How to Trade an Oil Price Sell-Off in to Futures Settlement at 2:30 PM EST for Reversal.

This Reversal (Snap-Back) Crude Oil Trade Provided a 190 Point Range for Our Oil Trading Room Traders.

One of the best ways to increase your oil trading profit is with reversal trading. Crude oil can be difficult to trade, so knowing where reversals in price are likely to occur (support areas of charting) greatly helps a trader with winning trade signals.

A Warning! In a reversal trade it is important to manage your stops, bias, trade size in accordance to your account size.

The example below is of a 30 contract size (possible) oil trading account used by our software EPIC V3.1.1.

I personally didn’t take the trade because I was tired and I had a few other reasons. But it cost me some excellent profit because the price of oil then reversed and rallied near 200 ticks – it would have been a great win for me.

Some of our traders in our oil trading room did get the win so that was great, so I learned a lesson for next time.

The biggest lesson being that when EPIC V3.1.1 alerts an oil trade and the signal is “in-play” it is best for me to get with it and take the trade because the software has been winning non stop since it’s “black swan” code updates.

The oil charts below are models developed by our trading team that are proprietary to our oil trade alert and trading room members, however, if you know how to properly chart conventionally you can also take advantage of this set-up.

Let’s start with the set-up for the possible reversal trade on the one hour chart model. The one hour oil chart suggests that a turn in price, or a topping, is near (refer to the curved grey arch on the chart).

More specifically to this trade set up, the yellow trend lines (algorithmic trend lines) provide for a possible area on the charting for intra-day support in a possible sell-off scenario in to futures settlement at 2:30 PM on Thursday May 7, 2020.

The alert went out to the oil trading room and trade alert feed as follows;

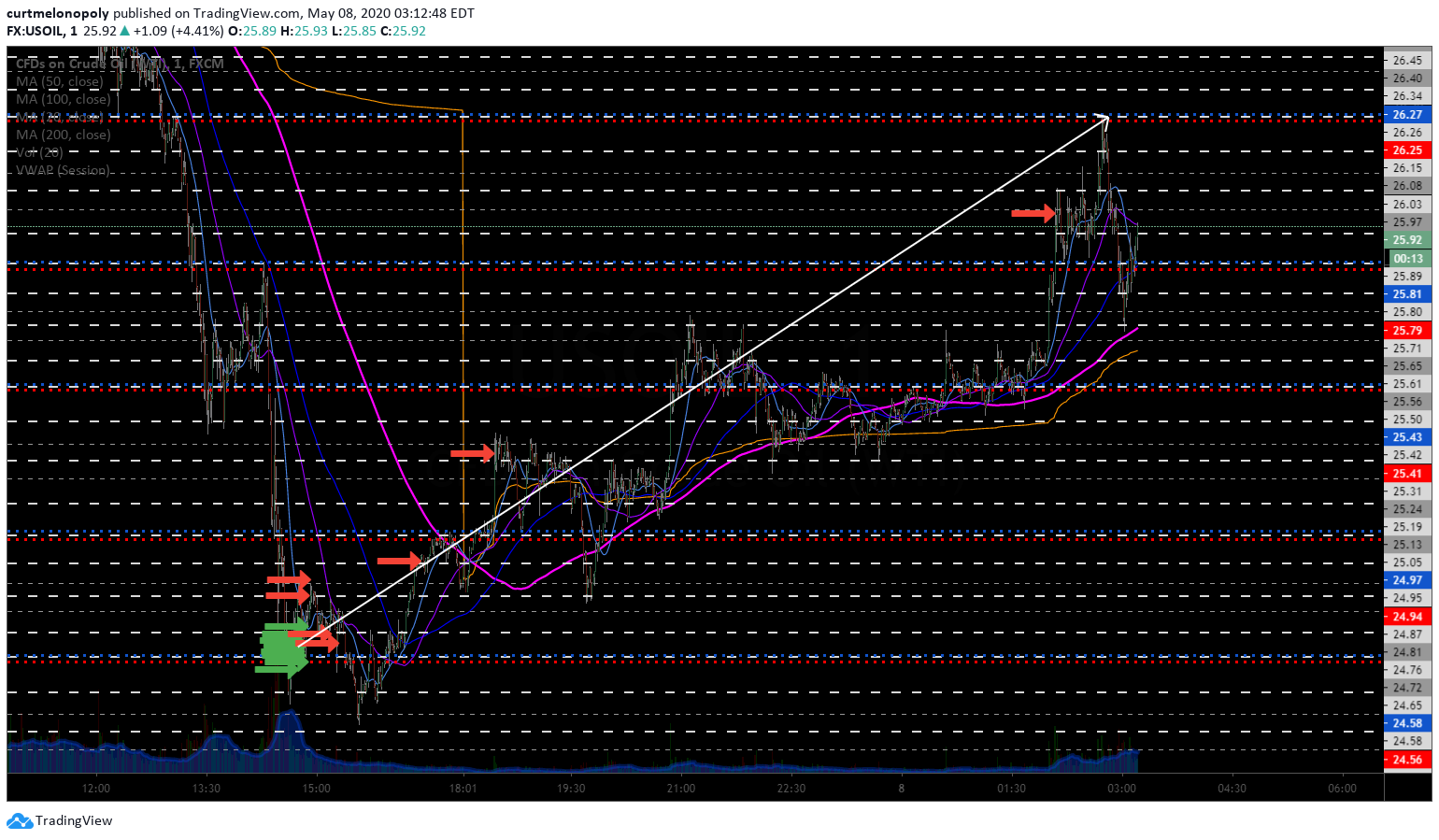

You can see on the oil chart below that price was crashing at 12:18:17 EST time (or 12:18 PM) so the possible set-up for a bounce after oil settled at 2:30 PM was setting up.

If you’re thinking of swinging crude oil for a bounce, we’re getting closer to support areas.

Intra-day time cycle on crude oil is 1:45 P.M. for a possible bounce (reversal), careful with expecting VWAP to hit with some funds turning short.

The chart below and guidance provided to subscribers was also that at 1:45 PM a time cycle intra-day was possibly at an inflection point (or peak / bottom) and this was reason to be on high alert.

Screen capture of oil trading alert feed telling oil trading room position started.

Then at 2:44, so 14 minutes after crude oil officially settled for the day the alert went out that we were opening our trade position long at 8/30 size at 24.67 and the screen image below shows some of the other alerts and comments as the trade was going well and in a winning position.

Long 8/30 24.67 FX USOIL WTI trade on CL — EPIC.

Screen capture image of oil trading room when I alerted the trade position opened and discussing trading strategies.

One of the things we do in the oil trading room is provide charting and as much trade strategy guidance for our subscribers as possible.

This image below is a screen shot of the Discord room where we’ll chatter and share ideas and there is also a live mic and charting trading room where I walk our traders through the trades on voice broadcast live and share the charts we are using – both run at same time..

If the trade works, the price target would be Friday 3:00 PM EST ish for 29.00 ish.

The guidance provided to the trading room after we entered the trade was the price targets and time of the targets possibly coming in to affect. The chart below shows an arrow that provides our traders with a trajectory of trade should the plan being working.

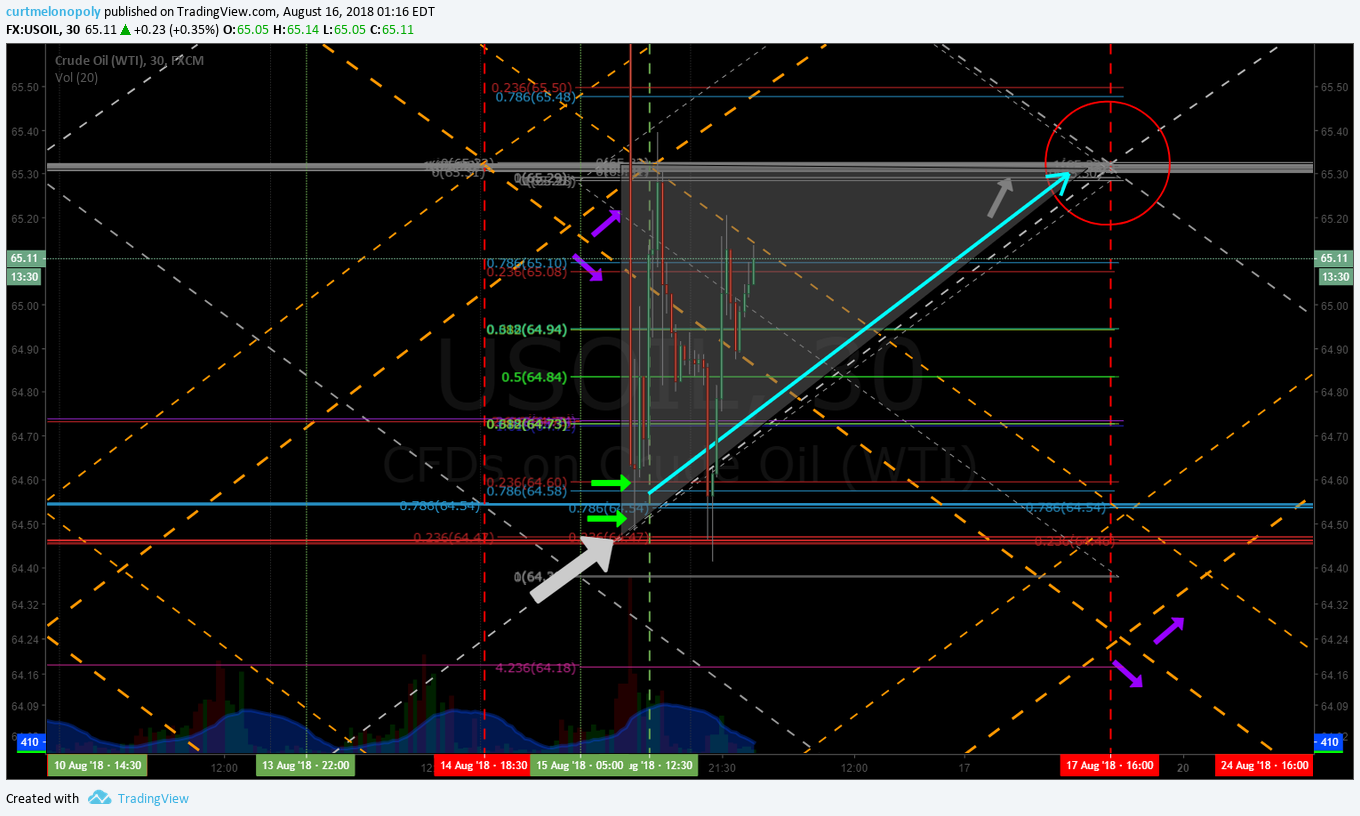

The crude oil one hour chart with symmetry time cycles has been an amazing model, working very well, details on video.

The image below shows the 1 hour algorithmic model and the symmetries in crude oil trade, time cycles and price targets. The reference to “the video” is that we record all trading sessions and make them available to our subscribers for $STUDY and review.

The Live Oil Trading Room Raw Video Feed

At 1:12:40 on the video timer is where the oil trade starts, you can see and hear the actual trade guidance for the signals I am providing our traders as the trade sets-up.

There isn’t a lot of trade guidance on mic because much of it was provide in advance in the trading room and on alert feeds, but you can idea of how it works in the trading room on the video. There is also a time stamp at near bottom right of screen in the video on the chart itself.

The Chart Below Shows Trade Long Entries (green arrows) and Take Profit Areas Selling (red arrows).

Crude Oil Trade Alerts dot plotted on 1 minute grid chart of EPIC V3.1.1 trade from oil trading room earlier today.

The trade on the 60 min symmetrical time cycle model (white arrow), long position after sell-off in to daily settlement.

The reversal trade works really well for oil traders as long as you manage the trade size according to your account size and be sure to stop out if you are on the wrong side of the trade.

Oil can trend down or up for weeks so staying on the wrong side of an oil trade can cost you your whole trading account.

So if you know your areas of support on the most dominant time frames (in this instance the 1 hour charting) and you execute your long trade after it looks like the sell-off has stopped then it becomes simply managing the ebb and flow of trade according to your personal style thereafter.

BUT IF IT FAILS, my best suggestion to you is to close the trade sooner than later.

I’ve also written other articles on intra-day reversal oil trades – they are more in-depth and a tad technical, but if you want to dig deeper in to this topic here are a few recent articles:

- Buying Support in to the Plunge During Crude Oil Intra-Day Sell-Off | Oil Trading Room Video, Alerts, Strategy.

- 134 Ticks in 1 Hour (Post EIA). Crude Oil Trading Tips: A Simple Intra-Day Reversal Strategy..

My tweet summarizing the oil trade on my personal Twitter feed (shows alert screen shots);

When crude oil sold off in to 2:30 settlement yesterday, EPIC V3.1.1 machine protocol went in deep long for swing trade, I didn’t follow… EPIC got it Direct hitFireBow and arrow I didn’t – in hindsight, likely cause I was tired. Good lesson.

#OTTT $CL_F $USOIL $WTI #OilTradeAlerts

When crude oil sold off in to 2:30 settlement yesterday, EPIC V3.1.1 machine protocol went in deep long for swing trade, I didn't follow… EPIC got it 🎯🔥🏹 I didn't – in hindsight, likely cause I was tired. Good lesson. #OTTT $CL_F $USOIL $WTI #OilTradeAlerts #MachineTrading pic.twitter.com/bcNUzTTER5

— Melonopoly (@curtmelonopoly) May 8, 2020

In the tweet below, I was explaining that oil traders would want to be focusing on trades that are on the outside extreme ranges in price.

The reason for this is that oil recently rallied off lows and we have a time cycle and price targets that see oil topping near – term. When oil starts to top or bottom in a wider time-frame it is then best to trade the range of trade on lower time-frames (such as the 1 minute, 5, 15 or 30 minute charting) until the larger trend is formed.

Oil traders, they’ll want to take the trades on the extremes the next two weeks #OOTT $CL_F $USO The whippy extremes will provide the best risk reward for oil traders.

Oil traders, they'll want to take the trades on the extremes the next two weeks #OOTT $CL_F $USO The whippy extremes will provide the best risk reward for oil traders.

— Melonopoly (@curtmelonopoly) May 6, 2020

So that’s the reversal snap-back trade in crude oil futures that you can either consider as a day trade or an intra-week swing trade. There are of course many other considerations we use (our software has over 9000 rules in its instructions), but for the purposes of a human trader, the above article should help get you started.

We endeavor to develop the best winning oil trading alerts and oil trading room service for oil traders.

Any questions please send me a note via email compoundtradingofficial@gmail.com.

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; oil, strategies, reversal, trade, swing trading, day trading, crude oil, oil trading room, oil trading alerts.