Compound Trading Monday April 17, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading and Live Stock Alerts. $CBLI, $HTGM, $LIGA, $MMEX, $USOIL, $WTIC, $DWT, $GLD, $DUST, $GDX – $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Thanks for kind words folks! Adding to page as time allows. GL this wk! https://compoundtrading.com/testimonials/ #community #testimonials #trading #premarket

Thanks for kind words folks! Adding to page as time allows. GL this wk! https://t.co/302JA1qXHM #community #testimonials #trading #premarket

— Melonopoly (@curtmelonopoly) April 17, 2017

Most recent lead trader blog posts:

Trading Checklist (Rules) I Follow Before Triggering. Part 2 of “Freedom Traders” Series.

https://twitter.com/CompoundTrading/status/853217228237422592

Now I’m Inspired! My Guarantee to Struggling Traders (and Yours). Part 3 “Freedom Traders” Series.

https://twitter.com/CompoundTrading/status/853764002584944640

Last market trading session Post Market Stock Trading Results can be found here:

https://twitter.com/CompoundTrading/status/853903631929790464

Premarket Trading Plan Watch-list for this session can be found here (locked to respect members and unlocked to public about a week later for transparency):

https://twitter.com/CompoundTrading/status/853948117523324928

Most recent Premarket Chart Set-Up Video (most recent available to public – there may be others in member’s newsletters):

Most recent Market Open Momentum Stock Trades Video (most recent available to public – there may be others in member’s newsletters):

Most recent Mid Day Chart Set-Up Review Video (most recent available to public – there may be others in member’s newsletters):

Most Recent Public Swing Trading Simple Charting can be found here: Swing Trading Simple Charts (Public) Apr 16 $SPY, $VIX, $USOIL $WTIC, $GLD, $GDX, $SLV, $DXY, $USDJPY, #GOLD, #SILVER

https://twitter.com/CompoundTrading/status/853551912599400448

Premarket Session:

Premarket momo $CLBI $WPRT $HTGM

Premarket mono $CLBI $WPRT $HTGM

— Melonopoly (@curtmelonopoly) April 17, 2017

$HTGM Premarket on fire with news. +30% Last round was awesome – again?

$HTGM Premarket on fire with news. +30% Last round was awesome – again? pic.twitter.com/ktFOLUljxH

— Melonopoly (@curtmelonopoly) April 17, 2017

In play today in chat room and on markets:

Premarket was in $CBLI $WPRT $HTGM and then on the day leader-board included $CBLI, $MOCO, $SCON, $SCON, $WKHS, $ALR and a few others. On OTC side it was $MMEX running mad.

Leaderboard: $CBLI, $MOCO, $SCON, $SCON, $WKHS, $ALR

— Melonopoly (@curtmelonopoly) April 17, 2017

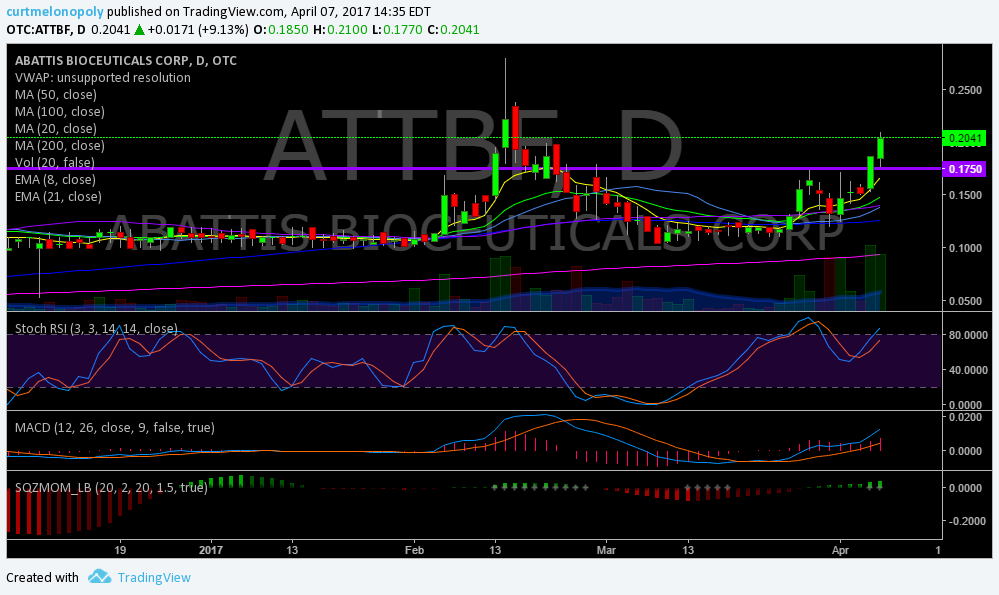

$MMEX up 78% off the watch list. Held 200 day and boom.

$MMEX up 78% off the watch list. Held 200 day and boom.

— Melonopoly (@curtmelonopoly) April 17, 2017

I took a small paper-cut on $CBLI at open, took a small long in $LIGA and added a 2nd position long to $DUST (inverse Gold play – short Gold miner’s actually $GDX) and now I am in 2/5 size $DUST at 1000 shares.

$DUST Gold Miner Bear has some momentum today. $NUGT $JDST $JNUG $GDX

$DUST Gold Miner Bear has some momentum today. $NUGT $JDST $JNUG $GDX pic.twitter.com/fdK0zKyk0J

— Melonopoly (@curtmelonopoly) April 17, 2017

Gold. Add to $DUST today. #Gold

Gold. Add to $DUST today. #Gold pic.twitter.com/LezKDzSIJ4

— Melonopoly (@curtmelonopoly) April 17, 2017

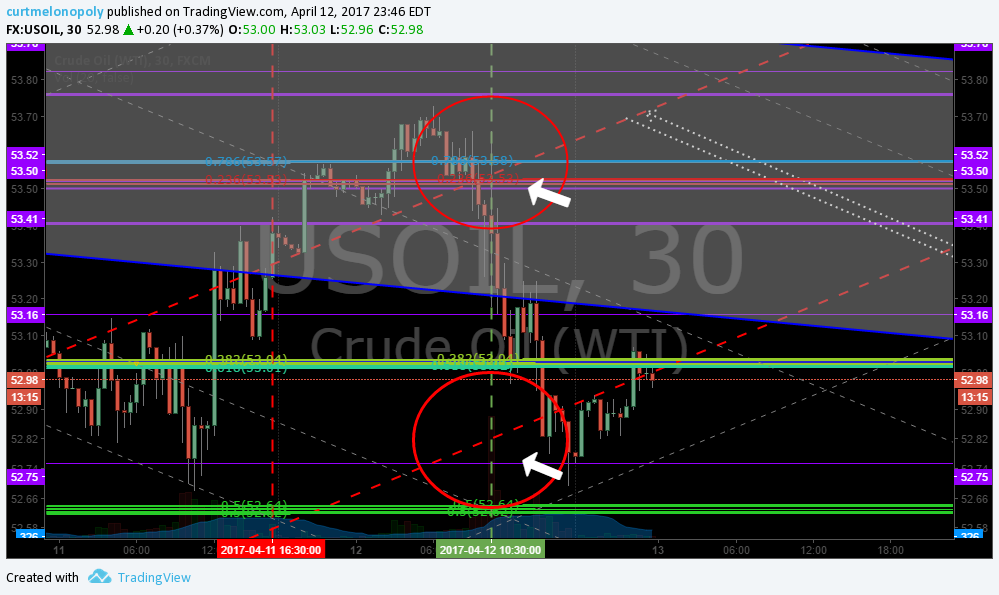

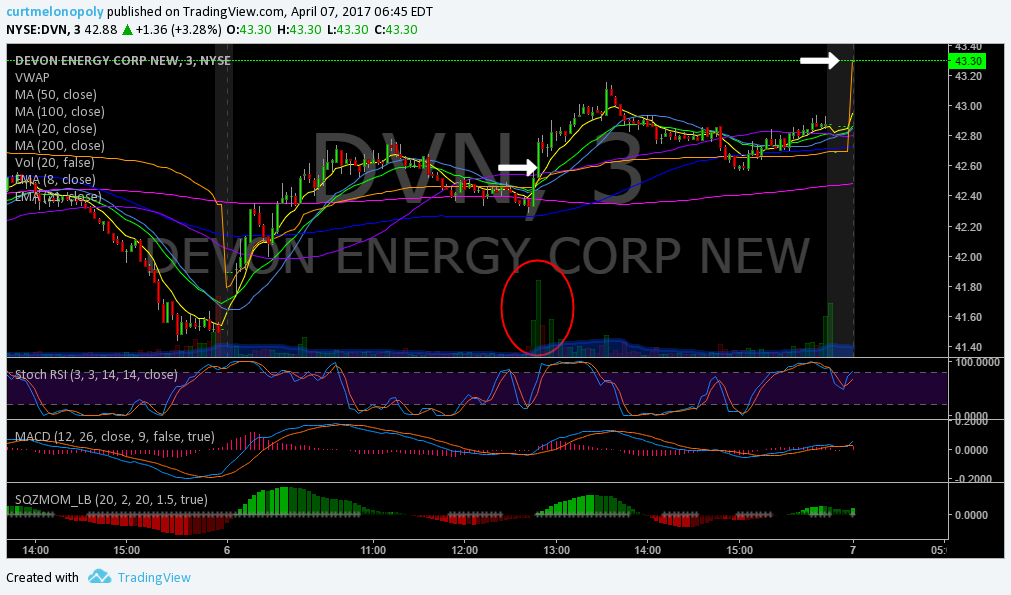

Holding $DWT because of course EPIC the Algo has been rocking the show and not missing a beat.

EPIC the Algo on fire?Hasn’t missed a turn since inception. All documented on http://compountrading.com . $USOIL $WTI $CL_F #OIL#trading #OOTT

EPIC the Algo on fire🔥Hasn't missed a turn since inception. All documented on https://t.co/1UiJPavLNe. $USOIL $WTI $CL_F #OIL#trading #OOTT pic.twitter.com/ALMOUuybCs

— Melonopoly (@curtmelonopoly) April 18, 2017

$DWT Oil Bear doing well today also. $UWT $USOIL $WTIC $UWTI $DWTIF $UWTIF $USO $UCO

$DWT Oil Bear doing well today also. $UWT $USOIL $WTIC $UWTI $DWTIF $UWTIF $USO $UCO pic.twitter.com/OvnpaF3Lxj

— Melonopoly (@curtmelonopoly) April 17, 2017

Oil. Hold $DWT no add today. #Oil

Oil. Hold $DWT no add today. #Oil pic.twitter.com/n2gAOeb9cC

— Melonopoly (@curtmelonopoly) April 17, 2017

And our MEMBERS HIT $CBLI OUT OF THE PARK!!! I say that because I talk to members and they tell me when they enter and exit even if they don’t publish publicly etc and there were some massive wins I MEAN MASSIVE – one win was over 50,000.00 on that one daytrade. They held right from open all the way to the end of the day. I’ve identified five members that are up over 200% so far this year!!! Way outperforming myself at about 50% YTD.

$CLBI up 141% Members is the room have a homerun on this today. I missed ha. They held right from open. Nice play.

$CLBI up 141% Members is the room have a homerun on this today. I missed ha. They held right from open. Nice play. pic.twitter.com/mcsMuqtZkv

— Melonopoly (@curtmelonopoly) April 17, 2017

Off mic till noon chart set-up review. Not best open w $HTGM, $CBLI, $RPRX, $WPRT etc Took a tiny papercut on long $CBLI and that was it.

Off mic till noon chart set-up review. Not best open w $HTGM, $CBLI, $RPRX, $WPRT etc Took a tiny papercut on long $CBLI and that was it.

— Melonopoly (@curtmelonopoly) April 17, 2017

How-to Trade Stocks, Lessons and Educational:

@jimcramer Did a wonderful piece last night on stock watchlist $STUDY for equities making new highs. Excellent for new & exp traders alike.

@jimcramer Did a wonderful piece last night on stock watchlist $STUDY for equities making new highs. Excellent for new & exp traders alike.

— Melonopoly (@curtmelonopoly) April 18, 2017

Watch the premarket, the market open and the mid day chart set-up reviews available on video that are in this post above if you are struggling to trade consistently for a profit.

Some days it’s more important to know when not to pull the trigger than it is to know when to pull the trigger. Lots of chop at open today.

Some days it's more important to know when not to pull the trigger than it is to know when to pull the trigger. Lots of chop at open today.

— Melonopoly (@curtmelonopoly) April 17, 2017

Successful trading is a boring, disciplined, intense war against self (inner rebellion). Conquer self – find freedom. Peace. #freedomtraders

Successful trading is a boring, disciplined, intense war against self (inner rebellion). Conquer self – find freedom. Peace. #freedomtraders

— Melonopoly (@curtmelonopoly) April 18, 2017

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size to micro sizing) – $DUST, $DWT, $XIV, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| CBLI | 4.80 | 207.69% | 38830129 | Top Gainers | |

| MOCO | 29.70 | 37.18% | 1167487 | Top Gainers | |

| SCON | 2.10 | 25.75% | 3935223 | Top Gainers | |

| STRP | 112.49 | 22.67% | 1701206 | Top Gainers | |

| WPRT | 1.27 | 19.81% | 3779500 | Top Gainers | |

| INFI | 2.19 | 19.02% | 3394200 | Top Gainers | |

| CBLI | 4.80 | 207.69% | 38830129 | New High | |

| MOCO | 29.70 | 37.18% | 1167487 | New High | |

| STRP | 112.49 | 22.67% | 1701206 | New High | |

| GAIA | 11.30 | 0.00% | 212000 | New High | |

| STRP | 112.49 | 22.67% | 1701206 | Overbought | |

| CBLI | 4.80 | 207.69% | 38830129 | Overbought | |

| CBLI | 4.80 | 207.69% | 38830129 | Unusual Volume | |

| MOCO | 29.70 | 37.18% | 1167487 | Unusual Volume | |

| PEX | 40.85 | 0.27% | 71900 | Unusual Volume | |

| ALR | 49.05 | 15.93% | 22722400 | Unusual Volume | |

| CIR | 61.69 | 9.89% | 308900 | Upgrades | |

| LMB | 13.62 | 0.96% | 13208 | Earnings Before | |

| SRNE | 1.88 | 4.17% | 1477455 | Insider Buying |

Market Outlook:

Selling ahead of tax day is normal. So is a bounce after. We discuss here ….

Selling ahead of tax day is normal. So is a bounce after. We discuss here …. https://t.co/A1f2mTyBMT

— Ryan Detrick, CMT (@RyanDetrick) April 13, 2017

Algorithm Charting News:

⤵ That tweat cause our $SPY algorithm warned us /members TWO WEEKS before last high we’d not return to high for some time?? @FREEDOMtheAlgo

⤵ That tweat cause our $SPY algorithm warned us /members TWO WEEKS before last high we'd not return to high for some time🎯🔥 @FREEDOMtheAlgo https://t.co/cfxBXmcOKB

— Melonopoly (@curtmelonopoly) April 14, 2017

We notified members in most recent trading range over last week that our algorithm identified a divergence and to expect an interimn top.

— Freedom $SPY Algo (@FREEDOMtheAlgo) March 21, 2017

⤵Epic nailed the top when the world was screaming this. @EPICtheAlgo

Bulls can end up on a plate too though… Oil Markets Turn Bullish Amid Spiking Geopolitical Risk https://t.co/0IzL7HxI0Q #oilprice

— Melonopoly (@curtmelonopoly) April 11, 2017

I wouldn’t get too excited long $SPY $ES_F $USOIL $WTI etc. until most recent highs are taken out and confirmed.

I wouldn't get too excited long $SPY $ES_F $USOIL $WTI etc. until most recent highs are taken out and confirmed.

— Melonopoly (@curtmelonopoly) March 30, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

When I started talking leaning in to oil related short 5 days ago LOT of people, well you know. EPIC the Oil Algo ?? $USOIL $WTI $CL_F #OIL

When I started talking leaning in to oil related short 4 days ago LOT of people, well you know. EPIC the Oil Algo 🎯🔥 $USOIL $WTI $CL_F #OIL pic.twitter.com/c8RXMY65HD

— Melonopoly (@curtmelonopoly) April 14, 2017

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

NA

Gold $GLD $XAUUSD

$GLD: SPDR Gold Shares Testing Post-2011 Down Trendline (linear scale) $GC_F

$GLD: SPDR Gold Shares Testing Post-2011 Down Trendline (linear scale) $GC_F pic.twitter.com/woDHVquqCJ

— Dana Lyons (@JLyonsFundMgmt) April 15, 2017

Keeping it simple doesn’t hurt??⤵ #Gold $GLD $XAUUSD $GC_F #Commodities

Keeping it simple doesn't hurt🎯💯⤵ #Gold $GLD $XAUUSD $GC_F #Commodities https://t.co/SQLmjfEafx

— Melonopoly (@curtmelonopoly) April 14, 2017

Gold Miner’s $GDX:

For those buying GDX on war concerns. Gold production tends to collapse during wars. Resources diverted to war efforts.

https://twitter.com/PolemicTMM/status/853374500083294208

Silver $SLV:

NA

Crude Oil $USOIL $WTI:

#IEA >>More oil on the market than last year, a report finds

🤔#IEA >>More oil on the market than last year, a report findshttps://t.co/lOD1dxOSpd #OOTT pic.twitter.com/VhBrw1hsXQ

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) April 15, 2017

HEDGE FUNDS’ ratio of long to short positions in NYMEX WTI rose to 5.4:1 on Apr 11 from 3.6 prior week and recent low of 3.1 on Mar 28

HEDGE FUNDS' ratio of long to short positions in NYMEX WTI rose to 5.4:1 on Apr 11 from 3.6 prior week and recent low of 3.1 on Mar 28 pic.twitter.com/IwRAVAgds0

— John Kemp (@JKempEnergy) April 15, 2017

Seasonality. Crude oil. $USOIL $WTI $CL_F #Crude #Oil

Seasonality. Crude oil. $USOIL $WTI $CL_F #Crude #Oil https://t.co/ct6jIXfsM6

— Melonopoly (@curtmelonopoly) April 14, 2017

U.S. Oil Rig Count Climbs to Highest in Almost Two Years

U.S. Oil Rig Count Climbs to Highest in Almost Two Years https://t.co/05Wuxx2OVH pic.twitter.com/Zv4XeRhadA

— Bloomberg Markets (@markets) April 13, 2017

WTI producers have trimmed their net short position in 2017 (mainly through more long exposure)

$WTI Producer net short. #oil https://t.co/FCOWIeE0om

— Melonopoly (@curtmelonopoly) April 14, 2017

Volatility $VIX:

$VIX Market Bottoms ? …. Is A Market Bottom Near? Watch For A VIX Spike Reversal – blog by @hedgopia

$SPY $VIX $VXX

$VIX Market Bottoms 🎯 …. Is A Market Bottom Near? Watch For A VIX Spike Reversal – blog by @hedgopia $SPY $VIX $VXX https://t.co/JELaLXDTdV

— Melonopoly (@curtmelonopoly) April 14, 2017

Stat Of The Day>Record $VIX Term Structure Skew: 1Mo/3Mo (VIX/VXV) @ Extreme High;8-Day/1MO (VXST/VIX) @ Extreme Low

Stat Of The Day>Record $VIX Term Structure Skew: 1Mo/3Mo (VIX/VXV) @ Extreme High;8-Day/1MO (VXST/VIX) @ Extreme Low pic.twitter.com/lVqwCHTak0

— Dana Lyons (@JLyonsFundMgmt) April 14, 2017

$SPY S&P 500 / $SPX:

A number of notable short-term extremes suggest $SPX is near a point of reversal higher.

A number of notable short-term extremes suggest $SPX is near a point of reversal higher. New from the Fat Pitch https://t.co/x8JPdGMjNP pic.twitter.com/R0PW6hghrq

— Urban Carmel (@ukarlewitz) April 14, 2017

$NG_F Natural Gas:

NA

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix. Also, please note, sometimes pieces of the transcript are missing (also something we are working on). But the video is raw and complete.

NOTICE: I AM SO UPSET because Sartaj and I both forgot to copy the transcript mid day – the stupid platform we are testing requires us to copy and paste it so we have a copy for this everyday. They don’t have an automatic back up. Stupid. Anyway, so we have to literally copy and paste a copy every two hours or it’s gone forever they say. Dumb. The point is we missed most the morning by the time we did it. But of course there is the video above. Ugh.

Sartaj: I know Curt is with me on this one, but if you are in here just to follow trades, you are likely in the wrong room

Sartaj: Welcome, David

Sartaj: I might also add that the Post-Market Report includes a chat transcript, which is disseminated over social media and on the blog (www.compoundtrading.com/blog) everyday after-hours, as well as a full video on our youtube channel of the broadcast day

Sartaj: So you have a couple of options in terms of being able to read when entries and exits were on trades

Curt M: $LIGA http://finance.yahoo.com/news/lig-assets-inc-announces-creation-164349498.html?.tsrc=rss

sspeixc572: The wrong room?!?! The great trade results on your home page is what attracted me in the first place.

Sartaj: You misunderstand me. You can watch the lead trader perform trades, that’s your prerogative, but there are a slew of reasons why we don’t encourage members to just sit there following the alerts. The trade results are meant to highlight the application of the trading discipline being applied here. So yes, while they may be attractive, it’s not an excuse to discard your own sense of risk management, what kind of positions you’d like to take, etc.

Curt M: $LIGA So bullish

Sammy: Taking a long on break-out if it comes here intra

MarketMaven: It is a decent set-up with news and lots of room

sspeixc572: You misunderstand me. At know point have I ever endorsed discarding my own sense of risk management or what kind of positions I’d like to take.

sspeixc572: know = no

Sartaj: And as you can see, part of it is contributing to the discussion – although that is optional, of course. I’m just being upfront with you that you can’t expect the proverbial pump-and-dumping that other chat rooms are privy to. We bring in guest analysts, run chart reviews like the one you just saw, review algorithmic charting as appropriate. We have had a problem with the nature of some of our members’ goals in the past

sspeixc572: Well that sounds good.

lenny: $CBLI super bullilsh too wow

Sartaj: Glad we cleared the air there, then. We are more than happy to help, but the last times we have had people asking about alerts, there was a huge gap in what their expectations were from us. Just FYI, so, didn’t mean to assume there

Curt M: The vol is decent too and Stoch RSI pointing up guys wow

Curt M: Watch the 100% mark

MarketMaven: Running that long on confirmed break of 100%

Curt M: $INFI watch for that Stoch RSI to turn up – very bullish also here

Sartaj: Let me know if you ever need help finding anything, I know it can be a lot of navigate through sometimes: info@compoundtrading.com

MarketMaven: Starting long test position $LIGA for break 10% size

Sammy: Long $LIGA also same format as Maven

Curt M: Things just got bullish it seems

sspeixc572: Bought some LIGA .0074

Curt M: Starting to leg in with you guys on $LIGA small and not alerting until it confirms and I hit it for real

Curt M: It’s gonna go, its just a matter if its today or not

Curt M: Some of the longer term holders may have to rotate out with profits – or not – I guess we’ll see

Flash G: Even though I don’t trade OTC it does say bull

Flash G: MACD is up on daily guys and gals

lenny: $CERU tape action but not my things

lenny: Stoch RSI on 3 min on $LIGA says maybe some down before up and if so I’ll hit my major entry when it hits bottom and curls (if it does today)

Flash G: Opening new long position in $TOL

Flash G: 1/4 size on swing $TOL – add on dips

OILK: Looking for entry on $PLUG for an overnight

OILK: $AAPL car $NEON maybe too CNBC

Sammy: Stoch RSI gonna curl up here on 3 min on $LIGA – may be time to wack it soon here.

Flash G: $SNAP at technical support

Flash G: Curt, your $BA call a while back on swing platform was perfect timing FYI

Flash G: Looks like they’re millkking the sentiment angle well

Flash G: Savvy did you go short?

sspeixc572: In ELED for a quick bounce

Flash G: Curt, ,our $AMZN…. thinking I my lighten 30%. What a fantastic trade,

MarketMaven: Long $CBLI 3000 3.146

Don: $PLUG looks reslly good here

Curt M: Looks to me like Tuesday is the big break-out day. Everything setting up today.

Flash G: Yes, that’s what is most likely.

sspeixc572: My ELED pick doing spectacularly so far

Curt M: Slowest day in a long time for me.

Curt M: Nice work on $ELED

sspeixc572: thanks!

sspeixc572: Will probably sell at/near VWAP

Curt M: VWAP may stop it but hmmm good play for sure

MarketMaven: Yepp

Sammy: $SCON on the move today but not aggressive on the move

Ned: $SCON b/o looks real

MarketMaven: 2:30 need some plays soon or it’s plan for tomorrow $STUDY

Ned: true

Sandra: been a $STUDY all day for me lololol

Flash G: slowest day we’ve had in the room has – have some decent earnings chart set-ups ready tho

Flash G: should be some good swing trading entries this week on earnings

Flash G: $SPY trading sure looks like a confirmation for higher tomorrow IMO

MarketMaven: $LEDS and $SCON high on my watchlist now.

Sammy: $SCON tape is interesting Maven

MarketMaven: I was just going to say ADDING $CLBI

MarketMaven: Power hour may as well give it a whirl

Curt M: Really consistent price action Maven good call on it

OptionSavvy: imo SPY anything less than about 234.50 is a sell

Flash G: $PTI new HOD

Flash G: thought you might like that Len and Maven

OILK: In $PTI

OILK: for a while now

OILK: Wn’t hold it o/n

Curt M: Looking at an add to $DUST

Curt M: Long $DUST 25.19 500 shares add 1/5 for 2/5 size

Curt M: Wow great play on $CLBI you guys wowo!!!

MarketMaven: Finished my third at at 3.50 s – best trade of the month thanks!

Sammy: $CLBI paying bills nice surprise

MarketMaven: All out $CLBI BTW yee f n ha ha nice win

Sammy: same

lenny: Ya great trade for sure and out

sspeixc572: Is $LIGA ever going to make a move before the close?

Curt M: I doubt it

Curt M: Likely a wait and see until tomorrow or Wed IMO – but no crystal ball lol

Curt M: I like it though but ya

Don: Holding 50% $CBLI guys to see if I can get a little more

Don: oh nice its goin

Don: Rolled some of my gains it to $SCON

MarketMaven: Us tooo Don $SCON $LIGA and watching a few others

Sammy: same story here

Flash G: RUnning as a pack has served you guys well for some time.

Curt M: Well…. without giving away any names there’s a group in here if you check back on the transcripts are up well over 200% this year. Not bad I must say. 4x my ROI.

Curt M: I just tweeted it lol

Curt M: you guys deserve some praise i would say – very humble

MarketMaven: Good vibes.

Flash G: Curt, long $NFLX before close:)

Curt M: I don’t do that.

Don: Time to pull shoot on $CBLI KAPOWZA WOWZA out and done.

MarketMaven: Well done:)

Curt M: $WILN Halt

MarketMaven: well thats all folks! Tomorrow!

Flash G: Bye Maven

Flash G: Tomorrow all.

Curt M: Yes, have a great evening.

lenny: Fantastic day!

lenny: $CBLI close is crazy ha

Sammy: yesssss

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $CBLI, $HTGM, $LIGA, $MMEX, $USOIL, $WTIC, $DWT, $GLD, $DUST, $GDX – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500