Compound Trading Premarket Trading Plan & Watch List Friday June 15, 2018.

In this edition: Tariffs, Bonds, $GOOS, $TWTR, $VSTM, $FB, $AGN, $FIT, $VRX, $AAPL, $SPY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text below are newer comments recently important.

Our Question and Answer Page has been updated for those asking about our services and platform options (with a recent inquiry example) here

https://twitter.com/CompoundTrading/status/1004427758913679361

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

https://twitter.com/CompoundTrading/status/1004257179438866432

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing. #IA #AI #Algorithms #Coding

Machine Trading – New Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Live Trading Room & Premarket Reporting:

Main Link and password is emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Next sessions recommence week of Monday June 4, 2018 as coding team is preparing new environment. Applicable members will begin to receive notice as sessions commence.

Premarket report is on a lead trader / trading team availability basis only (the premarket reports are not published every market day).

Real-time Alerts:

Real-time Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Disclaimer / Disclosure:

Every subscriber must read this disclaimer.

Private Discord Server Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email us.

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: QCOM, T, SD, AAPL, FOXA, ADBE & more –

Stocks making the biggest moves premarket: QCOM, T, SD, AAPL, FOXA, ADBE & more – https://t.co/2eDM0gMszP

— Melonopoly (@curtmelonopoly) June 15, 2018

25 Stocks Moving In Friday’s Pre-Market Session https://benzinga.com/z/11886065 $GOOS $VSTM $RDY $JBL $CHFS $NXPI $SRRA $ACHV $GNK $CISN $ADBE

25 Stocks Moving In Friday's Pre-Market Session https://t.co/WxWTDHHUVy $GOOS $VSTM $RDY $JBL $CHFS $NXPI $SRRA $ACHV $GNK $CISN $ADBE

— Benzinga (@Benzinga) June 15, 2018

Premarket analyst action – healthcare https://seekingalpha.com/news/3364218-premarket-analyst-action-healthcare?source=feed_f … #premarket $FPRX $PETS $TXMD $CRL

7 Stocks To Watch For June 15, 2018 https://benzinga.com/z/11885180 $ADBE $FNSR $GNK $TNP $VSTM $GOOS $JBL

7 Stocks To Watch For June 15, 2018 https://t.co/hSGGw0Ax1U $ADBE $FNSR $GNK $TNP $VSTM $GOOS $JBL

— Benzinga (@Benzinga) June 15, 2018

Market Observation:

As of 8:22 AM: US Dollar $DXY trading 94.87, Oil FX $USOIL ($WTI) trading 66.64, Gold $GLD trading 1296.31, Silver $SLV trading 17.19, $SPY 276.57, Bitcoin $BTC.X $BTCUSD $XBTUSD 6517.50 and $VIX trading 12.6.

Momentum Stocks to Watch: $CLPS $HJLI $GOOS $VSTM $DPW, $TWTR

News:

BREAKING: Trump administration to slap a 25% tariff on $50 billion of Chinese goods, threatens more

BREAKING: Trump administration to slap a 25% tariff on $50 billion of Chinese goods, threatens more https://t.co/gsIAsvFLrk

— CNBC Now (@CNBCnow) June 15, 2018

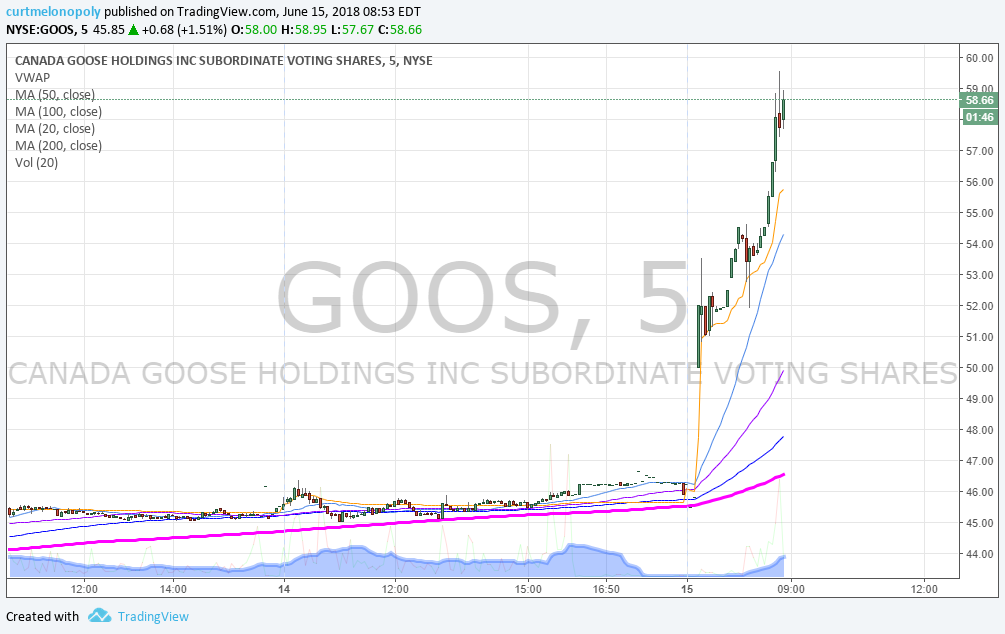

Canada Goose (GOOS) Tops Q4 EPS by 18c http://www.streetinsider.com/Earnings/Canada+Goose+%28GOOS%29+Tops+Q4+EPS+by+18c/14310697.html … via @Street_Insider

$TWTR – UBS analyst Eric Sheridan raised his price target on Twitter to $52 from $36 as he sees the World Cup as an important catalyst for the stock both in terms of engagement growth and ad demand trends.

$BMY Announces That The China National Drug Administration Has Approved Opdivo For NSCLC, The First And Only PD-1 Inhibitor Approved In China

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$ADBE $GOOS $RH $PLAY $BITA $HRB $KMG $YTRA $MIK $SBLK $CASY $LE $FNSR $KFY $TLRD $SAIC $FRED $JBL $LMNR $OXM $SNOA $APPS $PVTL $JW.A $DTEA $TNP $CRWS $CHKE $CULP $AZRE

#earnings for the week$ADBE $GOOS $RH $PLAY $BITA $HRB $KMG $YTRA $MIK $SBLK $CASY $LE $FNSR $KFY $TLRD $SAIC $FRED $JBL $LMNR $OXM $SNOA $APPS $PVTL $JW.A $DTEA $TNP $CRWS $CHKE $CULP $AZREhttps://t.co/r57QUKKDXL pic.twitter.com/LP1JQkCiot https://t.co/LSuIKv5RbB

— Melonopoly (@curtmelonopoly) June 10, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

VOLATILITY S&P INDEX (VIX) Time cycle concludes approx July 16, 2018 on large weekly structure. Moves probable in to and out of that timing. $VIX #volatility

US Dollar Index (DXY) Shorts MAY get some reprieve soon, but this move is structured – get out of its way until it isn’t. $DXY #algorithm

Alert 132 AM 66.02 long with price target 66.20 predicted at 400AM. Perfect hit to cent to minute. Precision oil trade alerts. Oil Algorithm (EPIC). FX $USOIL $WTI $USO $CL_F #OIL

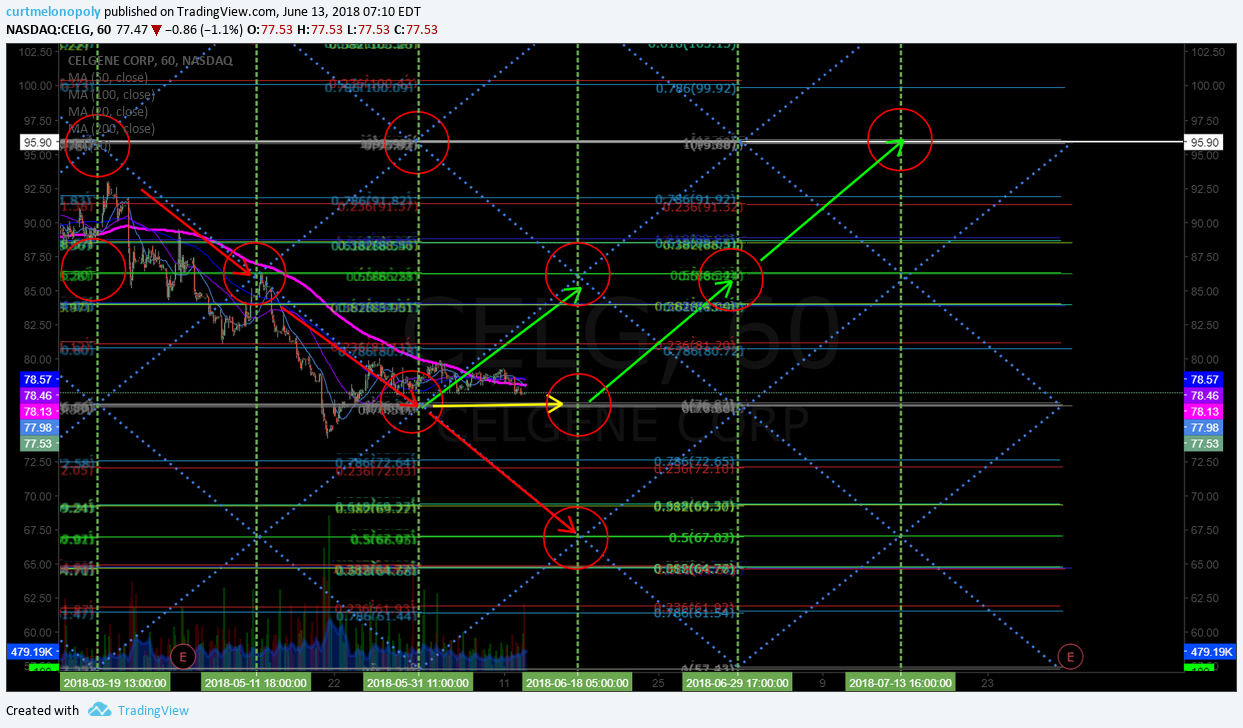

CELGENE (CELG) If you do get a reversal here, this is your likely up channel with price targets. #swingtrading

APPLIED OPTOELCTRONICS (AAOI). 49.50 July 5 target in play trading 43.52 intra. $AAOI #swingtrading

Ambarella (AMBA) If this holds 40.10 in to June 21 time cycle it will bounce on other side of that. $AMBA #snapback #washout #swingtrading

Overnight oil trade alerts went well, 100% win rate for months now. Ask for a time-stamped personal tour. Oil Algorithm (EPIC). FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

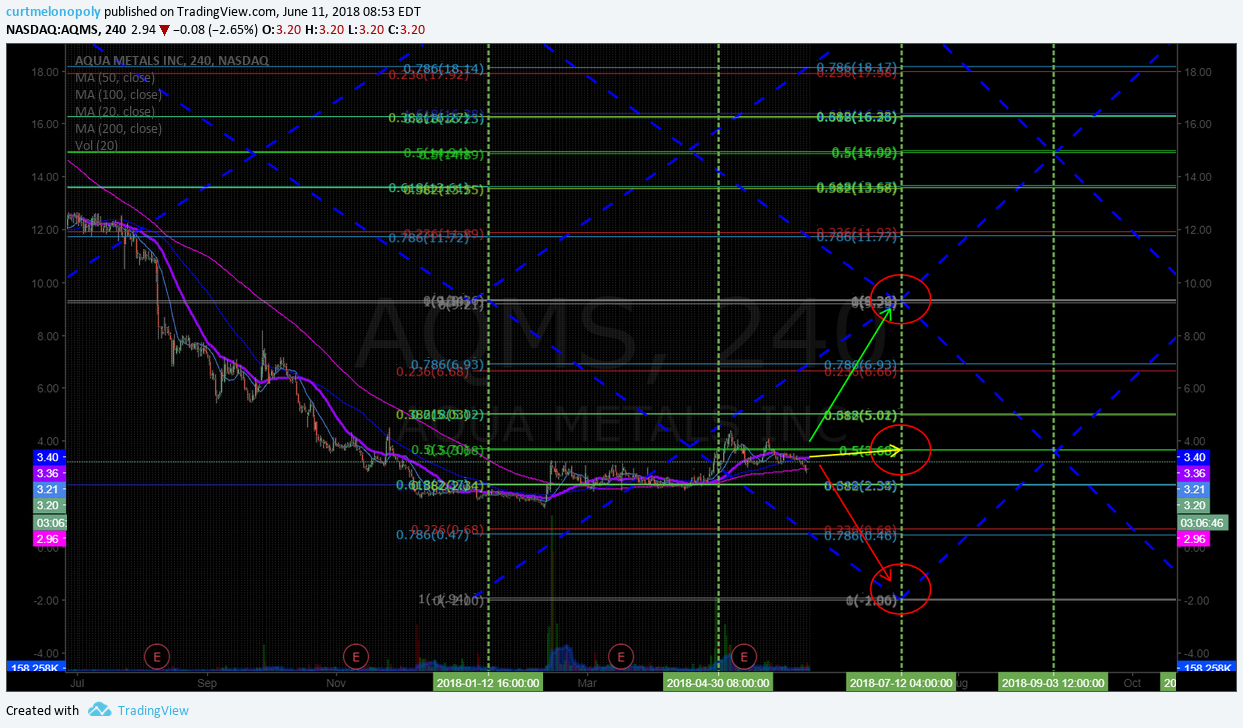

AQMS $AQMS premarket trading 3.24 up 8.5% #daytrading #swingtrading

Oil Chart (Daily). K.I.S.S. chart has MACD still turned down price on 100 MA. June 11 203 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

Oil Chart (Monthly). Trade under 200 MA under pivot but 20 MA about to breach 50 MA – indecisive. June 11 157 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

And we’re there Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto

Per recent;

This kinda looks like that #sesamestreet Silver trading #SILVER $SLV By the way, yes the 19th target was hit #symmetry

FITBIT (FIT) CHART. Remains in structured intra time frame bullish formation, over 6.14 main support, 6.65 PT in play. $FIT

WYNN RESORTS (WYNN) Per last alert, yesterday did bounce, looking for structure now On watch for washout snapback.

$CLDR MACD on weekly curled up long over 17.60 to 18.73

SP500 (SPY) target resistance 278.54 in play. Main resistance in range trim heavy in to it and caution above to 281.00 resistance. $SPY #swingtrading

TESLA (TSLA) Cleared 100 MA to stop just shy of 200 MA resistance. Trim in to 200 MA and 326.82 pivot add above. $TSLA

PACIRA Pharma (PCRX) +6.38% yesterday trading 37.50 over 37.05 targets 39.65 40.50 41.85 June 13 if as it confirms. $PCRX

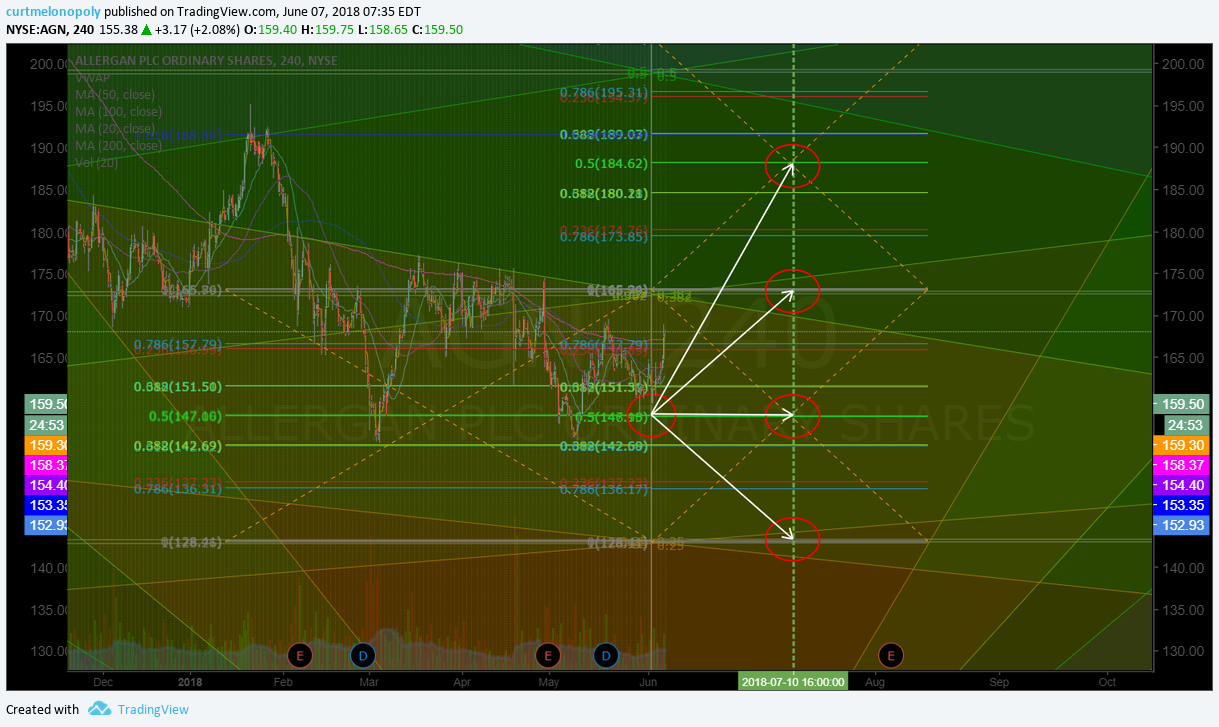

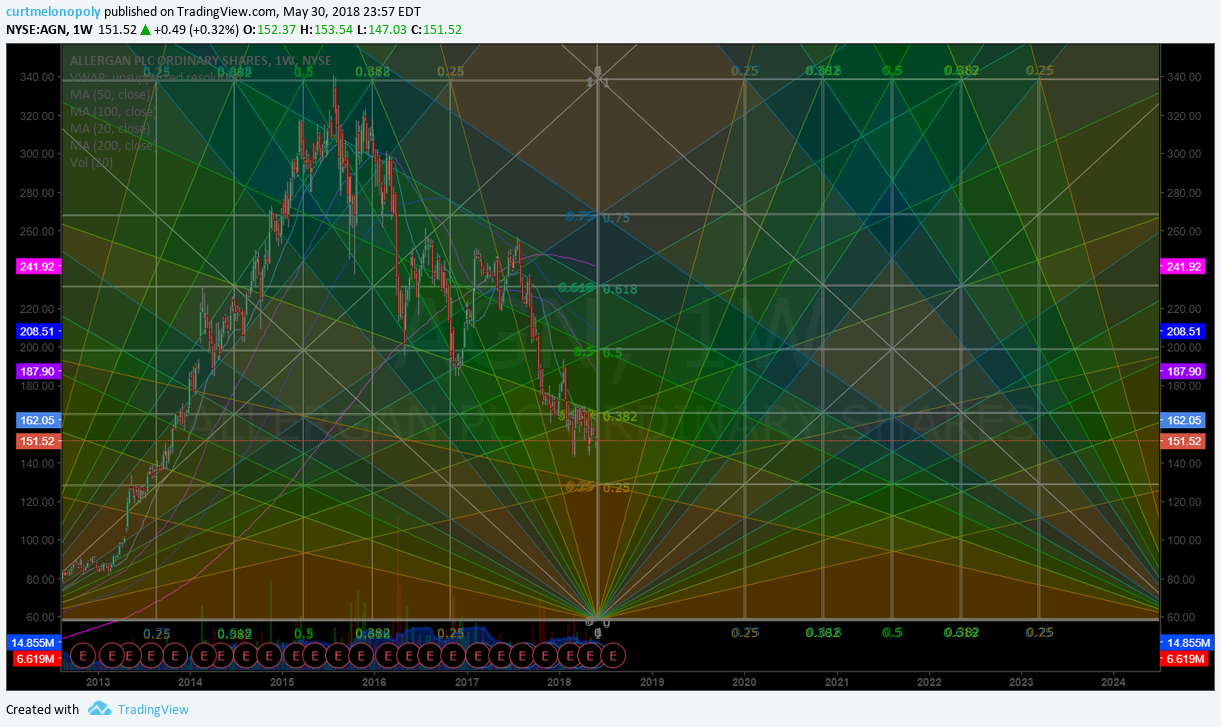

ALLERGAN (AGN) The trade I am looking for is over 165.50 preferrably to follow this trend forward.

VALEANT (VRX) Trade confirming trading 24.82 high of day. Nice trade here.. $VRX #swingtrading #daytrading .

ALLERGAN (AGN) 4 Hour Chart View with Price Targets. $AGN #chart

If AQMS gets over 50 MA (purple) on Weekly chart targets 9.38 Aug 13, 2018. Bullish scenario.

Markets are so machine controlled now 15 of 19 of these symmetrical targets $SLV $USLV $DSLV #Silver #Chart #Symmetry

LITHIUM AMERICAS CORP (LAC). Primary range support today, bounce, test 20 MA res, targets 7.80 Jan1 trading 5.54 intra. $LAC #swingtrading

MAXIM INTEGRATED PRODUCTS (MXIM) Short side trade went. Bulls in it bounced b4 50 MA weekly. $MXIM #swingtrading

$AAPL premarket over 191.44 intra resistance trading 191.67 premarket. Next resistance near 195.00 #daytrading #swingtrading #chart

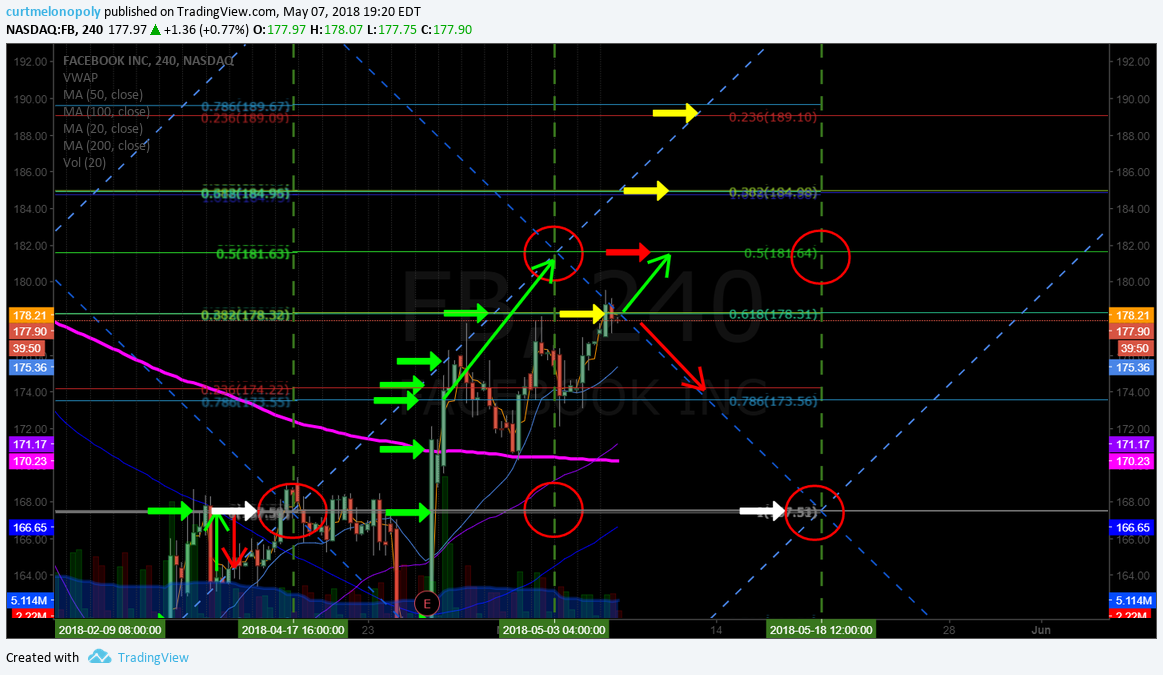

Facebook trade – longs should be trimming in to resistance, add above 189.75 for 195.88 June 5 most bullish target. #swingtrading $FB

$IBB on the move trading 108.93 with 112.80 Fib and quad wall resistance. #swingtrading

$GOOGL right up against key resistance – trim in and add above to next. #swingtrading #daytrading

Market Outlook, Market News and Social Bits From Around the Internet:

Five Things You Need to Know to Start Your Day

Get caught up on what’s moving markets.

https://www.bloomberg.com/news/articles/2018-06-15/five-things-you-need-to-know-to-start-your-day

Economic Data Scheduled For Friday.

Economic Data Scheduled For Friday pic.twitter.com/ZBfiYO5cCs

— Benzinga (@Benzinga) June 15, 2018

US High Yield Bonds strengthening, Emerging Market High Yield Bonds weakening. Divergence to watch. $HYG $EMHY

US High Yield Bonds strengthening, Emerging Market High Yield Bonds weakening. Divergence to watch. $HYG $EMHY pic.twitter.com/mQFPdXScaG

— Charlie Bilello (@charliebilello) June 15, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $CLPS 51%, $HJLI 29%, $GOOS 20%, $AMBO $BAK $VSTM $JRSH $GEVO $DPW $RDY $NNDM $TOPS $TVIX $TXMD $GLUU $HX $SOGO $UGAZ $UVXY $SNY

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan,Tariffs, Bonds, $GOOS, $TWTR, $VSTM, $FB, $AGN, $AAPL, OIL, $SPY, $VIX