Swing Trading Updates Nov 27 $IBB, $AAPL, $WMT, $AMD, $JKS, $FEYE, $LACDF, $CTSH, $NVO, $SNAP, $TSLA ….

Good Morning and Welcome to the Compound Trading Swing Trade updates Monday November 27, 2017. $IBB, $AAPL, $WMT, $AMD, $JKS, $FEYE, $LACDF, $CTSH, $NVO, $SNAP, $TSLA, $AMMJ and more …

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

As of November 27 the swing trading reports will include buy sell triggers for listed equities that setting up for a trade. Please see specific equities below that fit that category for more information.

Below is Part A of this post. Part B (the remaining equities listed not completed will be done Monday evening and sent to members).

This report is 1 of 5 in rotation.

We will categorize our coverage soon as we are following more stocks weekly than we expected when we first started the service.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) or email me ([email protected]) with specific questions regarding trades you are considering for assistance.

It is critical however that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Swing Trade Set Ups Nov 17; Oil, $WTI, $JJC, Copper, Bitcoin, $BTC, $OSTK, $AMBA, $HMNY, $AAOI…

Swing Trade Set Ups Nov 15 $XIV, $SPY, $OSTK, $HMNY, GOLD, OIL, $SQ, $SORL, $WPRT….

BEST Trade Set-ups in a while! Nov 10 (starts 4:42): OIL, GOLD, $VIX, $VRX, $ROKU, $AAOI, $HTZ …

Wed Nov 8 Trade Set-Ups Review: $SPI, $BTC, $VRX, $AAOI, $KBSF, $LEU, $ONCS, $DEPO, $SNAP…

Nov 7 Trade Set-Ups Review: $DVN, $GOOGL, $TSLA, $HMNY, $VRX, $AAOI, $MYO, $TOPS, $BTC…

Nov 6 Trade Set-Ups Review: GOLD, $GLD, $HMNY, $RCL, $BTC, $WTI, $USOIL, $FB, $TOPS, $SPPI, $BAS…

Nov 2 Trade Set-Ups Review: $TSLA, $USOIL, $GPRO, $DRNA, $GSIT, $W …

Nov 1 Trade Set-Ups Review: $MDXG, $OSTK, OIL, $WTI, $AMBA, $TRIL, $AAOI, $UAA, $LBIX, $DWT…

Oct 31 SwingTrade Set-Ups Review: $UAA, $TAN, $SPPI, $SHOP, $SNGX, $AKS, $HMNU, OIL, $BTC, $VRX…

Profit and Loss Statements:

Q3 to be released soon.

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month).

https://twitter.com/CompoundTrading/status/896897288798392320

July 2017 Trading Challenge P/L Report $NFLX, $XIV, $AAOI, $AKCA, $BWA, $SRG, $MCRB, $UGLD, $IPXL, $HIIQ and more

https://twitter.com/CompoundTrading/status/895889454212108289

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Swing Trading Stock Watch list

$AAPL – Apple

Nov 27 – Trading 174.97 with MACD turned down and SQZMOM trending down on daily. Will wait for MACD turn to consider a long.

Nov 3 – $AAPL Premarket up 3% Trading 173.16 ER beat, analyst praise and good fwd guidance. Should go a long way in the market bull continuation. As with all trending stocks wait for price to return to ma’s and get a bounce before entering long. Watching for that.

Sept 14 – Trading 159.58 post event. MACD and SQZMOM trend down – Waiting on MACD turn.

Aug 14 – Trading 157.48 post earnings. MACD trending up but Stoch RSI turned down, vol not best and SQZMOM starting to trend down. Watching for it to bounce off an MA on pull back and will assess.

July 26 – Trading 152.74. Earnings 6 days. Watching.

July 21 – Trading 153.37 earnings in 11 days and it did get its pop. All indicators are on a buy. May take a trade. Alert set for when 20 MA breached 50 MA (sidewinder set-up possible).

July 12 – Trading 145.53. MACD just crossed up. Will watch close now.

$AAPL signalling a possible buy here. Posted live charting with indicators in free chat room https://discordapp.com/invite/2HRTk6n #swingtrading

June 29 – Trading 145.57. Same.

June 23 – $AAPL Trading $145.62 Waiting on MACD on daily to turn up for possible long. Holding 100 ma.

$AMD Advanced Micro

Nov 27 – Below are the buy sell triggers and indicator set up needed for long entry.

$AMD Swing trade buy sell triggers – be sure MACD is turned up with SQZMOM Stoch RSI trending up at entry.

Nov 3 – Trading 11.04 with all indicators pointing down after wash out. This may be a bottom and I’m watching for MACD to turn up for a long.

Sept 14 – Trading 12.23 with all indicators flat – indecisive.

Aug 14 – Trading 12.23 sitting on 200 MA with MACD Stoch RSI and SQZMOM trending down. Watching for a bounce.

July 26 – Trading 15.64 AH on ER and is in new break-out territory. Will watch.

July 21 – Trading 13.78. Earnings in 4 days. Indicators indecisive (MACD flat for example) Watching.

July 12 – Trading 13.89. MACD crossing up. Watching close here now.

June 29 – Trading 13.23. Same.

June 23 – $AMD Trading 14.28. Primary indicator I am watching for long is MACD on weekly to cross up.

$WMT – Wallmart

Nov 27 – Trading 96.62 post earnings price is considerably above MA’s. Waiting for price to test MA’s and bounce to check indicators for a possible long.

Nov 3 – Trading at highs 88.80 with ER in 13 days. Trending stock that needs to return for a test of MA’s and bounce with MACD turned up before I will enter long.

Sept 14 – Trading 79.85 with flat indicators. Watching.

Aug 14 – Closed 78.76 from 74.81. Closed to early as its trading 80.40 right now but ER is in 3 days so watching ER for assessment.

https://twitter.com/SwingAlerts_CT/status/890255875490926592

July 26 – Trading 78.52 with all indicators a go – holding.

July 21 – $WMT Wallmart Bought the dip at 74.81 trading 76.02 earnings 25 days and SQZMOM just turned green. MACD trend up. #swingtrading

$WMT Wallmart Bought the dip at 74.81 trading 76.02 earnings 25 days and SQZMOM just turned green. MACD trend up. #swingtrading pic.twitter.com/AFVUEK873v

— Melonopoly (@curtmelonopoly) July 21, 2017

June 26 – Trading 73.47. Holding still. It could visit the 200 MA for a bit lower but I’m confident. If / when it gets upside I will add.

$WMT Long 74.81 trading 76.50 about to test 50 MA to upside. #swingtrading #rulesdbasedprocess

$WMT Long 74.81 trading 76.50 about to test 50 MA to upside. #swingtrading #rulesdbasedprocess pic.twitter.com/W2HVb0FcYD

— Melonopoly (@curtmelonopoly) June 29, 2017

June 23 – Trading 75.60. Long from 74.81 for possible gap fill swing trade (was in daytrade room as an entry and moving it to swing side). Held its 200 MA on weekly and if MACD crosses up I will likely add significantly to the trade long. Stop now at entry and if I have to close and re-enter I will.

$SRNE – Sorrento Therapeutics

Aug 14 – Discontinued coverage.

$LTBR – Lightbridge Corp.

Nov 27 – Trading 1.03 with indecisive indicators. Will watch.

Nov 4 – $LTBR Premarket trading 1.13 – not normally a bottom player but this may be one soon. Waiting on 200 MA refain and indicators to confirm.

Sept 14 – Trading 1.13 with moderately upward indicators. Watching.

Aug 14 – Trading 1.05 same.

July 26 – Trading 1.15 same.

July 21 – Trading 1.20. Watching.Very small position so I will hold through the downdraft.

July 12 – Trading 1.68. Watching. Holding. Still above 200 MA and in the bowl. Waiting for indicators to improve and will add considerably at that point.

June 29 – Trading 1.68. Watching. Holding.

June 23 – Trading 1.73 Price bounced off 200 ma so I am holding but MACD is trending down so we’ll see.100 ma about to breach 200 ma. If it does I may add long to 2.26 position.

June 12 – Trading 1,86 entering bowl phase (lost 20 MA has 200 MA trade as it should be). Holding 2.26 long will add as it proceeds through bowl. Likely bounce when 100 MA breaches 200 MA or when price hits 50 MA.

June 5 – $LTBR Daily 50 MA about to breach 200 MA with MACD SQZMOM and Stoch RSI up. Long 2.26 premarket.

https://twitter.com/SwingAlerts_CT/status/871663903012409344

$LTBR 100 MA resistance on weekly at 2.70. SQZMOM MACD Stoch RSI all up.

$RCL – Royal Caribbean

Nov 27 – $RCL Royal Caribbean Buy Sell Triggers on chart – Waiting for buy trigger and MACD SQZMOM and Stoch RSI to confirm.

Preferably enter long at white arrow *grey horizontal line) vs grey arrow. Price recently ran up to a sell trigger so now it is a matter waiting for price to test support at a buy trigger (or breaches a buy trigger for break out) for a long as long as MACD is turned up and the SQZMOM is trending up.

Nov 4 – $RCL trading 123.71 Trending stock when MACD turns up it is a possible long. Testing 50 MA under 20 MA. Watch for over 20 MA with MACD up.

Sept 14 – Trading 122.19 with moderately upward trending indicators. Watching.

Aug 14 – Trading 117.22 on pull back to 20 MA so I am watching that, but all indicators are trending down. Watching for a bounce and assess.

July 26 – Trading 114.92 ER 6 days watching.

July 21 – Trading 115.26. MACD turned up. Earnings 11 days. Trading near 52 week highs. On very close watch now for break out.

July 12 – Trading 109.26. Same. Waiting on that MACD to cross up so I can assess.

June 26 – Trading 110.31. Same.

June 23 – Trading 112.15. Looking for MACD to cross up for long.

June 12 – Trading 112.07. MACD on its way down will look at long when MACD crosses up.

June 5 – Trading 113.38 and up significantly since last report with 50 MA breach of 100 MA on weekly. On Daily all indicators are a go also. Main reason we are not entering here is extension. Too risky and extended for now.

May 30 – Royal Caribbean Weekly 50 MA about to breach 100 MA and 52 week high near. Break out trade possible very soon.

$JKS – Jinko Solar

Nov 27 – Trading 24.49 has lost 20 50 100 ma and on its way to test 200 ma for possible bounce. Will watch as it approaches 200 MA.

Nov 4 – Trading 27.10 above ma’s and relative strength. At this point it is a probable long when it returns to ma’s and bounces. On watch.

Sept 14 – $JKS Solar threatening break out trading at 28.99. On high alert now. #swingtrading

Aug 14 – trading 27.49 on pull back to 20 MA (watching), but all indicators are trending down. Watching for a bounce and assess. ER in 10 days.

July 26 – Trading 25.76 down 8% on the day. Watching for return to ma’s per below.

July 21 – Trading 27.15. MACD did turn up and price got a pop out of the bowl and now watching for a return to an MA (likely 20) and possible pop. I didn’t take the trade because I had many other trades but members have reported excellent trades between last report and now. 20 MA is about to breach 100 MA on the weekly.

July 11 – Trading 20.90. Still above 200 MA and in the bowl for continuation set-up. Waiting on MACD to cross up for possible long.

June 26 – Trading 20.63. Same watching.

June 23 – Trading 20.26. $JKS Solar. Resistance on deck with 200 MA on weekly overhead. However, 20 MA breaches 100 with price above pow. #swingtrading

June 12 – Trading 17.78. MACD down and waiting on it to cross up for long in continuation bowl over 200 MA.

June 5 – Closing trade flat – earnings on deck. Should have closed last week when it hit 22.00 range for a decent swing.

May 30 – $JKS Long hold 18.65 hit 23.14 last Thurs and I almost closed and likely should have (I know some of you did notify me of closing positions) and currently trading 19.03. Earnings in six days stop set at entry.

May 22 – $JKS MACD turned up on daily, unusual volume, SQZMOM turned green and earnings on deck. Short term swing between now and earnings. 500 Long 18.65 in premarket. Small starter.

$PCRX – PacIra Pharma

Nov 27 – $PCRX with primary buy sell triggers and fibs with Stoch RSI at top and MACD SQZMOM trend up.

This one is post earnings and bullish above its 200 ma. Any of the Fibs work well as buy sell triggers but the most effective are marked with arrows. The indicators are good with the exception of Stoch RSI higng. and ideal would be low and curling up. On watch for a break of 50.87 or retest of 200 MA and possible lob

Nov 3 – Trading 33.05 and it just may be a double bottom here. Watching for that for possible long and also an upside breach of 200 ma as alternative set up.

Sept 14 – Trading 37.75 under 200 MA. Watching for 200 MA test.

Aug 14 – Trading 36.40 post earnings with all indicators turned down but may be bottoming very soon. Watching the MACD at this point for a turn up.

July 26 – Trading 42.56 down 12% on the day and testing 200 MA. Watching.

July 21 – Trading 49.15. Earnings in 23 days testing 20 MA above 200 MA MACD and Stoch RSI trending down. Watching.

July 12 – Trading 49.70. Above 200 MA in the bowl Stoch RSI on daily turned down. Set alarm for Stoch RSI turn for assessing possible long.

June 26 – Trading 47.20. Same.

June 23 – $PCRX Indicators on daily good but on weekly mixed with price against 100 MA. Watching close for MACD cross up on weekly.

June 12 – $PCRX 43.75 Has 200 MA is moving through bowl process. MACD on daily about to curl up ans Stoch RSI on weekly about to cross up. If they do I will assess ma’s and likely long.

June 5 – Getting a small pop in premarket because they are presenting at a conference but indicators are still poor. Waiting.

May 30 – Trading 45.15. All indicators trending down. Watching.

May 22 – Trading 48.30 Chart indicators are indecisive. Will watch.

May 15 – $PCRX SQZMOM up MACD trending up, if price above 52.00 with indicators on side likely long with tight stop.

$PBR – PetroLeo

Aug 14 – Discontinued coverage.

$EWZ – I Shares Brazil ETF

Nov 3 – Trading 39.90 Currently test a pull back at 100 MA with 200 MA under and could test it. Watching for a bounce at 100 ma or 200 ma and a turn up of MACD for a long.

Sept 14 – Trading 42.40 with pull-back on deck imo. Watched the rise and didn’t execute. Watching for the MA tests now.

Aug 14 – Trading 38.00 with all indicators trending down. Watching.

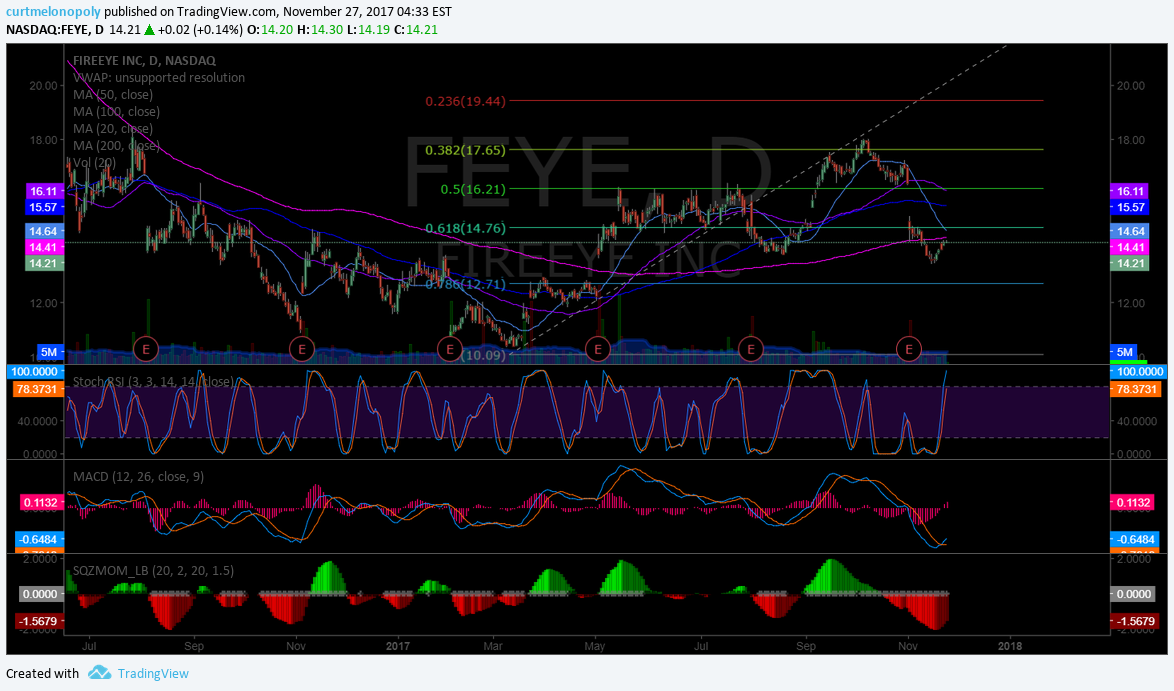

$FEYE – Fire Eye Inc.

$FEYE watching for over 14.76 over 200 MA with MACD turn up for gap fill and beyond long. The upper extension sell trigger isn’t shown but is at 22.32.

Nov 3 – $FEYE Testing 200 MA post earnings. Could be an excellent set-up long. #swingtrading

Sept 14 – Trading 16.90 – got a serious pop post earnings. Watching for a break of previous highs now for a possible long. On high lalert.

Aug 14 – Trading 14.01 with all indicators trending down, price under 20 50 and 100 but above 200 MA. Watching for a bounce.

July 26 – $FEYE closed 15.76 fr 14.40 entry up $650.00 on 500. ER in 7 days and scraping a break-out level. #swingtrading

$FEYE closed 15.76 fr 14.40 entry up $650.00 on 500. ER in 7 days and scraping a break-out level. #swingtrading pic.twitter.com/UtiUvv3ObF

— Melonopoly (@curtmelonopoly) July 25, 2017

July 21 – Trading 15.84 holding from 14.40. Indicators are flatish. Watching.

July 12 – Trading 15.36 long 14.40. Watching close for adds.

June 29 – $FEYE Trading 15.90, long 14.40 with 100 MA near breach of 200 MA and MACD cross on deck. #swingtrading

Will likely add if price confirms over previous high and 100 ma breaches 200 ma.

June 23 – Trading 15.59. Holding from 14.40. Likely adding in premarket today.

https://twitter.com/SwingAlerts_CT/status/878151849177755649

June 12 – Trading 14.99. Daily not looking great with MACD down but Stoch RSI about to curl up. But on weekly it has MACD trend up, Stoch RSI trend up and SQZMOM up. Jury is out. Holding 14.40 entry.

June 5 – Trading 14.70. Holding MACD on weekly still up and daily not but it’s 50/50 here and I have a stop at entry.

May 30 – Trading 14.80. Holding 14.40 entry. Stop set at entry now. Did hit 16.26 and should have closed there – or when MACD turned down. Here again a few members notified they closed so congrats on that swing! It does have 50 MA crossing / breaching 200 MA currently on daily so that is actually bullish. So it is indecisive.

May 22 – Trading 14.95. Holding from 14.40. Weekly SQZMOM green and trending up, MACD trending up, 100 MA resistance at 19.58 intra. Daily not as good – MACD possibly turning down, SQZMOM green but turning down but on positive side 50 MA may breach 200 MA to upside. Holding for now.

May 15 – Trading 14.97. May 11 Long 14.40 when 20 MA breached 50 MA (per set-up May 8 below). Stop 13.99. 500 shares. Stoch RSI is on its way down and we’re watching closely. Did not get the pop we wanted – a tad concerned. Caution warranted.

May 8 – $FEYE In break-out. Waiting for 20 MA to breach 200 MA to upside for long with price above and time indicators right – MACD, Stoch RSI, SQZMOM and volume.

Live $FEYE charting https://www.tradingview.com/chart/FEYE/PZMX2RzI-FEYE-In-break-out-Waiting-for-20-MA-to-breach-200-MA-to-upside/

$LACDF – Lithium Amers Corp OTC

Nov 27 – Closing position premarket average 1.56 as MACD is turned down. Will await MACD to set back up and publish buy sell triggers at that time.

Nov 3 – Trading 1.6099 and MACD has turned down. Good run but likely time to close and wait for MACD to turn back up for another run later.

Sept 14 – Trading 1.27 and overbought. Watching the Stoch RSI on daily for a turn back up for possible long.

Aug 14 – Trading .88 with all indicators trending up. Watching for break of .954 for break out play.

July 26 – Trading .8091 Watching

July 11 – Trading .725 Watching.

June 26 – Trading .676 Watching.

June 23 – Trading .685 Watching

June 12 – Trading .7315 It still has 200 MA on daily and it seems to be in indecision so I am waiting on MACD on daily and weekly to give me signal to look closer.

June 5 – Trading .6799 and indicators are still poor to indecision.

May 30 – Trading .708 Chart is still full of indecision.

May 22 – Trading .73. Indecision.

May 15 – Trading .7273 20 MA did not breach and we did not trade. Waiting on set up to complete.

May 8 – Trading .74 $LACDF 20 MA is about to breach 50 MA and 100 MA to upside with price above. If so it is long set-up if indicators confirm. This one is brought to us as a whisper by Hedge Hog Trader.

$LACDF Live Chart https://www.tradingview.com/chart/LACDF/IECwvASr-LACDF-20-MA-is-about-to-breach-50-MA-and-100-MA-to-upside-with/

$IBB – BioTechnology Index Fund

Nov 3 – $IBB trading 312.06 near its 200 ma. Waiting for bounce and MACD to turn for long.

Sept 14 – Trading 334.03 and is threatening further break-out. Up against historical resistance that I am watching.

Aug 14 – Trading 306.41 with all indicators trending down and price under 20 and 50 MA”s with a possible bounce here off top of 100 MA. Trading above 200 MA. Watching.

$AGN – Allergan

Nov 3 – Trading 176.00 premarket under all MA’s on daily but MACD is crossing up. On watch here now.

Sept 14 – Trading 227.29 with indicators indecisive.

Aug 14 – Trading 232.38. with all indicators trending down and price under 20 50 100 MA”s with a possible bounce off top of 200 MA. Watching.

$CTSH – Cognizant Technology

Nov 3 – Trading 74.20 and just tested its 100 ma to downside and bounced. Watching for follow-through and MACD cross up.

Sept 14 – Trading 72.27 threatening yet another break-out. On high alert here.

Aug 14 – Trading 70.61 with all indicators trending down and likely test of MA’s on pull back here over 200 MA. Watching.

July 26 – Trading 70.01 all indicators bullish with ER in 8 days.

July 21 – Trading 69.96 MACD crossed and it got a pop. Waiting on earnings for this.

July 12 – Trading 67.70 MACD about to cross up – watching very close now.

June 29 – Trading 67.03 – same.

June 23 – Trading 67.12. Looking at long if 50 ma breaches 100 ma on weekly. Also watching the weekly Stoch RSI for a turn up.

June 12 – Trading 66.39. MACD trending down on daily. Waiting on it to cross up for signal to review other indicators for possible long.

June 5 – Trading 67.30. Closing position in 67.30 area from 61.78 entry. Out of both positions now (the other was on another report that was transferred over from a daytrade that became a swing trade).

https://twitter.com/SwingAlerts_CT/status/871647793672212480

May 30 – Trading 66.70 and stop set at 66.50 from 61.78 entry.

May 22 – $CTSH Swing Trade Going Well. Trading 65.42 from 61.78 entry. 20 MA may breach 100 MA on weekly and may add. MACD trending and SQZMOM trending on weekly also.

May 15 – $CTSH Swing trade is going well. Trading 64.39. Holding long from 61.78. Will watch MACD and other indicators to close or add.

Live Chart : https://www.tradingview.com/chart/CTSH/qwtL29oD-CTSH-Swing-trade-is-going-well-Trading-64-39-Holding-long-fro/

May 8 – Trading 63.22. Earnings price action went well and when that passed and 20 MA breached 50 MA (per trigger below) to upside with indicators confirming we went long 500 shares at 61.78.

May 1 – $CTSH SQMOM just went green, MACD turned up, Waiting on 20 MA to confirm thru 50 MA for long. #swingtrading Careful with earnings on deck.

$NVO – Novo – Nordisk

Nov 3 – Trading 49.48 Trending stock above all ma’s with MACD trending down. Waiting for the cross up on the MACD for re evaluation.

Sept 14 – Trading 48.60. Watching for an MA pullback on daily. Weekly is structurally perfect. On high watch.

Aug 14 – Trading 45.82 post earnings, all indicators up, over 200 MA in the bowl and about to gap fill. On close watch here for long.

Closed 42.52 near flat on wash out.

https://twitter.com/SwingAlerts_CT/status/869913818343784448

July 26 – Trading 41.82, under pressure in premarket with ER in 14 days.

July 21 – Trading 43.85. Holding from 42.44 entry. Watching.

July 12 – Trading 42.10. Watching. Hold. In play with set-up sound.

June 26 – Trading 43.27. Holding long 42.44. Same as below.

June 23 – Trading 43.67. Holding long from 42.44. 200 MA overhead on weekly but MACD trending up still and 20 about to breach 50 ma with price above. Interesting scenario.

June 12 – Trading 42.59. 200 MA play still in order. 100 MA about to breach 200 MA on daily. We may get some downside but it is in play.

June 5 – Trading 43.99 Went long May 31 42.44 500 shares when 50 MA breached 200 MA. MACD trending up on daily.

https://twitter.com/SwingAlerts_CT/status/869913818343784448

May 30 – Trading 41.68. Interesting chart. MACD might turn up and 50 MA may breach soon – it may break out! On Watch!

May 22 – Trading 40 .85. Price action didn’t respond to 20 MA breach of 200 MA on daily (not good), however, on weekly MACD and SQZMOM trending up so will watch closely.

May 15 – $NVO Trading 40.60. 20 MA about to breach 200 MA. With price above and good price action will go long. Stoch RSI near bottom so hopefully on a curl up all indicators are right for long.

May 8 – Trading 40.87. Still waiting for 20 MA to breach 200 MA with price above for entry.

May 1 – $NVO Waiting for price above 200 MA and 20 MA to breach 200 MA to upside for long. #swingtrade

$TSLA – Tesla

Nov 3 – Trading 300.00. Under all it’s ma’s and MACD trending down. Waithing for a MACD cross up and likely a long at that point.

Sept 14 – Trading 365.66. Threatening recent high and then on to highs if it gets it. On watch.

Aug 14 – Trading 357.87 post earnings MACD and SQZMOM trending up with Stoch RSI overbought. 20 MA about to cross up and breach 50 MA with price above. On high watch here.

July 26 – Trading 339.44. MACD just turned up on high watch now. ER in 7 days.

July 12 – Trading 327.22. Waiting on MACD to assess.

June 26 – Trading 372.20. Pull back to 20 MA in progress. Waiting on MACD to turn back up on daily.

June 23 – Trading 382.61. Hasn’t stopped. Missed it for now.

June 5 – Trading 339.65 in premarket. In full break out with all indicators on daily turned up. Did not get our pullback.

May 30 – Trading 325.50 in premarket. Chart turning bullish. MACD about to turn up, Stoch RSI turned up, near 52 week high break out!

May 22 – Trading 310.57. MACD is still trending down on daily so we are confident we are getting our pullback and then we’ll consider a long at that point (that MACD curls up).

May 15 – Trading 317.58. Still looking for a better pull-back entry.

May 8 – Trading 311.75. MACD is trending down (cooling), Stoch RSI isn’t yet, and SQZMOM is trending down. Waiting for the indicators to bottom and turn up for long if MA’s confirm.

We decided to start covering Tesla because we feel it is out of the woods so to speak. There are many factors, but the bottom line is we are ready to trade this long term. It is revved right now, but it won’t be for long and we expect an entry sooner than later based on the simple charting below.

May 1 – Waiting. It is too heated. Stoch RSI at bottom turned up, MACD at top indecision however, SQZMOM green but trending down.

April 21 – Trading 302.80. Stoch RSI is at bottom likely to curl up, MACD at top crossed down, squeeze momentum indicator green but turning down, holding 8 ema. Waiting for indicators to line up.

April 13, 2017 – $TSLA Daily – Waiting on Stoch RSI to bottom, MACD down and turn up with MA’s on right side for a long position.

Live Tesla Chart https://www.tradingview.com/chart/TSLA/YlcqJMzy-TSLA-Daily-Waiting-on-Stoch-RSI-to-bottom-MACD-down-and-turn/

$SNAP – SNAP (60 Min Chart vs. Daily because it is a new issue)

Nov 3 – Trading 14.75 trending with earnings in 6 days. We hold a very small position still after a nice trade. Watching earnings.

Sept 14 – Trading 15.12. In a swing and expecting 15% + upside move soon.

Aug 14 – Trading 11.83 post earnings with all indicators trending down. Watch.

July 26 – Trading 13.92. All indicators trending down.

July 12 – Trading 15.47. Same.

June 29 – Trading 17.85. Same.

June 23 – Trading 17.64 watching.

June 5 – Trading 20.84. Indecisive. Watching.

May 30 – Trading 21.21. All indicators turned up but watching.

May 22 – Trading 20.16. Daily under all MA’s. Watching.

May 15 – Trading 19.18. Stopped at entry per below. Watching.

May 8 – Trading 23.02. Trading 23.02. Holding at 22.20. Stop at entry. Watching indicators close for exit if needed.

May 1 – Trading 22.52. When Stoch RSI per below bottomed we entered April 28 22.20 Long 500 Shares. Will add when Stoch RSI returns to bottom unless price trends toward entry for possible stop. 60 Minute chart.

$SNAP Live Chart https://www.tradingview.com/chart/SNAP/KhbQSyJg-May-1-Trading-22-52-When-Stoch-RSI-per-below-bottomed-we-ente/

April 21 – $SNAP responding to cross-overs on hourly 20 50 100 & 20 thru 200 MA? Stoch RSI revved need at bottom preferrably to trigger long. #trading

MOST IMPORTANT PART IS THE 200 MA swooping down. That’s bulliish!

Live chart $SNAP : https://www.tradingview.com/x/MLMZNGXi/

$SNAP responding to cross-overs on hourly 20 50 100 & 20 thru 200 MA? Stoch RSI revved need at bottom preferrably to trigger long. #trading pic.twitter.com/3K9Yzfp3r5

— Melonopoly (@curtmelonopoly) April 21, 2017

April 13, 2017 – We decided to add $SNAP to our coverage because some of our clients have asked us to cover it, plain and simple. So the challenge is that it does not have the history we like, so we have charted it on hourly for now. This is considered a high risk trade.

Live $SNAP chart – https://www.tradingview.com/chart/SNAP/lLVhJfMz-SNAP-Hourly-Waiting-on-20-MA-to-cross-up-through-50-MA-and-pr/

$SNAP Hourly – Waiting on 20 MA to cross up through 50 MA and price to be above for a long entry.

$VGZ – Vista Gold

NA

Sept 14 – Trading .78 with indicators trending down.

Aug 14 – Trading .79 with indicators post earnings slightly looking positive and price under all MA’s. Watching.

$AAU Almaden Minerals

NA

Sept 14 – Traing 1.20 Same.

July 21 – Trading 121. Same.

June 26 – Trading 1.32. Same.

June 23 – Trading 1.37. Watching.

June 5 – Trading 1.38. Holding 200 MA. Indecisive to bullish. Watching.

May 30 – Trading 1.45. MACD just turned up. Watching.

May 22 – Trading 1.29 Watching.

May 15 – Trading 1.42. Price under 20 MA on daily. Waiting and watching.

May 8 – Similar to $VGZ above – indicators trending down and indicators are a mess. Watching.

May 1 – Trading 1.47. Stoch RSI Bottom, MACD turned down, SQZMOM red trending down. Waiting on indicators to turn up and price to be above 20 ma at minimum.Price below 20 ma currently.

April 21 – Learning traders. Master this trade set-up. Change your life. #freedomtraders

Reviewing these trading set-ups in room all week at lunch. Here’s some raw footage. #trading #setups #freedomtraders https://www.youtube.com/watch?v=2_0PfnNiU-A&t=2704s

Reviewing these trading set-ups in room all week at lunch. Here's some raw footage. #trading #setups #freedomtraders https://t.co/6SqOEquC5J

— Melonopoly (@curtmelonopoly) April 21, 2017

#AAU Example of when 20 MA gets upside of 200 MA with price above. KAPOW! Waiting for Stoch RSI to return to bottom and curl up.

$AMMJ – American Cannabis

Nov 3 – Trading .54 with all indicators down waiting on MACD to turn up for long watch (add to very small position held)

Sept 14 – Trading .753 and looking to add on a bounce from its recent run up.

Aug 14 – Trading .6675 holding small position from .7592 2000 shares. Watching the 200 MA test area. https://twitter.com/SwingAlerts_CT/status/894981951727316994

July 21 – Trading .6298. Testing underside of 200 MA watching.

July 12 – Same

June 26 – .Trading 049 watching. Recaptured the 20 MA and price now testing 50 MA and 200 MA above.

June 23 – Trading .045 watching.

June 5 – Trading .500. Under 200 MA and all other ma’s on daily. Watching.

May 30 – Trading .5149 as per below.

May 22 – Trading .50. Watching.

May 15 – Trading .51 watching. Price under all MA’s.

May 8 – Trading .60. All indicators trending down. Watching.

May 1 – Lost its 200 MA. Waiting for MA’s to sort out and indicators to get right.

April 21 – Watching.

$AMMJ Has its 200 MA, waiting for Stoch RSI to hit bottom and turn up, MACD to turn up, and price over 20 MA and 50 MA with 20 MA up through 50 MA for long.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $AAPL, $WMT, $IBB, $AAPL, $RCL, $JKS, $FEYE, $LACDF, $CTSH, $NVO, $SNAP, $TSLA, $AMMJ