Tag: $DVAX

PreMarket Trading Plan Fri Sept 1 $RTNB, $APVO, $AMBA, $LULU, $BTCUSD, BITCOIN $DXY, US Dollar, #Gold, $GLD, #OIL, $USOIL, $WTI

Compound Trading Chat Room Stock Trading Plan and Watch List for Friday Sept 1, 2017 $RTNB, $LULU, $APVO, $BZUN, $MOMO, $DVAX, $AMBA – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Many new videos published to You Tube from trading room raw feed.

New Crypto Twitter feed. https://twitter.com/CryptotheAlgo

Crypto algorithm model newsletter service and alerts launch today.

Crypto trading room very near.

All reporting is behind but we do have a plan with interns to catch everything up this weekend and going forward.

I will start broadcasting my live oil trading platform in oil trading room soon because I am trading higher frequency and it is hard to alert when frequency gets high.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to [email protected] and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

I am now also trading for our private capital fund which will bring some slight changes.

The financing or our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of our private fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will considerably increase.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. I will be trading the algorithm models (the six we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade for our private fund will not be disclosed.

- ROI Objective. I will be trading under the goal / target of returning 100% per month (which is near impossible, especially for the 24 month period I will be trading). 50% would be very good and 25% is my minimum goal. So at minimum I am looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others I train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You will see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they are connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because I am also trading for the private fund, there will be trades I cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:

EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto to be released Sept 1.

New GOLD alerts Twitter feed is @GoldAlerts_CT.

New Crypto alert Twitter feed, regular public Crypto Twitter feed and Crypto trading room on-deck. Crypto subscription details on shopping page.

Post market catch up posts still on to do list (we have about fifty from last quarter to post for transparency). Hopefully going forward now that we aren’t releasing any new algorithm models etc I’ll be able to get the rhythm of reporting cycle fluent / regular. It was the development / math etc of the models that took most of the energy so it should be good going forward. Between now and Christmas we’re just locking in what we have tighter and tighter so it sounds like a good plan:)

Master Class Charting Series Webinars:

All members receive a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent lead trader blog / video / social posts:

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

Lots of new videos posted to You Tube not posted here yet.

Mid Day Trade Set Ups Aug 25 $CDNA, $SPY, $GOLD, $ARWR, $NAK, $RTNB etc

Mid day trade set-ups Aug 24 $ARWR, $XXII, $SHOP, $PETS, $PSTG, $BZUN, $EDIT etc

Aug 11 Trade Set Ups $SPY, $BTCS, $BTSC, $BITCF, $CALA, $ERGX, $USOIL, $SGMO, $TWLO, $AAOI

Aug 9 Trade Set Ups $BOFI, $ACHN, $AMMJ, $USOIL, $WTI, $GLD, #GOLD, $XIV, $CBLI …

Aug 8 Mid Day Trade Set-Ups $TWLO, $USOIL, #GOLD, $VRAY, $KORS, $OMVS, $BSTG, $XXII, $ESPR…

Aug 7 Part 2 Trade Set-up Review $HIIQ, $ZAGG, $WTW, $SPWR, $YELP …

Aug 7 Part 1 Trade Set-ups $OMVS, $TMPS, $XXII, $ARWR, $BBRY, $MYOK…

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

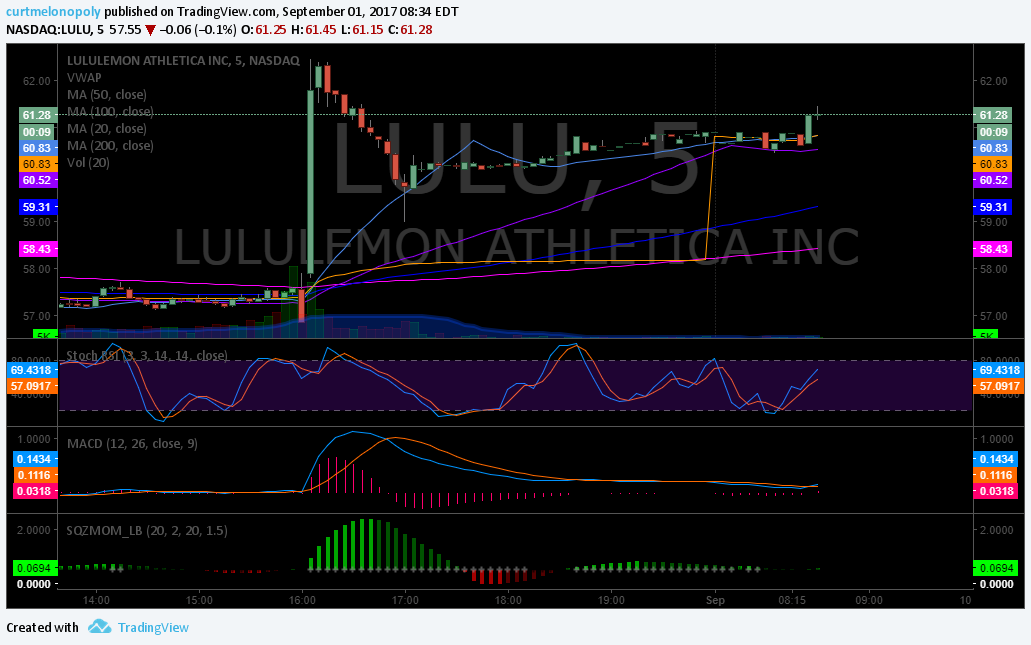

Morning Momentum / Gap / News / PR Stocks on Watch: $LULU, $APVO, $BZUN, $MOMO, $DVAX, $AMBA

Market observation / on watch: On jobs report this morning dollar got wacked and Gold up. Per last few newsletters: It’s all about the Dollar here now…. the dollar bounced off CRITICAL WIDE TIME-FRAME SUPPORT on the model. A huge development. Oil $USOIL $WTI,, Gold / Silver, $SPY correlations will be important, $BTCUSD love it and launching soon, and $VIX undecided – there is a general time / price cycle terminating early to mid Sept (Sept 9)… so I am watching closer as summer rolls on.

OTC on watch: $SUNEQ, $LTRE, $RMRK, $OMVS, $BSTG, $AMMJ, $HEMP, $BITCF, $BTCS, $BTSC, $GAHC

Recent SEC Filings to Watch:

Some Earnings On Deck:

Recent / Current Holds, Open and Closed Trades:

Thursday no trades other than closing $MSFT overnight for small profit.

Previous recent notes:

Yesterday was choppy and I nailed an oil scalp in overnight trading. In $MSFT yesterday on daytrade and swing side, in $CUR on daytrade side still and holding $UUP on swing trading side still.

Yesterday I had wins intra in $XIV and shorting $TVIX. also had an overnight hold in $CUR that is yet to be determined.

$XIV, $ARWR, $PETS wins on Thursday. On Wednesday oil $WTI big win and $PETS and $AMD on daytrade small account build yesterday.

Yesterday I closed $UWT daytrade for small win, large oil trade for win, small Gold trade for win and small loss in $TVIX. Recently $XIV I closed in premarket for small gain, still holding some position from previous, $UGLD (closed in premarket July 31 small gain), $FEYE (closed for nice gain), $SRG (closed for nice gain), $NFLX (closed for huge gain), $IPXL (closed for gain), $AKCA (closed nice gain), $MCRB (closed small gain), $WMT (closed excellent gains), $UUP (closed small loss), $BWA (closed tiny loss), Holding: $XIV and new entry $AMMJ. All other holds are small size (less than 4% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (all not including select swing trading or algorithm charting trades).

Recent Chart Set-ups on Watch:

$ARWR, $CDNA, $XXII, $NAK, $SHOP, $SSW, $ITCI, $SENS, $HCN, $GTHX, $EXTR, $EDIT, $IPI, $XOMO, $MBRX, $SOHN, $PDLI, $LPSN, $LTRX and more.

See mid day charting trade set-up reviews on You Tube (member only on email also FYI).

We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day. Many of the mid day reviews are published “private” for members only so be sure to watch your email inbox for these among other member only videos.

Market Outlook:

Lots of set ups. But it is all about the Dollar bounce and the $DXY model now.

Market News and Social Bits From Around the Internet:

August nonfarm payrolls rise 156,000, Unemployment rate is 4.4% $SPX http://dlvr.it/Pk6Cj1

U.S. employers added 156,000 jobs in August. Here's who's hiring… and who's not https://t.co/0T6LjHxMnY pic.twitter.com/VNUaouqbYj

— Bloomberg (@business) September 1, 2017

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $RTNB, $SDRL, $APVO, $HPE, $MFGP $NTNX $PANW $FCAU $KGC $MT $CRH $BZUN $NOK $MOMO $SHPG $DWT $FTI $AMD $BUD $TEVA $BBL will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : $AMBA

(3) Other Watch-List: $PRO $HTZ $CARB $ASTG $ASPS

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $ADMS PT upgrade as time allows I will update before market open or refer to chat room notices.

(6) Recent Downgrades: as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $RTNB, $LULU, $APVO, $BZUN, $MOMO, $DVAX, $AMBA – $DXY, US Dollar, #Gold, $GLD, #OIL, $USOIL, $WTI, Premarket, Watchlist, Stocks, Trading, Plan, $GLD, $GOLD, $SILVER, $USOIL, $WTI, $VIX, $SPY, BITCOIN, $BTCUSD

PreMarket Trading Plan Mon July 31 $OMVS, $DVAX, $NXTD, $USOIL, $WTI, $GLD, $GDX, $SPY, $DXY

Compound Trading Chat Room Stock Trading Plan and Watch List for Monday July 31, 2017 $OMVS, $DVAX, $NXTD, $USOIL, $WTI, $GLD, $GDX, $SPY, $DXY – $SSH, $LGCY, $TRCH, $ESEA, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to [email protected] and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Fund / Personal Trading Going Forward:

Starting Tuesday I will be trading for our private fund (as mentioned in the trading room and on recent Master Class video) which will bring some slight changes.

The financing or our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years they will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been very positive and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of intelligent assistance algorithm models) we are engaging the implementation of our private fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will considerably increase.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. I will be trading the algorithm models (the six we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade for our private fund will not be disclosed.

- ROI Objective. I will be trading under the goal / target of returning 100% per month (which is near impossible, especially for the 24 month period I will be trading). 50% would be very good and 25% is my minimum goal. So at minimum I am looking for 25% ROI per month compounded over 24 months. The fund size will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others I train as we progress may continue the legacy fund thereafter in some form or another.

Reporting and Next Gen Algorithms:

Rosie Gold $GLD $GDX algorithm has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY and $DXY are entering Generation 2 modeling in August.

New GOLD alerts Twitter feed is @GoldAlerts_CT

Post market catch up posts still on to do list (we have about thirty from last quarter to post for transparency). Hopefully going forward now that we aren’t releasing any new algorithm models etc I’ll be able to get the rhythm of reporting cycle fluent / regular. It was the development / math etc of the models that took most of the energy so it should be good going forward. Between now and Christmas we’re just locking in what we have tighter and tighter so it sounds like a good plan:)

Quarterly PL’s are in process.

Master Class Charting Series Webinars:

Master Class at 2:00 PM today. Every Tues, Wed, Thur, Fri from 2 PM to 3:30 PM until complete. All members receive a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members (anyone to date as of Tuesday when it starts) receives it free.

If you are a member that has received the video series and you ask me questions in the trading room, on DM, email etc that has the answer contained in the Master Class Series I will defer you to the training videos going forward:) That actually goes for any of the published reporting FYI.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent lead trader blog / video / social posts:

Master Class Video 6 has been sent to member email inboxes. It is published as “unlisted” so please respect that.

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

July 28 Chart / Trade Set-Ups $SBUX, $WIX, $CCJ, $GLD, $XXII, $UCTT, $FSLR, $IGMN, $BIDU, $ALGN …

July 27 Mid day chart set up review $DVAX, $MBRX, $GNC, $PDLI, $LPSN, $ESPR, $SENS, $R, $SNAP

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports will be out soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Morning Momentum Stocks on Watch: Looks like charts from our mid day reviews on fire today. Rules based trading. $DVAX $NXTD $MYO $XXII $CYTR … #premarket #tradingprocess

Other Gaps of Note Premarket:

Short term bias toward / on watch:Oil $USOIL $WTI near resistance, $DXY US Dollar near support, Gold / Silver moderate (closed long $UGLD test size this morning). $SPY moderate and $VIX moderate – there is a general time / price cycle terminating now-ish and a serious one early to mid Sept… so I am watching closer as summer rolls on.

OTC on watch: $OMVS

$OMVS On the move… to say the least. #OTC pic.twitter.com/QIcbPRKt3Z

— Melonopoly (@curtmelonopoly) July 31, 2017

Recent Momentum Stocks to Watch:

Recent SEC Filings to Watch:

Some Earnings On Deck: Mon morn #earnings $ICPT $PDS $NRZ $L $SNY $HSKA $ROP $DO $SOHU $AMG $ARLP $CNA $GLMD $AWI $CYOU $AHGP $BWP $CBU. PM $APAM $GPRE $P $SBAC $SIMO $SLCA $TMST $TXRH $WG $ZIOP

Recent / Current Holds, Open and Closed Trades: $UGLD (closed in premarket July 31 small gain), $FEYE (closed for nice gain), $SRG (closed for nice gain), $NFLX (closed for huge gain), $IPXL (closed for gain), $AKCA (closed nice gain), $MCRB (closed small gain), $WMT (closed excellent gains), $UUP (closed small loss), $BWA (closed tiny loss), Holding: $UGLD. All other holds are small size (less than 5% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (all not including select swing trading or algorithm charting trades).

Nice. $UGLD 3x Gold ETN up 2.56% yesterday #swingtrading pic.twitter.com/pseULq4Uy0

— Melonopoly (@curtmelonopoly) July 27, 2017

$HIIQ closed yesterday 28.95 from 23.90 long.

$HIIQ closed yesterday 28.95 from 23.90 long. pic.twitter.com/XlfyMJNnoq

— Melonopoly (@curtmelonopoly) July 27, 2017

$IPXL closed yesterday 19.30 from 18.87.

$IPXL closed yesterday 19.30 from 18.87. pic.twitter.com/2o2n3sU6on

— Melonopoly (@curtmelonopoly) July 27, 2017

$WMT closed yesterday 78.76 from 74.81.

$WMT closed yesterday 78.76 from 74.81. pic.twitter.com/BX1U2eu1tv

— Melonopoly (@curtmelonopoly) July 27, 2017

$AKCA closed yesterday 14.53 from 12.53 entry.

$AKCA closed yesterday 14.53 from 12.53 entry. pic.twitter.com/H1QC04yuOj

— Melonopoly (@curtmelonopoly) July 27, 2017

$MCRB Opened long 14.00 closed 14.16 didn’t act right #swingtrading

$MCRB Opened long 14.00 closed 14.16 didn't act right #swingtrading pic.twitter.com/LyaUZKruBB

— Melonopoly (@curtmelonopoly) July 25, 2017

$AAOI That was a nice $3000.00 win – again decent ROI. 9 days to ER and it’s scraping the ceiling again! wow! trading 95.63 #swingtrading

$AAOI That was a nice $3000.00 win – again decent ROI. 9 days to ER and it's scraping the ceiling again! wow! trading 95.63 #swingtrading pic.twitter.com/92vIa2Ghtv

— Melonopoly (@curtmelonopoly) July 25, 2017

$SPWR Open 10.52 closed 11.30 1000 for $800.00. Nice ROI. Trading 11.06 with ER in 7 days and in the bowl. #swingtrading

$SPWR Open 10.52 closed 11.30 1000 for $800.00. Nice ROI. Trading 11.06 with ER in 7 days and in the bowl. #swingtrading pic.twitter.com/aigmPr1MBC

— Melonopoly (@curtmelonopoly) July 25, 2017

$SRG Swing trade went well. 46.06 entry 1000 closed 49.94 and 48.18 from 46.06 (error in other alert) for near $3000.00 gain. #swingtrading

$SRG Swing trade went well. 46.06 entry 1000 closed 49.94 and 48.18 from 46.06 (error in other alert) for near $3000.00 gain. #swingtrading pic.twitter.com/eTWGovCHXq

— Melonopoly (@curtmelonopoly) July 25, 2017

$NFLX NetFlix 159.35 entry closed 188.40 200 for near $6000.00 gain. Trading 187.91 and may go again here. Watching. #swingtrading

https://twitter.com/curtmelonopoly/status/889719084568465408

$FEYE closed 15.76 fr 14.40 entry up $650.00 on 500. ER in 7 days and scraping a break-out level. #swingtrading

$FEYE closed 15.76 fr 14.40 entry up $650.00 on 500. ER in 7 days and scraping a break-out level. #swingtrading pic.twitter.com/UtiUvv3ObF

— Melonopoly (@curtmelonopoly) July 25, 2017

Down about 400.00 on that swing trade test of $DXY support area in $UUP. We’ll see how it handles next support. #swingtrading

Down about 400.00 on that swing trade test of $DXY support area in $UUP. We'll see how it handles next support. #swingtrading pic.twitter.com/ON1QWKFr0W

— Melonopoly (@curtmelonopoly) July 25, 2017

Recent Chart Set-ups on Watch: $FSLR, $COTY, $CCJ, $PDLI, $DVAX, $GNC, $MBRX, $LPSN, $ESPR, $SENS and others. See mid day reviews on You Tube (member only on email also FYI).

We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day. Many of the mid day reviews are published “private” for members only so be sure to watch your email inbox for these among other member only videos.

$CCJ I will look at if it gets up over 100 MA on weekly and proves itself in bowl on daily. #tradingprocess

$CCJ I will look at if it gets up over 100 MA on weekly and proves itself in bowl on daily. #tradingprocess #premarket #swingtrading pic.twitter.com/GqUrUXez5E

— Melonopoly (@curtmelonopoly) July 28, 2017

Market Outlook:

#earnings $AAPL $TSLA $AAOI $SHOP $SQ $S $ATVI $UAA $CHK $P $GRPN $PFE $OCLR $FEYE $FIT $ICPT $COHR $OLED $GPRO $NRZ

#earnings $AAPL $TSLA $AAOI $SHOP $SQ $S $ATVI $UAA $CHK $P $GRPN $PFE $OCLR $FEYE $FIT $ICPT $COHR $OLED $GPRO $NRZ https://t.co/O7ZQ2StiUn

— Melonopoly (@curtmelonopoly) July 30, 2017

Market News and Social Bits From Around the Internet:

9:45 am

Chicago PMI

10:00 am

Pending Home Sales

10:30 am

Dallas Fed Manufacturing Survey

3:00 pm

Farm Prices

$MYO Myomo, Inc. Obtains CE Mark Approval for MyoPro® https://finance.yahoo.com/news/myomo-inc-obtains-ce-mark-120000918.html?soc_src=social-sh&soc_trk=tw … via @YahooFinance

$MNGA MagneGas Announces Significant Continued Improvement in MagneGas2 Production from Butanol Feedstock

$ETRM PR: EnteroMedics Receives Approval for Gastric Vest System Clinical Study in Spain http://ir.enteromedics.com/releasedetail.cfm?ReleaseID=1035025 …

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $DVAX $NXTD $MYO $GNCMA $XXII $CYTR $DGAZ $SOHU $CHTR $NRZ $KOLD $EDIT $SSW $CLF $GPRO $RDFN $AKS $X $GPRO I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Recent Upgrades:$EXP $COLB $GPRO $MO $DVAX $ULH $CVA $VTRS $ADP $WFC $AAL $BIDU $ULH $ICLR $HLT $MHO $CELG $LSTR $TBBK as time allows I will update before market open or refer to chat room notices.

(6) Recent Downgrades:$COH $FB $HTZ $VC $CFR $ODFL $LSTR $NSC $ATHN $C $COL $WY $ULTA $EGO $ESS as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics:$OMVS, $DVAX, $NXTD, $USOIL, $WTI, $GLD, $GDX, $SPY, $DXY – $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Premarket, Watchlist, Stocks, Trading, Plan, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY

PreMarket Trading Plan Mon June 5 $LOXO, $DVAX, $TGTX, $LTBR, $JUNO, $GLD, GOLD

Compound Trading Chat Room Stock Trading Plan and Watch list for Monday June 5, 2017; $LOXO, $DVAX, $TGTX, $LTBR, $JUNO – $SSH, $LGCY, $TRCH, $ESEA, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to [email protected] and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it.

Post Market Reports:

Sorry we’re running behind on them – we’ll get them caught up this week. Getting the 24 hour oil room ready took a bit more manpower than we expected. But we’re on for June 12 launch!

Most recent lead trader blog posts:

Trading Set-ups. Video Explains Predictable Winning Process. Part 6 b) “Freedom Traders” Series.

Trading Set-ups. Video Explains Predictable Winning Process. Part 6 b) “Freedom Traders” Series. https://t.co/7XFIQ68CoY

— Melonopoly (@curtmelonopoly) May 29, 2017

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports will be out soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Trading Plan (Buy, Hold, Sell) and Watchlists:

Morning momentum stocks on watch so far: $LOXO, $DVAX, $TGTX

Bias toward / on watch: Watching to possibly close some longer term swings I have done well with such as $GOOGL, $AMZN and others. Watching Gold with a possible chart set up and looking for a bounce in oil (trading at 47.33 7:51 ET).

Markets: $SPY $ES_F $SPX I continue to be cautiously optimistic grinding up, $GLD, $GDX, $SLV continue in indecision but the charts say it could be up soon. $USOIL, $WTI ran up and tanked again overnight so we’re watching for a bounce. $DXY and $VIX no significant news.

OTC on watch: Randoms I am still watching.. $PGPM, $BRNE, $ELED, $PVCT, $LIGA (I hold),$AMLH, $BLDV $UPZS $OPMZ $MMEX $ACOL $BVTK $USRM $ORRV $JAMN $PFSD

Gaps to Watch:

Recent Momentum Stocks to Watch:

Stocks with News: $LOXO, $SRRA, $TGTX, $PBMD

Recent SEC Filings to Watch: $LACDF Lithium Americas Corp Director Acquires C$266,750.00 in Stock

Short Term Trader’s Edge: $LTBR, $JUNO

Some Earnings Today: $ASNA $CASY $COUP $THO

Holds: All holds are small size (less than 5% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA, $PVCT

Various Recent Chart Set-ups on Watch: $LTBR, $RCL, $JKS, $CALA, $LITE, $JUNO, $PCRX, $CTSH, $FEYE, $TSLA, $NVO, $FSLR, $AAOI, $HIIQ, $JASO, $VIPS – We are working on these and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day.

Midday Chart and Trade Setup Review June 1, 2017:

Midday Chart and #SwingTrading Setup Review, June 1, 2017: $JUNO $USOIL $WTI $GOOGL $VIPS $AGN $SNAP and more.

https://twitter.com/CompoundTrading/status/869275423879958530

Market Outlook :

Watch those large and mega caps – when they stall things could change. And don’t forget our $SPY algo warned about recent highs.

Market News and Social Bits From Around the Internet:

8:30am

-Productivity/ Costs

-US Consumer Spending

9:45am

PMI Services Index

10am

-Factory Orders

-Non-Mfg Index

-Market Conditions Index

$LOXO premarket up 40.77 % trading 68.95 on positive cancer drug trial news.

$SRRA Sierra Oncology Reports Encouraging Initial Progress from Ongoing Phase 1 Clinical Trials of Chk1 Inhibitor SRA737

$TGTX Announces Positive Data from Phase 3 GENUINE Trial of TG-1101 in Combination with Ibrutinib

$PBMD LAG-3Ig (IMP321) DEMONSTRATES POSITIVE SAFETY AND EFFICACY QUALITIES IN BREAST CANCER CLINICAL TRIAL

$XAUUSD 100 MA breaching 200 MA on Daily. SQZMOM green and MACD trending up. #GOLD $GLD pic.twitter.com/VThOIKY12j

— Melonopoly (@curtmelonopoly) June 5, 2017

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List :$LOXO, $DVAX, $NAKD $CLSN $HMNY $PBYI $TGTX $FOR $GIMO $PERI $RNN $MBVX $HAL $AEHR $MNKD $ARRY $HTGM $P I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : $UWT $SPY $XIV $LABD $JDST $DUST $JKS $SNAP $CHK I will update before market open or refer to chat room notices.

(3) Other Watch-List: $LABU $LOXO $DVAX $PBYI $TGTX $HMNY

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Recent Upgrades: $WEX $LOXO $STT $OUT $EC $OMAM $PB $PBCT $FOE $UFS $RFP $GPS $NAV $STI $IVZ $EBAY $EV $INCR $MDP $CW $SKX $YELP as time allows I will update before market open or refer to chat room notices.

(6) Recent Downgrades: $PRGO $VEEV $AAPL $AMG $FII as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $LOXO, $DVAX, $TGTX, $LTBR, $JUNO – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD

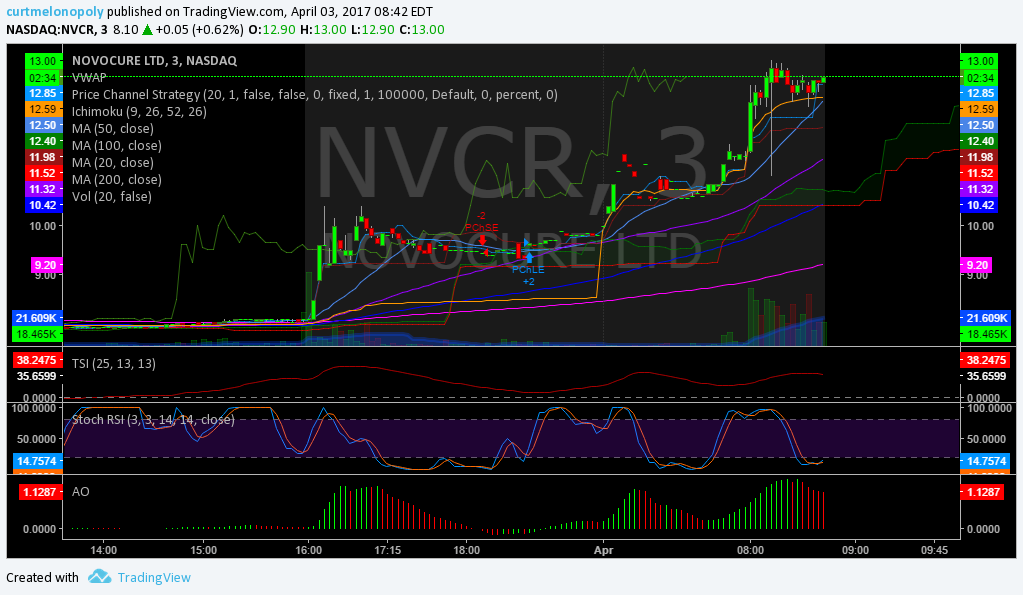

PreMarket Trading Plan Mon Apr 3 $NVCR, $STDY, $DVAX, $APOP, $TSLA, $XIV, $DWT

Compound Trading Chat Room Stock Trading Plan for Monday April 3, 2017; $NVCR, $STDY, $DVAX, $APOP, $TSLA, $XIV, $DWT – $ONTX, $DUST, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Today’s Live Trading Room Link: https://compoundtrading.clickmeeting.com/livetrading

New blog post: When You Learn It – You Are Free (Part 1 of Freedom Traders). My Stock Trading Story.

https://twitter.com/CompoundTrading/status/848681468125745153

Friday Stock Trading Results

https://twitter.com/CompoundTrading/status/848800429085536256

The Quarterly Daytrading Performance Review P/L with Charting is Published.

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L with Charting is Published. The Algorithms Quarterly Performance Reports are being compiled as I write and will be posted soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Most recent Keep it Simple Swing trade Charting Poston Sunday April 2, 2017 (MACD, MA, Stoch RSI, SQZMOM focus):

https://twitter.com/CompoundTrading/status/848756853169283073

Current Holds / Trading Plan:

Main watchlist in my trading plan today: $NVCR, $STDY, $DVAX, $APOP, $TSLA, $XIV, $DWT Oil is near resistance and I expect volatility to get crushed again possibly and $SPY to get some lift. The others are momentum plays such as $NVCR, $STDY, $DVAX, $APOP on watch. $TSLA, $XIV, $DWT looking for entries around swing levels posted.

All my holds are small to mid size holds in this order according to sizing – $ONTX, $DUST, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI.

Per recent;

$DUST I will close for a loss if Gold holds 1260 – sucks, but it was a relatively small position (to portfolio size) but I didn’t follow the golden rule… when a trade goes against your plan cut fast and I didn’t so I will likely pay the price. And I guess what has become the second golden rule… listen to the algos… they haven’t been wrong yet – so yes, I didn’t listen to my own invention ROSIE the Gold Algo (give Rosie a little plug there she deserves it lol). Embarrassing, especially because ROSIE nailed the bottom many weeks in advance of the bottom – all I had to do was listen and boom new house. Sad.

Market Outlook / Trading Plan:

It looks like technology and bio (wide-spread) may be the rotational choices short-term – we will see. I am interested in oversold retail and turn-around energy.

Per recent reports: There are significant resistance clusters above recent highs in oil and the S&P so I will be very cautious to upside going forward until recent highs are taken out and confirmed. I will also be wanting to move out of my significant swing trading side holdings and pick more closely. The daytrading side I am 95% cash now that I am out of $UWT so I am fine. I see significant upside challenges in Oil and SPY with most recent highs being taken out.

Per recent reports:

Swing trades on watch for me again (in addition to our algorithm models because everything is either at resistance or support) today (some are same as from our swing trading platform side) are $BABA, $VRX, $NFLX, $WYNN, $XME, $URRE, $TAN, $TWLO, $GSIT, $ABX and considering adding $LIT to the list. Also recently added to watch $CEW, $MYL, $TZA, $TREE and today added are $NVDA, $SOXS, $KBH, $BCOR. Also on OTC side new are $USRM, $PLSB, $LIGA and $ASCK.

Platinum on swing trading watchlist again. pic.twitter.com/3GfRhHKKrP

— Melonopoly (@curtmelonopoly) April 2, 2017

$GREK yup on my swing trading watch list. Love the chart. https://t.co/9zmg8B2wAC

— Melonopoly (@curtmelonopoly) April 1, 2017

Morning Momentum Stocks / News and Social Bits From Around the Internet:

Premarket momentum stocks to watch: $NVCR, $STDY, $DVAX, $APOP

Gaps on these plays:

News on these plays: $TSLA, $SRRA, $NVS, $KTOV, $XON, $ZIOP, $MRK, $SCMP, $DVAX

Chart Set-Ups: $TSLA

Previous Day Momentum Stocks to watch: $USRM, $XIV

9:45am

PMI Manufacturing Index

10am

-ISM Mfg Index

-Construction Spending

10:30am

William Dudley Speaks

5pm

Jeffrey Lacker Speaks

$TSLA Gapping up in pre-market.

Leap Therapeutics reports FY16 results https://seekingalpha.com/news/3255054-leap-therapeutics-reports-fy16-results?source=feed_f … #premarket $LPTX

$SAGE JPMorgan reiterates as Top Pick ahead of Phase 3 STATUS data. PT $83

$SRRA Sierra Oncology Collaborator ICR Reports Preclinical Synthetic Lethality Data for Chk1 Inhibitor SRA737 AACR

$NVS Novartis drug combination Tafinlar® + Mekinist receives EU approval for BRAF V600-positive advanced non-small cell lung cancer (NSCLC)

$KTOV U.S. Food and Drug Administration Grants Kitov a Waiver for New Drug Application Filing Fee

$XON $ZIOP $MRK provide an update on CAR-T strategic collaboration and license agreement.

OncoSec’s IL-12 construct shows positive effect in preclinical testing; shares ahead 8% premarket https://seekingalpha.com/news/3255053-oncosecs-ilminus-12-construct-shows-positive-effect-preclinical-testing-shares-ahead-8?source=twitter_sa_factset … #premarket $ONCS

$SCMP Acquires Vtesse $200M upfront

$DVAX Dynavax Announces FDA Advisory Committee Meeting to Review HEPLISAV-B

#bonds Bond Bears Battered As March Saw Biggest Short-Covering In 10Y Futures History | Zero Hedge https://t.co/DhNytX40XB

— Melonopoly (@curtmelonopoly) April 3, 2017

Access to corporate credit isn't important is it? 😲 If this trend continues, negative corporate messaging will come ripping. 3Q? #credit https://t.co/Can5QryYDP

— Melonopoly (@curtmelonopoly) April 3, 2017

Bullish? Sentiment / valuation read.⤵ https://t.co/3zd5WCw3cq

— Melonopoly (@curtmelonopoly) April 3, 2017

$SPX P/E Ratio above 10 year average. https://t.co/3BzGNUugvs

— Melonopoly (@curtmelonopoly) April 3, 2017

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead tech developer @hundalSHS, and associate trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $NVCR 40%, $STDY 25%, $DVAX 19%, $APOP $BVXV $EBIO $BCRX $SRRA $MDGS $ELOS $UGAZ $TECK $MTL $TSLA $HPE $LN $MPEL

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List: Per above

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $MHT $ELLI $VJET $HUN $GVA $DOV $ECL $FMC $OAS $EXR $HP $BBRY $AMC as time allows I will update before market open or refer to chat room notices.

(6) Downgrades:$FWP $RWLK $WPC $FPO $FWP $ANET $KCG $MJN $ACOR $UAA $ACN $IBKR $HLT $CNK as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $NVCR, $STDY, $DVAX, $APOP, $TSLA, $XIV, $DWT – $MGTI, $NE, $XOM, $ONTX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA, – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD

PreMarket Trading Plan Wed Mar 1 $SGY, $SKLN, $CLNE, $DVAX, $GDX, $UVXY

Stock Trading Plan for Wednesday Mar 1, 2017 in Compound Trading Chat room. $SGY, $SKLN, $CLNE, $DVAX – $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

https://twitter.com/CompoundTrading/status/836917297809805313

Instructions for onboarding to new trading platform are in your email. Any questions DM Sartaj or email us.

Tradingview software was down last evening so all the algorithm and swing trading updates will be sent out tonight.

Also, the educational video series we are working on we do not expect to have posted until this Sunday FYI.

Current Holds / Trading Plan:

All small to mid size holds in this order according to sizing – $BSTG, $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA.

I closed my $UWT multi-week swing yesterday for gains.

Per recent’ $DUST I will close for a loss if Gold holds 1260 – sucks, but it was a relatively small position (to portfolio size) but I didn’t follow the golden rule… when a trade goes against your plan cut fast and I didn’t so I will likely pay the price. And I guess what has become the second golden rule… listen to the algos… they haven’t been wrong yet – so yes, I didn’t listen to my own invention ROSIE the Gold Algo (give Rosie a little plug there she deserves it lol). Embarrassing, especially because ROSIE nailed the bottom many weeks in advance of the bottom – all I had to do was listen and boom new house. Sad.

As per previous $CBMX I am now out for huge gains and $JUNO on a nice swing.

As noted before I may exit $VRX and $UWT.

Market Outlook / Trading Plan:

Looks like the Trump train is in full gear here. Watching the metals very closey (and natural gas).

$SGY and $SKLN look like the opening momo plays (at this point).

Volatility is now on my radar again $TVIX $UVXY.

Morning Momo / News and Social Bits From Around the Internet:

Momo Watch: $SGY, $SKLN, $CLNE, $DVAX

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $SGY, $SKLN, $CLNE, $DVAX, $WTW, $NDRM, $BGFV $CLSD $TIME $BASI $TRCO $LOW $ONCS $MTL $MYL $JDST $RUSL $TECK

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $FRAC $MU $MRVL $WMB $GOGL $LPG $TEF $AMBA $GMS $HK $OC $BMO as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $ROST $CRUS $WM $RSG $AVT $BW $PANW $XOXO $ALL $CYH $HII $GD $DRQ $WDAY $ARI $TGT $SIG $NOC $BW $INCR $CETX $BW as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $SGY, $SKLN, $CLNE, $DVAX – $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F

Pre-Market Newsletter Tuesday Dec 13 $NVCN, $RGSE, $ORIG, $UWT, $AKAO $APRI $OPGN $SLV $NG_F $VIX $UVXY $TVIX $USOIL $WTIC $GLD $GDX …

My Stock Trading Plan for Tuesday Dec 13, 2016 in Chatroom. $NVCN, $RGSE, $ORIG, $SDRL, $OPHT, $UWT, $AKAO, $APRI, $OPGN, $NG_F, $SILVER, $SLV, $SL_F, $VIX, $UVXY $TVIX, $USOIL, $WTI, $GOLD, $GLD, $GDX, $USD/JPY, $SPY … more.

Welcome to the Tuesday morning Wall Street trading day session!

Important Notices:

Fed speak Wed 2:00 PM EST.

$UWTI $DWTI have been resurrected as $UWT and $DWT – this is a massive thing for my trading to say the least. http://uk.reuters.com/article/usa-investment-etn-idUKL1N1E31ZB

Oil meetings happened and we have a new break out!

Current Holds:

$CBMX, $JUNO

Market Outlook:

Watch out for the upcoming Fed road bumps – stay nimble.

Watching $AKAO from yesterday’s premarket watchlist and trades executed yesterday – $AKAO Announces Positive Results in Phase 3 cUTI and CRE Clinical Trials of Plazomicin and possible sympathy plays $APRI $OPGN.

Dips on $GOLD $GLD are NOT being bought now vs.selling the rips (so this by default plays in to $SILVER). The Trump train / reflation train. Watching $USD/JPY. Hoping we can get an inflection here to get in to a long position and start scaling in (one final dump in it and $SPY etc but likely to early yet). $USD/JPY is in a resistance area but the chart is far from broken so be careful Gold bulls!

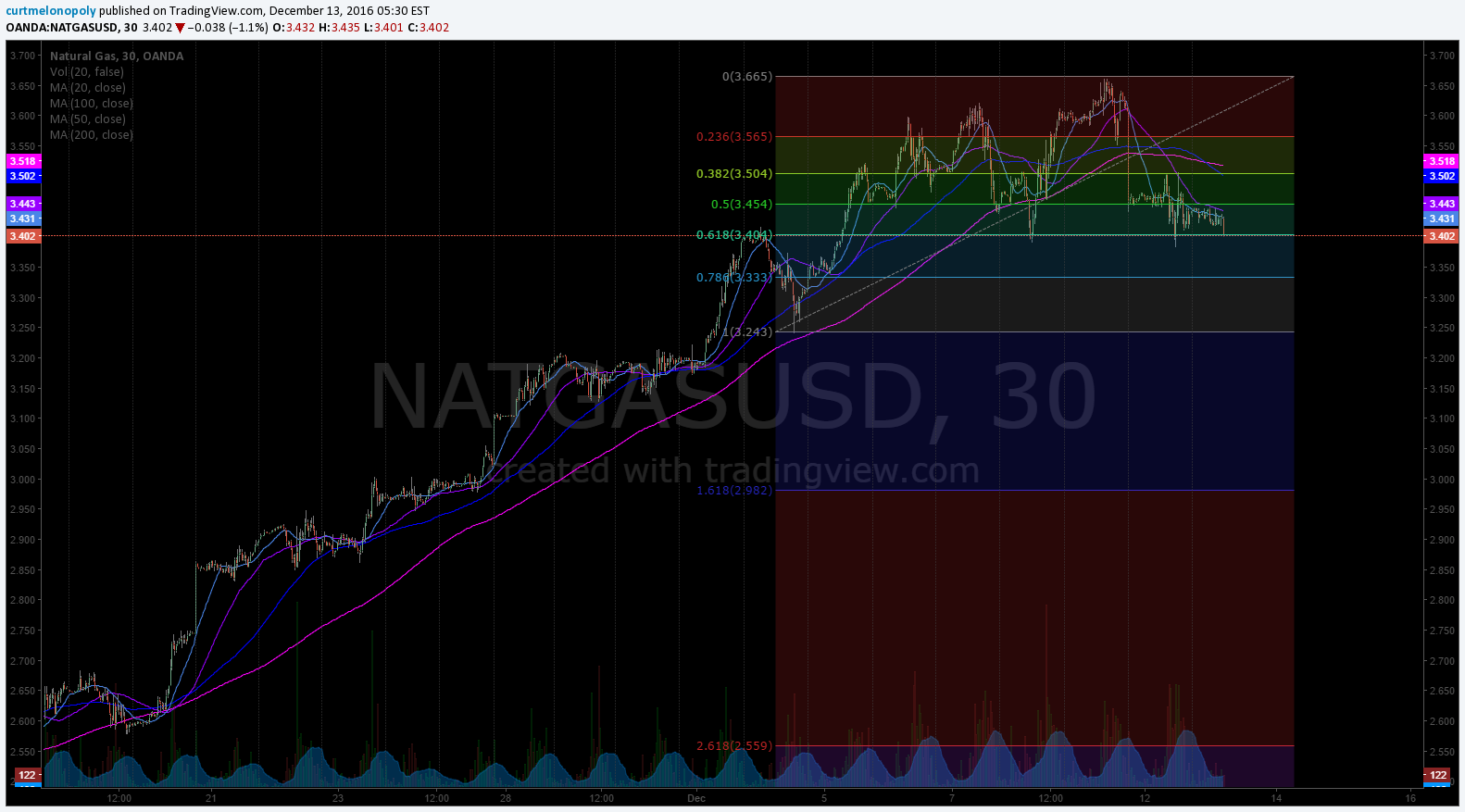

$NATGAS $NG_F has come off some from important resistance and is NOW AT AN IMPORTANT SUPPORT – ON WATCH HERE!!! See chart below.

$SPY has continued its upward trend. Watching markets for a pull back (as noted previous) sometime near or just after Christmas (it seems we have a Santa Claus rally etc). Very likely markets take a rest around Fed speak Wed 2:00 PM EST.

$VIX – volatility I called almost to the minute yesterday and $VIX hould get some spiking today and Wednesday. So I am watching close $TVIX $UVXY.

Crude Oil is trading upward in its trading range overnight – if this continues there is a high probability small cap equites pop Tuesday morning!!!

And that brings me to momo stocks and rotation therein, looks like we continue with huge opportunities there also!

If you are new to our trading service you should review recent blog posts and at minimum of our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. And you will notice quickly that they have been undeniably accurate on many time-rames (intra-day and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades). A quick hour of review at most will bring you up to date.

The algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks (at times), but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter ans Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $NVCN $RGSE $APR $ORIG $SDRL $OPHT $UWT $NE $SBGL $UCO $CHK $DB $LVS $SSL $SHPG $ESV I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List: $AKAO (momentum Monday) and sympathy plays $APRI $OPGN, $HMY (chart), $AGIO (recent wash-out), $SGY (recent swing), $CBMX (current swing), $JUNO (current swing), $ANF (previous wash-out on news), $SKLN (previous wash-out on news), $URBN (previous wash-out on news).

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $CE $CIB $ERF $UN $FRT $HR $MOH $CNC $BVN $HCP $SEAS $CPT $ABTX $CBS $MAA $EMR I will update before market open of refer to chat room notices.

(6) Downgrades: $MPW $SNH $HCN $PPG $ALXN $BMS $BWLD $SWK $OKE $LFUS $DVA $GNC $STC $WAC $GRFS $CBL $KRG $BRX $AKR $GTLS $MRO $ECPG $DEI $DDR I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Regular Trades:

S & P 500: $SPY $ES_F ($SPXL, $SPXS)

Outlook: Hasn’t stopped – but the Fed is coming so you want to watch. As pre previous and our algorithm call before election…. My bias is still to new highs but I am looking at a pull-back Christmas / Early 2017.

My Trading Plan: Right now I am trading $XIV instead of $SPXL or $SPXS. I do this because we are in a trend of crushed volatility. Now, when that changes and volatility starts to rise again (even if $SPY is rising at the same time) then I’ll flip over to trading $SPXL and $SPXS instead of $XIV.

227.80 looks fun. Caution overhead guys and gals. S & P 500 $SPY $ES_F ($SPXL, $SPXS)

Volatility: $VIX ($TVIX, $UVXY, $XIV)

Outlook: Looking for possible record lows before Christmas.

There was interesting action late Friday while $SPY was rising in $VIX and $XIV – ON HGH WATCH NOW.

Watch for volatility to rise on a trend – even if $SPY is still rising – volatility is a great indicator for what’s around the corner.

I WOULD PREPARE FOR A POP IN VOLATILITY BETWEEN NOW AND WEDNESDAY AFTERNOON and even perhaps in to next week Tuesday.

CNN Fear and Greed Index: http://money.cnn.com/data/fear-and-greed/

My Trading Plan for Volatility: I will likely follow that trend with $TVIX $UVXY $XIV buys at range pivots / pending price action, volume and other geo events.

Got $VIX? $UVXY $TVIX $XIV

Currencies and Other Global Markets: $DXY US Dollar Index ($UUP US Dollar Bull, $UDN British Pound, $USD/JPY, $FXY Japanese Yen Trust, $CNY China, $TZA, $SMK / $EWW Mexico Capped ETF)

Pre previous: Inflection point. No clear direction. $USD/JPY not backing off yet. Our $DXY algo had 100.50 as a PT so I’m watching. Lots of fundamentals at work here and geo.

My Trading Plan for Currencies / Global Markets: Waiting, waiting, waiting.

Gold: $GLD ($UGLD, $DGLD). Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG)

My Trading Plan for Gold: I am waiting for the trend reversal. We are very close to the price target at the bottom of that quadrant at 1133.00 ish. The initial wide frame target Rosie the algo nailed but there has been a wait and see for a reversal because of one more possible leg down. Getting very close IMO.

I haven’t started to take trades yet because I am waiting for “price – trigger – trade” set-ups. I will start chewing around the edges of stocks like $NUGT and $GLD likely. The idea is to get on the right side of the trade and trend.

Other equities I like for Gold Trade: $AUMN (penny stock)

Getting closer to 1133.00 our algo had 90% probability on. Gold algo intra work sheet 559 AM Dec 13 $GOLD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG #algo

Silver $SI_F: $SLV ($USLV, $DSLV)

Same as Gold – we’re waiting for a decision from market so we can get algo targets.

My Plan for Trading Silver:

Per previous;

Same as Gold, I’m waiting for the “price – trigger – trade” set-ups… I am going to start chewing around the edges of stocks when set-up confirms like $USLV and $SLV attempting to get on right side of trend trade.

Silver fighting with resistance. It could pop to 200 MA on 1 week. Possible. $SI_F $SLV $USLV, $DSLV

Other equities I like for Silver trade: $AUMN (penny stock).

Crude Oil FX : $USOIL $WTI ($UWTI, $DWTI, $GUSH, $ERX, $DRIP, $ERY, $USO, $UCO, $SCO, $UWT, $DWT, $CL_F)

The Oil break-out came so I am looking at small cap oil per list below. I am watching the support and resistance lines close – especially the yellow ones in the chart.

Outlook: Crude oil is trading within and respecting the main support and resistance areas of its upward channel. I am trading the support and resistance margins – I will consider shortside at the top of the channel or resistance and long at the bottom of the channel. I did take a trade Monday that was riskier because it was midrange and at a weak support but I had the algo on my side – mapped it out in advance – crude followed the plan so I took the trade in $UCO and it worked. Small scalp.

At the end of Monday the price was left right at a support level (a fibonacci support just above a trendline support) – I was going to take a long there at end of day but decided not to. I notice now in overnight trading it did hit support and has got some uplift – so I will monitor trade on Tuesday.

Trading Plan: Oil equities: Small cap oil may get some pop first thing Tuesday morning if crude is still trading in its upward channel. Positions in $UCO would be tough here.

Other Equities I like for Oil or Energy Trade: Tape / Chart – $ETE, $RIG. High Short Interest – $CRC, $EPE, $WLL, $RES, $JONE, $AREX, $REN, $CLR, $HP, $ATW, $SGY. Fundamentals: $EOG, Pipelines – $XLE: $HEP, $SXE, $KMI, $DPM, $TGS, $ENB, $EEP, $PTRC, $HGT

Natural Gas $NG_F $NATGAS ($UGAZ, $DGAZ):

Hit resistance as I thought and alerted.

Natural Gas hit heavy resistance, came off, now at a Fibonacci support. $NG_F $UGAZ $DGAZ

ON WATCH!!! This could get a considerable pop in to late Wednesday and even as far as in to late Monday next week is possible!!!

Study:

Now that a number of blog posts are being unlocked, it wouldn’t be a bad idea for traders to review them (especially new traders).

If you are trading relying on our charting or algorithms as trade indicators you should read this recent article, “Why our Stock Algorithms are Different.”

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, Small Cap Oil, $AKAO, $APRI, $OPGN, $DVAX, $CBMX, $JUNO, $GOLD, $SILVER, $USD/JPY, $USOIL $WTI, $VIX, $SPY, $NATGAS, $DWT, $UWT, $SLV, $GLD, $DXY

Pre-Market Newsletter Monday Dec 12 $SDRL $USOIL $WTIC $AKAO $DVAX $HMY $GLD $GDX $SLV $NG_F $USD/JPY $SPY $VIX …

My Stock Trading Plan for Monday Dec 12, 2016 in Chatroom. Oil, Small cap oil, Tech, Retail, $SDRL, $AKAO, $DVAX, $HMY, $GOLD, $GLD, Miners, $GDX, $SILVER, $SLV, $USOIL, $WTI, $USD/JPY, $SPY, $VIX, $NATGAS … more.

Welcome to the Monday Wall Street trading day session!

Important Notices:

$UWTI $DWTI have been resurrected as $UWT and $DWT – this is a massive thing for my trading to say the least. http://uk.reuters.com/article/usa-investment-etn-idUKL1N1E31ZB

Oil meetings happened and we have a new break out!

Current Holds:

$CBMX, $JUNO

Market Outlook:

Watch out for the upcoming Fed road bumps – stay nimble.

Small cap oil could go nuts – see list of names below. $SDRL on high alert. $USOIL $WTI is dialed in with EPIC the Oil Algo perfect and hit EPICs targets for last Wednesday and Friday and the algo lines and the time / price cycles (if you subscribe to EPIC’s newsletter be sure to check the report this morning!). Also, machines have been on since mid November break-out (so this makes trading oil related easier for me).

$AKAO Announces Positive Results in Phase 3 cUTI and CRE Clinical Trials of Plazomicin, $DVAX upgrade to “buy” by Cowen and $45 PT.

Dips on $GOLD $GLD are NOT being bought now vs.selling the rips (so this by default plays in to $SILVER). The Trump train / reflation train. Watching $USD/JPY.

$NATGAS $NG_F has come off some from important resistance I alerted – watching close.

$SPY has continued its upward trend. Watching markets for a pull back (as noted previous) sometime near or just after Christmas (it seems we have a Santa Claus rally).

And that brings me to momo stocks and rotation therein, looks like a fun week here setting up again. So these remain on high watch.

I am also watching Tech and Retail.

$HMY on watch – getting jiggy. $X and $CHK action.

There is so much going on it is best reviewed as market opens in the trading room today.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks (at times), but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $AKAO, $WTI, $VNR, $SGY, $REXX $MTL $CIE $ORIG $SDRL $ATW $DNR $PACD $AVXL $UWT $DGAZ $EPE $MEMP I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List: $HMY (chart), $AKAO Announces Positive Results in Phase 3 cUTI and CRE Clinical Trials of Plazomicin, $DVAX upgrade to “buy” by Cowen and $45 PT, $AGIO (recent wash-out), $SGY (recent swing), $CBMX (current swing), $JUNO (current swing), $ANF (previous wash-out on news), $SKLN (previous wash-out on news), $URBN (previous wash-out on news).

(4) Regular Algo Charting Watch-List: Gold $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas ($UGAZ, $DGAZ), S & P 500 $SPY ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $ABB $AEG $MGIC $AIG $BCR $CXW $WEB $HBI $PES $LULU $BRO $TRV $AMD $AUY $TAHO $TCP $COO $COP $UBS $T $EGHT $RNG $NVR $REGN $HBI $HOLX $DGX $FSV $GRA $FMC $TSO I will update before market open of refer to chat room notices.

(6) Downgrades: $CF $ALGT $PHG $GFI $CDNS $CMC $OPHT $IRET $MCC $KRG $EOG $MOS $DEPO $TTC $PEI $FOXA $GFI $EZPW $FLS $SYNA $WBMD $UBSH $FINL $CVS $CMC $WOR $SGEN $CERC $FUL $TMO $HUN $CC I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Regular Trades:

S & P 500: $SPY ($SPXL, $SPXS)

Outlook: Hasn’t stopped – but the Fed is coming so you want to watch. As pre previous and our algorithm call before election…. My bias is still to new highs but I am looking at a pull-back Christmas / Early 2017.

My Trading Plan: Right now I am trading $XIV instead of $SPXL or $SPXS. I do this because we are in a trend of crushed volatility. Now, when that changes and volatility starts to rise again (even if $SPY is rising at the same time) then I’ll flip over to trading $SPXL and $SPXS instead of $XIV.

Volatility: $VIX ($TVIX, $UVXY, $XIV)

Outlook: Looking for possible record lows before Christmas.

There was interesting action late Friday while $SPY was rising in $VIX and $XIV – ON HGH WATCH NOW.

Watch for volatility to rise on a trend – even if $SPY is still rising – volatility is a great indicator for what’s around the corner.

My Trading Plan for Volatility: I will likely follow that trend with $TVIX $UVXY $XIV buys at range pivots / pending price action, volume and other geo events.

Currencies and Other Global Markets: $DXY US Dollar Index ($UUP US Dollar Bull, $UDN British Pound, $USD/JPY, $FXY Japanese Yen Trust, $CNY China, $TZA, $SMK / $EWW Mexico Capped ETF)

Resistance in $USD/JPY starts at 115.95 and you can expect considerable turbulence if it continues uptrend in that region. BUT DON’T BE FOOLED BY THE BEARS – this chart is far from broken yet. But it is in to resistance so this could be inflection point. And being that Gold is very near our target watch close.

Pre previous: Inflection point. No clear direction. $USD/JPY not backing off yet. Our $DXY algo had 100.50 as a PT so I’m watching. Lots of fundamentals at work here and geo.

My Trading Plan for Currencies / Global Markets: Waiting, waiting, waiting.

Gold: $GLD ($UGLD, $DGLD). Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG)

$USD/JPY Per above.

My Trading Plan for Gold: I am waiting for the trend reversal. We are very close to the price target at the bottom of that quadrant at 1133.00 ish. The initial wide frame target Rosie the algo nailed but there has been a wait and see for a reversal because of one more possible leg down. Getting very close IMO.

Waiting for a long trade confirmation in Gold.

I haven’t started to take trades yet because I am waiting for “price – trigger – trade” set-ups. I will start chewing around the edges of stocks like $NUGT and $GLD likely. The idea is to get on the right side of the trade and trend.

Other equities I like for Gold Trade: $AUMN (penny stock)

Silver $SL_F: $SLV ($USLV, $DSLV)

Same as Gold – we’re waiting for a decision from market so we can get algo targets.

My Plan for Trading Silver:

Per previous;

Same as Gold, I’m waiting for the “price – trigger – trade” set-ups… I am going to start chewing around the edges of stocks when set-up confirms like $USLV and $SLV attempting to get on right side of trend trade.

Other equities I like for Silver trade: $AUMN (penny stock).

Crude Oil FX : $USOIL $WTI ($UWTI, $DWTI, $GUSH, $ERX, $DRIP, $ERY, $USO, $UCO, $SCO, $UWT, $DWT, $CL_F)

The Oil break-out came so I am looking at small cap oil per list below. I am watching the support and resistance lines close – especially the yellow ones in the chart.

Outlook: Looking for its new trading range and then I will trade the support and resistance areas.

Trading Plan: Oil equities:

Other Equities I like for Oil or Energy Trade: Tape / Chart – $ETE, $RIG. High Short Interest – $CRC, $EPE, $WLL, $RES, $JONE, $AREX, $REN, $CLR, $HP, $ATW, $SGY. Fundamentals: $EOG, Pipelines – $XLE: $HEP, $SXE, $KMI, $DPM, $TGS, $ENB, $EEP, $PTRC, $HGT

Natural Gas $NG_F : $NATGAS (, $UGAZ, $DGAZ):

Hit resistance as I thought and alerted. We’ll see what happens.

Study:

Now that a number of blog posts are being unlocked, it wouldn’t be a bad idea for traders to review them (especially learning traders).

Watch that $SKLN wash out snap back trade on YouTube I posted if you want to learn your indicators!

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, Small Cap Oil, $SDRL, $AKAO, $DVAX, $CBMX, $JUNO, $GOLD, $SILVER, $USD/JPY, $USOIL $WTI, $VIX, $SPY, $NATGAS, $DWT, $UWT, $SLV, $GLD, $DXY