Tag: $GPRO

PreMarket Trading Plan Fri Oct 5: $ARWR, $GPRO, $TSLA, $FEYE, $SPY, $SHOP, $ROKU, OIL, $VIX, $BTC …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Friday October 5, 2018.

In this premarket trading edition: $ARWR, $GPRO, $TSLA, $FEYE, $SPY, $SHOP, $ROKU, OIL, $VIX, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 5 – Lead trader booked for main trading room for market open, mid day review and futures trading this evening (as available and as market demands).

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars or when Lead Trader is not available.

- Scheduled this week:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 3 – Protected: Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

TESLA on watch in lower area of recent range, likely take a short term swing trade in TSLA today – long.

Gold, Silver and others I have now and I’m doing final edits. To be distributed over next day or two. Letting the set-ups firm up and start trading them again possibly as of Sunday night futures.

Likely start trading Bitcoin XBTUSD and VIX in to next week now also in to mid Dec time cycle.

SPY got a bump in premarket with jobs numbers, as with others above likely trading that aggressive in to time cycle peak mid Dec also come next week.

Oil in a small pull back but expect bullish trend to continue next week.

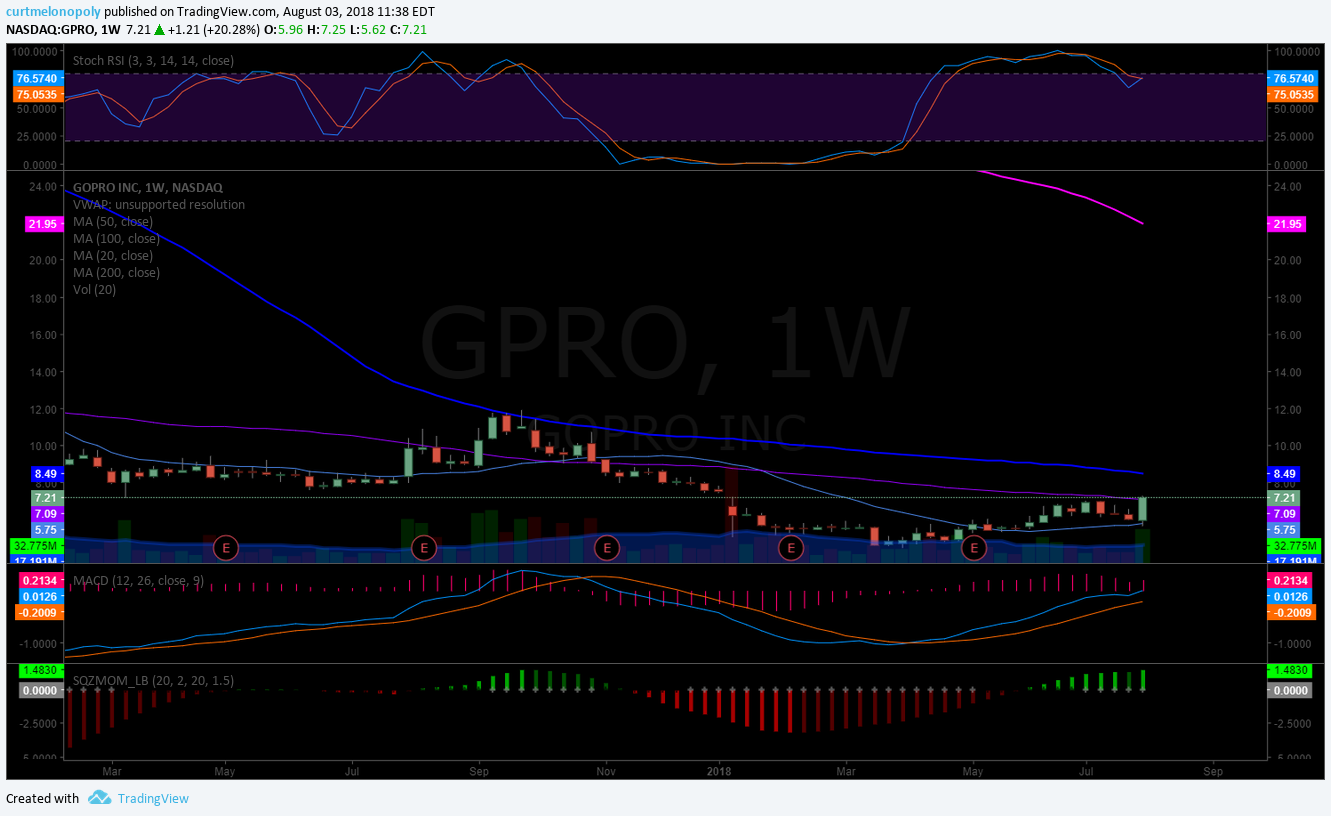

GoPro (GPRO) Reports ‘Strongest Week-One Unit Sell-Thru in Company History’ for HERO7 Black #swingtrading $GPRO http://www.streetinsider.com/Management+Comments/GoPro+%28GPRO%29+Reports+Strongest+Week-One+Unit+Sell-Thru+in+Company+History+for+HERO7+Black/14677954.html … via @Street_Insider

GoPro (GPRO) Reports 'Strongest Week-One Unit Sell-Thru in Company History' for HERO7 Black #swingtrading $GPRO https://t.co/AartczY17f via @Street_Insider

— Swing Trading (@swingtrading_ct) October 5, 2018

Market Observation:

Markets as of 7:18 AM: US Dollar $DXY trading 95.76, Oil FX $USOIL ($WTI) trading 74.63, Gold $GLD trading 1203.62, Silver $SLV trading 14.65, $SPY 289.66 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6544.00 and $VIX trading 14.3.

Momentum Stocks / Gaps to Watch: $INTC

23 Stocks Moving In Friday’s Pre-Market Session https://benzinga.com/z/12463981 $SGH $GPRO $EMKR $VSTM $TLRY $SNAP $GTXI $HSGX $KMPH $CUTR $TSLA $COST $IGC

News:

Delphi Technologies CEO steps down, cuts revenue and margin outlook

Snap rises on report of CEO’s profitability goal for 2019

Recent SEC Filings / Insiders:

Recent IPO’s:

OFS credit prices IPO at $20 a share to raise $50 million $OCCI #IPO https://on.mktw.net/2E0yJLa

Blank check company Collier Creek prices IPO.

Blank check company Collier Creek prices IPO https://t.co/JUJYAiROWf

— Melonopoly (@curtmelonopoly) October 5, 2018

Earnings:

#earnings for the week

$COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN

#earnings for the week $COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN https://t.co/r57QUKKDXL https://t.co/PJ2ABTMR7h

— Melonopoly (@curtmelonopoly) October 1, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

ROKU (ROKU) in pull back could see 58.52, on bounce looking for 78.01 then 87.75 ON WATCH $ROKU #swingtrading #setups

FIREEYE (FEYE) trading 17.35 current trajectory implies 19.31 or 22.32 price target Dec 1 2018 time cycle peak #swingtrade #tradealerts $FEYE

SP500 (SPY) Under pressure, careful with trajectory inflection lines (red) when trading long $SPY $ES_F $SPXL $SPXS #SPY #SwingTrade #Daytrade

SHOPIFY (SHOP) Hit price target from last trade alert, coming off to mid quad 200 MA support, follow trajectory after Oct 9 time cycle $SHOP #swingtrading

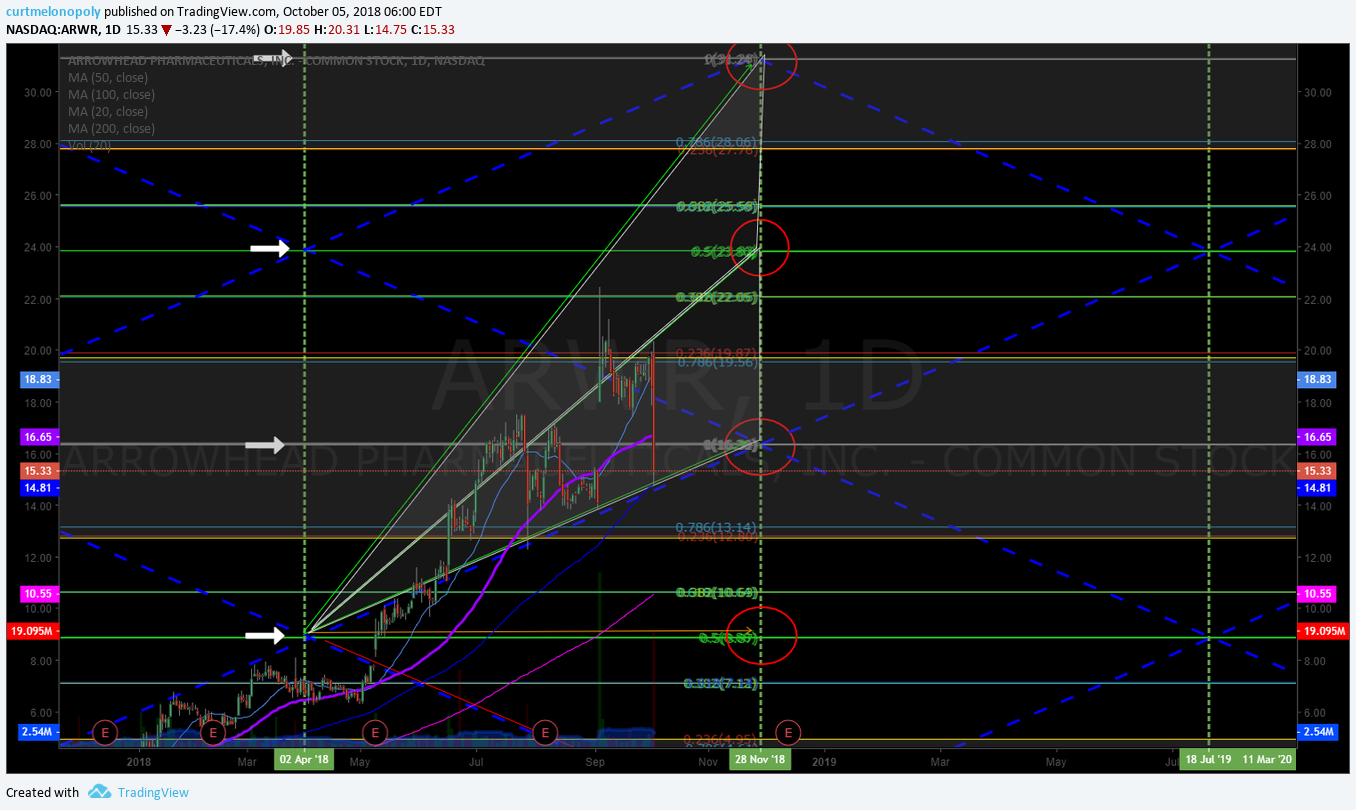

ARROWHEAD PHARMA (ARWR) Long positions starting at channel trajectory support mid 15s. Solid range support near 13.14 $ARWR #swingtrading #chart

APPLE (AAPL) premarket testing highs, leading the charge. $AAPL #premarket #trading

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

Crude Oil Monthly Chart testing 100 MA resistance. Oct 2 517 AM FX $USOIL $WTI $USO $CL_F #OIL #chart

ALLERGAN (AGN) Looks like it may not be ready to retrace to bottom of channel in forecast, testing new highs.

TESLA (TSLA) Upper and lower price targets in to next time cycle nearing $TSLA #tradealerts #swingtrading

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-It’s jobs day

-Senate to vote on Kavanaugh

-Mixed fortunes for commodities

-Markets drop

-Brazil election

https://bloom.bg/2zUd2s7

J&J, Arrowhead in gene-silencing drug deal worth up to $3.7 billion $ARWR #swingtrading https://finance.yahoo.com/news/j-j-arrowhead-gene-silencing-115253968.html?soc_src=social-sh&soc_trk=tw … via @YahooFinance

J&J, Arrowhead in gene-silencing drug deal worth up to $3.7 billion $ARWR #swingtrading https://t.co/DzGQNJTxnT via @YahooFinance

— Swing Trading (@swingtrading_ct) October 4, 2018

Analysts out positive on FireEye after summit, product launch https://seekingalpha.com/news/3395097-analysts-positive-fireeye-summit-product-launch?source=tweet … $FEYE #swingtrading

Analysts out positive on FireEye after summit, product launch https://t.co/jGKjbGbIwG $FEYE #swingtrading

— Swing Trading (@swingtrading_ct) October 4, 2018

The most influential endowment manager just jumped into crypto with bets on two Silicon Valley funds https://cnb.cx/2yk5zjQ

The most influential endowment manager just jumped into crypto with bets on two Silicon Valley funds https://t.co/pC7Rd3Ley1

— Crypto the BTC Algo (@CryptotheAlgo) October 5, 2018

Yale University has invested in everything from Puerto Rican bonds to New Hampshire timber. Now it’s getting into the market for cryptos https://www.bloomberg.com/news/articles/2018-10-05/yale-is-said-to-invest-in-crypto-fund-that-raised-400-million … via @markets

Yale University has invested in everything from Puerto Rican bonds to New Hampshire timber. Now it's getting into the market for cryptos https://t.co/ahcawVK8Nx via @markets

— Crypto the BTC Algo (@CryptotheAlgo) October 5, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $GTXI $VTVT $DELT $SGH $EMKR $PTIE $PGNX $BRZU $HIMX $PLX $LCI $OGEN $PBR $GPRO $ATRC $NBEV $SNAP

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Wolfe Research Downgrades ArcBest Corp $ARCB to Underperform

Wolfe Research Downgrades Trucking Subsector to Market Underweight

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, $ARWR, $GPRO, $TSLA, $FEYE, $SPY, $SHOP, $ROKU, OIL, $VIX, $BTC

PreMarket Trading Plan Wed Sept 26: EIA, Crude Oil, Fed, $ALDX, $SQ, $NKE, $SVMK, $GPRO, $DIS, $AMD more.

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday September 26, 2018.

In this premarket trading edition: $ALDX, $SQ, $NKE, $SVMK, $DIS, $OSIS, $BLDP, $LEBV, $CRON, $NBEV, $NFLX, $FB, $SHOP, OIL, $EDIT, $BABA, $GTHX, $AGN, $ROKU, $CVM, $XXII, $MOMO, $SPY, $DXY, $BOX, $CARA, $PROQR, $XBIO, $AAPL, $ARWR, $VIX, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Sept 26 – Lead trader booked for main trading room for market open, #EIA report crude oil trading at 10:30, mid day review and futures trading this evening (as available and as market demands).

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, special Trading Webinars or when the lead trader is not available.

- In final edits for release this week;

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

The Square $SQ trade from yesterday is going well, trading 96.30 in premarket today with a swing trade entry at 89.00 and looking for more legs in this trade (see Square $SQ feature post and video).

Today is EIA Petroleum Report day at 10:30 AM. Looking for a large swing trade in oil (see feature report sent to members last night).

Stocks making the biggest move premarket: NKE, IBM, MRK, KBH, SVMK & more https://www.cnbc.com/2018/09/26/stocks-making-the-biggest-move-premarket-nke-ibm-mrk-kbh-svmk–more.html

$SVMK Per CNBC;

SVMK – SVMK priced its initial public offering at $12 per share, above the expected range of $9 to $11 per share. The parent of SurveyMonkey also increased the size of its offering to 15 million shares from the original 13.5 million, and the IPO’s pricing gives the company a market value of $1.46 billion.

$NKE Per CNBC;

Nike – Nike reported quarterly profit of 67 cents per share, 4 cents a share above estimates. The athletic footwear and apparel maker’s revenue was just barely above Street forecasts. Nike benefited from strong consumer spending in the U.S. market, among other factors, but some analysts are concerned about what they consider weaker than expected profit margins.

$GRPO per CNBC;

GoPro – The stock was upgraded to “outperform” from “perform” at Oppenheimer, based on the high definition camera maker’s new product offerings and what the firm calls appropriate pricing.

Below are some trade position notes from the last week or so if you didn’t catch them;

Still watching the week set-up, I expect a significant oil size trade (swing and intra-day) very near, in a new Disney $DIS trade, the $XBIO set-up was awesome and there’s a number of others we are working on. I don’t see any reason why we won’t be able to push these set-ups out this evening after the markets close. There is so much going on right now in the markets (the ground is moving) that we have to start pushing this stuff out and get ready.

Doing some charting in premarket for $CLRB and $APDN – both very interesting set-ups IMO.

BTW the Bitcoin $BTC trade will be big soon, the charting is setting up, we will be updating members on the inflection move prior. We expect up, but we will be alerting the BTC set-up for both scenarios.

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

The videos this week and the boot camp trade set-up reviews have been right in the flow of the market. We’re working on the rest of the equities we follow now and will have them all out over the next few days. Today in mid-day review I will tackle some more of the set-ups.

Market Observation:

Markets as of 8:10 AM: US Dollar $DXY trading 94.14, Oil FX $USOIL ($WTI) trading 71.75, Gold $GLD trading 1198.21, Silver $SLV trading 14.43, $SPY 291.14 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6378.00 and $VIX trading 11.9.

Momentum Stocks / Gaps to Watch:

$ALDX Alderya’s stock rockets after positive trial results of mesothelioma treatment https://www.marketwatch.com/story/alderyas-stock-rockets-after-positive-trial-results-of-mesothelioma-treatment-2018-09-26?mod=BreakingNewsSecondary

28 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12409271 $ALDX $IGC $VSTM $EGY $KBH $GPRO $VNDA $DGLY $CONE $TEN $NKE $CTAS

28 Stocks Moving In Wednesday's Pre-Market Session https://t.co/OO2rmEC8Mv $ALDX $IGC $VSTM $EGY $KBH $GPRO $VNDA $DGLY $CONE $TEN $NKE $CTAS

— Benzinga (@Benzinga) September 26, 2018

News:

$TLRY Supreme Cannabis Signs $12M Guaranteed Supply Agreement with Tilray®Supreme Cannabis (SPRWF) and Tilray® enter into a twelve-month guaranteed supply agreement Supreme Cannabis (SPRWF) to supply 7ACRES premium dried cannabis to Tilray®

Recent SEC Filings / Insiders:

Recent IPO’s:

$SVMK SurveyMonkey IPO is bigger than expected https://www.marketwatch.com/story/surveymonkey-ipo-is-bigger-than-expected-2018-09-25?mod=mw_share_twitter

Elastic sets IPO terms to raise up to $203 million, to be valued at up to $2 billion

$BNGO REMINDER: Analyst IPO Quiet Period Expiration Today for BioNano Genomics

Ticketing company Eventbrite prices IPO at $23 to raise $230 million

Gritstone Oncology sets terms for IPO to raise up to $91.1 million

Qutoutiao prices IPO at $7 per ADS, raising $84 million

Earnings:

Actuant’s stock tumbles after earnings and sales beat but profit outlook falls short

#earnings for the week

$NKE $BB $KMX $RAD $KBH $JBL $ACET $FDS $MANU $BBBY $NEOG $ACN $CCL $INFO $ATU $MTN $WOR $CTAS $MKC $CAG $ASNA $AIR $OMN $CMD $FGP $PRGS $ESNC $ANGO $CAMP $FUL $DAC $ISR $SCHL

#earnings for the week$NKE $BB $KMX $RAD $KBH $JBL $ACET $FDS $MANU $BBBY $NEOG $ACN $CCL $INFO $ATU $MTN $WOR $CTAS $MKC $CAG $ASNA $AIR $OMN $CMD $FGP $PRGS $ESNC $ANGO $CAMP $FUL $DAC $ISR $SCHL https://t.co/r57QUKKDXL https://t.co/pVka1Ud3QD

— Melonopoly (@curtmelonopoly) September 24, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

$ALDX Premarket trading 12.60 up 27 percent Alderya’s stock rockets after positive trial results of mesothelioma treatment #premarket

DISNEY (DIS) swing trade trading HOD 114.70 with intra resistance, serious resistance at quad wall (dotted gray) next $DIS #swingtrading #tradealerts

SQUARE (SQ) swing trade alert going well. As trade nears previous highs on candles on 240 expect resistance until break-out. $SQ #tradealerts

ADVANCED MICRO (AMD) hit key resistance at mid quad and came off now near a support, some members in this play toward price target #swingtrading #tradealerts

Screen shot of crude oil trading room, lead trader discussing oil trading signals and strategy in chat. #oiltradingroom

Screen Shot of Crude Oil Trading Room and the oil trading signals discussed by lead trader.

Swing trade alert at 89.00 on Square $SQ today at market open. Chart shows the incredible trading in Square today. #swingtrade #tradealerts

$SQ opened strong today on upgrade, long 89.00 and we’ll be looking for more size / legs in this one. Closed the day at 95.95. #swingtrading #daytrading #tradealerts

$SQ opened strong today on upgrade, long 89.00 and we'll be looking for more size / legs in this one. Closed the day at 95.95. #swingtrading #daytrading #tradealerts pic.twitter.com/sYOmmRJ27s

— Melonopoly (@curtmelonopoly) September 26, 2018

As the media wars heat up, Chart Master Carter Worth sees one company as a buy: Disney $DIS #swingtrading

As the media wars heat up, Chart Master Carter Worth sees one company as a buy: Disney $DIS #swingtrading https://t.co/KiWbcjO7PO

— Swing Trading (@swingtrading_ct) September 25, 2018

Best Oil Stocks to Buy Now https://finance.yahoo.com/news/best-oil-stocks-buy-now-012433429.html?soc_src=social-sh&soc_trk=tw …

Best Oil Stocks to Buy Now https://t.co/mh3568k1o0 via @YahooFinance

— Melonopoly (@curtmelonopoly) September 24, 2018

APPLE (AAPL) premarket bullish momentum with 20 MA test and 224.60 range buy sell trigger above $AAPL #swingtrading #tradealerts

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

CARA THERAPEUTICS (CARA) Nice swing trade from trading bootcamp in to next leg at resistance intra day $CARA #swingtrade #tradealert

OSI SYSTEMS (OSIS) Trading 77.55 testing 50 MA and key Fib resistance, over targets 84.21 Dec 28, 18 $OSIS #tradealerts #swingtrading

BALLARD POWER (BLDP) Five out of five of the last major time cycles price reversed, Oct 10 is next time cycle peak. $BLDP #swingtrading #tradealerts

LEVEL BRANDS (LEVB) trading 6.54 premarket long in to 8.09 price target, 6.16 area support. $LEVB #daytrading #swingtrade

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

CRONOS – per yesterday’s trade alert and review video over trendline on way to resistance test in premarket $CRONO #tradealert #premarket

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

CVM Looking to break recent highs out of bullish bowl targets 5.00 then 6.00. $CVM #swingtrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

SP500 (SPY) near break upside test, above signals targets 293, 294.20, 295.50, 297 resistance Sept 21 ish $SPY $ES_F $SPXL $SPXS #SPY #Swingtrade #tradingalerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

PROQR THERAPEUTICS (PRQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

Risk appetite keeps climbing…

Risk appetite keeps climbing… pic.twitter.com/QhRj5H21zn

— David Schrottenbaum (@David_Schro) September 26, 2018

America avoided an apocalyptic ‘economic catastrophe’: Hank Paulson https://www.foxbusiness.com//economy/america-avoided-an-apocalyptic-economic-catastrophe-hank-paulson #FoxBusiness

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ANY $IGC $ALDX $INPX $JONE $EGY $VSTM $OASM $NBEV $MNKD $AMDA $KBH $MICT $AKER $TLRY $GPRO $NIO $NVAX

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $KBH $GOLD $LNG $SONC $MTB $GPRO $STM $VIAB $MTB $IBM

$SQ Square (SQ) PT Raised to $105 at Buckingham Research; ‘Story Keeps Getting Better’

Amazon.com (AMZN) PT Raised to $2,350 at Jefferies, Could Reach $3,000 By 2020

Activision stock rises after Piper Jaffray raises target due to new ‘Call of Duty’ battle royale mode

(6) Recent Downgrades: $KOS $DWDP $CHEF $XOXO $COG $SYF $PAYC $LRCX $CIEN $MANH

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, EIA, Crude Oil, Fed, $ALDX, $SQ, $NKE, $SVMK, $GPRO, $DIS, $AMD

Swing Trading Earnings Special Report (Members) Sun Aug 5 $GPRO, $NFLX, $TAN, $TWLO, $WYNN, $XLE, $XLF, $X, $RIG…

Swing Trading Report. In this Special Earnings Season (Member Edition) Sunday Aug 5, 2018: OIL $WTI $USOIL, SP500 $SPY, US Dollar $DXY, $SWIR, $GPRO, $NFLX, $GSIT, $AXP, $ABX, $TAN, $TWLO, $WYNN, $XLE, $XLF, $X, $RIG, $SLX and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from Aug 3 mid day, published August 5, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review sessions will become the premise for our next major Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

All quoted support and resistance are approximate.

Published Aug 5, recorded Aug 3, 2018 Mid Day Swing Trading Review.

July 3 and July 10 Swing Trading Regular Reports are referenced in this special earnings report. Members can reference those two reports for charts you may need (or review the video) as all the charting is not included in the report below due to weekly reporting time constraints.

Tickers covered;

OIL $WTI $USOIL – expecting oil to settle in cradle at end of week. Video has quick review of model.

$DXY US Dollar – Up against resistance threatening to move in to its next bullish structure – long over 95.62, PT 96.70.

SP 500 $SPY – over 200 ma on 60 mi, support 278.60, resistance 283.77, that’s your range for Monday.

$SWIR Sierra Wireless – Momentum stock on the day reviewed on video (moving averages). Nearing 50 MA resistance on weekly chart.

$GPRO GoPro – Testing 50 MA on weekly, up 20% on day, last time it used 100 MA for resistance.

Netflix $NFLX – 337.64 is main structural support. 421.70 is key resistance area. When it got the 200 MA on the hour previously is where we traded the buy sell triggers to the bullish side. 307.44 296.19 283.80 are supports and we’re looking for a long at end of retrace. At 309.70 I am interested in a long would prefer 284.18 could even sell in to 254.91 structural support. Detailed trendlines are discussed in video. Levels quoted will change on trend lines. 368.61 quad wall 377.20 200 MA 380.24 resistance area intra day. If I’m right we’ll get a bounce to the 379 area around 200 MA. Trading plan scenarios are discussed on video with various technical levels to watch.

GSI Technology $GSIT – Other side of earnings, has held previous lows, last report had indicators indecisive and it still is. Trade alert alarm set at 50 MA for a watch.

American Express $AXP – Was going to daytrade it and start sending out trade alerts on AXP but it keeps failing the break out I’m watching on the weekly chart. Indicators are flat and that’s a problem.

Barrick Gold $ABX – Main pivot has worked on charting alerted to members in the swing report. Likely sees the 8s before it bounces. Trading 11s.

Solar ETF $TAN – Same with this chart, the pivot has worked but there isn’t enough to make a bias decision.

TWILIO $TWLO – Daily chart, trending stock. Have to wait for earnings this week to make a decision.

$WYNN – Wash out territory on the daily. Sent out trade alerts on the $WYNN trade and we did okay but it is difficult to leg in to this trade. Set alarm to be alerted when Stochastic RSI turns.

Metals and Mining ETF $XME – Red line is a large structure weekly chart major pivot on the chart. Over 39.50 is a watch for a long side trade. Slight bullish bias.

Transocean $RIG – Not a clean set-up at this point. Support 11.76, 15.65 is resistance. 10.84, 9.71, 11.50, 7.84 in a sell-off.

Energy Sector Fund $XLE – Trading 75.05 Stochastic coming down on daily, over its previous highs it’s a long but it is really indecisive at this point.

Steel ETF $XLF – Daily SQZMOM on its way down but there is a pinch and coil on the 200 ma, slight edge to the bulls. The weekly chart looks better but it’s coiled around main pivot. It’s a decision area.

$SLX – MACD is coming down on weekly and indicators are indecisive at this point.

United States Steel Corp $X – Bear advantage. MACD on way down on weekly chart and has lost its 50 MA.

#swingtrading #earnings #tradealerts

Charts and Chart Links re: Member Version.

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

#swingtrading #tradealerts #trading #earnings

Follow Me:

PreMarket Trading Plan Mon Sept 12 $ALDX, $GPRO, $CDI, $AEMD, $ICPT, $ARRY, $SNAP

Compound Trading Chat Room Stock Trading Plan and Watch List for Monday Sept 12, 2017 $ALDX, $GRPO, $CDI, $AEMD, $ICPT, $ARRY, $SNAP – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Crypto trading room very near. I start trading crypto Wednesday at latest – I was delayed with account set-ups… and the hurricane didn’t help.

I will start broadcasting my live oil trading platform in oil trading room soon because I am trading higher frequency and it is hard to alert when frequency gets high. Still setting this up FYI. We’re on it.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to info@compoundtrading.com and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

I am now also trading for our private capital fund which will bring some slight changes.

The financing or our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of our private fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will considerably increase.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. I will be trading the algorithm models (the six we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade for our private fund will not be disclosed.

- ROI Objective. I will be trading under the goal / target of returning 100% per month (which is near impossible, especially for the 24 month period I will be trading). 50% would be very good and 25% is my minimum goal. So at minimum I am looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others I train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You will see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they are connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because I am also trading for the private fund, there will be trades I cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:

EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto was released Sept 1.

New Crypto alert Twitter feed, regular public Crypto Twitter feed and Crypto trading room on-deck. Crypto subscription details on shopping page.

Post market catch up posts still on to do list (we have about fifty from last quarter to post for transparency). Hopefully going forward now that we aren’t releasing any new algorithm models etc I’ll be able to get the rhythm of reporting cycle fluent / regular. It was the development / math etc of the models that took most of the energy so it should be good going forward. Between now and Christmas we’re just locking in what we have tighter and tighter so it sounds like a good plan:)

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. Looks like a master class will happen in Columbia Jan 2018 – will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent lead trader blog / video / social posts:

Sept 11 Red Day Review $SNAP, $ARRY, $TVIX, #Oil $WTI Trade Review, Mid Day Trade Set Up Review: http://youtu.be/lpoT4j5e8Ww?a via @YouTube

https://twitter.com/CompoundTrading/status/907566037209698304

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for more recent ones.

Sept 6 Trade Setup Review $ATHX, $GIII, $LFVN, $NDLS, $ZKIN, $SPY, $VIX, $USOIL, $WTI and more…

Aug 31 Mid Day Trade Set Ups $SPY, $USOIL, $WTI, Gold, $GLD, $DXY, $VIX, $AKS, $MNKD….

Aug 30 Trade Set Ups #EIA Oil EPIC Oil Algo, $WTI, $SPY. $OMVS, $MSFT, $MNKD, $VCEL, $ITCI …

Aug 29 Trade Set-ups $IMGN, $SPY, $EDIT, $KTOS, $JUNO, $XIV, $ACOR, $VIX…

Aug 28 Trade Set Ups Gold, $HTZ, $USOIL, $WTI, $BLUE, $CLLS, $CDNA, $IMDZ….

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Morning Momentum / Gap / News / PR Stocks on Watch:

Market observation / on watch: US Dollar $DXY moderate. Oil $USOIL $WTI continues in a very tight range (historcally), Gold / Silver moderate, $SPY is in bull mode, $BTCUSD love it and service is launched and I will be trading it this Wednesday at latest, and $VIX under pressure – a general time / price cycle terminated Sept 9 generally in markets so this could be a turn – and it looks bullish on the surface.

OTC on watch: $SUNEQ, $LTRE, $RMRK, $OMVS, $BSTG, $AMMJ, $HEMP, $BITCF, $BTCS, $BTSC, $GAHC

Recent SEC Filings to Watch:

Some Earnings On Deck:

Recent / Current Holds, Open and Closed Trades:

Review on $WTI, $SNAP, $ARRY and $TVIX trade in video above.

Previous recent notes:

Friday I went long $ARRY $SNAP and hedged with $TVIX (which is getting hammered premarket). Also in Oil in overnight trade with the smaller position accts flat at time of post and large account positions a tad underwater on it. But the chart is on my side (risk – reward).

Closed that $AMBA trade for a small loss and the most recent oil trade from last report for a win.

Thursday no trades other than closing $MSFT overnight for small profit.

Yesterday was choppy and I nailed an oil scalp in overnight trading. In $MSFT yesterday on daytrade and swing side, in $CUR on daytrade side still and holding $UUP on swing trading side still.

Yesterday I had wins intra in $XIV and shorting $TVIX. also had an overnight hold in $CUR that is yet to be determined.

$XIV, $ARWR, $PETS wins on Thursday. On Wednesday oil $WTI big win and $PETS and $AMD on daytrade small account build yesterday.

Yesterday I closed $UWT daytrade for small win, large oil trade for win, small Gold trade for win and small loss in $TVIX. Recently $XIV I closed in premarket for small gain, still holding some position from previous, $UGLD (closed in premarket July 31 small gain), $FEYE (closed for nice gain), $SRG (closed for nice gain), $NFLX (closed for huge gain), $IPXL (closed for gain), $AKCA (closed nice gain), $MCRB (closed small gain), $WMT (closed excellent gains), $UUP (closed small loss), $BWA (closed tiny loss), Holding: $XIV and new entry $AMMJ. All other holds are small size (less than 4% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (all not including select swing trading or algorithm charting trades).

Recent Chart Set-ups on Watch:

Added $GPRO for possible break out on chart and recent new includes $SNAP and $ARRY – $ARWR, $CDNA, $XXII, $NAK, $SHOP, $ITCI, $SENS, $HCN, $GTHX, $EXTR, $EDIT, $IPI, $XOMO, $MBRX, $PDLI, $LPSN and more that can be reviewed on You Tube videos or on weekly Swing Trading reports.

See other mid day charting trade set-up reviews on You Tube. I am extremely disappointed in the number of members that review those videos. The set-ups are key to success if you’re swing trading (even daytrading). So if I get a tear in the bear DM from folks that will be the first thing I’ll ask you… #fairwarning 🙂 All in love.

We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day. Many of the mid day reviews are published “private” for members only so be sure to watch your email inbox for these among other member only videos.

Market Outlook / Trading Plan:

Bullish turn on Monday so we will see if there is continuation.

$ALDX premarket up 47% trading 6.20 on positive results.

Market News and Social Bits From Around the Internet:

6am

Small Business Optimism Index

8:55am

Chain Store Sales

10am

Job Openings/ Labor Turnover Survey

$AEMD Aethlon Medical Announces Expedited Access Pathway Designation from the FDA to Accelerate US Access to Hemopurifier

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ALDX 41%, $AEMD 27% $RADA $HTBX $TEVA $CTIC $TA $ZFGN $ARTX $LPTH $DB $BCS $BYDDY $UGAZ $LIT $AEG $DWDP $AA $EYES

(2) Pre-market Decliners Watch-List : $HIIQ $SAGE $EFX $MRNS $OPK

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $INOV $AA $TAHO $KR $MTZ $ESNT $CMA $ABEV $CMCSA

(6) Recent Downgrades: $AIXG $STLD $NUE $AAP $PDS $TTI $EGO $LSI $NUE

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $ALDX, $GPRO, $CDI, $AEMD, $ICPT, $ARRY, $SNAP, $BTCUSD, BITCOIN $DXY, US Dollar, #Gold, $GLD, #OIL, $USOIL, $WTI – $DXY, US Dollar, #Gold, $GLD, #OIL, $USOIL, $WTI, Premarket, Watchlist, Stocks, Trading, Plan, $GLD, $GOLD, $SILVER, $USOIL, $WTI, $VIX, $SPY, BITCOIN, $BTCUSD

PreMarket Trading Plan Thurs Mar 16 $GLD, $GDX, $WTIC, $GPRO, $OCRL, $HTBX, $MICT, $SKLN, $CLRB, $GALE more.

Stock Trading Plan for Thursday Mar 16, 2017 in Compound Trading Chat room; $GLD, $GDX, $WTIC, $GPRO, $OCRL, $HTBX, $MICT, $SKLN, $CLRB, $GALE – $ONTX, $DUST, $USRM, $XOM, $NE, $BLKG, $DRYS, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Today’s Live Trading Room Link: https://www.youtube.com/watch?v=OA0T_srGJKY

Morning email note re: updates in case you missed it:

Morning Folks,

First, sorry if you get this email more than once – some day we’ll get that sorted.

Anyway, just got in to the office. It was a much longer trip than expected.

When I hit stop on the Wed trading room broadcast video (just now) YouTube is telling me it is processing. Due to extra length of video (normally we would hit stop right at end of market day) it seems to be taking some time for YouTube to “process” so I won’t be able to access the transcript until YouTube is done “processing” is my point.

So the trading room video and the transcript from Wed will not be ready until later and then we will publish it.

As far as the algorithm charting models and swing trading updates, we are starting processing now and will release them as they are available premarket today and some may not be ready until premarket Friday and possibly the odd one on weekend depending on data that comes back over the next few hours (trading status).

And really, considering the events of Wednesday… this isn’t so bad because the market is going to take a day or three to settle in to what just happened anyway.

Any questions let me know.

Curtis

Yesterday’s EPIC subscriber email note in case you missed it (it’s important):

“I would like to say however, I have spoken to a number of the EPIC traders the last few days about the recent action and trading oil in general. We have an updated EPIC performance report coming out soon that I have already seen and the results were staggering for me as a trader because the report was clear in that if a trader trades the outside widths of support and resistance only that EPIC provides they achieve an easy 50 – 100% return per year backtested. And then, if when the algo targets are reported as predictable by EPIC the trader uses them the ROI annually goes through the roof – all back-tested.

So in short, for any of you struggling (and I found a few that weren’t being disciplined) I encourage you to only trade the widths of resistance and support and only the targets when EPIC reports high predictability. It works. Report will be out over the coming days. As a trader is was humbling for me to see because of course I also struggle with that discipline and it is so easy.

Expect a detailed EPIC report tonight.

Curt”

Trading Room Attendance: With our commercial multi-user algorithm chart modeling client platform launch, upcoming 24 hour oil trading room and coding for our algorithm models for our trader’s cockpit (you’d have to read our story on our website to understand our build-out plans)… I won’t be in the trading room as much starting Tuesday March 14, 2017. I expect to be in the room most days the first hour or two and then I have to turn my attention to the platform development daily and assistance our software developers require of me. I will still have my monitors on and will likely comment and/or run intra-day review broadcasts etc – I just won’t be in the room minute by minute.

The Quarterly Swing Trading Performance Review P/L with Charting is Published. The Algorithms and Daytrading Quarterly Performance Reports are being compiled as I write and will be posted soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Yesterday’s trading results are not available yet – Tuesday’s are here:

https://twitter.com/CompoundTrading/status/841939498602754050

Most recent Keep it Simple Swing Charting Post (MACD focus):

https://twitter.com/CompoundTrading/status/840839909573349376

Results of Gold trade vote are in!

RESULTS ARE IN! Will the next leg in #Gold trading be up or down? Round 3. Tie breaker! $GC_F $GLD $XAUUSD $GDX $NUGT $DUST $JDST $JUNG https://t.co/7NVSaMQ3Kh

— Melonopoly (@curtmelonopoly) March 14, 2017

Current Holds / Trading Plan:

Even though my holds are small in size I would like to start focusing on trading out of some of these, if not all.

All small to mid size holds in this order according to sizing – $ONTX, $DUST, $USRM, $XOM, $NE, $BLKG, $DRYS, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI.

Per recent’ $DUST I will close for a loss if Gold holds 1260 – sucks, but it was a relatively small position (to portfolio size) but I didn’t follow the golden rule… when a trade goes against your plan cut fast and I didn’t so I will likely pay the price. And I guess what has become the second golden rule… listen to the algos… they haven’t been wrong yet – so yes, I didn’t listen to my own invention ROSIE the Gold Algo (give Rosie a little plug there she deserves it lol). Embarrassing, especially because ROSIE nailed the bottom many weeks in advance of the bottom – all I had to do was listen and boom new house. Sad.

Market Outlook / Trading Plan:

Markets are on fire after FOMC. $GC_F Gold has got some new life but still within range (under) our algo upside target (1251.11) so caution is still warranted, crude oil $WTI $UWOIL $CL_F is trading well within the algo range published to members in advance of recent trade so they knew where to trade resistance and support – there is resistance at 49.60 and 50.95, Silver is in same category as Gold generally and is under the upside extension target so same thing applies, the $DXY US Dollar remains to be seen – of course there is significant pressure on it but it is the wild card in my opinion still yet (I know many think they have it pinned), $SPY is trading just under our algo upside interim extension target, and well $VIX is dead still.

Swing Trading watchlist per previous:

My main newest watches for swing trading long are other than momentum stocks are $GSIT (possible semiconductor break-out), $AXP, $ABX, $RIG (higher lows), $XLE, $NFLX (turned long possible over 146.11), $URRE (wedge pattern), $TAN, $ABX, $WYNN (needs to confirm), $SLX, $TWLO, $X, $XME, $AKS, $TSLA over 262.20 and a few others.

Morning Momentum Stocks / News and Social Bits From Around the Internet:

Morning momo stocks / watchlist: $GPRO, $OCRL, $HTBX, $MICT, $SKLN, $CLRB, $GALE more.

News on these on my watchlist $HTBX, $MICT, $SKLN, $CLRB, $GALE

There are gaps on these: $WSM $NOAH $GBT $ALRM $ORCL $TSLA $GPRO $GES $BIIB

Noteables: GPRO +9%, JBL +1%, ORCL +6%, WSM +3%, TSLA +2%, FRSH +11%, MCRB +8%

Stock Futures Rise as Market Gains Extend Into Day 2 After Fed Lifts Rates https://t.co/vl1OqzzwAc via @TheStreet

— Melonopoly (@curtmelonopoly) March 16, 2017

8:30am

-Housing Starts

-Jobless Claims

-Philadelphia Fed Business -Outlook Survey

10am

JOLTS

10:30am

Nat Gas #

Housing starts top estimates in February http://seekingalpha.com/news/3251643-housing-starts-top-estimates-february?source=feed_f … #premarket

Two shops downgrade Biogen to neutral on dearth of near-term catalysts; shares ease 2% premarket http://dlvr.it/NdwV2d #BIIB

Goldman Sachs reduces Ciena to Neutral http://seekingalpha.com/news/3251648-goldman-sachs-reduces-ciena-neutral?source=feed_f … #premarket $CIEN

Intrepid Potash -12% after pricing 43.5M share offering http://seekingalpha.com/news/3251639-intrepid-potash-minus-12-percent-pricing-43_5m-share-offering?source=twitter_sa_factset … #premarket $IPI

Infinera upgraded to Buy at Goldman Sachs; +3.96% http://seekingalpha.com/news/3251636-infinera-upgraded-buy-goldman-sachs-plus-3_96-percent?source=twitter_sa_factset … #premarket $INFN

GoPro stock soars 11% premarket after job cuts, adjusted profitability reported

Pound moves higher after BOE thanks to one dissenter http://seekingalpha.com/news/3251633-pound-moves-higher-boe-thanks-one-dissenter?source=twitter_sa_factset … #premarket $FXB $EWU $GBB $EWUS

Dollar General Stock Climbs Premarket on 4Q Beat $DG http://dlvr.it/Ndvg54

Guess shares down 12.5% in premarket trading after late-Wednesday earnings http://ift.tt/1mwkxpg

Heat Biologics gets delisting notice from Nasdaq related to low bid price, investors do their pa… http://seekingalpha.com/news/3251604-heat-biologics-gets-delisting-notice-nasdaq-related-low-bid-price-investors-part-shares-19?source=twitter_sa_factset … #premarket $HTBX

$ORCL stock surges 6.85% premarket after profit beat and dividend raise late Wednesday

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: see above I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List: $GSIT, $AXP, $ABX, $RIG, $XLE, $NFLX, $URRE, $TAN, $ABX, $WYNN, $SLX, $TWLO, $X, $XME, $AKS, $TSLA

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades:Upgrades $ETR $INST $NCR $GPRO $ORCL $LITE $INFN $OAS $LC $AR $DAL $LRCX $GG $ABX $OXM $GOGL $COLB $PFGC $TJX $ATI $JBL $GG $SYNA $THRM as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $EWBC $RUBI $CIEN $TROV $MASI $GARS $CNP $DBVT $TCBI $NEM $WSM $BIIB $UAL $TSN as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $GLD, $GDX, $WTIC, $GPRO, $OCRL, $HTBX, $MICT, $SKLN, $CLRB, $GALE – $MGTI, $NE, $XOM, $USRM, $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $DRYS – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F