Tag: Bitcoin $BTC

Swing Trading Set-Ups | Premium | BITCOIN (BTC, XBTUSD), GERMANY ETF (EWG), ALLERGAN (AGN), JETBLUE (JBLU), SPDR S&P 500 (SPY)

Swing Trading Set-Ups.

Below are Swing Trades On Watch This Week (in addition to the others in recent reporting) BITCOIN (BTC, XBTUSD), GERMANY ETF (EWG), ALLERGAN (AGN), JETBLUE (JBLU), SPDR S&P 500 (SPY).

BITCOIN ($BTC, $XBTUSD, $XB_F)

We alerted the bottom long trade on Bitcoin Jan 30, 2019 at $3449.50 and it has now successfully cleared a number of areas of resistance on the model below – it traded as high as $9442.00 this weekend.

At each area of resistance we trim our long swing position in to the resistance and add above.

Trade has now hit a key area of resistance on the model (the trading box), this is typically considerable resistance. Up and over this area look to trade being range bound within the trading box until it breaks up or down from the trading box.

The move is obviously very bullish and following our trend trajectory near perfect from previous alerts and posts.

“Reasons we bot Bitcoin $BTC at bottom – luck, TA but mostly rumor of Zuck Coin $FB #cryptocurrency . Theory, if Fed gonna allow Zuck they likely take invisible hand off BTC price & not tarnish crypto fwd. Also why we’re coding crypto machine trade after oil #OOTT (90 days out).”

Reasons we bot Bitcoin $BTC at bottom – luck, TA but mostly rumor of Zuck Coin $FB #cryptocurrency . Theory, if Fed gonna allow Zuck they likely take invisible hand off BTC price & not tarnish crypto fwd. Also why we're coding crypto machine trade after oil #OOTT (90 days out). pic.twitter.com/jgBeuEnlJY

— Melonopoly (@curtmelonopoly) June 14, 2019

Anonymous Analyst That Predicted Bitcoin’s Price Surge Says It Could Reach $16,000 #swingtrading $BTC $XBTUSD https://usethebitcoin.com/anonymous-analyst-that-predicted-bitcoins-price-surge-says-it-could-reach-16000/

BITCOIN (BTC, XBTUSD) hit key resistance in trade this weekend, trim in to and add above for your swing trade. $BTC #swingtrading

GERMANY ETF (EWG) and VGK, EZU.

This could be a nice trend trade if the bulls continue the bounce from recent and get up over the 200 MA on the weekly charting. It is a touch and go scenario and would have to be managed closely because a break-down could be considerable in my opinion.

If the signal on this set up triggers a long trade alert I will likely model the charting for specific areas of trade entries, exits, trims and adds – key resistance and support areas and time cycles to watch. We do not at current have a model for this instrument of trade.

Mario Draghi: Is another ‘Whatever It Takes’ Moment at Hand? – Market Realist #swingtrading $EWG $VGK $EZU https://marketrealist.com/2019/03/mario-draghi-is-another-whatever-it-takes-moment-at-hand/?utm_source=yahoo&utm_medium=feed&yptr=yahoo

Mario Draghi: Is another ‘Whatever It Takes’ Moment at Hand? – Market Realist #swingtrading $EWG $VGK $EZU https://t.co/toxZxuam1V

— Swing Trading (@swingtrading_ct) June 16, 2019

GERMANY ETF (EWG) above 200 MA on weekly is a long for a possible trend trade in channel. On watch. $EWG #swingtrade

ALLERGAN (AGN)

ALLERGAN (AGN) After significant sell-off this looks ready for a bounce near key over sold support now $AGN #swingtrade

The area of support just below trade (see white arrow) looks to be a key area that is likely to find support and bounce. If it does bounce then I see three areas of key snap back for bullish trade. A general trajectory of trade possible in a bullish scenario is included below with 3 white arrows. We will see how trade near term is, but I like it for a bounce to at least the first price target (first white uptrending arrow).

7 Stocks Ripe for M&A as Trade War Pushes Market Off Record Highs https://www.investopedia.com/7-stocks-ripe-for-m-and-a-as-trade-war-pushes-market-off-record-highs-4689910?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

JETBLUE (JBLU)

Companies to watch: McDonald’s gets upgraded, JetBlue in buyback deal, Apple CEO meets Trump $JBLU $AAPL $MCD #swingtrading https://finance.yahoo.com/news/companies-to-watch-mcd-jblu-aapl-fcau-145511692.html?soc_src=social-sh&soc_trk=tw

JETBLUE (JBLU) Over 200 MA on weekly chart I will look to 22.00 then a move to 27.00. #swingtrading $JBLU

I really like this structured set-up, it does however need to get above and hold the 200 MA on weekly. You could trade it on a lower time-frame (such as daily), but considering where the markets are right now with Fed on deck and time cycle completion, I am playing safe until we’re over the hump of this time cycle inflection. I’ll get much more aggressive over the next week or two.

SPY SPDR S&P 500 (SPY)

SP500 (SPY) With time cycle completions behind us and the Fed on deck, expect a big move $SPY $ES_F $SPXL $SPXS #SwingTrade

We’re expecting a significant move with time cycle peaks on large time frames now in our rear view mirror (officially completely in the review view mirror at end of this week, allowing for a week either way of peak).

The two arrows representing large moves, one scenario up and one scenario down are on watch for the S&P 500. If you have access to our Volatility charting you want to consider it in your trade. The SPY chart also includes the model for structured trade and most considerable are the areas of support and resistance (marked with a series of arrows) and the TL support and resistance areas in red.

There is more SPY model charting in process right now with Jen back testing some newer models on other time frames FYI.

The Fed may break a lot of stock-market investors’ hearts this week https://on.mktw.net/2KkLBOG

https://twitter.com/CompoundTrading/status/1140373914931138561

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing Trading, Set Ups, Strategies, BITCOIN (BTC, XBTUSD), GERMANY ETF (EWG), ALLERGAN (AGN), JETBLUE (JBLU), SPDR S&P 500 (SPY)

PreMarket Trading Plan Thurs Aug 30: $MTSL, $REIS, $KTWO, $TRPX, $NTIP, $SIG, $CPB, $DG, $DLTR, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY more.

Compound Trading Premarket Trading Plan & Watch List Thursday August 30, 2018.

In this edition: CPB, DG, DLTR, SIG, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Thursday Aug 30:

- Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets).

- Between now and Sept 14 I will only be in the live trading room when I notify members (on email, Twitter, Discord). We are processing all the new algorithm models, upgrading all swing and algorithm newsletters, and preparing the content for the Sept 14-16 Trade Coaching event. In other words, we’re reconciling everything for our members over the next 2.5 weeks so that everything is updated, upgraded and distributed on schedule. Alerts will continue to go out on feeds and will also be upgraded to the new models. We will regularly be in member side Discord trading chat rooms as normal also.

9:25 Market Open – access limited to live trading room members12:00 Mid Day Trade Review – access limited to live trading room membersAny other live trading sessions will be notified by email.The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.Link: https://compoundtrading1.clickmeeting.com/livetradingPassword: **** (email for access if you do not have it, password changes will be emailed when changed only)For membership access, options here: https://compoundtrading.com/overview-features/

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

For those asking, wkly report distribution starts early Sun evening & continues through the wk starting w/Oil, Crypto, SPY, Swing and others. Reports are becoming size-able w new platform developments and as such they will flow on rotation Sun-Sat wkly.

https://twitter.com/CompoundTrading/status/1033822317057650688

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest move premarket: CPB, DG, DLTR, SIG & more –

Stocks making the biggest move premarket: CPB, DG, DLTR, SIG & more – https://t.co/AaxM0QicNi

— Melonopoly (@curtmelonopoly) August 30, 2018

Market Observation:

Markets as of 8:18 AM: US Dollar $DXY trading 94.52, Oil FX $USOIL ($WTI) trading 69.92, Gold $GLD trading 1205.51, Silver $SLV trading 14.67, $SPY 291.14 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6888.50 and $VIX trading 12.4.

Momentum Stocks / Gaps to Watch: $REIS $MTSL $EARS $KTWO $ZYNE $YGYI $TRPX $NTIP $TLYS $SIG $CIEN

$EA Will resume 09:00:00. News and Resumption Times. (Halted: 08:25:08)

30 Stocks Moving In Thursday’s Pre-Market Session https://benzinga.com/z/12283034 $TITN $SIG $TLYS $ZYNE $SMTC $INSY $AFMD $PDCO $MIK $BURL $DLTR $CPB $CRM $ANF $ATAI

30 Stocks Moving In Thursday's Pre-Market Session https://t.co/YbIekmybry $TITN $SIG $TLYS $ZYNE $SMTC $INSY $AFMD $PDCO $MIK $BURL $DLTR $CPB $CRM $ANF $ATAI

— Benzinga (@Benzinga) August 30, 2018

News:

$EARS Receives FDA Guidance at Type C Meeting for AM-111 in the Treatment of Sudden Sensorineural

Reis’s stock rockets after $278 million buyout deal with Moody’s

K2M Group $KTWO to Be Acquired by Stryker $SYK in $1.4 Billion Deal – , Stryker to acquire spinal technology company K2M in deal valued at $1.4 billion

Iridium Communications Reports Expansion Of Reach, Capabilities Of Autonomous Vessels In Deal With Rolls-Royce Marine $IRDM https://pro.benzinga.com

Your Thursday morning Speed Read:

– Twitter tests suggesting users unfollow pages they don’t interact with $TWTR

– Apple acquires AR company Akonia Holographics $AAPL

– Campbell Soup reports mixed Q4, soft guidance, & plans to sell its international & fresh food business $CPB

Your Thursday morning Speed Read:

– Twitter tests suggesting users unfollow pages they don't interact with $TWTR

– Apple acquires AR company Akonia Holographics $AAPL

– Campbell Soup reports mixed Q4, soft guidance, & plans to sell its international & fresh food business $CPB— Benzinga (@Benzinga) August 30, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Bitmain’s IPO

Documents highlight some of the issues:

* Investing too much in BCH

* Too much inventory

* Loss-making sales

However, Bitmain shipped 3 million miners & produced $1.3 billion of cashflow in 2017, demonstrating a strong execution capability

https://blog.bitmex.com/unboxing-bitmain/ …

Bitmain’s IPO

Documents highlight some of the issues:

* Investing too much in BCH

* Too much inventory

* Loss-making salesHowever, Bitmain shipped 3 million miners & produced $1.3 billion of cashflow in 2017, demonstrating a strong execution capabilityhttps://t.co/VH0uHsYWjZ pic.twitter.com/CeoAzD0360

— BitMEX Research (@BitMEXResearch) August 30, 2018

Earnings:

Burlington Stores’ stock falls after earnings beat, but same-store sales growth comes up a bit shy

Signet Jewelers stock soars 18% premarket after blowout earnings

Abercrombie & Fitch’s stock sinks after profit beat, but sales rose less than expected

#earnings for the week

$CRM $BBY $TIF $LULU $BILI $AMWD $DLTR $DKS $AEO $BOX $DSW $DG $NTNX $BNS $BJ $BURL $ANF $TD $ULTA $HPE $CPB $BMO $CTLT $BIG $CIEN $HAIN $EXPR $TLRY $PVH $SIG $KIRK $DY $JT $HEI $SFUN $ZUO $MOV $YRD $MIK $HRB $LCI $CHS $HOME $AMBA

http://eps.sh/cal

#earnings for the week$CRM $BBY $TIF $LULU $BILI $AMWD $DLTR $DKS $AEO $BOX $DSW $DG $NTNX $BNS $BJ $BURL $ANF $TD $ULTA $HPE $CPB $BMO $CTLT $BIG $CIEN $HAIN $EXPR $TLRY $PVH $SIG $KIRK $DY $JT $HEI $SFUN $ZUO $MOV $YRD $MIK $HRB $LCI $CHS $HOME $AMBAhttps://t.co/r57QUKKDXL https://t.co/bvDhbgW1NZ

— Melonopoly (@curtmelonopoly) August 25, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

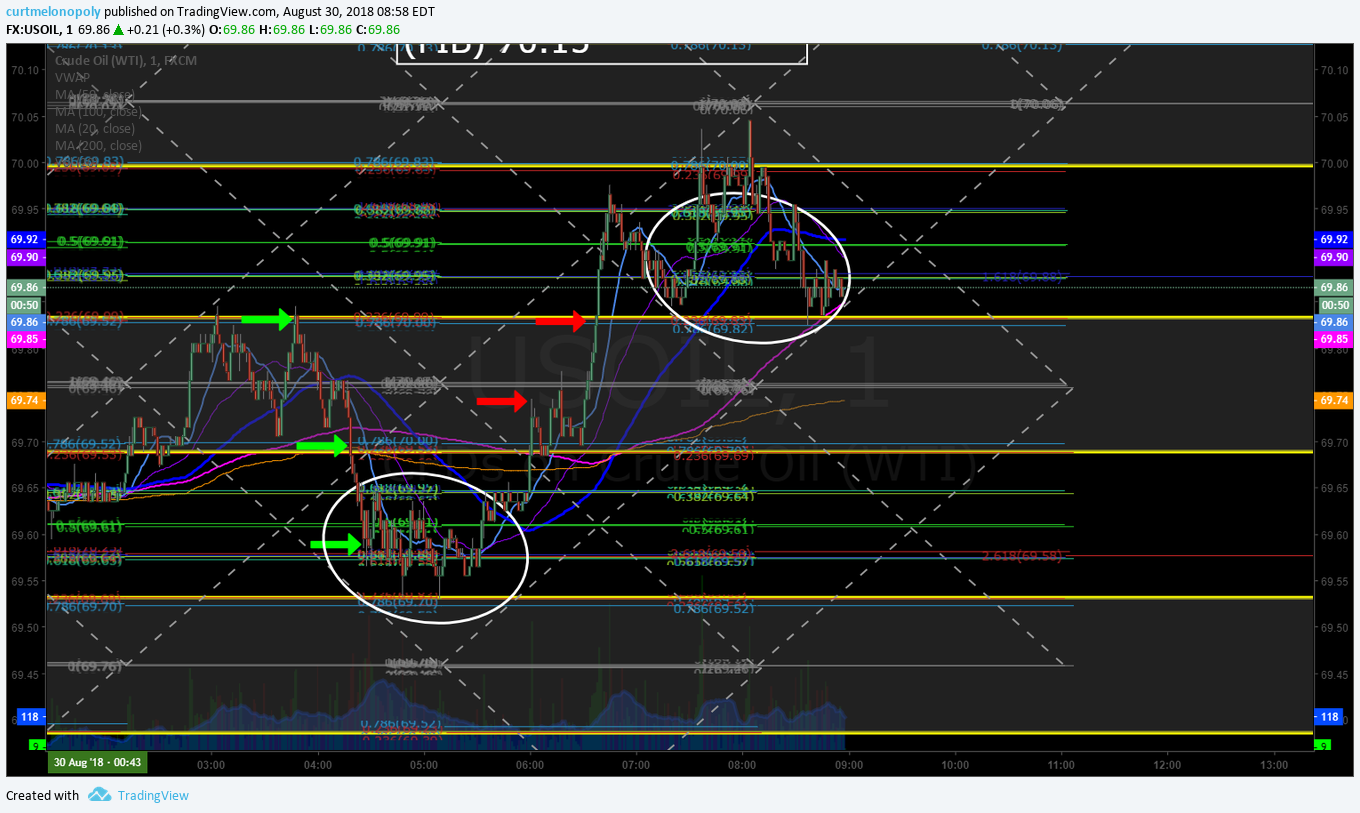

Wed oil futures trading in to Thurs premarket (green long entries, red trims, holding 1 part) #Crude #Oil #Trading

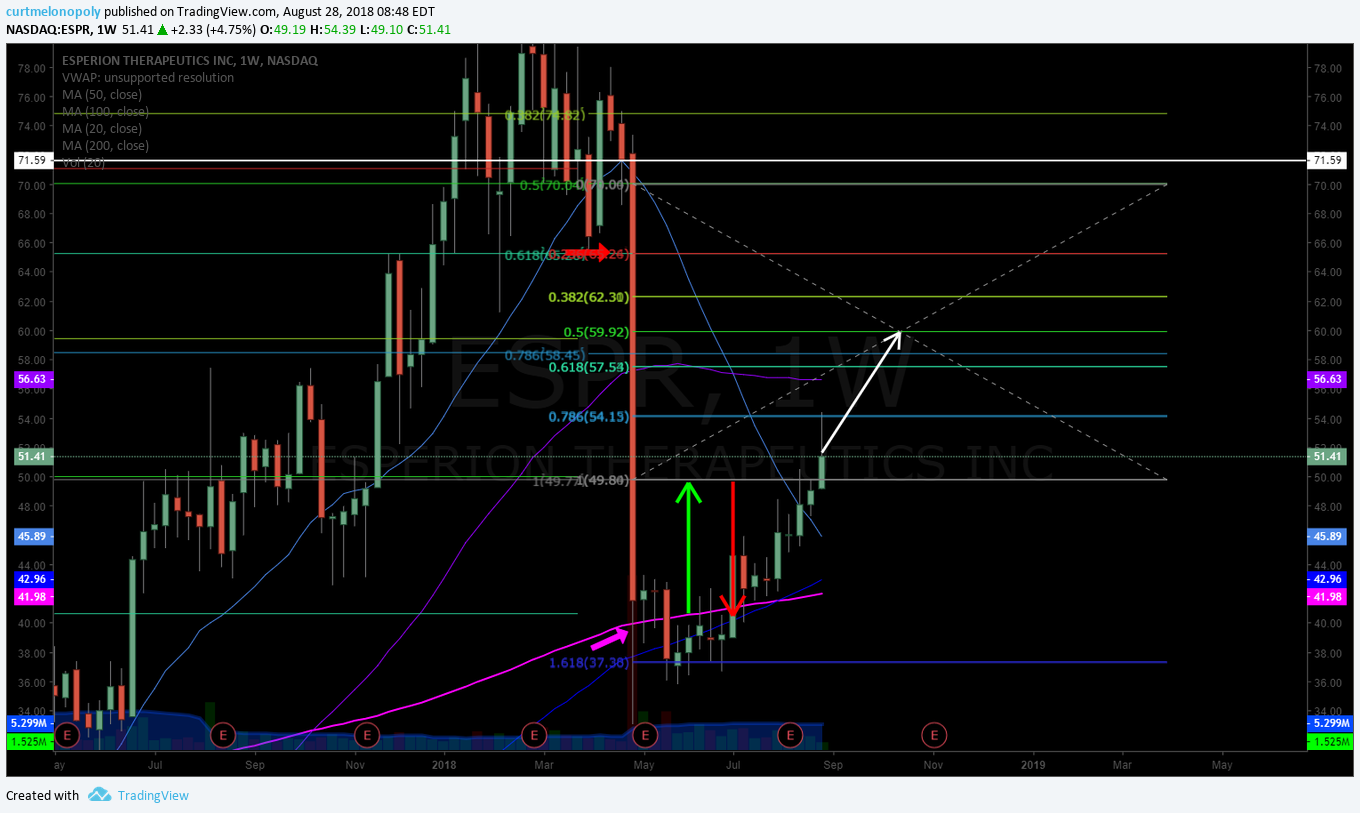

Great wash-out trade in progress from our swing trading platform… ESPERION (ESPR) . Long ads from our previous 49.11 buy side alert. Target reached and now targets 59.90. $ESPR #swingtrading #daytrading

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

The 11 min trade $USOIL $WTI $CL_F #premarket #oil #nonstop #OOTT

The 11 min trade $USOIL $WTI $CL_F #premarket #oil #nonstop #OOTT pic.twitter.com/z4BLWWsDlK

— Melonopoly (@curtmelonopoly) August 28, 2018

and we closed at the red arrow $USOIL$WTI $CL_F #oil #OOTT @EPICtheAlgo and we’re not done.

and we closed at the red arrow $USOIL$WTI $CL_F #oil #OOTT @EPICtheAlgo and we're not done. pic.twitter.com/hnjtFYhpyK

— Melonopoly (@curtmelonopoly) August 28, 2018

Nice quick first oil trade of the week (not at 100% alert win rate for the last number of months as I list last trade of last week, but high 90%) $USOIL $WTI $CL_F $USO $UWTI $DWTI #OIl #Trade #Alerts #OOTT

Nice quick first oil trade of the week (not at 100% alert win rate for the last number of months as I list last trade of last week, but high 90%) $USOIL $WTI $CL_F $USO $UWTI $DWTI #OIl #Trade #Alerts #OOTT pic.twitter.com/DrhjjCB9Hh

— Melonopoly (@curtmelonopoly) August 27, 2018

Oil Daily Chart. MACD cross up bullish testing underside of 50 MA. Aug 26 1030 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Nafta on track

-Barnier two-step

-Iran threat

-Markets drop

-Data due

https://bloom.bg/2PmGGv5

#5things

-Nafta on track

-Barnier two-step

-Iran threat

-Markets drop

-Data duehttps://t.co/lIddgvxu5s pic.twitter.com/t45JK5SXEy— Bloomberg Markets (@markets) August 30, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MTSL $REIS $KTWO $TRPX $NTIP $SIG $TLYS $CIEN $ZYNE $INSY $GES $EARS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $ZNH $GCO $TLYS $NTNX $AIMC $ITCB $ARLO $HDS

Nutanix stock gains after J.P. Morgan upgrade

(6) Recent Downgrades: $GSK $VOD $RES $THG

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, CPB, DG, DLTR, SIG, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY

PreMarket Trading Plan Tues 28: $ESPR, $BOX, $AFMD, $STAF, $ABIL, $DSW, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY more.

Compound Trading Premarket Trading Plan & Watch List Tuesday August 28, 2018.

In this edition: $ESPR, $BOX, $AFMD, $STAF, $ABIL, $DSW, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Tuesday Aug 28:

- Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets).

- Between now and Sept 14 I will only be in the live trading room when I notify members (on email, Twitter, Discord). We are processing all the new algorithm models, upgrading all swing and algorithm newsletters, and preparing the content for the Sept 14-16 Trade Coaching event. In other words, we’re reconciling everything for our members over the next 2.5 weeks so that everything is updated, upgraded and distributed on schedule. Alerts will continue to go out on feeds and will also be upgraded to the new models. We will regularly be in member side Discord trading chat rooms as normal also.

9:25 Market Open – access limited to live trading room members12:00 Mid Day Trade Review – access limited to live trading room membersAny other live trading sessions will be notified by email.The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.Link: https://compoundtrading1.clickmeeting.com/livetradingPassword: **** (email for access if you do not have it, password changes will be emailed when changed only)For membership access, options here: https://compoundtrading.com/overview-features/

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

For those asking, wkly report distribution starts early Sun evening & continues through the wk starting w/Oil, Crypto, SPY, Swing and others. Reports are becoming size-able w new platform developments and as such they will flow on rotation Sun-Sat wkly.

https://twitter.com/CompoundTrading/status/1033822317057650688

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest move premarket: TIF, BBY, DSW, AAPL, SBUX & more –

Stocks making the biggest move premarket: TIF, BBY, DSW, AAPL, SBUX & more – https://t.co/hXoALAgx0L

— Melonopoly (@curtmelonopoly) August 28, 2018

Market Observation:

Markets as of 8:11 AM: US Dollar $DXY trading 94.75, Oil FX $USOIL ($WTI) trading 68.90, Gold $GLD trading 1213.51, Silver $SLV trading 14.92, $SPY 290.26 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 7010.00 and $VIX trading 12.0.

Momentum Stocks / Gaps to Watch: $AFMD $STAF $ABIL $DSW $LSCC $ATAI $CRON $BILI $TLRY

4 Stocks To Watch Today: AMD, CGC, COOL, VSTM

4 Stocks To Watch Today: AMD, CGC, COOL, VSTM – https://t.co/ukliOJOrl9

— Investing.com Stocks (@InvestingStockz) August 28, 2018

30 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/12268396 $AFMD $STAF $DSW $BRKS $TMDI $TIF $TTPH $AKCA $IONS $MITK $BBY

30 Stocks Moving In Tuesday's Pre-Market Session https://t.co/dGUi6SGV7i $AFMD $STAF $DSW $BRKS $TMDI $TIF $TTPH $AKCA $IONS $MITK $BBY

— Benzinga (@Benzinga) August 28, 2018

News:

DSW to close its smallest #retail banner in Canadian marketplace $DSW https://bit.ly/2LxbWVV

UK’s NICE rejects $GILD’s CAR-T cancer cell therapy as too expensive https://cnb.cx/2MYUIoQ #biotech

Sears’ stock rockets after expansion of ship-to-store Amazon tire program.

Aspen Insurance’s stock jumps after Apollo buyout deal valued at $2.6 billion.

DSW Inc. shares soar 18% premarket after earnings blow past estimates.

Best Buy’s stock drops after profit and revenue beat, but downbeat earnings outlook.

Your Tuesday morning Speed Read:

– Monday a judge dismissed a shareholder lawsuit against Tesla over Model 3 production $TSLA

– Starbucks’ Pumpkin Spice latte released today, its earliest debut ever $SBUX

– Pres. Trump tweets Google search has been “rigged” against him $GOOGL

Your Tuesday morning Speed Read:

– Monday a judge dismissed a shareholder lawsuit against Tesla over Model 3 production $TSLA

– Starbucks' Pumpkin Spice latte released today, its earliest debut ever $SBUX

– Pres. Trump tweets Google search has been "rigged" against him $GOOGL— Benzinga (@Benzinga) August 28, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

BJ’s shares surge 6% premarket after earnings beat.

Tiffany’s stock soars after earnings and sales beat, raised outlook.

#earnings for the week

$CRM $BBY $TIF $LULU $BILI $AMWD $DLTR $DKS $AEO $BOX $DSW $DG $NTNX $BNS $BJ $BURL $ANF $TD $ULTA $HPE $CPB $BMO $CTLT $BIG $CIEN $HAIN $EXPR $TLRY $PVH $SIG $KIRK $DY $JT $HEI $SFUN $ZUO $MOV $YRD $MIK $HRB $LCI $CHS $HOME $AMBA

http://eps.sh/cal

#earnings for the week$CRM $BBY $TIF $LULU $BILI $AMWD $DLTR $DKS $AEO $BOX $DSW $DG $NTNX $BNS $BJ $BURL $ANF $TD $ULTA $HPE $CPB $BMO $CTLT $BIG $CIEN $HAIN $EXPR $TLRY $PVH $SIG $KIRK $DY $JT $HEI $SFUN $ZUO $MOV $YRD $MIK $HRB $LCI $CHS $HOME $AMBAhttps://t.co/r57QUKKDXL https://t.co/bvDhbgW1NZ

— Melonopoly (@curtmelonopoly) August 25, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

Great wash-out trade in progress from our swing trading platform… ESPERION (ESPR) . Long ads from our previous 49.11 buy side alert. Target reached and now targets 59.90. $ESPR #swingtrading #daytrading

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

The 11 min trade $USOIL $WTI $CL_F #premarket #oil #nonstop #OOTT

The 11 min trade $USOIL $WTI $CL_F #premarket #oil #nonstop #OOTT pic.twitter.com/z4BLWWsDlK

— Melonopoly (@curtmelonopoly) August 28, 2018

and we closed at the red arrow $USOIL$WTI $CL_F #oil #OOTT @EPICtheAlgo and we’re not done.

and we closed at the red arrow $USOIL$WTI $CL_F #oil #OOTT @EPICtheAlgo and we're not done. pic.twitter.com/hnjtFYhpyK

— Melonopoly (@curtmelonopoly) August 28, 2018

Nice quick first oil trade of the week (not at 100% alert win rate for the last number of months as I list last trade of last week, but high 90%) $USOIL $WTI $CL_F $USO $UWTI $DWTI #OIl #Trade #Alerts #OOTT

Nice quick first oil trade of the week (not at 100% alert win rate for the last number of months as I list last trade of last week, but high 90%) $USOIL $WTI $CL_F $USO $UWTI $DWTI #OIl #Trade #Alerts #OOTT pic.twitter.com/DrhjjCB9Hh

— Melonopoly (@curtmelonopoly) August 27, 2018

Oil Daily Chart. MACD cross up bullish testing underside of 50 MA. Aug 26 1030 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-U.S.-Mexico deal

-May tries to ease Brexit worries

-China growth seen slowing

-Markets quiet

-Oil developments

https://bloom.bg/2MYte2W

#5things

-U.S.-Mexico deal

-May tries to ease Brexit worries

-China growth seen slowing

-Markets quiet

-Oil developments https://t.co/Q7eHdqeHuT pic.twitter.com/baGogJIfQB— Bloomberg Markets (@markets) August 28, 2018

Bitcoin Surges Above $7,00 to a Three-Week High –

Bitcoin Surges Above $7,00 to a Three-Week High – https://t.co/oJwNIGEj9Z

— Investing.com News (@newsinvesting) August 28, 2018

The Week Ahead: Best Buy, Foot Locker Look To Extend Retail’s Rally https://benzinga.com/z/12262296 $AEO $BBY $FL $TTPH $CRM $BA $AKCA

The Week Ahead: Best Buy, Foot Locker Look To Extend Retail's Rally https://t.co/ysR2WAbHql $AEO $BBY $FL $TTPH $CRM $BA $AKCA https://t.co/XaWJxPYXCI

— Melonopoly (@curtmelonopoly) August 28, 2018

Crude #oil was sold for third week with the combined Brent and WTI net-long falling by 31k to 664k lots, an 11-month low. The change was driven by long liquidation in Brent (-16k) and fresh short selling in WTI (+15k). #OOTT

Crude #oil was sold for third week with the combined Brent and WTI net-long falling by 31k to 664k lots, an 11-month low. The change was driven by long liquidation in Brent (-16k) and fresh short selling in WTI (+15k). #OOTT pic.twitter.com/eErfrbj3Kk

— Ole S Hansen (@Ole_S_Hansen) August 26, 2018

The #gold net-short hit a fresh record of 79k lots last week, More than 3 times the previous record from Dec-15. The first signs buying was more than off-set by additional short-selling. The #silver short jumped by 26% but stayed well below the previous record from April

The #gold net-short hit a fresh record of 79k lots last week, More than 3 times the previous record from Dec-15. The first signs buying was more than off-set by additional short-selling. The #silver short jumped by 26% but stayed well below the previous record from April pic.twitter.com/KSIvqrmgKc

— Ole S Hansen (@Ole_S_Hansen) August 26, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $AFMD 162%, $STAF 41%, $DSW $ABIL $BRKS $SHLD $CHFS $EGLT $CRON $NVIV $BILI $LSCC $ATAI

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $RH $COTY $XLNX $WMGI $EL $FMS $FBIZ $EL $RPAI $REG

(6) Recent Downgrades: $AMAT $LRCX $CTRL $SBGL $HMY $MITK $NEWT $DDR

Benchmark downgrades Mitek after management departures https://seekingalpha.com/news/3386093-benchmark-downgrades-mitek-management-departures?source=feed_f … #premarket $MITK

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $ESPR, $BOX, $AFMD, $STAF, $ABIL, $DSW, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY

PreMarket Trading Plan Mon Aug 27: $TLRY, $CRON, $CGC, $NNDM, $TSLA, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY more.

Compound Trading Premarket Trading Plan & Watch List Monday August 27, 2018.

In this edition: $TLRY, $CRON, $CGC, $NNDM, $TSLA, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Monday Aug 27:

- Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets).

- Between now and Sept 14 I will only be in the live trading when I notify members (on email, Twitter, Discord). We are processing all the new algorithm models, upgrading all swing and algorithm newsletters, and preparing the content for the Sept 14-16 Trade Coaching event. In other words, we’re reconciling everything for our members over the next 2.5 weeks so that everything is updated, upgraded and distributed on schedule. Alerts will continue to go out on feeds and will also be upgraded to the new models. We will regularly be in member side Discord trading chat rooms as normal also.

9:25 Market Open – access limited to live trading room members12:00 Mid Day Trade Review – access limited to live trading room membersAny other live trading sessions will be notified by email.The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.Link: https://compoundtrading1.clickmeeting.com/livetradingPassword: **** (email for access if you do not have it, password changes will be emailed when changed only)For membership access, options here: https://compoundtrading.com/overview-features/

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

For those asking, wkly report distribution starts early Sun evening & continues through the wk starting w/Oil, Crypto, SPY, Swing and others. Reports are becoming size-able w new platform developments and as such they will flow on rotation Sun-Sat wkly.

https://twitter.com/CompoundTrading/status/1033822317057650688

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Market Observation:

Markets as of 8:25 AM: US Dollar $DXY trading 95.10, Oil FX $USOIL ($WTI) trading 68.74, Gold $GLD trading 1205.81, Silver $SLV trading 14.80, $SPY 288.73 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6740.00 and $VIX trading 12.3.

Momentum Stocks / Gaps to Watch:

24 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/12262324 $TLRY $CRON $CGC $NNDM $AMWD $JT $TSLA $BKE $PBT

24 Stocks Moving In Monday's Pre-Market Session https://t.co/rfk5CIEmqr $TLRY $CRON $CGC $NNDM $AMWD $JT $TSLA $BKE $PBT

— Benzinga (@Benzinga) August 27, 2018

News:

Your Monday morning Speed Read:

– Nokia takes €500M loan to develop 5G tech in bid to get ahead of competitors $NOK

– Tesla shares ⬇️ 3% premarket after abandoning its controversial go-private deal $TSLA

– AMD shares ⬆️ 3.7% premkt after announcing a new graphics card $AMD

Your Monday morning Speed Read:

– Nokia takes €500M loan to develop 5G tech in bid to get ahead of competitors $NOK

– Tesla shares ⬇️ 3% premarket after abandoning its controversial go-private deal $TSLA

– AMD shares ⬆️ 3.7% premkt after announcing a new graphics card $AMD— Benzinga (@Benzinga) August 27, 2018

Esperion announces positive results in trial of cardiovascular treatment.

Tesla plunges in pre-market trading after Musk abandons plan to take company private https://bloom.bg/2MMIoIz

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

#earnings for the week

$CRM $BBY $TIF $LULU $BILI $AMWD $DLTR $DKS $AEO $BOX $DSW $DG $NTNX $BNS $BJ $BURL $ANF $TD $ULTA $HPE $CPB $BMO $CTLT $BIG $CIEN $HAIN $EXPR $TLRY $PVH $SIG $KIRK $DY $JT $HEI $SFUN $ZUO $MOV $YRD $MIK $HRB $LCI $CHS $HOME $AMBA

http://eps.sh/cal

#earnings for the week$CRM $BBY $TIF $LULU $BILI $AMWD $DLTR $DKS $AEO $BOX $DSW $DG $NTNX $BNS $BJ $BURL $ANF $TD $ULTA $HPE $CPB $BMO $CTLT $BIG $CIEN $HAIN $EXPR $TLRY $PVH $SIG $KIRK $DY $JT $HEI $SFUN $ZUO $MOV $YRD $MIK $HRB $LCI $CHS $HOME $AMBAhttps://t.co/r57QUKKDXL https://t.co/bvDhbgW1NZ

— Melonopoly (@curtmelonopoly) August 25, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

Nice quick first oil trade of the week (not at 100% alert win rate for the last number of months as I list last trade of last week, but high 90%) $USOIL $WTI $CL_F $USO $UWTI $DWTI #OIl #Trade #Alerts #OOTT

Nice quick first oil trade of the week (not at 100% alert win rate for the last number of months as I list last trade of last week, but high 90%) $USOIL $WTI $CL_F $USO $UWTI $DWTI #OIl #Trade #Alerts #OOTT pic.twitter.com/DrhjjCB9Hh

— Melonopoly (@curtmelonopoly) August 27, 2018

Oil Daily Chart. MACD cross up bullish testing underside of 50 MA. Aug 26 1030 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5Things

-Mixed fortunes for trade talks

-Musk abandons Tesla plan

-Merkel says its time to step up

-Markets rise

-Lira’s back from holiday

https://bloom.bg/2BPLR4L

#5Things

-Mixed fortunes for trade talks

-Musk abandons Tesla plan

-Merkel says its time to step up

-Markets rise

-Lira's back from holidayhttps://t.co/nqHqCrWiyu pic.twitter.com/0bjIdt7rBT— Bloomberg Markets (@markets) August 27, 2018

Crude #oil was sold for third week with the combined Brent and WTI net-long falling by 31k to 664k lots, an 11-month low. The change was driven by long liquidation in Brent (-16k) and fresh short selling in WTI (+15k). #OOTT

Crude #oil was sold for third week with the combined Brent and WTI net-long falling by 31k to 664k lots, an 11-month low. The change was driven by long liquidation in Brent (-16k) and fresh short selling in WTI (+15k). #OOTT pic.twitter.com/eErfrbj3Kk

— Ole S Hansen (@Ole_S_Hansen) August 26, 2018

The #gold net-short hit a fresh record of 79k lots last week, More than 3 times the previous record from Dec-15. The first signs buying was more than off-set by additional short-selling. The #silver short jumped by 26% but stayed well below the previous record from April

The #gold net-short hit a fresh record of 79k lots last week, More than 3 times the previous record from Dec-15. The first signs buying was more than off-set by additional short-selling. The #silver short jumped by 26% but stayed well below the previous record from April pic.twitter.com/KSIvqrmgKc

— Ole S Hansen (@Ole_S_Hansen) August 26, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $JMEI $CRON $NNDM $IGC $TLRY $NEPT $PTLA $EIGI $ALNY $YINN $CGC $BILI $AMD $IQ $VIPS $AKS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $PTLA $AG $CIB

(6) Recent Downgrades: $OMP $QD $HIBB $CIT $AEO $BE

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $TLRY, $CRON, $CGC, $NNDM, $TSLA, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY

PreMarket Trading Plan Thurs Aug 23: Tariffs, $BABA, $PLCE, $TSLA, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY more.

Compound Trading Premarket Trading Plan & Watch List Thursday August 23, 2018.

In this edition: Tariffs, $BABA, $PLCE, $TSLA, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Good morning,

I’m working with our team Thurs and Fri to approve and get the weekly algorithm, swing and special report charting processed so I won’t be live broadcasting open or mid day.

Live alerts will still go out as we trade however, and we’ll be in Discord chat rooms of course.

Have a great day and let us know if you need anything.

Curt

Scheduled Events:

- Thursday Aug 23:

- Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets).

9:25 Market Open – access limited to live trading room members12:00 Mid Day Trade Review – access limited to live trading room membersAny other live trading sessions will be notified by email.The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.Link: https://compoundtrading1.clickmeeting.com/livetradingPassword: **** (email for access if you do not have it, password changes will be emailed when changed only)For membership access, options here: https://compoundtrading.com/overview-features/

- Before Sept 1 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 1 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 1 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Aug 25-26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

If your trading plan is based on flawed process you will continue to fail. Your plan is only as good as your rules based process is predictable. #tradingstrategy #premarket

If your trading plan is based on flawed process you will continue to fail. Your plan is only as good as your rules based process is predictable. #tradingstrategy #premarket

— Melonopoly (@curtmelonopoly) August 23, 2018

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

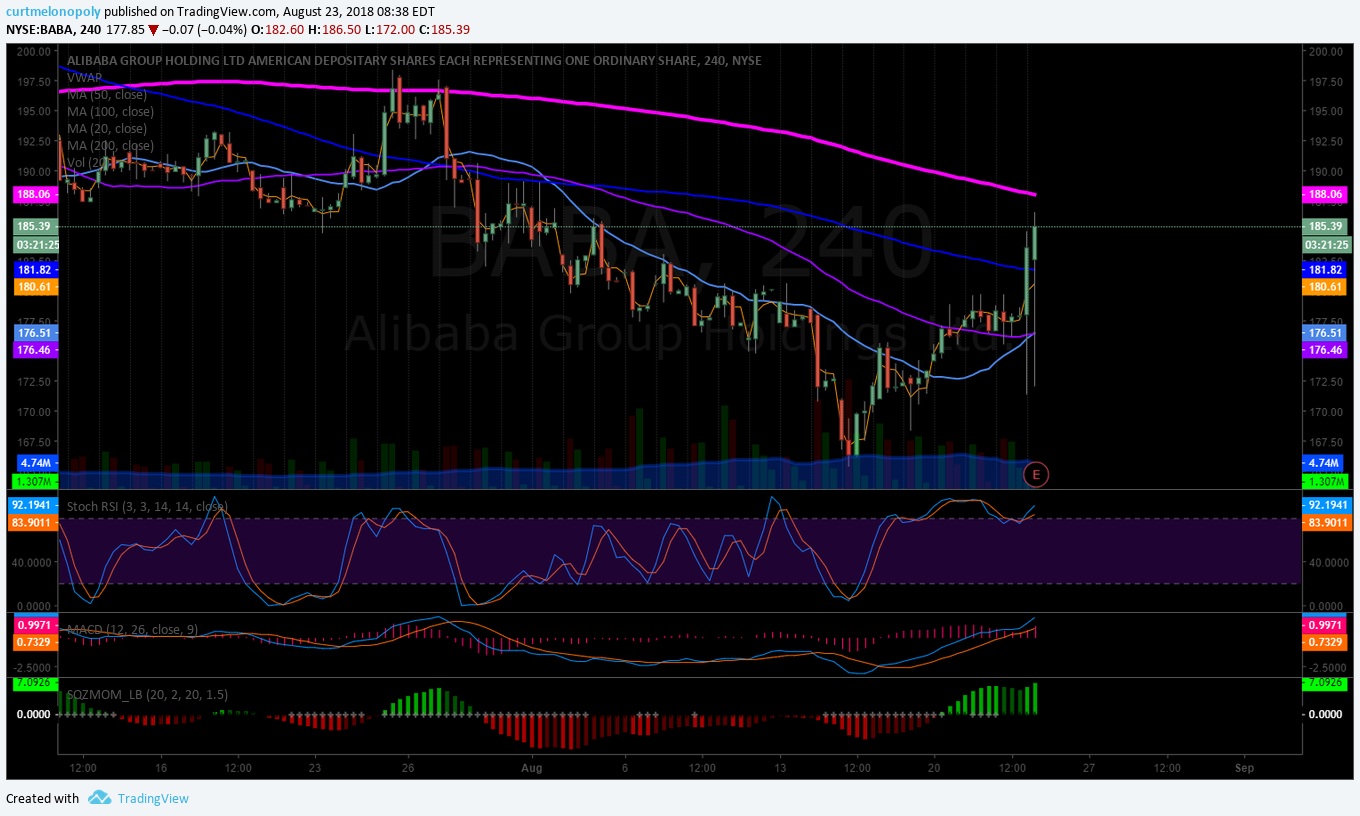

Looking for a long on $BABA over 200 MA on daily.

ALIBABA (BABA) premarket up on earnings beat trading just under 200 MA on 4 hour and daily. $BABA #earnings #premarket

Also looking for sizing in oil long if it continues today and possibly a short on Gold if the Dollar gets upside move here again to recent resistance (watching the support in $DXY). I would long $UUP and short Gold.

Market Observation:

Markets as of 6:35 AM: US Dollar $DXY trading 95.35, Oil FX $USOIL ($WTI) trading 67.76, Gold $GLD trading 1187.61, Silver $SLV trading 14.55, $SPY 286.03 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6414.00 and $VIX trading 12.1.

Momentum Stocks / Gaps to Watch:

24 Stocks Moving In Thursday’s Pre-Market Session https://benzinga.com/z/12249839 $BABA $LX $WSM $PLCE $SNPS $LTRX $RAVN $HYRE $PAVM $LB $QD $HRL $SMRT

24 Stocks Moving In Thursday's Pre-Market Session https://t.co/RalF39dRD5 $BABA $LX $WSM $PLCE $SNPS $LTRX $RAVN $HYRE $PAVM $LB $QD $HRL $SMRT https://t.co/86nW1YvhEW

— Melonopoly (@curtmelonopoly) August 23, 2018

Childrens’ Place stock surges 7% premarket after earnings blow past estimates

News:

Raymond James Downgrades Optical Name Finisar On Near-Term Pressures $FNSR https://pro.benzinga.com @benzinga

“A competitive threat is arising from competitors such as Applied Optoelectronics Inc (NASDAQ:AAOI) $AAOI pursuing certifications at OEMs, Leopold said.”

$GBT Expands Sickle Cell Disease Pipeline with Worldwide Licensing Agreement for Inclacumab for the Treatment of Vaso-occlusive Crisis

$AVGR Completes Enrollment in SCAN Clinical Study

Backing Elon Musk’s dream, option traders bet on Tesla at $430 $TSLA #swingtrading https://bloom.bg/2o1SfvP

Backing Elon Musk's dream, option traders bet on Tesla at $430 $TSLA #swingtrading https://t.co/J3dOtcnVx1

— Swing Trading (@swingtrading_ct) August 23, 2018

Recent SEC Filings / Insiders:

$SRPT CEO buys 16K shares @ avg price: $125.26/share

Weight Watchers 6M share Block Trade priced at $76.00 $WTW http://dlvr.it/QfyXKn

Recent IPO’s:

Aramco IPO on hold

BioNano Genomics to offer 2.45 million shares in IPO priced at $6 to $7 each

GoDaddy’s stock falls after public offering of 10.4 million shares

Earnings:

#earnings this week

$BABA $MOMO $TGT $KSS $LOW $EL $TJX $TOL $MDT $SPLK $SJM $FL $URBN $COTY $PLCE $ADI $LB $DGLY $PSTG $VEEV $JLL $HRL $VMW $ADSK $QD $HPQ $RY $BITA $INTU $NM $GPS $TUES $ROST $NDSN $MYGN $WSM $RRGB $FLWS $PLAB $RGS $TTC $FLY $SAFM $FN

http://eps.sh/cal

#earnings this week$BABA $MOMO $TGT $KSS $LOW $EL $TJX $TOL $MDT $SPLK $SJM $FL $URBN $COTY $PLCE $ADI $LB $DGLY $PSTG $VEEV $JLL $HRL $VMW $ADSK $QD $HPQ $RY $BITA $INTU $NM $GPS $TUES $ROST $NDSN $MYGN $WSM $RRGB $FLWS $PLAB $RGS $TTC $FLY $SAFM $FN https://t.co/r57QUKKDXL https://t.co/Sg0MDPbocw

— Melonopoly (@curtmelonopoly) August 20, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

ALIBABA (BABA) premarket up on earnings beat trading just under 200 MA on 4 hour and daily. $BABA #earnings #premarket

Smoking day on the alerts side, even ran after the final alert there, however, our lead tech had a challenging day (a loss) and I had non alerted intra day chop losses. But he alerts on my end are still batting 1000 for months. $USOIL $WTI $CL_F $USO #Oil #Trading #Alerts

Smoking day on the alerts side, even ran after the final alert there, however, our lead tech had a challenging day (a loss) and I had non alerted intra day chop losses. But he alerts on my end are still batting 1000 for months. $USOIL $WTI $CL_F $USO #Oil #Trading #Alerts pic.twitter.com/oIkcdfujnJ

— Melonopoly (@curtmelonopoly) August 22, 2018

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

Missed the top by a penny – hate that. Still batting 1000 for last number of months $USOIL $WTI $CL_F $USO #OIL #Trade #Alerts #OOTT

Missed the top by a penny – hate that. Still batting 1000 for last number of months $USOIL $WTI $CL_F $USO #OIL #Trade #Alerts #OOTT pic.twitter.com/GpJji9I0HO

— Melonopoly (@curtmelonopoly) August 20, 2018

$TSLA hit 288s to 321s here…. good thing fintwitterers and media had everyone in panic. #learntotradefear #hollywallstreet #premarket

Anyone telling ya $TSLA near a structural support? And if it loses that support where it is going to bounce? I know, I know it's Enron. I get it. And there's no crystal balls. Just herds. I get it.

— Melonopoly (@curtmelonopoly) August 20, 2018

APPLE (APPL) premarket nearing 212.65 range resistance trading 210.30, trim in to it add above. $AAPL #premarket #swingtrading

Oil sell-off today, EPIC Oil Algorithm buy side oil trade alerts 64.50 buy side at day lows for members. #oil #trade #alerts FX $USOIL $WTI $CL_F $USO #OOTT #Algorithm

https://twitter.com/EPICtheAlgo/status/1029927566403100673

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

PS Dollar trading HOD $DXY 95.47 and if 95,61 breached held it will rip some faces off.

PS Dollar trading HOD $DXY 95.47 and if 95,61 breached held it will rip some faces off.

— Melonopoly (@curtmelonopoly) August 9, 2018

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

It bounced and hasn’t looked back. #swingtrading $AAOI

It bounced and hasn't looked back. #swingtrading $AAOI https://t.co/vhSzw9TK58

— Melonopoly (@curtmelonopoly) August 8, 2018

$TSLA Swing target price hit. #swingtrading

$TSLA Swing target price hit. #swingtrading https://t.co/AoyhwOjYkz

— Melonopoly (@curtmelonopoly) August 8, 2018

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB #swingtrade #chart

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

$BTC 8300’s to 6900’s…. always know where that 200MA is. #Bitcoin #premarket #crypto

$BTC 8300's to 6900's…. always know where that 200MA is. #Bitcoin #premarket #crypto pic.twitter.com/HneG44UaSs

— Melonopoly (@curtmelonopoly) August 6, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Dollar rises on Fed minutes

-It’s PMI day

-Aramco IPO on hold

-Markets quiet

-Tariffs, trade talks

https://bloom.bg/2o3h7n7

#5things

-Dollar rises on Fed minutes

-It's PMI day

-Aramco IPO on hold

-Markets quiet

-Tariffs, trade talkshttps://t.co/pIE29tFsfn pic.twitter.com/r8LwzKQSFt— Bloomberg Markets (@markets) August 23, 2018

Stock Futures Quiet As U.S., China Launch Tariffs: 2 Stocks Near Buy Points http://dlvr.it/Qgr3Dk

Stock Futures Quiet As U.S., China Launch Tariffs: 2 Stocks Near Buy Points https://t.co/Vwx3W6BDMA pic.twitter.com/uijwtimRz0

— Investors.com (@IBDinvestors) August 23, 2018

Tariff Tiff: How Investors Can Cope With A Trade War Escalation http://dlvr.it/Qgqzcs

Tariff Tiff: How Investors Can Cope With A Trade War Escalation https://t.co/MIzvASGrxF pic.twitter.com/jQeZ6TEV7F

— Investors.com (@IBDinvestors) August 23, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $LEJU $LX $VLRX $INNT $MYND $WSM

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Citi $70

RNC $67

Gordon Haskett $64

Loop Capital $65

Deutsche Bank $65

Honeywell raises guidance and says spinoffs of two businesses are on track

Rosenblatt boosts AMD target to new Street high https://seekingalpha.com/news/3385197-rosenblatt-boosts-amd-target-new-street-high?source=feed_f … #premarket $AMD

Williams-Sonoma $WSM PT Raised to $55 at Credit Suisse

(6) Recent Downgrades:

Ulta Beauty $ULTA smashed on pre mkt downgrade

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Tariffs, $BABA, $PLCE, $TSLA, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY

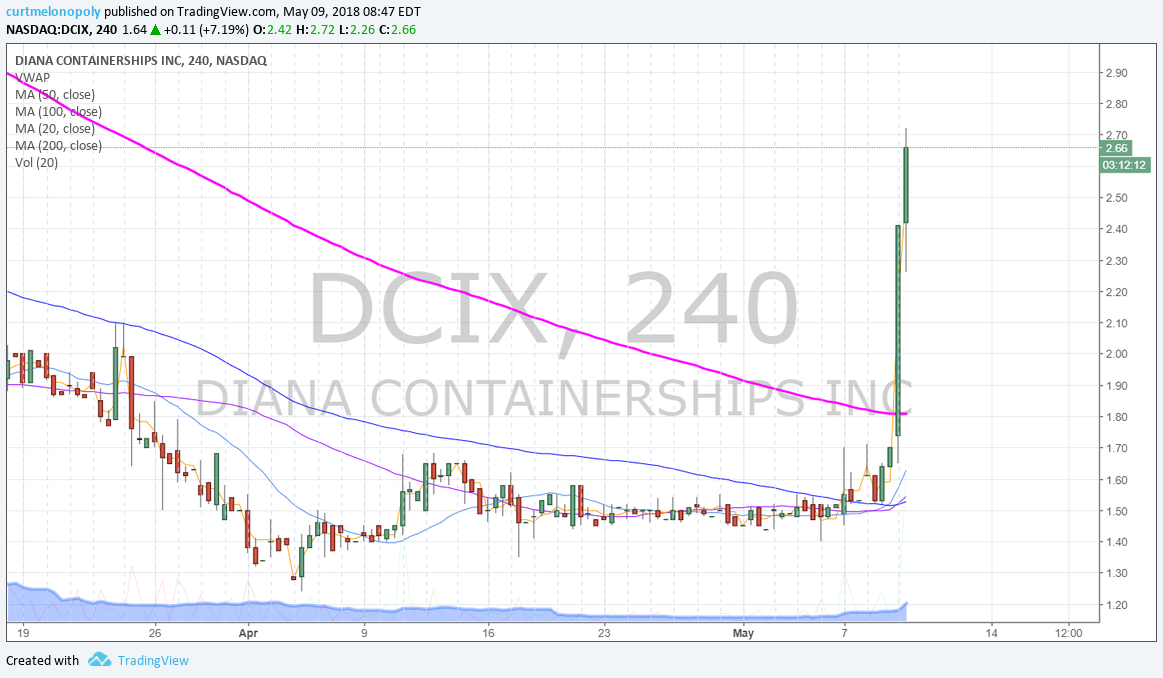

PreMarket Trading Plan Wed May 9: EIA Oil, Low Floats, Bitcoin $BTC, $DCIX, $TRIP, $AMDA, $AMBA more.

Compound Trading Trading Plan and Watch List Wednesday May 9, 2018.

In play in this issue: EIA Oil, Low Floats, Bitcoin $BTC, $DCIX, $TRIP, $AMDA, $AMBA, $FB, $TSLA and more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

All weekly reporting will be completed and out to members this evening. Delayed this week with coaching visitors and new machine trading office set-up.

Quick Update: Reporting, Live Rooms, New Team Members, Pricing, Discounts, Trade Coaching, New Book https://compoundtrading.com/quick-update-reporting-live-rooms-new-team-members-pricing-discounts-trade-coaching-new-book/

What’s New at Compound Trading April / May 2018. https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

EPIC (Oil) Members Note: Weekly #EIA Oil Trade webinar 10:30 AM ET Wed in main trading room (contrary to my previous posts).

Price Increase: Platform wide price increase May 15, 2018. Does not affect existing members that have not let subscription expire.

Machine Trading: May 15, 2018 the new three person teams starts. Mandate: Intelligent Assisted #IA Trading Platform / Code Algorithm Models, Run 24 Hour Crypto Trading Desk, Alert Trade Set-ups to Member Alert Feeds and near future Machine Learning.

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts