it. Careful trying to trade it. Buy sell triggers discussed and how to daytrade it.

$TGTX – may be setting up for a move.

Watch for the same on Friday and next week watch for the 100 chart reviews of our regular charting in preparation for trading through earnings season.

US Dollar Index (DXY) Chart. Perfect move from structure to structure at resistance now to next possible (public). $DXY $UUP #USD #swingtrading #dollar

ARCADIA BIOSCIENCES (RKDA) Premarket up 22% trading 8.41 on milestone news. $RKDA #premarket

DISNEY (DIS) Trading 113.95 testing quad TL, 113.80 and 113.51 support. Above 115.80 res targets 117.42 Sept 6. $DIS #swingtrading

ROYAL CARIBBEAN (RCL) hit 113.00 near PT resistance for trims. Above 115.00 has 118.67 res next and under 111.24 support and so on $RCL #charting

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.