Compound Trading Premarket Trading Plan & Watch List Thursday Aug 9, 2018.

In this edition: Semiconductors, Earnings, Tariffs, $ROKU, $YELP, $TSLA, $FB, $GOOGL, OIL, GOLD and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Thursday Aug 9 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- July 23-Aug 10 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a delayed complimentary version without algorithmic real-time charting and with or without charts).

- Mid/Late Aug – New pricing published representing next generation algorithm models (existing members no change).

- July 31-Aug 14 – Next generation algorithm models roll out in to August 14, 2018 (machine trading Gen 1).

- July 31-Aug 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Aug 25-26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Promos:

Promo Discounts End Aug 14! (for new members only).

Weekly Swing Trading Newsletter service Reg 119.00. Promo 83.30 (30% off). Promo Code “30P”. #swingtrading

Swing Trading Alerts Reg 99.00. Promo 69.37 (30% off). Promo Code “Deal30”. #swingtradealerts

https://twitter.com/CompoundTrading/status/1025205887034699776

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See You Tube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

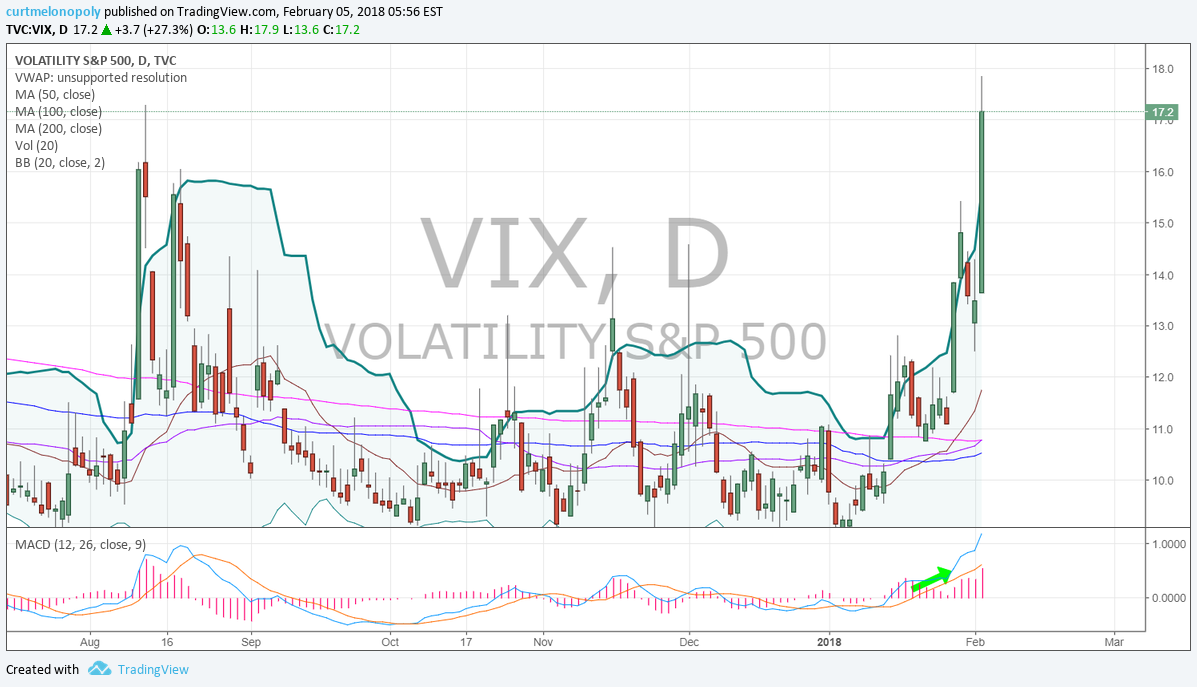

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

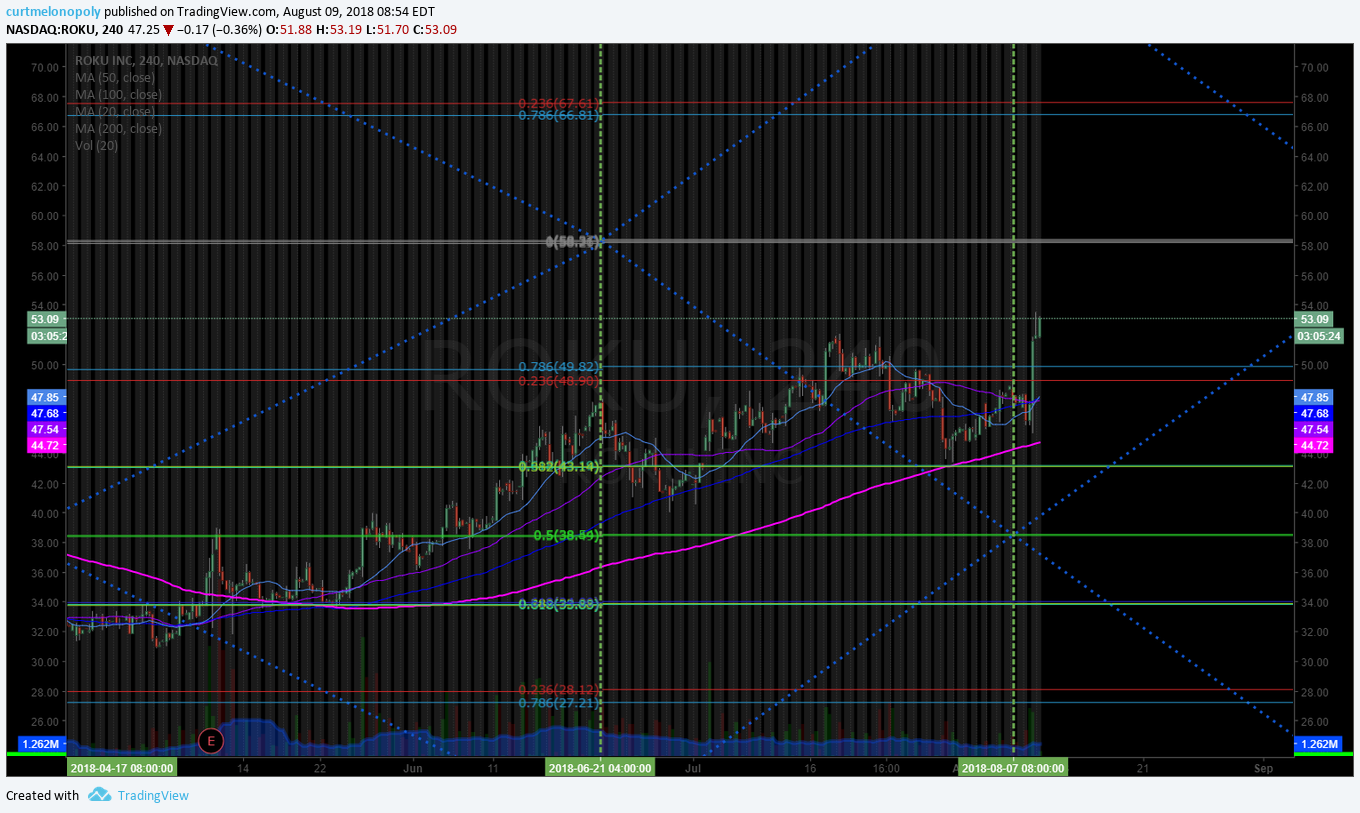

ROKU Inc (ROKU) Premarket up 12.38% trading 53.10 on better than expected earnings. $ROKU #premarket #earnings https://www.marketwatch.com/story/rocku-stock-jumps-8-after-second-quarter-profits-new-streaming-web-channel-2018-08-08?siteid=yhoof2&yptr=yahoo

Market Observation:

Markets as of 8:02 AM: US Dollar $DXY trading 95.22, Oil FX $USOIL ($WTI) trading 68.80, Gold $GLD trading 1215.90, Silver $SLV trading 15.49, $SPY 285.36, Bitcoin $BTC.X $BTCUSD $XBTUSD 6318.00 and $VIX trading 10.9.

Your Thursday morning Speed Read:

– U.S. initial jobless claims due @ 8:30am ET $SPY

– IPOs due today from Amalgamated Bank $AMAL, Mesa Air Group $MESA, & Vaccinex $VCNX

– Rite-Aid shares ⬇ 6% premarket after news Wed. evening its planned Albertsons merger has been axed $RAD

Your Thursday morning Speed Read:

– U.S. initial jobless claims due @ 8:30am ET $SPY

– IPOs due today from Amalgamated Bank $AMAL, Mesa Air Group $MESA, & Vaccinex $VCNX

– Rite-Aid shares ⬇️ 6% premarket after news Wed. evening its planned Albertsons merger has been axed $RAD— Benzinga (@Benzinga) August 9, 2018

Momentum Stocks / GAPS to Watch: $KBSF $BEL $CLDC $DNB $UPLD $YELP $SAIL $END $SESN $NETE

Roku and Yelp are among the biggest gainers in Thursday’s pre-market session. Meanwhile, e.l.f. Beauty and Gevo are down more than 15%. https://benzinga.com/z/12173256 $YELP $ROKU $HJLI $SAIL $CVNA $RIGL $JACK $ZUMZ $IAC $IPAS $GEVO $ABIL $PRGO $ACAD $FLO

Stocks – Rite Aid, ELF Beauty Plummet in Pre-market; #DunBradstreet, Yelp Soar – https://invst.ly/88uo2

News:

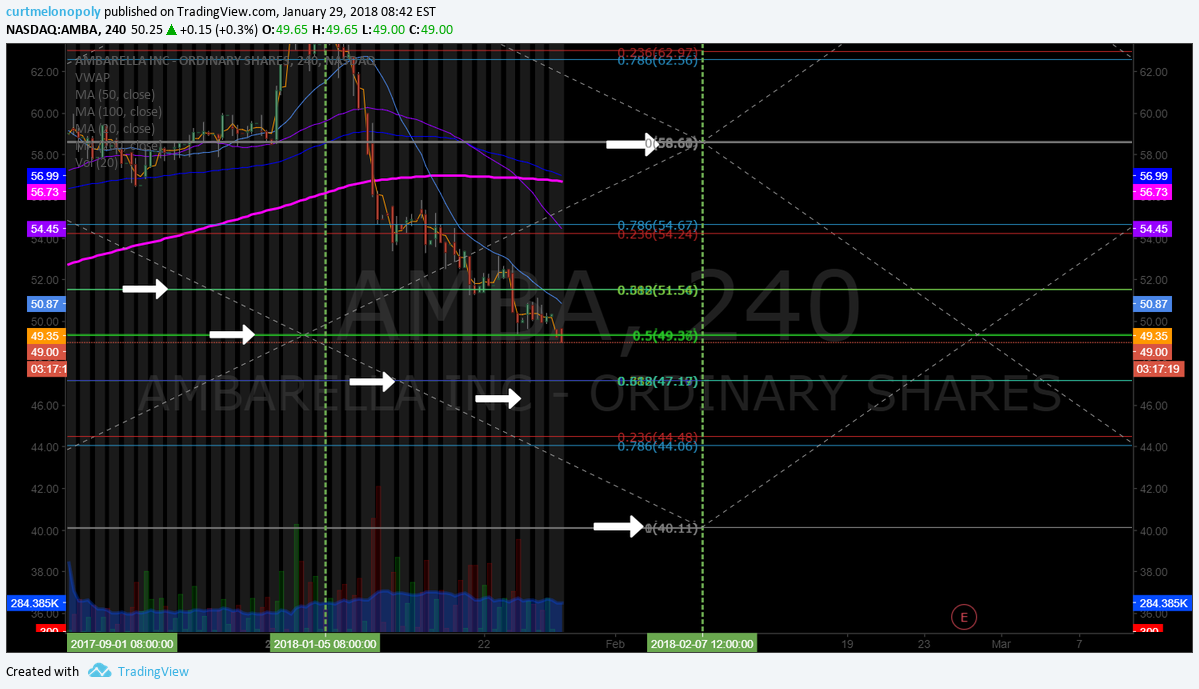

Morgan Stanley downgrades semiconductor industry view to Cautious $NVDA $XLNX $AMBA $APH $TEL $ADI $CY $ON $INTC $QCOM $MCHP $QRVO $MU $AVGO http://dlvr.it/QfKNFH

$KRYS KB105 Granted Orphan Drug Designation to Treat Patients With TGM-1 Deficient Autosomal Recessive Congenital Ichthyosis

Stocks making the biggest moves after hours: Yelp, Roku and more –

Stocks making the biggest moves after hours: Yelp, Roku and more – https://t.co/CTGFQ1VWiK

— Melonopoly (@curtmelonopoly) August 8, 2018

Recent SEC Filings:

Recent IPO’s:

Earnings:

Yelp’s second-quarter profit tops expectations as ad revenue jumps https://cnb.cx/2KKtPQI

L Brands’ stock surges after sales rise above expectations and upbeat earnings outlook

Norwegian Cruise’s stock driven higher by profit and revenue beat, raised outlook

#earnings for the week

$SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TA

#earnings for the week $SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TAhttps://t.co/r57QUKKDXL https://t.co/7T3vSl6F34

— Melonopoly (@curtmelonopoly) August 5, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

ROKU (ROKU) Premarket up 12.38% trading 53.10 on better than expected earnings. $ROKU #premarket #earnings

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

APPLIED OPTOELECTRONICS (AAOI) premarket trading 46.05 on earnings +23% $AAOI #daytrading #swingtrading #premarket

Oil Monthly Chart. Oil has a bounce at 50 MA with MACD pinch possible cross up . Aug 7 551 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart https://www.tradingview.com/chart/USOIL/O13OzkXH-Oil-Monthly-Chart-Oil-has-a-bouonce-at-50-MA-with-MACD-pinch/ …

https://twitter.com/EPICtheAlgo/status/1026768811356286976

It bounced and hasn’t looked back. #swingtrading $AAOI

It bounced and hasn't looked back. #swingtrading $AAOI https://t.co/vhSzw9TK58

— Melonopoly (@curtmelonopoly) August 8, 2018

$TSLA Swing target price hit. #swingtrading

$TSLA Swing target price hit. #swingtrading https://t.co/AoyhwOjYkz

— Melonopoly (@curtmelonopoly) August 8, 2018

The TESLA swing trading report from previous $TSLA #swingtrading #towin

The TESLA swing trading report from previous $TSLA #swingtrading #towin https://t.co/zXi67L3O60

— Melonopoly (@curtmelonopoly) August 8, 2018

FITBIT (FIT) Earnings wash-out swing trade setting up here. Levels on chart and this post $FIT #swingtrading #earnings #chart

TWILIO (TWLO) Over 20 MA on daily chart with stochastic RSi turned up, watching trend structure in to eanrings in one day. $TWLO #chart #earnings

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB #swingtrade #chart

Health Innovations (HIIQ) ripped through the chart structure in a fantastic way. Careful above channel resistance. $HIIQ chart. #swingtrade

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

$BTC 8300’s to 6900’s…. always know where that 200MA is. #Bitcoin #premarket #crypto

$BTC 8300's to 6900's…. always know where that 200MA is. #Bitcoin #premarket #crypto pic.twitter.com/HneG44UaSs

— Melonopoly (@curtmelonopoly) August 6, 2018

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm pic.twitter.com/mrwq8KDiNB

— $DXY US Dollar Algo (@dxyusd_index) August 3, 2018

$SWIR has held the 200 MA on daily, will be one to watch for Monday #daytrading

$SWIR has held the 200 MA on daily, will be one to watch for Monday #daytrading pic.twitter.com/b71F3ArbsC

— Melonopoly (@curtmelonopoly) August 3, 2018

Oil trade alert to start the week 68.61 long, 68.85 closed. Win rate high 90% – ask for a tour. Time stamped, recorded, live alerts. EPIC Oil Algorithm $USOIL $WTI $CL_F #OilTradeAlerts $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/1026287786113081344

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts pic.twitter.com/MdiUn2HB5U

— Swing Trading (@swingtrading_ct) August 2, 2018

SP500 (SPY) Chart – Closed at intra resistance with mid quad resistance next. $SPY $ES_F $SPXL $SPXS #SPY #SwingTrading #Chart

TESLA (TSLA) trading 351.55 on quad TL diagonal support, near key range resistance 383.42 today, over 354.91 targets 383.42 Nov 14 $TSLA #tradealerts

FACEBOOK (FB) Trim longs in to 174.50 main resistance add above trading 174.01 intra 167.50 support 181.50 next resistance. $FB #tradealerts

Oil Chart (Monthly). Trade still working the range between 100 MA and 200 MA on monthly. July 23 1219 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Hi Crush Partners Testing 200 MA on weekly with Stochastic RSI turn up, MACD turn on weekly. Looking for big trade. #swingtrade #daytrade $HCLP

Biotechnology Fund (IBB) Closed 115.41 just under key resistance 122.31. Bullish PT 142.21 Nove 30 bearish 102.57 $IBB #swingtrading

ALLERGAN (AGN) swing trade continues, 180.28 resistance hit, over then targets 184.62 main resistance Aug 16. $AGN #swingtrading

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo pic.twitter.com/pKL1iKE5T1

— Melonopoly (@curtmelonopoly) July 25, 2018

The $RIOT daytrade from yesterday went well: 7.30s – 8.40s nice mover and returns.

Working well #daytrading #towin $RIOT #blockchain pic.twitter.com/CyaVAM35UB

— Melonopoly (@curtmelonopoly) July 24, 2018

Arrow Pharmaceuticals (ARWR) Over mid quad resistance. Long side bullish bias. $ARWR #swingtrading #earnings

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

Market Outlook, Market News and Social Bits From Around the Internet:

U.S. oil vanishing from Chinese tariffs reveals America’s clout https://bloom.bg/2AUN2iD

#5things

-Russian sanctions

-Musk’s money mystery

-Lira falls again

-Markets quiet

-Data due

https://bloom.bg/2vTFdnJ

#5things

-Russian sanctions

-Musk's money mystery

-Lira falls again

-Markets quiet

-Data duehttps://t.co/ctwcvTktHs pic.twitter.com/iIUyfAOJj8— Bloomberg Markets (@markets) August 9, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $KBSF $BEL $CLDC $HJLI $DNB $SAIL $SND $YELP $CUR $AYX $SESN $ROKU $GOOS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $MNK, $AM, $CVNA, $RARX, $BMRN, $YELP, $ORCL, $KORS, $MTCH

Antero Midstream Partners LP $AM PT Raised to $38 at Wells Fargo

$BMRN PT raised to $120 at Citi

(6) Recent Downgrades:

$EGLT PT lowered to $1.50 from $4 at JMP

Morgan Stanley downgrades high flying chip sector to sell as ‘indicators are flashing red’ https://cnb.cx/2M8ceXF

Stock Futures Mixed; 3 Chip Stocks Dive On Downgrades http://dlvr.it/QfKHQl

DepoMed Inc $DEPO PT Lowered to $8 at RBC Capital

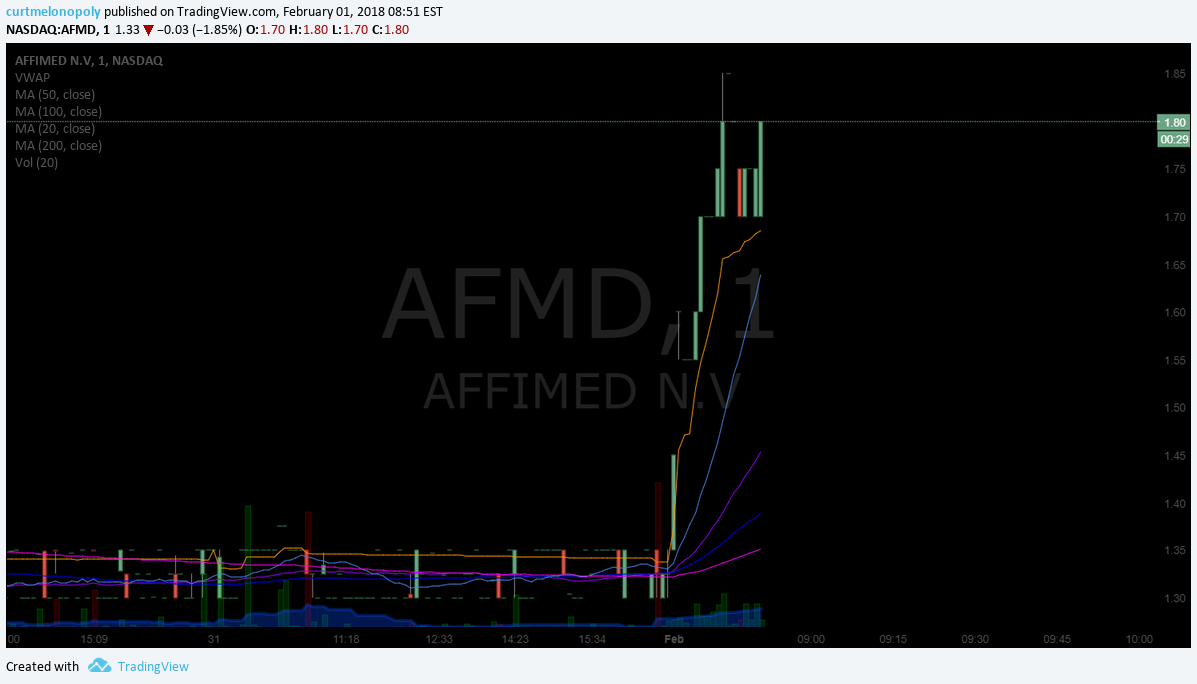

$AFMD PT lowered to $4 from $6 at BMO

ProPetro Holding $PUMP PT Lowered to $19 at RBC Capital

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Semiconductors, Earnings, Tariffs, $ROKU, $YELP, $TSLA, $FB, $GOOGL, OIL, GOLD