Tag: Trading

Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

Trade Set Up Reviews for Swing Trading Earnings Thursday Feb 14, 2019.

Swing Trading Signals in this Report: $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas.

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Investing.com Earnings Calendar: https://www.investing.com/earnings-calendar/

Earnings Whispers #earnings for the Week:

#earnings for the week

$NVDA $CGC $SHOP $ATVI $TWLO $GOOS $UAA $AMAT $CSCO $TEVA $KO $L $KMPR $CTL $GRPN $CNA $MPAA $NGL $QSR $CHGG $DO $AVYA $WM $ANET $CYBR $PEP $EXEL $NSP $YELP $MCY $GOLD $MRO $RNG $DGX $NTAP $ICBK $DE $NRZ $YETI $JLL $MOH $AKAM $OHI

#earnings for the week$NVDA $CGC $SHOP $ATVI $TWLO $GOOS $UAA $AMAT $CSCO $TEVA $KO $L $KMPR $CTL $GRPN $CNA $MPAA $NGL $QSR $CHGG $DO $AVYA $WM $ANET $CYBR $PEP $EXEL $NSP $YELP $MCY $GOLD $MRO $RNG $DGX $NTAP $ICBK $DE $NRZ $YETI $JLL $MOH $AKAM $OHIhttps://t.co/lObOE0dgsr pic.twitter.com/cTAZxWC37n

— Earnings Whispers (@eWhispers) February 9, 2019

Earnings Season Special Reports Thus Far:

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Ups:

ALPHABET (GOOGL):

Google (GOOGL) swing long starter 1135.56 PT 1158 1210 1266 1319. Will add as trade improves. #swingtrading $GOOGL

I entered this trade early Wednesday because broad market conditions appear to be improving (geopolitical etc). It’s a probability play. My position is 1/5 size because I am not ready to leg in to swing trades yet. But I am close.

My downside tolerance is more on this trade than my other new entry in Nike long. Under 1078.00 would cause concern. It closed at 1128.63 and my entry was long 1135.56.

https://twitter.com/SwingAlerts_CT/status/1095697800023732224

NIKE (NKE):

NIKE (NKE) swing long 84.84 is a break-out play with tight stops price target 1 is 88.65 then 91.39 and so on. #swingtrading $NKE https://www.tradingview.com/chart/NKE/Ddrfhb9k-NIKE-NKE-swing-long-84-84-is-a-break-out-play-with-tight-stops/ …

Nike long early today is momentum trade for me with specific targets. My downside threshold is minimal. Trade is on the right side right now and I will watch this one close. I am in long 1/5 size and don’t expect to size in more but that is yet to be seen. It closed the day 85.40 and my entry was 84.84 long.

https://twitter.com/SwingAlerts_CT/status/1095699317887852544

ARROW PHARMACEUTICALS (ARWR):

Arrow Pharmaceuticals (ARWR) Long from mid 15s looking for adds long at channel support pull back $ARWR #swingtrading

I am long on a long term swing mid 15’s, trading 17’s and looking to add soon – preferably at channel support (or near).

https://twitter.com/SwingAlerts_CT/status/1048151441704214528

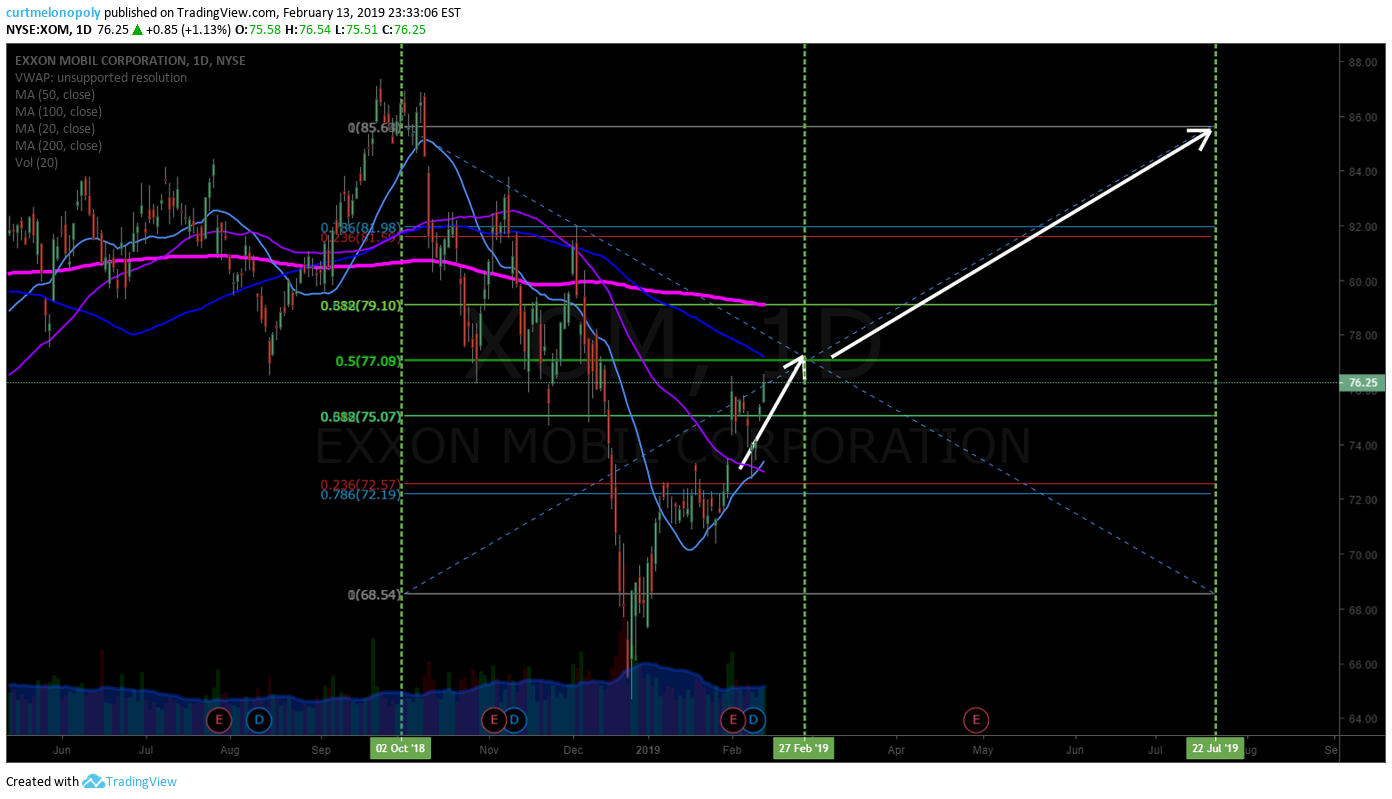

EXXON (XOM):

EXXON (XOM) holding initial position, near first price target, will trim in to that and add above #swingtrading #earnings

I am long from 72.60 as an earnings play. Close Wednesday 76.25. Long term swing in to late 2019.

https://twitter.com/SwingAlerts_CT/status/1090997581897961473

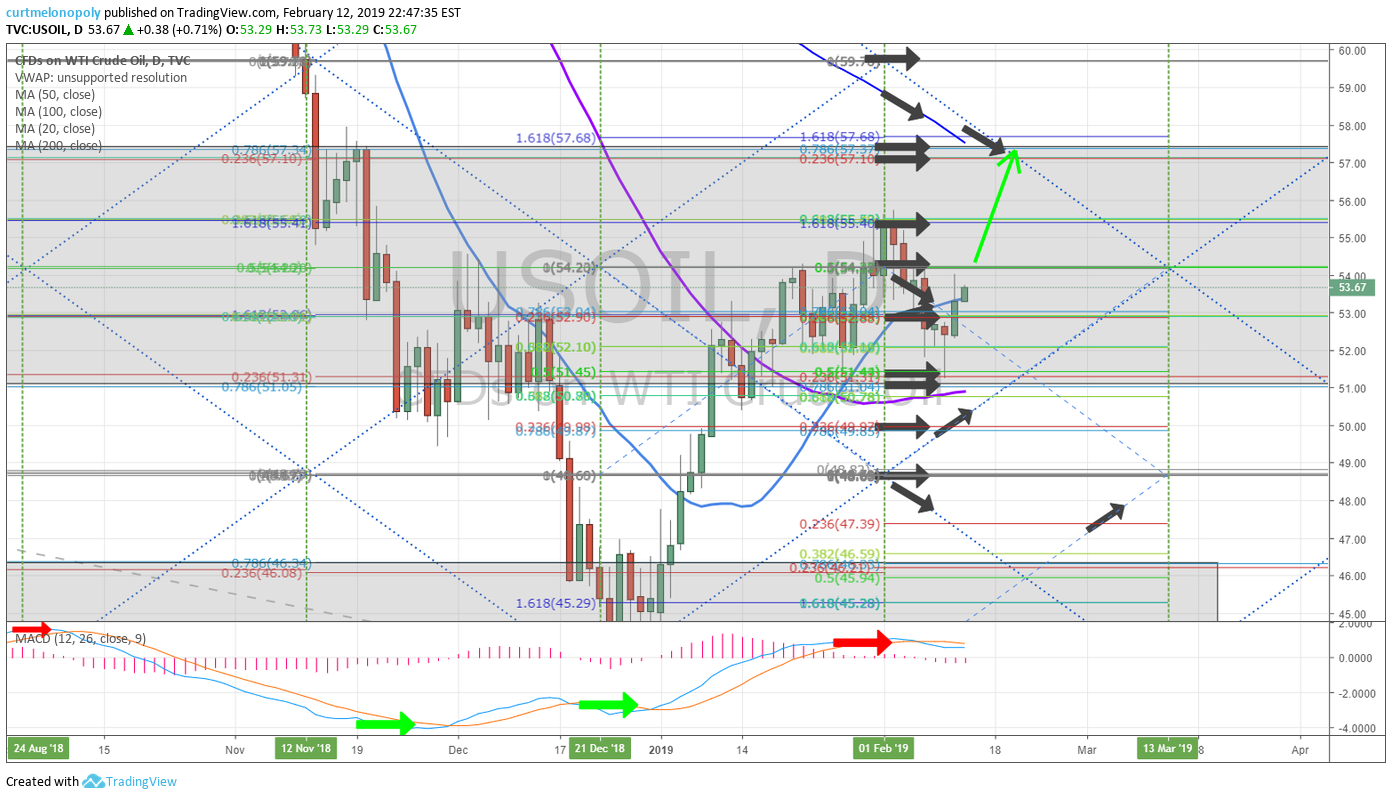

CRUDE OIL SHORT (DWT):

I’m holding this small starter swing trade position a bit longer, at minimum I’m thinking I close it for a small loss if oil swings down a bit. I’m watching a chart structure per below.

I’m long 10.59 1/20 size and it closed at 9.21 Wednesday.

Below is the original trade alert:

Long DWT 1/20 size 10.59, will build position as it develops. Moderately tight stops. Target 50.42 1st price target on FX USOIL WTI.

https://twitter.com/SwingAlerts_CT/status/1094969929974145025

DWT long (short oil) swing trade position needs to hold here, if it does follow the trendline up. #Oil #Short #swingtrade

Crude oil has two choices here, up and down trajectory shown with arrows on the daily chart.

GOLD (XAUUSD, GC_F):

Gold short trade 1/20 size 1319.78 entry holding and looking for adds. Gold trading 1308.55 intra-day at time of report.

Probability is for a pull back in Gold trade at resistance on this chart. If price gets above I will add short.

The original trade alert is below:

Starting Gold short position 1319.78 with initial price target 1186.00. 20 % sizing will add to 100% when it confirms. See Gold report for trading plan including dates and price targets due soon.

https://twitter.com/SwingAlerts_CT/status/1090810500001210368

BITCOIN (BTC):

Bitcoin has a decision to make soon at red trend line. Position long is assuming next is up in trade from base. BTC.

Long 1/5 size 3449.50 trading 3583.00 intra-day.

Original trade alert is below:

Starting a swing trade BTC Bitcoin on XBTUSD long 3449.50 price target 4200.00. 20% sizing. When it confirms will add to 100% – see Bitcoin report due soon. #swingtrading $BTC $XBTUSD

https://twitter.com/SwingAlerts_CT/status/1090809528633962496

NATURAL GAS (NG_F):

I am searching for a new trade in natural gas. The last one paid well.

Possible bounce on Natural Gas here. NATUSD NG_F $UGAZ

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas

Strategies for Day Trading and Swing Trading Crude Oil | Premium Member Newsletter

Strategies for Crude Oil Futures Trade February 12, 2019. Includes Rule-Set Instructions.

Below is the oil futures trading battle plan for day trading, swing trading intra-day and longer term swing trading.

This report includes a section that breaks out much of the rule-set for the 1 minute model with an actual trade progression as alerted in the oil trading room and on the Twitter alert feed. The report on whole provides key insight in to the rule-set we are using.

If you want to learn how we traded for over 63% gains last month, study this report and any recent reporting and videos closely. Our software techs believe 500% is not out of the question. I know it’s lofty, but when you consider the current win rate (over 90%) and that last months trading gains were only as a result of trading less than 10% of the time you can then begin to appreciate the power of a winning systematic oil trading rule-set.

The EPIC Crude Oil Algorithm Reporting below is an alternate format to the regular format – we will be using alternate formats during a period of establishing simplified trading strategies for our members (the trade rule-set).

Links for the 1 minute model and the 30 minute EPIC model are provided separate of this report to members as they are slightly different for different distribution lists (retail, commercial, institutional variations). If you need either please message us preferably at [email protected].

Oil Trading Strategies Below are in Large Part Based on the EPIC Oil Algorithm Charting Model.

We Weigh Trade Probabilities on all time-frames against the EPIC model. This is important to consider when assessing our trade alerts for your own trading plan.

The EPIC Crude Oil Trading Algorithm Model below is by far the most predictable model we use for trade (30 Minute chart model).

The 30 minute EPIC model provides a general trading structure for the day. Important areas of support and resistance should be considered. It is common for the outside quad walls to be tested on the upside and downside. Long trades at the bottom support and short trades at the top of each quad or channel should be considered. Specific points of trade execution should be considered on lower time frame charting models.

On the EPIC Algorithm model a trade in to top of quad range is probable if price is over mid quad.

Refer to historical EPIC reporting and videos on yYouTube for ways to structure trades in the model.

- Trading the Range of the Quadrants and Range of the Channels:

- Respecting the key resistance and support areas of the oil trading model at quadrant walls (orange dotted), channel support and resistance (orange dotted), mid quad horizontal support and resistance (horizontal line that cuts through middle of quad) and the mid channel lines (light gray dotted).

- We are finding that when oil trade is not in an uptrend or downtrend and is trading sideways around a pivot that trade will often test the mid channel lines (gray dotted) of the model. This causes the predictability of the quadrant support and resistance to be less (trade at quad support and resistance can be “sloppy”). This trade action in the model makes logical sense as a trend is not in play for an up or down channel. Another way to describe it would be trade using half quadrant support and resistance. While trade is in a sideways pattern on the daily your intra-day crude oil trading strategy should reflect this scenario. See examples from trade below:

-

“the predictability of the quadrant support and resistance to be less #crude #oil #trading #strategies” -

“when oil trade is not in an uptrend or downtrend and is trading sideways around a pivot (as it has the last eight or so trading days) that trade will often test #oil #trade”.

-

- Trade Size.

- Sizing should be considered at key support and resistance of the EPIC model structure. The model can be used to determine sizing bias on tighter time frames on one minute below. Sizing can also be a consideration for short term swing trading oil in the model.

Per previous;

Screen capture of trade moving through EPIC Crude Oil Algorithm range Jan 16 – 20. The quadrant walls and mid channel lines are support and resistance.

Timing Trades Using the One Minute Oil Chart Model.

- Volume.

- Wait for volume. Low volume periods have lower predictability in the models. Often early in futures trade and after 2:30 oil settlement daily are commonly low volume periods of trade.

- Trend.

- Determine the intra-day direction (trend) of trade. Strong bias should be considered for long or short positioning based on intra-day trend. Upward trend bias to long positions and down trend intra-day bias to short positions.

- Determine the trend on the daily chart also, some bias should be toward that. Watch the MACD on the daily, although it is a moderately late indicator it does confirm bias / trend.

- Check important timing for key global market open hours (inflections in intra-day trend can occur there, especially going in to New York regular market open).

- Support and Resistance.

- In an uptrend try and execute on support of the range on the one minute trading box (short term pull back) – the opposite is true in a downtrend. Break-up or break-down trades are more risky but can return positive results as long as a trader closes losing positions quickly.

- Trade Size and Positioning.

- In a predictable structure sizing intra-day should be maximum at entry and trims at mid trading box and top or bottom of trading box – specific to the 1 minute chart model. Our software for instance will enter with 10 contracts and release size as trade proves. See example below:

- Our trader in crude oil trading room providing signals for trade alert that went out to members – screen capture.

- “M – Machine sell program initiated. Short 52.44. Stop 52.61 or buy program detected. 1 Min model price targets 52.29 52.11 51.88 51.66. Support 51.73 on recent 30 min model in trading room and 52.50 52.38 52.19 51.75 EPIC. Resistance 52.62 52.75 53.04 53.16 53.51 EPIC.”

-

Our trader in crude oil trading room providing signals for trade alert that went out to members – screen capture.

- Our trader in crude oil trading room providing signals for trade alert that went out to members – screen capture.

- Position size and trimming to take profits as you go should also reflect key resistance and support on the EPIC algorithm model.

- Trim positions at mid trading box and top of trading box on the one minute chart model for long positions and the opposite is true in shorting. In a squeeze or sell-off this is more difficult and typically a trader will have to trade the break upside at resistance or downside as support is breached because pull-backs are not as likely in a squeeze.

- In a predictable structure sizing intra-day should be maximum at entry and trims at mid trading box and top or bottom of trading box – specific to the 1 minute chart model. Our software for instance will enter with 10 contracts and release size as trade proves. See example below:

- Using Trade Stops.

- From the example above, you will see the stop was set at 52.61 with allowance for a stop also to be triggered if momentum change was detected. “Stop 52.61 or buy program detected”.

- From the oil trading room see also this comment “M – there is a directional move component of the code (that will be included on rule-set that is in final edit tonight). If a move starts and doesn’t directionally continue with prescribed velocity, program will close at entry or prior.”

- The screen capture of the one minute chart below shows you the determined location for the stop for the trade.

- The stop was set just above VWAP and the resistance on the pivot trading box. Above is important to allow for other stops. Your stop will be a total of about 13 – 19 ticks depending on exact entry point.

- You will also notice that I have drawn the Fibonacci retracements on the chart to determine where the trading box pivot resistance is on the one minute model. If you do not know how to do this, be sure to either watch the videos we have on our You Tube channel, read through recent reporting or obtain some private coaching. We do not include the Fibonacci levels on the model because it makes the chart difficult to load on many machines – especially laptops.

-

The stop for the oil trade was set just above the pivot resistance and just above VWAP.

- The stop was moved to the trade entry point in the example below, as trade proved itself below the pivot support. “M – Machine stop at entry”.

- The stop at entry now put us in a no loss position. It was not moved until trade was below the pivot support AND trade hit the first Fibonacci support. Oil trade then bid up to 1 tick under the stop and entry point a number of times before continuing down intra-day.

- To be even more precise about the trade short entry point and the location of the stop you would have to view a fractal of the Fibonacci levels one down. This is not required or reasonable for the day trader executing orders manually to do, it would be too cumbersome for most traders. However, if you want to learn how to do this you can either get in to some trade coaching or ask at our next webinar for oil trading that will be held late February. I am simply pointing out that the precise entry and stop was not coincidental and the fact that trade returned to just under by one tick and ran sideways for nearly 30 minutes was no coincidence. That is machines in the oil trading market.

-

Oil trade dropped below pivot trading box support and hit first Fib mark and stop was now set to trade entry point.

- From the example above, you will see the stop was set at 52.61 with allowance for a stop also to be triggered if momentum change was detected. “Stop 52.61 or buy program detected”.

- Timing Trade Entry.

- The main trading box on the one minute is the support and resistance of the range (where the red and blue dotted and white dotted are).

- Below is an example screen shot of oil trade from the oil trading room example above that shows the intra-day trend of oil trade and the entry point short under the support which is now resistance.

- Trade was trending down in futures from open. Oil was now trading under support on 1 minute chart model, now resistance.

-

Crude oil trade short example chart shows intra-day trend, breach of support and execution of trade on chart.

- Below is an example screen shot of oil trade from the oil trading room example above that shows the intra-day trend of oil trade and the entry point short under the support which is now resistance.

- To pin point timing to the second you can use the pivot areas (top and bottom of range) and monitor the coil around the main support and resistance areas and use the smaller trading box around the pivots. Recent blog posts / videos discuss this and I will discuss further in near term video / blog posts.

- Indicators on the one minute that I use are the Stochastic RSI, MACD and Squeeze Momentum Indicator. The nature of these indicators on a short time frame like the one minute can be deceiving for even the more advanced trader. Use them with caution.

- The main trading box on the one minute is the support and resistance of the range (where the red and blue dotted and white dotted are).

- Using the Oil Trade Alerts.

- You can utilize our oil trade alerts in three main ways;

- The live trading room provides charting and voice broadcast from our lead trader. This is not a chat room – it is intended for traders to be able to hear our lead trader call trades live and view the charting he is using. Any chat is specifically kept to key signals from traders in attendance. This is primarily used by full time traders, institutional or private trading firms.

- The oil trade chat room (private Discord server) is for chat and oil trade signals etc. You can get push notifications to your phone for quick alerts. This is faster than the Twitter oil alert service provided but not as fast as being in the oil trading room with our lead trader. But the lead trader is not always in the live room so Discord provides fast alerts.

- The Twitter EPIC oil alert feed is also used by some of our traders.

- Trade alerts as shown in oil trading room (specifically the chat room private server on Discord) for trimming the short position as it proves out.

Trade alerts as shown in oil trading room for trimming the short position as it proves out. - Screen image of the oil trade alert feed on Twitter as the trade progressed.

-

Screen image of the oil trade alert feed on Twitter as the trade progressed.

- You can utilize our oil trade alerts in three main ways;

- Trimming Positions.

- In the example above (the screen shot of the Discord private member chat room), you see a series of trade alerts from our trader signalling position trimming.

- First Price Target Achieved. “M – first target hit 52.29 trim 10%.”

- The position was trimmed at 52.29 per the original alert signaled as follows “1 Min model price targets 52.29 52.11 51.88 51.66.”

- The amount or size of trim (cover) on the trade was determined to be 10% because this was only the first target in a highly probable trade. The probability rule-set encompasses about 5700 rules so we won’t go in to that here and is not needed for the oil trader to be highly successful using this trading system.

- The first price target alerted was 0.5 retracement on Fibonacci on 1 min oil trading model.

- Notice how trade reversed after the target was hit and was denied at the bottom of the pivot trading box and just under VWAP. Comment from lead trader in the chat room “when it dumped at 52.37 that was a VWAP touch at resistance – boom.”

The first price target alerted was 0.5 retracement on Fibonacci on 1 min oil trading model.

- Price Target 2 Hit. “M – Trim 20% 52.17 at target 2 @ 52.11 short time frame momo reversal”.

- When price misses a target and reverses, which is what it did in this instance (by a fraction), our rule-set in the strategy is to trim the position.

- The size of the trim was in accordance to price target 2 trim size in the rule-set, which is 20%.

- Below is the oil chart model showing the location of the alert to trim size and trade reversing intra-day after meeting price target objective.

Location of price target 2 was the trading box support on oil chart. Trade reversed a fraction before.

- At 30 minute candle expiring trade alert was sent to trim 10% because oil trade held support. In this case pivot trading box support. See chart below that coincides with alert “M – trim 10% 52.03 on timing”.

-

At 30 minute candle expiring trade trim 10% because oil trade held support. In this case pivot trading box support. - Remaining oil trade alerts to trim winning trade. Strategy works well. Oil trading room screen image is below.

- Alerts provided were as follows; “M – trim at 51.94 on timing (target 2 @ 51.88), 30%.

M – Correction: target 3 at 51.88

M – trim 10% 51.88 target 3 hit

M – stop on remaining 52.13 or 51.67 if hit.”

- Alerts provided were as follows; “M – trim at 51.94 on timing (target 2 @ 51.88), 30%.

-

Remaining oil trade alerts to trim winning trade. Strategy works well. Oil trading room screen image. - Trade alert to close oil trade position. “M – stop activated on remaining position 52.13″.

- Oil chart showing where to trim short trade at next Fibonacci support line.

-

Oil chart showing where to trim short trade at next Fibonacci support line. - Oil trade alert produced a 57 point move for an excellent win. Chart shows the trade progression.

-

Oil trade alert produced a 57 point move for an excellent win. Chart shows the trade progression.

Per previous;

Day Trading Crude Oil Futures One Minute Strategy Model Jan 27 504 PM FX USOIL WTI $CL_F $WTI $USO #Crude #Oil #Daytrading

Per previous;

The main trading box range is shown in chart below with purple arrows and the pivot at support and resistance trading box is shown with white arrows (for micro timing decisions).

Also Monitor Oil Resistance and Support Levels on the 4 Hour, Daily, Weekly and Monthly Chart Models.

Beyond using the EPIC Oil Algorithm model for weekly / daily trading strategy / structure and the one minute chart model for timing day trades, use the daily, weekly and monthly chart models for important decisions in oil trade.

The longer the charting time-frame the more serious support and resistance areas should be considered. In other words, key resistance on the monthly or weekly charts trump consideration on the daily and 4 hour and so on.

Trading trend, indicators, support and resistance, support and resistance, indicators and more should have bias to your trade sizing and positioning.

Crude oil trading strategy on 4 hour chart model, key areas of support and resistance noted with white arrows.

Although a test chart (for our machine trading), the 4 hour oil chart below has been responding well to the bounce trend in oil trade so I continue to use it. The key areas of support and resistance are noted, however, all lines are support and resistance levels.

Symmetry on 4 hour oil chart model should be considered. Currently trading over 50 MA.

Oil trade met the price target on the 4 hour model perfect to timing. See charts below.

Per previous;

4 Hour Crude Oil Chart – 20 MA seems the most logical support test for a long trade entry test likely 52.90 area on West Texas.

The previously published chart shows primary support areas to watch (per below).

Per previous;

Symmetry on this 4 hour oil chart model should be considered also. There are 3 options for trade trajectory here.

Per previous;

Key resistance and support for day trading crude oil futures on 4 hour test chart for sizing strategy on machine orders.

Symmetry on this chart structure says 55.30 on West Texas Crude is likely near Feb 1 and down to target. #oil #trading #strategy.

Per previous;

And with this chart also, it is responding well but also is a test chart. I’ve been watching it closely as the support and resistance areas on the charting do seem to be in play. Our techs are back testing test charts.

Daily crude chart resistance 54.23, above that holds and 57.32 is in play for Feb 20, 2019 price target.

Per previous;

Daily FX USOIL WTI chart shows 54.14 Feb 1 price target still in play, look for spike or drop in to date. #crude #oil.

A pull back to 20 MA on daily chart is most probable.

Per previous;

Key support and resistance on daily crude oil chart is noted for day trading strategy.

Various points of resistance and support on weekly oil chart. Watch the red trend lines close.

Per previous;

Weekly FX USOIL WTI crude oil chart has been responding well also to market support and resistance areas for trade.

Per previous;

Key support and resistance noted on weekly crude oil chart for futures trade strategy.

Other charts are used in decisions for bias toward trade, some are included below and for others visit the private oil chat room on Discord.

30 minute intra-day crude oil sketch chart from Curtis’ trading desk.

https://www.tradingview.com/chart/USOIL/etSPbOpT-30-minute-doodle-chart/

4 Hour chart structure shows sideways trade in crude oil of late. Also shows timing coming due this candle.

It is also highly recommended that you review recent reporting, discord room chat (regular guidance is posted in the oil chat room private server) and the various videos that are released on a regular basis.

January 2019 Oil Trading Alert Profit / Loss.

Feb 6 – Day Trading Short for a Break to Downside Price Targets (How to with video).

How I Day Trade Crude Oil Short | Downside Break (Waterfall) | Oil Trading Strategies (w/video).

Jan 31 – Day Trade Timing Strategies for Crude Oil Trade Around Time Cycles and EIA.

Jan 28 – Day Trading the Support and Resistance of the Model. How to.

100 Tick Move | Crude Oil Day Trading Strategies | Trade Model Support and Resistance

Jan 27 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategies | Day Trading Crude Oil | Premium Member Weekly Guidance.

Jan 23 – Day Trading Crude Oil Futures for Compound Gains.

Not Just Concept: Day Trading Crude Oil 10K – 1 Million in 24 Mos at 10 Ticks Day (Compound Gains).

Jan 20 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – A detailed inside look at our day traders’ strategies in crude oil day trading room.

How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – By far one of the most important videos for day trading crude oil since our inception;

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Futures, Strategy, USOIL, WTI, CL_F, USO

Follow:

Swing Trading Earnings w/Video | Time Cycle, $TWTR, $FB, $AMD, $ARWR, $FEYE, $XOM, $BP, OIL …

Trade Set Ups for Swing Trading Earnings Thursday Feb 7, 2019.

Swing Trading Signals in this Report: Time Cycle, $TWTR, $FB, $AMD, $ARWR, $FEYE, $XOM, $BP, OIL and more…

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Investing.com Earnings Calendar https://www.investing.com/earnings-calendar/

Earnings Whispers #earnings for the Week

$GOOGL $TWTR $SNAP $CLF $TTWO $ALXN $DIS $BP $CLX $SYY $GM $GILD $CMG $GRUB $EA $STX $SPOT $AMG $SAIA $RL $CNC $EL $UFI $GLUU $MTSC $JOUT $PM $GPRO $LITE $FEYE $SWKS $LLY $MPC $BDX $REGN $VIAB $ONVO $HUM $ARRY $PBI $ADM $BSAC

#earnings for the week $GOOGL $TWTR $SNAP $CLF $TTWO $ALXN $DIS $BP $CLX $SYY $GM $GILD $CMG $GRUB $EA $STX $SPOT $AMG $SAIA $RL $CNC $EL $UFI $GLUU $MTSC $JOUT $PM $GPRO $LITE $FEYE $SWKS $LLY $MPC $BDX $REGN $VIAB $ONVO $HUM $ARRY $PBI $ADM $BSAC https://t.co/r57QUKKDXL https://t.co/Bm7PEKXynT

— Melonopoly (@curtmelonopoly) February 3, 2019

Earnings Season Special Reports Thus Far:

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Ups:

Feb 6 – Inflection? Mid day review tells you what to watch and when. #timecycles #swingtrading #daytrading https://www.youtube.com/watch?v=UCyiwmTDYno

Feb 7 – TWITTER (TWTR) over 34 targets 38.72 then 51, under targets 26.26. $TWTR #swingtrading #earnings

Feb 7 – FACEBOOK (FB) hitting first target from previous report, over 174.00 targets 181.50 then 195.00 $FB.

Feb 7 – ADVANCED MICRO (AMD) hit the upside price target early from last report, over 24.16 then 25.30 targets 29.

Feb 7 – BP Try and ignore chart noise and focus on price targets, over 44.30 targets 48, 57.50, 67 #swingtrading $BP

This is a really strong structure for a run in to Oct 2019 at minimum. 57.50 is my personal bias and I’ll be taking a long over 44.30. Price needs to hold 44.30 to make it work. Closed Wednesday 43.04.

Feb 7 – Crude Oil Swing Trade Set-Up. Try and ignore noise on chart, focus on upside downside price targets when oil price trades out of structure.

I really like this crude oil swing trade set-up. Will be watching very closely. Where price leaves the structure is still unknown and I will update the set-up at that point in time. If it runs up I’ll short $DWT again and if not I’ll long $DWT for the swing.

Feb 7 – EXXON (XOM) holding initial position, will trim in to target add above for continuation $XOM.

Feb 6 – ARROWHEAD PHARMA (ARWR) Holding this long term starter swing position in to earnings – on watch for adds $ARWR.

https://twitter.com/SwingAlerts_CT/status/1093191421048299521

Feb 6 – FIREEYE (FEYE) FireEye over 19.30 is a long to 22.50 test and under is a short to 17.59 then 16.20. $FEYE

https://twitter.com/SwingAlerts_CT/status/1093203230073503745

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, Video, Time Cycle, $TWTR, $FB, $AMD, $ARWR, $FEYE, $XOM, $BP, OIL

Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C …

Video Review. Trade Set Ups for Swing Trading Earnings Tuesday January 29, 2019.

Swing Trading Stock Signals in this Video Report from Mid Day Review in Main Trading Room Jan 28: $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C and more…

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://www.investing.com/news/economy-news/economic-calendar–top-5-things-to-watch-this-week-1758816

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://t.co/XL7cEWGMce

— Swing Trading (@swingtrading_ct) January 27, 2019

Earnings Season Special Reports Thus Far:

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Video Review:

VIDEO TRANSCRIPT SUMMARY (there is much more detail on video itself):

#swingtrading #earnings

Jan 28, 2019 mid day report.

It’s earnings season, this is the big week with over one hundred companies are reporting. I am bias to a bullish run post earnings in to May 2019.

The following is my bias;

When oil bounces I will be long Oil adding to DWT short, long SPY, Dollar not sure, Volatility short, Silver and Gold slightly bias to short, BTC short, Natural Gas is a timing thing.

Oil is reviewed at various points in this video as it trades intra-day.

Refer to charting in the premium member special reporting issued recently (links above).

TESLA (TSLA) normally I would be looking for a long in this range on the charting but I am looking for short in this one instance. Looking for 231.00 and possibly more is my price target. If wrong first target upside for Tesla in 330s then 380s. March 26 timing.

In other words bullish the market and bearish TESLA.

ALIBABA (BABA) strong resistance just under trading box here. Price target 238.00 range (178.00 – 208.00 is reasonable bullish target area in trajectory of chart). I am really bullish Amazon.

FACEBOOK (FB) I don’t like but it could surprise and run here. Fundamental view and technically it is a bit of a mess. Nature of news flow could be setting up for a short squeeze. 150 MA in 166s is likely first price target, trading 147s intra-day. If sell-off happens refer to previous model in reports.

MICROSOFT (MSFT) not reviewing, not the same risk reward as Amazon here so I will likely trade Amazon and leave MSFT be.

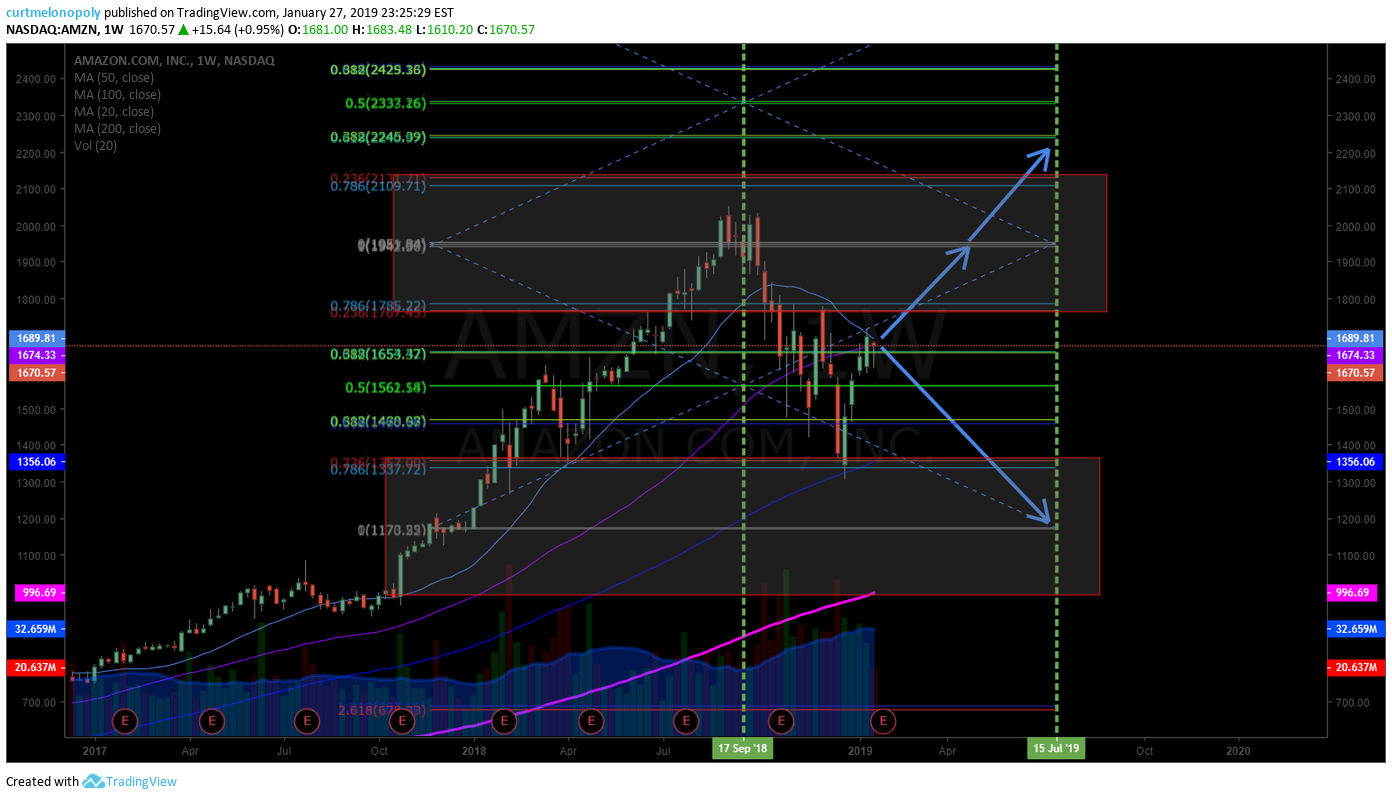

AMAZON (AMZN) price target 1946.00 and on a double extension is 2210.00 and even 2300s is possible in to July 2019. The price target timing is Feb 25 on the first area. 1173.00 is sell off target. The timing depends on the trajectory of trade post earnings.

EAGLE MATERIALS (EXP) trendline supports I am watching are the support areas I have as support, I’m looking for a bounce at the trend line with resistance at 73.00, 85.00, 91.00.

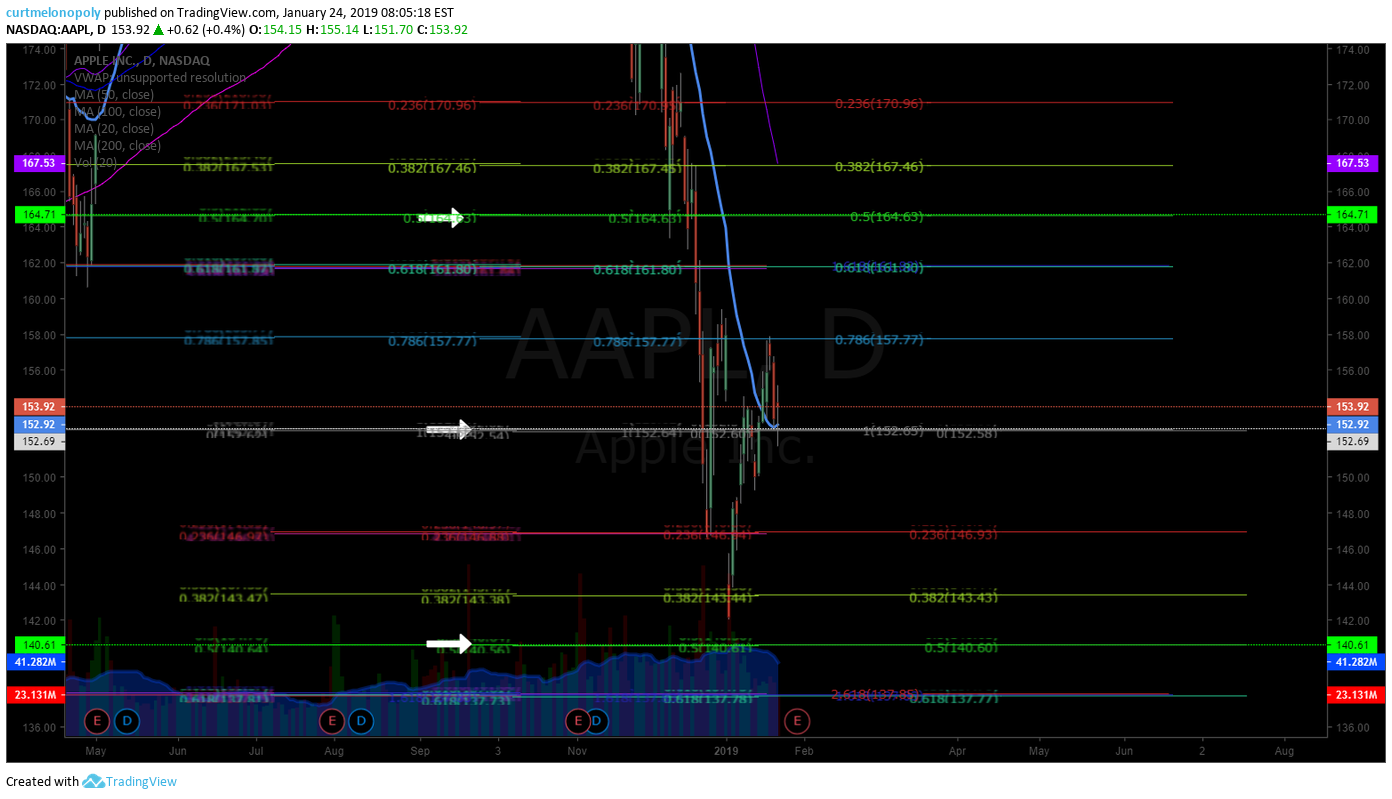

APPLE (AAPL) 152.98 is your main pivot and price is in that slot. Other side of earnings should bring a direction to the model and I’ll trade it.

ALLERGAN (AGN) Bounce at main pivot occurred in the sell off late 2018. Price target 155.9 support trading 157.13 (151.87 even possible then a rip). Bullish trend line to 202.00 is my price target. Other targets reviewed on video in trajectory up and support down noted. Mid May time cycle conclusion on AGN confirms on this and many charts.

ADVANCED MICRO (AMD) upside bullish trajectory is reviewed on the video. Other side of earnings 24s price target Mar 13 then 26.50 then 28s next reviewed on video.

AK STEEL (AKS) – has been in pivot trade on daily since Jan 8, upside target 4.03 and downside 1.63 trading 2.70. I have no bias.

NETFLIX (NFLX) support pivot 319.22 resistance 357.53 trading intra-day 331.80 off 1.85% on the day. Time cycle Jan 31 makes it difficult to take a trade here, trading in basket of trading quad here. Waiting for other side of Jan 31. 338.26 PT mid May 2019 as a bias.

AMERICAN EXPRESS (AXP) over 99.00 targets 112.00. Trading 99.76 down 1% on day. Model is very structured and following its trajectory When oil bounces this is one to take. 112.14 PT July which puts mid May in to play as PT timing if really bullish. Great example of post earnings structure. See vid.

Morgan Stanley (MS) more complicated chart, near bottom of trading channel, 42.81 intra day, long term 2021 Mar 76.50 is bullish target or in to Aug 55.21 is near term bullish price target.

DELTA AIRLINES (DAL) trading 48.13 intra day up .9% on day, 49.59 PT Feb 4 and then decision, other side of Feb 4 a trade entry can be taken.

BANK OF AMERICA (BAC) early in to earnings season I should have take this trade, the set-up on chart model is reviewed in detail on video, hoping for low 28s for entry. Decent set-up.

SHAW COMMUNICATIONS (SJR) getting in to early May 2019 there is a target zone and the trajectory and structure is explained, can’t trade it because of time cycles. Risk Reward not there for a trade.

CITIGROUP (C) – CITI is now in to its resistance area under its pivot, this is the 2nd I missed so far, 61.04 in sell off then 47.67, bias to 73.87 breach to upside price target early March then July and mid May time cycles reviewed.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, Video, $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C

Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA #swingtrading #earnings

Trade Set Ups Video for Swing Trading Earnings Season Monday January 28, 2019.

Swing Trading Stock Signals in this Report: $AMZN, $MSFT, $FB, $BABA, $TSLA …

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Notices:

Welcome to a series of special reports during earnings season for our swing trading platform. There will be a significant number of these mini reports.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week (on average) cycling the five reports (that include over one hundred equities) every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service rotation to also include reports for earnings season, special trade set-ups, themed reports and swing trade alerts direct to your email inbox.

After earnings season we will recommence the regular rotations.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://www.investing.com/news/economy-news/economic-calendar–top-5-things-to-watch-this-week-1758816

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://t.co/XL7cEWGMce

— Swing Trading (@swingtrading_ct) January 27, 2019

Our Earnings Season Special Reports Thus Far:

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Ups:

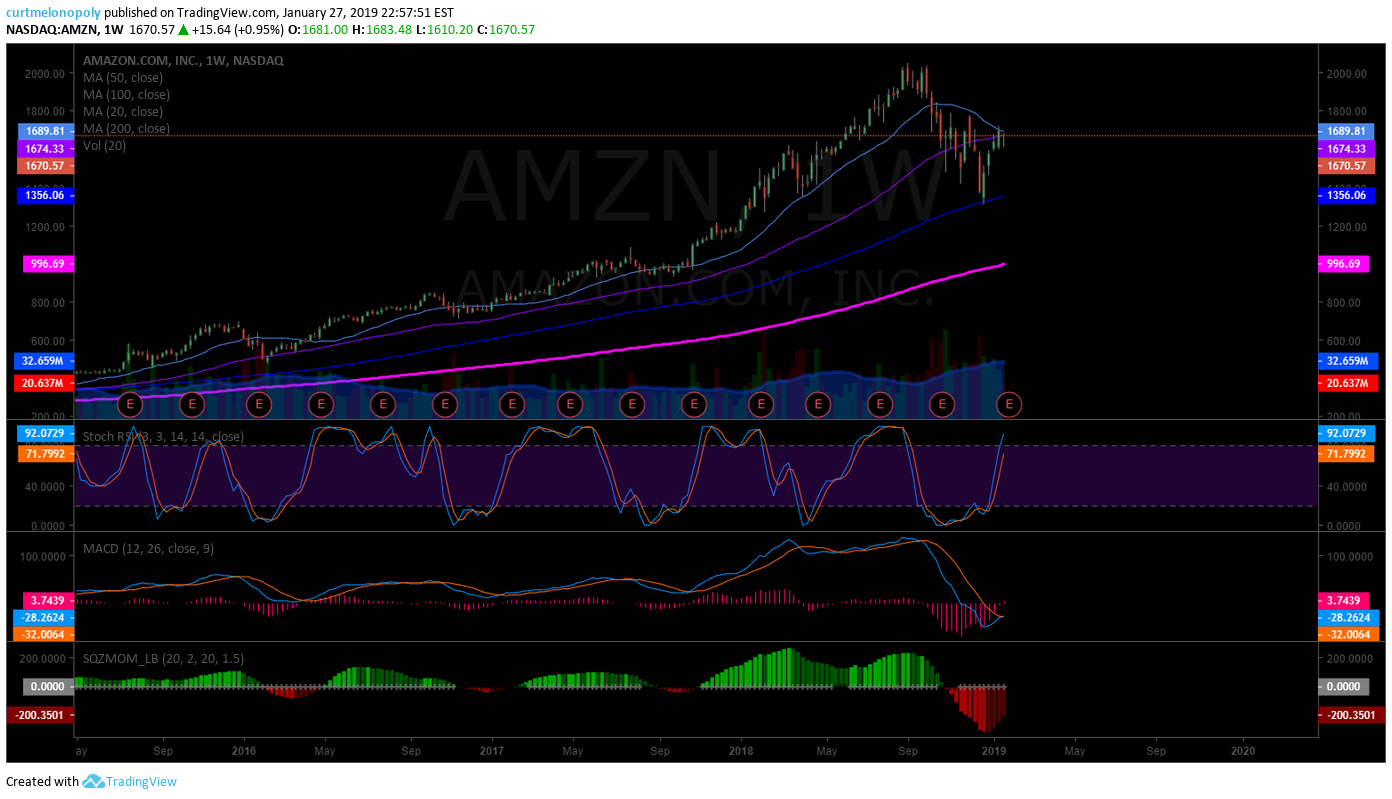

AMAZON (AMZN) Weekly chart says shorts better have it right in to earnings. MACD SQZMOM Price to MA’s say big move possible.

Jan 27 – The upside move here could be huge. Price on a launch pad right under 20 and 50 MA’s on weekly chart with SQZMOM and MACD supporting a possible move. Wouldn’t want to be short in to earnings. Risk reward very poor for shorts.

Amazon.com’s $4.5 Billion Retail Opportunity – 3,000 stores with 50% higher returns than conventional convenience stores. #swingtrading #earnings https://finance.yahoo.com/news/amazon-com-apos-4-5-220000638.html?soc_src=social-sh&soc_trk=tw

My Trading Plan for Amazon Earnings:

It’s simple, if price breaches the 20 and 50 MA it’s a long to test previous highs (the pivot of around 1950.00). And if previous highs are taken out, look for an equal extension to upside of previous highs (price target around 2200.00). If Amazon sells off, look to 200 MA (near) test and bounce.

AMAZON (AMZN) Earnings swing trade price targets for upside move or sell – off. $AMZN #swingtrading #earnings

MICROSOFT (MSFT) Similar to AMZN but I don’t like it as much. Retrace didn’t touch 100 MA and RR not the same imo. $MSFT #earnings #swingtrade

The set-up is very similar to Amazon, but the 20 and 50 MA’s aren’t pinching like on Amazon chart and price didn’t pull back enough. Also, the fundamental picture isn’t as strong. The Amazon chart trajectory holds much higher risk reward for the bullish trade bias.

However, if it sells-off I wouldn’t expect as much of pull back as with Amazon.

So it depends if you are considering a trade position in to earnings or not. I will wait until after earnings are announced for both, And likely not trade Microsoft. Yet to be seen.

Trading Plan for Microsoft Earnings:

In a bullish run you can expect previous highs, however, I wouldn’t expect much more near term.

In a sell-off I would target a touch to 100 MA (near to). Unlikely imo.

Forget IBM. Microsoft Is a Better Dividend Growth Stock $MSFT #swingtrading #earnings https://finance.yahoo.com/news/forget-ibm-microsoft-better-dividend-231200981.html?soc_src=social-sh&soc_trk=tw

FACEBOOK (FB) Price targets on 240 minute trading chart. $FB #earnings

We have used this model a number of times for win side trading on Facebook.

We will wait for earnings and then trade the price targets pending direction.

Facebook earnings: After a year of scandals, record profit still expected #swingtrading $FB https://on.mktw.net/2B2j9uw.

FACEBOOK (FB) Weekly chart. In a bullish move I will target 168.00 region for 50 MA test. In a sell-off there’s no saying. $FB

ALIBABA (BABA) I like the setup for the long side to 206.00 price target. Will wait for earning trade to confirm. $BABA.

TESLA (TSLA) My bias is down to 231.00 price target. Will wait for earnings, but that is my bias. $TSLA #earnings

Tesla’s first downgrade of the year comes down to this #swingtrading $TSLA #earnings https://on.mktw.net/2DteGCX

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, $AMZN, $MSFT, $FB, $BABA, $TSLA

Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP #swingtrading #earnings

Trade Set Ups Video for Swing Trading Earnings Season Thursday January 24, 2019.

Swing Trading Stock Signals in this Report: $AAPL, $AKS, $AMD, $AGN, $EXP …

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Notices:

Welcome to a series of special reports during earnings season for our swing trading platform. There will be a significant number of these mini reports.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week (on average) cycling the five reports (that include over one hundred equities) every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service rotation to also include reports for earnings season, special trade set-ups, themed reports and swing trade alerts direct to your email inbox.

After earnings season we will recommence the regular rotations.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Swing Trading Signals / Charts for Earnings Season.

Bloomberg Earnings Season Reporting Calendar List https://www.bloomberg.com/markets/earnings-calendar/us

AK STEEL (AKS) Swing Trading Earnings, Trade Set-Up with Support and Resistance Marked with White Arrows $AKS.

Jan 24 –

How Trump’s Steel Tariffs Could Play Out This Year https://marketrealist.com/2019/01/how-trumps-steel-tariffs-could-play-out-this-year?utm_source=yahoo&utm_medium=feed&yptr=yahoo

There are no clear price targets on the AKS chart, however, trading the range between key support and resistance post earnings could yeild result (key support and resistance at white arrows).

ADVANCED MICRO (AMD) swing trade long over 20.55 and short under 18.25 to price targets.

Jan 24 –

Big Chip Earnings Preview: Intel, AMD Set To Report Amid Changing Competitive Landscape, Cycle Risk #swingtrading $AMD https://finance.yahoo.com/news/big-chip-earnings-preview-intel-171733038.html?soc_src=social-sh&soc_trk=tw

ALLERGAN (AGN) Key areas of support and resistance noted on chart for post earnings swing $AGN.

Jan 24 –

Bouncing back from collapse: Old Republic International Corporation (ORI), Allergan plc (AGN) #swingtrading $AGN https://finbulletin.com/2019/01/23/bouncing-back-from-collapse-old-republic-international-corporation-ori-allergan-plc-agn/

APPLE (AAPL) Trade premarket 154.40, over 152.58 long to 164.63 under short to 140.60. $AAPL #swingtrading #earnings

Jan 24 –

Support and resistance areas of the Apple Stock chart should be in play for next quarter.

EAGLE MATERIALS (EXP) Nearing historical key diagonal Fib support areas for reversal trade set-up $EXP #swingtrading #earnings

Eagle Materials Schedules Third Quarter Fiscal 2019 Earnings Release and Conference Call with Senior Management

https://finance.yahoo.com/news/eagle-materials-schedules-third-quarter-211500013.html?.tsrc=rss

Jan 24 –

I will be looking for a reversal trade here to next resistance areas marked on chart. Trim in to them and add above according to rick tolerance and time frame.

A failure of key TL support is a divergent broken set-up and will be re-charted.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, $AAPL, $AKS, $AMD, $AGN, $EXP

Not Just Concept: Day Trading Crude Oil 10K – 1 Million in 24 Mos at 10 Ticks Day (Compound Gains)

Our Live Documented Journey to Compound Day Trading Crude Oil Futures for Gains That 99% Would Only Dream Possible…

And one of the best parts of our mad journey; we’re now beyond Concept and Theory…

and we’re proving it LIVE (well on our way to… Fact).

We are now Trading Crude Oil to Over 1% Per Day Returns, Live.

We have many other trades that are not live also because we are testing many models).

It’s been a bit of a petri dish. So far.

But as of late we’ve stopped the petri. It was unavoidable (the petri part).

Side thought – In all fairness, only we know what the petri part is (well not completely true because members do know the rules for the most part). The important point being… we’re done petri.

We are now trading crude oil in our process with consistency and ease, real-time live and we’re recording it, we are alerting the crude oil trades on a private Twitter member feed and sharing our work process (including all rules sets, thoughts, charts and more) in chat, and we’re even trading crude oil live in our oil trading room with screen share of our charts and voice broadcast from myself alerting the trades.

0.

The probabilities that our rule-set fails now after hundreds of trades, especially now that we are in minimal discovery and quickly moving to refinement and consolidation phases is… well, near 0.

Maybe.

Oh, and even more reason … our software runs trades near 24 hours a day now (non-alerted at this point), and nearly never loses. When it does, it’s for pennies. Soon we’ll unleash him/her (it) live.

Maybe.

For all intents and purpose, we don’t lose when manually executing trades either. Sure, we do lose sometimes, but very small if we do – very small. And even our manual executions are getting better all the time. And we (I) suck as traders.

Here’s an even better part; 3%, not 1% sees 10,000.00 to 2 Million Dollars in 180 days. And we’re going to do it.

Nobody knows the future! I know, I know.

1 – 3 Hours a Day.

A cool part… we do 1% or more with 1 – 3 hours a day of trade focus. Usually closer to an hour or so. We’re kind of busy with something I never thought I’d be doing…. code, machine learning, science, quantum thingys and other mind places.

Anybody Does Do It.

And better yet; anybody can do it. Why? Because we’re refining the process to its most simplest form. Quantum mind things to simple.

But there’s too many lines! I know, I know.

We have non traders (on staff) starting to use the rule-set and even starting to alert their trades. And the coolest part, they may be better at executing the trading rule-set than the experienced oil traders (initial indications are this could be very plausible).

We Like Tents… Almost as Much as We Love Beaches.

And the near best part (in my little world)… the money ain’t the motivator – I’d be equally happy living in a tent on a beach. Oh wait, I almost do. The shiny floors at the Hard Rock in Punta Cana were never my thing anyway.

And the best part; freedom is near (unless the world ends or something). Not only is freedom near for our staff (that have worked tirelessly day and night) but for our clients and members and their families and their families. Get the drift? This is why I’m so excited.

The Dream Realized. Next!

And we’re near done the first of many (instrument trading processes) we are developing. We’re in the final phases with our oil trading platform, soon it will simply be maintenance updates to the manual trading and machine trading parts of our oil trading services.

Yes, the other algorithm models and swing trading are next.

The Point?

Sharing our journey. I did promise when we started all this. That I would share.

Selling you on it. So you can join the movement to freedom. So you can help. So maybe you can be a part of it. Maybe you’ll take the next steps? Maybe anything is possible.

Maybe you will be our next donor when our software development needs a few million for the app.

Or maybe we’ll just boot strap that too.

Maybe I’ll inspire you. That would be novel.

Promises.

I also promised our sharing will end soon. It will be this year.

We’ll still be around to chat.

We’ll still have our enterprise.

We just won’t share.

It’s tiring. I just made a promise to share, to a point:)

How is it Done? … the trading up 1% gains or better in crude oil a day.

Members stay tuned for Part 2 of this post. Until then study the most recent report here:

Protected: Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Non members can visit our unlocked posts here:

Crude Oil Trading Academy : Learn to Trade Oil.

Non members could also get off their ass and subscribe and learn live. Just sayin.

How Does 10,000.00 turn in to over 1 Million at a Compound Rate in Less than Two Years?

When we first started this crazy venture I posted the post, it has a link to the calculator,

Come to think of it, I wrote it around the time that everyone told me I was nuts.

Fuel.

How $10,000 Turns in to 1 Million in 24 Mths @ 1% Per Day Compound Stock Trading.

Is There a Process in the Madness?

We have tried to explain it in the few moments of rest between days of no sleep and falling asleep in very strange places randomly the last two years.

We Weren’t Smart Enough to Think This Up.

We suspect we’re using similar ideas…

The mathematician who cracked Wall Street.

There’s my share of the month.

Now go spin it up.

And give EPIC Crude Oil Algorithm a follow.

Best and peace.

Curt

PS

Members stay tuned for Part 2 of this post.

Follow the Madness:

How I Day Trade Crude Oil +-90% Alert Win Rate | Friday’s 158 Tick Move | Strategy We Used To Trade It

Tools You Can Use to Day Trade Crude Oil for a Better Win Rate. 90%+- Is Within Reach.

How to Trade Oil Successfully with the Right Strategies: Trade Alerts, Chat Room Signals, Live Trading Room, Conventional Charts, Time Cycle Knowledge and Algorithmic Models.

My position in this post is simple; if you have the technical data needed to make the right trading decisions on all time frames (your oil trading strategy) provided to you (the oil day trader) in the most efficient manner, you can out trade the general market traders and compete with world class machine oil trading firms.

We endeavor to provide such a trading platform for our members. Below I explain how we are doing that.

But first, a trade coaching session for those learning to get on the winning side of their trading… if you are a pro that only needs the technical oil trading strategies included in this post… skip this rant and scroll down.

Why do I scream from the rooftops that my win oil trading rate is so high? Why do I scream transparency and documentation of my trading journey and the development of our oil trading systems?

I scream my win rate (that anyone can review our live recorded and time stamped documentation to verify) to drive home that you do not have to accept what the book selling circle jerk crew tries to sell you, “trade price, nobody knows the future and that a 60/40 win rate is acceptable” – this is a flawed process.

You do not have to accept what the book selling circle jerk crew tries to sell you.

Study our oil trading system development and you will find that trading price doesn’t work in oil and that thinking you can’t know the future (future decisions for up, down or sideways trade and the most probable price targets) is foolish thinking.

We know with high probability where price is going to be on any time frame (from a 1 minute chart to a monthly chart and all between) and we know with high probability how to trade the decisions a trader will face on the way to the possible price targets.

We know the natural trading structure of the financial instrument – in other words, we know the playing field. We play the game with the lights on while the majority of our competition is in the dark.

We know the natural trading structure of the financial instrument – in other words, we know the playing field.

A 60/40 win rate is painful, to accept and use that system you have to take a series of significant losing side cuts to only then take advantage of a winning swing trade trend pattern move. In other words, the problem with their process is that you win big when you win but you have to endure pain to get the big win. I do this myself, but only with 10% of my account.

For example I have been DWT short for a number of weeks in preparation for the reversal in oil trade we are now experiencing. But I do it so that I get the move even when I don’t have time to day trade it.

The problem with their process is that you win big when you win but you have to endure pain to get the big win.

Another problem with the 60/40 idea (and there are hundreds of problems with this thinking) is that oil can trade sideways for many weeks, in this scenario you get chopped up and this causes your brain to be confused and you begin questioning yourself.

The method we are developing, perfecting and teaching (that we have documented live in every fashion available for proof) has a much higher rate of return and win side rate, it allows you to be in cash daily, it is much less stressful (the draw downs when you do lose can be next to zero) and it is the equivalent of Wayne Gretzky on the ice (for example).

You can simply “out stick handle” your competition.

To be a 90%+ oil trading winner takes real work to learn, but on the other side you will have much less stress, you win more often, your ROI and ROE increase significantly, your lifestyle freedom increases and the most important part is it keeps your brain in the frame work of being a winner.

Worst case scenario – you add what you can or what you prefer to use of what we have learned and passed on to you so that your oil trading win rate increases.

The bottom line.

It is critical for your brain to know it wins. When it knows you are a winner it won’t accept losses. This is critical (you would have to do a serious psychological study to learn why this is so important – maybe someday I will write about what I’ve learned).

The bottom line is that your brain develops patterns of habit that manifest in reality. Your subconscious is the leader, and it needs to know when it trades crude oil, that you win.

The bottom line is that your brain develops patterns of habit that manifest in reality.

The only way this is possible (your brain knowing that you win so it won’t accept losing which causes your execution to be disciplined) is to be able to “out -trade” your competition.

Sure, you are competing with yourself – but in reality you are competing against the world’s best when you enter the markets everyday.

The only way to out-trade your competition is to have technical market information and tools they simply do not possess and / or do not have “as efficient” access to and they haven’t defined their trading process and skill-set to the same level you have.

This is what causes one to trade win-side at a rate of over 90%. And anyone can do it.

Lets Get on With The Technical Oil Trading Strategies You Can Use to Day Trade Crude Oil for a Better Win Rate.

Oil Trade Signals: The Strategy / Guidance I Provided to Members at Start of Week.

Crude Oil Time Cycles, Area of Trade, Support, Resistance, Trading Channels.

Note: The time stamps on the Private Member Discord Oil Chat Room Server is showing my time in the Dominican Republic (this time of year it is one hour later here in DR than Eastern Time in New York).

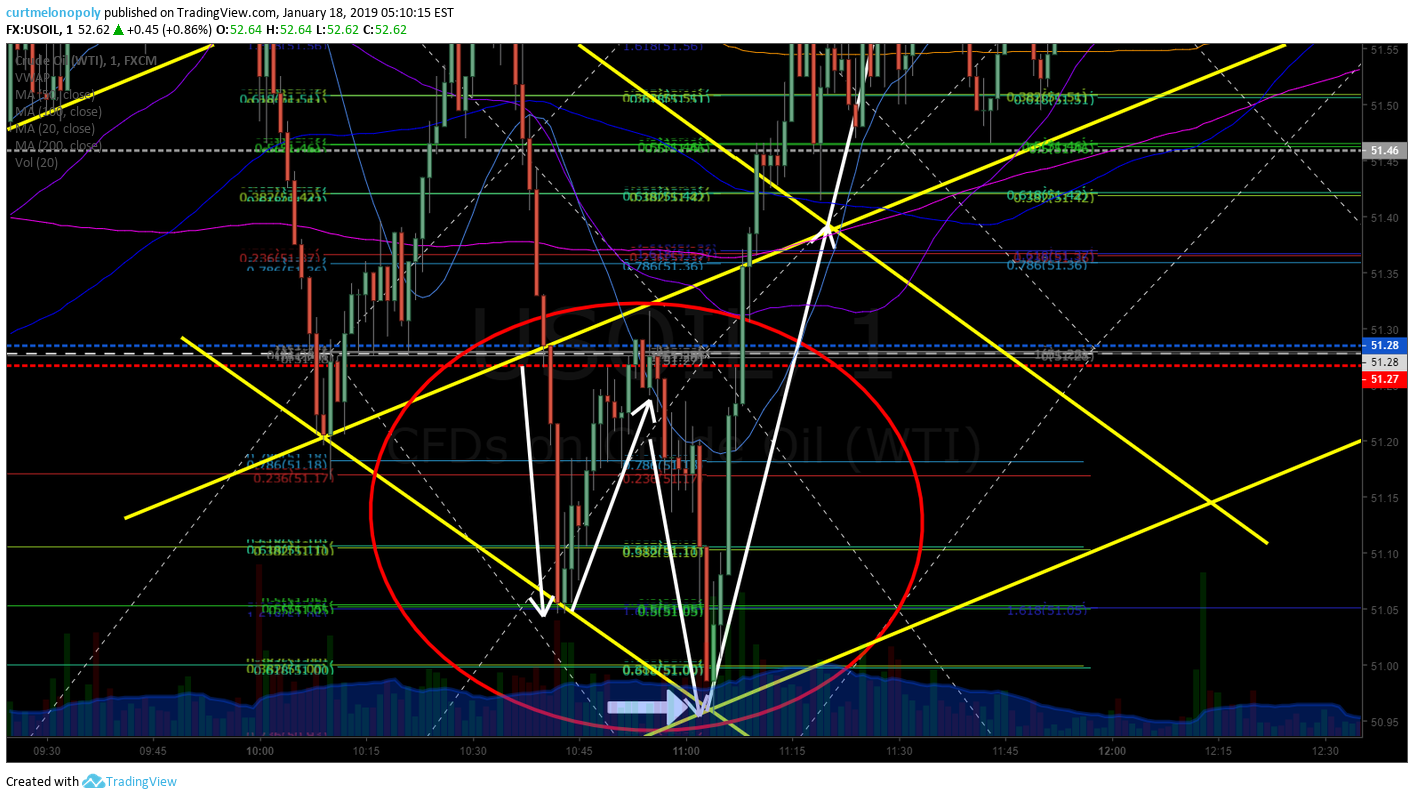

For this post (that focuses on examples from Friday Jan 18, 2019 in our oil trading room) I will start with trade signals I provided to our members at the beginning of the week (and some prior) to provide context for the guidance explained.

Below (3rd image down) you will find a private member server screen shot (to start the week of Jan 14, 2018) I shared with the chat room of a test chart our oil machine trade coding technicians are developing for sizing trades.

In addition to using our main oil charting (the EPIC Oil Algorithm model – a proprietary model based on a 30 minute oil chart) we use many other charts (conventional and algorithmic) on many time-frames to determine back tested and correlated probabilities for oil trade resistance, support, channels, reversals, time cycles and more.

In the instance below (at start of last week) I was signaling the possible channel oil would use for weekly trade – specifically if the scenario played out during weekly trade as it related to the previously provided signals to members (that we seen a time cycle ending in crude oil December 20, 2018).

Prior to this, we had provided members (many weeks in advance of Dec 20) that the time cycle peak / conclusion was for approximately Dec 20 (with allowance for a week either way of Dec 20 because the time cycle was so large as it was based on the weekly time cycle charting).

Then on Dec 26, 2018 oil did in fact turn up in trade and hasn’t stopped trading upward since.

Between Dec 20 and Dec 26 there was one last “flash down” in oil trade which is typical at the end or peak of a time cycle on any time frame from the one minute charting to monthly charting (this is typical of the final stops being triggered and shorts covering positions).

Then on Dec 26, 2018 oil did in fact turn up in trade and hasn’t stopped trading upward since.

Oil hit a low of 42.38 on FX USOIL WTI on Dec 24, 2018 and closed Friday Jan 18, 2019 at 52.38 – less than one month later.

Also of note, we predicted the down turn in oil trade at the time cycle peak – the time cycle turn prior to the Dec 20, 2018 reversal.

See this tweet from EPIC Oil Algorithm Public Twitter feed and the post linked to our blog.

“Dating back to 2002, 13 of 14 major time cycles on weekly crude oil chart structure seen trend reversal to some extent or another #Oil #OOTT #TimeCycles FX USOIL WTI $CL_F $USO $UWT $DWT https://www.tradingview.com/chart/USOIL/F8Z9UE66-Dating-back-to-2002-13-of-14-major-time-cycles-on-weekly-crude/ …

https://twitter.com/EPICtheAlgo/status/1084492522490155014

Back to Strategic Guidance Provided to Oil Chat Room Last Week:

The oil trade signals I alerted to members to assist in their oil trade strategy focused on the trading range our members could expect for oil the coming week. The alerted signals also gave our traders support and resistance areas on the charting and the most probable channel of trade (this is all in addition to the EPIC Oil Trading Weekly Report).

Curt Melonopoly Last Monday at 8:49 AM (7:49 AM EST)

“It’s a machine coding doodle chart for sizing etc so its a mess, but we are looking for channel highlighted in yellow to hold for trend reversal confirmation in crude oil – use proven EPIC model for confirmation for trading”.

Below is a screen shot of the live oil alert feed on Twitter providing the following signal to our members for the week:

“Under 52.16 FX USOIL WTI I am short term bearish, over 52.16 bullish to 53.34 and over to 55.65 – main test areas over head on weekly time frame.”

The examples above provide context to the guidance we provided our oil members at recent time cycle turns and at the beginning of the week…

Now lets jump to the specific point of this post that involves trade last Friday December 18, 2019 so we can learn how to day trade the opportunities in crude oil.

At 6:40 AM Friday Jan 19, 2019 I signaled the oil chat room that oil trade looked bullish and that our traders could expect a push toward the 53.40 resistance.

You can see on the chart / screen capture below how trade for the week had maintained the channel and that oil trade was following a trajectory (light blue vertical line) that I had outlined in the chat room earlier in the week as a probable upside strategy.

The strategy for the trajectory of the uptrending blue arrow was based on trajectory of time cycle targets on the short time frame assuming oil was bullish (price targets on our algorithmic charting can be assumed at where important trend lines cross, this is consistent through all time frames on all algorithmic models – this takes some time to learn).

The resistance I was alerting our members was at the top of the trading channel so they were aware of where to be aware of possibly trimming positions or at minimum being on watch for intra-day stall in trade.

“They’re pushing for that 53.40 area today (upside scenario), above could cause a significant squeeze”.

On this screen capture from the oil chat room I am showing our members that trade intra day was in the bullish scenario on a 4 hour test chart. Reconfirming the bullish scenario for day trading oil upward in Friday’s trade.

You will also notice at the bottom of the screen capture – the noted alert at the bottom of the screen, “53.50 is top of quad ton EPIC model resistance today, trading 52.83 intra” that this set-up coincided with our proprietary oil algorithm charting (the core oil algorithm charting – the core of our methodology, is not included in this post).

The core oil algorithm charting – the core of our methodology, is not included in this post.

Earlier that morning Jeremy has posted a link in the chat room to the article and video post covering trade from Thursday’s session and explanation of the one minute trading box set-up. You can study the set-up at the link below;

By far one of the most important crude oil trading articles we have posted since our inception.

Protected: How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video)

Password: ********

At 920 AM right before regular market open I provide chat room a crude oil position signal for preferred long entry point.

I also re-confirm my expectation that probability for the top of the quad area of the oil algorithm in trade gets hit and that my entry signal price target (preferred entry is 52.40) so that our traders could make their own decisions for execution.

Also mentioned here, the one minute trading model (the trading box area) as the preferred entry price so that our members know where I derived the 52.40 entry preference from.

Crude oil trade alert in chat room screen shot of long execution in to open and other alerts. Long oil at 52.67 with trims at 52.93 and 53.08.

Alert in oil chat room that I was closing the oil day trade at 53.03 due to internet issues and reiteration of price target 53.50 for day trade.

Then the price target for the day trade was hit. A 90 tick move so far on the day.

Below is screen shot capture of crude oil chat room of posted oil chart images of predictability of 1 minute oil day trading strategy in trading box model (as previously posted above – the Thursday featured blog post the day prior) when crude oil squeezes intra-day.

As the day trading session progressed I provided a number of alerts to impending resistance on all time frames in crude oil trade range expected for the day.

heavy resistance confirming on all time frames, but in a sqz u never know

Resistance areas of oil trade for guidance for day traders to consider trimming or closing positions.

Resistance had been hit on two 4 hour charts and the EPIC Oil Algorithm 30 Minute Model at this point of trade intra-day. Other charting time frames had resistance also.

240 Min Test Chart Scenarios posted to oil chat room revising the previous so that day trading signals for oil are updated.

LIVE OIL TRADING ROOM VIDEO | HOW TO DAY TRADE CRUDE OIL – STRATEGIES I USE.

#daytrade #crudeoil

Summary Notes for Video:

Note: Voice broadcast starts at 16:25 on video. When I am trading and on mic is noted below (the location times on video).