How to Trade Facebook (FB) Earnings. Monday Trade in Facebook – Stock $STUDY Preparation. Technical Charting for Swing Trading and Day Trading. Member Edition of Report.

Trading Plan for Facebook, Inc. (FB), July 28 2018.

Monday I expect a big day for Facebook trade post earnings. What a fantastic opportunity to see some great day trading returns and possibly swing trade Facebook with large sizing.

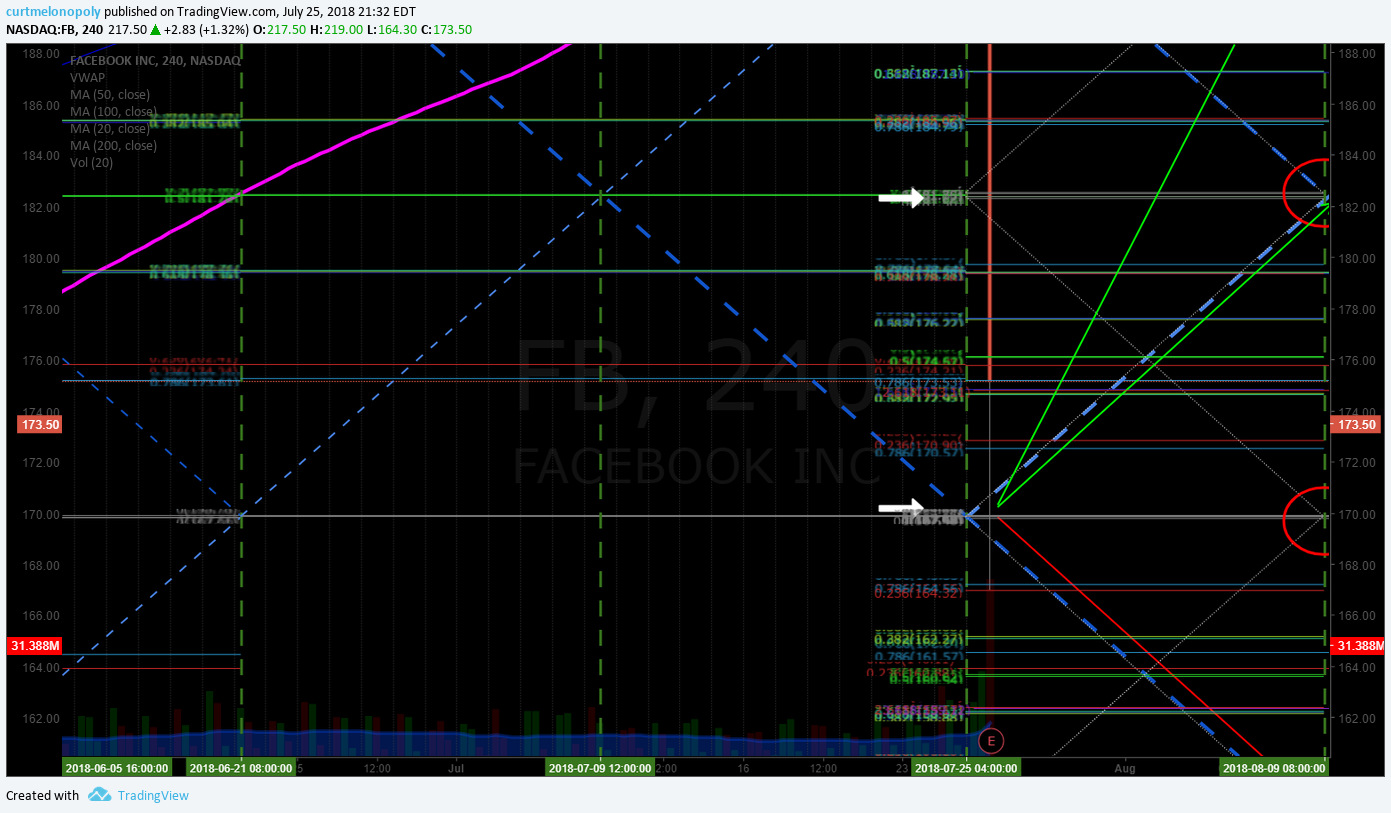

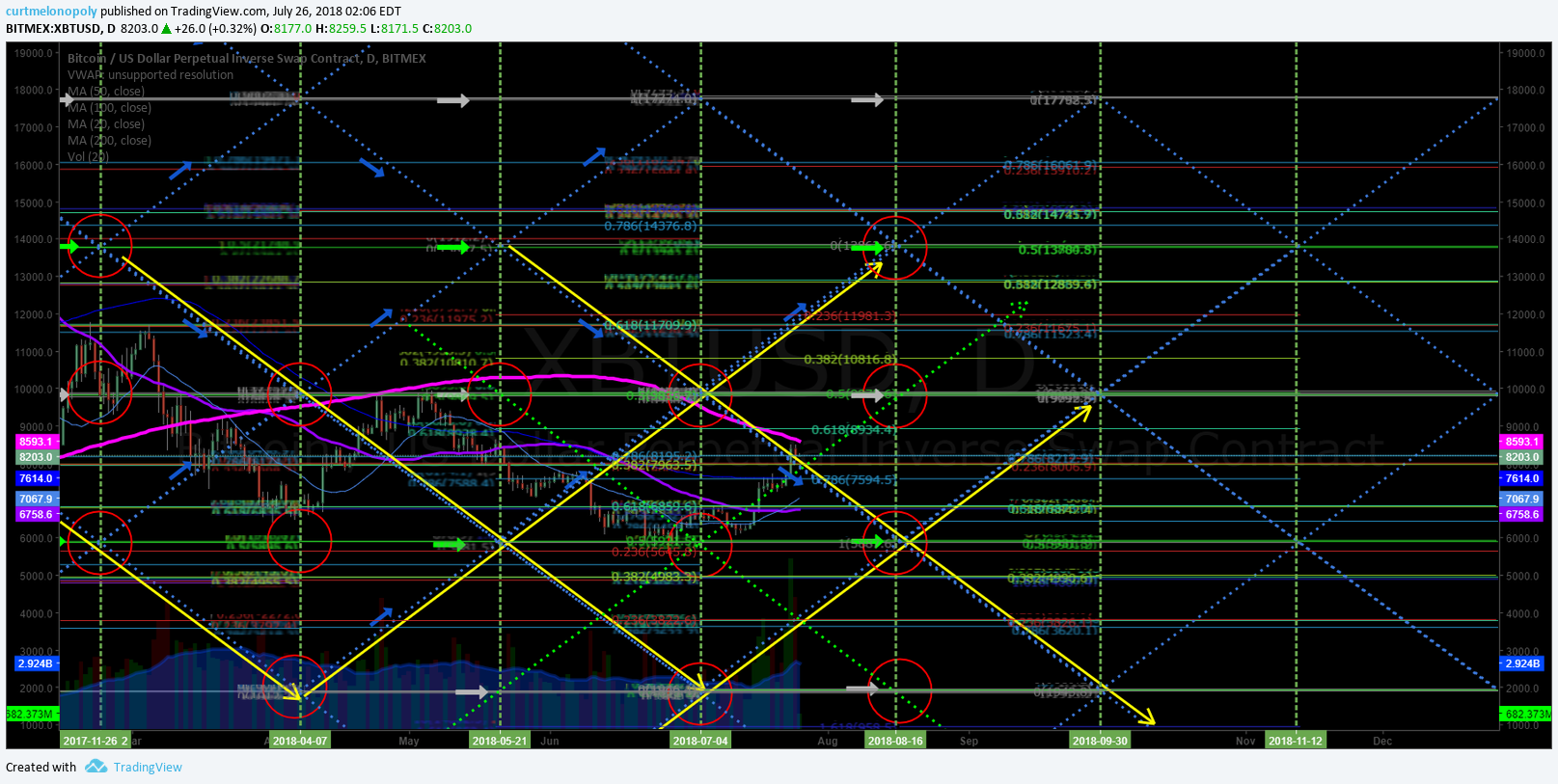

In this follow-up report to the one published last week (Trading Facebook (FB) Earnings Wash-out on Revenue Growth Warning) are follow-up technical charting details for trading Facebook. The technical charts below will assist you on short time frame daytrading premarket and and market open and for entries toward swing trading possibilities.

If you are unaware of what occurred last week with Facebook earnings, this article explains:

Facebook has the WORST day in Wall Street history as shares plunge 19% and $119 billion is wiped off company’s value, as analyst predicts more misery to come for the social media giant.

As mentioned in part one of this special report;

The last time we traded a Facebook wash-out the trade was one of our biggest winners of 2018 (thus far). We nailed the bottom of the sell-off and we followed the trade through as it gained upside until today. We have been out of the trade for a few weeks now in anticipation for today’s earnings announcement.

Below is one of many alerts issued to members in the last Facebook sell-off, we were in nice and early and banked considerably as a result:

$FB Facebook long side trade from 153.40 Mar 28 buy side trigger now testing buy sell trigger 167.51. See chart notes. #swingtrading

https://twitter.com/SwingAlerts_CT/status/984194323192266752

You can find the April 11, 2018 Facebook trade article from our blog here:

$FB Facebook Long Set-Up Testing Buy Sell Trigger #swingtrading (Public Edition)

Facebook Trading Plan:

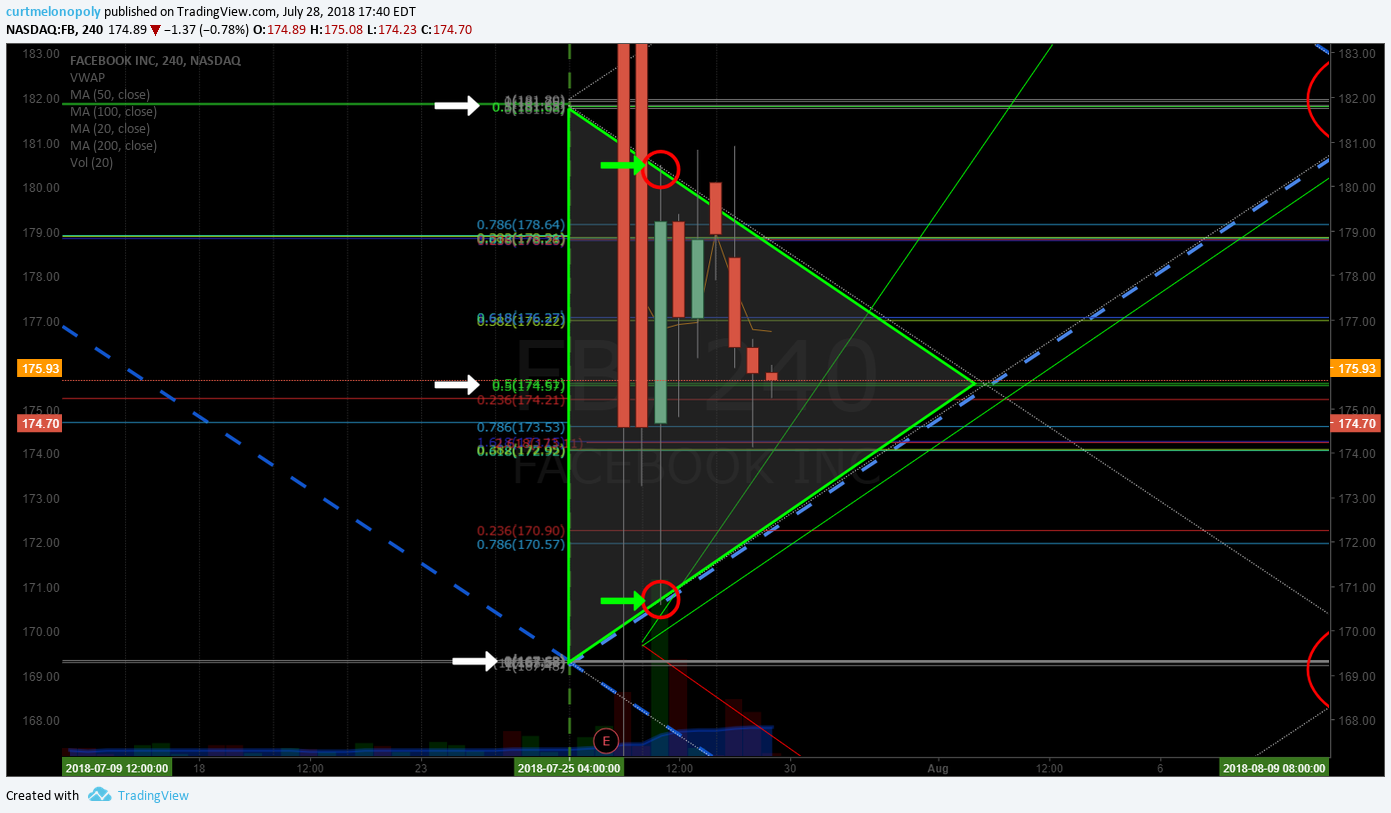

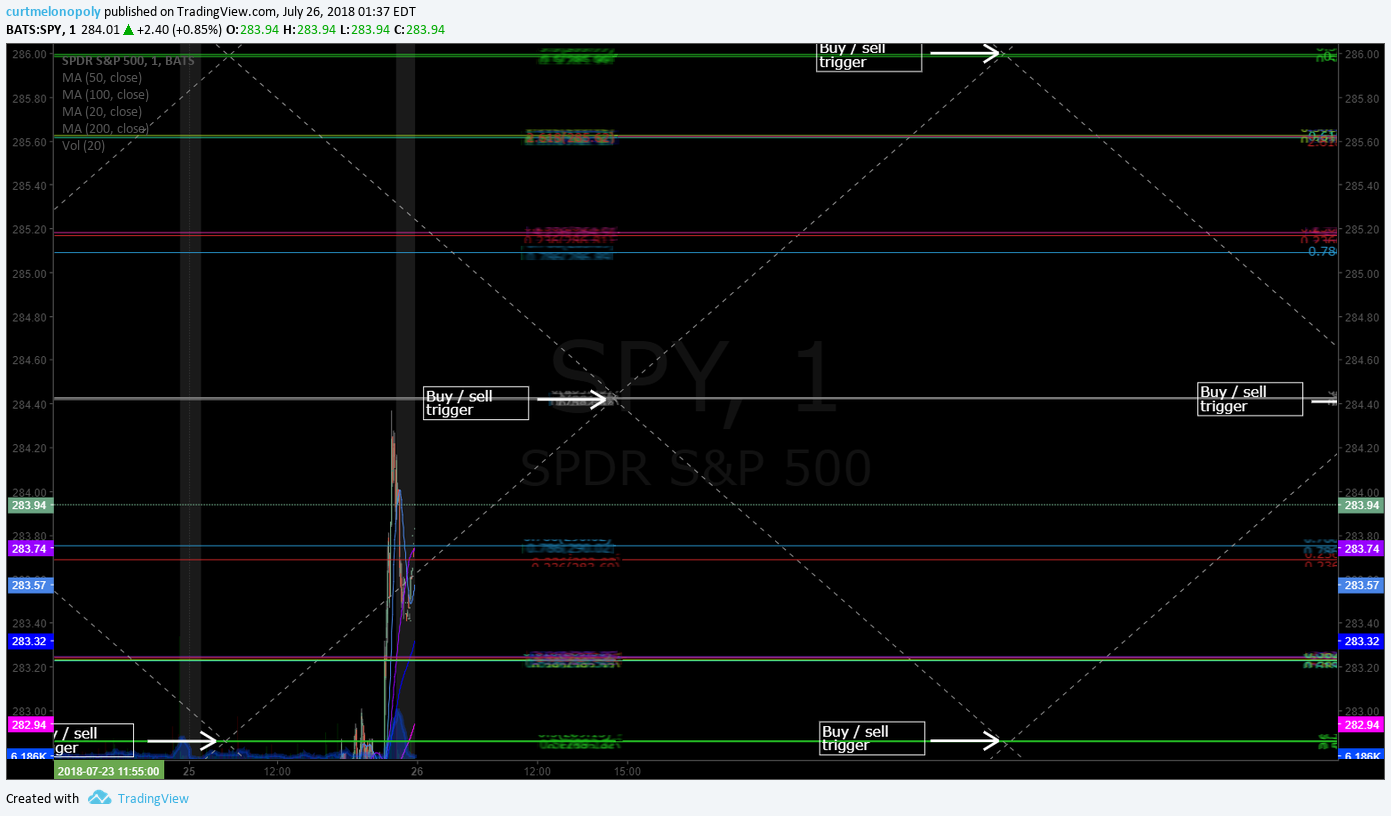

Facebook (FB) “On the Fly” Charting Model – Daytrading Chart with buy sell triggers for Monday. $FB #facebook #chart

Member version of this report is distributed in real-time (not delayed) and includes (in addition to a static chart) a link below to a live interactive Facebook daytrading chart on Trading View (with all technical levels).

Buy / sell triggers on the short time frame per chart (intended for short term day-trading):

153.51

160.59

167.61

174.60

181.60

188.79

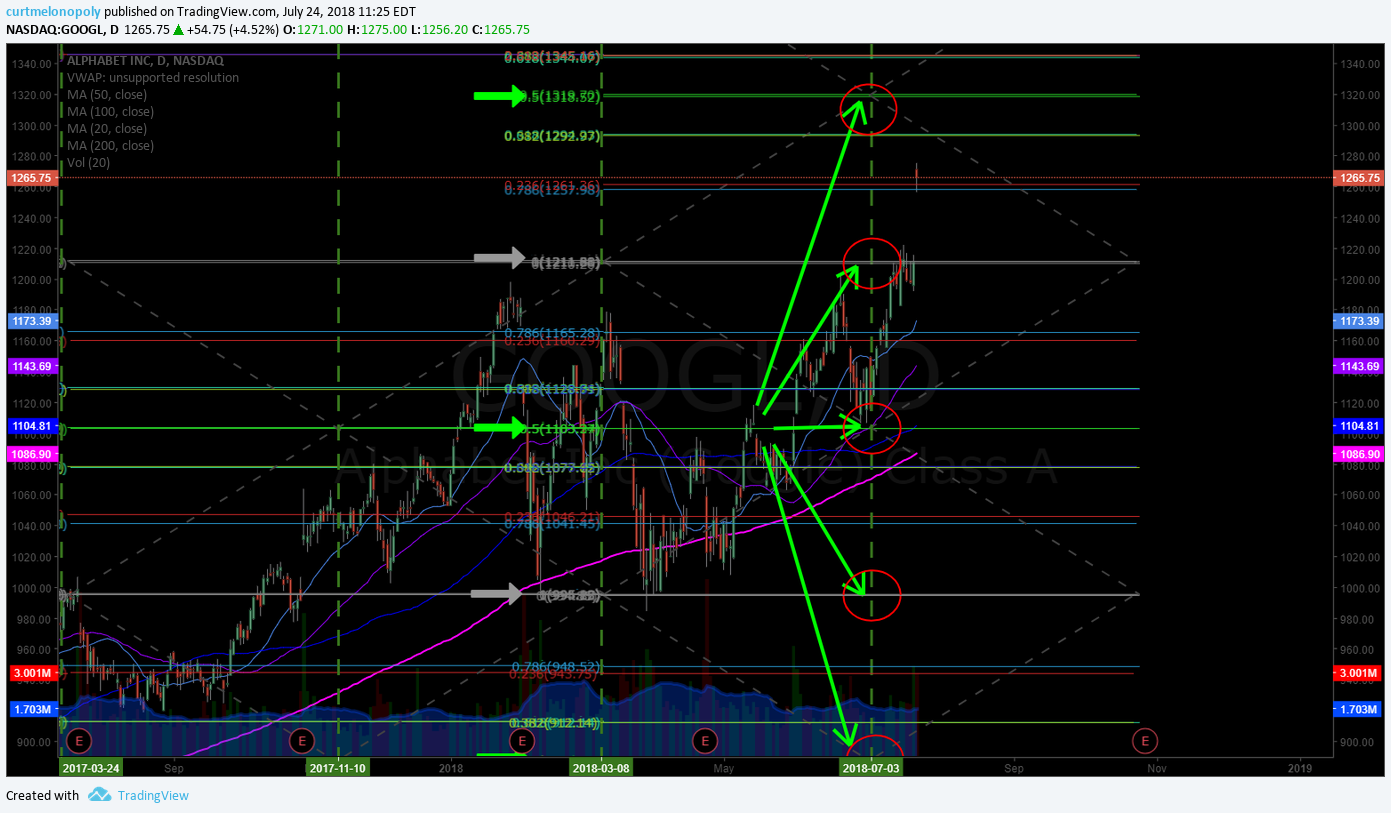

FACEBOOK (FB) Closed Friday just above 50% Fibonacci retrace pivot in trading structure alerted to members $FB #swingtrade #daytrade

My trading plan includes watching the Fibonacci retrace pivot noted at 174.60. Trade above is a long to diagonal down slope trendline that trade used as resistance last week. I won’t likely be shorting as the sell-off likely has the stock in an over-sold position (to be determined).

If trade loses the pivot then I will be looking to the lower uptrending Fibonacci trendline (bottom of quad) for long positions and then trimming (as above) at Fibonacci downtrending diagonal quad wall.

For ease the chart has the lines highlighted in green. When trade moves to the next part of the trading structure I will trade the next structure in a similar manner.

The time price targets are on the chart as red circles and are always at the main buy sell trigger points at the mid quad, top of quad, and lower quad. Trade the FB stock in the direction of trend in the trading structure toward the price targets (date for each price target is listed at the bottom of the chart).

I will be trading FB in premarket Monday and the live trading room will be open. I will also send alerts to our Swing Trading and Day Trading alert feeds as possible as trade develops.

If you have any questions about this special Facebook trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me: