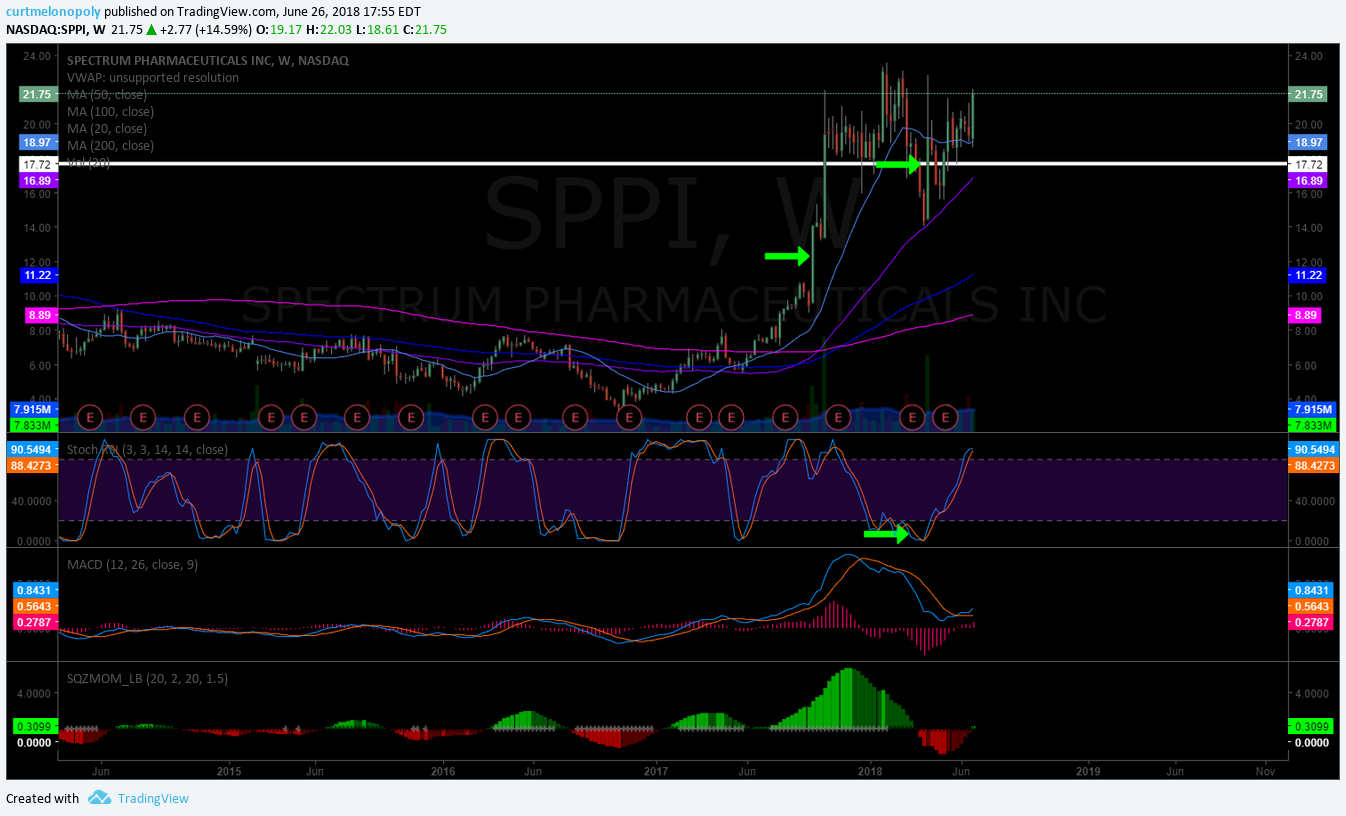

Tag: $SPPI

PreMarket Trading Plan Wed June 27: #EIA, OIL, $SPY, $DFBG, $MDGS, $CARA, $RKDA, $WWE, $CLPS, $SPPI, $DIS, $AKTX more.

Compound Trading Premarket Trading Plan & Watch List Wednesday June 27, 2018.

In this edition: #EIA, OIL, $SPY, $DFBG, $MDGS, $CARA, $RKDA, $WWE, $CLPS, $SPPI, $DIS, $AKTX and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- June 27 – Daytrading room to open sometime today, exact time unknown, testing now as this is in writing (daytrading members will receive notice on email in advance of each session).

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

https://twitter.com/CompoundTrading/status/1004257179438866432

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing.#IA #AI #Algorithms #Coding

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Daytrading Room:

- Target date for recommencement week of June 25. Link and password emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Applicable members will begin to receive notice as sessions commence.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Oil Algorithm EPIC Run: Winning continues for the EPIC Oil Algorithm. 100% live oil trade alert win rate for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts ⤵🎯

https://twitter.com/EPICtheAlgo/status/1010004212950843392

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

23 Stocks Moving In Wednesday’s Pre-Market Session $WWE $RKDA $CARA $DAC $LEVB $CLPS $SMMT $PTIE $AQXP $CNXM $SBLK https://www.benzinga.com/news/18/06/11941038/23-stocks-moving-in-wednesdays-pre-market-session

https://twitter.com/CompoundTrading/status/1011951711827775488

Market Observation:

Markets as of 8:22 AM: US Dollar $DXY trading 94.90, Oil FX $USOIL ($WTI) trading 71.03, Gold $GLD trading 1257.64, Silver $SLV trading 16.22, $SPY 271.80, Bitcoin $BTC.X $BTCUSD $XBTUSD 6059.00 and $VIX trading 17.4.

Momentum Stocks to Watch: $DFBG $MDGS $CARA $RKDA $WWE $CLPS

News:

Conagra to buy Pinnacle Foods for a cash/stock deal value of $68/share $CAG $PF

Apple CEO Tim Cook expected to be deposed by Qualcomm as part of the companies’ ongoing litigation $AAPL $QCOM

US House to vote on immigration bill today.

Cara $CARA Therapeutics reports positive data in trial of post-surgery pain treatment https://www.marketwatch.com/story/cara-therapeutics-reports-positive-data-in-trial-of-post-surgery-pain-treatment-2018-06-27?mod=BreakingNewsSecondary

$FOMX Doses Last Patient in Late-Stage Rosacea Studies For Minocycline Foam FMX103. Topline Data Early Q4

WTI Extends Gains After Biggest Crude Draw Since Sept 2016 $WTI $USOIL #OIL

https://twitter.com/EPICtheAlgo/status/1011723908926595073

Recent SEC Filings:

Hikari Power Ltd boosted its holdings in Akari Therapeutics PLC (NASDAQ:AKTX) by 320.5% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC).

Hikari Power Ltd boosted its holdings in Akari Therapeutics PLC (NASDAQ:AKTX) by 320.5% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). https://t.co/SfxSW6bCHC

— Swing Trading (@swingtrading_ct) June 27, 2018

Recent IPO’s:

$HRTX prices at $39.50

Busiest Week For IPOs In 2018 Includes BJ’s Wholesale, Uxin, Domo

https://twitter.com/CompoundTrading/status/1011685253520347136

Earnings:

#earnings for the week

$NKE $CCL $LEN $WBA $GIS $PAYX $STZ $RAD $FDS $JKS $ACN $KBH $BBBY $INFO $MKC $SCHN $UNF $CAG $APOG $CUK $SONC $GMS $AVAV $PIR $EROS $SNX $LNN $OMN $SJR $FUL $XPLR $CAMP $PRGS $NG $FC $DTRM $IRET $GBX $DAC

http://eps.sh/cal

https://twitter.com/CompoundTrading/status/1011220159246323713

upcoming #earnings releases with the highest #volatility

$PIR $AVAV $BBBY $EROS $CAMP $APOG $JKS $PRGS $SNX $RAD $SJR $KBH $SONC $INFO $LEN $OMN $SCHN $FUL

http://eps.sh/cal

upcoming #earnings releases with the highest #volatility $PIR $AVAV $BBBY $EROS $CAMP $APOG $JKS $PRGS $SNX $RAD $SJR $KBH $SONC $INFO $LEN $OMN $SCHN $FUL https://t.co/lObOE0dgsr pic.twitter.com/kbjyr7perU

— Earnings Whispers (@eWhispers) June 25, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

3 Advantages That Could Help Disney Beat Netflix @themotleyfool #stocks #swingtrade $DIS, $NFLX, $FOX

3 Advantages That Could Help Disney Beat Netflix @themotleyfool #stocks #swingtrade $DIS, $NFLX, $FOX https://t.co/70pvhoWF5s

— Swing Trading (@swingtrading_ct) June 27, 2018

Why Bank Stocks May Be Ready to Rebound $BAC $C $GS $JPM $MS $WFC

Why Bank Stocks May Be Ready to Rebound $BAC $C $GS $JPM $MS $WFC https://t.co/T1JntFr5go

— Swing Trading (@swingtrading_ct) June 27, 2018

SPECTRUM PHARMA (SPPI) Had a great day up 15.5% trading 21.90. Entries at the arrows. Long play. $SPPI #SwingTrading

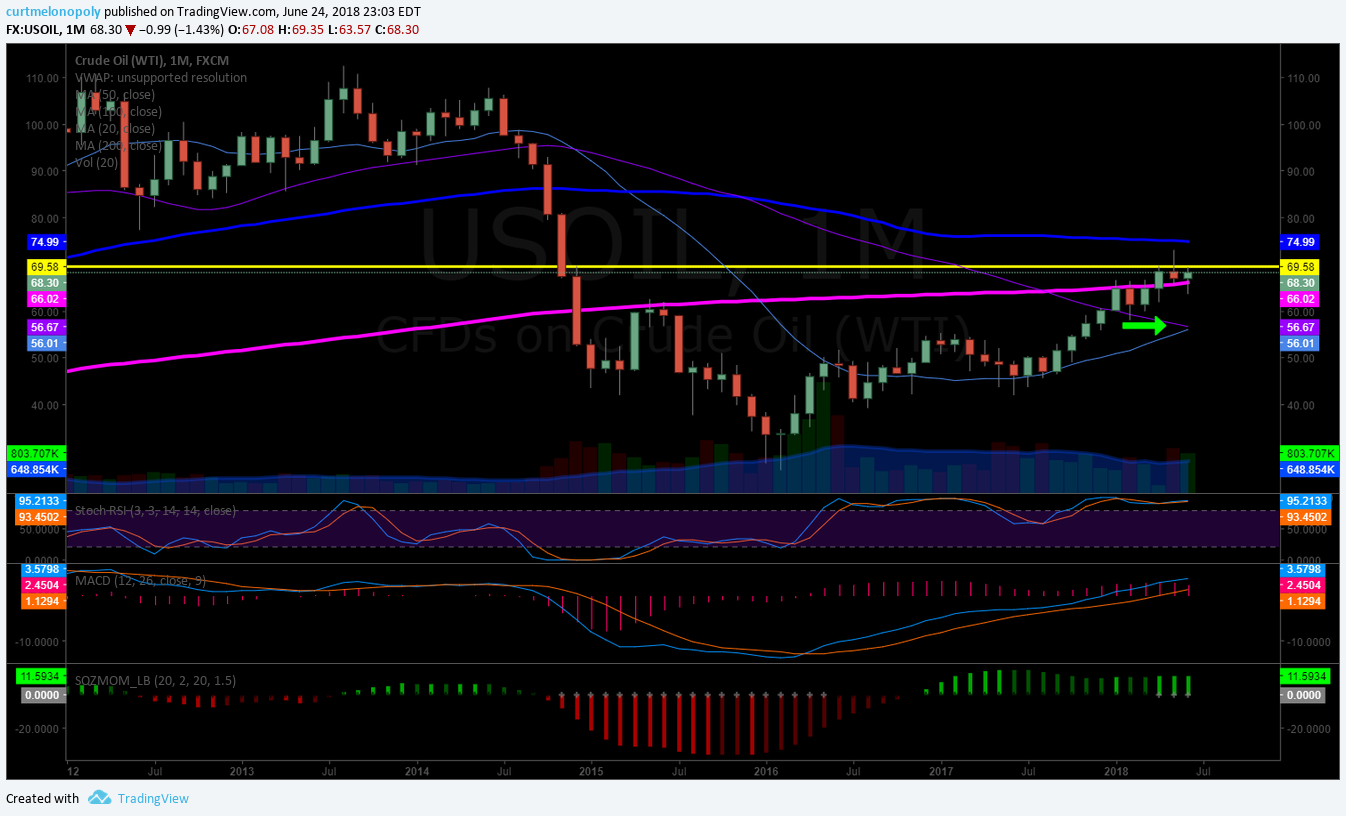

If I get lucky my starter test size trade from yesterday will do this Crude Oil trade on the fly model $USOIL $WTI

DISNEY (DIS) Held mid quad support in sell off, bounce here targets 110.66 Sept 5. On high watch. $DIS #swingtrading

KARI THERAPEUTICS (AKTX) Under 200 MA but significant volume last few days. On high watch. $AKTX #stock #chart

CITIGROUP INC (C) Keeps working that support line. No bias here. Watching. $C #stock #chart

Volatility following perfect structure on lift off in to time-cycle peak on 60 min algorithm model. $VIX #volatility

Volatility following perfect structure on lift off in to time-cycle peak on 60 min algorithm model. $VIX #volatility pic.twitter.com/Ire0fHoCNT

— Vexatious $VIX Algo (@VexatiousVIX) June 26, 2018

Silver Weekly chart compression near end June 25 228 AM #SILVER $SLV, $USLV, $DSLV

Volatility S&P 500 Index (VIX) Structured take-off on 60 minute model in to time-cycle peak. June 25 1108 PM $VIX #volatility $TVIX $UVXY

SPDR SP500 Monthly Chart (SPY) Elevated MACD pinch. On watch now. $SPY $ES_F $SPXL $SPXS

Oil Chart (Monthly). Trade touched pivot, 20 MA about to breach 50 MA (bullish if it happens) June 24 1103 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Chart (Daily). K.I.S.S. chart MACD turned up and price above 50 MA (bullish). June 24 1115 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

EPIC Oil Algorithm trade alert wins continue for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts #algorithm

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

LIVEPERSON (LPSN) Our $LPSN swing continues 24 intra – over 23.80 targets 24.60, 25.05, 25.90 main resistance. #swingtrading

ALLERGAN (AGN) swing trade continues – trading 176.55, over 174.76 targets 180.28, then 184.62 main resistance Aug 13. $AGN #swingtrading

PACIRA (PCRX) swing trade continues trading 39.40 – over 39.65 tragets 40.50 then 41.80 main resistance. $PCRX #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

150s to 201s Boom $FB We’re in from the 150 s on that great wash-out snap back swing trade set-up trading 201.74 #swingtrading #snapbacktrade #learntotradefear

INTRA CELLULAR (ITCI) Trading at key support (mid quad Fib) watch for directional swing trade to next target $ITCI #swingtrading

3rd target hit. Trade thesis complete for #EIA. Next levels to follow. Oil Algorithm (EPIC). June 20 1148 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

1st & 2nd price target areas on trade alert hit early. most trimmed 65.90s. Oil Algorithm (EPIC). June 18 201 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

SENSEONICS (SENS) swing trade is targeting most bullish apex of quad, trim in to resistance add above. $SENS #swingtrading

SP500 (SPY) Chart with trendlines to watch – MACD to likely turn down today. June 18 649 AM $SPY $ES_F $SPXL $SPXS #SPY #Chart

$GDX remains range bound but a tad divergent to bear side. $NUGT $DUST $JDST $JNUG

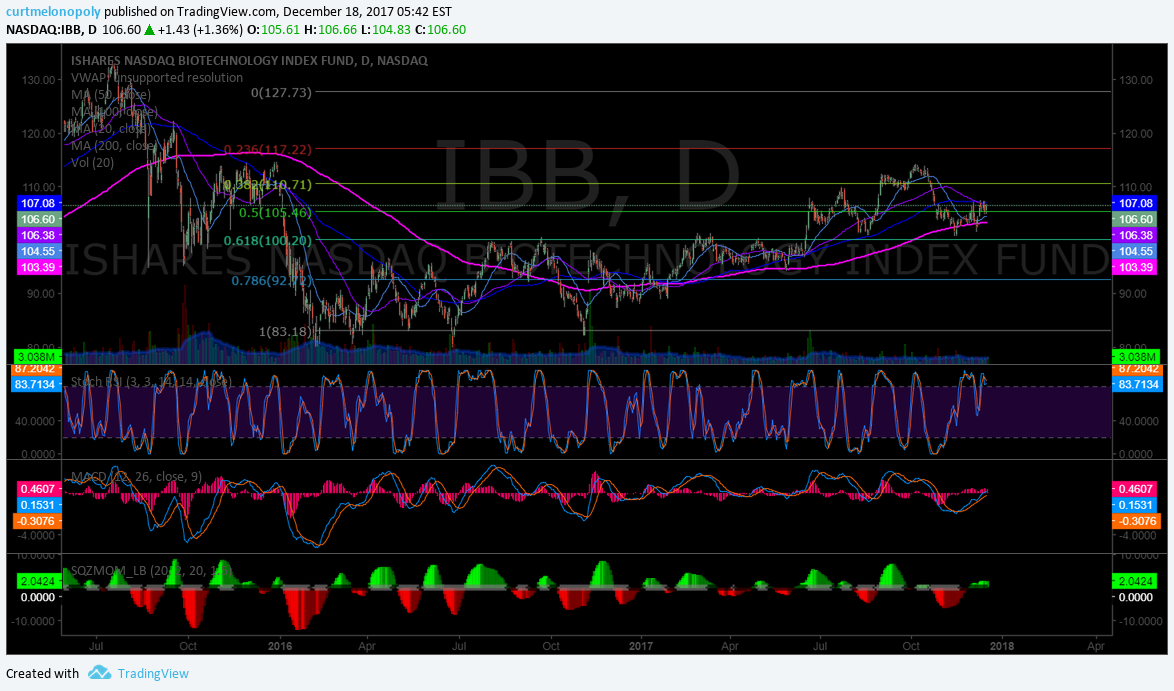

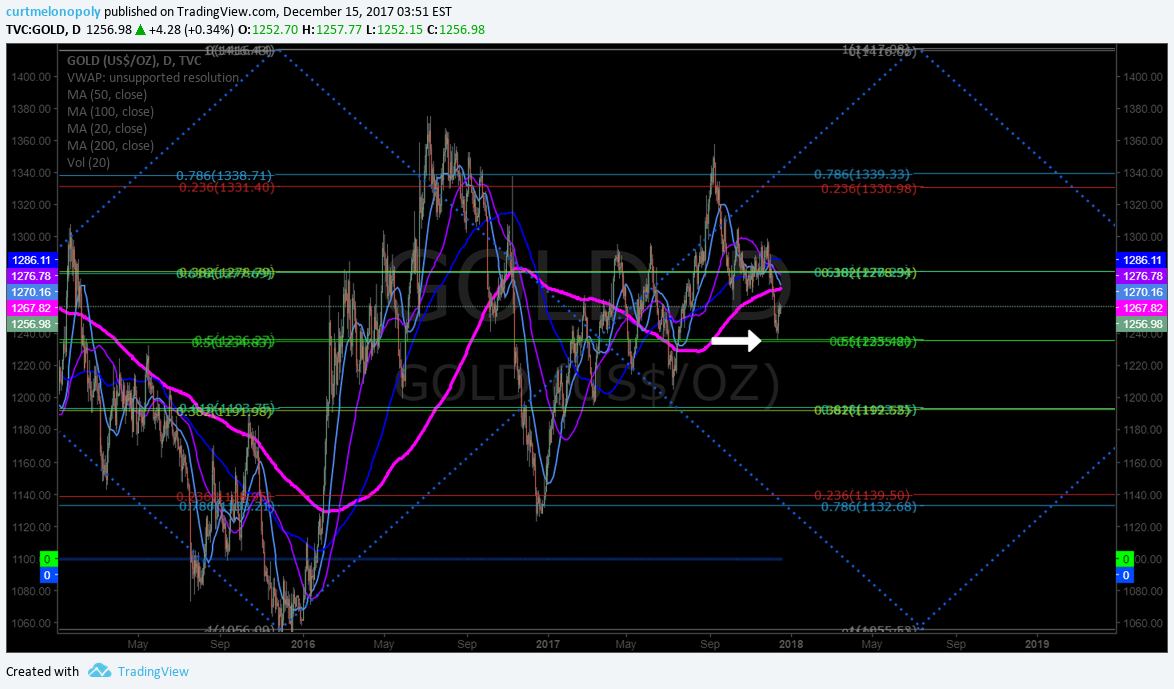

Gold failed 200 MA upside resistance test. #GOLD #CHART $GC_F $XAUUSD $GLD

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Trump softens China investment stance

– Oil continues to rise

– BOE warning

– Markets slip

– Another China bear

https://bloom.bg/2yPfzFu

#5things

-Trump softens China investment stance

– Oil continues to rise

– BOE warning

– Markets slip

– Another China bearhttps://t.co/fy0ucqsUjF pic.twitter.com/F39UfgWPZ8— Bloomberg Markets (@markets) June 27, 2018

Economic Data Scheduled For Wednesday

Economic Data Scheduled For Wednesday pic.twitter.com/bUT2zwqSwR

— Benzinga (@Benzinga) June 27, 2018

The biggest thing in oil last week wasn’t in Vienna, it was in Canada, says Goldman Sachs

https://twitter.com/EPICtheAlgo/status/1011334967836725249

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MDGS $CARA $RKDA $YTEN $DAC $AMRH $WWE $CCCR $ACRX $LEVB $I $MDCO $YANG $CLPS $WTI $JRSH $UGAZ $ENDP $GEVO $UWT $AKAO $XNET $NXPI $GIS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $ENIC $GE $MOS $TKR $HCSG $REGN $CB $WCG $AMOV $CCL $HEES $OKTA $MTB $INGR $T $CSII $MRVL

RBC Capital Starts Evofem Biosciences Inc $EVFM at Outperform

Netflix stock up 1.7% premarket as Imperial Capital initiates coverage at outperform

$SPOT Barclays Starts Spotify (SPOT) at Overweight

Nvidia stock gains after Benchmark starts coverage with buy rating

$AXGN price target raised to $70 from $45 at Leerink – reiterates Outperform rating

Sandler O’Neill Upgrades Sandy Spring Bancorp $SASR to Buy

(6) Recent Downgrades: $WCC $PF $TECH $SBGL $MOH $LH $DGX $POST $GMED $NUVA $LANC

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, #EIA, OIL, $SPY, $DFBG, $MDGS, $CARA, $RKDA, $WWE, $CLPS, $SPPI, $DIS, $AKTX

PreMarket Trading Plan Tues June 26: OIL, $SPY, $VIX, $NFLX, $LEE, $ACHV, $SPPI, $LEN, $JKS, $SENS more.

Compound Trading Premarket Trading Plan & Watch List Tuesday June 26, 2018.

In this edition: OIL, $SPY, $VIX, $NFLX, $LEE, $ACHV, $SPPI, $FRSX, $LEN, $EXEL, $GE, $MU, $JKS, $GEVO, $SENS, $HRTX and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete- Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

https://twitter.com/CompoundTrading/status/1004257179438866432

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing.#IA #AI #Algorithms #Coding

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Daytrading Room:

- Target date for recommencement week of June 25. Main Link and password emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Applicable members will begin to receive notice as sessions commence.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Oil Algorithm EPIC Run: Winning continues for the EPIC Oil Algorithm. 100% live oil trade alert win rate for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts ⤵🎯

https://twitter.com/EPICtheAlgo/status/1010004212950843392

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

26 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/11933869 $LEE $ACHV $SPPI $FRSX $LEN $EXEL $GE $MU $JKS $GEVO $SENS $HRTX

Market Observation:

Markets as of 7:52 AM: US Dollar $DXY trading 94.50, Oil FX $USOIL ($WTI) trading 68.31, Gold $GLD trading 1256.11, Silver $SLV trading 16.16, $SPY 271.00, Bitcoin $BTC.X $BTCUSD $XBTUSD 6059.00 and $VIX trading 17.4.

Momentum Stocks to Watch:

AbbVie shares rise on $1 bln investment in partnership with Alphabet-backed health company

Lee Enterprises rockets 23% premarket on news it will manage Berkshire’s newspapers

GE to maintain dividend for now, stock surges on first day ex-Dow

8 Stocks To Watch For June 26, 2018 https://benzinga.com/z/11932900 $AVAV $FDS $GEVO $LEN $HRTX $SENS $SONC $INFO

8 Stocks To Watch For June 26, 2018 https://t.co/1KmcpS6BEw $AVAV $FDS $GEVO $LEN $HRTX $SENS $SONC $INFO

— Benzinga (@Benzinga) June 26, 2018

News:

Netflix initiated at Outperform by Imperial Capital; firm sees potential 29% upside $NFLX

Energizer to acquire Nu Finish auto appearance brands for an undisclosed sum $ENR

Starbucks founder Howard Schultz steps down as Chairman today $SBUX

$VRX – Valeant’s (VRX) Salix And US WorldMeds Enter Into Exclusive Co-Promotion Agreement For Opioid Withdrawal Treatment LUCEMYRA @Street_Insider

$AKAO ZEMDRITM (plazomicin) Approved by FDA for the Treatment of Adults with Complicated Urinary Tract Infections (cUTI)

$XXII 22nd Century Announces New Non-GMO, Very Low Nicotine Flue-Cured and Burley Tobacco Varieties

$LEE Lee Enterprises will manage Berkshire Hathaway newspaper and digital operations in 30 markets

$ACHV Achieve Announces Positive Cytisine Data Demonstrating No Clinically Significant Drug-Drug Interaction

Recent SEC Filings:

Recent IPO’s:

$HRTX prices at $39.50

Earnings:

#earnings for the week

$NKE $CCL $LEN $WBA $GIS $PAYX $STZ $RAD $FDS $JKS $ACN $KBH $BBBY $INFO $MKC $SCHN $UNF $CAG $APOG $CUK $SONC $GMS $AVAV $PIR $EROS $SNX $LNN $OMN $SJR $FUL $XPLR $CAMP $PRGS $NG $FC $DTRM $IRET $GBX $DAC

http://eps.sh/cal

https://twitter.com/CompoundTrading/status/1011220159246323713

upcoming #earnings releases with the highest #volatility

$PIR $AVAV $BBBY $EROS $CAMP $APOG $JKS $PRGS $SNX $RAD $SJR $KBH $SONC $INFO $LEN $OMN $SCHN $FUL

http://eps.sh/cal

upcoming #earnings releases with the highest #volatility $PIR $AVAV $BBBY $EROS $CAMP $APOG $JKS $PRGS $SNX $RAD $SJR $KBH $SONC $INFO $LEN $OMN $SCHN $FUL https://t.co/lObOE0dgsr pic.twitter.com/kbjyr7perU

— Earnings Whispers (@eWhispers) June 25, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

Volatility following perfect structure on lift off in to time-cycle peak on 60 min algorithm model. $VIX #volatility

Volatility following perfect structure on lift off in to time-cycle peak on 60 min algorithm model. $VIX #volatility pic.twitter.com/Ire0fHoCNT

— Vexatious $VIX Algo (@VexatiousVIX) June 26, 2018

Silver Weekly chart compression near end June 25 228 AM #SILVER $SLV, $USLV, $DSLV

Volatility S&P 500 Index (VIX) Structured take-off on 60 minute model in to time-cycle peak. June 25 1108 PM $VIX #volatility $TVIX $UVXY

SPDR SP500 Monthly Chart (SPY) Elevated MACD pinch. On watch now. $SPY $ES_F $SPXL $SPXS

Oil Chart (Monthly). Trade touched pivot, 20 MA about to breach 50 MA (bullish if it happens) June 24 1103 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Chart (Daily). K.I.S.S. chart MACD turned up and price above 50 MA (bullish). June 24 1115 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

EPIC Oil Algorithm trade alert wins continue for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts #algorithm

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

LIVEPERSON (LPSN) Our $LPSN swing continues 24 intra – over 23.80 targets 24.60, 25.05, 25.90 main resistance. #swingtrading

ALLERGAN (AGN) swing trade continues – trading 176.55, over 174.76 targets 180.28, then 184.62 main resistance Aug 13. $AGN #swingtrading

PACIRA (PCRX) swing trade continues trading 39.40 – over 39.65 tragets 40.50 then 41.80 main resistance. $PCRX #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

150s to 201s Boom $FB We’re in from the 150 s on that great wash-out snap back swing trade set-up trading 201.74 #swingtrading #snapbacktrade #learntotradefear

INTRA CELLULAR (ITCI) Trading at key support (mid quad Fib) watch for directional swing trade to next target $ITCI #swingtrading

3rd target hit. Trade thesis complete for #EIA. Next levels to follow. Oil Algorithm (EPIC). June 20 1148 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

1st & 2nd price target areas on trade alert hit early. most trimmed 65.90s. Oil Algorithm (EPIC). June 18 201 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

SENSEONICS (SENS) swing trade is targeting most bullish apex of quad, trim in to resistance add above. $SENS #swingtrading

BOX INC (BOX) Resistance trim in to 28.32 and add above to 30.00 area res. $BOX #Swingtrading

SP500 (SPY) Chart with trendlines to watch – MACD to likely turn down today. June 18 649 AM $SPY $ES_F $SPXL $SPXS #SPY #Chart

$GDX remains range bound but a tad divergent to bear side. $NUGT $DUST $JDST $JNUG

Gold failed 200 MA upside resistance test. #GOLD #CHART $GC_F $XAUUSD $GLD

Market Outlook, Market News and Social Bits From Around the Internet:

In markets today:

* Stocks bounce back

* Bonds fall

* Shanghai composite enters a bear market

* Harley Davidson, Jack Daniels hurt by trade war

https://www.bloomberg.com/news/articles/2018-06-25/asia-stocks-to-extend-global-slide-dollar-dips-markets-wrap …

Five Things You Need to Know to Start Your Day

Get caught up on what’s moving markets.

#5things

-Navarro’s calming words

-China’s problems mount

-Immigration bill

-Markets quiet

-EM warnings

https://bloom.bg/2lAXSjF

#5things

-Navarro's calming words

-China's problems mount

-Immigration bill

-Markets quiet

-EM warningshttps://t.co/vCnAwucuN5 pic.twitter.com/nPiYiuhvTS— Bloomberg Markets (@markets) June 26, 2018

Economic Data Scheduled For Tuesday

Economic Data Scheduled For Tuesday pic.twitter.com/g6kMHMGWld

— Benzinga (@Benzinga) June 26, 2018

The biggest thing in oil last week wasn’t in Vienna, it was in Canada, says Goldman Sachs

https://twitter.com/EPICtheAlgo/status/1011334967836725249

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List:

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $CTL $MU $LRCX $CBOE $HOME $KMI $WH $MELI

Netflix stock up 1.7% premarket as Imperial Capital initiates coverage at outperform

$SPOT Barclays Starts Spotify (SPOT) at Overweight

Nvidia stock gains after Benchmark starts coverage with buy rating

$AXGN price target raised to $70 from $45 at Leerink – reiterates Outperform rating

Sandler O’Neill Upgrades Sandy Spring Bancorp $SASR to Buy

(6) Recent Downgrades: $INCY $UCBI $ABCP $SQ $AMCX $INTC $SO $TREE $SIRI $TTM $MGM $EDR $CAJ $ABCB

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, OIL, $SPY, $VIX, $NFLX, $LEE, $ACHV, $SPPI, $LEN, $JKS, $SENS

PreMarket Trading Plan Tues Apr 10: China, Trump, $NFLX, $SPY, $AMD, $CHFS, $CUR, $MYOS, $PAY, $SPPI…

Compound Trading Chat Room Stock Trading Plan and Watch List Tuesday April 10, 2018: – SP500, $SPY, $BTC, Bitcoin, Gold, $GLD, $GDX, OIL, $WTI, $USOIL, Volatility, $VIX , Silver, $SLV, US Dollar Index, $DXY … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Details to our next Trading Boot Camp in May! We’re over 70% booked so don’t wait. 30% off on this session! And what a location! #tradecoaching #learntotrade

https://twitter.com/CompoundTrading/status/982706326454358017

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Twitter Trading Plan $TWTR (Part two)

#SwingTrading Midday Review – Compound Trading: $LTBR, $ANF, $MOMO, $APTO, $USOIL, $WTI, $BA, $NFLX

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

#SwingTrading Midday Review: $BZUN $SPY $COT $AMRC

Using the S&P500 to Confirm Momentum Correlates: $SPY/$BZUN Model Structures

How I executed volatility trade with precision. $VIX $XIV #Volatility #Trading $TVIX, $UVXY, $SPY

@EPICtheAlgo #EIA Report, January 24, 2018: Inverse Hedge Between #CL and $SPY

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Recent Educational Videos:

Want to learn how to trade stocks for consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Today will be all about watching the models and structure of the charts and possible alerting some significant positions. I won’t detail them all here because we have over 100 equity models now all alarmed and ready. It will be a big day I am sure.

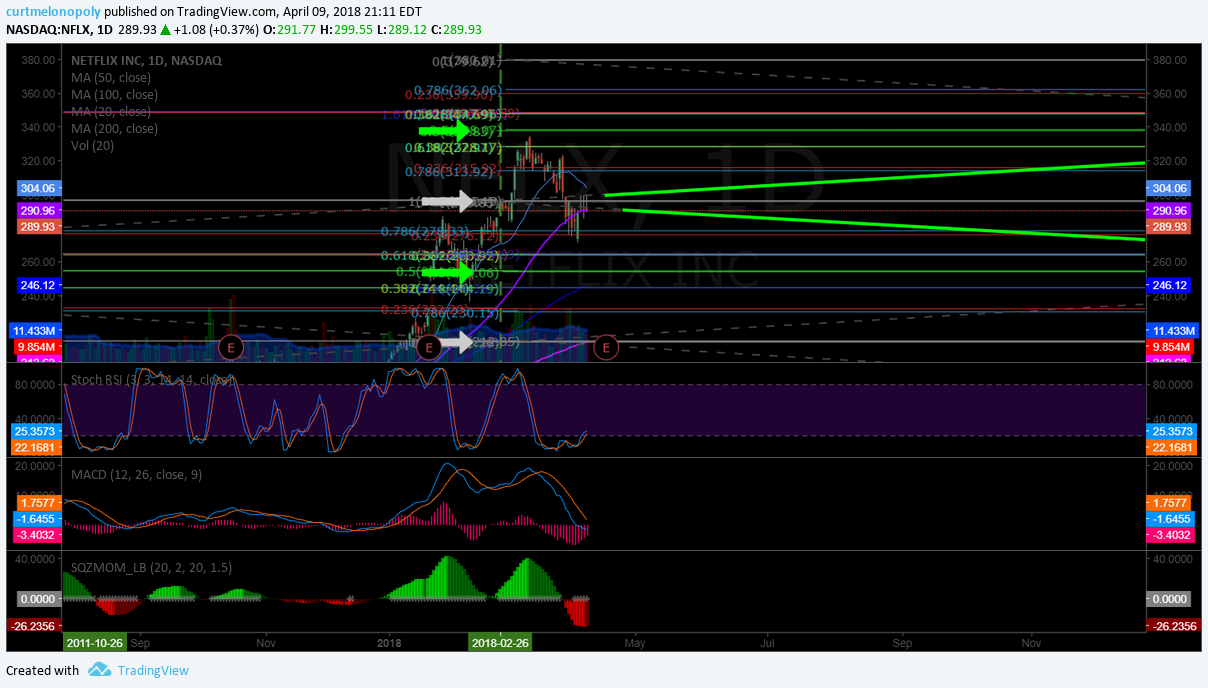

$NFLX Netflix’s stock surges after J.P. Morgan boosts price target

$NFLX Algorithm modelling tells you what the needle movers are doing (insiders) before the retail markets know. We alerted this move in detail last night. #tradingedge #premarket #charting

$NFLX Algorithm modelling tells you what the needle movers are doing (insiders) before the retail markets know. We alerted this move in detail last night. #tradingedge #premarket #charting

— Melonopoly (@curtmelonopoly) April 10, 2018

$NFLX Screen shots from our private Swing Trading member Discord screen last night #trading #algorithm #chart #models #premarket

$NFLX Screen shots from our private Swing Trading member Discord screen last night #trading #algorithm #chart #models #premarket pic.twitter.com/YvfQJdni0w

— Melonopoly (@curtmelonopoly) April 10, 2018

Stocks making the biggest moves premarket: GS, NVDA, PM, TEN, IEP, NKE, UAL & more

Stocks making the biggest moves premarket: GS, NVDA, PM, TEN, IEP, NKE, UAL & more https://t.co/TJ0HYnpV82

— Melonopoly (@curtmelonopoly) April 10, 2018

Market Observation:

As of 7:59 AM: US Dollar $DXY trading 89.90, Oil FX $USOIL ($WTI) trading 64.76, Gold $GLD trading 1336.50, Silver $SLV trading 16.51, $SPY trading 264.5, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 6741.00, and $VIX trading 20.5.

Recent Momentum Stocks to Watch:

News:

Netflix tracks higher after Morgan Stanley confidence https://seekingalpha.com/news/3344593-netflix-tracks-higher-morgan-stanley-confidence.

$SELB Presents Positive New Data from Ongoing Phase 2 Trial of SEL-212, in Development for Chronic Severe Gout, at PANLAR 2018 Congress

$AMD, $CHFS, $CUR, $LEVB, $MYOS, $PAY, $SPPI, $VBLT, $VTVT

Recent SEC Filings:

Recent IPO’s:

Pivotal Software to offer 37 million shares in IPO at $14 to $16 a pop

Earnings:

#earnings scheduled for the week

$JPM $C $RAD $WFC $DAL $BLK $BBBY $FAST $MSM $PNC $OZRK $APOG $SMPL $FRC $FHN $INFY $SLP $CBSH $SJR $EXFO $LAYN $NTIC $TISA $DPW $HQCL $DGLY

http://eps.sh/cal

#earnings scheduled for the week $JPM $C $RAD $WFC $DAL $BLK $BBBY $FAST $MSM $PNC $OZRK $APOG $SMPL $FRC $FHN $INFY $SLP $CBSH $SJR $EXFO $LAYN $NTIC $TISA $DPW $HQCL $DGLY https://t.co/r57QUKKDXL https://t.co/BcGzJRjTUB

— Melonopoly (@curtmelonopoly) April 7, 2018

Trade Set-up Alerts – Recent / Current Holds, Open and Closed Trades:

Swing Trading in Review. $DIS, $C, $TSLA, $FB, $SPY, $GDX, $CELG https://compoundtrading.com/swing-trading-review-dis-c-tsla-fb-spy-gdx-celg/ …

https://twitter.com/CompoundTrading/status/983045524839452672

Charts and Chart Set-ups on Watch:

Gold came off again at historical resistance for predictable short. Price target June 4 1320.00 area most probable. #Gold $GLD $GC_F https://www.tradingview.com/chart/GOLD/IcE7fVql-Historical-resistance-hit-again-Predictable-short-Chart-Notes/ …

Gold came off again at historical resistance for predictable short. Price target June 4 1320.00 area most probable. #Gold $GLD $GC_F https://t.co/1ic9v7LhsP pic.twitter.com/hZlfN8gjV9

— Rosie the Gold Algo (@ROSIEtheAlgo) April 9, 2018

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/ …

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://t.co/5AWSJCxqA5 pic.twitter.com/9SaQX01K5U

— Swing Trading (@swingtrading_ct) April 8, 2018

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://www.tradingview.com/chart/GDX/xqvoPTby-50-MA-Test-Structure-in-Play-Top-10-Easiest-Trades-See-Notes/ …

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://t.co/EX9GrJPGPK pic.twitter.com/uNM4IIwwCY

— Rosie the Gold Algo (@ROSIEtheAlgo) April 8, 2018

Oil Resistance One of Most Predictable Trades in Markets. See chart notes. $USOIL $WTI $CL_F #OIL #OOTT $USO $UWT $DWT https://www.tradingview.com/chart/USOIL/LFoaIZEq-Oil-Resistance-One-of-Most-Predictable-Trades-See-chart-notes/ …

https://twitter.com/EPICtheAlgo/status/982760354815053824

$MXIM under 55.94 short side looks great. MACD turn. See Chart notes. #swingtrading https://www.tradingview.com/chart/MXIM/l2JjyH3X-MXIM-under-55-94-short-side-looks-great-MACD-turn-Chart-notes/ …

$MXIM under 55.94 short side looks great. MACD turn. See Chart notes. #swingtrading https://t.co/nNQfOV6rMr pic.twitter.com/4241zYTpX0

— Swing Trading (@swingtrading_ct) April 8, 2018

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn’t bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.

https://www.tradingview.com/chart/LTCUSD/NAsEtGUs-Litecoin-likely-bounce-near-here-for-chart-structure-Chart-notes/ …

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn't bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.https://t.co/SMEVswx4ha pic.twitter.com/EHM5S9DmcC

— Crypto the BTC Algo (@CryptotheAlgo) April 7, 2018

$TSLA also blasting here from yesterday’s alert🔥 In it to win it. #swingtrading

$TSLA also blasting here from yesterday's alert🔥 In it to win it. #swingtrading pic.twitter.com/JEefAyUROL

— Melonopoly (@curtmelonopoly) April 5, 2018

$DIS swing trade set-up from swing trading report yesterday blasting here🔥 Nice set-up. In it to win it. #swingtrading https://twitter.com/SwingAlerts_CT/status/981914928528416768/photo/1pic.twitter.com/muDQaThxP2

$DIS swing trade set-up from swing trading report yesterday blasting here🔥 Nice set-up. In it to win it. #swingtrading https://t.co/muDQaThxP2 pic.twitter.com/UXpvTgLpuo

— Melonopoly (@curtmelonopoly) April 5, 2018

Trade in $C Citi on fire🔥In it to win it. #swingtrading

Trade in $C Citi on fire🔥In it to win it. #swingtrading pic.twitter.com/0HKG0jH9sb

— Melonopoly (@curtmelonopoly) April 5, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

:#5things

-Xi speech

-Russia selloff

-Trump v Mueller

-Markets rise

-Zuckerberg in Washington

https://bloom.bg/2H9HtPr

#5things

-Xi speech

-Russia selloff

-Trump v Mueller

-Markets rise

-Zuckerberg in Washington https://t.co/kniHNEhFfc pic.twitter.com/YPTU3KgBT3— Bloomberg Markets (@markets) April 10, 2018

Economic Data Scheduled For Tuesday

Economic Data Scheduled For Tuesday pic.twitter.com/RgRRr2NNib

— Benzinga (@Benzinga) April 10, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $PAY, $WATT, $CUR $SPPI $KPTI $UWT $VEON $GUSH $TQQQ $SCYX $MT $UCO $STM $SPXL $PTN $BHP $NVDA $GM $OAS $TSLA $ROKU $BA $NFLX $MU $AMD

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $ULTA $IOVA $ETN $PFPT $LYV $FRAC $PNFP $PACW $CBSH $LYV $BDX $VRTU $AUY $TGB $CFMS $ITW

Bernstein Starts E*TRADE $ETFC at Outperform, ‘Standalone Story Works’

$NFLX PT raised to $350 from $275 at $MS – keeps Overweight rated

Bernstein Starts TD Ameritrade $AMTD at Outperform, Likes The Attractive Valuation

Bernstein Starts IntercontinentalExchange $ICE at Outperform

(6) Recent Downgrades: $VTVT $CGNX $KGC $TV $CFR $MTG $RDN $LGIH $MTB $HSY

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, China, Trump, $NFLX, $SPY, $AMD, $CHFS, $CUR, $MYOS, $PAY, $SPPI

PreMarket Trading Plan Tues Jan 2 $BURG, $MICT, $XOMA, $SSW, $SPY ($SPXL), $AAOI, $SPPI, $BTC.X

Compound Trading Chat Room Stock Trading Plan and Watch List Tuesday Jan 2, 2018 $BURG, $MICT, $XOMA, $SSW, $SPY ($SPXL), $AAOI, $SPPI, $BTC.X – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

All charting and reporting for swing and algorithm models are out except $BTC.X, $VIX, $SILVER – the will be out tonight. If you have any questions about the reporting or suggestions please send us a note.

We’re emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and the end of our open house Jan 9. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports.

We're emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and the end of our open house Jan 9. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports. https://t.co/1CNAfDsAeI

— Melonopoly (@curtmelonopoly) January 1, 2018

Thanks for the support in our start-up year y’all! Our 2018 plans are in this post.

https://twitter.com/CompoundTrading/status/945635490795065344

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts. Many of the late year videos have not been posted yet, however, we will post them this evening.

Visit our You Tube channel for other recent videos.

Dec 28 Swing Trade Set-Ups; $SPY, $SPXL, $NATGAS, $SRNE, $ZKIN, $WPRT

Dec 27 Swing trade set-up review $SPY, Gold, $BTC.X, $BVXV, $XXII, $VRX, $EKSO…

Dec 26 swing trading review $SPY, $WTIC, OIL, $DMPI, $APTO, $FTFT, $INSY, $JRJC, $BWA, $ADOM…

If you’re a trader learning, need set-ups, have interest in our 2018 plans, what we see in markets fwd, want to see live trades / on fly analysis or learn bit about how we model charts and more…. this video is for you.

Dec 13 Swing Trade Set-Ups; $OSTK, Gold, $NUGT, $WTI, OIL, EIA, $VRX, $CELG, $AAOI, $RIOT, $MCIG

Fri Dec 8 Trade Set-ups $BTC, Crypto Scenarios, Gold, $WTI, OIL, Algorithms, $VRX, $SQ, $MYL …

Dec 7 Swing Trade Chart Set-Ups $OSIS, $SQ, $DPW, $FSLR, $FB, $TVIX, $XIV …

Dec 6 Swing Trading chart set-ups $ETSY, $FSLR, $VTGN, $APTN, $LMFA, $VRA …

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Holding – 5/10 sizing $SPY ($SPXL), small $AAOI, $SPPI, very small $OMVS

Per recent:

Crypto related still on watch. $MGIT, $OSTK, $ROKU, $MARA, $MGTI, $RIOT, $XNET, $BTCS and more.

Morning Momentum / Gap / News / PR / IPO Stocks on Watch:

Recent IPO’s : $LFIN

Also watching:

Market observation / on watch:

US Dollar $DXY under pressure trading 92.19, Oil $USOIL $WTI bullish trading 60.32, Gold / Silver up – Gold intra day trading 1312.12, $SPY pressure trading 267.76, Bitcoin $BTC $BTC.X $BTCUSD $XBTUSD trading 13946.00 in a falling wedge on daily and $VIX trading 10.8 moderate.

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

upcoming #earnings releases with the highest #volatility

$RAD $GBX $SONC $ANGO $CALM $CMC $STZ $RPM $WBA $LW $MON

upcoming #earnings releases with the highest #volatility$RAD $GBX $SONC $ANGO $CALM $CMC $STZ $RPM $WBA $LW $MON https://t.co/lObOE0dgsr pic.twitter.com/cazNDLvGgX

— Earnings Whispers (@eWhispers) January 1, 2018

Recent / Current Holds, Open and Closed Trades

Long 5/10 size $SPXL. Holding in some accounts $AAOI $SPPI long (small) and $OMVS really small position.

Per previous;

Closed $VRX trade – I had scaled in a lot larger than I alerted along the way last Friday – but the alerts were enough to scale and exit and use the signals to bank. Anyway, I followed it all the way down and then back up in the model provided in the room and sold near the recent top. Didn’t get the top though and I knew I was selling prior to the top but that’s how I trade – I take the middle if I can – consistent wins is all I look for. Compound my winnings with consistent low stress model high probability trading.

Opened $VRX trade on Friday that I am partially out and closed $NUGT for a small gain.

Closed $OSTK swing for gain. Holding Gold, $NUGT, $AAOI, $SPPI

Closed rest of $XIV swing trade for a nice win, enter $OSTK 56.50 yesterday trading 62.35 this morning and also entered $MCIG (OTC) yesterday. $NUGT swing up and $AAOI $SPPI still hold. Oh and a flat oil trade overnight and oil trade win yesterday. Looking to enter $BTC at bottom of range.

Overnight trade in oil went really well. Big win.

Small loss on Friday in $SQ and hold small position in $NUGT and previous swings $AAOI and $SPPI. Flat oil trade overnight.

1/10 size Gold and $NUGT still long, yesterday nailed $VIX short at open SS $TVIX and $VIX inverse with $XIV – still hold 50% of $XIV swing position from yesterday and holds over time $AAOI and $SPPI.

In a 1/10 long Gold position under water on, 1/10 $NUGT, hit a morning momo trade yesterday in $FSLR and still holding $AAOI and $SPPI.

Closed my $DWT and CL trades from Friday on Monday when internet got back up for wins.

Chart Set-ups on Watch:

Watching all charts on list above plus the ones listed here:

$XOMA The symmetry in daily chart shows a clean swing trade long here if history holds or repeats. #swingtrading

$XOMA The symmetry in daily chart shows a clean swing trade long here if history holds or repeats. #swingtrading pic.twitter.com/XXKMt3ibC3

— Melonopoly (@curtmelonopoly) January 1, 2018

$XOMA This chart provides a zoom in of all horizontal fib buy sell triggers and a trend line to follow Enter long near trend line use fibs as buy sell triggers and watch your indicators for a successful trade.

$XOMA This chart provides a zoom in of all horizontal fib buy sell triggers and a trend line to follow Enter long near trend line use fibs as buy sell triggers and watch your indicators for a successful trade. pic.twitter.com/0kUx3FrVX1

— Melonopoly (@curtmelonopoly) January 1, 2018

$SSW Swing trade time price targets buy sell triggers (see notes on chart at link) – full analysis on report due out in an hour. #swingtrading https://www.tradingview.com/chart/SSW/c83a4j0C-SSW-Swing-trade-time-price-targets-buy-sell-triggers-notes/ …

$SSW Swing trade time price targets buy sell triggers (see notes on chart at link) – full analysis on report due out in an hour. #swingtrading https://t.co/GyvBsYZe2G pic.twitter.com/ffWw7uS8oR

— Melonopoly (@curtmelonopoly) January 1, 2018

Biggest challenge Gold bulls will face in next six months is quad wall at arrow. 403 Jan 1 #Gold $GLD $GC_F $XAUUSD $NUGT $DUST

Biggest challenge Gold bulls will face in next six months is quad wall at arrow. 403 Jan 1 #Gold $GLD $GC_F $XAUUSD $NUGT $DUSThttps://t.co/jQj9YGn0Ga pic.twitter.com/rWoZ5z4HPg

— Melonopoly (@curtmelonopoly) January 1, 2018

Sample Swing Trading Report: Use Code “XOMASWING” Protected: Swing Trading Report Jan 1 – $SNAP, $ARRY, $ARWR, $CDNA, $SENS, $XOMA, $XXII, $NAK, $SHOP… https://compoundtrading.com/swing-trading-report-jan-1-snap-arry-arwr-cdna-sens-xoma-xxii-nak-shop/ … #premarket #swingtrade

Sample Swing Trading Report: Use Code "XOMASWING" Protected: Swing Trading Report Jan 1 – $SNAP, $ARRY, $ARWR, $CDNA, $SENS, $XOMA, $XXII, $NAK, $SHOP… https://t.co/VVCLzSLNvi #premarket #swingtrade

— Melonopoly (@curtmelonopoly) January 2, 2018

Market Outlook:

Stocks making the biggest moves premarket: JNJ, LEN, ABT, BP, LVS, WYNN & more –

Stocks making the biggest moves premarket: JNJ, LEN, ABT, BP, LVS, WYNN & more – https://t.co/pQ5lizkwu1

— Melonopoly (@curtmelonopoly) January 2, 2018

Market News and Social Bits From Around the Internet:

Europe Stocks Slide, Wall Street Gains as Dollar Slump Extends into New Year https://www.thestreet.com/story/14432436/1/europe-stocks-slide-wall-street-gains-as-dollar-slump-extends-into-new-year.html … via @TheStreet

Europe Stocks Slide, Wall Street Gains as Dollar Slump Extends into New Year https://t.co/8OdyrOELYk via @TheStreet

— Melonopoly (@curtmelonopoly) January 2, 2018

$MICT gap. $9.3M market cap and receives $5.3M from $DPW

$BURG premarket up 107% trading 5.45 on you guessed it – #crypto – a rewards program. #premarket https://finance.yahoo.com/news/chanticleer-holdings-deploy-mobivity-blockchain-130000267.html?.tsrc=rss

$BURG premarket up 107% trading 5.45 on you guessed it – #crypto – a rewards program. #premarket https://t.co/XCEZjbY4aB pic.twitter.com/GBuMuqDILy

— Melonopoly (@curtmelonopoly) January 2, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $BURG, $MICT, $EROS, $NLST $WATT $DPW $PLX $YINN $FRO $BTX $RENN $ERJ $UGAZ $XNET $SBGL $EDC $NUGT $JNUG $ABT

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $INCY, $ODT

(6) Recent Downgrades: $TRSO, $MRUS, $PLNT

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $BURG, $MICT, $XOMA, $SSW, $SPY ($SPXL), $AAOI, $SPPI, $BTC.X, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY

PreMarket Trading Plan Thurs Dec 28 $LIVE, $WATT, $SPY ($SPXL), $AAOI, $SPPI, Bitcoin, EIA, Oil, Gold, Silver, $VIX

Compound Trading Chat Room Stock Trading Plan and Watch List Thursday Dec 28, 2017 $LIVE, $WATT, $SPY ($SPXL), $VRX, $AAOI, $SPPI – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

All charting and reporting for swing and algorithm models will be updated and sent between now and Jan 1. If you have any questions about the reporting or suggestions please send us a note.

Thanks for the support in our start-up year y’all! Our 2018 plans are in this post.

https://twitter.com/CompoundTrading/status/945635490795065344

Christmas at Compound Trading. We’re emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and Christmas FYI. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports. #premarket

Christmas at Compound Trading. We're emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and Christmas FYI. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports. #premarket https://t.co/1CNAfDsAeI

— Melonopoly (@curtmelonopoly) December 5, 2017

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

Part 2 of Episode 4 Podcast – Data Scientist

Part 2 – Episode 4 Podcast : Data Scientist Fireside, https://t.co/r85TlxJ9a4

— Melonopoly (@curtmelonopoly) October 23, 2017

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts. Many of the late year videos have not been posted yet, however, we will post them this evening.

Dec 13 Swing Trade Set-Ups; $OSTK, Gold, $NUGT, $WTI, OIL, EIA, $VRX, $CELG, $AAOI, $RIOT, $MCIG

If you’re a trader learning, need set-ups, have interest in our 2018 plans, what we see in markets fwd, want to see live trades / on the fly analysis or learn a bit about how we model charts and more…. this video is for you. #premarket #tradingstrategy #trading #video

Fri Dec 8 Trade Set-ups $BTC, Crypto Scenarios, Gold, $WTI, OIL, Algorithms, $VRX, $SQ, $MYL …

Dec 7 Swing Trade Chart Set-Ups $OSIS, $SQ, $DPW, $FSLR, $FB, $TVIX, $XIV …

Dec 6 Swing Trading chart set-ups $ETSY, $FSLR, $VTGN, $APTN, $LMFA, $VRA …

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Swing Trade Set Ups Nov 17; Oil, $WTI, $JJC, Copper, Bitcoin, $BTC, $OSTK, $AMBA, $HMNY, $AAOI…

Swing Trade Set Ups Nov 15 $XIV, $SPY, $OSTK, $HMNY, GOLD, OIL, $SQ, $SORL, $WPRT….

BEST Trade Set-ups in a while! Nov 10 (starts 4:42): OIL, GOLD, $VIX, $VRX, $ROKU, $AAOI, $HTZ …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Holding – $SPY ($SPXL), $AAOI, $SPPI

Did not trade yesterday.

Per recent:

Crypto related still on watch. $MGIT, $OSTK, $ROKU, $MARA, $MGTI, $RIOT, $XNET, $BTCS and more.

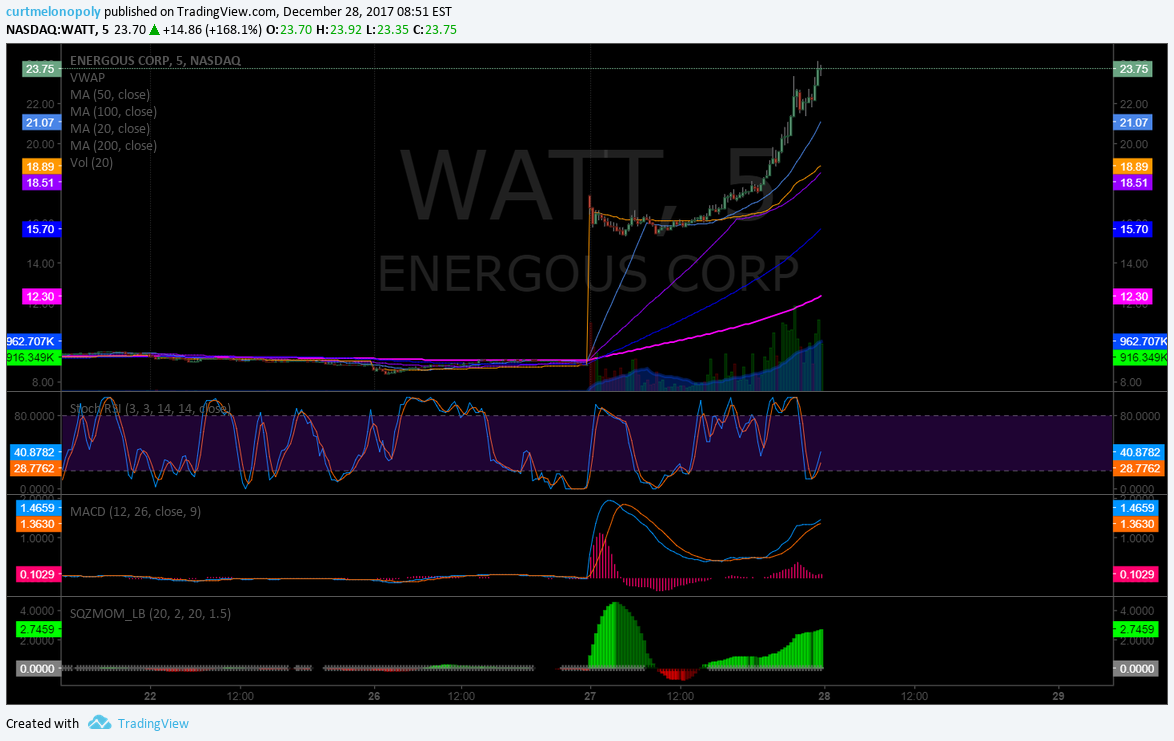

Morning Momentum / Gap / News / PR / IPO Stocks on Watch: $WATT, $LIVE

$WATT premarket continues bullish trade on FDA clearance – trading 23.75

Recent IPO’s : $LFIN

Also watching:

Market observation / on watch:

US Dollar $DXY off and under pressure trading 92.89, Oil $USOIL $WTI bullish but hit considerable model resistance and backed off again trading 59.61, Gold / Silver up – Gold intra day trading 1291.70 – nearing important resistance in model, $SPY moderate / up in premarket trading 267.76, Bitcoin $BTC $BTC.X $BTCUSD $XBTUSD trading intra under pressure on daily 14272.00 holding a mid pivot on daily model and $VIX trading 10.4 moderate and slightly up from yesterday.

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

Recent / Current Holds, Open and Closed Trades

Long 5/10 size $SPXL. Holding in some accounts $AAOI $SPPI long.

$SPY has skip in its step again premarket – lets see some follow-thru! $SPXL $SPXS

$SPY has skip in its step again premarket – lets see some follow-thru! $SPXL $SPXS https://t.co/5mGpeBxcGi

— Melonopoly (@curtmelonopoly) December 28, 2017

$SPY buy trigger set up and live alert. $SPXL

$SPY buy trigger set up and live alert. $SPXL pic.twitter.com/YhBKZ1M0Cf

— Melonopoly (@curtmelonopoly) December 27, 2017

Per previous;

$SPY 1 Min model with current trading range buy sell triggers, fibs, quads, moving averages Dec 27 551 AM AM $SPXL $SPXS