PreMarket Trading Plan Thur June 22 $TROV, $ORCL, $GLD, $AAL, $UWT, $WTIC

Compound Trading Chat Room Stock Trading Plan and Watch list for Thursday June 22, 2017; $TROV, $ORCL, $GLD, $AAL, $UWT, $WTIC – #CL, $SRNE, $WMT, $UUP, $SSH, $LGCY, $TRCH, $ESEA, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Service Update: My travel, oil trading room, winning, new member experience and more.

https://twitter.com/CompoundTrading/status/877831631897153536

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to [email protected] and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it.

Post Market Reports:

Will start again this evening and all reporting in full swing by weekend.

Most recent lead trader blog posts:

Oil Trading Room – How to Use EPIC the Oil Algorithm Model Chart June 21 #Oil #OOTT $USOIL $WTI $CL_F $USO $UCO $UWT $DWT

https://twitter.com/EPICtheAlgo/status/877407110862172160

Trading Set-ups. Video Explains Predictable Winning Process. Part 6 b) “Freedom Traders” Series.

Trading Set-ups. Video Explains Predictable Winning Process. Part 6 b) “Freedom Traders” Series. https://t.co/7XFIQ68CoY

— Melonopoly (@curtmelonopoly) May 29, 2017

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports will be out soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Trading Plan (Buy, Hold, Sell) and Watch Lists:

Morning momentum stocks on watch so far: $TROV

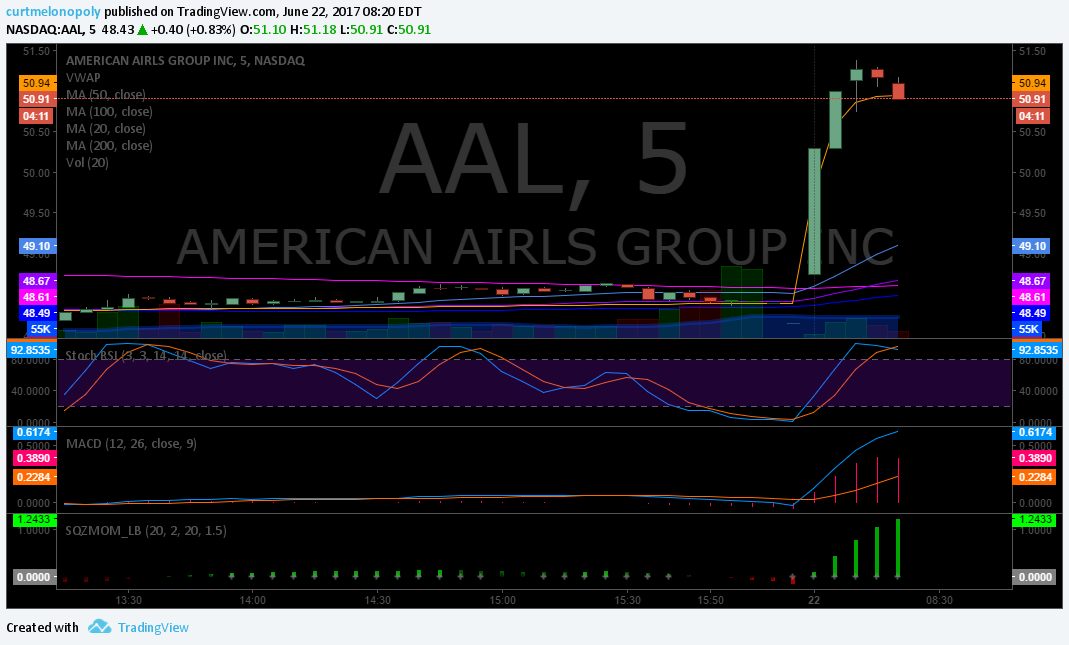

Bias toward / on watch: Airlines $AAL, $DAL, $UAL. $IBB recently broke out.

Markets: $SPY $ES_F $SPX I continue to be cautiously optimistic, $GLD, $GDX, $SLV may get up short term. $USOIL, $WTI traded long two adds overnight in oil room. $DXY no major news and $VIX has no significant news. I am long a small test size in US Dollar related $UUP.

OTC on watch:

Gapping Premarket: $UGAZ $UWT $ORCL $ESPR $SKLN $DAL $AAL $LUV $UAL $SPLS $LABU $JNUG $NUGT

Recent Momentum Stocks to Watch:

Stocks with News: $TROV, $AAL

Recent SEC Filings to Watch:

Earnings On Deck: $BBBY $SNX $SONC

Holds: CL, $WMT, $SRNE, $UUP test starter swing. All holds are small size (less than 5% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (not including my swing trading or algorithm charting trades).

Recent Chart Set-ups on Watch: $FSLR, $COTY, $HIIQ, $CELG, $VFC, $CMI, $ACHN, $ANTM, $BA, $AXP, $PSTG We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day.

$AAL premarket up 5.29% on news.

Market Outlook:

NA

Market News and Social Bits From Around the Internet:

8:30am

Initial Jobless Claims

9am

House Price Index

10am

Leading Indicators

10:30am

NatGas Inventory

11am

KC Fed Mfg Survey

American Airlines says Qatar Airways is interested in buying a 10% stake https://bloom.bg/2rUCZW1 $AAL $UAL $DAL

$RETA Reata Pharma Receives Orphan Drug Designation for Omaveloxolone

BREAKING: American Airlines shares jump 5% after it says Qatar Airways has expressed interest in taking ~10% stake http://www.cnbc.com/quotes/?symbol=AAL …

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List : $TROV 39%, $ORCL 11%, $HAIN $SPLS $MARA $DCTH $TK $AKG $USLV $PSDV $FTR $UWT $NUGT $JNUG $UGAZ $CHK $ERIC $WLL $AU I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : $XIV $SPY $SCS $DGAZ $DWT $JDST $DUST $ACN $WB $DRYS $JCAP $SINA $TMHC $NEOS $YY $MOMO $STM $JD $KMDA I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Recent Upgrades: $EAT $TXRH $ATU $WPX $KMX $VNTV $INFN $DAN $SPLK $ORCL $VLO $LUV $FFWM $MD as time allows I will update before market open or refer to chat room notices.

(6) Recent Downgrades: $TSM $EFII $CNK $DFT $ANF $SPKE $DAN as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $TROV, $ORCL, $GLD, $AAL, $UWT, $WTIC – $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD