Month: June 2017

PreMarket Trading Plan Mon June 26 $CBIO, $IDXG, $NFLX, $WTI, $USOIL

Compound Trading Chat Room Stock Trading Plan and Watch list for Monday June 26, 2017; $CBIO, $IDXG, $NFLX, $WTI, $USOIL – $SRNE, $WMT, $UUP, $SSH, $LGCY, $TRCH, $ESEA, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Service Update: My travel, oil trading room, winning, new member experience and more.

https://twitter.com/CompoundTrading/status/877831631897153536

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to info@compoundtrading.com and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it.

Post Market Reports:

Will start again this evening.

Most recent lead trader blog posts:

NEW: How I Develop a Trading Plan Watch List (Swing Trading and Day Trading). Part 7 a) “Freedom Traders” Series.

NEW: How I Develop a Trading Plan Watch List (Swing Trading and Day Trading). Part 7 a) “Freedom Traders” Series. https://t.co/fp22VMVZRS

— Melonopoly (@curtmelonopoly) June 26, 2017

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports will be out soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Trading Plan (Buy, Hold, Sell) and Watch Lists:

Morning momentum stocks on watch so far:

Bias toward / on watch:

Markets: $SPY $ES_F $SPX I continue to be cautiously optimistic, $GLD, $GDX, $SLV under pressure. $USOIL, $WTI traded long overnight for a win and oil came off early morning so we will see. $DXY no major news and $VIX has no significant news and still dying. I am long a small test size in US Dollar related $UUP.

OTC on watch:

Gapping Premarket: $STOR $VRX $COOL $PTLA $MU $MOMO $AVEO

Recent Momentum Stocks to Watch:

Stocks with News: $CBIO, $IDXG, $VOXX, $NEOT. $CNAT is running company PR.

Recent SEC Filings to Watch: $PSTG Jun 22, CFO Sells 8255 Shrs; Net: -108.43k; Acq’d: 0; Disp’d: 8255 13.14/s https://is.gd/cQHEjO

Earnings On Deck:

Mon – $NG

Tue – $DRI $KBH $MRKT

Wed – $PIER $MON $PAYX

Thu – $RAD $MU $NKE $WBA $CAG $STZ

Holds: $WMT, $SRNE, $UUP test starter swing. All holds are small size (less than 5% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (not including my swing trading or algorithm charting trades).

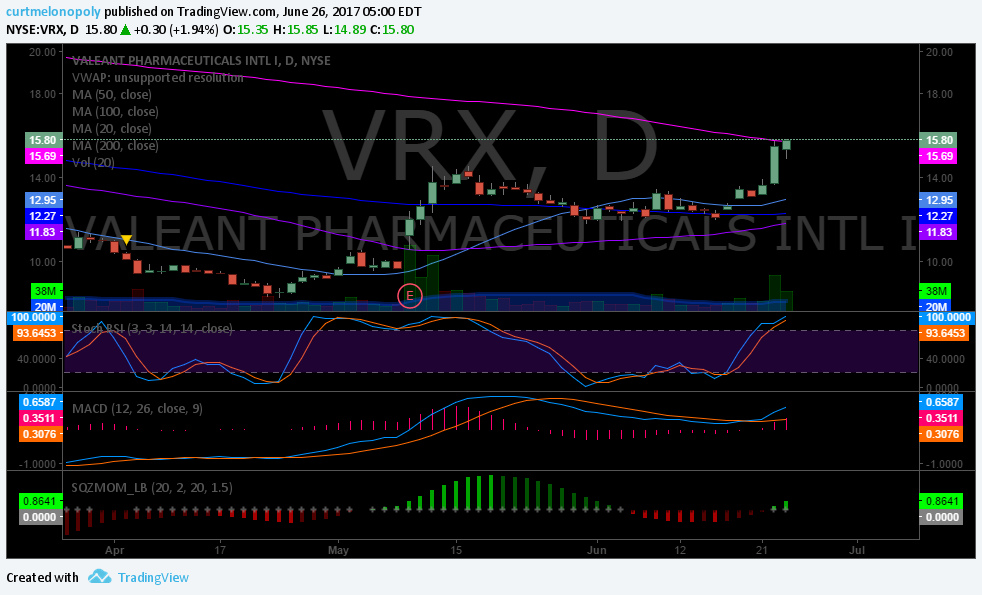

Recent Chart Set-ups on Watch: $NFLX is on my radar and $VRX. We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day.

Market Outlook:

End of quarter so I am expecting some window dressing this week. Looks like a hot open on deck.

Key Events In The Coming Busy Week: Yellen, Inflation, Durables And GDP https://t.co/EB2nP1jKLb

— zerohedge (@zerohedge) June 26, 2017

Market News and Social Bits From Around the Internet:

8:30am

-Durable Goods

-Chicago Fed National Activity Index

10:30am

Dallas Fed Manufacturing Survey

$IDXG Interpace Diagnostics Announces Coverage of Thyroid Test By Premera Blue Cross (Dow Jones 06/26 08:15:01)

PANETTA: FUTURE BAIL-INS POSSIBLE, NOW “IN TRANSITION PERIOD” – BBG

VOXX sells its Hirschmann car communication business to TE Connectivity https://seekingalpha.com/news/3275452-voxx-sells-hirschmann-car-communication-business-te-connectivity?source=feed_f … #premarket $VOXX $TEL

Neothetics stock halted on news of negative results for fat-reduction drug http://on.mktw.net/2tc7SoN

$ALGN price target raised to $194 from $149 at Leerink – keeps Outperform rating

Goldman Sachs downgrades Stratasys, lowers EPS estimates https://seekingalpha.com/news/3275453-goldman-sachs-downgrades-stratasys-lowers-eps-estimates?source=feed_f … #premarket $SSYS

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

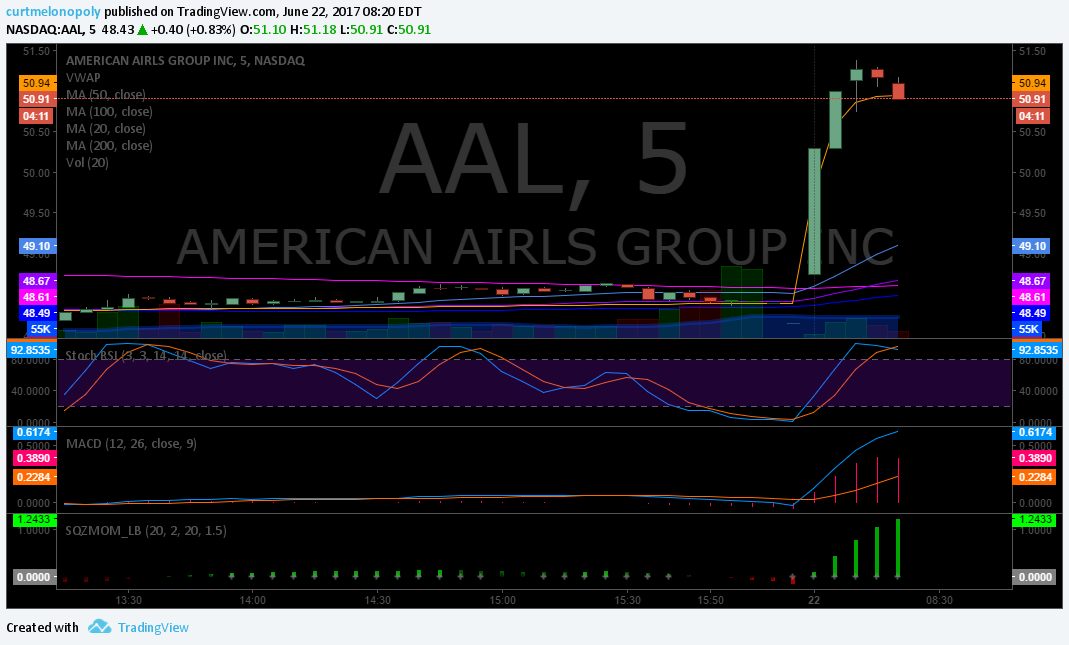

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List : $SRNE 13%, $DCTH 12%, $STOR $SDRL $BLPH $COOL $AVEO $SOL $JDST $DUST $UGAZ $CNAT $DGLD $PTLA $P $MU $FIT $VRX $DB I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : $UVXY $NUGT $GLD $DGAZ $DWT $AAOI $MTNB $ARNC $BBRY $LABD $GRUB I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Recent Upgrades: $UBS $DUK $PPL $VC $BERY $COST $PLCE as time allows I will update before market open or refer to chat room notices.

(6) Recent Downgrades: $SYSS $AEP $AEE $WEC $GRUB $HIIQ $REGN $AGIO $RMP $RICE as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $CBIO, $IDXG, $NFLX, $WTI, $USOIL – $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD

Weekly Swing Trading Stocks Mon June 26 $NFLX, $VRX, $LIT, $GSIT, $DXY, $UUP …

Welcome to the Compound Trading Weekly Swing Trading Stocks for the Week of June 26, 2017. $NFLX, $VRX, $LIT, $GSIT, $DXY, $UUP… and more.

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

This report is 2 of 3 reports weekly. You can expect the next report within in 48 hours of this report (along with the completion of this one as this one isn’t completely done yet). We know we’re a tad out of sync with my recent travel.

We will categorize our coverage soon as we are following more than we expected when we first started the service and with end of quarter fast approaching you can expect a chart clean-up and PL statements soon.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates below in red for ease.

Stock Pick Coverage

$PSTG – Pure Storage

June 26 – The way this stock trades I am waiting for it to prove out the move above 200 ma in a different way than last two times. It does not have the historical data I like so this is the only way to confirm the current move.

June 18 – $PSTG 20 ma crossed 200 ma and 50 crossed 100 and 50 ma cross 200 ma possible with MACD cross possible. Not an easy stock to trade but it may fly if it confirms.

$DXY US Dollar Index $UUP

June 26 – $DXY trading 97.26 up from 96.99 entry in $UUP. Watching.

June 18 – $UUP trading 25.12 from 25.07 initial entry $DXY trading 97.17 from 96.99 entry with MACD, Stoch RSI and SQZMOM trending up – watching for continuation to add.

June 8 – Long $UUP legging in 1/5 size 500 shares 25.07 from main account possible downside 95.55 DXY and it is trading 96.99 so its a managed trade

https://twitter.com/SwingAlerts_CT/status/872898660861857792

$DXY US Dollar Index MACD just turned up on daily. $UUP #swingtrading pic.twitter.com/itEfwfyeXd

— Melonopoly (@curtmelonopoly) June 9, 2017

$XAUUSD #Gold $GLD

June 26 – Trading 1244.58. Indicators aren’t great. Watching.

$XAUUSD Touch to 200 MA MACD trending down SQZMOM trend down. $GLD #GOLD $GC_F

June 18 – $XAUUSD #Gold $GLD Trading 1252.85 with MACD trending down and SQZMOM gone red short term pop possible with Stoch RSI. Looking for 1303.87 or no long.

https://www.tradingview.com/chart/XAUUSD/jHwdJSpN/

June 6 – On a break of $XAUUSD GOLD 1303.87 area I will be long $UGLD or $GLD.

https://twitter.com/SwingAlerts_CT/status/872015624041504768

$XAUUSD Some follow thru on yesterdays post 100 MA breach 200 MA Daily. SQZMOM green MACD trending. #GOLD $GLD pic.twitter.com/DWnJNpAxZx

— Melonopoly (@curtmelonopoly) June 6, 2017

$MXIM – MAXIM Integrated Products

June 26 – Trading 45.92. MACD and SQZMOM trending down – waiting for turn to assess.

June 12 – Trading 46.25. All indicators on daily down – waiting for the turn.

June 6 – Closing $MXIM 48.50

https://twitter.com/SwingAlerts_CT/status/872178801580494848

June 6 – $MXIM Trading 48.51. Holding from 46.94 BUT will likely be rolling out of this and closing it because Stoch RSI and MACD are near peak on weekly and we will be looking at rolling out of many long positions over next two weeks for end of quarter reassessment.

May 31 – Trading 47.70 holding.

$MXIM This swing trade going better now – took some pain in beginning on my break-out #powertrade thesis. #swingtrading

May 23 – Trading 46.69 Holding. All indicators are still a go.

Long $MXIM 46.94 range premarket 5:14 AM MAy 17, 2107. MACD crossed up, 20 MA thru 50 MA with price above. Confirmed break-out. Will hold likely until MACD turns down.

$ATHM – AutoHome

June 26 – Trading 45.47 MACD on daily still trending down with SQZMOM green but flat lined. Watching for the turn.

June 18 – Trading 43.94 all indicators trending down – watching for the turn.

June 6 – Trading 40.86. Looks like we picked a decent exit. BUT the 50 MA is close to breaching the 100 MA on weekly so it is on high watch.

May 30 – Closing $ATHM swing trade in 42.11 range premarket from 40.22 entry.

https://twitter.com/SwingAlerts_CT/status/869828281817645056

Closing $ATHM swing t42.11 range premarket from 40.22 entry. Under 5% not the best on that one but it works – quick. #breakout #swingtrade

Closing $ATHM swing t42.11 range premarket from 40.22 entry. Under 5% not the best on that one but it works – quick. #breakout #swingtrade pic.twitter.com/6FUEIZFfD0

— Melonopoly (@curtmelonopoly) May 31, 2017

May 23 – Trading 42.49. Went long 40.22 500 shares per below triggers – Stoch RSI turn up (prior to alerts service). Holding. Stop at entry. Tight stop.

May 17 – Trading 39.88. $ATHM Weekly Stoch RSI turn up near top, MACD turn up, SQZMOM up, Vol up, Post earnings, 50 MA near 100 MA breach. See daily notes below.

May 17 – $ATHM Even though on weekly it looks like a buy, on daily we are waiting for Stoch RSI to turn up at minimum.

May 9 – Every indicator is flashing a buy, except earnings are on deck and 20 MA has to breach 50 MA and we’re long.

$BWA – BorgWarner

June 26 – Trading 41.20. MACD and SQZMOM on daily trending down. Waiting for the turn.

June 18 – Trading 40.99 with all indicators on daily trending down and about to test 200 MA. Waiting for the cross-over turn back up.

June 6 – $BWA Trading 44.31. Got its pop. Price above MA’s on Daily. Stoch RSI near top, MACD trending up and SQZMOM green. Looks good but will likely wait for the 50 MA to breach 100 MA to upside on Weekly. But it is set up. WARNING to 200 MA resistance at 48.11 on weekly if you do enter.

May 30 – Trading 42.19. Still indecisive indicators. Watching.

May 23 – Trading 41.37. Price under 20 MA. Under pressure. Watching.

May 17 – Trading 42.21. Resistance on weekly 48.10 (200 MA above) and 50 MA near crossing 100 MA. On daily indecision on MA’s – we’re watching.

May 9 – Waiting for 20 MA to breach the 100 ma (blue) and 50 ma (purple) with price above and MACD confirm.

$LIT – Global Lithium

June 26 – Trading 29.21 with all indicators pointing down but it looks like a turn may be near as Stoch RSIE looks bottomed and Fri volume appeared. On Watch.

June 18 – Trading 29.41 all indicators pointing down and waiting for the turn.

June 6 – Trading 29.92 Holding but be aware it could come of a bit soon before running again as Stoch RSI turned down on daily and its high on weekly.

May 31 – MACD crossed up on 24th and went long 29.44 500 per alert notes below (before we integrated live alerts), will add when 60 min MACD at bottom and turns back up (will live alert it also).

May 23 – Trading 29.31. Waiting for MACD to turn up.

May 17 – Trading 29.43. MACD turned up last Friday and all indicators on weekly and daily are flashing a buy. Very likely will enter long May 17 premarket.

May 9 – Trading 28.55. Same.

May 3 – Trading 28.79. Watching for MACD and SQZMOM to turn up.

April 24 – Watching. Stoch RSI turned up at bottom and MACD trending down.

April 19 – MACD crossed down April 13. Closed 28.30 all shares.

April 10 – Trading 28.87 Holding.

April 5 – $LIT Alerted on March 27 report and went long 27.32 March 30 – long entry still intact as MACD is up, SQZMOM green or wait for pull back then enter. We expect this sector to stay hot – but if not in you may want to wait for STOCH RSI to cool and turn back up and go long.

$BA – Boeing

June 26 – Trading 202.23. So I missed the long and should have followed my set up on June 6. All indicators pointing up and making new 52 week highs. Fantastic trending stock and kicking myself for not taking that entry. Waiting for a pull back to assess.

June 18 – Trading 196.44. Per below it was in fact a good long. MACD has confirmed and price is now in break out trading at 52 week highs. I may trade this break out with a 1/5 size entry in pre market and wait for first pull back to add. Indicators on weekly turned up also.

June 6 – Trading 188.47. Per last report it was an okay long. SQZMOM green MACD trending up but Stoch RSI on daily trending down on daily and on weekly the MACD may turn down and SQZMOM Green but trending down. Watching for now.

May 31 – Trading 187.09. MACD on daily turned up. Likely a good long here but waiting.

May 23 – Trading 183.40. Waiting MACD on daily to turn up.

May 17 – $BA Trading 182.70. Closed 183.82 when MACD turned down on daily May 11 from 180.06 entry 500 shares.

May 8 – $BA Boring Swing trade going well. Trading 186.13. Long 180.06. Holding. MACD, Stoch RSI, SQZMOM all trending. #swingtrading

$BA Live Chart https://www.tradingview.com/chart/BA/ba7cjyIj-May-8-BA-Boring-Swing-trade-going-well-Trading-186-13-Long/

May 3 – Trading 183.13. Holding. MACD still trending up. Stoch RSI trending down so it is a tad overbought and likely to come off a bit so watching close.

April 24 – Long 180.06 500 share test April 21 because MACD turned up and SQZMOM turned green. Earnings on deck so very careful. May close before earnings and re-enter after.

April 19 – Watching. Waiting for MACD to cross up.

Apr 10, 2017 – Watching

April 5, 2017 – $BA Boeing – It’s early but increasing volume, Stoch RSI turn up, MACD turn up pinch, SQZMOM wait for it to turn green and POW

$BA Boeing live chart – https://www.tradingview.com/chart/BA/9oB2G2vk-BA-Boeing-It-s-early-but-increasing-volume-Stoch-RSI-turn-up/

$EXK – EXK Silver Mining

June 26 – Trading 3.17 holding from 3.49 entry – small so I am holding for the win.Chart is full of indecision.

June 18 – Trading 2.91 same.

June 6 – Trading 2.92. Holding.

May 31 – Trading 2.92. Yes still holding.

May 23 – Trading 3.13, Holding. MACD still turned up. High RR.

May 17 – Trading 3.31 holding long 3.49 entry. MACD turned up again on 12th and Stoch RSI is at top and resistance at 3.64 ish on daily 100 MA. Waiting now for 20 MA to breach 50 MA on daily for possible add.

May 8 – Trading 2.88. Holding per below.

May 3 – Trading 2.92. Holding long 3.49 3000 shares. It isn’t like us to hold through a down draft, however it is trading at a recent low equivalent so we are watching closely.

Apr 24 – Trading 3.12. Holding long 3.49 3000 shares.

Apr 19 – Holding long 3.49. Trading 3.20. Stoch RSI almost at bottom and will watch close when Stoch RSI turns back up.

Apr 10 – Holding trading 3.45

Apr 5 – $EXK Silver Mining SQZMOM turned green today, increasing volume, MACD up – may want to let it cool a bit before long. We are long at 3.49 average cost basis April 4 3000 shares.

$BABA – Alibaba

June 26 – Trading 143.01. Well, here we go with the no pull back again. All indicators are trending up on daily but the Stoch RSI turned down on weekly and volume is consistently coming down so I think a pull back is near.

June 18 – Trading 134.87. Still no pull back and I continue to pay. Anyway on weekly stoch rsi is turned down so we will see but MACD and SQZMOM is turned up so who knows when it will stop.

June 6 – Trading 125.20. Didn’t get our pull back and we’re paying. BUT SQZMOM just slightly turned down on weekly now so maybe we’ll get that pullback yet.

May 31 – Trading 123.60. Watching for a pull back.

May 23 – Trading 125.10. Well we got the pullback around earnings and missed it. Hopefully some members got it. It’s trading at near ATH’s right now in premarket.

May 17 – Trading 124.00. Every indicator on hourly, daily and weekly are still flashing buy, however, there has been no pullback to get an entry long. Watching.

May 8 – Trading 117.20. Same as below. Earnings nine days away also.

May 3 – Watching for it to cool off. Unfortunately we did miss some of the move. Waiting for MACD to trend down and catch it on its next turn up.

April 24 – Watching.

April 19 – Closed 111.40 at target from 104.64 cost avg 500 shares. Will allow MACD to return to bottom for re-entry.

April 10 – Hit 110.45, very near our 111.40 target. Holding, trading 109.34. Long 104.64.

April 4 – Holding long 500 shares from 104.64 now trading 108.17. It is testing all time highs and we may add on a break of all time highs. If it pulls back we may cut for a small profit. First price target is 111.40 (see below)

$BABA Live chart with indicators including that SQZMOM indicator – sweeet tool! https://www.tradingview.com/chart/BABA/Lbao9BVu-BABA-Swing-Trade-going-well-Our-Swing-Trading-side-is-in-at-10/

$BABA Swing Trade going well. Our Swing Trading side is in at 104.64 trading at 108.17. #swingtrading pic.twitter.com/x2zOezrBQ3

— Melonopoly (@curtmelonopoly) April 4, 2017

March 27 – We’re long 104.64 500 shares March 22 at test of 20 MA. Stop is at our entry and we are looking for a fresh break-out. However, the market sentiment is not great right now so we are unsure. There is an upside pivot at 111.38 we are watching for resistance should price continue up. Also watching MACD close.

March 20 – Wait for MACD to turn up and confirm and stay long until MACD turns down. The Stoch RSI seems to be frontrunning the MACD fyi. $BABA is one of my favorites right now and I see a long entry early in the week.

$BABA Live Trading Chart – https://www.tradingview.com/chart/SPY/GsGBi5f2-BABA-Daily-100-MA-50-MA-Cross-MACD-Pinch-SQZMOM-up-Stoch-RSI/

$BABA Daily 100 MA 50 MA Cross, MACD Pinch, SQZMOM up, Stoch RSI up. Wait for MACD for long. #swingtrading

$NFLX

June 26 – Trading 158.33.

$NFLX pull back may be over MACD could cross up with SQZMOM and Stoch RSI trend up.On watch and I may take a long entry in premarket today.

June 18 – Trading 152.38. $NFLX They say exit timing is as important or more so than the entry. That worked. #swingtrading All indicators trending down now so will wait on the MACD on daily before considering a long position.

June 8 – $NFLX Opened long 148.40 closing in premarket 165.88 range #swingtrading

June 6 – Trading 165.06 from 148.40 entry. All indicators pointing up on weekly and daily but we will likely roll out of this long soon.

May 31 – Trading 163.20. 148.40 entry. Stop set at 158.00 now. If price tests 20 MA on daily but doesn’t take out stop I will add and alert live.

$NFLX swing trade going wll. Trading 163.20 premarket from 148.40 entry. #swingtrading

May 23 – Trading 157.32. Stop set at 153.10 to protect equity. Holding otherwise. MACD turned down on daily and may add if it turns up.

May 17 – $NFLX Swing trade going well. Trading 158.50 from 148.40 entry. SQZMOM may turn down as with MACD and Stoch RSI truned down may exit soon and re-enter when indicators turn back up.

May 9 – $NFLX Swing trade going well. Long at 148.40 trading 156.08. SQZMOM and MACD trending but Stoch RSI may cool soon, vol decent. Will add per below.

$NFLX Live Chart https://www.tradingview.com/chart/NFLX/rjcjiVBz-NFLX-Swing-trade-going-well-Long-at-148-40-trading-156-08-SQ/

May 3 – April 25 148.40 Long 500 shares April 25 when MACD turned up per below. Trading 156.28. MACD trending up, SQZMOM trending up and Stoch RSI at top and may come off short term – so a short term turn down is possible here. Will likely re-add when STOCH RSI comes off and turns back up as long as MACD is trending up still and has room to top.

April 24 – Trading 142.87. Watching.

April 19 – Trading 143.75 – waiting for MACD to turn up.

April 10 – We closed flat 145.50. Trading 142.80. Waiting for MACD, Stoch RSI, SQZMOM to turn green for entry long.

April 4 – March 29 we entered 145.50 500 shares when MACD turned up per watch trigger below. Stop is at flat at entry and we will re-enter if we have to. Will look at adding pending triggers – will advise.

$NFLX Live chart with indicators https://www.tradingview.com/chart/NFLX/ozKJQ8t4-NFLX-March-29-we-entered-swing-trade-145-50-when-MACD-turned-t/

$NFLX March 29 we entered swing trade 145.50 when MACD turned, trading 146.82, stop at flat and re-enter if we have to. #swingtrading pic.twitter.com/DI8fiL6nsv

— Melonopoly (@curtmelonopoly) April 4, 2017

March 27 – MACD has been flat or turned down since last post. Looking close at MACD turn up and entry this week.

March 20 – The only thing that concerns me is the price staying above approximately 145.05 as a low on any given day. I may also look for that in addition to indicators lists below. Same thing with this one, exit when MACD turning down. Chances are high I will enter long early week.

Live $NFLX Chart – https://www.tradingview.com/chart/NFLX/4RQP5P9P-NFLX-Daily-abover-20-MA-Stoch-RSI-Revved-MACD-turning-up-SQZMOM/

$NFLX Daily abover 20 MA Stoch RSI Revved MACD turning up SQZMOM watch close for green. Long on MACD and QZMOM confirmation.

$GSIT

June 26 – Trading 7.90. Big volume came in on Friday and indicators all look like theyre ready to turn up. On high watch here.

June 18 – Trading 7.82. Indicators turned back down on daily. Watching.

June 9 – Trading 8.68. All indicators turned up daily. On high watch. The issue with this trade is that we are along now a number of legs since price breached the 200 MA on the daily.

$GSIT All indicators turned up on daily. 20 MA thru 50 MACD trending SQZMOM trending Stoch RSI tad high.

$GSIT Live Chart Trade Set-Up With Indicators https://www.tradingview.com/chart/GSIT/wrOpbJRu-GSIT-All-indicators-turned-up-on-daily-20-MA-thru-50-MACD-tren/

June 6 – Trading 8.38. All indicators turning up on daily but waiting and watching.

May 31 – Trading 7.59. Same.

May 23 – Trading 7.99. Watching per below.

May 17 – Trading 7.91. All the indicators are indecisive. Waiting.

May 9 – Trading 7.40. See below.

May 3 – Trading 8.03. MACD pinching. Will enter long when MACD turns up AND be sure price is above moving averages and 20 MA is in fact over 50 MA. 20 50 100 200 all in order with price above in other words. Should be soon.

$GSIT Live chart https://www.tradingview.com/chart/GSIT/MLQDlG9S-GSIT-MACD-pinch-Enter-long-when-MACD-turns-be-sure-price-above/

April 24 – Trading 7.96. Watching.

April 19 – Trading 7.63. MACD still trending down. Waiting for it to turn up.

April 10 – Trading 8.18, Stoch RSI curling up, waiting on MACD to cross up and SQZMOM to turn green for long.

April 4 – $GSIT finally cooling off and coming back to earth. Watching that MACD very close for a turn up (after it returns to bottom hopefully).

Mar 27 – Sure enough, it was on its way to the 20 MA this past week and stopped short and got some lift and closed Friday sitting on 8 ema. Will wait for it to line up.

Mar 20 – The reason I have this on the list is because as a break-out stock it is about as clean as they come, however, break out stocks come with risk. So you have two options (and shorting right now isn’t one), you can either wait for it to get near a 20 MA test and go long when other indicators line up or open a short time-frame chart and trade it. I will be waiting for the 20 MA test.

GSI Technology, Inc. to Present at the Global Predictive Analytics Conference http://finance.yahoo.com/news/gsi-technology-inc-present-global-173705866.html

$GSIT in break-out. Daily Stoch RSI peaking, MACD near peak, SQZMOM near peak. Wait for 20 MA retest and MACD confirm for long.

$AXP

June 26 – Trading 82.22. Indicators are starting to cool a bit on daily – waiting for a pull back turn.

June 18 – $AXP Testing 52 week highs near break out stoch RSI peaking MACD trend up and SQZMOM trend up. Bullish. This is a break out play and I may enter a 1/5 size and add at pull back. Watching the 20 MA breaching 50 and 100 ma’s and vol spike. Very bullish.

June 9 – $AXP SQZMOM green MACD up Stoch RSI high Waiting on MA’s to sort out with price above. Vol up. On High Watch.

May 31 – Trading 77.05. Same.

May 23 – Watching. Indicators indecisive.

May 17 – Trading 78. Sitting on 200 MA on weekly. On daily price is under 20 and 50 MA with MACD turned down. Watching.

May 9 – Trading 78.27. Closed 78.74 May 4 when MACD crossed down from 78.01 long. We still like this stock so we are watching close for indicators to turn back up.

May 3 – Trading 79.54. Holding long while MACD trends up and price above entry and 20 MA is above 50 MA. Stoch RSI is coming off so we expect some downward pressure short term.

April 24 – Trading 79.63. Long 78.01 500 shares April 20 when MACD turned up. Watching for MACD, Stoch RSI to remain, and SQZMOM to turn green for possible add.

April 19 – Trading 75.50. MACD getting close to bottom. On watch for MACD cross up.

April 10 – Trading 77.77. Waiting on Stoch RSI to curl up, MACD to cross up and SQZMOM to turn green for long.

April 4 – $AXP American Express. So close. SQZMOM about to turn, MACD cross on deck just need PTPTRR to line up. Need volume & power. #swingtrading $AXP Price Trigger Power Trade Risk Reward – PTPTRR #trading Over the Wall!

March 27 – MACD has turned down and SQZMOM is red and negative but Stoch RSI is starting to curl – waiting for that MACD to take an entry.

March 20 – This is a trend play. The only thing you have to do is manage your entry point and risk. Wait for indicators to confirm next leg up about to start and take long entry. When MACD turns down on daily that is your exit. I really like this one, especially because MA’s are all on right side (aligned) and trend reversal is in place.

$AXP Setting up for next possible leg up. Wait for MACD SQZMOM Stoch RSI to turn up. Will likely test near 100 MA at min 50MA.

$ABX – Barrick Gold

June 26 – Trading 16.30 Same. It did hold the 200 MA on weekly and MACD may turn up on weekly here soon.

June 18 – Trading 15.69 Same.

June 9 – Trading 16.64 Same.

May 31 – Trading 16.41. Same.

May 23 – Trading 16.95. Watching.

May 17 – Trading 17.14. On daily MACD is turned up, waiting on results of 20 MA test (happening now). On weekly MACD is turned down and would like to see that crossed up.

May 9 – Trading 16.26. See below.

May 3 – Trading 16.37. Watching. All indicators pointing down.

April 24 – Trading 19.25 watching. Earnings on deck.

April 19 – Trading 19.46. Indicator indecision. Waiting on clarity.

April 10 – Waiting on MACD and Stoch RSI to cross and turn up for long. SQZMOM is green now. Trading 19.09.

April 4 – $ABX Setting up nicely. Above 200 MA, wait for Stoch RSI to return to bottom and turn if possible, be sure SQZMOM green and MACD turns up and kapow. Some volume and power would help too.

March 27 – Very close now. SQZMOM just turned green, MA’s are starting to line up but not all yet, Stoch RSI is turned down at top of range so I would like to see it at bottom when we enter and the MACD is turned up. So we’re waiting for the MA’s to line up and the Stoch RSI to be near or at bottom curling up (ideally).

March 20 – I will enter a long when price above 20 50 100 200 MA’s and will likely wait for the 200 MA to cross 100 MA (although not absolute). Like with all others I will exit when MACD turns down.

Freeport a better buy? https://www.fool.com/investing/2017/03/18/better-buy-freeport-mcmoran-inc-vs-barrick-gold.aspx

Inflation may send Gold higher. http://ir.baystreet.ca/article.aspx?id=528&1489764218

$ABX Daily MACD turning up, Stoch RSI way up, price on 20 MA, SQZMOM needs to confirm, 200 MA 100 MA cross would help with price above.

$TAN

June 23 – Trading 19.80.

$TAN Got its 200 MA and price popped w 50 MA about to breach 200 and indicators up. I will wait for that Stoch RSI on daily to bottom and turn and take a long entry.

June 18 – Trading 18.34 MACD has turned down on daily and SQZMOM has also. Watching for a turn. It is also just under 200 MA on daily.

June 9 – $TAN Daily 200 MA popped, 20 MA to breach 200 MA and 50 MA about to breach 100 MA MACD trend up SQZMOM Green on high watch #swingtrading

May 31 – Trading 18.57. Will let this play through a bit before a long – but its getting very close now.

$TAN MACD Turned up on daily and price popped off 50 MA testing 200 MA now. #trading #premarket

May 17 – Trading 18.20. MACD on daily is just barely crossed up and other indicators are still indecisive. Going to let it play out some.

May 23 – Trading 18.18. Watching.

May 17 – Trading 18.20. MACD on daily is just barely crossed up and other indicators are still indecisive. Going to let it play out some.

May 9 – Trading 17.84. Waiting for 20 MA to breach 50 MA now – CLOSE!

May 3 – Trading 17.67. $TAN Watching MACD turned up price over 20 MA SQZMOM green. Need price over 50 MA with 20 MA breach 50 MA.

$TAN Live Chart Link: https://www.tradingview.com/chart/TAN/7JpW1gSP-TAN-Watching-MACD-turned-up-price-over-20-MA-SQZMOM-green-Need/

This is one of those where we are early. In other words the price isn’t above all MA’s yet. So one could take the trade as long as MACD is up and preferably long entry timed when 20 MA is about to breach 50 MA and price is above. But watch out for the 200 MA above.

April 24 – Trading 17.04. Watching.

April 19 – Trading 17.39. This one is getting close. Stoch RSI has to come off and then turn up. SQZMOM is almost green and MACD cross up. When those line up we will take a long position.

April 10 – Trading 17.20, Stoch RSI pinch, MACD pinch. Waiting on Stoch RSI to curl up, MACD to cross up and SQZMOM to confirm green for long.

April 4 – NA

Mar 27 – $TAN chart is now “broken” and price is on its way to the lower pivot around 16.44. All indicators are pointing to down. It closed Friday at 17.29. So we will keenly watch it as it nears the lower pivot and see if the indicators line up for a long trade. If it lost lower pivot we may even consider a short side entry pending indicators.

Mar 20 – Nice reversal play if it turns out. In addition to below watch the 200 MA as resistance if you go long.

$TAN Reversal Play. Daily MACD needs to turn up, Stoch RSI is up, SQZMOM needs to turn up. 100 MA about to cross 50 MA – bullish.

$VRX

June 26 – Trading 15.85.

$VRX 200 MA test. MACD up SQZMOM up. Vol up. On high watch now.

June 18 – Trading 12.66. Same.

June 9 – Trading 13.26 but chart says its not ready.

May 31 – Trading 12.29 Watching.

May 23 – Trading 13.41. Watching.

May 17 – $VRX Early stages of possible bottom bounce. SQMOM green, 20 MA about to breach 50 MA price still under 200 MA, MACD up. We may trade this more as a daytrade . swingtrade until it firms above 200 MA.

May 9 – Trading 9.77. See below.

May 3 – Trading 10.50. MACD is turned up and the SQZMOM has not confirmed green. Earnings in six days so watch for that. The MA’s are exactly like the $TAN scenario above so the same rules apply. We are not entering yet but may at any second. Again it is an early trade because you want price above the 200 MA and 20 MA to breach 20 MA that is perfect timing (with MACD trending up). But many people take these early at this point. Refer to considerations noted above with $TAN also. Same set-up.

April 24 – Trading 8.51 Watching.

April 19 – Trading 8.95. Not ready.

Apr 10 – Waiting on Stoch RSI to curl up, MACD to cross up and SQZMOM to confirm green for long.

April 4 – I thought I’d run a poll on my Twitter feed to help us with this one.

$VRX Premarket is up 1% – Could this be the bottom?

— Melonopoly (@curtmelonopoly) April 4, 2017

$VRX Premarket up 1%. MACD cross flat… is this the bottom?

$VRX Premarket live chart https://www.tradingview.com/chart/VRX/F7bVqHl7-VRX-Premarket-up-1-MACD-cross-flat-could-this-be-bottom/

March 27 – $VRX continues stepping down on the chart… per below, really important to wait for all the indicators to line up. So we remain patient and watch.

March 20 – This was looking like it was going to curl up last week and bounce but it failed. A great example of carefully watching a falling knife indicators before taking a long position. Use patience and when all indicators in play take a long.

$VRX Bottom Play. Daily MACD needs to turn, Stoch RSI turning up, SQZMOM needs to turn then as MA cross-overs occur it will strengthen.

$TWLO

June 26 – Trading 30.00 in premarket. All indicators are turned up but I just don’t trust the chart without historical. The alert below on June 9 turned out positive I just couldn’t execute.

June 18 – Trading 26.87 With MACD on daily turned up and testing natural resistance. Turns out per below it was a decent short term long. Unsure.

June 9 – Trading 25.49 The indicators on the 60 min say you could go long with a decently strong thesis (not enough chart history for Daily or Weekly chart), however, considering the short history price action I will wait – I think it is accumulating and the chart possibly repairing.

May 31 – Trading 24.48. Watching.

May 23 – Trading 25.00. Watching for bottom bounce to form. MACD up on daily right now.

May 17 – Trading 24.53. Waiting on MACD turn cross up on daily before anything.

May 9 – Trading 23.50. See below. Not ready.

May 3 – Trading 23.70. Closed 33.57 1000 shares before earnings on a 29.60 buy. Never hold through earnings unless you are unusually confident (yes we did recently with $GOOGL and $AMZN but very unusual for us to do that). Anyway, watching now. Downdraft was intense from forward guidance.

April 24 – Trading 30.82. Holding 1000 shares 29.60.

April 19 – Trading 30.51. April 12 MACD turned up opened long 29.60 1000 shares.

April 10 – Trading 28.40. Stoch RSI curling up, waiting on MACD cross and SQZMOM to turn green for long.

April 4 – No change.

March 27 – Price failed when it had to poke through 100 MA and continue – it failed and is on its way (possibly) to the previous low. So here, as with $VRX we employ patience – but get ready because the long in this one will be decent. Use the indicators noted below.

March 20 – Looks like bottom may be in. It is trending up. Looking for 100 MA to cross down under 20 MA (pinching now) and price to trade above 20 MA for long. Be sure to wait for MACD to confirm also first.

$TWLO Bottom Play on Watch. 100 MA needs to cross 20 MA with price over them. Stoch RSI pinch, MACD pinch, SQMOM turning up not green.

$WYNN

June 26 – Trading 138.30. $WYNN just got its 200 MA on weekly. Stoch RSI on weekly is crossed down with other indicators a buy. Will wait for Stoch RSI to cross up before assessing a long.

June 9 – Trading 134.73. MACD turned up on 7th and it got the pop we were thinking would come. Watching for follow through and possible long today. On high watch also.

May 31 – Trading 126.30 Watching for MACD to turn up.

May 23 – Trading 125.11. Watching for set up.

May 17 – Trading 126.91 coming up on underside of 200 MA test on weekly. MACD on daily is about to cross up. Will wait for MACD on daily and assess.

May 9 – Stopped flat on May 5, 2017. Watching SQZMOM, Stoch RSI, MACD, volume indicators now for a turn.

May 3 – Trading 125.55. Long 122.56 April 25 when MACD turned up (per below) and watching for continuation in MACD and price. Will exit if MACD turns down or price hits our entry. We may even add. It looks good.

April 24 – Trading 114.89. Watching.

April 19 – Trading 115.95. MACD trending down. Waiting for bottom and turn up. It has a ways to go.

April 10 – Closed 500 shares Friday 117.20. Trading 116.50. Watching MACD, Stoch RSI, SQZMOM for reset at bottom and turn for re-entry.

April 4 – We triggered a stop at flat March 27 and had a re-entry at 111.04 when we looked at it again for 500 shares. Currently trading at 116.00 and we are watching MACD. Which is currently at top. We may exit as MACD turns down and re-enter when MACD turns back up. Alternatively we may ride the MACD turn down as long as our original entry isn’t triggered as stop and when MACD turns back up add to position. Both are valid and we are undecided.

March 26 – We took a long position at 110.93 for 500 share start on March 21. HOWEVER, we have a stop at our entry price (due to current market sentiment) and it is currently trading at 111.92. Careful with this one.

March 20 – This isn’t easy to swing but is so hot it would be foolish to ignore, so discipline like with so many other plays in the current market is required. Seeing it hold 110.00 for a full day with indicators in line would put me in a long position.

$WYNN 200 MA needs to cross 100 MA, trade over 110 full day. Stoch RSI peaking, MACD up, SQMOM up.

$XME

June 26 – Trading 29.19. Watching.

June 18 – Trading 28.13 with all indicators pointed down. Will watch for a turn.

June 9 – Trading 30.20. Interesting – all indicators are a go except ma’s yet – so its on watch here now.

May 30 – Trading 29.25. Watching.

May 23 – Trading 29.23. Watching.

May 17 – Trading 29.32 MACD on weekly is down and price on Daily is under MA’s. Waiting on 20 MA to cross up and price to be above.

May 9 – Trading 28.73. See below.

May 3 – Trading 29.71. Watching for MACD to turn up. Currently pinched.

April 24 – Trading 29.79. Watching.

April 19 – Trading 29.48. Close flat 30.59 on the 12th. Testing 200 MA now. Watching for Stoch RSI to turn up, MACD to turn up and SQZMOM to turn green for long.

April 10 – Trading 30.84 holding. Long at 30.59. Tight stop.

April 5 – We opened a tight long position (so stop will be tight because you can always re-enter and metals charts still have to confirm so we are a tad early here) long 30.59 500 shares will add if it confirms and will cut bait if it comes off at most 2% and re-enter. Indicators look good BUT we are early. Use caution until metals etc confirm.

$XME Live trading chart with indicators listed. https://www.tradingview.com/chart/XME/lkPWMXSp-XME-Metals-and-Mining-ETF-Above-21-ema-8-ema-20-MA-200-MA-MACD/ #swingtrading

March 27 – Price action has been poor since last report, the 200 MA is just below price now so we are going to see if the indicators line up for a bounce long position.

March 20 – MACD is pinching and about to turn up, also waiting for price above 20 MA. This is a great looking chart and an argument could be made that a long position before everything lines up as I noted is sound. It’s a great looking chart because MACD is bottom (for clarity), so when it turns if all other indicators look good there should be room for a decent trade. Caution should be noted that now after having gone through a number of charts this evening the market is at a decision so any swing trades should be considered at length and stops should be tight IMO.

$XME Daily MACD pinching, SQZMOM starting to turn, Stoch RSI peaking, Price needs 20 MA

$URRE

June 26 – Same

June 18 – Trading .1.40 Same

June 9 – Trading 1.55 Watching.

Mar 23 – Trading 1.50 Watching.

May 17 – Trading 1.56. Watching.

May 9 – Trading 1.57. Waiting on MACD, SQZMOM to turn up, price to be above 20 MA and 20 MA to breach 50 MA. It is a ways away.

May 3 – Trading 1.68. Watching.

April 24 – Trading 1.84. Watching.

April 19 – Trading 1.94. Watching. Indicator indecision.

Apr 10 – No change.

April 5 – $URRE isn’t as close to a buy as $XME above, HOWEVER, the SQZMOM did signal green today and the MACD is slightly turning up! So it is on HIGH WATCH now!

March 27 – Almost a replay from last week (the indicators), so we remain patient and watch.

March 20 – Like so many of the charts this week, there is indecision. However, if the indicators line up this has excellent upside potential. The MACD pinching at the bottom is key IMO.

$URRE Daily MACD pinching at bottom, Stoch RSI turn up, SQZMOM needs green, price needs 20 MA.

$RIG

June 26 – Trading 8.09 same.

June 18 – Trading 8.62 all indicators flat watching.

June 9 – Trading 8.42 Watching.

May 23 – Trading 10.51 Watching.

May 17 – Trading 10.69. Watching.

May 9 – Trading 11.14 – SQZMOM trending up but red, MACD about to cross up, volume is up all after earnings. Waiting on price to be above 20 MA and breach 50 MA. Interesting action now (moderately positive) since earnings.

May 3 – Trading 10.60. Watching.

April 24 – Trading 11.24. Watching.

April 19 – Watching.

Apr 10 – No Change. Trading 12.50.

April 5, 2017 – $RIG Sooo close. MACD up, SQZMOM about to turn GR, wedged, needs increasing volume and break-out confirmation for a long.

March 27 – It is holding its 200 MA like a trooper, but I want to see it at least be over 20 MA and other indicators to line up.

March 20 – MACD pinching, watching for it to turn up, Above 200 day but needs to trade above 20 MA for long.

$XLE

June 26 –

June 18 – Trading 66.30 MACD on daily turned up but waiting on MACD on weekly.

June 9 – Trading 64.86 Watching.

May 23 – Trading 67.93 Watching.

May 17 – Watching.

May 9 – Trading 67.79. Similar action to $RIG above. Watching.

May 3 – Trading 67.31. Watching.

April 24 – Trading 67.79. Watching.

April 19 – Watching

April 10 – No change.

April 5 – $XLE chart is very similar to $RIG and others in this space, HOWEVER, it is still under 200 MA. On watch for break of 200 MA.

March 27 – The 50 has crossed the 100 and the 20 the 200 to downside – this is very bearish in the near term. Watching. It does qualify as a short and best when MACD at top turning down and Stoch RSI at top turning down with confirmation of price action and MA’s.

March 20 – MACD pinching, watching for it to turn up, Needs 200 day and to trade above 20 MA for long or it becomes a short.

$SLX – Vaneck Vectors Steel

June 18 – Trading 35.52. Waiting on MACD cross up on weekly.

June 9 – Trading 37.25. Testing 200 MA resistance. Will watch.

May 23 – Trading 36.74. Watching.

May 17 – Just regained its 200 MA, MACD crossed up Stoch RSI trending up. Waiting on 20 MA to breach 50 MA with price above.

May 9 – trading 36.16. All indicators are indecisive. Watching.

May 3 – Trading 38.16. Sitting on 200 MA. MACD is turned up but all moving averages above price and SQZMOM not green so we are waiting.

April 24 – Trading 37.55. On close watch.

April 19 – At 200 MA support test now. Watching indicators closely.

April 10 – No change. Trading 39.90.

April 5 – $SLX On watch for SQZMOM to turn green and MACD to turn up. Close.

March 27 – As with $XLE above this also qualifies as a short (pending short term indicators lining up when you take the position). Price lost the 100 MA and the indicators are negative – very bearish. Watching.

March 20 – MACD is pinching on the turn back up – waiting for it to turn up and 45.50 to hold for one day to confirm break out. Or, on downdraft I would look at a 100 MA long entry also.

$X – United States Steel Corp.

June 9 – Trading 21.77 watching

May 23 – Same

May 17 – Watching as with above.

May 9 – Trading 21.32. As below watching. Indicators are not flashing long at all.

May 3 – Trading 21.92 Watching.

April 24 – Trading 30.10. On close watch. Earnings on deck. MACD needs to turn up.

April 19 – Trading 28.65. At 200 MA support test. As above watching indicators closely.

April 10 – Trading 34.40 premarket Monday. ON HIGH WATCH MACD about to cross up.

April 5 – Same as $SLX indicators above. Very close now.

March 27 – The $X trade is almost identical to $SLX above. Waiting.

March 20 – This one is riskier than most on this list, however, I am watching the MACD for a turn up for a possible long.

$AKS – Iron Steel Mills Foundry

June 18 – Trading 5.99 Waiting on MACD on weekly to cross up.

May 31 – Trading 6.21 Watching.

May 23 – Same

May 17 – Watching.

May 9 – As with $X above.

May 4 – Trading 6.21 Watching.

April 24 – Trading 6.72. On close watch. MACD pinching up.

April 19 – Trading 6.40. Closed 6.97 fr loss April 11 when it lost 200 MA. On watch again.

April 10 – Long 7.30 April 7 1000 shares. MACD just turned up but SQZMOM is not green yet. 1/3 size entry with other 2/3 entry when SQZMOM turns green with other indicators confirming.

$AKS Live Chart – https://www.tradingview.com/chart/AKS/BbzvqPhJ-AKS-Swing-trade-position-long-April-7-swingtrading-stock-pic/

April 5 – Sitting right on 200 MA now. Watching for 200 MA to hold, MACD to turn up, SQZMOM to green.

March 27 – AKS is coming in on the 200 MA test. Watching.

March 20 – MACD is turning up now, watching for price to trade above 20, 50, 100 that are clustered together. It is well over 200 MA.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; $NFLX, $VRX, $LIT, $GSIT, $DXY, $UUP, Compound Trading, Swing, Trading, Stock, Picks

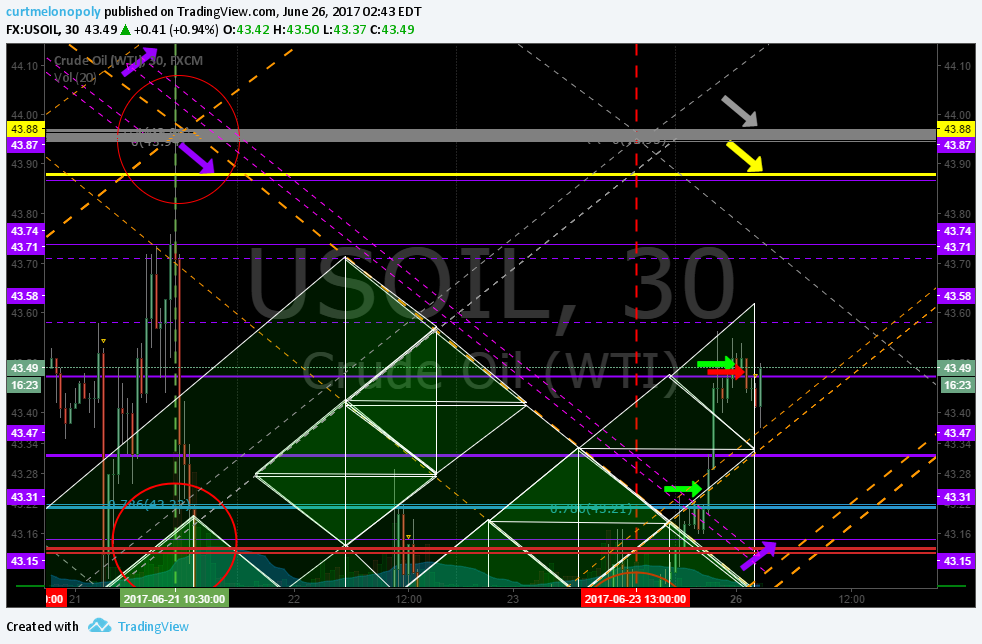

EPIC Oil Algorithm. Charting Mon June 26 FX: $USOIL $WTIC $CL_F $USO $CL_F $UWT $DWT $UCO $SCO $ERX $ERY $GUSH $DRIP

EPIC the Oil Algorithm Chart Report June 26, 2017 (Member Edition). FX: $USOIL $WTIC – $USO $CL_F $UWT $DWT $UCO $SCO $ERX $ERY $GUSH $DRIP

Welcome to my new FX: $USOIL $WTI oil trade report. My name is EPIC the Oil Algo and I am one of six Algorithmic Charting services in development at Compound Trading.

NOTICES:

New members to the oil room need to be sure to onboard in a way that assists us in being sure you are equipped to be profitable. Visit my Twitter feed and review tweets over the last few months (there are posts on there such as my profit and loss ledger, time cycle expiry, target hits, likes to important videos and more ), visit our blog and review my recent bog posts, our you tube channel has a how my algorithm works video and the weekly EIA report videos and our website explains how I was developed. If you do those four things your chance of success will be much greater.

Oil Trading Room – How to Use My Oil Algorithm

Oil Trading Room – How to Trade Intra-day with my Algorithm Charting

Most Recent P/L Link:

https://twitter.com/EPICtheAlgo/status/874109738652286976

On June 28 there is a webinar in the main trading room scheduled for 10:00 AM ET for the EIA report.

MULTI-USERS: Institutional / commercial platform now available.

PATENT PHASE: I am now in patent application phase. Stay tuned for agreements concerning disclosure and use coming to members.

SOFTWARE: My algorithmic charting is going to developer coding phase early 2017 for our trader’s dashboard program. Please review my algorithm development process and about my oil algorithm story on our website www.compoundtrading.com and my oil algo charting posts on my Twitter feed and this blog.

HOW MY ALGORITHM WORKS: I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on win ratio merit – all not shown on chart at any given time) – such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and various other charting, geometric and mathematical factors. I do not yet have AI or Geo Political integration – only math as it relates to traditional indicators with the primary goal being probabilities. I am not a high frequency robot type algorithm – I am represented on and used on a traditional trading chart as one would normally use as a probability indicator. The goal is to provide our trader’s with an edge when triggering entries and exits on trades with instruments that rely on the price of crude oil.

Below you will find my simplified view of levels that can be used on a traditional chart (both intra-day and as a swing trader or investor). This work, and associated trade, should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on. Questions to; info@compoundtrading.com, message our lead trader on Twitter, or message a lead trader in the trade room.

Visit this link for more information about my oil algorithm development, this link explains how our algorithmic charting is done, this YouTube video explains in summary how my algorithm works https://www.youtube.com/watch?v=LUNyxFoXJp8 this link for more information about our algorithmic stock charting models and what makes them different than most.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/.

FX: $USOIL $WTI Observations:

Below is the link for the live chart version of EPIC the Oil Algo Live Trading Chart for June 26, 2017. If you click on share button beside thumbs up icon when that screen opens you can click on make it mine to make edits etc:

Current area of trade. 244 AM June 26 EPIC Oil Algorithm Chart FX $USOIL $WTI #OIL $USO $UWT $DWT $CL_F #OOTT #Algo

June 26, 2017

The first most predictable trade is the significant resistance cluster well overhead (see previous posts) that is trending downward slowly. If we trade near range I will update the cluster for our traders.

The second most predictable trade (Wide trading range primary resistance and support). Upper algorithmic model wide trading range resistance 43.95 – 44.05 (grey arrow). Lower algorithmic model wide trading range support 40.40 – 40.50 (grey arrow) – remember that these areas are general support and resistance areas (our algorithm uses a .15 – .20 cent buffer on either side for these trades).

Third most predictable trade (support and resistance of uptrend or down trend channels). On the chart an upward trending trade channel is presented and (channels are diagonal dotted orange lines and purple arrows help show direction and purple dotted lines help show width of channel).

Fourth and fifth most predictable trades (support and resistance of 30 min quadrants and Fibonacci support and resistance). The diagonal lines make up quadrants and the Fib support and resistance lines are the horizontal lines in various colors (there are also natural support and resistance lines shown in purple – they represent historical support and resistance). The strongest of the historical support and resistance lines are shown in yellow horizontal.

Sixth most predictable trade signal we use are the time and price targets – unless they are very predictable, which they have not been in recent trade. When trade is in a significant uptrend or downtrend the targets become very precise and move up the indicator priority list quick. Current and most recent trade is not conducive to target predictability. Oil trade has been in a sideways trading range for months (which is very unusual so the targets on Tues, Wed and Fri are not and have not been as predictable as otherwise).

The Tues, Wed and Fri algo targets for this week are not represented on the charting yet for this week because oil trade is at a crossroads and needs to decide whether it is the upward or downward trading channel on the intra-day.

The Seventh most predictable trade with my model is intra-day. You will notice on some of the charting geometric shapes in green. They are charted live in the trading room.

Double Lines: When the chart is rebalancing you will notice double diagonal lines that otherwise wouldn’t be on the chart. Try and ignore the right of the two – the left is most pertinent and correct.

Multi Week Trading Range for Swing Trading:

Note: Be careful with the prices you see in the purple boxes on the right of the chart – they do not line up on chart for price action (they are for indicators).

Trade the ranges noted above.

Diagonal Trend Lines:

Diagonal trend-lines are critical inflection points. Please review many of my recent posts so you can learn about how important these diagonal trend-lines are. If one is breached you can look to pull-back to next diagonal trend line about 90% of the time. Also pay attention to how thick the lines are – the thicker the line the more important because they represent extensions from previous time / price cycles.

Remember you can come in to the chat room to message the trader and REMEMBER I have posted a live chart link earlier in this post so if you can’t see the lines well on this chart above you can go to the live chart link and watch for member live algo chart links through-out the day in your email inbox!

The diagonal trend-lines are marked on main chart above.

Conventional Charting Observations:

Per previous reports:

There are a cluster of resistance points in oil overhead and the charts below show this best:

Simple lines show expose clusters of resistance. Crude algo intra work sheet 201 AM Apr 10 FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

https://www.tradingview.com/chart/USOIL/mOQxIWO7-USOIL-WTI-Simple-Lines-Expose-Areas-of-Resistance/

Notice how when the daily chart is opened, the simple lines extend to current day trade.

Daily chart view. Simple lines show expose clusters of resistance. Crude algo intra work sheet 213 AM Apr 10 FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

Daily chart view magnified. Simple lines show expose clusters of resistance. Crude algo intra work sheet 217 AM Apr 10 FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

Fibonacci Levels:

Watch the lines for support and resistance. Careful using them as traditional retracement levels with crude because the algo lines etc are more dominant / predictable. But the Fib lines are excellent indicators for intra-day trade support and resistance.

The Fibonacci lines are marked on main chart above.

Horizontal Trend-Lines (purple):

Horizontal trend-lines are not as important as the other indicators reviewed above, however, they do serve as important resistance and support intra-day for tight trading and they are important if thick (in other words they come from previous time / price cycles). WE STARTED TO REPRESENT THE REALLY IMPORTANT LINES IN YELLOW FYI FOR EASE. Refer to chart for current applicable horizontal trend-lines.

Horizontal trend-lines are marked on charts above.

Oil Time / Price Cycles:

Watch your email and / or my Twitter feed for time price cycles they may start to terminate.

Time / price cycles are the single most important indicator and my record calling them is near 100% – since inception seven months ago. The reason they are so important is that a trader does not want to be holding a crude oil instrument at termination of a time cycle if not absolutely sure if price will go up or down. A trade may choose to enter a large position in advance of a time price cycle termination IF THERE IS A HIGH PROBABILITY OF A DIRECTION IN PRICE and if the market is trading at a really important pivot area. In other words, if the market is trading at the bottom of the upward trending channel at a support (yellow lines) and we knew there was a significant probability of a time cycle about to terminate a trader may enter with a long position. The price really spikes or drops significantly when these important time cycles terminate.

The problem with time / price cycle terminations is they change from minute to minute (depending on where price is on the chart) so you have to be in the trade room to get the alert. Our lead traders will do everything they can in future to send these on SMS but we have to be careful because it can be difficult with so much going on in the room. The reason they (time cycles) change is because they are actually represented by or are geometric shapes in the chart – I know it sounds odd but I have (as I mentioned) hit these calls just shy of 100%. The oil political people know the same algorithmic modeling principles and they ALWAYS TIME THEIR BIG ANNOUNCEMENTS AROUND THE TIME PRICE CYCLE TERMINATIONS.

So if you can picture a triangle on the chart – and price is trading in the triangle – and price is going to come to the edge of the triangle and there is a significant support or resistance or an algo line terminating there too or a target (those type of indications)… then we know there is a high probability of a time and price change. In other words, it is where there are clusters of algorithm points that cross and when price is going to cross over that cluster is where they are. And these are represented on all the different time frames – the larger the time frame – the larger the time price cycle termination – the larger the spike or downdraft. This is where we establish our intra-day quadrants from for sniping trades (which we will put in to the room soon because it looks like the geo political rhetoric is over for a while making them more predictable). Difficult to explain in short. So we will do our best to SMS alert these in future.

Also, the real large or important time / price cycle terminations we know far in advance and they can be put in these newsletters.

If you review my Epic the Oil Algo Twitter feed, my blog posts and my story on our website you will get a feel for how accurate these calls are.

Alpha Algo Trading Trend-Lines (Primary – Red dotted lines. Secondary – White dotted lines):

To determine which algo line is most alpha (or probable) intra day, it is the nearest line to price action. This can also help you determine the trend of trade. If the algo line is trending up the price will follow it up until price is tested at an algorithm indicator (the main tests are diagonal trendlines, horizontal trendlines, time / price cycles etc – as I have shared with you). This is why it is important to watch all the lines because they are all support and resistance. To keep it simple trade the range (yellow lines) as I’ve mentioned but keep an eye on these indicators.

Current Alpha Algo Targets (Red circles):

Your closest target that crude is trending toward is always the most probable. Crude is currently trending toward a target (red circles on chart) Then, your second most probable is the one that is up or down trend depending on whether general price is in an upward or downtrend for the most recent week or so and what your other indicators look like (such as the MA’s I explained above).

The other way to determine which targets are in play is actually quite simple, you will notice that crude trades between the channel lines up and down and up and down and there are various support and resistance along the way. If it hits a target at the top of the channel you can bet most times (unless the next day like today) that the next target hit will be at the bottom of the channel.

Wait for the price to trend toward a target and take your position and watch as price gets closer and closer to the target. Remember, that the machines trade from decision to decision – or in other words from support to next resistance or resistance to next support or when the times come each week on Tuesday Wednesday and Friday they will trend toward the target that market price action determines they go to.

Our lead trader will explain more in the room and do not hesitate to ask our lead trader in the room by private message or on twitter to explain intra day decisions.

Oil Intra-Day Algo Trading Quadrants (white dotted lines):

Intra-day trading quadrants are available on all time – cycles and all of them are not detailed on this charting. The charting above represents the 30 minute trading quadrants. If you require tighter time-frames please email us and we will update charting for the time cycle you are looking for.

Trading quadrants are simply support and resistance lines that can assist your intra-day trading – they are not alpha or primary support and resistance by any measure. Price action does however typically move more assertively when leaving a trading quadrant.

Indicator Methods:

As explained above, my algorithm is a consideration of up to fifty traditional indicators at any one time – each one given its own weight in accordance to its accuracy (win rate). This is how we establish the probability of specific targets hitting (we call them alpha algo targets).

Alpha Algo Targets, Algo Trend-lines, Algo Timing, Quadrants for Intra Snipes:

Algo targets are the red circles – they correspond with important times each week in oil reporting land. Tuesday 4:30 PM, Wednesday 10:30 AM and Friday at 1:00 PM. The red dotted diagonal lines are the algo trend-lines. And the vertical dotted (red or green) are marking the important times each week. You will find that the price of crude will hit one of the alpha algo targets about 90% of the time. In the absence of market direction the machines take price to the next algo line and/or target. Understanding how the price of crude reacts to the algos and how they move price from target to target is critical for intra-day and swing trading crude oil and associated instruments.

You will notice that price action of crude will use these algo trend-lines and act as support and resistance, and that price also often violently moves when an alpha algo line is breached either upward or downward.

We cover this in much more detail in the member updates, trading room. A review of my Twitter feed and previous blog posts will help you understand the relation of these indicators. We will start posting video blogs (for my subscribers) on YouTube (in addition to my daily blog posts) for swing traders that work during regular trading hours.

Also… we will cover how to establish algo trend-lines and price targets future forward (as you have seen me do on my Twitter feed for some time now).

Conclusion:

See you in the live trade room! And again, if you struggle to know how to use these indicators as a trader’s edge, it is recommended (if you have earnestly reviewed all of our documentation first) that you obtain private coaching prior to trading a real account with real money – we recommend you use a paper trading account at first.

You can also send specific questions to our email inbox at info@compoundtrading.com – if you do this be sure to ask a specific question so it can be answered specifically. When the 24 hour oil trading room opens you will have ample opportunity in that 24 hour room to ask questions also.

Watch my EPIC the Oil Algo Twitter feed for intra day notices and your email in box for member only material intra day also.

EPIC the Oil Algo

PS If you are not yet reviewing the daily post market trading results blog posts, please do so, they are on the blog daily and often there is information that also may assist your trading. Trade room transcripts (for example) may review topics pertinent to your trading.

Article topics: EPIC, Oil, Trading Room, Crude, $USOIL, $WTI, $USO, $UCO, $CL_F, $UWT, $DWT, $ERX, $ERY, $GUSH, $DRIP, Chart, Algorithm

How I Develop a Trading Plan Watchlist (Swing Trading and Day Trading). Part 7 a) “Freedom Traders” Series.

Part Seven a) of the “Freedom Traders” Series: Trading Plans. How I Build my Personal Trading Plan and Watch List for Swing Trading and Day Trading.

Introduction.

Below is a quick post about how to develop your own trading plan watch list for both day trading and swing trading. I’ve also done a quick 23 minute video for you on the topic. I keep my method simple so its quick and efficient. Once I’ve found a stock that meets my set-up criteria then the real work begins (refer to part 6 for trading set-ups or our daily mid day review videos to understand more of my methods).

The Purpose.

The purpose of a trading plan is to provide you (the trader) with a focused target list for the day (for day traders) or a watch list for swing trading. It is a short list, or I like to look at it as my journal. From there you can build out your specific chart set up criteria for each possible trade.

How to Build a Trading Plan Watch List: Video Number One.

Topics in How I Build a Trading Plan Watch List Video 1:

The primary focus in building your plan in my opinion is to keep it easy.

I use my hot list on Trading View charting software. My hot list are momentum stocks on each day that have liquidity.

I look at each momentum stock to see if each is setting up in accordance to the trade set-ups that I am looking for (refer to our mid day review chart trade set ups videos on You Tube to understand my set ups).

When I find a stock that it developing as a great set up I then chart the set up and set the alarms for Swing Trading first and the for Day Trading on tighter time frames.

And that is as simple as it gets and then I don’t have to listen to the noise on CNBC, on social media etc.

It works time and time again. Simple and effective. Check my results:)

Click here for the link to sign on to any of our services. https://compoundtrading.com/shop/

Message me anytime with your story or questions. And if you follow me on Twitter and I don’t follow back so you can DM then send us an email to info@compoundtrading.com with your Twitter handle.

Cheers!

Curtis

Previous Freedom Trader Post Links:

Part 1 : My Personal Stock Trading Story. How I Blew up Two Accounts and then Learned How to Trade.

Part 2: Trading Checklist (Rules) I Follow Before Triggering a Stock Trade.

Part 3: Now I’m Inspired. A Struggling Trader That Inspired Change.

Part 4: We Want (Need) You! Apply to Nearest Recruiting Station.

Part 5: Learn How to Trade Stocks (Build a Small Account) Following my Journey.

Part 6 a: Trading Set-ups. How-To Develop a Systematic – Predictable Process.

Part 6 b: Trading Set-ups. Video Explains Predictable Winning Process.

Article Topics; Compound, Trading, Plan, Watch List, Freedom, Traders, Learn, How to, Day Trading, Swing Trading

Weekly Swing Trading Updates Fri June 23 $AAPL, $WMT, $AMD, $TSLA, $FEYE, $NVO, $JKS, $LTBR ….

Good Morning Swing Traders and Welcome to the Compound Trading Weekly Swing Trading updates (1 of 3 this week) for the Week of June 19, 2017. $AAPL, $WMT, $AMD, $TSLA, $FEYE, $NVO, $JKS, $LTBR and more …

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Good morning!

Swing service newsletters and alerts will resume regular rotation this weekend as the hardwired internet at my new local is now working. I know this report says 1 of 3 (it is supposed to be earlier in week of course. Anyway, thanks for your patience with the internet / travel issue.

Twitter alert service at @SwingAlerts_CT. I know many have expressed interest in the email only, but the Twitter option is available going forward for those that prefer that. Please bear with us as we integrate and orientate ourselves to this new function in our daily routines.

This report (1 of 3) focuses on the more recent stocks we have added to our swing trading set-up coverage. They include; $TSLA, $SNAP, $VGX, $AAU, $AMMJ, $AGN, $CTSH, $IBB, $FEYE, $LACDF, $PCRX, $PBR, $EWZ , $JKS. $RCL, $LTBR and we have added $WMT Wallmart, $AMD Advanced Micro, $SRNE Sorrento Therapeutics and $AAPL Apple coverage.

We are going to categorize our coverage soon because we are following more than we expected when we first started the service..

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates below in red for ease.

Our Q1 2017 Swing Trading Results are available here:

https://twitter.com/swingtrading_ct/status/841079400485478400

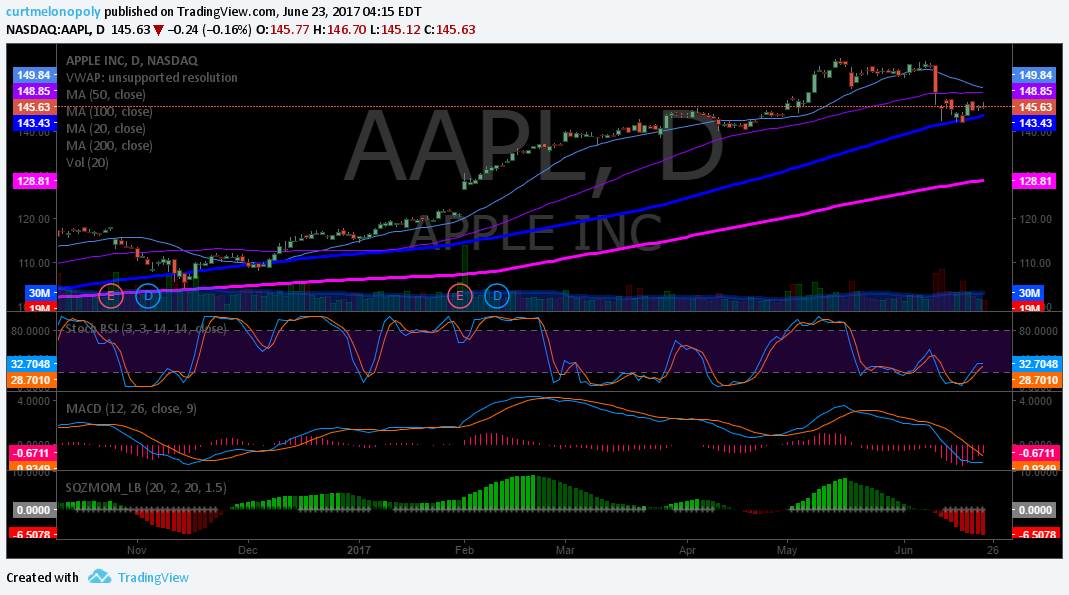

$AAPL – Apple

June 23 – $AAPL Trading $145.62 Waiting on MACD on daily to turn up for possible long. Holding 100 ma.

$AMD Advanced Micro

June 23 – $AMD Trading 14.28. Primary indicator I am watching for long is MACD on weekly to cross up.

$WMT – Wallmart

June 23 – Trading 75.60. Long from 74.81 for possible gap fill swing trade (was in daytrade room as an entry and moving it to swing side). Held its 200 MA on weekly and if MACD crosses up I will likely add significantly to the trade long. Stop now at entry and if I have to close and re-enter I will.

$SRNE – Sorrento Therapeutics

$SRNE Trading 1.95 long from 2.07 wash out snap back gap fill play.

$LTBR – Lightbridge Corp.

June 23 – Trading 1.73 Price bounced off 200 ma so I am holding but MACD is trending down so we’ll see.100 ma about to breach 200 ma. If it does I may add long to 2.26 position.

June 12 – Trading 1,86 entering bowl phase (lost 20 MA has 200 MA trade as it should be). Holding 2.26 long will add as it proceeds through bowl. Likely bounce when 100 MA breaches 200 MA or when price hits 50 MA.

June 5 – $LTBR Daily 50 MA about to breach 200 MA with MACD SQZMOM and Stoch RSI up. Long 2.26 premarket.

https://twitter.com/SwingAlerts_CT/status/871663903012409344

$LTBR 100 MA resistance on weekly at 2.70. SQZMOM MACD Stoch RSI all up.

$RCL – Royal Caribbean

June 23 – Trading 112.15. Looking for MACD to cross up for long.

June 12 – Trading 112.07. MACD on its way down will look at long when MACD crosses up.

June 5 – Trading 113.38 and up significantly since last report with 50 MA breach of 100 MA on weekly. On Daily all indicators are a go also. Main reason we are not entering here is extension. Too risky and extended for now.

May 30 – Royal Caribbean Weekly 50 MA about to breach 100 MA and 52 week high near. Break out trade possible very soon.

$JKS – Jinko Solar

June 23 – Trading 20.26. $JKS Solar. Resistance on deck with 200 MA on weekly overhead. However, 20 MA breaches 100 with price above pow. #swingtrading

June 12 – Trading 17.78. MACD down and waiting on it to cross up for long in continuation bowl over 200 MA.

June 5 – Closing trade flat – earnings on deck. Should have closed last week when it hit 22.00 range for a decent swing.