Category: Day Trading

The Home Depot Stock Trade | Earnings Sell-Off | Trade Set-Up Alert

Home Depot Trade: Swing Trade and Day Trade.

Home Depot is trading 185.36 pre-market down 2.43% on earnings guidance.

The News Story Link:

Home Depot Misses Q4 Earnings on Interline Charge; Sees Softer 2019 Profit #swingtrading $HD #earnings https://www.thestreet.com/investing/earnings/home-depot-misses-q4-earnings-on-interline-charge-sees-softer-2019-profit-14877506

The Chart:

How to Trade It:

Key Support 174.30 area trading 185’s in premarket so 174’s is quite a ways down, however, I think it is possible.

Key Resistance 191.00 area. Anything under 191 seems short bias to 174 s.

Watch the 182 s on way down (trading box support) and the 200 MA on the 4 hour.

On the day trade side of things, use the horizontal support and resistance levels on the chart for the trade. I will alert as I trade it also.

Thanks

Curt

Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Crude Oil Day Trading Strategies From Our Oil Trading Room Video Footage.

If there is one thing we have seen time and time again in our crude oil futures daytrading room (see previous articles) is that our EPIC Oil Algorithm model and day traders can pin-point the buy sell signals for the reversal for intra-day trend to capture a reversal in trade.

The focus of this post is to teach you how to find the intra-day bottom when daytrading crude oil. Step by step the lead trader explains what signals to watch for to simplify the process and ensure your winning strategy.

It is important to learn how to catch the bottom of sell-offs to increase your ROI on trades and capture the next move. You may have to enter a number of trades with tight stops to get a position that is set for the move, but it is worth the time if you learn how.

#DaytradingOil #OilTradingStrategy #TradeReversal # FX: $USOIL $WTI $CL_F $USO

Main Points of Trade Strategy Covered in this Article:

- Day trading oil signals covered in the video and post below:

- EPIC Crude Oil Algorithm Charting.

- Conventional Oil Charting.

- Charting Indicators; Moving averages, squeeze momentum, MACD.

- Time Cycles.

- Price Targets (intra-day and weekly).

- Trading Boxes.

- Charting Time Frames.

- Order Volume.

- Short cover rally intra-day.

- Entries around the edge of range.

Video Date and Description: October 17, 2018 10:25 AM – EIA Petroleum Report Live Trading Session.

Voice broadcast starts at 2:10 minutes on video.

Video Transcript Summary Highlights:

At 2:20 on video FX USOIL WTI trading 70.73 at the beginning of the session, trading on top of support at top of trading box at down side channel support.

The down channel in trade is confirming per the most recent guidance in recent reports and I am expecting that in to end of October and then up in to Christmas.

Resistance points on algorithmic model short side is most probable for winning in down trend (retracement) – areas to short pointed out on charting at 3:05 on video.

Bias was a long intra-day when report was released, but there was a surprise build today.

I usually don’t trade the first 5 mins after the EIA crude inventory numbers are released.

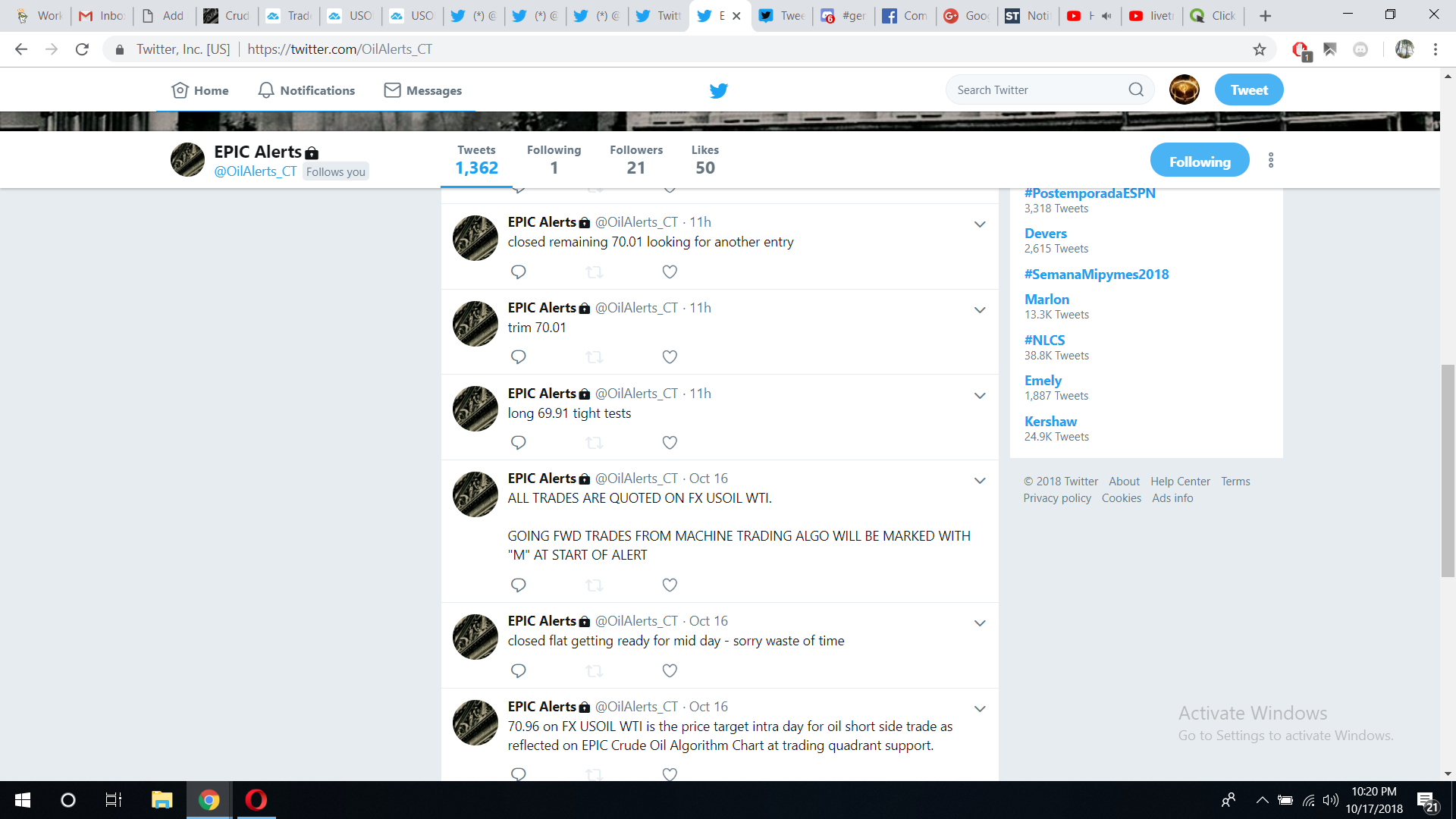

Example of EIA report data as posted on EPIC’s Twitter Feed:

#WeeklyPetroleumStatusReport for week ending 10/12/18 posted https://go.usa.gov/xPRx3 #oil #gasoline #diesel #heatingoil #propane #OOTT

https://twitter.com/EPICtheAlgo/status/1052567708473032704

3:40: On the oil algorithm there is a buy trigger signal intra-day at 69.97 at the mid channel support test for a daytrade.

3:50: Symmetry chart has a buy signal at 70.19 at top of oil trading box.

4:08 Trade on monthly chart is still between the 100 MA and 200 MA and I expect a break to upside or downside early November and my bias is to upside.

4:14 On the weekly wedge chart 70.00 watch very close at top of trading box, end of October time-cycle peak to bottom of wedge on chart 68.42 – that is possible.

4:45 On the daily oil chart trade intra-day is right at the pivot. 50 MA is just under price and to the upside the price intra-day was rejected at the pivot.

Don’t miss the last report on oil trade guidance I provided that guides on signals from now in to early 2019 on all charting.

5:10 Charting trend lines reviewed with time cycle peak early December in 76.00 region.

7:20 on video #EIA report comes out.

7:27 the sell-off on oil is apparent in trade with stops in oil getting taken out.

I start reviewing oil charting at this point on video for various supports to possibly take a position long.

8:50 6.5 million barrel build in crude oil inventories is discussed. 69.50 possible low in oil trade is discussed here.

9:40 Trading 73.00. Any long positions be sure to keep your position with tight stops until down to the 69.50 support range.

Top of trading box on the weekly wedge support at 69.99 is considered.

11:15 Watching chart indicators; MACD, Squeeze Momentum and Stochastic RSI on 1 minute time frame here as price is getting in to the first signal for a possible buy zone daytrade at support.

11:40 I explain that I am looking for a short cover rally for the oil daytrade and then shorting the resistance. As shorts cover price goes up, this occurs when the sell-off on the day comes to an end as oil shorts cover positions.

11:50 I explain that trade is down 3% on the day and that this is typically the area of the short covering and reversal intra-day.

12:40 As price bounces I start to look toward the upside 20 MA resistance on the 1 minute chart.

13:35 I provide guidance that we are possibly looking at 69.00 area and even 68.46 on the wedge chart.

14:50 My daytrade plan for support area and resistance areas and the intra day time cycle confirmation of up or down channel for trade is reviewed on the oil algorithm charting.

17:10 Watching the possible buy zone and 1 min chart for squeeze momentum to turn.

20:20 We are watching the pressure in oil trade in to the bottom of the trading box on the 1 minute chart and considering more stops to get ta’ken out if trade goes below the support on the trade box.

22:20 15 minute candle expires (important point of time to watch trade closely). The bottom of the trading box then is lost.

23:50 I discuss the problem created with governments manipulate price in markets (such as Trump with oil) and what will likely happen with the price of oil when the anomaly will cause a sever snap back trade in oil (also referenced earlier in video). Essentially the structure of the natural trading range of a financial instrument is manipulated.

26:00 oil starts to trade up and I’m watching for the 20 MA upside resistance test.

27:00 I explain that many traders would have taken the buy signal at the mid channel line on the chart and that I likely should have.

28:10 After 20 MA resistance has occurred and price is on the way back down to the next support and I explain where that is and that it is my possible buy area on chart.

29:25 The buy side for oil comes in and I explain that I’ve now missed two buy triggers.

42:00 I am long crude oil futures at 69.91.

44:19 I explain the 5 min candles and a place to trim the position at top of the trading box and alerting that I have trimmed my long position at 70.01 and advise that the 50 MA on the 1 min is coming. Ten minute candle expiry on watch.

45.40 I alert that there is resistance heavy intra day 70.28 range.

46.55 I close the remainder of the daytrade and look for another entry.

Below is the screen shot of my trade alert for the day trade in crude oil on the long side and my closing the position. This reflects what it looks like when you try and catch the reversal on intra-day trading.

There is more to the video, with various discussion on daytrading crude oil with what signals to watch for and there is another trade on the video also.

See video for more on related discussions.

Below is the guidance in given to the oil trading room with charts at the start of futures trading later that day.

Price targets for 900 AM Oct 18 price cycle completion intraday crude oil trade.

Buy sell trade signals at each highlighted trendline (yellow) on chart.

Signals for end of week price targets. Upper target bias – lead trader.

Thanks

Curt

Any questions let me know!

Further Reading:

5 Steps to Making a Profit in Crude Oil Trading.

https://www.investopedia.com/articles/investing/100515/learn-how-trade-crude-oil-5-steps.asp

What is a ‘Trade Signal’:

A trade signal is a trigger for action, either to buy or sell a security or other asset, generated by analysis. That analysis can be human generated using technical indicators, or it can be generated using mathematical algorithms based on market action, possibly in combination with other market factors such as economic indicators. https://www.investopedia.com/terms/t/trade-signal.asp

Other Crude Oil Trading Reports & Videos:

Learning to Trade Oil Links on our Site and/or YouTube.

Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video).

Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

Oil Trading Room – How to Use EPIC the Oil Algorithm June 21, 2017 (video).

Oil Trading Room – How to Use Oil Algorithm Chart & Recent Trades June 29, 2017 (video).

Here we unlock historical member reports at intervals after time cycles have expired for traders that are learning to trade oil. When you clock on link scroll down at landing page on blog section you will be transferred to so that you can get to reports that are unlocked over time: https://compoundtrading.com/category/epic-the-oil-algo-chart-report/

Subscribe:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Follow:

Article Topics: Daytrading, Crude Oil, Strategy,Trading Room, Alerts, Signals, USOIL, WTI, CL_F, USO

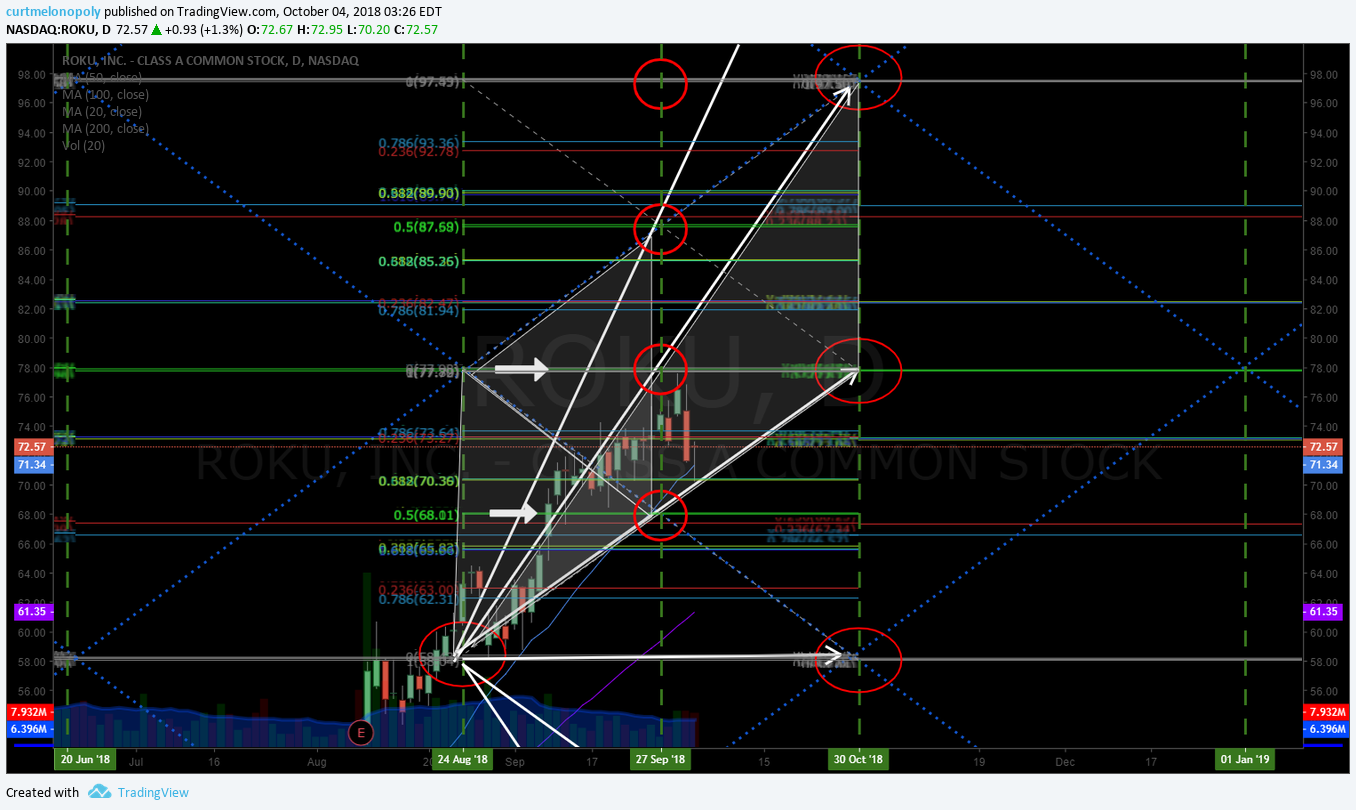

Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Daytrading Stocks Isn’t Easy, But You Can Increase Your Win Rate When Trading Momentum Stocks Using Technical Analysis Along With A Catalyst Thesis.

In this post I use the market open trade in $ROKU as an example (live raw trading room footage is below) to teach you how to daytrade stocks that have a catalyst (in this case an upgrade in ROKU by a well known market analyst that morning) and using technical analysis to structure the trade (long trade entry point on chart, where to trim the position and where to close the position at key resistance).

My trade was clean, without stress, I alerted the trade live on the live trade alerts feed and traded it live in the trading room. When I alerted the trade I also gave our members a price target for closing the trade.

Hopefully my experience in using technical analysis while daytrading stocks will help you win more and lose less when you lose.

Live Trading Room Raw Video and Transcript Highlights Detailing Trade Entry, Price Target, Trims and Closing Trade.

The video below is the raw live trading room video feed that includes review of various trade set-ups in premarket and market open. The summary of the ROKU trade is below the video with points of reference on timing on video for easy reference.

At 5:55 on video: In premarket I explain to the trading room that ROKU is my primary watch (the others I also reviewed on the video) on the day on the analyst upgrade. ROKU trading up 2% at 74.63 premarket. Over 77.62 is an add (to those already in the swing trade). For the longer term than daytrading 93.93 is a possible price target in a bullish scenario and 87.58 is more likely and 78.00 most likely for the target date on the chart at the time cycle peak.

The points of support and resistance on the charting that I reference follow a process of technical analysis that we use on all of our algorithmic charting.

ROKU trade is following trajectory. Be sure to trim trade positioning in the resistance areas on the chart and add above (or alternatively add at pull backs).

I also how 5 minutes in to open is an important area to watch and how I am cautious Monday mornings, but on this Monday premarket trading was bullish.

At 9:12 on video: Market open at 9:30 Eastern time. ROKU trading 74.72 at open, over 77.62 is a buy / add to any existing swing trade position. Support on ROKU intra day is at 73.15 – 73.20. Buy side coming in at this point and 3 – 4 dollar day trade range possible prior to resistance over head.

At 13:44 on video: Watching the market open first 5 minute candle conclusion. Over high of day (HOD) ROKU could run in to 77.70 price target. At this point in the trading session I explain that I may run the trade with the market to the price target. Trading 75.65 intra-day looking for 76.00 for a long entry for daytrade now.

At 14:41 on video: At this point I alert that I am long ROKU at 76.00 with a tight stop bias with price target for ROKU daytrade of 77.50. I would trim heavy in to that price target and possibly add above.

At 17:28 on video: Just about triggered an add to my long position in ROKU at 75.82, probably should have. Watch next 5 minute candle completion.

At 18:40 on video: ROKU is strong in to 5 minute candle switch. Now I have a stop at entry 76.00. If it dumps (sells-off) beyond my entry price at 76.00 I may re-enter.

At 21:01 on video: Trimming my position at 50% size at 76.69. Decent little day trade. It’s strong. Nice buys there.

At 25:15 on video: We’re getting pretty close to my price target.

At 25:50 on video: Trimming 25% of position 77.16 – likely early but….

At 27:10 on video: This is going to be an important candle turn. If a daytrade is going to soften (fade) it is likely to do that in to 10:00 AM, so I am watching the 10 minute point candle prior to the turn at the top of the hour at 10:00 AM.

At 28:28 on video: In to the candle turn I am watching the bottom of the candle body close. At candle turn watch for bullish or bearish trade action for a clue of how the next candle is going to trade. At this point ROKU is trading bullish trading near high of day. Looking for trade in next candle to hold the top of the body of the previous candle.

At 29:38 on video: Getting close to price target now it trade 77.29 there. 77.16 closed last 25% of the daytrade in ROKU.

The Catalyst: Analyst Upgrade on ROKU:

“Shares of Roku Inc (NASDAQ:ROKU) gapped up prior to trading on Monday after Needham & Company LLC raised their price target on the stock from $60.00 to $85.00. The stock had previously closed at $71.24, but opened at $73.03. Needham & Company LLC currently has a buy rating on the stock. Roku shares last traded at $76.48, with a volume of 8448678 shares”.

Article Here: Shares of ROKU Gap Up After Analyst Upgrade.

The Original Alert That Put ROKU on Watch for a Trade for our Members:

Below is a screen shot of the original trade alert posted on the swing trading alert feed (a copy was also posted to our daytrading alert feed on Twitter) that ROKU was on watch with a time cycle peak nearing (if you need to learn how to chart and/or trade time cycles reach out for some trade coaching, get access to trade coaching boot camp videos or spend some time in our live trading room).

It is important to note here that with the alert we also posted the link to the live chart on Trading View. This is important when you are harnessing your trade thesis in technical analysis, our members do not have to do the charting on their own, we provide that service as part of the platform.

Another important note is that when we are alerting day trades or swing trades for equities or commodity, crypto or currency trades… in most instances our members already have the technical charting models from previous analysis done for members in previous trade alerts or newsletters etc.

ROKU (ROKU) near short term time cycle, on watch for a daytrade and possibly swing long in to timing $ROKU #daytrading #tradealerts

https://twitter.com/SwingAlerts_CT/status/1044978728110100481

Day Trading Alert Feed.

Below are the screen shots for the actual trade entry, trimming the trade, where the stop on my trade was set and the price target for the trade on the day.

Day Trading Chat Room

And below is the screen shot of the trade alert in the daytrading chat room on Discord.

If you have any questions about the trade alert detailed in this article reach out! You can get me on email info@compoundtrading.com or private message me on any of my social media accounts.

Trade safe and cut losers fast!

Curt

Subscribe:

Need help learning to trade set-ups like the one included in this post? Visit our trade coaching page.

If you are serious about learning in depth technical analysis and algorithmic charting and how to trade with that knowledge for a much higher win rate we have a master class video series that is approximately 20 hours of in depth teaching by our lead trader that retails for 1499.00. The master class trade coaching series is only available at this point by request by emailing our office at info@compoundtrading.com. The unedited raw master class videos are now available and the most recent trade coaching event videos are included as an added bonus (usually another twenty hours or so of teaching).

Interested in our live trading room, swing trading newsletters or trade alerts? Visit our menu of trading services.

Subscribe to Live Trading Room.

Subscribe to Live Day Trading Alerts.

Subscribe to Swing Trading Alerts.

Article Topics: daytrading, learn to trade, momentum, stocks, technical analysis, ROKU, trade alerts, catalyst