Review of my Chat Room Stock Day Trades, Algorithm Charting Calls and Alerts for Thursday Dec 15 – $UWT, $CBIO, $PIR, $SPY, $VIX, $GLD, $GDX, $USDJPY, $DXY, $USOIL, $WTIC, $NG_F, $UGAZ and more.

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

Notices:

Notice: There is a new feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are using our algorithms or charting it is a must read.

Notice: We are testing fault settings for multiple trading rooms in 2017 (main room, momentum, options, swing, commodities, etc). We can have groups in different rooms all seeing same screen and announcements / broadcast – if you’re moved don’t sweat it – it won’t affect your experience.

Overview Perspective & Review of Chat Room, Algo Calls, Trades and Alerts:

From my post market report Monday and follow-ups since,

Well, we have Fed talk Wednesday so yes the market may oompff a bit – but I expect it to run again until near Christmas or even closer to Preident Elect Donald Trump’s power transition.

I followed up with a warning in the member’s premarket with specific area of challenge in $SPY chart at 227.80.

Price action on $SPY struggled with that area all day and remained a challenge overnight, Wed Fed day challenged price action and overnght it is still struggling BUT THE CHART IS NOT BROKE and until otherwise our algo predicts are in play (new reports processing and available within a day or three).

$SPY Struggling with resistance overnight our algo alerted as resistance prior to Fed meeting. $ES_F $SPXS $SPXL S&P 500

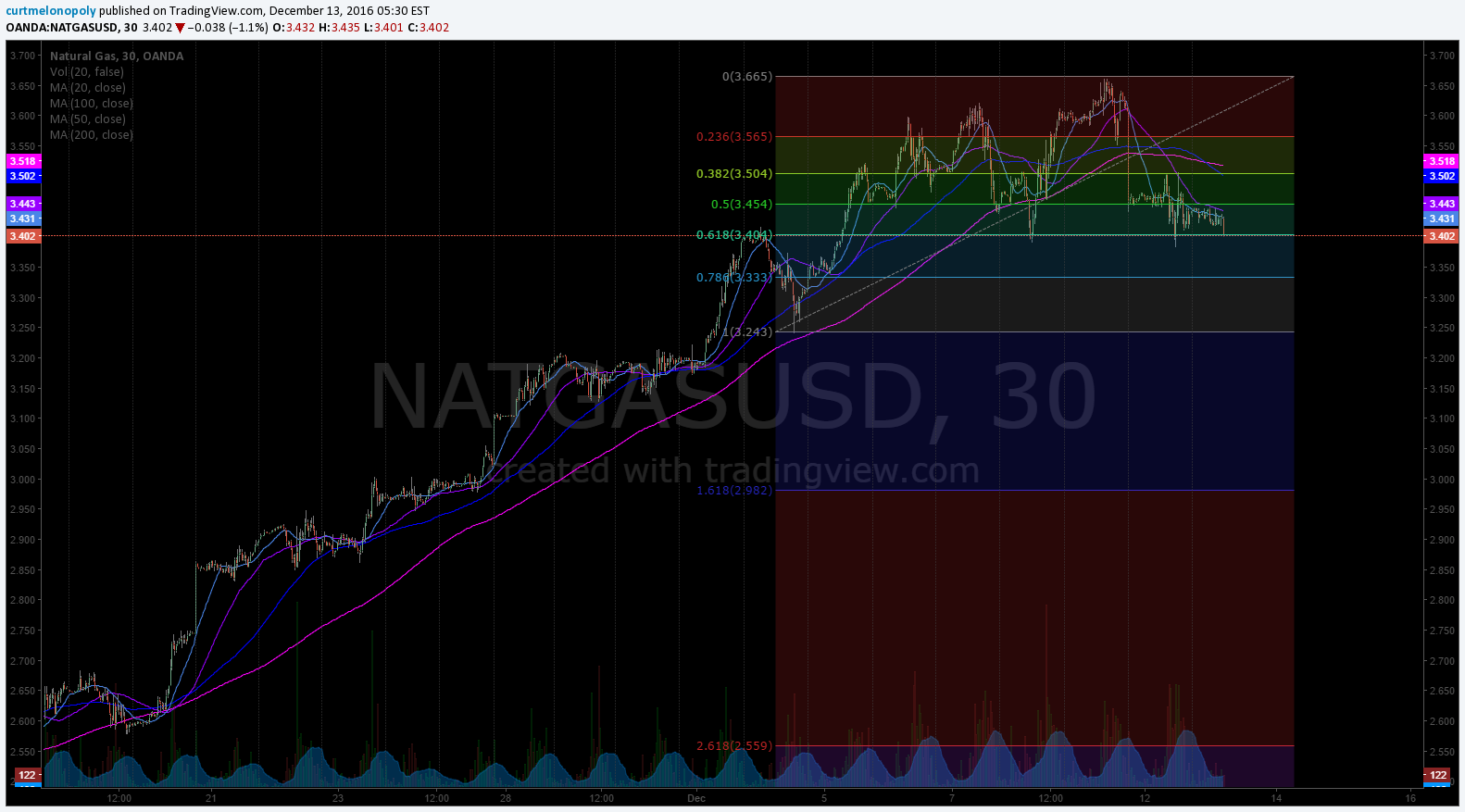

SILVER. Well here we go🔥 Target Hit! @SuperNovaAlgo called 15.80 – 16.25 price target months ago! $SLV $SI_V $USLV $DSLV Algos on fire! pic.twitter.com/qQyynuchnS

— Melonopoly (@curtmelonopoly) December 15, 2016

Hit my PT from July call but not lower quad. Gold algo intra work sheet 558 AM Dec 5 $GOLD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG pic.twitter.com/Uqoxwu4fCt

— Rosie the Gold Algo (@ROSIEtheAlgo) December 5, 2016

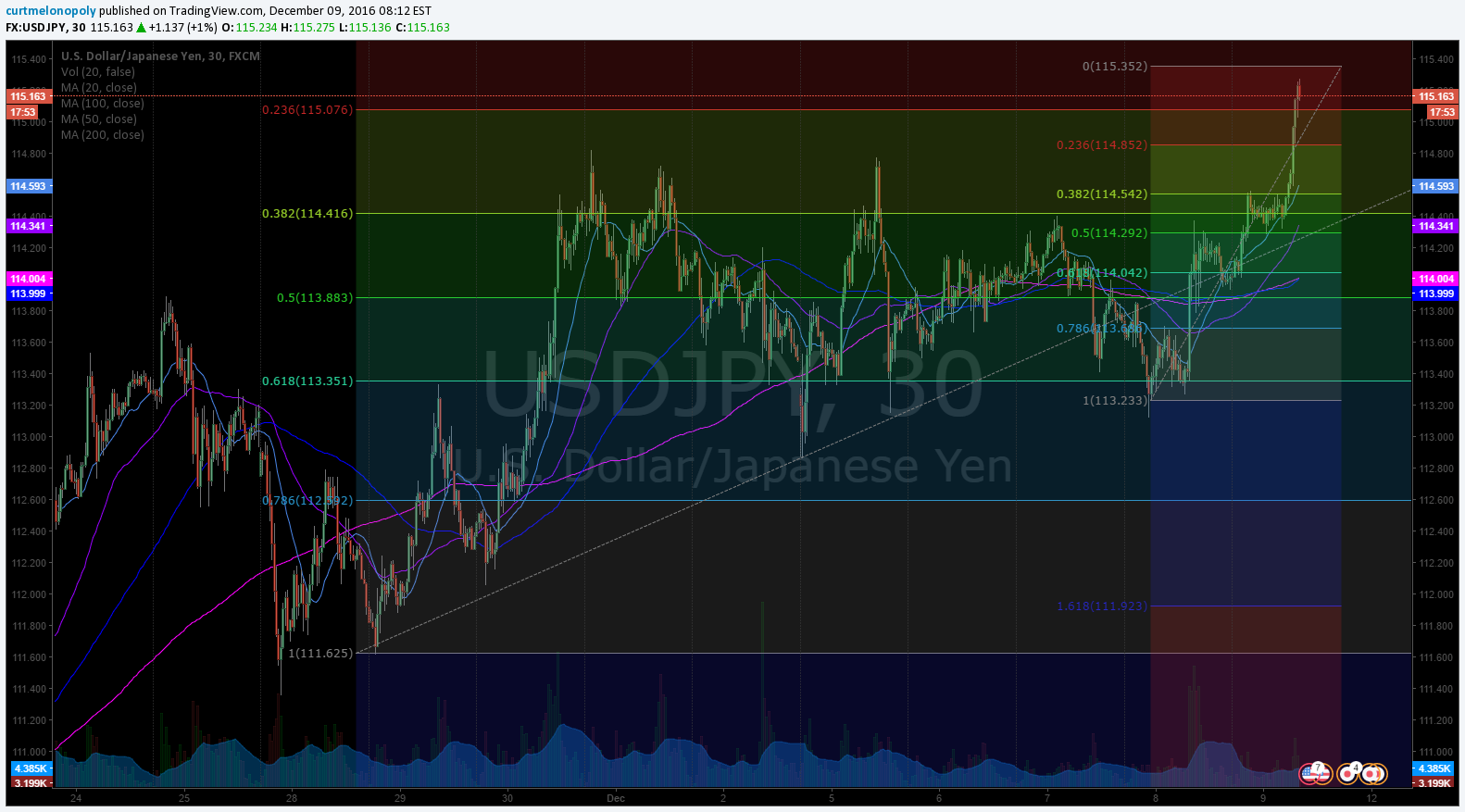

$USDJPY Did warn em. Break out. $GLD $GDX $NUGT $DUST $JDST $JNUG $DXY pic.twitter.com/BdhnHDIIKy

— Melonopoly (@curtmelonopoly) December 9, 2016

Target Hit! Gold collapse in to our 1133.00 price target to bottom of algo quadrant. $GOLD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG #algo

So that again leaves our inaugural algo EPIC!

From yesterday:

Epic the Oil Algo calls price and time for every Tuesday at 4:30, Wednesday at 10:30 and Friday at 1:00 (and much more than those calls) the week prior in his newsletter oil reports the week prior so that traders can plan their trades etc. Anyway… the Tuesday at 4:30 price and time target zone was hit yet once again! He’s firing at 93.3% call win rate (all published in advance like all over our algos).

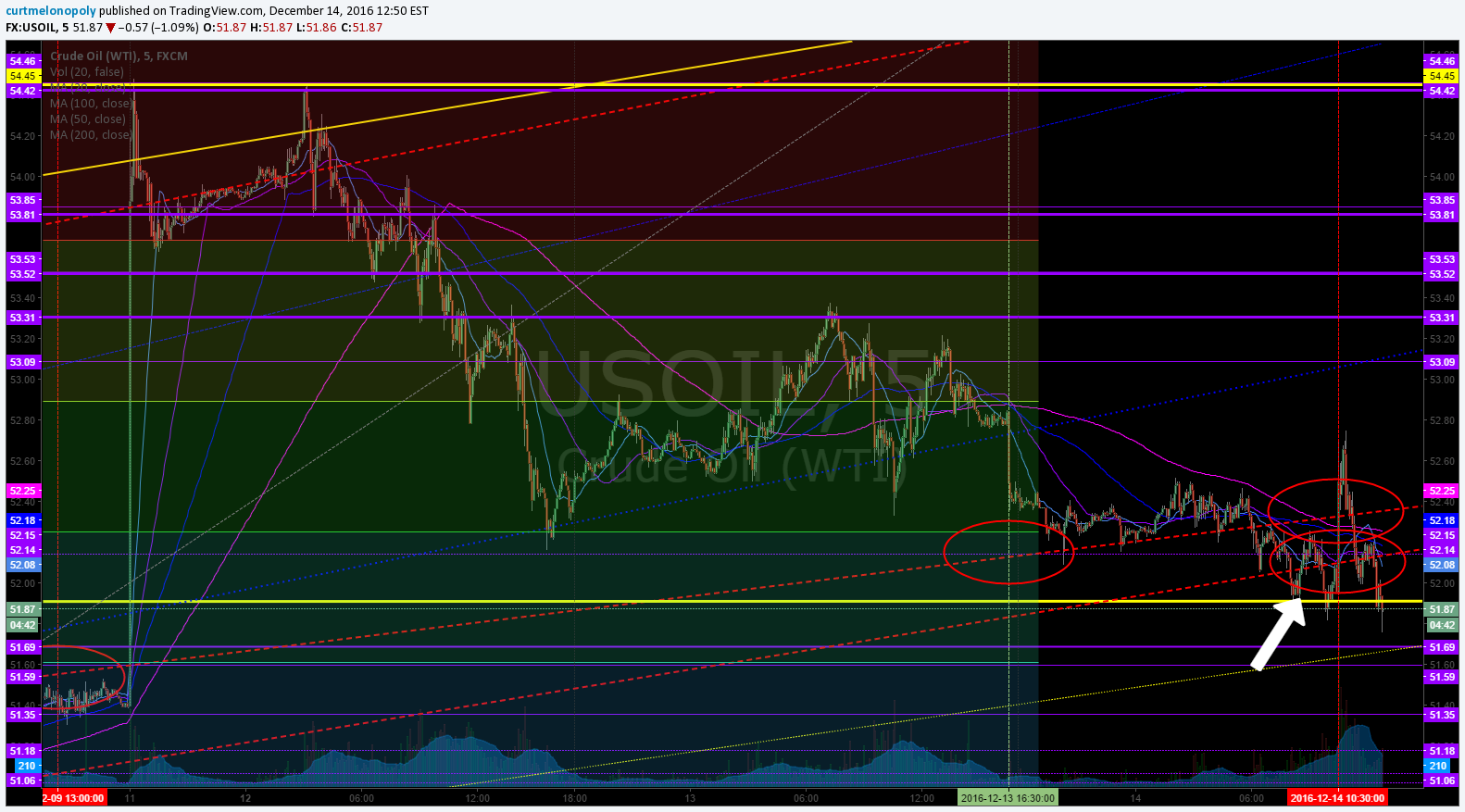

And what do you know! Wednesday EPIC the Oil Algo HIT THE PRICE PREDICT TARGET TO THE EXACT CENT AT THE EXACT SECOND OF THE PREDICTION NINE DAYS PRIOR!

So were weren’t sure which target was going to hit – funny thing is primary target hit right to the cent at the second of the call and the secondary target hit about 2 seconds later right to the exact cent also. What a day for EPIC. Below is a shot of when price was on its way to targets and above is price of crude hitting both called targets within seconds of each other.

Targets for next week Tuesday 4:30 PM, Wednesday 10:30 AM and Friday 1:00 PM will be calculated by EPIC the Oil Algo and sent to members this weekend!

Friday 1:00 target for this week on deck!

My Personal Trades:

I only added to my long position in my swing account on $UWT and held overnight. There was an awesome set up (our code word for it in the lab is “right ear sidewinder” AND WOW DID IT PLAY OUT EXACTLY AS WE SAID IT WOULD to the second all the way through the trade. I will try and find time to a do a detailed video in this set-up this weekend – we hit that trade set-up at least 95% of the time and the price spike is violent so it is an awesome crude oil instrument related trade. Normally I would have sold right at the top of the spike (because of course knowing where that is in advance is key). But I am loading crude oil related plays in my swing account right now. Mid term play. Anyway, it was recorded live in detail in the trading room so I hope to get a video done on it.

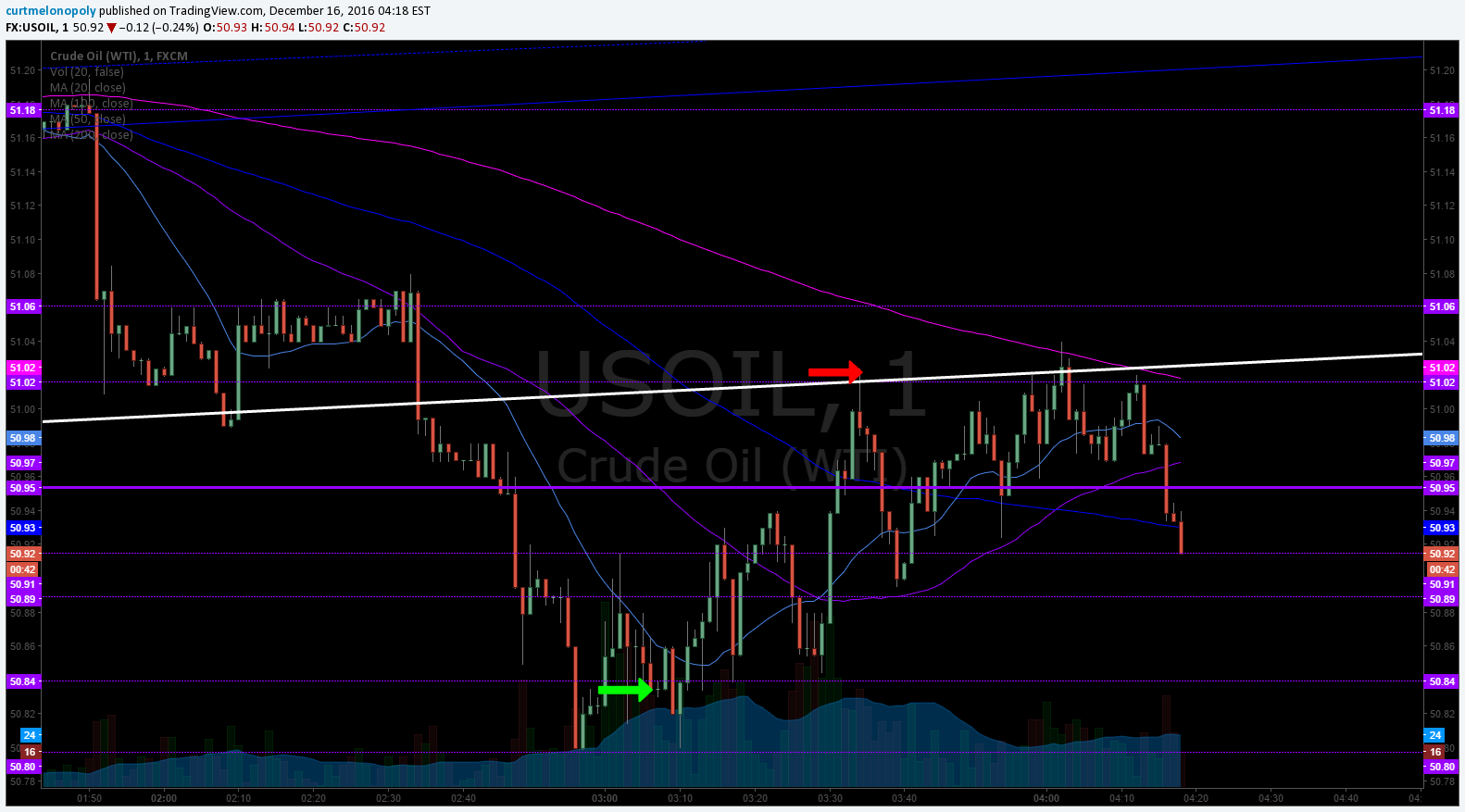

Here’s generally what the oil related trade looked like on a chart along with some tweets and you will see in the log below of me alerting of the set-up and when it was complete (the details are more important and that is why I need to do the video, that set-up can be used over and over with oil related trade on intra-day trading with near 100% accuracy).

Right ear sidewinder oil play called right to the second in trading room. Entry – exit Crude algo intra work sheet 418 AM Dec 16 FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DET #OOTT #algo – Green arrow entry alert, Red arrow exit alert – very detailed advance trade set-up explanation in the trading room and walked the traders through the whole process live second by second. The white line is the bottom of a time / price triangle trading quadrant the members were alerted to days ago that played out also – no traditional charting on earth provides that charting.

The alert process on Twitter (room transcript below and video coming from live trading session)

$UWT is a long crude ETN day trading instrument that allows you to get magnified gains if you are on right side of the trade. Not for beginners.

Got $UWT ?

— Melonopoly (@curtmelonopoly) December 15, 2016

I was confident because I had confirmation in the trading action that I was now again trading with the machines – makes it REALLY PREDICTABLE – to the second – watch the video – literally to the second. And that $USD/JPY from today – same thing – exactly to the cent to the second knowing in advance because when the machines are in they are in, in a way humans are not.

Happy to report they're back #machines

— Melonopoly (@curtmelonopoly) December 15, 2016

I alerted that there were large blocks trading in $USO – further confirmation.

$USO blocks

— Melonopoly (@curtmelonopoly) December 15, 2016

Right ear sidewinder in $USOIL watch out bears thank me later

— Melonopoly (@curtmelonopoly) December 15, 2016

I alerted prior to spike that I did accept tips (you never know a guy might get some love) – THEN IT SPIKED HARD! And of course I was broadcasting every step for our crew in the room.

I accept Silver tips

— Melonopoly (@curtmelonopoly) December 15, 2016

I have a big hat fyi

— Melonopoly (@curtmelonopoly) December 15, 2016

Alerted to exit the trade.

sidewinder completion

— Melonopoly (@curtmelonopoly) December 15, 2016

I'll do a step by step video this weekend on that sidewinder

— Melonopoly (@curtmelonopoly) December 15, 2016

A kind man thanked me.

very good call man

— JoeBuccamasa (@LuisitoRamone) December 15, 2016

Primary Lessons That May Help You With Your Trades:

Watch the two videos we’ll do on the oil trade and the USDJPY trade when ready.

Again, Mathew would have a book full of lessons with his trades lately (lots for folks to learn there) so it will be nice to have him on audio broadcasting in the room and I look forward to his watch lists and blog posts.

Looking Forward:

Now we are waiting for price action for our six algos to confirm targets etc and we’ll trade the other side of this inflection. IT IS GOING TO BE NUTS! Watch the algos on this inflection trade!

Announcements in Trading Room:

09:00 am Curtis M : PREMARKET MOMENTUM $CBIO $BOSC $PIR $ATHN $DSLV $JDST $ARWR $DUST $ONVO $DGAZ $NMM $MDLZ $MTL $LLY $IDXG $KKR

09:07 am Curtis M : $CBIO $DRYS news PREMARKET MOMENTUM $CBIO $BOSC $PIR $ATHN $DSLV $JDST $ARWR $DUST $ONVO $DGAZ $NMM $MDLZ $MTL $LLY $IDXG $KKR

09:08 am Curtis M : $CBIO $BOSC $ATHN $PIT $DRYS $DSLV $DUST $JDST $ARWR $MVIX $DGAZ $DWT $ONVO $LLY

09:31 am Curtis M : Watching momos $CBIO $BOSC $ATHN $PIR $DRYS $DSLV $DUST $JDST $ARWR $MVIX $DGAZ $DWT $ONVO $LLY Then on to Gold Oil SPY etc

10:25 am Curtis M : Momo $CBIO $PTCO $ESEA $PIR $ATHN $BOSC $DRYS $DCIX $JDST $DUST $PTN $IDCC $MVIS $UHS $GRFS

11:37 am Curtis M : On Lunch until 12:15 EST

Stock Chat-room Trading Transcript:

Miscellaneous chatter is removed.

09:06 am Curtis M : $CBIO mania

09:15 am Carol B : premarket looks decent

09:26 am Mathew Waterfall : Made it in. I’m having some weird issues apparently with my computer this AM so if things are laggy sorry about that

09:26 am Curtis M : modern life:)

09:27 am Curtis M : Watching open plays and then I will move over to standard when open settles down

09:33 am Tyler H : $CBIO went wrong direction

09:33 am Tyler H : Sorry $BOSC

09:34 am Mathew Waterfall : $AAPL pushing in to the gap. Watching to close out some of those calls

09:35 am OILQ K : I am staying long $AAPL in to Jan 1 in that time frame

09:36 am Curtis M : $CBIO and others not getting a great open yet

09:38 am MarketMaven M : $PIR bull

09:39 am Curtis M : $PIR squeeze is strong

09:45 am Joel O : Looking at $AMZN today on long bias

09:46 am Mathew Waterfall : $AAPL new highs. Losings the 10 on the 1′ and I’m cutting. Will let it run until 117 and get out around there

09:47 am Tyler H : Large spec on bid $ES_F we’re going hgher folks

09:49 am OILKING K : $VRX ss

09:50 am Mathew Waterfall : Out half of the $AAPL Dec16 118’s at .2 from .25. Will keep the other as a lotto play that will either double or go to zero, either way I’m fine. Didn’t buy enough time, looking at next weeks 118s

09:52 am Curtis M : This could it be it soon here on the sell side of $SPY

09:53 am Mathew Waterfall : On the mic, let me know if you can hear me

09:53 am OILKING K : Nice!

09:54 am Carol B : Thanks Matt

09:55 am Tyler H : $ES_F blasat off time

09:57 am Curtis M : Good quality head gear there Matt – clear

09:57 am Mathew Waterfall : Seeing a lot of IWM call buying and some large put sellers here. Should be in good shape for at least a pop into the end of the week. $ON calls working, $MPEL has some work to do

09:58 am Mathew Waterfall : Cool, glad that was easy lol

09:59 am Curtis M : The last time Iwent long and held ON and didnt check a stock was like 2 years ago – I did that with UWT – not sure if good or bad lol

09:59 am Mathew Waterfall : And right on time $IWM going vert. Looking for a hgher high over yesterday as first stop

10:01 am Curtis M : $SBPH halt

10:05 am Mathew Waterfall : Out half $IWM Dec23 138.5’s at .5 from .32. Keeping it tight. Will let the other half run

10:06 am Mathew Waterfall : And if you’re late it’s now even further north which is always nice

10:06 am Curtis M : snap back gonna be mean

10:07 am Mathew Waterfall : Yea /ES looks angry right now. Stop run to the north for the Santa rally

10:10 am Mathew Waterfall : $ON consolidating over yesterdays HOD. Like the steam in this one

10:11 am Curtis M : Shippers running

10:17 am Michael P : Back in 3 mins

10:22 am Mathew Waterfall : $XOM in a fed Dec23 92.5c’s @.3. Small position to start. Looking to see if this can retain some strength today and get back into the 92/93 range. Wanted it lower but it held up well

10:26 am OILKING K : Oil looks good yet IMO Mat

10:26 am Mathew Waterfall : Agreed. I don’t expect a downdraft in OIL but $XOM is always a bit of a proxy for OIL so you have to take that into consideration

10:27 am Curtis M : true that

10:36 am Mathew Waterfall : Out rest of my dec23 $IWM 138.5c’s. .62 from .32. Think it goes higher but looking for a breather and will reload. If not $XOM will have to carry me home

10:40 am Curtis M : $OPKA great chart

10:40 am Curtis M : $OPK

10:42 am Tyler H : Shippers dropped

10:43 am Mathew Waterfall : $AAPL bouncing off of gap support. Slow melt in last hour concerning but should be good for a pop north

10:43 am Mathew Waterfall : $ON 13’s. Booyah. Final target is 4’s on this one

10:43 am Dani M : excellent

10:45 am DaytradeX X : $NFLX stalking here

10:45 am Mathew Waterfall : If you’re in the trade and want to play tight can set a stop right above entry. It shouldn’t slip back below 12.73. If it does I would consider cutting

10:48 am Curtis M : $NFLX – I dont see how that biz gonna stay afloat – just me

10:50 am Curtis M : Gold in a dangerous place – next quadrant right below – algos will rape it down there -they have been in control

11:02 am Curtis M : I wonder if the 200 on the 1 min matters lol funny

11:03 am Curtis M : here we go

11:07 am Curtis M : Scaling 6000 $UWT picking my places tho short leash at fib crooss

11:12 am MarketMaven M : With ya Curt and tight stops too

11:12 am MarketMaven M : Nice fn timing

11:12 am OILKING K : That was interesting

11:13 am OILKING K : Right ear sidewinder?

11:13 am Curtis M : Its an oil trading term from way back lol – maybe they dont use it anymore

11:21 am Mathew Waterfall : Coffee break. Back in 20 or so

11:22 am Curtis M : Running scans enjoy

11:22 am Curtis M : me too

11:32 am Curtis M : Well that sucked

11:32 am Curtis M : But Im holding

11:32 am MarketMaven M : I am too but small positoin

11:34 am Curtis M : Where’s sandeep?

11:34 am Curtis M : u must b away from your computer

11:34 am John M : oil looks risky but I see your method

11:34 am John M : Im long TSLA

11:36 am Curtis M : One more round of deval and $USDJPY takes flight and Gold wlil be in bot hell

11:56 am Curtis M : Huge technical resistance on $USDJPY

12:02 pm John M : Curt USDJPY should take a breather here i think u ar right

12:04 pm Curtis M : Crude on top of a number of micro technical challenges now

12:07 pm John M : Yahoo a dog

12:07 pm David Z : Oil looking good now haha

12:07 pm Mathew Waterfall : Little lunchtime melt going on here. Expecting some more strength to come back into the market as bear haven’t been able to do much as of yet

12:08 pm DaytradeX X : Christmas rally will continue and trump train and gains tax train

12:09 pm Mathew Waterfall : USD is the thorn in our sides currently. Thanks Yellen

12:10 pm Dani M : Yellen seems out of touch

12:11 pm Curtis M : lol I will delete Yellen comments before publishing trading log bahahahah

12:11 pm Curtis M : She looks like she’d send the dogs of war

12:12 pm OILQ K : Long Spy or QQQ my think maybe

12:12 pm Mathew Waterfall : hahaha she will sick her horrible policy dogs on us

12:13 pm Curtis M : something yes she spooks me

12:13 pm Curtis M : its those collars

12:13 pm Mathew Waterfall : lol her outfits are like modern day chinese regime

12:14 pm Curtis M : haha

12:15 pm Mathew Waterfall : Just hit $NUGT for a bounc. 10 cent trailing stop, likely won’t net me much but it does like to bounce if the dollar yen can cooperate

12:15 pm Curtis M : Tempting trade with ths resistance

12:15 pm Curtis M : lol same time

12:21 pm Mathew Waterfall : Small add to $XOM position. Again nice strength on the day and looks like a cup and handle formation in progress

12:21 pm Mathew Waterfall : Only currently playing next weeks 92.5’s which are cheap

12:25 pm Michael P : what kinda magic was that wtf?

12:26 pm Curtis M : lilttle technical trick

12:26 pm Curtis M : did you watch how I did that?

12:26 pm Carol B : I DID

12:27 pm Drew M : That was sick

12:27 pm Curtis M : sick meaning good lol haha

12:27 pm Curtis M : mght still fail

12:29 pm Drew M : crazzy

12:41 pm Mathew Waterfall : $NUGT trying here, with a trailer I’m not really actively managing this trade but let’s see some bounce in the step please

12:45 pm Mathew Waterfall : $CHK Dec23 7.5 lotto trade. in @ .1. If oil holds this should get a pop. # bagger or doughnut on this no other option really so play at your own risk

12:47 pm OILKING K : I was looking at chk too

12:50 pm Mathew Waterfall : I’ll explain my thoughts on these lottos later today post market if you guys want some background in my thinking on these

12:51 pm Curtis M : Curt – remember 12:24 $USDJPY video and Sidewinder play on oil noon (note to self)

12:52 pm Curtis M : Matt u should do a blog post on it I’ll get Sartaj to get you set up

12:52 pm Mathew Waterfall : Sounds good

12:52 pm MarketMaven M : great ideas boyz like

12:53 pm Mathew Waterfall : $NUGT trying for 6. thought this was dead in the water 15′ ago lol

12:55 pm Mathew Waterfall : stopped at 5.95. Good enough for 20 cents a share on no real trade management. I’ll take the small win

12:55 pm Curtis M : yes nice profit is proft

01:01 pm Dani M : SPY gonna go

01:01 pm Curtis M : You are likely right

01:07 pm Curtis M : so glad I hammerd down so hard

01:07 pm Mathew Waterfall : Nice call Curt!

01:07 pm Curtis M : hey thanks Mat – truth is it was 50 50 but happy needed a hit

01:08 pm MarketMaven M : School today with you two guys. THANK YOU

01:08 pm Curtis M : 🙂

01:08 pm Mathew Waterfall : 50/50 with proper risk management can still pay the bills

01:09 pm Curtis M : Thats the secret right there

01:14 pm OILQ K : Anything look good Mathew?

01:15 pm Mathew Waterfall : No new positions for me, baybsitting what I have on the books

01:16 pm Curtis M : Not my skill

01:35 pm David Z : Pit close will be good or bad guys?

01:36 pm Curtis M : Tough call 50 50 with a little slant to good because of momo

01:38 pm Mathew Waterfall : I could see some profit taking here but I’m not playing it outside of my oil stock plays so YMMV

01:38 pm Curtis M : Ya you never go wrong taking profit

01:39 pm David Z : Good point

01:39 pm DaytradeX X : great day – lots of ed

02:09 pm OILKING K : what a cool play exactly like you said it would play too crazy neet

02:10 pm Dani M : Watching netflox again $NFLX

02:13 pm Darni P : Serious Mathew and Curtis best learning day and I have trade for 11 years. Looking forward to tomorrow. And Matts blog. I was thinking %DRYS for close thooughts?

02:20 pm OILKING K : Long $DRYS small

02:20 pm Mathew Waterfall : Glad you learned a few things today. Never stop learning

02:21 pm Mathew Waterfall : $drys looks ok. It couldnm’t get above 4.75 and has a recent low at 4.4 to play against so not a great r/r set up IMO

02:23 pm Curtis M : pure momo play

02:34 pm Curtis M : $KALV on scan

02:37 pm Curtis M : Just ran all the background on $KALV decent outfit guys

02:40 pm Mathew Waterfall : $DFIN working on a breakout for a swing

02:43 pm Curtis M : $CBIO blocks

02:48 pm Curtis M : $DRYS looking jiggy

02:55 pm Curtis M : $DCIX pop

03:00 pm Mathew Waterfall : $QHC HOD into the close here

03:03 pm Mathew Waterfall : Volume is lackluster but the daily candle will be a beauty. I’ll watch for continuation tomorrow

03:03 pm Curtis M : yup

03:04 pm Mathew Waterfall : And firmly into a gap that closes around 9.75 so a good candle to play against. Long over stop at LOD or around $7

03:14 pm Curtis M : So with this snap back $DRYS NHOD sqeeze I would ratchet stops at 5

03:16 pm Curtis M : If you get thru 5 your next res is 5.30 – 5.40

03:22 pm Curtis M : $CBIO 110% is a bit much but the way ths market is 300% may happen tomorrow

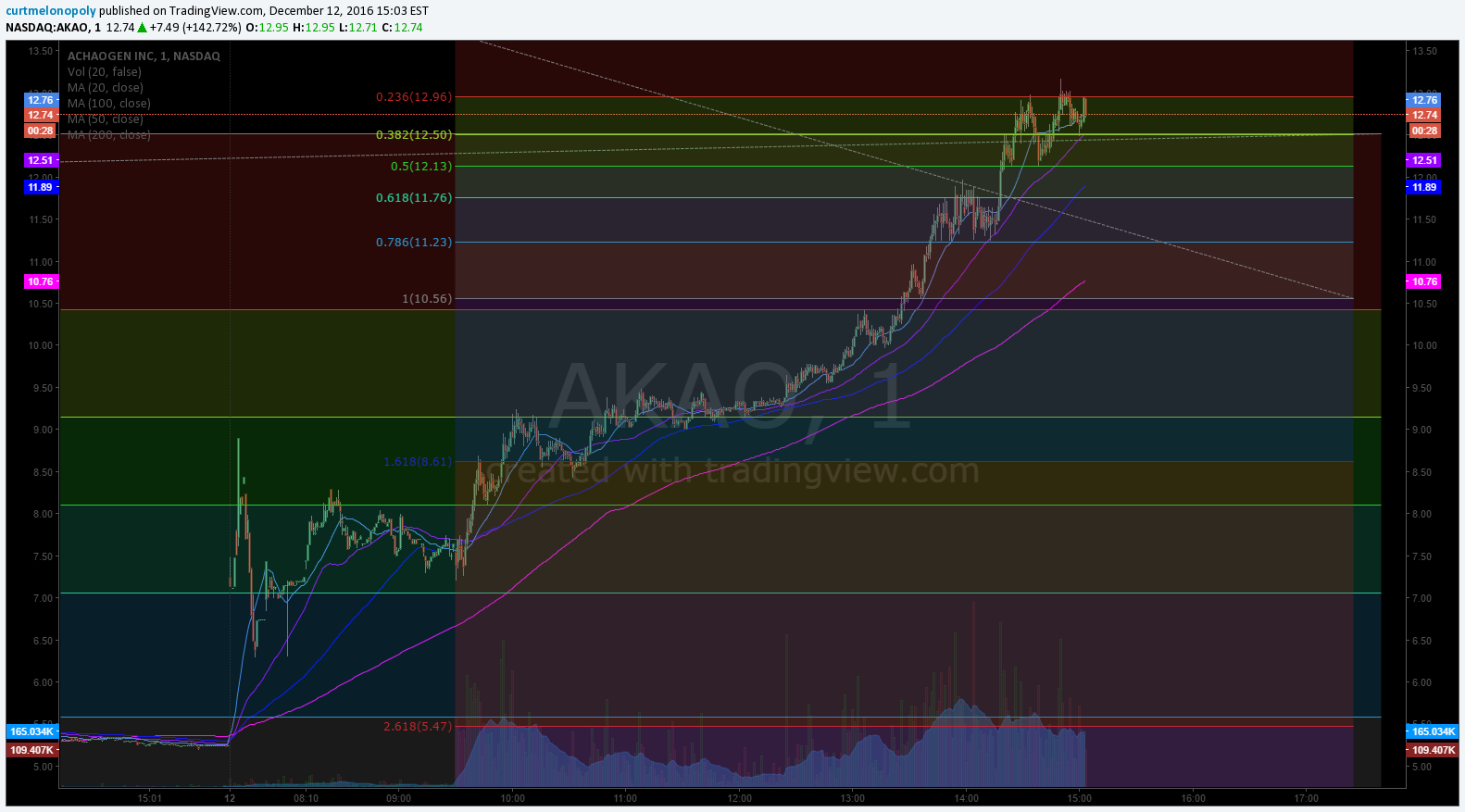

03:23 pm Mathew Waterfall : $AKAO says it can keep going lol

03:23 pm Curtis M : $DRYS just entered warp

03:26 pm Tyler H : I am out on $DRYS 40 cent winner

03:27 pm Darni P : ME TOO! thanks curt

03:27 pm Curtis M : I just alerted I didn’t play wish I did

03:27 pm Curtis M : risky stuff

03:35 pm MarketMaven M : $DRYS surprises me all the time. I wouldn’t hold it.

03:35 pm Mathew Waterfall : Debating $ORCL next week lottos for earnings. One of my favorite plays. recent strength with a sell off into the close right before earnings. ~1.50 move expected. Eyeing next week 43s but will likely just watch

03:37 pm Michael P : need to learn your moves mathew

03:37 pm Michael P : i will read your post

03:38 pm Dani M : see you tomorrow gyz!

03:39 pm Mathew Waterfall : I’ll work on it this weekend. It will have some technical stuff in there but be a decent primer for options with a slant towards lottos

03:39 pm Mathew Waterfall : $DFIN and $QHC looking strong into close. close eye on both$ON rallying to finish the day as well

03:40 pm Curtis M : All look good on that list

03:44 pm Mathew Waterfall : Rolling half of my $ON jan 13’s to 14’s for .36 credit. Great way to take some profits and keep the trade on. This will move the effective cost of those 14’s to .16 a piece. Keeping the other half of the 13’s and will outright sell those in coming days

03:45 pm Mathew Waterfall : You could also sell against the 13’s to creat a spread if you wanted or straight sell to lock gains but I think this goes higher as my previously mentioned target is 14 if the market cooperates

03:46 pm Mathew Waterfall : I promise, on of these days I will also learn to type. Editing my blog post this weekend will take longer than writing it I’m sure

03:46 pm Mathew Waterfall : *one see lol

03:47 pm Curtis M : lol

03:50 pm Mathew Waterfall : $AKS and $CLF pushing to close at HOD as well. in $XOM could join that would be very constructive

03:50 pm John M : Like $CLF

03:53 pm Mathew Waterfall : Same here John. 9.62 is an important level. Now that we’re over that I’m looking for a move back to the highs

03:53 pm Curtis M : $CLF makes sense

03:53 pm DaytradeX X : Im out good nite!!!

03:54 pm Joel O : in the morning peeps bye

03:54 pm Mathew Waterfall : $CLF was 121 in 08. Crazy

03:55 pm Darni P : YES TO $CLF – Catchya tmrw

03:57 pm Curtis M : Great day guys and gals thanks for the support!

03:57 pm Mathew Waterfall : See ya in the AM guys and gals

03:58 pm Carol B : see ya mat

03:58 pm Jack D : peace

04:01 pm Curtis M : out

You can follow along with public calls our algorithms post on Twitter here:

The algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Article Topics: Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Stock Market, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD $GDX $USOIL $WTIC $SPY $DXY $VIX $GDXJ $NUGT $DUST $JNUG $JDST $GC_F $USO $UCO $SCO $CL_F $UWT $DWT $ERX $ERY $GUSH $DRIP $SPY S&P 500