Tools You Can Use to Day Trade Crude Oil for a Better Win Rate. 90%+- Is Within Reach.

How to Trade Oil Successfully with the Right Strategies: Trade Alerts, Chat Room Signals, Live Trading Room, Conventional Charts, Time Cycle Knowledge and Algorithmic Models.

My position in this post is simple; if you have the technical data needed to make the right trading decisions on all time frames (your oil trading strategy) provided to you (the oil day trader) in the most efficient manner, you can out trade the general market traders and compete with world class machine oil trading firms.

We endeavor to provide such a trading platform for our members. Below I explain how we are doing that.

But first, a trade coaching session for those learning to get on the winning side of their trading… if you are a pro that only needs the technical oil trading strategies included in this post… skip this rant and scroll down.

Why do I scream from the rooftops that my win oil trading rate is so high? Why do I scream transparency and documentation of my trading journey and the development of our oil trading systems?

I scream my win rate (that anyone can review our live recorded and time stamped documentation to verify) to drive home that you do not have to accept what the book selling circle jerk crew tries to sell you, “trade price, nobody knows the future and that a 60/40 win rate is acceptable” – this is a flawed process.

You do not have to accept what the book selling circle jerk crew tries to sell you.

Study our oil trading system development and you will find that trading price doesn’t work in oil and that thinking you can’t know the future (future decisions for up, down or sideways trade and the most probable price targets) is foolish thinking.

We know with high probability where price is going to be on any time frame (from a 1 minute chart to a monthly chart and all between) and we know with high probability how to trade the decisions a trader will face on the way to the possible price targets.

We know the natural trading structure of the financial instrument – in other words, we know the playing field. We play the game with the lights on while the majority of our competition is in the dark.

We know the natural trading structure of the financial instrument – in other words, we know the playing field.

A 60/40 win rate is painful, to accept and use that system you have to take a series of significant losing side cuts to only then take advantage of a winning swing trade trend pattern move. In other words, the problem with their process is that you win big when you win but you have to endure pain to get the big win. I do this myself, but only with 10% of my account.

For example I have been DWT short for a number of weeks in preparation for the reversal in oil trade we are now experiencing. But I do it so that I get the move even when I don’t have time to day trade it.

The problem with their process is that you win big when you win but you have to endure pain to get the big win.

Another problem with the 60/40 idea (and there are hundreds of problems with this thinking) is that oil can trade sideways for many weeks, in this scenario you get chopped up and this causes your brain to be confused and you begin questioning yourself.

The method we are developing, perfecting and teaching (that we have documented live in every fashion available for proof) has a much higher rate of return and win side rate, it allows you to be in cash daily, it is much less stressful (the draw downs when you do lose can be next to zero) and it is the equivalent of Wayne Gretzky on the ice (for example).

You can simply “out stick handle” your competition.

To be a 90%+ oil trading winner takes real work to learn, but on the other side you will have much less stress, you win more often, your ROI and ROE increase significantly, your lifestyle freedom increases and the most important part is it keeps your brain in the frame work of being a winner.

Worst case scenario – you add what you can or what you prefer to use of what we have learned and passed on to you so that your oil trading win rate increases.

The bottom line.

It is critical for your brain to know it wins. When it knows you are a winner it won’t accept losses. This is critical (you would have to do a serious psychological study to learn why this is so important – maybe someday I will write about what I’ve learned).

The bottom line is that your brain develops patterns of habit that manifest in reality. Your subconscious is the leader, and it needs to know when it trades crude oil, that you win.

The bottom line is that your brain develops patterns of habit that manifest in reality.

The only way this is possible (your brain knowing that you win so it won’t accept losing which causes your execution to be disciplined) is to be able to “out -trade” your competition.

Sure, you are competing with yourself – but in reality you are competing against the world’s best when you enter the markets everyday.

The only way to out-trade your competition is to have technical market information and tools they simply do not possess and / or do not have “as efficient” access to and they haven’t defined their trading process and skill-set to the same level you have.

This is what causes one to trade win-side at a rate of over 90%. And anyone can do it.

Lets Get on With The Technical Oil Trading Strategies You Can Use to Day Trade Crude Oil for a Better Win Rate.

Oil Trade Signals: The Strategy / Guidance I Provided to Members at Start of Week.

Crude Oil Time Cycles, Area of Trade, Support, Resistance, Trading Channels.

Note: The time stamps on the Private Member Discord Oil Chat Room Server is showing my time in the Dominican Republic (this time of year it is one hour later here in DR than Eastern Time in New York).

For this post (that focuses on examples from Friday Jan 18, 2019 in our oil trading room) I will start with trade signals I provided to our members at the beginning of the week (and some prior) to provide context for the guidance explained.

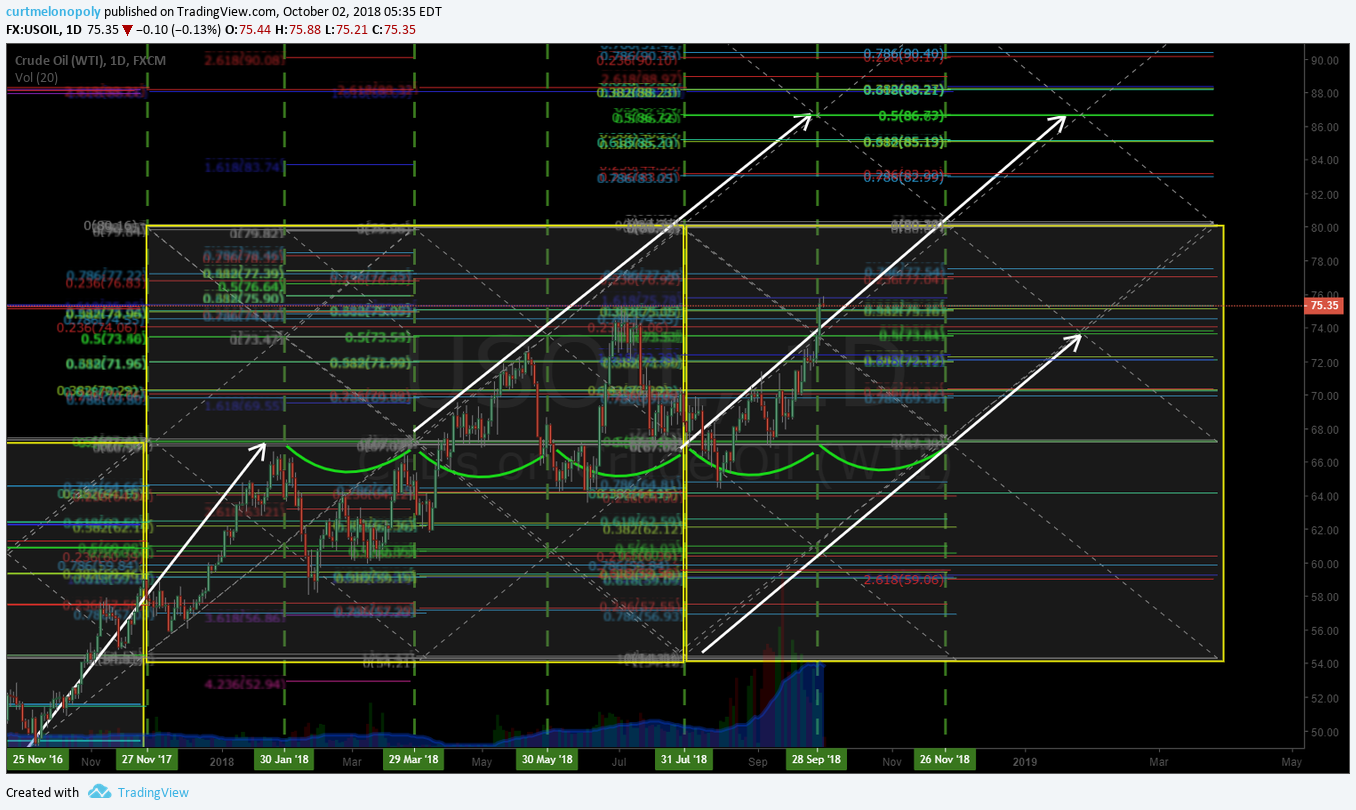

Below (3rd image down) you will find a private member server screen shot (to start the week of Jan 14, 2018) I shared with the chat room of a test chart our oil machine trade coding technicians are developing for sizing trades.

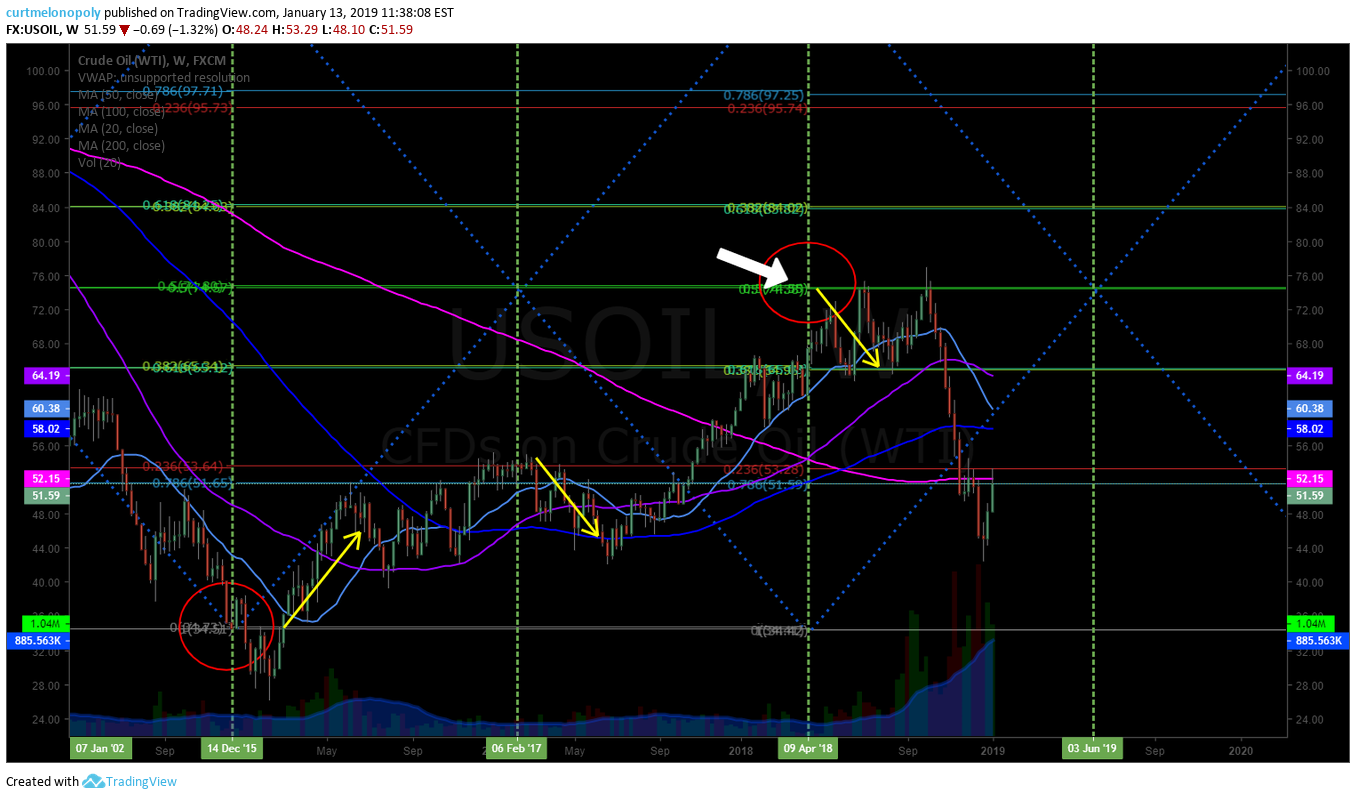

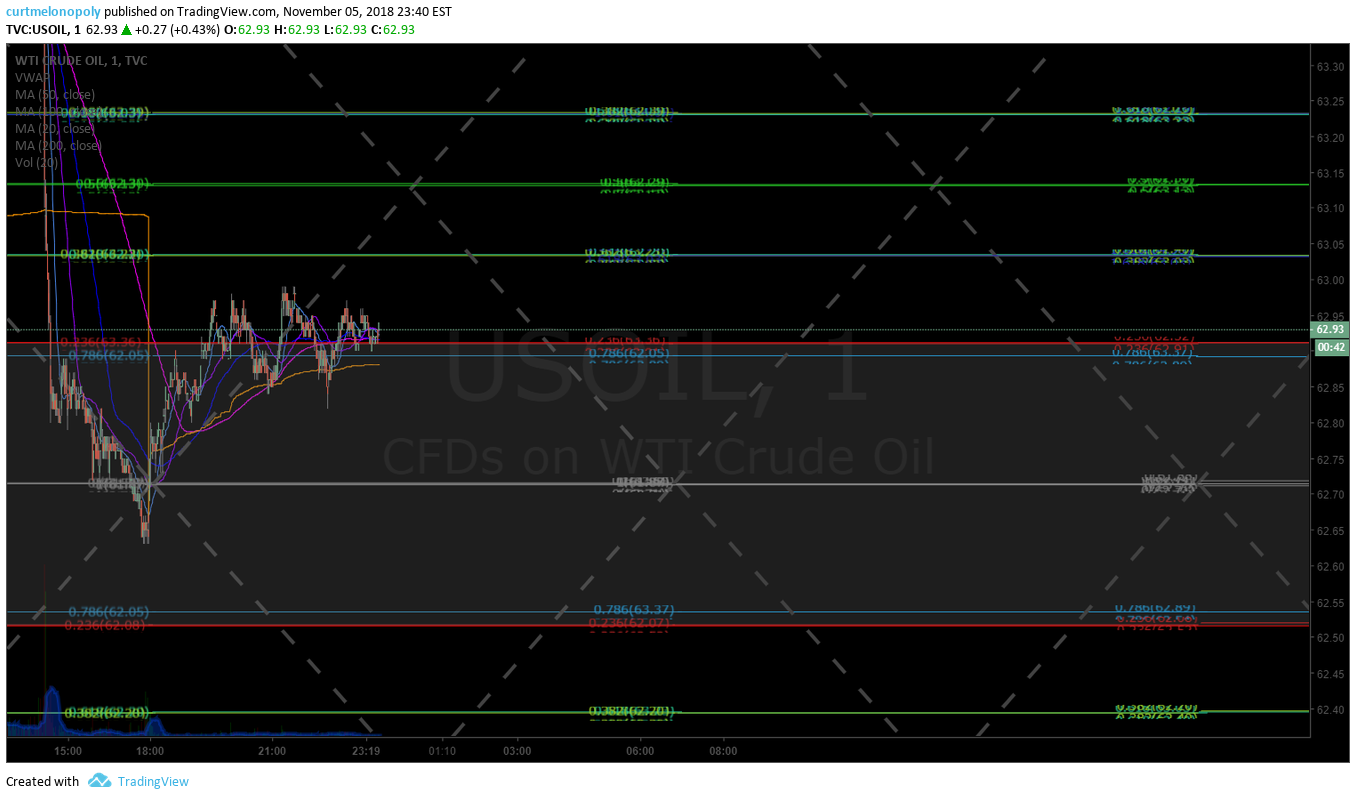

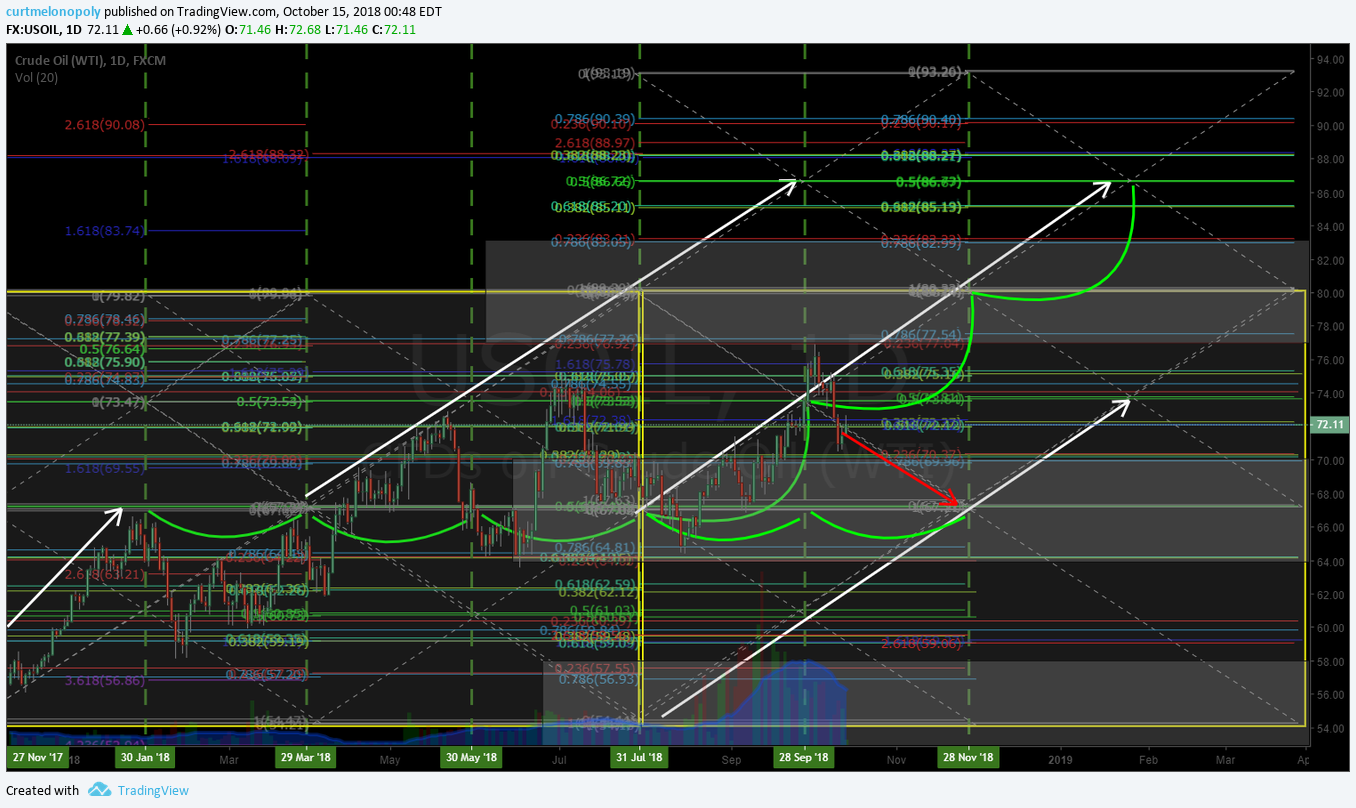

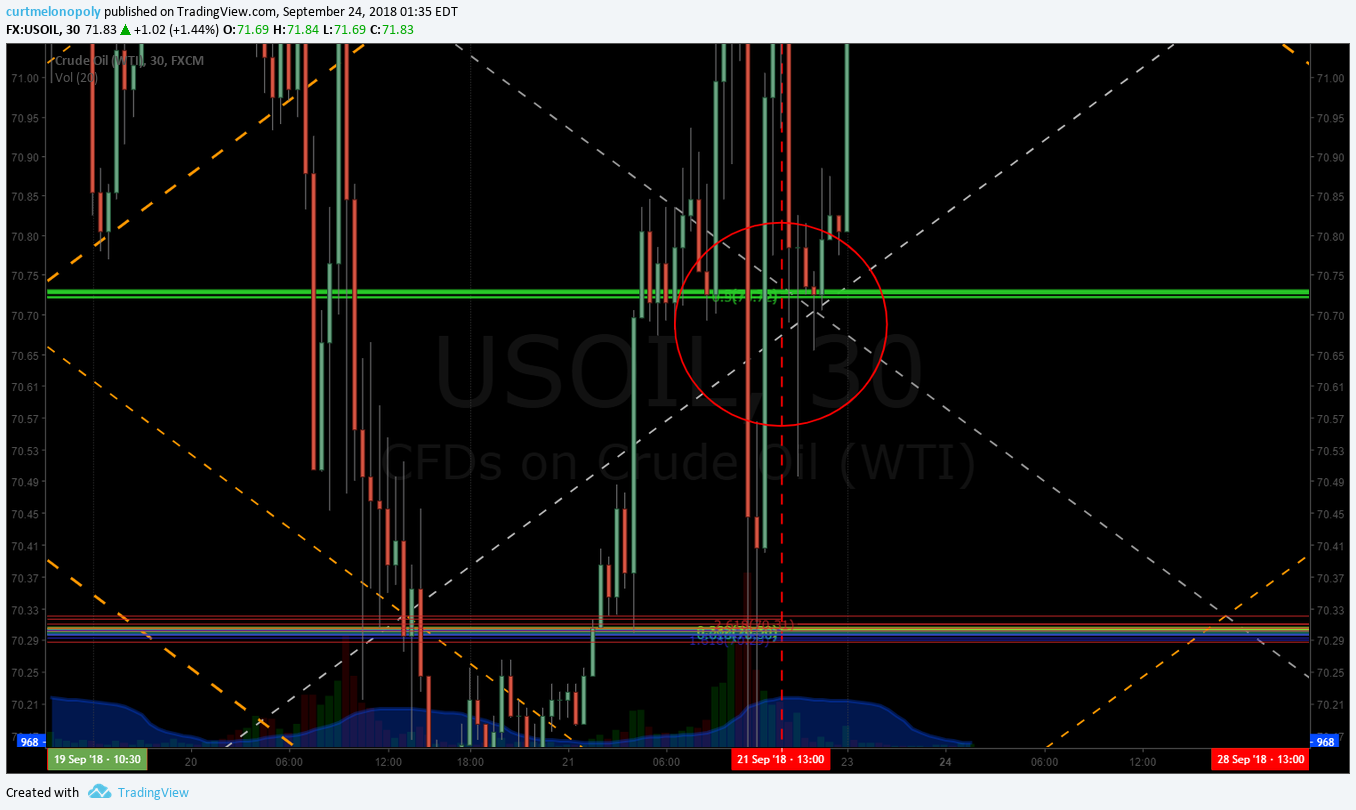

In addition to using our main oil charting (the EPIC Oil Algorithm model – a proprietary model based on a 30 minute oil chart) we use many other charts (conventional and algorithmic) on many time-frames to determine back tested and correlated probabilities for oil trade resistance, support, channels, reversals, time cycles and more.

In the instance below (at start of last week) I was signaling the possible channel oil would use for weekly trade – specifically if the scenario played out during weekly trade as it related to the previously provided signals to members (that we seen a time cycle ending in crude oil December 20, 2018).

Prior to this, we had provided members (many weeks in advance of Dec 20) that the time cycle peak / conclusion was for approximately Dec 20 (with allowance for a week either way of Dec 20 because the time cycle was so large as it was based on the weekly time cycle charting).

Then on Dec 26, 2018 oil did in fact turn up in trade and hasn’t stopped trading upward since.

Between Dec 20 and Dec 26 there was one last “flash down” in oil trade which is typical at the end or peak of a time cycle on any time frame from the one minute charting to monthly charting (this is typical of the final stops being triggered and shorts covering positions).

Then on Dec 26, 2018 oil did in fact turn up in trade and hasn’t stopped trading upward since.

Oil hit a low of 42.38 on FX USOIL WTI on Dec 24, 2018 and closed Friday Jan 18, 2019 at 52.38 – less than one month later.

Also of note, we predicted the down turn in oil trade at the time cycle peak – the time cycle turn prior to the Dec 20, 2018 reversal.

See this tweet from EPIC Oil Algorithm Public Twitter feed and the post linked to our blog.

“Dating back to 2002, 13 of 14 major time cycles on weekly crude oil chart structure seen trend reversal to some extent or another #Oil #OOTT #TimeCycles FX USOIL WTI $CL_F $USO $UWT $DWT https://www.tradingview.com/chart/USOIL/F8Z9UE66-Dating-back-to-2002-13-of-14-major-time-cycles-on-weekly-crude/ …

https://twitter.com/EPICtheAlgo/status/1084492522490155014

Back to Strategic Guidance Provided to Oil Chat Room Last Week:

The oil trade signals I alerted to members to assist in their oil trade strategy focused on the trading range our members could expect for oil the coming week. The alerted signals also gave our traders support and resistance areas on the charting and the most probable channel of trade (this is all in addition to the EPIC Oil Trading Weekly Report).

Curt Melonopoly Last Monday at 8:49 AM (7:49 AM EST)

“It’s a machine coding doodle chart for sizing etc so its a mess, but we are looking for channel highlighted in yellow to hold for trend reversal confirmation in crude oil – use proven EPIC model for confirmation for trading”.

Below is a screen shot of the live oil alert feed on Twitter providing the following signal to our members for the week:

“Under 52.16 FX USOIL WTI I am short term bearish, over 52.16 bullish to 53.34 and over to 55.65 – main test areas over head on weekly time frame.”

The examples above provide context to the guidance we provided our oil members at recent time cycle turns and at the beginning of the week…

Now lets jump to the specific point of this post that involves trade last Friday December 18, 2019 so we can learn how to day trade the opportunities in crude oil.

At 6:40 AM Friday Jan 19, 2019 I signaled the oil chat room that oil trade looked bullish and that our traders could expect a push toward the 53.40 resistance.

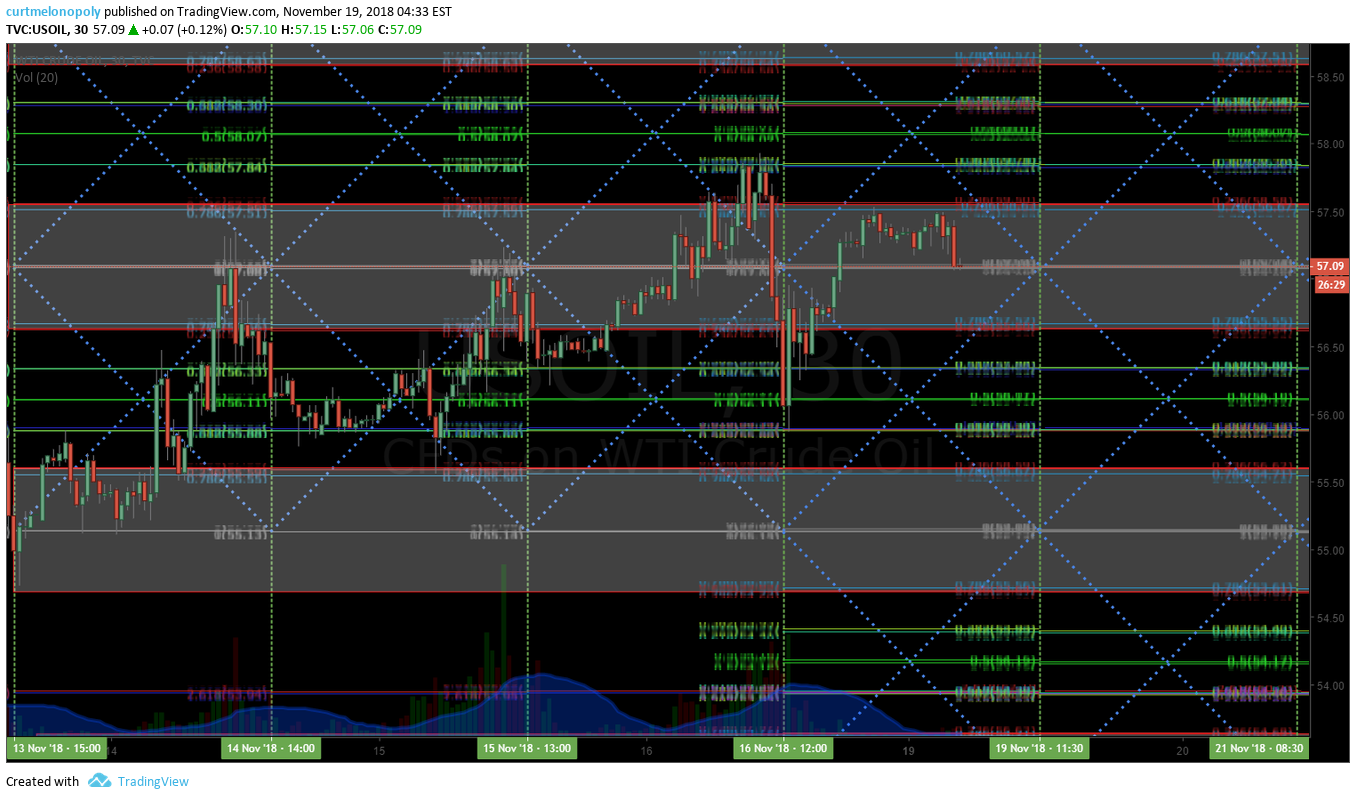

You can see on the chart / screen capture below how trade for the week had maintained the channel and that oil trade was following a trajectory (light blue vertical line) that I had outlined in the chat room earlier in the week as a probable upside strategy.

The strategy for the trajectory of the uptrending blue arrow was based on trajectory of time cycle targets on the short time frame assuming oil was bullish (price targets on our algorithmic charting can be assumed at where important trend lines cross, this is consistent through all time frames on all algorithmic models – this takes some time to learn).

The resistance I was alerting our members was at the top of the trading channel so they were aware of where to be aware of possibly trimming positions or at minimum being on watch for intra-day stall in trade.

“They’re pushing for that 53.40 area today (upside scenario), above could cause a significant squeeze”.

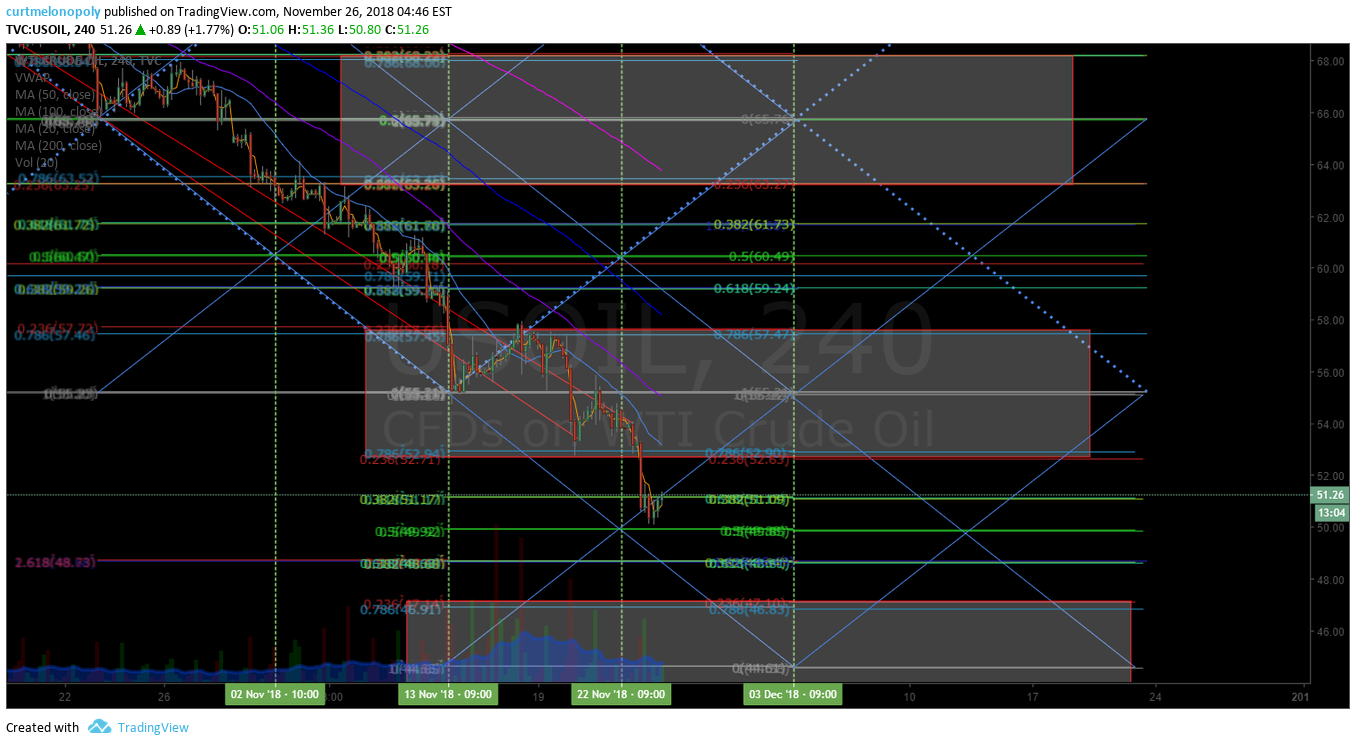

On this screen capture from the oil chat room I am showing our members that trade intra day was in the bullish scenario on a 4 hour test chart. Reconfirming the bullish scenario for day trading oil upward in Friday’s trade.

You will also notice at the bottom of the screen capture – the noted alert at the bottom of the screen, “53.50 is top of quad ton EPIC model resistance today, trading 52.83 intra” that this set-up coincided with our proprietary oil algorithm charting (the core oil algorithm charting – the core of our methodology, is not included in this post).

The core oil algorithm charting – the core of our methodology, is not included in this post.

Earlier that morning Jeremy has posted a link in the chat room to the article and video post covering trade from Thursday’s session and explanation of the one minute trading box set-up. You can study the set-up at the link below;

By far one of the most important crude oil trading articles we have posted since our inception.

Protected: How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video)

Password: ********

At 920 AM right before regular market open I provide chat room a crude oil position signal for preferred long entry point.

I also re-confirm my expectation that probability for the top of the quad area of the oil algorithm in trade gets hit and that my entry signal price target (preferred entry is 52.40) so that our traders could make their own decisions for execution.

Also mentioned here, the one minute trading model (the trading box area) as the preferred entry price so that our members know where I derived the 52.40 entry preference from.

Crude oil trade alert in chat room screen shot of long execution in to open and other alerts. Long oil at 52.67 with trims at 52.93 and 53.08.

Alert in oil chat room that I was closing the oil day trade at 53.03 due to internet issues and reiteration of price target 53.50 for day trade.

Then the price target for the day trade was hit. A 90 tick move so far on the day.

Below is screen shot capture of crude oil chat room of posted oil chart images of predictability of 1 minute oil day trading strategy in trading box model (as previously posted above – the Thursday featured blog post the day prior) when crude oil squeezes intra-day.

As the day trading session progressed I provided a number of alerts to impending resistance on all time frames in crude oil trade range expected for the day.

heavy resistance confirming on all time frames, but in a sqz u never know

Resistance areas of oil trade for guidance for day traders to consider trimming or closing positions.

Resistance had been hit on two 4 hour charts and the EPIC Oil Algorithm 30 Minute Model at this point of trade intra-day. Other charting time frames had resistance also.

240 Min Test Chart Scenarios posted to oil chat room revising the previous so that day trading signals for oil are updated.

LIVE OIL TRADING ROOM VIDEO | HOW TO DAY TRADE CRUDE OIL – STRATEGIES I USE.

#daytrade #crudeoil

Summary Notes for Video:

Note: Voice broadcast starts at 16:25 on video. When I am trading and on mic is noted below (the location times on video).

At 16:25 on video “I am triggering long 52.67 with tight stops because of test on 240 minute crude oil charting, so I may trigger in and out here, we’ll see. Will probably get in to pressure right in to open here but I didn’t want to miss the move. A little bit of FOMO.”

At 19:50 on video “The one minute candle turn in advance of market open is coming here, get ready for some pressure.”

Keep in mind the strategy guidance provided to members in the oil chat room specific to the preferred by trigger at 52.40 (in other words support on one minute day-trading model).

And Then The Internet Crashes! A Work Crew Down the Street Cut The Line.

At 23:00 mins on video I come on mic to announce the internet problem to the trading room (at which time I didn’t know what the specific problem with the internet was).

At 24:50 on video the pressure in oil trade comes (which made sense to me considering the resistance decision but I decided to hold because oil was so bullish through the time cycle). I could have cut and re-entered which may have yielded a better profit by 10 ticks or so.

And then the internet continues to crash intermittently. Had the internet not been crashing I would have been on mic providing our traders guidance.

At 56:40 I announce we are back up on a cellular network and that I am holding the position.

At 1:10:50 On video I announce I am trimming at 53.08 holding 25% – there was significant resistance on the EPIC Oil Algorithm so I trimmed.

In the trading chat room (not on video due to internet issues) I announce I am closing trade due to internet issues even though price wasn’t to the top of the algorithm quadrant and price target for the day, “closed 53.03 may re enter i had to close due to internet.”

Had the internet been restored timely I would have traded right top of quadrant and price target for the day.

At 1:18:00 on video you can see trade hitting the price target for the day (top of algorithm quadrant).

In a normal scenario I would have been trading the one minute trading chart model in the trading boxes and on mic in the trading room announces my trades. But on this day as fate would have it I couldn’t do it because I couldn’t risk the internet crashing while on the temporary cellular platform we were using.

Important note:

Much of the proprietary charting links, member oil reporting, and proprietary algorithmic charting is not included in this post. In 2019 we have started to limit dissemination of proprietary content due to copy cat trading firms.

Summary Thoughts for Context.

It is important to note that there were many many more trade alerts, charting updates, chat room trades / signals / guidance and trading room live trade coverage for the week.

Our members have much, much more information available to them for crude oil day trading decisions needed every day of the week on all time frames.

Having advanced technical know-how derived from a systematic scientific process that gets fed in to our various oil trading platform services to trading members allows for our members to “out stick handle” the everyday trading community and compete with world class machine trading firms.

My win rate and the oil machine trading win rate was well over 90% for the week and the reason is the combined tools available – available to myself, to our machine trading techs and thus the developed software and also made available to the members in our oil trading service.

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Trading, Signals, Strategy, Alerts, Trade Room, Chat, Algorithm, USOIL, WTI, CL_F, USO

Follow: