Tag: setup

Part 2 – The Battle Plan | How to Trade the Ambarella (AMBA) Stock Move

The Imminent Ambarella (AMBA) Stock Move (2 / 3)

How to Trade the $AMBA Move: Price Targets | Buy Sell Triggers | Time Cycles #swingtrading #daytrading

In Part One We Covered; Thesis, Catalysts, The Company, Chart History, Chart Study (for Part 1 click here).

Excerpt summary from part one….

Ambarella (AMBA) stock has dumped from the mid 60’s to the mid 40’s since early January 2018 (a huge short side win – the Trump effect) and is now near recent historical lows (the Trump effect catalyst and run-up from September 2017 to January 2018).

Below is Part 2 of a 3 part detailed trading plan for Ambarella. You will find a trading plan for the bullish thesis and levels to watch for a bear thesis leading in to earnings in 39 days (June 5, 2018) and a critical time-cycle completion on the chart model at / or near the same timing (approximately June 9, 2018).

In the trading plan I include price targets, support and resistance levels, buy sell triggers and time cycle completions.

Using this technical set-up you will know how to exploit the move for a much greater return if are an active trader (of course this is not required for an excellent gain) and you trim long positions in to resistance in anticipation of moderate retrace and add above each resistance after each retrace.

Part Two below is a detailed battle plan for day trading and swing trading this move.

Part Three (for swing trading newsletter members) will cover the move in detail as it plays out.

First, what’s new at Compound Trading…

What’s New;

- April 30% Off Sale ends this Monday. Click here for available Sale Promo Codes.

- Interested in more free swing trading setups like this? Sign up here Complimentary Swing Trading Report Mailing List.

- Information about our next trade coaching event May 4, 5, 6 can be found here Trade Coaching Boot Camp.

- Now available for serious traders, information here for our exclusive Legacy All Access Membership.

- 24 Hour Crypto Trading Desk opens mid May 2018 along with our Coding Algorithm Models for Machine Trading. Formal announcements to follow.

Part 2 – The Battle Plan | How to Trade the $AMBA Move

Here’s your technical chart set-up for trading $AMBA:

As noted in part one,

If I’m right (and if I’m not it’s a simple cut fast with a minor cut) there’s a wash-out snap-back trade setting up here that is near epic proportions…

At minimum I’m looking for $AMBA to snap back in to the 53s. A trade from the low 40s to the mid 50s is a serious return (if it actually happens and if it happens over the course of the next 3 to 4 months).

$AMBA closed April 27 at 46.75.

Trend Change: This set-up is a long over 49.50 (if 49.50 area is held) for a major trend change to the upside. Resistance is at 51.50 area in this scenario (trim in advance and add over).

or for Active Trading: This is a long over 47.25 in to resistance near 49.40 (trim in advance and add over).

Be sure to trim longs in advance of that and then if resistance is breached add over that to the next resistance and then rinse and repeat. The horizontal fib lines on the chart show you support and resistance points.

On the short side for a day trade… Friday’s close was 46.75 and the next support is in the 44.55 range… so if there is pressure on the stock in premarket or at open Monday then a short in to the 44.55 support may work out. But be cautious, this thing has science all over it saying that a snap-back is very possible and it should be vicious when it starts.

Support and Resistance Levels – I’ve made the chart easy to manage visually by adding white arrows to each major support and resistance level. The white arrows are your primary buy sell triggers.

Note also the “trading quad walls”. These are Fibonacci based diagonal trend-lines that form a trading structure “quadrants”. They also act as support and resistance.

The red circles are price targets. The price targets for June 10, 2018 time cycle peak are 58.60 (bullish), 49.40 (moderate), 40.13 (bearish). Trade in accordance to price action toward the appropriate target. It is paint by numbers trading – just follow the rules and if your trade fails be sure to cut losses quickly and be ready to turn with price as needed. Trust the plan.

The MOST INTERESTING THING about this set-up is the possibility for a trend reversal based on a simple wash-out down trend with a snap-back that could see a significant three to six month trend to the upside.

In Part 3 (for our Swing Trading Members) I will cover that scenario for significant gains should that transpire.

Also… pay attention to the downside bearish scenario playing out here. If that occurs I will do a Part 3 specific to that and include a detailed trading plan.

My Personal Earnings Rule: 95% of the time I will not hold in to earnings. Trade your plan however you wish.

Here’s your technical chart set-up for trading Ambarella $AMBA.

Here’s your technical chart set-up for trading Ambarella $AMBA. by curtmelonopoly on TradingView.com

Good luck with your Ambarella trade and if you need any help message me anytime!

To register as a swing trading member click here.

Best and Peace.

Curt

If you are not already on our Free Swing Trading Periodical email list follow the link here to get on it to receive trading set-ups in the future. Unsubscribe anytime.

In Closing:

A few hours of trade coaching or study on exactly how to trim in to resistance and how to add to your positions on winners and how to cut losses properly and quickly will return huge dividends.

You can subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

Any questions feel welcome to contact me anytime.

Best with this trade!

Peace and best.

Curt

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States.

Recent Trading Set-Up Review Webinars and Blog Posts

Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA Password “ELON” https://compoundtrading.com/how-to-trade-the-tesla-move-price-targets-buy-sell-triggers-time-cycles-tsla-swingtrading-daytrading/

Oil Member Trade Alert Blog Post. Password “LONG” – Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Swing Email Subscriber Blog Post – Trade Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for full-time daytraders. Private coaching and live alerts.

Article Topic; AMBARELLA (AMBA) CHART. How to Trade AMBARELLA, Stock, $AMBA, #swingtrading #daytrading

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

The Imminent Ambarella (AMBA) Stock Move

How to Trade the $AMBA Move: Price Targets | Buy Sell Triggers | Time Cycles #swingtrading #daytrading

Ambarella (AMBA) stock has dumped from the mid 60’s to the mid 40’s since early January 2018 (a huge short side win – the Trump effect) and is now near recent historical lows (the Trump effect catalyst and run-up from September 2017 to January 2018).

Below is Part 1 of 2 parts for a detailed trading plan for Ambarella. You will find a trading plan for the bullish thesis and levels to watch for a bear thesis leading in to earnings in 39 days (June 5, 2018) and a critical time-cycle completion on the chart model at / or near the same timing (approximately June 9, 2018).

In the trading plan I include price targets, support and resistance levels, buy sell triggers and time cycle completions.

I encourage you to stay on top of this set-up because the gains to the upside on a simple retrace are at least 30% and more likely 40% or more over 3 months (if the bullish thesis plays out).

Check my call record – when I put out an alert do not ignore this trade set-up… the probability of a serious return is extremely high – the proof is in my record.

Using this technical set-up you will know how to exploit the move for a much greater return if are an active trader (of course this is not required for an excellent gain) and you trim long positions in to resistance in anticipation of moderate retrace and add above each resistance after each retrace.

First, what’s new at Compound Trading…

What’s New;

- April 30% Off Sale ends this Monday. Click here for available Sale Promo Codes.

- Interested in more free swing trading setups like this? Sign up here Complimentary Swing Trading Report Mailing List.

- Information about our next trade coaching event May 4, 5, 6 can be found here Trade Coaching Boot Camp.

- Now available for serious traders, information here for our exclusive Legacy All Access Membership.

- 24 Hour Crypto Trading Desk opens mid May 2018 along with our Coding Algorithm Models for Machine Trading. Formal announcements to follow.

The Ambarella Trading Plan In Detail.

The AMBA chart structure has had my curiosity for some time, it has traded very clean and predictable through the model I have been using. The support and resistance areas at the key Fibonacci levels (price) react well, the time cycles are spot on and the trend is your friend with this stock.

We alerted the run up in late 2017 and the down turn in 2018 – both were fantastic trend trade set-ups. Find below example of the public alerts I put out (not withstanding the member technical alerts fed out in private):

$AMBA could rip in to earnings in 17 days – Stoch RSI close to bottom with a break above sees 61.00 fast 65.00 possible. #swingtrading

$AMBA could rip in to earnings in 17 days – Stoch RSI close to bottom with a break above sees 61.00 fast 65.00 possible. #swingtrading pic.twitter.com/1iqGppNGQF

— Melonopoly (@curtmelonopoly) November 13, 2017

$AMBA There it goes. In it to win it #swingtrading

$AMBA There it goes. In it to win it #swingtrading pic.twitter.com/1rRHa2whzt

— Melonopoly (@curtmelonopoly) November 20, 2017

I am expecting we will see yet another turn in price trend leading in to earnings and the time cycle completion in early June, 2018.

Trade Set-Up Catalyst(s):

Earnings: Here you will find the Nasdaq website link for Ambarella earnings: AMBA Earnings Date Earnings announcement* for AMBA: Jun 05, 2018.

Time Cycle: This set-up is excellent in that the timing cycle on the trading range peaks in and around (just after) the scheduled earnings date. From a technical perspective, the dates could not be lined up better (see technical charting below).

Historical Support / Lows: AMBA hit low 40’s in September 2017 and ran up to mid 60’s by January 2018. The September lows were perfect to a time cycle peak and I’m looking at them as a technical catalyst for the trade.

The Trump Effect: The Trump effect was massive on this stock play, a simple Google search and $STUDY will show you the obvious effect on this and related plays.

About Ambarella:

If you are not familiar with Ambarella the company, read about them here at the Wikipedia page link: Ambarella, Inc. (NASDAQ: AMBA) is a fabless semiconductor design company, focusing on low-power, high-definition (HD) and Ultra HD video compression and image processing products.

And This is Why AMBA Could Be a Grand Slam Trade Opportunity | Emotional Investing and Trading.

A quote from this widely read article, “Will Computer Vision Lift Ambarella Higher?” written by Nicholas Rossolillo, and published to The Motley Fool April 23, 2018 sets up the bull wash-out snap-back thesis perfect leading in to earnings… and if you look around some you will see many such media sentiment driven messages to the general investment public.

Here’s the quote;

…leaving Ambarella shareholders with a stock that has been stuck in a rut the last few years…

This is an example of how generally the average market participant will operate in panic and sell low after buying high on emotion (from media messaging) and / or will become excessively short side bias and a retrace rally ensues.

And then…. look around… there are snippets of the turn coming… it may not be this earnings… but it could be, and if it isn’t this earnings season (poor results are more likely), it will be the next or the next. But what is most important is the action of the panicked shareholder in advance of earnings relative to sentiment and the simple science behind the retrace that is imminent – it is only a matter of when.

Here’s is just one example of grains of hope in a turn for future ER;

Force Protection Video Equipment (FPVD) announced today that it is receiving record orders…

Force Protection Video Equipment Reports Record Sales from the Release of New Product Catalog

Whichever way this goes, our duty as swing or day traders is to always trade price and to HAVE A PLAN, so below is your technical chart set-up and trading plan either way for excellent profit for Q2 2018!

The Bottom Line? | Profit

So what’s my bottom line in my thesis? If I’m right (and if I’m not it’s a simple cut fast with a minor cut) there’s a wash-out snap-back trade setting up here that is near epic proportions (relative to market returns for 2018).

At minimum I’m looking for $AMBA to snap back in to the 53s. A trade from the low 40s to the mid 50s is a serious return (if it actually happens and if it happens over the course of the next 3 to 4 months).

Could I be early or wrong? Sure. Trade price. Below is how…

The Technical Chart Set-up for Trading Ambarella $AMBA.

Here is how the technical set-up appears on the daily chart for $AMBA in advance of the earnings trade. This is the playing field for a trade set-up that should easily net 30 – 40 % gains in the next 3 months. In Part 2 of this article I provide a detailed play by play plan for the trade.

Next in part two we will review the chart set-up above and form a specific trading plan (for a turn up or down) including price targets, buy sell triggers, support and resistance and more.

If you are on our mailing list you will receive Part 2 in this article today. If you are not already on our Free Swing Trading Periodical email list follow the link here to get on it to receive this trading set-up and others in the future. Unsubscribe anytime.

In Closing:

A few hours of trade coaching or study on exactly how to trim in to resistance and how to add to your positions on winners and how to cut losses properly and quickly will return huge dividends.

You can subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

Any questions feel welcome to contact me anytime.

Best with this trade!

Peace and best.

Curt

Connect:

Register to Free Swing Trading Periodicals and Webinar Notices. Contact Form: https://compoundtrading.com/swing-trading-periodical-contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States.

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for full-time daytraders. Private coaching and live alerts.

Article Topic; AMBA CHART. How to Trade AMBA, $AMBA, #swingtrading #daytrading

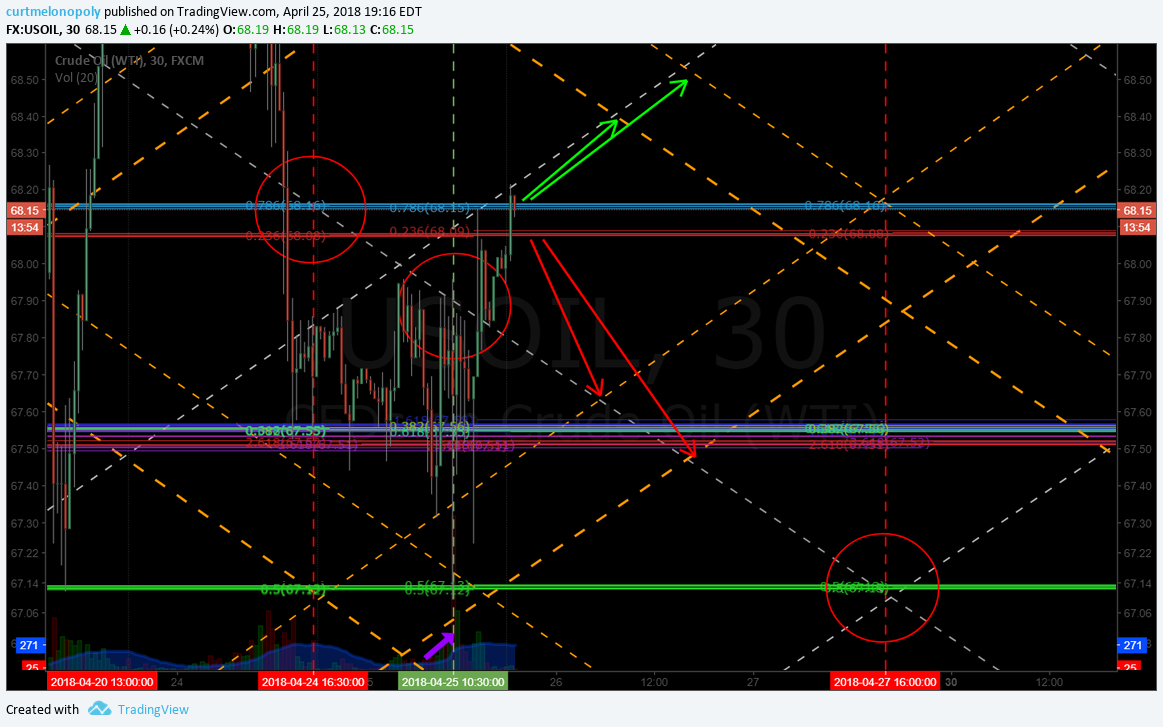

Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Here’s the trading plan for our oil trade in overnight futures trading.

Oil trade set-up scenarios up and down going in to early Thurs AM – down is my bias. On Watch. #OIL $WTI $USOIL $CL_F

EPIC Alert Feed:

https://twitter.com/OilAlerts_CT/status/989282272275726341

Then the bulls started to step in…

EPIC Alert Feed:

8:30 PM – 25 Apr 2018 Long side trade setup alert 68.30.

https://twitter.com/OilAlerts_CT/status/989300641175687168

Long side trade setup alert 68.30. FX $USOIL $WTI with price targets red arrows trim in to and add above.

Private Oil Trading Room Discord Server Guidance:

Watching for power…. vol

MACD and SQZMOM are too flat for my comfort to go long there. Price is moving but no vol and MACD and SQZMOM

no power yet but the bulls are creeping in with some open field here

A lot of assumption in that chart, but thats my plan machines just tapped the first target

pink dotted horizontal shows you a resistance pivot at mid quad on intra – there’s one there all the time but we don’t represent it on charting – anyway…. thats where the first target came from

Real time link to chart with trade set up detail:

https://www.tradingview.com/chart/USOIL/G0KTH73e-EPIC-OIL-ALGORITHM-TRADE-SETUP-DETAIL/

EPIC OIL ALGORITHM TRADE SETUP DETAIL by curtmelonopoly on TradingView.com

Subscribe:

Temporary Discount Offers:

30% Off Oil Newsletter: Use Promo Coupon Code “epic30” When Subscribing to our Weekly Oil Newsletter Here: https://compoundtrading.com/product/standalone-epic-newsletter/ (cancel anytime, for new members only to trial the service).

30% Off Oil Alerts: Use Promo Coupon Code “oilalerts30” for Real-Time Oil Trade Alerts via Private Twitter Feed @OilAlerts_CT Here: https://compoundtrading.com/product/live-oil-trading-alerts/?attribute_plan=One+Month (cancel anytime, for new members only to trial the service).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Subscribe to our Weekly Oil Newsletter Here: https://compoundtrading.com/product/standalone-epic-newsletter/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States.

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.

$FB Facebook Long Set-Up Testing Buy Sell Trigger #swingtrading (Public Edition)

Facebook Trade is Heating Up Again! Next Levels.

$FB Facebook 0.78% long side trade from 153.40 Mar 28 buy side trigger now testing buy sell trigger 167.51

The Facebook 0.78% wash-out snap-back trade has been one heck of a profitable trade for our group.

When this first set-up I alerted it a number of times in different ways on different platforms – I even texted people and sent private messages. I was screaming this from the rooftops (look at my Twitter feed, Trading View account, StockTwits account or our alert feeds on Twitter – screaming this).

As time goes on in your trading life you learn over and over again how this particular type of set-up has profit written all over it. The secret however, is knowing where your trading chart structure is in advance of trade getting to that area of restructuring after the wash-out. Knowing that is key.

Knowing your support and resistance points, your trading range and the time cycle peaks and potential targets puts you way ahead of your competition (the other traders) – and that is key to winning.

Another key becomes trusting the process… but that’s for another day.

Here’s the charting and below that is the new technical set-up with buy sell triggers and price targets with time cycle dates.

Facebook New Buy / Sell Trigger Here Now. See Chart Notes. by curtmelonopoly on TradingView.com

So whats next in the Facebook 0.78% trade?

If you got in near the first buy / sell trigger point at 153.40 on March 29 you are sitting pretty – you’re up big. So you want to watch this test area in and around 167.51. This is a major structural decision – a major model trading pivot / mid quad.

Above 167.51 buy / sell trigger (and it holds) price targets 173.55 then 174.18 then 178.30 and finally 181.63 on April 17, 2018 (approximately).

I’ve marked every upside resistance test on the chart for you with yellow caution arrows. The 100 MA (blue), 200 MA (pink), Quad wall (diagonal Fibonacci trendline resistance – dotted blue line) etc.

If price becomes range bound, the sideways target is also on the chart.

I haven’t charted the downside in detail but there is enough there to know where your supports are etc. If the downside occurs you can bet I’ll be all over alerting the set-up again.

Congrats longs! Glad this one worked out so well for the team.

For more detail on the time cycle peaks for your trade, price targets, and support / resistance points relating to your personal trading plan contact me with any questions you have.

Best and peace!

Curt

PS Remember to trade price – if the trade goes against you it is always better to take a small loss than be married to a bad chart / stock.

I will be live broadcasting this trading set-up and other chart set-ups documenting my process in detail for review w/ daily PL’s, video, charting set-ups and alerts.

Get Involved:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmelonopoly/

Facebook: https://www.facebook.com/compoundtrading/

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin 1.14% , $ETH, $LTC, $XRP,) $DXY -0.12% US Dollar -0.12% and Swing Trading Newsletter. Live trading rooms for daytrading and oil 0.10% traders. Private coaching and live alerts.

Twitter bounce near 200MA on wkly. Trade set-up w/ Chart Notes.

Twitter bounced near 200 MA on weekly support. $TWTR

With the recent pressure on related equities I am watching $TWTR $GOOGL $FB and a few others very closely at open on Monday.

Here’s the 4 hour chart post from Friday I alerted (200MA on 4 hour as intra-day resistance) – it did back off near that resistance intra-day.

Here’s a Friday news (Real Money) take on the issues facing Twitter and others: https://realmoney.thestreet.com/articles/03/30/2018/dont-buy-dip-facebook-twitter-and-alphabet?puc=yahoo&cm_ven=YAHOO&yptr=yahoo

I love trading wash-out snap-backs because the returns can be fast and hard if you have the technical set-ups the pros use.

FOR PART II:

For the complete technical analysis / trading plan on this set-up, click here: https://compoundtrading.com/swing-trading-periodical-contact

For those reasons, and of course the chart setup forming my trading plan I will go in to this week extremely bullish unless price action and or media / news tell me to back off.

For more detail on the time cycle peaks for your trade, price targets, and support and resistance points relating to your personal trading plan contact me with any questions you have.

Best and peace!

PS Remember to trade price – if the trade goes against you it is always better to take a small loss than be married to a bad chart / stock.

Monday I will be live broadcasting this trading set-up and other chart set-ups documenting my process in detail for review w/ daily PL’s, video, charting set-ups and alerts.

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Twitter bounce near 200MA on wkly. Trade set-up w/ Chart Notes. by curtmelonopoly on TradingView.com

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmelonopoly/

Facebook: https://www.facebook.com/compoundtrading/

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin -0.37% , $ETH, $LTC, $XRP,) $DXY -0.13% US Dollar -0.13% and Swing Trading Newsletter. Live trading rooms for daytrading and oil 0.82% traders. Private coaching and live alerts.

For the complete technical analysis on this swing trading set-up, click here: https://compoundtrading.com/swing-trading-periodical-contact

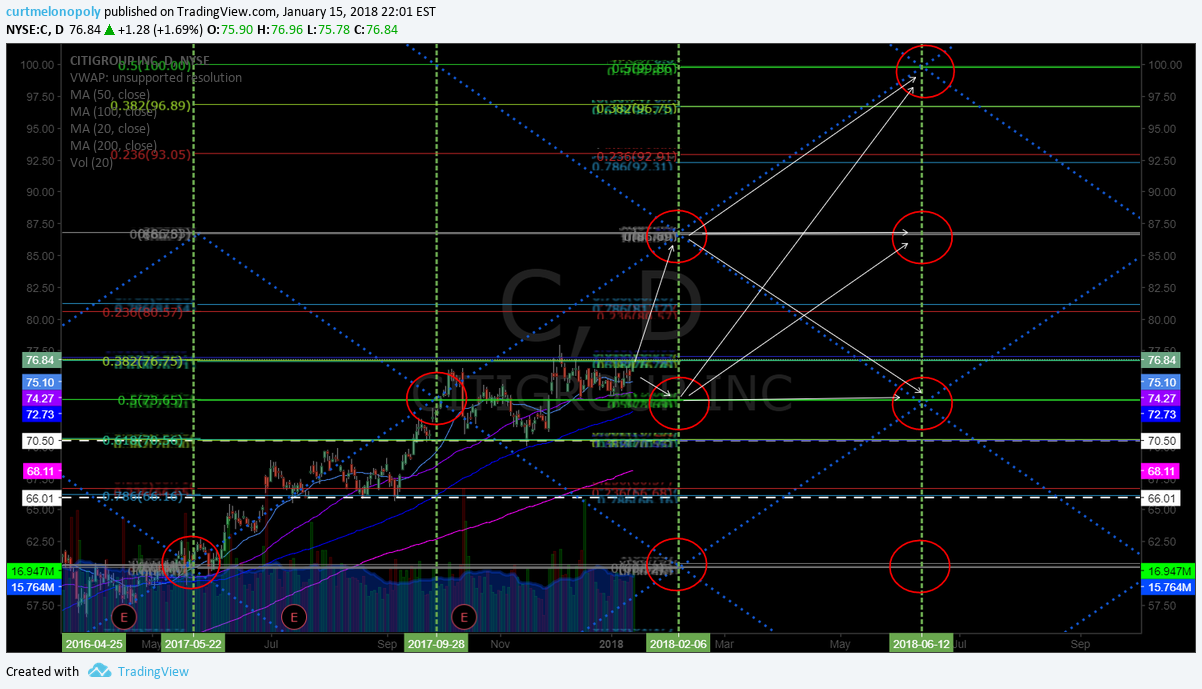

CitiGroup $C Trading Chart Buy / Sell Triggers for Day Trade and Swing Trading Earnings

CitiGroup ( C) Swing and Day Trade Chart Set-Up with Buy / Sell Triggers for Traders

Below is the technical set-up of a simple algorithm model based on Fibonacci structure that specifically identifies trading signals for trade in CitiGroup to the upside and downside for earnings report on January 16, 2018.

Financial giant Citigroup ( C ) will announce fourth-quarter results on January 16. Analysts expect earnings of $1.18 per share. During the same period last year the company earned $1.14, and the stock has gained 13.0% since the end of June.

The chart structure for CitiGroup has been very consistent for the past six reporting quarters, so I have this particular chart on my watch list for daytrading tomorrow morning. And if trade continues to be predictable I will swing trade in accordance to the set-up below based on how trade plays out when earnings for Citi are released.

My invite to the public to receive a free copy of this trading set-up on social media. To receive future earnings trade set-ups, free webinars and videos and other trading information register to our email mailing list (click here).

Citi (CitiGroup) has been trading in a predictable chart structure for six quarters. Nice set-up for earnings. For a complete free report on how to trade earnings action with buy and sell triggers register to email mailing list here #swingtrading #ER $C https://www.tradingview.com/chart/C/ZYwtorum-Citi-has-been-trading-in-a-predictable-chart-structure-for-six-q/ …

Citi (CitiGroup) has been trading in a predictable chart structure for six quarters. Nice set-up for earnings. For a complete free report on how to trade earnings action with buy and sell triggers register to email mailing list here #swingtrading #ER $C https://t.co/z6YPIGzGg2 pic.twitter.com/XcVoLwuk0s

— Melonopoly (@curtmelonopoly) January 16, 2018

CitiGroup $C Earnings Chart Set-up for Swing Trading – Daily Chart. #swingtrading

Live chart link:

The chart below shows price targets for trade through to Feb 6, 2018 (red circles). The white arrows show possible trading scenarios based on the price targets and specific time cycles. As trade progress through the Fibonacci horizontal support and resistance lines (buy / sell triggers) and diagonal support and resistance lines (blue dotted lines forming quadrants) on its way to (trending toward) a spcific price target you can trade accordingly in your swing trade.

Your most important support / resistance buy / sell triggers are as follows:

Currently trading at: 76.84

Buy Sell triggers for upside price trend swing trade: 80.60, 81.60, 86.74, 92.24, 93.01, 96.64, 99.63 (most bullish target for June 12, 2018 – unlikely but it is).

Buy Sell triggers for downside price trend swing trade: 73.60, 70.54, 66.65, 66.06, 60.64

Here is the link to the live chart. Click on share button bottom right to open live chart (past initial viewer) and then “make it mine” to open. When chart is open double click on chart field to remove indicators at bottom of chart (the Stochastic RSI, MACD, SQZMOM) and double click to return indicators to chart.

Daytrading the Citi Earnings Report – Buy Sell Triggers

Below is the chart with additional horizontal Fibonacci buy / sell triggers if you choose to daytrade the market action in the morning.

Click the link below for the real-time chart:

Summary for Trade Set-Up

The charts above allow you to trade the earnings report price action as it happens when earnings are released. Once trade establishes a trend then a complete swing trading plan can be established. I will follow-up the CITI earnings report with members on the swing trading members report with a complete swing trading plan when the trend is established.

Trade Coaching

Important to new traders and/or users of our algorithm model charting can be the opportunity for private one-on-one coaching with our lead trader and / or an experienced trader that has worked under our lead trader (our lead trader maintains a trading win rate well in excess of 80% – recorded, verified, and alerted real-time for transparency).

On our website there are standard one-on-one online coaching packages (coaching via Skype) or you can request a customized package (reflecting the time you are wanting to invest in your learning). Keep in mind there is often a waiting list, but as students will attest, well worth the wait (if so).

To request a custom package most suited to your needs email us at info@compoundtrading.com or click here for a standard private trade coaching package. Other options for coaching include online webinars for members (from time to time), private on location and in-person coaching sessions at our new trading location(s) and organized trading conference events starting early 2018.

To learn more about our trade coaching email us or click here.

If you need assistance with the CitiGroup trade outlined above contact our lead trader on social or email us info@compoundtrading.com.

Thank-you.