Tag: $RCL

Swing Trading Report (Earnings Season Special Report) July 19: $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

Swing Trading Report and Video for July 19, 2018.

In this Edition: $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

The Mid Day Trade Set-Ups Video:

Trade set-ups on this video; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

Mid Day Chart Swing Trading Set-ups July 19, 2018 Summary:

Note: Voice broadcast on this video starts at 1:47.

Swing Trading Review of charts from July 19 Mid Day Review. Between Monday July 23 and Friday 27 we will be reviewing the charting for all one hundred equities we follow on our swing trading platform (it’s earnings season so it is important to be on top of the charting and buy sell trigger alarms). Each report from mid day will be sent to swing trading members daily.

Tickers covered; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

$VIX – Volatility time cycle on large weekly structure is coming to conclusion near mid next week. Watch for a possible trend reversal in the $VIX as we complete the time cycle. $VIX is currently in downtrend pinch on chart.

US Dollar $DXY – Algorithm model summary review (review dollar algorithm reports for complete detail or review mid day chart review videos from recent months). Intra day at resistance and if it trades above the resistance look to next structure above. Very bullish and 97.00 upside is very possible. Detail on video.

$SPY – Over 281.04 is a long side trade trigger 283.89. Support at 278.66. How to trade the algorithmic model (60 min) is discussed some on video. Other main support and resistance areas discussed.

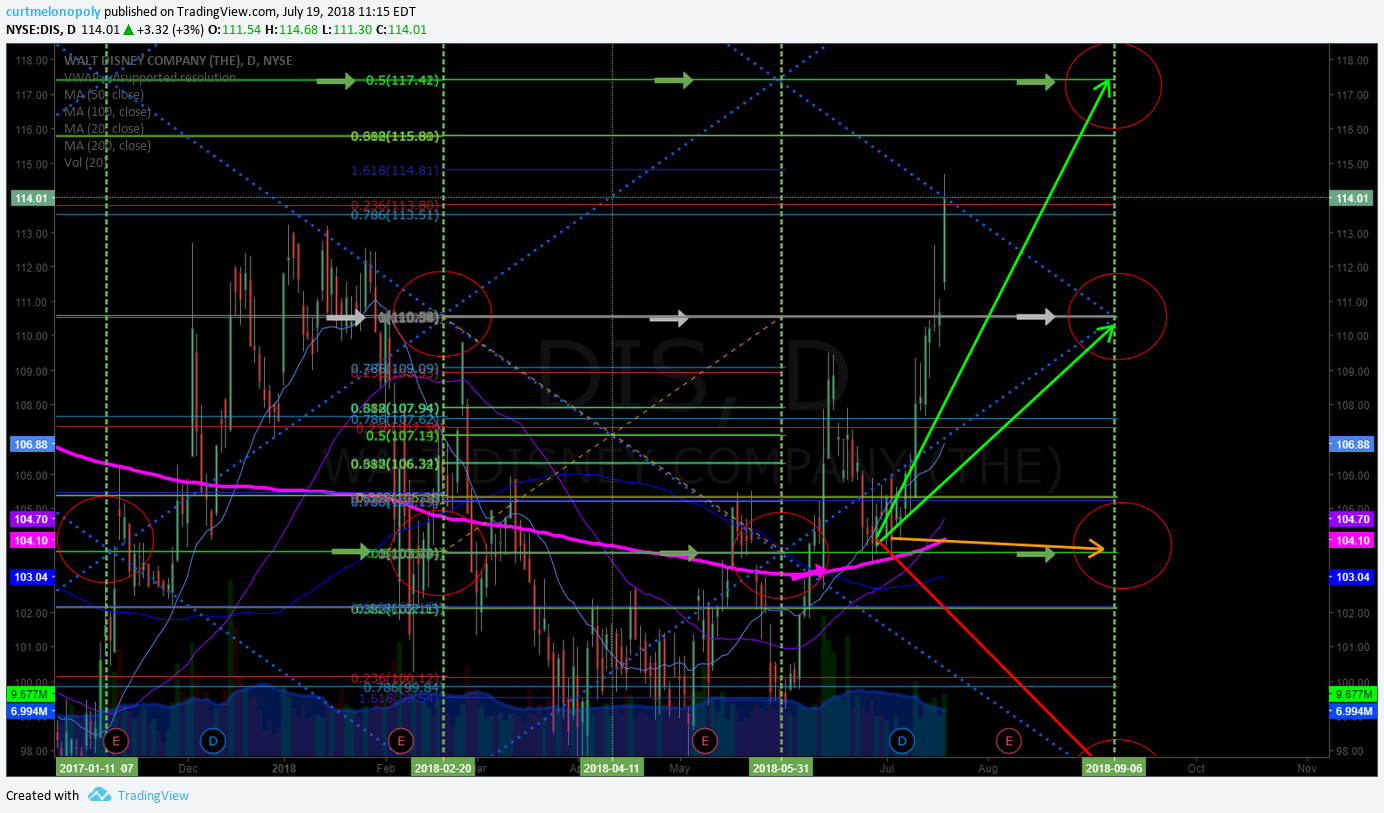

$DIS – Disney has been a great trade. The algorithmic charting has been good. Hit resistance today at a Fibonacci horizontal. Price Targets: Bullish 117.53 early Sept, 110.60 if it comes off, 103.68 is the bearish target, trade each support and resistance on way to each target. Up over today’s resistance is a long to price target on video.

$RCL – Royal Caribbean, short warning was good and it popped and got in to price target early so this is a trim 115.00 resistance, 98.50 is bearish scenario. 131.00 is bullish price target scenario above 115.00. On an upside trajectory watch the 200 MA (pink line) overhead.

$RKDA – Conventional charting reviewed for Arcadia Biosciences, This chart has lots of room to move. 50 MA is getting close to price on daily chart and that puts this on watch for a huge potential move up. We have alarmed the chart for when / if price crosses 50 MA and we’re looking for a run to the 100 MA (14.00 possible from 8’s). Watch the 200 MA overhead on way to 100 MA if that scenario occurs.

$SQ – Square, chart seems over extended and a revisit to 20 MA should occur soon. Longs should be cautious.

$HEAR – What a move, missed the major part of the move and only got daytrade snipes. Longs should trim in advance of a retrace.

$SMIT – daytraders chart and that’s it. Careful trying to trade it. Buy sell triggers discussed and how to daytrade it.

$TGTX – may be setting up for a move.

Watch for the same on Friday and next week watch for the 100 chart reviews of our regular charting in preparation for trading through earnings season.

US Dollar Index (DXY) Chart. Perfect move from structure to structure at resistance now to next possible (public). $DXY $UUP #USD #swingtrading #dollar

ARCADIA BIOSCIENCES (RKDA) Premarket up 22% trading 8.41 on milestone news. $RKDA #premarket

DISNEY (DIS) Trading 113.95 testing quad TL, 113.80 and 113.51 support. Above 115.80 res targets 117.42 Sept 6. $DIS #swingtrading

ROYAL CARIBBEAN (RCL) hit 113.00 near PT resistance for trims. Above 115.00 has 118.67 res next and under 111.24 support and so on $RCL #charting

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.

Swing Trading Report Thurs July 12 (Part A) $AAPL, $AMD, $WMT, $LTBR, $RCL, $JKS, $PCRX, $EWZ, $FEYE more.

Compound Trading Swing Trade Report Thursday July 12, 2018 (Part A).

Swing Trading Stock Picks In this Issue: $AAPL, $AMD, $WMT, $LTBR, $RCL, $JKS, $PCRX, $EWZ, $FEYE and article links to $EQJ $RSX $EZA $EWW more.

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part A of this report.

This report is 1 of 5 in rotation with our mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

We will categorize our coverage soon as we are following more stocks weekly than we expected when we first started the service.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading room at mid-day and ask questions by text in the chat area of the room.

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required. If nothing else you can always book some coaching time and I’ll assist.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates in red for ease.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Swing Trading Stock Watch List

$AAPL – Apple

July 12 – Decision area continues for Apple trade.

APPLE (AAPL) Continues to rotate around the primary 188.59 pivot, Use the fib lines to trade up or down. #swingtrading

May 29 – There is an exclusive member feature post here that reflects the report below:

Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: TRADEAAPL

May 29 – Apple chart support and upside move test on deck with 20 MA coming up to 185.78 support and current trade at 197.90 $AAPL #swingtrading

Apple Real-Time Chart Link:

How to Trade Apple:

Either side of the main buy / sell trigger (pivot) in this range are the important levels to watch. The pivot is 188.61 and the important upside test Fib is at 199.44 and the important support is 185.78 area.

With the 20 MA moving up through the lower support and nearing intra-day trade this could get interesting here. If price loses the 20 MA watch for the support to break. If that breaks at 185.78 then price targets 181.75.

If price trends up with 20 MA then next resistance is the 199.44 and above that is a good upside swing risk reward.to next pivot at 200.66.

It seems with the news below (announcements on June 4, 2018 per CNBC) and how well Apple held up in today’s sell-off that the risk reward is still to the bullish side. But let the test of the upside resistance prove the bull thesis out.

Apple News:

$AAPL Apple will lay out its plans and priorities for the next year on Monday: Here’s what to expect

https://cnb.cx/2L63Bso https://www.cnbc.com/2018/05/29/apple-wwdc-2018-what-to-expect-ios-12-macos-tvos-watchos.html?__source=yahoo%7Cfinance%7Cheadline%7Cstory%7C&par=yahoo&yptr=yahoo

Buy / sell triggers to watch for a swing trade with Apple stock (approximate):

176.62

181.75

185.78

188.61

191.44

194.94

200.66

205.79

209.81

Apple Static Chart:

April 16 – $AAPL Buy sell trigger 152.66 hit, then 164.92 testing 176.62. Over long to PT 188.61 with 181.75 and 185.78 res tests.

Apple has been a fantastic structured wash-out snap back swing trade set-up so far. The big test / major pivot in this trading structure is the upside test at 176.62. Longs should trim in to that and add over to next test at 181.75 and add over and so on.

The other scenario is a retrace to the Fibonacci support at 171.22 and on bounce long. If price does not bounce on a retrace to 171.22 then short in to 167.41 as first target.

Also, MACD on daily is turned up but Stochastic RSI is high and likely to cool lower with price and then watch for bounce.

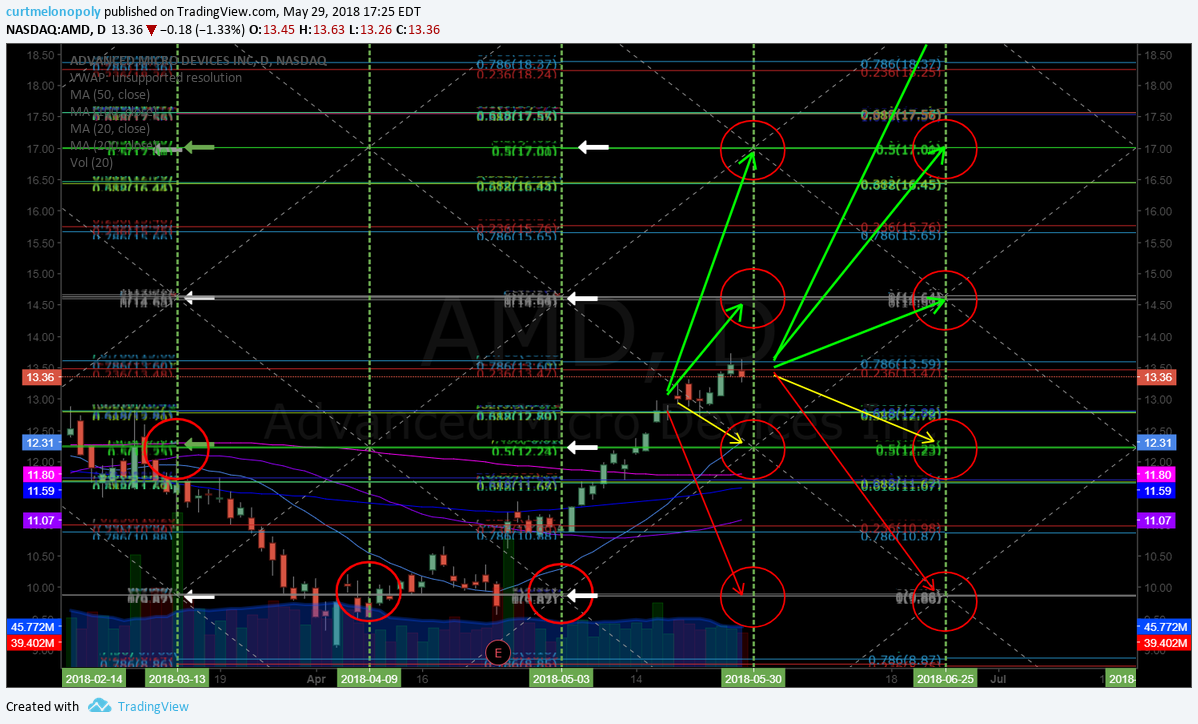

$AMD Advanced Micro

July 12 – ADVANCED MICRO (AMD) Trading near previous highs struggling to hold up trend channel, trade main triggers. #swingtrading

News: Why AMD Stock Will Rally Before Its Earnings Announcement $AMD https://finance.yahoo.com/news/why-amd-stock-rally-earnings-035823418.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

April 29 – $AMD The close this gets to the key resistance in 14.60s the more short bias I am for a swing trade.

This surprised me since last report (I did some review on this surprise on a number of mid day review videos on YouTube channel).

Anyway, I don’t like the way it trades… it is manipulated by media, sentiment or otherwise and as it gets closer to previous highs overhead soon and near the key resistance in 14.60s I am yet again short bias to $AMD:) We’ll see, but I’ll likely pull the trigger this time.

$WMT – Walmart

WALMART (WMT) Continues down trend with 82.81 buy zone and 91 sell trigger, under 200 MA $WMT #chart

Walmart Buy / Sell Triggers:

124.77

116.23 – tighter time-frame

108.06

99.56 – tighter time-frame

91.20

74.25

Walmart is ‘dead money’ as the Dow stock sits in a bear market, says trader $WMT https://www.cnbc.com/2018/07/11/walmart-is-dead-money-as-the-dow-stock-sits-in-a-bear-market.html?__source=yahoo%7Cfinance%7Cheadline%7Cstory%7C&par=yahoo&yptr=yahoo

May 29 – Wallmart stock continues its soft landing but indicators are flatening. Short side RR diminishing now.

I wouldn’t be surprised if that 82.61 pivot is gained to the upside again and we see a pop to upside resistance points on chart.

If that does not transpire in trade then the 74.54 is the bottom, bottom support in 2018 most probably. I really doubt trade will see 74.54. But keep an open mind and follow price per the chart support and resistance points.

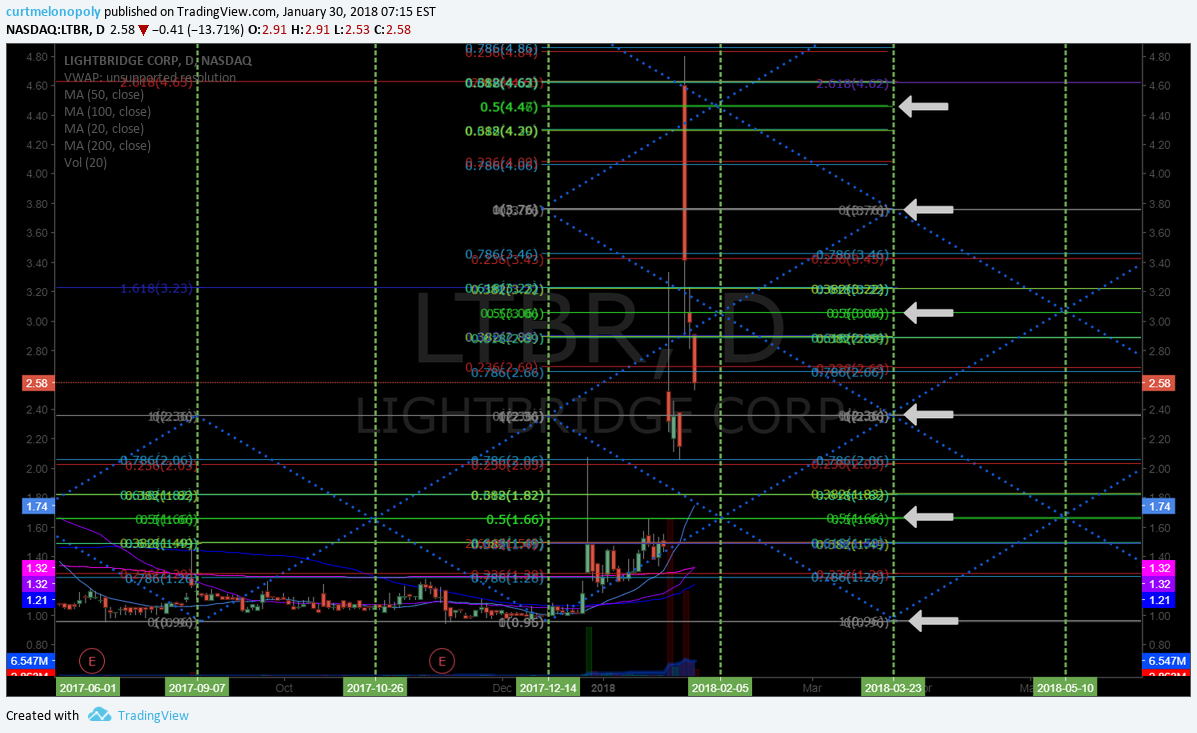

$LTBR – Lightbridge Corp.

July 12 – LIGHTBRIDGE (LTBR) Continues range bound at main support area. Watching. $LTBR #Chart

See chart link below in previous post.

May 29 – Literally watching for the 200 MA not far above to be gained and then watch this for a pop. It has the 50 MA now and I expect the bottom players to step in here soon.

$LTBR has the 50 MA with 200 MA not far overhead. On watch for 200 MA and then boom. #swingtrading

$RCL – Royal Caribbean

Buy sell triggers for $RCL swing trading are as follows:

98.91

115.00

131.09

147.04

163.28

July 12 – ROYAL CARIBBEAN (RCL) Range bound trade, waiting for a direction to swing trade. $RCL #stock #chart

May 29 – $RCL short side risk reward diminishing now and July 23 downside target 98.88 less likely. Trading 105.78.

I’m watching this support test area close now, this should turn up for a swing trade soon. As always follow price.

Royal Caribbean Cruises (RCL) Down 5.5% Since Earnings Report: Can It Rebound? https://finance.yahoo.com/news/royal-caribbean-cruises-rcl-down-072207247.html?.tsrc=rss

April 16 – $RCL Indecisive at this point and trading just under primary pivot resistance on chart. On watch. Buy sell triggers marked with white arrows.

Mar 6 – $RCL trading above 200 MA with targets in play swingtrading in to July 18 2018. #swingtrading

If price holds 200 MA and breaches that diagonal Fibonacci trendline at next quad wall (dotted gray line) near range overhead then at minimum the first upside if not the full extension target upside is possible.

If price turns down at quad wall then it targets the lowest area target to bearish side.

$JKS – Jinko Solar

July 12 – JINKOSOLAR (JKS) Continues under pressure trading 14.20. Watching for a turn. $JKS #Stock #chart

May 29 – $JKS with earnings in 8 days is having trouble breaking range. Above 50 MA possible #swingtrade

April 16 – $JKS MACD on weekly may cross up here for long over 200 MA.

$PCRX – PacIra Pharma

July 12 – PACIRA PHARMA (PCRX) Testing underside of 200 MA for a break up to 42s possible. #swingtrading

May 25 – Trading 35.2 still under pressure and under 200 MA. On watch for over 200 MA for a swing.

April 16 – $PCRX under pressure. Over 200 MA long but on short side there isnt enough RR at this point.

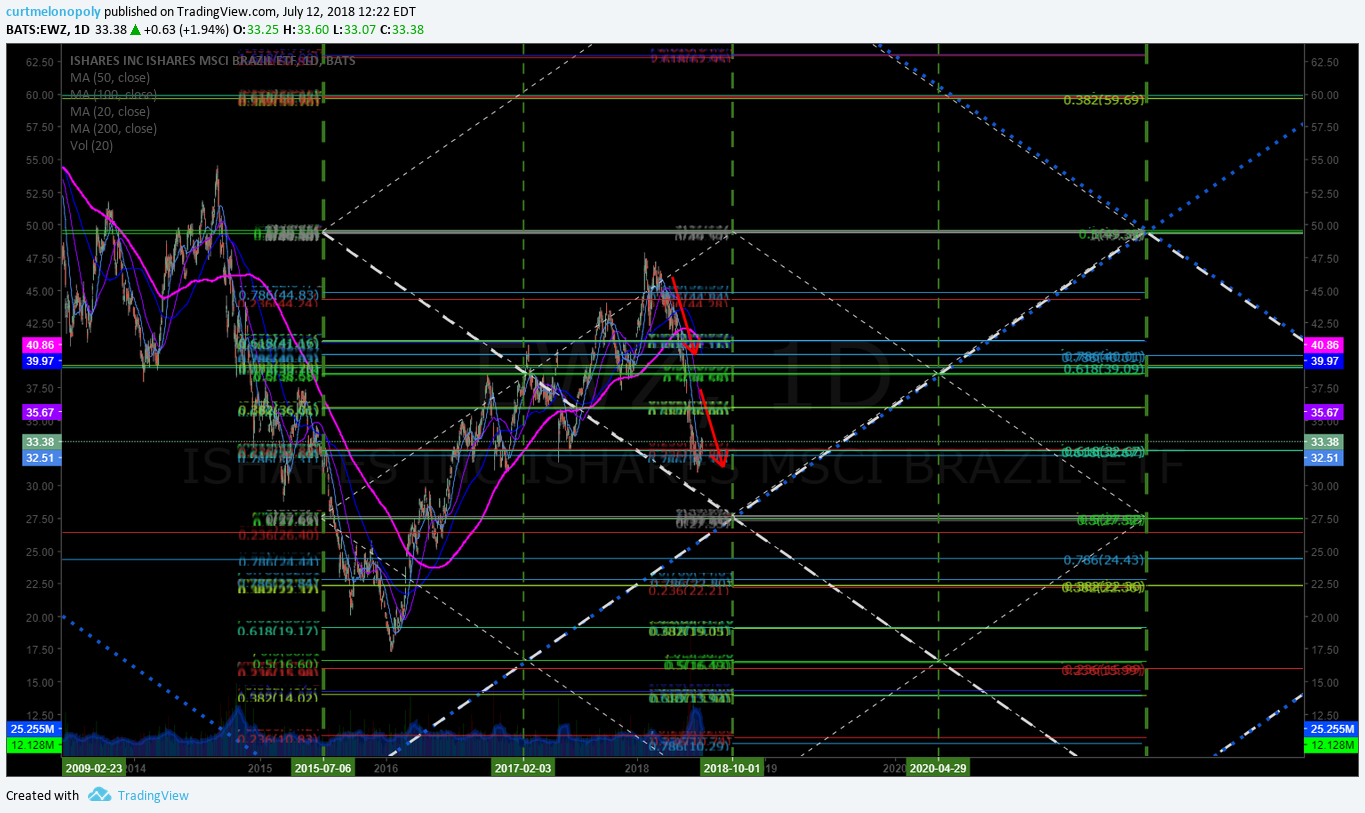

$EWZ – I Shares Brazil ETF

July 12 – ISHARES BRAZIL ETF (EWZ) Trading 33.39 looking for confirmation bounce for run to 38.53. $EWZ #swing #trading #plan

The two downside price targets on the down trend swing trading scenario have been hit, so I’m thinking we may see a turn here soon. On watch really close.

Finding Opportunity in the Global Market Selloff $EWZ $EQJ $RSX $EZA $EWW https://www.barrons.com/articles/japan-stands-out-as-global-markets-falter-not-all-em-headed-for-slower-growth-1531332082

May 29 – $EWZ continued pressure likely until near quad wall diagonal Fib trend line for a bounce. On watch.

$FEYE – Fire Eye Inc.

July 12 – FIREEYE (FEYE) in to price target, other side of time cycle, 17.10 intra 17.64 targets 19.43 19.68 22.35 #swingtrade $FEYE

FireEye Stock Upgraded: What You Need to Know https://finance.yahoo.com/news/fireeye-stock-upgraded-know-153334694.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

May 29 – $FEYE near 50 MA support now. On watch for an upside swing trade if it bounces. #swingtrading

It is also very near key support. This is a significant watch area now for a trade.

April 16 – $FEYE trade went as prescribed in last report – bias long to upside price target 22.32 June 27.Over 19.70 long to 22.32 price target.

$LAC – Lithium Americas Corp

May 30 – Sitting on mid quad support – big test here. Above is long to target and below short. $LAC #swingtrading #chart

Lithium Americas Corp (TSE:LAC): What Are The Future Prospects?

https://finance.yahoo.com/news/lithium-americas-corp-tse-lac-121406216.html?.tsrc=rss

Per recent’

April 22 – $LAC trading 5.59 bounced at quad wall support (blue diagonal line marked with green arrow- important) targets 7.81 Jan 30 2019. If it gets bullish I will chart shorter time frames.

I like the structure of this chart. Will be watching very close.

Also, note 200 MA overhead.

Mar 10 – $LAC trading 6.35, over 6.52 targets 7.21 and 7.77, under targets 5.40 #pricetargets

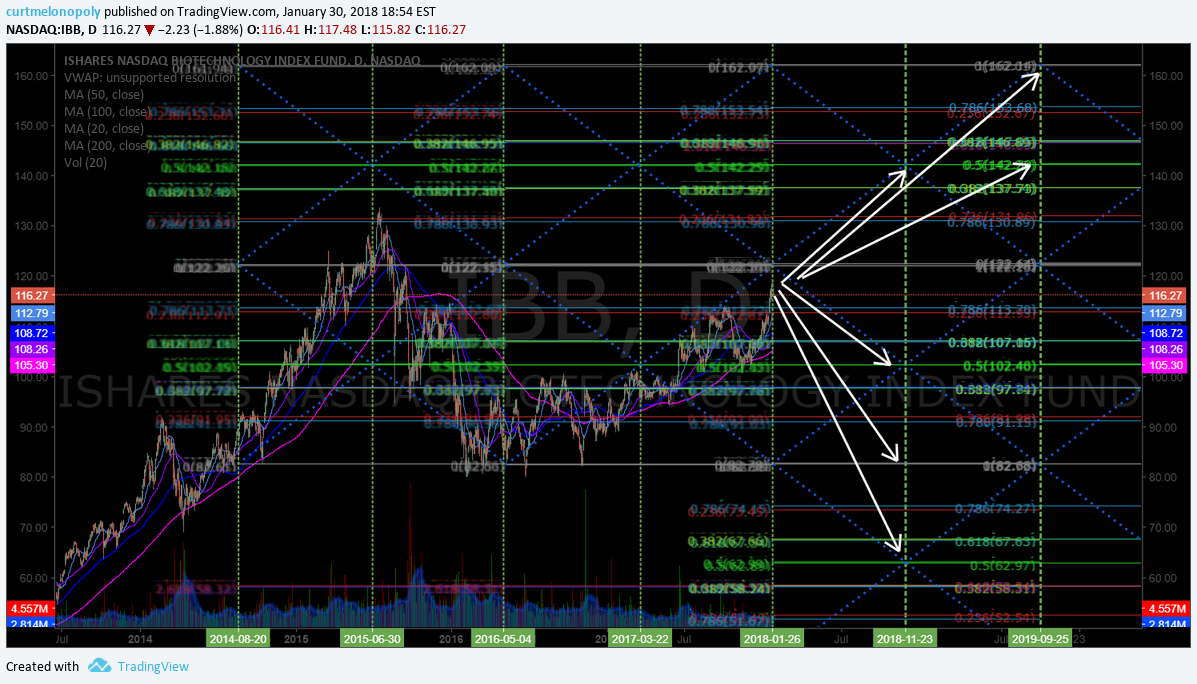

$IBB – BioTechnology Index Fund

May 30 – $IBB chart on daily above mid quad support and 200 ma targeting upside 112.81 next FIB resistance.

This is a decent set up with a decent risk reward and a decent structured chart. It’s not a great set-up, but decent.

Biotech ETFs Are the Best Way to Play the Recovering Sector https://finance.yahoo.com/news/biotech-etfs-best-way-play-154314422.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

Per recent;

April 22 – $IBB daily chart with targets above pivot decision at 102.46 and below. #swingtrading

Above 102.46 tested targets 122.34 or 142.11 pending trade.

Under 102.46 targets 92.81 or 63.04 pending trade.

Time cycle peak completion Nov 27 2018.

As price proves above or under the main pivot I will alert the trade and chart the shorter time frames.

Mar 10 – $IBB trading 114.36 triggered long at and if holds 113.78 for 118.88 and 124.70.

$AGN – Allergan

May 30 – Really excited for the huge $AGN time cycle conclusion on or about June 4, 2018. Career trade setting up imo. #swingtrading #swingtrading #setups https://www.tradingview.com/chart/AGN/iAaFQ6U5-Really-excited-for-the-huge-AGN-time-cycle-conclusion-on-or-abo/

$AGN Allergan to sell women’s health, infectious disease units https://finance.yahoo.com/m/919ae015-3199-352f-820a-3beef365d573/allergan-to-sell-women%26%2339%3Bs.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

If $AGN holds 147.00 as trade gets on other side of time cycle it should target upper price targets on this model. #swingtrading

Per recent;

April 22 – $AGN I know it’s psychedelic but I think the time cycle is over soon and it reverses. #swingtrading

June 4 165.48 is the first upside target if there is a reversal here. On watch. If we get a reversal near term I will model and alert it for a swing trade.

Mar 10 – Trading 157.28 so the previous post downside worked, however, indicators are now indecisive. Watching.

Jan 30 – $AGN Weekly chart suggests more near term down before things get better.

Dec 18 – $AGN Trading 171.80 premarket indecisive with MACD up Stoch RSI high under MA’s.

Likely a decent bottom side trade with decent risk reward if you want to manage it through the moving averages.

$CTSH – Cognizant Technology

May 30 – $CTSH Bottom line is that I won’t trade it until it dumps the 200 MA again for a bounce on weekly chart. #swingtrading

Cognizant Interactive Among Top of Ad Age’s Agency Report 2018 Rankings https://finance.yahoo.com/news/cognizant-interactive-among-top-ad-100000992.html?.tsrc=rss

April 22 – $CTSH Trading 81.71. Earnings in 14 days and very extended over moving averages on weekly. Watching.

$CTSH – Trading 84.71 still vertical move intact. Enter long, set stop, close eyes and hope or wait for pull back at MA’s for a bounce to long.

$NVO – Novo – Nordisk

May 30 – Best I can do for now with $NVO is watch for chart structure to form on monthly. Not there yet. Price on daily is way below 200 MA and MACD is turned down.

Novo Nordisk’s Oral Ozempic Positive in Diabetes Study https://finance.yahoo.com/news/novo-nordisk-apos-oral-ozempic-122812593.html?.tsrc=rss

April 22 – $NVO trading 47.23 below 200 MA on the weekly. Watching for further downside short.

April 22 – $NVO trading 47.23 looks like a short side trade on monthly to at least 44’s in to 20 MA if not further.

$TSLA – Tesla

May 30 – The technical chart for Tesla (TSLA) is the same set-up as previously posted below.

April 23 – $TSLA trading 290.34. Over 280.00 is long and under 280.00 is a short. We have had some great trading in this one with recent wash-out.

278.00 needed as long side limited entry trigger. Less is short side. Simple on the fly daytrading model. $TSLA https://www.tradingview.com/chart/TSLA/2XQqKq0c-278-00-needed-as-long-side-limited-entry-trigger-Less-is-short/ …

https://twitter.com/SwingAlerts_CT/status/978995397594177537

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target. https://www.tradingview.com/chart/TSLA/dn8THUSe-TSLA-long-confirming-here-over-280-55-with-304-17-next-resistan/ …

https://twitter.com/SwingAlerts_CT/status/981610107770429443

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target..png

$TSLA also blasting here from yesterday’s alert trade hit intra resistance at 299.84 area. Strong set-up.

https://twitter.com/SwingAlerts_CT/status/981915345802973184

$TSLA also blasting here from yesterday’s alert trade hit res at 299.84 area. Strong set-up..png

Mar 10 – $TSLA monthly chart – trade range in triangle model and follow price to up or down target. #swingtrading

$SNAP – SNAP (60 Min Chart vs. Daily because it is a new issue)

May 30 – The SNAP chart is a disaster but it does look like a near term bottom area. Lots of caution of course.

April 23 – $SNAP Just regained 200 MA. Trading 15.20. Over 15.18 targets 15.86, 15.99 then 17.00. Under targets 14.65. #swingtrading

$VGZ – Vista Gold

May 30 – Nothing yet. Trading .704

April 23 – Trading .78. $VGZ holding the 200 MA on weekly and testing 50 MA resistance. Long side advantage, but not great yet.

Mar 10 – Trading .76 under 20, 50, 200 MA’s with MACD trending down on daily – watching.

Jan 30 – $VGZ chart structure is slowly building – on watch now – waiting for structure to form and then I will model it.

NA

Sept 14 – Trading .78 with indicators trending down.

Aug 14 – Trading .79 with indicators post earnings slightly looking positive and price under all MA’s. Watching.

$AAU Almaden Minerals

May 30 – Trading .71 with terrible indicators.

April 23 – $AAU trading .849 with indicators indecisive.

Mar 10 – Trading .85 under all MA’s on daily. Watching.

Jan 30 – $AAU trading .87 is still on a sell signal on weekly chart.

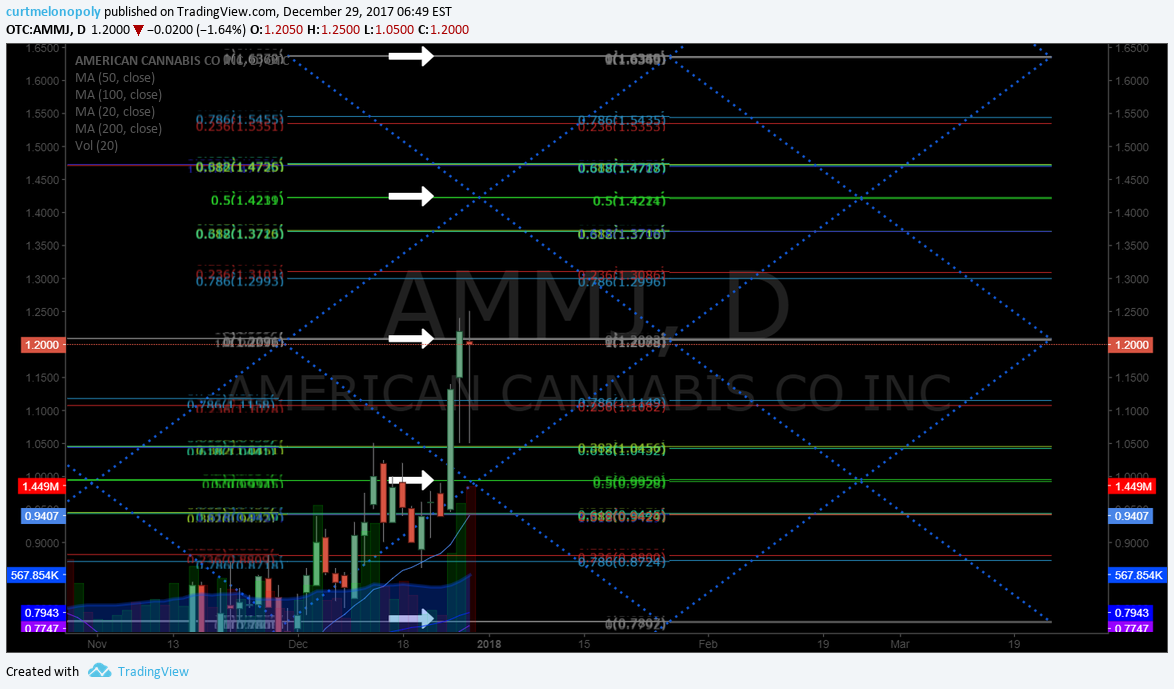

$AMMJ – American Cannabis

May 30 – Trading .976 with flat indicators.

April 23 – $AMMJ trading 1.03 with buy sell triggers (white arrows), targeting Apr 26 .9911 May 24 1,21 (path of least resistance).

Mar 10 – trading .90 with sideways action on chart. Watching.

Jan 30 – $AMMJ Ammerican Cannabis buy sell triggers at white arrows for your swing trade. Triggers and targets have been spot on. #swingtrading #cannabis https://www.tradingview.com/chart/AMMJ/T7F2Rgmg-AMMJ-Ammerican-Cannabis-buy-sell-triggers-at-white-arrows-for-y/

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $AAPL, $AMD, $WMT, $LTBR, $RCL, $JKS, $PCRX, $EWZ, $FEYE

Swing Trading Report Tues May 29 (Part A) $AAPL, $AMD, $WMT, $LTBR, $RCL, $JKS, $FEYE, $EWZ, $PCRX more.

Compound Trading Swing Trade Report Tuesday, May 29, 2018 (Part A).

Swing Trading Stock Picks In this Issue: $AAPL, $AMD, $WMT, $LTBR, $RCL, $JKS, $FEYE, $EWZ, $PCRX more.

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part A of this post.

This report is 1 of 5 in rotation.

We will categorize our coverage soon as we are following more stocks weekly than we expected when we first started the service.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading room at mid-day and ask questions by text in the chat area of the room.

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required. If nothing else you can always book some coaching time and I’ll assist.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates in red for ease.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Swing Trading Stock Watch List

$AAPL – Apple

May 29 – There is an exclusive member feature post here that reflects the report below:

Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: TRADEAAPL

May 29 – Apple chart support and upside move test on deck with 20 MA coming up to 185.78 support and current trade at 197.90 $AAPL #swingtrading

Apple Real-Time Chart Link:

How to Trade Apple:

Either side of the main buy / sell trigger (pivot) in this range are the important levels to watch. The pivot is 188.61 and the important upside test Fib is at 199.44 and the important support is 185.78 area.

With the 20 MA moving up through the lower support and nearing intra-day trade this could get interesting here. If price loses the 20 MA watch for the support to break. If that breaks at 185.78 then price targets 181.75.

If price trends up with 20 MA then next resistance is the 199.44 and above that is a good upside swing risk reward.to next pivot at 200.66.

It seems with the news below (announcements on June 4, 2018 per CNBC) and how well Apple held up in today’s sell-off that the risk reward is still to the bullish side. But let the test of the upside resistance prove the bull thesis out.

Apple News:

$AAPL Apple will lay out its plans and priorities for the next year on Monday: Here’s what to expect https://cnb.cx/2L63Bso https://www.cnbc.com/2018/05/29/apple-wwdc-2018-what-to-expect-ios-12-macos-tvos-watchos.html?__source=yahoo%7Cfinance%7Cheadline%7Cstory%7C&par=yahoo&yptr=yahoo

Buy / sell triggers to watch for a swing trade with Apple stock (approximate):

176.62

181.75

185.78

188.61

191.44

194.94

200.66

205.79

209.81

Apple Static Chart:

April 16 – $AAPL Buy sell trigger 152.66 hit, then 164.92 testing 176.62. Over long to PT 188.61 with 181.75 and 185.78 res tests.

Apple has been a fantastic structured wash-out snap back swing trade set-up so far. The big test / major pivot in this trading structure is the upside test at 176.62. Longs should trim in to that and add over to next test at 181.75 and add over and so on.

The other scenario is a retrace to the Fibonacci support at 171.22 and on bounce long. If price does not bounce on a retrace to 171.22 then short in to 167.41 as first target.

Also, MACD on daily is turned up but Stochastic RSI is high and likely to cool lower with price and then watch for bounce.

Mar 6 – $AAPL Price a magnet to the major pivot support resistance 176.67 – decision up or down in play. Go with price. #swingtrading

$AMD Advanced Micro

April 29 – $AMD The close this gets to the key resistance in 14.60s the more short bias I am for a swing trade.

This surprised me since last report (I did some review on this surprise on a number of mid day review videos on YouTube channel).

Anyway, I don’t like the way it trades… it is manipulated by media, sentiment or otherwise and as it gets closer to previous highs overhead soon and near the key resistance in 14.60s I am yet again short bias to $AMD:) We’ll see, but I’ll likely pull the trigger this time.

April 16 – $AMD Bias toward lower price target 7.49 May 3. Buy sell triggers marked in white arrows. However, this is not the easiest trade to execute. Watching.

$WMT – Wallmart

May 29 – Wallmart stock continues its soft landing but indicators are flatening. Short side RR diminishing now.

I wouldn’t be surprised if that 82.61 pivot is gained to the upside again and we see a pop to upside resistance points on chart.

If that does not transpire in trade then the 74.54 is the bottom, bottom support in 2018 most probably. I really doubt trade will see 74.54. But keep an open mind and follow price per the chart support and resistance points.

April 16 – $WMT Wallmart under pressure under 200 MA with 91.07 as primary resistance. Watching.

Wallmart Buy / Sell Triggers:

124.77

116.23 – tighter time-frame

108.06

99.56 – tighter time-frame

91.20

74.25

$LTBR – Lightbridge Corp.

May 29 – Literally watching for the 200 MA not far above to be gained and then watch this for a pop. It has the 50 MA now and I expect the bottom players to step in here soon.

$LTBR has the 50 MA with 200 MA not far overhead. On watch for 200 MA and then boom. #swingtrading

Apr 16 – $LTBR Trading 1.18 with all indicators and price action flat. Watching.

Mar 6 – $LTBR Lightbridge psychedelic chart structure with specific buy sell triggers at arrows. Big range likely.

Price is sitting above 200 MA with a significant risk reward scenario setting up if it starts an up move.

$RCL – Royal Caribbean

May 29 – $RCL short side risk reward diminishing now and July 23 downside target 98.88 less likely. Trading 105.78.

I’m watching this support test area close now, this should turn up for a swing trade soon. As always follow price.

Royal Caribbean Cruises (RCL) Down 5.5% Since Earnings Report: Can It Rebound? https://finance.yahoo.com/news/royal-caribbean-cruises-rcl-down-072207247.html?.tsrc=rss

April 16 – $RCL Indecisive at this point and trading just under primary pivot resistance on chart. On watch. Buy sell triggers marked with white arrows.

Mar 6 – $RCL trading above 200 MA with targets in play swingtrading in to July 18 2018. #swingtrading

If price holds 200 MA and breaches that diagonal Fibonacci trendline at next quad wall (dotted gray line) near range overhead then at minimum the first upside if not the full extension target upside is possible.

If price turns down at quad wall then it targets the lowest area target to bearish side.

Buy sell triggers for $RCL swing trading are as follows:

98.91

115.00

131.09

147.04

163.28

$JKS – Jinko Solar

May 29 – $JKS with earnings in 8 days is having trouble breaking range. Above 50 MA possible #swingtrade

April 16 – $JKS MACD on weekly may cross up here for long over 200 MA.

$PCRX – PacIra Pharma

May 25 – Trading 35.2 still under pressure and under 200 MA. On watch for over 200 MA for a swing.

April 16 – $PCRX under pressure. Over 200 MA long but on short side there isnt enough RR at this point.

Mar 10 – $PCRX trading 31.90 post earnings with MACD turned up. Long risk reward preferred. #swingtrading

Set-up isn’t strong enough to warrant a specific model, however, price is at historical support so odds are in favor in long here.

$EWZ – I Shares Brazil ETF

May 29 – $EWZ continued pressure likely until near quad wall diagonal Fib trendline afor a bounce. On watch.

April 16 – $EWZ short side scenario played out since last report. Watching now for bounce at support or pressure down target.

Mar 10 – $EWZ under 49.50 is a short to next test on chart and over is long to next test on chart.

$FEYE – Fire Eye Inc.

May 29 – $FEYE near 50 MA support now. On watch for an upside swing trade if it bounces. #swingtrading

It is also very near key support. This is a significant watch area now for a trade.

April 16 – $FEYE trade went as prescribed in last report – bias long to upside price target 22.32 June 27.Over 19.70 long to 22.32 price target.

$LAC – Lithium Americas

April 22 – $LAC trading 5.59 bounced at quad wall support (blue diagonal line marked with green arrow- important) targets 7.81 Jan 30 2019. If it gets bullish I will chart shorter time frames.

I like the structure of this chart. Will be watching very close.

Also, note 200 MA overhead.

Mar 10 – $LAC trading 6.35, over 6.52 targets 7.21 and 7.77, under targets 5.40 #pricetargets

Jan 30 – $LAC Lithium Americas Daily chart with horizontal Fibs, diagonal Fibs, quads, moving averages for tighter trade. Over 8.00 long.

Real-time $LAC charting https://www.tradingview.com/chart/LAC/DTV8PsnK-LAC-Lithium-Americas-Daily-chart-with-horizontal-Fibs-diagonal/

$IBB – BioTechnology Index Fund

April 22 – $IBB daily chart with targets above pivot decision at 102.46 and below. #swingtrading

Above 102.46 tested targets 122.34 or 142.11 pending trade.

Under 102.46 targets 92.81 or 63.04 pending trade.

Time cycle peak completion Nov 27 2018.

As price proves above or under the main pivot I will alert the trade and chart the shorter time frames.

Mar 10 – $IBB trading 114.36 triggered long at and if holds 113.78 for 118.88 and 124.70.

Jan 30 – Key resistance test on $IBB Biotech Index Fund. Channel scenario targets up 142.00 or 162.00 down 83.00 or 103.00 #charting #stocks #swingtrading https://www.tradingview.com/chart/IBB/U8HEYQvC-Key-resistance-test-on-IBB-Biotech-Index-Fund-Channel-scenario/

Over 122.50 targets the upper trending channel targets and below 112.71 lower targets are in play. $IBB #swingtrading #pricetargets

$IBB real-time chart link with indicators https://www.tradingview.com/chart/IBB/1TKf04sH-IBB-weekly-chart-indicators-suggest-a-rest-and-go-MACD-Stoch/

$IBB weekly chart indicators suggest a rest and go (MACD, Stoch RSI, SQZMOM) – upper targets from previous chart most probable. #swingtrading

$AGN – Allergan

April 22 – $AGN I know it’s psychedelic but I think the time cycle is over soon and it reverses. #swingtrading

June 4 165.48 is the first upside target if there is a reversal here. On watch. If we get a reversal near term I will model and alert it for a swing trade.

Mar 10 – Trading 157.28 so the previous post downside worked, however, indicators are now indecisive. Watching.

Jan 30 – $AGN Weekly chart suggests more near term down before things get better.

Dec 18 – $AGN Trading 171.80 premarket indecisive with MACD up Stoch RSI high under MA’s.

Likely a decent bottom side trade with decent risk reward if you want to manage it through the moving averages.

$CTSH – Cognizant Technology

April 22 – $CTSH Trading 81.71. Earnings in 14 days and very extended over moving averages on weekly. Watching.

$CTSH – Trading 84.71 still vertical move intact. Enter long, set stop, close eyes and hope or wait for pull back at MA’s for a bounce to long.

Jan 30 – $CTSH trading 77.76 continues in uptrend on daily and weekly suggest more up trend trade. Watching for stoch RSI cross up to time a long. On high watch here.

Yahoo news:

Cognizant Scales New 52-Week High: What’s Driving the Stock?

$NVO – Novo – Nordisk

April 22 – $NVO trading 47.23 below 200 MA on the weekly. Watching for further downside short.

April 22 – $NVO trading 47.23 looks like a short side trade on monthly to at least 44’s in to 20 MA if not further.

Mar 10 – $NVO above 50 MA is a long and below is a short.

$TSLA – Tesla

April 23 – $TSLA trading 290.34. Over 280.00 is long and under 280.00 is a short. We have had some great trading in this one with recent wash-out.

278.00 needed as long side limited entry trigger. Less is short side. Simple on the fly daytrading model. $TSLA https://www.tradingview.com/chart/TSLA/2XQqKq0c-278-00-needed-as-long-side-limited-entry-trigger-Less-is-short/ …

https://twitter.com/SwingAlerts_CT/status/978995397594177537

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target. https://www.tradingview.com/chart/TSLA/dn8THUSe-TSLA-long-confirming-here-over-280-55-with-304-17-next-resistan/ …

https://twitter.com/SwingAlerts_CT/status/981610107770429443

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target..png

$TSLA also blasting here from yesterday’s alert trade hit intra resistance at 299.84 area. Strong set-up.

https://twitter.com/SwingAlerts_CT/status/981915345802973184

$TSLA also blasting here from yesterday’s alert trade hit res at 299.84 area. Strong set-up..png

Mar 10 – $TSLA monthly chart – trade range in triangle model and follow price to up or down target. #swingtrading

$SNAP – SNAP (60 Min Chart vs. Daily because it is a new issue)

April 23 – $SNAP Just regained 200 MA. Trading 15.20. Over 15.18 targets 15.86, 15.99 then 17.00. Under targets 14.65. #swingtrading

Mar 10 – $SNAP over 18.05 bullish to next resistance line and under is bearish to next support.

$VGZ – Vista Gold

April 23 – Trading .78. $VGZ holding the 200 MA on weekly and testing 50 MA resistance. Long side advantage, but not great yet.

Mar 10 – Trading .76 under 20, 50, 200 MA’s with MACD trending down on daily – watching.

Jan 30 – $VGZ chart structure is slowly building – on watch now – waiting for structure to form and then I will model it.

NA

Sept 14 – Trading .78 with indicators trending down.

Aug 14 – Trading .79 with indicators post earnings slightly looking positive and price under all MA’s. Watching.

$AAU Almaden Minerals

April 23 – $AAU trading .849 with indicators indecisive.

Mar 10 – Trading .85 under all MA’s on daily. Watching.

Jan 30 – $AAU trading .87 is still on a sell signal on weekly chart.

$AMMJ – American Cannabis

April 23 – $AMMJ trading 1.03 with buy sell triggers (white arrows), targeting Apr 26 .9911 May 24 1,21 (path of least resistance).

Mar 10 – trading .90 with sideways action on chart. Watching.

Jan 30 – $AMMJ Ammerican Cannabis buy sell triggers at white arrows for your swing trade. Triggers and targets have been spot on. #swingtrading #cannabis https://www.tradingview.com/chart/AMMJ/T7F2Rgmg-AMMJ-Ammerican-Cannabis-buy-sell-triggers-at-white-arrows-for-y/

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $AAPL, $AMD, $WMT, $LTBR, $RCL, $JKS, $FEYE, $EWZ, $PCRX

Swing Trading Report Mon Apr 16 Part A $AAPL, $AMD, $WMT, $LTBR, $RCL, $JKS, $EWZ, $FEYE, $PCRX more.

Welcome to the Compound Trading Swing Trade Report for Monday, April 16, 2018 (Part A). Swing Trading Stock Picks; $AAPL, $AMD, $WMT, $LTBR, $RCL, $JKS, $EWZ, $FEYE, $PCRX more.

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part A of this post. Part B is to follow.

This report is 1 of 5 in rotation.

We will categorize our coverage soon as we are following more stocks weekly than we expected when we first started the service.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading room at mid-day and ask questions by text in the chat area of the room.

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required. If nothing else you can always book some coaching time and I’ll assist.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates in red for ease.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

$FB Facebook Long Set-Up Testing Buy Sell Trigger

Twitter Trading Plan $TWTR (Part two)

#SwingTrading Midday Review – Compound Trading: $LTBR, $ANF, $MOMO, $APTO, $USOIL, $WTI, $BA, $NFLX

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

#SwingTrading Midday Review: $BZUN $SPY $COT $AMRC

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Swing Trading Stock Watch list

$AAPL – Apple

April 16 – $AAPL Buy sell trigger 152.66 hit, then 164.92 testing 176.62. Over long to PT 188.61 with 181.75 and 185.78 res tests.

Apple has been a fantastic structured wash-out snap back swing trade set-up so far. The big test / major pivot in this trading structure is the upside test at 176.62. Longs should trim in to that and add over to next test at 181.75 and add over and so on.

The other scenario is a retrace to the Fibonacci support at 171.22 and on bounce long. If price does not bounce on a retrace to 171.22 then short in to 167.41 as first target.

Also, MACD on daily is turned up but Stochastic RSI is high and likely to cool lower with price and then watch for bounce.

Mar 6 – $AAPL Price a magnet to the major pivot support resistance 176.67 – decision up or down in play. Go with price. #swingtrading

Jan 30 – $AAPL Apple trading buy sell triggers I am watching for earnings. #swingtrading #earnings

Earnings bullish scenario – 164.59 area is a buy long if it holds after earnings for a first target of 176.56 and then 188.67.

Bear scenario – 164.59 fails targets a swing lower to 152.63.

Real-time chart link: https://www.tradingview.com/chart/AAPL/wsVdwBgD-AAPL-Apple-trading-buy-sell-triggers-I-am-watching-for-earnings/

Secondary buy / sell triggers per Fib horizontal lines on chart below.

Buy / sell triggers to watch for a swing trade with Apple stock (approximate):

176.56

181.71

185.73

188.56

181.38

184.87

200.52

$AMD Advanced Micro

April 16 – $AMD Bias toward lower price target 7.49 May 3. Buy sell triggers marked in white arrows. However, this is not the easiest trade to execute. Watching.

Mar 6 – $AMD targeting 12.23 Mar 13 as most probable sideways trade. Other price targets noted on chart. #swingtrading

$WMT – Wallmart

April 16 – $WMT Wallmart under pressure under 200 MA with 91.07 as primary resistance. Watching.

Mar 6 – $WMT Wallmart most probable price target 91.00 April 11, 2018. Other buy sell triggers noted. #swingtrading

Wallmart Buy / Sell Triggers:

124.77

116.23 – tighter time-frame

108.06

99.56 – tighter time-frame

91.20

74.25

$LTBR – Lightbridge Corp.

Apr 16 – $LTBR Trading 1.18 with all indicators and price action flat. Watching.

Mar 6 – $LTBR Lightbridge psychedelic chart structure with specific buy sell triggers at arrows. Big range likely.

Price is sitting above 200 MA with a significant risk reward scenario setting up if it starts an up move.

Jan 30 – $LTBR LightBridge If 2.36 holds it targets 3.06 first price target and then 3.77 #trading

Lightbridge Provides Video Footage and Photos of Press Conference Announcing Enfission Joint Venture with Framatome

Real-time $LTBR chart with buy sell price triggers:

$RCL – Royal Caribbean

April 16 – $RCL Indecisive at this point and trading just under primary pivot resistance on chart. On watch. Buy sell triggers marked with white arrows.

Mar 6 – $RCL trading above 200 MA with targets in play swingtrading in to July 18 2018. #swingtrading

If price holds 200 MA and breaches that diagonal Fibonacci trendline at next quad wall (dotted gray line) near range overhead then at minimum the first upside if not the full extension target upside is possible.

If price turns down at quad wall then it targets the lowest area target to bearish side.

Jan 30 – $RCL Royal Caribbean buy sell triggers and diagonal resistance lines we established months back have proven profitable for our swing traders.

Buy sell triggers for $RCL swing trading are as follows:

98.91

115.00

131.09

147.04

163.28

Plus the secondary horizontal lines you see on the chart.

Real-time chart link: https://www.tradingview.com/chart/RCL/9YwFkoBq-RCL-Royal-Caribbean-buy-sell-triggers-and-diagonal-resistance-l/

$JKS – Jinko Solar

April 16 – $JKS MACD on weekly may cross up here for long over 200 MA.

Mar 6 – Price under pressure with earnings Mar 22. Current indicators and price say watch with no preferred direction.

Jan 30 – $JKS Solar Weekly chart – waiting for MACD to to cross up on the weekly for possible long trade. #swingtrading

$PCRX – PacIra Pharma

April 16 – $PCRX under pressure. Over 200 MA long but on short side there isnt enough RR at this point.

Mar 10 – $PCRX trading 31.90 post earnings with MACD turned up. Long risk reward preferred. #swingtrading

Set-up isn’t strong enough to warrant a specific model, however, price is at historical support so odds are in favor in long here.

Jan 30 – $PCRX on daily chart trading 36.45 – waiting on MACD to cross up for long side trade assessment.

$EWZ – I Shares Brazil ETF

April 16 – $EWZ short side scenario played out since last report. Watching no for bounce at support or pressure down target.

Mar 10 – $EWZ under 49.50 is a short to next test on chart and over is long to next test on chart.

Jan 30 – $EWZ Brazil ETF weekly chart, ttrading 46.31, over 48.18 with indicators lined up is a long or on proper pull back. On watch for swing trade.

$FEYE – Fire Eye Inc.

April 16 – $FEYE trade went as prescribed in last report – bias long to upside price target 22.32 June 27.Over 19.70 long to 22.32 price target.

Mar 10 – $FEYE Buy trigger at 14.75 proved well, next trigger at 17.65 triggered for 19.44 target. #swingtrading

Jan 30 – $FEYE trading 15.10 above buy trigger at 14.75 – indecisive but clean chart and on 200 MA.

Real-time $FEYE chart link: https://www.tradingview.com/chart/FEYE/iNjl2yjy-FEYE-trading-15-10-above-buy-trigger-at-14-75-indecisive-but/

$LAC – Lithium Americas

Mar 10 – $LAC trading 6.35, over 6.52 targets 7.21 and 7.77, under targets 5.40 #pricetargets

Jan 30 – $LAC Lithium Americas Daily chart with horizontal Fibs, diagonal Fibs, quads, moving averages for tighter trade. Over 8.00 long.

Real-time $LAC charting https://www.tradingview.com/chart/LAC/DTV8PsnK-LAC-Lithium-Americas-Daily-chart-with-horizontal-Fibs-diagonal/

$IBB – BioTechnology Index Fund

Mar 10 – $IBB trading 114.36 triggered long at and if holds 113.78 for 118.88 and 124.70.

Jan 30 – Key resistance test on $IBB Biotech Index Fund. Channel scenario targets up 142.00 or 162.00 down 83.00 or 103.00 #charting #stocks #swingtrading https://www.tradingview.com/chart/IBB/U8HEYQvC-Key-resistance-test-on-IBB-Biotech-Index-Fund-Channel-scenario/

Over 122.50 targets the upper trending channel targets and below 112.71 lower targets are in play. $IBB #swingtrading #pricetargets

$IBB real-time chart link with indicators https://www.tradingview.com/chart/IBB/1TKf04sH-IBB-weekly-chart-indicators-suggest-a-rest-and-go-MACD-Stoch/

$IBB weekly chart indicators suggest a rest and go (MACD, Stoch RSI, SQZMOM) – upper targets from previous chart most probable. #swingtrading

Dec 18 – $IBB premarket trading 106.93 above 200 MA with 110.73 in sight and other swing trade targets on chart. MACD trending up.

$AGN – Allergan

Mar 10 – Trading 157.28 so the previous post downside worked, however, indicators are now indecisive. Watching.

Jan 30 – $AGN Weekly chart suggests more near term down before things get better.

Dec 18 – $AGN Trading 171.80 premarket indecisive with MACD up Stoch RSI high under MA’s.

Likely a decent bottom side trade with decent risk reward if you want to manage it through the moving averages.

$CTSH – Cognizant Technology

$CTSH – Trading 84.71 still vertical move intact. Enter long, set stop, close eyes and hope or wait for pull back at MA’s for a bounce to long.

Jan 30 – $CTSH trading 77.76 continues in uptrend on daily and weekly suggest more up trend trade. Watching for stoch RSI cross up to time a long. On high watch here.

Yahoo news:

Cognizant Scales New 52-Week High: What’s Driving the Stock?

$NVO – Novo – Nordisk

Mar 10 – $NVO above 50 MA is a long and below is a short.

Jan 30 – $NVO near previous all time highs and indicators suggest a pull back.

Nov 3 – Trading 49.48 Trending stock above all ma’s with MACD trending down. Waiting for the cross up on the MACD for re evaluation.

$TSLA – Tesla

Mar 10 – $TSLA monthly chart – trade range in triangle model and follow price to up or down target. #swingtrading

Jan 30 – $TSLA Tesla trading 345.82 with weekly chart MACD turn up, SQZMOM trend up and Stoch RSI near top. Suggests a pop and rest then test most probable. #trading #TESLA

Real-time Tesla $TSLA chart analysis :

Tesla News: $TSLA Tesla Tests Money Managers’ Demand for $546 Million Bond Deal https://finance.yahoo.com/news/tesla-tests-money-managers-demand-180753134.html?.tsrc=rss

$SNAP – SNAP (60 Min Chart vs. Daily because it is a new issue)

Mar 10 – $SNAP over 18.05 bullish to next resistance line and under is bearish to next support.

Jan 30 – Buy sell trading triggers on simple $SNAP chart model have worked well. #swingtrading #charting https://www.tradingview.com/chart/SNAP/qJ0gRCyt-Buy-sell-trading-triggers-on-simple-SNAP-chart-model-have-worke/

$SNAP swing trading plan: Long as it nears 12.27 for 14.63 Mar 12, 2018.

$VGZ – Vista Gold

Mar 10 – Trading .76 under 20, 50, 200 MA’s with MACD trending down on daily – watching.

Jan 30 – $VGZ chart structure is slowly building – on watch now – waiting for structure to form and then I will model it.

NA

Sept 14 – Trading .78 with indicators trending down.

Aug 14 – Trading .79 with indicators post earnings slightly looking positive and price under all MA’s. Watching.

$AAU Almaden Minerals

Mar 10 – Trading .85 under all MA’s on daily. Watching.

Jan 30 – $AAU trading .87 is still on a sell signal on weekly chart.

$AMMJ – American Cannabis

Mar 10 – trading .90 with sideways action on chart. Watching.

Jan 30 – $AMMJ Ammerican Cannabis buy sell triggers at white arrows for your swing trade. Triggers and targets have been spot on. #swingtrading #cannabis https://www.tradingview.com/chart/AMMJ/T7F2Rgmg-AMMJ-Ammerican-Cannabis-buy-sell-triggers-at-white-arrows-for-y/

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $AAPL, $AMD, $WMT, $LTBR, $RCL, $IBB, $JKS, $FEYE, $LACDF, $CTSH, $NVO, $SNAP, $TSLA, $AMMJ, $AAU, $VGZ, $AGN, $LAC, $EWZ, $PCRX

Swing Trading Report Tues Mar 6 Part A Swing Trading Stock Picks $AAPL, $AMD, $WMT, $LTBR, $RCL …

Welcome to the Compound Trading Swing Trade Report for Tuesday, March 6, 2018 (Part A). Swing, Trading, Stock, Picks, $AAPL, $AMD, $WMT, $LTBR, $RCL and more …

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part A of this post. Part B is to follow.

This report is 1 of 5 in rotation.

We will categorize our coverage soon as we are following more stocks weekly than we expected when we first started the service.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading room at mid-day and ask questions by text in the chat area of the room.

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required. If nothing else you can always book some coaching time and I’ll assist.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

#SwingTrading Midday Review: $BZUN $SPY $COT $AMRC

Using the S&P500 to Confirm Momentum Correlates: $SPY/$BZUN Model Structures

How I executed volatility trade with precision. $VIX $XIV #Volatility #Trading $TVIX, $UVXY, $SPY

@EPICtheAlgo #EIA Report, January 24, 2018: Inverse Hedge Between #CL and $SPY

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Swing Trading Stock Watch list

$AAPL – Apple

Mar 6 – $AAPL Price a magnet to the major pivot support resistance 176.67 – decision up or down in play. Go with price. #swingtrading

Jan 30 – $AAPL Apple trading buy sell triggers I am watching for earnings. #swingtrading #earnings

Earnings bullish scenario – 164.59 area is a buy long if it holds after earnings for a first target of 176.56 and then 188.67.

Bear scenario – 164.59 fails targets a swing lower to 152.63.

Real-time chart link: https://www.tradingview.com/chart/AAPL/wsVdwBgD-AAPL-Apple-trading-buy-sell-triggers-I-am-watching-for-earnings/

Secondary buy / sell triggers per Fib horizontal lines on chart below.

Dec 18 – Apple looks good here. Trade was strong Friday and premarket it’s on the move here Monday – I’ll likely wait for highs to break and then watch the buy / sell Fib levels for a decision from there.

$AAPL MACD is turning up with Stoch RSI and SQZMOM up – buy sell triggers at fib levels on break out on chart.

https://www.tradingview.com/chart/AAPL/pfXeZHyS-AAPL-MACD-is-turning-up-with-Stoch-RSI-and-SQZMOM-up-buy-sell/

Buy / sell triggers to watch for a swing trade with Apple stock:

176.56

181.71

185.73

188.56

181.38

184.87

200.52

$AMD Advanced Micro

Mar 6 – $AMD targeting 12.23 Mar 13 as most probable sideways trade. Other price targets noted on chart. #swingtrading

Jan 30 – $AMD important levels to watch for trading earnings. Bull scenario targets first 14.95 and bearish 12.25 first #premarket

Will be watching earnings close. Upside target is 17.00 if 14.95 is gained and held post earnings.

Five Reasons to Buy AMD (AMD) Ahead of Earnings https://finance.yahoo.com/news/five-reasons-buy-amd-amd-231411295.html?.tsrc=rss

Dec 18 – $AMD trading 10.30 bounced off important support under 200 MA with MACD turning up. Tough call here.

Indecisive action because price is under 200 MA but it will likely see the outside wall of the quadrant – which makes it difficult to state a sell trigger because the quad is diamond shaped so you would have to watch how price handles the diagonal fib related quad wall resistance as trade approaches.

$WMT – Wallmart

Mar 6 – $WMT Wallmart most probable price target 91.00 April 11, 2018. Other buy sell triggers noted. #swingtrading

Jan 30 – $WMT Important trading levels for Wallmart earnings in 21 days. #earnings #trade

Wal-Mart Sharpens Online Edge, Join Forces With Rakuten – Zacks Equity Research January 29, 2018

Wallmart Buy / Sell Triggers:

124.77

116.23 – tighter time-frame

108.06

99.56 – tighter time-frame

91.20

74.25

Real-time live chart link for Wallmart https://www.tradingview.com/chart/WMT/KvzsVZHm-WMT-Important-trading-levels-for-Wallmart-earnings-in-21-days/

$LTBR – Lightbridge Corp.

$LTBR Lightbridge psychedelic chart structure with specific buy sell triggers at arrows. Big range likely.

Price is sitting above 200 MA with a significant risk reward scenario setting up if it starts an up move.

Jan 30 – $LTBR LightBridge If 2.36 holds it targets 3.06 first price target and then 3.77 #trading

Lightbridge Provides Video Footage and Photos of Press Conference Announcing Enfission Joint Venture with Framatome

Real-time $LTBR chart with buy sell price triggers:

Dec 18 – $LTBR chart trading 1.06 under 200 MA with indecisive indicators. No trade signal.

$RCL – Royal Caribbean

Mar 6 – $RCL trading above 200 MA with targets in play swingtrading in to July 18 2018. #swingtrading

If price holds 200 MA and breaches that diagonal Fibonacci trendline at next quad wall (dotted gray line) near range overhead then at minimum the first upside if not the full extension target upside is possible.

If price turns down at quad wall then it targets the lowest area target to bearish side.

Jan 30 – $RCL Royal Caribbean buy sell triggers and diagonal resistance lines we established months back have proven profitable for our swing traders.

Buy sell triggers for $RCL swing trading are as follows:

98.91

115.00

131.09

147.04

163.28

Plus the secondary horizontal lines you see on the chart.

Real-time chart link: https://www.tradingview.com/chart/RCL/9YwFkoBq-RCL-Royal-Caribbean-buy-sell-triggers-and-diagonal-resistance-l/

$RCL Trading 133.55 with Stoch RSI turning down MACD and SQZMOM still trending but against diagonal resistance.

With resistance diagonal just over-head an entry long is not the best risk reward. Will be looking for a pull-back to enter long.

$RCL I have set MACD cross up as trigger for long – will assess at that point – weekly MACD just crossed up also FWIW.

Dec 18 – $RCL trading 125.09 with MACD on daily still trending down. Will wait for a proper trade set-up.

Nov 27 – $RCL Royal Caribbean Buy Sell Triggers on chart – Waiting for buy trigger and MACD SQZMOM and Stoch RSI to confirm.

Preferably enter long at white arrow *grey horizontal line) vs grey arrow. Price recently ran up to a sell trigger so now it is a matter waiting for price to test support at a buy trigger (or breaches a buy trigger for break out) for a long as long as MACD is turned up and the SQZMOM is trending up.

$JKS – Jinko Solar

Jan 30 – $JKS Solar Weekly chart – waiting for MACD to to cross up on the weekly for possible long trade. #swingtrading

Dec 18 – $JKS trading 24.37 with MACD about to turn up waiting for price over moving averages for swing trade.

Some of our traders did report taking that ounce off the 200 MA – I didn’t because at minimum I was looking for MACD to confirm or have price over the MA’s. On watch now.

$PCRX – PacIra Pharma

Jan 30 – $PCRX on daily chart trading 36.45 – waiting on MACD to cross up for long side trade assessment.

Dec 18 – $PCRX trading 43.85 ideal swing set-up with 200 MA bounce test and if MACD turns buy sell triggers at Fibs on chart.

Nov 27 – $PCRX with primary buy sell triggers and fibs with Stoch RSI at top and MACD SQZMOM trend up.

This one is post earnings and bullish above its 200 ma. Any of the Fibs work well as buy sell triggers but the most effective are marked with arrows. The indicators are good with the exception of Stoch RSI high. and ideal would be low and curling up. On watch for a break of 50.87 or retest of 200 MA and possible low.

Nov 3 – Trading 33.05 and it just may be a double bottom here. Watching for that for possible long and also an upside breach of 200 ma as alternative set up.

Sept 14 – Trading 37.75 under 200 MA. Watching for 200 MA test.

Aug 14 – Trading 36.40 post earnings with all indicators turned down but may be bottoming very soon. Watching the MACD at this point for a turn up.

July 26 – Trading 42.56 down 12% on the day and testing 200 MA. Watching.

July 21 – Trading 49.15. Earnings in 23 days testing 20 MA above 200 MA MACD and Stoch RSI trending down. Watching.

July 12 – Trading 49.70. Above 200 MA in the bowl Stoch RSI on daily turned down. Set alarm for Stoch RSI turn for assessing possible long.

June 26 – Trading 47.20. Same.

June 23 – $PCRX Indicators on daily good but on weekly mixed with price against 100 MA. Watching close for MACD cross up on weekly.

June 12 – $PCRX 43.75 Has 200 MA is moving through bowl process. MACD on daily about to curl up ans Stoch RSI on weekly about to cross up. If they do I will assess ma’s and likely long.

June 5 – Getting a small pop in premarket because they are presenting at a conference but indicators are still poor. Waiting.

May 30 – Trading 45.15. All indicators trending down. Watching.

May 22 – Trading 48.30 Chart indicators are indecisive. Will watch.

May 15 – $PCRX SQZMOM up MACD trending up, if price above 52.00 with indicators on side likely long with tight stop.

$EWZ – I Shares Brazil ETF

Jan 30 – $EWZ Brazil ETF weekly chart, ttrading 46.31, over 48.18 with indicators lined up is a long or on proper pull back. On watch for swing trade.

Dec 18 – $EWZ Brazil ETF trading 38.76 testing 200 MA and not likely a great risk reward here but I will watch.

$FEYE – Fire Eye Inc.

Jan 30 – $FEYE trading 15.10 above buy trigger at 14.75 – indecisive but clean chart and on 200 MA.

Real-time $FEYE chart link: https://www.tradingview.com/chart/FEYE/iNjl2yjy-FEYE-trading-15-10-above-buy-trigger-at-14-75-indecisive-but/

Dec 18 – $FEYE premarket trading 14.50 testing 200 MA underside over 14.76 it moves above Fib and enters gap play. On high watch.

Nov 27 – $FEYE watching for over 14.76 over 200 MA with MACD turn up for gap fill and beyond long. The upper extension sell trigger isn’t shown but is at 22.32.

Nov 3 – $FEYE Testing 200 MA post earnings. Could be an excellent set-up long. #swingtrading

$LAC – Lithium Americas

Jan 30 – $LAC Lithium Americas Daily chart with horizontal Fibs, diagonal Fibs, quads, moving averages for tighter trade. Over 8.00 long.

Real-time $LAC charting https://www.tradingview.com/chart/LAC/DTV8PsnK-LAC-Lithium-Americas-Daily-chart-with-horizontal-Fibs-diagonal/

$IBB – BioTechnology Index Fund

Jan 30 – Key resistance test on $IBB Biotech Index Fund. Channel scenario targets up 142.00 or 162.00 down 83.00 or 103.00 #charting #stocks #swingtrading https://www.tradingview.com/chart/IBB/U8HEYQvC-Key-resistance-test-on-IBB-Biotech-Index-Fund-Channel-scenario/

Over 122.50 targets the upper trending channel targets and below 112.71 lower targets are in play. $IBB #swingtrading #pricetargets

$IBB real-time chart link with indicators https://www.tradingview.com/chart/IBB/1TKf04sH-IBB-weekly-chart-indicators-suggest-a-rest-and-go-MACD-Stoch/

$IBB weekly chart indicators suggest a rest and go (MACD, Stoch RSI, SQZMOM) – upper targets from previous chart most probable. #swingtrading

Dec 18 – $IBB premarket trading 106.93 above 200 MA with 110.73 in sight and other swing trade targets on chart. MACD trending up.

Nov 3 – $IBB trading 312.06 near its 200 ma. Waiting for bounce and MACD to turn for long.

$AGN – Allergan

Jan 30 – $AGN Weekly chart suggests more near term down before things get better.

Dec 18 – $AGN Trading 171.80 premarket indecisive with MACD up Stoch RSI high under MA’s.

Likely a decent bottom side trade with decent risk reward if you want to manage it through the moving averages.

Nov 3 – Trading 176.00 premarket under all MA’s on daily but MACD is crossing up. On watch here now.

Sept 14 – Trading 227.29 with indicators indecisive.

Aug 14 – Trading 232.38. with all indicators trending down and price under 20 50 100 MA”s with a possible bounce off top of 200 MA. Watching.

$CTSH – Cognizant Technology

Jan 30 – $CTSH trading 77.76 continues in uptrend on daily and weekly suggest more up trend trade. Watching for stoch RSI cross up to time a long. On high watch here.

Yahoo news:

Cognizant Scales New 52-Week High: What’s Driving the Stock?

Nov 3 – Trading 74.20 and just tested its 100 ma to downside and bounced. Watching for follow-through and MACD cross up.

Sept 14 – Trading 72.27 threatening yet another break-out. On high alert here.

Aug 14 – Trading 70.61 with all indicators trending down and likely test of MA’s on pull back here over 200 MA. Watching.

July 26 – Trading 70.01 all indicators bullish with ER in 8 days.

July 21 – Trading 69.96 MACD crossed and it got a pop. Waiting on earnings for this.

July 12 – Trading 67.70 MACD about to cross up – watching very close now.

June 29 – Trading 67.03 – same.

June 23 – Trading 67.12. Looking at long if 50 ma breaches 100 ma on weekly. Also watching the weekly Stoch RSI for a turn up.

June 12 – Trading 66.39. MACD trending down on daily. Waiting on it to cross up for signal to review other indicators for possible long.

June 5 – Trading 67.30. Closing position in 67.30 area from 61.78 entry. Out of both positions now (the other was on another report that was transferred over from a daytrade that became a swing trade).

https://twitter.com/SwingAlerts_CT/status/871647793672212480

May 30 – Trading 66.70 and stop set at 66.50 from 61.78 entry.

May 22 – $CTSH Swing Trade Going Well. Trading 65.42 from 61.78 entry. 20 MA may breach 100 MA on weekly and may add. MACD trending and SQZMOM trending on weekly also.

$NVO – Novo – Nordisk

Jan 30 – $NVO near previous all time highs and indicators suggest a pull back.

Nov 3 – Trading 49.48 Trending stock above all ma’s with MACD trending down. Waiting for the cross up on the MACD for re evaluation.

$TSLA – Tesla

Jan 30 – $TSLA Tesla trading 345.82 with weekly chart MACD turn up, SQZMOM trend up and Stoch RSI near top. Suggests a pop and rest then test most probable. #trading #TESLA

Real-time Tesla $TSLA chart analysis :

Tesla News: $TSLA Tesla Tests Money Managers’ Demand for $546 Million Bond Deal https://finance.yahoo.com/news/tesla-tests-money-managers-demand-180753134.html?.tsrc=rss

Nov 3 – Trading 300.00. Under all it’s ma’s and MACD trending down. Waiting for a MACD cross up and likely a long at that point.

Sept 14 – Trading 365.66. Threatening recent high and then on to highs if it gets it. On watch.

Aug 14 – Trading 357.87 post earnings MACD and SQZMOM trending up with Stoch RSI overbought. 20 MA about to cross up and breach 50 MA with price above. On high watch here.

$SNAP – SNAP (60 Min Chart vs. Daily because it is a new issue)