Part 1 – Crude Oil Day Trade Strategy For 200 Ticks Win From Our Oil Trading Room – Step by Step Tips on How We Traded It and Alerted it Live

The main question for oil traders reading this and /or watching the instructional video should be, “How did we know that oil intra-day would most likely reverse where it did on the chart?”

The oil trading alert went out at 6:37 AM EST and the one prior to that was at 4:09 PM the day prior (Monday June 8, 2020), so it isn’t that we send out many alerts every day, we send our alerts only out when it is the most highly probable area of intra day trade for a win.

So why then at that time of day? What was happening with intra-day trade, the charting, time of day and with other signals that caused us to trade in size long at 6:37 AM EST today?

In short it was the only trade entry alert of the day, the trade was in size and it happened to be at the low price of trade on the day also.

Below are the secrets of this time tested oil trading strategy.

Important Tips for this Simple Intra-Day Crude Oil Trading Strategy

- Time of Day is Important – Today’s 200 tick oil day trade was started in the morning prior to US regular market open and after many traders around the world in different time zones (and overnight Futures traders) have finished their trading day.

- Chart Trend Lines – I teach students to always have classical charting trend lines for support and resistance ready at all times on all time-frames.

- Key Algorithmic Charting Levels – Not all oil traders have this at their disposal, but this was one key reason for our trade success today..

Time of Day.

Time of day when day trading crude oil is very important. In this trade example it was the time of day where overnight futures traders (as far as USA traders are concerned) usually finish their day as well as some traders from around the world also (depending on time zone) and day traders in the U.S. start their day.

When traders start and stop their trading day is not the only time of day consideration.

There are other time of day considerations such as regular U.S. open premarket, regular U.S. market open at 9:30 AM EST, daily settlement at 2:30 PM EST, weekly inventory statistics from the American Petroleum Institute at 4:30 PM EST Tuesday’s and U.S. Energy Information Administration (EIA) at 10:30 AM EST on Wednesdays.

Specifically as it applies to this intra-day oil trading strategy, this trade was taken when the overnight futures traders were typically finished “taking profits or losses” on their day trade sessions and the new batch of day trader liquidity was entering the market. VERY KEY. Again, today’s oil trade was first entered and alerted at 6:37 AM EST, in size.

Below is a screen capture image from our Oil Trading Room with the day trade execution at 6:37 AM for 6 contracts entered – adding to existing 6 contracts in the long position sequence of trade.

Also in the image are some of the alerts in the trading room as the trade progressed (this is the private member oil trade chat room in Discord, there is a live charting and mic broadcast room also).

You can also see in the image the lead trader discussing another time of day coming at 9:00 AM and to be prepared to watch the possible signals of oil trade at that specific time. Time of day in oil trading is one of the best signals oil day traders can use in their strategies.

Oil trading alerts screen capture of today’s oil trade that was first entered and alerted at 6:37 AM EST, in size.

Below is a screen capture of the actual oil trading alerts feed showing the lead tech alerting the buy in crude oil.

The broker platform trade executions by our oil machine trading algorithm are shown (screen shots) in this tweet:

Crude oil trading alert feed today, deep dive early in premarket for a great 200 point rally through the day.

#OOTT $CL_F $USO $USOIL

#oiltradingalerts #machinetrading

https://twitter.com/EPICtheAlgo/status/1270435771615510531

Trading Trend Line Support and Break Outs.

In today’s trading action there was a trend line support signal on the charting for the long position at 6:37 AM and the a trend line break later in the day for a break out to continue the rally.

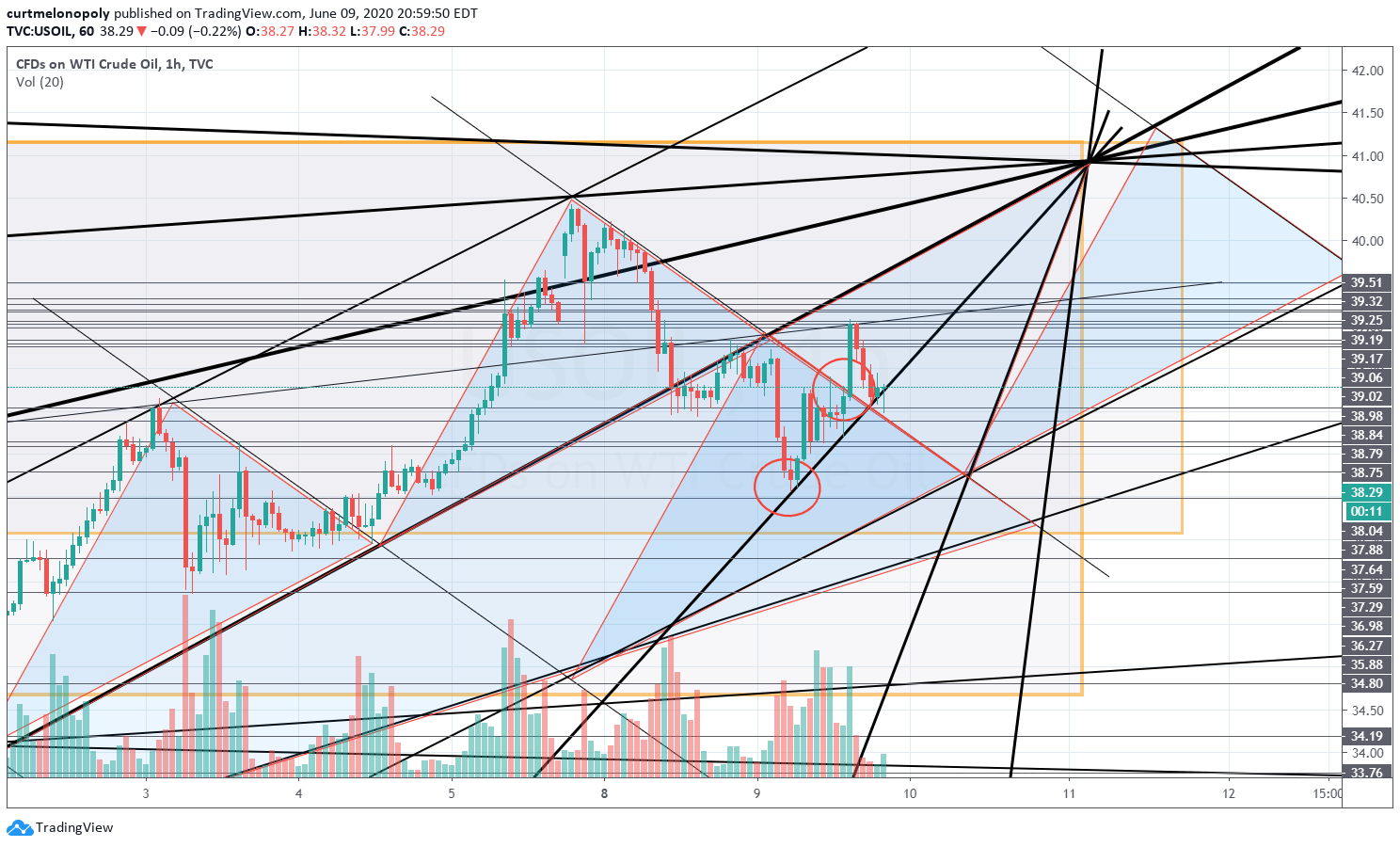

First, below see the initial support area of the trend line chart for the long trade entry. This signal is from a classical 1 hour oil chart with trend lines that included the mirrored fractal trading trend lines. This “mirrored fractal trend line” is where the signal was to enter the trade.

The one hour trading time frame is a significant oil trading signal because it is a larger than say a 1 minute, 5 minute, 15 or 30 minute chart timeline for daytrading. The one hour timing can be used also for intra-week trading signals.

The mirrored trend line fractal is a bit more than basic oil charting 101 in that it takes some technical analysis experience to learn, but not much and if you are an oil day trader it is a good skill to learn because the machine liquidity in the markets use mirrored fractals greatly.

You can see this technical charting skill helped garner a 200 point rally oil trade win today.

Crude Oil Trend line Chart, oil hit key support on the chart and this was one key signal for taking and alerting the trade.

And then later in the day came the trend Line resistance break out.

I marked the intra day oil trend line resistance break out area on the chart below with a second red circle.

I recently did a video instructional on oil trend line resistance break outs that explains the rules and tips for how to trade intraday break outs above a trend line resistance. It was identical to today’s set up and signals that produced this excellent win.

Here is an excerpt from that article:

Three Possible Trade Scenarios When Price Breaks Out;

1. The break out fails. This is possible so be sure to use stops or reverse your trade if the break out of resistance fails.

2. The break out succeeds and price keeps running without a retest of previous resistance (now support). If price does not come back to test support of the trend line then you have to be prepared to take the trade long and go with price action.

3. And finally, price breaks out of resistance and then comes back to retest the new support (which was previously the resistance of the trendline structure).

You can find Part 1 to the article with video tutorial here:

and

Part 2 for our premium members is here:

Trend line break outs, especially on larger time frame charting such as the one hour like with today’s trading are very powerful signals.

I even publicly gave my Twitter followers a bit of a heads up intra-day because I could see the trend line breach set up coming. My tweet went out at 11:30 AM and shortly after noon oil was in break out mode above the trend line resistance.

oil shorties could get wrecked here

oil shorties could get wrecked here

— Melonopoly (@curtmelonopoly) June 9, 2020

In Part 2 of this article we will take a look at how the swing trading strategies played in to this set up for our Swing Trade Alert service members.

In Part 3 for our Pro Oil Day Traders (Oil Trade Subscribers) we will look at the algorithmic charting structures that enabled this successful trade.

The video tutorial for this specific article (Part 1) is below.

As always, any questions please send me a note via email compoundtradingofficial@gmail.com.

Thank you.

Curt

< Updated June 10 7:41 AM EST >

There is another classical charting reason possible for crude oil’s 200 Point reversal rally intra-day, Fibonacci level 50% was hit perfectly.

Nonetheless, there were strong algorithmic charting reasons for the reversal rally intra-day that I will go in to in more detail for our oil trader members in Part 3. Considering the machine trading liquidity in the oil trading markets I would weigh those indicators / signals much more greatly than the chart below.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; Oil, Trading, Alerts, Oil Trading Room, Strategies, Day Trading, Intra Day, Trend Lines, Break – Outs, Support, Time of Day