Tag: Technical

Crude Oil Trading Strategy | Technical Analysis & Guidance

A Quick Article With Charting for my Oil Trading Strategies for the Week.

Continued sell-off last week seen oil trade below the multi – week uptrend and trade dropped below support on the weekly wedge chart that I have been sharing.

I wouldn’t be surprised at this point to see a bounce in price, however, the weekly wedge support now becomes resistance. If price breaches the previous support (now resistance) then trades should be ready for a retest of previous support before possible higher.

On the monthly oil chart, price ended the week near the 200 MA support within range of recent monthly candles. Watch the support area.

On the one minute crude oil chart in late trade Friday there were wild price swings (some reporting sweepers, specifically in $XOP). This could be an attempt to a floor in price by a hedge fund or other large money pool.

On the daily chart price ended the week right above the 200 MA and above the primary pivot marked on the chart. The MACD is nearing a bottom to FYI.

On the 4 hour crude oil chart we are using as a test model for trimming and adding to positions trade ended near resistance. This is an untested non back tested chart.

On the weekly pivot charting trade was working near support as with other charts.

Bottom line, the EPIC Crude Oil Algorithm continues to reward those that take long positions at support (channel support and quad support) and short at resistance areas of the algorithmic trading model. This will be my focus and I know the machine trading tech(s) will be focused primarily to those areas of trade also.

Until there is a bounce, retrace and confirmed reversal the bias is short at resistance. The opposite will be true when a reversal is confirmed.

“Bottom line, the EPIC Crude Oil Algorithm continues to reward…”

The machine trade crude oil alert from last week was perfect to the penny at an intra-day top – I would expect the machine trading alerts to increase in intensity this week.

I’ll be in the oil trading room most of the week as I expect a big week in oil trade with the test areas in play.

Follow this link for a detailed description of my longer term crude oil trading strategy review at this post.

Increase Your Crude Oil Trading With These Tools.

- There is a link below to our oil trading academy page that has a number of links to articles on our site,.

- You can book private online trade coaching via Skype.

- Join our live trading room.

- Sign on to our oil trading alert feed subscription, (alerts are on a private member Twitter feed).

- Sign on to our weekly algorithm reporting that provides the algorithm model, conventional charting, guidance for the week etc.

- Attend a trading boot camp (in person or online).

- Request via email the videos of our most recent trading boot camp or the master class series videos (both sets are approximately 20 hours each). They are available only by email request at this time by emailing info@compoundtrading.com. Soon they will be posted to our shop on website.

Thanks

Curt

Any questions let me know!

Further Reading to Help You Trade Oil:

Find more posts like this one on our Oil Trading Academy Page – links to numerous oil trade strategy reports.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Our Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Crude, Oil, Trading, Strategy, Technical, Analysis, Alerts, Trading Room, USOIL, WTI, CL_F, USO

Follow:

Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video

A Career Trade In Crude Oil Is Setting Up. My Personal Oil Trading Strategy Near Term.

This article reviews the oil trade technical set-ups reviewed Monday in the Oil Trading Room for the near term, intra-day (daytrading), swing trading and my thesis (strategy) for a career trade setting up.

With mid-term elections near, President Trump wanting the price of oil lower (economy related), the recent Saudi geopolitical problems and other geopolitical pressure it seems a perfect storm for oil shorts is brewing.

It is my thesis that there is a very real possibility that shorts will get caught (as mid term elections near or shortly thereafter) and the price of crude oil could rebound out of the pressure and run in to early 2019 in a bullish fashion.

If that doesn’t happen I’ll follow the trend down and provide our members with the technical analysis for the scenario, but I think shorts are going to get caught on wrong side of the trade in to 2019.

#Crude #Oil #Trading #Strategy FX: $USOIL $WTI $CL_F $USO

Oil Trading Room Video – Technical Analysis of Oil Trade Strategies Near Term and in to Next Six Months.

Voice broadcast starts at 2:30 on video.

Summary of Video Transcript – Lead Trader Technical Analysis for Strategy:

The video is very detailed, the summary below doesn’t cover a lot of what was discussed on the video so if you are trading oil be sure to watch the video as it is a very in depth look at the charting and more.

Oil trading 69.05 at noon Monday during review.

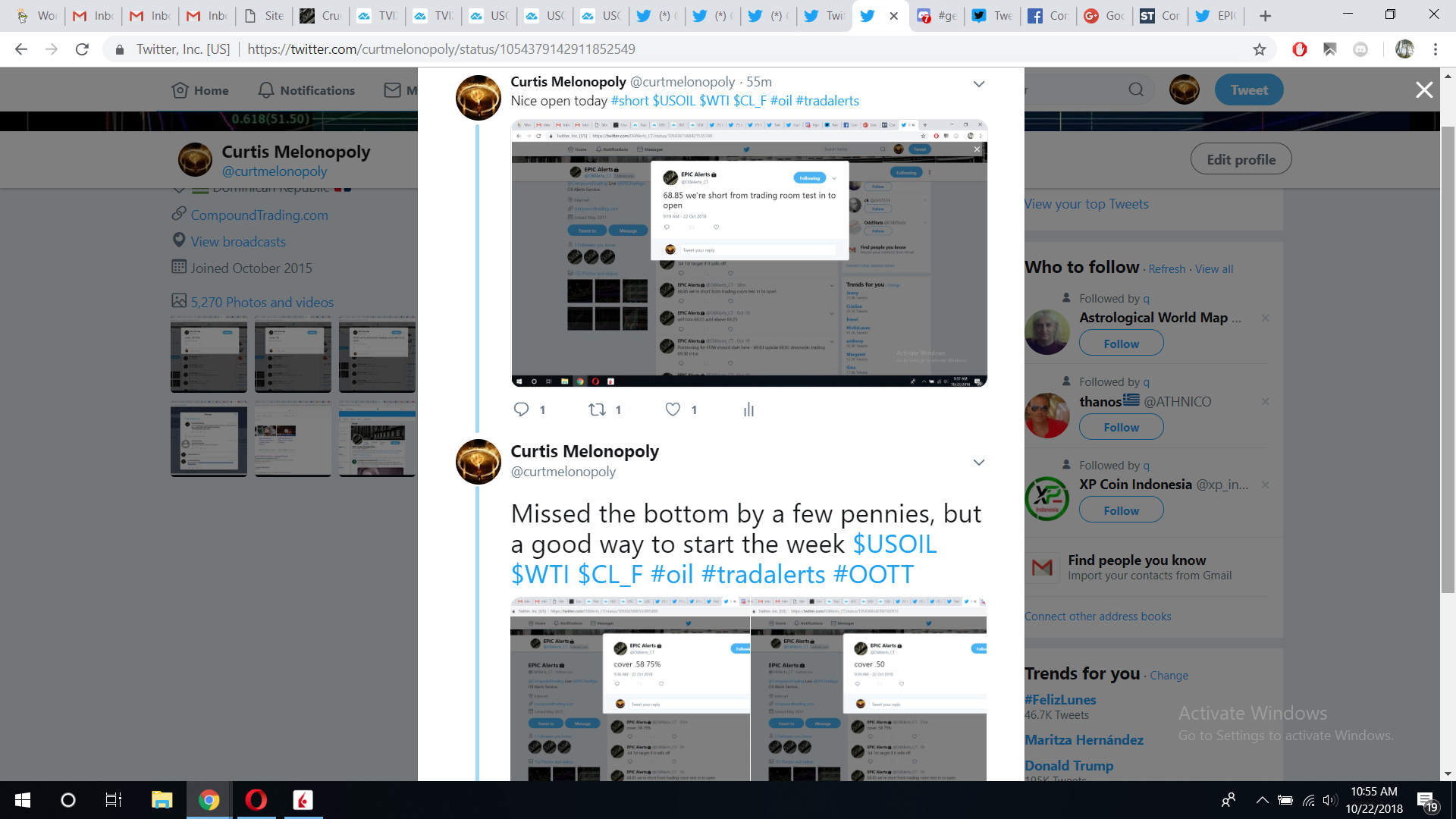

Review of our crude oil trade and trade alerts in to the regular market open:

We were short crude oil 68.85 in to open. We covered 68.58 75% of the position and then the final 25% we covered the trade at 68.50.

Below are the screen shots of the Oil Trade Alerts from private member Oil Twitter Alert Feed.

Below is a screen shot of EPIC Oil Algorithm charting that shows the short oil trade entry (green arrow) and the areas of the chart where we covered the trade.

Below the chart from the oil trading room shows the obvious short and long positions that could be traded on the algorithm model (also what the machine trading is programmed to execute oil trades with).

At 4:00 on video I discuss the machine coding progress and the obvious trades on the oil algorithm charting and how clean that trading has been in the trading range on the model.

At 4:45 in the the Oil Trading Room there was a member comment pointed out that is very true for trading the model with success.

“Trade the model until it breaks, take you lumps when it does.”

I have been looking for an area to re-short in to the week and I just haven’t executed but there was an excellent area of the charting to do that.

At 6:00 on the video a question in the private oil trading room on Discord is answered with reference to the wide swing trading ranges on the model.

ifitworksYesterday at 10:29 AM

@Curt Melonopoly do you are you able to back test any data for how the market reacts(probability) stays around the grey line before it makes a decision to change trend. if that makes any sense?

At that point in the video I explain how we are coding the oil algorithm for machine trading and more specifically the swing trading range at the grey horizontal main pivots on the charting.

At 8:00 areas to short oil and the down channel in oil trade is reviewed on the algorithmic model and charting.

A member call for intra-day oil trade from the oil trading room is also discussed;

RichYesterday at 12:12 PM

If it holds here at 68.95 should be a good opportunity to go long to 69.30

At 10:44 hidden pivots on the charting are discussed and trend lines for trade.

At 11:00 the Trend Line charting is discussed. A very good chart to watch. Support and resistance is strong.

At 11:20 the Symmetry charting is reviewed. It looks like oil trade is going to return to its natural order. What to expect going forward in trade is reviewed and historical advantages.

At 12:30 the trading box on the daily oil charting is reviewed. Down trend waves are reviewed. 70.85 is very likely intra-day on the chart. The 200 MA test is likely.

At 13:00 on the video is the weekly wedge charting reviewed and how trade in oil is playing out almost perfect to the time cycle and price. 68.38 (approximate) is the area near the bottom of the quad to watch. The upside thesis is reviewed here for trade between now and early 2019. AND YES I know they aren’t the “primaries” haha – lots going on in the brain while in a trading day.

At 15:00 200 MA 67.05 on monthly chart is reviewed. This is in large part why I don’t think we will sell off heavy.

Either way I want a big move in crude oil trade in to Christmas, I want a career trade and that is what I will be watching for.

In to the end of the video the 4 hour chart for crude oil is reviewed showing the trend line support areas of the charting and I review some possible “tells” on the oil chart.

It’s important to watch the video to get the support areas in a sell-off – if 68.50 is lost in trade it’s 67.00’s and so on.

Trading Strategy in Summary

This is how I think the shorts are going to get caught. The decision area (support in trade) is similar on all the charts. The technical set-up and thesis that shorts will get caught off-side is reviewed here. I think there is going to be a sell-ff that will freak out the long positions and the shorts will be caught in a compressed situation after mid terms.

Increase Your Crude Oil Trading With These Tools.

- There is a link below to our oil trading academy page that has a number of links to articles on our site,.

- You can book private online trade coaching via Skype.

- Join our live trading room.

- Sign on to our oil trading alert feed subscription, (alerts are on a private member Twitter feed).

- Sign on to our weekly algorithm reporting that provides the algorithm model, conventional charting, guidance for the week etc.

- Attend a trading boot camp (in person or online).

- Request via email the videos of our most recent trading boot camp or the master class series videos (both sets are approximately 20 hours each). They are available only by email request at this time by emailing info@compoundtrading.com. Soon they will be posted to our shop on website.

Thanks

Curt

Any questions let me know!

Further Reading to Help You Trade Oil:

Find more posts like this one on our Oil Trading Academy Page – links to numerous oil trade strategy reports.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Our Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Crude, Oil, Trading, Trading Room, Strategy, Technical, Analysis, Alerts, USOIL, WTI, CL_F, USO

Follow:

Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Daytrading Stocks Isn’t Easy, But You Can Increase Your Win Rate When Trading Momentum Stocks Using Technical Analysis Along With A Catalyst Thesis.

In this post I use the market open trade in $ROKU as an example (live raw trading room footage is below) to teach you how to daytrade stocks that have a catalyst (in this case an upgrade in ROKU by a well known market analyst that morning) and using technical analysis to structure the trade (long trade entry point on chart, where to trim the position and where to close the position at key resistance).

My trade was clean, without stress, I alerted the trade live on the live trade alerts feed and traded it live in the trading room. When I alerted the trade I also gave our members a price target for closing the trade.

Hopefully my experience in using technical analysis while daytrading stocks will help you win more and lose less when you lose.

Live Trading Room Raw Video and Transcript Highlights Detailing Trade Entry, Price Target, Trims and Closing Trade.

The video below is the raw live trading room video feed that includes review of various trade set-ups in premarket and market open. The summary of the ROKU trade is below the video with points of reference on timing on video for easy reference.

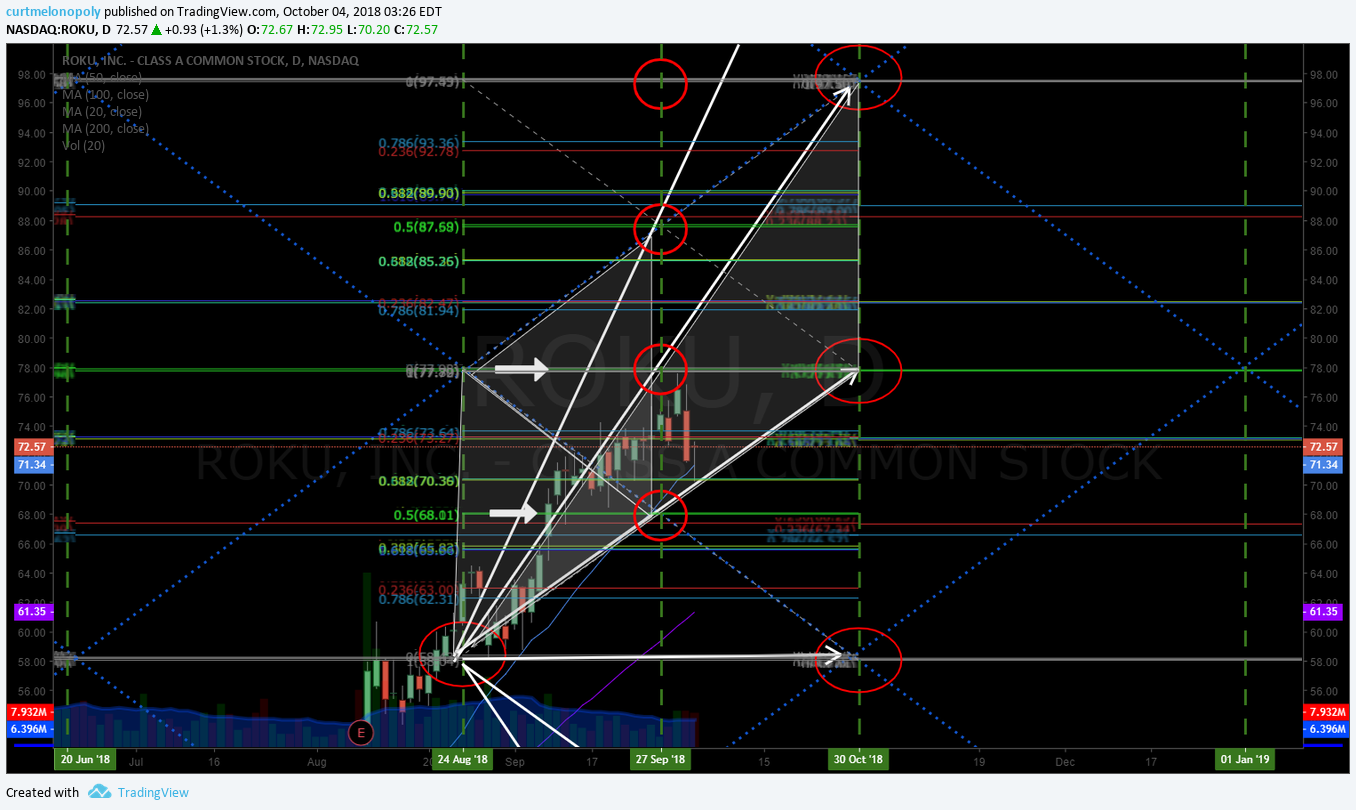

At 5:55 on video: In premarket I explain to the trading room that ROKU is my primary watch (the others I also reviewed on the video) on the day on the analyst upgrade. ROKU trading up 2% at 74.63 premarket. Over 77.62 is an add (to those already in the swing trade). For the longer term than daytrading 93.93 is a possible price target in a bullish scenario and 87.58 is more likely and 78.00 most likely for the target date on the chart at the time cycle peak.

The points of support and resistance on the charting that I reference follow a process of technical analysis that we use on all of our algorithmic charting.

ROKU trade is following trajectory. Be sure to trim trade positioning in the resistance areas on the chart and add above (or alternatively add at pull backs).

I also how 5 minutes in to open is an important area to watch and how I am cautious Monday mornings, but on this Monday premarket trading was bullish.

At 9:12 on video: Market open at 9:30 Eastern time. ROKU trading 74.72 at open, over 77.62 is a buy / add to any existing swing trade position. Support on ROKU intra day is at 73.15 – 73.20. Buy side coming in at this point and 3 – 4 dollar day trade range possible prior to resistance over head.

At 13:44 on video: Watching the market open first 5 minute candle conclusion. Over high of day (HOD) ROKU could run in to 77.70 price target. At this point in the trading session I explain that I may run the trade with the market to the price target. Trading 75.65 intra-day looking for 76.00 for a long entry for daytrade now.

At 14:41 on video: At this point I alert that I am long ROKU at 76.00 with a tight stop bias with price target for ROKU daytrade of 77.50. I would trim heavy in to that price target and possibly add above.

At 17:28 on video: Just about triggered an add to my long position in ROKU at 75.82, probably should have. Watch next 5 minute candle completion.

At 18:40 on video: ROKU is strong in to 5 minute candle switch. Now I have a stop at entry 76.00. If it dumps (sells-off) beyond my entry price at 76.00 I may re-enter.

At 21:01 on video: Trimming my position at 50% size at 76.69. Decent little day trade. It’s strong. Nice buys there.

At 25:15 on video: We’re getting pretty close to my price target.

At 25:50 on video: Trimming 25% of position 77.16 – likely early but….

At 27:10 on video: This is going to be an important candle turn. If a daytrade is going to soften (fade) it is likely to do that in to 10:00 AM, so I am watching the 10 minute point candle prior to the turn at the top of the hour at 10:00 AM.

At 28:28 on video: In to the candle turn I am watching the bottom of the candle body close. At candle turn watch for bullish or bearish trade action for a clue of how the next candle is going to trade. At this point ROKU is trading bullish trading near high of day. Looking for trade in next candle to hold the top of the body of the previous candle.

At 29:38 on video: Getting close to price target now it trade 77.29 there. 77.16 closed last 25% of the daytrade in ROKU.

The Catalyst: Analyst Upgrade on ROKU:

“Shares of Roku Inc (NASDAQ:ROKU) gapped up prior to trading on Monday after Needham & Company LLC raised their price target on the stock from $60.00 to $85.00. The stock had previously closed at $71.24, but opened at $73.03. Needham & Company LLC currently has a buy rating on the stock. Roku shares last traded at $76.48, with a volume of 8448678 shares”.

Article Here: Shares of ROKU Gap Up After Analyst Upgrade.

The Original Alert That Put ROKU on Watch for a Trade for our Members:

Below is a screen shot of the original trade alert posted on the swing trading alert feed (a copy was also posted to our daytrading alert feed on Twitter) that ROKU was on watch with a time cycle peak nearing (if you need to learn how to chart and/or trade time cycles reach out for some trade coaching, get access to trade coaching boot camp videos or spend some time in our live trading room).

It is important to note here that with the alert we also posted the link to the live chart on Trading View. This is important when you are harnessing your trade thesis in technical analysis, our members do not have to do the charting on their own, we provide that service as part of the platform.

Another important note is that when we are alerting day trades or swing trades for equities or commodity, crypto or currency trades… in most instances our members already have the technical charting models from previous analysis done for members in previous trade alerts or newsletters etc.

ROKU (ROKU) near short term time cycle, on watch for a daytrade and possibly swing long in to timing $ROKU #daytrading #tradealerts

https://twitter.com/SwingAlerts_CT/status/1044978728110100481

Day Trading Alert Feed.

Below are the screen shots for the actual trade entry, trimming the trade, where the stop on my trade was set and the price target for the trade on the day.

Day Trading Chat Room

And below is the screen shot of the trade alert in the daytrading chat room on Discord.

If you have any questions about the trade alert detailed in this article reach out! You can get me on email info@compoundtrading.com or private message me on any of my social media accounts.

Trade safe and cut losers fast!

Curt

Subscribe:

Need help learning to trade set-ups like the one included in this post? Visit our trade coaching page.

If you are serious about learning in depth technical analysis and algorithmic charting and how to trade with that knowledge for a much higher win rate we have a master class video series that is approximately 20 hours of in depth teaching by our lead trader that retails for 1499.00. The master class trade coaching series is only available at this point by request by emailing our office at info@compoundtrading.com. The unedited raw master class videos are now available and the most recent trade coaching event videos are included as an added bonus (usually another twenty hours or so of teaching).

Interested in our live trading room, swing trading newsletters or trade alerts? Visit our menu of trading services.

Subscribe to Live Trading Room.

Subscribe to Live Day Trading Alerts.

Subscribe to Swing Trading Alerts.

Article Topics: daytrading, learn to trade, momentum, stocks, technical analysis, ROKU, trade alerts, catalyst

Part 2 – The Battle Plan | How to Trade the Ambarella (AMBA) Stock Move

The Imminent Ambarella (AMBA) Stock Move (2 / 3)

How to Trade the $AMBA Move: Price Targets | Buy Sell Triggers | Time Cycles #swingtrading #daytrading

In Part One We Covered; Thesis, Catalysts, The Company, Chart History, Chart Study (for Part 1 click here).

Excerpt summary from part one….

Ambarella (AMBA) stock has dumped from the mid 60’s to the mid 40’s since early January 2018 (a huge short side win – the Trump effect) and is now near recent historical lows (the Trump effect catalyst and run-up from September 2017 to January 2018).

Below is Part 2 of a 3 part detailed trading plan for Ambarella. You will find a trading plan for the bullish thesis and levels to watch for a bear thesis leading in to earnings in 39 days (June 5, 2018) and a critical time-cycle completion on the chart model at / or near the same timing (approximately June 9, 2018).

In the trading plan I include price targets, support and resistance levels, buy sell triggers and time cycle completions.

Using this technical set-up you will know how to exploit the move for a much greater return if are an active trader (of course this is not required for an excellent gain) and you trim long positions in to resistance in anticipation of moderate retrace and add above each resistance after each retrace.

Part Two below is a detailed battle plan for day trading and swing trading this move.

Part Three (for swing trading newsletter members) will cover the move in detail as it plays out.

First, what’s new at Compound Trading…

What’s New;

- April 30% Off Sale ends this Monday. Click here for available Sale Promo Codes.

- Interested in more free swing trading setups like this? Sign up here Complimentary Swing Trading Report Mailing List.

- Information about our next trade coaching event May 4, 5, 6 can be found here Trade Coaching Boot Camp.

- Now available for serious traders, information here for our exclusive Legacy All Access Membership.

- 24 Hour Crypto Trading Desk opens mid May 2018 along with our Coding Algorithm Models for Machine Trading. Formal announcements to follow.

Part 2 – The Battle Plan | How to Trade the $AMBA Move

Here’s your technical chart set-up for trading $AMBA:

As noted in part one,

If I’m right (and if I’m not it’s a simple cut fast with a minor cut) there’s a wash-out snap-back trade setting up here that is near epic proportions…

At minimum I’m looking for $AMBA to snap back in to the 53s. A trade from the low 40s to the mid 50s is a serious return (if it actually happens and if it happens over the course of the next 3 to 4 months).

$AMBA closed April 27 at 46.75.

Trend Change: This set-up is a long over 49.50 (if 49.50 area is held) for a major trend change to the upside. Resistance is at 51.50 area in this scenario (trim in advance and add over).

or for Active Trading: This is a long over 47.25 in to resistance near 49.40 (trim in advance and add over).

Be sure to trim longs in advance of that and then if resistance is breached add over that to the next resistance and then rinse and repeat. The horizontal fib lines on the chart show you support and resistance points.

On the short side for a day trade… Friday’s close was 46.75 and the next support is in the 44.55 range… so if there is pressure on the stock in premarket or at open Monday then a short in to the 44.55 support may work out. But be cautious, this thing has science all over it saying that a snap-back is very possible and it should be vicious when it starts.

Support and Resistance Levels – I’ve made the chart easy to manage visually by adding white arrows to each major support and resistance level. The white arrows are your primary buy sell triggers.

Note also the “trading quad walls”. These are Fibonacci based diagonal trend-lines that form a trading structure “quadrants”. They also act as support and resistance.

The red circles are price targets. The price targets for June 10, 2018 time cycle peak are 58.60 (bullish), 49.40 (moderate), 40.13 (bearish). Trade in accordance to price action toward the appropriate target. It is paint by numbers trading – just follow the rules and if your trade fails be sure to cut losses quickly and be ready to turn with price as needed. Trust the plan.

The MOST INTERESTING THING about this set-up is the possibility for a trend reversal based on a simple wash-out down trend with a snap-back that could see a significant three to six month trend to the upside.

In Part 3 (for our Swing Trading Members) I will cover that scenario for significant gains should that transpire.

Also… pay attention to the downside bearish scenario playing out here. If that occurs I will do a Part 3 specific to that and include a detailed trading plan.

My Personal Earnings Rule: 95% of the time I will not hold in to earnings. Trade your plan however you wish.

Here’s your technical chart set-up for trading Ambarella $AMBA.

Here’s your technical chart set-up for trading Ambarella $AMBA. by curtmelonopoly on TradingView.com

Good luck with your Ambarella trade and if you need any help message me anytime!

To register as a swing trading member click here.

Best and Peace.

Curt

If you are not already on our Free Swing Trading Periodical email list follow the link here to get on it to receive trading set-ups in the future. Unsubscribe anytime.

In Closing:

A few hours of trade coaching or study on exactly how to trim in to resistance and how to add to your positions on winners and how to cut losses properly and quickly will return huge dividends.

You can subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

Any questions feel welcome to contact me anytime.

Best with this trade!

Peace and best.

Curt

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States.

Recent Trading Set-Up Review Webinars and Blog Posts

Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA Password “ELON” https://compoundtrading.com/how-to-trade-the-tesla-move-price-targets-buy-sell-triggers-time-cycles-tsla-swingtrading-daytrading/

Oil Member Trade Alert Blog Post. Password “LONG” – Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Swing Email Subscriber Blog Post – Trade Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for full-time daytraders. Private coaching and live alerts.

Article Topic; AMBARELLA (AMBA) CHART. How to Trade AMBARELLA, Stock, $AMBA, #swingtrading #daytrading

How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Here’s How We Are Trading The Impending Tesla Stock Move in the Markets

Tesla stock has been a wild ride lately and with earnings scheduled after market May 2, 2018 this should be an excellent trade (either way).

Below is a trading plan for trading Tesla up or down with price targets, support and resistance levels, buy sell triggers and time cycle peaks. But first… a few announcements on what’s new at Compound Trading!

What’s New!

April Sale On Now! 10 Promo Codes Per Select Items Only – 30% Off. Sale items end April 30, 2018 or if the Promo Code limit for the specific item has been reached (10). If there is no sale price beside the item listed the maximum promo codes have been used. Click here for available Promo Codes.

Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

Information about our next trade coaching event May 4, 5, 6 can be found here Trade Coaching Boot Camp.

Now available for serious traders – Legacy All Access Membership.

24 Hour Crypto Trading Desk opens May 2018 along with our Coding Algorithm Models for Machine Trading. Formal announcements to follow.

Tesla Trading Plan

I have been posting this trade set-up for some time, and we have done well with the trades since. But here forward it could get even better. Here’s a post from April 4, 2108 on Trading View that details the Tesla trading chart structure.

Earnings catalyst:

Here’s the Nasdaq website link for Tesla earnings: Tesla, Inc. is expected* to report earnings on 05/02/2018 after market close. The report will be for the fiscal Quarter ending Mar 2018.

About Tesla:

For those that need to know a little about the company Tesla, here is the Wikipedia Tesla page link: Tesla, Inc. (formerly Tesla Motors) is an American company that specializes in electric vehicles, energy storage and solar panel manufacturing based in Palo Alto, California.

And Here is Why Tesla Could Be A Historic Trade Opportunity.

Tesla is bar none the most hated stock on Wall Street.

Tesla has the highest short interest of any major company. As I write, more than 30% of Tesla’s float is being shorted – up significantly in the last two weeks. That’s an utterly massive level of shorting for a stock with a $47 billion market capitalization. Simply put, being short Tesla is a very crowded trade right now.

And shorts are making a very big mistake.

That is a quote from this article; The Biggest Mistake Tesla Short Sellers Are Making Right Now.

And the writer could be right!

And there is a never ending array of news coverage on the Tesla story as we lead up to earnings…

Musk’s ‘no new capital’ promise faces scrutiny when Tesla reports results

Either way, our job as traders is to trade price action, so below is your technical chart set-up to trade Tesla either way for massive profit!

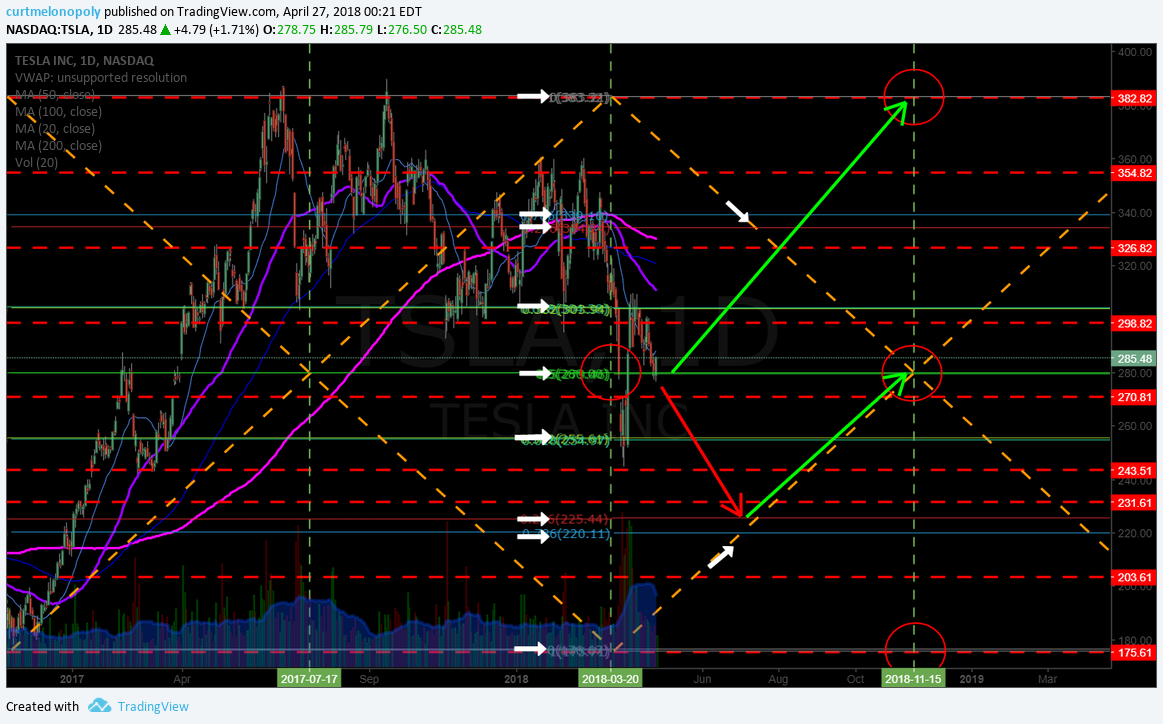

Here’s your technical chart set-up for trading Tesla $TSLA.

$TSLA closed April 26 at 285.48.

This set-up is a long over 280.00.

Your next major resistance is at 303.90 so be sure to trim longs in advance of that and then if resistance is breached add over that to the next resistance and then rinse and repeat. The horizontal fib lines on the chart show you support and resistance points. Also of note are the red dotted horizontal lines, they are also support and resistance lines, they represent historical support and resistance levels that can affect trade – pay some note to them also.

If 280.00 support (which is the main pivot in this trading range… mid trading quad support) then look to support at 255.60. If you’re short you will want to start covering in advance of trade getting to 255.60. If that is breached to the downside then add to your short and trim in advance of the next support on the chart.

I’ve made the chart easy to manage visually by adding white arrows to each major support and resistance level. The white arrows are your primary buy sell triggers. Note also the white arrows at the “trading quad walls”. These are Fibonacci based trend-lines that form a trading structure “quadrants”. They also act as support and resistance.

The red circles are price targets. The price targets for Nov 15, 2018 are 383.00 (bullish), 280.00 (moderate), 175.00 (bearish). Trade in accordance to price action toward the appropriate target. It is paint by numbers trading – just follow the rules and if your trade fails be sure to cut losses quickly and be ready to turn with price as needed. Trust the plan.

Here’s your technical chart set-up for trading Tesla $TSLA.

Here’s your technical chart set-up for trading Tesla $TSLA. by curtmelonopoly on TradingView.com

In Closing:

A few hours of trade coaching or study on exactly how to trim in to resistance and how to add to your positions on winners and how to cut losses properly and quickly will return huge dividends.

You can subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

Good luck with your Tesla trade and if you need any help message me anytime!

Peace.

Curt

Recent Trading Set-Up Review Webinars and Blog Posts

Oil Member Trade Alert Blog Post. Password “LONG” – Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Swing Email Subscriber Blog Post – Trade Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.

Article Topics; TESLA (TSLA) CHART. How to Trade TESLA, $TSLA, #swingtrading #daytrading