Tag: Stocks

How To Swing Trade Stock Time Cycles: STONECO Trade Review, Part 1 #swingtrading #timecycles

Swing Trading Structured Charting Stock Time Cycles for Predictable Wins and Significant Gains. Part 1.

The STONECO (STNE) Trade Provides an Excellent Opportunity for a Tutorial on How to Swing Trade Stock Time Cycles.

Time cycles are through-out the financial markets, indices, sectors, equities (stocks), commodities, currencies, crypto and in every corner of the financial markets.

- One of the single most considerable trader “edges” we have in our tool kit are time cycles.

- Stock time cycles allow for a trader to gain a better probability edge.

- Time cycles in stock trading allow a trader to better time entries and exits in a trade, time trades and establish appropriate size risk.

The STONECO trade example provides swing traders with a clear idea of how this swing trading strategy works.

In Part 1 we look at the the trade executions, the entries and profit taking areas of trade.

In Part 2 (Premium User) we will look at how exactly traders can replicate our success in this specialized area of swing trading expertise. How to chart the structure of the stock, choosing the best time-frame for the trade, time cycles, advanced Fibonacci Retrace levels and chart modeling, sizing your trade, exits and entries, risk management and more.

Okay, lets look at the trade itself first:

Finding a systematic trading process provides a trader’s edge. The more a trader has, the better. Learn to play the game better, achieve better returns.

Life is like a game of cards. The hand you are dealt is determinism; the way you play it is free will.

Jawaharlal Nehru

Life is like a game of cards. The hand you are dealt is determinism; the way you play it is free will.

Jawaharlal Nehru

— Melonopoly (@curtmelonopoly) June 18, 2020

Below is a tweet I sent out today that includes screen shots of the swing trade alert feed of the charting and alerts for exits and entries in this time cycle trade.

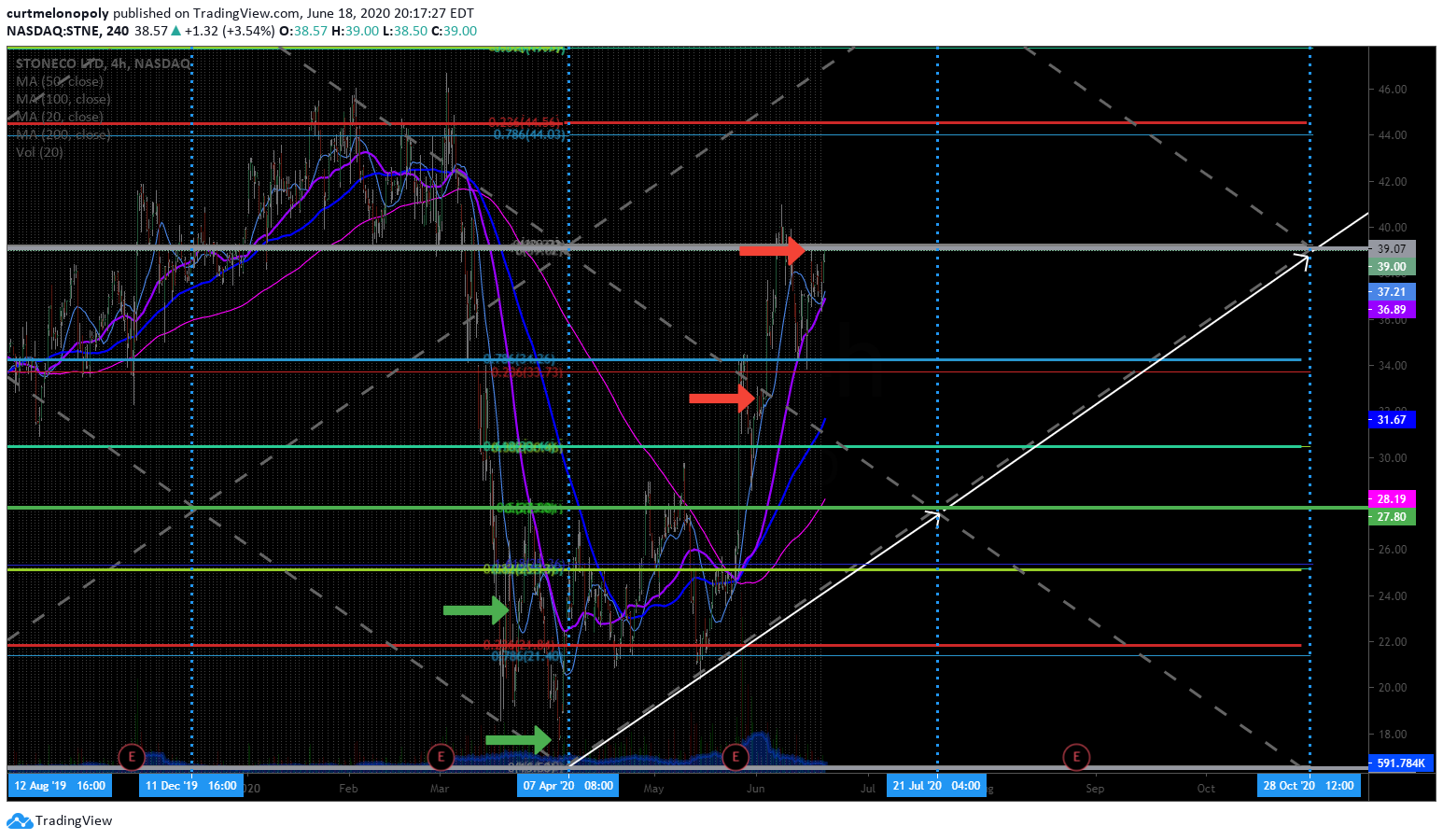

What #timecycle #swingtrade looks like on structured model.

Vertical blue lines are time cycle peaks.

Long IN SIZE & added IN SIZE in to time cycle sell off (blue vertical, trading fear) while others panic.

Near double $STNE time cycle trade

Alerts & charting

What #timecycle #swingtrade looks like on structured model.

Vertical blue lines are time cycle peaks.

Long IN SIZE & added IN SIZE in to time cycle sell off (blue vertical, trading fear) while others panic.

Near double $STNE time cycle trade🎯🏹🔥

Alerts & charting👇 pic.twitter.com/nlOqqKDqrx

— Melonopoly (@curtmelonopoly) June 19, 2020

“Long in SIZE” means that I entered this trade and ADDED to the trade in size. 4/10 sizing (20% on the initial entry and 20% on the adds) for me is massive. This means I was 40% in this trade long of what my maximum trade size tolerance was, most trades

I don’t get above 30% because I am a position trader within the structure of the financial instrument. I need room to get out of the trade if it goes against me.

How? I know where the next support is. If I’m in a trade 30% size I can amp up my size on a very short term at the next support say another 30% for a bounce back to my entry and clear out. If that leg support doesn’t bounce or hold then I need to exit the swing trade. This is how I win a significant percentage of swing trades, I manage size and I know the playing field of trade (the structure of the stock chart support and resistance).

You can see in the swing trade alerts in the above tweet with screen shots that my first entry didn’t hold and the trading price of the stock continued down. This is an example of sizing properly, managing risk and knowing your charting structure to win big.

My second entry, “the adds” were as price was collapsing in to the peak timing of THE TIME CYCLE (see blue vertical line).

The sell off was the COVID fear sell off and we were managing over 60 equity swings so the alerts weren’t the most clear, however, we do and did provide other reporting, swing trade $STUDY sessions and various other subscriber guidance. The screen shots of the swing trade alert feed provided are just some examples.

As the trade started to go my way I started to trim profits and today trimmed profits to the point of only having 5% of my original size left because a key area of the stock structure is where trade was post market today.

You can see in the chart below the time cycles, the key horizontal Fibonacci levels for support and resistance, the diagonal Fibonacci trend lines and the entries (marked in green arrows) and the exit areas of the swing trade (marked with red arrows).

I encourage anyone that wants to learn how to increase their win rate swing trading (or even day trading) and returns on trades to increase your Profit and Loss to learn how to trade time cycles.

The power of these structured swing trade set ups we are working with can’t be understated

2x – 10x wins with high probability & managed process to protect downside. And we’re coding it too.

Do your DD, review the alert feed and see for yourself.

#SwingTrading $VERI

The power of these structured swing trade set ups we are working with can't be understated 🎯🏹🔥

2x – 10x wins with high probability & managed process to protect downside. And we're coding it too.

Do your DD, review the alert feed and see for yourself. #SwingTrading $VERI pic.twitter.com/g7hYaNjmeW

— Melonopoly (@curtmelonopoly) June 18, 2020

An example of time cycles in volatility is in the article below, we are currently writing a series of time cycle articles for our swing trade members to learn how this trading strategy can increase profitability significantly.

In Part 2 we unpack exactly how this trading strategy works – technical analysis and charting the structure of the stock, trading time-frames, time cycles, advanced Fibonacci Retrace levels, sizing, exits and entries, risk management and more.

As always, if you have any questions reach out anytime [email protected].

Peace and best.

Curt

Current List of Available P&Ls (remaining dates are in progress now to be released soon):

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trades.

- Swing Trading Alert Profit Loss – Annualized ROI 1543.93% Feb 1-Feb 21, 2020. $200,000.00 – $230,051.00 #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trading Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics: Swing Trading, Time Cycles, Stocks, How To, Trade, Alerts, Charting

Premarket Trading Watch List: $MARK, $AKBA, $OSTK, $IQ, $NTRA, $VIX, $OVX, $CL_F, $USO, $SPY, Fauci and more.

Premarket Trading Watch List

Good morning Traders,

With stocks to watch and trades in play, on day trade alert side I’d like to see TL (diagonal trendline) on $OSTK break for a run. Also the overhead horizontal resistance on $AKBA for a run. We got the $IQ yesterday and first part of $OSTK and $AKBA. Check your charts sent out.

Congrats to $MARK longs, I didn’t get it but here’s your key resistance.

Your resistance mark on $MARK should be 200 MA on weekly (pink) just over 3.00 per beach side video last night #daytrading #premarket https://t.co/Xh0NxErgbn pic.twitter.com/xnpXlMEC4W

— Day Trading Alerts (@DayTrade_Alert) May 12, 2020

On swing trade alert side resistance over head near on $SPY model and $AAPL chart models. Of course we’re swing trading $AKBA and $OSTK also. Managing many others, nothing specifically yet today for new entries, after oil reports API EIA we expect more swing trade positioning / entries. $VIX and $OVX are on close watch for long starts soon-sh (see Sunday Swing Trade $STUDY Webinar video for more). There are countless plays on watch and many in play right now.

Also the $NTRA break out set-up is super interesting here, really strong yesterday – also see the weekend $STUDY videos for this and chart model sent out on Swing Trade Alert feed.

Oil trading alerts Sunday overnight and Monday were super quiet for both myself and EPIC V3.1.1, however, I expect this to change at latest after API could be sooner, for now see hourly for range trade – it’s a range trade because of the time cycle rounding the trajectory per model.

We do have Fauci speak today so go easy.

Will be in live room and will get on mic if active trade starts.

Beach Side Video from yesterday with some comments to above trading.

Beautiful day🙏🌴 $AKBA $IQ $OSTK $AAPL $MARK $$TLRY $GLD $SLV $BTC $$SPY $VIX $TSLA Trade size P&Ls Sunday Swing $STUDY

and more https://t.co/AAfsJkiPq3— Melonopoly (@curtmelonopoly) May 11, 2020

Any questions let me know!

Curt

Article Topics; premarket, stocks, commodities, watchlist, $MARK, $AKBA, $OSTK, $IQ, $NTRA, $VIX, $OVX, $CL_F, $USO, $SPY

Swing Traders $STUDY Guide “Trading Down Trend-Line Break-Outs” ARCUS BIOSCIENCES Set-Up (Premium Part 2 of 2) #swingtradingreviews

Part 2 of 2: Swing Trade $STUDY Review on ARCUS BIOSCIENCES (RCUS) Swing Trade Alert Trading Strategy.

“Down Trending Resistance Trend Line Break-out Swing Trade”.

Below there are so many secrets to our swing trading success, in this article we look at the following areas of trading discipline for your trading plan:

- Determining bias according to market time-cycles,

- How to scan for swing trading set-ups,

- How to determine price extensions for realistic price targets,

- Support and resistance diagonal trend-lines, horizontal trend-lines, Fibonacci levels,

- How to manage execution of the swing trade set-up,

- How to manage trading stops, trade sizing, ebb and flow trade executions at support and resistance.

Part 2 of this analysis (below) is a Premium Member Only article and Part 1 can be found here;

Determining Time Cycle Bias for Your Trades.

Recently I wrote a few articles on the topic of time cycles in the markets using the Volatility (VIX) structured time cycles, this is a great place to start when determining first your bias of being bullish or bearish. In other words, should you be more focused on swing trades to the long or short side?

You can find Part 1 of the two part article here: How to Swing Trade Volatility $VIX Time-Cycles (UNLOCKED PT 1): Achieve Higher Gains in Stocks, Commodities, Indices, Crypto, Currencies and Theme Trades.

If the trajectory of market volatility is down (compressed) and you are more confident that volatility will be lower as you approach the next time cycle inflection then in most cases you would be bullish equities – this of course is just one example.

Alternatively you would be bias to the down-side for trading volatility so you may short $TVIX in this instance.

There are many ways to take advantage of the time cycles with various swing trades from Indices, Currencies, Crypto, Sectors, Stocks and more.

Just because the volatility is expected to rise or fall doesn’t mean however this should be the only determining factor when choosing theme trade set-ups, below is an example of just that with the ARCUS stock trade.

First, lets look at how stock scanning works.

How to Scan For Stock Swing Trading Set-Ups.

Good stock technical analysis knows before the news hits more often than not what the likely trade on each stock will be.

Technical analysis knows before the news hits because the stock will start to provide “tells” within the trade action of the stock and various technical points become clear.

So if you can know the TA of a specific stock better than most you have an advantage over other traders at all times because you can usually be ahead of the main part of the move.

Anyone, even the best fundamental traders would do better if they were also experts at technical analysis.

If the technical structure of the chart is suggesting a bullish move for example, you can then start to take small entries and build a position in expectation of a move.

The technical “tells” develop when insiders know something about upcoming news or even as geopolitical narratives are changing.

And then as you start to see specific technical trade patterns set-up in more and more equities you will find that this is a manifestation of the expert traders all beginning to bias their trades toward a theme usually within a sector, whether it be for a technical reason or a geo-political reason or perhaps some other fundamental or market sentiment reason.

If you get in “the pocket” right, you will find many set-ups during a period of time that will be almost identical and will provide excellent returns one after another.

This is what happened with our trading of the technical set-up in RCUS, many others were very similar during this time period in the markets and our returns increased rapidly.

I keep it simple and use Trading View for my scans.

On any given day, usually sometime after lunch I will open Trading View and click on the fire emblem on top right side of screen – this is your hot-lists of hot stocks on the day (see screen shot of my Trading View below). You can set the scanner in Trading View for various levels and parameters. I scan the running stocks with large gains, the losers and the OTC markets.

Then I simply open each chart (primarily scanning the hot stocks on the day) and I start with the weekly time-frame.

I’m looking for chart history or patterns of trade, chart memory or some semblance of chart history with some order. The simpler the chart patterns the better. Anyway, as you learn all the different set-ups this gets much easier and faster.

Every financial instrument I trade I make sure that it has a structure, some order is required or your trading edge is not increased.

When I find a chart set-up I like I open the chart and take a look at it on various time-frames and consider how to trade the stock, price targets and various support and resistance levels.

Then I look at things like incoming volume, company news, sector themes, geopolitical type things, look at insider buying or selling and various other research.

During the period of time we took the swing trade in ARCUS the trend-line resistance break-out trade was happening regularly and was providing excellent returns for 2 – 6x and even more in some cases wins.

When I Used the Scanner and Isolated the ARCUS Swing Trade Set-Up It Was Yet Another Trend-line Resistance Set-Up That Was Likely to Explode.

Below is the chart I found when scanning, it shows clearly the trend-line resistance set-up. The chart below is from one of the earlier swing trade alerts we sent out to members for this set-up. You can see the spike through the trend-line resistance (which occurred after the original alert).

You can clearly see the down-sloping trend-line in the chart on the alert.

This set-up was on high alert because this specific trade set-up was hitting one after another, if this was not the case I wouldn’t have been so keen on taking these trades.

you want to be where the wolf pack is

It is the theme that is important, you want to be where the wolf pack is, where all the other winning traders are. Just a winning set-up isn’t enough. Just a news event or a fundamental set up on its own is not the optimal scenario, you want to be where the flow is. This is critical.

And then as the trade progressed (after alerting the swing trade sometime earlier) the structure of trade was clear and it was just a matter of trading risk in ebb and flow (see chart below).

It is important to note that we cannot alert every pull back and add and trim, it isn’t possible, what we do is get our members started in a swing trade and then endeavor to alert the key trades (especially key areas of resistance) as it progresses. Our trader’s platform (automation for alerts) will solve this manpower issue, but really every trader should be planning their sizing and support and resistance adds and trims for profit based on their own account risk, risk tolerance, style and more. If you are just blindly following another trader this will not work for you.

Charting Price Extensions for Price Targets and Timing.

This can be more art than science and your price extensions and price targets may change as the price or timing of the stock price movements move along.

In the chart below you will see diagonal white arrows (3 of them). The angle is just a reflection of the down-slope (a mirror of the angle). The length of the price extension is simply a mirror of the down-slope trend from previous. So each of the 3 arrows trending up are equal in duration and price.

These are a simple way of taking a shot at the most probable price extensions.

One key note here is that often you will get 1.5 extensions or 3. Why I don’t know. If you look at the chart below that is how I determined my price target from 15.00 to 30.00 and in last weeks trade the price target was hit early.

You will also notice (in blue on chart) I drew in an Elliott Impulse Wave, but I do that more for fun to see if I can tell the exact future of the play, you can see in this instance I was close, but the bulls were more aggressive than I even thought they would be.

Support and resistance diagonal trend-lines, horizontal trend-lines, Fibonacci levels.

In the chart above the diagonal trend-lines (charted in advance of trend-lines being there) are determined by taking the down trending price action of prior and extending the the tops of each lower high as the stock traded down in trend. the angle of the trend-lines was simply determined by historical trade.

The horizontal trend-lines (thin grey ones on the chart) were determined by simply drawing horizontal rays at the highs in the previous downtrend then duplicating to create a grid. These are not that important, I use them to see if there is a grid to be had. Why? Because I’m looking for order or structure.

And then the Fibonacci levels are simply done using your Fibonacci retracement drawing tool between the key support (or bottom of chart) and the price extension top. And then you copy and paste it up for each key leg in possible future trade. I always chart the low and high as horizontal key support and run them straight across horizontally on the chart as grey or green as these represent key areas of support and resistance.

How to Swing Trade It – manage execution of the swing trade set-up: Starter positioning, trading stops, trade sizing, ebb and flow trade executions at support and resistance.

Usually, when price breaks the trend-line resistance to the upside this is your trigger to be at least on watch for your initial entry.

You need to determine how many entries you are prepared to take. Hopefully it is more than one and preferably up to 10. Here is why;

When price breaks out upside the trend-line you want to be able to take at least a starter right away because most traders will wait until price returns to the previous resistance now support for the test of support and then go.

Some will even wait for it to bounce and get higher than the previous candle. All methods are fine but if you’re in it to win it then I would suggest taking 1/10 size at each of those three triggers I just explained.

Why? Because sometimes price doesn’t come back to you. The stronger the theme, the stronger the market, the stronger the stock set-up the less chance it’s coming back to you and then you’re chasing it.

Now if you’re in 3/10 size or 30% size and your trade breaks down, you’re down on your trade but if you are winning 80% or better you can lose 10% 2 out of 10 times and win 30% or more 8 out of 10 times.

In the ARCUS example price never came back.

I look at every trade like a chess board, the more dot plots or entries and trims of profit the better, this is how we’re coding the 200 equities to trade under the machine trading program and how we’re coding the trader’s digital platform so members of our swing trade alerts will be able to see this real time. Until then, there is myself and three staff managing the numerous trades in various equities along with coding, alerts, newsletter publications and various other duties – hence the reason for coding automation.

Now, in the ARCUS example above you would have taken your starter 10 – 20% in size and it didn’t come back, what it did is it hit the first key resistance and then came back.

AT THAT RESISTANCE you need to trim 50% of your profit and then add to the trade at key supports in bits until it bounces and then continue with taking profits along the way at each key resistance.

Managing your trade size is critical. If you’re only going to be a one hit wonder, taking one entry for the win then you need to learn how to bring your charting down to a daytrading time frame so that you can execute your position on a lower time-frame of charting like a 5, 15 or 30 minute chart. I have an article coming on this discipline but in the meantime if you need to know how I do this ask me for a coaching session and I’ll show you.

Setting your stops is based on many things and this is why I don’t like publishing alerts with stops. This is determined by your experience (newer traders have to take more cuts because they don’t know what a prime set up is) so newer traders have to use hard stops religiously, I don’t because I know I can dot plot my way out of any trade as long as the stock isn’t destroyed by some black swan event.

In a black swan (market wide) I don’t worry because I’m in structured strong set-ups 90% of the time. If it’s not a strong set-up I’ll usually alert that or if its risky etc.

newer traders have to use hard stops religiously, I don’t because I know I can dot plot my way out of any trade as long as the stock isn’t destroyed by some black swan event

All of our trades we are sizing adds at support and trimming at resistance areas. There are many things that determine this also, such as market time cycles, market sentiment, sector sentiment, perhaps the technical set up is no longer being run by the bulls and many other factors.

False break-outs happen so you need to be prepared to take a loss, but when you get better at being able to determine key set-ups for all the reasons above and more you won’t be as concerned about that.

Other considerations technically speaking;

Most traders will wait for the current chart candle to close beyond the down-sloping trend-line resistance so they have a confirmed break-out, but remember, sometimes this won’t happen and a really bullish stock will just leave you in the dust.

Most traders will take their initial long starter position in the trade when the stock price has retraced back near or at the original trend-line, but again, this does not always happen and you can get left behind.

Most traders will set their stop just beyond failure of the trend-line but this can cause a trader’s account balance to be dwindled due to death by a thousand cuts.

The secret here is to not be most traders.

In this game if you are like most you will have like most (at best) returns, around 15% a year if you are lucky.

The traders that consistently post returns of 3, 4, 5 x or more per year are using a strategy that most do not.

What is that?

How did Wayne Gretzky explain how he played hockey? He had a knack at knowing where the puck was going to be so he went there.

“Skate to where the puck is going, not where it has been.”

— Wayne Gretzky

“Skate to where the puck is going, not where it has been.”

— Wayne Gretzky

— Melonopoly (@curtmelonopoly) April 26, 2020

Same thing here.

Below is one of many of my rants on the subject, on my personal twitter feed;

Great question RE: Bitcoin $BTC trade bull or bear cycles within the next two global market time cycles. #timecycles #trading https://t.co/2CAQIOjvxL

— Melonopoly (@curtmelonopoly) April 25, 2020

If you get good at what I am describing above you will always know in advance (with high probability) when the price of the stock is going to move that you are trading, so manage the risk between where it is and where it is going like a chess board and you will see returns of 3, 4, 5 x or more per year.

Any questions email me anytime at [email protected].

Thanks

Curt

Current List of Available P&Ls (remaining dates are in progress now to be released soon):

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trades.

- Swing Trading Alert Profit Loss – Annualized ROI 1543.93% Feb 1-Feb 21, 2020. $200,000.00 – $230,051.00 #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trading Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; swing trading, swing trade review, study, stocks, alerts, set-ups, patterns, break-outs, themes, support, resistance, trendlines, sizing, stops, risk, technical analysis, Fibonacci, price targets, price extensions, strategy.

How to Swing Trade Volatility $VIX Time-Cycles (UNLOCKED PT 1): Achieve Higher Gains in Stocks, Commodities, Indices, Crypto, Currencies and Theme Trades.

PART 1: How to Swing Trade Volatility $VIX Time-Cycles and Achieve Much Higher Gains (ROI) in Equities, Commodities, Indices, Crypto and Theme Trades.

In my opinion, this is the single most important skill a trader can possess, charting and trading time-cycle inflections within the markets.

Below is Part 1 of my new $STUDY guide series for swing traders and daytraders alike.

I am asked all the time why my Swing Trading win percentage is high, most assume I am a mystic of some sort because I always write about or share on social media charting or comments relating to market time-cycles. Seriously, people message me all the time with these sorts of assertions or questions.

In the technical analysis work I do in time-cycles there is nothing mystic about it at all. I don’t sit on a tripod, I don’t meditate (at least in the way you might imagine), I don’t look to the stars or special numbers. I use structural mathematical chart modeling and more often than not geometric charting structures built on Fibonacci levels.

Every financial instrument has a natural trading structure, patterns or as some refer to it as chart memory.

In nature all entities have a natural order or structure, this is the premise of Fibonacci. Financial instruments are natural in that they are traded on public markets by humans – this makes the instruments natural in structure.

However, there are times where specific events such as world calamities occur like COVID-19 Black Swan Event, the Iraq war, the 911 terrorist attack etc.

During these times the trading structure of financial instruments is more often than not divergent – or trading outside of its natural structure.

Central bank intervention (QE) can also cause divergent trade within a stock, commodity, indices etc as can company news (referring to publicly traded stocks). The smaller the company the more opportunity for divergent trade outside of the natural structure. Here the trade instrument or market liquidity becomes important.

If then random events cause the natural trade action of a stock (or whatever) to not be normal this is usually accompanied by increased volatility. A great example of this is the recent COVID-19 Black Swan Event and how it affected various markets around the world.

A specific example can be seen in the trade action of crude oil futures, and more specifically the trade volatility of crude oil, which is called or traded as symbol $OVX . Oil volatility (OVX) was trading in the 20’s (where we were accumulating based on time cycle work) and when the Black Swan event hit the price of $OVX Oil Volatility hit 334.00s, an incredible win. This was all based on time cycle work.

Below is a chart showing the trade action of OVX (Oil Volatility) during the COVID-19 Black Swan Event.

So if we know that specifically time cycle events (that normally come with increased volatility) occur within public markets then is it possible that knowing the structure of volatility (VIX) itself and related financial instruments such as oil volatility (OVX) can assist with a trader’s bias for trading various stocks, metals, currencies, crypto, indices and more?

The answer is yes. But it gets better.

Each instrument itself has its own natural order, or structure. The instrument structure say for example with Apple (AAPL) stock can then be charted on various time-frames from weekly, daily, hourly etc (we chart on thirteen time-frames). This provides a trader with the structure of timing for volatility and price trajectory on various time-frames, for investing, swing trading and daytrading.

And it even gets better (like the TV commercials haha) because when a trader understands how the volatility (VIX) and market time-cycles can line up and also with various themes (for example stock or sector themes) then things get really interesting for your ROI because now you have all structures of trade firing together in a symbiotic fashion. It becomes pure trading ecstasy.

This my friends is why our swing trading platform is so successful and why we structure our trade bias the way we do.

When the iron is hot we strike (time cycles) and when it cools we are taking profit and in deep $STUDY of the financial instrument structures and time cycles.

Another recent example is when the market bull seemed as though it would never stop, and four days before it stopped in a very volatile fashion we publicly announced that we were taking our profits and leaving our long positions behind, we cashed out. This, was done with time cycle work.

The tweet below explains (and shows the actual swing trade alerts) of some of our time cycle work,

I am explaining that I knew about the Black Swan event coming (called it Dec 19, 2019) and then on February 13, 2020 4 days before the market started to collapse we publicly announced we were taking our profits in the bull run home and closing longs.

And then even better yet, we sized in to shorting NIKE, WYNN and MASTERCARD for epic wins. This is where your profits are, in the time cycle inflections, everything else is $STUDY and positioning (managing size and getting your position and trajectory of trade right for the boom).

“Dec 19 call for pins to be pulled, last time cycle published, Feb 13 out of long positions 90% (publicly) then we hammered down short $NKE $WYNN $MA etc..

Why is this important?

For a victory lap? How bout truth.

#Timecycles, market instrument structure.

Natural law.”

Dec 19 call for pins to be pulled, last time cycle published, Feb 13 out of long positions 90% (publicly) then we hammered down short $NKE $WYNN $MA etc..

Why is this important?

For a victory lap? How bout truth.#Timecycles, market instrument structure.

Natural law.

🎯🏹🔥 pic.twitter.com/sV4NgPrcqs

— Melonopoly (@curtmelonopoly) April 5, 2020

So in part two of this article (it will be Premium member only) we will look specifically at Volatility (VIX) and how the time cycles within volatility work and then we’ll move to various stock theme swing trades we are looking at in this current time cycle along with also doing some articles over the coming days on the trade set-ups within this cycle for crypto, metals, indices, currencies and more.

This time period now is all about getting ready, understanding how time cycles work, starting to get our positioning in the various themes of trade and watching for the trajectories to line up between now and the peak of the next time cycle and the one after.

Also, before I forget, I am also going to be covering in articles for our members soon the need for a proper trading plan before entering your trade including how to size your trade, how to ebb and flow the support and resistance within the structure, sizing and trading the time cycle inflections of the instrument and more.

If you need help with a trade set-up email me at [email protected].

Thanks,

Curt

Part Two in this $STUDY Series can be found here:

Current List of Available P&Ls (remaining dates are in progress now to be released soon):

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trades.

- Swing Trading Alert Profit Loss – Annualized ROI 1543.93% Feb 1-Feb 21, 2020. $200,000.00 – $230,051.00 #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trading Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; swing trading, time cycles, volatility, VIX, stocks, commodities, crypto, metals, indices, trading, currencies, Fibonacci, charting, markets, black swan events