Machine Learning is Changing Our World and Compound Gains are Powerful. This is a Short Story About How Machine Trading is Changing Portfolio Return, Risk and Compound Trading Expectations.

The World is Changing Fast. The Landscape of Public Markets, Risk and Portfolio Return Along With It.

A brief search on Google brings many articles about the increase in automated machine trading and the possible future forward scenarios for public markets.

I was recently interviewed about this very topic – the future is unknown, but in my basic thinking machine learning is here to stay, I have tried to compete against it and I intend to be on the right side of the ROI trajectory.

- Per Trevor Noren (@trevornoren) “Passive now controls 60% of US equity assets while quant funds control 20%—staggering 80% combined. Blackrock & Vanguard oversee $12t, up from less than $8t 5 years ago. And algorithmic trading systems are now responsible for 75% of global trading volume.” https://latest.13d.com/risks-passive-algorithmic-transformation-equity-markets-crisis-6ea6f6e9e271

- JP Morgan doubles down on machine learning for FX algorithms https://www.thetradenews.com/jp-morgan-doubles-machine-learning-fx-algorithms/

- Google’s AI AlphaGo Is Beating Humanity At Its Own Games (HBO) https://www.youtube.com/watch?v=8dMFJpEGNLQ

First, A Snap-Shot of Our Brief History.

When we started our trading service we demonstrated how day trading and swing trading could net good day traders consistently 100% – 400% a year with a systematic rules-based process.

We video recorded every session live, alerted the trades to our clients and documented each trade.

The naysayer says “I seen this or that trade that didn’t work!” – the small cross-section analyst that didn’t do their homework that is. Sure, we had our losses. But what they don’t say is that over-all we proved the returns were not only possible but probable (live recorded, time stamped, live alerted) in a systematic manner if a day trader uses a sound rules-based process, has an appropriate account size to execute various trades and sizing to spread risk (as we alerted live) and protects his/her downside. Anyone can go through our live alerts and videos to determine this to be the case. And we’re not the only day trading service that has or continues to provide these results – some even more.

What’s the point?

The point is that if you take an isolated cross-section of time, or you kinda executed the processes or kind of protected your downside or didn’t start with an appropriate account size to spread your risk then your individual scenario may have been different. But over-all, an investigation in to our processes show over 100% returns over all per annum daytrading and / or swing trading.

More specifically to the point, the same principle applies to machine trade development and testing.

When a trader reaches this level of day trading (a winning process within an appropriate account size with protected risk), he/she can then start thinking about compounding his/her gains (the holy grail for a day trader).

Or, as we did, the successful trader may chose to turn their attention to algorithmic modeling and then on to machine trading.

In our case, we started with cracking the code to and building software for trading crude oil futures contracts.

Why go in to further risk? Because I knew what my potential returns were investing (I have over three decades of experience) and I now knew what my potential returns were day trading and swing trading. The last frontier for me was machine learning and whether we could achieve better returns in automated trade with less future forward risk and effort.

My retirement years will be as a trader, the only questions for me are; what kind of trader and what are the returns?

Day trading and swing trading equities (along with trading various ETF type instruments) is much easier to master than day trading crude oil and manifold times easier than building software to trade crude oil or any other instrument.

We knew that if we mastered the code / rule-set of machine trade that higher returns were obviously possible and that we could then build software for numerous other instruments (at will) and obviously leverage our time and compound return potential far in to the future.

The EPIC v1 machine software real-world trade test was returning a projected 20% per annum, v2 40%, v3 80% and the goal for EPIC’s version 4 was 160%.

Version 4 was too aggressive and exceeded our risk tolerance so we returned to EPIC v3 and it has been running with sound stability and very low downside risk for seven weeks at approximately 90% projected annual returns. We expect this percentage to consistently increase over time (as the software learns) with little to no additional down-side risk.

Stability of Software – downside risk vs. return is key. V4 EPIC I believe could hit 800% per year or more but the volatility and subsequent risk therein was too much for us to stomach in real-world testing (real-world is also key and required – paper-trading when testing the software doesn’t cut it).

Below is the Seven Week Real-World Trading Performance YTD for EPIC v3 Crude Oil Futures Machine Trading Software.

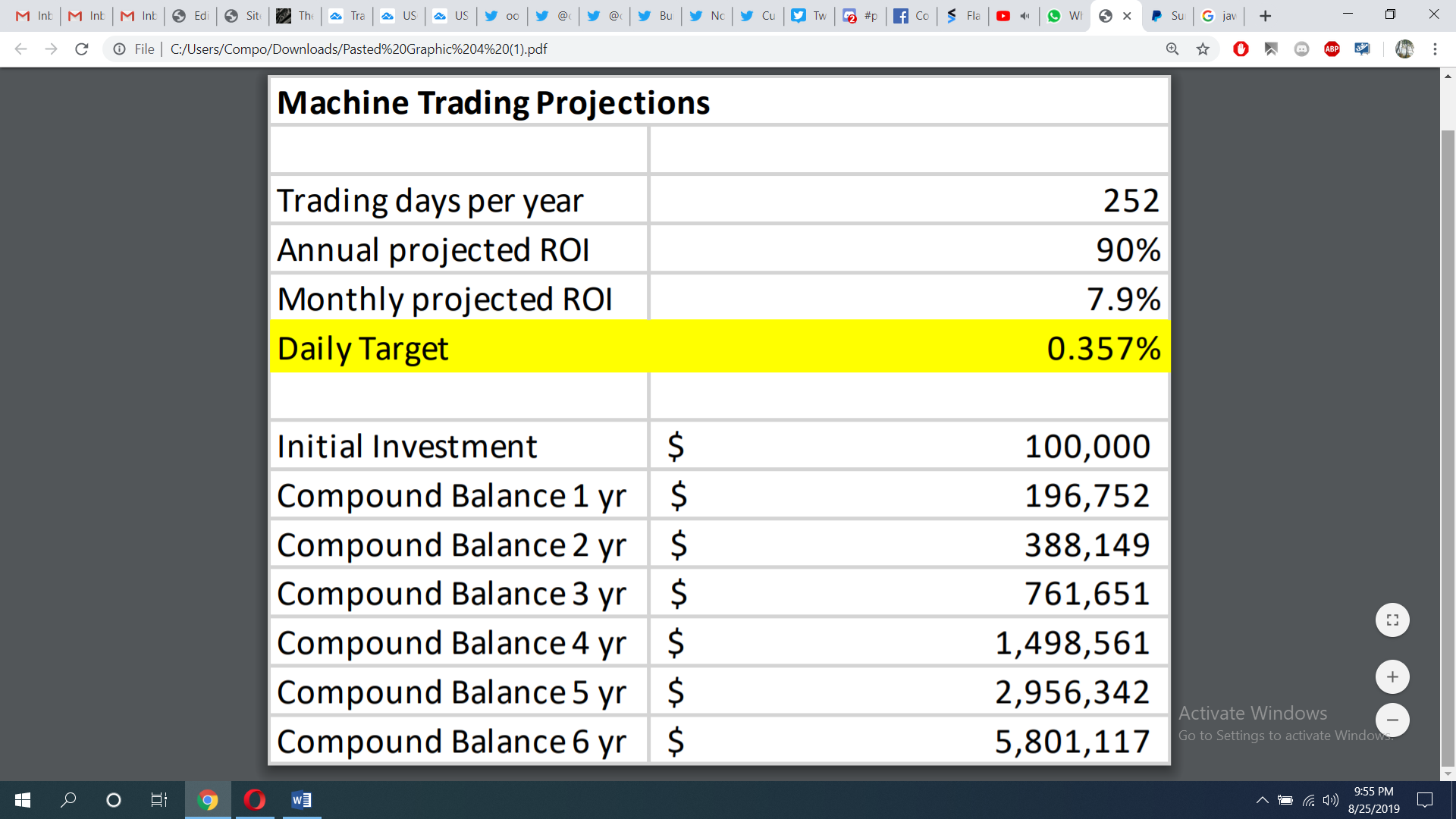

Below I provide the Compound Returns Based on our Current Oil Trading Results at 90% per annum Profit Compounded Over 3 Year Period.

The sample account starts with 100,000.00 and after 3 years has a balance of 761,651.00.

And below are the Compound Account Returns according to Current Oil Trading Results at 90% per annum profit Compounded Over a Six (6) Year Period.

The sample account starts with 100,000.00 and after 6 years has a balance of 5,801.117.00.

Will We Meet The Annual Return and Compound Trade Return Projection?

Only time will tell the story.

What I know for sure is that our v3 EPIC Crude Oil Machine Trade Software is extremely stable, has near zero down-side risk and has consistent gains.

It has been running for seven weeks as of this Tuesday, which in the machine trading world is a near life-time. At the eight week mark it is almost mathematically impossible for it to fail and at the twelve week point it is something like 99.99999% sure it will meet or exceed the expectations within current ROI trajectory.

My guess, v3 ends up performing at 100% – 150% and easily meets or exceeds the projections, I have zero doubt about its stability and ability to protect downside loss. But as I said, all return projections are yet to be seen, time will tell.

Relative to the Top Performing Hedge Funds of 2018 we are doing well, the Odey fund came out on top of the pack, generating about 53% in returns. Also relative to the best returns of all time we’re competing; The Renaissance Technologies Medallion fund is considered to be one of the most successful hedge funds ever. It has averaged a 71.8% annual return, before fees, from 1994 through mid-2014.

I always said we would never have taken this project on if we thought there was a considerable chance we would fail. We knew it would be one of the hardest things we’ll ever try and accomplish, but we believed we would get there.

In my best estimation, we have now successfully cracked the code.

Thanks for being part of and supporting our journey.

Curt

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, machine trading, trading, compound, returns, ROI, $CL_F, $USOIL, $WTI, $USO, CL