S&P 500 $SPY Trade Update Friday Feb 3, 2017 $ES_F ($SPXL, $SPXS) Charting / Algorithm Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Below is classic charting, models / scenarios, and will be such until Monday. This weekend $SPY and $VIX will be our focus (for completion) – all the algos will be fully updated then. When they are done this weekend then all six are finished.

Midweek Update:

So trade in $SPY has done absolutely zero to require any updates to any of the charting models from yesterday. So I have simply pasted them in to this post so you have them easily. I have however updated the Fibonacci levels for tight trading / trading quadrants intra-day per below. Hopefully we get some range to work with – it is required for algorithmic modeling.

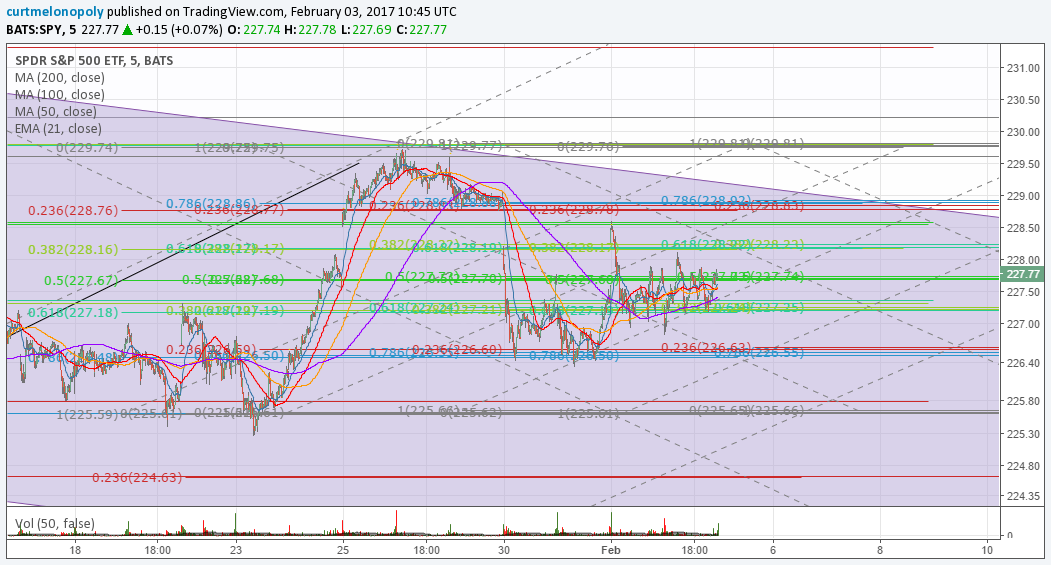

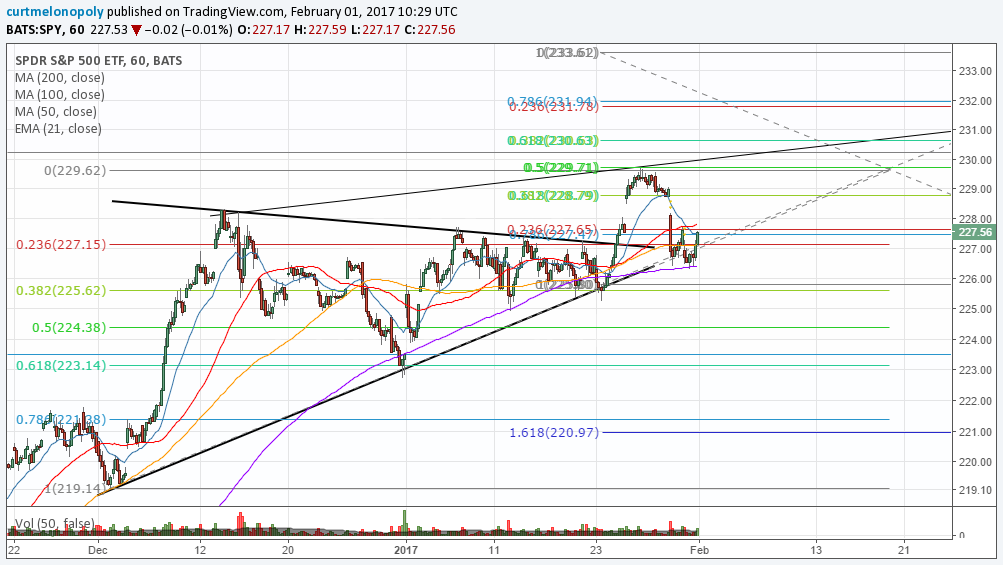

Tight Fibonacci Lines for Intrad Day Trading our Traders will use today – S&P 500 $SPY Trade Charting Feb 3 545 AM $ES_F ($SPXL, $SPXS)

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/dHN78OuZ-Tight-Fibonacci-Lines-for-Intrad-Day-Trading-our-Traders-will-us/

Per previous report:

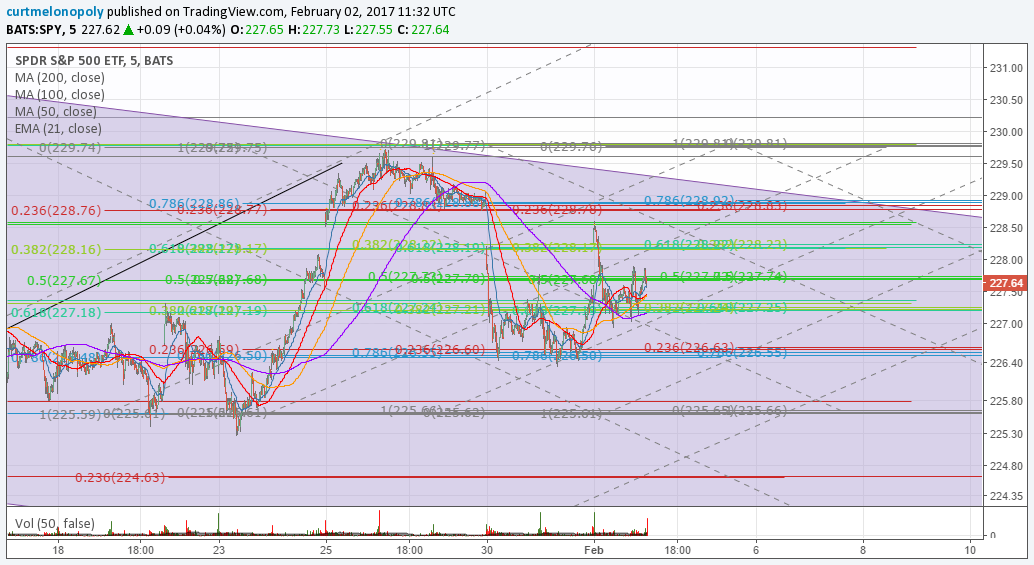

Ascending Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 2 603 AM $ES_F, $SPXL, $SPXS

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/DEMaG0dg-Ascending-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-2-6/

Price action in this model is intact. Notice price used the 200 day ma as support in recent trade!

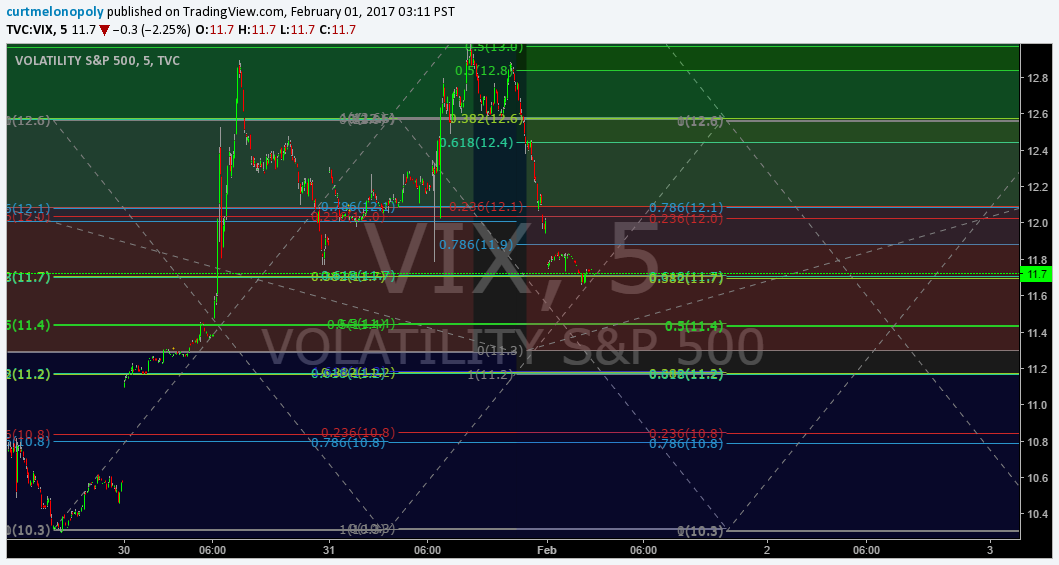

Sideways Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 2 609 AM $ES_F $SPXL, $SPXS

This scenario is also intact.

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/x5FEa3EI-Sideways-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-2/

Descending with Fib, Symmetry and Time Price Cycle Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 2 615 AM $ES_F $SPXL, $SPXS

Live $SPY Trading Chart: https://www.tradingview.com/chart/SPY/dIJqIFq8-Descending-with-Fib-Symmetry-and-Time-Price-Cycle-Trade-Scenari/

This chart model is also intact. The important parts are not the general trade direction red dotted lines or that prospective black downward trendline – the downward channel and its associated trading width is the important indicator to watch on this chart.

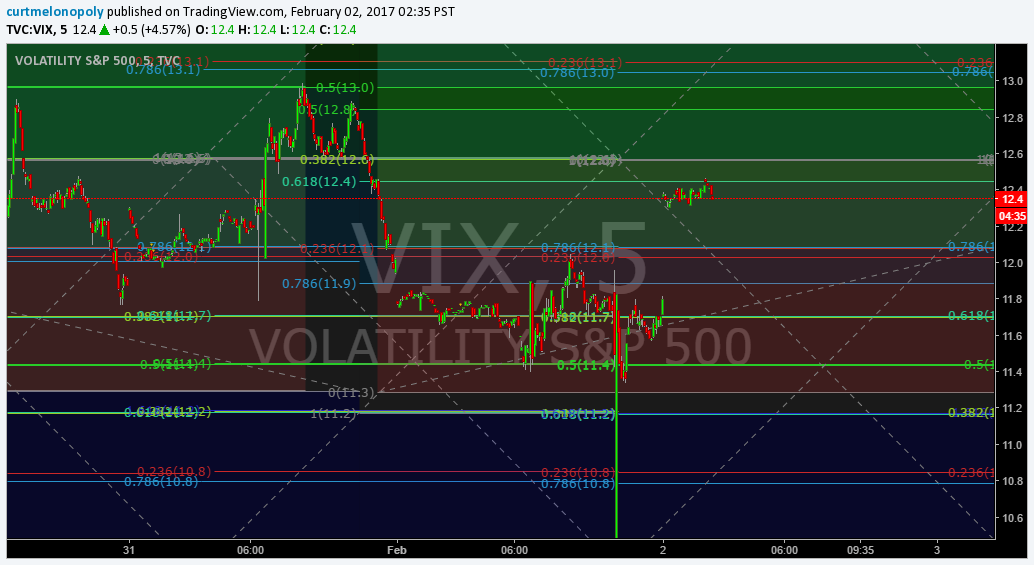

Tight Fibonacci Lines for Intrad Day Trading our Traders will use Feb 2 – 633 AM S&P 500 $SPY Trade Charting $ES_F $SPXL, $SPXS

Live $SPY Chart: https://www.tradingview.com/chart/SPY/NriLZXx5-Tight-Fibonacci-Lines-for-Intrad-Day-Trading-our-Traders-will-us/

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $SPY, $ES_F, $SPXL, $SPXS