Day Trading Strategy for Crude Oil Futures Trade the Week of January 20, 2019.

Oil futures open tonight at 6:00 Eastern, below is my battle plan for this week. The regular EPIC Crude Oil Weekly Reporting is taking on a different format this week per below.

My strategy this week for my oil trading is primarily based on the EPIC Oil Algorithm charting model.

The EPIC model is by far the best model we use. This week the model will be completely normalized as we are past the charting anomalies from the holiday period. The updated EPIC charting will be emailed to members after futures open and after the techs have renewed the model to new data (post open).

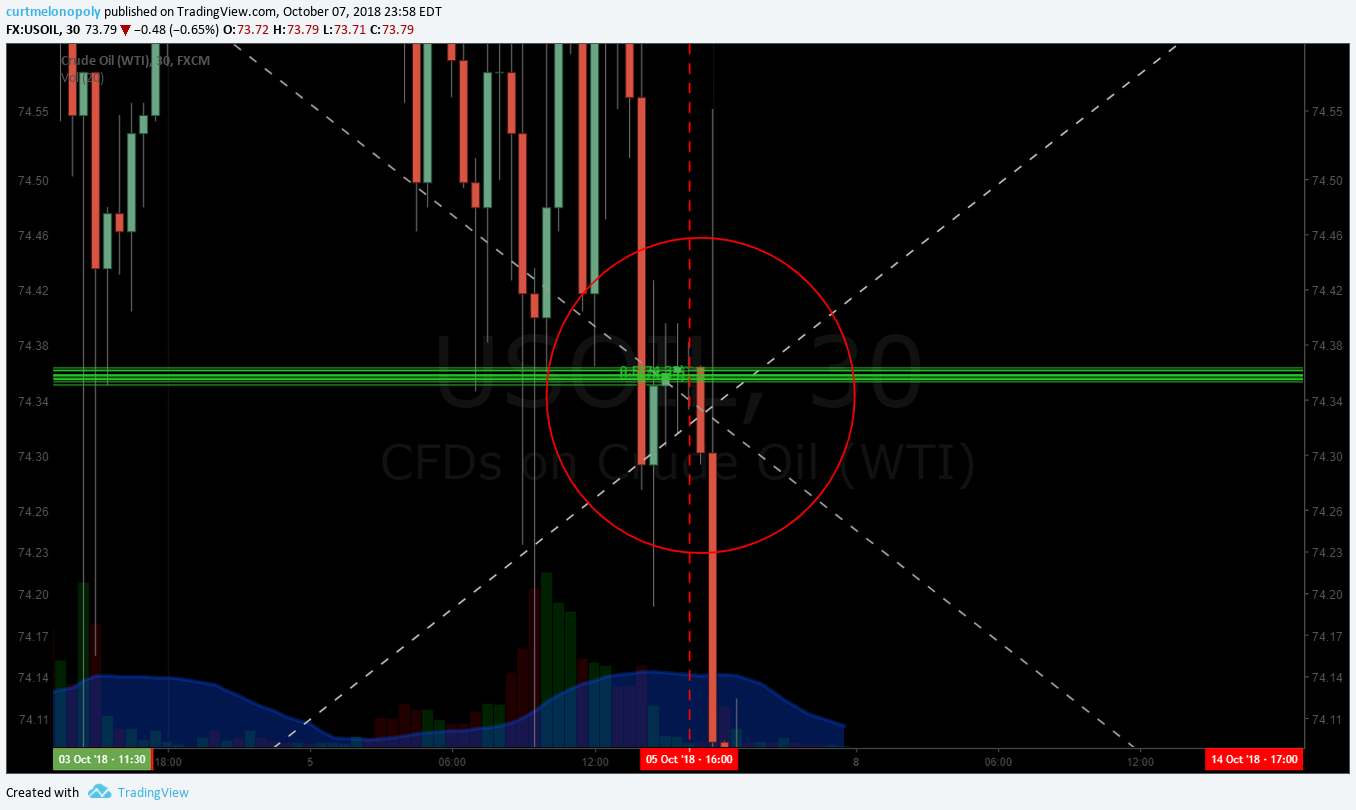

- Trading the range of the quadrants and range of the channels.

- Respecting the key resistance and support areas of the model at quadrant walls (orange dotted), channel support and resistance (orange dotted), mid quad horizontal support and resistance (horizontal line that cuts through mid quad) and the mid channel lines (light gray dotted).

- Sizing should be considered at key support and resistance of the EPIC model structure. The model can be used to determine sizing bias on tighter time frames on one minute below. Sizing can also be a consideration for short term swing trading the model.

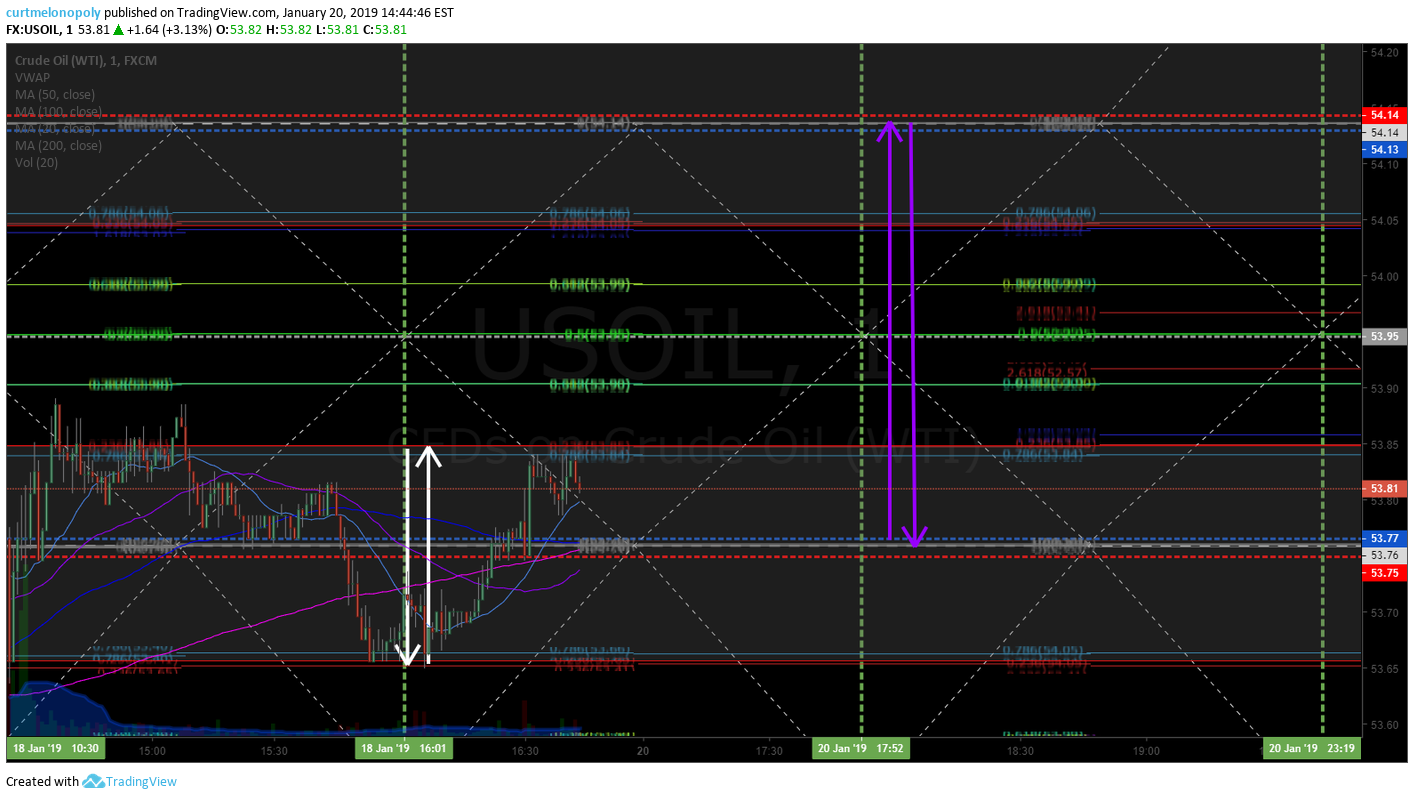

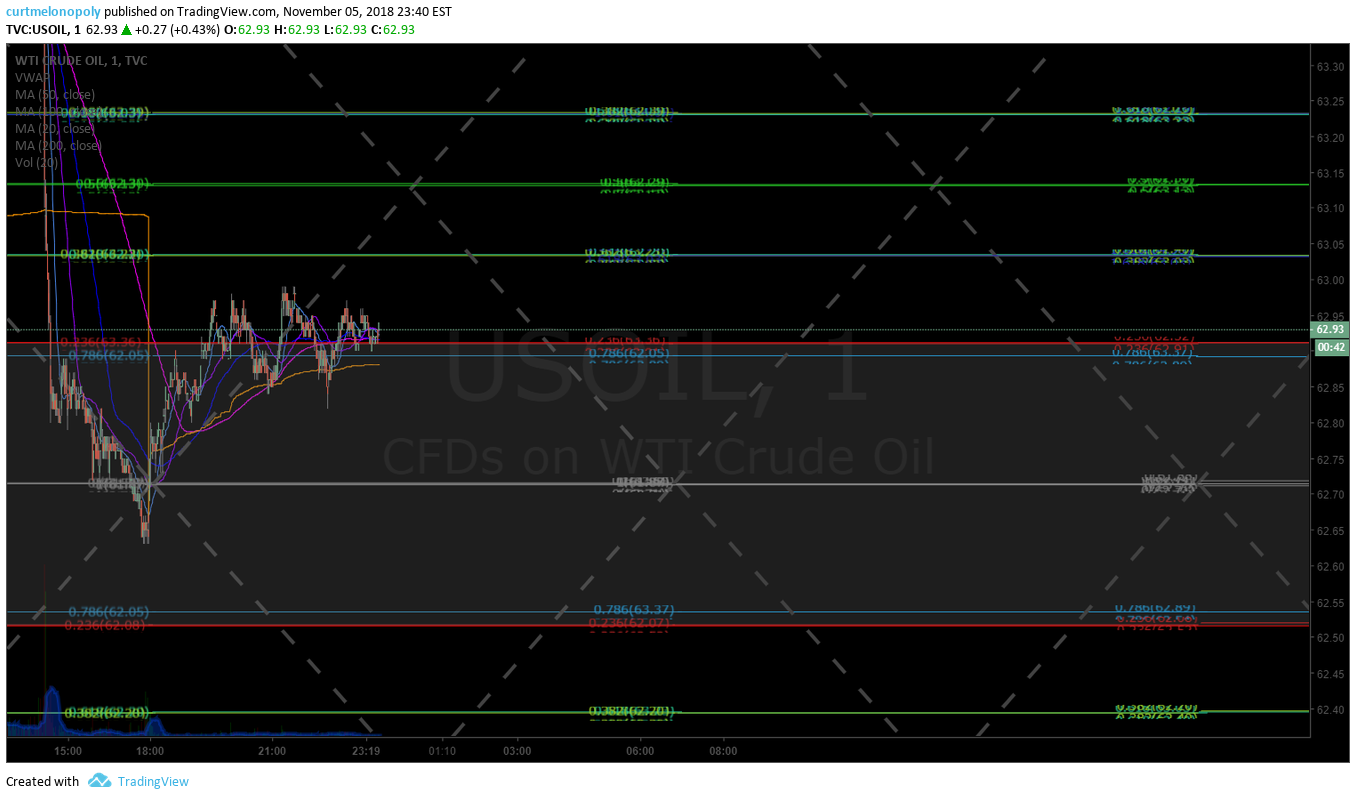

Screen capture of trade moving through EPIC Crude Oil Algorithm range in trade last week.

The timing of my trades will be based on the one minute chart model.

- Volume.

- Wait for volume. Low volume periods have lower predictability in the models.

- Trend.

- Determine the intra-day direction (trend) of trade. Strong bias should be considered for long or short positioning based on intra-day trend. Upward trend I will be bias to long positions and down trend intra-day I will be bias to short positions.

- Determine the trend on the daily chart, some bias should be toward that. Watch the MACD on the daily, although it is a moderately late indicator it does confirm your bias.

- Check important timing for key global market open hours (inflections in day trend can occur here, especially with New York).

- Support and Resistance.

- In an uptrend try and execute on support of the range on the one minute trading box (short term pull back) – the opposite is true in a downtrend.

- Trade Sizing and Positioning

- In a predictable structure sizing intra-day should be maximum at entry and trims at mid trading box and top or bottom of trading box – specific to the 1 minute chart model.

- Trim positions at mid trading box and top of trading box for long positions and the opposite is true in shorting. In a squeeze or sell-off this is more difficult. Typically I trade the break upside at resistance or downside at support breached.

- Timing Entry.

- The main trading box on the one minute is the support and resistance of the range (where the red and blue dotted and white dotted are), however, to pin point timing to the second you can use the pivot areas (top and bottom of range) and monitor the coil around the main support and resistance areas and use the smaller trading box around the pivots. Recent blog posts / videos discuss this and I will discuss further in near term video / blog posts.

- Indicators on the one minute that I use are the Stochastic RSI, MACD and Squeeze Momentum Indicator. The nature of these indicators on a short time frame like the one minute can be deceiving for even the more advanced trader. Use them with caution.

One Minute Model for Day Trading Crude Oil Futures Jan 20 236 PM FX USOIL WTI $CL_F $WTI $USO #CrudeOil #Daytrading

The main trading box range is shown in chart below with purple arrows and the pivot at support and resistance trading box is shown with white arrows (for micro timing decisions).

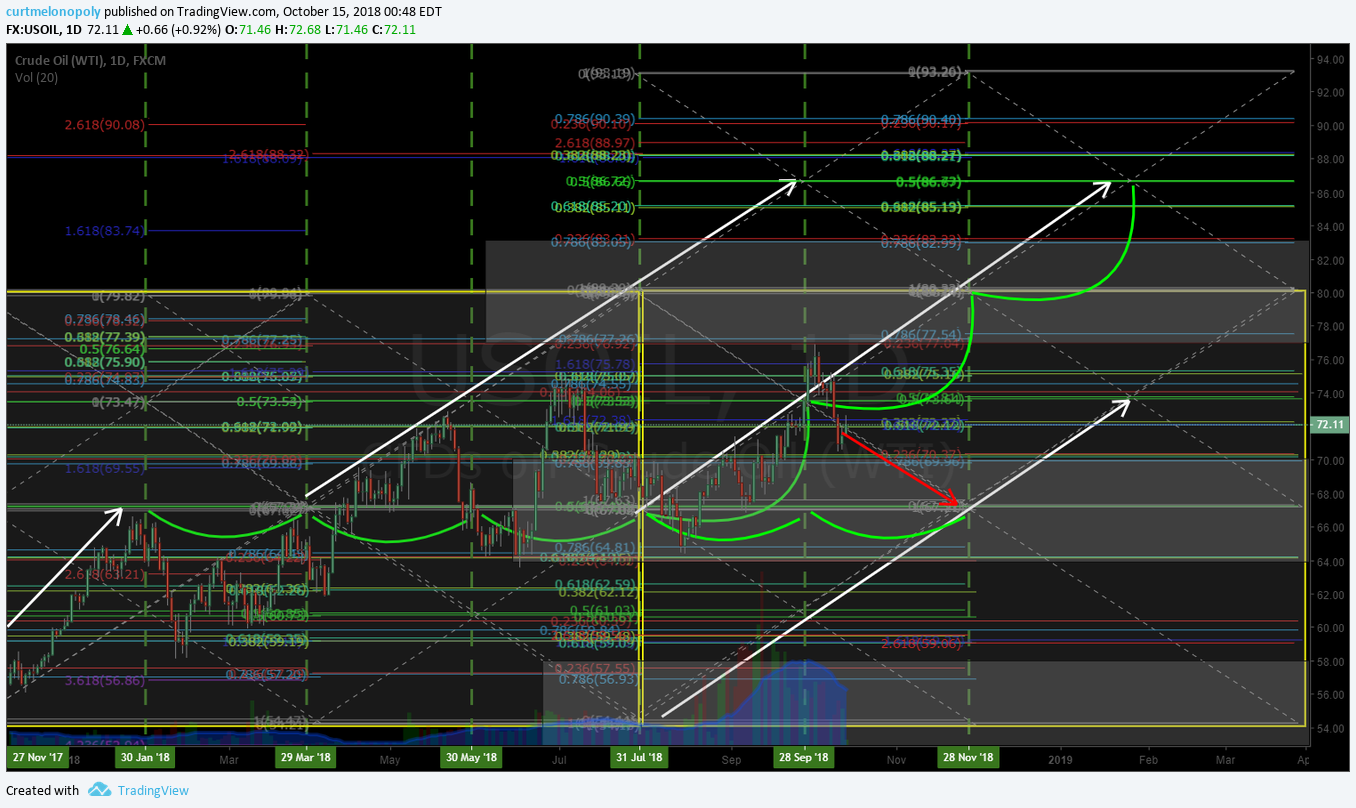

I will also watch resistance and support levels on the 4 hour, daily, weekly and monthly chart models.

Beyond using the EPIC Oil Algorithm model for your weekly / daily trading structure and the one minute chart model for timing day trades I also use the daily, weekly and monthly chart models.

The longer the charting time-frame the more seriously support and resistance areas should be considered. In other words, key resistance on the monthly or weekly charts should trump consideration on the daily and 4 hour and so on.

Trading trend, indicators, support and resistance, support and resistance, indicators and more should have bias to your trade sizing and positioning.

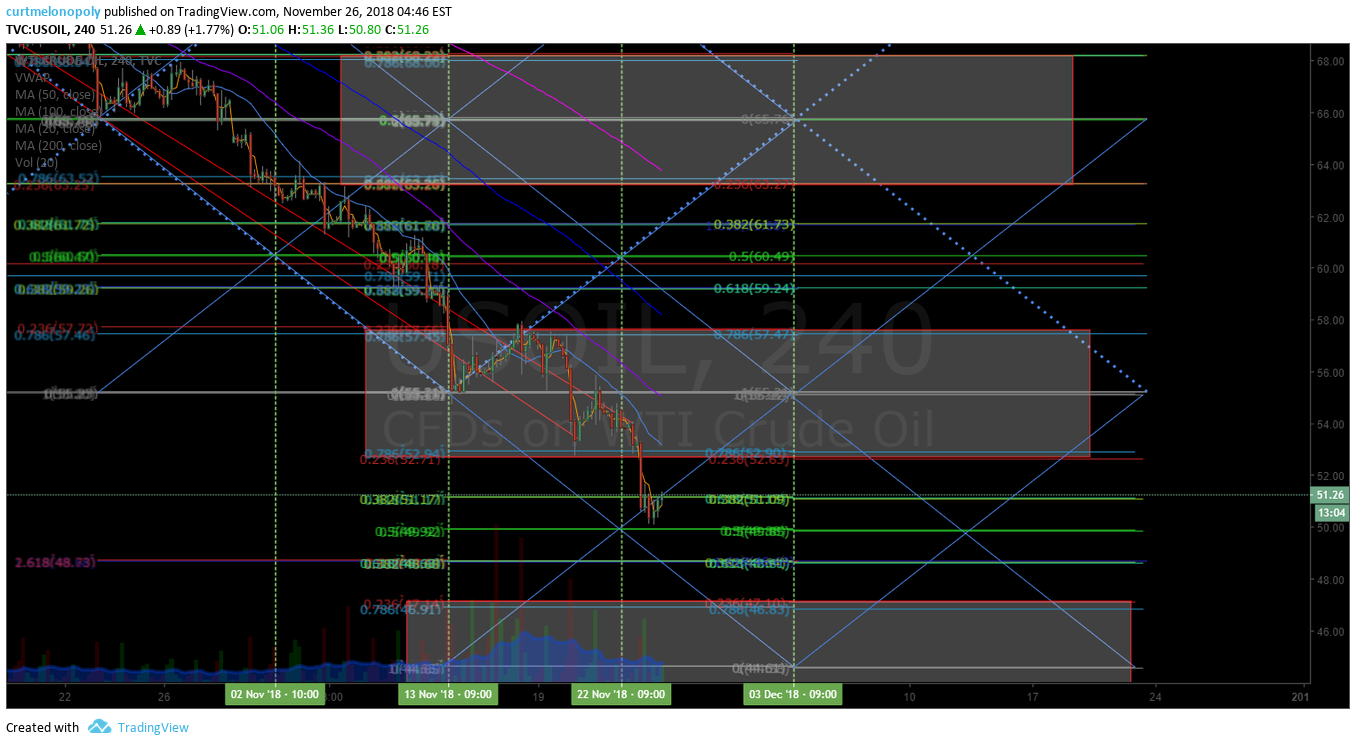

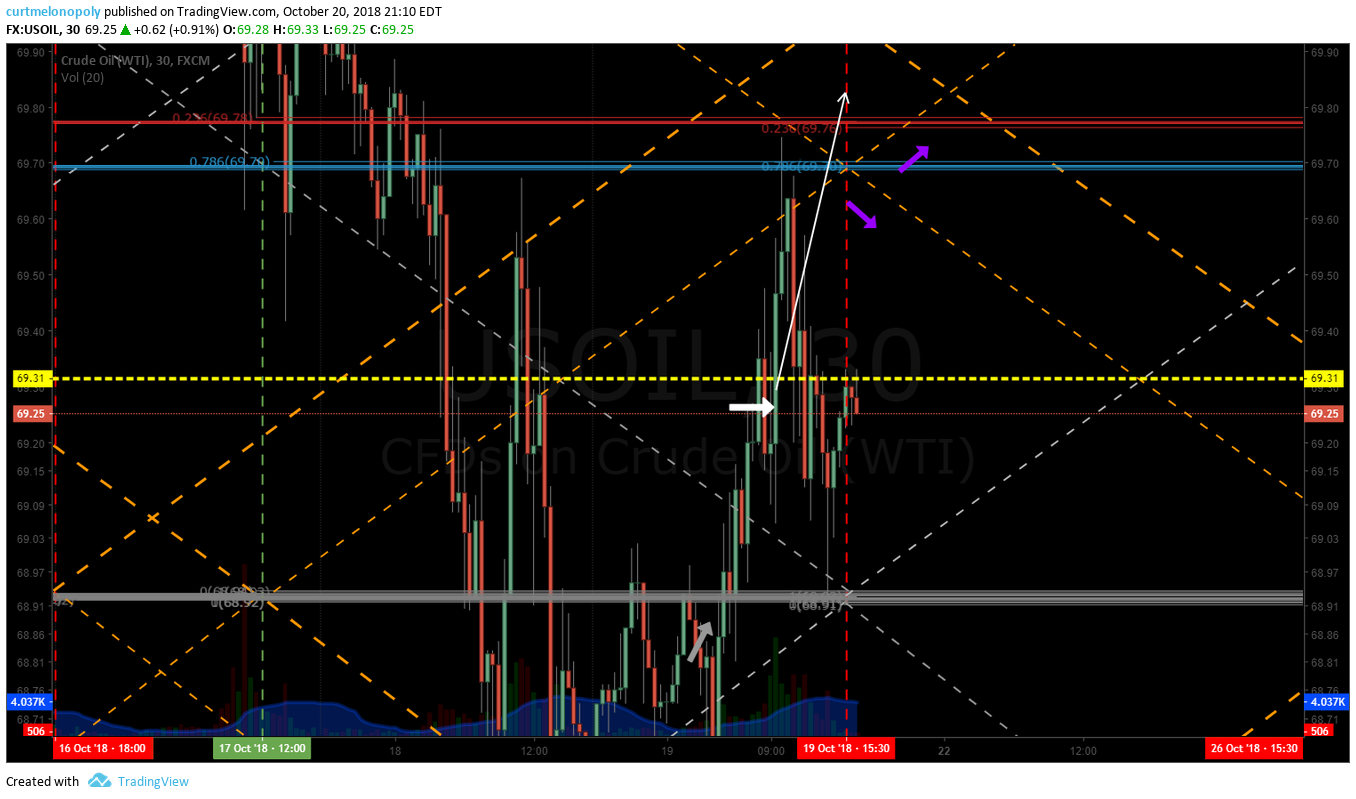

Crude oil trading strategy on 4 hour chart model, key areas of support and resistance noted with white arrows.

Although a test chart (for our machine trading), this chart has been responding well to the bounce trend in oil trade so I continue to use it. The key areas of support and resistance are noted, however, all lines are support and resistance levels.

Key resistance and support for day trading crude oil futures on 4 hour test chart for sizing strategy on machine orders.

And with this chart also, it is responding well but also is a test chart. I’ve been watching it closely as the support and resistance areas on the charting do seem to be in play. Our techs are back testing test charts.

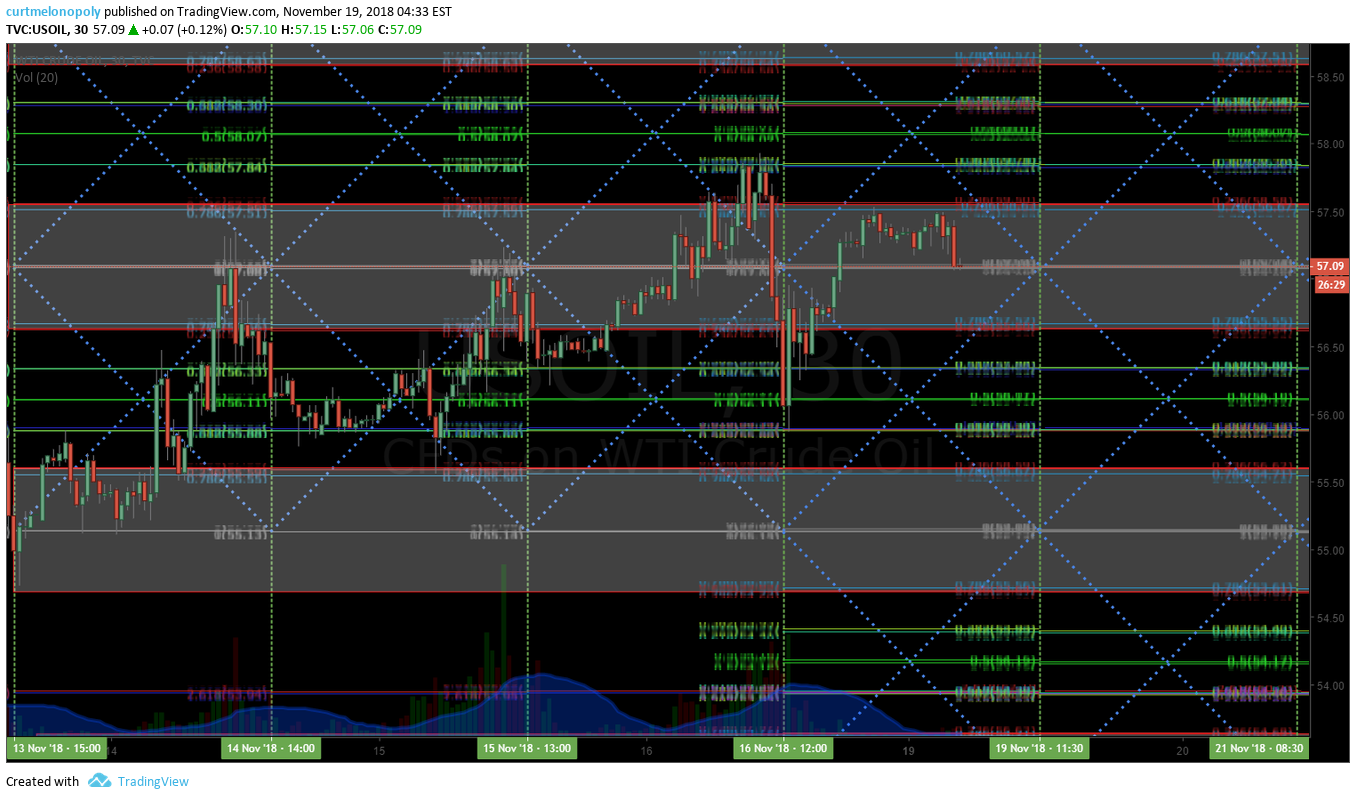

Key support and resistance on daily crude oil chart is noted for day trading strategy.

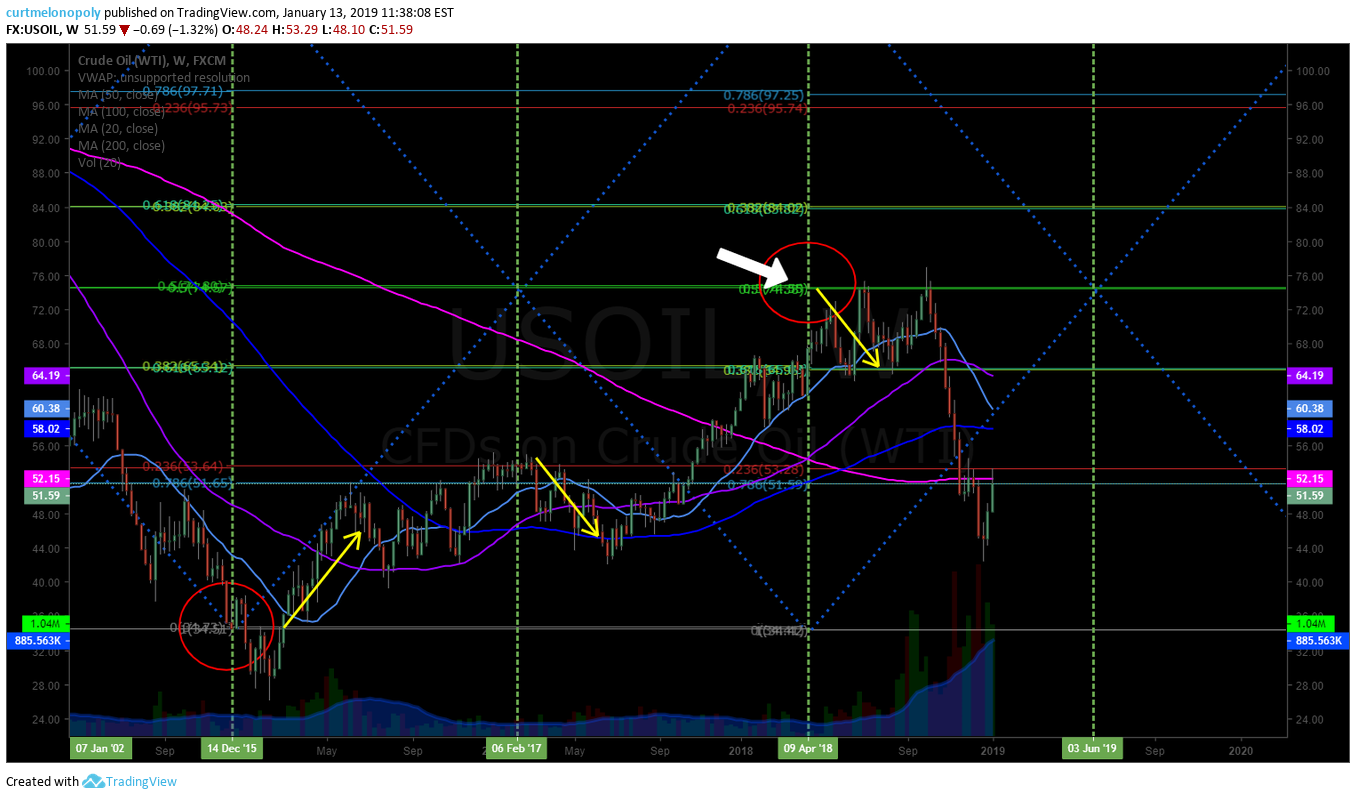

Key support and resistance noted on weekly crude oil chart for futures trade strategy.

Other charts are used in decisions for bias toward trade, refer to the most recent Crude Oil Member EPIC Algorithm reporting and private member discord oil trading room for other charting and guidance.

It is also highly recommended that you review recent reporting and videos released.

Jan 19 – A detailed inside look at our day traders’ strategies in crude oil day trading room.

How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – By far one of the most important videos for day trading crude oil since our inception;

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

Jan 14 – Oil day traders need to see this article;

Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance.

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Futures, Strategy, USOIL, WTI, CL_F, USO

Follow: