Tag: BITCOIN

PreMarket Trading Plan Tues Sept 25: Market Screams Epic Opportunity Near, $DIS, $APDN, $CLRB, $KORS, $NFLX, $BLDP, OIL, Bitcoin, more.

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Tuesday September 25, 2018.

In this premarket trading edition: $DIS, $APDN, $CLRB, $ARMN, $ACST, $XON, $OSIS, $BLDP, $LEBV, $CRON, $NBEV, $NFLX, $FB, $SHOP, OIL, $EDIT, $BABA, $GTHX, $AGN, $ROKU, $CVM, $XXII, $MOMO, $SPY, $SSW, $DXY, $BOX, $CARA, $PROQR, $XBIO, $AAPL, $ARWR, $VIX, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Sept 25 – Lead trader booked for main trading room for market open, mid day review and futures trading this evening (as available and as market demands).

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, special Trading Webinars or when the lead trader is not available.

- In final edits for release this week;

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced in part (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

See the general market news near bottom of this report – the are epic market trading opportunities on the near horizon.

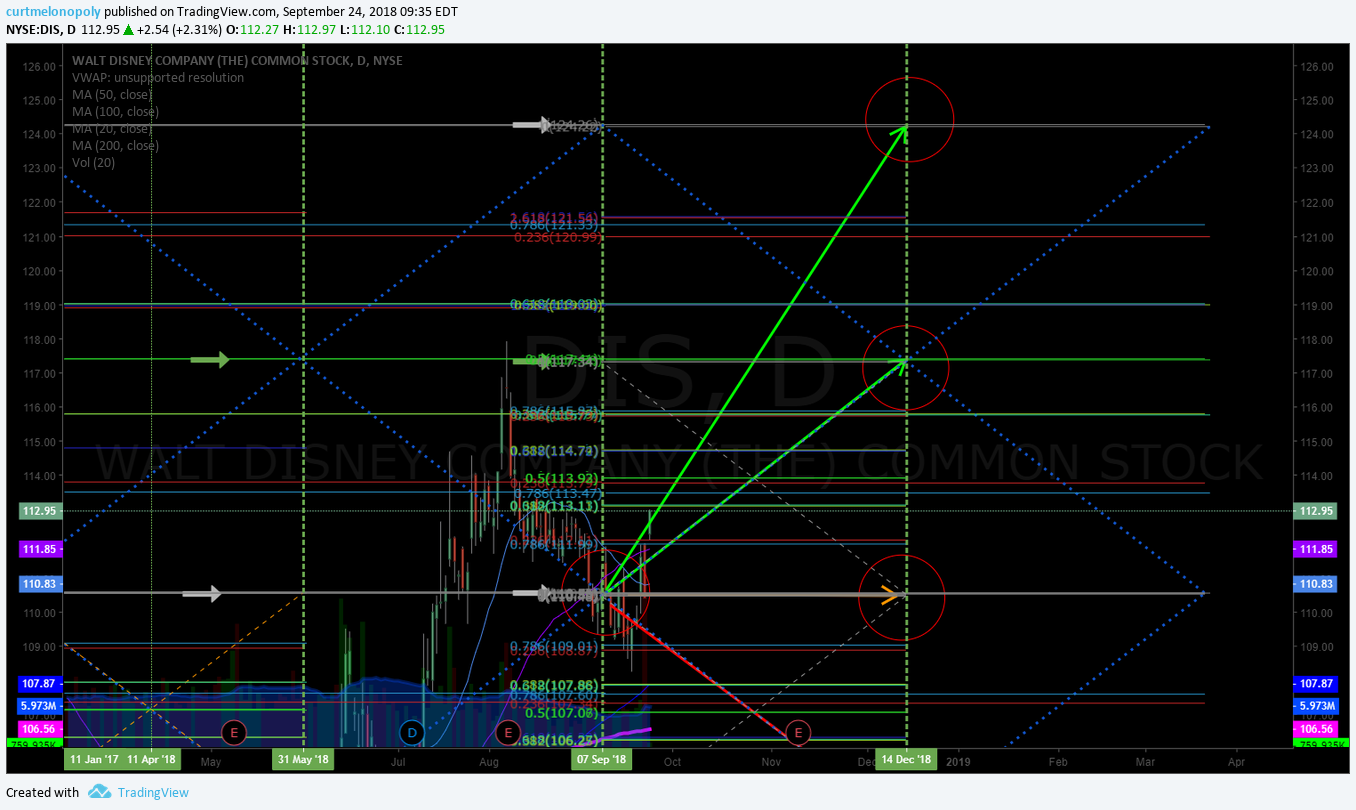

Still watching the week set-up, I expect a significant oil size trade (swing and intra-day) very near, in a new Disney $DIS trade, the $XBIO set-up was awesome and there’s a number of others we are working on. I don’t see any reason why we won’t be able to push these set-ups out this evening after the markets close. There is so much going on right now in the markets (the ground is moving) that we have to start pushing this stuff out and get ready.

Doing some charting in premarket for $CLRB and $APDN – both very interesting set-ups IMO.

BTW the Bitcoin $BTC trade will be big soon, the charting is setting up, we will be updating members on the inflection move prior. We expect up, but we will be alerting the BTC set-up for both scenarios.

Below are some trade position notes from late last week if you didn’t catch them;

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

The videos this week and the boot camp trade set-up reviews have been right in the flow of the market. We’re working on the rest of the equities we follow now and will have them all out over the next few days. Today in mid-day review I will tackle some more of the set-ups.

Market Observation:

Markets as of 7:43 AM: US Dollar $DXY trading 94.25, Oil FX $USOIL ($WTI) trading 72.40, Gold $GLD trading 1201.21, Silver $SLV trading 14.30, $SPY 291.83 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6378.00 and $VIX trading 11.9.

Momentum Stocks / Gaps to Watch: $JAGX $CEI $JONE $ASNA $TLRY $APDN $GNCA $HMNY

30 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/12401306 $JAGX $ASNA $TLRY $MTNB $INFO $TGTX $OPNT $AINC $FDS $PETQ $KORS $CNP

https://twitter.com/CompoundTrading/status/1044562223388127232

News:

$APDN Applied DNA Expands Cannabis Tagging Portfolio to Address Large Growers https://finance.yahoo.com/news/applied-dna-expands-cannabis-tagging-090000755.html?soc_src=hl-viewer&soc_trk=tw … via @YahooFinance

$CLRB: Cellectar’s CLR 131 Receives FDA Orphan Drug Designation for the Treatment of Pediatric Osteosarcoma

Michael Kors takes over fashion icon Versace in $2 billion deal

The Knot parent XO Group’s stock soars after $933 million buyout deal

$FCSC Awarded $1.4M FDA Orphan Grant for FCX-007 for Treatment of Recessive Dystrophic Epidermolysis Bullosa

Fiserv to buy U.S. Bancorp unit’s debt-card processing, ATM services and MoneyPass for $690 million

Aleafia to receive $10 million investment as part of deal to take majority stake in Serruya-led One Plant

$PSTI here is PR: FDA Orphan Drug Designation for PLX cell therapy for the Treatment of Graft Failure

Recent SEC Filings / Insiders:

Recent IPO’s:

Elastic sets IPO terms to raise up to $203 million, to be valued at up to $2 billion

$BNGO REMINDER: Analyst IPO Quiet Period Expiration Today for BioNano Genomics

Ticketing company Eventbrite prices IPO at $23 to raise $230 million

Gritstone Oncology sets terms for IPO to raise up to $91.1 million

Qutoutiao prices IPO at $7 per ADS, raising $84 million

Earnings:

Jabil’s stock jumps after profit, revenue beat expectations

#earnings for the week

$NKE $BB $KMX $RAD $KBH $JBL $ACET $FDS $MANU $BBBY $NEOG $ACN $CCL $INFO $ATU $MTN $WOR $CTAS $MKC $CAG $ASNA $AIR $OMN $CMD $FGP $PRGS $ESNC $ANGO $CAMP $FUL $DAC $ISR $SCHL

#earnings for the week$NKE $BB $KMX $RAD $KBH $JBL $ACET $FDS $MANU $BBBY $NEOG $ACN $CCL $INFO $ATU $MTN $WOR $CTAS $MKC $CAG $ASNA $AIR $OMN $CMD $FGP $PRGS $ESNC $ANGO $CAMP $FUL $DAC $ISR $SCHL https://t.co/r57QUKKDXL https://t.co/pVka1Ud3QD

— Melonopoly (@curtmelonopoly) September 24, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

DISNEY (DIS) trade alert long 112.30, over 112.10 targets 117.38 or 124.27 Dec 14 pending trajectory of trade $DIS #swingtrading #tradealerts

As the media wars heat up, Chart Master Carter Worth sees one company as a buy: Disney $DIS #swingtrading

As the media wars heat up, Chart Master Carter Worth sees one company as a buy: Disney $DIS #swingtrading https://t.co/KiWbcjO7PO

— Swing Trading (@swingtrading_ct) September 25, 2018

Best Oil Stocks to Buy Now https://finance.yahoo.com/news/best-oil-stocks-buy-now-012433429.html?soc_src=social-sh&soc_trk=tw …

Best Oil Stocks to Buy Now https://t.co/mh3568k1o0 via @YahooFinance

— Melonopoly (@curtmelonopoly) September 24, 2018

APPLE (AAPL) premarket bullish momentum with 20 MA test and 224.60 range buy sell trigger above $AAPL #swingtrading #tradealerts

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

CARA THERAPEUTICS (CARA) Nice swing trade from trading bootcamp in to next leg at resistance intra day $CARA #swingtrade #tradealert

OSI SYSTEMS (OSIS) Trading 77.55 testing 50 MA and key Fib resistance, over targets 84.21 Dec 28, 18 $OSIS #tradealerts #swingtrading

ADVANCED MICRO (AMD) hit key support and bounced, targets 33.62 Oct 2 or sell off 28.87, watch structure uoutlined on chart #swingtrading #tradealerts

BALLARD POWER (BLDP) Five out of five of the last major time cycles price reversed, Oct 10 is next time cycle peak. $BLDP #swingtrading #tradealerts

LEVEL BRANDS (LEVB) trading 6.54 premarket long in to 8.09 price target, 6.16 area support. $LEVB #daytrading #swingtrade

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

CRONOS – per yesterday’s trade alert and review video over trendline on way to resistance test in premarket $CRONO #tradealert #premarket

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

CVM Looking to break recent highs out of bullish bowl targets 5.00 then 6.00. $CVM #swingtrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

SP500 (SPY) near break upside test, above signals targets 293, 294.20, 295.50, 297 resistance Sept 21 ish $SPY $ES_F $SPXL $SPXS #SPY #Swingtrade #tradingalerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

PROQR THERAPEUTICS (PRQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

Seems we are on doorstep of the biggest opportunities in my 30 years of market involvement. Gut feeling…. but I think when I look back in a year I’ll be like…. yep. Last time I was saying this was prior to election, that next quarter was epic for us #premarket #trading

https://twitter.com/curtmelonopoly/status/1044559698639409152

The Federal Reserve will raise interest rates this week and continue its quarterly drumbeat of 25-basis-point increases straight through to June 2019.

Read: https://goo.gl/TUWp3h

The Federal Reserve will raise interest rates this week and continue its quarterly drumbeat of 25-basis-point increases straight through to June 2019.

Read: https://t.co/Hznba52AsN pic.twitter.com/fhbWNjspBZ

— NDTV Profit (@NDTVProfitIndia) September 25, 2018

Record-beating S&P 500® stock buybacks…yesterday’s preliminary results indicated $190.6 billion of shares repurchased in Q2 2018, up 58.7% compared to Q2 2017… dollar amount displaced previous quarterly record of $189.1 billion, set in Q1 2018

Record-beating S&P 500® stock buybacks…yesterday’s preliminary results indicated $190.6 billion of shares repurchased in Q2 2018, up 58.7% compared to Q2 2017… dollar amount displaced previous quarterly record of $189.1 billion, set in Q1 2018 @SPGlobal

— Liz Ann Sonders (@LizAnnSonders) September 25, 2018

If you’re holding $GOOGL (YouTube) $TWTR $FB and others in to the Trump / Globalist battlefield starting to heat up…. not sure I would. You may want to look at the players on the other side of each key battle. #swingtrading

If you're holding $GOOGL (YouTube) $TWTR $FB and others in to the Trump / Globalist battlefield starting to heat up…. not sure I would. You may want to look at the players on the other side of each key battle. #swingtrading

— Melonopoly (@curtmelonopoly) September 25, 2018

Liquidity in emerging-markets high-yield debt has dried up steadily this year. Bloomberg Intelligence’s Damian Sassower charts average the bid-ask spreads in the debt and how they’ve widened by 49% so far this year.

Liquidity in emerging-markets high-yield debt has dried up steadily this year. Bloomberg Intelligence's Damian Sassower charts average the bid-ask spreads in the debt and how they've widened by 49% so far this year. pic.twitter.com/1Ycp2TRPgx

— Lisa Abramowicz (@lisaabramowicz1) September 25, 2018

The biggest oil producing nations don’t have that much capacity to pump more crude, raising concern that prices could rise if there’s further disruption in Libya, Iran or Venezuela. Here’s a chart of how much OPEC nations could produce less the amount they’re currently pumping.

The biggest oil producing nations don't have that much capacity to pump more crude, raising concern that prices could rise if there's further disruption in Libya, Iran or Venezuela. Here's a chart of how much OPEC nations could produce less the amount they're currently pumping. pic.twitter.com/sbhPTNX4Qf

— Lisa Abramowicz (@lisaabramowicz1) September 25, 2018

The trade wars – moderate market concern, the fact that oil is being run up and that the Dollar could rock higher – considerable, Fed – considerable, but if gut is right…. Trump / Globalist show down gonna rock the markets $VIX – my guess… mid Dec thru mid Feb. Just a guess.

The trade wars – moderate market concern, the fact that oil is being run up and that the Dollar could rock higher – considerable, Fed – considerable, but if gut is right…. Trump / Globalist show down gonna rock the markets $VIX – my guess… mid Dec thru mid Feb. Just a guess.

— Melonopoly (@curtmelonopoly) September 25, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $JAGX $CEI $JONE $APDN $TLRY $ASNA $NBEV $GERN $PSTI $PYX $CRON $GOLD $TS $ABX $AEG $MDGS $CGC

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $TTD $NVDA $SQ $AMZN $AMRN $ALXN $HP $VCTR $IRET $HCCI $WK $SAIC $HP $ASC $AKOB $TS $CNI $ABX $CLX

Square stock gains after Instinet boosts target to $125, compares it to the FANGs

(6) Recent Downgrades: $CY $DFIN $MPWR $ON $MCHP $INTC $ADI $CY $VALE $GG $SBOW $HEP $OIBR $MDTR $CACI

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, $DIS, $APDN, $CLRB, $KORS, $NFLX, $BLDP, OIL, Bitcoin

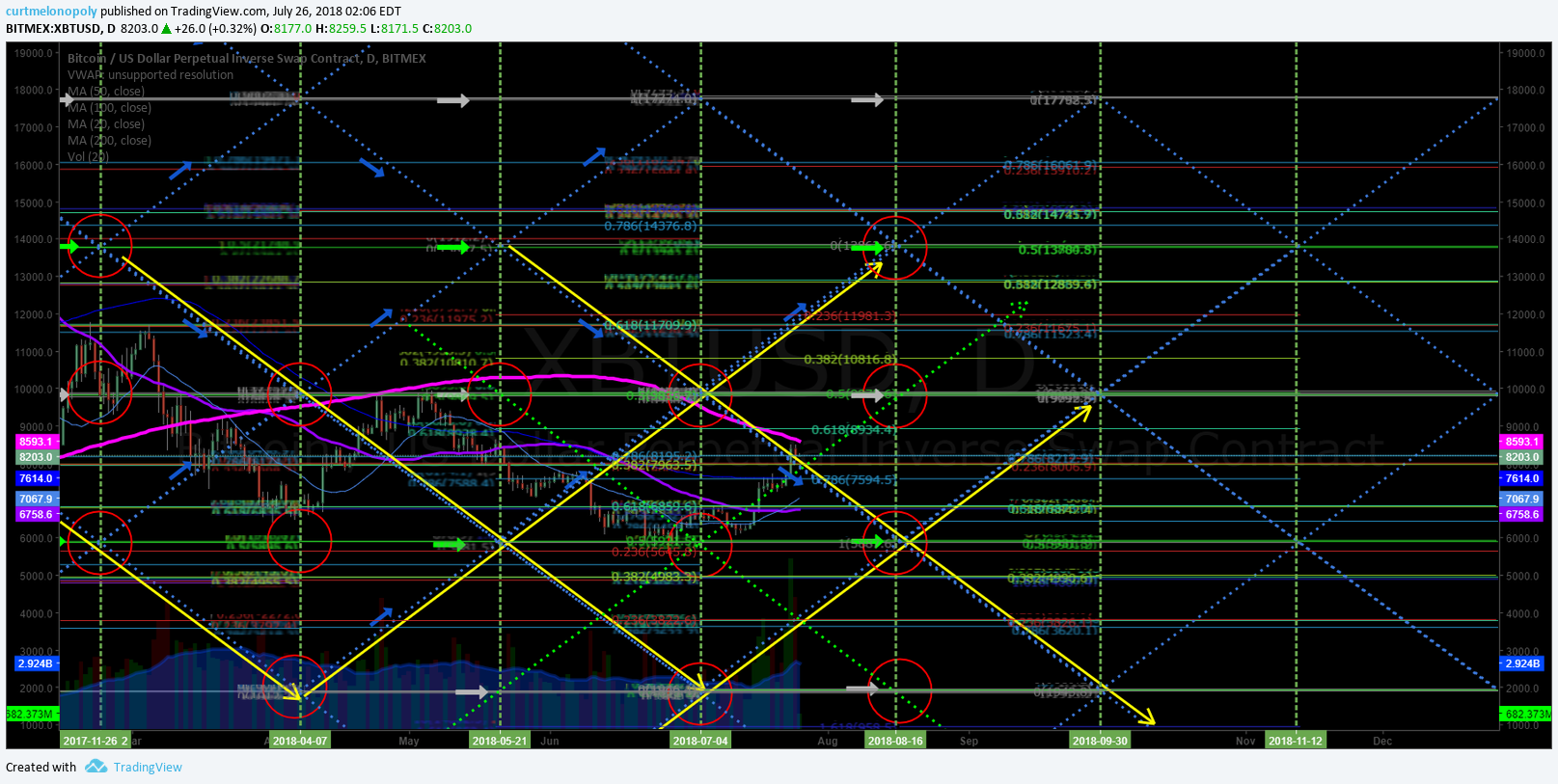

Bitcoin Algorithm (Crypto). Thurs July 26. $BTC $XBTUSD $XBT $ETH $LTC $XRP #Bitcoin #Algorithm

Bitcoin Algorithm Report (Crypto). Thursday July 26, 2018. Includes Time Cycles, Price Targets and Buy / Sell Triggers.

$BTC $BTCUSD $XBTUSD $XBT $BTC.X $ETH $LTC $XRP #Bitcoin #Crypto

Hello, my name is Crypto the Bitcoin Algorithm. Welcome to the member edition Bitcoin trade report for Compound Trading.

Like our other algorithmic chart models, I am in development and testing for coding phase to be used as an intelligent assistant for our traders. My algorithm charting model is specifically suitable for the use and purpose of trading Bitcoin $BTCUSD, Bitcoin/USD perpetual swaps $XBTUSD, Bitcoin related equities and you will find additional preliminary algorithmic modeling for $ETH, $LTC and $XRP in this report.

Note: The $XBTUSD (Bitcoin swaps) model is built on a chart from BitMEX. Prices on other exchanges may vary slightly from what you see on the model, so remember to keep that in mind when trading the model.

Notices:

- More extensive chart models for $BTCUSD, $ETHUSD, $XRPUSD, $LTCUSD and others (such as a few bitcoin related equities) will be featured in future reporting.

- Join us in our private Crypto Trading room server on discord!

- For newer users – read the blog post about how to trade Bitcoin here.

Primary Methods of Bitcoin Trade:

The primary method of trade we have found works with the most predictability is to wait for bitcoin to breach the upper right wall of a quadrant (the orange, blue or grey diagonal dotted lines – the thicker lines are more significant as they represent wider time-frames) and confirm over the next horizontal Fibonacci resistance. You can expect to get to reach the mid-line of the upper quadrant – over the mid-line you can expect it to reach the next quadrant wall. Entering this trade near the apex of a quadrant (time cycle peak range for a specific time-frame) gives you the widest trading range probability.

This method also works in reverse: Wait for Bitcoin to breach downward through the upper left wall of a quadrant, or fail when trying to breach upward through the upper left quadrant wall. Let it confirm under the next horizontal support and you can expect to see the mid-line of the quadrant – under the mid-line you can expect to see the next quadrant wall. Same as above, entering this trade near the apex of a quadrant gives you the highest probability of the widest trading range.

Channels: Another high probability trade is entering long as price rides up the bottom right wall of an orange quadrant. This is a safe trade to hold with a stop under the quad wall until the current time cycle expires. This trade works in reverse as well. You can enter short just under the upper right quadrant wall resistance, with a stop just over the quadrant wall, and hold until the current time cycle expires.

Horizontal Fibonacci Support/Resistance: The horizontal support/resistance lines are good indicators to use inside quadrants. The light green 0.5 Fibonacci line and the grey 1.0 or 0 Fibonacci levels (mid-lines) are the most significant. Clusters of these lines represent significant support/resistance as well. Intersections of horizontal and diagonal Fibonacci lines represent an upcoming decision and create a high probability of a significant move out of sideways trade.

Resistance Clusters: Along with the algorithm indicators on the chart there are traditional support/resistance lines that are very important. When these lines converge volatility tends to increase. Under the cluster is a high probability short. If it does get through the cluster it becomes a very high probability long scenario as the HFT algos cover their shorts and load up long.

Targets: Red circles on charting. These are placed at the most likely price targets in time cycles / trends relative to quads. These are still in very early stage of development/testing and should be used for observation only at this point. Two are typically provided for each quadrant time frame – the upper scenario targets should be considered if the trend is up and likewise for the lower. I do not recommend entering trades based on these targets. Also, at times the mid quad support / resistance line is highlighted with a target if trade is not extremely bullish or bearish.

Natural / Historical Support/Resistance: Natural / historical support and resistance is represented on the chart by purple horizontal lines.

Conventional Charting: Conventional charting should be weighed against the model(s) with all trade decisions.

In summary, our first generation Bitcoin algorithm chart model uses the following indicators (listed from most predictable to least in terms of win rate):

- Trading range created by long term algorithmic modeled quadrant support and resistance (blue dotted lines)

- Trading range between buy/sell trigger levels (grey/green arrows and solid lines)

- Directional channels formed by long term algorithmic modeled support and resistance

- Horizontal Fibonacci support and resistance (multi-colored horizontal lines)

- Conventional Natural support and resistance (purple horizontal lines)

- Long term conventional trend lines (red diagonal lines)

- Conventional MA’s

Bitcoin Algorithm – Daily Chart (Suitable for Swing Trading):

Click link to open initial chart viewer screen, then share button at bottom right of screen, then make it mine, then double click on chart body to hide or reveal indicators at bottom of chart (MACD etc).

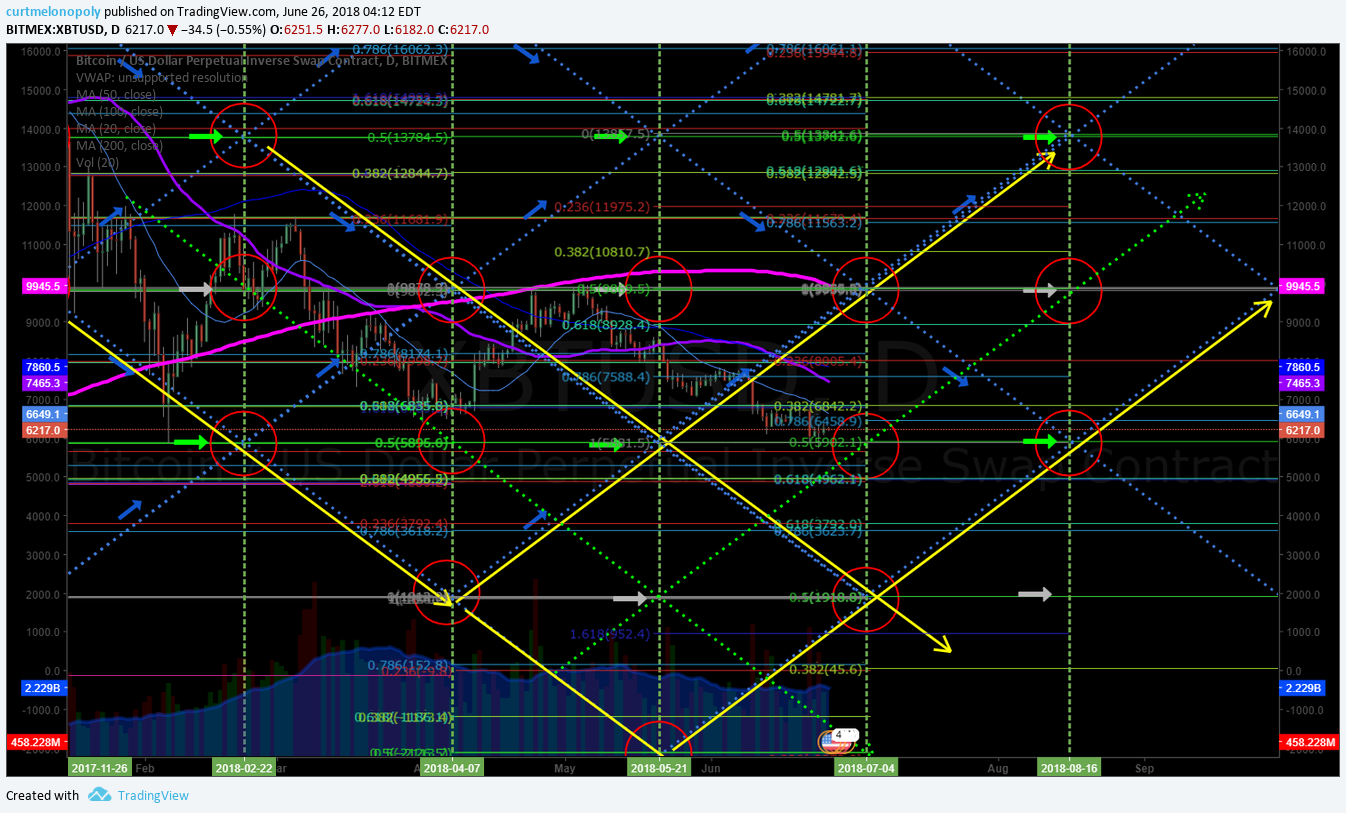

Bitcoin Algorithm. Daily chart model testing 50 MA resistance in possible turn up channel. 207 AM July 26 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daily chart model testing 50 MA resistance in possible turn. 302 AM July 17 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Trading Plan (Observations / Chart Indicators):

July 26 – As with the last two previous reports, it is a 50 MA resistance test but the trajectory of downdraft is changing and a turn is possible soon. Watching.

July 17 – As with previous, it is a 50 MA test but the trajectory of downdraft is changing and a turn is possible soon. Patiently watching.

July 9 – Trading just under 50 MA, watching for a decision at the 50 MA test for direction.

June 26 – Range bound trade – waiting for a direction.

June 19 – My current bias and trading plan is exactly what it was last report (range bound trade)

June 11 – If Bitcoin $XBTUSD dumps lower than 5900.00 then high probability it continues in down channel (illustrated down channel with yellow arrows). It holds and up channel is in play (also illustrated on charting).

On the daytrading chart below it seems too early to comment on a bias… looking for structure to build.

My personal bias is it should turn up channel, conventionally that makes sense in trading after a dump, however, the 5900.00 is key as a mid quad area.

A few tweets / comments in private Bitcoin member serve recently reflecting my bias:

And we’re there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto

And we're there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto pic.twitter.com/fK3u1dM7mx

— Melonopoly (@curtmelonopoly) June 10, 2018

Bitcoin Algorithm. 30 Minute Charting (Suitable for Daytrading BTC).

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 324 AM July 26 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 327 AM July 17 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 136 AM July 9 $BTC $XBTUSD #Bitcoin #Algorithm

Recent Bitcoin Real-Time Trade Alerts / Charting Set-up Alerts

If you are reviewing this newsletter (as a historical unlocked post) and not a member of our service and would like a tour of our private discord server (trading chat / alerts etc) or our private Twitter member $BTC alert feed let us know. You can check out our call rate for yourself. Transparent trading is important to us.

July 26 – Alert examples will be updated soon.

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading pic.twitter.com/RM68yktgur

— Melonopoly (@curtmelonopoly) May 20, 2018

May 13 – Will post recent alerts soon when time allows.

Per recent;

April 29 – There have been many calls since bottom on our private server and private twitter feed… I’m not going to take the time to post them here right now but I will post this rant of tweets… the private member alerts I’ll post next report if time (they were all spot on alerts).

I even told ya how I knew where the bottom was. $BTC #Bitcoin #algorithm

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading screenshot

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading

$BTC near HOD and some bullish action on intra. Tweet screen shot.

$BTC near HOD and some bullish action on intra. $BTC #bitcoin #calls

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading pic.twitter.com/l1pafs56QD

— Crypto the BTC Algo (@CryptotheAlgo) April 18, 2018

Bitcoin coming in to a possible buy trigger zone on daytrading chart. $BTC #Bitcoin

https://twitter.com/BTCAlerts_CT/status/978317583987429376

$BTC Bitcoin popped now 400 points since alert of support. Not a bad RR here for long test. If nothing else a day trade.

https://twitter.com/BTCAlerts_CT/status/978397655796801538

Bitcoin time price cycle peak coming April 7 – path of least resistance down target but my bias is to up. Trade price. We start trading live again Monday so I’ll broadcast our trading group moves live for this setup. $BTC #Bitcoin #trading #crypto (alerted in private member Discord server)

And the result…. price is dumping in to lower target identified on trade alert…. intrad-day getting close. Charting wins. Trader bias not so good on this one.

Ethereum Algorithm. Basic Charting Model on Daily Time Frame:

Ethereum Algorithm. Daily Chart. Price testing 50 MA resistance, in channel. On watch. July 26 26 332 AM $ETH $ETHUSD #Ethereum #Algorithm

Ethereum Algorithm. Daily Chart. 625 resistance 418 support July 9 316 AM $ETH $ETHUSD #Ethereum #Algorithm

Ethereum Algorithm. Daily Chart. Price in channel, with weak trade. On watch. June 26 434 AM $ETH $ETHUSD #Ethereum #Algorithm

Litecoin Algorithm. Basic Charting Model.

Primary buy sell triggers on Litecoin daily chart:

475.00

381.00

287.00

192.00

98.00

July 26 – No significant change to below;

Litecoin Algorithm. LTC showing signs of possible bottom turn reversal. July 17 332 AM $LTCUSD #Litecoin #Algorithm

Litecoin Algorithm. LTC still in down trend channel. July 9 324 AM $LTCUSD #Litecoin #Algorithm

Ripple Basic Algorithm Charting Model $XRP

July 26 – No noteworthy change.

July 17 – No noteworthy change.

July 9 – No noteworthy change.

May 13 – Ripple needs .932 for a chance for a bullish structured run. $XRP $XRPUSD.

I put some tighter time from Fib structure in the model for those that asked for daytrading signals.

Per recent;

May 10 – Nothing to report. Flat.

April 29 – $XRP flat but over 200 MA on daily.

BUT still great returns from 40s to near 90s WOW.

https://www.tradingview.com/chart/XRPUSD/0aDABOJz-XRP-flat-but-over-200-MA-on-daily/

Per recent;

April 22 – $XRP over .888 targets 1.31 then 1.65 mid term. Daytrading model on -deck. #ripple

Crypto News:

Crypto Markets Recover After Weekend Losses Saw Bitcoin at Lowest 2018 Level

< End of report >

Any questions give us a shout anytime!

Follow Me:

Live Twitter Alert Feed for Bitcoin Trade Set-ups: @BTCAlerts_CT, Public Feed: @cryptothealgo

To Subscribe to our Crypto Services:

Link to Services and Pricing Overview (master list).

Link to Standalone $BTC Crypto Newsletter.

Link to Real-Time Live Bitcoin Alerts (Twitter).

Link to Crypto Bundle (Alerts, Private Trading Discord Server, Newsletter).

Review historical (unlocked to public) Weekly Bitcoin Newsletter Algorithm Reporting. Scroll down landing page to get to historical reports.

Post topics; Crypto, Algorithm, BTC, Bitcoin, chart, $BTC, $BTCUSD, $XBTUSD, $BTC.X, $ETH, $LTC, $XRP, trade, price targets, time cycles

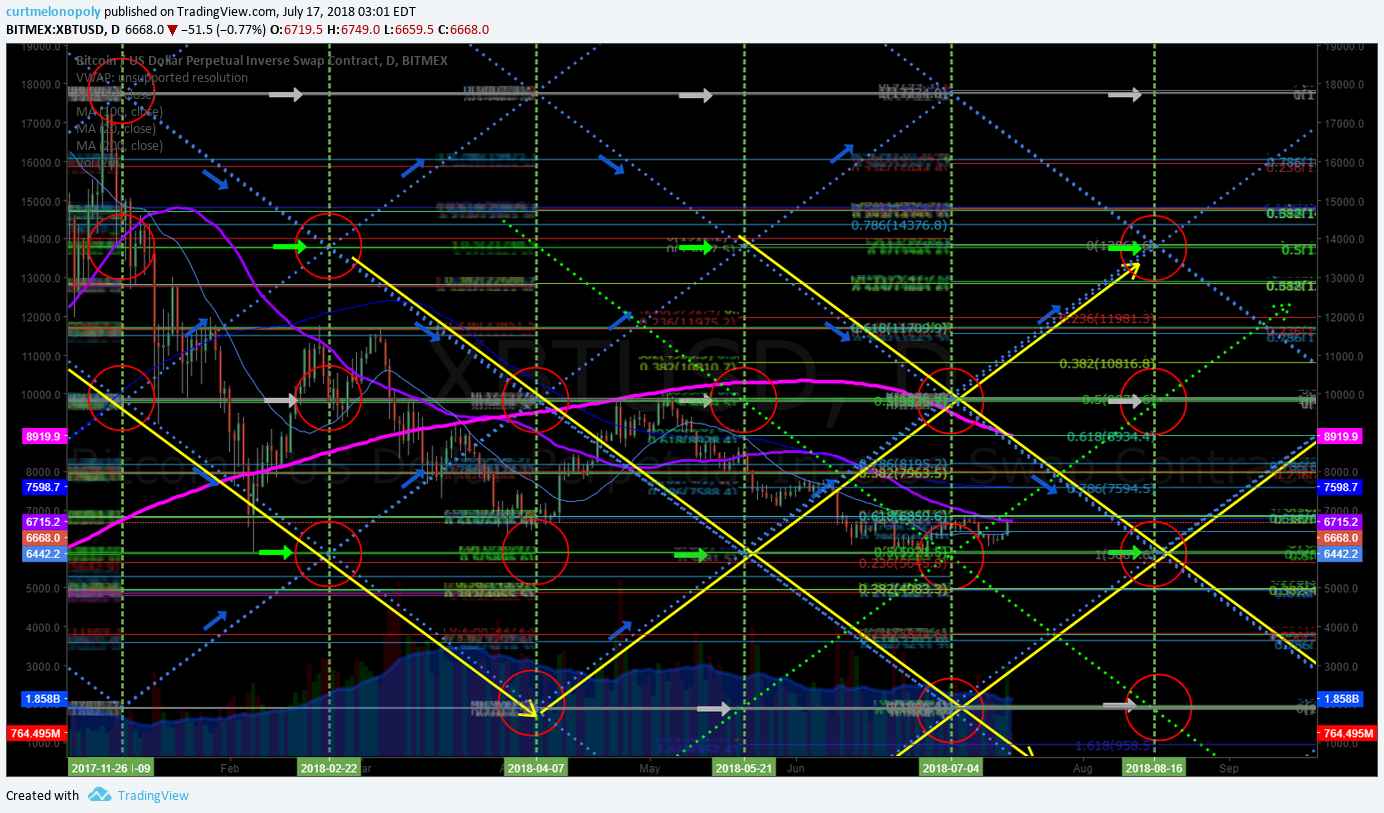

Bitcoin Algorithm (Crypto). Tues July 17. $BTC $XBTUSD $XBT $ETH $LTC $XRP #Bitcoin #Algorithm

Bitcoin Algorithm Report (Crypto). Tuesday July 17, 2018. Includes Time Cycles, Price Targets and Buy / Sell Triggers.

$BTC $BTCUSD $XBTUSD $XBT $BTC.X $ETH $LTC $XRP #Bitcoin #Crypto

Hello, my name is Crypto the Bitcoin Algorithm. Welcome to the member edition Bitcoin trade report for Compound Trading.

Like our other algorithmic chart models, I am in development and testing for coding phase to be used as an intelligent assistant for our traders. My algorithm charting model is specifically suitable for the use and purpose of trading Bitcoin $BTCUSD, Bitcoin/USD perpetual swaps $XBTUSD, Bitcoin related equities and you will find additional preliminary algorithmic modeling for $ETH, $LTC and $XRP in this report.

Note: The $XBTUSD (Bitcoin swaps) model is built on a chart from BitMEX. Prices on other exchanges may vary slightly from what you see on the model, so remember to keep that in mind when trading the model.

Notices:

- More extensive chart models for $BTCUSD, $ETHUSD, $XRPUSD, $LTCUSD and others (such as a few bitcoin related equities) will be featured in future reporting.

- Join us in our private Crypto Trading room server on discord!

- For newer users – read the blog post about how to trade Bitcoin here.

Primary Methods of Bitcoin Trade:

The primary method of trade we have found works with the most predictability is to wait for bitcoin to breach the upper right wall of a quadrant (the orange, blue or grey diagonal dotted lines – the thicker lines are more significant as they represent wider time-frames) and confirm over the next horizontal Fibonacci resistance. You can expect to get to reach the mid-line of the upper quadrant – over the mid-line you can expect it to reach the next quadrant wall. Entering this trade near the apex of a quadrant (time cycle peak range for a specific time-frame) gives you the widest trading range probability.

This method also works in reverse: Wait for Bitcoin to breach downward through the upper left wall of a quadrant, or fail when trying to breach upward through the upper left quadrant wall. Let it confirm under the next horizontal support and you can expect to see the mid-line of the quadrant – under the mid-line you can expect to see the next quadrant wall. Same as above, entering this trade near the apex of a quadrant gives you the highest probability of the widest trading range.

Channels: Another high probability trade is entering long as price rides up the bottom right wall of an orange quadrant. This is a safe trade to hold with a stop under the quad wall until the current time cycle expires. This trade works in reverse as well. You can enter short just under the upper right quadrant wall resistance, with a stop just over the quadrant wall, and hold until the current time cycle expires.

Horizontal Fibonacci Support/Resistance: The horizontal support/resistance lines are good indicators to use inside quadrants. The light green 0.5 Fibonacci line and the grey 1.0 or 0 Fibonacci levels (mid-lines) are the most significant. Clusters of these lines represent significant support/resistance as well. Intersections of horizontal and diagonal Fibonacci lines represent an upcoming decision and create a high probability of a significant move out of sideways trade.

Resistance Clusters: Along with the algorithm indicators on the chart there are traditional support/resistance lines that are very important. When these lines converge volatility tends to increase. Under the cluster is a high probability short. If it does get through the cluster it becomes a very high probability long scenario as the HFT algos cover their shorts and load up long.

Targets: Red circles on charting. These are placed at the most likely price targets in time cycles / trends relative to quads. These are still in very early stage of development/testing and should be used for observation only at this point. Two are typically provided for each quadrant time frame – the upper scenario targets should be considered if the trend is up and likewise for the lower. I do not recommend entering trades based on these targets. Also, at times the mid quad support / resistance line is highlighted with a target if trade is not extremely bullish or bearish.

Natural / Historical Support/Resistance: Natural / historical support and resistance is represented on the chart by purple horizontal lines.

Conventional Charting: Conventional charting should be weighed against the model(s) with all trade decisions.

In summary, our first generation Bitcoin algorithm chart model uses the following indicators (listed from most predictable to least in terms of win rate):

- Trading range created by long term algorithmic modeled quadrant support and resistance (blue dotted lines)

- Trading range between buy/sell trigger levels (grey/green arrows and solid lines)

- Directional channels formed by long term algorithmic modeled support and resistance

- Horizontal Fibonacci support and resistance (multi-colored horizontal lines)

- Conventional Natural support and resistance (purple horizontal lines)

- Long term conventional trend lines (red diagonal lines)

- Conventional MA’s

Bitcoin Algorithm – Daily Chart (Suitable for Swing Trading):

Click link to open initial chart viewer screen, then share button at bottom right of screen, then make it mine, then double click on chart body to hide or reveal indicators at bottom of chart (MACD etc).

Bitcoin Algorithm. Daily chart model testing 50 MA resistance in possible turn. 302 AM July 17 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daily chart model. 208 AM July 9 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Trading Plan (Observations / Chart Indicators):

July 17 – As with previous, it is a 50 MA test but the trajectory of downdraft is changing and a turn is possible soon. Patiently watching.

July 9 – Trading just under 50 MA, watching for a decision at the 50 MA test for direction.

June 26 – Range bound trade – waiting for a direction.

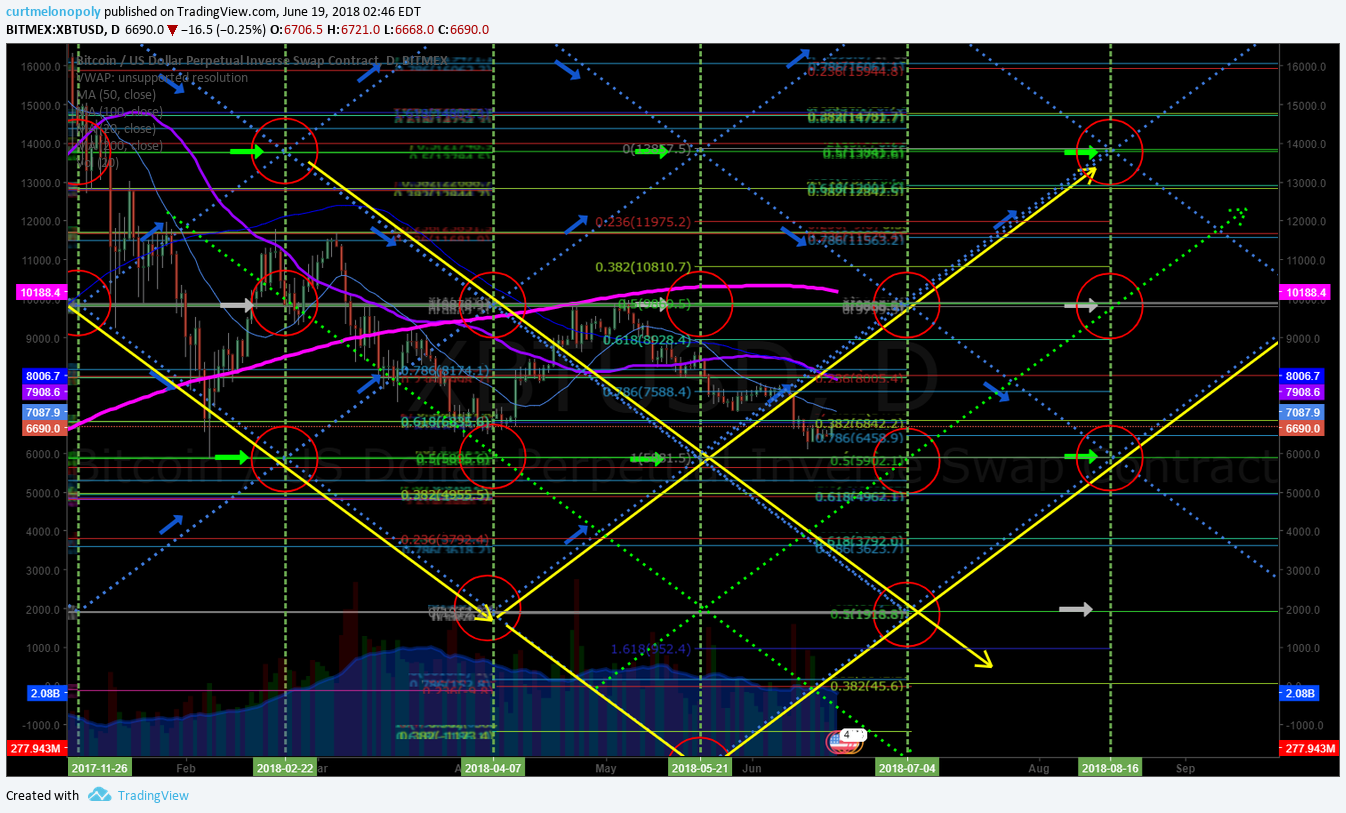

June 19 – My current bias and trading plan is exactly what it was last report (range bound trade)

June 11 – If Bitcoin $XBTUSD dumps lower than 5900.00 then high probability it continues in down channel (illustrated down channel with yellow arrows). It holds and up channel is in play (also illustrated on charting).

On the daytrading chart below it seems too early to comment on a bias… looking for structure to build.

My personal bias is it should turn up channel, conventionally that makes sense in trading after a dump, however, the 5900.00 is key as a mid quad area.

A few tweets / comments in private Bitcoin member serve recently reflecting my bias:

And we’re there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto

And we're there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto pic.twitter.com/fK3u1dM7mx

— Melonopoly (@curtmelonopoly) June 10, 2018

Bitcoin Algorithm. 30 Minute Charting (Suitable for Daytrading BTC).

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 327 AM July 17 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 136 AM July 9 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading chart with buy sell triggers (white arrows) 428 AM June 26 $BTC $XBTUSD #Bitcoin #Algorithm

Recent Bitcoin Real-Time Trade Alerts / Charting Set-up Alerts

If you are reviewing this newsletter (as a historical unlocked post) and not a member of our service and would like a tour of our private discord server (trading chat / alerts etc) or our private Twitter member $BTC alert feed let us know. You can check out our call rate for yourself. Transparent trading is important to us.

July 17 – Alert examples will be updated soon.

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading pic.twitter.com/RM68yktgur

— Melonopoly (@curtmelonopoly) May 20, 2018

May 13 – Will post recent alerts soon when time allows.

Per recent;

April 29 – There have been many calls since bottom on our private server and private twitter feed… I’m not going to take the time to post them here right now but I will post this rant of tweets… the private member alerts I’ll post next report if time (they were all spot on alerts).

I even told ya how I knew where the bottom was. $BTC #Bitcoin #algorithm

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading screenshot

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading

$BTC near HOD and some bullish action on intra. Tweet screen shot.

$BTC near HOD and some bullish action on intra. $BTC #bitcoin #calls

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading pic.twitter.com/l1pafs56QD

— Crypto the BTC Algo (@CryptotheAlgo) April 18, 2018

Bitcoin coming in to a possible buy trigger zone on daytrading chart. $BTC #Bitcoin

https://twitter.com/BTCAlerts_CT/status/978317583987429376

$BTC Bitcoin popped now 400 points since alert of support. Not a bad RR here for long test. If nothing else a day trade.

https://twitter.com/BTCAlerts_CT/status/978397655796801538

Bitcoin time price cycle peak coming April 7 – path of least resistance down target but my bias is to up. Trade price. We start trading live again Monday so I’ll broadcast our trading group moves live for this setup. $BTC #Bitcoin #trading #crypto (alerted in private member Discord server)

And the result…. price is dumping in to lower target identified on trade alert…. intrad-day getting close. Charting wins. Trader bias not so good on this one.

Ethereum Algorithm. Basic Charting Model on Daily Time Frame:

Ethereum Algorithm. Daily Chart. 625 resistance 418 support July 9 316 AM $ETH $ETHUSD #Ethereum #Algorithm

Ethereum Algorithm. Daily Chart. Price in channel, with weak trade. On watch. June 26 434 AM $ETH $ETHUSD #Ethereum #Algorithm

Per recent;

Ethereum Algorithm. Daily Chart. Price may test upside moving averages resistance. On watch. June 19 350 AM $ETH $ETHUSD #Ethereum #Algorithm

Litecoin Algorithm. Basic Charting Model.

Primary buy sell triggers on Litecoin daily chart:

475.00

381.00

287.00

192.00

98.00

Litecoin Algorithm. LTC showing signs of possible bottom turn reversal. July 17 332 AM $LTCUSD #Litecoin #Algorithm

Litecoin Algorithm. LTC still in down trend channel. July 9 324 AM $LTCUSD #Litecoin #Algorithm

Ripple Basic Algorithm Charting Model $XRP

July 17 – No noteworthy change.

July 9 – No noteworthy change.

May 13 – Ripple needs .932 for a chance for a bullish structured run. $XRP $XRPUSD.

I put some tighter time from Fib structure in the model for those that asked for daytrading signals.

Per recent;

May 10 – Nothing to report. Flat.

April 29 – $XRP flat but over 200 MA on daily.

BUT still great returns from 40s to near 90s WOW.

https://www.tradingview.com/chart/XRPUSD/0aDABOJz-XRP-flat-but-over-200-MA-on-daily/

Per recent;

April 22 – $XRP over .888 targets 1.31 then 1.65 mid term. Daytrading model on -deck. #ripple

Crypto News:

Crypto Markets Recover After Weekend Losses Saw Bitcoin at Lowest 2018 Level

< End of report >

Any questions give us a shout anytime!

Follow Me:

Live Twitter Alert Feed for Bitcoin Trade Set-ups: @BTCAlerts_CT, Public Feed: @cryptothealgo

To Subscribe to our Crypto Services:

Link to Services and Pricing Overview (master list).

Link to Standalone $BTC Crypto Newsletter.

Link to Real-Time Live Bitcoin Alerts (Twitter).

Link to Crypto Bundle (Alerts, Private Trading Discord Server, Newsletter).

Review historical (unlocked to public) Weekly Bitcoin Newsletter Algorithm Reporting. Scroll down landing page to get to historical reports.

Post topics; Crypto, Algorithm, BTC, Bitcoin, chart, $BTC, $BTCUSD, $XBTUSD, $BTC.X, $ETH, $LTC, $XRP, trade, price targets, time cycles

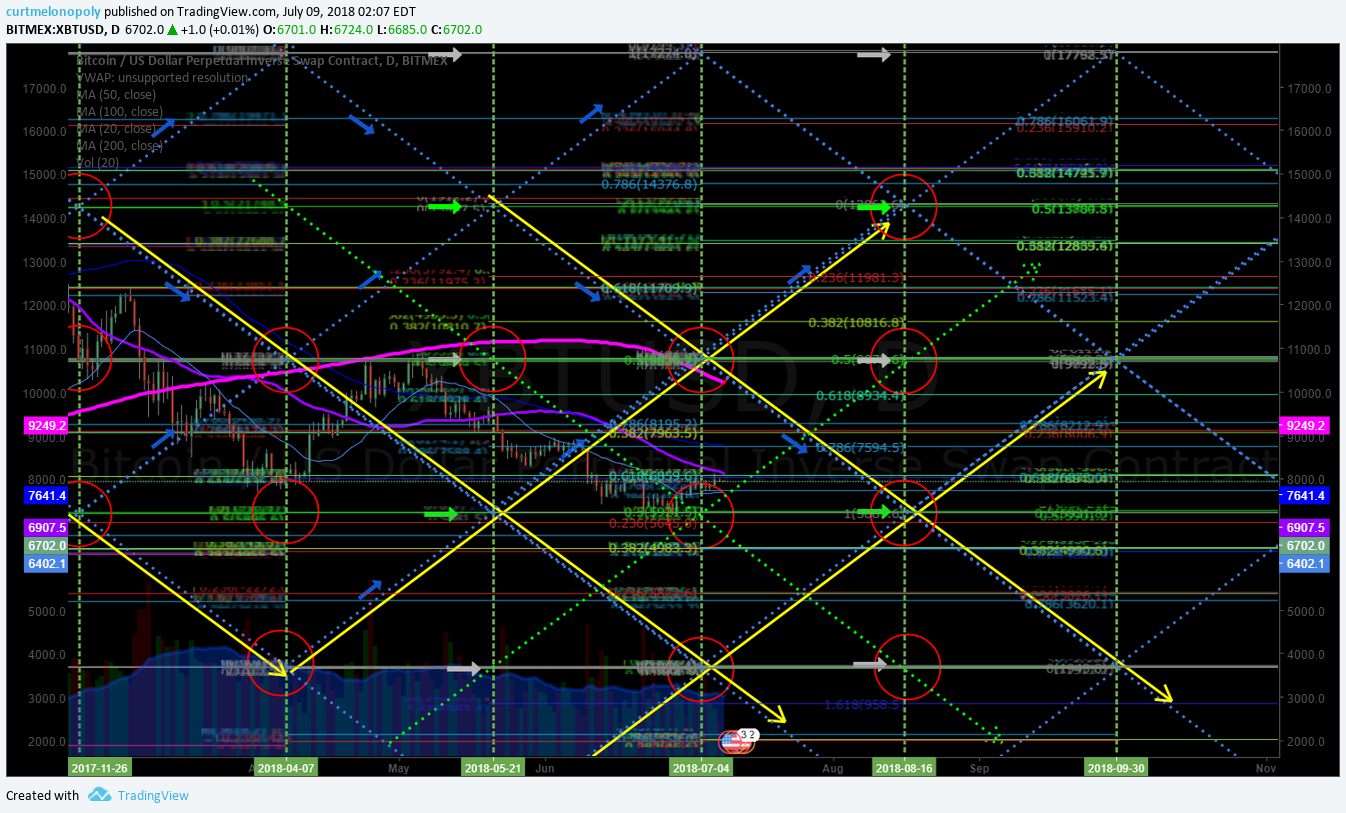

Bitcoin Algorithm (Crypto). Mon July 9. $BTC $XBTUSD $XBT $ETH $LTC $XRP #Bitcoin #Algorithm

Bitcoin Algorithm Report (Crypto). Monday July 9, 2018. Includes Time Cycles, Price Targets and Buy / Sell Triggers.

$BTC $BTCUSD $XBTUSD $XBT $BTC.X $ETH $LTC $XRP #Bitcoin #Crypto

Hello, my name is Crypto the Bitcoin Algorithm. Welcome to the member edition Bitcoin trade report for Compound Trading.

Like our other algorithmic chart models, I am in development and testing for coding phase to be used as an intelligent assistant for our traders. My algorithm charting model is specifically suitable for the use and purpose of trading Bitcoin $BTCUSD, Bitcoin/USD perpetual swaps $XBTUSD, Bitcoin related equities and you will find additional preliminary algorithmic modeling for $ETH, $LTC and $XRP in this report.

Note: The $XBTUSD (Bitcoin swaps) model is built on a chart from BitMEX. Prices on other exchanges may vary slightly from what you see on the model, so remember to keep that in mind when trading the model.

Notices:

- Our 24 hour crypto trading desk is live and this team will be alerting to feeds this week. This team of three is also responsible for the development and coding of our algorithms and alerting to realtime Twitter alert feeds. Read more here; https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

- More extensive chart models for $BTCUSD, $ETHUSD, $XRPUSD, $LTCUSD and others (such as a few bitcoin related equities) will be featured in future reporting.

- Join us in our private Crypto Trading room server on discord!

- For newer users – read the blog post about how to trade Bitcoin here.

Primary Methods of Bitcoin Trade:

The primary method of trade we have found works with the most predictability is to wait for bitcoin to breach the upper right wall of a quadrant (the orange, blue or grey diagonal dotted lines – the thicker lines are more significant as they represent wider time-frames) and confirm over the next horizontal Fibonacci resistance. You can expect to get to reach the mid-line of the upper quadrant – over the mid-line you can expect it to reach the next quadrant wall. Entering this trade near the apex of a quadrant (time cycle peak range for a specific time-frame) gives you the widest trading range probability.

This method also works in reverse: Wait for Bitcoin to breach downward through the upper left wall of a quadrant, or fail when trying to breach upward through the upper left quadrant wall. Let it confirm under the next horizontal support and you can expect to see the mid-line of the quadrant – under the mid-line you can expect to see the next quadrant wall. Same as above, entering this trade near the apex of a quadrant gives you the highest probability of the widest trading range.

Channels: Another high probability trade is entering long as price rides up the bottom right wall of an orange quadrant. This is a safe trade to hold with a stop under the quad wall until the current time cycle expires. This trade works in reverse as well. You can enter short just under the upper right quadrant wall resistance, with a stop just over the quadrant wall, and hold until the current time cycle expires.

Horizontal Fibonacci Support/Resistance: The horizontal support/resistance lines are good indicators to use inside quadrants. The light green 0.5 Fibonacci line and the grey 1.0 or 0 Fibonacci levels (mid-lines) are the most significant. Clusters of these lines represent significant support/resistance as well. Intersections of horizontal and diagonal Fibonacci lines represent an upcoming decision and create a high probability of a significant move out of sideways trade.

Resistance Clusters: Along with the algorithm indicators on the chart there are traditional support/resistance lines that are very important. When these lines converge volatility tends to increase. Under the cluster is a high probability short. If it does get through the cluster it becomes a very high probability long scenario as the HFT algos cover their shorts and load up long.

Targets: Red circles on charting. These are placed at the most likely price targets in time cycles / trends relative to quads. These are still in very early stage of development/testing and should be used for observation only at this point. Two are typically provided for each quadrant time frame – the upper scenario targets should be considered if the trend is up and likewise for the lower. I do not recommend entering trades based on these targets. Also, at times the mid quad support / resistance line is highlighted with a target if trade is not extremely bullish or bearish.

Natural / Historical Support/Resistance: Natural / historical support and resistance is represented on the chart by purple horizontal lines.

Conventional Charting: Conventional charting should be weighed against the model(s) with all trade decisions.

In summary, our first generation Bitcoin algorithm chart model uses the following indicators (listed from most predictable to least in terms of win rate):

- Trading range created by long term algorithmic modeled quadrant support and resistance (blue dotted lines)

- Trading range between buy/sell trigger levels (grey/green arrows and solid lines)

- Directional channels formed by long term algorithmic modeled support and resistance

- Horizontal Fibonacci support and resistance (multi-colored horizontal lines)

- Conventional Natural support and resistance (purple horizontal lines)

- Long term conventional trend lines (red diagonal lines)

- Conventional MA’s

Bitcoin Algorithm – Daily Chart (Suitable for Swing Trading):

Click link to open initial chart viewer screen, then share button at bottom right of screen, then make it mine, then double click on chart body to hide or reveal indicators at bottom of chart (MACD etc).

Bitcoin Algorithm. Daily chart model. 208 AM July 9 $BTC $XBTUSD #Bitcoin #Algorithm

Per recent;

Bitcoin Algorithm. Trading just above a buy sell trigger, awaiting decision. 412 AM June 26 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Trading Plan (Observations / Chart Indicators):

July 9 – Trading just under 50 MA, watching for a decision at the 50 MA test for direction.

June 26 – Range bound trade – waiting for a direction.

June 19 – My current bias and trading plan is exactly what it was last report (range bound trade)

June 11 – If Bitcoin $XBTUSD dumps lower than 5900.00 then high probability it continues in down channel (illustrated down channel with yellow arrows). It holds and up channel is in play (also illustrated on charting).

On the daytrading chart below it seems too early to comment on a bias… looking for structure to build.

My personal bias is it should turn up channel, conventionally that makes sense in trading after a dump, however, the 5900.00 is key as a mid quad area.

A few tweets / comments in private Bitcoin member serve recently reflecting my bias:

And we’re there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto

And we're there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto pic.twitter.com/fK3u1dM7mx

— Melonopoly (@curtmelonopoly) June 10, 2018

June 4 – No change.

Bitcoin Algorithm. 30 Minute Charting (Suitable for Daytrading BTC).

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 136 AM July 9 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading chart with buy sell triggers (white arrows) 428 AM June 26 $BTC $XBTUSD #Bitcoin #Algorithm

Per recent;

Bitcoin Algorithm. Daytrading chart with buy sell triggers (white arrows) 325 AM June 19 2018 $BTC $XBTUSD #Bitcoin #Algorithm

Per last report the main watch here was the 200 MA – price now has the ma so this is on high watch now.

Recent Bitcoin Real-Time Trade Alerts / Charting Set-up Alerts

If you are reviewing this newsletter (as a historical unlocked post) and not a member of our service and would like a tour of our private discord server (trading chat / alerts etc) or our private Twitter member $BTC alert feed let us know. You can check out our call rate for yourself. Transparent trading is important to us.

July 9 – Alert examples will be updated soon.

June 26 – Alert examples will be updated soon.

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading pic.twitter.com/RM68yktgur

— Melonopoly (@curtmelonopoly) May 20, 2018

May 13 – Will post recent alerts soon when time allows.

Per recent;

April 29 – There have been many calls since bottom on our private server and private twitter feed… I’m not going to take the time to post them here right now but I will post this rant of tweets… the private member alerts I’ll post next report if time (they were all spot on alerts).

I even told ya how I knew where the bottom was. $BTC #Bitcoin #algorithm

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading screenshot

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading

$BTC near HOD and some bullish action on intra. Tweet screen shot.

$BTC near HOD and some bullish action on intra. $BTC #bitcoin #calls

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading pic.twitter.com/l1pafs56QD

— Crypto the BTC Algo (@CryptotheAlgo) April 18, 2018

Bitcoin coming in to a possible buy trigger zone on daytrading chart. $BTC #Bitcoin

https://twitter.com/BTCAlerts_CT/status/978317583987429376

$BTC Bitcoin popped now 400 points since alert of support. Not a bad RR here for long test. If nothing else a day trade.

https://twitter.com/BTCAlerts_CT/status/978397655796801538

Bitcoin time price cycle peak coming April 7 – path of least resistance down target but my bias is to up. Trade price. We start trading live again Monday so I’ll broadcast our trading group moves live for this setup. $BTC #Bitcoin #trading #crypto (alerted in private member Discord server)

And the result…. price is dumping in to lower target identified on trade alert…. intrad-day getting close. Charting wins. Trader bias not so good on this one.

Ethereum Algorithm. Basic Charting Model on Daily Time Frame:

Ethereum Algorithm. Daily Chart. 625 resistance 418 support July 9 316 AM $ETH $ETHUSD #Ethereum #Algorithm

Ethereum Algorithm. Daily Chart. Price in channel, with weak trade. On watch. June 26 434 AM $ETH $ETHUSD #Ethereum #Algorithm

Per recent;

Ethereum Algorithm. Daily Chart. Price may test upside moving averages resistance. On watch. June 19 350 AM $ETH $ETHUSD #Ethereum #Algorithm

Litecoin Algorithm. Basic Charting Model.

Primary buy sell triggers on Litecoin daily chart:

475.00

381.00

287.00

192.00

98.00

Litecoin Algorithm. LTC still in down trend channel. July 9 324 AM $LTCUSD #Litecoin #Algorithm

Litecoin Algorithm. LTC channel trade so far here. June 26 438 AM $LTCUSD #Litecoin #Algorithm

Per recent;

Litecoin Algorithm. LTC testing mid quad support. On high watch here. June 19 359 AM $LTCUSD #Litecoin #Algorithm

Ripple Basic Algorithm Charting Model $XRP

July 9 – No noteworthy change.

May 13 – Ripple needs .932 for a chance for a bullish structured run. $XRP $XRPUSD.

I put some tighter time from Fib structure in the model for those that asked for daytrading signals.

Per recent;

May 10 – Nothing to report. Flat.

April 29 – $XRP flat but over 200 MA on daily.

BUT still great returns from 40s to near 90s WOW.

https://www.tradingview.com/chart/XRPUSD/0aDABOJz-XRP-flat-but-over-200-MA-on-daily/

Per recent;

April 22 – $XRP over .888 targets 1.31 then 1.65 mid term. Daytrading model on -deck. #ripple

Crypto News:

Crypto Markets Recover After Weekend Losses Saw Bitcoin at Lowest 2018 Level

< End of report >

Any questions give us a shout anytime!

Follow Me:

Live Twitter Alert Feed for Bitcoin Trade Set-ups: @BTCAlerts_CT, Public Feed: @cryptothealgo

To Subscribe to our Crypto Services:

Link to Services and Pricing Overview (master list).

Link to Standalone $BTC Crypto Newsletter.

Link to Real-Time Live Bitcoin Alerts (Twitter).

Link to Crypto Bundle (Alerts, Private Trading Discord Server, Newsletter).

Review historical (unlocked to public) Weekly Bitcoin Newsletter Algorithm Reporting. Scroll down landing page to get to historical reports.

Post topics; Crypto, Algorithm, BTC, Bitcoin, chart, $BTC, $BTCUSD, $XBTUSD, $BTC.X, $ETH, $LTC, $XRP, trade, price targets, time cycles

Bitcoin Algorithm (Crypto). Tues June 26. Crypto Recovers After Weekend Losses $BTC $XBTUSD $XBT $ETH $LTC $XRP #Bitcoin #Algorithm

Bitcoin Algorithm Report (Crypto). Tuesday June 26, 2018. Includes Time Cycles, Price Targets and Buy / Sell Triggers.

$BTC $BTCUSD $XBTUSD $XBT $BTC.X $ETH $LTC $XRP #Bitcoin #Crypto

Hello, my name is Crypto the Bitcoin Algorithm. Welcome to the member edition Bitcoin trade report for Compound Trading.

Like our other algorithmic chart models, I am in development and testing for coding phase to be used as an intelligent assistant for our traders. My algorithm charting model is specifically suitable for the use and purpose of trading Bitcoin $BTCUSD, Bitcoin/USD perpetual swaps $XBTUSD, Bitcoin related equities and you will find additional preliminary algorithmic modeling for $ETH, $LTC and $XRP in this report.

Note: The $XBTUSD (Bitcoin swaps) model is built on a chart from BitMEX. Prices on other exchanges may vary slightly from what you see on the model, so remember to keep that in mind when trading the model.

Notices:

- Our 24 hour crypto trading desk was launched May 15 – over time this team will start alerting to feeds. This team of three is also responsible for the development and coding of our algorithms and alerting to realtime Twitter alert feeds. Read more here; https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

- More extensive chart models for $BTCUSD, $ETHUSD, $XRPUSD, $LTCUSD and others (such as a few bitcoin related equities) will be featured in future reporting.

- Join us in our private Crypto Trading room server on discord!

- For newer users – read the blog post about how to trade Bitcoin here.

Primary Methods of Bitcoin Trade:

The primary method of trade we have found works with the most predictability is to wait for bitcoin to breach the upper right wall of a quadrant (the orange, blue or grey diagonal dotted lines – the thicker lines are more significant as they represent wider time-frames) and confirm over the next horizontal Fibonacci resistance. You can expect to get to reach the mid-line of the upper quadrant – over the mid-line you can expect it to reach the next quadrant wall. Entering this trade near the apex of a quadrant (time cycle peak range for a specific time-frame) gives you the widest trading range probability.

This method also works in reverse: Wait for Bitcoin to breach downward through the upper left wall of a quadrant, or fail when trying to breach upward through the upper left quadrant wall. Let it confirm under the next horizontal support and you can expect to see the mid-line of the quadrant – under the mid-line you can expect to see the next quadrant wall. Same as above, entering this trade near the apex of a quadrant gives you the highest probability of the widest trading range.

Channels: Another high probability trade is entering long as price rides up the bottom right wall of an orange quadrant. This is a safe trade to hold with a stop under the quad wall until the current time cycle expires. This trade works in reverse as well. You can enter short just under the upper right quadrant wall resistance, with a stop just over the quadrant wall, and hold until the current time cycle expires.

Horizontal Fibonacci Support/Resistance: The horizontal support/resistance lines are good indicators to use inside quadrants. The light green 0.5 Fibonacci line and the grey 1.0 or 0 Fibonacci levels (mid-lines) are the most significant. Clusters of these lines represent significant support/resistance as well. Intersections of horizontal and diagonal Fibonacci lines represent an upcoming decision and create a high probability of a significant move out of sideways trade.

Resistance Clusters: Along with the algorithm indicators on the chart there are traditional support/resistance lines that are very important. When these lines converge volatility tends to increase. Under the cluster is a high probability short. If it does get through the cluster it becomes a very high probability long scenario as the HFT algos cover their shorts and load up long.

Targets: Red circles on charting. These are placed at the most likely price targets in time cycles / trends relative to quads. These are still in very early stage of development/testing and should be used for observation only at this point. Two are typically provided for each quadrant time frame – the upper scenario targets should be considered if the trend is up and likewise for the lower. I do not recommend entering trades based on these targets. Also, at times the mid quad support / resistance line is highlighted with a target if trade is not extremely bullish or bearish.

Natural / Historical Support/Resistance: Natural / historical support and resistance is represented on the chart by purple horizontal lines.

Conventional Charting: Conventional charting should be weighed against the model(s) with all trade decisions.

In summary, our first generation Bitcoin algorithm chart model uses the following indicators (listed from most predictable to least in terms of win rate):

- Trading range created by long term algorithmic modeled quadrant support and resistance (blue dotted lines)

- Trading range between buy/sell trigger levels (grey/green arrows and solid lines)

- Directional channels formed by long term algorithmic modeled support and resistance

- Horizontal Fibonacci support and resistance (multi-colored horizontal lines)

- Conventional Natural support and resistance (purple horizontal lines)

- Long term conventional trend lines (red diagonal lines)

- Conventional MA’s

Bitcoin Algorithm – Daily Chart (Suitable for Swing Trading):

Click link to open initial chart viewer screen, then share button at bottom right of screen, then make it mine, then double click on chart body to hide or reveal indicators at bottom of chart (MACD etc).

Bitcoin Algorithm. Trading just above a buy sell trigger, awaiting decision. 412 AM June 26 $BTC $XBTUSD #Bitcoin #Algorithm

Per recent;

Bitcoin Algorithm. Watching for a turn up prospective channel.. 247 AM June 19 2018 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Price Targets on Daily Chart Model ($XBTUSD):

Trading 6688.50 intraday;

July 4 Bitcoin Price Targets:

Bearish 5902.00 (out of current algorithmic channel not yet tested)

Moderate 9808.00

Bullish 13821.00

Extreme Bullish 17745.00

Bitcoin Trading Plan (Observations / Chart Indicators):

June 26 – Range bound trade – waiting for a direction.

June 19 – My current bias and trading plan is exactly what it was last report (range bound trade)

June 11 – If Bitcoin $XBTUSD dumps lower than 5900.00 then high probability it continues in down channel (illustrated down channel with yellow arrows). It holds and up channel is in play (also illustrated on charting).

On the daytrading chart below it seems too early to comment on a bias… looking for structure to build.

My personal bias is it should turn up channel, conventionally that makes sense in trading after a dump, however, the 5900.00 is key as a mid quad area.

A few tweets / comments in private Bitcoin member serve recently reflecting my bias:

And we’re there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto

And we're there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto pic.twitter.com/fK3u1dM7mx

— Melonopoly (@curtmelonopoly) June 10, 2018

June 4 – No change.

Bitcoin Algorithm. 30 Minute Charting (Suitable for Daytrading BTC).

Bitcoin Algorithm. Daytrading chart with buy sell triggers (white arrows) 428 AM June 26 $BTC $XBTUSD #Bitcoin #Algorithm

Per recent;

Bitcoin Algorithm. Daytrading chart with buy sell triggers (white arrows) 325 AM June 19 2018 $BTC $XBTUSD #Bitcoin #Algorithm

Per last report the main watch here was the 200 MA – price now has the ma so this is on high watch now.

Per recent;

Bitcoin Algorithm. Daytrading chart a bit sloppy but levels in play. Watch the buy sell triggers (white arrows) 848 PM June 11 2018 $BTC $XBTUSD #Bitcoin #Algorithm

The 200 MA coming down to meet price at top of chart (pink line) seems an important watch as it has been tested as resistance in this time-frame and previously failed. If price regains the 200 MA then likely we see a reversal.

Per recent;

Bitcoin Trading Plan – Long adds scenario, trim in to mid quad resistance (white arrows at key Fibonacci resistance lines) add above to next. June 3, 18 714 PM #Bitcoin #Algorithm 2018 $BTC $XBTUSD

https://www.tradingview.com/chart/XBTUSD/fdHYeyER-Bitcoin-Daytrading-Temporary-Chart/

Recent Bitcoin Real-Time Trade Alerts / Charting Set-up Alerts

If you are reviewing this newsletter (as a historical unlocked post) and not a member of our service and would like a tour of our private discord server (trading chat / alerts etc) or our private Twitter member $BTC alert feed let us know. You can check out our call rate for yourself. Transparent trading is important to us.

June 26 – Alert examples will be updated soon.

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading pic.twitter.com/RM68yktgur

— Melonopoly (@curtmelonopoly) May 20, 2018

May 13 – Will post recent alerts soon when time allows.

Per recent;

April 29 – There have been many calls since bottom on our private server and private twitter feed… I’m not going to take the time to post them here right now but I will post this rant of tweets… the private member alerts I’ll post next report if time (they were all spot on alerts).

I even told ya how I knew where the bottom was. $BTC #Bitcoin #algorithm

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading screenshot

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading

$BTC near HOD and some bullish action on intra. Tweet screen shot.

$BTC near HOD and some bullish action on intra. $BTC #bitcoin #calls

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading pic.twitter.com/l1pafs56QD

— Crypto the BTC Algo (@CryptotheAlgo) April 18, 2018

Bitcoin coming in to a possible buy trigger zone on daytrading chart. $BTC #Bitcoin

https://twitter.com/BTCAlerts_CT/status/978317583987429376

$BTC Bitcoin popped now 400 points since alert of support. Not a bad RR here for long test. If nothing else a day trade.

https://twitter.com/BTCAlerts_CT/status/978397655796801538

Bitcoin time price cycle peak coming April 7 – path of least resistance down target but my bias is to up. Trade price. We start trading live again Monday so I’ll broadcast our trading group moves live for this setup. $BTC #Bitcoin #trading #crypto (alerted in private member Discord server)

And the result…. price is dumping in to lower target identified on trade alert…. intrad-day getting close. Charting wins. Trader bias not so good on this one.

Ethereum Algorithm. Basic Charting Model on Daily Time Frame:

Ethereum Algorithm. Daily Chart. Price in channel, with weak trade. On watch. June 26 434 AM $ETH $ETHUSD #Ethereum #Algorithm

Per recent;

Ethereum Algorithm. Daily Chart. Price may test upside moving averages resistance. On watch. June 19 350 AM $ETH $ETHUSD #Ethereum #Algorithm

Per recent;

Ethereum Algorithm. Daily Chart has exactly the same structural scenario as BTC chart. June 11 911 PM $ETH $ETHUSD #Ethereum #Algorithm

Litecoin Algorithm. Basic Charting Model.

Primary buy sell triggers on Litecoin daily chart:

475.00

381.00

287.00

192.00

98.00

Litecoin Algorithm. LTC channel trade so far here. June 26 438 AM $LTCUSD #Litecoin #Algorithm

Per recent;

Litecoin Algorithm. LTC testing mid quad support. On high watch here. June 19 359 AM $LTCUSD #Litecoin #Algorithm

Per recent;

June 11 – No significant change in Litecoin Algorithm structure on charting model, refer to chart link below for real-time charting.

Ripple Basic Algorithm Charting Model $XRP

June 26 – No noteworthy change as with previous.

June 19 – No noteworthy change as with previous.

June 11 – No noteworthy change as with previous.

June 4 – No noteworthy change as with previous.

May 30 – No noteworthy change in charting – use link below.

May 21 – No noteworthy change in charting – use link below.

May 13 – Ripple needs .932 for a chance for a bullish structured run. $XRP $XRPUSD.

I put some tighter time from Fib structure in the model for those that asked for daytrading signals.

Per recent;

May 10 – Nothing to report. Flat.

April 29 – $XRP flat but over 200 MA on daily.

BUT still great returns from 40s to near 90s WOW.

https://www.tradingview.com/chart/XRPUSD/0aDABOJz-XRP-flat-but-over-200-MA-on-daily/

Per recent;

April 22 – $XRP over .888 targets 1.31 then 1.65 mid term. Daytrading model on -deck. #ripple

Crypto News:

Crypto Markets Recover After Weekend Losses Saw Bitcoin at Lowest 2018 Level

< End of report >

Any questions give us a shout anytime!

Follow Me:

Live Twitter Alert Feed for Bitcoin Trade Set-ups: @BTCAlerts_CT, Public Feed: @cryptothealgo

To Subscribe to our Crypto Services:

Link to Services and Pricing Overview (master list).

Link to Standalone $BTC Crypto Newsletter.

Link to Real-Time Live Bitcoin Alerts (Twitter).

Link to Crypto Bundle (Alerts, Private Trading Discord Server, Newsletter).

Review historical (unlocked to public) Weekly Bitcoin Newsletter Algorithm Reporting. Scroll down landing page to get to historical reports.

Post topics; Crypto, Algorithm, BTC, Bitcoin, chart, $BTC, $BTCUSD, $XBTUSD, $BTC.X, $ETH, $LTC, $XRP, trade, price targets, time cycles

Bitcoin Algorithm (Crypto). Tues June 19 Report. $BTC $XBTUSD $XBT $ETH $LTC $XRP #Bitcoin #Crypto #Algorithm

Bitcoin Algorithm Report (Crypto). Tuesday June 19, 2018. Includes Time Cycles, Price Targets and Buy / Sell Triggers.

$BTC $BTCUSD $XBTUSD $XBT $BTC.X $ETH $LTC $XRP #Bitcoin #Crypto

Hello, my name is Crypto the Bitcoin Algorithm. Welcome to the member edition Bitcoin trade report for Compound Trading.

Like our other algorithmic chart models, I am in development and testing for coding phase to be used as an intelligent assistant for our traders. My algorithm charting model is specifically suitable for the use and purpose of trading Bitcoin $BTCUSD, Bitcoin/USD perpetual swaps $XBTUSD, Bitcoin related equities and you will find additional preliminary algorithmic modeling for $ETH, $LTC and $XRP in this report.

Note: The $XBTUSD (Bitcoin swaps) model is built on a chart from BitMEX. Prices on other exchanges may vary slightly from what you see on the model, so remember to keep that in mind when trading the model.

Notices: