Tag: $GM

PreMarket Trading Plan Thurs May 31: $AAOI, $MDGL, $VKTX, $VTVT, $AKER, $CRIS, $GM, $DG, $SHLD, $PVH, $BOX, $GES, $BRKB more.

Compound Trading Trading Plan and Watch List Thursday May 31, 2018.

In this edition: $AAOI, $MDGL, $VKTX, $VTVT, $AKER, $CRIS, $GM, $DG, $SHLD, $PVH, $BOX, $GES, $BRKB and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing. #IA #AI #Algorithms #Coding

Machine Trading – New Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Live Trading Room & Premarket Reporting:

Main Link and password is emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Next sessions recommence week of Monday June 3, 2018 as coding team is preparing new environment.

Premarket report is on a lead trader / trading team availability basis only (the premarket reports are not published every market day).

Real-time Alerts:

Real-time Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Disclaimer / Disclosure:

Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email us.

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: GM, DG, SHLD, PVH, BOX, GES, BRKB & more

28 Stocks Moving In Thursday’s Pre-Market Session https://benzinga.com/z/11804285 $MDGL $VTVT $CRIS $TYLS $EXPR $BURL $CLSD $CRSP $SHLD $BOX $DG

28 Stocks Moving In Thursday's Pre-Market Session https://t.co/KXcusW9CEr $MDGL $VTVT $CRIS $TYLS $EXPR $BURL $CLSD $CRSP $SHLD $BOX $DG

— Benzinga (@Benzinga) May 31, 2018

12 Stocks To Watch For May 31, 2018 https://benzinga.com/z/11802912 $AEO $BOX $CHMI $DG $TECD $DLTR $PVH $GME $LULU $TLYS $COST

12 Stocks To Watch For May 31, 2018 https://t.co/Wn8tYES8N6 $AEO $BOX $CHMI $DG $TECD $DLTR $PVH $GME $LULU $TLYS $COST

— Benzinga (@Benzinga) May 31, 2018

Market Observation:

As of 8:18 AM: US Dollar $DXY trading 93.88, Oil FX $USOIL ($WTI) trading 67.48, Gold $GLD trading 1303.76, Silver $SLV trading 16.50, $SPY 272.78, Bitcoin $BTC.X $BTCUSD $XBTUSD 7554.00 and $VIX trading 14.6.

Momentum Stocks to Watch: $MDGL $VKTX $VTVT $AKER $CRIS

News:

GM’s self-driving unit has drawn a $2.25 billion investment from SoftBank Vision Fund https://bloom.bg/2J04oi1

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$CRM $MOMO $COST $BOX $HPQ $DKS $DLTR $KORS $ADI $ULTA $DG $LULU $ONVO $VMW $BAH $BNS $AMWD $WDAY $ANF $MRVL $AEO $PVH $CIEN $GME $HEI $WMS $BURL $ESLT $DSW $BMO $BIG $TECD $LABL $QTNT $GES $CHS $SPTN $JT $ILL $CMD $KIRK $CMCO

#earnings for the week$CRM $MOMO $COST $BOX $HPQ $DKS $DLTR $KORS $ADI $ULTA $DG $LULU $ONVO $VMW $BAH $BNS $AMWD $WDAY $ANF $MRVL $AEO $PVH $CIEN $GME $HEI $WMS $BURL $ESLT $DSW $BMO $BIG $TECD $LABL $QTNT $GES $CHS $SPTN $JT $ILL $CMD $KIRK $CMCO https://t.co/lObOE0dgsr pic.twitter.com/9SxxOUl6iF

— Earnings Whispers (@eWhispers) May 26, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to date on the top of each chart.

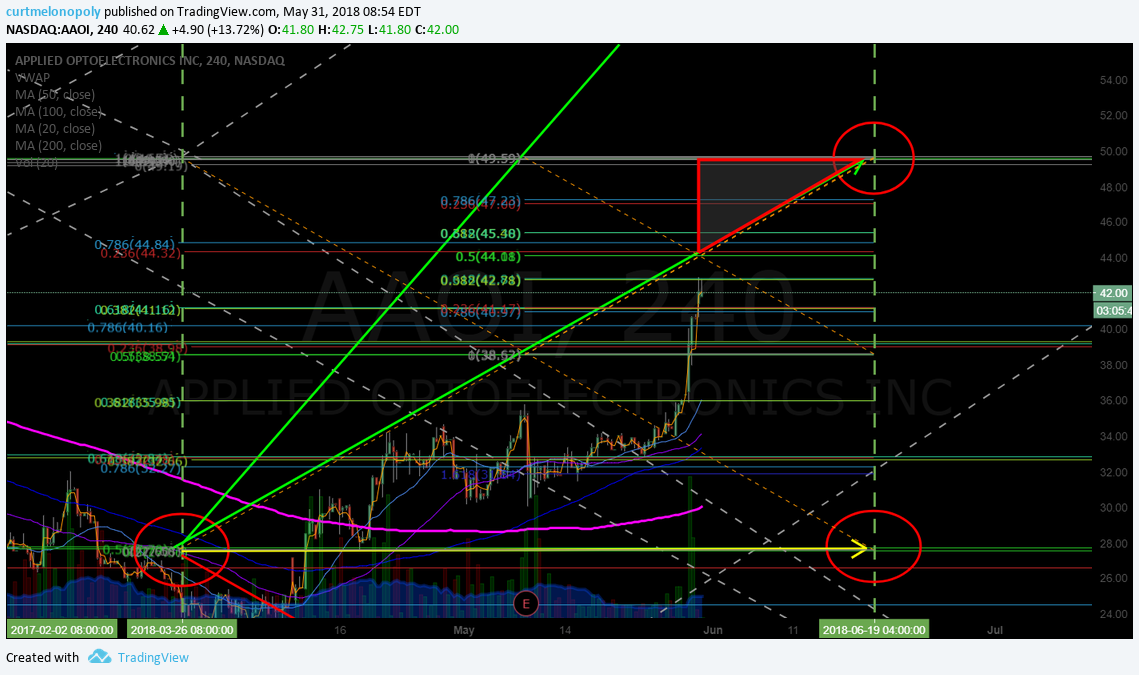

AAOI swing trades over 44.08 can target triangle uptrend area to June 16 target #swingtrading $AAOI

$AAOI daytrading support and resistance at horizontals – 44.08 is main resistance trading 42.10 premarket #daytrading

Really excited for the huge $AGN time cycle conclusion on or about June 4, 2018. #swingtrading #setups

With MACD turn up and testing under 200 MA this is the test. Above 200 MA add to long #GOLD #CHART $GC_F $XAUUSD $GLD

Gold monthly chart saga continues. Wow. $XAUUSD $GLD $GC_F $GLD $UGLD $DGLD #Gold #Chart

Apple support and upside move test on deck with 20 MA coming up to 185.78 support and current trade at 197.90 $AAPL #swingtrading

$SPY using 100 MA on Daily as Support for Now. MACD looks to be turning down here. SP500

Oil trade in sell-off bounced off 200 MA on Monthly Chart as support for now. $USOIL $WTI $USO #OIL #OilTrading

64.91 Fibonacci level support and 20 MA should be watched on weekly charting. $USOIL $WTI $USO #OIL #OilTrading

US Dollar Index Weekly chart 200 MA resistance is long side swing trade trim area. $DXY $UUP #USD

Market Outlook, Market News and Social Bits From Around the Internet:

Five Things You Need to Know to Start Your Day

Economic Data Scheduled For Thursday

Economic Data Scheduled For Thursday pic.twitter.com/Hc2SvP4AWf

— Benzinga (@Benzinga) May 31, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MDGL $VKTX $VTVT $AKER $CRIS $KTOV $TLYS $NGL $CTRV $JILL $EXPR $GM $TECD $FRO $TRXC $SESN $NBRV $BURL $AAOI $AKS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $BLUE, $LOXO, $BOX, $CMG, $DKS, $LULU, $EXAS, $MOMO

(6) Recent Downgrades: $KORS

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $AAOI, $MDGL, $VKTX, $VTVT, $AKER, $CRIS, $GM, $DG, $SHLD, $PVH, $BOX, $GES, $BRKB

PreMarket Trading Plan Tues May 22: $NFLX, $AAPL, $SPY, OIL, $SNES $CHEK $PLAB $ENT, $KSS, $AAP, $AZO, $GM, $F, $FCAU, $MU more.

Compound Trading Trading Plan and Watch List Tuesday May 22, 2018.

In this edition: $NFLX, $AAPL, $SPY, OIL, $SNES $CHEK $PLAB $ENT, $KSS, $AAP, $AZO, $GM, $F, $FCAU, $MU and more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Quick Update: Reporting, Live Rooms, New Team Members, Pricing, Discounts, Trade Coaching, New Book https://compoundtrading.com/quick-update-reporting-live-rooms-new-team-members-pricing-discounts-trade-coaching-new-book/

What’s New at Compound Trading April / May 2018. https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

Price Increase: Platform wide price increase May 15, 2018. Does not affect existing members. Official announcement to follow.

Machine Trading: May 15, 2018 the new teams start. Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: KSS, AAP, AZO, GM, F, FCAU, MU & more

Micron spikes after $10 billion buyback plan caps bullish Q3 earnings forecast

https://www.thestreet.com/markets/micron-spikes-after-10-billion-buyback-plan-caps-bullish-q3-earnings-forecast-14596880 …

25 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/11755265 $CHEK $MU $CYRN $KSS $PACB $ACIA $LBY $DY $PSTG $AAP $SAIL

https://www.benzinga.com/news/18/05/11755265/25-stocks-moving-in-tuesdays-pre-market-session

Market Observation:

As of 8:35 AM: US Dollar $DXY trading 93.539, Oil FX $USOIL ($WTI) trading 72.58, Gold $GLD trading 1295.87, Silver $SLV trading 16.66, $SPY 273.85, Bitcoin $BTC.X $BTCUSD $XBTUSD 8182.00 and $VIX trading 13.0.

Momentum Stocks to Watch: $SGOC $SNES $CHEK $PLAB $ENT

News:

$ALRN $CHEK $CNET $IMTE $PRPO $RDVT

#Crude rises as #Venezuela #sanctions stoke crude supply risk concern. Read more: http://www.worldoil.com/news/2018/5/22/crude-rises-as-venezuela-sanctions-stoke-crude-supply-risk-concern …

China and U.S. reportedly agree the outline of a plan to settle ZTE’s ban on buying American technology https://bloom.bg/2KMDarh

$RTTR to Present Two Posters at Digestive Disease Week 2018 Highlighting Treatment Data of RP-G28 for Lactose Intolerance

Lowe’s shares climb nearly 2% after announcement that it is hiring the JC Penney CEO Marvin Ellison http://cnb.cx/2rZTePK

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$LOW $TGT $BBY $KSS $AZO $NTNX $TJX $SPLK $TOLL $QD PSTG $DPW $NTAP $HPE $MNRO $FL $AAP $MDT $TIF $INTU $LB $ADSK $MCK $IGT $URBN $CBRL $RL $TD $CTRP $VEEV $ROST $RY $NDSN $WUBA $LX $HRL $PLAB $GPS $EV $DY $DXC $GSM $TTC $RDCM

http://eps.sh/cal

#earnings for the week$LOW $TGT $BBY $KSS $AZO $NTNX $TJX $SPLK $TOLL $QD PSTG $DPW $NTAP $HPE $MNRO $FL $AAP $MDT $TIF $INTU $LB $ADSK $MCK $IGT $URBN $CBRL $RL $TD $CTRP $VEEV $ROST $RY $NDSN $WUBA $LX $HRL $PLAB $GPS $EV $DY $DXC $GSM $TTC $RDCM https://t.co/r57QUKKDXL https://t.co/kTMLDoQ8zI

— Melonopoly (@curtmelonopoly) May 20, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

$ITCI Over 22.63 targets 23.77 and 24.62-66 main resistance on chart. #swingtrading

$PG Wash-out snap-back trade set-up 50 MA on daily resistance. On watch for continued trade.

$NFLX Momentum today trading 331.17 intra resistance support 328.50 triggers in to 337.80 – .83

PSTG earnings play 24.20 targets 25.12 and support areas noted in bearish scenario

$SPY – 273.30 resistance, 273.60, 274.51, 276.04, 276.30, 278.43 – .50 May 30 main resistance price target.

$AAPL – 188.62 main pivot buy sell trigger, trading 188.86 intra, 191.41 194.82 200.60 main resistance

US Dollar Index Daily Chart MACD flat, price above main pivot (red line) over 200 MA. $DXY $UUP

US Dollar Index Daily Chart MACD flat, price above main pivot (red line) over 200 MA. $DXY $UUP

Oil Monthly. Above important chart pivot nearing 100 MA. Use caution long in to 100 MA resistance. $USOIL $WTI $USO #OIL

Nice clean weekend trade. White arrow – alert. Green arrow – buy trigger. Red arrow – resistance per alert. Red circles – price targets. $BTC $XTUSD #Bitcoin #Cryptotrading

Dating back to 2002, 12 of 13 major time cycles on weekly oil chart have seen trend reversal to some extent or another (detailed post on deck to blog) #OILChart

$BOX testing upside buy sell trigger in 28.34 area. Trim in to and add above. #swingtrading

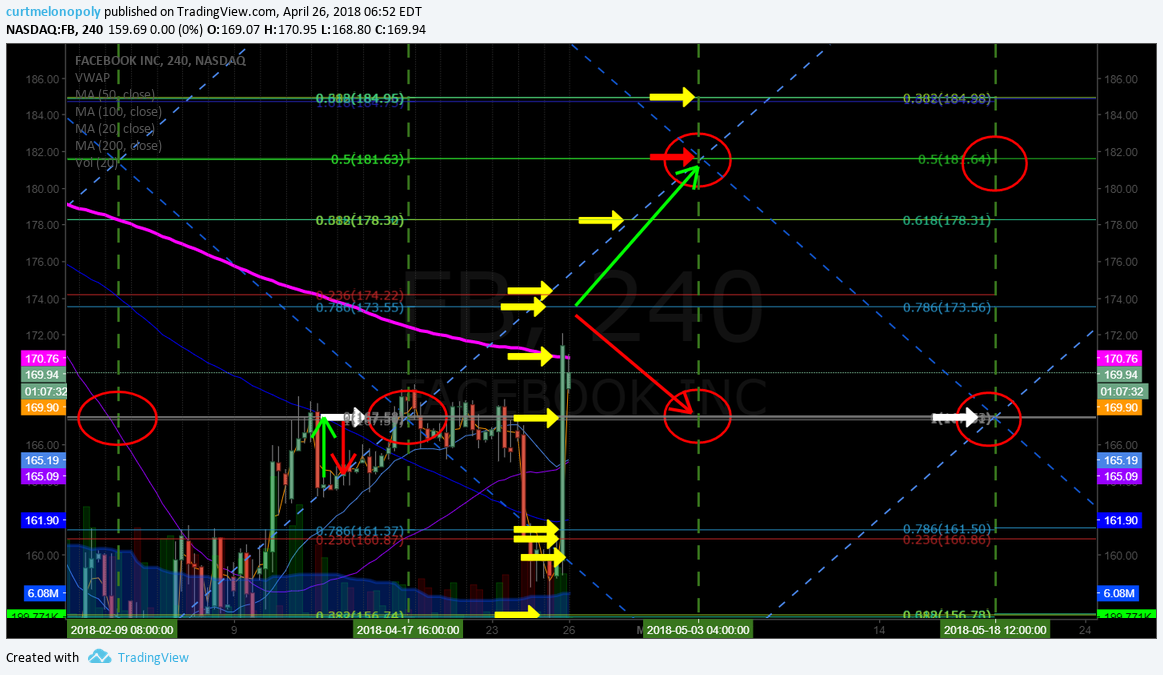

$FB has now retraced to near mid quad support price target 181.72 for May 18. New price targets for June 4 time cycle on chart.

Since the May 11 article we have successfully traded the wash-out snap-back swing trade in $FB. First part of the move here.

$AMD triggering long side add over 12.80 targeting 13.47 13.60 with significant resistance 14.62 #swingtrading

Disney over 200 MA over 103.76 resistance trading 103.96 targets 105.28 next resistance #swingtrading $DIS

Intra Cellular over 21.24 resistance trading 21.36 next target 22.28 and main price target resistance 23.80. #swingtrading

Intra day chart model update for $BOX swing trade #swingtrading #daytrading

$AMBA over 51.60 mid quad res over 200 MA trading 52.19 HOD targeting 54.25 54.75 58.66 #swingtrading

$AAOI hit HOD 33.12 at resistance above targets 37.27 38.69 40.11 200 MA 49.56 July 4 unlikely #swingtrading

$LAC Lithium trading 6.30 power bounce off mid quad 5.40 targeting 6.43 6.54 200 MA res, Jan 1 price targets 7.81 12.60

$MXIM over 20 MA on weekly is a long to 61.38 area. Pivots noted on chart.

Path of least resistance of US Dollar weekly chart 200 MA 94.80 area $DXY

CITI bought conistently at historical support noted previous. MACD trend up. Resistance above. Riding 200 MA. $C

Swing trade $EXP excellent swing trade over buy side 106.10 trim in to 112.28 resistance, next 177.70 major res.

$EDIT flying here hit 37.20 trim in to 37.60 add above – it’s a power move and thats mid quad resistance

$HTZ trading 17.89 premarket – trim in to 50 MA on hourly add above.

Gold. Monthly. $XAUUSD $GC_F $GLD $NUGT $DUST $JDST $JNUG #Gold

Simple symmetrical time cycle on weekly, Volatility reversal leading in to July 23 ish probable. $VIX $UVXY $TVIX

$VIX under moving averages on Daily Chart and under lower bollinger. Long bias RR setting in.

Doesn’t really matter how you draw the lines – there’s a decision coming on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Massive time cycle comes due late July on Gold Daily. Structure in place still. May 14 218 AM #Gold $GLD $GC_F $XAUUSD $NUGT $DUST

With earnings on deck this week watch this one close. 118.00 upside 93.00 downside. Good range. $EXP

$CALA targeting 3.00 range July 6. Trending down quad wall near perfect. Watch for bounce. #swingtrading

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-China cuts car tariffs

-Korea, Nafta talks

-Italy PM, Brexit negotiations

-Markets quiet

-Zuckerberg in Brussels.

https://www.bloomberg.com/news/articles/2018-05-22/five-things-you-need-to-know-to-start-your-day …

Economic Data Scheduled For Tuesday

Economic Data Scheduled For Tuesday pic.twitter.com/k3Zf9ok2IN

— Benzinga (@Benzinga) May 22, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $SGOC $CHEK $PLAB $SNES $TGA $MU $IMTE $KSS $BRZU $DNR $ACIA $CNET $AVEO $CHK $MFGP $GOGL $AAP

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

$MU Stifel Nicolaus Maintains Buy on Micron Technology, Raises Price Target to $106

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $NFLX, $AAPL, $SPY, OIL, $SNES $CHEK $PLAB $ENT, $KSS, $AAP, $AZO, $GM, $F, $FCAU, $MU

PreMarket Trading Plan Thurs Apr 26: $FB, $SPY, $CRK, $MATR, $PENN, #OIL, $WTI, #Crypto, $BTC, $GM, $UPS, $LUV, $DNKN

Compound Trading Chat Room Stock Trading Plan and Watch List Thursday April 26, 2018: $FB $SPY $CRK $MATR $PENN #OIL $WTI #Crypto $BTC $GM, $UPS, $LUV, $DNKN, $PEP, $DHI, $HSY – SP500, $SPY, $BTC, Bitcoin, Gold, $GLD, $GDX, OIL, $WTI, $USOIL, Volatility, $VIX , Silver, $SLV, US Dollar Index, $DXY … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

What’s New at Compound Trading April / May 2018. https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

Trade Coaching Boot Camp coming up. https://compoundtrading.com/trade-coaching/

Preparation for Trade Coaching Boot Camp (for in person & online attendees) #FreedomTraders https://compoundtrading.com/preparation-for-trade-coaching-boot-camp-for-in-person-online-attendees-freedomtraders/

EPIC (Oil) Members Note: Weekly EIA Oil Trade webinar 10:30 AM ET Wed in oil trading room. Also, weekly webinar Wed 11:00 AM ET specific for Oil trade chart analysis, algorithm model use (swing and intra) and cover questions as needed. The videos will be available to EPIC members as a library online. (Previously EIA was in main trading room, but for this purpose we will meet in the oil trading room. The private oil trading Discord channel can also be used for live two way voice question and answer).

April Sale On Now! 10 Promo Codes Per Select Items Only! Ends Apr 30 or if Promo Code limit for a specific item has been reached (10). If there is no sale price beside item listed it is sold out. Click here for available Promo Codes. https://compoundtrading.com/overview-features/ … #trading #stockmarket

April Sale On Now! 10 Promo Codes Per Select Items Only! Ends Apr 30 or if Promo Code limit for a specific item has been reached (10). If there is no sale price beside item listed it is sold out. Click here for available Promo Codes. https://t.co/TFgZFPzOBt #trading #stockmarket

— Melonopoly (@curtmelonopoly) April 16, 2018

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Recent Educational Videos:

Want to learn how to trade stocks for consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: $GM, $UPS, $LUV, $DNKN, $PEP, $DHI, $HSY & more https://cnb.cx/2HuKJBR

Stocks making the biggest moves premarket: $GM, $UPS, $LUV, $DNKN, $PEP, $DHI, $HSY & more https://t.co/rIQQPlCeRc

— Melonopoly (@curtmelonopoly) April 26, 2018

Market Observation:

As of 7:03 AM: US Dollar $DXY trading 91.25, Oil FX $USOIL ($WTI) trading 68.44, Gold $GLD trading 1324.81, Silver $SLV trading 16.56, $SPY trading 263.63, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 8826 , and $VIX trading 17.6.

Recent Momentum Stocks to Watch:

News:

$STML Announces Clinical Presentations of SL-801 and SL-701 at the Upcoming #ASCO18

$ALKS Completes Patient Enrollment in Pivotal Weight Study of ALKS 3831 for Schizophrenia. Topline Results From ENLIGHTEN-2 Study Expected in Q4 2018

$AXSM Announces Positive Outcome of Interim Analysis of STRIDE-1 Phase 3 Trial of AXS-05 in Treatment Resistant Depression

$YTEN Addresses Application of Metabolic Engineering to Increase Crop Yield in Paper Published in Plant Science

$ABBV To Commence Tender Offer For Up To $7.5B Of Common Stock Through Modified ‘Dutch Auction’ Tender Offer As Early As May 1, 2018 BZ Wire

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$AMZN $FB $AMD $MSFT $BA $TWTR $GOOGL $INTC $CAT $HAL $X $V $LMT $PYPL $ALK $XOM $ABBV $F $MMM $AMTD $VZ $T $FCX $WYNN $KMB $UPS $HAS $KO $CMCSA $RTN $AAL $WDC $BIIB $STM $QCOM $TXN $SBUX $GM $ALGN $LUV $UTX $NOK $CMG $CVX $SIRI

#earnings for the week$AMZN $FB $AMD $MSFT $BA $TWTR $GOOGL $INTC $CAT $HAL $X $V $LMT $PYPL $ALK $XOM $ABBV $F $MMM $AMTD $VZ $T $FCX $WYNN $KMB $UPS $HAS $KO $CMCSA $RTN $AAL $WDC $BIIB $STM $QCOM $TXN $SBUX $GM $ALGN $LUV $UTX $NOK $CMG $CVX $SIRIhttps://t.co/r57QUKKDXL https://t.co/mmyg7TNe2o

— Melonopoly (@curtmelonopoly) April 21, 2018

Trade Set-up Alerts & Reports. Recent / Current Holds, Open and Closed Trades:

$FB between mid quad support and 200 MA on 240 Min – break up long break down short.

Oil trade alert from last night going well.

#IA Intelligent Assisted Trading with EPIC Oil Algorithm Model. Next level #AI #MachineLearning on deck May 13, 2018. FX $USOIL $WTI $CL_F $USO #OOTT

#IA Intelligent Assisted Trading with EPIC Oil Algorithm Model. Next level #AI #MachineLearning on deck May 13, 2018. FX $USOIL $WTI $CL_F $USO #OOTT pic.twitter.com/tkCLcDGY1B

— Melonopoly (@curtmelonopoly) April 26, 2018

Oil trade alert next price target hit, trim heavy in to next resistance – that is range resistance. $USOIL $WTI EPIC OIL ALGORITHM

Dollar bulls keep an eye on 200 MA overhead on daily. $DXY #USD $UUP #chart #resistance

$SSW trade going really well. Target in play 8.82. #swingtrading

$AAOI over 32.90 targets 39.18 then 40.66. Watch for 50 MA overhead. (purple)

$AGN I know it’s psychedelic but I think the time cycle is over soon and it reverses. Targets in report. #swingtrading https://www.tradingview.com/chart/AGN/7qp2fwSt-AGN-I-know-it-s-psychedelic-but-I-think-time-cycle-over-soon/ …

$SPY ended week under 50 MA (bearish) however, MACD is still trending up and earnings season in full swing.

Per previous;

Silver touch to 100 MA on Weekly. Not saying it will go… but I wouldn’t want to be short. $SLV, $USLV, $DSLV

100 Day Moving Average on Monthly Oil Chart logical price target. $USOIL $WTI #OIL $USO $UWT $DWT $CL_F #OOTT

Gold bulls continue to press the upper resistance points on daily chart model. #Gold $GLD $GC_F $XAUUSD $NUGT $DUST

$GDX Gold miner trading near mid quad resistance test and perfectly on way to price target. $NUGT $DUST $JNUG $JDST

Bitcoin: April 12 – Bullish indicator – price didn’t drop in to target this time. Not absolute indication of turn, but is a signal. $BTC

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/ …

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn’t bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn't bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.https://t.co/SMEVswx4ha pic.twitter.com/EHM5S9DmcC

— Crypto the BTC Algo (@CryptotheAlgo) April 7, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Iran doubts

-Decision day at the ECB

-Deutsche Bank retrenchment

-Markets flat

-Earnings, earnings, earnings

https://www.bloomberg.com/news/articles/2018-04-26/five-things-you-need-to-know-to-start-your-day …

#5things

-Iran doubts

-Decision day at the ECB

-Deutsche Bank retrenchment

-Markets flat

-Earnings, earnings, earningshttps://t.co/RcjzezoMRY pic.twitter.com/8ocFa3g54h— Bloomberg Markets (@markets) April 26, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $CRK $MATR $PENN $CMG $ORLY $AMD $ALXN $CYS $FB $AXSM $GNC $TAL $PYPL $TQQQ $HMY $YTEN $BLMN $SQ $FCAU $TWTR $ABBV $MU $V

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $TWTR $PHM $CVTI $TOWN $HLX $BA $SSL $CMG $WEX $AVY $ANTM $CSFL $FWRD

$TWTR upgraded to Outperform at Macquarie.

FLIR Systems, Inc. $FLIR PT Raised to $56 at Seaport Global Securities

Stephens Upgrades CenterState Banks $CSFL to Overweight

More

Merit Medical Systems, Inc. $MMSI PT Raised to $54 at Needham & Company

(6) Recent Downgrades: $ONB $LMAT $CYOU $HT $CTXS $GFI $TRVG $FII

AXT, Inc. $AXTI PT Lowered to $10 at Dougherty & Co

Qualcomm $QCOM PT Lowered to $55 at Macquarie Citing ‘weaker demand, lower Licensing, and …

Uranium Energy Corp $UEC PT Lowered to $3.60 at H.C. Wainwright

AMD $AMD PT Lowered to $12 at Macquarie, ‘Strong quarter, but Crypto debate will continue’

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $FB, $SPY, $CRK, $MATR, $PENN, #OIL, $WTI, #Crypto, $BTC, $GM, $UPS, $LUV, $DNKN

PreMarket Trading Plan Mon Apr 9 Gene Editing, $NVCN, $TRPX, $MRK, $VIAB, $CBS, $FB, $GM, $HLT, $BA, $TSLA …

Compound Trading Chat Room Stock Trading Plan and Watch List Monday April 9, 2018: Gene Editing, $AVXS, $NVCN, $TRPX, $MRK, $VIAB, $CBS, $FB, $GM, $HLT, $BA, $TSLA – SP500, $SPY, $SPXL, $SPXS, $BTC, Bitcoin, Gold, $GLD, $GC_F, Gold Miners, $GDX, $DUST, $NUGT, OIL, $WTI, $CL_F, $USOIL, Volatility, $VIX , Silver, $SLV, US Dollar Index, $DXY … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Details to our next Trading Boot Camp in May! We’re over 70% booked so don’t wait. 30% off on this session! And what a location! #tradecoaching #learntotrade

https://twitter.com/CompoundTrading/status/982706326454358017

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Twitter Trading Plan $TWTR (Part two)

#SwingTrading Midday Review – Compound Trading: $LTBR, $ANF, $MOMO, $APTO, $USOIL, $WTI, $BA, $NFLX

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

#SwingTrading Midday Review: $BZUN $SPY $COT $AMRC

Using the S&P500 to Confirm Momentum Correlates: $SPY/$BZUN Model Structures

How I executed volatility trade with precision. $VIX $XIV #Volatility #Trading $TVIX, $UVXY, $SPY

@EPICtheAlgo #EIA Report, January 24, 2018: Inverse Hedge Between #CL and $SPY

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Recent Educational Videos:

Want to learn how to trade stocks for consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

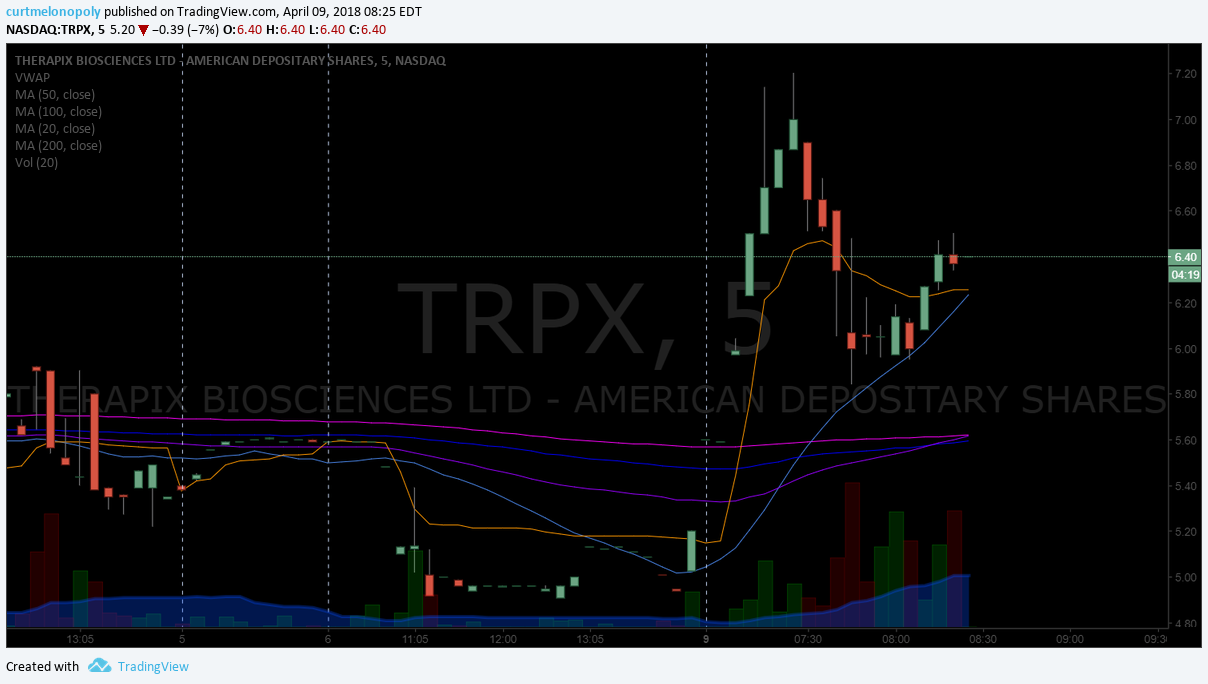

$TRPX premarket up 23% trading 6.40 on positive trial for Tourette.

Market Observation:

As of 6:36 AM: US Dollar $DXY trading 90.07, Oil FX $USOIL ($WTI) trading 62.20, Gold $GLD trading 1328.20, Silver $SLV trading 16.34, $SPY trading 259.72, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 6794.00, and $VIX trading 20.8.

Recent Momentum Stocks to Watch:

News:

$AVXS to be acquired by $NVS for $218/share in cash, or approximately $8.7 bln

$GTXI GTx Announces Early Completion of Patient Enrollment in the ASTRID Trial, a Phase 2 Clinical Trial.

Merck’s stock surges after positive Keytruda trial results.

$IONS licenses IONIS-AZ6-2.5-LRx, or AZD2693 to $AZN. $30M to $INOS

$WYY: WidePoint Awarded Follow-On Mobile Management Contract by the National Center for Advancing Translational Sciences (NCATS)

FDA accepts Verastem’s marketing application for blood cancer med duvelisib, action date October

$MRK KEYTRUDA Monotherapy Met Primary Endpoint in Phase 3 KEYNOTE-042 Study in Locally Advanced or Metastatic NSCLC Patients

Cellect Announces a Major Milestone for Enabling Stem Cells Production http://www.streetinsider.com/Press+Releases/Cellect+Announces+a+Major+Milestone+for+Enabling+Stem+Cells+Production/14034081.html … via @Street_Insider

AstraZeneca licenses NASH candidate from Ionis Pharma https://seekingalpha.com/news/3344332-astrazeneca-licenses-nash-candidate-ionis-pharma?source=feed_f … #premarket $IONS $AZN

Nexeo solutions enter into an agreement with BASF https://seekingalpha.com/news/3344323-nexeo-solutions-enter-agreement-basf?source=feed_f … #premarket $NXEO

Menlo Therapeutics’ stock plunges over 50% after disappointing trial results. Menlo Therapeutics’ lead candidate flunks mid-stage study; shares down 55% premarket https://seekingalpha.com/news/3344347-menlo-therapeutics-lead-candidate-flunks-mid-stage-study-shares-55-percent-premarket?source=feed_f … #premarket $MNLO

China Information Technology Announces the Sale of 9,000 CNIT Terminals Across 3 Contracts

Recent SEC Filings:

Recent IPO’s:

Pivotal Software to offer 37 million shares in IPO at $14 to $16 a pop

Earnings:

#earnings scheduled for the week

$JPM $C $RAD $WFC $DAL $BLK $BBBY $FAST $MSM $PNC $OZRK $APOG $SMPL $FRC $FHN $INFY $SLP $CBSH $SJR $EXFO $LAYN $NTIC $TISA $DPW $HQCL $DGLY

http://eps.sh/cal

#earnings scheduled for the week $JPM $C $RAD $WFC $DAL $BLK $BBBY $FAST $MSM $PNC $OZRK $APOG $SMPL $FRC $FHN $INFY $SLP $CBSH $SJR $EXFO $LAYN $NTIC $TISA $DPW $HQCL $DGLY https://t.co/r57QUKKDXL https://t.co/BcGzJRjTUB

— Melonopoly (@curtmelonopoly) April 7, 2018

Trade Set-up Alerts – Recent / Current Holds, Open and Closed Trades:

Swing Trading in Review. $DIS, $C, $TSLA, $FB, $SPY, $GDX, $CELG https://compoundtrading.com/swing-trading-review-dis-c-tsla-fb-spy-gdx-celg/ …

https://twitter.com/CompoundTrading/status/983045524839452672

Charts and Chart Set-ups on Watch:

Gold came off again at historical resistance for predictable short. Price target June 4 1320.00 area most probable. #Gold $GLD $GC_F https://www.tradingview.com/chart/GOLD/IcE7fVql-Historical-resistance-hit-again-Predictable-short-Chart-Notes/ …

Gold came off again at historical resistance for predictable short. Price target June 4 1320.00 area most probable. #Gold $GLD $GC_F https://t.co/1ic9v7LhsP pic.twitter.com/hZlfN8gjV9

— Rosie the Gold Algo (@ROSIEtheAlgo) April 9, 2018

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/ …

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://t.co/5AWSJCxqA5 pic.twitter.com/9SaQX01K5U

— Swing Trading (@swingtrading_ct) April 8, 2018

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://www.tradingview.com/chart/GDX/xqvoPTby-50-MA-Test-Structure-in-Play-Top-10-Easiest-Trades-See-Notes/ …

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://t.co/EX9GrJPGPK pic.twitter.com/uNM4IIwwCY

— Rosie the Gold Algo (@ROSIEtheAlgo) April 8, 2018

Oil Resistance One of Most Predictable Trades in Markets. See chart notes. $USOIL $WTI $CL_F #OIL #OOTT $USO $UWT $DWT https://www.tradingview.com/chart/USOIL/LFoaIZEq-Oil-Resistance-One-of-Most-Predictable-Trades-See-chart-notes/ …

https://twitter.com/EPICtheAlgo/status/982760354815053824

$MXIM under 55.94 short side looks great. MACD turn. See Chart notes. #swingtrading https://www.tradingview.com/chart/MXIM/l2JjyH3X-MXIM-under-55-94-short-side-looks-great-MACD-turn-Chart-notes/ …

$MXIM under 55.94 short side looks great. MACD turn. See Chart notes. #swingtrading https://t.co/nNQfOV6rMr pic.twitter.com/4241zYTpX0

— Swing Trading (@swingtrading_ct) April 8, 2018

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn’t bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.

https://www.tradingview.com/chart/LTCUSD/NAsEtGUs-Litecoin-likely-bounce-near-here-for-chart-structure-Chart-notes/ …

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn't bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.https://t.co/SMEVswx4ha pic.twitter.com/EHM5S9DmcC

— Crypto the BTC Algo (@CryptotheAlgo) April 7, 2018

$TSLA also blasting here from yesterday’s alert🔥 In it to win it. #swingtrading

$TSLA also blasting here from yesterday's alert🔥 In it to win it. #swingtrading pic.twitter.com/JEefAyUROL

— Melonopoly (@curtmelonopoly) April 5, 2018

$DIS swing trade set-up from swing trading report yesterday blasting here🔥 Nice set-up. In it to win it. #swingtrading https://twitter.com/SwingAlerts_CT/status/981914928528416768/photo/1pic.twitter.com/muDQaThxP2

$DIS swing trade set-up from swing trading report yesterday blasting here🔥 Nice set-up. In it to win it. #swingtrading https://t.co/muDQaThxP2 pic.twitter.com/UXpvTgLpuo

— Melonopoly (@curtmelonopoly) April 5, 2018

Trade in $C Citi on fire🔥In it to win it. #swingtrading

Trade in $C Citi on fire🔥In it to win it. #swingtrading pic.twitter.com/0HKG0jH9sb

— Melonopoly (@curtmelonopoly) April 5, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

Stocks making the biggest moves premarket: $MRK, $VIAB, $CBS, $FB, $GM, $HLT, $BA, $TSLA & more

Stocks making the biggest moves premarket: MRK, VIAB, CBS, FB, GM, HLT, BA, TSLA & more https://t.co/RP0qHTia26

— Melonopoly (@curtmelonopoly) April 9, 2018

#5things

-Sewing up at Deutsche Bank

-China looks to yuan

-Markets rise

-Brexit II

-Huge week for commodities

bloom.bg/2H8qa17

#5things

-Sewing up at Deutsche Bank

-China looks to yuan

-Markets rise

-Brexit II

-Huge week for commodities https://t.co/koa5aUiMIL pic.twitter.com/ylAwt31Cz4— Bloomberg Markets (@markets) April 9, 2018

“The irony of the market is that it doesn’t know what it doesn’t care to find out about.” #OPEC #Oil $WTI $USO

"The irony of the market is that it doesn't know what it doesn't care to find out about." #OPEC #Oil $WTI $USO https://t.co/Yi4LM1JqoG

— Melonopoly (@curtmelonopoly) April 8, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $AVXS, $NVCN, $TRPX, $RGNX $RUSS $SDRL $VSTM $APOP $NOG $CATB $LABU $MDGS $CCIH $USA $HMNY $YINN $XNET $DB $MRK $CLLS $AA $GM

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $DUK, $DXCM, $PCRX, $AMTD, $GM, $NTRA, $BIDU

GM upgraded to Overweight on infrastructure bill potential at Morgan Stanley $GM $FCAU $F http://dlvr.it/QNwgN7

Craig-Hallum Starts Natera $NTRA at Buy

Baidu +1.8% on analyst upgrade https://seekingalpha.com/news/3344335-baidu-plus-1_8-percent-analyst-upgrade?source=feed_f … #premarket $BIDU

(6) Recent Downgrades: $NLNK, $CMCSA, $INCY, $MNLO

Cantor Fitzgerald Downgrades NewLink Genetics $NLNK to Neutral

Comcast $CMCSA: Cutting PT On Smaller Than Expected Buyback – Nomura

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Gene Editing, $AVXS, $NVCN, $TRPX, $MRK, $VIAB, $CBS, $FB, $GM, $HLT, $BA, $TSLA

PreMarket Trading Plan Wed Feb 28 #EIA Report $WTI OIL, $SPY, $FB, $ETSY, $HTBX, $LOW, $BKNG, $DKS, $GM, $SQ

Compound Trading Chat Room Stock Trading Plan and Watch List Wednesday Feb 28, 2018 #EIA Report $WTI OIL, $SPY, $FB, $ETSY, $HTBX, $LOW, $BKNG, $DKS, $GM, $SQ – SP500, $SPY, $SPXL, $SPXS, $BTC, Bitcoin, Gold, $GLD, $GC_F, Gold Miners, $GDX, $DUST, $NUGT, OIL, $WTI, $CL_F, $USOIL, Volatility, $VIX , Silver, $SLV, US Dollar Index, $DXY … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia, Brasil, and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Recent Educational Videos:

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: $LOW, $BKNG, $DKS, $GM, $SQ, $ETSY & more –

Stocks making the biggest moves premarket: LOW, BKNG, DKS, GM, SQ, ETSY & more – https://t.co/g6a0TADHMe

— Melonopoly (@curtmelonopoly) February 28, 2018

#Earnings Breaks Up-Channel, Testing All-Time Highs #Premarket – $ETSY chart

#Earnings Breaks Up-Channel, Testing All-Time Highs #Premarket – $ETSY chart https://t.co/Gp2o0P02QN

— Melonopoly (@curtmelonopoly) February 28, 2018

Possible Up-Channel Continuation Testing Trad. MA’s+Sup/Res – $FB chart

Possible Up-Channel Continuation Testing Trad. MA's+Sup/Res – $FB chart https://t.co/P6PQCgHfDS

— Melonopoly (@curtmelonopoly) February 28, 2018

Market Observation:

US Dollar $DXY trading 90.42, Oil FX $USOIL ($WTI) trading 62.83, Gold $GLD trading 1319.40, Silver $SLV trading 16.43, $SPY trading 274.43 last, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 10483.00, and $VIX trading 18.2.

Recent Momentum Stocks to Watch: $M, $NFLX, $SQ, $NXTD, $MOMO, $X, $CHK

News:

Heat Biologics up 9% premarket in interim mid-stage data on HS-110 – https://invst.ly/6s3vo

$FOMX topline data from FMX101 Phase.3 trial Q3 or early Q4.

Heat Biologics up 9% premarket in interim mid-stage data on HS-110 https://seekingalpha.com/news/3335065-heat-biologics-9-percent-premarket-interim-mid-stage-data-hsminus-110?source=feed_f … #premarket $HTBX

Recent SEC Filings:

Recent IPO’s:

Earnings:

Big earnings movers this morning:

•Lowe’s (LOW) – EPS miss, revenue beat, comps beat

•Etsy (ETSY) – EPS beat, revenue beat

•Papa John’s (PZZA) – EPS miss, revenue beat, ends NFL sponsorship

•Weight Watchers (WTW) – EPS beat, revenue beat

(h/t @VinCaruso92)

Big earnings movers this morning:

•Lowe’s (LOW) – EPS miss, revenue beat, comps beat

•Etsy (ETSY) – EPS beat, revenue beat

•Papa John’s (PZZA) – EPS miss, revenue beat, ends NFL sponsorship

•Weight Watchers (WTW) – EPS beat, revenue beat(h/t @VinCaruso92) pic.twitter.com/ckztpEQqCa

— CNBC Halftime Report (@HalftimeReport) February 28, 2018

#earnings for the week

$SQ $JD $VRX $PCLN $FIT $JCP $M $CRM $LOW $PANW $LL $BBY $NTNX $WTW $ADI $FL $TOL $AMT $SN $SWN $EMES $AZO $IONS $VMW $EXEL $KSS $BCC $CLVS $CPRT $AMC $ALB $ACAD $TJX $DF $AWI $RRC $SPLK $FTR $ENDP $SRPT $CRK $PZZA $DDD $WDAY $BUD

http://eps.sh/cal

#earnings for the week$SQ $JD $VRX $PCLN $FIT $JCP $M $CRM $LOW $PANW $LL $BBY $NTNX $WTW $ADI $FL $TOL $AMT $SN $SWN $EMES $AZO $IONS $VMW $EXEL $KSS $BCC $CLVS $CPRT $AMC $ALB $ACAD $TJX $DF $AWI $RRC $SPLK $FTR $ENDP $SRPT $CRK $PZZA $DDD $WDAY $BUDhttps://t.co/r57QUKKDXL https://t.co/uvzYbb2kZy

— Melonopoly (@curtmelonopoly) February 26, 2018

Recent / Current Holds, Open and Closed Trades:

New alerts platform in transition.

Charts and Chart Set-ups on Watch:

$ETSY premarket up 17% on earnings trading 24.60 #premarket #earnings

$ETSY earnings news premarket: https://finance.yahoo.com/video/etsy-ceo-q4-beat-shows-113300115.html?.tsrc=rss …

$FB Facebook premarket at important pivot area for next move. 182.00 is your line. #swingtrading See chart notes.

Real-time $FB premarket chart link: https://www.tradingview.com/chart/FB/P7wNIGpS-FB-Facebook-premarket-at-important-pivot-area-See-chart-notes/

$SPY Trading SPDR SP500 Price Targets to Mar 8 Price Time Cycle Peak #SP500 #Swingtrading

Real-time $SPY chart-link: https://www.tradingview.com/chart/SPY/4Rk6yqpF-SPY-Trading-SPDR-SP500-Price-Targets-to-Mar-8-Price-Time-Cycle/

$DKS #Premarket Elliot Symmetry After 100 MA Bounce

Real-time $DKS chart link: https://www.tradingview.com/chart/DKS/3vQIaMl3-Premarket-Elliot-Symmetry-After-100-MA-Bounce/

Per previous;

$M Macy’s #Earnings Breaks Heavy Resistance in #Premarket

https://www.tradingview.com/chart/M/ocX2u9pe-Earnings-Breaks-Heavy-Resistance-in-Premarket/

Technicals:

1. Trading at 30.19 in premarket, up 9.65%

2. Price has broken heavy resistance at previous highs on earnings news, as of writing

3. MACD is turned up, and still has some space to go

4. Previously, there have been tests at the 200 and 100 MA’s, coinciding with a mean reversion working into an ascending wedge/up-chnnel option over ~25.30

Fundamentals:

Earnings before opening bell: https://www.cnbc.com/2018/02/27/macys-q4-2017-earnings.html?__source=yahoo%7Cfinance%7Cheadline%7Cstory%7C&par=yahoo&yptr=yahoo

Up-channel Option Testing Highs in #Premarket, #Earnings – $SQ chart

Up-channel Option Testing Highs in #Premarket, #Earnings – $SQ chart https://t.co/6IaXdrI8Er

— Melonopoly (@curtmelonopoly) February 27, 2018

Bitcoin was trading 11400’s at alert now trading 9700’s $BTC $XBTUSD #crypto #algorithm #charting #model #timecycles

Bitcoin was trading 11400's at alert now trading 9700's $BTC $XBTUSD #crypto #algorithm #charting #model #timecycles https://t.co/QyX3k79kk3

— Melonopoly (@curtmelonopoly) February 26, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

Economic Data Scheduled For Wednesday

Economic Data Scheduled For Wednesday pic.twitter.com/jzw5NApCmk

— Benzinga (@Benzinga) February 28, 2018

Wall Street on course for February loss, first in 10 months – https://invst.ly/6s3em

Wall Street on course for February loss, first in 10 months – https://t.co/25LDncrIPn

— Investing.com Stocks (@InvestingStockz) February 28, 2018

#5things

-Stocks fall

-Euro-area inflation drops

-Mnuchin says U.S. may return to TPP

-E.U. presents draft Brexit deal

-Data due

https://www.bloomberg.com/news/articles/2018-02-28/five-things-you-need-to-know-to-start-your-day …

#5things

-Stocks fall

-Euro-area inflation drops

-Mnuchin says U.S. may return to TPP

-E.U. presents draft Brexit deal

-Data duehttps://t.co/oJyKUb2RKH pic.twitter.com/uIHxFwWZ76— Bloomberg Markets (@markets) February 28, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $STB $AAXN $ETSY $BPMX $WTW $ENPH $HTBX $DQ $NIHD $SVXY $YANG $SNAP $BEDU $AEG $WPP $BCS $JNUG $GSK

(2) Pre-market Decliners Watch-List : $FTR, $VRX, $LOW $CELG $HTZ $UVXY $TVIX $CROX $BBL $RIO

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $MNK, $SQ, $PYDS

$MELI MercadoLibre PT Raised to Street High (PT to $500 from $270)at JPMorgan on Fintech

Etsy $ETSY PT Raised to $28 at DA Davidson

(6) Recent Downgrades: $TSRO, $CELG, $FPRX, $HMNY

Lumber Liquidators $LL PT Lowered to $24 at Morgan Stanley

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, #EIA Report $WTI OIL, $SPY, $FB, $ETSY, $HTBX, $LOW, $BKNG, $DKS, $GM, $SQ

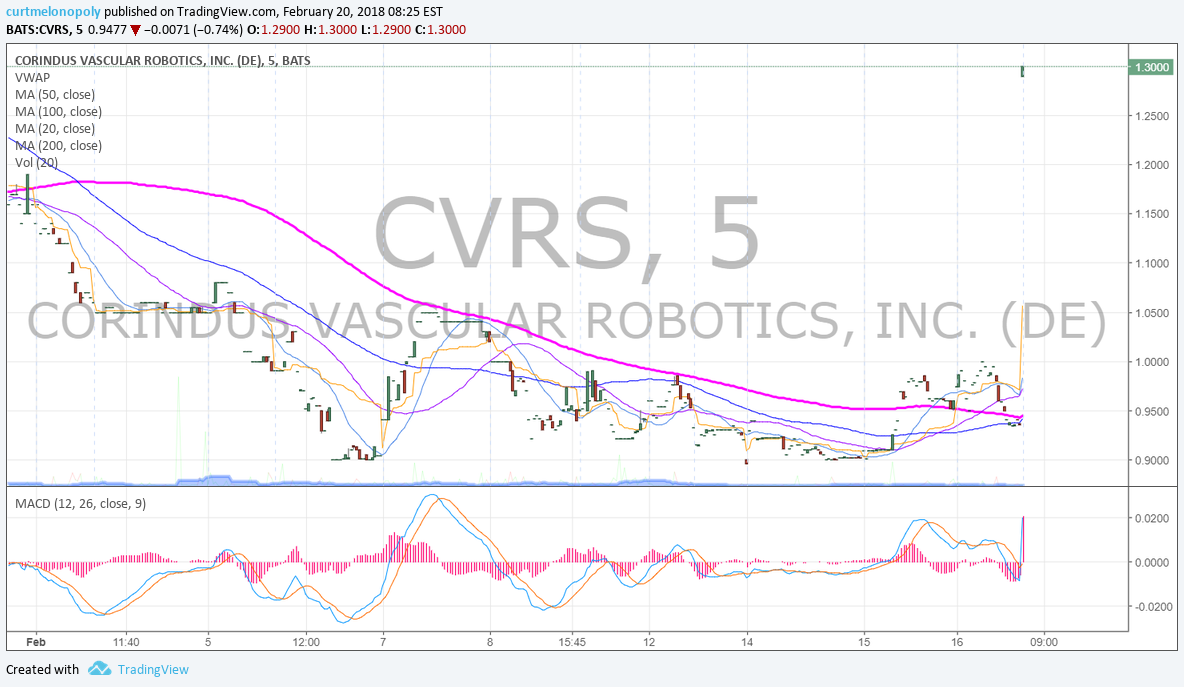

PreMarket Trading Plan Tues Feb 20 $CVRS, $WMT, $HD, $QCOM, $GE, $GM, $HSBC, $AAPL

Compound Trading Chat Room Stock Trading Plan and Watch List Tuesday Feb 20, 2018 $CVRS, $WMT, $HD, $QCOM, $GE, $GM, $HSBC, $AAPL – $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY – $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL, $VIX , Gold Miners $GDX, Silver $SLV, $USOIL, US Dollar Index $USD/JPY, $DXY, S&P 500, Volatility … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

Curtis is on annual holiday from Feb 13 – 23.

Reporting and trading rooms run per normal. Mid day reviews will recommence when he returns. Curtis will be intermittently in trading rooms only during that time.

Service(s) Memo Follow-Up re: Compliance and Service Offerings Going Forward

https://twitter.com/CompoundTrading/status/963218112668631041

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia, Brasil, and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Recent Educational Videos:

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: WMT, HD, QCOM, GE, GM, HSBC, AAPL & more http://cnb.cx/2EG8N7D

Stocks making the biggest moves premarket: WMT, HD, QCOM, GE, GM, HSBC, AAPL & more https://t.co/mR75eopYUd pic.twitter.com/DuifmaIFne

— The Exchange (@CNBCTheExchange) February 20, 2018

30 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/11224640 $RAD $OAKS $DCAR $PTX $NXPI $ADMS $RIOT $BBL $SNAP $KIRK

30 Stocks Moving In Tuesday's Pre-Market Session https://t.co/7DZYlgTHLn $RAD $OAKS $DCAR $PTX $NXPI $ADMS $RIOT $BBL $SNAP $KIRK

— Benzinga (@Benzinga) February 20, 2018

Market Observation:

US Dollar $DXY trading 89.32, Oil FX $USOIL ($WTI) trading 61.98, Gold $GLD trading 1338.64, Silver $SLV trading 16.49, $SPY trading 271.89 last, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 11470.00, and $VIX trading 20.9.

Recent Momentum Stocks to Watch:

News:

Recent SEC Filings:

Recent IPO’s:

Some Earnings On Deck:

#earnings for the week

$WMT $HD $ROKU $DPZ $CHK $OLED $AAOI $MGM $MDT $UCTT $FSLR $TTD $DUK $EXAS $SIX $P $STMP $TREE $CBRL $AAP $RIG $CTB $WLL $NBL $LNG $HLX $WLK $TPH $WAB $W $OC $APA $DVN $GRMN $HFC $GPC $SO $EGN $HSIC $LC $ECL $MOS $SLCA $DLPH $CAR

#earnings for the week$WMT $HD $ROKU $DPZ $CHK $OLED $AAOI $MGM $MDT $UCTT $FSLR $TTD $DUK $EXAS $SIX $P $STMP $TREE $CBRL $AAP $RIG $CTB $WLL $NBL $LNG $HLX $WLK $TPH $WAB $W $OC $APA $DVN $GRMN $HFC $GPC $SO $EGN $HSIC $LC $ECL $MOS $SLCA $DLPH $CARhttps://t.co/r57QUKKDXL https://t.co/5WENUDJCMO

— Melonopoly (@curtmelonopoly) February 20, 2018

Recent / Current Holds, Open and Closed Trades

This will commence when Curtis returns from holiday. “With new alert protocol buy / sell signals will be posted here as trade signals trigger along with specific thesis and chart set-ups”.

Per recent;