Category: Swing Trading Crude Oil

Lessons from Oil Trading Room (Part 1). Positioning 250 Tick Swing Trade Short Oil EIA & Day Trade Reversal.

How to Position Oil Trade Intra Week Swing Trading and Day Trading Strategies with Crude Oil Futures (Part 1 of 3)

#oiltradingroom #oiltradealerts #tradingstrategies

This three part article series deals with strategies for position trading crude oil intra-week. Positioning your size for events such as the EIA report Wednesday, API Tuesday, the Federal Reserve decision and more.

The live oil trading room video is an excellent supplement to the article as it provides a live raw feed insider’s look in to how our oil trading experts were trading crude oil this week both on swing trading and day trading time frames. Charting is reviewed along with key levels of support and resistance.

As the swing trade short starts to play out and oil sells off intra day 250 ticks the lead trader explains all strategies involved for the big win.

The automated software was also trading short and revered perfectly for an excellent intra week swing trade and day trade in this oil trading room video.

First the video below and then the charting and screen shots of alerts from oil trade alerts live feed.

Oil Trading Room Video (raw feed):

Video is live raw video feed from our oil trading room of a live positioning strategy short crude oil in to the EIA report 10:30 Wednesday and the reversal trade after a 250 tick CL_F crude oil sell off for a rally trade long.

‘Incredible day in our oil trading room on Thursday July 30, 2020.

Both our lead trader and EPIC V3.1.1 machine trading software were executing trades in this trading strategy master class. One of the best videos in our library for learning how to swing trade and day trade crude oil and how to position events such as EIA reporting.”

The oil trading strategy started with an alert to short oil 10% size 41.27 900 AM Wednesday morning in advance of EIA report.

And then alerts went out to buy and sell small positions in size in advance of the EIA report, in to EIA 1 futures contract was held.

At 1214 PM I started a personal swing trade short alerting it as 10% size at 41.35 on FX USOIL WTI traded on CL futures.

Image of guidance provided to oil trading room and alerts feed and overnight in to Thurs oil was selling off, strategy was working

Another screen shot of guidance I provided oil traders in oil trading room of strategy and what signals to watch for.

Screen capture image of oil trade room alerts my swing trade and software closing oil swing trade positions for nice win.

Image of oil trade alert feed for new position long crude oil intraday in oil trading room to 20% size.

Image capture of oil trading room alert feed alerts for a win as price reversal strategy intraday works selling contracts.

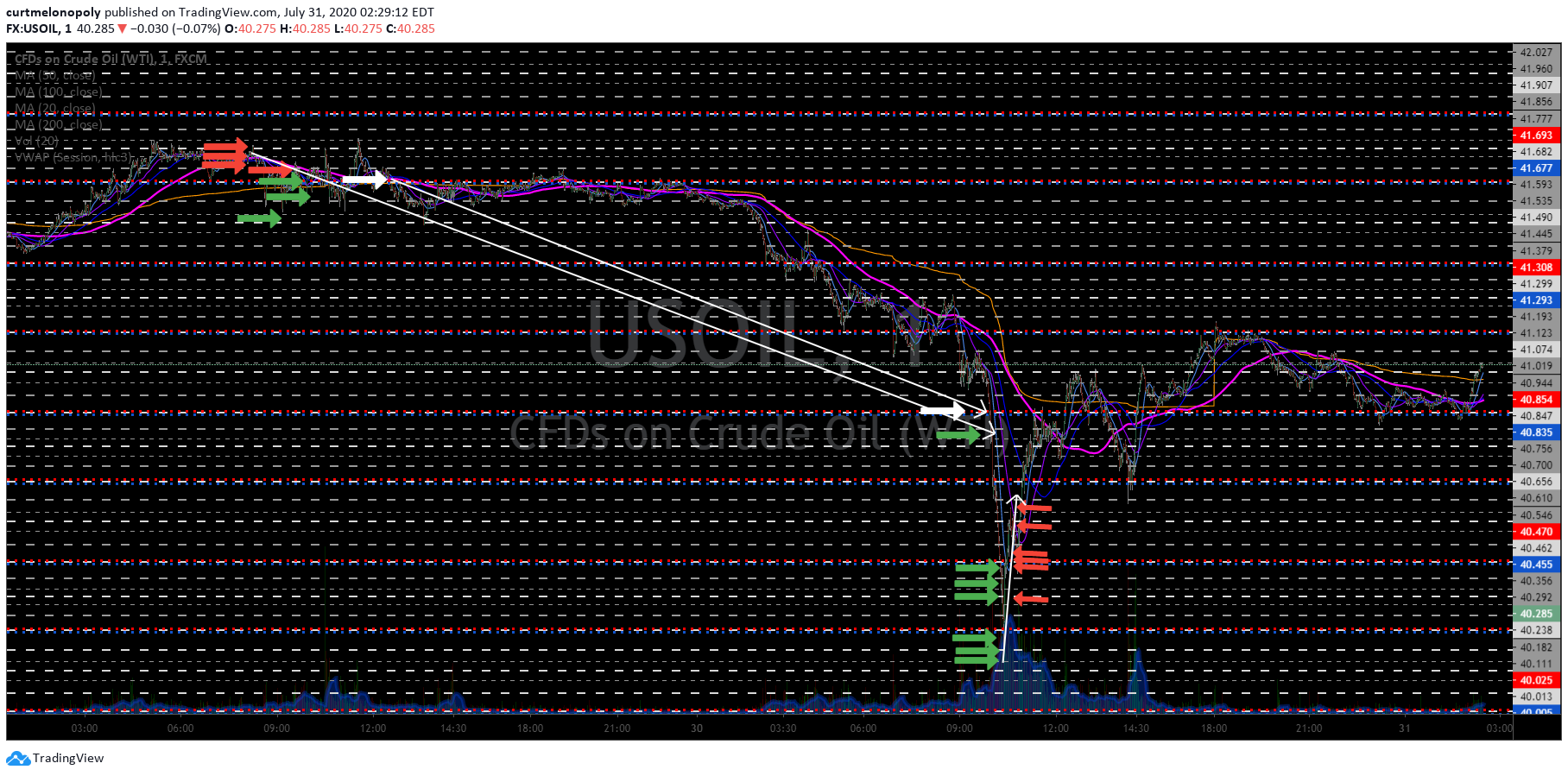

The chart below shows all the trade alerts – entries and exits of positions traded in oil trading room live, green arrows are buys and red arrows are sell CL contracts.

The red arrows are EPIC V3 selling futures contracts, green arrows are the buy alerts and the white arrows are my personal positions. You can see the start of the trade was an intra week short swing trade position in oil in advance of the Wed EIA report by the software and I entered my swing trade after EIA. Then the next series of trades on the chart below are the intra day trades the oil trading software took for a long position snap back trade as oil reversed.

Black Swan Update, June 1-July 30 Profit & Loss YTD +$28,105 or $222,064 74% ROI Per Annum. EPIC V3.1.1 Oil Machine Trade 300k Account

In Part 1 above we show you exactly what happened in the oil trade (trading room video, chart that shows the trade execution positions, screen shots of the actual alerts) for the nice win.

In Part 2 I include charting for our Swing Trading subscribers and strategies used to position for the sell off in crude oil intra week. You can find the article here: Protected: Lessons from Oil Trading Room. Part 2 – Swing Trader Premium “5 Key Strategies”. How to Position Swing Trade Short Oil.

In Part 3 I explain in detail what strategies were used for such precise trade executions for day trading crude oil for our Oil Trading Service Subscribers. You can find the article here: Protected: Lessons from Oil Trading Room. Day Trading Strategies – Part 3 Premium. Positioning 250 Tick Trade Short Oil EIA & Day Trade Reversal.

Our goal is to develop the best oil trading room and alerts service available with the highest win rate % and the most repeatable strategies for consistent wins.

We have published a number of oil trading strategy articles to assist our subscribers with how to trade crude oil and win. You will find in the articles at this link “Crude Oil Trading Academy” videos from the live oil trading room, profit and loss of our trading, various trade alert examples and more.

If you are not progressing in such a way that your win rate is going up and your returns are steadily increasing you may want to consider some short term trade coaching. Even the best traders in the world have trade coaches for times they are struggling.

Below is a recent video from a webinar we recorded in our Oil Trading Room, “How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching” and for more specific trading strategies there are more specific video links below.

https://www.youtube.com/watch?

The recently released white paper about EPIC V3 performance explains also its method of execution of trades, see the report here;

White Paper: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading Methods

Anything else we can do to assist you in your trading journey please email us at compoundtradingofficial@gmail.

Thank you.

Curt

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Follow:

Article Topics: Oil Trade Alerts, Oil Trading Room, Crude Oil, Trading, Trading Strategies, Swing Trading, Day Trading

Keep It Simple (KISS) Crude Oil Swing Trading Part 1 – Using Moving Averages, Gap Fills, MACD for Directional Bias, Size and Position.

PART 1 – K.I.S.S. Swing Trading Crude Oil – Gap filled, now time to watch 200 MA on 4 hour, last time price tested it twice and sold off. #swingtrading #crudeoil

In this short public facing unlocked oil swing trading article, we look at simple indicators oil traders can use to position swing trade bias and trade sizing.

If price gets under 200 MA on 4 Hr and 20 MA crosses 200 MA with price under, this is a fairly decent signal a trend change is setting in for a considerable pull back. You can run this basic indication on each time frame to get a feel for your swing trade positioning and sizing.

A simple but effective way to gauge bias, sizing, risk, positioning strategy etc for oil swing traders.

Another great strategy for swing trading crude oil, specifically for directional bias is watching the MACD on the daily, currently crossed down.

If oil does sell off, the trading support levels noted on the chart would be preferred areas to take profits along the way in a swing trade.

In Part 2, we will go in to some Premium Swing Trade Member charting for structured oil swing trading models including time cycles, price targets and more.

In Part 3 for our Oil Trading Premium Members we will build out our oil trading strategy further with Algorithmic Trading Models.

Look for those later this evening.

If you need anything email me at compoundtradingofficial@gmail.com.

Thanks

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; Swing Trading, Crude Oil, Trading, Oil, MACD, Moving Averages, Gap Fill, Support Levels, Sizing, Bias.

How to Swing Trade Crude Oil: The Next Leg Has Started, Will it Last? Our Oil Trading Strategy (Part 1 of 3)

Swing Trading Crude Oil – Next Leg of the Rally Has Started. A Review of Our Strategy.

Since crude oil traded to negative prices, we have been writing a series of articles for our subscribers (some are unlocked for the public) – they are below. This is a continuation of the article series for the current price rally.

Trading crude oil is difficult enough, the technical analysis we will review here (including price resistance, support, retracement levels, time cycles, symmetry) and various other topics such as; Surprise Jobs Numbers, Fed stimulus, Corona Virus, OPEC and more.

The technical analysis for the legs of the rally have been spot on (as of time of writing the public can refer to the first 3 unlocked articles below on Apr 29, Apr 30 and May 2 – eventually they will be all unlocked), the trick is trading it.

- May 29 – Protected: How to Trade Crude Oil – Recent Rally, Time Cycle, My Current Oil Swing Trade (Premium) $CL_F $USO $USOIL

- May 20 – Protected: How to Trade Current Price Decisions in Crude Oil (Premium) $CL_F $USO $USOIL

- May 19 – Protected: Oil Trading Newsletter (Premium): Charting, Alerts, Price Targets, Trading Strategies, Time Cycles. $CL_F $USO $USOIL

- May 15 – Protected: What’s Next? Crude Oil Trading Strategy – Trading Trend Line Resistance Break-Outs (PREMIUM) #CrudeOil #OOTT $CL_F $USO

- May 4 – Protected: The Symmetry and Time Cycle Price Targets of Next Move in Oil Trade | Part 4 (Premium) How We Daytrade Crude Oil.

- May 2 – BOOOM! Price and Time Exactly as Predicted Days in Advance | Part 3 – How We Daytrade Crude Oil #OOTT $CL_F $USOIL $WTI $USO

- April 30 – “Excuse Me, While I Kiss The Sky”. Part 2 Insider’s Look at How We Daytrade Crude Oil (w/ real-time alert screen shots from oil trading room).

- April 29 – What They Won’t Tell You – How We DayTrade Crude Oil Against The AI’s in the Markets, A Sneak Peak.

In the most recent article on May 29 I was clear that I was starting to short the rally in advance of the key resistance in the 38.57 area on FX USOIL WTI and that doing so was not an easy trade and that if the rally continued in to the next leg that I would reverse the trade – this happened Friday morning.

From May 29:

The big challenge with this oil trade strategy is that I am trading against the wider trend, the trend is up and I am trying to position ahead of the turn down in oil, this is not a simple strategy to execute.

In the oil trading room and on the oil trade alerts feed Thursday / Friday I also had said that I was going to trade the rest of the decisions along with EPIC because I could see the decision coming.

Commentary from Oil Trading Chat Room and Oil Trade Alerts (there is also a live trading room with voice alerts and charting separate of this).

As the price of oil was nearing the key resistance area of the charting in this leg of trade EPIC software (as was I) was shorting the resistance. I was noting that a reversal trade was likely imminent.

Curt MelonopolyYesterday at 8:16 AM

EPIC is shorting 38.56 and will likely reverse above, booting up trading room.

And then when price breached the resistance area we reversed our short trade 3/30 size to 12/30 size long for the next leg of trade. Oil rallied on the day from there more than 100 points.

Reversal trades are tough, this morning I (and various EPIC V3 programs) reversed at 38.50-.70 an oil short 3/30 size for 12/30 size longs for a rocket ride🚀 Hit 39.65 on FX USOIL WTI trading 39.44. Wild day. We'll see what next brings.#OOTT $CL_F $USO #swingtrading #crudeoil pic.twitter.com/L9VpJkyQAG

— Melonopoly (@curtmelonopoly) June 5, 2020

Curt MelonopolyYesterday at 8:40 AM

On the oil swing EPIC did reverse 12 contracts from 3 short released 4 so far trading 39.19, we’re in live room. Will release P&L as we go here so you can see what it is doing. 38.56 is the mark for sure for reversals.

Oil Trading Room Chat Screen Capture.

Strategy, Time Cycles, The Fed, The Virus.

The image below provides an idea of what our oil trading alerts feed looks like as trade progresses.

The strategy for swing trading the oil price rally was long until key resistance areas are near as with what occurred on Friday. The other important part of this current area of the rally is that there was a mid time cycle for volatility occurring around the week of June 3 so we were being extra cautious with our long bias.

The mid time cycle would be an opportune time for oil to reverse in the rally, however, the Fed has once again brought in stimulus, continues to signal all kinds of magic money and signals the possibility of more, the world is re-opening after the initial COVID scare, a surprise jobs number was posted Friday and Trump is talking up virus vaccines ready which is almost guaranteed to have the rally continue.

This will all be on close watch however this week because quite often Fed stimulus, magic money talk, news flow in general is timed perfectly within market cycles (they are not stupid) and this can unwind fast, so we will be vigilant being long in this current leg of the rally – to say the least.

So What is the Plan for the Next Part of the Trading Strategy?

Some of the questions an oil trader needs to consider in planning for the week coming;:

- Where is key resistance and support?

- How to size at key resistance and support?

- When to reverse the trade if it support is broken or resistance is breached?

- When to add to the trade or trim the trade?

- Key areas to trim size within each structure or range – position trading.

Lets Start With The Primary Simple Structure of the Oil Chart Trend Lines (for Part 1 public facing article).

Then in Part 2 for our Swing Trading and Oil Trade Subscribers we will go in to Swing Trading the Time Cycle Charts and Models (helps swing trade and position key areas of support and resistance, time and symmetry decisions which is key for sizing adds and trimming positions).

Then in Part 3 for our Pro Oil Day Traders (Oil Trade Subscribers) we will review the various EPIC Oil Algorithm Chart Models for Day Trading and Swing Trading decisions on a variety of time frames.

Part 1 – Simple Oil Charts for Swing Trade Strategies

The oil chart below is from 11:14:37 AM Thursday, crude oil was just holding on to the support of both the trading box of the “gap” on the one hour chart and the lower uptrending support.

And then Friday morning the surprise jobs number came out and oil rallied again to the top of the resistance on the simple trend line crude oil swing trading chart.

Shown below is the Simple Crude Oil Chart for the Gap and Trend lines.

So what is the Plan for a Simple Swing Trading Strategy for Crude Oil here?

You should be long at the key support areas of the chart, the horizontal trend lines that make up the “gaps” historically on the 60 minute chart and more importantly at the up trending trend lines which oil traders are obviously using to size their trades.

At end of week trade on Friday oil price was left at the resistance area of the upper trend line with another possible upper uptrend trend line and trading box “gap” resistance above.

If oil fails to hold support or breaches the resistance areas of this chart you will need a plan – this we will cover in Part 2 and Part 3 of this article.

Below are some simple tips;

If oil breaches resistance look to the next resistance in your strategy and be sure that you are aware of how break-outs work paying close attention to previous resistance now support levels.

If oil fails support be sure you don’t get chopped up by death of a thousand cuts around the key support (in and out of trade taking small losses that add up) and you will need a plan for this also.

Knowing the order flow of intra day trade helps a lot (along with various other more technical indications which increase probability that you are on the right side of a move) which is why we have the oil machine trading software side of our business that our oil trading room and alert clients are alerted to. You can find the most recent EPIC white paper here: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL.

In Part Two, “Protected: Part 2 of 3 – Swing Trading Crude Oil: Key Chart Considerations (Time Cycles, Symmetry, Support and Resistance Levels for Sizing)” we will look at more charting and strategies for our Swing Trading and Oil Trade Subscribers including time cycles, other chart time-frames, symmetry, support and resistance, sizing and more.

In Part Three, “Protected: Part 3 – Algorithmic Crude Oil Trading Strategies (Day Trading, Swing Trading, Position Trading, Time Frames, Models)” for our Pro Oil Day Traders (Oil Trade Subscribers) we will review the various EPIC Oil Algorithm Chart Models for Day Trading and Swing Trading decisions on a variety of time frames.

As always, any questions please send me a note via email compoundtradingofficial@gmail.com.

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; How to, Swing Trade, Crude Oil, Oil Trading Strategy