Tag: Algorithm

Oil Algorithm Trading Report (EPIC) Sun Aug 12 FX: $USOIL $WTI $CL_F $USO #Oil #Trading #Algorithm

Crude Oil Trading Algorithm Chart Report (EPIC) Sunday Aug 12, 2018.

FX: $USOIL $WTI $USO $CL_F $UWT $DWT $UCO $SCO $ERX $ERY $GUSH $DRIP

Welcome to the oil trading algorithm report. My name is EPIC the Oil Algorithm and I am one of seven primary Algorithmic Chart Models in development at Compound Trading Group (there are near 300 in total in development at various stages for all markets).

NOTICES:

New members to our oil algorithm charting model are encouraged to on-board in a way that equips you as an oil trader for profit.

Visit my Twitter feed EPIC Oil Algorithm Twitter (@EPICtheAlgo) and review tweets over the last few months, visit our blog and review the recent oil algorithm blog posts, our You Tube channel “how my oil algorithm works”, “how to use my charting”, weekly EIA oil report videos and our website (it explains how the oil algorithm was developed). Reviewing those important points of reference will increase your probability of success considerably. This report includes links to some recent example “how-to” videos.

Oil Trade Coaching – Users of this algorithmic oil charting model may opt for private one-on-one coaching with our lead trader and / or an experienced trader that has worked under our lead trader. On our website standard one-on-one online coaching packages are made available (coaching via Skype) or you can request a customized package (reflecting the time you wish to invest in learning). To request a custom package suited to your needs email [email protected] or click here for standard private trade coaching packages. Other options for coaching include online webinars and private on location (in person) coaching sessions.

Oil Trading – How to Use the Oil Algorithm

Oil Trading – How to Trade Intra-day with my Algorithmic Charting

Oil Trading Alerts. Live Lead Trader Video Trading w EPIC Oil Algorithm

Recent articles from our blog about how to trade crude oil with our oil trading algorithm;

Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech).

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

MULTI-USERS: Institutional / commercial platform now available.

SOFTWARE: My algorithmic charting is planned to go to developer coding phase for our trader’s dashboard program. Please review my algorithm development process, about my oil algorithm story on our website www.compoundtrading.com and my oil algo charting posts on my Twitter feed and/or this blog.

HOW MY ALGORITHM WORKS: I am an oil algorithm model in development. My math is based on traditional indicators (up to fifty at any given time each weighted on win ratio merit – all not shown on chart at any given time) – such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and various other charting, geometric and mathematical factors. I do not yet have AI integration – only math as it relates to traditional indicators with the primary goal being probabilities. I am not a high frequency robot type algorithm – I am presented on (and used on) a traditional trading chart as one would normally use as a probability indicator. The goal is to provide our trader’s with an edge when triggering entries and exits on trades with instruments that rely on the price of crude oil.

Below you will find simplified levels represented on a traditional chart (both intra-day and as a swing trader or investor). This work (and associated trade) should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on. Questions to; [email protected], message our lead trader on Twitter, or message a lead trader in the private Discord oil trade room server.

Visit this link for more information about my oil algorithm development, this link explains how our algorithmic charting is done, this YouTube video explains in summary how my algorithm works https://www.youtube.com/watch?v=LUNyxFoXJp8 this link for more information about our algorithmic stock charting models and what makes them different than most.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE SIGNAL (ON EVERY VENUE) IS VIDEO RECORDED, ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/.

Oil Algorithm Observations:

Below is a link for the live chart version of EPIC the Oil Algorithm. The charting is a real-time trading chart represented on FX $USOIL $WTI published Aug 12, 2018.

Click on share button (bottom right beside flag) and when that screen opens click on “make it mine” to view real-time, make edits etc:

Oil Algorithm (EPIC). Current trade. Aug 12 909 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Aug 12, 2018

New: The new trade signals are the machine trading lower / tighter day-trading time frames (overlay charting versions we are beginning to share).

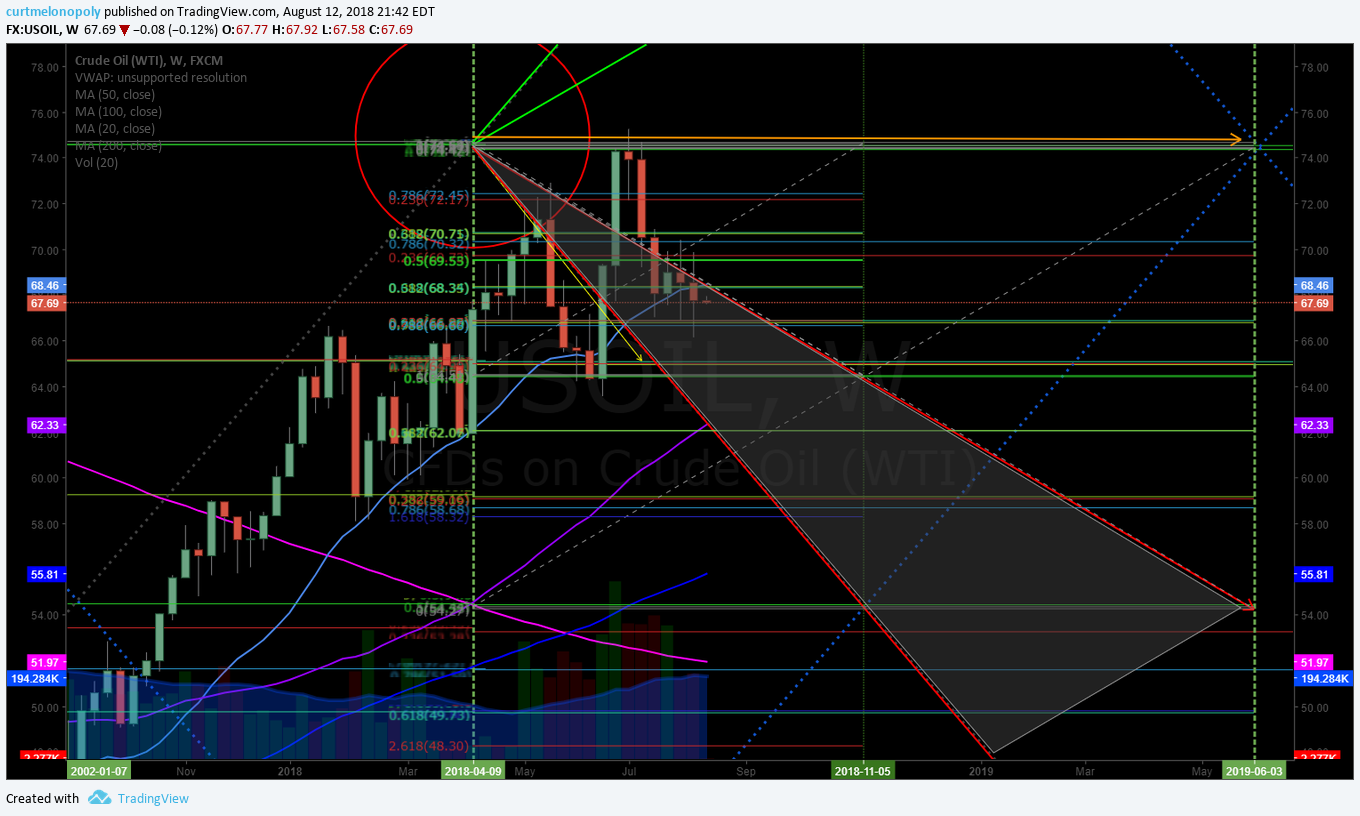

The first most predictable trade are the resistance and support cluster areas formed by long term chart trend lines (see charts that have trend-lines represented in red as made available below).

The second most predictable trade (wide trading range primary resistance and support that become predictable buy and sell triggers). Current algorithmic model wide trading range resistance (grey arrow – grey horizontal line) at approximately 68.92 in the current trading range. Current algorithmic model wide trading range support (grey arrow – grey horizontal line) at approximately 65.32 in the current trading range – these areas are general range support and resistance areas (our algorithm uses a .15 – .20 cent buffer on either side for these trades). Trading between the resistance / support horizontal grey lines is extremely profitable risk – reward if one is disciplined to the patience required and follows the trend of trade.

The lower trading range is 61.71 to 65.31. The upper trading range 68.93 to 72.54.

Trading Bias / Forward Guidance: As with previous report, range bound. Slightly bearish to range support at 65.32 for the week.

Current (as of Aug 12, 2018) MACD is down on the daily oil chart.

Third most predictable trade (support and resistance of uptrend or down trend channels). On the chart an upward trending trade channel is presented and a downward option (channel support and resistance / trading range is represented as diagonal dotted orange lines and purple arrows – as made available, assist in displaying directional trade decision areas).

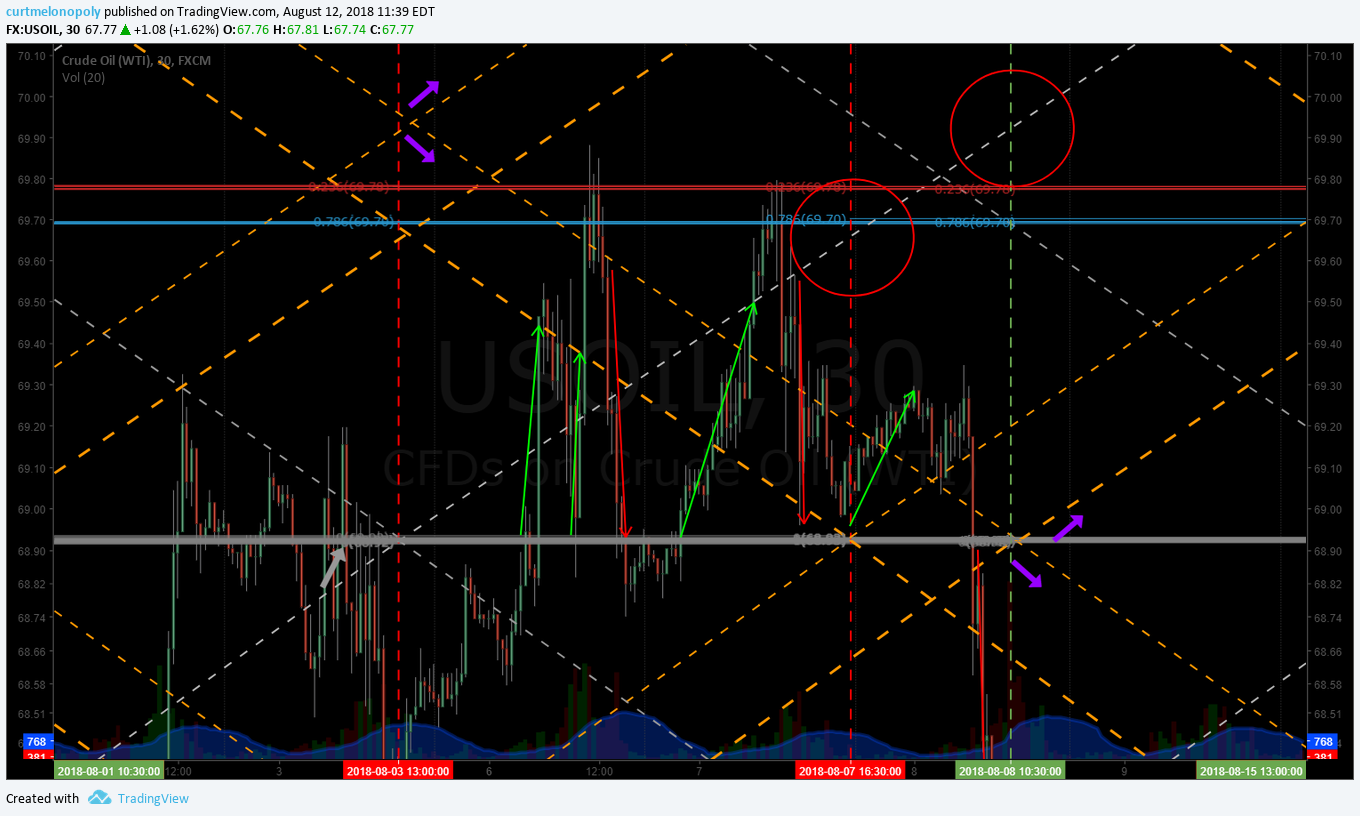

Fourth most predictable trade (support and resistance of 30 min quadrants). The diagonal lines make up quadrants (in this instance on a 30 min chart) and are represented as orange diagonal lines that make up geometric diamond shapes. These lines also assist in intra-day trade.

Fifth most predictable trade (support and resistance of most applicable Fibonacci) the Fib support and resistance lines are the horizontal lines in various colors with the exception of purple and yellow (see below). These horizontal lines become support and resistance for intra-day trade.

Sixth most predictable trade (support and resistance of historical support and resistance) Natural / historical support and resistance lines shown in purple or yellow – they represent historical support and resistance. The strongest of the historical support and resistance lines are shown in yellow horizontal and are typically accompanied by a yellow arrow marker.

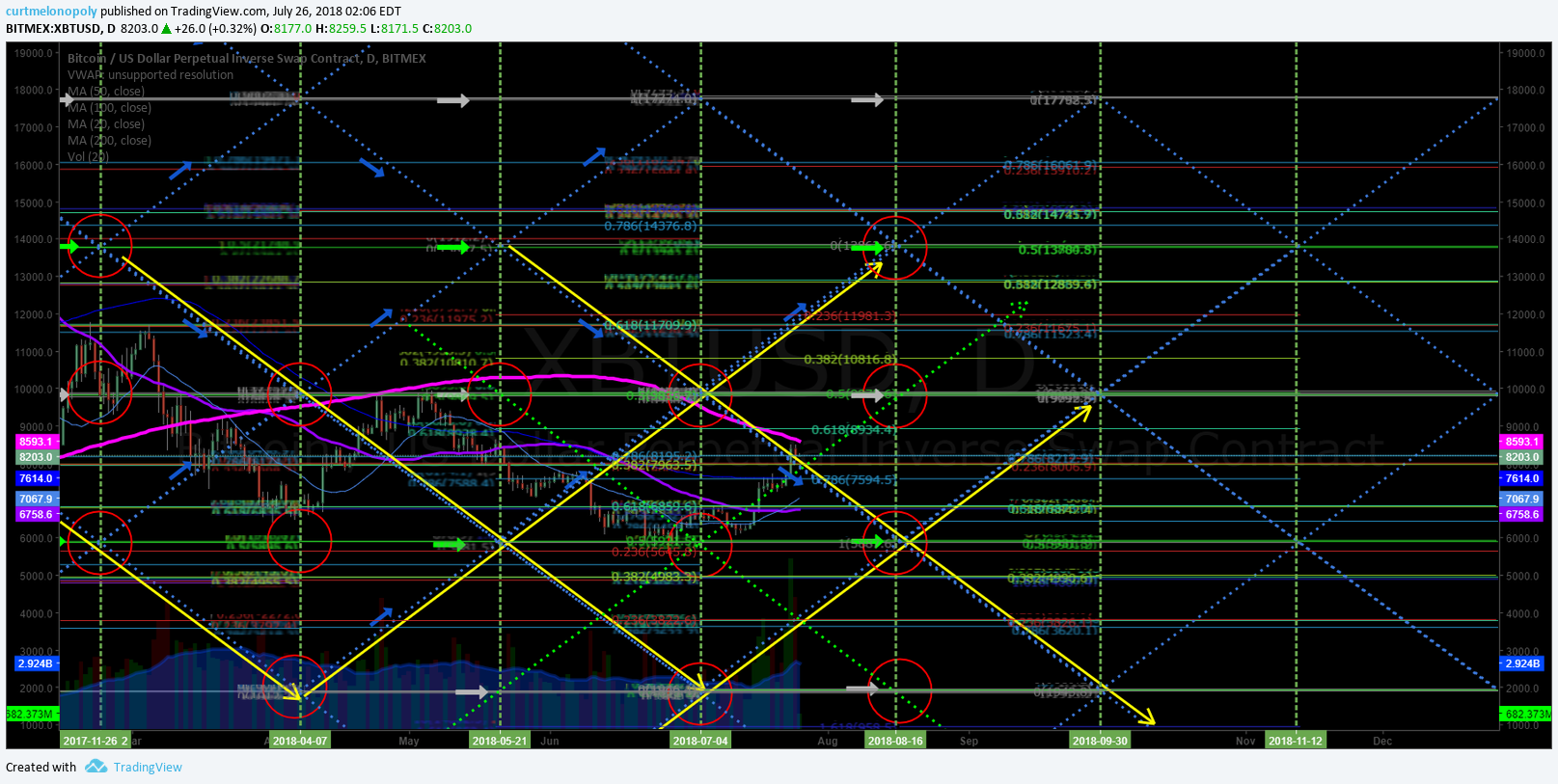

Seventh most predictable trade signal we use are the time and price targets (red circles). When trade is in a significant uptrend or downtrend the targets become very precise and move up the indicator priority list quick.

Tues, Wed and Fri targets are most predictable in extended multi week uptrends or downtrends. In recent time, trade could be described as range-bound in recent downtrend.

The Eighth most predictable trade is intra-day. You will notice on some of the charting geometric shapes in green on some of my charting (at times). They are charted live in the trading room and at times the lead trader will highlight these areas intra with white outlines (typically geometric shapes such as diamonds or triangles).

Intra-day Trading Bias

Intra day bias is short – based on wide range resistance at top of quad.

Wide Trading Range – Buy and Sell Triggers for Swing Trading Crude Oil:

Trade the ranges noted above between the thick grey lines (grey arrows) for the most predictable swing trades between 58.13 to 61.72, 61.72 to 65.32, 65.32 to 68.92, 68.93 to 72.54 and 72.54 to 76.15. This is a highly profitable risk-reward way to trade oil if you can be patient to trigger at only the break of the wide range charting areas and are disciplined to cut a losing trade that does not prove in your anticipated trend.

Or trade the range between the channel diagonal lines at support and resistance in up or down channel (orange dotted diagonals).

Oil Algorithm (EPIC). Up trend channel chart. Aug 12 920 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Oil Algorithm (EPIC). Down trend channel chart. Aug 12 922 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Oil Machine Trading Algorithm Charting Overlay.

Below is the first of many time-frames we will be sharing with our members that our algorithm software coding team is using to develop our intelligent assisted oil trader platform.

Please note: It is not advisable to trade these chart overlays until you have had some experience with them. How to trade the machine trading day trade chart videos will be forthcoming. The shorter time fram overlays on the chart below also cause the chart to be considerably more “noisy” so please use caution.

Oil Algorithm (EPIC). Machine trading daytrade time-frame. Aug 12 929 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #MachineTrading

Oil Swing Trade Charting.

Monthly Oil Chart:

Oil Monthly Chart. Price above 200 MA below pivot MACD trend up, Stoch RSI down. Aug 12 936 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Oil Monthly Chart. Price above 200 MA at pivot under 100 MA MACD trending up. Aug 7 523 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Weekly Oil Chart:

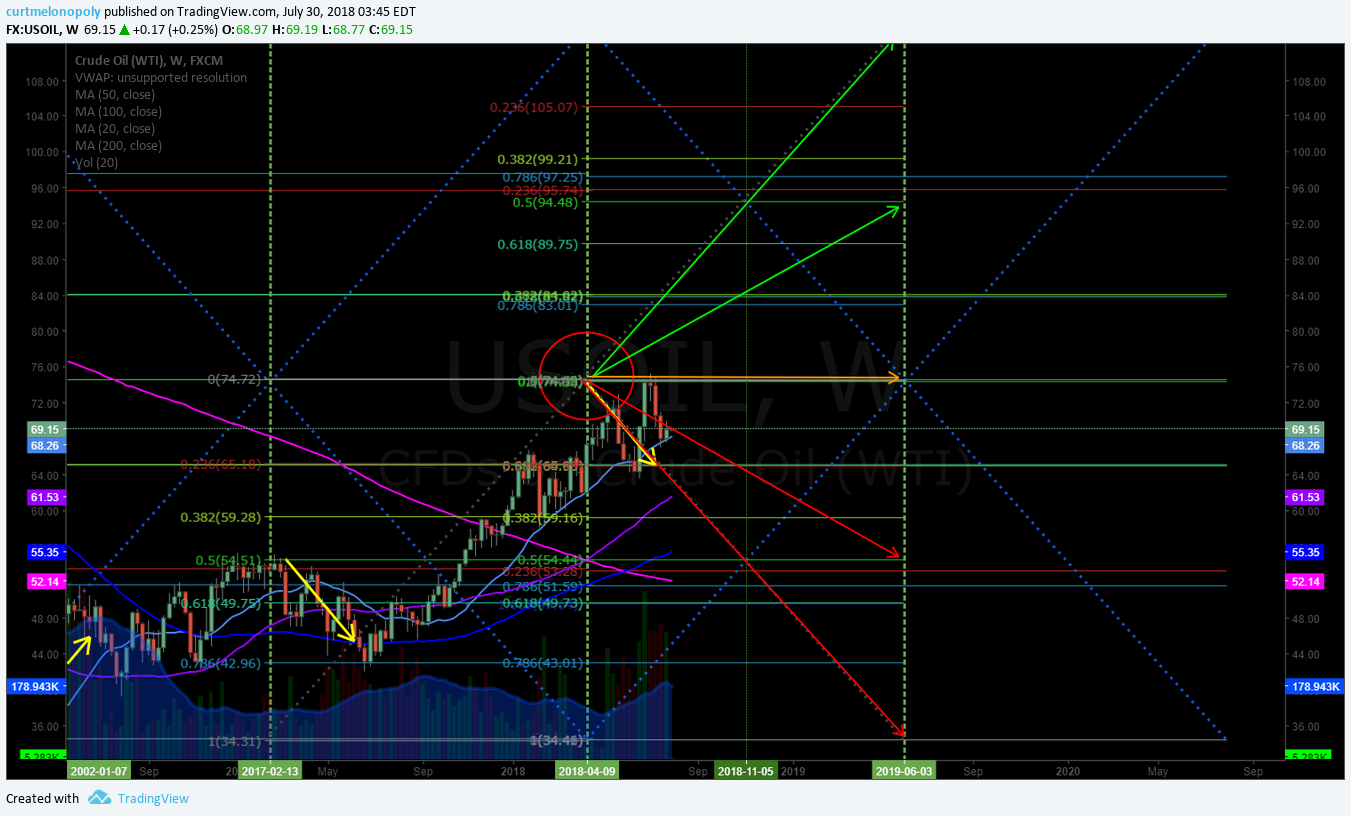

Oil Algorithm Simple Weekly Gen 1 Model. Highlighted trend structure seems bearish on this weekly chart. Aug 12 942 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Oil Algorithm Simple Weekly Gen 1 Model. Oil Continues bullish structure on weekly chart. Aug 7 536 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

May 21 – A feature post was published this week to review time cycles, retrace possibilities on the other side of time cycles on the weekly charts. Below is the post link:

Feature Post: 12 of Last 13 Oil Chart Time-Cycles Have Trend Reversal. $USOIL $WTI $CL_F $USO $UCO $UWT $DWT #OIL #OOTT

Daily Oil Chart:

Oil Daily Chart. MACD cross up failed, trade under 50 MA. Bearish trend continues. Aug 12 947 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Oil Monthly Chart. Oil has a bounce at 50 MA with MACD pinch possible cross up . Aug 7 551 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Diagonal Trend Lines:

Diagonal trend-lines are critical inflection points (currently represented in red below on our conventional charting).

Please review many of my recent posts so you can learn about how important these diagonal trend-lines are. If one is breached you can look to pull-back to next diagonal trend line about 90% of the time. Also pay attention to how thick the lines are – the thicker the line the more important because they represent extensions from previous time / price cycles.

Remember you can come in to the chat room to message the trader and REMEMBER I have posted a live chart link in this post so if you can’t see the lines well on this chart above you can go to the live chart link and watch for member live algo chart links through-out the day in your email inbox!

The diagonal trend-lines are marked on chart below:

Oil Chart (Weekly). Oil trend lines on weekly time-frame. Aug 12 951 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Chart (Weekly). Oil trend lines on weekly time-frame. Aug 7 605 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Previous posts for perspective;

Oil has now cleared every trendline resistance provided on conventional charting I’ve posted last year. $USOIL $WTI $CL_F #OOTT #OIL $USO $UWT $DWT 233 PM Jan 1

Notice when the daily chart is opened, the simple lines extend to current day trade.

Daily chart view. Simple lines show expose clusters of resistance. Crude algo intra work sheet 213 AM Apr 10 FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

Fibonacci Levels:

Watch the lines for support and resistance. Careful using them as traditional retracement levels with crude because the algo lines etc are more dominant / predictable. But the Fib lines are excellent indicators for intra-day trade support and resistance.

The Fibonacci lines are marked on main chart above.

Horizontal Trend-Lines (purple):

Horizontal trend-lines are not as important as the other indicators reviewed above, however, they do serve as important resistance and support intra-day for tight trading and they are important if thick (in other words they come from previous time / price cycles). WE STARTED TO REPRESENT THE REALLY IMPORTANT LINES IN YELLOW FYI FOR EASE. Refer to chart for current applicable horizontal trend-lines.

Horizontal trend-lines are marked on charts above.

Oil Time / Price Cycles:

Watch your email and / or my Twitter feed for time price cycles they may start to terminate.

Time / price cycles are the single most important indicator and my record calling them is near 100% – since inception seven months ago. The reason they are so important is that a trader does not want to be holding a crude oil instrument at termination of a time cycle if not absolutely sure if price will go up or down. A trade may choose to enter a large position in advance of a time price cycle termination IF THERE IS A HIGH PROBABILITY OF A DIRECTION IN PRICE and if the market is trading at a really important pivot area. In other words, if the market is trading at the bottom of the upward trending channel at a support (yellow lines) and we knew there was a significant probability of a time cycle about to terminate a trader may enter with a long position. The price really spikes or drops significantly when these important time cycles terminate.

The problem with time / price cycle terminations is they change from minute to minute (depending on where price is on the chart) so you have to be in the trade room to get the alert. Our lead traders will do everything they can in future to send these on SMS but we have to be careful because it can be difficult with so much going on in the room. The reason they (time cycles) change is because they are actually represented by or are geometric shapes in the chart – I know it sounds odd but I have (as I mentioned) hit these calls just shy of 100%. The oil political people know the same algorithmic modeling principles and they ALWAYS TIME THEIR BIG ANNOUNCEMENTS AROUND THE TIME PRICE CYCLE TERMINATIONS.

So if you can picture a triangle on the chart – and price is trading in the triangle – and price is going to come to the edge of the triangle and there is a significant support or resistance or an algo line terminating there too or a target (those type of indications)… then we know there is a high probability of a time and price change. In other words, it is where there are clusters of algorithm points that cross and when price is going to cross over that cluster is where they are. And these are represented on all the different time frames – the larger the time frame – the larger the time price cycle termination – the larger the spike or downdraft. This is where we establish our intra-day quadrants from for sniping trades (which we will put in to the room soon because it looks like the geo political rhetoric is over for a while making them more predictable). Difficult to explain in short. So we will do our best to SMS alert these in future.

Also, the real large or important time / price cycle terminations we know far in advance and they can be put in these newsletters.

If you review my Epic the Oil Algo Twitter feed, my blog posts and my story on our website you will get a feel for how accurate these calls are.

Alpha Algo Trading Trend-Lines (Primary – Red dotted lines. Secondary – White dotted lines):

To determine which algo line is most alpha (or probable) intra day, it is the nearest line to price action. This can also help you determine the trend of trade. If the algo line is trending up the price will follow it up until price is tested at an algorithm indicator (the main tests are diagonal trendlines, horizontal trendlines, time / price cycles etc – as I have shared with you). This is why it is important to watch all the lines because they are all support and resistance. To keep it simple trade the range (yellow lines) as I’ve mentioned but keep an eye on these indicators.

Current Alpha Algo Targets (Red circles):

Your closest target that crude is trending toward is always the most probable.Then, your second most probable is the one that is up or down trend depending on whether general price is in an upward or downtrend for the most recent week or so and what your other indicators look like (such as the MA’s I explained above).

The other way to determine which targets are in play is actually quite simple, you will notice that crude trades between the channel lines up and down and up and down and there are various support and resistance along the way. If it hits a target at the top of the channel you can bet most times (unless the next day like today) that the next target hit will be at the bottom of the channel.

Wait for the price to trend toward a target and take your position and watch as price gets closer and closer to the target. Remember, that the machines trade from decision to decision – or in other words from support to next resistance or resistance to next support or when the times come each week on Tuesday Wednesday and Friday they will trend toward the target that market price action determines they go to.

Our lead trader will explain more in the room and do not hesitate to ask our lead trader in the room by private message or on twitter to explain intra day decisions.

Recent Live Crude Oil Trade Alerts (samples):

The most recent trades are found in this recent report:

Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Click on feature post for recent crude oil trading alerts blog post; Oil Trading Alerts Live Video w EPIC Oil Algorithm #EIA Report #Oil #Trading #Algorithm #Alerts $USOIL $WTI $CL_F

Oil trade alert to start the week 68.61 long, 68.85 closed. Win rate high 90% – ask for a tour. Time stamped, recorded, live alerts.

https://twitter.com/EPICtheAlgo/status/1026287786113081344

Oil trade alert to start the week 68.61 long, 68.85 closed.

Oil trade alert to start the week 68.61 long, 68.85 closed (Part 2).

Machine trading 🙂

Machine trading 🙂 $USOIL $WTI $CL_F #OIL #Algorithmic #trading #alerts pic.twitter.com/Hja5Tbgmob

— Melonopoly (@curtmelonopoly) August 3, 2018

A scalp to start the day. Multi-month winning streak continues. Ask for a tour of the feed if you need proof.

A scalp to start the day. Multi-month winning streak continues. Ask for a tour of the feed if you need proof. EPIC Oil Algorithm FX $USOIL $WTI #CL $USO $UWT $DWT #OOTT #Oil #trading #algorithm pic.twitter.com/JTHCMp58Cv

— Melonopoly (@curtmelonopoly) July 27, 2018

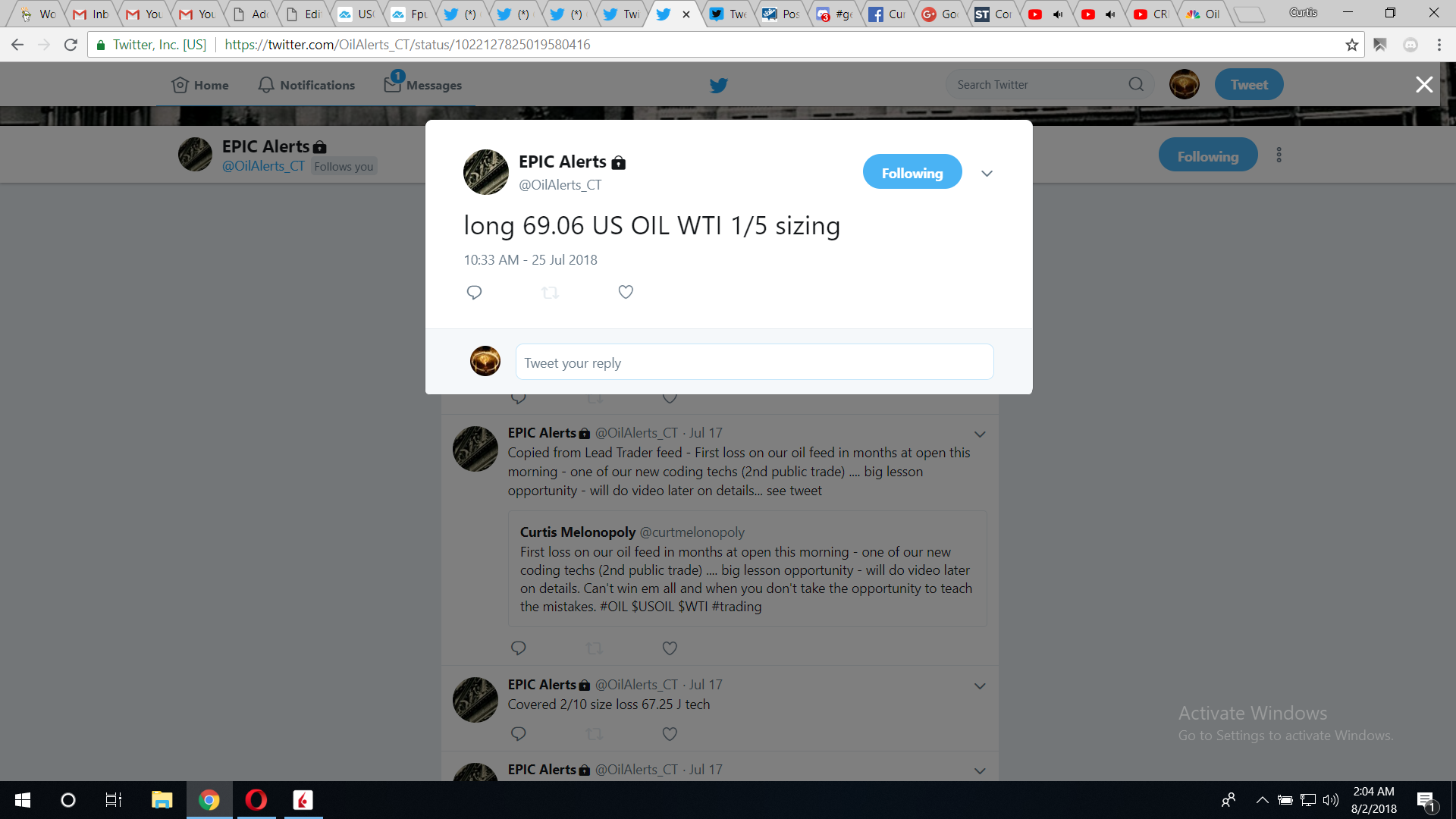

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back).

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo pic.twitter.com/pKL1iKE5T1

— Melonopoly (@curtmelonopoly) July 25, 2018

Live oil trade alert. Long 69.06 US OIL WTI 1 5th sizing EPIC Oil Algorithm.

Live oil trade alert. Trim 50 percent 69.30. EPIC Oil Algorithm.

Live oil trade alert. Long 68.93 add 50 percent. EPIC Oil Algorithm.

Live oil trade alert. Trim other 50 percent 69.26 50 percent.

Overnight oil trade: short 72.79 add 72.71 cover 72.27s-72.35s. Not cleanest trade but HUGE win. 100% win rate continues (for months). Guidance detail in oil trading room (to expect heat). Live alerts, time stamped, recorded.

https://twitter.com/EPICtheAlgo/status/1015202909041102849

Overnight oil trade short 72.79 add 72.71 cover 72.27s to 72.35s. Not cleanest trade but HUGE win. 100% win rate continues

Member guidance in oil chat room this morning “i’ll be selling spikes in to resistance until it doesn’t work – the larger more obvious i’ll alert against downtrend upper channel orange dotted etc”

https://twitter.com/EPICtheAlgo/status/1014943645974323204

Member guidance this morning i’ll be selling spikes in to resistance until it doesn’t work

Scalp day. 100 percent win rate for months continues. Time stamped, live alerted, recorded.

https://twitter.com/EPICtheAlgo/status/1014938308961595393

100 percent win rate for months continues. Time stamped, live alerted, recorded.

Oil trading chat room member guidance and intra day daytrading charting example ‘70.02 would be the swing retrace. So the thesis is sound but you may have pain before potential drop”.

Oil trading chat room member guidance and intra day daytrading charting example “Target is in 70.70 area so I will likely give this lots of room swing if I have to. We’ll see”.

Oil trading chat room member guidance and intra day daytrading charting example “Machines defending the retrace intra day”.

Trims / close longs 71.39 to 71.71 oil trade alert.

https://twitter.com/EPICtheAlgo/status/1011981290051129346

Long 71.21 oil trade alert with the one add.

https://twitter.com/EPICtheAlgo/status/1011980052198719488

Today’s #EIA oil trade with Oil Algorithm (EPIC) Live alert entries (green) exits (red).

https://twitter.com/EPICtheAlgo/status/1011977209442177026

Screen shot member oil chat room first oil trade alert of day – Long 71.21 hoping we squeeze in to EIA

One minute algorithmic on the fly chart trade came off after initial long side oil trade alert- see green arrow.

Screen shot of alert to trim half at 71.39 place stop 71.26 on remaining half and resistance guidance.

Oil chat room screen shot of next trade alert to trim long at 71.52 25 percent and hold 25 percent.

Final crude oil trade alert to close final 12.5 percent at 71.74 and hold 0 percent at chart resistance.

And then the post EIA 1030 Wed trade alert with trading plan price targets were posted – usually wait 2nd 5 min candle

And then this happened, oil shot up right through the price targets from the alert.

Winning streak continues. 100% live oil trade alert win rate for many weeks now. Time stamped real time.

https://twitter.com/EPICtheAlgo/status/1010004212950843392

EPIC Oil Algorithm trade alert wins continue for many weeks now. Time stamped real time.

Boom “3rd target hit. Trade thesis complete for #EIA. Next levels to follow.

Boom "3rd target hit. Trade thesis complete for #EIA. Next levels to follow. Oil Algorithm (EPIC). June 20 1148 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT " pic.twitter.com/WAl4N9n2yH

— Melonopoly (@curtmelonopoly) June 20, 2018

First 3 targets intra if long side trade alert holds. Trim in add above or on pull back and turns up.

Trade is using our 50% retrace on daytrade coding level intra as pivot.

Close up of intra day trading battle.

1st of 3 targets hit. Curt didn’t get it but coding team did.

Up over 1st target longs want to trim in to 2nd target level.

3rd target hit. Trade thesis complete for #EIA. Next levels to follow.

Daytrading support and resistance fractals (white arrows key).

Recent Oil Algorithm Price Target Hits:

Wed 1030 EIA report lower price target a perfect hit published on weekend report. Oil Algorithm (EPIC). FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTThttps://twitter.com/EPICtheAlgo/status/1024665109338222592

Wed 1030 EIA report lower price target a perfect hit published on weekend report.

Tues 430 lower price target a perfect hit, as published on weekend report. Oil Algorithm (EPIC). FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

https://twitter.com/EPICtheAlgo/status/1024447086102827011

Tues 430 lower price target a perfect hit published on weekend report. Oil Algorithm (EPIC). FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Oil Intra-Day Algo Trading Quadrants (white dotted lines):

Trading quadrants are simply support and resistance lines that can assist your intra-day trading – they are not alpha or primary support and resistance by any measure. Price action does however typically move more assertively when leaving a trading quadrant.

Indicator Methods:

As explained above, my algorithm is a consideration of up to fifty traditional indicators at any one time – each one given its own weight in accordance to its accuracy (win rate). This is how we establish the probability of specific targets hitting (we call them alpha algo targets).

Alpha Algo Targets, Algo Trend-lines, Algo Timing, Quadrants for Intra Snipes

Algo targets are the red circles – they correspond with important times each week in oil reporting land. Tuesday 4:30 PM, Wednesday 10:30 AM and Friday at 1:00 PM. The red dotted diagonal lines are the algo trend-lines. And the vertical dotted (red or green) are marking the important times each week. You will find that the price of crude will hit one of the alpha algo targets about 90% of the time. In the absence of market direction the machines take price to the next algo line and/or target. Understanding how the price of crude reacts to the algos and how they move price from target to target is critical for intra-day and swing trading crude oil and associated instruments.

You will notice that price action of crude will use these algo trend-lines and act as support and resistance, and that price also often violently moves when an alpha algo line is breached either upward or downward.

We cover this in much more detail in the member updates, trading room. A review of my Twitter feed and previous blog posts will help you understand the relation of these indicators. We will start posting video blogs (for my subscribers) on YouTube (in addition to my daily blog posts) for swing traders that work during regular trading hours.

Also… we will cover how to establish algo trend-lines and price targets future forward (as you have seen me do on my Twitter feed for some time now).

Conclusion:

See you in the live trade room! And again, if you struggle to know how to use these indicators as a trader’s edge, it is recommended (if you have earnestly reviewed all of our documentation first) that you obtain private coaching prior to trading a real account with real money – we recommend you use a paper trading account at first.

You can also send specific questions to our email inbox at [email protected] – if you do this be sure to ask a specific question so it can be answered specifically. When the 24 hour oil trading room opens you will have ample opportunity in that 24 hour room to ask questions also.

Watch my EPIC the Oil Algo Twitter feed for intra day notices and your email in box for member only material intra day also.

EPIC the Oil Algo

Subscribe to my Service here:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room Bundle (includes weekly newsletter charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Temporary Discount Offers (New members only):

30% Off Oil Newsletter: Use Promo Coupon Code “epic30” When Subscribing to our Weekly Oil Newsletter Here: https://compoundtrading.com/product/standalone-epic-newsletter/ (cancel anytime, for new members only to trial the service).

30% Off Oil Alerts: Use Promo Coupon Code “oilalerts30” for Real-Time Oil Trade Alerts via Private Twitter Feed @OilAlerts_CT Here: https://compoundtrading.com/product/live-oil-trading-alerts/?attribute_plan=One+Month (cancel anytime, for new members only to trial the service).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article topics: EPIC, Oil, Algorithm, Trading, Alerts, Crude, $USOIL, $WTI, $USO, $UCO, $CL_F, $UWT, $DWT, Chart

Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Last week I was involved in a friendly oil trading challenge. The live alert trading challenge was between myself and our coding team (the team coding our oil algorithm charting models to a machine trading software platform).

The results are mind-boggling – learn to trade oil with the one or two set-ups explained below and you will realize returns so significant that you will likely never turn back.

This (and the follow-up) are the most significant trade reviews and analysis we have done since our inception. Take the time you need to study this report if you want to be profitable trading crude oil.

In this challenge we both used exactly the same charting – conventional crude oil charts and algorithm oil charts (courtesy of EPIC Oil Algorithm).

The coding team realized oil trading profit was hundreds of percent greater than mine. We both won – but they won big.

The coding team won big – with less time invested, less stress and they used a simple, absolute, rigid rules based oil trading system.

How they did it is explained in detail below.

This report could easily have been titled, “How to Trade Crude Oil in Today’s Market – With Intelligent Assisted Technology (EPIC Oil Trading Algorithm).” However, it was a friendly competition between myself (lead trader) and our coding team, hence the title I used.

As you will see below, the results are absolutely astounding.

Allow me to explain who this article is suitable for, what data is reviewed in this report, the charting used and what trading rules were used.

This report is suitable for the following reader(s);

- If you want to learn to trade crude oil,

- If you already trade oil, are struggling to be profitable, and in need of a proper rules based trading process to be sure you win,

- If you are a pro oil trader exploring other profitable oil trading systems that may assist your ROI / ROE objectives,

- If you are researching what the future of the best oil trading systems will look like,

- And of course this report is a great study guide for current EPIC the Oil Algorithm clients.

Below I review in detail the following (with real chart examples, copies of our trading alerts and more);

- The surprising final results of our oil trading challenge between man and machine algorithm (both using the same information),

- The rules based trading process used,

- My personal learning experience after last week’s trading challenge.

How Trades Were Executed and the Information Used by The Traders (charts, algorithms).

As I explained above, this was a competition between our algorithm coding technicians trading crude oil with EPIC the Oil Algorithm chart models (algorithmic oil charting) vs. myself (lead trader at Compound Trading Group) using the exact same algorithmic charting and conventional charts. We both had access to the identical charting – algorithmic oil charting and conventional charting on various time frames.

In fact, the coding team executed their trades manually (as did I, of course). They were not executing their trades automatically (machine trading).

The massive difference in the trading results (the profit achieved) after the week of trading is directly a result of

- How the charts were used (interpretation),

- What charts were used and why (which charts were given more or less weight in decisions), and

- How trades were executed within the charting time-frames and structure.

In other words, we both had exactly the same information at our disposal, we both executed our trades manually, but we executed our trades on a slightly different rule-set within the same structured rules based trading system.

I was executing trades manually and intuitively (as a pro trader- in my mind) using EPIC the Oil Algorithm Charting Models (even on different time frames) and I also used conventional crude oil charting.

The coding team used the exact same oil charts, but the difference was that they executed their crude oil trades under a very strict system – using only the rules as prescribed by and under the reporting that is distributed to our clients in the weekly EPIC Oil Algorithm newsletter reports (the reports for those unaware include a rules based system along with various charting for the week).

The system of trading oil the coding team implemented was rigid to the rules of our algorithm model and my system was more pro trader intuitive – I flexed the rules as I felt I needed to. That was the simple and only difference.

Learning to trade crude oil successfully is not an easy task because conventional charting rules do not apply in many instances. Crude oil trading can be very volatile and as a result oil trading can be very profitable if you are on the winning side in most trades. If you loose as an oil trader it can be very punishing.

To trade oil successfully you need to know the structure of oil trade – the rules book and the playing field. Understanding the structure of oil trading charts, how to execute trades properly within that structure and when to cut losses and trim gains is critical to your return on investment (ROI) or return on equity (ROE).

Specifically how the coding team beat me so bad last week.

Lets review real life examples of the price of crude oil over the last week, how we each traded it, the conventional charting we used, the intelligent assisted algorithm charting we used, the trade alerts sent out, when and how each of us executed crude oil trades for excellent winning side returns, but with significantly different results.

The week prior to this challenge something interesting happened, our coding team foreman was allowed to start alerting oil trade alerts to our Twitter alert feed and wouldn’t you know it, in his first two alerts he lost big (I think he had a few small wins also). I on the other hand have been on the winning side of my trade alerts for months now. Of course our members enjoy that predictability… but there is a much bigger story here.

When our coding foreman lost, he was on the losing side of his first two alerts of his career because he didn’t follow one simple rule:

He did not close the trade when it went against him and as a result he lost big.

He alerted the trade entry properly, but when the trade of oil went against him he didn’t alert to close the losing trade.

This caused significant stress, challenged our team and much discussion ensued. We rolled around our work, the charting, the algorithm models, machine trading software scenarios, alerts, trading rules and more – over and over and over.

On my side of the story, I am alerting winning oil trades for months now with-out fail, but my trades are quick and only on the winning side of 10 cents to approximately 40 cents… about 20 cents on average. Now in oil futures a 20 cent or 30 cent win consistently is a fantastic living and in my thinking that’s great because I near always win and if you near always win that’s just fine…

but it doesn’t nearly take advantage of the power of the trading algorithm model charting I have at my disposal.

So before our challenge last week we both had a problem, I was leaving the majority of the obvious profit on the table even though my trade alerts were winners every time and he was not following the rule of closing a losing trade side alert that goes against you, and closing it fast.

We were both breaking the rules and we both would have much higher ROE if we adjusted some very simple things… our coding foreman adjusted perfectly – me, not so perfect – but this week is a new week so watch out!

Anyway, so we agreed to a challenge, he would not alert to the client oil alert feed for now and he would show me that he could trade explicitly to the rules as set out in the EPIC Oil Algorithm reports. And I would also do the same, but alert my trades and with a caveat that I could use my pro trader bias to over-rule the algorithm charting rules at will (my error).

A detailed account of our recent oil trades / alerts;

New traders should know that EPIC the Oil Algorithm chart models are charted on FX $USOIL $WTI but can be used to trade oil futures contracts $CL_F or leveraged oil derivative market products such as $USO, $UCO, $UWT, $DWT, $UWTI, $DWTI and more. I typically use CL contracts and will daytrade at times $UWT or $DWT if I am confident that I won’t be holding over-night.

Okay, first lets look at my trades / alerts (this is almost embarrassing to review – humility engaged).

In the examples below and the follow up report you will see actual screen shots of the live twitter oil trade alert feed (time stamped, real-time), screen shots of the private oil chat room and screen shots of EPIC the Oil Algorithm charting we were using (with notes).

Also it is important that the profit / loss represented are approximate as our team is trading various environments (read our disclosure) – we are testing and trading many platform scenarios, instruments (oil contracts, market derivatives, etc), with various traders, various accounts (real world and/or model platforms for testing purposes) in the team (as our work is toward achieving a machine trading environment and intelligent assisted trader platform – read about our mandates on our website) that it would take days to explain. Additionally, there are trades executed for win or loss that are never alerted to our members.

So for the purpose of this exercise I keep the analysis below simple and to what applies specifically to this exercise ensuring that we cover what the public (our member clients) would have had opportunity to act on in their own trading environment (actionable trading alerts) and if one did in fact act on the alerts what the expected returns may be vs. trading what the rules-based trading system of EPIC the Oil Algorithm reports prescribe to our members in the weekly reporting they receive from Compound Trading Group.

There will be a member only follow-up to this report published within 7 days that will show the 1 minute conventional charting used with exact entry and exit areas detailed on the charting with the thought process by the trader in each trade and this report will also include the machine trading charting that influenced our trade.

Oil Trade Alert # 1

The first trade that was marked as a tech trade was, but it was alerted internally by me and authorized to the tech to alert. So for the purpose of our competition it was my trade by origin (we’ve decided this in team discussion). So I’ll take it as I need all the help I can get here.

The first trade was 24 cent win at 2 oil contracts (avg) so it was a gain of about 510.00.

Oil trade alert to start the week 68.61 long, 68.85 closed (the initial alert).

Oil trade alert to start the week 68.61 long, 68.85 closed (the closing alert on #1 for the week).

Oil Trade Alert # 2

The second trade of the week was a timing cycle issue, price didn’t react soon enough so I closed the trade for a small profit.

A 5 cent win with two contracts for 100.00 win (approx).

Long 69.19 lead trader test size.

Closed 69.24 not holding in to time cycle when it is this soft.

Oil Trade Alert #3

The third trade alert has a type o that was obvious, but more important than that is that this is where the difference in the fine details put the coding team way ahead of me. At this point the trading was so intense that I had to generalize the tweet alerts, but you will get the point with what was alerted. There is more explanation below that clarifies the calculations here;

66.49 to 55.57 with contract sizing average of 3 contracts on about 3 times = 800.00 profit approx.

Long test 66.49 lead trader will cut fast as needed and trade chop.

This was obviously 66.57 and there were various type o’s, it should have read something like this…

Chipping out some 55.57 and waiting for next leg to go again.

At this point I alerted the member private Twitter feed that we would for the time alert in the live trading room (where I can speak on live mic broadcast to our oil traders) – this is specifically in a Click Meeting conference room (it is our main trading room that our EPIC Oil Algorithm bundle members can access as they like). We also have a private oil chat room in Discord and a public side on Discord.

At this point there were a number of trades, I will only include screen shots in this report specifically of what was alerted to only the Twitter feed (there isn’t time to get the audio from live trading room right now for the various occasions I was in that room last week – that will all be in a reconciled report from Jen in our offices). It won’t make a difference to the main point of this report – I was beat by the coding team so badly it doesn’t matter.

The real point of this exercise (this report) is to help oil traders with a rules based system to win and win with the highest return.

We’re trading possible turn in live oil trading room isn’t time to alert on feed.

Oil Trade Alert #4

The fourth oil trade of the week was a win. Short from 67.17 and cover at 66.80 for a 37 cent win at 3 contracts.

Win side 1100.00 approx.

Short test lead trader.

Short oil trade alert at 67.17.

Covered 66.80 lead trader – nice quick win on that alert.

Oil Trade Alert #5.

Oil trade number five was a decent trade from 67.13 (average) to 67.29 with trims starting at 67.27.

8 contracts at approx 14 cent profit = 1200.00 gain (approx).

Long lead trader break out test 67.09 – 67.18 4/10 sizing.

Trimming long positions 67.27.

Oil Trade Alert #6

There we many trades here and the range was .30 cents to the win side on the original alert. For simplicity it was 5 trades at an average size of 2 contracts at an average win of .10 cents.

Oil trade number six approx. profit = 1200.00

Long oil trade again here.

Trimming long oil positions here.

Too busy to alert all legs in and trims but we got a nice break up there 67.20s to 67.50s.

Summary of Lead Trader Alerted Trades to Live Twitter Feed P/L

So specific to only what was alerted as trade alerts on the live feed and the contract sizing for those trade alerts the total gains for the week = approximately 4900.00 for this account scenario.

Now lets look at what our coding team foreman was able to do with the exact same charting information (that I and our members can use).

In his instance he traded specifically to the rule-based system as prescribed to our members in the weekly EPIC Oil Algorithm reporting.

There were many trades in each leg. He started trades at 2/10 sizing then as the trade progressed he trimmed 1/10 size at resistance and if it failed would exit the other 1/10 at about have the trade range. As trade got above the key resistance he would add above key resistance 1 size and continue. And if the trade went against him right away he would cut fast. So he had a number of losses, but his losses were small and the wins far outweighed the gains.

The week started with an uptrend so he traded the key range support and resistance as prescribed in EPIC the Algorithm reports (gray horizontal line you see on chart below). As trade failed or at key resistance he would trim as noted above.

The key to his trading process was using the key range support and resistance as the launch area for longs, the short area for shorting oil and if the trade went against him he closed the trade for a loss.

The EPIC Algorithm Chart he was using (the gray horizontal line is the main support and resistance pivot prescribed to members and the other indications on the charting). How to trade crude oil applying the rules based process in this report can be reviewed in detail on our web site blog under EPIC Oil Algorithm and scroll down to unlocked historical charting – the more recent reports are locked to the general public. The EPIC reports explain specifically the rules based process in point form.

The first chart is the initial trading range for the week that our tech was using. The day and time is noted at the bottom of the chart. You can see how is bias for trade direction was specific to the main pivot area as provided on the algorithm charting.

Charting used by technician (EPIC Oil Trading Algorithm Charting). Bias for trades is noted with green and red arrows.

You can see in the charting below that each time trade breached the main pivot on the charting model that his trading was to the long side bias until trade hit a significant resistance in the model (at which point he trimmed).

The first two on the chart are green arrow long side trades were off the main pivot and trimmed at the quad wall resistance area.

The the third is a red arrow on the chart as a short side trade bias because trade was already at the marked target price for the Tuesday 430 algorithmic target. In other words, there was a low probability of further upside gain prior to Tuesday at 430 so his short term bias was short.

Then the fourth arrow (green) and fifth (red) were a rinse and repeat of the bias explained above.

The sixth arrow (or trading bias area) was long in to the Wednesday 10:30 AM EPIC Oil Algorithm price target (for the up channel scenario) but trade turned and when it turned and lost the main pivot (gray) and the trading quadrant (orange dotted) he turned short bias in a significant way. There were many failures to the long side in the algorithmic model at this time in the trading week.

The short side bias was solidified with the expiry of the main time cycle in trade (purple arrows that separate the up channel scenario or lower channel scenario in the oil algorithm weekly reports).

The next time frame of the week (second) charting used by technician in his trading system with noted areas of trading bias with red and green arrows.

As trade moved to either side of the main pivot his bias is represented (per the process prescibed in the EPIC Oil Algorithm weekly reports) and then in to the bottom of a trading quadrant (he used the rules for trading quadrants) after oil selling off to extreme levels on the week.

As oil sold off the tech simply trimmed at support areas on the algorithm charting and added to short side bias as trade lost each support.

On the way down oil trade hit the Wednesday 10:30 AM EIA price target as published in the previous weekend EPIC report for the lower channel scenario.

The final chart time cycle used by technician in his trading system for week.

The last time frame was text book how to trade crude oil class. For this the tech moved to the prescribed trading process rules in the trading quadrant (the orange dotted lines that form a diamond). He simply took long side positions at the support of the quadrant and trimmed at the main resistance areas. Trade got in to the Friday 1:00 PM target but did not perfectly hit the center.

Trade ended the week at the top of the trading quadrant – near the quadrant basket where he assumed with trade direction and historical algorithmic chart from EPIC that trade was most likely to complete the week.

It’s obvious the technician using the rules based system prescribed to our members had significantly higher returns last week than I did. Our members will be receiving the full report.

As explained above;

There will be a member only follow-up to this report published soon that will show / explain the 1 minute conventional charting used with exact entry and exit areas detailed on the charting with the thought process by each trader in each trade and this report will also include the machine trading charting that influenced each trade.

The follow-up report will provide our members and our team staff opportunity to learn in great detail how to time the entries and exits of the trades. It will hopefully bring members in to the mind of each trader. This is a member only report because proprietary machine coding charting and various other proprietary information will be shared.

Also, please note that over the coming weeks in to the fall season that our techs will be alerting more and more to the live alert feed under and will be doing such exclusively under the rules based system as prescribed in the EPIC Oil Algorithm weekly reports to members.

Some Important Final Thoughts.

It is easy to look back and criticize your trades – especially when the trade direction is so obviously apparent on an algorithmic charting model such as EPIC’s as in this report.

I personally won’t be hard on myself (as you should not also) because it is impossible to be a machine and if I am on the winning side more than losing and my accounts are consistently green that is what matters most.

However, in my continuing quest to learn how to trade crude oil to my best ability I will be adjusting my oil trading style this week to more reflect the prescribed rules based system as prescribed in the EPIC Oil Algorithm weekly reporting. It obviously works and the science proves that – so I need to adjust to continue to get better as an oil trader and coach that teaches others how to trade oil.

I look forward to the follow-up report that Jen is writing now for our members that will provide in detail how last week trades were decided. She just finished interviewing me about each of my trades and is interviewing our tech team later today for the report.

Best with your trading and if there is anything you need from me reach out anytime on any of my personal social feeds or by email [email protected].

Thanks

Curtis (Lead Trader at Compound Trading Group).

To Learn More About Trading Oil:

Learning to Trade Links on our Site and/or YouTube.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

Oil Trading Room – How to Use EPIC the Oil Algorithm June 21, 2017 (video).

Oil Trading Room – How to Use Oil Algorithm Chart & Recent Trades June 29, 2017 (video).

Here we unlock historical member reports at intervals after time cycles have expired for traders that are learning to trade oil. When you clock on link scroll down at landing page on blog section you will be transferred to so that you can get to reports that are unlocked over time: https://compoundtrading.com/category/epic-the-oil-algo-chart-report/

Off-site Learning Site Links:

Learn how to trade crude oil in 5 steps https://www.investopedia.com/articles/investing/100515/learn-how-trade-crude-oil-5-steps.asp

How to Trade Oil on Stock Exchange https://finance.zacks.com/trade-oil-stock-exchange-4532.html

How to trade oil. Learn everything you need to know about speculating on oil and gas markets. We explain how oil trading works, with a step-by-step guide to trading oil. https://www.ig.com/au/commodities/oil/how-to-trade-oil

Subscribe Here:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Temporary Discount Offers (New members only – ending Aug 14, 2018):

30% Off Oil Newsletter: Use Promo Coupon Code “epic30” When Subscribing to our Weekly Oil Newsletter Here: https://compoundtrading.com/product/standalone-epic-newsletter/ (cancel anytime, for new members only to trial the service).

30% Off Oil Alerts: Use Promo Coupon Code “oilalerts30” for Real-Time Oil Trade Alerts via Private Twitter Feed @OilAlerts_CT Here: https://compoundtrading.com/product/live-oil-trading-alerts/?attribute_plan=One+Month (cancel anytime, for new members only to trial the service).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Follow:

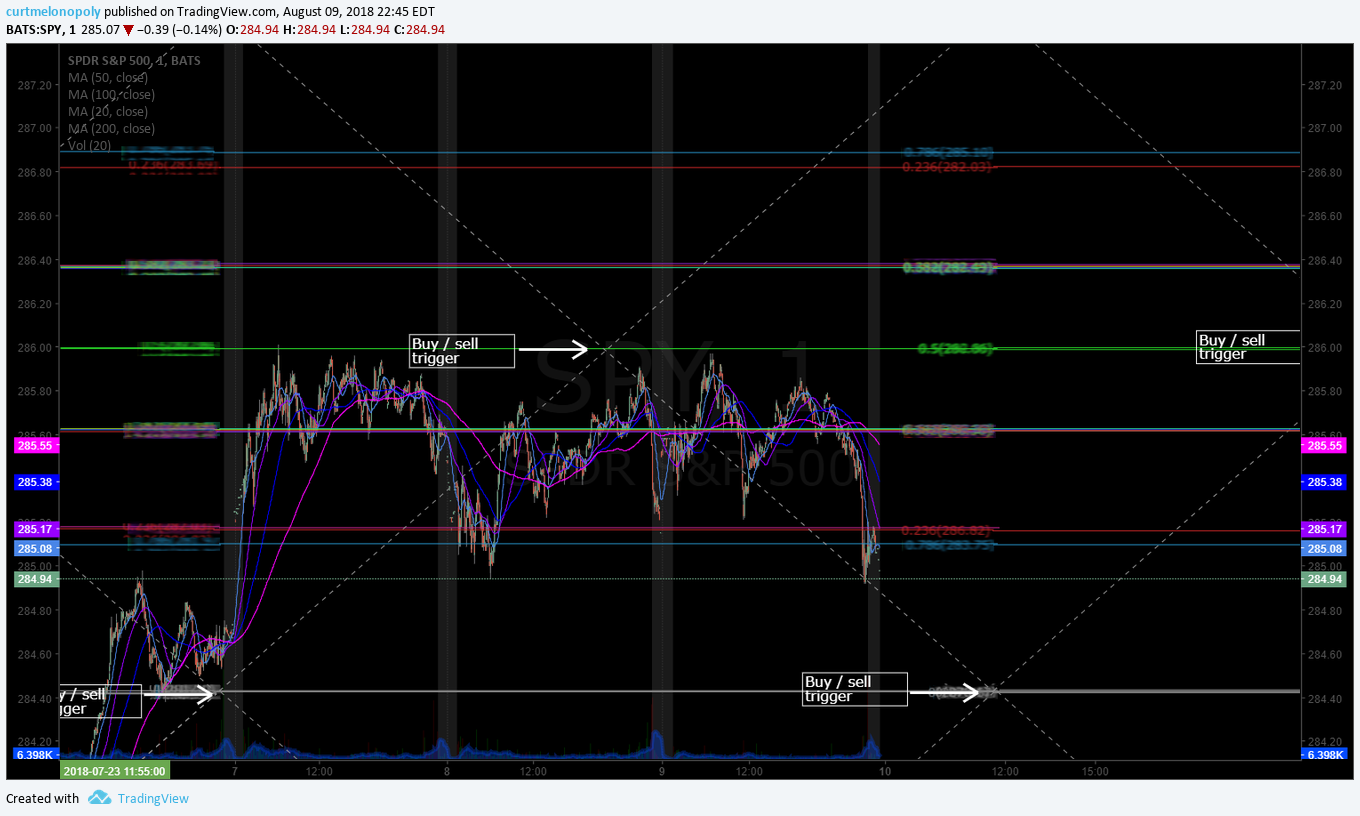

SP500 Algorithm (SPY). Thurs Aug 9 Report. $SPY $ES_F $SPXL, $SPXS #SPY #Algorithm

S&P 500 SPY Trading Algorithm Update Thursday August 9, 2018.

$SPY $ES_F ($SPXL, $SPXS) Chart Observations

My name is Freedom the SPY Algo ($SPY). Welcome to my S&P 500 trade report for Compound Trading Group.

Below you will find algorithmic model charting based on Fibonacci extensions, timing and various other principles. This is a very early stage development model (generation 2 – 5 modeling rolls out in 2018 and as a result the reporting frequency increase significantly – our more advanced algorithm chart models are 4th and 5th generation, such as EPIC the Oil Algo that is graduating to #IA coding).

Notices:

NA

How to use this charting model:

This S&P 500 (SPY) algorithm report includes a 1 minute model and a 60 minute model with buy sell triggers and reports in near future will include other time-frames for different styles / time-frames of trade.

The simplest way to use the charting is to consider all lines support and resistance decisions with the horizontal grey lines (marked with grey arrows) to be significant trading ranges in the model. The thicker the line the more important. And please consider that all support and resistance lines are approximate as this is a working chart model (a work-sheet). Horizontal and diagonal dotted lines are consider support and resistance.

This chart model is best weighed against conventional charting and used in conjunction with a conventional chart.

If you have questions about the best use of the chart model or private coaching options email our developers anytime at [email protected].

SP500 Algorithm (SPY). 1 Min Chart (Intra-Day Trading) $SPY.

Current Buy / Sell Triggers for $SPY SP500:

292.29

290.70

289.15

287.58

286.00

284.45

282.88

281.30

279.74

278.17

276.61

275.02

273.46

271.89

270.33

268.75

267.20

265.62

264.04

262.47

260.92

When you open the live chart below in “viewer” mode you can then click on the share button at bottom right and then click on “make it mine” to open real-time chart. Double click the body of the chart to remove or institute indicators at bottom of chart (MACD, Stoch RSI, SQZMOM).

SP500 Algorithm (SPY). 1 Min chart. Current trade. Buy sell triggers, fibs, quads, MA’s. Aug 9 1046 PM. $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

SP500 Algorithm (SPY). 1 Min chart. Current trade. Buy sell triggers, fibs, quads, MA’s. July 26 137 AM. $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

SP500 Algorithm (SPY). 60 Minute Chart (Swing Trading) $SPY:

SP500 Algorithm (SPY). 60 Min chart. Current trade above mid quad support. Aug 9 1100 PM $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

SP500 Algorithm (SPY). 60 Min Gen 1. Current trade above pivot. Buy sell triggers, fibs, quads, MA’s. July 26 148 AM. $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

SP500 (SPY) Conventional Charting Considerations $SPY:

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

July 26, 2018 – Structure from previous still intact.

SP500 (SPY) Chart – MACD still turned down, messy structure. $SPY $ES_F $SPXL $SPXS #SPY #Chart

SPY chart with bearish (or at best indecisive) overtones in its structure.

Recent Real-Time Alerts, Trading, Model Price Target hits etc.

Aug 9 – Alert and price target examples will be updated soon.

Per recent;

9:56 AM – 19 Apr 2018 $SPY Divergent trade returning to target area it tried to pass in the fast lane. See previous recent posts.

$SPY Divergent trade returning to target area it tried to pass in the fast lane. See previous recent posts. pic.twitter.com/3vo4sgNXKH

— Melonopoly (@curtmelonopoly) April 19, 2018

5:18 AM – 18 Apr 2018 That 273.20 mark that comes due in a time cycle peak for $SPY at around 2:00 EST today…. that’s the start of a double extension getting really stretched on the models – corresponds with everything that moved. There ain’t much room available above that short term. Rest on deck.

That 273.20 mark that comes due in a time cycle peak for $SPY at around 2:00 EST today…. that's the start of a double extension getting really stretched on the models – corresponds with everything that moved. There ain't much room available above that short term. Rest on deck. pic.twitter.com/wKfBQ9njDc

— Melonopoly (@curtmelonopoly) April 18, 2018

4:48 AM – 18 Apr 2018 $SPY long side trade cleared mid quad and quad wall. Closed 270.19, next res trims 270.22, 270.45, 271.99, 273.25

https://twitter.com/SwingAlerts_CT/status/986526884790927360

3:37 PM – 13 Apr 2018 The resistance dump after the alert and the 50 MA support may become your buy area Mon morning. $SPY #swingtrading https://www.tradingview.com/chart/SPY/H375XWXb-The-resistance-dump-after-the-alert-and-the-50-MA-support-may-be/ …

https://twitter.com/SwingAlerts_CT/status/984878380284858369

11:05 AM – 13 Apr 2018 $SPY trim quad resistance alert worked well.

https://twitter.com/SwingAlerts_CT/status/984809783768346624

9:31 AM – 13 Apr 2018 $SPY upside resistance trim alert to long side as it approaches 268.00 mid quad res

https://twitter.com/SwingAlerts_CT/status/984786277189988352

$SPY at upside resistance pivot and structured trade worked out. Trim longs add above.

$SPY building structure near the buy trigger and channel bottom we expected. It’s long while it holds area. Trading 261.23 intra day.

https://twitter.com/SwingAlerts_CT/status/981571557771350018

$SPY Time cycle peak on this simple model is now. If its going to follow channel up it will be soon that it starts. If not, it could be another channel down yet.

https://twitter.com/DayAlerts_CT/status/978990333278253056/photo/1pic.twitter.com/50zcoPctuv

Best with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: SP500, Algorithm, SPY, $SPY, Chart, Model, $ES_F, $SPXL, $SPXS

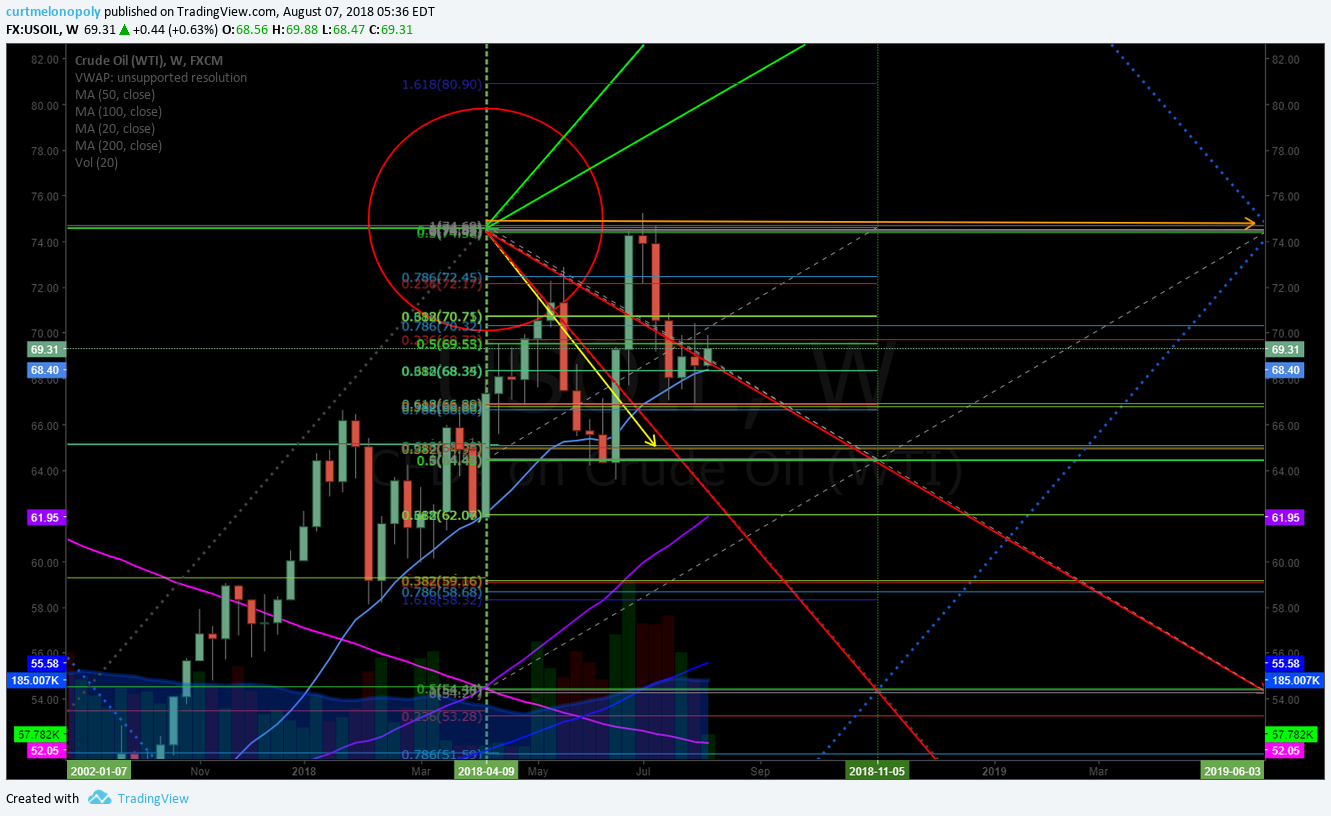

Oil Algorithm Trading Report (EPIC) Tues Aug 7 FX: $USOIL $WTI $CL_F $USO #Oil #Trading #Algorithm

Crude Oil Trading Algorithm Chart Report (EPIC) Tuesday Aug 7, 2018.

FX: $USOIL $WTI $USO $CL_F $UWT $DWT $UCO $SCO $ERX $ERY $GUSH $DRIP

Welcome to the oil trading algorithm report. My name is EPIC the Oil Algorithm and I am one of seven primary Algorithmic Chart Models in development at Compound Trading Group (there are near 300 in total in development at various stages for all markets).

NOTICES:

New members to our oil algorithm charting model are encouraged to on-board in a way that equips you as an oil trader for profit.

Visit my Twitter feed EPIC Oil Algorithm Twitter (@EPICtheAlgo) and review tweets over the last few months, visit our blog and review the recent oil algorithm blog posts, our You Tube channel “how my oil algorithm works”, “how to use my charting”, weekly EIA oil report videos and our website (it explains how the oil algorithm was developed). Reviewing those important points of reference will increase your probability of success considerably. This report includes links to some recent example “how-to” videos.

Oil Trade Coaching – Users of this algorithmic oil charting model may opt for private one-on-one coaching with our lead trader and / or an experienced trader that has worked under our lead trader. On our website standard one-on-one online coaching packages are made available (coaching via Skype) or you can request a customized package (reflecting the time you wish to invest in learning). To request a custom package suited to your needs email [email protected] or click here for standard private trade coaching packages. Other options for coaching include online webinars and private on location (in person) coaching sessions.

Oil Trading – How to Use the Oil Algorithm

Oil Trading – How to Trade Intra-day with my Algorithmic Charting

Oil Trading Alerts. Live Lead Trader Video Trading w EPIC Oil Algorithm

A recent article from our blog about how to trade crude oil with our oil trading algorithm, “The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

MULTI-USERS: Institutional / commercial platform now available.

SOFTWARE: My algorithmic charting is planned to go to developer coding phase for our trader’s dashboard program. Please review my algorithm development process, about my oil algorithm story on our website www.compoundtrading.com and my oil algo charting posts on my Twitter feed and/or this blog.

HOW MY ALGORITHM WORKS: I am an oil algorithm model in development. My math is based on traditional indicators (up to fifty at any given time each weighted on win ratio merit – all not shown on chart at any given time) – such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and various other charting, geometric and mathematical factors. I do not yet have AI integration – only math as it relates to traditional indicators with the primary goal being probabilities. I am not a high frequency robot type algorithm – I am presented on (and used on) a traditional trading chart as one would normally use as a probability indicator. The goal is to provide our trader’s with an edge when triggering entries and exits on trades with instruments that rely on the price of crude oil.

Below you will find simplified levels represented on a traditional chart (both intra-day and as a swing trader or investor). This work (and associated trade) should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on. Questions to; [email protected], message our lead trader on Twitter, or message a lead trader in the private Discord oil trade room server.

Visit this link for more information about my oil algorithm development, this link explains how our algorithmic charting is done, this YouTube video explains in summary how my algorithm works https://www.youtube.com/watch?v=LUNyxFoXJp8 this link for more information about our algorithmic stock charting models and what makes them different than most.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE SIGNAL (ON EVERY VENUE) IS VIDEO RECORDED, ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/.

Oil Algorithm Observations:

Below is a link for the live chart version of EPIC the Oil Algorithm. The charting is a real-time trading chart represented on FX $USOIL $WTI published Aug 7, 2018.

Click on share button (bottom right beside flag) and when that screen opens click on “make it mine” to view real-time, make edits etc:

Oil Algorithm (EPIC). Current trade. Aug 7 430 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Aug 7, 2018

The first most predictable trade are the resistance and support cluster areas formed by long term chart trend lines (see charts that have trend-lines represented in red as made available below).

The second most predictable trade (wide trading range primary resistance and support that become predictable buy and sell triggers). Current algorithmic model wide trading range resistance (grey arrow – grey horizontal line) at approximately 72.54 in the current trading range. Current algorithmic model wide trading range support (grey arrow – grey horizontal line) at approximately 68.93 in the current trading range – these areas are general range support and resistance areas (our algorithm uses a .15 – .20 cent buffer on either side for these trades). Trading between the resistance / support horizontal grey lines is extremely profitable risk – reward if one is disciplined to the patience required and follows the trend of trade.

The lower trading range is 65.32 to 68.92. The upper trading range 72.54 to 76.15.

Trading Bias / Forward Guidance: As with previous report, range bound. Slightly bullish based on MACD pinch and cross up possible on daily, but very slight.

Current (as of Aug 7, 2018) MACD is starting to pinch up on the daily oil chart.

Third most predictable trade (support and resistance of uptrend or down trend channels). On the chart an upward trending trade channel is presented and a downward option (channel support and resistance / trading range is represented as diagonal dotted orange lines and purple arrows – as made available, assist in displaying directional trade decision areas).

Fourth most predictable trade (support and resistance of 30 min quadrants). The diagonal lines make up quadrants (in this instance on a 30 min chart) and are represented as orange diagonal lines that make up geometric diamond shapes. These lines also assist in intra-day trade.

Fifth most predictable trade (support and resistance of most applicable Fibonacci) the Fib support and resistance lines are the horizontal lines in various colors with the exception of purple and yellow (see below). These horizontal lines become support and resistance for intra-day trade.

Sixth most predictable trade (support and resistance of historical support and resistance) Natural / historical support and resistance lines shown in purple or yellow – they represent historical support and resistance. The strongest of the historical support and resistance lines are shown in yellow horizontal and are typically accompanied by a yellow arrow marker.

Seventh most predictable trade signal we use are the time and price targets (red circles). When trade is in a significant uptrend or downtrend the targets become very precise and move up the indicator priority list quick.

Tues, Wed and Fri targets are most predictable in extended multi week uptrends or downtrends. In recent time, trade could be described as range-bound with moderate uptrend.

The Eighth most predictable trade is intra-day. You will notice on some of the charting geometric shapes in green on some of my charting (at times). They are charted live in the trading room and at times the lead trader will highlight these areas intra with white outlines (typically geometric shapes such as diamonds or triangles).

Intra-day Trading Bias

Intra day bias is long based on wide range support.

Wide Trading Range – Buy and Sell Triggers for Swing Trading Crude Oil:

Trade the ranges noted above between the thick grey lines (grey arrows) for the most predictable swing trades between 58.13 to 61.72, 61.72 to 65.32, 65.32 to 68.92, 68.93 to 72.54 and 72.54 to 76.15. This is a highly profitable risk-reward way to trade oil if you can be patient to trigger at only the break of the wide range charting areas and are disciplined to cut a losing trade that does not prove in your anticipated trend.

Or trade the range between the channel diagonal lines at support and resistance in up or down channel (orange dotted diagonals).

Oil Algorithm (EPIC). Up trend channel chart. Aug 7 435 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Oil Algorithm (EPIC). Down trend channel chart. Aug 7 436 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Oil Swing Trade Charting.

Monthly Oil Chart:

Oil Monthly Chart. Price above 200 MA at pivot under 200 MA MACD trending up. Aug 7 523 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Oil Chart (Monthly). Trade still working range between 100 MA and 200 MA. July 30 334 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

https://www.tradingview.com/chart/USOIL/1A0isCoe-Oil-Chart-Monthly-Trade-still-working-range-between-100-MA-an/

Weekly Oil Chart:

Oil Algorithm Simple Weekly Gen 1 Model. Oil Continues bullish structure on weekly chart. Aug 7 536 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Oil Algorithm Simple Weekly Gen 1 Model. Oil still in bullish structure on the weekly chart. July 30 346 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Oil Algorithm Simple Weekly Gen 1 Model. Oil still in bullish structure on the weekly chart. July 23 1224 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

May 21 – A feature post was published this week to review time cycles, retrace possibilities on the other side of time cycles on the weekly charts. Below is the post link:

Feature Post: 12 of Last 13 Oil Chart Time-Cycles Have Trend Reversal. $USOIL $WTI $CL_F $USO $UCO $UWT $DWT #OIL #OOTT

Daily Oil Chart:

Oil Monthly Chart. Oil has a bounce at 50 MA with MACD pinch possible cross up . Aug 7 551 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

MACD trend down on daily oil chart with price above 100 MA under 20 and 50. #OIL $USOIL $WTI

Diagonal Trend Lines:

Diagonal trend-lines are critical inflection points (currently represented in red below on our conventional charting).

Please review many of my recent posts so you can learn about how important these diagonal trend-lines are. If one is breached you can look to pull-back to next diagonal trend line about 90% of the time. Also pay attention to how thick the lines are – the thicker the line the more important because they represent extensions from previous time / price cycles.

Remember you can come in to the chat room to message the trader and REMEMBER I have posted a live chart link in this post so if you can’t see the lines well on this chart above you can go to the live chart link and watch for member live algo chart links through-out the day in your email inbox!

The diagonal trend-lines are marked on chart below:

Oil Chart (Weekly). Oil trend lines on weekly time-frame. Aug 7 605 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

July 30 – No significant change to chart below.

Oil Chart (Weekly). Oil trend lines on weekly time-frame. July 2 212 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Previous posts for perspective;

Oil has now cleared every trendline resistance provided on conventional charting I’ve posted last year. $USOIL $WTI $CL_F #OOTT #OIL $USO $UWT $DWT 233 PM Jan 1

Notice when the daily chart is opened, the simple lines extend to current day trade.

Daily chart view. Simple lines show expose clusters of resistance. Crude algo intra work sheet 213 AM Apr 10 FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

Fibonacci Levels:

Watch the lines for support and resistance. Careful using them as traditional retracement levels with crude because the algo lines etc are more dominant / predictable. But the Fib lines are excellent indicators for intra-day trade support and resistance.

The Fibonacci lines are marked on main chart above.

Horizontal Trend-Lines (purple):

Horizontal trend-lines are not as important as the other indicators reviewed above, however, they do serve as important resistance and support intra-day for tight trading and they are important if thick (in other words they come from previous time / price cycles). WE STARTED TO REPRESENT THE REALLY IMPORTANT LINES IN YELLOW FYI FOR EASE. Refer to chart for current applicable horizontal trend-lines.

Horizontal trend-lines are marked on charts above.

Oil Time / Price Cycles:

Watch your email and / or my Twitter feed for time price cycles they may start to terminate.

Time / price cycles are the single most important indicator and my record calling them is near 100% – since inception seven months ago. The reason they are so important is that a trader does not want to be holding a crude oil instrument at termination of a time cycle if not absolutely sure if price will go up or down. A trade may choose to enter a large position in advance of a time price cycle termination IF THERE IS A HIGH PROBABILITY OF A DIRECTION IN PRICE and if the market is trading at a really important pivot area. In other words, if the market is trading at the bottom of the upward trending channel at a support (yellow lines) and we knew there was a significant probability of a time cycle about to terminate a trader may enter with a long position. The price really spikes or drops significantly when these important time cycles terminate.

The problem with time / price cycle terminations is they change from minute to minute (depending on where price is on the chart) so you have to be in the trade room to get the alert. Our lead traders will do everything they can in future to send these on SMS but we have to be careful because it can be difficult with so much going on in the room. The reason they (time cycles) change is because they are actually represented by or are geometric shapes in the chart – I know it sounds odd but I have (as I mentioned) hit these calls just shy of 100%. The oil political people know the same algorithmic modeling principles and they ALWAYS TIME THEIR BIG ANNOUNCEMENTS AROUND THE TIME PRICE CYCLE TERMINATIONS.

So if you can picture a triangle on the chart – and price is trading in the triangle – and price is going to come to the edge of the triangle and there is a significant support or resistance or an algo line terminating there too or a target (those type of indications)… then we know there is a high probability of a time and price change. In other words, it is where there are clusters of algorithm points that cross and when price is going to cross over that cluster is where they are. And these are represented on all the different time frames – the larger the time frame – the larger the time price cycle termination – the larger the spike or downdraft. This is where we establish our intra-day quadrants from for sniping trades (which we will put in to the room soon because it looks like the geo political rhetoric is over for a while making them more predictable). Difficult to explain in short. So we will do our best to SMS alert these in future.

Also, the real large or important time / price cycle terminations we know far in advance and they can be put in these newsletters.

If you review my Epic the Oil Algo Twitter feed, my blog posts and my story on our website you will get a feel for how accurate these calls are.

Alpha Algo Trading Trend-Lines (Primary – Red dotted lines. Secondary – White dotted lines):

To determine which algo line is most alpha (or probable) intra day, it is the nearest line to price action. This can also help you determine the trend of trade. If the algo line is trending up the price will follow it up until price is tested at an algorithm indicator (the main tests are diagonal trendlines, horizontal trendlines, time / price cycles etc – as I have shared with you). This is why it is important to watch all the lines because they are all support and resistance. To keep it simple trade the range (yellow lines) as I’ve mentioned but keep an eye on these indicators.

Current Alpha Algo Targets (Red circles):

Your closest target that crude is trending toward is always the most probable.Then, your second most probable is the one that is up or down trend depending on whether general price is in an upward or downtrend for the most recent week or so and what your other indicators look like (such as the MA’s I explained above).